Author: Alan Weissberger

Bullitt Satellite Connect: Another 2-way Satellite Messaging Service announced at CES 2023

Bullitt Group, the British manufacturer specializing in rugged mobile phones, has revealed a few more details about its two-way satellite messaging service at CES 2023. The service will be commercially available in North America and Europe the first quarter of 2023, the company said. Australia, New Zealand, Africa and Latin America will launch sometime in the first half of 2023, with other regions following the second half of the year.

Bullitt said Motorola, a Lenovo company, will be the first to include Bullitt’s two-way satellite messaging technology. The next device in Motorola Mobility’s Defy phone line-up will be the first smartphone to support Bullitt’s satellite messaging service.

The company previously said it was using telecom chipset supplier MediaTek. It now says it will use Skylo for satellite connectivity. Skylo manages connections to devices over existing licensed GEO satellite constellations, like Inmarsat and others.

Bullitt Satellite Connect solves a real connectivity problem. American’s send 6 billion SMS text messages each day* but, due to the sheer scale and topography of the country, no single carrier covers more than 70% of the US land mass and around 60 million Americans lose coverage for up to 25% of each day**.

That means hundreds of millions of instances where people who want to communicate via their phone cannot. Coverage blackspots persist to a greater and lesser extent the world over. We have a truly international solution. Bullitt Satellite Messenger provides total reassurance that you will have a connection wherever you have a clear view of the sky.

Citing data from Opensignal, Bullit said it’s solving “a real connectivity problem,” where around 60 million Americans lose coverage for up to 25% of each day. Bullitt Satellite Messenger promises to provide a signal wherever there’s a clear view of the sky, similar to the service Qualcomm announced this week with Iridium for Android devices.

The Bullitt service works by combining Bullitt smartphone hardware and an OTT app, Bullitt Satellite Messenger, to send messages to any smartphone. The service will first try to connect via Wi-Fi or cellular, and if neither are available, it will connect via satellite.

Quotes:

Resources:

https://www.fiercewireless.com/wireless/bullitt-taps-motorola-satellite-messaging-phone-launch

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Deutsche Telekom to deploy more small cells to solidify its 5G network

Deutsche Telekom plans to deploy more small cells to solidify its 5G network, the company said in a podcast. The carrier explained that small cells improve the quality of the network in areas of high density, such as train or bus stations, markets or shopping arcades.

In late December, Deutsche Telekom said it would repurpose approximately 3,000 old public payphones as 5G small cells by 2025. They will have a range of a few hundred meters and will serve city centres and pedestrian zones using the 3.6 GHz frequency band. Telekom said its 5G small cells serve a 200-metre radius.

Telekom already uses phone box small cells for LTE networks on the 2.6GHz frequency, but will start a 5G rollout using the 3.6GHz band in 2023, having completed a pilot phase.

Telekom stressed its enthusiasm for designs that “fit in with the urban landscape, either by standing out with a decorative design or by harmoniously blending into their surroundings”. The latest roll out of phone box small cells will see 5G connectivity with little to no visual impact on German streets.

Telekom has partnered with Swiss network equipment vendor Huber+Suhner on small cells since 2019, using them to densify its 4G network across a number of German cities. The Huber+Suhner kit is installed in existing street furniture — including phone boxes — operating over a range of frequencies from 1.7GHz to 4.2GHz. When the deal was signed, then-Chief Technology Officer Walter Goldenits said that small cells would form an “important component of our expansion strategy”. He added that the Swiss vendor’s equipment can be converted to support 5G networks “in a few easy steps” (Deutsche Telekomwatch, #87). With this latest phone box small-cell rollout, it appears that this option has not been taken.

5G small cell antennas. © Deutsche Telekom AG

Deutsche Telekom Technik, the operator’s German network deployment and management unit, has been trialling street-level 5G small-cell designs since at least 2019. Then, it highlighted “creative designs” to densify the network, including the use of antenna housings shaped like clocks and birds perching on lampposts.

References:

https://www.telekom.com/en/search-this-website?query=small+cells++

https://www.telekom.com/en/media/media-information/archive/5g-small-cell-antennas-579790

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Qualcomm and Iridium have introduced Snapdragon Satellite, a solution that brings satellite-to-cellular services to next-generation Android smartphones. Snapdragon Satellite will support two-way messaging from pole to pole in remote, rural, and offshore locations on premium Android smartphones.

Snapdragon Satellite will provide global connectivity using mobile messaging from around the world1, starting with devices based on the flagship Snapdragon 8 Gen 2 Mobile Platform.

Powered by Snapdragon 5G Modem-RF Systems and supported by the fully operational Iridium® satellite constellation, Snapdragon Satellite will enable OEMs and other service providers to offer truly global coverage. The solution for smartphones utilizes Iridium’s weather-resilient L-band spectrum for uplink and downlink.

“Robust and reliable connectivity is at the heart of premium experiences. Snapdragon Satellite showcases our history of leadership in enabling global satellite communications and our ability to bring superior innovations to mobile devices at scale,” said Durga Malladi, SVP and GM of Cellular Modems and Infrastructure at Qualcomm.

Image credit: Jose Luis Stephens/Adobe Stock

While the partners say the service can be used for recreational purposes, satellite connectivity is most beneficial for emergencies.

Apple partnered with Globalstar last year to launch its own satellite-powered emergency SOS feature. Numerous people reported that the feature saved their lives just weeks after launch.

In one case, after a car plunged off a mountain cliff, a passenger’s iPhone automatically detected the crash and made a satellite SOS call to alert emergency services of the accident and its location. Within 30 minutes, the occupants were rescued by helicopter.

“If they hadn’t been able to get out the SOS, they could have spent overnight there, gotten wet, developed hypothermia,” Sergeant John Gilbert, a deputy for the local sheriff’s department, told PEOPLE. “To walk out and get help, in a remote area with no cell reception, they were lucky.”

Snapdragon Satellite will provide similar benefits for Android users, starting with devices based on the Snapdragon 8 Gen 2 Mobile Platform.

“Iridium is proud to be the satellite network that supports Snapdragon Satellite for premium smartphones,” said Matt Desch, CEO, Iridium. “Our network is tailored for this service – our advanced, LEO satellites cover every part of the globe and support the lower-power, low-latency connections ideal for the satellite-powered services enabled by the industry-leading Snapdragon Satellite. Millions depend on our connections every day, and we look forward to the many millions more connecting through smartphones powered by Snapdragon Satellite.”

Snapdragon Satellite will use Garmin’s satellite emergency response services.

“Garmin welcomes the opportunity to expand our proven satellite emergency response services to millions of new smartphone users globally,” said Brad Trenkle, VP of Garmin’s outdoor segment. “Garmin Response supports thousands of SOS incidents each year and has likely saved many lives in the process, and we are looking forward to collaborating with Qualcomm Technologies and Iridium to help people connect to emergency services no matter where life takes them.”

In the near future, Qualcomm and Iridium say that Snapdragon Satellite will expand to other devices including laptops, tablets, vehicles, and IoT devices.

“Working with a mobile technology leader such as Qualcomm Technologies and their powerful Snapdragon platforms allows Iridium to serve the smartphone industry horizontally – and offers us an opportunity to enable other consumer and vehicular applications in the future,” concludes Desch.

References:

Qualcomm and Iridium bring satellite-to-cellular services to Android (telecomstechnews.com)

Qualcomm unveils Snapdragon Satellite for two-way messaging (techrepublic.com)

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications previewed its Q4 2022 results today, revealing it gained 75,000 new fiber customers and had 8,000 total broadband net additions.

- Strong customer growth in Q4 led Frontier to finish 2022 with 17% more fiber broadband customers than it had at the end of 2021.

- For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

During a Citi investor conference presentation following the announcement, CFO Scott Beasley said growth spanned both new and existing markets and resulted in part from gains made against cable competitors. “We continue to outpace our cable competitors, gaining share in nearly every geography we operate in. Our new position as the ‘un-cable’ provider is taking hold. We are bringing customers a superior product and it is paying off in record broadband customer growth.”

According to Beasley, the vast majority of its net additions are customers who are new to Frontier rather than those converting from a legacy DSL service. That means most either moved into or within the operator’s territory during the quarter or switched from cable. “We had success against every competitor in every geography,” the CFO stated. Asked whether cable’s recent efforts to woo consumers with fixed-mobile bundles presented a challenge, Beasley said Frontier hasn’t yet “seen much of an impact from their converged offerings.”

Frontier doesn’t appear to be concerned about advances from fixed wireless access (FWA) rivals either. New Street Research noted Frontier’s net add announcement implied it lost 67,000 copper subscribers, which was significantly higher than the 56,000 the analyst firm had expected. However, Beasley said fixed wireless has had “very little impact” on its fiber gross additions.

Regarding its DSL based services, Beasley said “we haven’t seen any significant impact from fixed wireless (FWA)” in terms of churn but acknowledged FWA is “nibbling around the edges” where new movers only have the choice between Frontier’s DSL or a fixed wireless product.

Beasley added despite macroeconomic challenges and a recessionary environment, Frontier hasn’t seen any slowdown in bill payments or tier step-downs from customers. In fact, as it works to achieve a goal of 3% to 4% year-on-year average revenue per user (ARPU) growth by the end of 2023, he said it will actually look to encourage customer plan step-ups. Beasley noted uptake of its gigabit plans currently stands around 15% among Frontier’s base and around 45% for new customers, leaving plenty of room for movement. The company will also implement “normal base price increases to reflect higher input costs” and use gift card promotions to retain and gain other subscribers, he said.

Media Contact:

Chrissy Murray

VP, Corporate Communications

+1 504-952-4225

[email protected]

References:

https://investor.frontier.com/news/news-details/2023/Frontier-Adds-Record-Fiber-Broadband-Customers-in-Q4-2022/default.aspx

https://investor.frontier.com/events-and-presentations/events/event-details/2023/Citi-Communications-Media–Entertainment-Conference/default.aspx

https://www.fiercetelecom.com/broadband/frontier-bags-75k-fiber-subs-q4-2022-eyes-arpu-gains-23

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

Blues Wireless Raises $32M To Accelerate Adoption of Cellular IoT for Enterprises

Embedded connectivity startup Blues Wireless (Blues), today announced a $32 million Series A1 funding round led by Positive Sum, and including new investors Four Rivers, Northgate, and Qualcomm. Previous backers Sequoia, Cascade, Lachy Groom and XYZ also participated.

By using the Blues Notecard and Notehub, businesses can quickly, securely, and cost-effectively connect their physical products to the cloud via a cellular network (LTE Cat 1, LTE Cat M1, or NB-IoT).

- The Notecard is a low-code data pump embedded within a customer’s products. The Notecard combines prepaid cellular connectivity, low-power design, and secure “off-the-internet” communications in one 30mm x 35mmSystem-on-Module.

- The Notehub routes that data to the customer’s cloud. A hosted service for securely routing Notecard data to your cloud application of choice. Manage fleets of devices, update host and Notecard firmware over-the-air.

- Serving enterprise customers and developers alike, Blues is a hyper-scaler focused on 5G cellular Internet of Things (IoT).

“Even in these difficult economic times, enterprises will not hesitate to invest in transforming their physical products to be capable of remote monitoring and control,” said Ray Ozzie, Founder and CEO of Blues (inventor of Lotus Notes). “To date, connecting products to the cloud using cellular has been a time-consuming and expensive endeavor, fraught with risk. Complexity kills. Blues has taken a unique, developer-centric approach that simply eliminates complexity, from device to cloud, enabling products realistically to go from prototype to scale deployment in months instead of years.”

“We are thrilled to be partnering with Blues. They are well positioned to create an inflection point in IoT,” said Alison Davis Riddell, Partner at Positive Sum. “Blues is clearly the culmination of Ray’s life’s work, bringing to bear all of his experience and passion. The company has strong market signal, with rapid growth and demand from some of the world’s leading companies to connect their products to the cloud securely, economically, and with unprecedented speed. Having worked directly in the IoT space for six years, I can confidently say that Blues’ approach is unlike anything we’ve seen, and the opportunity is tremendous.”

Blues will be exhibiting at CES in Las Vegas (Booth #10752, North Hall) from January 5-8, 2023 with the message that any company can cloud-connect their product using cellular. Customers and partners will be alongside Blues in a shared exhibit space to demonstrate their industry-changing products, and to discuss the Notecard’s and Notehub’s role in helping them to win in the market.

Blues Wireless (Blues) is a hyperscale cellular IoT solution provider founded in 2019 by serial entrepreneur Ray Ozzie. Their flagship products, Notecard and Notehub, work together to provide a complete high-scale device-to-cloud data pump. Blues reduces the cost and complexity of building connected products by including provisioning, security, and cloud device management as standard features, with the simplicity and flexibility enabling it to be incorporated within new and existing designs. More than 800 forward-thinking companies, from startup to enterprise, use Blues to securely cloud-connect their products.

Email [email protected] or visit blues.io for more information.

Notecard Cellular Modem SoMs:

| Image | Manufacturer Part Number | Description | Supplied Contents | Available Quantity | View Details | |

|---|---|---|---|---|---|---|

|

|

NOTE-WBNA-500 | NOTECARD, LTE CAT 1 (N AMERICA) | Board(s) | 95 – Immediate | View Details |

|

|

NOTE-WBEX-500 | NOTECARD, LTE CAT 1 (EMEA) | Board(s) | 122 – Immediate | View Details |

|

|

NOTE-NBGL-500 | NOTECARD, NB-IOT/LTE-M (GLOBAL) | Board(s) | 99 – Immediate | View Details |

|

|

NOTE-NBNA-500 | NOTECARD, LTE CAT M1 (N AMERICA) | Board(s) | 123 – Immediate | View Details |

References:

https://www.digikey.com/en/product-highlight/b/blues-wireless/notecard-cellular-modem-som

Adani Group to launch private 5G network services in India this year

Adani Group, the newest entrant in India’s telecom space, is looking to launch private 5G services for enterprises in 2023. The conglomerate also announced that it would be launching consumer apps this year as part of its digital strategy.

Addressing his employees in the New Year, Chairman Gautam Adani said they will invest in expanding the network of data centers, building AI-ML and industrial cloud capabilities, along with rolling out 5G services and launching B2C apps.

“While we are fully invested in building India, it is an opportune time to contribute to nation-building outside India. All of these are big ticket, independent yet mutually connected digital opportunities that are backed by our adjacency in the energy business,” he said.

The Gujarat-based conglomerate surprised industry incumbents when it took part in 5G auctions in 2022. While Adani has not purchased spectrum across all 5G bands and thus cannot provide consumer telephony, the conglomerate parted with Rs. 212 crore to buy 400MHz spectrum in the mm-wave band. Adani is gunning to provide private network services to enterprises, including its own.

However, telecom operator Bharti Airtel beat Adani to the punch, bagging the first private 5G network deal with Mahindra Group late last year.

Reliance Jio has also indicated that private 5G will be a key avenue for monetization for the operator in the future. Chairman Mukesh Ambani has committed Rs 2 trillion investment for rolling out a 5G network across the country by December 2023, according to a recent report by the Press Trust of India.

Other entities, such as IT major Tata Consultancy Services (TCS), could also participate in the private 5G network market. They are awaiting spectrum assignment rules from the DoT and TRAI, who are still deliberating the spectrum bands, which will be given to enterprises for private network use through administrative allocation.

References:

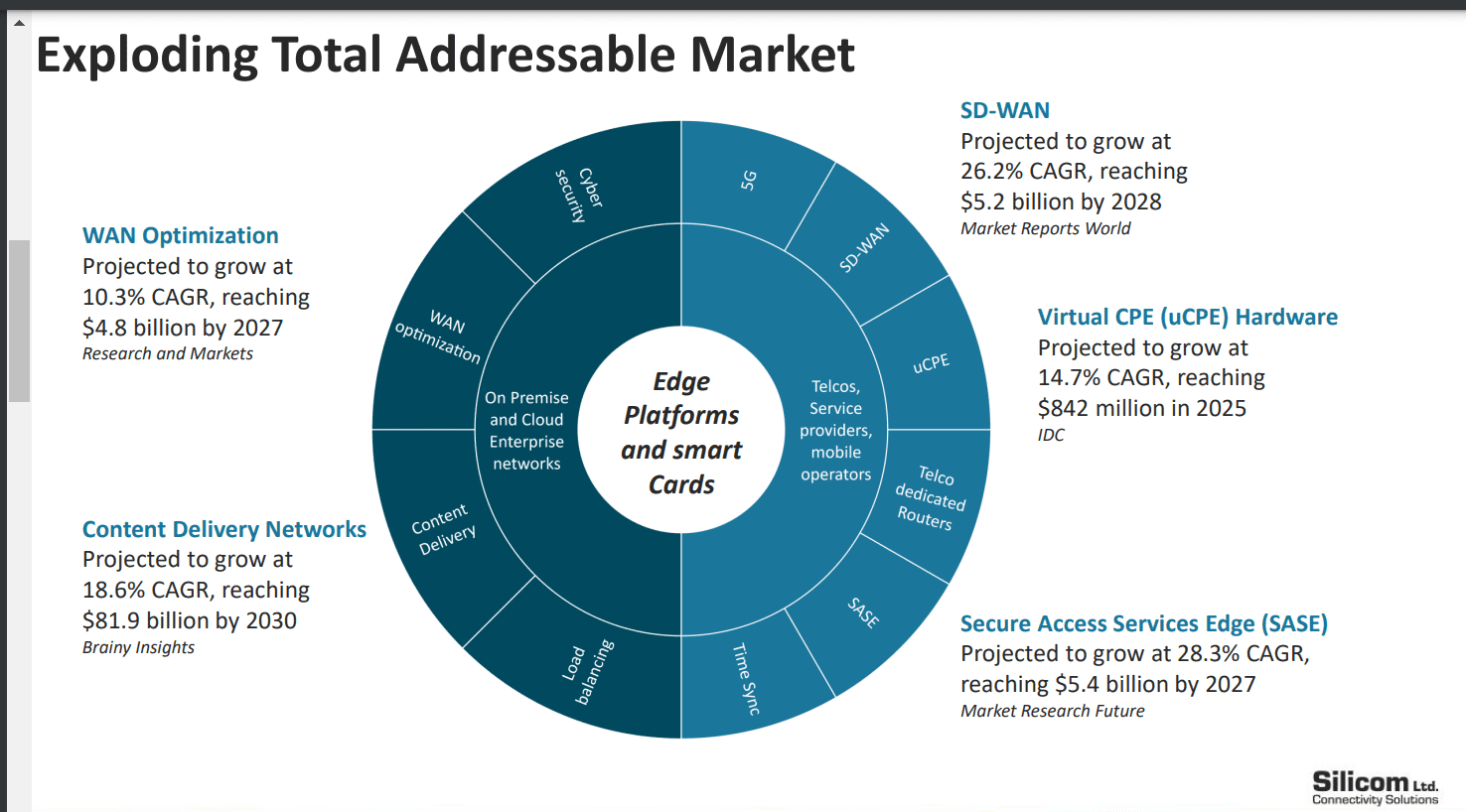

Silicom Ltd. secures major SD-WAN design win, identifies total addressable market

Israel headquartered Silicom Ltd., a leading provider of networking and data infrastructure solutions, today announced that it has secured a Design Win from an undisclosed leading SD-WAN vendor, a Fortune 500 company with SD-WAN–related customers in the Americas, APAC and EMEA. The win is for a customized version of one of Silicom’s 5G-integrated High-Runner Edge Networking products, which the vendor selected due to its unique feature-set, flexible connectivity options and compelling ‘look and feel,’ qualities that will differentiate its offerings in the competitive SD-WAN market.

According to the customer’s guidance, orders based on this Design Win are expected to ramp up throughout 2023, with deployment levels reaching a steady state beginning in 2024.

“This prestigious Design Win demonstrates, once again, the depth and quality of our Design Win pipeline and the compelling value proposition that we offer for next-generation Edge networking use cases: best-in-class Edge products based on deep 5G and LTE expertise, rapid customization capabilities, a ‘partnership’ approach and unmatched support,” commented Liron Eizenman, Silicom’s CEO.

“While this unique combination has already given us leadership of the SD-WAN space, it is also bringing us interest from additional Edge Networking use cases, such as SASE, Enhanced-Internet and telco-dedicated routing. Software vendors, telcos, services providers, cloud players and Enterprises are searching for products that can bring their products and networks stand-out performance, differentiating feature-sets and price advantages – and this is why they are selecting and evaluating our products.”

Mr. Eizenman continued, “Nothing demonstrates this more concretely than our selection by this SD-WAN leader, who chose our Edge Platform after an extremely thorough search and multiple negotiation rounds. Given this confirmation of our value, the high level of opportunities that we are already addressing and the future growth potential of the Edge Networking paradigm, we believe our Edge product family is poised to become one of our most potent growth drivers.”

About Silicom Ltd:

Silicom Ltd. is an industry-leading provider of high-performance networking and data infrastructure solutions. Designed primarily to improve performance and efficiency in Cloud and Data Center environments, Silicom’s solutions increase throughput, decrease latency and boost the performance of servers and networking appliances, the infrastructure backbone that enables advanced Cloud architectures and leading technologies like NFV, SD-WAN and Cyber Security. Our innovative solutions for high-density networking, high-speed fabric switching, offloading and acceleration, which utilize a range of cutting-edge silicon technologies as well as FPGA-based solutions, are ideal for scaling-up and scaling-out cloud infrastructures. Here’s a look at the total addressable market for their products:

Silicom products are used by major Cloud players, service providers, telcos and OEMs as components of their infrastructure offerings, including both add-on adapters in the Data Center and stand-alone virtualized/universal CPE devices at the edge.

Silicom’s long-term, trusted relationships with more than 200 customers throughout the world, its more than 400 active Design Wins and more than 300 product SKUs have made Silicom a “go-to” connectivity/performance partner of choice for technology leaders around the globe.

For more information, please visit: www.silicom.co.il

References:

https://www.silicom-usa.com/news/march-16-2022/

|

Company Contact: Eran Gilad, CFO Silicom Ltd. Tel: +972-9-764-4555 E-mail: [email protected] |

Investor Relations Contact: Ehud Helft EK Global Investor Relations Tel: +1 212 378 8040 E-mail: [email protected] |

Ookla: Fixed Broadband Speeds Increasing Faster than Mobile: 28.4% vs 16.8%

A new report from Ookla shows that fixed broadband speeds are gaining faster than mobile speeds globally. Speedtest Global Index™, tracks countries’ internet speeds and the overall global median internet speeds which are increasing across the world as countries continue to invest in fiber and 5G. Fixed broadband download speeds increased by 28% over the past year. That’s compared to a nearly 17% increase for mobile speeds, according to Speedtest Global Index™ data from November 2021 to November 2022.

Here are selected charts from their report:

Ookla is excited to see how global speeds and rankings change over the next year as individual countries and their providers choose to invest and expand different technologies, particularly in 5G and fiber. Be sure to track your country’s and check in on our monthly updates on the Speedtest Global Index. If you want more in-depth analyses and updates, subscribe to Ookla Insights™.

References:

https://www.ookla.com/articles/global-index-internet-speed-growth-2022

Ookla: State of 5G Worldwide in 2022 & Countries Where 5G is Not Available

Performance analysis of big 3 U.S. mobile operators; 5G is disappointing customers

MoffettNathanson: 87.4% of available U.S. homes have broadband; Leichtman Research: 90% of U.S. homes have internet

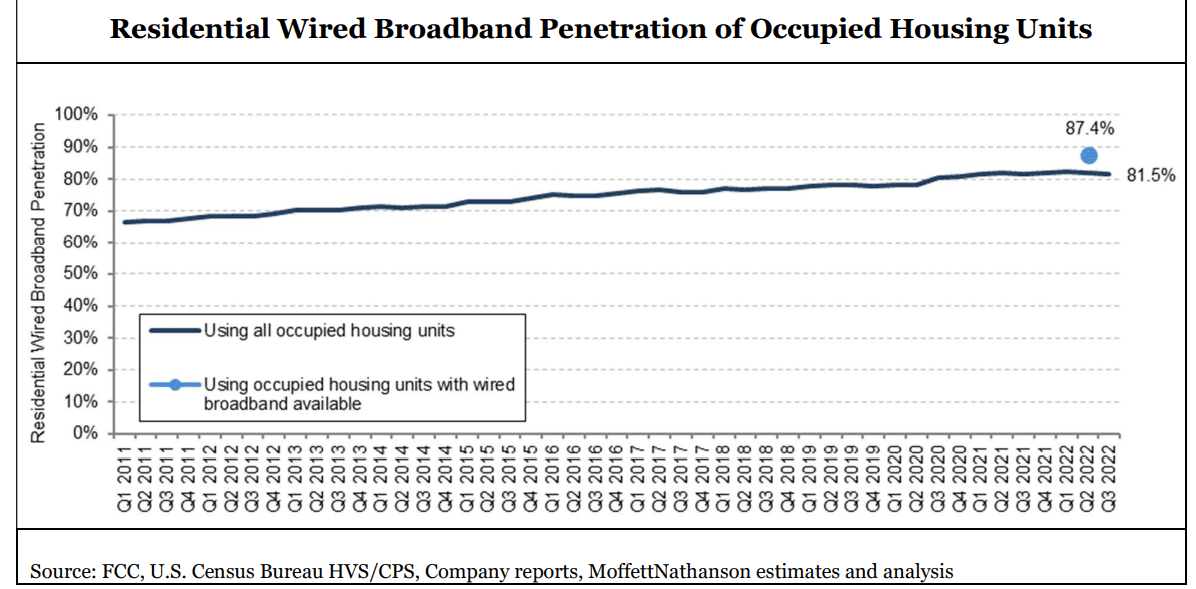

When the FCC announced the November 18th release date for their long-awaited broadband mapping update, reflecting location-specific broadband availability as of June 2022, analysts at MoffettNathanson thought it would contain information on how many of U.S. homes have access to broadband and how many are too rural and are therefore unserved. However, that FCC release didn’t offer the numbers they needed, and the market research fim didn’t

have the necessary information to calculate it themselves.

In the underlying FCC datasets, which are provided for public download, each location served by a given technology or provider is a separate entry. One location is equivalent to one street address. But many street addresses in the U.S. correspond to multiple living units, and the number of units per location is not publicly available (the location fabric used by the FCC was contracted to a third party, CostQuest Associates, and that fabric is provided only to the FCC, broadband providers, state/local government entities, and select other interested parties). With approximately 31% of residences in multifamily homes, according to a 2019 survey by the Census Bureau, the number of units per location was, as of the November 18th release, a crucial missing piece for any meaningful coverage analysis we could do on our own.

Principal Analyst Craig Moffett wrote:

The FCC’s new maps of broadband availability can tell us coverage for residential locations or business locations, but not the combined total. The companies we cover sometimes break out residential and commercial, but not always. [As an aside, about half of small businesses in the U.S. are actually operated out of peoples’ homes, but hopefully this, at least, doesn’t introduce further distortion, since we are presumably still seeing just one subscription for one location]. So we’ll do our best to make sure we’re matching numerator and denominator by specifying whether we’re looking at all locations or residential locations only.

The FCC’s coverage data also doesn’t distinguish between occupied and vacant units. For our calculation of penetration, we’d want to exclude most vacant units, since vacant units don’t need broadband. Excluding all vacant units likely understates the denominator, though; for example, some second homes (which are treated as vacant) may have year-round broadband subscriptions. The best we can do is assume the coverage of total units is the same as the coverage of occupied units, and that vacant units with broadband subscriptions are negligible.

The FCC does report service coverage for satellite and fixed wireless. But some of those FWA subscribers are in areas where there’s no access to wired broadband, while others are in areas where wired broadband is available. Naturally, the companies won’t tell us how many of each there are. So we’ll just have to leave them all out. We’ll focus just on the availability of wired broadband.

Editor’s Note: The FCC broadband map for my address show a Licensed Fixed Wireless operator serves my condo. It’s California Internet with symmetrical 1G upstream/1G downstream. Also, there are two Satellite providers – Hughes Network Systems, LLC 25M/3M and Space X 350M/40M. Wired internet is available from AT&T and Comcast.

We’d really want to know how many DSL subscribers are in each of those different cohorts. But the

companies we cover don’t report how many of their DSL subscribers are in areas where there is

also a cable or fiber operator, and how many are in areas where DSL is the only option. The first

group is at risk. The second group is not. So, we’ll just have to include all DSL.

According to the FCC’s current estimates, wired broadband (defined as anything over 200 kbps downstream and 200 kbps upstream) was available to 93.7% of residential units in America as of June 30, 2022. Again, we don’t know the percentage of occupied housing units with wired broadband available, but let’s assume it’s the same. And we don’t know the number of residential units in the location fabric, so we’ll use the Census Bureau’s estimate of 128.1M occupied housing units in the U.S. Given these assumptions, we estimate wired broadband was available to around 120.0M occupied housing units as of June 30, 2022. With, by our count, an estimated 104.9M residential wired broadband subscriptions in America in Q2 2022 – again, including DSL, and sometimes including commercial as well as residential subscribers – that translates into penetration of 87.4% of broadband-available homes. We estimate that 81.5% of all households subscribe to wired broadband.

Craig’s Conclusions:

The goal for the FCC is to create maps that are not frozen in time but instead become living and breathing reflections of a dynamic marketplace. The new maps are subject to a public challenge process, enabling interested parties, including operators, local governments, and even individual would-be subscribers, to dispute reported availability. Challenges will eventually be part of a routine updating process. Indeed, the maps released in November were the product of what had already been a months-long initial challenge process. The maps are, again, a critical input to distribution of $42.5 billion of funds earmarked for rural broadband by the JOBS/Infrastructure Act. The National Telecommunications and Information Administration (NTIA) is required by law to use the FCC’s new map to distribute those funds in what is referred to as the Broadband Equity, Access, and Deployment (BEAD) Program, something they have committed to do by June 2023. They are likely to begin that process almost immediately, based on the number of unserved locations in each state, although NTIA chief Alan Davidson has said they will wait for the FCC to release the second version of its coverage map, later this year, before they actually begin to disburse those funds.

The network operators themselves, including the cable operators in particular, will in our view be major participants in the BEAD process, bidding aggressively to bring broadband to unserved census blocks on the periphery of their current franchise areas.

…………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, Leichtman Research Group indicates that 90 per cent of U.S. households get an Internet service at home, compared to 84 per cent in 2017, and 74 per cent in 2007. Broadband accounts for 99 per cent of households with an Internet service at home, and 89 per cent of all households get a broadband Internet service – an increase from 82 per cent in 2017, and 53 per cent in 2007.

These findings are based on a survey of 1,910 households from throughout the United States and are part of a new LRG study, Broadband Internet in the U.S. 2022. This is LRG’s twentieth annual study on this topic.

Other related findings include:

- Individuals ages 65+ account for 34% of those that do not get an Internet service at home

- 56% of broadband subscribers are very satisfied (8-10 on a 1-10 scale) with their Internet service at home, while 6% are not satisfied (1-3).

- 44% of broadband subscribers do not know the download speed of their service – compared to 60% in 2017

- 61% reporting Internet speeds of >100 Mbps are very satisfied with their service, compared to 41% with speeds <50 Mbps, and 57% that do not know their speed

- 40% of broadband households get a bundle of services from a single provider – compared to 64% in 2017, and 78% in 2012

- 59% of adults with an Internet service at home watch video online daily – compared to 59% in 2020, 43% in 2017, and 17% in 2012

“The percentage of households getting an Internet service at home, including high-speed broadband, is higher than in any previous year,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Computer usage and knowledge remain the foundation for Internet services in the home. Among those that do not get an Internet service at home, 58% also do not use a computer at home..”

References:

https://broadbandmap.fcc.gov/home

https://www.leichtmanresearch.com/90-of-u-s-households-get-an-internet-service-at-home/

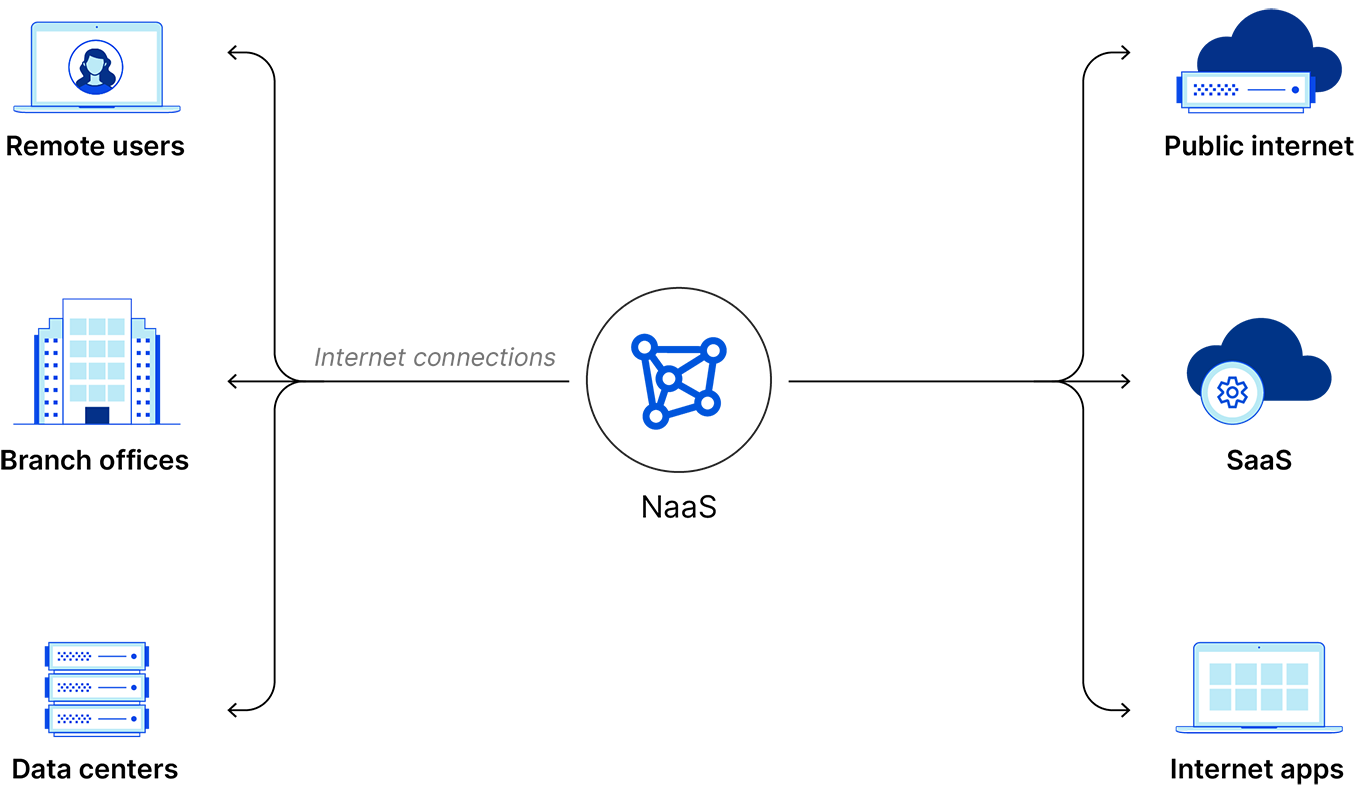

NaaS emerges as challenger to legacy network models; likely to grow rapidly along with SD WAN market

Enterprises are starting to think “much more strategically” about how to support remote and hybrid workers, with as-a-service network models beginning to take over the market, IDC Analyst Brandon Butler told SDxCentral. Organizations are increasingly looking to extend enterprise-class networks to remote and hybrid workers, a concept IDC calls “the branch of one.” IDC reported that 69% of global respondents to a recent survey are planning to invest in network transformation over the next 12 months, highlighting network-as-a-service (NaaS) as a challenger to legacy network models that necessitate substantial upfront capital.

“I would say in the early days there were a lot of what I would call band-aid solutions in terms of, well, maybe I’m just going to spin up some more VPN capacity to be able to support my remote and hybrid workers,” Butler told SDxCentral. IDC conducted a web survey of technology-buying decision makers in 402 medium to large organizations (with 500+ employees), across 13 countries in North America, Europe, and Asia/Pacific, and in nine industries to understand the role of Network as a Service in their network strategy. Here is what they found:

As organizations leverage the value of their networks to jumpstart digital transformation, the Network as a Service market is expected to grow rapidly, at a similar rate as the SD WAN market, which is forecast at a 41% compound annual growth rate from 2019 to 2024.

- The most important Network as a Service capabilities are a hybrid network and SD WAN [1.].

- Real-time, high-bandwidth capabilities are needed for the future network.

- Many enterprises outsource network services, mainly ongoing managed network services, preventative management, and network design.

- Virtualizing, automating, and modernizing the network as well as dealing with security threats are top priorities in a pandemic and post-pandemic world. Specifically – adding virtualized network and security services as well as cloud security are top of the list of things to upgrade.The majority of enterprises plan a network transformation in the next two years. Skills shortages, stakeholder buy-in, and legacy infrastructure hold back progress. The cost of doing nothing can be significant.

Note 1. According to Reasarch@Markets, the global SD-WAN market is projected to grow from USD 3.4 billion in 2022 to USD 13.7 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 31.9% during the forecast period.

In 2022, companies like Verizon and Aruba worked to bolster their NaaS offerings. The global NaaS market generated $11.2 billion in revenues in 2021, and is estimated to reach $72.2 billion in revenue by 2031, according to a report from Allied Market Research.

NaaS replaces legacy network architecture like hardware-based VPNs and MPLS connections or on-premises networking appliances like firewalls and load balancers. Enterprises use NaaS to operate and control a network without needing to purchase, own, or maintain network infrastructure.

Butler said these as-a-service models are “really helping organizations sort of transform how they’re thinking about their relationships with their vendors. Things like as-a-service models, they certainly take into account a sort of consumption model and having more subscriptions, and operating expenses versus capital expenses.”

NaaS models also bring in other benefits, like “being able to be faster or to be able to spin up services or spin down services, that sort of elasticity of them.”

The ability to add and remove features more dynamically, and manage networks from the cloud is another “tenant” that Butler said is key to as-a-service models.

“I always like to say that it’s it’s important to think about what the business needs from the IT department,” he added.

“That’s, I think, the best place to start in terms of what sort of business problems is your broader organization looking to solve and what goals does your organization have,” Butler said. “And then I think that can help determine what sort of technology solutions are the right fit to help meet those business goals.”

References:

https://www.sdxcentral.com/articles/interview/will-2023-be-the-year-of-naas/2023/01/

https://www.naasenterprisesurvey.com/#executive-summary

https://www.alliedmarketresearch.com/network-as-a-service-market

https://www.cloudflare.com/learning/network-layer/network-as-a-service-naas/

ABI Research: Network-as-a-Service market to be over $150 billion by 2030