Author: Alan Weissberger

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T and a unit of investment titan BlackRock will form a joint venture to operate a commercial fiber-optic platform, with AT&T as its first wholesale tenant. The objective is to further propel AT&T’s fiber ambitions outside of the carrier’s traditional 21-state wireline footprint and move on AT&T’s long-simmering fiber expansion plans. The newly formed joint venture (JV) — Gigapower, LLC — expects to provide a best-in-class fiber network to internet service providers (ISPs) and other businesses across the United States.

The Gigapower joint venture will operate the commercial fiber service. That service – not to be confused with AT&T’s previous “GigaPower” broadband offering – will be targeted at internet service providers (ISPs) and enterprises.

BlackRock’s work in the venture will be through its Alternatives division and through a fund managed by its Diversified Infrastructure business. That business recently raised $4.5 billion in initial investor commitments. AT&T executive veteran Bill Hogg was named CEO of Gigapower.

The JV’s initial plans are to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform. This will be incremental to AT&T’s own fiber deployment plans targeted at reaching more than 30 million locations within its 21-state wireline footprint by the end of 2025. The JV will tap into AT&T’s nationwide 5G wireless service to support sales outside of its traditional wireline footprint. This will allow it to take advantage of AT&T’s already established enterprise arrangements and more quickly get a sales channel up and running.

“Now more than ever, people are recognizing that connecting changes everything,” said John Stankey, CEO of AT&T. “With this joint venture, more customers and communities outside of our traditional service areas will receive the social and economic benefits of the world’s most durable and capable technology to access all the internet has to offer.”

“We are excited to form the Gigapower joint venture in partnership with AT&T, which will be serving as not only a joint owner but also the first wholesale tenant. We believe Gigapower’s fiber infrastructure designed as a commercial open access platform will more efficiently connect communities across the United States with critical broadband services,” said Mark Florian, Global Head of Diversified Infrastructure, BlackRock. “We look forward to partnering with Gigapower’s highly experienced management team to support the company’s fiber deployment plans and shared infrastructure business model.”

Gigapower plans to deploy a reliable, multi-gig fiber network to an initial 1.5 million customer locations across the nation using a commercial open access platform. The Gigapower fiber deployment will be incremental to AT&T’s existing target of 30 million-plus fiber locations, including business locations, by the end of 2025. Combined with existing efforts within AT&T’s 21-state footprint, this capital efficient network deployment will advance efforts to bridge the digital divide, ultimately helping to provide the fast and highly secure internet people need. This network expansion will also help spur local economies in each of the communities in which Gigapower operates.

“Fiber is the lifeblood of digital commerce,” said Bill Hogg, CEO of Gigapower. “We have a proven team of professionals building this scalable, commercial open access wireline fiber network. Our goal is to help local service providers provide fiber connectivity, create the communications infrastructure needed to power the next generation of services and bring multi-gig capabilities to help close the gap for those who currently are without multi-gig service.”

Tammy Parker, Principal Analyst at GlobalData, a leading data and analytics company, wrote:

“AT&T is pursuing a shrewd path to extend its fiber footprint nationwide without assuming all the risk by itself. Although the new Gigapower platform will be operated as a joint venture with BlackRock, offering commercial open access to not only AT&T but also other internet service providers and businesses, the carrier’s influence features prominently: the moniker ‘GigaPower’ was formerly applied to AT&T’s fiber-based service, which was renamed ‘AT&T Fiber’ in October 2016.

“The Gigapower platform will serve customers outside of AT&T’s traditional 21-state wireline footprint, and as the platform’s first wholesale tenant AT&T will be able to sell fiber service in more wireline markets, complement its nationwide mobile service footprint, and enable the carrier to market fixed-mobile service bundles in those markets. Over time, AT&T should be able to leverage this dual-technology capability to not only attract new customers and revenue streams, but also increase customer retention as subscribers who take multiple services from a carrier tend to be ‘stickier’ and less likely to stray to a rival service provider.

“The AT&T and BlackRock JV poses a competitive challenge to cable providers and regional fiber providers, whose broadband reaches are geographically restricted, though those carriers could possibly become tenants on the open access Gigapower platform to extend their own footprints.

“Gigapower will also help AT&T extend its fiber offerings to compete against the highly successful fixed wireless access (FWA) services being marketed by rivals T-Mobile US and Verizon to residential and business broadband customers both inside and outside of AT&T’s existing wireline service area. However, unlike FWA services, which can ride on top of existing mobile network coverage and are often self-installable, fiber requires the deployment of new infrastructure and truck rolls to the premises to be served, impacting time to market for AT&T and BlackRock’s ambitious plan. Additionally, Gigapower’s initial footprint will cover only 1.5 million customer locations, and it is unclear what the deployment timeline will be.

“After largely extracting itself from its previous foray into entertainment, AT&T continues doubling down on its broadband focus, committing to both 5G and fiber nationwide. AT&T’s JV with BlackRock has the potential to alter the broadband landscape, not only by enabling AT&T to market fiber in more markets but also by providing a platform for public-private broadband partnerships between Gigapower and local municipalities. However, it will take time to see results from this long-term play.”

References:

https://www.sdxcentral.com/articles/analysis/att-bags-blackrock-for-gigapower-fiber-jv/2022/12/

Ovzon receives an order from Swedish Space Corporation for SATCOM-as-a-Service

Satellite hardware company Ovzon today received an order from their new partner Swedish Space Corporation (SSC), for Ovzon’s SATCOM-as-a-Service [1.]. The initial contract covers a period during the first half of 2023.

Ovzon’s SATCOM-as-a-Service is the markets leading integrated solution. It combines Ovzon’s ultra-small mobile satellite terminals, highly resilient and high-performance satellite networks, and the best-in-industry service and support from Ovzon’s Network Operations Center (NOC).

Note 1. SATCOM-as-a-Managed Service is an end-to-end turnkey service for high-throughput connectivity that can support the demands of users on base, at varied tactical locations and during critical missions — anytime and anywhere.

With this contract, Ovzon deepens its collaboration with SSC, which acts both as the main party in the dialogue with customers, mainly within the Swedish government, and as a partner in the delivery of the service. Both are important parts of the end-to-end solution that has now been created to meet the specific and critical needs of these end customers.

“We are very happy and proud to receive this first order in collaboration with SSC. We provide the customer with a world-leading all-Swedish and highly efficient satellite communication service based on Swedish technology and innovation. The service enables a new level of capability needed in a world of heightened geopolitical unrest. Of course, we also hope for continued cooperation around our satellite Ovzon 3 and its unique features with increased mobility, performance, and resiliency. Ovzon 3 will further strengthen the ability of customers who must be able to conduct vital societal functions and protect critical infrastructure during operations in complex and vulnerable situations”, says Per Norén, CEO of Ovzon.

The Ovzon T5 is an all-in-one, laptop-sized broadband terminal providing access to the high throughput Ovzon satellite service as per this image:

In January 2022, Ovzon secured a $9.8 million contract for 14 months of Satcom as a Service (SaaS) for the Italian Fire and Rescue Service. The service will equip the Italian Fire and Rescue Service with a communications network that can support data and voice communications, and high-definition video streaming.

“Fires are an increasing threat in Italy, as climate change factors become visible in areas such as the Mediterranean. The complexity and risk to safety and rescue and disaster recovery operations requires reliable and fast communication and Ovzon’s satellite communication solution is a perfect solution for this need,” said Gaetano Morena, CEO of Gomedia Satcom.

About Ovzon:

Ovzon offers world-leading mobile satellite communications services, SATCOM-as-a-Service, to customers across the globe. The services combine high data speed with high mobility. Ovzon’s SATCOM-as-a-Service meets the growing demand for global connectivity for customers with high performance and security requirements such as Defense, Emergency Services, NGOs, Media and Commercial organizations. Ovzon was founded in 2006 and has offices in Stockholm, Sweden, Herndon, VA and Tampa, FL in the USA. Ovzon is listed on Nasdaq Stockholm Mid Cap. For more information visit www.ovzon.com.

For further information, please contact: Per Norén, CEO, [email protected], +1 206 931 7232

References:

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

As 2022 nears an end, India based telcos like Reliance Jio and Bharti Airtel have deployed about 33,000 base stations for 5G services. Sources in India’s Department of Telecommunications told businessline that the telcos deployed around 10,000 base stations in December, taking the cumulative number of base stations deployed for 5G services to about 33,000.

[For another report on 5G base stations in India see; 20,980 base stations installed for 5G, about 2,500 being set up per week, Government tells Rajya Sabha | Headlines (devdiscourse.com)]

Telecom operators commenced deploying the 5G network after Prime Minister Narendra Modi inaugurated 5G services on October 2. Only Reliance Jio and Bharti Airtel have commenced 5G capex, as debt-laden Vodafone Idea is still trying to raise additional funds to commence capital expenditure for its 5G network.

Quoting the Ministry of Communications report to the Rajya Sabha, businessline reported last week that the telcos had deployed about 21,000 base stations for 5G services till November 26. According to senior DoT officials, the telcos have added more than 10,000 additional base stations to that number.

Since operators need to deploy 2–6 base stations per tower, the number of telecom towers for 5G has not increased substantially in the past three months. The two operators alone would have deployed 3,000 to 4,000 telecom towers for 5G services.

While telcos have commenced deploying 5G towers in the majority of Indian States, the national capital Delhi is experiencing the fastest deployment of 5G services. Almost a third of all the base stations deployed are located in Delhi. Therefore, users in Delhi NCR will experience the best 5G services.

References:

Telecom operators deploy 33,000 5G base stations this year – The Hindu BusinessLine

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

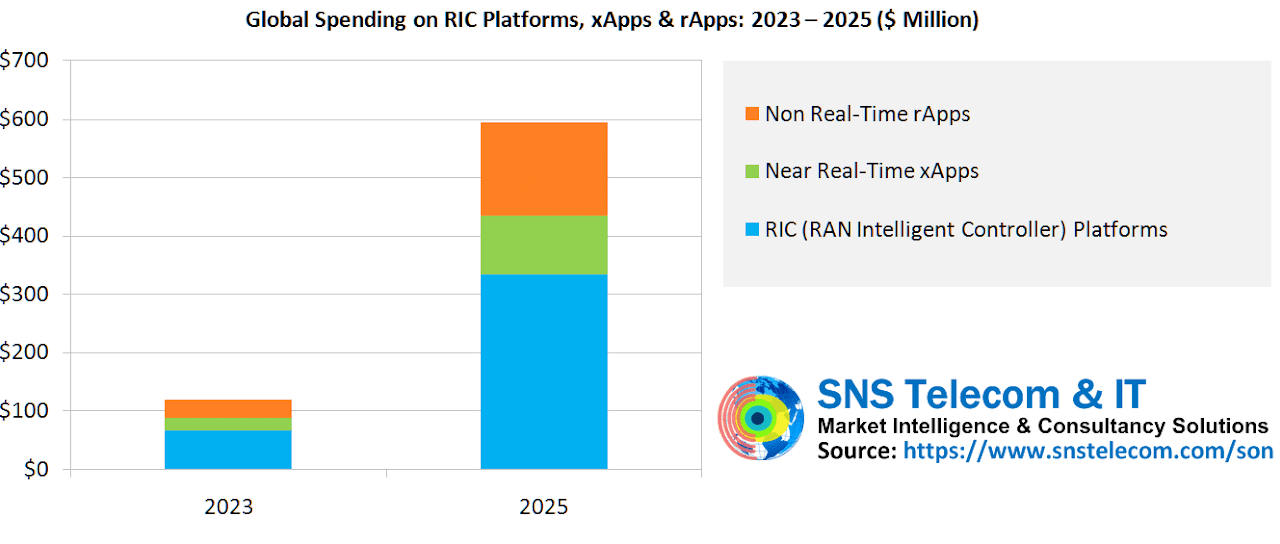

Global spending on Open RAN compliant RIC (RAN Intelligent Controller) platforms, xApps and rApps will reach nearly $600 Million by the end of 2025, according to a new report by SNS Telecom & IT. The market research and consulting firm estimates that global spending on RIC platforms, xApps and rApps will reach $120 Million in 2023 as initial implementations move from field trials to production-grade deployments. With commercial maturity, the submarket is further expected to quintuple to nearly $600 Million by the end of 2025.

Annual investments in the wider SON (Self-Organizing Network) [1.] market – which includes licensing of embedded D-SON features, third party C-SON functions and associated OSS platforms, in-house SON capabilities internally developed by mobile operators, and SON-related professional services across the RAN, mobile core and transport domains – are expected to grow at a CAGR of approximately 7% during the same period.

Note 1. SONs (Self-Organizing Networks) are radio access networks (RANs) that automatically plan, configure, manage, optimize, and heal themselves. SONs can offer automated functions such as self-configuration, self-optimization, self-healing, and self-protection.technology minimizes the lifecycle cost of running a mobile network by eliminating manual configuration of network elements at the time of deployment right through to dynamic optimization and troubleshooting during operation. Besides improving network performance and customer experience, SON can significantly reduce the cost of mobile operator services, improving the OpEx-to-revenue ratio and deferring avoidable CapEx. SONs strive to make complicated network administration a thing of the past by enabling the creation of a plug-and-play environment for both simple and complex network tasks.

…………………………………………………………………………………………………………………………………………………………………….

- AT&T is among the first mobile operators to invest in the development of Open RAN-aligned RIC functionality and associated applications – particularly xApps for real-time RAN control and optimization. Since 2019, the operator has been collaborating with Nokia and other partners to co-develop an RIC software platform and identify xApp use cases, in alignment with the O-RAN Alliance architecture, to enable RAN programmability for easy integration of new services, as well as AI (Artificial Intelligence) and ML (Machine Learning)-driven algorithms for automated optimization. At present, the mobile operator is trialing interference management, traffic steering and energy savings-related xApps across a 200-cell site cluster in New Jersey.

- As a precursor to rApp capabilities, rival operator Verizon has deployed Qualcomm’s RAN automation platform that uses AI/ML-driven algorithms to automate the optimization of new 5G NR cell sites and simplify the development of custom SON applications for its wireless network.

- New entrant DISH Network Corporation is trialing VMware’s RIC as the platform on top of which RAN applications will run. Through the trial, DISH will specifically evaluate VMware’s RIC on its ability to create custom solutions from a vibrant ecosystem of xApps and rApps, use RAN programmability and intelligence for network automation, and enhance security to monitor and protect RAN traffic at the point it enters the network.

Europe

- In Europe, Vodafone is actively investing in RIC applications within the framework of its wider Open RAN initiative. The mobile operator group – in collaboration with Cohere Technologies, VMware, Capgemini Engineering, Intel Corporation and TIP (Telecom Infra Project) – has successfully completed a multi-vendor PoC (Proof-of-Concept) trial, which demonstrated a two-fold increase in the capacity of a 5G NR cell site using a programmable, AI-based RIC platform supporting a mix of Open RAN components from multiple vendors. As part of the trial, Vodafone used Cohere’s Spectrum Multiplier xApp running on VMware’s distributed RIC to enable more efficient use of spectrum through a novel MU-MIMO (Multi-User MIMO) scheduler.

- In addition, Vodafone is collaborating with Juniper Networks and Parallel Wireless to carry out a multi-vendor RIC trial for tenant-aware admission control use cases using Open RAN standards-compliant interfaces. The trial is initially running in Vodafone’s test labs in Türkiye with plans to move into the mobile operator group’s test infrastructure.

- DT (Deutsche Telekom) is hosting the SD-RAN outdoor field trial in Berlin, Germany, that integrates the ONF’s (Open Networking Foundation) near real-time RIC and end-to-end 5G platform with Open RAN components from various vendors, including xApps for controlling RUs (Radio Units), DUs (Distributed Units) and CUs (Central Units). As part of a separate effort, DT has been collaborating with VMware and Intel Corporation to develop, test and validate an open-standards compliant intelligent vRAN solution, which also features an RIC element.

- Telefónica’s German business unit has connected a Nokia-supplied RIC to a mobile communications cluster – initially spanning 11 RAN nodes supporting 5G NR, LTE and 2G coverage in Berlin’s Hellersdorf district – within its live commercial network. In the initial “learning” phase of operation, the RIC will continuously analyze network data to detect unusual behavior of radio cells. In the second phase, the near-real-time RIC will take AI-driven decisions to dynamically balance the load of the radio cells, selecting optimum parameters from the network data obtained and continuously adjust them in near real-time. Since 2021, Telefónica has also been collaborating with NEC Corporation in validating and implementing cutting-edge Open RAN technologies and various use cases at its lab in Madrid, Spain, including AI-driven RIC applications for RAN optimization.

- BT Group is trialing Nokia’s Open RAN standards-compliant RIC platform across a number of sites in the city of Hull (East Riding of Yorkshire, England), United Kingdom, to optimize network performance for customers of the EE mobile network. French telecommunications giant Orange is also evaluating Open RAN standards-compliant RIC, xApps and rApps provided by various suppliers.

- In Asia, Japan’s Rakuten Mobile is embedding Juniper Networks’ RIC solution into its operating platform to support RAN automation and optimization-related applications.

- NTT DoCoMo is collaborating with NEC Corporation and NEC’s subsidiary Netcracker to jointly develop a RIC platform aimed at improving performance, enhancing customer experience, reducing power consumption and minimizing operational costs.

- Rival Japanese mobile operator KDDI has been collaborating with Samsung to trial various E2E (End-to-End) network slicing-related use cases with an RIC platform in Tokyo, Japan.

- China Mobile has also been working with multiple equipment vendors and third-party suppliers to develop and implement Open RAN standards-compliant RIC, xApps and rApps. Among other engagements, the mobile operator has collaborated with Nokia to carry out a field trial of an AI-powered RAN over its live commercial LTE and 5G NR network infrastructure. Specifically, the trial evaluated AI-based UE traffic prediction in Shanghai and an ML-enabled network anomaly detection solution across more than 10,000 4G/5G cells in Taiyuan.

The “SON (Self-Organizing Networks) in the 5G & Open RAN Era: 2022 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the SON market, including the value chain, market drivers, barriers to uptake, enabling technologies, functional areas, use cases, key trends, future roadmap, standardization, case studies, ecosystem player profiles and strategies. The report also provides global and regional market size forecasts for both SON and conventional mobile network optimization from 2022 till 2030, including submarket projections for three network segments, six SON architecture categories, four access technologies and five regional submarkets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The report will be of value to current and future potential investors into the SON and wider mobile network optimization market, as well as SON-x/rApp specialists, OSS and RIC platform providers, wireless network infrastructure suppliers, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “SON (Self-Organizing Networks) in the 5G & Open RAN Era: 2022 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.

For a sample of the report please contact: [email protected]

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies, and vertical applications.

References:

https://www.snstelecom.com/ric-xrapps

https://www.celona.io/network-architecture/self-organizing-network

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

StrandConsult: 2022 Year in Review & 2023 Outlook for Telecom Industry

Selected Comments by John Strand, CEO of StrandConsult:

Spectrum:

While we can fault the Chinese government for its authoritarian ways, it deserves credit for allocating the right radio spectrum frequencies to its best technological use in the case of 5G. Simply put, if you want to deploy 5G, you need mid-band spectrum in the 2.6-6 GHz range, the frequencies which maximize data transmission across distance. This is nothing more than basic physics and technocratic management, but US policymakers are failing on this front.

As of this writing the US Congress still has not reauthorized the auction authority of the Federal Communications Commission (FCC). To align the incentives and economics to best serve Americans, the FCC should have perpetual auction authority. Today the FCC only received a 3-month extension, which expire in March 2023!.

It’s hard to contemplate a modern nation being so irresponsible. We are talking about the ability of the US government to raise hundreds of billions of dollars being put on ice because the Defense Department can’t modernize. Simply put, the US military lost its spectrum edge by waging wars with non-peers for two decades. Instead of upgrading to the most spectrally-efficient tools on the appropriate frequency, the Pentagon is entrenched with bloated legacy systems on the mid-band beachfront with 12 times the spectrum that’s available for 5G.

It is remarkable that the US has achieved such incredible wireless success to date with the limited access to frequencies. But to compete with China in the future, the US will need a more aggressive approach to making mid-band spectrum available for exclusive licensed use. China has not been so foolish to squander its spectrum resources. It just unveiled a high-power, low-frequency P-band (216-450 MHz) satellite-hunting radar, reported to detect and track low-orbiting satellites and functions around the clock in all weather conditions. Observers dubbed it the “Anti-Starlink” system.

Broadband fair cost recovery:

As countries look at their populations and those who suffer a lack of digital equity, particularly people of color, low-income, and the elderly, they will see that the traditional concept of universal service should come to an end. Taxing broadband subscriptions for the sake of raising money for infrastructure does not scale when it comes to closing the digital divide for the poor.

Making the cost of broadband higher for end users undermines its affordability for the digital poor and disenfranchised. Countries will increasingly look at Big Tech to foot the bill for the unrecovered costs they impose on networks. Closing the digital divide globally and getting some 3 billion people online for the first time are also the goals of the International Telecommunications, now led by a woman for the first time in its history.

South Korea, the world’s #1 broadband nation, has long recognized that content providers have a financial responsibility to ensure the quality and delivery of their data and has had operated a cost recovery regime since 2016. South Korea enjoys the highest adoption of FTTH (86%) and 5G (47%) in part because end users are not forced to bear the full burden of the cost of broadband.

Indeed, Google’s gambit to undermine the policy effort of good faith negotiation for cost recovery backfired. It is a bad look for a company which is the single largest source of traffic in South Korea hijacking the democratic process.

Google Korea launched a series of Google ads against a Korean Assembly bill and enjoined South Korean YouTubers to join. Asia-Pacific Vice President for YouTube Gautam Anand warned that the bill would “penalize the companies that provide the content, and the creators who share a living with them.” Some 265,000 YouTubers signed the petition.

However Google’s lobbying practices came under fire in one Assembly hearing which revealed that South Korea’s leading internet advocacy non-profit OpenNet, which was founded with Google as the sole sponsor, received some $10 million to espouse favorable policy. Lawmakers questioned the relationship for what appeared to be lobbying efforts outside the organization’s remit and an official financial disclosure from the organization that noted a far lower figure than the actual gift from Google.

Big Tech may grumble about not getting to free access to networks, but they are enjoying record profits in the country. Google Korea reported its 2021 sales grew almost a third over the prior year to 292.3 billion won with 88 percent operating profit.

Netflix, another person non grata that enjoys record profits in South Korea, declares that it has “no obligation to pay for or to negotiate for the use of” another’s network. Strand Consult has detailed the Scrooge-worthy saga of Netflix’s litigation against a local broadband provider in Netflix v. SK Broadband. The David and Goliath Battle for Broadband Fair Cost Recovery in South Korea.

In the US, there is bipartisan Congressional support for the FCC to investigate the feasibility of a fair cost recovery regime. With Congress having failed to rein in Big Tech on the antitrust front, fair cost recovery remains one of the few rational, evidence-based methods to address Big Tech’s abuse of market power, namely its perversion of public policy to achieve its corporate goals and the free use of public and private resources.

Economists will have a field day exploring the cost recovery business models: market-based pay as you go (PAYG), ad taxes, usage fees, USF surcharges and so on. While there is no one size fits all for every country, there is an increasingly recognition that broadband policy must evolve. The prevailing models of broadband access where enshrined when email was the killer app of the internet more than 30 years ago. No one knew that video entertainment would become the key use case and account for 80% of the internet’s traffic. It’s time to update policy to reflect reality.

In 2023, Strand Consult will launch an update to its earlier report Middle Mile Economics: How streaming video entertainment undermines the business model for broadband. The new report describes an investigation of 50 broadband providers in 24 US states. It finds that middle mile costs are growing 2-3 times faster than household broadband revenues, that traffic from Big Tech consumes as much as 90 percent of network capacity, and that few, if any, broadband providers have been able to monetize the increase in video streaming entertainment traffic in their network.

Metaverse: Second Life 2.0?

Meta (formerly Facebook) calls its Metaverse, “the future of digital connection…moving beyond 2D screens and into immersive experiences in the metaverse, helping create the next evolution of social technology.” It’s all very exciting, the dream (or nightmare) of science-fiction turned into a commercialized reality of being ever closer to people you don’t know in a digital world. The big question is whether it will become a reality or whether it will be a replay of Second Life, which flopped big time.

To test whether the Metaverse will succeed, try innovation expert Clay Christiansen’s milkshake test. The milkshake test attempts to gauge whether a new product or service can become a reliable, affordable substitute. For example, some order a milkshake for breakfast at the fast-food drive though because it is as filling as breakfast (We are not weighing in on the nutrition here!). The milkshake question whether the firm—Meta–can produce a quasi-food beverage (or experience) such that it gets enough users with the right monetization.

For Strand Consult the more interesting questions are whether Meta will pay for the radio spectrum and infrastructure which the asserted “successor” to the mobile network will require. Meta announced a $19.2B investment in the new online world for 2023. That’s about half of the capex that the world’s mobile operators spend on RAN in a good year.

Few of the people gushing about the marvels of the Metaverse have stopped to think what it would cost, along with the other proposed online “verses”. If you are concerned about online streaming video entertainment consuming as much as 90 percent of internet bandwidth today, how will it be for broadband providers to recover costs when even more data to be pumped into networks? How will such a broadband subscription be price in today’s framework? Is it such that users are asking for every Meta bell and whistle, or do they just want some of the experience? There will need to be some policy innovation and business model upgrade before the Metaverse is real.

Emergence of the Titanium Economy: Over the top vs. Net Centric?

Strand Consult is excited about 5G and the mobile industry’s continuous improvement of its networks. 5G for home broadband, also known as Fixed Wireless Access (FWA), is a game changer and can substitute for wireline broadband in many cases. While the tower is connected to a larger network with wires and/or radio links, no wires are required to the customer’s premises, only a wireless receiving device. FWA is soon expected to account for 10 percent of all US broadband connections.

What’s beyond home broadband is the bigger question for 5G. Many want to see 5G transform industry and bring a new era of advanced healthcare, transportation, and manufacturing. Indeed some leading manufacturers already integrate 5G into their production like John Deere, Bosch, ASML and some carmakers. Even more exciting is the manufacturing renaissance afoot in USA led by small and mid-cap companies earning returns that rival the online tech/software sector. They are not widely known or discussed, but there are some 4000 of them, driving about $200b in revenue. Their startup costs are relatively low, and they take advantage of 5G, and 5G enabled AI, robotics, automation, and cloud computing. Strand Consult’s suggested holiday reading on this topic is The Titanium Economy: How Industrial Technology Can Create a Better, Faster, Stronger America by Nick Santhanam, Gaurav Batra, and Asutosh Padhi.

Strand Consult is keenly interested in the 5G value chain, where monetization will occur, and who will win. The big question is whether operators are positioned to capture the value in applications or services, or whether over the top (OTT) third parties be the winners. If 4G is any guide, the content and application providers took the prize.

Network monetization has long dogged the mobile telecom industry. In 2009, GSMA launched a suplement to premium SMS, a reboot of SMS payment introduced in 1999. However, few or non innovations succeed. Strand Consult’s report OneAPI – Next Generation Value Added Services in the Mobile Industry described many of the challenges to launch this kind of mobile network business models.

Simply put, the long-term trend for consumer monetization by mobile operators goes in a negative direction. It may be a boon for consumers that broadband prices have stayed constant (if not fallen) during this cost-of-living crisis, in the long term it does not scale for mobile operators to continually upgrade networks with better technology if they earn declining returns. This can be improved on the policy front with consolidation, lowering costs so operators can get a better case for investment. Strand Consult suggests that countries should move from 4 to 3 mobile network operator markets, as Strand Consult details in its report Understanding 4 to 3 mobile mergers.

Another needed policy reform is to modernize net neutrality. Strand Consult predicts that policymakers will pick this up in 2023.

Net neutrality:

Following the lead of United Kingdom’s Ofcom which proposes to modernize its rules, Strand Consult predicts that European and Latin American telecom regulators will issue a call for evidence on the performance of net neutrality regulation. Invariably they will find that the policy is failing consumers, innovators, and investors. These countries want to move forward with 5G smart networks, but they have policy designed to maintain a dumb pipe. This can’t be resolved, even with the proffered “5G slicing” techniques.

More important, consumers are denied their freedom of choice by being forced to value all data uniformly and equally when their preferences show that they place different values on different data. Policymakers will see that they are trading away billions of dollars in network investment for the sake of a “look good, feel good policy” which does not serve consumers, startups, or investors. Simply put, no leading 5G nation has hard net neutrality rules, and yet they protect consumers and the ecosystem with competition law and transparency rules. Strand Consult will launch a report on this topic in early 2023. Check out our library of reports and research notes covering this issue for the last decade.

Mobile operators will mature their ESG practices

Green energy consumption is a big deal in broadband. Many mobile telecom operators have formalized in Environmental, Social and Governance (ESG) goals into key performance indicators. Yet the corporate maximization of ESG by some companies has led to “greenwashing”, deceptive marketing to create the illusion of goodness and to hide malpractice perpetuated by ESG practices and regulation.

Politicians, regulators, and business leaders often claim to be focused on sustainability. Yet, few fully appreciate the difference between being truly sustainable and just “less bad”. The traditional ESG metrics of CO2 emissions, energy consumption, etc. are used as proxies for sustainability progress, but often performance is merely incrementally improved and then celebrated as sustainability. This is not sustainable – it is just “less bad” performance, as the negative impact is still there.

As such, the Future-Fit Business Benchmark has emerged for clear, actionable guidance to perform without negatively impacting people, society and the planet. European solar power producer Better Energy uses Future Fit in its provision of Purchasing Power Agreements for certified green energy to mobile telecom operators and content/application companies, and its performance model is likely to be adopted even more widely.

Another key learning is that operating parallel infrastructures with small cells is not sustainable. The business case for small cell is in network sharing. Mobile operators in United Kingdom just announced trials of a shared small cell network which hosts all 4 mobile operators.

Conclusions:

Strand Consult’s Christmas wish is that the war in Ukraine will end in 2023. We have a simple choice in this world: democratic capitalist systems with promote human freedom, rights and flourishing OR totalitarian systems which demand control over public and private life and prohibit opposition. Mobile networks telecom networks improve quality of life for their users. In 2023 Strand Consult will continue its work in policy transparency to ensure that mobile telecom networks have sustainability, security, and integrity.

This past year In 2022 Strand Consult published many research notes and reports, and featured half a dozen industry experts on our guest blog. Strand Consult’s analysis was quoted in some 1000 news stories globally. Our work took us to all the continents but Antarctica. Our readership continues to grow. For the last 22 years, Strand Consult has made predictions for the coming year. You can check our archive to see whether we were right.

Sincerely, John Strand, CEO

Iridium Introduces its NexGen Satellite IoT Data Service

Iridium Communications Inc. has announced the service introduction of Iridium Messaging TransportSM (IMTSM), a two-way cloud-native networked data service optimized for use over Iridium Certus® and designed to make it easier to add satellite connections to existing or new IoT solutions. IMT provides an IP data transport service unique to the Iridium® network, designed for small-to-moderate-sized messages supporting satellite IoT applications. Integrated with Iridium CloudConnect and Amazon Web Services (AWS), the new service can reduce development costs and speed time to market for new Iridium Connected® IoT devices. IMT has been highly anticipated by Iridium’s partner ecosystem and is currently available for the Iridium Certus 100 service with introduction on Iridium Certus 200, 350 and 700 planned for the first quarter of 2023.

As a connectionless messaging service for Iridium CertusTM modules, IMT aligns with current established server-device message constructs using hubs, Pub/Sub or queues, depending on application platforms. The IMT service can be used by a customer application that is ‘store and forward’ or has small amounts of data traffic that does not require a persistent connection between servers, utilizing an Iridium Certus terminal. Whether it’s machine-to-machine (M2M), e-mails, weather updates, transactions, or group communications, IMT enhances two-way messaging to and from anywhere in the world.

IMT is utilized with the Iridium CloudConnect model of server-side message processing, regardless of the underlying over-the-air and ground systems technologies and protocols. The Iridium CloudConnect service combines Iridium IoT capabilities with AWS cloud services extending customers’ IoT reach to the more than 85 percent of the earth that lacks terrestrial coverage. IMT utilizes industry-standard protocols and technology for managing and delivering messages in the cloud, including MQTT, HTTPS and WebSocket (WSS). This makes IMT an easier, faster, and less expensive protocol to develop with, supporting users with countless advantages to design applications that are scalable and easier to distribute to other platforms.

Among the first products built with IMT available are the RockREMOTE by Ground Control and STREAM+ by MetOcean Telematics. The RockREMOTE offers a reliable and flexible solution for industrial IoT applications including oil and gas, mining, utilities and renewables, and transport & cargo. It has a built-in MQTT application that allows developers to submit and receive data payloads across the MQTT protocol. Users can send and receive messages, pictures, to and from anywhere in the world utilizing this IMT implementation over the Iridium Certus 100 service.

Also powered by Iridium Certus 100, STREAM+ allows users to send and receive files and messages securely. Designed for field applications with size, weight, and power constraints, STREAM+ offers a range of industry standard protocols, features, and inputs simplifying integration and installation for end users and reducing development costs and overall time to market.

Also currently working on IMT service-based solutions are Iridium partners Beam Communications, Blue Sky Network, CLS Group, Globalsat Group, Lars Thrane A/S and Zunibal.

“The launch of Iridium Messaging Transport adds another powerful capability to the Iridium Certus portfolio and another value-added service for our partners and the growing IoT market,” said Bryan Hartin, executive vice president, sales and marketing, Iridium. “Our partners are excited about IMT as it will make it faster and easier for them to add Iridium satellite connectivity to new and existing solutions needed across a number of industries.”

Unique in the satellite industry, Iridium Certus is the only broadband service that provides reliable, weather-resilient connectivity for on-the-move internet, high-quality voice, email, live-action video and IoT data transfer. Through its constellation of crosslinked satellites in Low-Earth Orbit (LEO), Iridium is the only communications company that offers truly global coverage and is ideally suited for IoT applications.

In a 2021 blog post, Iridium wrote:

The Iridium® network is uniquely qualified to provide global satellite IoT services due to its network architecture of 66 Low Earth Orbit (LEO) satellites, blanketing the earth with reliable and ubiquitous coverage.

Examples of satellite IoT usage can be found across all industry verticals from the maritime market to machine-to-machine (M2M) applications in transportation, agriculture, oil and gas, utilities and construction, among many others. To help paint a clear picture of how satellite IoT is used today, let’s explore the heavy equipment market. Many of the world’s largest heavy equipment Original Equipment Manufacturers (OEMs) rely on Iridium’s satellite IoT solutions to remotely monitor and manage deployed assets. For instance, Kobelco Construction Machinery (KCM) recently partnered with Iridium to integrate Iridium’s two-way satellite communications into its hydraulic excavator machinery, heavy equipment, and remote asset management platform. Through the addition of Iridium IoT services, KCM equipment is now fitted with truly global coverage for the first time. Additionally, KCM deployed assets can be programmed to automatically deliver recurring telematics information like engine performance, run time, fault diagnostics, and other maintenance related data to customers through critical, real-time, actionable reports and alerts.

About Iridium Communications:

Iridium® is the only mobile voice and data satellite communications network that spans the entire globe. Iridium enables connections between people, organizations and assets to and from anywhere, in real time. Together with its ecosystem of partner companies, Iridium delivers an innovative and rich portfolio of reliable solutions for markets that require truly global communications. In 2019, the company completed a generational upgrade of its satellite network and launched its new specialty broadband service, Iridium Certus®. Iridium Communications Inc. is headquartered in McLean, Va., U.S.A., and its common stock trades on the Nasdaq Global Select Market under the ticker symbol IRDM. For more information about Iridium products, services and partner solutions, visit www.iridium.com.

References:

RVA LLC: Fiber Deployment in U.S. Reaches Highest Level Ever; Google Fiber Returns

Fiber facility service providers passed 7.9 million additional homes in the U.S. in 2022—the highest annual deployment ever, even with challenges in materials supply chain and labor availability, according to a fiber deployment report from the Fiber Broadband Association.

The 2022 Fiber Provider Survey was based on research conducted by RVA LLC Market Research & Consulting (RVA). Their researchers found that there are now a total of 68 million fiber broadband passings in the U.S., with strong recent increases of 13% over the past 12 months and 27% over the past two years. The survey also found that 63 million unique homes have now been passed (this figure “excludes homes with two or more fiber passings”). To date, fiber has passed nearly half of primary homes and over 10% of second homes. The annual fiber deployment rate is likely to be even higher over the next five years as BEAD and other broadband funding programs kick in.

In its research, RVA notes that although deployment expectations from individual companies are in constant flux based on many factors, many service providers have announced network builds exceeding the fiber footprint they have built through private funding. Canada is seeing strong fiber deployment as well, with about 66% of homes passed.

“High-quality broadband has become more important to consumers every year. Fiber broadband exceeds all other types of delivery in every single measurement of broadband quality, including speeds, uptime, latency, jitter, and power consumption,” Gary Bolton, Fiber Broadband Association president and CEO, said in a prepared statement. “For the consumer this has real-world impacts, like more productivity, better access to health care and education, more entrepreneurism, and the option of more rural living. For society, this means more sustainability and, ultimately, digital equity.”

Mike Render, Founder and CEO of RVA, will present the findings of the 2022 Fiber Provider Survey on Fiber for Breakfast, Wednesday, December 28, 2022, at 10:00am ET. Click here to register for the episode.

About the Fiber Broadband Association (FBA):

The Fiber Broadband Association is the largest and only trade association that represents the complete fiber ecosystem of service providers, manufacturers, industry experts, and deployment specialists dedicated to the advancement of fiber broadband deployment and the pursuit of a world where communications are limitless, advancing quality of life and digital equity anywhere and everywhere. The Fiber Broadband Association helps providers, communities, and policy makers make informed decisions about how, where, and why to build better fiber broadband networks. Since 2001, these companies, organizations, and members have worked with communities and consumers in mind to build the critical infrastructure that provides the economic and societal benefits that only fiber can deliver. The Fiber Broadband Association is part of the Fibre Council Global Alliance, which is a platform of six global FTTH Councils in North America, LATAM, Europe, MEA, APAC, and South Africa. Learn more at fiberbroadband.org.

The Fiber Broadband Association is also helping with the expansion by helping to train installers through its Optical Telecom Installation Certification (OpTIC) Path program.

Press Contact:

Ashley Schulte

Connect2 Communications for the Fiber Broadband Association

[email protected]

…………………………………………………………………………………………………………………………………………………………….

Separately, Light Reading says that Webpass to play role in Google Fiber’s new expansion efforts. “As we continue to grow our footprint across the country, we’re integrating this [wireless] method for delivering high-speed service in more areas where it makes sense in all our existing cities and in our new expansion areas as well,” Tom Brownlow, senior network operations manager at Google Fiber, and Blake Drager, the head of technology at Google Fiber’s Webpass business, wrote in a post to the company’s website.

Google Fiber recently announced talks were underway with city leaders in five states – Arizona, Colorado, Nebraska, Nevada and Idaho – about expanding fiber services to various communities. Cities to make Google Fiber’s new-build list recently include Omaha, Nebraska, Mesa, Arizona and Lakewood, Colorado. Brownlow and Drager didn’t specify which of those expansion markets might include wireless offerings.

References:

MoffettNathanson: ROI will be disappointing for new fiber deployments; FWA best for rural markets

From two recent research reports to clients, MoffettNathanson chief analyst Craig Moffett wrote:

There is no question that there will be a great deal of new fiber deployed in the U.S. But we expect it will be considerably less than current worst-case scenarios for two reasons.

- There simply isn’t sufficient labor availability for all operators to meet the projections they’ve set forth (this issue will be significantly exacerbated by the upcoming rural Broadband Equity, Access, and Deployment (BEAD) program, which will introduce a dramatic new source of labor demand).

- The expected return from fiber overbuilds will be disappointing, in our view, both because deployment costs (including the cost of capital) have risen sharply, and because expected densities of available markets are falling sharply.

We are skeptical about the returns that will be generated by fiber builds, as costs are rising and densities are falling. The spiraling costs of fiber deployment also make it likely that there will be upward, not downward, pressure on broadband ARPU in competitive markets, as overbuilders scramble to cost-justify not only their existing projects, but, perhaps more importantly, the projects on which they have not yet broken ground (and which, without a more generous ARPU assumption, can no longer be return-justified). Craig had argued earlier this year that the fiber buildout bubble may pop.

Wireless operators have an enormous cost advantage in offering fixed wireless access (FWA) service on preexisting network facilities; the marginal cost of offering FWA is zero if it is simply using excess capacity. The capacity available for such a strategy is relatively limited, making the strategic leverage of FWA relatively limited as well. Cable operators have a smaller, but still significant, cost advantage in offering wireless services that can offload at least some of their traffic onto existing infrastructure. And unlike wireless operators offering FWA, their capacity to do so is unlimited.

Almost no telecom investor with whom we have spoken views FWA as an important part of the story for the companies that actually offer it. Investors seem to have already come to the view (for the wireless operators, at least) that FWA is at best a costly sideline in rural markets. Longer term, the bigger threat to cable broadband is likely fiber rather than fixed wireless, Moffett said. But even with that, the analyst seems to be less concerned that cable operators will overspend on fiber or that overbuilders will present more competition.

The convergence arguments for fiber to the home (FTTH) are arguably even weaker. As we’ve pointed out often, AT&T’s wireline footprint covers but 45% or so of the U.S. (by population), and of that, just a third is wired for fiber. In total, then, AT&T can deliver a bundled solution to just 15% or so of the population. In our view, a strategy (bundling) that “works” in 15% of the country isn’t a strategy.

We certainly aren’t convinced that the U.S. market will be fundamentally shaped by convergence. But if it is, the cable operators, not the telcos, are positioned to benefit.

References:

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

Ookla: State of 5G Worldwide in 2022 & Countries Where 5G is Not Available

Executive Summary:

In a new blog post, Ookla asseses The State of Worldwide 5G in 2022. The market research firm examined Speedtest Intelligence® data from Q3 2022 Speedtest® results to see how 5G performance has changed since last year, where download speeds are the fastest at the country level, and how satellite technologies are offering additional options to connect. Ookla also looked at countries that don’t yet have 5G to understand where consumers are seeing improvements in 4G LTE access.

Editor’s Note: for some unknown reason, China is not included in Ookla’s report

- 5G speeds were stable at the global level with:

a] Median global 5G download speed of 168.27 Mbps in Q3 2022 as compared to 166.13 Mbps in Q3 2021

b] Median upload speed over 5G slowed slightly to 18.71 Mbps (from 21.08 Mbps) during the same period

- Ookla® 5G Map™: 127,509 5G deployments in 128 countries as of November 30, 2022, compared to 85,602 in 112 countries the year prior

- South Korea and the United Arab Emirates led countries for 5G speeds

- 5G Availability points to on-going challenges

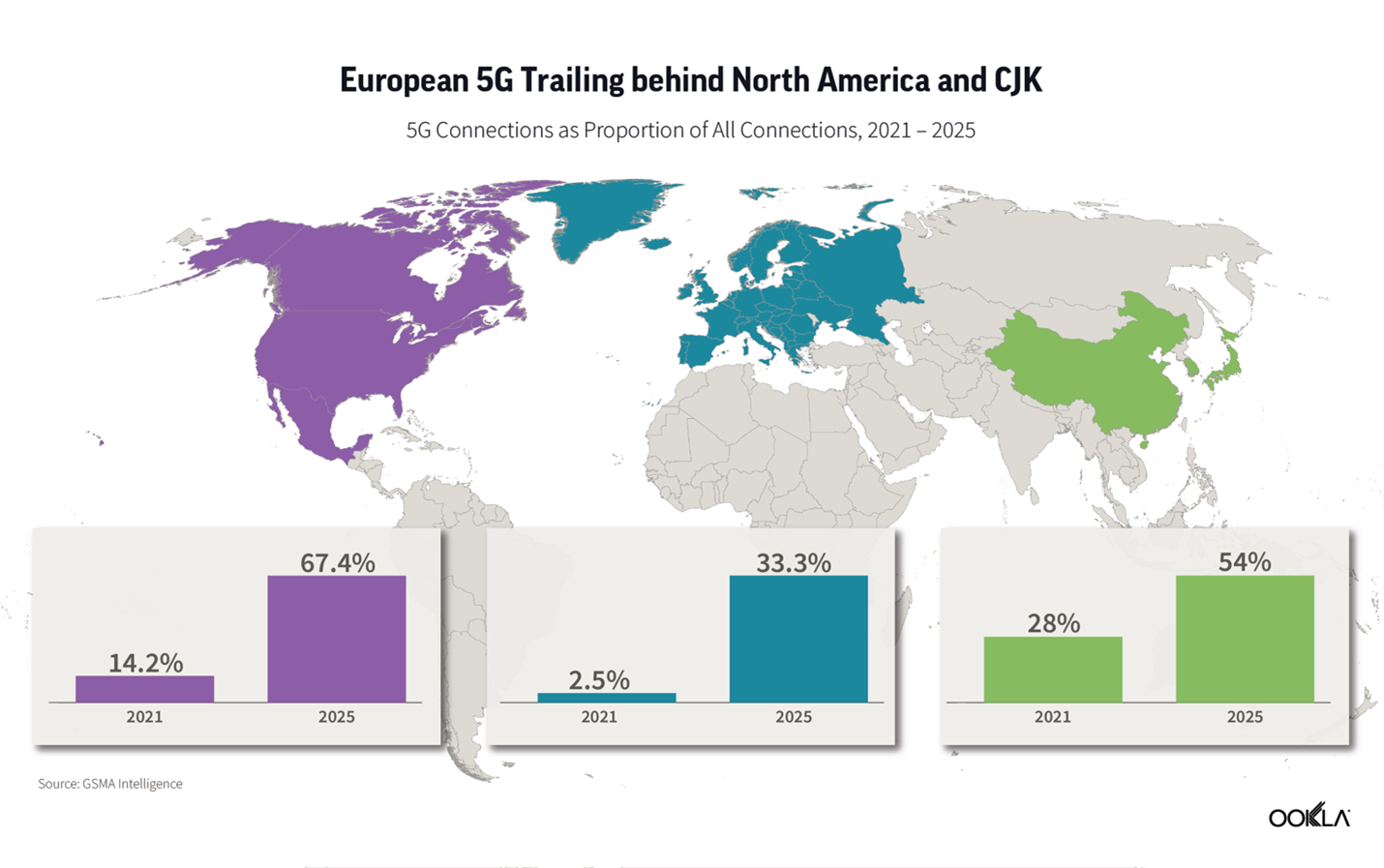

5G Availability measures the proportion of Speedtest users with 5G-capable handsets, who spend a majority of time connected to 5G networks. It’s therefore a function of 5G coverage and adoption. We see wide disparity in 5G Availability among markets worldwide, with for example the U.S. recording 54.3% in Q3 2022, well ahead of markets such as Sweden and the U.A.E., with 8.6% and 8.3% respectively.

Critical levers for mobile operators to increase 5G Availability include:

- Increasing 5G coverage by deploying additional base stations

- Obtaining access to, or refarming, sub-GHz spectrum, to help broaden 5G coverage, as sub-GHz spectrum has superior propagation properties than that of higher frequency spectrum bands.

- Encouraging 5G adoption among users with 5G-capable handsets.

Speedtest Intelligence points to 5G adoption challenges in some markets, with 5G Availability dropping in Bulgaria, South Korea, the Netherlands, and the U.A.E. As more users acquire 5G-capable devices, operators need to balance their pricing models to ensure users have sufficient incentives to purchase a 5G tariff.

Countries where 5G is not readily available:

Speedtest Intelligence showed 29 countries in the world where more than 20% of samples were from 2G and 3G connections (combined) during Q3 2022 and met our statistical threshold to be included (down from 70 in Q3 2021). These are mostly countries where 5G is still aspirational for a majority of the population, which is being left behind technologically, having to rely on decades-old technologies that are only sufficient for basic voice and texting, social media, and navigation apps. We’re glad to see so many countries fall off this list, but having so many consumers on 2G and 3G also prevents mobile operators from making 4G and 5G networks more efficient. If operators and regulators are able to work to upgrade their users to 4G and higher, everyone will benefit.

Countries That Still Rely Heavily on 2G and 3G Connections

Speedtest IntelligenceⓇ | Q3 2021

| Country | 2G & 3G Samples |

|---|---|

| Central African Republic | 76.2% |

| Turkmenistan | 58.5% |

| Kiribati | 51.6% |

| Micronesia | 47.4% |

| Rwanda | 41.1% |

| Belarus | 39.7% |

| Equatorial Guinea | 37.7% |

| Afghanistan | 36.7% |

| Palestine | 33.5% |

| Madagascar | 27.5% |

| Sudan | 27.4% |

| Lesotho | 26.5% |

| South Sudan | 26.3% |

| Benin | 26.0% |

| Guinea | 25.5% |

| Cape Verde | 24.3% |

| Tonga | 24.3% |

| Syria | 23.4% |

| The Gambia | 23.4% |

| Ghana | 23.3% |

| Palau | 22.9% |

| Niger | 22.8% |

| Tajikistan | 22.7% |

| Mozambique | 22.4% |

| Guyana | 21.8% |

| Togo | 21.8% |

| Congo | 21.1% |

| Moldova | 20.8% |

| Saint Kitts and Nevis | 20.0% |

Conclusions:

Ookla was glad to see performance levels normalize as 5G expands to more and more countries and access improves and we are optimistic that 2023 will bring further improvements. Keep track of how well your country is performing on Ookla’s Speedtest Global Index™ or track performance in thousands of cities worldwide with the Speedtest Performance Directory™.

References:

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

With its new report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries,” Strand Consult brings valuable evidence of the location, amount, and share of Chinese and non-Chinese equipment in European telecom networks. This report, the second of its kind, describes the respective amounts of 5G equipment from Huawei, ZTE, and non-Chinese vendors in European mobile networks and the share of such in equipment in the 5G Radio Access Network (RAN). Here are the highlights from the new report.

- There is little transparency about the amount, type, location, and share of 4G and 5G Chinese equipment in European networks.

- In 8 of 31 countries, more than 50% of the 5G RAN equipment comes from Chinese vendors. In 2020, it was 16 of 31 countries in which the 4G RAN equipment came from Chinese vendors.

- In one country, 100% of the 5G RAN comes from Chinese vendors. In 2020 there were 3 European countries with 100% 4G RAN equipment from Chinese vendors.

- Only 11 of 31 European countries can offer their users access to clean, non-Chinese networks.

- 41% of the mobile subscribers in Europe have access to 5G RAN from Chinese vendors. In 2020, 51% of European mobile subscribers had access to 4G RAN from Chinese vendors.

- The large European countries–Germany, Italy, Poland, Portugal, Austria, and Spain–purchase significant amounts of 5G equipment from Chinese vendors.

- Operators like Telenor and Telia in Norway, TDC in Denmark, 3 in Denmark and Sweden, T-Mobile Nederland’s, and Proximus in Belgium have switched out Chinese suppliers. None of those operators report increased networks cost or delay in 5G rollout.

- The data suggests that Germany appears not to take the security threat of China seriously. Nord Stream 2 was Germany’s debacle oil energy supplies from Russia; it appears that Germany sets up a similar scenario in the communications domain with Huawei and ZTE.

- As Germany accounts for 25% of European mobile customers, the German government’s lax approach to communications infrastructure creates a risk for Germany and all people who interconnect with German networks.

- Germany together with Italy, Poland, and Austria, comprise 50% of European mobile customers. These countries are heavily dependent on Chinese equipment, creating risk for their own nations and others which use their networks.

- In 2020, 57% of Germany’s 4G RAN came from Chinese vendors. In 2022, 59% of the 5G RAN in Germany comes from Chinese vendors.

- Huawei enjoys a higher market share in Berlin than in Beijing where it shares the market with ZTE and other vendors.

- US General Darryl A. Williams serves as the commanding general of the United States Army Europe and Africa (based in Wiesbaden, German) and commander of the Allied Land Command. He oversees more than 20,000 staff. Unwittingly when he uses a commercial mobile phone, the traffic is sent through a network built with Chinese equipment. Similarly when American military use their personal devices, they engage on a Chinese network at risk for intrusion.

Strand Consult’s report delivers detailed information about Chinese and non-Chinese network equipment in Europe at country level. The report highlights of the importance of the EU’s 5G toolbox and provides recommendations to improve its implementation. The toolbox applies to most of Europe’s 102 mobile operators across 31 countries serving some 673 million mobile customers. The report also provides valuable economic context to understand the market for RAN equipment.

The focus on 5G and 4G RAN reflects the shift of the security debate. There is consensus across most countries outside China that equipment provided by vendors owned and affiliated with the Chinese government and military poses unacceptable risk for the security and integrity of the core of the network. The discussion has evolved to whether and to what degree should such vendors be allowed to supply the RAN.

The 4G RANs studied in the 2020 report were purchased in the 12-year period of 2008-2020. Most of RANs were delivered and installed during 2009-2016 when operators upgraded their 2G and 3G networks to 4G networks. The main part of the 5G RAN was purchased, delivered, and installed after 2020.

When performing a financial analysis of the cost of restricting Huawei, one must consider that network upgrades will happen regardless of selection of vendor. There is a sunk cost to network upgrades which must be subtracted from the total cost of using a Chinese vendor.

Despite the widespread knowledge of the threat associated with using Chinese equipment, some of Europe’s largest operators have purchased and deployed Chinese 5G equipment in their networks after 2020. That decision could have major consequences for their shareholders if Europe’s policymakers conclude that it is not smart to depend on Chinese telecommunications infrastructure in the same way as it did for Russian gas.

The report is valuable for mobile operators and their shareholders, communications policymakers, security and defense analysts, network engineers, and other professionals in the field. Contact Strand Consult today to get your free copy of the report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries.”

References:

https://strandconsult.dk/field/reports/

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

Strand Consult: MWC 2022 Preview and What to Expect

Strand Consult: 5G in 2019 and 2020 telecom predictions