Author: Alan Weissberger

Dell’Oro: SASE Market grew 33% in 2022; forecast to hit $8B in 2023

According to Dell’Oro Group, the ongoing need to modernize the network and security architecture for branch offices and hybrid users led to the vigorous 33% revenue growth in the SASE [1.] market. The market research firm anticipates that enterprises will continue to place a high priority on SASE and cause the overall SASE market to grow to $8B for the full year 2023. In contrast, Gartner forecasts that total worldwide end-user spending on SASE will reach $9.2 billion in 2023, a 39% increase from 2022.

Note 1. In 2019, Gartner coined the term secure access service edge, or SASE, that brings a more secure and flexible way to perform advanced security inspection directly in the cloud, instead of backhauling application traffic to a data center before forwarding it to the cloud. This cloud-first approach to security also aligns with the increasing adoption of hybrid work post-pandemic, where workers will balance their time in the office and working remote for the foreseeable future.

……………………………………………………………………………………………………………………………………………………………….

“3Q 2022 was the seventh consecutive quarter of year-over-year SASE revenue growth topping 25%, which signals the importance enterprises are placing on SASE,” said Mauricio Sanchez, Research Director, Network Security, and SASE & SD-WAN at Dell’Oro Group. “Unlike some other network security markets we track, we expect the high investment priority will continue and lead to the SASE market eclipsing $8 B in 2023,” added Sanchez.

Image Source: https://trustgrid.io/sase/

Additional highlights from the 3Q 2022 SASE & SD-WAN Quarterly Report:

- SASE security, also referred to as SSE (the basket of products providing cloud-delivered SWG, CASB, ZTNA, and FWaaS), achieved its tenth consecutive quarter of sequential revenue expansion.

- SASE networking, synonymous with SD-WAN, had a challenging Y/Y comparison in 3Q 2022 against a very strong 3Q 2021 when enormous pent-up demand was a significant driver. Nonetheless, the ongoing trend of improved supply chains allowed vendors to better service demand and sustain a similar level of market growth compared to recent quarters.

Cisco, Fortinet, Palo Alto Networks, Symantec/Broadcom, Versa Networks, VMware and Zscaler are the leading SASE suppliers, according to Del’Oro (see different list below). However, Sanchez also mentioned another company not typically associated with SASE: Microsoft.

“The dark horse is Microsoft. Not a significant player today, but could easily become one virtually overnight,” he said. “Microsoft – Windows, Azure – has all the technology elements to not only do SASE but compete on a number of other fronts: identity management, firewalls, email/content security, WAF, DDoS, endpoint, cloud security, cloud networking. Moreover, Microsoft has been beating the drum louder about their security capabilities and desire to go after share of security wallet.”

Author’s Note: SASE is a single vendor turn key solution so vendor selection is ultra important.

The Dell’Oro Group SASE & SD-WAN report includes manufacturers’ revenue covering the SASE and Access Router markets. In addition, the report analyzes the SASE market from two perspectives, technology (SD-WAN networking and SSE security) and implementation (unified and disaggregated). The report also provides unit information for the Access Router market. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise network, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

…………………………………………………………………………………………………………………………………………………

Definition: SASE (an acronym coined by Gartner) converges network (SD-WAN, ZTNA) and network security services (SWG, CASB, FWaaS, etc). All of these services are integrated and delivered based on user and device identities, context, policies with continuous assessment of risk/trust throughout a session. This combination creates small perimeters around users, devices, and applications, that are then additionally hardened by security services.

Netskope research says that by 2024, at least 40% of enterprises are expected to have explicit strategies for adopting SASE. SASE solutions will help small to large businesses with extracting the security incidents mentioned in the below image. According to MarketWatch, the global SASE market is expected to reach $3936.4 million by 2026.

Image Source: https://trustgrid.io/sase/

According to Software Testing Help, the leading SASE vendors are:

- #1) Cato SASE (Recommended)

- #2) Perimeter 81

- #3) Twingate

- #4) Netskope

- #5) Zscaler

- #6) Barracuda Networks

- #7) VMware

- #8) Fortinet

- #9) PaloAlto Network

- #10) Akamai Enterprise Application Access

- #11) Cisco

To leverage the SASE platform, it should have cloud-native & cloud-based architecture. It should support all edges and be distributed globally across many PoPs (Points of Presence). A SASE platform with significant geographical reach will let you compete effectively and meet the requirements of low latency. A platform with agent-based capabilities can facilitate policy-based access, and some on-premises-based capabilities can provide network functions like QoS.

References:

https://www.delloro.com/news/strong-enterprise-demand-drives-sase-growth-33-percent-in-3q-2022/

https://www.softwaretestinghelp.com/top-sase-vendors/

Gartner: SASE tops Gartner list of 6 trends impacting Infrastructure & Operations over next 12 to 18 months

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

Cheerleading from 5G Americas contradicts disappointing financial results from 5G telcos

Chris Pearson, President of 5G Americas said,”5G continues to make significant progress throughout the world. The foundation of this new era of innovation is spectrum, standards (lack thereof?) and a growing ecosystem of key technologies that are being adopted by operators, vendors and end users.”

With 75 countries reporting 5G connections, most recent data from Omdia suggests 433 million global 5G connections were added from Q3 2021 to Q3 2022, almost doubling connections from 489 million to 922 million. Overall, those figures represent 14.4 percent sequential quarterly growth from 806 million in Q2 2022 to 921 million in Q3 2022. Global 5G connections are forecast to again accelerate in 2023, approaching 2 billion and reaching 5.9 billion by the end of 2027.

North America is a leader in the uptake of wireless 5G connections with a total of 108 million 5G and 506 million LTE connections by the end of Q3 2022. 5G penetration of the population in the North American market is approaching 30 percent, as the region added 14 million 5G connections for the quarter – a gain of 15.47 percent over Q2 2022. Overall, a total of 137 million 5G connections is projected to come from North America by the end of 2022, bolstered by strong 5G smartphone shipments in the US. IDC predicts the US 5G smartphone market will reach 118.1 million units shipped in 2022, showing a 27% increase from 2021.

Kristin Paulin, Principal Analyst at Omdia said, “There is still much more to come from 5G that will drive growth. Expanding mid-band coverage will bring a better 5G experience, balancing coverage and speed. And the standalone 5G deployments in progress will enable new applications that take 5G to the next level.”

In comparison, 4G LTE is expected to remain strong in Latin America and the Caribbean through the end of 2022. In Q3 2022, there were 530 million 4G LTE connections, representing 2.14 percent quarterly growth with the addition of 11 million new LTE subscriptions. Latin America and the Caribbean is projected to have 22 million 5G connections by year end of 2022, and 399 million by 2027.

According to Jose Otero, Vice President of Caribbean and Latin America for 5G Americas, “With over half a billion connections, 4G LTE is the foundation of mobile wireless connectivity throughout the Latin America region. Yet, as we look forward to the future, 5G will begin to play a bigger and bigger role for citizens in the region as deployments and connections increase significantly.”

Overall, the number of 5G commercial networks globally has reached 250, according to data from TeleGeography and 5G Americas. That number is expected to reach 253 by the end of 2022 and 397 by the end of 2025 representing strong 5G network investment growth in many regions throughout the world.

The number of 5G and 4G LTE network deployments as of December 14, 2022, are summarized below:

5G:

- Global: 250

- North America: 14

- Caribbean and Latin America: 28

4G LTE:

- Global: 702

- North America: 17

- Caribbean and Latin America: 131

Visit www.5GAmericas.org for more information, statistical charts, infographic and a list of LTE and 5G deployments by operator and region. Subscriber and forecast data is provided by Omdia and deployment data by TeleGeography (GlobalComm).

About 5G Americas: The Voice of 5G and LTE for the Americas

5G Americas is an industry trade organization composed of leading telecommunications service providers and manufacturers. The organization’s mission is to facilitate and advocate for the advancement and transformation of LTE, 5G and beyond throughout the Americas. 5G Americas is invested in developing a connected wireless community while leading 5G development for all the Americas. 5G Americas is headquartered in Bellevue, Washington. More information is available at 5G Americas’ website and Twitter.

5G Americas’ Board of Governors Members include Airspan Networks Inc., Antel, AT&T, Ciena, Cisco, Crown Castle, Ericsson, Intel, Liberty Latin America, Mavenir, Nokia, Qualcomm Incorporated, Samsung, Shaw Communications Inc., T-Mobile US, Inc., Telefónica, VMware, and WOM.

Contacts

5G Americas

Viet Nguyen

+1 206 218 6393

[email protected]

Ericsson expects RAN market to be flat with 5G build-out still in its early days; U.S. cellular industry growth to slow in 2023

Ericsson is planning for a flat RAN market and is structuring its cost base and operations accordingly. Underlying the flat market is a technology shift to 5G from earlier generation. 5G build-out is still in its early days with only about 20% of all base station sites outside China installed with 5G mid-band. Because 5G is still in its early days, vendors like Ericsson and Nokia are seeing lower margins. Therefore, they are relying more heavily on patent royalties to boost profits. Because 5G is still in its early days, vendors like Ericsson and Nokia are seeing lower margins. Therefore, they are relying more heavily on patent royalties to boost profits.

Given the rapid increase in network traffic levels, operators’ investment in performance and capacity is expected to remain robust. The 5G RAN market is expected to grow by over 11% per annum over the next three years, with potential further upside from areas such as Fixed Wireless Access, Enterprise connectivity, XR and Mission Critical Services (which require URLLC which meets performance requirements in ITU M.2410).

In Networks, Ericsson expects to expand its global footprint and enhance gross income through continued investments in technology for performance and cost leadership and, in addition, improve productivity and capital efficiency across the supply chain. In particular the Segment will continue investing in enhanced portfolio energy performance, enabled by Ericsson Silicon and innovating next-generation open architecture, such as Cloud RAN – key areas of strategic importance for its operator customers. Cloud RAN also offers potential in the enterprise segment.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, Morgan Stanley analysts forecast that the U.S. wireless industry growth will slow in 2023.

“Carriers could move to cut pricing in order to maintain their subscriber bases,” the Morgan Stanley analysts wrote in a report to investors issued Thursday. That could reduce the operators’ ability to make money, they noted. “A continued adoption of premium plans could also support wireless service revenue growth,” they added.

Morgan Stanley analysts expect the U.S. wireless industry – including Verizon, AT&T, T-Mobile, Dish Network and cable companies like Comcast and Charter Communications – to collectively add 8.7 million new postpaid phone customers during 2023. That’s down only slightly from 8.9 million during 2022 and just below the record 10 million that providers collectively added over the course of 2021.

“We see the biggest slowdown in 2023 adds at AT&T, while Verizon could grow adds modestly yoy [year over year] off a low base, and T-Mobile can do slightly better given this year saw the impact of the Sprint network shutdown,” the Morgan Stanley analysts wrote. “We will be watching the growing deployment of eSIM technology to see if it opens the door to higher switching activity, while it should also help carriers lower costs through an easier activation process.”

References:

https://www.prnewswire.com/news-releases/ericsson-capital-markets-day-2022-301704231.html

https://telecoms.com/519003/ericsson-expects-ran-market-growth-to-be-flat-for-years/

T-Mobile and Cisco launch cloud native 5G core gateway

T-Mobile US announced today that it has collaborated with Cisco to launch a first-of-its kind cloud native 5G core gateway. T-Mobile has moved all of its 5G and 4G traffic to the new cloud native converged core which provides customers with more than a 10% improvement in speeds and lower latency. The new core gateway also allows T-Mobile to more quickly and easily test and deliver new 5G and IoT services, like network slicing and Voice over 5G (VoNR) thereby expediting time to market.

The T-Mobile US 5G SA core is based on Cisco’s cloud-native control plane that uses Kubernetes to orchestrate containers running on bare metal. The companies said this frees up more than 20% of the CPU cores.

It also uses Cisco’s 8000 Series routers, 5G and 4G LTE packet core gateways, its Unified Computing System (UCS) platform, and Cisco’s Nexus 9000 Series Switches that run the vendor’s Network Services Orchestrator for full-stack automation.

“T-Mobile customers already have access to the largest, most powerful 5G network in the country, and we’re innovating every day to supercharge their experience even further,” said Delan Beah, Senior Vice President of Core Network and Services Engineering at T-Mobile. “This cloud native core gateway takes our network to new heights, allowing us to push 5G forward by delivering next-level performance for consumers and businesses nationwide while setting the stage for new applications enabled by next-gen networks.”

With a fully automated converged core gateway, T-Mobile can simplify network functions across the cloud, edge and data centers to significantly reduce operational life cycle management. The increased efficiency is an immediate benefit for customers, providing them with even faster speeds. The new core is also more distributed than ever before, leading to lower latency and advancing capabilities like edge computing.

“Our strategic relationship with T-Mobile is rooted in co-innovation, with a shared vision to establish best practices for 5G and the Internet for the Future,” said Masum Mir, Senior Vice President and General Manager, Cisco Networking Provider Mobility. “This is the type of network every operator aspires to. It will support the most advanced 5G applications for consumers and businesses today and enables T-Mobile to test and deliver new and emerging 5G and IoT applications with simplicity at scale.”

The fully automated converged core architecture is based on Cisco’s cloud native control plane, optimized with Kubernetes orchestrated containers on bare metal, freeing up over 20% of the CPU (Central Processing Unit) cores. The converged core solution uses a broad mix of Cisco’s flagship networking solutions including the Cisco 8000 Series routers, 5G and 4G packet core gateways, Cisco Unified Computing System (UCS), and Cisco Nexus 9000 Series Switches with Cisco Network Services Orchestrator for full stack automation.

T-Mobile is the U.S. leader in 5G, delivering the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers 323 million people across 1.9 million square miles – more than AT&T and Verizon combined. 260 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G, and T-Mobile plans to reach 300 million people with Ultra Capacity next year.

For more information on T-Mobile’s network, visit: https://www.t-mobile.com/coverage/4g-lte-5g-networks.

……………………………………………………………………………………………………

Cisco was part of T-Mobile US’ initial 5G SA core launch in 2020. This included the user plane, session management, and policy control functions. Those network functions run on Cisco servers, switching, and its virtualization orchestration stack.

This 5G work built on Cisco providing its packet gateway for T-Mobile’s 4G LTE mobile core, later adding its evolved packet core (EPC), and eventually virtualized the operator’s entire packet core in 2017. T-Mobile was also the first major operator to introduce Cisco’s 4G control and user plane separation (CUPS) in the EPC at production scale in 2018.

Cisco has also been core to 5G SA work by operators like Dish Network and Rakuten Mobile

References:

https://www.sdxcentral.com/articles/news/t-mobile-selects-cisco-for-cloud-native-5g-core/2022/12/

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Comcast announced in a press release it successfully tested a symmetrical multi-gigabit DOCSIS 4.0 connection on its live network, taking a major step toward “offering 10G-enabled services” in the second half of 2023. In Philadelphia, where Comcast is headquartered, it connected service at an undisclosed business location using multiple cable modems and a DOCSIS 4.0-enabled 10G node. If you’re wondering what 10G means, the answer is — more than 5G. As we noted in 2019, the cable industry rolled out its marketing term just in time to have something that’s twice as many Gb/sec as 5G wireless has.

DOCSIS 4.0 technology should enable download speeds of up to 10Gbps with 6Gbps uploads, and Comcast said a lab test in January achieved more than 4Gbps speed in both directions.

Earlier this year, Comcast announced it was working on rolling out multi-gig Internet speeds to more than 50 million residences and businesses in the U.S. by the end of 2025. The company planned on deploying 2Gbps speeds to 34 cities by the end of this month and has also given a slight bump to download speed on internet service in many areas.

The advantage of 10G tech is that it should make multi-gig speeds available for both downloads and uploads (currently, Comcast’s gigabit plans include upload speeds of just 200Mbps), just as it is with fiber optic internet connections. However, for anyone considering upgrading, we should note that you will probably need another new cable modem.

Ideally, this will increase speeds for those in places where fiber isn’t available, especially non-metropolitan areas. And in places that have competition, it measures closer against rivals that deliver fiber services, such as Verizon, AT&T, Google, and Frontier Communications, which are already offering some customers symmetrical multi-gigabit connections.

“We started this year with the announcement of our world-first test of 10G modem technology capable of delivering multi-gig speeds to homes and, as of today, 10G is a reality with the potential to transform and evolve the Internet as we know it,” said Elad Nafshi, EVP and Chief Network Officer at Comcast Cable. “It’s been an incredible year of progress, and we look forward to continuing to refine and harden our 10G technology as we work to make this service—and all its incredible benefits—available to all customers in the years ahead.”

……………………………………………………………………………………………………………………………………………………………………………………………

Separately, TDS Telecom [1.] said its new symmetrical 8Gb/sec (gig) service is already available in more than 75 of its fiber markets and runs $295 per month. While most U.S. operators [2.] are sticking with 2-gig as their top tier product for now, a handful of others have already pushed further into multi-gig territory. AT&T and Ziply Fiber, for instance, both offer residential plans providing up to 5 Gbps. And fewer still have gone beyond that. Lumen Technologies introduced an 8-gig tier for its Quantum Fiber service in August and Google Fiber has announced plans to trot out 5-gig and 8-gig plans in early 2023. Lumen’s service costs $300 per month.

Note 1. TDS Telecom offers internet service across 31 states with the greatest coverage in Wisconsin, Tennessee, and Utah.

Note 2. TDS is competing directly against AT&T, Comcast, Consolidated Communications and Lumen in the territory it serves.

While TDS in a press release pitched the 8-gig product as suitable for power users such as gamers and content creators, an operator representative told Fierce Telecom it doesn’t initially expect significant uptake of the plan. Instead, such offerings are tools in a marketing war being waged across the broadband industry.

Wire 3 offers a 10-gig service to customers in Florida, and Tennessee’s EPB and also provides a 25-gig service. However, it is not likely that consumers need those kinds of speeds currently.

On TDS’s Q3 2022 earnings call, TDS CFO Michelle Brukwicki stated its 1-gig and 2-gig plans are “important tools that will allow us to defend and win new customers.” She added nearly a quarter of new customers are taking its 1-gig service where it is available and its faster, higher-APRU tiers helped it boost residential broadband revenue in the quarter. However, TDS expects to miss 2022 fiber build target.

References:

https://corporate.comcast.com/press/releases/comcast-live-10g-connection-4-gig-symmetrical-speeds

https://www.theverge.com/2022/12/12/23505779/comcast-multi-gigabit-10g-docsis-40-cable-fiber-isp

https://www.fiercetelecom.com/broadband/tds-cranks-fiber-speeds-8-gbps

OneWeb, Jio Space Tech and Starlink have applied for licenses to launch satellite-based broadband internet in India

On December 13th, the chairman of Telecom Regulatory Authority of India (TRAI), PD Vaghela, said that India will be the first country in the world to auction spectrum for satellite communications. Noting that India’s telecom regulator (DoT was working on the matter, he added that TRAI will soon come out with ‘some sort of a model’ for the auction of space spectrum.

Addressing the Broadband India Forum summit, Vaghela said that TRAI has received a reference from the Department of Telecommunications (DoT) on the allocation of the spectrum and other allied aspects. He added that TRAI plans to streamline the process of seeking permissions from multiple ministries. In this regard, the regulator will make recommendations to the Ministry of Information and Broadcasting, Communications and the Ministry of Space to ensure ease of doing business in the sector. “Any system that we will be bringing is to actually encourage and promote investment in the sector, and not increase any burden,” added Vaghela.

Responding to questions about the status of the consultation paper on the spectrum action for satellite communication, TRAI chief said that the telecom authority was deliberating with experts and regulators globally to arrive at a suitable framework. The paper could see the light of the day only after these discussions are over. He reiterated that nanosatellites coupled with other emerging technologies would drive innovation and bridge the digital divide.

“Nanosatellites and satellite Internet of Things (IoT) would drive the next generation of technology and such innovations are expected to enable connectivity across industries and empower it and the upcoming 6G capability. Innovations in satellite ground stations, orbital services, payloads, operational systems and artificial intelligence would enable satellites to perform more complex functions,” the chairman said.

TRAI chairman’s comments have come at a time when the satellite communications arena is witnessing rapid developments. In the recently released Telecommunications Bill, 2022, the government has sought to extend the scope of telecommunication services to include satellite-based communication services.

Alongside, the center is also looking at new technologies to increase the penetration of the internet. Recently, Minister of State for Electronics and Information Technology Rajeev Chandrasekhar said that satellite communications would play a key role in delivering internet services to 1.2 Bn Indians by 2025-26.

The government recently also announced a slew of reforms for the satcom space. The center has relaxed norms for obtaining the Global Mobile Personal Communication by Satellite (GMPCS) license, which is mandatory to operate as a Satcom player in India.

So far, usual telecom players are looking to grab a pie of this burgeoning space. In the race are Airtel-backed OneWeb and Jio Space Tech. Besides, Elon Musk‘s Starlink has also applied for a license to launch satellite-based broadband in India.

As per a report, the global demand for satellite applications is expected to soar to $7 Bn by 2031. On similar lines, the overarching Indian space industry is projected to grow to $13 Bn by 2025, with the satellite launch services segment expected to garner the fastest growth.

TRAI Chairman PD Vaghela addressing Broadband India Forum

………………………………………………………………………………………………………………………………………………………

In summary:

- TRAI is said to have already received a reference from DoT for the auction of the spectrum

- TRAI will send recommendations to multiple ministries to streamline the process of permissions and enhance ease of doing business

- The government targets to deliver internet services to 1.2 B India residents by 2025-26

References:

https://inc42.com/buzz/india-to-be-first-country-to-auction-satcom-spectrum-trai-chairman/

India creates 6G Technology Innovation Group without resolving crucial telecom issues

Telecoms.com Survey Report assesses telecom industry in 2022 and outlook for 2023

Telecoms.com newly published survey report assesses the telecom industry’s performance over this year, as well as the views of the professionals participating in the survey on the outlook of 2023 and beyond. A general sense of optimism and achievement comes through as 63% of respondents believe that the business performance of telecoms in 2022 has been ‘excellent’ or ‘good’ while also reaching consensus on a positive outlook for next year.

Here are some of the key findings from the survey:

- More than two thirds view the industry’s business outlook for 2023 as positive, including about a third that believe the outlook to be very positive.

- Around two out of three respondents believe the industry’s performance in 2022 has been either excellent or good

- The majority of respondents believe 5G standalone (SA) core network will have a materially favorable effect on the adoption of 5G, but there remain many obstacles for deployment.

- Around one in three respondents report they have many service concepts to monetise as their capabilities evolve, but they find configuration and testing of services challenging.

- One in four respondents will upgrade existing BSS and charging stack to support new use cases for enterprise and B2B2X.

- Legacy infrastructure is considered the largest barrier to automated zero-touch services.

- Most respondents consider video delivery key for their telecom businesses, including more than a third who consider it a top priority.

- Healthcare and connected vehicles are the top two most interesting IoT use-cases.

- Nearly two thirds of respondents either plan to or have already deployed Open RAN commercially.

The survey report states that Security, Digital Transformation, IoT, and Broadband will be the top four areas for telecom businesses in 2023. 5G standalone core is identified as having a materially positive impact on the wider adoption of 5G. Nonetheless, high costs in network equipment and network deployment are still seen as the biggest key challenge for deploying standalone 5G.

Other challenges identified with broadband network and service automation include legacy infrastructure and siloed operations across technologies. Lack of skills and resources is also flagged as a key barrier to the deployment of IoT and also Open RAN technologies.

In terms of emerging services and technologies, Metaverse is identified with 60% as the most hyped emerging technology while more than half of respondents also view it as ‘not commercially interesting’. Meanwhile, the survey reports that more than four in five telecom professionals find video delivery as key for telecom businesses, including a third who consider it ‘top priority’.

References:

2022 has been a great year for telecoms, industry professionals say

Microsoft acquires Lumenisity – hollow core fiber high speed/low latency leader

Executive Summary:

Microsoft announced it has acquired Lumenisity® Limited, a leader in next-generation hollow core fiber (HCF) solutions. Lumenisity’s innovative and industry-leading HCF product can enable fast, reliable and secure networking for global, enterprise and large-scale organizations.

The acquisition will expand Microsoft’s ability to further optimize its global cloud infrastructure and serve Microsoft’s Cloud Platform and Services customers with strict latency and security requirements. The technology can provide benefits across a broad range of industries including healthcare, financial services, manufacturing, retail and government.

Organizations within these sectors could see significant benefit from HCF solutions as they rely on networks and datacenters that require high-speed transactions, enhanced security, increased bandwidth and high-capacity communications. For the public sector, HCF could provide enhanced security and intrusion detection for federal and local governments across the globe. In healthcare, because HCF can accommodate the size and volume of large data sets, it could help accelerate medical image retrieval, facilitating providers’ ability to ingest, persist and share medical imaging data in the cloud. And with the rise of the digital economy, HCF could help international financial institutions seeking fast, secure transactions across a broad geographic region.

Types of Hollow Core Fiber:

Various types of hollow-core photonic bandgap fibers:

(a) Photonic crystal fiber featuring small hollow core surrounded by a periodic array of large air holes.

(b) Microstructured fiber featuring medium-sized hollow core surrounded by several rings of small air holes separated by nano-size bridges.

(c) Bragg fiber featuring large hollow core surrounded by a periodic sequence of high and low refractive index layers

Lumenisity HCF benefits:

Lumenisity’s hollow core fiber technology replaces the standard glass core in a fiber cable with an air-filled chamber. According to Microsoft, light travels through air 47% faster than glass. Lumenisity’s next generation of HCF uses a proprietary design where light propagates in an air core, which has significant advantages over traditional cable built with a solid core of glass, including:

- Increased overall speed and lower latency as light travels through HCF 47% faster than standard silica glass.[1]

- Enhanced security and intrusion detection due to Lumenisity’s innovative inner structure.

- Lower costs, increased bandwidth and enhanced network quality due to elimination of fiber nonlinearities and broader spectrum.

- Potential for ultra-low signal loss enabling deployment over longer distances without repeaters.

Lumenisity was formed in 2017 as a spinoff from the world-renowned Optoelectronics Research Centre (ORC) at the University of Southampton to commercialize breakthroughs in the development of hollow core optical fiber. In 2021 and 2022, the company won the Best Fibre Component Product for their NANF® CoreSmart® HCF cable in the European Conference on Optical Communication (ECOC) Exhibition Industry Awards. As part of the Lumenisity acquisition, Microsoft plans to utilize the organization’s technology and team of industry-leading experts to accelerate innovations in networking and infrastructure.

Lumenisity said: “We are proud to be acquired by a company with a shared vision that will accelerate our progress in the hollow-core space. This is the end of the beginning, and we are excited to start our new chapter as part of Microsoft to fulfill this technology’s full potential and continue our pursuit of unlocking new capabilities in communication networks.”

………………………………………………………………………………………………………………………………………………………………..

Analysis:

The purchase is also noteworthy in light of Microsoft’s other recent acquisitions in the telecommunications sector, which include Affirmed Networks, Metaswitch Networks and AT&T’s core network operations (including 5G SA Core Network).

Microsoft isn’t the only company interested in HCF technology and Lumenisity. Both BT in the UK and Comcast in the US have tested Lumenisity’s offerings.

Comcast announced in April it was able to support speeds in the range of 10 Gbit/s to 400 Gbit/s over a 40km “hybrid” connection in Philadelphia that utilized legacy fiber and the new hollow core fiber. Comcast worked with Lumenisity.

“As we continue to develop and deploy technology to deliver 10G, multigigabit performance to tens of millions of homes, hollow core fiber will help to ensure that the network powering those experiences is among the most advanced and highest performing in the world,” said Comcast networking chief Elad Nafshi in the release issued in April.

References:

https://www.datacenterdynamics.com/en/news/microsoft-acquires-hollow-core-fiber-firm-lumenisity

Comcast Deploys Advanced Hollowcore Fiber With Faster Speed, Lower Latency

Another Opinion: 5G Fails to Deliver on Promises and Potential

Introduction:

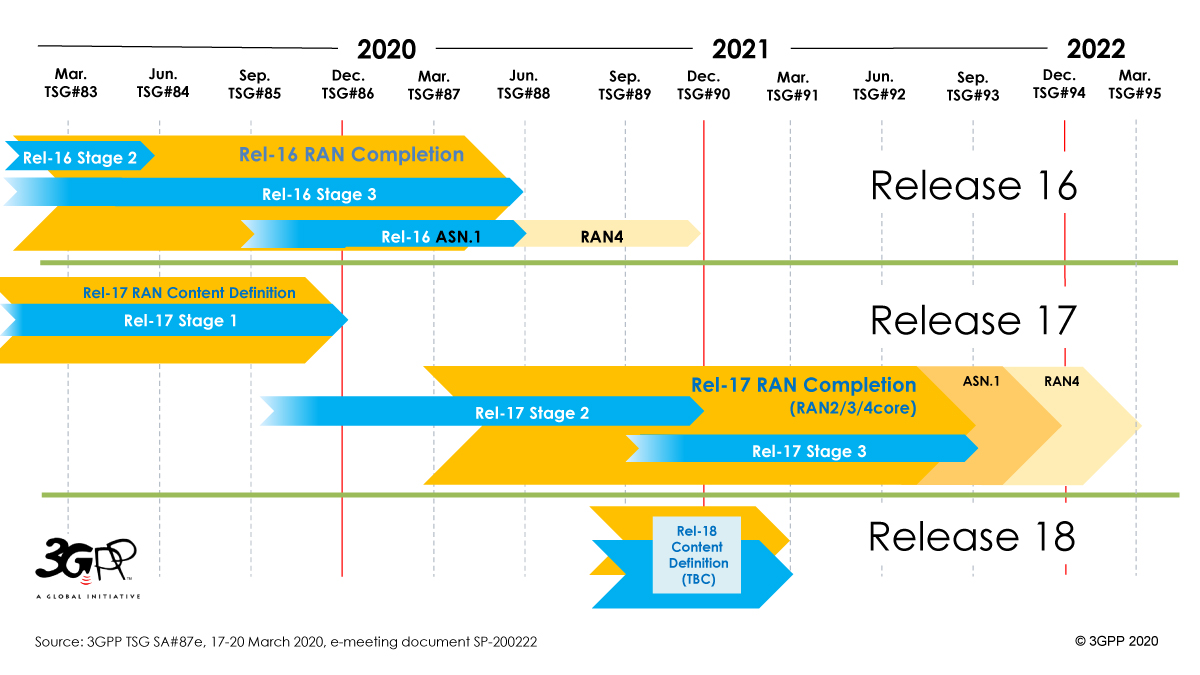

For many years now, this author has repeatedly stated that 5G would be the biggest train wreck in all of tech history. That is still the case. It’s primarily due to the lack of ITU standards (really only one- ITU M.2150) and 5G core network implementation specs (vs 5G network architecture) from 3GPP.

We’ve noted that the few 5G SA core networks deployed are all different with no interoperability or roaming between networks. I can’t emphasize enough that ALL 3GPP defined 5G functions and features (including security and network slicing) require a 5G SA core network. Yet most of the deployed 5G networks are NSA which use a 4G infrastructure for everything other than the RAN.

It also must be emphasized that the 5G URLLC Physical layer specified in ITU-R M.2150 does not meet the performance requirements in ITU-R M.2410 as the URLLC spec is based on 3GPP Release 15. Astonishingly, the 3GPP Release 16 work item “URLLC in the RAN” has yet to be completed, despite Release 16 being “frozen” in June 2020 (2 1/2 years ago). The official name of that Release 16 work item is “Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC)” with the latest spec version dated June 23, 2022. That work item is based on the outcome of the study items resulting in TR 38.824 and TR 38.825. It specifies PDCCH enhancements, UCI enhancements, PUSCH enhancements, enhanced inter UE TX prioritization/multiplexing and enhanced UL configured grant transmission.

Finally, revision 6 of ITU-R recommendation M.1036 on terrestrial 5G frequency arrangements (especially for mmWave), still has not been agreed upon by ITU-R WP5D. That has resulted in a “frequency free for all,” where each country is defining their own set of 5G mmWave frequencies which inhibits 5G end point device interoperability.

……………………………………………………………………………………………………………………………………………………………………..

In an article titled, 5G Market Growth, Mohamad Hashisho provides his view of why 5G has not lived up to its promise and potential.

Standalone 5G Is Yet to Breakout:

5G market growth still needs to feel as imposing as many imagined it. A technology created to replace previous generations still relies on their infrastructure. Standalone (SA) 5G is unrestricted by the limits of the prior generation of telecommunications technology because it does not rely on the already-existing 4G infrastructure. As a result, it can deliver the fast speeds and low latency that 5G networks have consistently promised. Clearly, standalone(SA) 5G is the way to go, so why do we not see effective implementation and marketing for it?

The numerous challenges businesses encounter while using SA are alluded to in the various telco comments about device availability, carrier aggregation, and infrastructure upgrades. The 5G New Radio system is connected to the current 4G core, the network’s command center, with older NSA. As its name suggests, SA sweeps this crutch aside and substitutes a new 5G core. But operators face several difficulties when they push it out, according to Brown. The first is the challenge of creating “cloud-native” systems, as they are known in the industry. Most operators now want to fully utilize containers, microservices, and other Internet-world technologies rather than simply virtualizing their networks. With these, networks risk being less efficient and easier to automate, and new services may take longer to launch. But the transition is proving to be challenging.

Overpromising, Yet to Deliver:

5G came out of the corner swinging. Huge promises were thrown around whenever the subject of 5g was discussed. It has been a while since 5G came to fruition, yet its market growth remain humble. Some might say that the bark was way more extensive than the bite. While some of these promises were delivered, they weren’t as grand as the ones yet to happen.

Speed was one of the main promises of 5G. And while some argue that this promise is fulfilled, others might say otherwise. Speeds are yet to reach speeds that can eclipse those of 4G. It is not only about speeds, though. It is about the availability of it. The high-speed services of 5G networks are only available in some places. Its been years and many regions are yet to receive proper 5G services. Simply put, a large portion of the dissatisfaction surrounding 5G can be attributed to the failure to fully deploy the infrastructure and the development of applications that fully utilize 5G.

5G of Tomorrow Struggles With Its Today:

5G is, without a doubt, the way to go for the future, but does its present state reflect that? Maybe. That is the issue. Years into its adoption, the answer should be decisive. Telcos might see potential in the maybes and work based on tomorrow’s potential. Consumers won’t be as patient. The consumers need the promised services now. You need to keep your customer base around with promises of the future. Especially when 4G LTE did the job well, really well.

Moreover, some areas in the US, not in struggling countries, have speeds slower than 4G LTE. Some 5G phones struggle to do the minimum tasks. Phones have to stick to specific chips capable of 5G support. But it is not about the small scale. Let’s think big, going back to the big promises 5G made. Smart cities, big-scale internet activities happening in real-time. IoT integration everywhere, controlling drones and robots from across the world. Automated cars as well, 5G was promised to deliver on all that, today and not tomorrow, but here we are.

Finally, the marketing was hit and miss, more miss, to be frank. Most consumers pay more to be 5G ready, while 5G still needs to be truly prepared. It’s hard to keep people interested when 4G is doing great. The only thing that the people needed was consistency, and sadly 5G is less consistent than some would hope.

Concluding Thoughts:

Lastly, innovation waits for none. This even includes 5G and 5G market growth. There are talks, even more than talks, about 6G. China is pushing for 6G supremacy, while Nokia and japan are starting the conversation about 7G. A major oversight that 5G missed was range. 5 G does great over small distances.

When the promises were massive in scale and global, you practically shot yourself in the foot. Time is running out for 5G, or is it pressuring 5G to live up to its potential?

……………………………………………………………………………………………………………………………………………………………………………

References:

https://insidetelecom.com/5g-market-growth/

https://www.itu.int/rec/R-REC-M.2150/en

https://www.itu.int/pub/R-REP-M.2410

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf

https://www.3gpp.org/specifications-technologies/releases/release-16

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Introduction:

Telco cloud has evolved from the much hyped (but commercially failed) NFV/Virtual Network Functions or VNFs and classical SDN architectures, to today’s more robust platforms for managing virtualized and cloud-native network functions that are tailored to the needs of telecom network workloads. This shift is bringing many new participants to the rapidly evolving telco cloud [1.] landscape.

Note 1. In this instance, “telco cloud” means running telco network functions, including 5G SA Core network on a public, private, or hybrid cloud platform. It does NOT imply that telcos are going to be cloud service providers (CSPs) and compete with Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud, IBM, Alibaba and other established CSPs. Telcos gave up on that years ago and sold most of their own data centers which they intended to make cloud resident.

………………………………………………………………………………………………………………………………………………………………………………..

In its recent Telco Cloud Evolution Survey 2022, Omdia (owned by Informa) found that both public and private cloud technology specialists are shaping this evolution. In July 2022, Omdia surveyed 49 senior operations and IT decision makers among telecom operator. Their report reveals their top-of-mind priorities, optimism, and strategies for migrating network workloads to private and public cloud.

Transitioning from VNFs to CNFs:

The existing implementations of telco cloud mostly take the virtualization technologies used in datacenter environments and apply them to telco networks. Because telcos always demand “telco-grade” network infrastructure, this virtualization of network functions is supported through a standard reference architecture for management and network orchestration (MANO) defined by ETSI. The traditional framework was defined for virtual machines (VMs) and network functions which were to be packaged as software equivalents (called network appliances) to run as instances of VMs. Therefore, a network function can be visualized as a vertically integrated stack consisting of proprietary virtualization infrastructure management (often based on OpenStack) and software packages for network functions delivered as monolithic applications on top. No one likes to admit, but the reality is that NFV has been a colossal commercial failure.

The VNFs were “lift & shift” so were hard to configure, update, test, and scale. Despite AT&T’s much publicized work, VNFs did not help telcos to completely decouple applications from specific hardware requirements. The presence of highly specific infrastructure components makes resource pooling quite difficult. In essence, the efficiencies telcos expected from virtualization have not yet been delivered.

The move to cloud native network functions (CNFs) aims to solve this problem. The softwardized network functions are delivered as modern software applications that adhere to cloud native principles. What this means is applications are designed independent of the underlying hardware and platforms. Secondly, each functionality within an application is delivered as a separate microservice that can be patched independently. Kubernetes manages the deployment, scaling, and operations of these microservices that are hosted in containers.

5G Core leads telcos’ network workload containerization efforts:

The benefits of cloud-native are driving telcos to implement network functions as containerized workloads. This has been realized in cloud native 5G SA core networks (5G Core), the architecture of which is specified in 3GPP Release 16. A key finding from the Telco Cloud Evolution Survey 2022, was that over 60% of the survey respondents picked 5G core to be run as containerized workloads. The vendor ecosystem is maturing fast to support the expectations of telecom operators. Most leading network equipment providers (NEPs) have built 5G core as cloud-native applications.

Which network functions do/will you require to be packaged in containers? (Select all that apply):

This overwhelming response from the Omnia survey respondents is indicative of their growing interest in hosting network functions in cloud environments. However, there remain several important issues and questions telcos need to think about which we now examine:

The most challenging and frequent question is whether telcos should run 5G core functions and workloads in public cloud (Dish Network and AT&T) or in their own private cloud infrastructure (T-Mobile)? The choice is influenced by multiple factors including understanding the total cost of running network functions in public vs private cloud, complying with data regulatory requirements, resilience and scalability of infrastructure, maturity of cloud platforms and tools, as well as ease of management and orchestration of resources across distributed environments.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ericsson says the adoption of cloud-native technology and the new 5G SA Core network architecture will impact six strategic domains of a telco network, each of which must be addressed and resolved during the telco’s cloud native transformation journey: Cloud infrastructure, 5G Core, 5G voice, automation and orchestration, operations and life cycle management, and security.

In the latest version of Ericsson’s cloud-native 5G Core network guide (published December 6, 2022), the vendor has identified five key insights for service providers transitioning to a cloud native 5G SA core network:

- Cloud-native transformation is a catalyst for business transformation. Leading service providers make it clear they view the transformation to cloud-native as a driver for the modernization of the rest of their business. The company’s ability to bring new products and solutions to market faster should be regarded as being of equal importance to the network investment.

- Clear strategy and planning for cloud-native transformation is paramount. Each individual service provider’s cloud-native transformation journey is different and should be planned accordingly. The common theme is that the complexity of transforming at this scale needs to be recognized, and must not be underestimated. For maximum short-and-long-term impact tailored, effective migration strategies need to be in place in advance. This ensures that investment and execution in this area forms a valuable element of an overall transformation strategy and plan.

- Frontrunners will establish first-mover advantage. Time should be a key factor in driving the plans and strategies for change. Those who start this journey early will be leading the field when they’re able to deploy new functionalities and services. A common frontrunner approach is to start with a greenfield 5G Core deployment to try out ideas and concepts without disrupting the existing network. Additionally, evolving the network will be a dynamic process, and it is crucial to bring application developers and solution vendors into the ecosystem as early as possible to start seeing faster, smoother innovation.

- Major potential for architecture simplifications. The standardization of 5G Core has been based on architecture and learnings from IT. The telecom stack should be simplified by incorporating cloud native principles into it – for example separating the lifecycle management of the network functions from that of the underlying Kubernetes infrastructure. While any transformation needs to balance both new and legacy technologies, there are clear opportunities to simplify the network and operations further by smart investment decisions in three major areas. These are: simplified core application architecture (through dual-mode 5G Core architecture); simplified cloud-native infrastructure stack (through Kubernetes over bare-metal cloud infrastructure architecture); and Automation stack.

- Readiness to automate, operate and lifecycle manage the new platform must be accelerated. Processes requiring manual intervention will not be sufficient for the levels of service expected of cloud-native 5G Core. Network automation and continuous integration and deployment (CI/CD) of software will be crucial to launch services with agility or to add new networks capabilities in line with advancing business needs. Ericsson’s customer project experience repeatedly shows us another important aspect of this area of change, telling us that the evolution to cloud-native is more than a knowledge jump or a technological upgrade – it is also a mindset change. The best platform components will not deliver their full potential if teams are not ready to use them.

Monica Zethzon, Head of Solution Area Core Networks, Ericsson said: “The time is now. Service providers need to get ready for the cloud-native transformation that will enable them to reach the full potential of 5G and drive innovation, shaping the future of industries and society. We are proud to be at the forefront of this transformation together with our leading 5G service providers partners. With this guide series we want to share our knowledge and experiences with every service provider in the world to help them preparing for their successful journeys into 5G.”

Ericsson concludes, “The real winners of the 5G era will be the service providers who can transform their core networks to take full advantage of what 5G Standalone (SA) and cloud-native technologies can offer.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Omdia says another big challenge telcos need to manage is the fragmentation in cloud-native tools and approaches adopted by various technology providers. Again, this is nothing new as telcos have faced and lived through similar situations while evolving to the NFV era. However, the scale and complexity are much bigger as network functions will be distributed, multi-vendor, and deployed across multiple clouds. The need for addressing these gaps by adopting clearly defined specifications (there are no standards for cloud native 5G core) and open-source projects is of utmost importance.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Overcoming the challenges telcos face on their journey to containerized network functions

https://omdia.tech.informa.com/OM023495/Telco-Cloud-Evolution-Survey–2022

https://www.ericsson.com/en/news/2022/10/ericsson-publishes-the-cloud-native

https://www.t-mobile.com/news/network/t-mobile-lights-up-standalone-ultra-capacity-5g-nationwide