5G SA/5G Core network

Vodafone Germany plans to activate 2,700 new 5G cell sites in 1H 2023

Vodafone Germany plans to activate 2,700 new 5G cell sites with a total of 8,000 antennas in the first half of 2023, the telco said today in a press release. The company has so far connected 80% of the German population with 5G. It has activated 5G at 12,000 sites with more than 36,000 antennas altogether. For the 5G expansion, Vodafone Germany is relying on frequencies in the 3.6 GHz, 1.8 GHz and 700 MHz bands in large urban areas, residential areas and suburbs, and rural areas across Germany.

During 2022, Vodafone technicians commissioned 5,450 5G sites with more than 16,000 antennas. In total, Vodafone has already equipped 36,000 antennas with 5G, the company has said. The network operator said its 5G network is already providing coverage to 65 million people across the country, representing nearly 80% of Germany’s population.

Vodafone Germany had previously noted that its 5G Standalone (SA) network is currently available to nearly 20 million people across Germany. Vodafone previously said that 5G SA technology will reach nationwide coverage by 2025. The German telco had already deployed over 3,000 base stations for the provision of 5G SA services. Vodafone initially launched its 5G network in Germany in 2019, using 3.5 GHz frequencies that it acquired from Telefónica in 2018.

The telco also said it will continue to expand its LTE infrastructure across the country. Nationwide, Vodafone said it currently supplies around 98% of households with LTE.

“In 2023, Vodafone will bring the LTE mobile communications standard to even more people and to even more places: almost 1,900 expansion measures are pending in the first half of the year to set up new stations, carry out modernization work and install additional LTE antennas at existing stations,” Vodafone said.

“Together with Altice, Vodafone will start Germany’s largest fiber optic alliance in spring 2023, subject to the approval of the antitrust authorities. The goal is to supply up to 7 million households with new fiber optic connections in the next 6 years,” Vodafone added.

Vodafone Germany had recently successfully completed a field test with Open RAN (O-RAN) technology in Plauen, in the Saxony region.

The German carrier had recently announced that it will carry out comprehensive pilot projects for open 5G radio access networks at several locations in Germany. The first two stations for the operator’s O-RAN technology are located in rural Bavaria. The pilots are scheduled to start in early 2023 and mark the beginning of a broader deployment of O-RAN technology in Vodafone’s European mobile networks.

The pilot projects will use O-RAN hardware and software, which Vodafone successfully tested in the U.K. earlier this year. Samsung is currently supplying mobile technology and software for these O-RAN trials.

Separately, Vodafone has agreed to sell its Hungarian division for €1.7billion (£1.5billion) to local telecoms company 4iG and the Hungarian state. The sale is expected to be completed this month, with the proceeds to be used to pay off some of Vodafone’s debt.

References:

T-Mobile and Cisco launch cloud native 5G core gateway

T-Mobile US announced today that it has collaborated with Cisco to launch a first-of-its kind cloud native 5G core gateway. T-Mobile has moved all of its 5G and 4G traffic to the new cloud native converged core which provides customers with more than a 10% improvement in speeds and lower latency. The new core gateway also allows T-Mobile to more quickly and easily test and deliver new 5G and IoT services, like network slicing and Voice over 5G (VoNR) thereby expediting time to market.

The T-Mobile US 5G SA core is based on Cisco’s cloud-native control plane that uses Kubernetes to orchestrate containers running on bare metal. The companies said this frees up more than 20% of the CPU cores.

It also uses Cisco’s 8000 Series routers, 5G and 4G LTE packet core gateways, its Unified Computing System (UCS) platform, and Cisco’s Nexus 9000 Series Switches that run the vendor’s Network Services Orchestrator for full-stack automation.

“T-Mobile customers already have access to the largest, most powerful 5G network in the country, and we’re innovating every day to supercharge their experience even further,” said Delan Beah, Senior Vice President of Core Network and Services Engineering at T-Mobile. “This cloud native core gateway takes our network to new heights, allowing us to push 5G forward by delivering next-level performance for consumers and businesses nationwide while setting the stage for new applications enabled by next-gen networks.”

With a fully automated converged core gateway, T-Mobile can simplify network functions across the cloud, edge and data centers to significantly reduce operational life cycle management. The increased efficiency is an immediate benefit for customers, providing them with even faster speeds. The new core is also more distributed than ever before, leading to lower latency and advancing capabilities like edge computing.

“Our strategic relationship with T-Mobile is rooted in co-innovation, with a shared vision to establish best practices for 5G and the Internet for the Future,” said Masum Mir, Senior Vice President and General Manager, Cisco Networking Provider Mobility. “This is the type of network every operator aspires to. It will support the most advanced 5G applications for consumers and businesses today and enables T-Mobile to test and deliver new and emerging 5G and IoT applications with simplicity at scale.”

The fully automated converged core architecture is based on Cisco’s cloud native control plane, optimized with Kubernetes orchestrated containers on bare metal, freeing up over 20% of the CPU (Central Processing Unit) cores. The converged core solution uses a broad mix of Cisco’s flagship networking solutions including the Cisco 8000 Series routers, 5G and 4G packet core gateways, Cisco Unified Computing System (UCS), and Cisco Nexus 9000 Series Switches with Cisco Network Services Orchestrator for full stack automation.

T-Mobile is the U.S. leader in 5G, delivering the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers 323 million people across 1.9 million square miles – more than AT&T and Verizon combined. 260 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G, and T-Mobile plans to reach 300 million people with Ultra Capacity next year.

For more information on T-Mobile’s network, visit: https://www.t-mobile.com/coverage/4g-lte-5g-networks.

……………………………………………………………………………………………………

Cisco was part of T-Mobile US’ initial 5G SA core launch in 2020. This included the user plane, session management, and policy control functions. Those network functions run on Cisco servers, switching, and its virtualization orchestration stack.

This 5G work built on Cisco providing its packet gateway for T-Mobile’s 4G LTE mobile core, later adding its evolved packet core (EPC), and eventually virtualized the operator’s entire packet core in 2017. T-Mobile was also the first major operator to introduce Cisco’s 4G control and user plane separation (CUPS) in the EPC at production scale in 2018.

Cisco has also been core to 5G SA work by operators like Dish Network and Rakuten Mobile

References:

https://www.sdxcentral.com/articles/news/t-mobile-selects-cisco-for-cloud-native-5g-core/2022/12/

Another Opinion: 5G Fails to Deliver on Promises and Potential

Introduction:

For many years now, this author has repeatedly stated that 5G would be the biggest train wreck in all of tech history. That is still the case. It’s primarily due to the lack of ITU standards (really only one- ITU M.2150) and 5G core network implementation specs (vs 5G network architecture) from 3GPP.

We’ve noted that the few 5G SA core networks deployed are all different with no interoperability or roaming between networks. I can’t emphasize enough that ALL 3GPP defined 5G functions and features (including security and network slicing) require a 5G SA core network. Yet most of the deployed 5G networks are NSA which use a 4G infrastructure for everything other than the RAN.

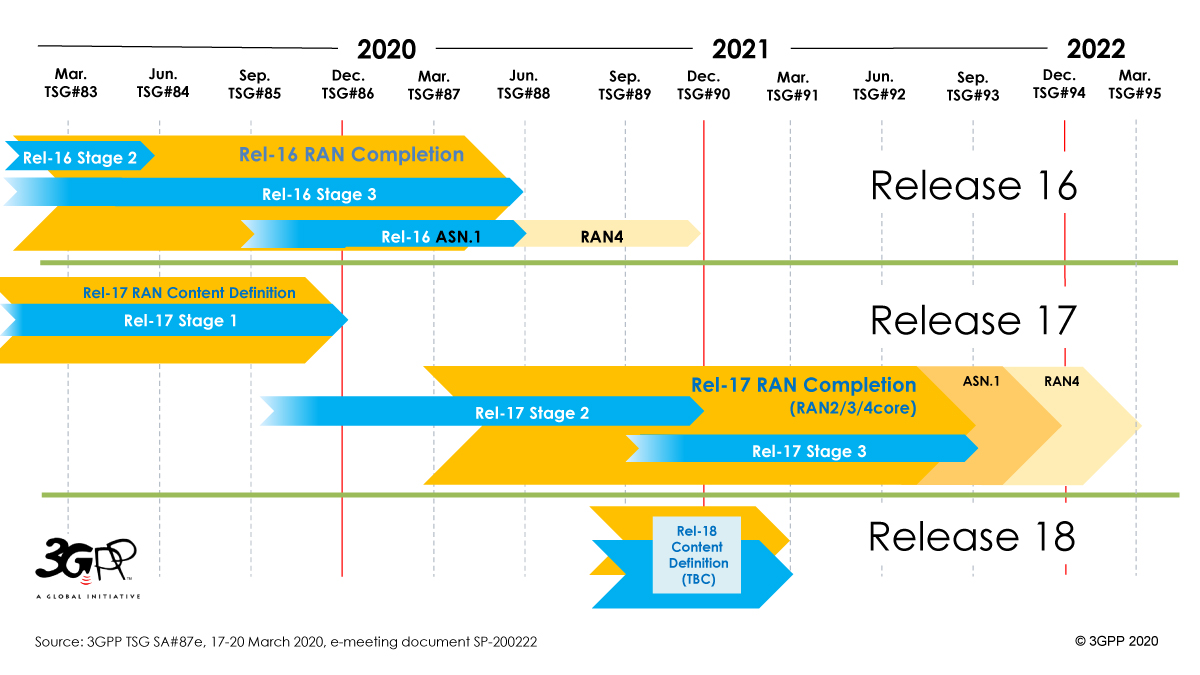

It also must be emphasized that the 5G URLLC Physical layer specified in ITU-R M.2150 does not meet the performance requirements in ITU-R M.2410 as the URLLC spec is based on 3GPP Release 15. Astonishingly, the 3GPP Release 16 work item “URLLC in the RAN” has yet to be completed, despite Release 16 being “frozen” in June 2020 (2 1/2 years ago). The official name of that Release 16 work item is “Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC)” with the latest spec version dated June 23, 2022. That work item is based on the outcome of the study items resulting in TR 38.824 and TR 38.825. It specifies PDCCH enhancements, UCI enhancements, PUSCH enhancements, enhanced inter UE TX prioritization/multiplexing and enhanced UL configured grant transmission.

Finally, revision 6 of ITU-R recommendation M.1036 on terrestrial 5G frequency arrangements (especially for mmWave), still has not been agreed upon by ITU-R WP5D. That has resulted in a “frequency free for all,” where each country is defining their own set of 5G mmWave frequencies which inhibits 5G end point device interoperability.

……………………………………………………………………………………………………………………………………………………………………..

In an article titled, 5G Market Growth, Mohamad Hashisho provides his view of why 5G has not lived up to its promise and potential.

Standalone 5G Is Yet to Breakout:

5G market growth still needs to feel as imposing as many imagined it. A technology created to replace previous generations still relies on their infrastructure. Standalone (SA) 5G is unrestricted by the limits of the prior generation of telecommunications technology because it does not rely on the already-existing 4G infrastructure. As a result, it can deliver the fast speeds and low latency that 5G networks have consistently promised. Clearly, standalone(SA) 5G is the way to go, so why do we not see effective implementation and marketing for it?

The numerous challenges businesses encounter while using SA are alluded to in the various telco comments about device availability, carrier aggregation, and infrastructure upgrades. The 5G New Radio system is connected to the current 4G core, the network’s command center, with older NSA. As its name suggests, SA sweeps this crutch aside and substitutes a new 5G core. But operators face several difficulties when they push it out, according to Brown. The first is the challenge of creating “cloud-native” systems, as they are known in the industry. Most operators now want to fully utilize containers, microservices, and other Internet-world technologies rather than simply virtualizing their networks. With these, networks risk being less efficient and easier to automate, and new services may take longer to launch. But the transition is proving to be challenging.

Overpromising, Yet to Deliver:

5G came out of the corner swinging. Huge promises were thrown around whenever the subject of 5g was discussed. It has been a while since 5G came to fruition, yet its market growth remain humble. Some might say that the bark was way more extensive than the bite. While some of these promises were delivered, they weren’t as grand as the ones yet to happen.

Speed was one of the main promises of 5G. And while some argue that this promise is fulfilled, others might say otherwise. Speeds are yet to reach speeds that can eclipse those of 4G. It is not only about speeds, though. It is about the availability of it. The high-speed services of 5G networks are only available in some places. Its been years and many regions are yet to receive proper 5G services. Simply put, a large portion of the dissatisfaction surrounding 5G can be attributed to the failure to fully deploy the infrastructure and the development of applications that fully utilize 5G.

5G of Tomorrow Struggles With Its Today:

5G is, without a doubt, the way to go for the future, but does its present state reflect that? Maybe. That is the issue. Years into its adoption, the answer should be decisive. Telcos might see potential in the maybes and work based on tomorrow’s potential. Consumers won’t be as patient. The consumers need the promised services now. You need to keep your customer base around with promises of the future. Especially when 4G LTE did the job well, really well.

Moreover, some areas in the US, not in struggling countries, have speeds slower than 4G LTE. Some 5G phones struggle to do the minimum tasks. Phones have to stick to specific chips capable of 5G support. But it is not about the small scale. Let’s think big, going back to the big promises 5G made. Smart cities, big-scale internet activities happening in real-time. IoT integration everywhere, controlling drones and robots from across the world. Automated cars as well, 5G was promised to deliver on all that, today and not tomorrow, but here we are.

Finally, the marketing was hit and miss, more miss, to be frank. Most consumers pay more to be 5G ready, while 5G still needs to be truly prepared. It’s hard to keep people interested when 4G is doing great. The only thing that the people needed was consistency, and sadly 5G is less consistent than some would hope.

Concluding Thoughts:

Lastly, innovation waits for none. This even includes 5G and 5G market growth. There are talks, even more than talks, about 6G. China is pushing for 6G supremacy, while Nokia and japan are starting the conversation about 7G. A major oversight that 5G missed was range. 5 G does great over small distances.

When the promises were massive in scale and global, you practically shot yourself in the foot. Time is running out for 5G, or is it pressuring 5G to live up to its potential?

……………………………………………………………………………………………………………………………………………………………………………

References:

https://insidetelecom.com/5g-market-growth/

https://www.itu.int/rec/R-REC-M.2150/en

https://www.itu.int/pub/R-REP-M.2410

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf

https://www.3gpp.org/specifications-technologies/releases/release-16

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Introduction:

Telco cloud has evolved from the much hyped (but commercially failed) NFV/Virtual Network Functions or VNFs and classical SDN architectures, to today’s more robust platforms for managing virtualized and cloud-native network functions that are tailored to the needs of telecom network workloads. This shift is bringing many new participants to the rapidly evolving telco cloud [1.] landscape.

Note 1. In this instance, “telco cloud” means running telco network functions, including 5G SA Core network on a public, private, or hybrid cloud platform. It does NOT imply that telcos are going to be cloud service providers (CSPs) and compete with Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud, IBM, Alibaba and other established CSPs. Telcos gave up on that years ago and sold most of their own data centers which they intended to make cloud resident.

………………………………………………………………………………………………………………………………………………………………………………..

In its recent Telco Cloud Evolution Survey 2022, Omdia (owned by Informa) found that both public and private cloud technology specialists are shaping this evolution. In July 2022, Omdia surveyed 49 senior operations and IT decision makers among telecom operator. Their report reveals their top-of-mind priorities, optimism, and strategies for migrating network workloads to private and public cloud.

Transitioning from VNFs to CNFs:

The existing implementations of telco cloud mostly take the virtualization technologies used in datacenter environments and apply them to telco networks. Because telcos always demand “telco-grade” network infrastructure, this virtualization of network functions is supported through a standard reference architecture for management and network orchestration (MANO) defined by ETSI. The traditional framework was defined for virtual machines (VMs) and network functions which were to be packaged as software equivalents (called network appliances) to run as instances of VMs. Therefore, a network function can be visualized as a vertically integrated stack consisting of proprietary virtualization infrastructure management (often based on OpenStack) and software packages for network functions delivered as monolithic applications on top. No one likes to admit, but the reality is that NFV has been a colossal commercial failure.

The VNFs were “lift & shift” so were hard to configure, update, test, and scale. Despite AT&T’s much publicized work, VNFs did not help telcos to completely decouple applications from specific hardware requirements. The presence of highly specific infrastructure components makes resource pooling quite difficult. In essence, the efficiencies telcos expected from virtualization have not yet been delivered.

The move to cloud native network functions (CNFs) aims to solve this problem. The softwardized network functions are delivered as modern software applications that adhere to cloud native principles. What this means is applications are designed independent of the underlying hardware and platforms. Secondly, each functionality within an application is delivered as a separate microservice that can be patched independently. Kubernetes manages the deployment, scaling, and operations of these microservices that are hosted in containers.

5G Core leads telcos’ network workload containerization efforts:

The benefits of cloud-native are driving telcos to implement network functions as containerized workloads. This has been realized in cloud native 5G SA core networks (5G Core), the architecture of which is specified in 3GPP Release 16. A key finding from the Telco Cloud Evolution Survey 2022, was that over 60% of the survey respondents picked 5G core to be run as containerized workloads. The vendor ecosystem is maturing fast to support the expectations of telecom operators. Most leading network equipment providers (NEPs) have built 5G core as cloud-native applications.

Which network functions do/will you require to be packaged in containers? (Select all that apply):

This overwhelming response from the Omnia survey respondents is indicative of their growing interest in hosting network functions in cloud environments. However, there remain several important issues and questions telcos need to think about which we now examine:

The most challenging and frequent question is whether telcos should run 5G core functions and workloads in public cloud (Dish Network and AT&T) or in their own private cloud infrastructure (T-Mobile)? The choice is influenced by multiple factors including understanding the total cost of running network functions in public vs private cloud, complying with data regulatory requirements, resilience and scalability of infrastructure, maturity of cloud platforms and tools, as well as ease of management and orchestration of resources across distributed environments.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ericsson says the adoption of cloud-native technology and the new 5G SA Core network architecture will impact six strategic domains of a telco network, each of which must be addressed and resolved during the telco’s cloud native transformation journey: Cloud infrastructure, 5G Core, 5G voice, automation and orchestration, operations and life cycle management, and security.

In the latest version of Ericsson’s cloud-native 5G Core network guide (published December 6, 2022), the vendor has identified five key insights for service providers transitioning to a cloud native 5G SA core network:

- Cloud-native transformation is a catalyst for business transformation. Leading service providers make it clear they view the transformation to cloud-native as a driver for the modernization of the rest of their business. The company’s ability to bring new products and solutions to market faster should be regarded as being of equal importance to the network investment.

- Clear strategy and planning for cloud-native transformation is paramount. Each individual service provider’s cloud-native transformation journey is different and should be planned accordingly. The common theme is that the complexity of transforming at this scale needs to be recognized, and must not be underestimated. For maximum short-and-long-term impact tailored, effective migration strategies need to be in place in advance. This ensures that investment and execution in this area forms a valuable element of an overall transformation strategy and plan.

- Frontrunners will establish first-mover advantage. Time should be a key factor in driving the plans and strategies for change. Those who start this journey early will be leading the field when they’re able to deploy new functionalities and services. A common frontrunner approach is to start with a greenfield 5G Core deployment to try out ideas and concepts without disrupting the existing network. Additionally, evolving the network will be a dynamic process, and it is crucial to bring application developers and solution vendors into the ecosystem as early as possible to start seeing faster, smoother innovation.

- Major potential for architecture simplifications. The standardization of 5G Core has been based on architecture and learnings from IT. The telecom stack should be simplified by incorporating cloud native principles into it – for example separating the lifecycle management of the network functions from that of the underlying Kubernetes infrastructure. While any transformation needs to balance both new and legacy technologies, there are clear opportunities to simplify the network and operations further by smart investment decisions in three major areas. These are: simplified core application architecture (through dual-mode 5G Core architecture); simplified cloud-native infrastructure stack (through Kubernetes over bare-metal cloud infrastructure architecture); and Automation stack.

- Readiness to automate, operate and lifecycle manage the new platform must be accelerated. Processes requiring manual intervention will not be sufficient for the levels of service expected of cloud-native 5G Core. Network automation and continuous integration and deployment (CI/CD) of software will be crucial to launch services with agility or to add new networks capabilities in line with advancing business needs. Ericsson’s customer project experience repeatedly shows us another important aspect of this area of change, telling us that the evolution to cloud-native is more than a knowledge jump or a technological upgrade – it is also a mindset change. The best platform components will not deliver their full potential if teams are not ready to use them.

Monica Zethzon, Head of Solution Area Core Networks, Ericsson said: “The time is now. Service providers need to get ready for the cloud-native transformation that will enable them to reach the full potential of 5G and drive innovation, shaping the future of industries and society. We are proud to be at the forefront of this transformation together with our leading 5G service providers partners. With this guide series we want to share our knowledge and experiences with every service provider in the world to help them preparing for their successful journeys into 5G.”

Ericsson concludes, “The real winners of the 5G era will be the service providers who can transform their core networks to take full advantage of what 5G Standalone (SA) and cloud-native technologies can offer.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Omdia says another big challenge telcos need to manage is the fragmentation in cloud-native tools and approaches adopted by various technology providers. Again, this is nothing new as telcos have faced and lived through similar situations while evolving to the NFV era. However, the scale and complexity are much bigger as network functions will be distributed, multi-vendor, and deployed across multiple clouds. The need for addressing these gaps by adopting clearly defined specifications (there are no standards for cloud native 5G core) and open-source projects is of utmost importance.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Overcoming the challenges telcos face on their journey to containerized network functions

https://omdia.tech.informa.com/OM023495/Telco-Cloud-Evolution-Survey–2022

https://www.ericsson.com/en/news/2022/10/ericsson-publishes-the-cloud-native

https://www.t-mobile.com/news/network/t-mobile-lights-up-standalone-ultra-capacity-5g-nationwide

AT&T Launching a dozen 5G “Edge Zones” across the U.S.; Seeking Federal Funds for Fiber Optic Network Expansion

AT&T is expanding its 5G standalone (SA) core network through “edge zones” that can more quickly connect to cloud service providers including Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP).

AT&T CTO Jeremy Legg noted in a blog post that the carrier currently has 10 of these edge zones up and running across the U.S., with plans to add at least two more of these “localized 5G network capabilities” before the end of the year. Many more will follow in 2023 and beyond.

These edge zones are powered by AT&T’s regional 5G SA network cores and are located near connection points that can quickly access cloud service provider data centers. Legg explained AT&T will explore different options on how to make the edge zones accessible to developers, either through stores operated by hyperscale companies or SDKs.

The edge zones are based on three key elements:

- Local standalone network cores

- Local public cloud or private data center computing resources

- Software-defined network capabilities and virtualized network functions

AT&T commenced work on edge networks in 2021, when it previewed a network in conjunction with Microsoft Azure.

Alongside its SA 5G network, AT&T is employing local public cloud and private data centre resources, and software-defined network elements in its edge zones. It situated the capabilities in data centres close to facilities with connections to nearby cloud providers including Microsoft Azure, Google Cloud and AWS.

An AT&T representative told Mobile World Live that Equinix is providing the cross-connect capabilities. Legg noted the edge zones enable AT&T to offer customised managed services. “It’s an exciting time for us. We’re at the dawn of a new age of killer apps almost everywhere you look,” he concluded.

Jeremy Legg, AT&T CTO

……………………………………………………………………………………………………………….

Separately, Bloomberg reports that AT&T is counting on U.S. government stimulus grants to help fund its fiber optic buildout. The telco wants small towns to use federal economic recovery money to pay it to provide landline high-speed internet to rural and remote areas.

Evansville, Indiana is a showcase for how AT&T is working with local governments to reach people with little or no internet access. While Indiana is part of AT&T’s 21-state telecommunications service region, the company will soon announce a widening expansion into markets outside its traditional territory, according to people familiar with the plan who didn’t want to tip off competitors before the announcement. The first was Mesa, Ariz., where AT&T promised to deliver fiber connections to a market where it had offered only wireless service. That marked the first move in decades outside its existing footprint.

AT&T CEO Stankey’s seven-hour, six-stop tour in Indiana was focused on a public-private partnership, one of several in the region for AT&T. The contract with Vanderburgh County calls for the company to put $29.7 million toward building out fiber networks that will serve superfast broadband to at least 20,000 homes and businesses. An additional $9.9 million will come from the county’s American Rescue Plan money, an injection of federal funds to help with recovery from the Covid-19 pandemic.

………………………………………………………………………………………………………………………………………………………………….

References:

https://www.att.com/es-us/sdabout/blogs/2022/legg-5g-edge-zones.html

AT&T’s 5G SA core is being distributed nationwide – converging wired and wireless in municipalities across the U.S.

Jeremy Legg, AT&T’s new chief technology officer (replacing Andre Fuetsch), said historically the wired networks of copper and fiber were operated separately from the wireless network, but AT&T is converging wired and wireless in municipalities across the country. It’s also in the process of deploying its 5G standalone core via Microsoft Azure public cloud.

Unlike previous generations of wireless core technology, AT&T is going to distribute the core software at sites around the country. “We want to federate where those cores sit,” said Legg. “Cores have historically only been in a very few locations. We’re trying to put them in a lot more locations.”

Legg said a distributed 5G core SA network is important for voice applications, where it’s nice to keep calls geographically close. And it could be really important in the future for uses such as autonomous cars. The company isn’t quantifying how many locations it might ultimately put 5G SA core software. “It’s really a function of what the demand curve looks like,” said Legg. “We could put a core in 1,000 edges.”

The company has thousands of central offices all around the country. A select number of these central offices are already running its 5G SA core software.

……………………………………………………………………………………………………………………..

Chris Sambar, AT&T’s executive vice president for Network, said the company spends “well over a billion dollars per year on power.”

Sambar described how AT&T had moved from proprietary equipment for its central offices to off-the-shelf compute servers that run networking software, which AT&T Labs developed. AT&T has since sold this software to Microsoft, which is free to resell it to other telcos around the world.

AT&T still keeps all its network functions on its own premises at central offices, running with its version of its network software. The company has a few hundred of these AIC cloud pods around the country.

Sambar said, “Now we have this disaggregated architecture where we can control everything in the box. There’s a lot more flexibility in the network to mix and match. And we continue to make iterations on top. AT&T uses public cloud providers for its less-sensitive storage and compute functions.

………………………………………………………………………………………………………………………………………………

Joe Mosele, vice president for Mobility, IoT and 5G, said, AT&T is the leader in IoT in the U.S., based on the number of its IoT connections. It has 95.9 million connected devices and more than 53.3 million connected cars on the AT&T network. China is the IoT leader in the world.

Sidebar: 5G SA Advantages and Challenges:

5G Standalone (SA) networks offer lower latency, the ability to connect a huge number of devices at once, and advanced services such as network slicing. These features mean 5G SA networks will prove particularly valuable in the private sector, including transport and manufacturing. The future success of the IoT is reliant on the rollout of SA 5G networks, given that low latency is a must for real-time machine-to-machine communications and use cases like self-driving vehicles. Most important is that all of the 5G features are only realizable with a 5G SA core network, e.g. network slicing/virtualization, 5G security, automation and orchestration, MEF, etc.

There are of course challenges here. Building this infrastructure requires significant investment and some operators are still unsure that the business case for SA 5G is established enough to warrant the expenditure. Establishing roaming connections and agreements for SA 5G is another key part of the puzzle. As it stands, these connections are still being trialed and there is no live SA roaming (for the time being). To support 5G IoT use cases, in particular, operators will require international roaming interoperability for standalone 5G. However, many are reluctant to commit to such investment while the number of SA networks is still low.

References:

https://www.fiercewireless.com/5g/att-distributes-its-5g-sa-core-software-across-us

The steps needed to unlock 5G Standalone’s future – Telecoms.com

Mavenir and NEC deploy Massive MIMO on Orange’s 5G SA network in France

Mavenir and NEC Corporation (NEC) have deployed massive MIMO (mMIMO) on Orange’s 5G standalone (SA) experimental network in France.

Mavenir’s cloud-native Open virtualized Radio Access Network (Open vRAN) software has been deployed on Orange’s cloud infrastructure with NEC’s 32T32R mMIMO active antenna unit (AAU) to deliver high capacity and enhanced coverage. Interoperability between radios and virtualized Distributed Units (vDUs) over the O-RAN Alliance Open Fronthaul Interface is key to Open RAN’s ability to simplify the deployment of multi-vendor networks and eliminate vendor lock-in.

The technologies have been deployed at the Orange Gardens campus in Chatillon near Paris, and are part of the extension of project Pikeo – Orange’s cloud-based and fully automated 5G SA experimental network, also called Pikeo at this site.

“Mavenir and NEC’s successful Open RAN deployment of mMIMO on Orange’s Innovation 5G SA experimental network is a major stepping stone on the road towards Open RAN deployments and illustrates Orange’s commitment to support the development of multi-vendor Open RAN solutions with innovative partners. Our Open RAN Integration Centre, open to our partners worldwide, contributes to the development of a strong Open RAN ecosystem in Europe,” said Arnaud Vamparys, SVP Radio Access Networks and Microwaves at Orange.

The deployment includes Mavenir’s cloud-native Open virtualized Radio Access Network (Open vRAN) software rolled out across Orange’s cloud infrastructure with NEC’s 32T32R mMIMO active antenna unit (AAU) to deliver high capacity and enhanced coverage.

“Deploying 5G SA mMIMO is a significant milestone in developing Open RAN and transitioning from virtualized to cloudified networks,” said Hubert de Pesquidoux, executive chairman of Mavenir.

“We are very proud of our continuing collaboration with Orange, NEC and other companies that are proving the potential of the multi-vendor, cloud-native, standards-based approach.”

The deployment forms part of the extension of project Pikeo – Orange’s cloud-based and fully automated 5G SA experimental network.

“The latest deployment of Open RAN mMIMO in Europe is another milestone for Open RAN and one that required close collaboration and tight integration between multiple vendors. This synergy is exactly what Open RAN needs to successfully deliver on its promise of a truly open multi-vendor ecosystem,” said Naohisa Matsuda, general manager of NEC’s 5G strategy and business.

“Forward-thinking mobile operators like Orange are showcasing the potential of Open RAN mMIMO. This is the right time for the mobile industry to follow the blueprint set by industry-leading operators to move to the new era of Open RAN-powered connectivity.”

About Mavenir:

Mavenir is building the future of networks and pioneering advanced technology, focusing on the vision of a single, software-based automated network that runs on any cloud. As the industry’s only end-to-end, cloud-native network software provider, Mavenir is focused on transforming the way the world connects, accelerating software network transformation for 250+ Communications Service Providers and Enterprises in over 120 countries, which serve more than 50% of the world’s subscribers.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC.

References:

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

……………………………………………………………………………………………………………………………………………….

……………………………………………………………………………………………………………………………………………….

Separately, ZTE says they’ve produced the industry’s smallest 5G Core network product, dubbed the Mini5GC. The new Mini5GC features miniaturization, light weight, simple networking and ultra-high integration. The company states that it can well facilitate safe production, flexible adjustment of work sites, and efficient and accurate emergency rescue in mining areas.

References:

https://sdnfv.zte.com.cn/en/news/2022/2/ZTE-5G-Common-Core-Aims-to-Improve-Digital-Economy

https://www.zte.com.cn/global/products/core_network/packet_core/202003251501/5G-Common-Core

Spark New Zealand completes 5G SA core network trials with AWS and Mavenir software

Backgrounder:

Telecommunication companies in New Zealand are currently implementing ‘non-standalone’ 5G – while networks have been updated to 5G, data centres and network cores are still running on legacy, non-5G systems, which are dependent on 4G infrastructure.

To achieve standalone 5G, data centres and core mobile networks need to be upgraded and deployed on a cloud-native platform. Existing mobile networks run out of a centralised data centre have relatively static use-cases and are complex to customize.

A 5G standalone network is ‘cloud native’, meaning that it is fully virtualized, can run on any cloud service, is designed with a microservices approach and architected to address evolving customer needs in a scalable way, while also offering inherent resilience. This creates flexibility in an end-to-end 5G solution and allows users of the network to realise the full range of benefits of a standalone 5G network – including low latency, and advanced capabilities such as 5G network slicing, 5G security, 5G private networks, and multi access edge computing (MEC).

Spark’s 5G SA PoC Trials:

Spark New Zealand this week shared details of two 5G SA proof-of-concepts (PoCs) it carried out, and Amazon Web Services (AWS) was heavily involved in both of them. Spark deployed a 5G SA cloud-native core solution on AWS Snowball Edge, Amazon’s rugged, briefcase-sized edge cloud. It enabled the incumbent to create a portable storage and compute solution that can be deployed right at the edge of its 5G network, offering high throughput and low latency when and where it is needed.

The PoC also marked the first deployment of Mavenir’s 5G SA core network solution on Snowball Edge. Using this set-up, Spark tested a video analytics tool, recording a 70 percent reduction in latency compared to its 5G non-standalone network.

Spark’s other PoC used the same Mavenir 5G SA core software on AWS Outposts, a managed service that extends AWS infrastructure, APIs and tools to customer premises. It means a customer can work within the same development environment as the AWS public cloud, but use local storage a compute resources, resulting in lower latency. Spark said it wanted to see how this architecture might improve the performance of its 5G fixed wireless access (FWA) service. By deploying cloud-native core network software on AWS Outposts, the telco said it achieved faster download speeds and reduced latency compared to non-standalone FWA.

“These proof-of-concepts create line of sight for us to deliver the enhanced benefits of standalone 5G – both to New Zealand businesses looking to innovate using 5G connectivity and multi access edge compute (MEC), and to New Zealanders accessing a network that supports applications such as instant video streaming, cloud hosted gaming and the reaction times required for driverless vehicles,” said Josh Bahlman, Spark’s lead for telco cloud, in a statement.

“The 5G standalone network opens the door on capacity and low latency to help accelerate IoT trends, such as connected cars, smart cities and IoT in the home and office,” he added.

Amazon’s heavy involvement with these PoCs suggests Spark might be seriously considering a public cloud deployment for its 5G SA network. AT&T is doing exactly that with Microsoft Azure while Dish Network is using AWS public cloud. However, that 5G SA core network has yet to be deployed.

However, the overwhelming majority of telcos that have either deployed or committed to deploying 5G SA have also committed to rolling it out on their own telco cloud. Dell’Oro research director Dave Bolan recently wrote, “We found that 27 5G SA networks have been commercially deployed and only one MNO is running its 5G workloads in the public cloud. The balance chose to run their own telco clouds.”

Spark didn’t categorically state that its commercial 5G SA network will use AWS architecture, it might still go for an in-house option. At this stage, it doesn’t appear to have ruled anything in or out.

“The solutions offered by AWS and Mavenir provide an opportunity to test and learn by leveraging cloud-native solutions and multi access edge compute services optimised for 5G. Testing the technology in this way allows us to identify the optimal combination of vendors and solutions to deliver the benefits we want to achieve,” Bahlman said. “We have further proof-of-concepts underway as we work to bring relevant use cases specific to New Zealand’s local requirements.”

This is Mavenir’s first global edge deployment on Snowball Edge, and using such a device “allowed Spark to create a highly portable edge solution that could literally fit into a suitcase – to process and store data close to where it’s generated, enabling low latency and real time responsiveness”, said Spark.

The company said: “This is the first New Zealand mobile network deployment on AWS Outposts. Testing a wireless broadband service on this proof of concept showed faster download speeds and reduced latency when compared to pre-deployment results, providing a better experience for Spark’s wireless broadband customers.”

Mavenir’s president of core networks, Ashok Khuntia, said: “Our cloud-based network solution offers flexibility and advanced capabilities such as network slicing to enable efficiencies in overall service design and deployment times to accelerate trials and service rollouts.”

References:

https://www.sparknz.co.nz/news/spark-trials-5G-standalone-1/

https://www.capacitymedia.com/article/2ajorogc3p282dw7ozcw/news/aws-cloud-to-support-standalone-5g-in-new-zealand

https://www.spark.co.nz/5g/home.html

https://www.spark.co.nz/5g/home/5g-safety

https://about.att.com/story/2021/att_microsoft_azure.html

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

In separate announcements today, Ericsson and Nokia stated they had completed 5G Network Slicing trials with Google on Pixel 6 Pro smart phones running the Android 13 mobile OS [1.].

Network Slicing is perhaps the most highly touted benefits of 5G, but its commercial realization is taking much longer than most of the 5G cheerleaders expected. That is because Network Slicing, like all 5G features, can only be realized on a 5G standalone (SA) network, very few of which have been deployed by wireless network operators. Network slicing software must be resident in the 5G SA Core network and the 5G endpoint device, in this case the Google Pixel 6 Pro smartphone.

Note 1. On August 15, 2022, Google released Android 13 -the latest version of its mobile OS. It comes with a number of new features and improvements, as well as offers better security and performance fixes. However, it’s implementation on smartphones will be fragmented and slow according to this blog post.

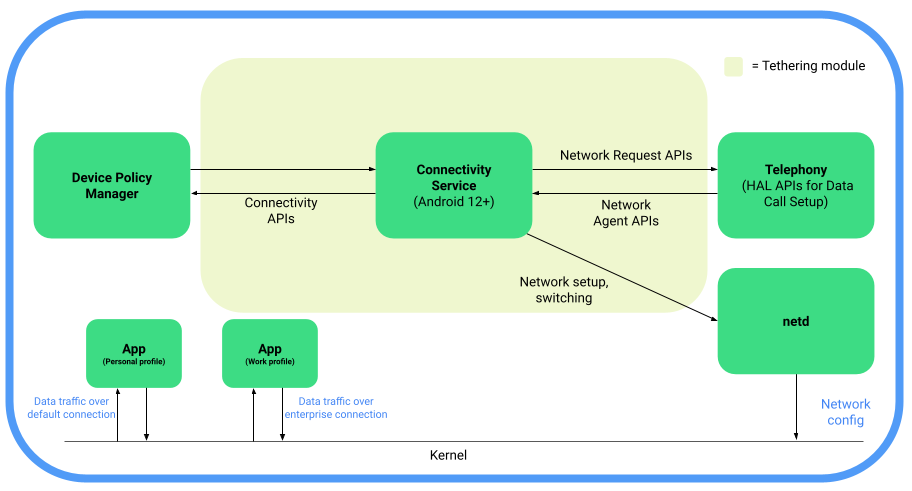

For devices running Android 12 or higher, Android provides support for 5G Network Slicing, the use of network virtualization to divide single network connections into multiple distinct virtual connections that provide different amounts of resources to different types of traffic. 5G network slicing allows network operators to dedicate a portion of the network to providing specific features for a particular segment of customers. Android 12 introduces the following 5G enterprise network slicing capabilities, which network operators can provide to their enterprise clients.

Android 12 introduces support for 5G network slicing through additions to the telephony codebase in the Android Open Source Project (AOSP) and the Tethering module to incorporate existing connectivity APIs that are required for network slicing.

Here’s a functional block diagram depicting 5G network slicing architecture in AOSP:

Image Credit: Android Open Source Project

1. Ericsson and Google demonstrated support on Ericsson network infrastructure for multiple slices on a single device running Android 13, supporting both enterprise (work profile) and consumer applications. In addition, for the first time, a slice for carrier branded services will allow communications service providers (CSP) to provide extra flexibility for customized offerings and capabilities. A single device can make use of multiple slices, which are used according to the on-device user profiles and network policies defined at the CSP level.

The results were achieved in an Interoperability Device Testing (IODT) environment on Google Pixel 6 (Pro) devices using Android 13. The new release sees an expansion of the capabilities for enterprises assigning network slicing to applications through User Equipment Route Selection Policy (URSP ) rules, which is the feature that enables one device using Android to connect to multiple network slices simultaneously.

Two different types of slices were made available on a device’s consumer profile, apart from the default mobile broadband (MBB) slice. App developers can now request what connectivity category (latency or bandwidth) their app will need and then an appropriate slice, whose characteristics are defined by the mobile network, will be selected. In this way either latency or bandwidth can be prioritized, according to the app’s requirements. For example, the app could use a low-latency slice that has been pre-defined by the mobile network for online gaming, or a pre-defined high-bandwidth slice to stream or take part in high-definition video calling.

In an expansion of the network slicing support offered by Android 12, Android 13 will also allow for up to five enterprise-defined slices to be used by the device’s work profile. In situations where no USRP rules are available, carriers can configure their network so traffic from work profile apps can revert to a pre-configured enterprise APN (Access Point Name) connection – meaning the device will always keep a separate mobile data connection for enterprise- related traffic even if the network does not support URSP delivery.

Monica Zethzon, Head of Solution Area Packet Core at Ericsson said: “As carriers and enterprises seek a return on their investment in 5G networks, the ability to provide for a wide and varied selection of use cases is of crucial importance. Communications Service Providers and enterprises who can offer customers the flexibility to take advantage of tailored network slices for both work and personal profiles on a single Android device are opening up a vast reserve of different uses of those devices. By confirming that the new network slicing capabilities offered by Android 13 will work fully with Ericsson network technology, we are marking a significant step forward in helping the full mobile ecosystem realize the true value of 5G.”

Ericsson and partners have delivered multiple pioneering network slicing projects using the Android 12 device ecosystem. In July, Telefonica and Ericsson announced a breakthrough in end-to-end, automated network slicing in 5G Standalone mode.

2. Nokia and Google announced that they have successfully trialed innovative network slice selection functionality on 4G/5G networks using UE Route Selection Policy (URSP) [2.] technology and Google Pixel 6 (Pro) phones running Android 13. Once deployed, the solution will enable operators to provide new 5G network slicing services and enhance the customer application experience of devices with Android 13. Specifically, URSP capabilities enable a smartphone to connect to multiple network slices simultaneously via different enterprise and consumer applications depending on a subscriber’s specific requirements. The trial, which took place at Nokia’s network slicing development center in Tampere, Finland, also included LTE-5G New Radio slice interworking functionality. This will enable operators to maximally utilize existing network assets such as spectrum and coverage.

Note 2. User Equipment Route Selection (URSP) is the feature that enables one device using Android to connect to multiple network slices simultaneously. It’s a feature that both Nokia and Google are supporting.

URSP capabilities extend network slicing to new types of applications and use cases, allowing network slices to be tailored based on network performance, traffic routing, latency, and security. For example, an enterprise customer could send business-sensitive information using a secure and high-performing network slice while participating in a video call using another slice at the same time. Additionally, consumers could receive personalized network slicing services for example for cloud gaming or high-quality video streaming. The URSP-based network slicing solution is also compatible with Nokia’s new 5G radio resource allocation mechanisms as well as slice continuity capabilities over 4G and 5G networks.

The trial was conducted using Nokia’s end-to-end 4G/5G network slicing product portfolio across RAN-transport-core as well as related control and management systems. The trial included 5G network slice selection and connectivity based on enterprise and consumer application categories as well as 5G NR-LTE slice interworking functionalities.

Nokia is the industry leader in 4G/5G network slicing and was the first to demonstrate 4G/5G network slicing across RAN-Transport-Core with management and assurance. Nokia’s network slicing solution supports all LTE, 5G NSA, and 5G SA devices, enabling mobile operators to utilize a huge device ecosystem and provide slice continuity over 4G and 5G.

Nokia has carried out several live network deployments and trials with Nokia’s global customer base including deployments of new slicing capabilities such as Edge Slicing in Virtual Private Networks, LTE-NSA-SA end-to-end network slicing, Fixed Wireless Access slicing, Sliced Private Wireless as well as Slice Management Automation and Orchestration.

Ari Kynäslahti, Head of Strategy and Technology at Nokia Mobile Networks, said: “New application-based URSP slicing solutions widen operator’s 5G network business opportunities. We are excited to develop and test new standards-based URSP technologies with Android that will ensure that our customers can provide leading-edge enterprise and consumer services using Android devices and Nokia’s 4G/5G networks.”

Resources:

…………………………………………………………………………………………………………………………………………………………….

Addendum:

- Google’s Pixel 6 and Pixel 6 Pro, which run on Android 12, are the first two devices certified on Rogers 5G SA network in Canada, which was deployed in October 2021. However, 5G network slicing hasn’t been announced yet.

- Telia deployed a commercial 5G standalone network in Finland using gear from Nokia and the operator highlighted its ability to introduce network slicing now that it has a 5G SA core.

- OPPO, a Chinese consumer electronics and mobile communications company headquartered in Dongguan, Guangdong, recently demonstrated the pre-commercial 5G enterprise network slicing product at its 5G Communications Lab in collaboration with Ericsson and Qualcomm. OPPO has been conducting research and development in 5G network slicing together with network operators and other partners for a number of years now.

- Earlier this month, Nokia and Safaricom completed Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial.

References:

https://source.android.com/docs/core/connect/5g-slicing

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial