FTTP

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

The city of Amarillo, TX has selected AT&T to install fiber-to-the-premises (FTTP) networks, covering more than 22,000 customer locations. The project will cost about $24 million (with $2 million coming from the city). The network, which will be built out over three years, still requires final approval by Amarillo and a final contract between AT&T and the city.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build-out.

[Amarillo residents and businesses also served by Altice USA’s Suddenlink Communications.]

AT&T is taking the public/private partnership route here. The telco inked a similar $39.6 million agreement (with about $10 million coming from public funds) last year with Vanderburgh County, Indiana, to build fiber to about 20,000 locations in the rural, southern tip of the state. AT&T also has a $33 million fiber project underway to connect about 20,000 locations in Oldham County, Kentucky.

As noted in an earlier IEEE Techblog post, AT&T’s FTTP buildout/upgrade plan is targeting 30 million locations by 2025. AT&T added 289,000 FTTP subs in Q1 2022, ending the period with a grand total of 6.28 million, and enough to offset a quarterly loss of 284,000 non-fiber subs (including U-verse Internet customers).

“What we’re doing here in Amarillo that’s different is that this is an urban core,” said Jeff Luong, president, broadband access and adoption initiatives for AT&T. “The city of Amarillo identified a specific area that they believe is challenging from a connectivity perspective in their urban core,” he added.

“The area that the city wanted to address is actually the city core. It’s actually an area they feel is underserved,” he said. “We are expanding access, we are providing a very affordable free solution when partnered with ACP [Affordable Connectivity Program] and then we’ll be actively engaging in adoption, digital literacy and other type of activities to ensure that people have access, they can afford it and that they understand how to use the service.”

“We’re working with the public sector to identify areas that are more challenging to build on our own from a private sector perspective and creating these type of public/private partnerships where we, AT&T, will invest our own capital. But the public sector would also contribute a share of the cost to expand fiber connectivity to these locations,” Luong said.

AT&T today delivers services in the area via other technologies, including legacy copper networks. The new fiber overlay, based on XGS-PON, will be capable of delivering symmetrical speeds of 5 Gbit/s, replicating a new mix of multi-gigabit services that AT&T has launched in its other FTTP markets.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build.

About AT&T in Texas:

AT&T customers and FirstNet® subscribers in Texas got a big boost in wireless connectivity and fiber access last year. In 2021, AT&T completed nearly 1,000 wireless network enhancements in Texas, including adding nearly 200 new macro sites. AT&T also made fiber available in more than 300,00 new locations in Texas in 2021. These network improvements will enhance the state’s broadband coverage and help give residents, businesses and first responders faster, more reliable service.

From 2018 to 2020, we expanded coverage and improved connectivity in more communities by investing more than $7.7 billion in our wireless and wireline networks in Texas. This investment boosts reliability, coverage, speed and overall performance for residents and their businesses.

And in Amarillo, we expanded coverage and improved connectivity by investing more than $60 million in our wireless and wireline networks from 2018-2020.

References:

https://www.att.com/local/fiber/texas/amarillo

https://about.att.com/story/2022/amarillo-broadband-access.html

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

U.S. utility operators see a bright future in fiber broadband

Leaders from three rural utility providers discussed their expansions into deploying fiber and how their organizations are getting involved with delivering broadband on a webinar hosted last week by the Fiber Broadband Association, In Holland, Michigan, for example, the Holland Board of Public Works (HBPW) started building fiber 30 years ago for “enhanced connectivity for monitoring and control” to its systems, said Pete Hoffswell, superintendent of broadband services at HBPW, which operates a power plant, water treatment plant and water reclamation plant.

“Fiber is absolutely essential for very reliable, high-performance connectivity for all that equipment,” said Hoffswell. “If we lose contact with one of our substations and the power goes down, that’s a bad day in our town. And fiber helps us keep that up.”

Katie Espeseth, vice president of new products at EPB, a municipally owned electric power distributor in Chattanooga, Tennessee, that started delivering fiber in 2008 and today has roughly 11,000 miles of fiber deployed, shared Hoffswell’s sentiment and added a number to it. “We have about 11,000 miles of fiber in our footprint. We serve about 125,000 customers with our broadband services,” said EPB’s Espeseth.

“The cost of power outages in Chattanooga was nearly $100 million a year,” she said, referring to costs to the community (“the cash register or the point of sale terminals not working and that sort of thing,” she explained). Today, the fiber network has reduced power outages by 65% and outage minutes by 52%, which the utility estimates as a $50 million return to the community, she added.

“A lot of our local offices are relying on the local Internet. And so the systems that we have, from a corporate standpoint, some of our field engineers can’t even run those systems because the Internet connection in those local areas is so poor,” he said. “It’s significant to know that you do not have a limitation from a communication standpoint.”

EPB, Alabama Power and HBPW, which all began deploying fiber to support their power grids, have each expanded into delivering fiber broadband either directly or indirectly. EPB – which turned Chattanooga into “the first gigabit community in the world,” according to Gary Bolton, CEO of the Fiber Broadband Association – operates its own ISP called Fi-Speed. Today, Fi-Speed delivers residential service speeds of 300 Mbit/s, 1 Gbit/sec and 10 Gbit/sec.

In Michigan, Holland BPW delivers fiber to local businesses, municipalities and community institutions and works in partnership with six ISPs: 123.net, Everstream, Sirus, Merit Network, US Signal and The ISERV Group.

“When we started the fiber, we decided any excess capacity in our network would be made available to our community,” said HBPW’s Hoffswell. “We did that and have provided lit services and dark fiber services to our greater community for 30 years now.”

Similar to HBPW, Alabama Power started its fiber build 30 years ago but did not expand into fiber distribution until “three or four years ago,” said Stegall. Rather than looking to serve as an ISP (“that’s outside of our scope,” he said), Alabama Power is delivering middle mile fiber and currently has service provider partnerships in seven of the 14 markets where its fiber distribution networks are active.

“The other seven are in more rural areas and [it is] harder to find those partners,” Stegall said. “So, we’re very interested and excited to see what the infrastructure bill is going to do in terms of enabling business cases for some areas that did not have traditional telecom business cases.”

Service and infrastructure ‘decoupling’

Indeed, the multi-billion-dollar broadband grant programs in the Biden administration’s infrastructure law specifically reference electric utilities’ role in the future of fiber and broadband delivery.

The $1 billion middle mile program calls out “electric utilities that increasingly recognize their capability to transform the communications market.” And the $42.45 billion Broadband, Equity, Access and Deployment (BEAD) grant program names electric utilities among the “non-traditional providers” as eligible subgrantees and encourages funding open access networks.

That push toward funding open access networks, and recognizing electric utilities and cooperatives as well placed to close broadband infrastructure gaps in the rural US, is enabling new business and delivery models.

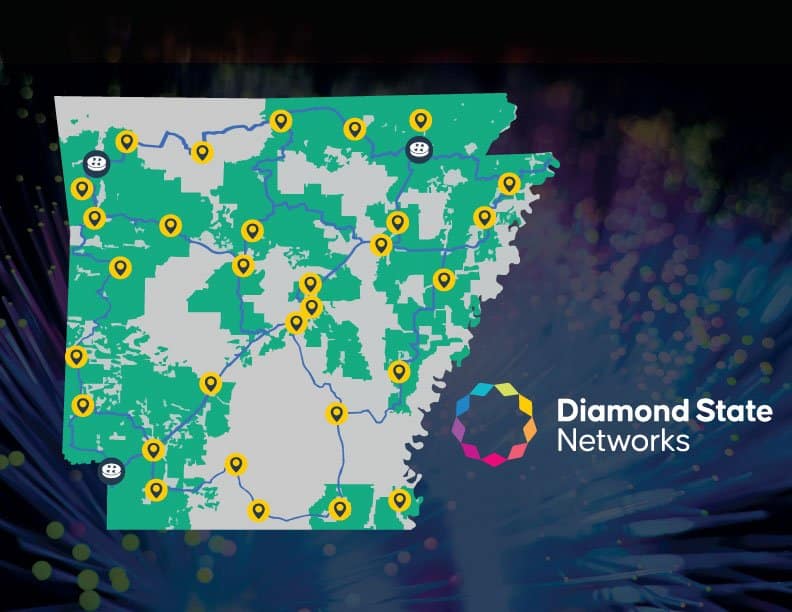

In Arkansas, for example, a group of 13 electric co-ops has recently banded together to form Diamond State Networks, a wholesale fiber network, to deliver broadband across the state.

Conexon, a consultancy that works with electric co-ops on fiber delivery, is another example; its newer ISP arm Conexon Connect operates broadband services for electric co-ops that don’t want to take on the role of service provider. (“We help people design and build networks, and we are interested – when an electric co-op is not – in operating the network,” Jonathan Chambers, partner at Conexon, told Broadband World News.)

Alabama Power’s Stegall expects the federal government’s focus on open access to push more utility providers that were previously hesitant to compete with service providers into delivering fiber infrastructure. “What I see in a sense is the decoupling of an infrastructure play and a services play. It’s the future,” he said.

References:

Diamond State Networks to invest more than $1.66 billion in fiber infrastructure in Arkansas

A new consortium in Arkansas is leading the way forward for electric cooperatives in the rural U.S. can increase bandwidth and save costs by collaborating on fiber broadband delivery.

Diamond State Networks (DSN) is a collective of 13 electric co-ops from across the state of Arkansas which are joining forces to deliver wholesale fiber broadband. All in, the cooperative networks’ 50,000 miles of fiber will cover 64% of Arkansas and reach 1.25 million rural Arkansans. The goal for DSN is to serve 600,000 residences and businesses in Arkansas in the next few years, with over 250,000 locations already deployed. Here’s a network coverage map:

The 13 member cooperatives in DSN include: OzarksGo, Clay County Connect, Farmers Electric Cooperative, Petit Jean Fiber, Enlightened by Woodruff Electric, NEXT Powered by NAEC, Wave Rural Connect, Arkansas Fiber Network (AFN), Four States Fiber Internet, empower (delivered by Craighead Electric), MCEC Fiber, South Central Connect and Connect2First.

Doug Maglothin, DSN’s director of operations, says his company expects to add “a couple more cooperatives” to that list. (The state of Arkansas has 17 electric co-ops, served by a central entity called the Arkansas Electric Cooperative Corporation.)

The collective of co-ops that form DSN are at different phases of their service delivery journey. Some, like Farmers Electric, are in the early planning stages. OzarksGo – the subsidiary of Ozarks Electric Cooperative – is furthest along and nearing 40,000 subscribers. Indeed, Maglothin referred to Ozarks Electric CEO Mitchell Johnson as the “visionary” for DSN, who saw the need for the state’s electric co-ops to get involved with broadband delivery in 2015 and 2016.

But as electric co-ops began entering the space in 2017 and 2018, “pretty quickly, you find out how difficult and expensive it can be to buy connectivity to the global Internet,” said Maglothin. It was “from that necessity” that the plan for DSN was born.

While the consolidated electric cooperative model is unique for the broadband space, other states and communities are deploying broadband as collectives or partners. That includes Utopia Fiber’s municipal, open access fiber delivery network in Utah as well as California’s planned open-access statewide middle-mile network. And this week, a group of rural telcos and an electric cooperative in Indiana announced plans to launch HoosierNet, a “multi-year, multi-million-dollar” statewide fiber network.

Maglothin said DSN is collaborating with other states looking for a similar solution and that Diamond State has “kind of become a beacon for cooperative middle mile,” as it offers a model that allows electric co-ops to control their costs.

“The more bandwidth you grow, the more content you collect, the more powerful your voice is in negotiating pricing to get to these big anchor points for your network,” said Maglothin. “So we feel like there’s a potential future for cooperative companies working together like this where we become one of the largest bandwidth aggregators probably in the country.”

The 13 member co-ops are investing more than $1.66 billion in fiber infrastructure for DSN. According to Maglothin, less than 20% of that funding is from federal and state grants. But he expects that DSN will be eligible for Broadband Equity, Access, and Deployment (BEAD) and Middle Mile grant funding, federal programs worth $42.45 billion and $1 billion, respectively.

According to Broadband.Money, a platform connecting local providers and networks with funding opportunities, Arkansas is estimated to receive $1.4 to $1.6 billion for broadband through the Infrastructure Investment and Jobs Act (IIJA). But those numbers are still to be determined by federal broadband mapping data that officials say will be released later this year.

Notably, while existing FCC broadband data is widely understood to undercount the digital divide in the US, a recent presentation by the Broadband Development Group at the Arkansas Rural Connect Broadband Forum revealed that the state’s broadband gap may now be smaller than the FCC’s count shows. While federal data puts Arkansas’ digital divide at 250,000 households or 21% of the population, BDG’s analysis brought that to 209,000 households (17%).

Maglothin attributes this increase in broadband access to the work electric co-ops have done in recent years. “It’s because of the rapid onset of cooperative fiber being pushed out,” he said.

For this reason, and with more funding coming down through the BEAD program, Maglothin thinks that Arkansas can go from being among the lowest-ranked states in the US for connectivity to the highest.

References:

https://www.diamondstatenetworks.com/

https://www.broadbandworldnews.com/document.asp?doc_id=778063&

57% of European homes can now get FTTH/B internet access; >50% growth forecast over next 5 years

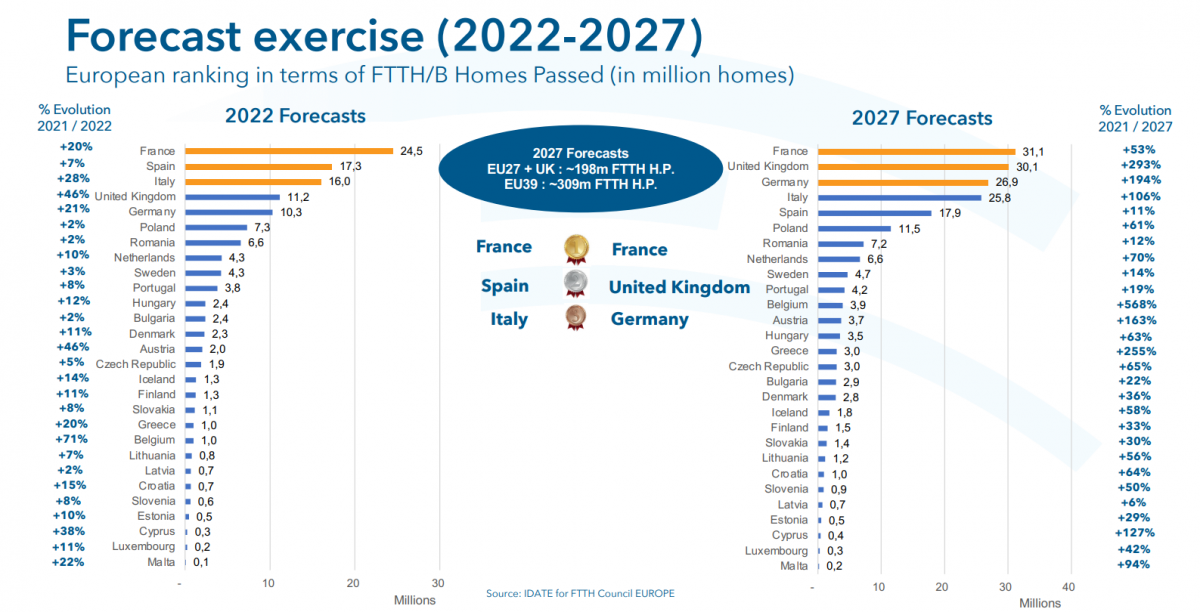

Europe has reached 200 million (M) homes that are now able to access FTTH/B services. That number is forecast to grow over 50 percent in the next five years, to more than 300 million homes passed, according to the latest research commissioned by the FTTH Council Europe. The new figures were released at its annual conference in Vienna, along with fiber subscriber numbers and research intro rural coverage.

The latest research by Idate for the council shows nearly 198.4 million homes were passed by FTTH or FTTB as of September 2021, up from 176.3 million a year earlier. The annual expansion was led by France (+4.3 M), the UK (+3.4 M), Germany (+2.4 M) and Italy (+1.5 M), all countries with a strong copper network footprint that previously held back fiber optic deployments.

The figures cover 39 countries across Europe and equal 57 percent of total households in the area, up by 4.5 percent points from a year earlier. In the 27 EU countries plus the UK, the coverage reached 48.5 percent of homes, up by 4.6 percent over the 12 months.

The number of subscribers on the fiber networks reached 96 million. The fastest growing markets in terms of new subscribers were France (+3.8 M), Spain (+1.2 M), Romania (+1 M), Italy (+820 K) and the UK (+765K). In total, 48.5 percent of households able to receive fibre services actually subscribed to the services, an increase of 3.6 percent in the network penetration rate. In the EU plus UK, take-up was at 52.4 percent, up 5.6 percent year-on-year.

Alternative operators still account for the majority of the FTTH/N coverage (57%), with incumbent operators taking 39 percent and 4 percent built by municipalities and utilities. Overall, there is a strong acceleration in fiber deployment, with a firm commitment to cover both urban and rural areas, the researchers said.

Idate also updated its five-year forecast for the FTTH/B market. It expects 199 million homes passed in 2027 in the EU+UK region and 309 million in the wider EU 39 region. Over the same period, the number of subscribers is expected to reach respectively 124 million and 190 million, equal to network penetration of over 62 percent in the EU and UK and more than 61 percent in the EU 39.

Further research shows that only 30 percent of rural inhabitants could enjoy fibre network access as of September 2021. Rural FTTH/B coverage is highest in Denmark (76%), Latvia (74%), Spain (66%), Romania (62%) and Luxembourg (55%). The report emphasized that immediate action should be oriented towards the rural regions, with increased public support through subsidies and partnerships to cover every European premise with high-speed broadband.

At the conference, the FTTH Council also announced several awards for contributions to the industry’s progress. UK wholesale operator CityFibre received the operator award; Jacek Wisniewski, CEO of Polish operator Nexera received the individual award; and Eurofiber CEO Alex Goldblum was winner of the Charles Kao award, named after the eponymous scientist who won a Nobel prize for physics for his research into fiber-optic communications.

References:

https://www.fibre-systems.com/news/europe-track-meet-connectivity-targets-rural-areas-gaining-focus

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

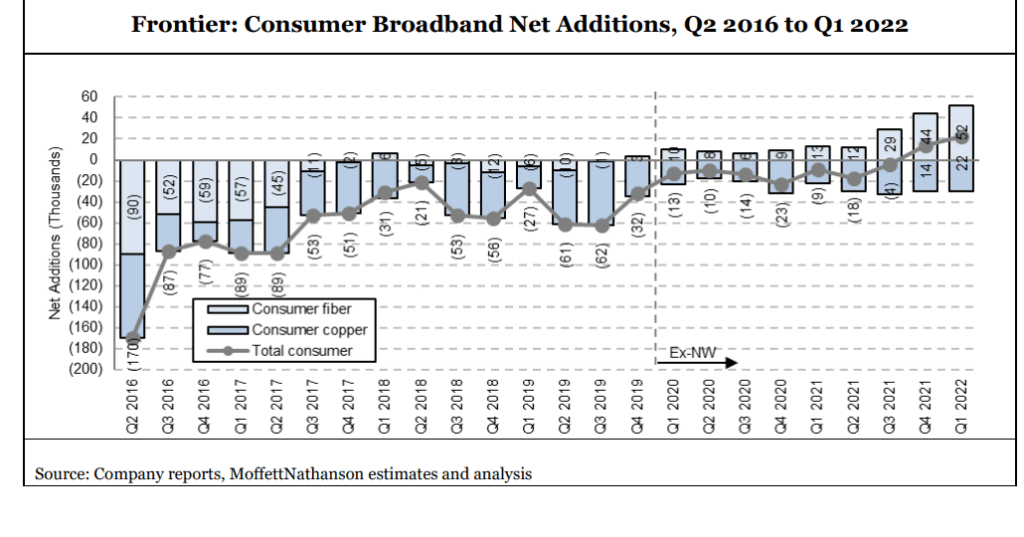

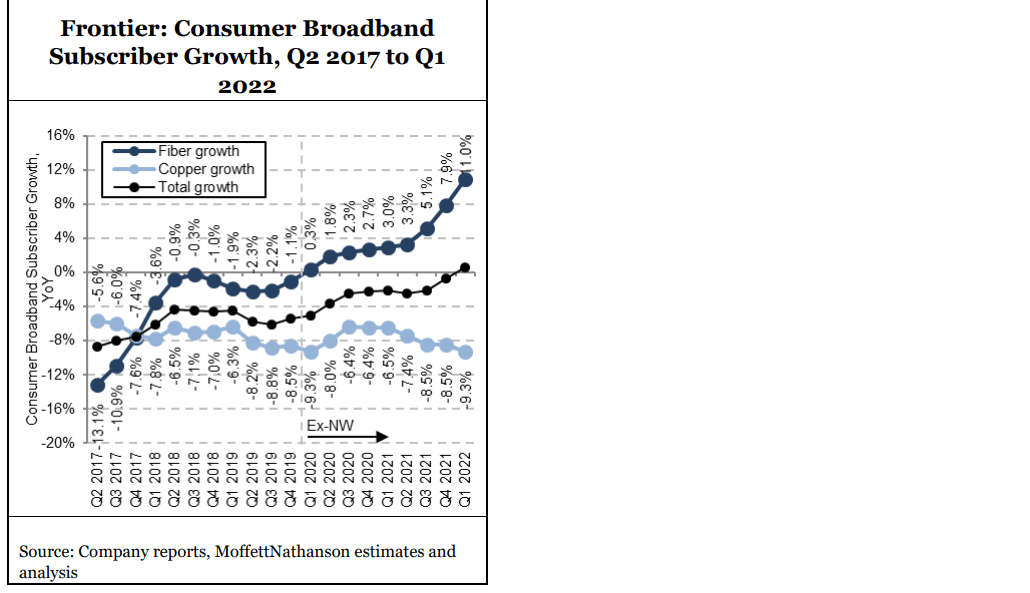

Frontier Communications added a record 54,000 fiber broadband customers in the first quarter of 2022, a 20% gain over the previous record set in Q4 2021 and somewhat higher than expectations coming in to the quarter. These fiber customer adds are coming from both new and existing fiber markets. Frontier’s data continues to track nicely: 22% penetration at the 12-month mark for its 2020 cohort and 18% for its larger 2021 cohort, and 44% at the 24-month mark for its (admittedly small and probably not broadly representative) 2020 cohort. Base market penetration was up 50 basis points in the quarter and 90 basis points over the past two quarters.

Frontier’s aggressive fiber network buildout and a record low churn of 1.19%, enabled the telco to offset copper losses and add 20,000 net broadband subs for Q1 2021. That’s a record nearly two times higher than that set in the prior quarter. Frontier ended the quarter with 1.38 million residential fiber broadband subs, up 11% YoY.

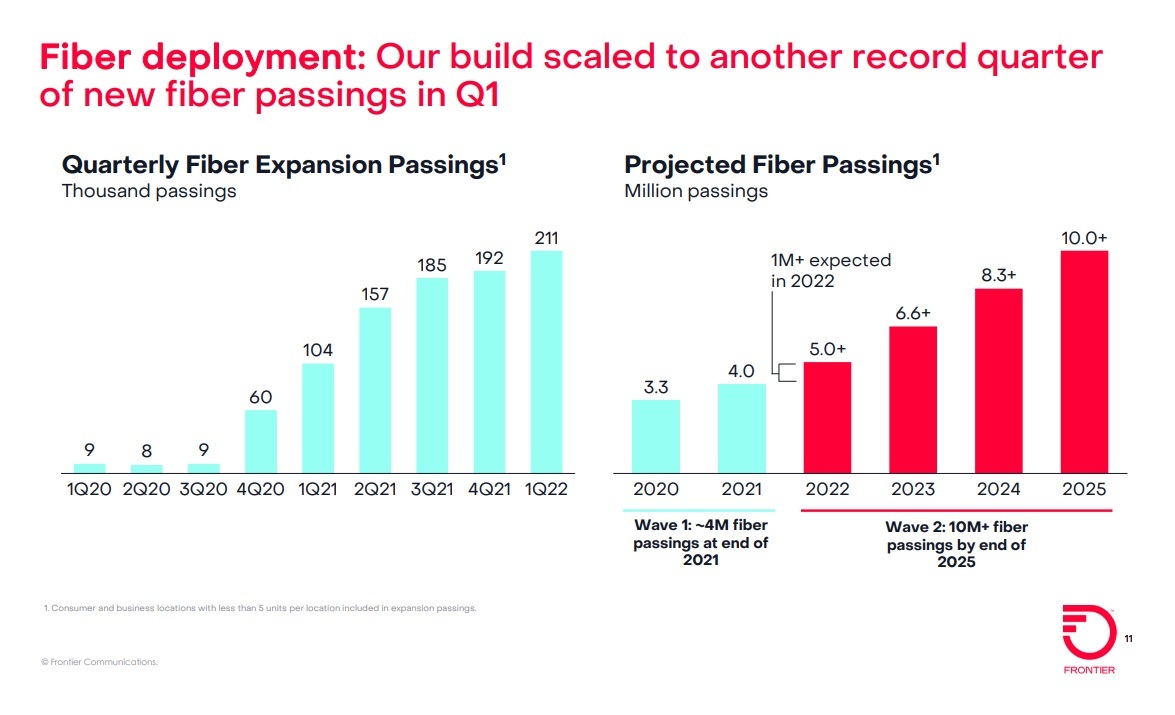

Frontier plans to expand its fiber-to-the-premises (FTTP) footprint to 10 million locations by 2025 – a figure that includes the company’s “Wave 1” and “Wave 2” builds. Frontier built fiber out to another 211,000 locations in the first quarter of 2022, and says it’s on track to add more than 1 million FTTP locations for all of 2022, and another 1.6 million in 2023.

Frontier passed another 211K locations with fiber in the quarter, up from the ~190K level of the prior two quarters, a nice accomplishment in light of the disruptions associated with Omicron early in the quarter (100K of the 211K passings were achieved in March alone). Management continues to expect to add at least 1M fiber locations in 2022, and it seems on track to meet or exceed that target.

“Positive net adds is the new normal,” Nick Jeffery, Frontier’s president and CEO, declared on Friday’s earnings call. The CEO continued:

“We gained momentum in business and wholesale, reaching a key inflection point in SMB and we made progress improving our employee engagement. And last week, we unveiled our new Frontier brand. A year ago, we said we will take a long and hard look at our brand and its future and after a thorough data-driven evaluation I am delighted with the results. Our new brand is modern, more relevant, more tech-oriented, and reflects our commitment to relentlessly being better in our business and for our customers. We also gained customers in our mature fiber market, what we refer to as our base fiber footprint. In our base fiber footprint, penetration increased 50 basis points sequentially to 42.4%. And our base fiber footprint serves as a target for where we expect to drive penetration in our expansion fiber footprint and we expect to steadily grow penetration to at least 45% over time.

In our expansion fiber footprint, we are also making excellent progress. At the 12-month mark, our 2021 build cohort reached penetration of 18%, consistent with our target range of 15% to 20%. And at the 24-month mark, our 2020 build cohort reached penetration of 44%, significantly outperforming our target range of 25% to 30%. As larger builds are pulled into our 2020 cohort throughout the year, we continue to expect penetration of 25% to 30% at the 24-month mark.”

Indeed, Frontier’s operations and service levels have improved dramatically over the past two years. Our colleague Nick Del Deo at MoffettNathanson wrote in a research note to clients:

By some measures, Frontier is now operating at as high a level as key competitor Charter in the California market. And this is having an effect on its customer perceptions and market traction. Its American Consumer Satisfaction Index scores are slowly moving up, while its net promoter score has surged, especially where it has rolled out FTTH. Churn has fallen, as have customer care call volumes.

Frontier’s post-emergence management team has taken a data-driven approach to running the business and making key decisions. Put simply, the choice to refresh the company’s font and logo rather than totally rebrand is further evidence that changes to the business are working.”

To reiterate, 1Q-2022 fiber penetration rates rose to 42.45% in the company’s base fiber footprint. Frontier expects to reach penetration rates of at least 45% over time.

In the expansion areas, Frontier realized a penetration rate of 12% at the 12-month mark in its 2021 fiber build cohort – within its target range of 15%-20%. In the 2020 FTTP build cohort, Frontier is seeing a 44% penetration rate at the 24-month mark, outperforming its target range of 25%-30%.

Source: Frontier Communications Q1 2022 earnings presentation

CEO Jeffery said Frontier’s fiber-powered services are taking share from incumbent cable operators, but didn’t elaborate on how much damage Frontier is inflicting. He also acknowledged that fixed wireless access (FWA) could present an attractive option in rural areas where fiber isn’t present. Jeffery also believes fiber represents “a fundamentally different proposition” over FWA, given current data usage trends. In March, the average Frontier fiber subscriber consumed about 900 gigabytes of data, up 30% from pre-pandemic levels, with a portion consistently consuming more than 1 terabyte per month.

Significantly, Frontier gained new customers in areas where fiber is being built out. “This is critical because we know our future is fiber and fiber customers are the ones that will drive our growth in the years to come,” said Jeffery, a former Vodafone UK exec who took the helm of Frontier in March 2021.

For the full 2022 year, Frontier is targeting adjusted EBIDTA of $2 billion to $2.15 billion, and capital expenditures in the range of $2.4 billion to $2.5 billion, the same as guidance issued last quarter. This implies $2,003M for the remainder of the year at the midpoint. Management continues to target FTTH builds in 2022 of at least 1,000K vs. 638K built in 2021.

References:

https://s1.q4cdn.com/144417568/files/doc_financials/2022/q1/Frontier-First-Quarter-2022-Results.pdf

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

During its annual Analyst & Investor day virtual presentations today, AT&T said that Fiber is Foundational for the company’s growth. It is the critical asset in making AT&T the most pervasive and scaled broadband network provider. According to the company, that fiber foundation includes: Multi-gig capable speeds, Symmetric and low latency connectivity, Sustainable, and Enabling critical technologies.

“To us, fiber is foundational to our entire network. Wherever fiber goes, wireless follows,” Jeff McElfresh, CEO of AT&T Communications, said. McElfresh is confident that AT&T has the heft and deals in place to execute on the plan in the face of supply chain constraints and increasing demand and costs for labor.

“We are a very large fiber overbuilder,” he said. “We’ve got scale and we’ve done it before. That scale translates to things like supply chain agreements that are long in tenure and have really good protections for both us and our suppliers.”

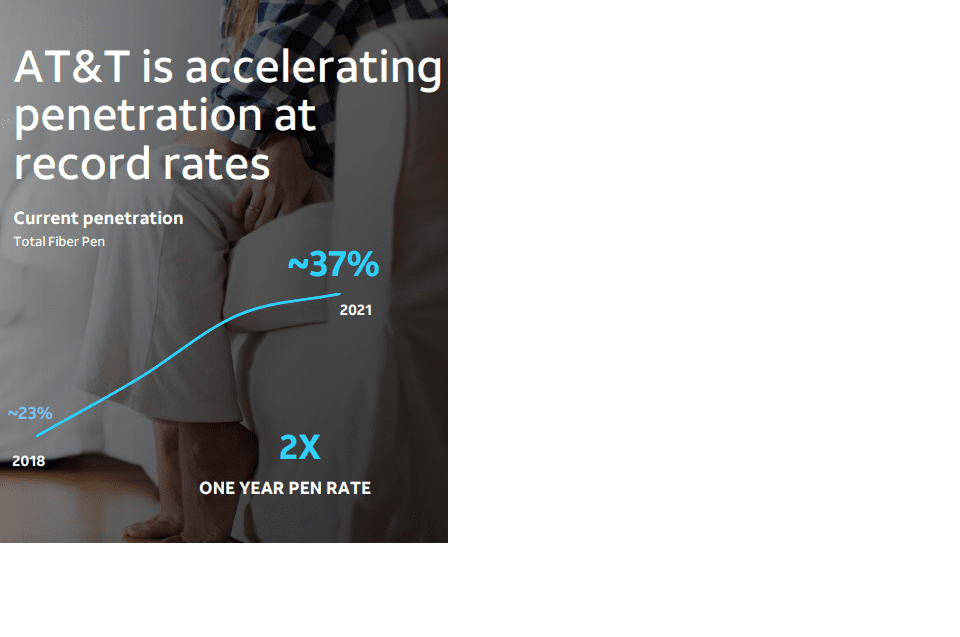

Furthermore, AT&T experienced 37% service penetrations across its entire fiber footprint, including new-build areas, last year.

In markets such as New Orleans, Miami and Louisville, where AT&T is now building FTTP rapidly, penetrations are “well north of 30% after only 12 months of fiber deployment,” Jenifer Robertson, AT&T’s EVP and GM, mobility, said during AT&T’s annual analyst and investor day.

About two-thirds of AT&T’s fiber adds are new to AT&T, Robertson added. With a nod toward service bundling, AT&T is also seeing a 50% boost in wireless market share in its fiber footprint.

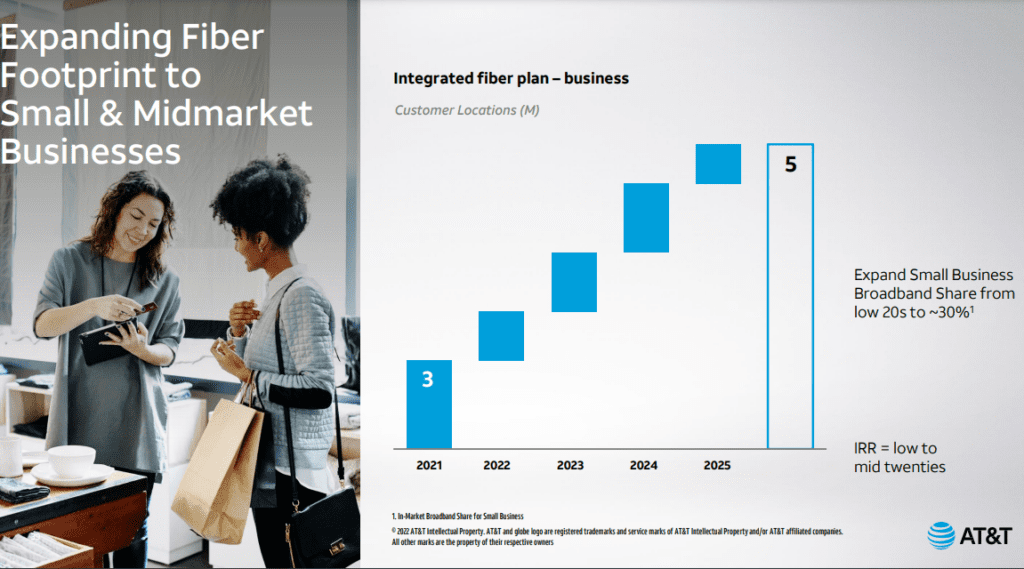

AT&T is targeting small and medium businesses with its FTTP deployments. That’s depicted in this graphic:

AT&T built about 2.6 million new fiber locations in 2021. The company reiterated a plan to build out a footprint of 30 million-plus locations (25 million residential, 4 million small businesses and 1 million enterprise locations) by 2025. It will build in the range of 3.5 million to 4 million locations per year in the coming years to hit that mark. AT&T also expects to spend $3 billion to $4 billion per year to fulfill its fiber buildout mission.

In tandem with the aggressive fiber buildout, AT&T expects broadband revenue to grow by 6% or more in 2022, and in the mid-to-high single-digit range in 2023. Total annual capital expenses are poised to hit $24 billion in 2022 and 2023, up from $20.1 billion in 2021.

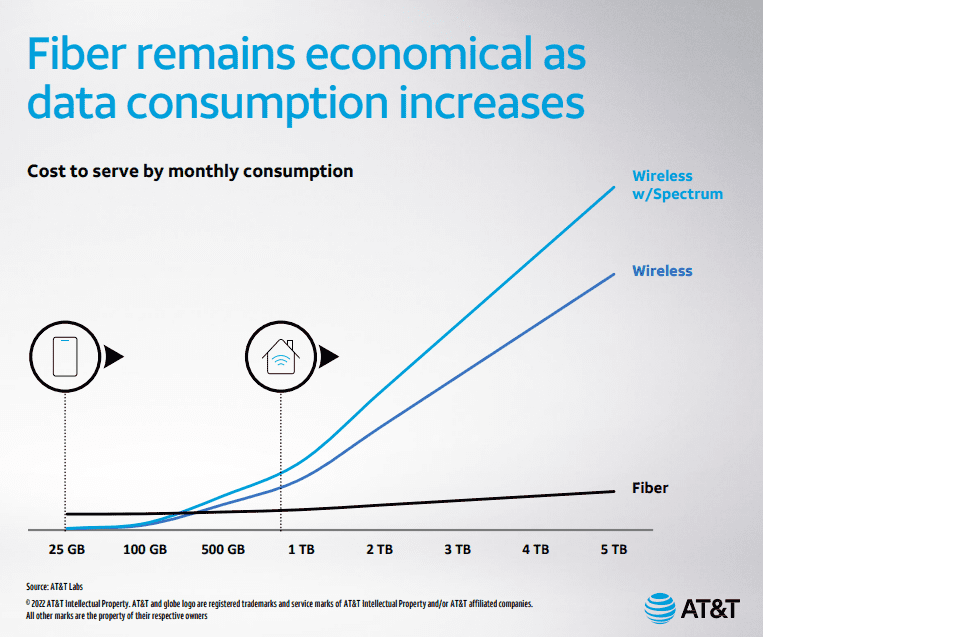

McElfresh outlined the data growth the company expects in coming years that will take advantage of fiber-level speeds. While consumer data consumption has reached the neighborhood of 0.9 terabytes (TB) today, the company expects that to climb to 4.6 TB by 2025. AT&T expects to see big gains in its small- and medium-sized (SMB) and enterprise segments. It also anticipated that the average number of devices connected to the home network will triple, to about 40, by 2025.

“We’re not attempting to serve terabytes of monthly consumption over wireless,” McElfresh said, implying such high data consumption would be via fiber.

Commenting on future networking trends, AT&T CEO John Stankey said:

We conservatively project a 5x data increase on our network over 5 years. A couple of examples. The evolution of social interaction, gaming and experiential alternate realities will consume huge amounts of real-time, low latency 2-way data.

Dramatically improving collaboration tools will enable more effective distributed work environments that will take traffic off of corporate lands and onto robust distributed WANs. Improved health care outcomes and lower cost to address an aging population will rely on access, telemetry and observation to address the challenge of rising cost curves and the list goes on. Some worry and ask, will we get paid for this new rule? History has shown us that sound policy will, in fact, provide returns and solutions.

In the lab, software and hardware will mature rapidly and efficiently. As has been the case since the advent of compute, distributed networking will be running to keep pace. We exit the pandemic with a credible real-world testimony to the value of reliable and pervasive connectivity.

In order to meet the bandwidth and latency needs of broadband applications “nothing is going to top fiber,” he added, noting that AT&T is making a “longer term bet” with its fiber buildout plan.

Separately, U.S. fiber investment forecast from RVA LLC calls for service providers to spend $125 billion over the next five years, exceeding the total amount that has been invested in fiber since providers first began deploying it.

………………………………………………………………………………………………………….

References:

https://video.ibm.com/recorded/131492715

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

Fiber Investment Forecast to Surpass $125 Billion Over Next Five Years

FTTP build out boom continues: AT&T and Google Fiber now offer Gig speeds to residential/business customers

AT&T has extended its symmetrical 2-Gig and 5-Gig to parts of its full fiber-to-the-premises (FTTP) footprint. The expansion (the full list can be viewed here) follows AT&T’s initial launch of multi-gig services to more than 70 US markets.

AT&T said this expansion includes parts of its fiber footprint spanning more than 100 U.S. metro areas.

AT&T Fiber and their Hyper-Gig speeds will be introduced to 7 all-new fiber metro areas in Texas, Oklahoma and Ohio by year-end 2022. Customers in these areas can sign up to be alerted when AT&T Fiber is available to their address through the company’s Notify Me service by visiting att.com/notifyme.

AT&T said it will continue to expand multi-gig capabilities inside its FTTP footprint in 2022, and reiterated plans to expand fiber to more than 30 million customer locations by the end of 2025. Markets on tap for fiber builds include Abilene, Tyler, Victoria, Wichita Falls, and Longview, Texas; Lawton, Oklahoma; and Youngstown, Ohio.

Pricing on AT&T’s new multi-gig remain at the levels announced last month:

- Residential 2-Gig for $110 per month, or business 2-Gig for $225 per month

- Residential 5-Gig for $180 per month, or business 5-Gig for $395 per month

“We’re thrilled to bring our fastest speeds and our best internet experience to more homes and businesses across the country,” said Rick Welday, Executive Vice President & GM of Broadband, AT&T. “The energy and momentum we have in the marketplace is unmistakable and we are proud to be bringing connectivity to more people every single day.”

“The importance of high-speed broadband internet service has never been clearer,” said Bob O’Donnell, President of TECHnalysis Research. “Whether it’s ongoing hybrid work efforts with bandwidth-hungry video meetings, increasing reliance on high-resolution streaming video content, growing interest in online gaming and more, US consumers recognize the need and value of high-quality internet. Multi-gig fiber ups the ante and answers those demands with faster, reliable, symmetrical download and upload speeds.”

AT&T Fiber is internet that upgrades everything! There’s a big difference in the architectural nature of fiber compared to cable. Cable was designed to provide TV content to households, while fiber was designed specifically to provide high-speed internet. Fiber allows high-capacity tasks, such as uploading large documents during video calls and gaming, to flow seamlessly, even during high-usage times.

……………………………………………………………………………………………………………………………………………………………….

AT&T’s gig FTTP offering comes as Frontier Communications, Verizon Communications and Ziply Fiber, get more aggressive with their own multi-gig offerings. Cablecos like CableOne,Suddenlink Communications (asubsidiary of Altice USA), and Comcast/Xfinity are also offering gig download speeds to residential subscribers.

FTTX (Node, Curb, Building, Home) architectures vary with regard to the distance between the optical fiber and the end user. The building on the left is the central office; the building on the right is one of the buildings served by the central office. Dotted rectangles represent separate living or office spaces within the same building.

…………………………………………………………………………………………………………………………………………………………………

Meanwhile, long dormant (and presumed dead) Google Fiber has moved ahead with the debut of a top-tier broadband service for business users that delivers 2 Gbit/s downstream and 1 Gbit/s upstream. Google Fiber’s Webpass fixed wireless services currently deliver up to 1 Gbit/s. Business 2 Gig is available to any business address in any Google Fiber service area. You can Sign up today to see where truly fast, affordable internet can take your business!

Google Fiber’s new business tier costs $250 per month. It’s being bundled with a static IP address (for components such as web and email servers), a Wi-Fi 6 router and a tri-band mesh extender. The new 2-Gig business tier sells for the same price previously affixed to Google Fiber’s 1-Gig service for business, which has been reduced to $100 per month.

Google Fiber introduced its $100 per month, 2-Gig residential service in the fall of 2020, and initially tested it in Nashville, Tennessee, and Huntsville, Alabama. The company has since launched 2-Gig in other FTTP markets, including Atlanta; Austin; Charlotte, North Carolina; San Antonio; Kansas City (Missouri and Kansas); Orange County; Provo and Salt Lake City, Utah; The Triangle, North Carolina. Google Fiber is in the process of launching services in West Des Moines, Iowa, where it tangles with Mediacom Communications.

………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.att.com/story/2022/expands-hyper-gig-fiber-offering.html

https://about.att.com/ecms/dam/pages/internet-fiber/ATT-Fiber-market-cities.pdf

For more information or to check availability for all speed tiers of AT&T Fiber, visit att.com/hypergig

https://fiber.google.com/blog/2022/your-business-now-even-faster/

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

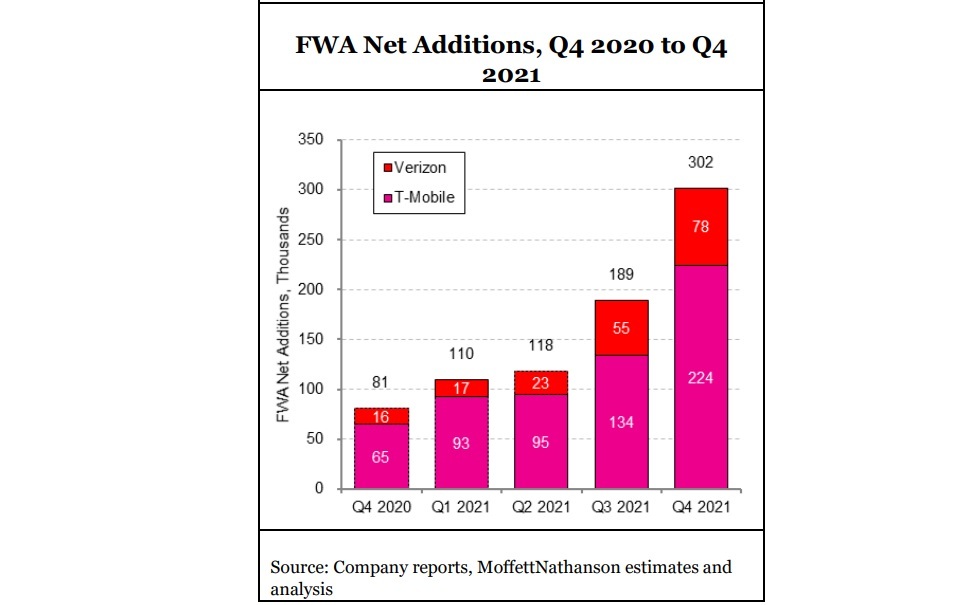

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications says it’s on track with a plan to add 1 million fiber-to-the-premises (FTTP) locations in 2022. Under the plan, Frontier expects to expand its FTTP footprint to 10 million locations by 2025, up from about 4 million today. However, fiber-related revenue growth has yet to match up to recent fiber subscriber and NPS gains. Frontier reported Q4 2021 fiber revenues of $675 million, down from $684 million in the year-ago period.

“We’ve got good supply resilience. We’ve expanded the number of vendors in every category, and we’ve got good forward cost visibility as well,” Nick Jeffery, Frontier’s president and CEO, said Wednesday on the company’s 4th quarter 2021 earnings call.

But he acknowledged that Frontier, which has taken on a “fiber first” posture, was “lucky,” in that the company started to accelerate its fiber build ahead of many other telcos and cable operators.

“We’re in relatively good and insulated position because, frankly, we got there first and we signed up the terms before anyone else had a chance to do so,” Jeffery said.

Supply chain constraints didn’t slow Frontier’s fiber build in Q4 2021, as the company added a record 192,000 FTTP passings in the quarter, improving on the 185,000 new fiber passings built in Q3 2021. Last month Frontier announced that it added a record 45,000 fiber broadband subscribers in the fourth quarter of 2021, beating its prior record in Q3 2021 by more than 50%. That was also enough to overtake subscriber losses from Frontier’s legacy copper broadband business, as the company posted a Q4 net gain of 14,000 consumer broadband subs. Frontier ended 2021 with 1.33 million fiber broadband customers, up 8% year-over-year. About half of Frontier’s consumer broadband sub base is now served by fiber.

Frontier, which launched a symmetrical 2-Gig fiber service on February 22nd, is seeing solid penetration in its existing “base” FTTP markets and positive signs in newer fiber buildout areas. Penetration in Frontier’s relatively mature base-fiber footprint rose to nearly 42%, and the company expects that to eventually increase to 45%.

In its FTTP expansion effort, Frontier is seeing penetrations of 22% at the 12-month mark, expecting that to rise to 25% to 30% at 24 months. In later years, the company expects the percentage to jump to a terminal penetration of 45%.

“We’re now, I believe, gaining market share in all of our fiber markets against every single one of our competitors,” Jeffery said. “That is not a moment in time or an aberration. That’s the result of strong operational execution across many different dimensions, and I think we’ll see that carry forward into the future.”

Frontier said its fiber-related net promoter score (NPS) went positive for the first time in November 2021, while fiber churn dropped to 1.32% in Q4 2021, improved from 1.56% in the year-ago quarter.

Scott Beasley, Frontier’s CFO, said Frontier expects fiber revenues to reach positive territory as 2022 progresses, driven by the growth of its consumer fiber segment and a stabilization of the company’s business and wholesale units.

MoffetNathanson analyst Nick Del Dio had this to say in a research note to clients:

“Large scale network upgrade projects take years to complete. Achieving targeted levels of penetration once the network in a given geography has been upgraded takes years, too. By our estimates, it will be about a decade before Frontier’s potential will be fully realized.”

“Frontier’s operating metrics continue to move in the right direction. Total consumer broadband net adds were positive for the first time in many, many years; copper losses were stable, while the company gained fiber subscribers in both new and existing markets. Fiber gross adds and churn both improved in Q2. Frontier’s fiber NPS scores have improved dramatically over the past year, going from -24 in January 2021 to +9 in December 2021, a 33 point swing, with NPS scores associated with new customers better than those associated with old customers. The company expects continued strength in fiber and better churn in copper in coming periods. Consumer fiber broadband ARPU declined about $1 sequentially, which management attributed to promoting autopay adoption and giving gift cards for new customers.”

……………………………………………………………………………………………………………………………………………………………………………………………

Frontier’s plan to bring FTTP to 10 million locations by 2025 includes what the company calls Wave 1 and Wave 2 builds. Wave 3 includes another 5 million locations that might be built out using supplemental government funding and partnerships, or could be tied to potential divestments or system swaps. Frontier’s analysis of the Wave 3 section continues, and the company should have some specific guidance in the coming months, said John Stratton, Frontier’s executive chairman of the board.

Q4 2021 was the last quarter in which Frontier received subsidy revenues from the Connect America Fund (CAF) II program. Yet they hope President Biden’s infrastructure bill passes and directs revenues to telcos to help them build out their networks.

“It’s complicated,” Stratton said with respect to government stimulus funding, noting that Frontier expects to be an active participant in the new infrastructure bill. “The rules of engagement, both at the federal and state level, are still being worked… Our thought process is that this a 2023 and onward in terms of it becoming something that starts to scale.”

References:

Cox Communications commits to symmetrical 10-Gig; many upgrade paths are possible

Cox Communications is the latest U.S. cable operator to formally announce a commitment to “10G,” the cable industry’s initiative focused on delivering symmetrical 10-Gig speeds over multiple types of access networks, including hybrid fiber/coax (HFC), fiber-to-the-premises (FTTP) and fixed wireless. Comcast is definitely on board that train, an executive told this author. Both Comcast and Charter Communications have announced lab tests of DOCSIS 4.0, and CableOne formed a partnership to pursue FTTP deployments and is preparing for DOCSIS 4.0 upgrades as it begins to boost the capacity of its HFC networks to 1.8GHz.

Cox estimates it has invested more than $19 billion in network and product upgrades over the past decade. The company promises to deliver on their 10G plan through a mix of upgrades to DOCSIS 4.0 on HFC and deployments of FTTP. The company has previously made some FTTP headway under a “Gigablast” initiative focused on extending 1-Gig capabilities across the bulk of its footprint. The privately held network operator said it will make a “multibillion-dollar annual infrastructure investment over the next several years to build a 10-Gigabit-capable, fiber-based network.”

“Connectivity is at the heart of everything we do. With new applications of technology from virtual reality classrooms to autonomous vehicles to the metaverse, people will require increased bandwidth to power their digital futures,” said Mark Greatrex, president of Cox Communications. “Included in this investment is our commitment to bring robust and reliable services to underserved communities and to be the internet provider customers count on to make those valuable connections a reality,” he added.

In addition to faster speeds, Cox also continues to provide secure and reliable WiFi connections covering the whole home. Cox’s Panoramic WiFi offers the latest gateway technology to deliver the most advanced experience with reliable speed, coverage, control and security that can be easily updated as technology changes. Customers also have personal control and security through the Panoramic WiFi app with Advanced Security, protecting every device connected to their network.

“Our intent is to remind the market that we are going to continue to aggressively invest in the communities we serve to maintain and build highly competitive networks,” a Cox spokesman wrote in an email to Telecompetitor.

Multiple Upgrade Paths are Possible:

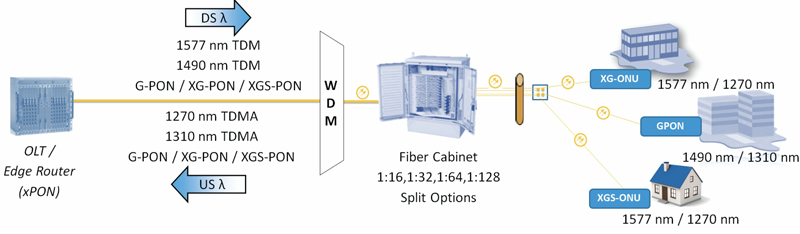

A typical upgrade involves deploying XGS-PON equipment on the same infrastructure that supports widely deployed GPON technology. A key question for cable companies is whether to invest in DOCSIS 4.0 and in augmenting HFC infrastructure to obtain speeds that might reach 6 Gbps symmetrically, or whether it would be more prudent to deploy XGS-PON. All the major cable companies – including Cox – seem to be wrestling with that issue. XGS-PON can support speeds approaching 10 Gbps in both directions.

Supporting multi-gigabit symmetrical speeds is challenging for cable companies’ traditional hybrid fiber coax (HFC) infrastructure. Although the cable industry’s DOCSIS 3.1 and DOCSIS 4.0 specifications call for speeds up to 10 Gbps downstream, upstream bandwidth is more limited. DOCSIS 3.1 and DOCSIS 4.0 are just part of the CableLabs 10G initiative which aims to enable cable companies to support multi-gigabit speeds. Maximizing symmetrical speeds – and the number of customers who can obtain those speeds – will require other network upgrades, such as taking fiber closer to the customer and/or splitting nodes and moving to a DAA approach to reduce the number of customers served from each node.

It appears that not all cable operators will pursue DOCSIS 4.0 aggressively. Altice USA, as one example, announced this week it will accelerate its deployment of FTTP upgrades in both its Optimum and more rural-facing Suddenlink footprints. In Europe, Liberty Global will take multiple upgrade paths using both FTTP and HFC/DOCSIS 4.0, but building fiber overlays is the primary focus at Virgin O2 in the UK, Virgin Media (Ireland) and Telenet (Belgium).

…………………………………………………………………………………………………………………………………………………………………………………………………………

As a private company, Cox Communications does not publicize financial data, but the company has in the neighborhood of 6 million residential broadband customers, and nearly 7 million when business customers are included. A company official told Light Reading that Cox continues to grow total customers, with nearly all new customers taking broadband.

The Cox multi-gigabit press release references a “fiber-based network to more than 100,000 homes and businesses in communities near [the company’s] existing footprint.” In doing this, Cox said it expects to leverage federal funding opportunities – a potential reference to the BEAD program created in the infrastructure act adopted late last year, although the spokesman declined to confirm that.

Cox declined to say what percentage of its network will head down the road of D4.0 or all-fiber, but did note that its current investment commitment includes bringing broadband to underserved communities. Cox came away with a small piece of the first phase of the Rural Digital Opportunity Fund (RDOF) auction – about $6.63 million for 8,212 locations in nine states. The company said it hopes to partner with local cities and towns in pursuing these funding opportunities, but here, too, the spokesman declined to provide specifics.

This won’t be the first time Cox has pursued rural broadband opportunities. The company won funding in the 2020 Rural Digital Opportunity Fund to cover some of the costs of deploying fiber broadband in unserved rural areas, and the company received final authorization of that win in December.

About Cox Communications:

Cox Communications is committed to creating meaningful moments of human connection through technology. The largest private broadband company in America, we proudly serve nearly seven million homes and businesses across 18 states. We’re dedicated to empowering others to build a better future and celebrate diverse products, people, suppliers, communities and the characteristics that make each one unique. Cox Communications is the largest division of Cox Enterprises, a family-owned business founded in 1898 by Governor James M. Cox.

………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cable-tech/cox-sets-path-to-10g-/d/d-id/775402?

Cox Plans Multi-Billion Dollar Symmetrical Multi-Gigabit Upgrade

Cable One joint venture to expand fiber based internet access via FTTP