RAN

AI RAN Alliance selects Alex Choi as Chairman

Backgrounder:

The AI RAN Alliance, formed earlier this year, is a groundbreaking collaboration aimed at revolutionizing the RAN industry. Partnering with tech giants, the goal is to transform traditional Radio Access Networks (RANs) into intelligent, self-optimizing systems using advanced AI technologies. Their website states:

Bringing together the technology industry leaders and academic institutions, the AI-RAN Alliance is dedicated to driving the enhancement of RAN performance and capability with AI. Moreover, we aim to optimize RAN asset utilization, and unlock new revenue streams. By pioneering AI-based innovations in RAN, we aspire to profitably propel the telecom industry towards 6G.

The alliance’s founding members include Amazon Web Services, Inc. (AWS), Arm, DeepSig Inc. (DeepSig), Telefonaktiebolaget LM Ericsson (Ericsson), Microsoft Corporation (Microsoft), Nokia, Northeastern University, NVIDIA, Samsung Electronics, SoftBank Corp. (SoftBank) and T-Mobile USA, Inc. (T-Mobile).

The group’s mission is to enhance mobile network efficiency, reduce power consumption, and retrofit existing infrastructure, setting the stage for unlocking new economic opportunities for telecom companies with AI, facilitated by 5G and 6G.

Image Courtesy of the AI RAN Alliance.

Purpose:

The AI RAN Alliance is dedicated to eliminating the inefficiencies of traditional RAN systems by embedding AI directly into network infrastructures. This shift will enable, for example, dynamic resource allocation, predictive maintenance, and proactive network management.

Industry Benefits:

Enhanced Network Efficiency: Real-time optimized bandwidth allocation and improved user experiences.

Economic Advantages: Cost savings from AI-driven automation and reduced energy consumption.

Innovative Revenue Opportunities: New services such as real-time AI Assistants on your mobile devices.

Key Focus Areas:

- AI for RAN

- AI on RAN (RAN for AI)

- AI and RAN

………………………………………………………………………………………………………………………….

New AI RAN Alliance Chairman:

On August 15, 2024, the AI RAN Alliance appointed Dr. Alex Jinsung Choi, Principal Fellow of SoftBank Corp.’s Research Institute of Advanced Technology as Chairman.

“The AI-RAN Alliance is set to transform telecommunications through AI-RAN advancements, increased efficiency, and new economic opportunities,” said Choi. “As Chair, I’m excited to lead this AI-RAN initiative, working with industry leaders to enhance mobile networks, reduce power consumption, and modernize infrastructure with 5G and 6G with AI/ML. Our goal is to drive societal progress through AI-RAN, transitioning from traditional to next-generation communications infrastructure.”

Satadal Bhattacharjee, Sr. Director of Marketing, Infrastructure BU, ARM, said, “We’re excited to collaborate with Choi, the Chair of the AI-RAN Alliance. Like Choi, we believe that AI will fundamentally change the way wireless services are deployed, fostering broad innovation and enhancing operational efficiency. We look forward to working with key industry leaders from silicon to software to fulfill the promise of ubiquitous AI and 6G.”

Jim Shea, Co-founder and CEO of DeepSig, said, “As a pioneer in AI-native communications together with his prior experience growing the O-RAN ALLIANCE, Choi will lead this important initiative that is shaping the future of intelligent radio access networks. DeepSig’s extensive AI/ML wireless expertise will play a key role in this exciting collaboration to leverage advanced technologies to help the industry unlock unprecedented network efficiency and accelerate innovation.”

Mathias Riback, VP & Head of Advanced Technology U.S., Ericsson, said, “I’m thrilled to welcome Dr. Choi as Chair of the AI-RAN Alliance. As a non-standardization organization, the Alliance can uniquely complement the work of existing SDOs by focusing on shaping innovative use cases that integrate AI with RAN. In addition to realizing benefits from AI in RAN implementations, it will be important to advance ‘AI on RAN’ use cases, where mobile networks play a critical role in enabling AI applications. Ericsson is fully committed to fostering a collaborative environment that unites all players in the evolving AI ecosystem to shape the future of telecom together.”

Shawn Hakl, VP of 5G Strategy, Microsoft, said, “At Microsoft, we recognize artificial intelligence (AI) as a pivotal technology of our era. We are excited to be a part of the AI-RAN Alliance and are particularly pleased to see Choi step into the role of Chair. Choi’s leadership will be key as we collaborate to leverage AI in optimizing RAN infrastructure investments and expanding the capabilities of RAN to introduce new AI-driven services for modern mobile applications.”

Ari Kynäslahti, Head of Strategy and Technology, Mobile Networks at Nokia commented, “Nokia is proud to be part of the AI-RAN Alliance and contribute towards integrating AI into radio access networks. The potential of AI to optimize networks, predict and resolve issues, and enhance performance and service quality is significant. As we embark on this transformative journey, collaboration is essential to harness our collective expertise. We are pleased to see Dr. Alex Choi appointed to this role, and look forward to him guiding our efforts to achieve these goals.”

Tommaso Melodia, William L. Smith Professor, Northeastern University, said, “We are pleased to have Choi as the Chair of the AI-RAN Alliance, leading our efforts to transform the industry. Choi has been a strong advocate for the evolution towards a more open, software-driven, and AI-integrated future. Under Choi’s leadership, the AI-RAN Alliance is set to fast-track the development of new services and use cases by leveraging openness, softwarization, and AI integration to enhance network performance, energy efficiency, spectrum sharing, and security, ultimately redefining the landscape of global communications.”

Soma Velayutham, GM, AI and Telecoms, NVIDIA, said, “The AI-RAN Alliance is a critical initiative for advancing the convergence of AI and 5G/6G technologies to drive innovation in mobile networks. The consortium’s new leadership will bring a fresh perspective and focus on delivering the next generation of connectivity.”

Dr. Ardavan Tehrani, Samsung Research, AI-RAN Alliance Board of Directors Vice Chair, said, “We are excited to have Dr. Alex Choi leading the AI-RAN Alliance as the Chair of the Board. The Alliance will play a pivotal role in fostering collaboration, driving innovation, and transforming future 6G networks utilizing AI. Under Dr. Choi’s leadership, the Alliance will strive to deliver substantial value to end users and operators through pioneering AI-based use cases and innovations.”

Ryuji Wakikawa, VP and Head of Research Institute of Advanced Technology, SoftBank Corp., said, “SoftBank is committed to realizing an AI-powered network infrastructure, and we strongly believe that Choi’s extensive background and expertise will be a great force in advancing AI-RAN technology and driving significant progress for the mobile industry in this AI era with lightning speed.”

John Saw, EVP and CTO, T-Mobile, said, “We are thrilled to have Alex Choi as Chair of the AI-RAN Alliance. AI is advancing at an unprecedented rate and with our 5G network advantage we have a unique opportunity to harness this momentum. By developing solutions that make the most of both RAN and AI on GPUs — and working alongside Choi and the top industry leaders within the Alliance — we believe there is potential for change that will revolutionize the industry.”

Dr. Akihiro Nakao, Professor, The University of Tokyo, said, “Dr. Alex Jinsung Choi’s appointment as Chair of the AI-RAN Alliance represents a pivotal step in advancing AI within the telecommunications sector. His leadership is expected to unite academic and industry efforts, nurturing the next wave of innovators who will drive the future of AI and telecommunications. This initiative will not only fast-track the adoption of AI across diverse applications but also foster international collaboration and set new standards for efficiency, energy management, resilience, and the development of AI-driven services that will reshape the telecommunications industry and benefit society worldwide.”

……………………………………………………………………………………………………………………………………………….

References:

https://ai-ran.org/news/industry-leaders-in-ai-and-wireless-form-ai-ran-alliance/

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Nokia’s 760 global private networking contracts are mostly 4G-LTE Advanced

Backgrounder:

Private Wireless Radio Access Network (RAN) revenue growth slowed in the fourth quarter of 2023 on a year-over-year basis. However, full-year revenues accelerated by approximately 40% in 2023, propelling private wireless to comprise around 2% of the overall RAN market.

“Private wireless RANs are now growing at a formidable pace, in contrast to public RAN and enterprise WLAN – both segments are projected to contract in 2024,” said Stefan Pongratz, Vice President at Dell’Oro Group in April.

The top 3 Private Wireless RAN suppliers in 2023 were Huawei, Nokia, and Ericsson. Excluding China, they were Nokia, Ericsson, and Samsung.

……………………………………………………………………………………………………………………………………………..

Nokia leads in Private RANs:

Nokia recently told Fierce Network that it signed 30 new private networking contracts in the second quarter of 2024. Nokia has said that it has signed more than 760 private network contracts around the world. NGIC, Sigma Lithium and Solis are some of the most recent names it has signed.

Nokia said that 78% of its private network business is based on 4G LTE-Advanced [1.], compared to 18% being 5G only, and the remaining 4% combining the two broadband cellular technologies.

Note 1. In October 2010, LTE-Advanced successfully passed the ITU-R’s evaluation process and was found to meet or exceed IMT-Advanced requirements. It was standardized a “IMT Advanced,” which support low to high mobility applications and a wide range of data rates in accordance with user and service demands in multiple user environments. IMT Advanced also has capabilities for high quality multimedia applications within a wide range of services and platforms, providing a significant improvement in performance and quality of service.

Image courtesy of Research Gate

…………………………………………………………………………………………………………………………………………….

David de Lancellotti, VP of enterprise campus edge business at Nokia talked to Fierce about Nokia’s performance in the private networking space. “Thirty in Q2, and roughly 50 — a little more than 50 — in the first half,” he said of contracts signed.

“We kind of jumped into this a bit earlier than anybody else,” Nokia’s de Lancellotti explained. “I think we’ve always taken a real service provider approach in terms of quality, in terms of feature set [and] in terms of roadmap,” while noting Nokia’s “real drive to pick up the enterprise space.”

Industry verticals – transportation, energy and manufacturing – continue to “lead the way” for private networking contracts in Q2. “When we talk about transportation, I think that’s the port side of business, which continues to be strong for us,” David said.

References:

https://www.fierce-network.com/wireless/nokia

Private Wireless RAN Revenues up ~40 Percent in 2023, According to Dell’Oro Group

https://en.wikipedia.org/wiki/LTE_Advanced

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-adv/Pages/default.aspx

https://www.researchgate.net/figure/Network-architecture-of-LTE-Advanced_fig1_333886291

Highlights of Dell’Oro’s 5-year RAN forecast

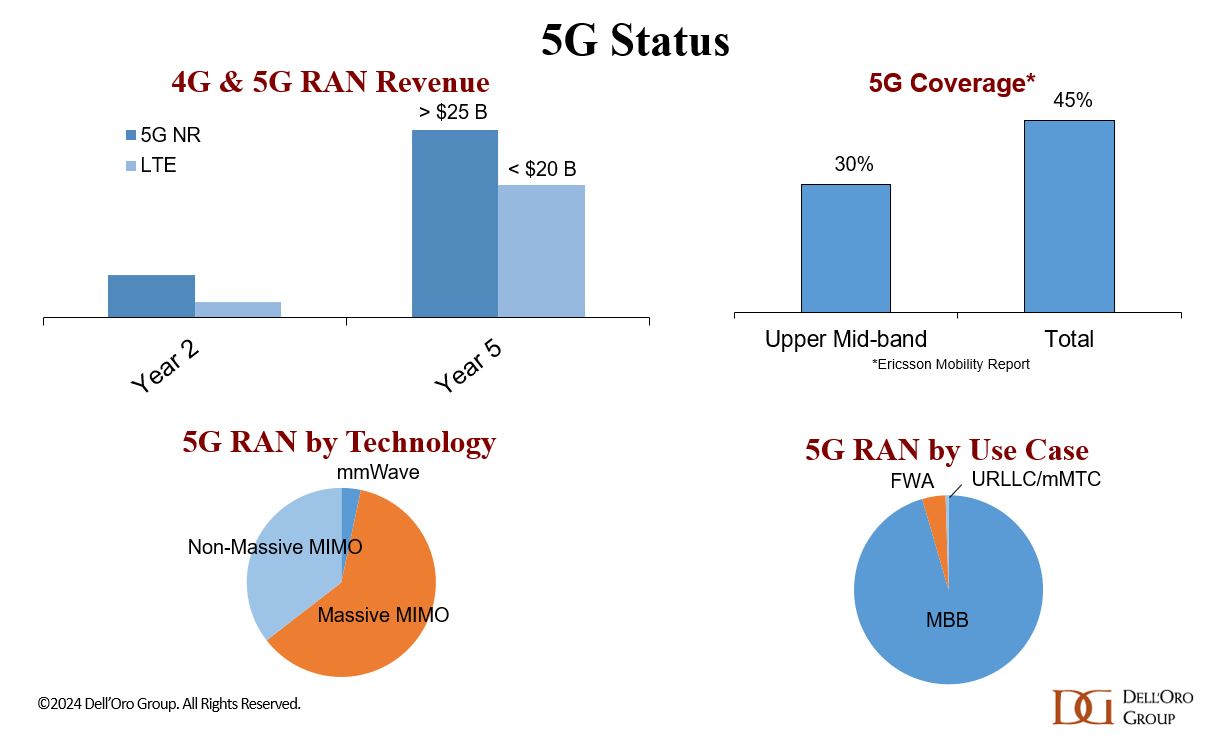

Market conditions remain challenging for the broader RAN market. Following the 40% to 50% ramp between 2017 and 2021, the RAN market has been declining since then. These trends are expected to prevail throughout the forecast period. However, the pace of the decline should moderate somewhat after 2024.

“It is not a surprise that there is rain after sunshine,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “In addition to MBB-based coverage-related challenges, this disconnect between mobile data traffic growth and the capacity boost provided by the mid-band, taken together with continued monetization uncertainty, is clearly weighing on the market,” Pongratz added.

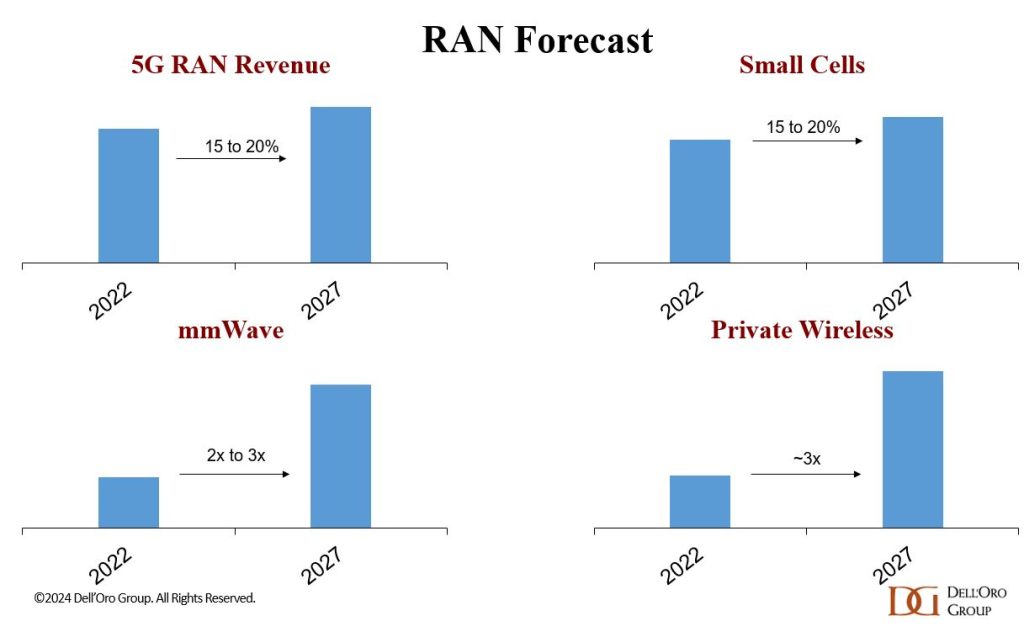

- Worldwide RAN revenues are projected to decline at a 2 percent CAGR over the next five years, as continued 5G investments will be offset by rapidly declining LTE revenues.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North American region. Even with some recovery, North American RAN revenues are expected to remain significantly lower relative to the peak in 2022.

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

Commentary:

Worldwide RAN revenues are projected to decline at a 2% CAGR between 2023 and 2028, as rapidly declining LTE revenues will offset continued 5G investments. This is predicated on the assumption that the MBB portion of the RAN market will continue to trend downward, and the upside from new growth opportunities is not enough to change the trajectory.

The mix between existing and new use cases has not changed. We still forecast private/enterprise RAN to grow at a 20%+ CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some for private RAN to move the broader RAN needle.

As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels, there are serious concerns about the timing of capacity upgrades. The network utilization metric will play a much more significant role as we move further into the capacity phase.

Generally, the less advanced 5G regions are expected to perform better than the mature 5G markets. As a result, markets with lower 5G POP coverage, including Middle East & Africa, Caribbean and Latin America, and APAC Excluding China/India should perform better.

Easier comparisons following steep contractions in 2023 will improve the North American region’s growth prospects. Even with some recovery, North American RAN revenues are expected to remain significantly below peak levels in 2022.

5G-Advanced will play an essential role in the broader 5G journey. However, 3GPP Releases 18-20 are not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets. Also, ITU-R WP5D has not started any work related to a 5G-Advanced recommendation(s).

More importantly, some RAN segments will stand out even as the broader RAN market shrinks. RAN segments expected to grow over the next five years include 5G NR, Non-MM 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

References:

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

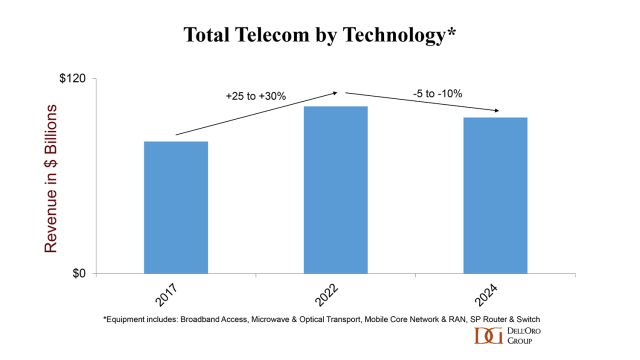

Preliminary Dell’Oro Group data found that worldwide telecom equipment revenues across the six telecom programs tracked – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and Service Provider routers.

The North America telecom equipment market declined faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

………………………………………………………………………………………………………………………………………………………………………………………………

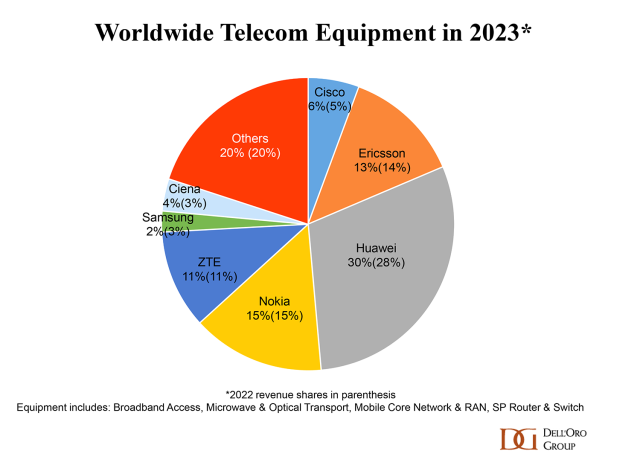

Dell’Oro says that Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the U.S. government and other countries to limit its addressable market and access to Android and the latest chips and semiconductor technology from TSMC. In fact, Dell’Oro’s assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Supplier rankings were mostly unchanged. However, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top seven suppliers accounted for around 80% of the overall market.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.

References:

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

A new report from the Dell’Oro Group reveals that the global Radio Access Network (RAN) market concluded the year with another difficult quarter, resulting in a global decrease of nearly $4 billion in RAN revenues for the full year of 2023. However, despite these challenges, the results for the quarter exceeded expectations, partly due to robust 5G deployments in China.

“Following the intense rise between 2017 and 2021, it’s clear that the broader RAN market is now experiencing a setback, as two out of the six tracked regions are facing notable declines,” said Stefan Pongratz, Vice President for RAN market research at the Dell’Oro Group. “In addition to challenging conditions in North America and Europe, the narrowing gap between advanced and less advanced operators (e.g. India) in this first 5G wave, compared to previous technology cycles, initially had a positive impact but is now constraining global 5G and broader RAN growth prospects,” Pongratz added.

Additional highlights from the 4Q 2023 RAN report:

- Overall concentration in the RAN market showed signs of improvement in 2021 and 2022, but this progress slowed down in 2023.

- While full-year RAN rankings remained mostly unchanged for major suppliers, revenue shares within the RAN market showed more variability, with Huawei and ZTE enhancing their global revenue shares. Similarly, Huawei and Nokia saw improvements in their revenue shares outside of China.

- The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Regional projections are mostly unchanged, with market conditions expected to remain tough in 2024 due to difficult comparisons in India. Nevertheless, the base-case scenario anticipates a more moderate pace of decline this year.

…………………………………………………………………………………………………………………………

Source: Dell’Oro Group

…………………………………………………………………………………………………………………………

Separately, Rémy Pascal of Omdia says that global RAN revenues (including both hardware and software) declined by 11% last year to just over $40 billion. The worst performing region by far was North America, which almost halved, but this should be viewed in the context of a relatively strong 2022.

India and China were been the best performing countries for new RAN deployments. This partly explains why Huawei continues to be the top RAN vendor despite attempts by the U.S. and its allies to prevent that, but as the Omdia table below shows, the Chinese vendor is still doing well in many other regions too. We’re told this table looked pretty much the same last year.

Top RAN vendors by region, full year 2023:

|

North America |

Asia & Oceania |

Europe, Middle East and Africa |

Latin America & the Caribbean |

|

Ericsson |

Huawei |

Ericsson |

Huawei |

|

Nokia |

ZTE |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Nokia |

Source: Omdia

Omdia expects the RAN market size to decrease by around 5% compared to 2023. That’s an improvement on the 11% 2022-23 decline but still not good news for the RAN industry.

For all the talk of Open RAN, it clearly has yet to inspire significant capex from operators. The same goes for private 5G or programmable networks. Less than halfway through the presumed 5G cycle, spending has stalled and it’s not at all clear what will restart it.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

References:

RAN Market Shows Faint Signals of Life in 4Q 2023, According to Dell’Oro Group

https://www.telecoms.com/wireless-networking/global-ran-market-declined-by-11-in-2023

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

https://www.silverliningsinfo.com/5g/ericsson-nokia-and-state-global-ran-2024

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

According to a new report by Dell’Oro Group, the Radio Access Network (RAN) market is now in a downward trajectory. That’s no surprise to readers of the IEEE Techblog, as we forecasted the “5G train wreck” many years ago and continued the drumbeat due to the scarcity of 5G SA core networks, without which there are NO 5G features/functions. Also that URLLC performance requirements were not met by either the 3GPP Release 16 Enhancements for URLLC in the RAN spec or the ITU M.2150 recommendation which is the official standard for 5G NR.

Following the >40 percent ascent between 2017 and 2021, RAN revenues stabilized in 2022, and are on target to decline sharply in 2023. Market conditions are expected to remain challenging in 2024 as the Indian RAN market pulls back, though the pace of the global decline this year and for the remainder of the forecast period should be more moderate.

“The big picture has not changed. MBB-based investments are now slowing and the upside with new growth areas including FWA and private wireless is still too small to change the trajectory,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Also weighing on the MBB market is the fact that the upper mid-band capacity boost is rather significant relative to current data traffic growth rates in some markets, which could impact the timing for capacity upgrades,” continued Pongratz.

Additional highlights from the Mobile RAN 5-Year January 2024 Forecast Report:

- Worldwide RAN revenues are projected to decline at a 1 percent CAGR over the next five years.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North America region.

- 5G-Advanced is expected to play an important role in the broader 5G journey, however, it is not expected to fuel another major capex growth cycle.

- RAN segments that are expected to grow over the next five years include: 5G NR, FWA, mmWave, Massive MIMO, Open RAN, private wireless, small cells, and Virtualized RAN.

Dell’Oro said in November said it was optimistic about the long-term growth prospects of the RAN space, but simultaneously noted that after a peak in 2021, RAN revenues will track downwards until the second half of the current decade; overall it predicted a 1% compound annual growth rate between 2020 and 2030. That forecast will now have to be revised DOWN significantly as 6G- the next big RAN mover- won’t be standardized till 2031 at the earliest.

RAN remains a concentrated market, with the top 8 RAN suppliers accounting for more than 98% of the 1Q23-3Q23 RAN market. New technologies, architectures, and segments can in some cases present opportunities for vendors with smaller footprints. Still, the track record for new entrants is far from perfect.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 7 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

References:

RAN Decline to Extend Beyond 2023, According to Dell’Oro Group

https://techblog.comsoc.org/2024/01/18/where-have-you-gone-5g-midband-spectrum-fwa-decline-in-capex-and-ran-revenue-in-2024/

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: OpenRAN revenue forecast revised down through 2027

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

LightCounting & TÉRAL RESEARCH: India RAN market is buoyant with 5G rolling out at a fast pace

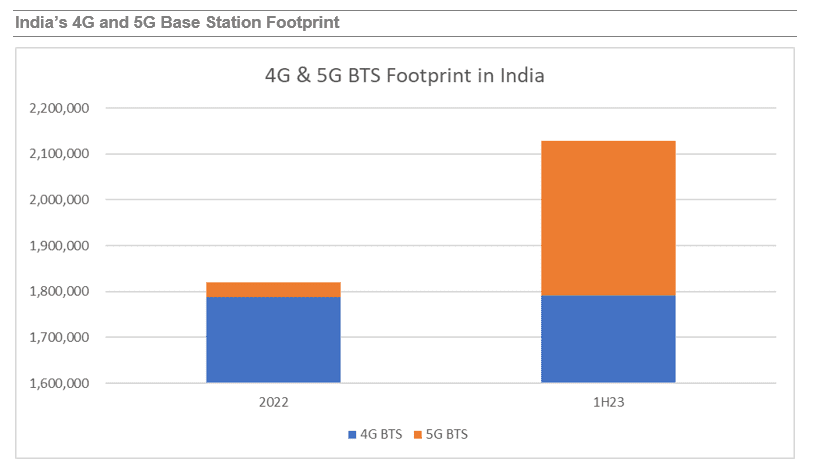

The India Wireless Infrastructure Report provides an update on the 5G radio access (RAN) developments in India, including geopolitics trends and technology. The report says that The RAN market in India is buoyant with a swelling local ecosystem that boasts big international ambitions.

Reliance Jio is rolling out 5G at a fast pace, followed by Bharti Airtel. As a result,1H23 RAN sales surged 300% YoY, and kept Ericsson in the driver’s seat, followed by Nokia and Samsung. Although the rollout pace has slowed down, 2023 is looking up, looks like the peak year, and we expect RAN equipment sales to more than double compared to last year, still driven by Jio and Airtel while BSNL will contribute with its 4G deployment.

“It’s a two-horse race, the near Jio / Airtel duopoly is quickly blanketing the country with 5G while the rest are struggling and catching up with 4G.” said Stéphane Téral, Chief Analyst at LightCounting Market Research and Founder of TÉRAL RESEARCH.

Source: LightCounting

………………………………………………………………………………………………………………………….

- 2024 is shaping up as a shift year from 5G network buildout to how to foster utilization and some midband FWA experiments.

- Due to the looming formation of a CSP duopoly, the looming merger of MTNL into BSNL, and Vodafone Idea’s unsustainable indebtment, our long-term forecast points to a lumpy RAN market. There is no surprise that India is a tough cellular market characterized by flat subscriber growth, ultralow ARPUs and low equipment average sales pricing.

- Open RAN is the brightest spot with a penetration of the total RAN market that will surpass 50% by 2028.

- At the same time, a mushrooming energetic local ecosystem is rising with great international ambitions enabled by strong ties between the U.S. and India.

…………………………………………………………………………………………………………..

References:

https://www.lightcounting.com/report/september-2023-india-wireless-infrastructure-217

https://www.lightcounting.com/report/september-2023-open-vran-market-213

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

OTT players in India struggle in telco partnerships

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India to set up 100 labs for developing 5G apps, business models and use-cases

Adani Group to launch private 5G network services in India this year

LightCounting: Wireless infrastructure market down in 2Q-23 (no surprise)

| Historical data accounts for sales of the following vendors: | |||

| Vendor | Segments | Source of Information | |

| Altran | vRAN | Estimates | |

| Amdocs | 5GC | Estimates | |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates | |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates | |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates | |

| Corning | vRAN | Estimates | |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Enea | 5GC | Estimates | |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates | |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Fujitsu | RAN | Survey data and estimates | |

| HPE | 2G/3G core, 5GC | Estimates | |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| JMA Wireless | vRAN | Estimates | |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates | |

| Microsoft (acquired Metaswitch and Affirmed Networks, 2020) | 5GC, vEPC and 2G/3G core | Estimates | |

| Movandi | RAN/vRAN (RU/repeater) | Estimates | |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Node-H | vRAN (small cells) | Estimates | |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| NEC (including Blue Danube Systems, January 2022) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates | |

| Oracle | 5GC | Estimates | |

| Parallel Wireless | vRAN (CU, DU) | Estimates | |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates | |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Qucell | RAN, vRAN | Estimates | |

| Rakuten Symphony (acquired Altiostar, August 2021) | vRAN (CU, DU) | Estimates | |

| Ribbon Communications | 2G/3G core | Survey data and estimates | |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates | |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors | |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates | |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

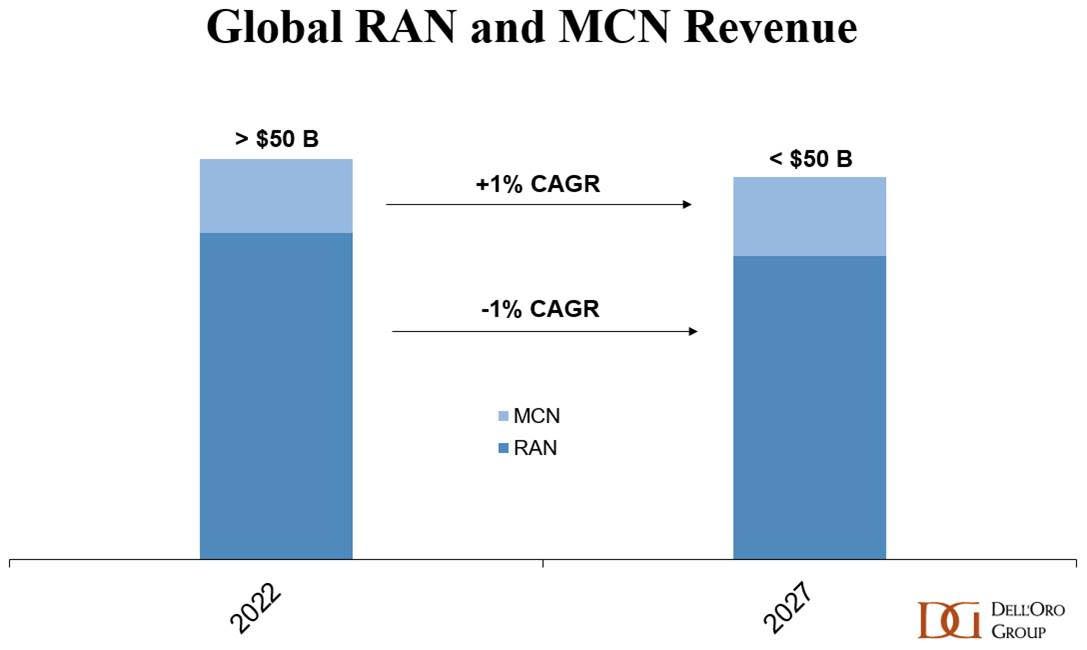

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

According to a newly published forecast report by Dell’Oro Group,the Radio Access Network (RAN) market is done expanding for now. Following the 40% to 50% ascent between 2017 and 2021, RAN revenues flattened out in 2022 and these trends extended to 1Q 2023.

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak,” said Stefan Pongratz, Vice President at Dell’Oro Group.

“Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?” Pongratz added.

Additional highlights from the Mobile RAN 5-Year July 2023 Forecast Report:

- Global RAN is projected to decline at a 1 percent CAGR over the next five years.

- The less advanced 5G regions are expected to perform better while the more developed 5G regions, such as North America and China, are projected to record steeper declines.

- LTE is still handling the majority of the mobile data traffic, but the focus when it comes to new RAN investments is clearly on 5G. Even with the more challenging comparisons, 5G is projected to grow another 20 percent to 30 percent by 2027, which will not be enough to offset steep declines in LTE.

- With mmWave comprising a low single-digit share of the RAN market and skepticism growing about the MBB business case, it is worth noting that our position has not changed. We still envision that the mmWave spectrum will play a pivotal role in the long-term capacity roadmap.

……………………………………………………………………………………………………………………….

Separately, Dell’Oro again lowered its forecasts for the Mobile Core Network market (which is now 5G SA core network), this time citing a slowdown in customer growth. It now predicts that the worldwide market for mobile core networks will expand at a CAGR of 1% over the next five years, having previously forecast a 2% CAGR as recently as January.

“We have reduced our forecast for the third consecutive time, primarily caused, this time, by an expected slowdown in subscriber growth,” said Dave Bolan, Research Director at Dell’Oro Group.

Dave said that Dell’Oro has reduced its expectations for the Multi-Access Edge Computing (MEC) market (which requires 5G SA core network). It now anticipates MEC will have a CAGR of 31%, noting that commercially-viable enterprise applications are taking much longer to come to fruition than many had hoped.

“Mobile Network Operators (MNOs) are concerned about inflation, a possible recession, and political conflicts. They are therefore being restrained in their capital expenditures, another factor weighing in on a more conservative forecast,” said Bolan. “As we continue refining our count of MNOs that have launched 5G Standalone (5G SA) eMMB networks, we note that only 4 MNOs have commercially deployed new 5G SA networks compared to six in the first half of 2022,” he added.

Additional highlights from the Mobile Core Network & Multi-Access Edge Computing 5-Year July 2023 Forecast Report:

- Year-over-year MCN revenue growth rates are projected to be flat in 2026 and turn negative in 2027.

- The North America and China regions are expected to have negative CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific excluding China regions are expected to have the highest positive CAGRs.

Vodafone became one of those first-half 2023 launches, when it brought 5G Ultra to market in the UK in late June. In its latest Mobility Report, published around the same time, Ericsson noted that while around 240 telcos have launched commercial 5G services, only 35 of them have brought standalone 5G to market.

That should bode well for the mobile core market, and indeed it is faring better than the RAN space, in growth potential terms, at least.

Nonetheless, Dell’Oro predicts that year-on-year growth rates in mobile core network revenues will be flat by 2026 and turn negative the following year.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year July Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

RAN Market to Decline at a 1 Percent CAGR Through 2027, According to Dell’Oro Group

Slower Subscriber Growth to Cut Mobile Core Network Market Growth, According to Dell’Oro Group

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

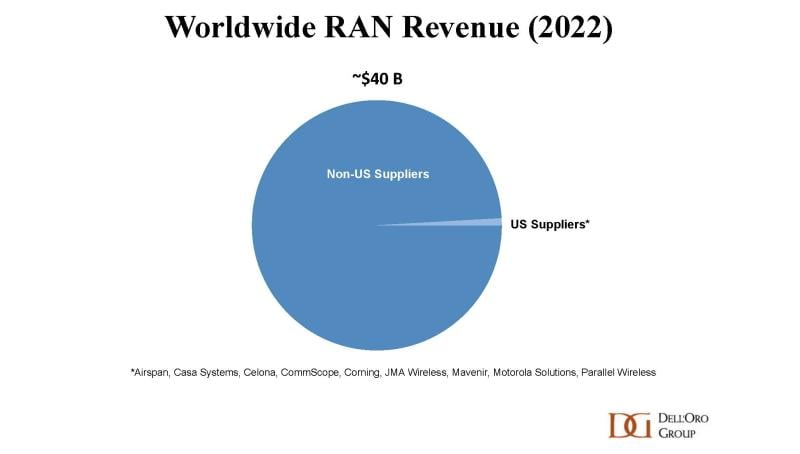

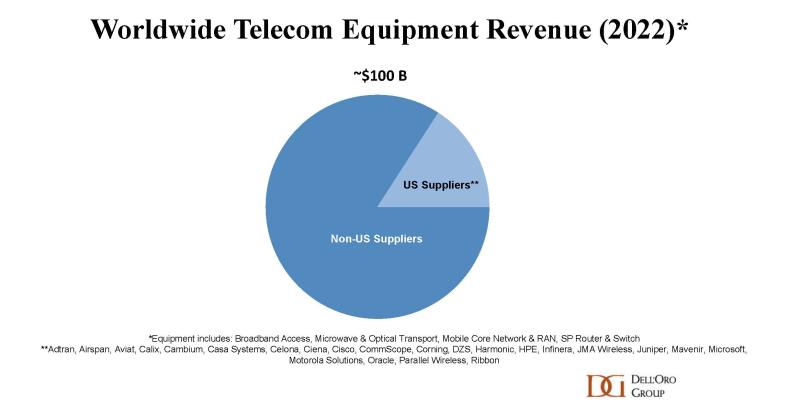

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz