T-MobileUSA

Leichtman Research Group: Fixed Wireless Services Accounted for 90% of the Broadband Net Adds in 2022!

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 95% of the market – acquired about 3,500,000 net additional broadband Internet subscribers in 2022, compared to a pro forma gain of about 3,725,000 subscribers in 2021.

These top broadband providers account for about 110.5 million subscribers, with top cable companies having 75.6 million broadband subscribers, top wireline phone companies having 30.8 million subscribers, and top fixed wireless services having 4.1 million subscribers.

LRG’s findings for 2022 include:

- Overall, broadband additions in 2022 were 94% of those in 2021.

- The top cable companies added about 515,000 subscribers in 2022 – compared to about 2.8 million net adds in 2021.

- The top wireline phone companies lost about 180,000 total broadband subscribers in 2022 – compared to about 210,000 net adds in 2021.

- Wireline Telcos had about 2.4 million net adds via fiber in 2022, offset by about 2.6 million non-fiber net losses.

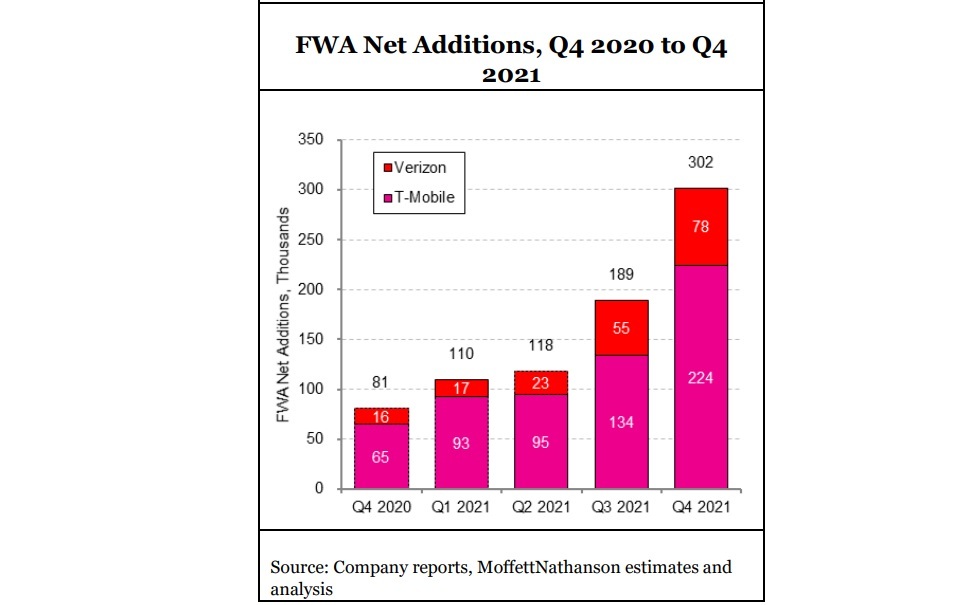

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

“Top broadband providers added about 3.5 million subscribers in 2022. Fixed wireless services (FWA) accounted for 90% of the net broadband additions in 2022, compared to 20% of the net adds in 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Total broadband net adds in 2022 were slightly lower than last year, and down from about 5 million in 2020, but were more than in any year from 2012-2019.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

FWA in the Spotlight:

A recent survey of some T-Mobile fixed wireless customers, conducted by the financial analysts at Wolfe Research, “T-Mobile Fixed Wireless Consumer Survey & Broadband Industry Implications,” found that 90% rated their service as “good enough.” The firm surveyed Facebook’s T-Mobile FWA user group, totalling over 15,000 members, in December 2022. Based on the 60 replies it received, 90% said they were mostly satisfied. The firm also found that 42% of respondents previously subscribed to a cable connection, 37% hailed from DSL operators, and 6% previously used fiber. Around 8% had no prior broadband service. Moreover, the financial analysts at Evercore expect T-Mobile to accumulate around 450,000 new fixed wireless customers in the first quarter of 2023, down from the 524,000 the operator reported in the fourth quarter of 2022.

Verizon added 262,000 residential FWA customers in Q4, up from +38,000 in the year-ago period, to end 2022 with 884,000 residential FWA subscribers. The company also signed on 117,000 business FWA subs in the quarter, up from +40,000 in the year-ago period, ending 2022 with 568,000 business FWA customers. About 70% of the consumer fixed wireless gross additions have come from bundling an existing wireless service, while 30% are new to Verizon. Interestingly, the experience is flipped for Verizon Business, where 70% of FWA customers were new to Verizon.

In contrast to the widely-held view that FWA is a “lower quality” service than wired broadband, Verizon says their principal selling point is FWA network’s greater reliability versus wireline alternatives. Cable’s outside plant issues can take days to resolve, a particularly critical issue in B2B, where cablecos (like Comcast Business) have increased their market share.

Image Credit: Verizon

The Wireless Internet Service Providers Association (WISPA) kicked off its annual trade show this week in Louisville, Kentucky, stating that WISPs service a total of 9 million Americans, many of whom live in the hardest to reach and serve parts of the country

According to Fierce Wireless, Cox is using 5G technology to test FWA services near Macon, Georgia; Tucson, Arizona; and Oklahoma City, Oklahoma.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

| Broadband Providers | Subscribers at end of 2022 | Net Adds in 2022 |

| Cable Companies | ||

| Comcast | 32,151,000 | 250,000 |

| Charter | 30,433,000 | 344,000 |

| Cox* | 5,560,000 | 30,000 |

| Altice | 4,282,900 | (103,300) |

| Mediacom* | 1,468,000 | 5,000 |

| Cable One** | 1,060,400 | 14,400 |

| Breezeline** | 693,781 | (22,997) |

| Total Top Cable | 75,649,081 | 517,103 |

| Wireline Phone Companies | ||

| AT&T | 15,386,000 | (118,000) |

| Verizon | 7,484,000 | 119,000 |

| Lumen^ | 3,037,000 | (253,000) |

| Frontier | 2,839,000 | 40,000 |

| Windstream* | 1,175,000 | 10,300 |

| TDS | 510,000 | 19,700 |

| Consolidated** | 367,458 | 724 |

| Total Top Wireline Phone | 30,798,458 | (181,276) |

| Fixed Wireless Services | ||

| T-Mobile | 2,646,000 | 2,000,000 |

| Verizon | 1,452,000 | 1,171,000 |

| Total Top Fixed Wireless | 4,098,000 | 3,171,000 |

| Total Top Broadband | 110,545,539 | 3,506,827 |

* LRG estimate

** Includes LRG estimate of pro forma net adds

^ Includes the impact of a divestiture completed in October 2022

- TDS residential subscribers, includes 305,200 wireline subscribers and 204,800 cable subscribers

- Company subscriber counts may not solely represent residential households – about 6.5% of the total are non-residential

- Top broadband providers represent approximately 95% of all subscribers

- Net additions reflect pro forma results from system sales and acquisitions, reporting adjustments, and the addition of new providers to the list – therefore, comparing totals in this release to prior releases will not produce accurate findings

About Leichtman Research Group, Inc:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com

References:

https://wispa.org/news_manager.php?page=29725

https://www.verizon.com/about/blog/fixed-wireless-access

T-Mobile and Cisco launch cloud native 5G core gateway

T-Mobile US announced today that it has collaborated with Cisco to launch a first-of-its kind cloud native 5G core gateway. T-Mobile has moved all of its 5G and 4G traffic to the new cloud native converged core which provides customers with more than a 10% improvement in speeds and lower latency. The new core gateway also allows T-Mobile to more quickly and easily test and deliver new 5G and IoT services, like network slicing and Voice over 5G (VoNR) thereby expediting time to market.

The T-Mobile US 5G SA core is based on Cisco’s cloud-native control plane that uses Kubernetes to orchestrate containers running on bare metal. The companies said this frees up more than 20% of the CPU cores.

It also uses Cisco’s 8000 Series routers, 5G and 4G LTE packet core gateways, its Unified Computing System (UCS) platform, and Cisco’s Nexus 9000 Series Switches that run the vendor’s Network Services Orchestrator for full-stack automation.

“T-Mobile customers already have access to the largest, most powerful 5G network in the country, and we’re innovating every day to supercharge their experience even further,” said Delan Beah, Senior Vice President of Core Network and Services Engineering at T-Mobile. “This cloud native core gateway takes our network to new heights, allowing us to push 5G forward by delivering next-level performance for consumers and businesses nationwide while setting the stage for new applications enabled by next-gen networks.”

With a fully automated converged core gateway, T-Mobile can simplify network functions across the cloud, edge and data centers to significantly reduce operational life cycle management. The increased efficiency is an immediate benefit for customers, providing them with even faster speeds. The new core is also more distributed than ever before, leading to lower latency and advancing capabilities like edge computing.

“Our strategic relationship with T-Mobile is rooted in co-innovation, with a shared vision to establish best practices for 5G and the Internet for the Future,” said Masum Mir, Senior Vice President and General Manager, Cisco Networking Provider Mobility. “This is the type of network every operator aspires to. It will support the most advanced 5G applications for consumers and businesses today and enables T-Mobile to test and deliver new and emerging 5G and IoT applications with simplicity at scale.”

The fully automated converged core architecture is based on Cisco’s cloud native control plane, optimized with Kubernetes orchestrated containers on bare metal, freeing up over 20% of the CPU (Central Processing Unit) cores. The converged core solution uses a broad mix of Cisco’s flagship networking solutions including the Cisco 8000 Series routers, 5G and 4G packet core gateways, Cisco Unified Computing System (UCS), and Cisco Nexus 9000 Series Switches with Cisco Network Services Orchestrator for full stack automation.

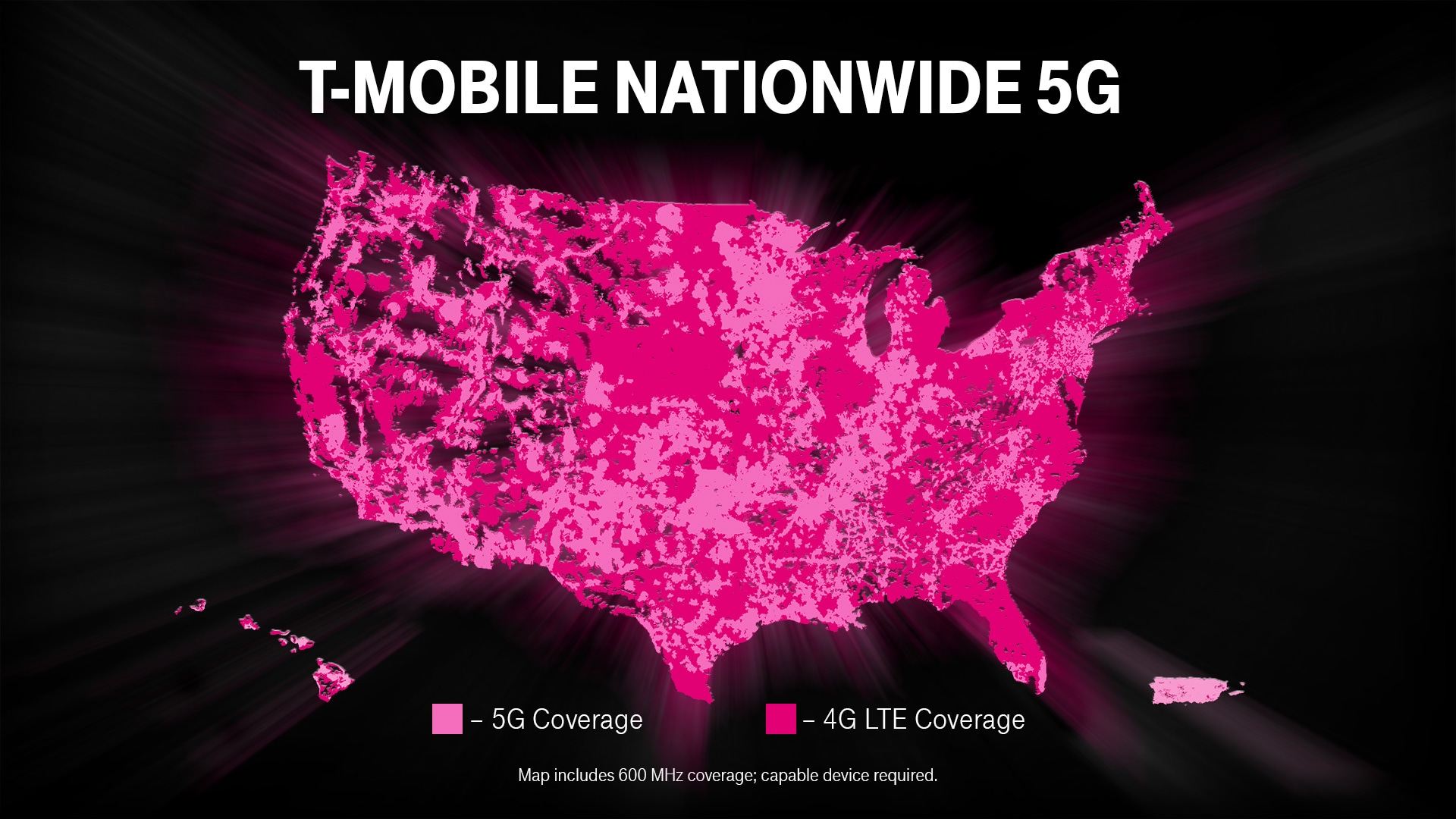

T-Mobile is the U.S. leader in 5G, delivering the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers 323 million people across 1.9 million square miles – more than AT&T and Verizon combined. 260 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G, and T-Mobile plans to reach 300 million people with Ultra Capacity next year.

For more information on T-Mobile’s network, visit: https://www.t-mobile.com/coverage/4g-lte-5g-networks.

……………………………………………………………………………………………………

Cisco was part of T-Mobile US’ initial 5G SA core launch in 2020. This included the user plane, session management, and policy control functions. Those network functions run on Cisco servers, switching, and its virtualization orchestration stack.

This 5G work built on Cisco providing its packet gateway for T-Mobile’s 4G LTE mobile core, later adding its evolved packet core (EPC), and eventually virtualized the operator’s entire packet core in 2017. T-Mobile was also the first major operator to introduce Cisco’s 4G control and user plane separation (CUPS) in the EPC at production scale in 2018.

Cisco has also been core to 5G SA work by operators like Dish Network and Rakuten Mobile

References:

https://www.sdxcentral.com/articles/news/t-mobile-selects-cisco-for-cloud-native-5g-core/2022/12/

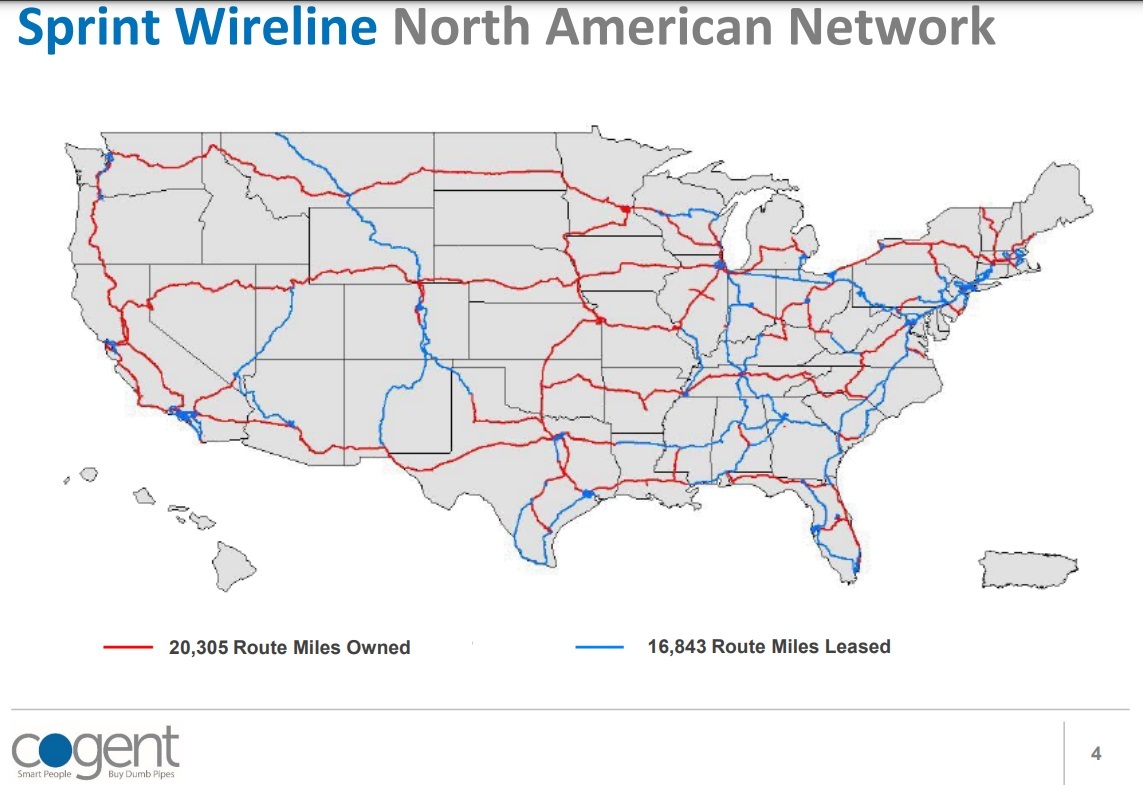

T-Mobile sells Sprint wireline business to Cogent for $1

T-Mobile will sell its wireline business, acquired from Sprint, to Cogent Communications Holdings Inc for $1, while taking a $1 billion charge on the transaction. The deal includes a $700 million contract under which Cogent will provide transit services to T-Mobile for 4-1/2 years after the deal closes. Cogent and T-Mobile expect to close the deal in or prior to December 2023.

T-Mobile has been turning its attention away from the wireline business that includes assets from its $26 billion acquisition of Sprint Corp in 2020. The decline of Sprint’s wireline business has been astounding to this author. For years, Sprint was the leader in wireline technologies like X.25, Primary Rate ISDN, Frame Relay, ATM, Carrier Ethernet and MPLS. Their optical network was second to none and was used as a backbone network for many carriers, including AT&T.

The deal for the Sprint wireline assets, a unit formerly known as Sprint Global Markets Group, provides a range of services, including MPLS (Cogent plans to convert those to VPLS and WAN), DIA (dedicated Internet access) and transit, wavelength and colocation services. The unit generated roughly $560 million in revenues in 2021 and has about 1,300 employees. In North America, the unit operates approximately 19,000 long-haul route miles, 1,300 metro route miles, and some 16,800 route miles of leased dark fiber. Total wireline business revenue was $739 million last year, according to Reuters.

In the most recent earnings call, T-Mobile Chief Executive Michael Sievert said the company was no longer using Sprint infrastructure to support its wireless business and that an asset review was underway.

“We think that T-Mobile must be receiving some sort of discount on the IP transit services that they will be buying from Cogent contractually, and they will save on the costs that they’d otherwise have to keep, maintain and improve (the infrastructure),” said Michael Ashley Schulman, partner and chief investment officer at Running Point Capital Advisors.

For Cogent, the deal provides a U.S. long-haul network that could eventually replace its current leased network and help expand the company’s product set to consumers and enterprises.

Cogent expects its revenue base to be about $1.1 billion, or 180% of its current $600 million run rate, CEO Dave Schaeffer said on a conference call. He outlined several strategic benefits from the deal, noting it will increase its fiber footprint and boost scale in the DIA, transit, virtual private networks and colocation/data centers markets.

The deal also paves the way for Cogent to enter the North American market for wavelength sales, and compete with market leaders Lumen and Zayo. Cogent, which is also looking to enter the market for dark fiber sales, said it also stands to gain international operating licenses in India and Malaysia, where it has no presence today.

Among other benefits, Cogent will also acquire a legacy Sprint customer base of about 1,400 businesses that, it claims, fall outside Cogent’s typical customer profile.

Cogent expects to offer customers the ability to migrate from their legacy MPLS VPN solutions to modern Ethernet / VPLS or SD-WAN / DIA solutions for their corporate needs. Cogent also expects to facilitate the migration of netcentric internet access customers from the T-Mobile Wireline Business (legacy Sprint) AS1239 to Cogent’s AS174.

Cogent expects its revenue base, post-close, to be $1.1 billion, or 180% of its current $600 million run-rate. Cogent likewise expects its multi-year revenue growth post-close will be 5% to 7% annually, with targeted aggregate revenue of over $1.5 billion by 2028.

A newly formed direct subsidiary of Cogent will consummate the acquisition. Cogent does not plan to issue new debt or equity in order to finance the acquisition, and the transaction is not expected to be dilutive to Cogent’s existing stockholders. Cogent plans to maintain its current dividend per share, which is expected to continue to increase over time.

Morgan Stanley served as the financial adviser for Cogent, while Houlihan Lokey was T-Mobile’s financial adviser.

References:

https://www.cogentco.com/en/about-cogent/events/3565-cogent-investor-call

T-Mobile US achieves speeds over 3 Gbps using 5G Carrier Aggregation on its 5G SA network

T-Mobile US said it was able to aggregate three channels of mid-band 5G spectrum, reaching speeds over 3 Gbps on its standalone 5G network. It’s the first time the test has ever been done with a commercial device, here the Samsung Galaxy S22 powered by Snapdragon 8 Gen 1 Mobile Platform with Snapdragon X65 Modem-RF System), on a live production network, the company said.

5G Carrier Aggregation (New Radio or NR CA) allows T-Mobile to combine multiple 5G channels (or carriers) to deliver greater speed and performance. In this test, the carrier merged three 5G channels – two channels of 2.5 GHz Ultra Capacity 5G and one channel of 1900 MHz spectrum – creating an effective 210 MHz 5G channel.

The achievement is only possible with standalone 5G architecture (SA) and is just the latest in a series of important SA 5G milestones for T-Mobile. The carrier said it was the first in the world to launch a nationwide SA 5G network nearly two years ago. The carrier began lighting up Voice over 5G (VoNR) this month so that all services can run on 5G. By removing the need for an underlying LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity, the company mentioned.

NR CA is live in parts of T-Mobile’s network today, combining two 2.5 GHz 5G channels for greater speeds, performance and capacity. Customers with the Samsung Galaxy S22 will be among the first to experience a third 1900 MHz 5G channel later this year. This functionality will expand across the carrier’s network and to additional devices in the near future.

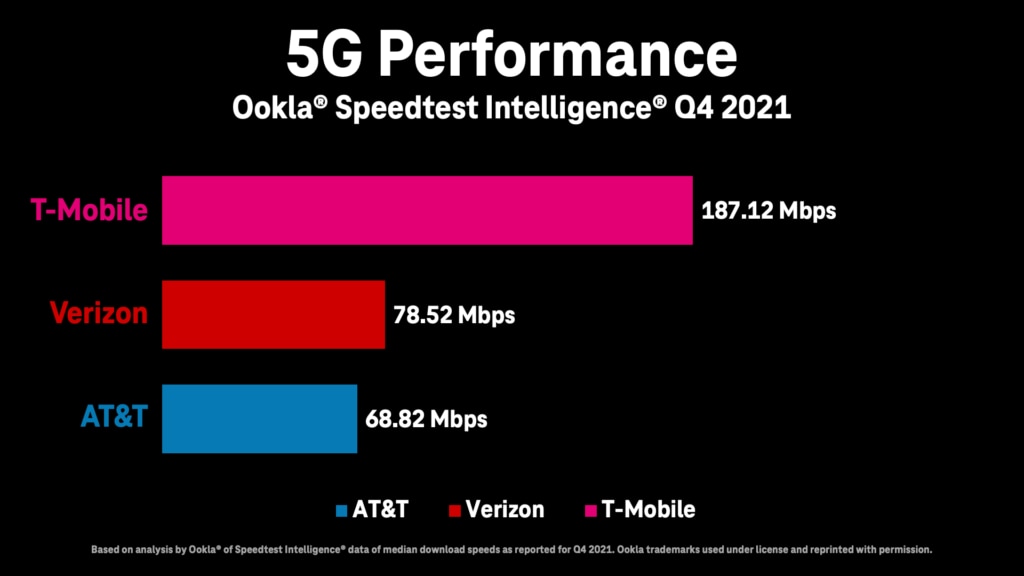

T-Mobile US was the first in the world to launch a nationwide SA 5G network nearly two years ago and has been driving toward a true 5G-only experience for customers ever since. Just this month the Un-carrier began deploying Voice over 5G (VoNR) so ALLvoice services can run on 5G. By removing the need for an underlying 4G LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity. The carrier’s 5G network covers 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year. It also has the fastest 5G network, according to Ookla speed tests in Q4 2021:

Note that neither Verizon or AT&T have deployed 5G SA core networks with no future dates specified.

References:

IBD – Controversy over 5G FWA: T-Mobile and Verizon are in; AT&T is out

Two of the three biggest U.S. telecom network providers, T-Mobile US and Verizon Communications, contend that selling 5G FWA (Fixed Wireless Access) broadband services to homes will prove to be a good business. However, AT&T has no plans to make a big push into that space. We wrote about this topic earlier this year, but it remains a conundrum as debate continues.

Whether these 5G FWA services will heat up broadband competition with cable TV companies — who dominate in high-speed internet services — is a controversial issue for telecom stocks. The fixed 5G wireless services also may compete with local phone companies in areas still served by copper line-based “DSL” services.

“Verizon and T-Mobile think the service can be a growth driver and will have attractive economics,” UBS analyst John Hodulik told Investor’s Business Daily (IBD). “FWA (fixed wireless access) is likely to do better where there are limited options for broadband and among subscribers used to lower speeds, so that means legacy DSL subscribers and slower speed cable. The big question is whether FWA has staying power over the next 5 to 10 years given necessary speed increases.”

AT&T has downplayed the potential of fixed 5G wireless. AT&T contends that as data usage surges over time, FWA will become increasingly uneconomic vs. fiber-optic landline alternatives.

“I think it stems from a genuinely different view of the engineering and capacity constraints,” MoffettNathanson analyst Craig Moffett told IBD. “The divergence in views about fixed wireless access between AT&T and Verizon or T-Mobile speaks to a genuine controversy in the telecom industry.” Craig added that telecom companies are scrambling to make money from huge investments in 5G radio spectrum.

Moffett said: “The renewed appetite for FWA may be a sign of a dawning realization that the gee-whizzy use cases of 5G may never materialize. That could be forcing operators to revisit every possible source of incremental revenue in a bid to earn at least some return on their huge investments in 5G spectrum.”

U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In a government auction that ended in early 2021, Verizon spent $45.45 billion on 5G “C-band” airwaves while T-Mobile invested $9.3 billion. AT&T spent $23.4 billion on the auction but it’s putting its 5G investments in areas other than FWA, like industrial 5G applications.

Meanwhile, there are cable TV firms looming with high-speed, coaxial cable. Comcast says it’s not worried about broadband competition from fixed 5G wireless services to homes.

“Time will tell, but it’s an inferior product,” Comcast Chief Executive Brian Roberts said at a recent Morgan Stanley conference. “And today, we can say we don’t feel much impact from (it). It’s lower speeds. And in the long run, I don’t know how viable the technology holds up.”

Cable companies offer hard landlines while 5G wireless services provide high-speed internet to homes mainly via indoor antennae that consumers self-install.

Eighty-seven percent of U.S. households subscribe to an internet service at home, compared with 83% in 2016, according to Leichtman Research Group. Also, cable TV firms comprise 70% of the broadband market, LRG said.

Verizon ended 2021 with 223,000 fixed wireless broadband customers, but most connected via 4G wireless networks. Meanwhile, T-Mobile had 646,000 fixed 5G broadband subscribers.

T-Mobile has told Wall Street analysts it expects to serve in a range of 7 million to 8 million fixed 5G wireless subscribers by 2025. Verizon has projected 3 million to 4 million subscribers over the same period.

T-Mobile charges $50 monthly for its home internet service. Verizon’s pricing starts at $50 or $70 monthly, depending on the data speeds provided. Verizon mobile phone customers with unlimited data plans get a discount.

T-Mobile’s 5G internet to home services provides data speeds up to 115 megabits per second, or Mbps. Verizon plans to provide speeds up to 300 Mbps.

T-Mobile uses mid-band radio spectrum to deliver fixed 5G broadband to homes. Verizon uses a mix of mid-band and high-band radio spectrum. In urban areas, Verizon may be able to deliver higher internet speeds with high-band spectrum, analysts say.

One area of debate remains whether fixed 5G broadband finds more success in suburban/urban markets or in rural areas.

“FWA is definitely a threat to cable companies,” Peter Rysavy, head of Rysavy Research, said in an email. “Particularly with (high frequency) mmWave, 5G can compete directly with cable. Mid-band spectrum is also effective but is best suited for lower density population areas. In these deployments, even T-Mobile limits the number of fixed wireless subscribers it can support in any geographical area.”

At UBS, Hodulik says that even if positioned as a low-end service, fixed 5G broadband still has a potential market of 20 million to 30 million homes.

AT&T, whose forerunner was regional Bell SBC Communications, has a sizable wireline local service area in 22 states. So it will face competition from fixed 5G broadband, just like cable TV firms. Verizon is based mainly in the northeast. T-Mobile doesn’t sell local phone services.

“AT&T has a huge wireline asset base that is only 25% upgraded to fiber,” Oppenheimer analyst Tim Horan told IBD. “So they are very exposed to competition from fixed wireless.”

At an analyst day on March 11, AT&T said it plans to upgrade 50% of its local markets, about 30 million customer locations, to high-speed fiber-optic broadband service by year-end 2025.

Meanwhile, AT&T CEO John Stankey commented on the controversy over FWA. AT&T sees FWA as playing a limited role for mobile small business and enterprise applications as well as in rural areas.

“We’re not opposed to fixed wireless, and I’m sure there’s going to be segments of the market where it’s going to be acceptable and folks are going to find it to be adequate right now,” Stankey said.

Fixed 5G broadband services to homes isn’t the only potential moneymaker for telecom network providers. Verizon, AT&T and T-Mobile aim to upgrade mobile phone users to unlimited data plans. They also plan to sell “private 5G” connections to businesses, Internet of Things (IoT) and 5G connections to industrial devices.

References:

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

OpenSignal: T-Mobile’s 5G speeds are #1 in U.S. thanks to 2.5 GHz mid-band spectrum

The U.S. 5G experience is in the middle of a period of great change. U.S. wireless carriers will be soon be able to start using new mid-band spectrum (3.7 GHz, or C-band) in 46 markets from December. Together they have spent a combined $81.11bn in licences to improve the 5G experience with this additional capacity. Already, Opensignal has observed an impressive rise in T-Mobile users’ 5G Download Speed enabled by T-Mobile’s existing mid-band spectrum. Our T-Mobile 5G users saw their average 5G download speeds soar by 66.5%, from 71.3 Mbps in Opensignal’s April 2021 5G Experience report to 118.7 Mbps in the latest report published in October 2021.

This means that in our most recent analysis T-Mobile led by 62.7 Mbps over second placed Verizon and 67.2 Mbps over AT&T — with 5G download speeds more than twice as fast as those achieved by their competitors. In our new analysis we see that T-Mobile’s use of its 2.5 GHz mid-band spectrum enabled this increase and non-standalone access was important here. Furthermore, this change helps explain the different amounts that each carrier spent in the C-band auction: Verizon, $45.45bn; AT&T, $23.41bn; while T-Mobile spent significantly less at $9.34bn.

To explain the change in 5G experience observed by our T-Mobile users, we analyzed their average 5G download speeds over time looking at the two different spectrum bands that the operator is focusing its 5G deployment efforts on — the 600 MHz (NR band 71) and 2.5 GHz (NR band 41).

Our analysis shows that T-Mobile’s surge in 5G Download Speed was driven by its ongoing deployment of the 2.5 GHz band. We observed that, not only T-Mobile expanded its use of the 2.5 GHz band over time, but the operator has also very likely increased the amount of spectrum capacity allocated for 5G in that band. In fact, we have seen the average 5G download speeds experienced by our T-Mobile users when connected to the 2.5 GHz band increase by more than 40% rising from 170.1 Mbps in March 2021 to 239.3 Mbps in September 2021. By contrast, average 5G speeds on the 600 MHz band had no statistically significant change and remained flat at slightly below 30 Mbps.

Notably, the bulk of the boost on the 2.5GHz band happened between March and July 2021 —an increase of 39.3% — after that average 5G speeds remained stable just above 235 Mbps. For context, in September 2021 T-Mobile said that it had deployed 60-80 MHz of the mid-band, up from the 40-50MHz it had been using in late 2020, and that stated that it is aiming to use 100 MHz on sites by the end of the year. Additional spectrum capacity makes it easier for users to see higher 5G speeds.

We saw much slower speeds that changed little when our T-Mobile users connected to the 600 MHz band. This is not surprising, given the propagation characteristics and amount of spectrum that T-Mobile owns on this band. Low bands like 600 MHz provide mobile coverage to wider areas with fewer cells deployed, but at a cost of more limited capacity. Mid-bands like 2.5 GHz, which T-Mobile acquired after its merger with Sprint, usually offer higher capacity, but need more cells per square mile to achieve similar coverage to the low bands.

T-Mobile refers to its 5G spectrum deployment strategy as a ‘layer cake’ — with low bands used for wide coverage, complemented by mid and higher frequency bands to provide greater capacity for small and dense city areas. The way T-Mobile uses these spectrum bands is consistent with what we observed in our analysis.

We then looked at the proportions of 5G readings that we collected when our users were connected to T-Mobile’s 600 MHz and 2.5 GHz bands. The share of 5G readings observed on the 2.5 GHz band has increased more than three times, from nearly 9% in March 2021 to over 27% in September 2021. This means that T-Mobile 5G users are able to access the 2.5GHz band more easily which further explains the increase in the overall 5G speed seen by T-Mobile users.

We investigated the role of standalone access (SA) and non-standalone access (NSA) 5G in explaining T-Mobile’s experience, building on our previous analysis of standalone 5G on T-Mobile. Now, we can see that the 2.5 GHz band is predominantly used with NSA and so SA is not the key reason for the improvement in 5G speeds (although it likely does continue to have other benefits).

Perhaps counterintuitively, the average 5G download speed our users saw on the 600 MHz band with SA was slower than on NSA. In part, this is because of the role of 4G bands in supporting the 5G experience when a smartphone is in NSA mode as we have seen in other markets (for example South Korea or in Europe).

“Opensignal’s latest report validates what our customers already know – T-Mobile’s differentiated approach to 5G is delivering meaningful 5G experiences now with ever-increasing speeds and expanding coverage,” said Neville Ray, president of Technology at T-Mobile, in a statement. “Our two-year lead on building 5G will continue as we add even more Ultra Capacity coverage and expand it to reach 200 million people nationwide this year. T-Mobile customers benefit from a real 5G network that today can power immersive and transformative experiences.”

T-Mobile justifiably claims they have the largest, fastest and most reliable 5G network. Nearly a dozen independent third-party reports this year also show how T-Mobile’s differentiated 5G deployment delivers meaningful connections to customers – naming T-Mobile 5G #1 in nationwide speed and availability. After recently launching a new Ultra Capacity 5G icon showing customers when they are in an area where they can tap into T-Mobile’s fastest 5G speeds, the number of customers testing T-Mobile’s Ultra Capacity 5G network increased. As customers learned how broadly Ultra Capacity 5G is available, they also experienced how game-changing mid-band 5G can be.

AT&T and Verizon will seek to boost their 5G experience with mid-band soon:

Our analysis shows that T-Mobile’s acquisition of Sprint’s mid-band spectrum assets through the merger allowed it to build a substantial lead over its competitors as measured in our recent USA 5G Experience reports. T-Mobile now has a significant competitive advantage over its competitors, which don’t have access to any mid-band spectrum bands just yet.

However, everything will change soon, as U.S. operators purchased licenses in the C-band spectrum band (3.7 – 3.98 GHz) during Auction 107 earlier this year. In fact, the first tranche of this C-band spectrum will be available for use by December 2021. Plus the second portion will be available by the end of 2023. T-Mobile’s 5G experience highlights the importance for Verizon and AT&T to maximize their use of new mid-band spectrum.

References:

https://www.opensignal.com/2021/10/27/25-ghz-mid-band-spectrum-drives-t-mobiles-5g-speeds-in-the-us

https://www.t-mobile.com/news/network/ultra-capacity-mid-band-5g-opensignal

https://www.fiercewireless.com/5g/t-mobile-5g-speeds-get-40-boost-from-2-5-ghz-opensignal

T-Mobile US CFO on the Big Hack, Verizon Tracfone, Supply Chain Shortages, and FWA

Peter Osvaldik (photo below), executive vice president & chief financial officer (CFO) of T-Mobile US provided a business update today at the BofA 2021 Media, Communications and Entertainment Conference.

Selected Quotes:

“With respect to the (well advertised) data breach, T-Mobile US is not immune to criminal acts, but we have a responsibility to our customers which we take very seriously. We acted quickly to shut down the attack, investigate and get in touch with the consumers that were impacted. We definitely saw some temporary customer cautiousness. But now, several weeks later, consumer flows have normalized. We’re taking significant steps to enhance our security.”

“$750M annual T-Mo revenues would go away if Verizon is successful in acquiring Tracfone, which is clearly a competitor. We feel good in that space, especially with Metro by T-Mobile as the leading pre-paid service provider.”

“The network experience will become more compelling with 5G, especially mid band (2.5GHz) 5G with 300M bit/sec targeted speeds and the massive capacity that brings. We’re exactly in the right spot as we take these assets and deploy them at breakneck speeds.”

“We are the 5G (U.S.) leader and that lead will continue to grow. We were first to bring a differentiated rate plan (Magenta MAX) that won’t slow you down.”

“Certainly, from a network perspective, we’re not experiencing any supply chain issues. From a home broadband (FWA) perspective, sometimes demand did exceed supply. We’re already seeing increasing supply there. We feel very good about our momentum on the home broadband side of the house.”

“Samsung has really fallen behind the eight ball relative to other OEMs [original equipment manufacturers] on the global supply chain issue.” Osvaldik noted that Samsung discontinued its Galaxy Note smartphone “which many of our customers just loved,” and that many of the company’s S-series smartphones “are in very short supply.”

“A lot of our customer base are very significant Samsung lovers, and so we probably saw a little bit more of the supply chain issue there. Others (wireless network operators) that have an Apple oriented customer base have been less impacted.”

“The demand we’re seeing for FWA, with download speeds of 100 M bit/sec and soon to increase, is very strong. We have a target of 7 to 8M FWA customers by the end of 2025. We’re confident we’ll receive our target (number of subscribers) this year.”

“Large enterprises and government are a tremendous opportunity for us. It’s opened up a lot of conversations with government organizations. We’re very pleased with the traction we’ve seen.”

Peter Osvaldik, Executive Vice President & CFO, T-Mobile

…………………………………………………………………………………………………………………………….

References:

T-Mobile 5G hype vs Craig Moffett: “We’re not in the 5G era yet”

T-Mobile US reported total revenues of $19.8 billion and service revenues of $14.2 billion in the last quarter. T-Mobile’s gain of 1.2M post-paid net additions was solidly ahead of Wall Street consensus of 1.0M, and was similar to last year’s pro forma gain of 1.3M. The company added 773K post-paid phone subscribers, dramatically better than last year’s pro-forma gain of just 104K, and blowing away consensus of 475K.

T-Mobile’s 773,000 postpaid phone customer additions during the first quarter handily beat AT&T’s 536,000 and Verizon’s loss of 178,000 customers, according to Walter Piecyk, a financial analyst at LightShed Partners. They continue to take market share. Their annual post-paid subscriber growth rate of 3.9% marks a sharp acceleration from the 2.7% growth rate reported last quarter.

T-Mobile has already migrated 20% of Sprint’s customers, and 50% of Sprint’s traffic (a doubling from

last quarter), to the much more robust T-Mobile network. The vast majority of Sprint customers

are already enjoying service benefits from access (even with legacy handsets) to T-Mobile’s

lower frequency spectrum bands.

T-Mobile: America’s Largest, Fastest and Most Reliable 5G Network Extends its Lead

- Extended Range 5G covers 295 million people across 1.6 million square miles, 4x more than Verizon and 2x more than AT&T

- Ultra Capacity 5G covers 140 million people and on track to cover 200 million people nationwide by the end of 2021

- Majority of independent third-party network benchmarking reports show T-Mobile as the clear leader in 5G speed and availability

- Network perception catching up to reality with a nearly 120 percent increase in consumers who view T-Mobile as “The 5G Company” since Q3 2019

Image Credit: T-Mobile

……………………………………………………………………………………………………………………………………………….

On the company’s earnings call, T-Mobile US CEO Mike Sievert said that “discerning customers” are choosing T-Mobile’s new Magenta Max pricing plan, which offers few limits in the amount of 5G data that customers can consume. T-Mobile’s new Magenta Max customers consume 40% more data than its other 5G customers, and fully 70% more data than T-Mobile’s average 4G LTE customers.

“The take rate has just been amazing,” T-Mobile CFO Peter Osvaldik said of Magenta Max. “There are premium customers that are attracted to this premium network.”

“We’ve never been able to outrun the insatiable demand that customers have,” Sievert said of Internet service providers in general. “So when you provide the industry’s only true, unlimited plan, they do what they do, they use it up.”

According to Sievert, that indicates that T-Mobile’s 5G network will be a big winner. “We’re really starting to pull away from the pack. T-Mobile is positioned to maintain our 5G leadership for the duration of the 5G era.”

In a great example of braggadocio, Sievert said:

“We have again demonstrated that our unique winning formula and balanced approach enables us to grow share while delivering strong financial results. In our increasingly connected world, we recognize our role as stewards of this profitable company and industry, while continuing to use our Un-carrier DNA to bring change to wireless and broadband alike, to disrupt the status quo and ultimately benefit customers. And this quarter was no exception.”

T-Mobile said it now covers fully 140 million people with its 2.5GHz network, which it calls “ultra capacity.” By the end of this year, the company said that number will increase to 200 million people. Meantime, speeds available on that network will rise from an average of 300 Mbit/s today to up to 400 Mbit/s by the end of this year, the operator said. 5G speeds will continue to rise after that, according to T-Mobile’s network chief Neville Ray. “2022 is going to be even better,” he said.

Analyst Craig Moffett (who participated in the earnings call) put somewhat of a damper on all that 5G hype by stating: “But we’re not in the 5G era yet. We’re not even a year into the first generation of 5G iPhones. Less than 10% of Americans have 5G-enabled phones, and half of those probably only got a new phone because they needed a replacement. 5G isn’t really driving handset selection, or service provider selection, yet.”

“That T-Mobile continues to take share even in the twilight of the LTE era is reassuring. In a world of roughly comparable networks, they are competing on the basis of price alone… and they are taking share rapidly. In 5G, they will compete not only on the basis of the industry’s lowest prices, but also the industry’s best network. As we’ve said before, T-Mobile’s ‘worst to first’ story is a generational one. Networks don’t achieve advantage overnight, and they don’t lose it overnight, either. Ten and twenty-year cycles in telecom aren’t unusual.”

“T-Mobile’s brand, and its network, have been ascendant for years. But they have, up to now, achieved only parity. Their path to network superiority is potentially even longer, and, we suspect, even brighter.”

T-Mobile continues to increase market share even in the twilight of the LTE era is reassuring. In a

world of roughly comparable networks, they are competing on the basis of price alone… and they

are taking share rapidly. In 5G, they will compete not only on the basis of the industry’s lowest prices, but also the industry’s best network.

……………………………………………………………………………………………………………………………………….

References:

https://www.t-mobile.com/news/business/t-mobile-reports-strong-first-quarter-2021-results

https://www.lightreading.com/5g/does-5g-make-difference-t-mobile-says-yes/d/d-id/769256?

Lumen Technologies and T-Mobile collaborate on edge compute for enterprise customers

Following this week’s Verizon-AWS announcement on Multi-access Edge Computing (MEC), T-Mobile US has entered the mobile edge computing business using wireline carrier Lumen Technologies (formerly CenturyLink) as its initial preferred vendor.

T-Mobile US has taken a decidedly different MEC approach compared to its two domestic rivals (Verizon and AT&T). The U.S.’s #2 wireless network operator effectively views the edge as a latter opportunity that doesn’t merit a large initial investment. Its edge computing initiatives are exclusively focused on businesses and government agencies that fall under Lumen’s enterprise unit and T-Mobile for business.

“By pairing America’s largest and fastest 5G network with Lumen’s enterprise solutions, we can break down industry barriers and deliver unparalleled network reach to enterprise and government organizations looking to optimize their applications across networks,” Mike Katz, EVP for T-Mobile for Business, said in a prepared statement. “With our leading 5G network, Lumen and T-Mobile have the opportunity to accelerate business innovation in an era where the network is more critical than ever,” Katz added,

Enterprise applications will likely benefit from Lumen’s hundreds of thousands of fiber connected enterprise locations paired with T-Mobile’s “largest and fastest 5G network.”

“The Lumen platform, with 60 plus planned edge market nodes distributed on our high-capacity global fiber network enables application designs with latency of 5 milliseconds or less between the workload and the endpoint device,” wrote David Shacochis, VP of enterprise technology and field CTO at Lumen.

“Lumen’s fiber reach and edge computing resources can augment business solutions for T-Mobile customers, and private wireless solutions can augment business solutions for Lumen customers,” Shacochis added.

“The companies envision starting with metropolitan areas where they are already well connected, and expanding their joint go-to-market over time,” Shacochis wrote, adding that more details about commercial availability and services will be shared throughout 2021.

These efforts aim to address the pressing needs of enterprises to transform their networks to meet the data-intensive challenges across a variety of industries and use cases. Both companies will also continue to drive innovation in this space through T-Mobile’s labs and Tech Experience Center and the Lumen Edge Experience Center.

“Our relationship with T-Mobile aims to introduce a powerful trifecta – access to national 5G wireless and fiber connectivity, managed services across a range of technologies and edge computing resources,” said Shaun Andrews, executive vice president and chief marketing officer for Lumen Technologies. “T-Mobile’s expansive 5G footprint coupled with our extensive edge computing platform would provide enterprise developers with the best of both worlds to power the next wave of digital business.”

- For a current list of Lumen live and planned edge locations, visit: https://www.lumen.com/en-us/solutions/edge-computing.html#edge-computing-map

- The Lumen low latency network is comprised of approximately 450,000 global route miles of fiber and more than 180,000 on-net buildings, seamlessly connected to:

- 2,200 public and private third-party data centers in North America, Europe & Middle East, Latin America, and Asia Pacific

- Leading public cloud service providers including Amazon Web Services, Microsoft Azure ExpressRoute & Azure Government, Google Cloud, IBM Cloud and Oracle Cloud

T-Mobile’s partnership with Lumen is likely just the beginning. “As in all things with 5G, I think a lot of our efforts have to be done through partnerships,” said John Saw, EVP of advanced and emerging technologies at T-Mobile. Apparently, the network operator will form partnerships with many of the big vendors in the space, including hyperscalers (Google, Amazon, Microsoft), and other specialized mobile edge computing vendors.

Similarly, Shacochis said Lumen is also “open to and looking at” other partnerships in the wireless space. Lumen executives outlined a plan to offer edge compute services in August 2019. The company deployed its first block of edge nodes and obtained its first customer in Q3-2020, before formally launching its edge platform in December 2020.

Building on cloud partnerships with Microsoft Azure, Google Cloud and Amazon Web Services (AWS), Lumen bolstered its edge capabilities through additional deals with VMware and IBM.

…………………………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/lumen-lands-t-mobiles-first-5g-edge-contract/2021/04/

https://www.fiercetelecom.com/telecom/lumen-strikes-edge-compute-deal-t-mobile

https://www.sdxcentral.com/edge/definitions/multi-access-edge-computing-vendors/

IBM and Verizon Business Collaborate on 5G, Edge Computing and AI Solutions for Enterprise Customers

T-Mobile US CEO talks up Sprint merger & 5G leadership in U.S.

T-Mobile has begun shuttering Sprint’s network in a few locations following its acquisition, but doesn’t expect to really start until 2021-to-2022.

Talking with a fireplace in the background during a UBS Global TMT Virtual Conference on December 8th, T-Mobile CEO Mike Sievert said in response to a question about when Sprint’s network will shut down: “We’ve already done some on an isolated basis.”

T-Mobile has boasted of $6 billion in savings through its Sprint merger which has resulted in a single “master brand.”

We can go into an area, and as we get capacity on the destination T-Mobile network, we can migrate traffic off the Sprint network on to that destination network without having to touch those rate plans or billing relationships at all. We might move the brand relationship from Sprint to T-Mobile in advance of that or we might wait until later.

T-Mobile acquired Sprint for $26 billion earlier this year. Industry observers have been awaiting news on the company’s plans to shutter the old network as the “New T-Mobile” rolls out—which promises 14 times more capacity in six years than standalone T-Mobile has today. Sievert went on to say most of the shutdowns won’t happen until 2022 when at least most of Sprint’s legacy customers should have transitioned over to T-Mobile’s network.

This isn’t T-Mobile’s first acquisition and network shut down. In 2012, T-Mobile acquired MetroPC’s regional network and then dismantled it. It’s a fairly standard practice which Sprint did in 2016. After acquiring Clearwire, Sprint shut down the WiMax network it so highly promoted as the first real 4G.

Author’s Note:

T-Mobile’s 3G network is based on GSM while Sprint uses CDMA. Running two competing 3G networks simultaneously doesn’t help the bottom line. Both telcos support 4G LTE which is the ONLY 4G network since no carrier deployed WiMax Advanced.

…………………………………………………………………………………………………………………

Sievert summed up the Sprint network integration with this statement:

It’s really important that we use our capacity to migrate Sprint mobile customers over, right? So, we’re going to be — while we’re revenue-farming spectrum and building the destination network that’s our priority. So, you’ll see us go at pace for the first couple of years on broadband because the bigger prize for our shareholders is synergy attainment.

…………………………………………………………………………………………………………………….

Sievert said:

“What we’ve got at the dawn of the 5G era is the ability to lead all through this era with a superior product and a superior value simultaneously, something no company has ever been positioned to do. And obviously, they see that and they feel that they need to act. Now, they’ll try and convince you that what they’re doing is economic. By the way, it’s nothing too extraordinary, nor surprising.”

With respect to use of 600MHz for 5G is 2 or 3 times faster than 4G-LTE. Sievert said:

As of the last quarterly announcement, we were reaching about 270 million people with 600 megahertz Extended Range 5G. And that’s 5G even more on 4G LTE. These are dedicated lanes, and to your point, increasing dedicated lanes, because during this farming process and transition process, we’re actually leasing additional 600 megahertz spectrum from a variety of parties.

And what that allows us to do is to open up really wide dedicated Extended Range 5G lanes, so different than what you’re seeing from our competitors with DSS instead. They don’t have those dedicated lanes. And so they’re having to divide up their LTE spectrum into both technologies. It doesn’t get you much.

Our dedicated Extended Range 600 megahertz 5G is two times faster, in some cases, three times faster than LTE. So it’s a really nice pickup and experience for customers, but importantly, also gives us the capacity that we need to move quickly on migration. And that’s obviously the bigger payday for us and for customers. So those are the numbers.

About 1.4 million square miles as of the last quarterly announcement. That’s about three times what Verizon has, about double what AT&T had around that time. And again, we announced that we weren’t stopping there. We’re moving very quickly for the year-end time period. Next time we talk to you shortly after the New Year, we’ll have covered significantly more than those numbers. And so terrific progress there.

Most of the phones are compatible with 600 on the LTE front. Right now, close to 6 million on the 5G front and rapidly growing, because as you know, some of the most popular ones have only very recently been launched. And again this is something — this level of device compatibility is not something we had in prior mergers. And, boy, is it great to see, because we’re able — again, it’s a thing that’s allowing us to move quickly.

The company will add its newly-acquired midband 2.5GHz spectrum to its existing low band 600MHz 5G network. Sievert comments were very strong and “game changing”:

We’re tracking really nicely, to be at 100 million 5G covered people by the end of this year, certainly, by the next time we talk to you. That’s incredible.

The other guys are bumping around, like a Verizon with Ultra Wideband, maybe 2, 3, 4 million. And they’re talking about a lot of new cities, but little parts of cities and towns. You know their strategy. I predict they’re going to have a wholesale change in their strategy over at Verizon. They’re going to discover that they need to have a mid-band-centric 5G approach.

This is the way that you get very-very high ultra capacity 5G experiences to people by the millions and tens of millions. Our signal reaches miles, not meters. And so, that’s really important for the everyday experience. And people are going to see — across these tens of millions of people, they’re going to see an experience that’s not a little bit better than 4G LTE, but a transformation. So 7, 8, 9, 10 times faster, 300, 400 megabits per second, peak speeds over 1 gigabit. And this isn’t just a little smattering of certain street corners and when the leaves aren’t out. This is across vast swaths of the country.

So that’s really game changing. And it’s probably the place where we lead the most. And it’s going to be what millions of people see. It’s going to be FOMO, it’s going to be bragging rights. And everybody is going to be able to see this difference that T-Mobile is able to give you across massive swaths of the country.

100 million as we exit this year into the first part of 2021 and then 200 million as we exit next year. And so, this is game-changing. And it was a huge part of why we worked so hard to get this merger done, because we knew how it would benefit tens of millions of people and by extension, benefit our business.

……………………………………………………………………………………………………………………………

T-Mobile CTO Ray Neville has said is “really going to deliver an incredible 5G experience.”

Neville said in May that T-Mobile’s plan is to grow the company’s ~65,000 towers to 85,000 macro cell sites by building 15,000 new cell towers and decommissioning unnecessary, overlapping Sprint cell sites. T-Mobile says that it’s been adding 2.5GHz transmission radios to its existing towers at the rate of roughly 1,000 per month.

The company claims to be the first wireless telco to deploy a 5G Stand Alone (SA)/ 5G core network.

Sievert’s 5G boasting hit a peak with this statement:

In 5G, that’s our opportunity. We’re starting out way ahead and we intend to lead for the entire era. And not just be the best 5G network in terms of speed and capacity but to be the best network. And this – we’re a pure-play wireless company. And we know that in order to win, we have to have the best and the leading network in this country. And we have to become famous for it, which frankly is even harder because brands are stubborn. Brands are powerful.

That helps us on some fronts because simultaneous to being the best network in this country we’re the best value. And consumers and businesses already give us credit for that. We can’t lose that. We build behind it and lead through the entirety of the 5G era on network.

And then the third leg of the stool is experiences. Our company believes in delivering the best experiences. We have the highest Net Promoter Scores in the history of this industry. We’ve won five years in a row on J.D. Power for both consumers and businesses. Customers love us because we hire the best people and we have a culture of treating customers with respect and love. And so when you have the best value, the best network and the best experiences, that’s a winning formula. And we intend to lead with that formula through the entire 5G decade.

With respect to the legacy wireless competition, especially AT&T, Sievert said:

I don’t think we’ve caught AT&T on revenues yet. So, we surpassed them on customers. It’s always hard to tell what these comparisons. Our competitors can always provide the same exact transparency that we do.

But we think we’re right behind them on revenues. And so there’s a few differences between our model and the others. One is we have a denser network grid which is going to convey some of that advantage that I talked about that’s so important for growth. So, we intend to be a share taker and a grower through the time period and there’s always some cost to near-term margins to that very small.

We also intend to continue being the best value and there’s a small cost to that on margins. But both of those accrue to terminal value and growth rates and enterprise value-creation potential. And so there are things that are deliberate and we’re proud of and plan to keep.

Beyond that there aren’t that big of differences. And so you’ll see synergy attainment close the gap. And there will be differences as I just said, but between synergies and cost transformation of bringing these companies together, you’ll see that margin gap start to close. And we’ll talk more about it when we lay out more of our plans. But everything we talked about in 2018 when we announced this merger in terms of long-term potential, we still see. And in fact in some cases we see it unfolding better than we had anticipated back in 2018.

On the enterprise (business) market, Sievert said:

One of our biggest growth engines right now is enterprise. And we’re very focused not just on the here and now, but what enterprises want two and three and four years from now. And again, we’ve got this big network capacity, including the spectrum that backs up the network. And ultimately that gives us tools to be able to work with enterprises around the kinds of solutions that they may want in the future for dedicated networks, very low-latency, high-capacity dedicated networks with advanced dedicated spectrum capabilities. And there’s really exciting opportunities there.

Some of them are more two and three years out before they contribute in a very big way. But they’re real. And ultimately we’re so well positioned for that part of the market. Right now what we’re doing is selling our macro capabilities. And enterprises unlike consumers, where we have a bit of a brand deficit, we’ve got to overcome on network, meaning we’re not famous yet, as the best network in the space.

Enterprises don’t care about any of that, because they check out 100 phones and test them for a few weeks and then they come back and pick us. And so that’s a tailwind on our business. You’re seeing it in our present performance. In Q3, we had an all-time record on enterprise sales and you’re going to see it continue. It’s something that we’re really, really focused on a big growth engine for the company. 90-plus percent of the customers out there are with somebody else.

References:

https://event.webcasts.com/viewer/event.jsp?ei=1402861&tp_key=ad09ead741