Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Cisco’s Restructuring Plan:

Cisco plans to lay off over 4,100 employees or 5% of its workforce, the company announced yesterday. That move is part of a restructuring plan to realign its workforce over the coming months to strengthen its optical networking, security and platform offerings. Cisco noted in financial filings it expects to spend a total of $600 million, with half of that outlay coming in the current quarter. The company will also reduce its real estate portfolio to reflect an increase in hybrid work.

In a transcript of Cisco’s Q1 2023 Earnings Call on November 17th, Cisco Chief Financial Officer Scott Herren characterized the move as a “rebalancing.” On that call, Chairman and Chief Executive Officer Chuck Robbins said the company was “rightsizing certain businesses.”

Herren and CEO Chuck Robbins said the company is looking to put more resources behind its enterprise networking, platform, security and cloud-based products. In the long run, analysts expect Cisco margins to improve as more revenue comes from security and software products.

By inference Cisco is de-emphasizing sales of routers to service providers who are moving towards white boxes/bare metal switches and/or designing their own switch/routers.

A Cisco representative told Fierce Telecom:

“This decision was not taken lightly, and we will do all we can to offer support to those impacted, including generous severance packages, job placement services and other benefits wherever possible. The job placement assistance will include doing “everything we can do” to help affected employees step into other open positions at the company.”

Cisco implemented a similar restructuring plan in mid-2020 which included a substantial number of layoffs.

Growth through Acquisitions:

Much of Cisco’s revenue growth over the years has come from acquisitions. The acquisitions included Ethernet switch companies like Crescendo Communications. Kalpana and Grand Junction from 1993-1995. Prior to those acquisitions, Cisco had not developed its own LAN switches and was primarily a company selling routers to enterprises, telcos and ISPs.

Here are a few of Cisco’s acquisitions over the last five years:

- In 2017, Cisco acquired software maker AppDynamics for $3.7 billion. It bought BroadSoft for $1.9 billion in late 2017.

- In July 2019, Cisco acquired Duo Security for $2.35 billion, marking its biggest cybersecurity acquisition since its purchase of Sourcefire in 2013. Acquiring Duo Security bolstered Cisco in an emerging category called zero trust cybersecurity.

- In late 2019, Cisco agreed to buy U.K.-based IMImobile, which sells cloud communications software, in a deal valued at $730 million.

- In May 2020, Cisco acquired ThousandEyes, a networking intelligence company, for about $1 billion.

Aside from acquisitions, new accounting rules have been a plus for revenue recognition. The rules known as ASC 606 require upfront recognition of multiyear software licenses.

One bright spot for Cisco have been sales of the Catalyst 9000 Ethernet switches. The company claims they are the first purpose-built platform designed for complete access control using the Cisco DNA architecture and software-defined SD access. This means that this series of switches simplifies the design, provision and maintenance of security across the entire access network to the network core.

There is also an opportunity for Cisco in data center upgrades. The so-called “internet cloud” is made up of warehouse-sized data centers. They’re packed with racks of computer servers, data storage systems and networking gear. Most cloud computing data centers now use 100 gigabit-per-second communications gear. A data center upgrade cycle to 400G technology has been delayed.

Routed Optical Networking:

Cisco in 2019 agreed to buy optical components maker Acacia Communications for $2.6 billion in cash. China’s government delayed approval of the deal. In January 2021, Cisco upped its offer for Acacia to $4.5 billion and the deal finally closed on March 1, 2021. Acacia designs, manufactures, and sells a complete portfolio of high-speed optical interconnect technologies addressing a range of applications across datacenter, metro, regional, long-haul, and undersea networks.

Acacia’s Bright 400ZR+ pluggable coherent optical modules can plug into Cisco routers, enabling service providers to deploy simpler and more scalable architectures consisting of Routed Optical Networking, combining innovations in silicon, optics and routing systems.

Routed Optical Networking works by merging IP and private line services onto a single layer where all the switching is done at Layer 3. Routers are connected with standardized 400G ZR/ZR+ coherent pluggable optics.

With a single service layer based upon IP, flexible management tools can leverage telemetry and model-driven programmability to streamline lifecycle operations. This simplified architecture integrates open data models and standard APIs, enabling a provider to focus on automation initiatives for a simpler topology. It may be a big winner for Cisco in the near future as service providers move to 400G transport.

References:

https://www.fiercetelecom.com/telecom/cisco-plans-cut-5-workforce-under-600m-restructuring-plan

https://www.cisco.com/site/us/en/products/networking/switches/catalyst-9000-switches/index.html

https://www.cisco.com/c/en/us/about/corporate-strategy-office/acquisitions/acacia.html

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

To understand the future of high speed coherent optics, Heavy Reading launched the Coherent Optics Market Leadership Program with industry partners Ciena, Effect Photonics, Infinera and Ribbon. The 2022 project was based on a global network operator survey, conducted in August, that attracted 87 qualified responses.

Heavy Reading reports that network operators are using or evaluating coherent optics for 400G transport services for both internal and external applications, as well as 100G data rates for the metro edge.

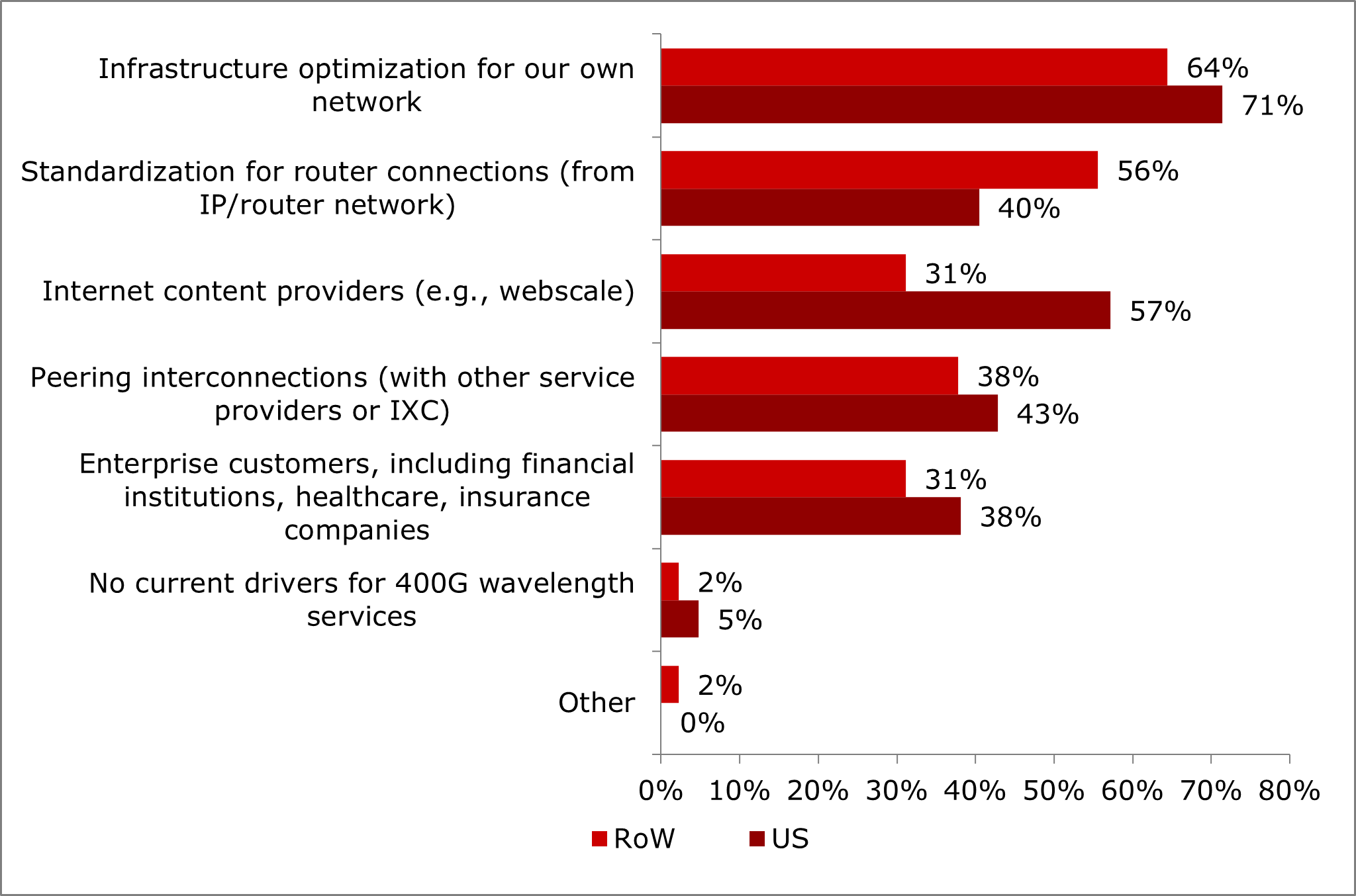

Nearly half of operator respondents in Heavy Reading’s survey will have deployed 400G transport services in their network between now and the end of 2023. But what are their top motivations for offering 400G transport services? Globally, the top driver for 400G services by far is infrastructure optimization for internal networks. This driver was selected by more than two-thirds of operators surveyed and well ahead of the second choice, standardization of router connections.

The data suggests that, for the global audience of operators, there are not that many customers currently that require full 400Gbit/s connectivity. Yet, there is value in grooming internal traffic up to 400G for greater efficiency and lower costs (e.g., fewer ports, lower cost per bit, etc.).

Beyond internal infrastructure, however, the drivers vary significantly by region, particularly when separating U.S. respondents from their Rest of World (RoW) counterparts. 57% of U.S.operators surveyed identified hyperscalers (or Internet content providers) as a 400G service driver — a strong showing and second only to internal infrastructure in the U.S. In contrast, just 31% of RoW operators identified Internet content providers as a top driver.

What are your top drivers for 400G wavelength (or optical) transport services?

High launch power optics are widely seen as essential for 400G+ pluggables in telecom applications, which are typically brownfield networks with lots of ROADM nodes. However, when filtering the survey results to include optical specialists only (i.e., those who identify as working in optical transport), higher launch power is the number one requirement, well ahead of remote diagnostics. It is likely that, at this early stage, optical specialists within operators understand the criticality of this particular technical requirement better than their peers.

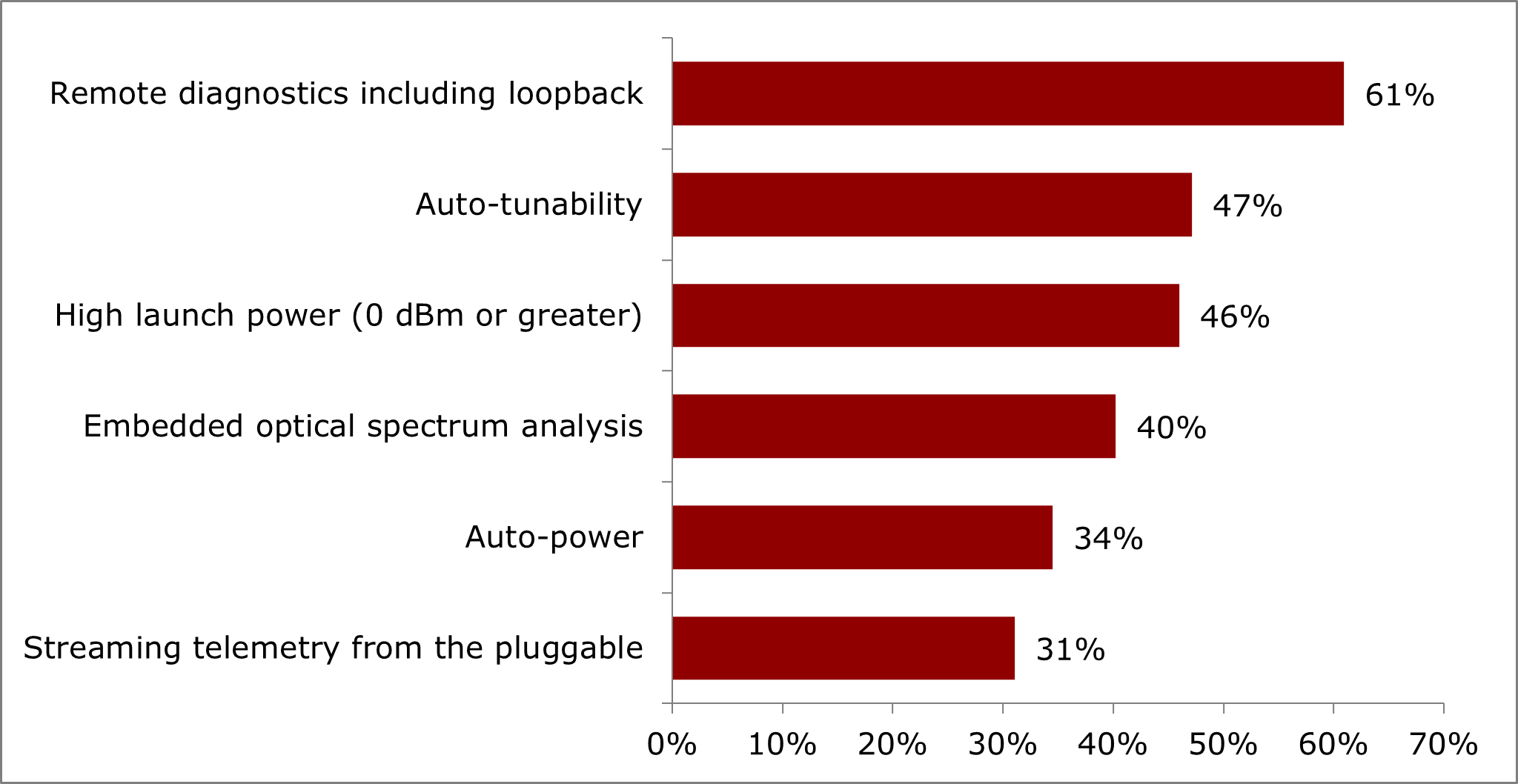

What advanced coherent DWDM pluggable features or capabilities do you find most beneficial to your network/operations?

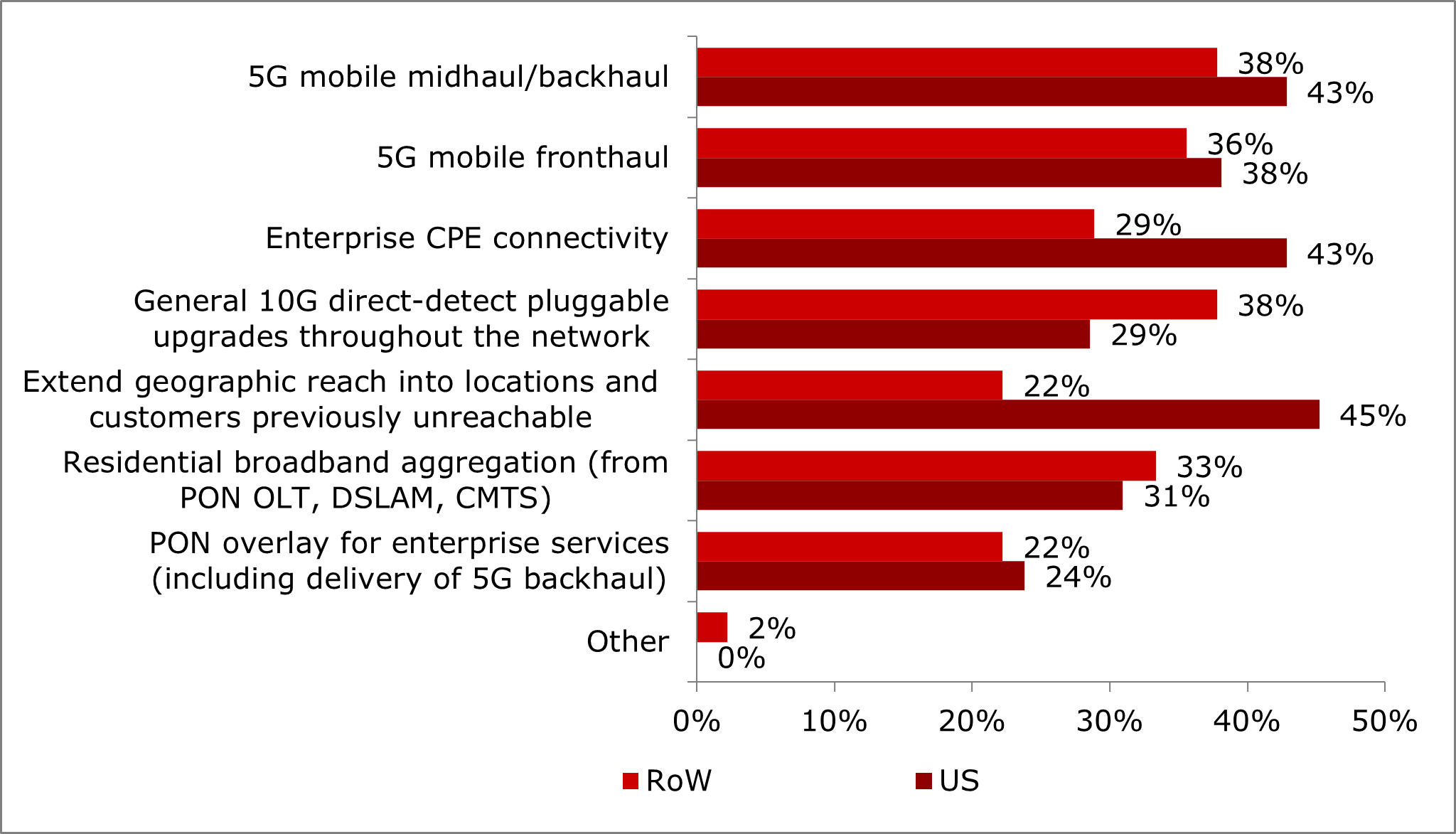

Coherent pluggable optics at 100G have use case priorities which vary significantly based on geographic region, particularly when separating U.S. respondents from their RoW counterparts. For the U.S., extending geographic reach is the top use case, followed by 5G backhaul/midhaul and enterprise connectivity. For RoW operators, however, extending geographic reach is not a priority use case.

When considering 100G coherent pluggables, what do you see as the most common use cases?

References:

https://www.lightreading.com/new-frontiers-for-coherent-optics/a/d-id/781813?

Coherent Optics: 100G, 400G and Beyond

Coherent Optics: 100G, 400G, & Beyond: A 2022 Heavy Reading Survey

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Cignal AI: Metro WDM forecast cut; IP-over-DWDM and Coherent Pluggables to impact market

Smartoptics Takes Leading Role in Sustainable Optical Networking

OpenVault: Broadband data usage surges as 1-Gig adoption climbs to 15.4% of wireline subscribers

Dramatic increases in provisioned speeds are continuing to shift the broadband landscape, according to the Q3 2022 edition of the (OpenVault Broadband Insights) report. The report was issued today by OpenVault [1.], a market-leading source of SaaS-based revenue and network improvement solutions and data-driven insights for the broadband industry.

Note 1. OpenVault is a company that specializes in collecting and analyzing household broadband usage data. It bases its quarterly reports on anonymized and aggregated data from “millions of individual broadband subscribers.”

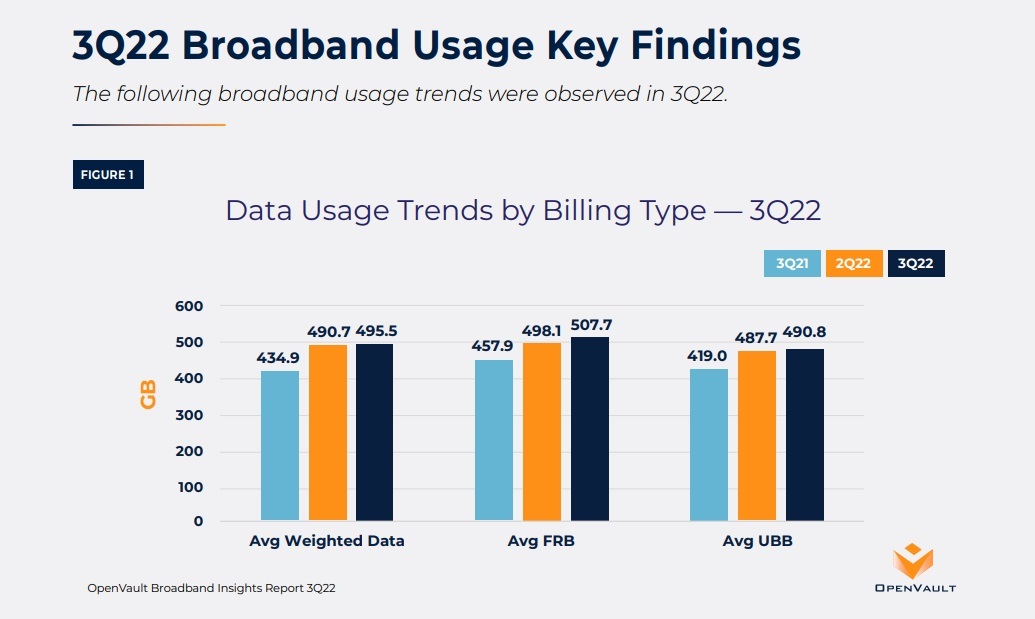

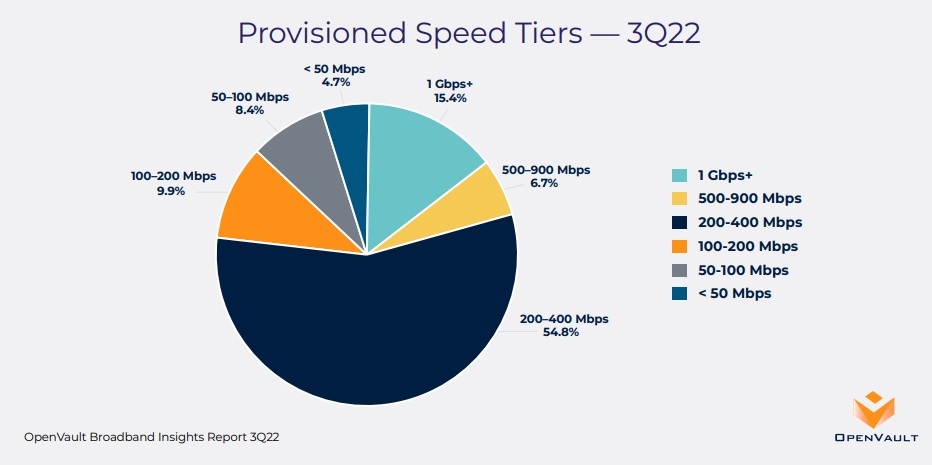

Using data aggregated from OpenVault’s broadband management tools, the 3Q22 OVBI shows a continued increase in gigabit tier adoption, as well as migration of subscribers to speeds of 200 Mbps or higher. Fifteen percent of subscribers were on gigabit tier plans in 3Q22, an increase of 35% over the 11.4% figure in 3Q21, and the percentage of subscribers on plans between 200-400 Mbps doubled to 54.8% from 27.4% in 3Q21. At the end of the third quarter, only 4.7% of all subscribers were provisioned for speeds of less than 50 Mbps, a reduction of more than 50% from the 3Q21 figure of 9.8%.

Gigabit tier subscribers are up more than 600% since the third quarter of 2019 and are now 15.4% of all wireline internet subs. “This trend is impacting bandwidth usage characteristics, with faster growth in power users and median bandwidth usage. Faster speeds are fueling greater consumption that may be reflected in the need for greater capacity in the future.”

Key findings in the 3Q22 report:

Other Highlights:

-

- Average monthly usage of 495.5 GB was up 13.9% from 3Q21’s average of 434.9 GB, and represented a slight increase over 2Q22’s 490.7 GB. Median broadband was up 14.3% year over year, representing broader growth across all subscribers.

- The speed tier with the fastest annual growth is in the range of 200 Mbit/s to 400 Mbit/s, which doubled to 54.8% of all subscribers. The percentage of customers on low-end 50Mbit/s tiers shrank to just 4.7% in Q3 2022, down more than 50% from the year-ago quarter.

- Year-over-year growth of power users of 1TB or more was 18%, to 13.7% of all subscribers, while the super power user category of consumers of 2 TB or more rose almost 50% during the same time frame.

- Participants in the FCC’s Affordable Connectivity Program (ACP) consumed 615.2 GB of data in 3Q22, 24% more than the 495.5 used by the general population.

OpenVault founder and CEO Mark Trudeau told Light Reading in October that high levels of data usage among ACP participants is surprising, but he said it’s likely due to households in the program that use the funds to upgrade to faster speed packages. As a successor to the original Emergency Broadband Benefit (EBB) program, ACP provides qualifying low-income households with a $30 per month subsidy ($75 for tribal households) that can be applied toward Internet subscriptions.

The entire report is at https://xprss.io/zdgeG if you fill in a form and click SEND (to OpenVault).

OpenVault also provides continuously updated broadband consumption figures at https://openvault.com/broadbandtracker/.

References:

https://www.telecompetitor.com/clients/openvault/2022/Q3/index.php

Ookla Ranks Internet Performance in the World’s Largest Cities: China is #1

Cloud Computing Giants Growth Slows; Recession Looms, Layoffs Begin

Among the megatrends driving the technology industry, cloud computing has been a major force. But for the first time in its brief history, the cloud has grown stormy as third-quarter cloud giant earnings details made very clear:

- Amazon Web Services (AWS) fell short of the mark on both earnings and revenue. Reports say parent Amazon.com (AMZN) has frozen hiring at its cloud computing unit and will be laying off 10,000 employees.

- Microsoft’s (MSFT) Azure cloud business at posted an unexpected slowdown in cloud computing growth. At Microsoft, “Intelligent Cloud” revenue rose 24% to $25.7 billion during the company’s fiscal first quarter, including Azure’s 35% growth to $14.4 billion. Excluding the impact of currency exchange rates, Azure revenue climbed 42%

- Alphabet’s (GOOGL) Google Cloud business came in ahead of forecasts, but Oppenheimer analyst Tim Horan said in a note to clients that it has “no line of sight to meaningful profits.”

Note: We don’t consider Facebook/Meta Platforms a cloud service provider, even though they build the IT infrastructure for their cloud resident data centers. They are first and foremost a social network provider that’s now desperately trying to create a market for the Metaverse, which really does not exist and may never be!

In late October, Synergy Research reported that Amazon, Microsoft and Google combined had a 66% share of the worldwide cloud services market in the 3rd quarter, up from 61% a year ago. Alibaba and IBM placed fourth and fifth, respectively according to Synergy. In aggregate, all cloud service providers excluding the big three have tripled their revenues since late 2017, yet their collective market share has plunged from 50% to 34% as their growth rates remain far below the market leaders.

In 2022, capital spending on internet data centers by the three big cloud computing companies will jump a healthy 25% to $74 billion, estimates Dell’Oro Group. In 2023, spending on warehouse-size data centers packed with computer servers and data storage gear is expected to slow. Dell’Oro puts growth at just 7%, which would take the market up to $79 billion.

Oppenheimer’s Horan wrote, “Cloud providers remain very bullish on long-term trends, but investors have been surprised at how economically sensitive the sector is. “Sales cycles in cloud services have elongated and customers are looking to cut cloud spending by becoming more efficient. Despite the deceleration, cloud is now a $160 billion-plus industry. But investors will be concerned given this is our first real cloud recession, which makes forecasts difficult.”

“This macro slowdown clearly will impact all aspects of tech spending over the next 12 to 18 months. Cloud spending is not immune to the dark macro backdrop as seen during earnings season over the past few weeks,” Wedbush analyst Daniel Ives told Investor’s Business Daily via an email. “That said, we estimate 45% of workloads have moved to the cloud globally and (the share is) poised to hit 70% by 2025 in a massive $1 trillion shift. Enterprises will aggressively push to the cloud and we do not believe this near-term period takes that broader thesis off course. The near-term environment is more of a speed bump rather than a brick wall on the cloud transformation underway. Microsoft, Amazon, Google, IBM (IBM) and Oracle (ORCL) will be clear beneficiaries of this cloud shift over the coming years and will power through this Category 5 (hurricane) economic storm.”

Bank of America expects a boost from next-generation cloud services that cater to “edge computing.” Amazon, Microsoft and Google are “treating the edge as an extension of their public cloud,” said a BofA report. The giant cloud computing companies have all partnered with telecom firms AT&T (T), Verizon (VZ) and T-Mobile US (TMUS). Their aim to embed their cloud services within 5G wireless networks. “Telcos are leveraging the hyperscale cloud to launch their own edge compute businesses,” BofA said.

At BMO Capital Markets, analyst Keith Bachman says investors need to reset their expectations as the coronavirus pandemic eases. The corporate switch to working from home spurred demand for cloud services. Online shopping boomed. And consumers turned to internet video and online gaming for entertainment.

“We think many organizations accelerated the journey to the cloud as Covid and hybrid work requirements exposed weaknesses in existing on-premise IT capabilities,” Bachman said in a note. “While spend remains healthy in the cloud category, growth has decelerated for the past few quarters. We believe economic forces are at work as well as a slower pace of cloud migrations post-Covid.”

Market research heavyweight Gartner updated its global cloud computing growth forecast Oct. 31. The new forecast was completed before third-quarter earnings were released by Amazon, Microsoft and Google. Gartner forecasted worldwide end-user spending on public cloud services will grow 20.7% in 2023 to $591.8 billion. That’s up from 18.8% growth in 2022.

In a press release, Gartner analyst Sid Nag cautioned: “Organizations can only spend what they have. Cloud spending could decrease if overall IT budgets shrink, given that cloud continues to be the largest chunk of IT spend and proportionate budget growth.

AWS, Microsoft Azure and Google’s cloud computing units are all growing at an above-industry-average rate. Still, AWS and Azure are slowing, perhaps a bit due to size as well as the economy.

- At Wolfe Research, MSFT stock analyst Alex Zukin said in his note: “The damage in Microsoft’s case came from another Azure miss in the quarter, but the bigger surprise was the guide of 37%. That is the largest sequential growth deceleration on record.”

- Google’s cloud computing revenue rose 38% to $6.28 billion. That’s up 2% from the previous quarter and topped estimates from GOOGL stock analysts by 4%. However, the company reported an operating loss of $644 million for the cloud business versus a $699 million loss a year earlier. Hoping to take market share from bigger AWS and Microsoft’s Azure, Google has priced cloud services aggressively, analysts say. It also stepped up hiring and spending on data centers. And it acquired cybersecurity firm Mandiant for $5.4 billion.

- “Amazon noted it has seen an uptick in AWS customers focused on controlling costs and is working to help customers cost-optimize,” Amazon stock analyst Youssef Squali at Truist Securities said in a report to clients. “The company is also seeing slower growth from certain industries (financial services, mortgage and crypto sectors),” he added.

- Oppenheimer’s Horan estimates that AWS will produce $13.9 billion in free cash flow in 2022. But he sees Google’s cloud unit having $10.6 billion in negative free cash flow.

Nonetheless, Deutsche Bank analyst Brad Zelnick remains upbeat on the cloud computing business. He wrote in a research note:

“We see a temporary slowdown in bringing new workloads to the cloud, though importantly not a change in organizations’ long-term cloud ambitions. The near-term forces of optimization can obscure what we believe remain very supportive underlying trends. We remain confident that we are in the early innings of a generational shift to cloud.”

References:

The First Real Cloud Computing Recession Is Here — What It Means For Tech Stocks

Synergy: Q3 Cloud Spending Up Over $11 Billion YoY; Google Cloud gained market share in 3Q-2022

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

AST SpaceMobile, the company building the first and only space-based cellular broadband network accessible directly by standard mobile phones, announced today that it had successfully completed deployment of the communications array for its test satellite, BlueWalker 3 (“BW3”), in orbit.

BW3 is the largest-ever commercial communications array deployed in Low Earth Orbit (LEO) and is designed to communicate directly with cellular devices via 5G frequencies (which have yet to be standardized by ITU-R in M.1036 revision 6).

The satellite spans 693 square feet in size, a design feature critical to support a space-based cellular broadband network. The satellite is expected to have a field of view of over 300,000 square miles on the surface of the Earth.

The unfolding of BW3 was made possible by years of R&D, testing and operational preparation. AST SpaceMobile has a portfolio of more than 2,400 patent and patent-pending claims supporting its space-based cellular broadband technology. Additional details on the BlueWalker 3 mission can be seen in this video.

“Every person should have the right to access cellular broadband, regardless of where they live or work. Our goal is to close the connectivity gaps that negatively impact billions of lives around the world,” said Abel Avellan, Chairman and Chief Executive Officer of AST SpaceMobile. “The successful unfolding of BlueWalker 3 is a major step forward for our patented space-based cellular broadband technology and paves the way for the ongoing production of our BlueBird satellites.”

AST SpaceMobile has agreements and understandings with mobile network operators (“MNOs”) globally that have over 1.8 billion existing subscribers, including a mutual exclusivity with Vodafone in 24 countries. Interconnecting with AST SpaceMobile’s planned network will allow MNOs, including Vodafone Group, Rakuten Mobile, AT&T, Bell Canada, MTN Group, Orange, Telefonica, Etisalat, Indosat Ooredoo Hutchison, Smart Communications, Globe Telecom, Millicom, Smartfren, Telecom Argentina, Telstra, Africell, Liberty Latin America and others, the ability to offer extended cellular broadband coverage to their customers who live, work and travel in areas with poor or non-existent cell coverage, with the goal of eliminating dead zones with cellular broadband from space.

“We want to close coverage gaps in our markets, particularly in territories where terrain makes it extremely challenging to reach with a traditional ground-based network. Our partnership with AST SpaceMobile – connecting satellite directly to conventional mobile devices – will help in our efforts to close the digital divide,” said Luke Ibbetson, Head of Group R&D, Vodafone and an AST SpaceMobile director.

Tareq Amin, CEO of Rakuten Mobile and Rakuten Symphony and an AST SpaceMobile director, added “Our mission is to democratize access to mobile connectivity: That is why we are so excited about the potential of AST SpaceMobile to support disaster-readiness and meet our goal of 100% geographical coverage to our customers in Japan. I look forward not only to testing BW3 on our world-leading cloud-native network in Japan, but also working with AST SpaceMobile on integrating our virtualized radio network technology to help bring connectivity to the world.”

Chris Sambar, President – Network, AT&T, added “We’re excited to see AST SpaceMobile reach this significant milestone. AT&T’s core mission is connecting people to greater possibilities on the largest wireless network in America. Working with AST SpaceMobile, we believe there is a future opportunity to even further extend our network reach including to otherwise remote and off-grid locations.”

About AST SpaceMobile:

AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on YouTube, Twitter, LinkedIn and Facebook. Watch this video for an overview of the SpaceMobile mission.

References:

Musk’s SpaceX and T-Mobile plan to connect mobile phones to LEO satellites in 2023

New developments from satellite internet companies challenging SpaceX and Amazon Kuiper

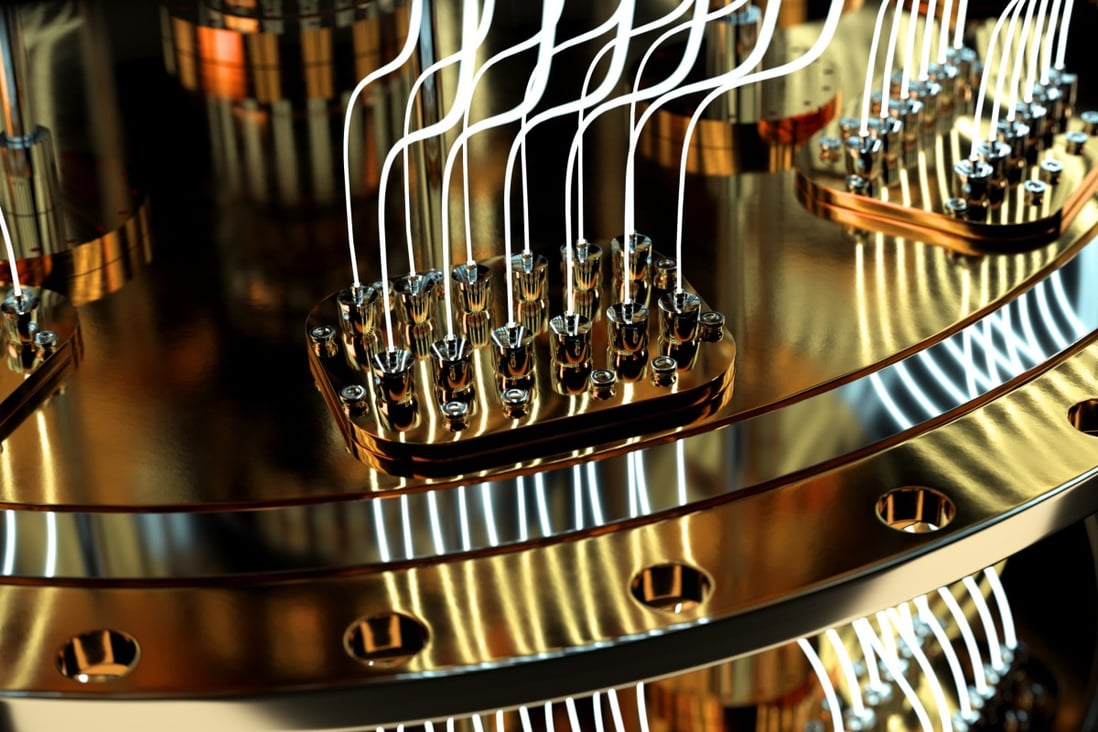

Quantum Technologies Update: U.S. vs China now and in the future

The quantum computing market could be worth up to $5 billion by 2025, driven by competition between the US and China, according to London-based data analytics fir GlobalData whose Patent Analytics Database reveals that the U.S. is the global leader in quantum computing. The analytics company notes that China is currently about five years behind the U.S., and the recently passed U.S. CHIPS and Science Act will enhance U.S. quantum capabilities while hindering China.

Sidebar; What is a Quantum Computer:

Unlike a classical computer, which performs calculations one bit or word at a time, a quantum computer can perform many calculations concurrently. Quantum computers use a basic memory unit called a qubit, which has the flexibility to represent either zero, one or both at the same time. This ability of an object to exist in more than one form at the same time is known as superposition. The concept of entanglement is when multiple particles in a quantum system are connected and affect each other. If two particles become entangled, they can theoretically transmit and receive information over very long distances. However, the transmission error rates have yet to be determined.

Because quantum computers’ basic information units can represent all possibilities at the same time, they are theoretically much faster and more powerful than the regular computers we are used to.

Physicists in China recently launched a quantum computer they said took 1 millisecond to perform a task that would take a conventional computer 30 trillion years.

The aforementioned U.S. CHIPS and Science Act, signed into law in August 2022, represents an escalation in the growing tech war between the U.S. and China. The act includes measures designed to cut off China’s access to US-made technology. In addition, new export restrictions were announced on October 10, some of which took immediate effect. These restrictions prevent the export of semiconductors manufactured using US equipment to China. Currently, the U.S. is negotiating with allied nations to implement similar restrictions. Included in the CHIPS Act is a detailed package of domestic funding to support US quantum computing initiatives, including discovery, infrastructure, and workforce.

Among the many commercial companies researching the technology, IBM, Alphabet (parent company of Google), and Northrop Grumman have filed the most patents, with a respective 1,885, 1,000, and 623 total publications.

Earlier this week, IBM unveiled the largest quantum bit count (433 qubits) of its quantum computers to date, named Osprey, at this week’s IBM Quantum Summit. The company also introduced its latest modular quantum computing system.

“The new 433 qubit ‘Osprey’ processor brings us a step closer to the point where quantum computers will be used to tackle previously unsolvable problems,” IBM SVP Darío Gil said in a statement.

The IBM Osprey more than tripled the qubit count of its predecessor — the 127-qubit Eagle processor, launched in 2021. “Like Eagle, Osprey includes multi-level wiring to provide flexibility for signal routing and device layout, while also adding in integrated filtering to reduce noise and improve stability,” Jay Gambetta, VP of IBM Quantum wrote in a blog post.

The company claims Osprey is more powerful to run complex computations and the number of classical bits needed to represent a state on this latest processor far exceeds the total number of atoms in the known universe.

Gambetta noted IBM has been following along its quantum technology development roadmap. The company put its first quantum computer on the cloud in 2016 and aims to launch its first 1000-plus qubit quantum processor (Condor) next year and a 4000-plus qubit processor around 2025.

The US government has committed $3 billion in funding for federal quantum projects, which are either being planned or already underway, including the $1.2 billion National Quantum Computing initiative. In addition, the U.S. government almost certainly conducts quantum projects in secret through the Defense Advanced Research Projects Agency (DARPA) and the National Security Agency (NSA).

The U.S. government has committed $3bn in funding to federal quantum projects that are either already in train or being planned. The biggest project is the $1.2bn U.S. National Quantum Computing Initiative. Of course, the military and security services will be assiduously tending their own quantum gardens.

As expected, considerably less is known about China’s advancements and investments in quantum technology. The country proclaims itself to be the world-leader in secure quantum satcoms. The CCP (which runs the People’s Republic of China or PRC) can devote huge resources to any technology perceived to give the PRC a strategic geo-political advantage – such as global quantum supremacy.

“Quantum computing has become the latest battleground between the U.S. and China,” GlobalData associate analyst Benjamin Chin said in a statement. “Both countries want to claim quantum supremacy, not only as a matter of national pride but also because of the financial, industrial, scientific, and military advantages quantum computing can offer. “China has already established itself as a world leader in secure quantum satellite communications. Moreover, thanks to its autocratic economic model, it can pool resources from institutions, corporations, and the government. This gives China a distinct advantage as it can work collectively to achieve a single aim – quantum supremacy.”

China has already developed quantum equipment with potential military applications:

- This year, scientists from Tsinghua University developed a quantum radar that could detect stealth aircraft by generating a small electromagnetic storm.

- In 2017, the Chinese Academy of Sciences also developed a quantum submarine detector that could spot submarines from far away.

- In December 2021, China created a quantum communication network in space to protect its electric power grid against attacks, according to scientists involved in the project. Part of the network links the power grid of Fujian, the southeastern province closest to Taiwan, to a national emergency command centre in Beijing.

Consider Alibaba’s innocuously named DAMO Academy (Discovery, Adventure, Momentum and Outlook), which has already invested $15bn in quantum technology and will continue to plough more and more money into the venture. The Chinese government has also invested at least $10bn in the National Laboratory for Quantum Information Science, whose sole purpose is to conduct R&D only into quantum technologies with “direct military applications.”

Photo: Shutterstock Images

Swiss company ID Quantique, a spin-off from the Group of Applied Physics at the University of Geneva, is launching technology to make satellite security quantum proof. The company was founded in 2011 and has more than a decade of experience in quantum key distribution systems, quantum safe network encryption, single photon counters and hardware random number generators. The latest additions to its portfolio are two extremely robust, ruggedized and radiation-hardened QRNG (Quantum Random Number Generator) chips designed and fabricated especially for space applications.

The generation of genuine randomness is a vital component of cybersecurity: Systems that rely on deterministic processes, such as Pseudo Random Number Generators (PRNGs), to generate randomness are insecure because they rely on deterministic algorithms and these are, by their nature, predictable and therefore crackable. The most reliable way to generate random numbers is based on quantum physics, which is fundamentally random. Indeed, the intrinsic randomness of the behaviour of subatomic particles at the quantum level is one of the very few absolutely random processes known to exist. Thus, by linking the outputs of a random number generator to the utterly random behaviour of a quantum particle, a truly unbiased and unpredictable system is guaranteed and can be assured via live verification of the numbers and monitoring of the hardware to ensure it is operating properly.

The two new space-hardened microprocessors, the snappily named IDQ20MC1-S1 and IDQ20MC1-S3, are certified to the equally instantly memorable ECSS-Q-ST-60-13, the standard that defines the requirements for selection, control, procurement and usage of electrical, electronic and electro-mechanical (EEE) commercial components for space projects. The IDQ20MC1-S3 is a Class 3 device, predominantly for use in low-earth orbit (LEO) missions. The IDQ20MC1-S1 is a Class 1 device, for use in MEO and GEO mission systems. IDQ is the first to enable satellite security designers to upgrade their encryption keys to quantum enhanced keys.

References:

https://ibm-com-qc-dev.quantum-computing.ibm.com/quantum/summit

Has Edge Computing Lived Up to Its Potential? Barriers to Deployment

Despite years of touting and hype, edge computing (aka Multi-access Edge Computing or MEC) has not yet provided the payoff promised by its many cheerleaders. Here are a few rosy forecasts and company endorsements:

In an October 27th report, Markets and Markets forecast the Edge Computing Market size is to grow from $44.7 billion in 2022 to $101.3 billion by 2027, which is a Compound Annual Growth Rate (CAGR) of 17.8% over those five years.

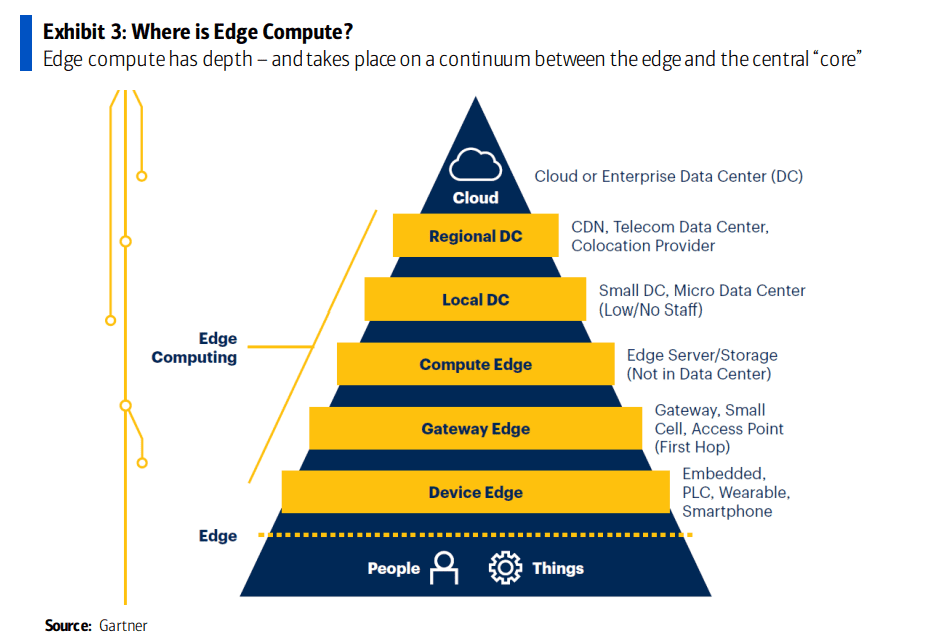

IDC defines edge computing as the technology-related actions that are performed outside of the centralized datacenter, where edge is the intermediary between the connected endpoints and the core IT environment.

“Edge computing continues to gain momentum as digital-first organizations seek to innovate outside of the datacenter,” said Dave McCarthy, research vice president, Cloud and Edge Infrastructure Services at IDC. “The diverse needs of edge deployments have created a tremendous market opportunity for technology suppliers as they bring new solutions to market, increasingly through partnerships and alliances.”

IDC has identified more than 150 use cases for edge computing across various industries and domains. The two edge use cases that will see the largest investments in 2022 – content delivery networks and virtual network functions – are both foundational to service providers’ edge services offerings. Combined, these two use cases will generate nearly $26 billion in spending this year (2022). In total, service providers will invest more than $38 billion in enabling edge offerings this year. The market research firm believes spending on edge compute could reach $274 billion globally by 2025 – though that figure would be inclusive of a wide range of products and services.

HPE CEO Antonio Neri recently told Yahoo Finance that edge computing is “the next big opportunity for us because we live in a much more distributed enterprise than ever before.”

DigitalBridge CEO Marc Ganzi said his company continues to see growth in demand for edge computing capabilities, with site leasing rates up 10% to 12% in the company’s most recent quarter. “So this notion of having highly interconnected data centers on the edge is where you want to be,” he said, according to a Seeking Alpha transcript.

Equinix CEO Charles Meyers said his company recently signed a “major design win” to provide edge computing services to an unnamed pediatric treatment and research operation across a number of major US cities. Equinix is one of the world’s largest data center operators, and has recently begun touting its edge computing operations.

……………………………………………………………………………………………………………………………………………………………..

In 2019, Verizon CEO Hans Vestberg said his company would generate “meaningful” revenues from edge computing within a year. But it still hasn’t happened yet!

BofA Global Research wrote in an October 25th report to clients, “Verizon, the largest US wireless provider and the second largest wireline provider, has invested more resources in this [edge computing] topic than any other carrier over the last seven years, yet still cannot articulate how it can make material money in this space over an investable timeframe. Verizon is in year 2 of its beta test of ‘edge compute’ applications and has no material revenue to point to nor any conviction in where real demand may emerge.”

“Gartner believes that communications and manufacturing will be the main drivers of the edge market, given they are infrastructure-intensive segments. We highlight existing use cases, like content delivery in communications, or

‘device control’ in manufacturing, as driving edge compute proliferation. However, as noted above, the market is still undefined and these are only two possible outcomes of many.”

Raymond James wrote in an August research note, “Regarding the edge, carriers and infrastructure companies are still trying to define, size and time the opportunity. But as data demand (and specifically demand for low-latency applications) grows, it seems inevitable that compute power will continue to move toward the customer.”

……………………………………………………………………………………………………………………………………………

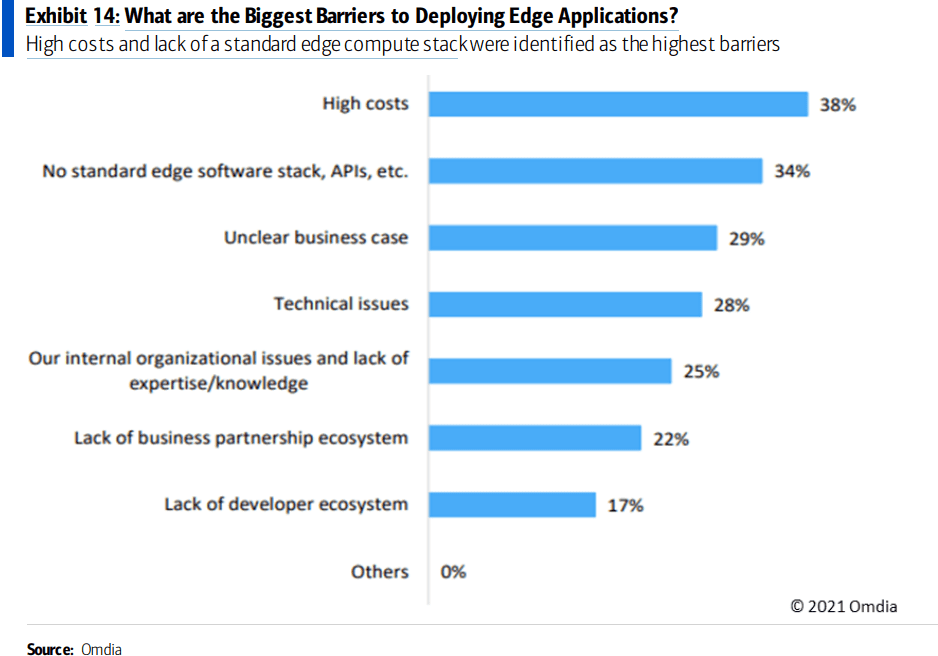

BofA Global Research – Challenges with Edge Compute:

The distributed nature of edge compute can pose several risks to enterprises. The number of nodes needed between stores, factories, automobiles, homes, etc. can vary wildly. Different geographies may have different environmental issues, regulatory requirements, and network access. Furthermore, the distributed scale in edge compute puts a greater burden on ensuring that edge compute nodes are secured and that the enterprise is protected. Real-time decision making on the edge device requires a platform to be able to anonymize data used in analytics, and secure data in transit and information stored on the edge device. As more devices are added to the network, each one becomes a potential vulnerability target and as data entry points expand across a corporate network, so do opportunities for intrusion.

On the other hand, the risk is somewhat double-sided as some security risk is mitigated by keeping the data distributed so that a data breach only impacts a fraction of the data or applications. Other barriers to deploying edge applications include high costs as a result of its distributed nature, as well as a lack of a standard edge compute stack and APIs.

Another challenge to edge compute is the issue of extensibility. Edge computing nodes have historically been very purpose-specific and use-case dependent to environments and workloads in order to meet specific requirements and keep costs down. However, workloads will continuously change and new ones will emerge, and existing edge compute nodes may not adequately cover additional use cases. Edge computing platforms need to be both special-purpose and extensible. While enterprises typically start their edge compute journey on a use-case basis, we expect that as the market matures, edge compute will increasingly be purchased on a vertical and horizontal basis to keep up with expanding use cases.

References:

The Amorphous “Edge” as in Edge Computing or Edge Networking?

Edge computing refuses to mature | Light Reading

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

ETSI MEC Standard Explained – Part II

Lumen Technologies expands Edge Computing Solutions into Europe

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

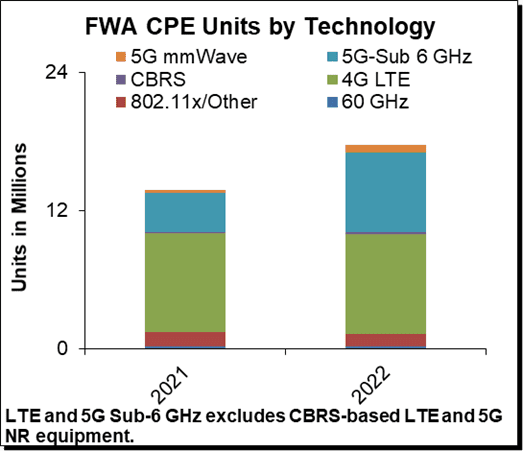

Dell’Oro Group announced today the launch of its new Fixed Wireless Access Infrastructure and CPE advanced research report (ARR). Preliminary findings suggest total Fixed Wireless Access (FWA) revenues, including both RAN equipment and CPE revenue remain on track to advance 35% in 2022, driven largely by subscriber growth in North America.

“Fixed Wireless Access has become a key component to bridging the digital divide and connecting rural and underserved markets globally. What we are also seeing is that FWA can effectively compete with existing fixed broadband technologies, especially with the advent of 5G and other higher-throughput, non-3GPP technologies,” said Jeff Heynen, Vice President and analyst with the Dell’Oro Group.

“Right now, CPE for fixed wireless access using 5G sub-6GHz technologies are growing the fastest. We do expect these units to tail off over time as current investments in fiber networks, along with cable’s DOCSIS 4.0 and fiber upgrades, will limit the addressable market for large-scale fixed wireless services,” Jeff added.

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Global FWA revenues are projected to surpass $5 B by 2026, reflecting sustained investment and subscriber growth in both 3GPP- and non-3GPP-based network deployments.

- The North American market remains the most dynamic in terms of deployed FWA technology options, with CBRS and other sub-6GHz options growing alongside 5G NR and 60GHz options.

- Long-term subscriber growth is expected to occur in emerging markets in Southeast Asia and MEA, due to upgrades to existing LTE networks and a need to connect subscribers economically.

- The Satellite Broadband market will also be a key enabler of broadband connectivity in emerging markets, thanks to LEOS-based providers including Starlink, OneWeb, and Project Kuiper.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional subscriber forecasts for FWA and satellite broadband technologies, as well as Gateway forecasts for satellite broadband deployments. To purchase this report, please contact us by email at [email protected].

Note: The IEEE Techblog has featured many FWA success stories and that FWA is probably the top 5G use case to date. The main reason is that a 5G FWA network doesn’t involve roaming or a 5G SA core network for which there are no ITU/ETSI standards or 3GPP implementation specs. As long as the FWA CPE supports 5G NR (via ITU M.2150 recommendation or 3GPP Release 16) all the other functions can be customized in software which only has to work with the network provider offering the FWA service.

References:

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Huawei aims to lead Africa’s 5G digital transformation, as U.S. and Europe lockouts continue

Faced with continuing bans in the U.S. and Europe, Huawei is focusing network equipment sales in Africa, which in turn is emphasizing “digital transformation.”

“As the third wave of the global 5G market, Africa will open the 5G era in 2023,” Benjamin Hou, president of Huawei’s northern Africa business, told the Africa 5G summit, that took place in Bangkok, Thailand on October 24th. The event was seen as a platform to draw African countries to 5G tech powered by Shenzhen-based Huawei.

Hou said: “Huawei will further increase its investment in Africa to support the steady development of 5G to facilitate digital transformation in the region. In Africa, for Africa, Huawei will continue to deepen cooperation with industry partners to support customers’ business success in the 5G era.”

Huawei has already built massive information and communications technology (ICT) infrastructure across Africa, but faces challenges in the United States and other Western countries in the northern hemisphere over security concerns. The Trump administration banned tech exports to Chinese companies including Huawei Technologies, ZTE and China Telecom over alleged ties to Chinese military or surveillance networks, and lobbied allied nations to do the same. President Biden took his predecessor’s restrictions forward last year, signing a law to block Chinese companies including Huawei. The Federal Communications Commission (FCC) has named Chinese telecoms firms China Unicom and Pacific Networks Corp as threats to U.S. national security, with a formal ban likely to go through soon.

China’s foreign ministry said: “What the U.S. did violates the rules of the market economy … and seriously hurts the interests of Chinese companies.” “China firmly rejects this. We urge the U.S. side to immediately change its wrong course of action and stop hobbling and suppressing Chinese companies.” In Africa, however, local operators have invested heavily in Chinese equipment and infrastructure, with Beijing often providing funding to build ICT infrastructure including data centers, fiber optic cables and cloud services.

Huawei also faces headwinds in Europe, where Britain and some European Union countries have blacklisted the company from supplier lists for mobile networks, including 5G.

Delivering the keynote speech at the Bangkok summit, Coulibaly Yacouba, CEO of the Ivory Coast mobile spectrum authority, hailed the advent of the 5G era in his country – due to host the Africa Cup of Nations in early 2024.

“The government and local operators are making comprehensive preparations for the commercial launch of 5G in the country. People are expected to enjoy the ultimate service experience brought by innovative 5G technologies during the next Africa Cup of Nations,” he said.

Late last month, two more African mobile network operators – in South Africa and Kenya – launched 5G networks powered by Huawei. South Africa’s partly state-owned Telkom followed smaller data-only network Rain – which in 2019 became Africa’s first telecoms to deploy a commercial 5G network using Huawei. In Kenya, largest mobile network operator Safaricom became East Africa’s first telecoms company to commercially launch 5G high-speed internet services, with infrastructure built by Huawei and Finland’s Nokia.

Deploying multiple vendors, as Safaricom has done, is seen as a way for African operators to get around US or European sanctions and calls to avoid Chinese technology. In South Africa, Vodacom – a subsidiary of Britain’s Vodafone – uses Nokia alongside Huawei as a network provider, while MTN uses tech from Sweden’s Ericsson as well as Huawei and ZTE.

Abishur Prakash, co-founder and geopolitical futurist at the Centre for Innovating the Future, a Canada-based advisory firm, said the Western pushback had made Huawei realise that some countries were “off limits”, with its most lucrative business lines, like 5G, being banned or restricted from India to Japan to Britain. “Now, Huawei is focusing on markets that are less under the thumb of the West – like Africa and the Middle East,” Prakash said. What Huawei was experiencing was part of a new era of “vertical globalisation”, he said. “The world is no longer open and accessible, as it has been for decades … In this new design of the world, Huawei cannot operate freely, the way [America’s] IBM and GE once did.” The US-China rivalry was revealing a new African position, Prakash noted. “African nations are willing to put their own interests first. Take Kenya. It will continue buying from Huawei, even if the US doesn’t want this. It’s this attitude, where Africa is willing to ignore the US, that’s encouraging Huawei to focus more on the continent. Of course, none of this comes without challenges.” Prakash said that while Africa was acting independently, it was also ceding sovereignty as U.S. and Chinese technology companies dominated their societies.

“[As] for the West, it will have to contend with the footprint China is building in Africa, and how this drives Chinese power in the 21st century.”

No government in Africa has banned operators from using Huawei technology. In 2019, South African President Cyril Ramaphosa hinted his country would choose Huawei for its 5G roll-out, and also criticized the U.S. government. “Because they have been outstripped, they must now punish that company and use it as a pawn in the fight they have with China. We want 5G and we know where we can get 5G.”

Those sentiments are also supported by operators in Africa. According to Stephane Richard, CEO of French telecoms giant Orange, Africa’s No 2 operator after MTN: “We’re working more and more with Chinese vendors in Africa, not because we like China, but we have an excellent business relationship with Huawei. They’ve invested in Africa while the European vendors have been hesitating,” Richard told Reuters during last year’s Mobile World Congress in Barcelona, Spain.

New Zealand-based Kenyan telecoms and IT consultant, Peter Wanyonyi, said US and European warnings to African and other developing countries against using Huawei had nothing to do with security or spying. “It’s all about geopolitical power and protectionism – and the West’s fear of a rising China,” Wanyonyi said.

He maintains that the West saw Huawei – and other leading Chinese companies – as threats to the dominance that Western companies had enjoyed in Africa and the Global South for 200 years. The economies of scale meant Huawei could bring leading-edge products onto the market much faster than Western rivals could, and China’s pro-business outlook encouraged investment in research and development at rates that the West simply could not match, he said. “The result is that Huawei technologies are more affordable and now more robust than what the West has to offer, and African countries are jumping at the opportunity afforded by Huawei to modernise their technology infrastructure.” Chinese investments in Africa were not charity, he added.

“To many Africans, it is a relief to just be able to do business without having to deal with the paternalism and historical baggage that Western companies carry around with them when doing business in Africa. “Huawei technology is affordable, available, unconditional and does the job – and will thus continue to be the technology of choice for many African telecoms.” Dobek Pater, business development director at the market research firm Africa Analysis, said Huawei equipment has improved significantly over the years and was very competitive in terms of quality and price with traditional “Western” equipment.

“Particularly in the case of 5G, Huawei has invested a lot in R&D. This makes Huawei often a preferred supplier,” Pater said. “Moreover, in many instances the mobile network operators or fixed-line operators already have quite a bit of Huawei kit installed in their networks and it makes sense to continue building out networks with Huawei equipment,” Pater said. He said some of the operators followed a strategy of using multiple suppliers of new technologies.

“In the case of 5G, there are only really three main providers of [radio access network] equipment. Huawei is one of them. Therefore, it naturally becomes a choice in many instances,” Pater said. Another advantage for Huawei was the Chinese government’s willingness to advance soft loans to help in infrastructure development. However, Huawei has not gone without controversy in Africa, he added.

n 2018, French newspaper Le Monde reported Huawei had bugged the African Union headquarters in Addis Ababa, Ethiopia – claims that were rejected by the company. The following year, Huawei lodged a protest with The Wall Street Journal after it reported that the Chinese company had helped the Ugandan and Zambian governments spy on political opponents. Huawei denied the allegations.

References:

https://www.huawei.com/en/technology-insights/publications/huawei-tech/202203/5g-business-success

https://www.connectingafrica.com/author.asp?section_id=728&doc_id=778960

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

South Korea’s Samsung Electronics says it has achieved record-setting average downlink speeds of 1.75 Gbps and uplink speeds of 61.5 Mbps over a 10 km (6.2 miles) 5G mmWave network in a recent field trial conducted with Australia’s NBN Co. As the farthest 28 GHz 5G mmWave Fixed Wireless Access (FWA) connection recorded by Samsung, this milestone demonstrates the expanded reach possible with this powerful spectrum, and its ability to efficiently deliver widespread broadband coverage across the country.

Source: Accton

To achieve average downlink speeds of 1.75 Gbps at such extended range, the trial by Samsung and NBN utilized eight component carriers (8CC), which is an aggregation of 800MHz of mmWave spectrum. The potential to support large amounts of bandwidth is a key advantage of the mmWave spectrum and Samsung’s beamforming technology enables the aggregation of such large amounts of bandwidth at long distance. At its peak, the company also reached a top downlink speed of 2.7Gbps over a 10km distance from the radio.

“The results of these trials with Samsung are a significant milestone and demonstrate how we are pushing the boundaries of innovation in support of the digital capabilities in Australia,” said Ray Owen, Chief Technology Officer at NBN Co. “As we roll out the next evolution of our network to extend its reach for the benefit of homes and businesses across the country, we are excited to demonstrate the potential for 5G mmWave. nbn will be among the first in the world to deploy 5G mmWave technology at this scale, and achievements like Samsung’s 10km milestone will pave the way for further developments in the ecosystem.”

There’s a total of AUD $750 million investment in the nbn Fixed Wireless network (made up of AUD $480 million from the Australian Government and supported by an additional AUD $270 million from nbn). NBN will use software enhancements and advances in 5G technology, and in particular 5G mmWave technology, to extend the reach of the existing fixed wireless footprint by up to 50 percent and introduce two new wholesale high-speed tiers. The nbn FWA network covers nearly 650,000 premises in the country. The company wants to add at least 120,000 locations in Australia that are currently served by a satellite-based service.

“This new 5G record proves the massive potential of mmWave technology, and its ability to deliver enhanced connectivity and capacity for addressing the last mile challenges in rural areas,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “We are excited to work with nbn to push the boundaries of 5G technology even further in Australia and tap the power of mmWave for customer benefit.”

As demonstrated in the trials, 5G mmWave spectrum is not only viable for the deployment of high-capacity 5G networks in dense urban areas, but also for wider FWA coverage. Extending the effective range of 5G data signals on mmWave will help address the connectivity gap, providing access to rural and remote areas where fiber cannot reach.

For the trial, Samsung used its 28GHz Compact Macro and third-party 5G mmWave customer premise equipment (CPE). Samsung’s Compact Macro is the industry’s first integrated radio for mmWave spectrum, bringing together a baseband, radio and antenna into a single form factor. This compact and lightweight solution can support all frequencies within the mmWave spectrum, simplifying deployment, and is currently deployed in commercial 5G networks across the globe, including Japan, Korea and the U.S.

Since launching the world’s first 5G mmWave FWA services in 2018 in the U.S., Samsung has been leading the industry, offering an end-to-end portfolio of 5G mmWave solutions — including in-house chipsets and radios — and advancing the 5G mmWave momentum globally.

The nbn® network is Australia’s digital backbone that helps deliver reliable and resilient broadband across a continent spanning more than seven million square kilometers. nbn is committed to responding to the digital connectivity needs of people across Australia, working with industry, governments, regulators and community partners to increase the digital capability of Australia.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

Nokia had previously announced it was supplying 5G FWA mmWave CPE equipment for nbn’s efforts that also operates in the 28 GHz band with similar performance characteristics stated by Samsung for its test, including a range of up to 6.2 miles from the transmission tower. However, Samsung said that Nokia’s equipment was not part of its test.

Nokia noted that its CPE includes an antenna installed on the roof of a premises that is linked using a 2.5 Gb/s power over Ethernet (PoE) connection to an indoor unit that powers the on-premises internet connectivity.

Related Articles:

- Samsung Electronics Supports NTT East’s Continued Expansion of Private 5G Networks in Japan

- Samsung Electronics Tapped To Support Comcast’s 5G Connectivity Efforts

- Samsung Electronics To Deliver Private 5G Network Solutions to Korea’s Public and Private Sectors

References:

https://www.sdxcentral.com/articles/news/samsung-nokia-power-5g-mmwave-potential/2022/11/