Samsung introduces 5G mmWave small cell for indoor use with Verizon as 1st customer

Samsung Electronics unveiled a new integrated 5G mmWave small cell for indoor use as part of the company’s full suite of 5G in-building products, Samsung Link. Samsung said its new 5G indoor small cell dubbed “Link Cell” will help provide enhanced 5G experiences to users in indoor environments. It provides 5G-powered applications within enterprises, including manufacturing or distribution facilities, corporate offices, and entertainment or public venues (such as shopping centres, stadiums or hotels). Link Cell is among the first commercial products available globally that provides wireless operators with a mmWave indoor small cell. It includes the Qualcomm 5G RAN platform, which builds on the collaboration between Qualcomm Technologies and Samsung.

Durga Malladi, Senior Vice President and General Manager, 4G/5G, Qualcomm Technologies said:

“Small cells are an excellent vehicle to deliver the incredible speed, capacity and low latency benefits of 5G mmWave to indoor locations. We are very pleased to continue our long standing relationship with Samsung to support development of high-performance 5G small cell infrastructure that addresses the challenging power and size requirements for enterprise deployments, using Qualcomm Technologies’ 5G RAN Modem-RF technology.”

Link Cell gives wireless network operators a way to extend 5G service into businesses and venues. It’s also a critical component for future private 5G networks in enterprises, such as manufacturing, healthcare, retail and warehouse facilities. That’s a market segment AT&T wants to penetrate for its 5G services, including extending their 5G network indoors.

Photo Credit: Samsung Electronics

Verizon will be the first U.S. wireless network operator to commercially deploy Samsung’s Link Cell, which the wireless provider will use to extend the footprint of its 5G Ultra Wideband network. This marks a new phase in delivering enterprise private 5G networks, and advancing next generation mobile technology use cases and applications. Verizon recently said lab trials were underway with Samsung to test the product, along with field tests of an in-building 5G cell site from Corning.

The first version of Samsung’s Link Cell will support 28GHz and has the functionality to combine four 100MHz bandwidth of frequencies, offering high capacity and ultra-fast download speeds. Moreover, it brings together a radio, antenna and digital unit into one compact box, and is less than 4 liters in volume, one of the smallest in the industry.

Link Cell offers fast and easy indoor installation; it can be discretely placed on walls or ceilings, similar to a Wi-Fi access point, while minimising noise through fanless convection cooling. Designed to self-organise, Link Cell will adjust for optimal RF performance, allowing mobile applications to operate within a facility or—as applications transition from a macro 5G network outside to the in-building network—maintain high-quality communications continuity. Link Cell is available now for wireless operators to purchase for use in commercial rollouts.

Commenting on the Link Cell, Jaeho Jeon, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics, said:

“Today, we are excited to unveil Samsung Link for wireless operators to expand the capabilities of 5G networks and seamlessly link together outdoor and indoor 5G experiences. As one of the first commercial 5G mmWave indoor small cells, Link Cell will enable wireless operators and enterprises to bring 5G services to various offices, facilities and venue locations.”

“Verizon continues to rapidly advance our 5G deployment, and the addition of indoor cell sites will extend the availability of the fastest 5G service in the U.S. This is a key step in providing industry-changing, scalable, latency-sensitive, robust 5G solutions for enterprises,” said Adam Koeppe, senior vice president of Technology Planning and Development at Verizon, in a statement. “The addition of indoor cell sites will extend the availability of the fastest 5G service in the U.S,” he added.

Verizon was the first to deploy Samsung’s 5G NR integrated mmWave access unit, which helped hit 4.2 Gbps speeds during a live network demo in February. Samsung is also working with Verizon on network virtualization, providing its commercial 5G vRAN solution. That might be part of the $6.65B contract Samsung recently was awarded by Verizon.

………………………………………………………………………………………………………………………………………………………………………………………………………………

The new Samsung Link portfolio features several products to help businesses address indoor 5G service needs. In addition to Link Cell, Samsung will deliver products supporting other indoor needs and spectrums. Link Hub and Link HubPro provide low and mid-band support to operators and enterprises.

Link Hub is designed for venues with existing Distributed Antenna Systems (DAS), providing low and mid-band 5G service across an existing in-building infrastructure. Link HubPro is an active antenna system, which includes a hub and indoor radios for mid-to-large enterprises with support for various spectrum options. Link Hub and Link HubPro are expected to begin commercial rollouts beginning 1Q 2021.

References:

https://news.samsung.com/us/5g-indoor-mmwave-small-cell/

https://www.neowin.net/news/samsung-reveals-its-indoor-5g-small-cell-solution/

https://www.fiercewireless.com/tech/samsung-debuts-indoor-5g-mmwave-small-cell

AT&T plans to deploy 5G SA this year; “cloud native” 5G core benefits, assessment and status

Status of AT&T 5G SA:

Speaking Tuesday at the Big 5G Event hosted by Light Reading, Yigal Elbaz, SVP of wireless and access technology at AT&T said that its 5G+ mmWave network has been deployed in 35 cities (densely populated, campuses, etc) and AT&T will continue to expand beyond those cities.

‘The new (transformational) 5G architecture being introduced is a cloud native architecture and software for the 5G core and RAN. We’re moving to a disaggregated and open architecture which will allow AT&T to introduce additional players in the ecosystem and drive further innovations. These capabilities manifest themselves in 5G Stand Alone (SA) core.”

5G SA core brings many benefits, through a true end to end 5G network. This is achieved via a virtualized “cloud native 5G core network,” the implementation of which has not been standardized .[1] or even completely specified in 3GPP Release 16.

Yigal said one important benefit of 5G SA core is network slicing, which supports different use cases and quality of experiences. A better way to optimize spectrum and increase 5G coverage [2.] are other important benefits. Most importantly, is the ability to introduce agility and capabilities of iterating development and pushing software, in the same way it was introduced in IP based network systems.

Note 1. Because there is no standard for implementing a 5G SAcore, every 5G SA network operator works with its 5G core vendors to agree on a detailed implementation specification which is then created as software, mostly running on “cloud native” compute servers.

Note 2. By decoupling 5G spectrum from the LTE network used in 5G NSA, 5G coverage area can be increased. Please see Note 3. for further drill down details.

Elbaz described AT&T’s move toward standalone 5G as an important evolutionary step. “Like anything else in 5G, this is a journey,” he explained. He said standalone 5G can support network slicing, improved latency (?) and improved coverage (by decoupling 5G spectrum from the LTE network used in 5G NSA as per the Note 3. below).

Yigal said that with 5G SA extended architecture, AT&T could now more easily extend the 5G network into the enterprise premises. AT&T has more than 3M enterprise customers of different sizes. With multi-access edge compute on prem, those enterprise customers could then have a cost effective 5G network that could keep sensitive data in house, yet still realize 5G benefits, like “low latency.” Vertical industry types for this hybrid inside/outside 5G network include: manufacturing, health care, robotics, military, education, and others.

Regarding the 5G SA core timeline, Elbaz said AT&T is currently developing and testing 5G Stand Alone (SA) operation now and will deploy it by the end of the year. He added that AT&T would work on “scaling” the technology throughout 2021.

Light Reading’s Phil Harvey tried to get Yigal to be more specific. He asked, “When will 5G SA from AT&T be deployed nationwide?”

Yigal replied, “You need to think about the complete capabilities of the ecosystem that needs to evolve. It’s not just the core….Everything needs to be in place to support the scale of 5G SA and supports the use cases that come with it.”

After repeating his remarks about the 5G SA timeline noted above, Yigal said they don’t have specific dates for 5G SA deployment as it is a “journey.”

AT&T did not disclose its standalone 5G core network vendors. Neither has Verizon (see below), which has hinted it would also deploy 5G SA by the end of 2020. [T-Mobile’s 5G core vendors are Cisco and Nokia; Dish Network recently said Nokia would supply its forthcoming 5G core; Rakuten is working with NEC for their 5G core; Reliance Jio says it’s doing its own 5G core].

…………………………………………………………………………………………………………………………………………………………………………

From Ericsson – Standalone 5G facts:

- Target 5G network architecture option

- Simplified RAN and device architecture

- New cloud-native 5G Core

- Brings ultra-low latency (not true until 3GPP Release 16 URLLC for the core network and RAN are completed and tested)

- The only option to provide same 5G coverage for low band as legacy system

- Supports advanced network-slicing functions (and others like virtualization, orchestration, and automation)

Note 3.: Another benefit of 5G SA, noted by AT&T above is improved coverage. That is because the 5G spectrum used is decoupled from the LTE network that is required for 5G NSA. Thereby, that 5G spectrum may be used to reach areas outside of the LTE coverage area. T-Mobile plans to use their 5G SA 600MHz spectrum to achieve wider coverage than would be possible with 5G NSA. The catch is for the 5G only coverage areas there is no fallback to 4G LTE if something goes wrong.

………………………………………………………………………………………………………………………………………………………………………….

In an August 25th press release, Verizon said:

“Instead of adding or upgrading single-purpose hardware, the move to a cloud-native, container-based virtualized architecture with standardized interfaces leads to greater flexibility, faster delivery of services, greater scalability, and improved cost efficiency in networks.”

“Virtualizing the entire network from the core to the edge has been a massive, multi-year redesign effort of our network architecture that simplifies and modernizes our entire network,” said Adam Koeppe, Senior Vice President of Technology and Planning for Verizon. “Verizon has been on the leading edge of virtualizing the core over the past few years and has been bullish in the design and development of open RAN technology, as well as in the testing of that technology with great success.”

………………………………………………………………………………………………………………………………………………………………………………….

Samsung says the 5G core network is further leveraging the cloud concept by migrating to a cloud native core, in which network functions are modularized and containerized to enable highly flexible scaling and function lifecycle management. The cloud native core provides capabilities that allow the network to adapt to changing demands and support new services with minimal interactions required by operational teams. Samsung’s cloud native 5G core implementation includes the following types of software: microservices, containers and a container engine, stateless operation, intelligent orchestration, and efficient NFVi (NFV Infrastructure).

With its 5G core, network operators will be able to rapidly develop services, launch them on time, and adapt the network frequently according to market demands. Open source can accelerate this innovation by providing platform services with features commonly used by 5G core functions such as monitoring, database activities, and high availability related features.

Samsung collaborates with many operators and partners in efforts to create 5G core solutions and to expand the 5G ecosystems through active participation in the following organizations:

- Cloud Native Computing Foundation (CNCF), which leads the de-facto standard for cloud technology, and

- Open Network Automation Platform (ONAP), a telco-oriented open source project

………………………………………………………………………………………………………………………………………………………………………………..

Other Voices on 5G SA:

Ericsson’s Peter Linder, head of 5G marketing in North America told RCR Wireless:

“When we accelerated the standard and said we can do 5G at the end of 2018 rather than the end of 2020, we did not have the ability then to do both core and radio at the same time. We said, ‘Let’s focus on doing all the radio stuff first in way that it’s as easy as we can possibly make it to connect into an existing EPC that’s upgraded with 5G capabilities.”

“The difference between EPC and 5G core is essentially an architectural difference and how you operate and execute around that,” Linder said. “When we looked at all the different migration options…we came to the conclusion that the only way you could secure a smooth evolution for service providers is to combine EPC and 5G core. The dual mode is essentially about giving the option of doing either EPC or 5G core or EPC and 5G core combined.” In that combined scenario, “You can cut and freeze the investment in the current physical and virtualized platforms. Over time you can start phasing out both physical and virtualized EPC and have everything supported by the 5G core.”

“The move from virtualized to cloud-native eliminates integration steps. People went through so much pain depending on which virtualization [solutions]they used on which hardware. Right now, moving toward cloud-native, that takes away a lot of that cost.” Another key factor Linder identified was OPE. With standalone, “The biggest thing that will have an impact on the total costs is the automation. You have to automate as much as you possibly can.”

Speaking on Arden Media’s “Will 5G Change the World?” podcast, Oracle’s John Lenns, vice president of product management, sized up the transition to 5G SA based on three types of network operators: early adopters, fast followers and the mass market. With early adopters (like T-Mobile US, AT&T, Verizon), “You’ll see some standalone architecture networks going live this calendar year.” The fast followers are “putting out requests for information to prepare themselves for issuing RFPs, and the mass market is still further out into the future.”

Lenns highlighted security and rapid security responsiveness and cost efficiencies both capital and operating. “From a capex perspective, they are looking for an efficient transition through virtualization to cloud-native. They don’t want to pay twice. From an opex perspective, they are recognizing that assembling this 5G solution…is a challenge. It’s not easy…The CSPs are looking for solutions that make that opex journey less expensive. How that manifests itself is they are looking for a solution that offer them efficiencies of deployment, more automation, more embedded test tools, more self-healing behavior.”

HPE’s VP and GM of Communications and Media Solutions Phil Mottram tied 5G core adoption to new service-based revenue opportunities. “Investing in a new 5G network before the revenue streams are there is a financial and technical challenge for many carriers, but… telcos can start deployments today and pay for the infrastructure as their revenue grows.”

Omdia (market research firm owned by Informa) expects that few commercial 5G SA core deployments of scale will take place this year. They expect COVID-19 to have delayed deployment timelines by as much as six months as most converged operators prioritized 4G capacity upgrades and fixed broadband investments given the unprecedented rise in home working during the pandemic, and some mobile carriers lowered or deferred capex to prepare for the potential financial shock of fewer net adds and much reduced roaming revenue.

………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/atandt-to-launch-standalone-5g-later-this-year/d/d-id/764109?

https://www.ericsson.com/en/blog/2019/7/standalone-and-non-standalone-5g-nr-two-5g-tracks

T-Mobile Announces “World’s 1st Nationwide Standalone 5G Network” (without a standard)

T-Mobile US: 5G SA Core network to be deployed 3Q-2020; cites 5G coverage advantage

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

EU Recommendations on very high capacity broadband network infrastructure and a joint approach to 5G rollouts

Summary:

On September 18th, the European Commission (EC) released a recommendation on how all 27 European Union (EU) member states could ensure a timely and more cost-effective way of deploying very high-capacity broadband connectivity infrastructure and develop a “joint approach” to 5G rollouts. The EC says that 5G is the most fundamental block of the digital transformation and an essential pillar of the recovery.

The EC says “the timely deployment of 5G networks will offer significant economic opportunities for the years to come, as a crucial asset for European competitiveness, sustainability and a major enabler for future digital services.”

The EC’s joint approach to 5G is by means of a “toolbox” that defines best practices, including “realistic measures” to assign radio spectrum for 5G networks under investment-friendly conditions. The Commission aims to facilitate the deployment of very high capacity fixed and wireless networks “by, for example, removing unnecessary administrative hurdles and streamlining permit granting procedure.”

The objective is to agree on a toolbox by March 30, 2021. The commission has requested each member state provide it with a roadmap for implementation by April 30, 2021, reporting back by the same date the following year. Please refer to detail timeline in Next steps below.

……………………………………………………………………………………………………………………………………………………………………………………………….

In parallel, and closely linked to this Recommendation, the Commission proposed a new Regulation for the European High Performance Computing Joint Undertaking to maintain and advance Europe’s leading role in supercomputing technology to underpin the entire digital strategy and to ensure the Union’s competitiveness in the global setting.

The commission said the proposal “would enable an investment of €8 billion in the next generation of supercomputers – a substantially larger budget compared to the current one.” The EC noted that the COVID-19 crisis “has shown that connectivity is essential for people and businesses,” and that “very high capacity networks” have been enabling remote working and schooling, healthcare, and personal communication and entertainment. The EC said the pandemic “has changed the economic outlook for the years to come. Investment and reforms are needed more than ever to ensure convergence and a balanced, forward-looking and sustainable economic recovery.”

Executive Vice-President for a Europe fit for the Digital Age, Margrethe Vestager, said:

“Broadband and 5G connectivity lay the foundation for the green and digital transformation of the economy, regardless if we talk about transport and energy, healthcare and education, or manufacturing and agriculture. And we have seen the current crisis highlight the importance of access to very high-speed internet for businesses, public services and citizens, but also to accelerate the pace towards 5G. We must therefore work together towards fast network rollout without any further delays.”

Commissioner for the Internal Market, Thierry Breton, added:

“Digital infrastructures have proven to be crucial during the pandemic to help citizens, public services and businesses get through the crisis and yet recent investments have slowed down. At a time when access to broadband Internet represents both a fundamental commodity for Europeans and a geostrategic stake for companies, we must – together with Member States – enable and accelerate the rollout of secure fibre and 5G networks. Greater connectivity will not only contribute to creating jobs, boosting sustainable growth and modernising the European economy, it will help Europe building its resilience and achieve its technological autonomy.”

The Commission invites Member States to come together to develop, by 30 March 2021, a common approach, in the form of a toolbox of best practices, for the timely rollout of fixed and mobile very high-capacity networks, including 5G networks. Such measures should aim to:

- Reduce the cost and increase the speed of deployment of very high capacity networks, notably by removing unnecessary administrative hurdles;

- Provide timely access to 5G radio spectrum and encourage operators’ investments in expanding network infrastructure;

- Establish more cross-border coordination for radio spectrum assignments, to support innovative 5G services, particularly in the industry and transport fields.

The Recommendation also sets out guidance for best practices to provide timely access to radio spectrum for 5G as well as ensure stronger coordination of spectrum assignment for 5G cross-border applications. This is particularly important to enable connected and automated mobility, as well as the digitisation of industry and smart factories. Enhanced cross-border coordination will help to provide Europe’s main transport paths, particularly road, rail and in-land waterways, with uninterrupted 5G coverage by 2025. However, until mid-September 2020, Member States (and the UK) had assigned on average only 27.5% of the 5G pioneer bands. It is therefore essential that Member States avoid or minimise any delays in granting access to radio spectrum to ensure timely deployment of 5G.

The Recommendation also highlights the need to ensure that 5G networks are secure and resilient. Member States have worked together with the Commission and the EU Cybersecurity Agency (ENISA) on a respective toolbox of mitigating measures and plans, designed to address effectively major risks to 5G networks. In July, a progress report was published.

Sustainable network deployment for improved connectivity:

The Recommendation also builds upon the Broadband Cost Reduction Directive. It promotes the rollout of high-speed networks by reducing deployment costs through harmonised measures to ensure network providers and operators can share infrastructure, coordinate civil works and obtain the necessary permits for deployment. The Recommendation is calling on Member States to share and agree on best practices under this Directive, to:

- Support simpler and more transparent permit-granting procedures for civil works;

- Improve transparency on existing physical infrastructure, so that operators can access more easily all relevant information on the infrastructure available in a certain area, and facilitate permit-granting procedures, through a single information point in the administration of public authorities;

- Expand network operators’ rights to access existing infrastructure controlled by public sector bodies (i.e. buildings, street lamps and those belonging to energy and other utilities) to install elements for network deployment;

- Improve the effectiveness of the dispute resolution mechanism related to infrastructure access.

Improved connectivity can also minimise the climate impact of data transmission and thus contribute to achieving the Union’s climate targets. Member States are encouraged to develop criteria for assessing the environmental impact of future networks and provide incentives to operators to deploy environmentally sustainable networks.

Next steps:

The Recommendation calls for Member States to identify and share best practices for the Toolbox by 20 December 2020. The Member States should agree on the list of best practices by 30 March 2021.

As announced in its strategy “Shaping Europe’s digital future” in February, the Commission plans two further actions in this area:

- The update of its action plan on 5G and 6G in 2021. The updated plan will rely and expand on the spectrum-related actions in this Recommendation. It will look at the progress made so far, and set new, ambitious goals for 5G network roll-out.

- The revision of the Broadband Cost Reduction Directive. The next steps in this process are the launch of an open consultation in autumn 2020 and of a dedicated study to evaluate the current Directive and assess the impact of several policy options.

The Recommendation will contribute to the achievement of the objectives set out in the Broadband Cost Reduction Directive as well as the European Electronic Communications Code. The Code, which needs to be implemented into national law in Member States by 21 December 2020, aims to promote connectivity and access to very high-capacity networks by all citizens and businesses.

The Commission’s strategy on Connectivity for a European Gigabit Society sets the EU’s connectivity objectives. By 2025, all main socio-economic drivers (i.e. schools, hospitals, transport hubs) should have gigabit connectivity, all urban areas and major terrestrial transport paths should be connected with uninterrupted 5G coverage, and all European households should have access to connectivity offering at least 100 Mbps upgradable to Gigabit speeds.

Other EU Projects and Country Plans:

As announced in June 2020, the EU is funding 11 new technology and trial projects to enable 5G connectivity and pave the way for autonomous driving on main road, train and maritime routes in Europe.

Individual EU member states are also grappling with their own post-pandemic recovery plans. For example, France is earmarking €240 million ($284 million) for fiber networks as part of its €100 billion ($118 billion) stimulus package.

………………………………………………………………………………………………………………………………………………………..

References:

https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1603

https://www.lightreading.com/5g/ec-pins-recovery-hopes-on-5g-and-supercomputing/d/d-id/764064?

ITU-R work in progress: Providing enhanced mobile broadband services to remote sparsely populated and underserved areas

Editor’s Note: This is an excerpt of an ITU-R working document, subject to significant revision(s). It has no official status and has NOT been approved by ITU-R WP5D. ITU TIES account holders may access the document on the ITU-R WP 5D website as an October 2020 meeting contribution .

ATDI proposes to insert text (not included here) at Section 4 ‘Solutions that support remote sparsely populated areas providing high data rate coverage’ of the Draft Working Document.

Why this is an important topic:

Many people in developing countries like India live in villages or rural areas. In most cases they have little or no mobile broadband coverage.

In the U.S., the Federal Communications Commission (FCC) estimates that 26.4% of rural America, or 16.9 million people, lack access to a broadband connection of 25Mbps downstream/3Mbps upstream. This has been proven to be a highly conservative estimate because of the way the FCC collects broadband data. More accurate studies suggest the FCC’s estimates could be off by upwards of 50%. A 2017 study by Microsoft, for instance, found that half of all Americans, or 162.8 million people, lack access to broadband. Also, many wireless telcos are hesitant to roll out mobile broadband to rural America because of a perceived lack of return on investment.

According to data from the FCC, 39% of people living in rural areas in the United States lack access to high-speed broadband, compared with just 4% of urban Americans.

In addition to using IMT 4G/5G for mobile communications (discussed in the draft report below), 5G Fixed Wireless Access (FWA) will make a significant impact on global markets, both developing and developed. In the U.S., sparsely populated, rural areas currently lag far behind metro area cities in broadband access. As there is no standard for 5G FWA, it will likely be based on the enhanced Mobile Broadband use case for IMT 2020, or proprietary versions of IEEE 802.11ax (WiFi 6).

………………………………………………………………………………………………………………………………………………………………………………………….

Introduction:

On a global basis, the total number of mobile subscriptions was around 8 billion in Q3 2019, with 61 million subscriptions added during the quarter, the mobile subscription penetration is at 104 percent. There are 5.9 billion unique mobile subscribers using mobile networks, while 1.8 billion people remain unconnected. In year 2025 it is forecasted to be 2.6 billion 5G subscriptions and 8.6 billion mobile subscriptions globally at a penetration level of about 110%1. In year 2025 there may be up to 6.8 billion unique mobile subscribers using mobile networks, while 1.5 billion people remain unconnected, many of whom are below the age of nine.

The prospect of providing mobile and home broadband services for most of the 1.5 billion unconnected people, living in such underserved rural areas, is largely related to techno-economic circumstances.

This Report provides details on scenarios associated with the provisioning of enhanced mobile broadband services to remote sparsely populated and underserved areas with a discussion on enhancements of user and network equipment.

1 Ericsson Mobility Report, November 2019, mobile broadband includes radio access technologies HSPA (3G), LTE (4G), 5G, CDMA2000 EV-DO, TD-SCDMA and Mobile WiMAX.

Background:

Deploying networks in remote areas is normally more expensive, and at the same time, expected revenues are lower in comparison with deployments in populated areas. A further reason for not being incentivized to deploy new IMT broadband (e.g. IMT-2020/5G) Base Stations (BS) in these areas is the expected number of new BS sites. Therefore, the total economic incentives to deploy traditional networks in sparsely populated areas are consequently narrowed.

The competition model, applying to densely populated areas, is normally not providing rural coverage expansion at a speed that society wish. Connectivity in underserved remote areas is important to national policy makers facing needs of consumers, to service providers for reasons of branding, and to satisfy regulatory conditions in countries.

When expanding coverage in remote areas, it may imply an undesirable local monopoly, suggesting that only one service provider would expand in to such a remote area due to a low consumer base.

Rural coverage might in the future be driven by the need for national security and public safety connectivity, intelligent traffic systems, internet of things, industry automation and end users need for home broadband services as an alternative to fiber connections. In order to fulfil the needs of rural coverage, it is a matter of urgency to identify viable solutions for mobile and home broadband services.

Solutions that support remote sparsely populated areas providing high data rate coverage:

Possible technical solutions to achieve both extended coverage as well as high capacity in remote areas could be to use dual frequency bands at the same time, one lower band for the uplink (UL) and one higher band for the downlink (DL), in aggregated configurations.

Combining spectrum bands in the mid-band range and the low-band range on an existing grid can provide extended capacity compared to a network only using the low-band range.

An alternative technical solution to provide extended coverage in a remote area using a reduced number of terrestrial BS sites, aiming to bringing cost down, requires careful selection of proper locations and technical characteristics compared to configurations of suburban networks. Realizing such extended network configuration for coverage, several considerations need to be taken into account, both at a BS site and at customer premises. Considerations of accommodating BSs on high towers in sparsely populated areas could be further studied. Such opportunities rest with traditionally high tower used for analogue or digital television with an average inter-site distance (ISD) of the order of 60 km to 80 km designed to provide blanket coverage of national terrestrial television services.

Other sections of this report:

- Analyzing configurations for an IMT broadband network operating in dual bands

Combining spectrum bands in the mid-band range 3.5 GHz and the low-band range, e.g. 600 MHz, 700 MHz or 800 MHz, on an existing grid can provide extended capacity compared to a network only using the low-band range. The reason being that the mid-band range offer access to more spectrum bandwidth, and the low-band range combined, can provide the coverage for cell edge users in a unified manner.

- Analyzing configurations for an IMT broadband network operating only in the band 3.5 GHz

In underserved remote areas, the DL capacity performance can be significantly improved by using the band 3.5 GHz whilst the UL coverage is representing the bottleneck in attempts of satisfying needs for coverage. With potential upgrades of BS and consumer premises UE configurations, the feasibility of providing improved remote area coverage is considered by using only the band 3.5 GHz.

References:

ITU-R Report: Terrestrial IMT for remote sparsely populated areas providing high data rate coverage

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

At Goldman Sachs Communacopia conference, AT&T CEO John T. Stankey said that broadband connectivity was a key focus area for the company. “Anything that we can do to put more fiber out into the network, serve both our consumer and business segments and use that to power what over time is going to become a much more dense and distributed wireless network. And that’s, first of all, one of our key focus areas and something that we see as being very important to us,” he said.

What Stankey said next was somewhat of a surprise, “We think we’re great storytellers, and that we have a unique ability to produce (video) content that’s special and different. And we’d like to continue doing that and telling those great stories and then using the combination of that connectivity in those stories to wrap it in software.”

When asked where should AT&T allocate capital, the CEO said:

- Invest in its core business, which is fiber and broadband connectivity on 5G

- Software driven entertainment products with HBO Max at the forefront of that, but it is a multi-year effort.

- Ensuring that AT&T operations are set up to be successful and effective in the market that they’re serving customers. Also, that AT&T has data properly positioned for advertising monetization and to gain “great insights on customers.”

“When you have a great 5G network, you’re deploying a lot of fiber, and that’s something that we think are married well,” Stankey said, as per this transcript. “And we think we’re in a very unique position because the fiber that we deploy not only powers our wireless business, but it helps our consumer business and fixed broadband. It helps our enterprise customers and how we deal with them as well, and so we strategically want to make sure we’re doing that.”

When asked if there was a business case for adding more fiber, Stankey answered in the affirmative. Stankey said AT&T’s confidence level for deploying more fiber is even higher now due to increased traffic on its network as a result of the Covid-19 lockdowns.

“There is clearly an easy path for us to think about a substantially larger fiber footprint than what we have today with returns that are as good as the great returns we’ve gotten from the first tranche that we’ve built,” Stankey said.

“If you go in and look at the rest of our business on the core connectivity, we thought robust scale and connectivity networks were always going

to be important. And what we’ve seen is what was important in the urban areas is now distributed. And while we’ve had good infrastructure in

place in many areas, we have an opportunity to go do more. We have an opportunity to think about more varied forms of access that are more

flexible. And I think that, that plays right into our strength, and we’re looking at redoubling our efforts on those product development opportunities

that allow for true flexibility of bandwidth as somebody moves through a city center out to suburban areas. Our play in 5G, a more dense fiber

network all play really well into those thing.”

Stanky added that he was pleased with the investments the company has made in infrastructure and in its network over the last several years. Also, some of the new initiatives round FirstNet and focus on the development of 5G are really starting to to “bear fruit” in terms of AT&T’s performance in the industry.

In closing, Goldman moderator John E. Waldron asked the AT&T CEO, “If we were to have this conversation 5 to 10 years from now, how do you think AT&T will have changed from the company you are today?”

Stankey talked up AT&T’s broadband services and entertainment products:

“If I were to think about 5 years out and what I’d like to be able to come and tell you is, to my point earlier, that we are focused in a set .of products; that we’re really proud of in the market that were — that customers love and think are really strong; that our broadband connectivity products (these are actually services, not products), whether you’re a business with a complicated distributed network or you’re at home, using one of our fixed broadband connections or a subscriber of our wireless service, you view them as being the best-in-class that are there; that our entertainment products are unique and that you can’t live without the stories that we’re telling; and that our employees who bring those products and services to our customers have a lot of pride in those, and they see them as being best-in-class and unique and special in the market. And that’s kind of universally held across our business. And as a result of that, employees want to come, not only continue to work here, we’re able to go out the market and recruit because people say, “Those are great products. It’s a great company that offers those things, and I feel compelled to want to go and participate in that.” So a high degree of employee loyalty around the products and services that we bring in that manifest itself in great employee engagement and great customer receptivity of those products. And 5 years from now that we’re known in that regard.”

………………………………………………………………………………………………………………………………………………………

References:

https://event.webcasts.com/viewer/event.jsp?ei=1365838&tp_key=1587a26f6b

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

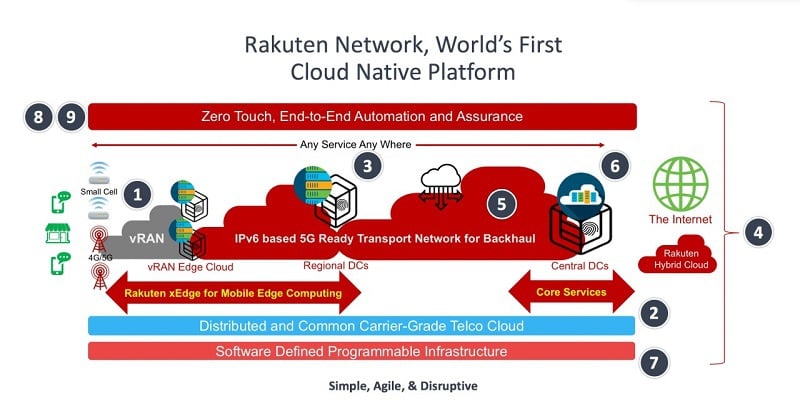

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

Synergy Research: Strong demand for Colocation with Equinix, Digital Realty and NTT top providers

New data from Synergy Research Group shows that just 25 metro areas account for 65% of worldwide retail and wholesale colocation revenues. Ranked by revenue generated in Q2 2020, the top five metros are Washington, Tokyo, London, New York and Shanghai, which in aggregate account for 27% of the worldwide market. The next 20 largest metro markets account for another 38% of the market.

Those top 25 metros include eleven in North America, nine in the APAC region, four in EMEA and one in Latin America. The world’s three largest colocation providers are Equinix, Digital Realty and NTT. One of those three is the market leader in 17 of the top 25 metros. The global footprint of Equinix is particularly notable and it is the retail colocation leader in 16 of the top 25 metros. In the wholesale segment Digital Realty is leader in seven of the metros, with NTT, Global Switch and GDS each leading in at least two metros. Other colocation operators that feature heavily in the top 25 metros include 21Vianet, @Tokyo, China Telecom, China Unicom, CoreSite, CyrusOne, Cyxtera, KDDI and QTS.

Over the last twenty quarters the top 25 metro share of the worldwide retail colocation market has been relatively constant at around the 63-65% mark, despite a push to expand data center footprints and to build out more edge locations.

->That seems to indicate that edge computing hasn’t made a wider impact beyond the 25 largest colo metro areas.

Among the top 25 metros, those with the highest colocation growth rates (measured in local currencies) are Sao Paulo, Beijing, Shanghai and Seoul, all of which grew by well over 20% in the last year. Other metros with growth rates well above the worldwide average include Phoenix, Frankfurt, Mumbai and Osaka. While not in the group of highest growth metros overall, growth in wholesale revenues was particularly strong in Washington DC/Northern Virginia and London.

“We continue to see strong demand for colocation, with the standout regional growth numbers coming from APAC. Revenue growth from hyperscale operator customers remains particularly strong, demonstrating the symbiotic nature of the relationship between cloud and colocation,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “The major economic hubs around the world are naturally the most important colocation markets, while hyperscale operators tend to focus their own data center operations in more remote areas with much lower real estate and operating costs. These cloud providers will continue to rely on colocation firms to help better serve major clients in key cities, ensuring the large metros will maintain their share of the colocation market over the coming years.”

About Synergy Research Group

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database tool, which enables easy access to complex data sets. Synergy’s CustomView ™ takes this research capability one step further, enabling our clients to receive ongoing quantitative market research that matches their internal, executive view of the market segments they compete in.

References:

https://www.srgresearch.com/articles/top-25-metros-generate-65-worldwide-colocation-revenues

AT&T Announces 5G Roaming in Japan when 5G roam-capable devices are available

AT&T 5G customers will be the first U.S. mobile customers to have the ability to access 5G in Japan through an international roaming agreement with NTT DOCOMO, Inc. and by using a 5G roam-capable device – the first of which will become available on the AT&T network this week.

The agreement delivers on AT&T’s commitment to keeping its customers connected and providing them with access to 5G – at home and around the globe – as capable devices become available. However, this agreement is only for 5G NSA which uses an LTE anchor/core for all non-RAN related functions.

“As a longtime industry leader providing global connectivity, we’re evolving the breadth and depth of our global coverage with 5G,” said Susan A. Johnson, executive vice president – Global Connections & Supply Chain, AT&T. “This marks a significant milestone for AT&T and our customers.”

AT&T customers on a wireless plan that includes access to 5G in the U.S. will be able to access 5G in Japan through NTT DOCOMO, Inc., when they use a 5G roam-capable device.

But what are those 5G roam-capable devices and when will they be available? They will surely be based on 3GPP Release 15 5GNR for the data plane, and 4G LTE for everything else, e.g. signaling, network management, security, 4G core/EPC, etc. Hence, this arrangement might be called “5G NSA roaming with a LTE core network/EPC.” 5G SA roaming will be much more complicated as there is no standard for 5G core network and all the “cloud native” functions (like network slicing and virtualization) it will support.

“We’re excited to launch 5G roaming in Japan on NTT DOCOMO, Inc.’s network because of what it means for our customers,” said JR Wilson, vice president – Tower Strategy & Roaming, AT&T. “Our teams never stop innovating, developing and deploying the latest technology to provide our customers with access to a next-generation network – at home and abroad.”

AT&T claims they have historically been a leader in global roaming. So, while the company continues innovating to enable customers with compatible devices to access 5G internationally, those with LTE devices can still expect the same great roaming coverage they’re used to while traveling.

NTT DOCOMO is the first mobile operator in Japan to offer an inbound 5G roaming service. Going forward, DOCOMO plans to expand its inbound 5G roaming service with mobile operators around the globe. Again, that will surely be for 5G NSA service.

References:

https://www.nttdocomo.co.jp/english/info/media_center/pr/2020/0914_00.html

Addendum: 5G SA roaming will be much more difficult

Roaming with a 5G SA endpoint device (smartphone, tablet, notebook PC, robot/industrial equipment, etc. won’t be achieved anytime soon. Why? There is no standard for 5G core network which have to interoperate with one another for roaming.

The 3GPP core network specs are architecture documents that do NOT specify implementation details. Therefore, every 5G network provider will have its own 5G core spec which is implemented in the core network routers/compute servers and endpoints. So each 5G endpoint (e.g. smartphone or tablet/notebook PC) will have to download a 5G SA software update from the 5G network provider. That means that unless there are bilateral 5G carrier roaming agreements, a 5G end point can only work on the 5G core network it’s subscribed to, e.g. no portability or interoperability!

3GPP Rel 16 5G Core/Architecture specs:

- TS 23.501 5G Systems Architecture, with annexes which describe 5G core deployment scenarios:

- TS 23.502 [3] contains the stage 2 procedures and flows for 5G System

- TS 23.503 [45] contains the stage 2 Policy Control and Charging architecture for 5G System

………………………………………………………………………………………………………………………………………………….

Netgear Nighthawk 5G Hotspot Pro from AT&T; Netgear’s audio video over IP (AV over IP)

“The combination of AT&T 5G technology and the NETGEAR Nighthawk 5G Mobile Hotspot Pro gives AT&T customers fast speeds, low-latency and improved bandwidth for all of their WiFi needs,” said David Christopher, executive vice president and general manager, AT&T Mobility. “The 5G addition is innovative in a hotspot and much needed during a time when many of our customers continue to work and learn from home.”

“We are delighted to team with AT&T, to release their next generation 5G hotspot. The NETGEAR Nighthawk 5G Mobile Hotspot Pro combines the best of WiFi and mobile technologies – WiFi 6 and 5G, to keep you always connected at home and on the go via the AT&T 5G network,” said Patrick Lo, chairman and chief executive officer for NETGEAR. “This new mobile hotspot with WiFi 6 provides robust WiFi connectivity to the increasing number of mobile devices and computers simultaneously with the best mobile internet speeds available over 5G.”

The introduction of this hotspot also exceeds AT&T’s commitment to offer 15 5G-capable devices to our lineup in 2020. This expansive portfolio gives our customers a wide variety to choose from, with features and price points that best serve their needs. All of these devices tap into our nationwide 5G network, offering fast, reliable and secure connectivity across the U.S. Plus, 5G access is included in all of our current consumer and business unlimited wireless plans at no extra cost to you.3

NETGEAR NIGHTHAWK 5G MOBILE HOTSPOT PRO FEATURES

The NETGEAR Nighthawk 5G Mobile Hotspot Pro is the perfect portable device. Whether you’re constantly on the move or looking for an alternative to in-home broadband, it offers the following features that will provide a steady and reliable connection wherever you are:

- Capacity: Share your connection with up to 32 WiFi devices such as smartphones, tablets, and laptops for a connection you can count on.

- 5G Compatibility: In addition to AT&T’s nationwide 5G network, this device can also access AT&T 5G+ in parts of 35 cities across the country. Together, these two flavors of 5G create the best mix of speeds and coverage, and will power new experiences coming to life.

- WiFi 6: Tap into the latest WiFi technology that will power fast surfing, downloading, and streaming for the whole family.

- Touch Screen: Set up your device and manage your usage with ease from the NETGEAR Nighthawk 5G Mobile Hotspot Pro’s touchscreen.

- Battery Life: Power through your day and night with the long-lasting, powerful 5,040 mAh rechargeable battery. It also operates without battery when connected via the quick charge power adapter.

FIRST RESPONDERS

The NETGEAR Nighthawk 5G Pro Hotspot will also be FirstNet Ready™, which means first responders can use it to tap into the power of FirstNet® – America’s public safety communications network. FirstNet Ready devices are tested and approved to operate with services using the FirstNet LTE network core. This gives public safety access to the critical capabilities that FirstNet enables, like the full power of AT&T’s LTE network, including Band 14 spectrum, which serves as a VIP lane for first responders.4

For more information on AT&T 5G, visit att.com/5G. For the latest on how we’re using this next generation of wireless technology, head to att.com/5GNews.

https://about.att.com/story/2020/netgear_nighthawk_5g_mobile_hotspot_pro.html

……………………………………………………………………………………………………………………………………………………………………………………….

- An entirely new series of switches developed and engineered for the growing audio, video over IP (AV over IP) market. These AV Line switches combine years of networking expertise with best practices from leading experts in the professional AV market.

- The new AV Line incorporates NETGEAR IGMP Plus™ for flawless video over IP (including audio and control). If you are using Dante or AVB in your audio deployment, you can trust that NETGEAR’s new AV Line switches are designed to seamlessly integrate into your solution.

- The new M4250 AV interface presents the common AV controls right up front with user-selectable profiles for common AV platforms making it a snap to ensure the settings are correct for a specific audio or video application.

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

CenturyLink has taken on a new identity — Lumen — a name it says better highlights the company’s future direction and focus on selling business services to large customers. [Note that there is already a Texas based company named Lumen Technologies Inc so there’s sure to be confusion and a possible trademark lawsuit in the near future.]

Lumen is a measure of the brightness of light, and the company’s competitive advantage this century has come from its massive fiber network, stretching 450,000 route miles. That has helped CenturyLink survive even as consumers cut their home phone lines in favor of wireless providers and switched off DSL in favor of faster alternatives.

But transporting light signals can also be a commodity service. Lumen is now pushing to offer more higher-value applications and enterprise services directly to its customers, reflected in the company’s new motto: “The Platform for Amazing Things.”

Lumen says on its website:

Lumen is an enterprise technology platform that enables companies to capitalize on emerging applications that power the 4th Industrial Revolution. Most IT leaders don’t feel ready to face the nearly century’s worth of data-driven innovation they expect in the next five years.

“Our people are dedicated to furthering human progress through technology. Lumen is all about enabling the amazing potential of our customers, by utilizing our technology platform, our people, and our relationships with customers and

partners,” said Lumen CEO Jeff Storey, in a statement on the name change.

“For the past three years we have been reinventing ourselves and repositioning the company to deliver on a brand-new promise: Furthering human progress through technology,” said Lumen CTO Andrew Dugan, who held the same title at CenturyLink. “We have been considering this change for many months. We are ideally positioned to help resolve the biggest data and application challenges of our time—this is why now is the right time to introduce Lumen.”

The CenturyLink brand will continue to be used for residential and small business customers using traditional copper based networks. “CenturyLink, with its strong heritage, will remain as a trusted brand for residential and small business customers over traditional networks,” the company said.

………………………………………………………………………………………………………………………………………………………………………………………

The number of telecom and cloud service providers that have been acquired by CenturyLink is truly astounding. That list includes: US West (which was acquired by Qwest Communications), Embarq (which included Sprint Local and US Telecom), Savvis, App Frog, Tier 3, and the big one –Level 3 Communications in a deal valued at around $25 billion. Level 3, in turn, had also acquired a boat load of telecom providers such as Global Crossing and TW Telecom and before that: WilTel Communications, Broadwing Corporation, Looking Glass Networks, Progress Telecom, and Telcove (formerly Adelphia Business Solutions) and ICG Communications.

………………………………………………………………………………………………………………………………………………………………………………….

These acquisitions, long with internal software innovations, they have given Lumen the ability to provide enterprise customers with a variety of services in a variety of areas. However, the company still does not have presence in the cellular communications business.

“Unfortunately, today’s network, cloud and IT architectures present latency, cost and security challenges that inhibit the performance of distributed applications and real-time data processing. Ultimately, the world needs a new architecture platform that has been designed to support the intensive performance requirements of next-generation applications. And that is exactly what we aim to provide with Lumen,” said Lumen’s chief marketing officer Shaun Andrews, in a video message.

Smart cities, retail and industrial robotics, real-time virtual collaboration and automated factories are some of the applications that Lumen believes it can help customers achieve in what it and others call the 4th Industrial Revolution. Steam power, electricity and then the computer chip all pushed economic progress, and now the melding of the digital and physical worlds that connectivity permits is doing the same, Andrews added.

That is the future direction, where the company sees the greatest potential for growth and new revenues. But Andrews emphasized that residential and small business consumers will still deal with CenturyLink, a brand executives believe still has value two decades into the new century. It is the name that will continue to show up on residential customers’ bills. CenturyLink Field in Seattle will retain its name.

Another new entity, Quantum Fiber, will handle the residential and small business transition to digital as the company rolls out more fiber-optic connections directly to homes and businesses (FTTH and FTTP, respectively). The company added capacity to reach about 300,000 homes and small businesses last year with gigabit service and plans to reach another 400,000 this year, according to Fierce Telecom.

Lumen says the can provide the ability to control latency, bandwidth and security for applications across cloud data centers, the market edge and on-premises, according to a blog by Dugan. Instead of putting critical applications into a centralized cloud, Lumen’s edge compute platform, which includes more than 100 active edge compute nodes across large metro markets in the U.S—puts them closer to the end user for low latency and better security.

“The Lumen brand is focused on supporting our enterprise business customers. It alludes to our network strength and to the incredible capabilities powered by our platform to help transform how businesses operate,” Dugan said.

“Quantum Fiber is an important new brand within Lumen with a focus on superior fiber connectivity and a fully enabled digital customer experience,” Dugan said. “Quantum Fiber serves residential and small business customers, and Lumen focuses on enterprise, government and global businesses.”

In 2019, CenturyLink expanded its fiber network to reach an estimated 300,000 additional homes and small businesses with its gigabit service. CenturyLink’s consumer fiber-to-the-home (FTTH) projects provide symmetrical speeds of up to 940 Mbps. The faster speeds were enabled in parts of Boulder, Colo., Spokane, Wash., and Tucson, Ariz. last year.

CenturyLink previously said it would build out its fiber network to an additional 400,000 homes and small businesses this year, including in Denver, Omaha, Neb., Phoenix, Portland, Ore., Salt Lake City, Spokane, Wash., and Springfield, MO.

MoffetNathanson analysts wrote in a note to clients (emphasis added):

The flagship Lumen brand is targeted toward larger enterprises, the likes of which would be most likely to adopt the company’s most advanced services. The CenturyLink brand is being retained for legacy copper services delivered to residential customers and some SMBs, as well as existing FTTH customers. And the new Quantum Fiber brand is being introduced for SMB services delivered via the automated platform the company has been developing and has indicated it would soon be rolling out to on-net, out-of-region locations (mostly ex-Level 3 buildings), and will include consumer FTTH sold in a similar manner. The services and capabilities Lumen delivers to each of these customer segments varies dramatically, so it’s not at all inappropriate to have separate brands for each. Innumerable examples of this phenomenon exist across other industries – automotive, consumer products, airlines, apparel, media, and so on. Within the world of telecom, carriers often have brands that target different segments or highlight different product types (Verizon with FiOS, AT&T with Cricket, T-Mobile US with MetroPCS, Altice USA with Optimum vs. Lightpath, and so on).

CenturyLink was an amalgamation of many different companies, assets, and capabilities. Management’s decision to rebrand as Lumen, Quantum Fiber, and CenturyLink acknowledges those differences and gives management an opportunity to refresh and communicate its vision for the company to customers, employees, and investors.

Andrews said the name change won’t include a relocation to Denver of the corporate headquarters, which will remain in Monroe, La., home of the original CenturyLink. Of the company’s 40,000 employees globally, 5,800 are based in Colorado, and metro Denver remains an important hub of operations, especially the ones that Lumen will emphasize.

It remains to be seen what will happen with CenturyLink’s wholesale and carriers carrier backbone services, which acquisitions such as Level 3 and Global Crossing mainly focused on, i.e. selling high bandwidth fiber optic long haul links to other carriers.

References:

https://www.lumen.com/en-us/home.html

https://news.lumen.com/CTO-Andrew-Dugan-explains-how-the-Lumen-platform-keeps-data-moving