Month: April 2022

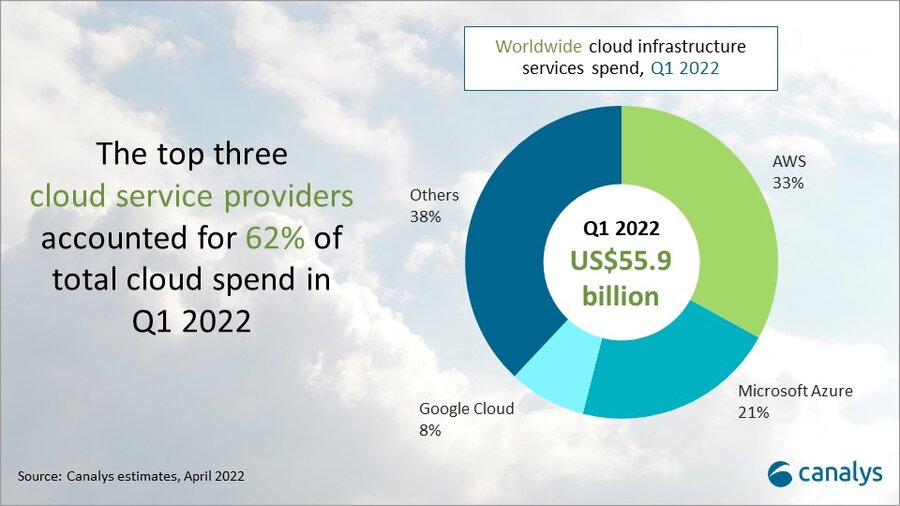

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

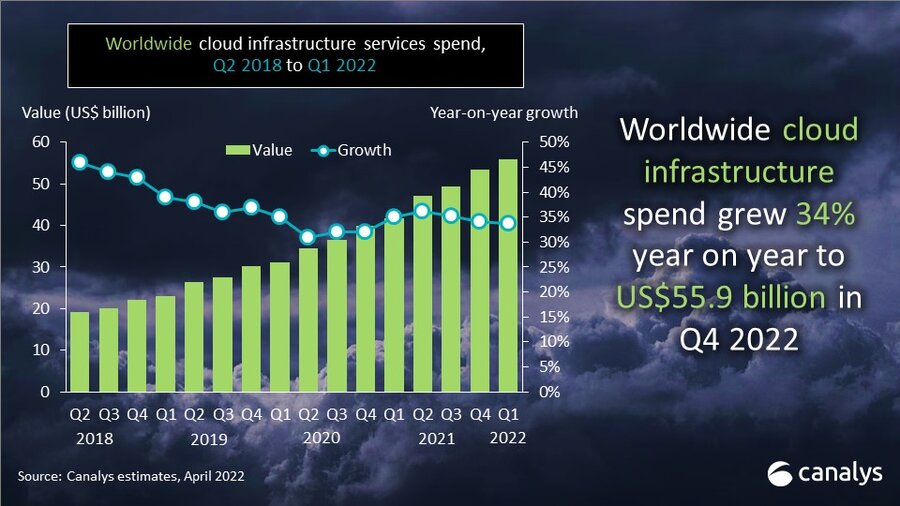

New data from Synergy Research Group shows that Q1 enterprise spending on cloud infrastructure services was approaching $53 billion. That is up 34% from the first quarter of 2021, making it the eleventh time in twelve quarters that the year-on-year growth rate has been in the 34-40% range.

To the surprise of no one, Amazon AWS continues to lead with its worldwide market share remaining at 33%. For the third consecutive quarter its annual growth came in above the growth of the overall market.

Microsoft Azure continues to gain almost two percentage points of market share per year while Google Cloud’s annual market share gain is approaching one percentage point.

In aggregate all other cloud providers have grown their revenues by over 150% since the first quarter of 2018, though their collective market share has plunged from 48% to 36% as their growth rates remain far below the market leaders.

Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $52.7 billion, with trailing twelve-month revenues reaching $191 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 37% in Q1. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 71% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

“While the level of competition remains high, the huge and rapidly growing cloud market continues to coalesce around Amazon, Microsoft and Google,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Aside from the Chinese market, which remains totally dominated by local Chinese companies, other cloud providers simply cannot match the scale and geographic reach of the big three market leaders. As Amazon, Microsoft and Google continue to grow at 35-50% per year, other non-Chinese cloud providers are typically growing in the 10-20% range. That can still be an attractive proposition for those smaller providers, as long as they focus on regional or service niches where they can differentiate themselves from the big three.”

…………………………………………………………………………………………………………………..

Separately, Canalys estimates global cloud infrastructure services spending increased 34% to US$55.9 billion in Q1 2022, as organizations prioritized digitalization strategies to meet market challenges. That was over US$2 billion more than in the previous quarter and US$14 billion more than in Q1 2021.

The top three cloud service providers have benefited from increased adoption and scale, collectively growing 42% year on year and accounting for 62% of global customer spend.

Cloud-enabled business transformation has become a priority as organizations face global supply chain issues, cybersecurity threats and geopolitical instability. Organizations of all sizes and vertical markets are turning to cloud to ensure flexibility and resilience in the face of these challenges.

SMBs, in particular, have driven investment in cloud infrastructure services to support workload migration, data storage services and cloud-native application development. At the same time, infrastructure hardware shortages and the threat of further price inflation has spurred many large enterprises to invest in large-scale, multi-year cloud contracts to lock in upfront discounts with the hyperscalers.

All the major cloud providers have seen a significant increase in order backlogs as a result, which now total several hundred billion dollars worldwide. This in turn is driving the importance of cloud marketplaces as a sales channel for third-party software and security, as businesses seek to burn down these cloud commitments, further fueling infrastructure consumption.

“Cloud has continued to be a hot market and transformation strategies are emphasizing digital resiliency to face the market challenges of today and tomorrow,” said Canalys Research Analyst Blake Murray. “To be effective in resiliency planning, customers are turning to channel partners with the technical and consulting skills to help them effectively embrace hyper-scaler cloud services.”

Top cloud partners are doubling down on certification efforts and skills recruitment around hyper-scaler cloud services.

Global systems integrators, including Accenture, Atos, Deloitte, HCL Technologies, TCS, Kyndryl, Tech Mahindra and Wipro, are building practices with tens of thousands of cloud engineers and consultants. This has also included acquisitions of cloud application development and migration specialists, as well as the launch of new dedicated cloud services brands.

Smaller consultants, resellers, service providers and distributors are pursuing similar strategies as mid-market and SMB customers also demand support with cloud adoption.

“As the use cases for cloud infrastructure services expand so does the potential complexity, and we see that hybrid and multi-cloud deployments are commonplace in the market,” said Canalys Research Analyst Yi Zhang. “The hyperscalers are investing in rapid channel development and partners are responding as the opportunities grow.”

…………………………………………………………………………………………………………….

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://www.canalys.com/newsroom/global-cloud-services-Q1-2022

………………………………………………………………………………………………………………………………………..

May 6, 2022 Update from Light Counting:

|

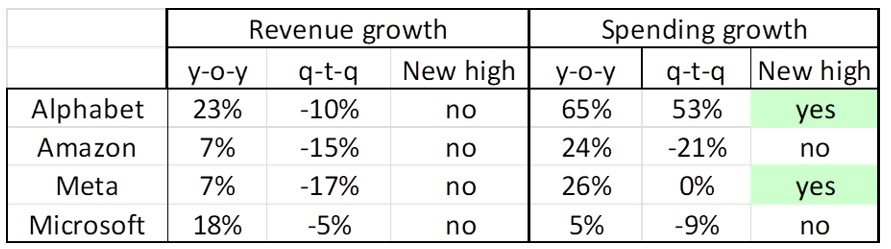

ICPs (Internet Cloud Providers) have grown spending by double digit rates (year-over-year) for many quarters and Q1 2022 looks like it will be no exception, as the combined spending of Alphabet, Amazon, Meta, and Microsoft increased 29% versus Q1 2021. What is surprising though is that Alphabet, not Meta, showed the fastest growth, with a 65% increase to more than $9.5 billion, a new record. And Alphabet’s big increase was not fueled by spending on infrastructure however, but by the closing of purchases of office facilities in New York, London, and Poland, which the company said added $4 billion to total spending in the quarter. We expect Alphabet’s Q2 capex will return from the stratosphere to the $5 billion range it has been running at. If Alphabet’s real estate spending is removed, Q1 capex for the group of four was up only 15% compared to Q1 2021, at the low end of the typical range for the Top 15 ICPs. While ICP spending appears on track to continue growing at double-digit rates this year, Q1 revenues were decidedly ‘off’ for the four majors that have reported, with no records set, and two of the four (Amazon and Meta) growing sales by only single-digit growth rates y-o-y. |

|

|

The Cloud services revenues of Alphabet, Amazon, and Microsoft continued to grow faster than overall company sales, increasing 44%, 37%, and 17% respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Network equipment makers sales growth in Q1 2022 declined by 1% y-o-y in aggregate among the reported companies, but this figure belies the fact that individual company growth rates ranged from strong double-digits (Adtran, ADVA), middling single-digits (Ericsson Networks, Infinera, ZTE), to sales declines (Nokia Networks, Ribbon Communications).

Five Chinese optical transceiver vendors have reported Q1 results, and four of them showed strong growth: HG Tech, Innolight, Accelink, and Eoptolink. CIG was negatively impacted by shutdowns in both Shanghai and Shenzhen, which affected its ability to fulfill orders.

Among U.S.-based optical component makers, Neophotonics reported Q1 2022 revenue of $89 million, up 47% year-over-year, with 400G and above products growing 70% y-o-y to $54 million. The company is now shipping production volumes of 400ZR modules to cloud and data center customers.

Two years after the start of the COVID-19 pandemic, the effects of the COVID mitigation measures continue to disrupt manufacturing, shipping, and sales in the optical industry. Several companies warned that shortages and higher component and shipping costs would persist or even worsen as 2022 progresses. And finally, costs from Russia’s invasion of Ukraine, and subsequent withdrawals from the Russian telecoms market are starting to become known, ranging from $5 million (Infinera) to 900 million Euro (Ericsson).

|

BT and Toshiba commercial trial of a ‘quantum-secured’ metro network

BT and Toshiba have launched what they say is the world’s first “commercial trial” of a quantum-secured metro network (QSMN).

The QSMN infrastructure will be able to connect numerous customers across London, helping them to secure the transmission of valuable data and information between multiple physical locations over standard fiber optic links using quantum key distribution (QKD).

QKD is an important technology, playing a fundamental role in protecting networks and data against the emerging threat of cyber-attack using quantum computing. The London network represents a critical step towards reaching the UK government’s strategy to become a quantum-enabled economy

The QSMN is a three-node London exchange fiber optic ring using commercially available QKD hardware from Toshiba. BT provided fiber connectivity and “quantum-enabled” local exchanges.

Source: BT

German based optical network vendor ADVA is also involved in the QSMN. For the dedicated QKD “access tails,” BT used a commercially available Optical Spectrum Access Filter Connect (OSA FC) solution from Openreach, the UK incumbent’s infrastructure arm. OSA FC was developed by ADVA.

Financial services firm EY, the network’s first commercial customer, will use the network to connect two of its sites in London, one in Canary Wharf, and one near London Bridge. It will demonstrate how data secured using QKD can move between sites and will showcase the benefits this network brings to its own customers.

BT is working with EY (a non paying customer) and others that want to try QSMN to work out which types of QKD services will be in demand and how the business case might pan out. That initiative will likely be done over a three-year period,

“It’s a commercial trial in the sense that it’s built on commercial kit,” Professor Tim Whitley, managing director at BT’s applied research division, told Light Reading.

“It’s also a commercial trial in the sense that, unlike many trials around, it is effectively integrated in and part of a national operator’s communications infrastructure. It is managed out of our national operations center at Adastral Park.”

BT and Toshiba announced their commitment to creating a trial network in October 2021. BT will operate the network, providing a range of quantum-secured services including dedicated high bandwidth end-to-end encrypted links, delivered over Openreach’s private fibre networks, while Toshiba will provide quantum key distribution hardware and key management software. In the network, QKD keys will be combined with the in-built ethernet security, based on public-key based encryption, which will enable the resultant keys to be used to encrypt the data.

Some recent QKD history:

- BT and Toshiba have been conducting QKD trials since 2013, including a recent collaboration to provide a point-to-point QKD link in Bristol between the National Composites Centre and the Centre for Modelling & Simulation.

- In April 2020, Leo Lehman wrote an article about New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution.

- In September 2020, Verizon said it was trialing QKD for encryption over Fiber Optic Links.

……………………………………………………………………………………………………………………….Quotes:

Howard Watson, CTO, BT stated: “Quantum-enabled technologies are expected to have a profound impact on how society and business operates in the future, but they are remarkably complex to understand, develop and build: in particular, ensuring that the end-to-end service designs meet the stringent security requirements of the market. I’m incredibly proud that BT and Toshiba have successfully united to deliver this unique network, and with EY as our first trial customer, we are paving the way for further commercial explorations for quantum technologies and their use in commercial, and societal applications in the future.”

Shunsuke Okada, Corporate Senior Vice President and Chief Digital Officer of Toshiba commented: “Both Toshiba and BT have demonstrated world-class technology development and leadership through decades of innovation and operation. Combining BT’s leadership in networks technologies and Toshiba’s leadership in quantum technologies has brought this network to life, allowing businesses across London to benefit from quantum secured communications for the first time.”

Preparation, technical deployment and testing for the network commenced in late 2021. This included equipment deployment in racks, adding security systems and resilience testing, and finally running and optimising the network. While Tuesday 26th April marked the official launch of the network, it has been running since early April, and will operate for an initial period of up to three years.

Praveen Shankar, EY UK & Ireland Managing Partner for Technology, Media and Telecoms (TMT), commented: “Quantum technology creates new and significant opportunities for business, but presents potential risks. Quantum secure data transmission represents the next major leap forward in protecting data, an essential component of doing business in a digital economy. Our work with two of the world’s leading technology innovators will allow us to demonstrate the power of quantum to both EY and our clients.”

………………………………………………………………………………………………………………

The UK Government’s “strategic intent” to develop a quantum-enabled economy was first published in 2020. It sets out a vision for the next 10 years in which quantum technologies will become an integral part of the UK’s digital backbone, unlock innovation to drive growth and help build a thriving and resilient economy, and contribute significant value to the UK’s prosperity and security.

The London network represents an important step to building a national network for quantum secured communications, which will stimulate the growth of a quantum ready economy in the UK.

Howard Watson continued: “This is a significant moment in the UK’s journey towards a quantum-enabled economy, but we’re not there yet. Further investment commitments will be required to broaden the study of quantum technologies that will contribute to this new economy, including quantum computing, quantum cryptography and quantum communications. We look forward to working with our government and industry partners to continue the momentum BT has started and shaping the UK’s quantum strategy.”

The technical collaboration for this network was conducted in BT’s Adastral Park labs in Suffolk, UK, and the Quantum technology Business Division of Toshiba, based in Tokyo, Japan and Cambridge, UK, where the quantum key distribution technology has been developed and is manufactured.

………………………………………………………………………………………………….

References:

https://www.global.toshiba/ww/news/corporate/2022/04/news-20220427-01.html

Verizon Trials Quantum Key Distribution for Encryption over Fiber Optic Links

New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution

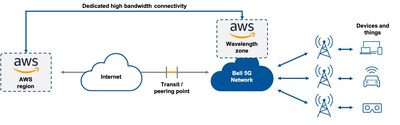

Bell Canada deploys the first AWS Wavelength Zone at the edge of its 5G network

In yet another tie-up between telcos and cloud computing giants, Bell Canada is the first Canadian network operator to launch multi-access edge computing (MEC) services using Amazon Web Services’ (AWS) Wavelength platform.

Building on Bell’s agreement with AWS, announced last year, together the two companies are deploying AWS Wavelength Zones throughout the country at the edge of Bell’s 5G network starting in Toronto.

The Bell Canada Public MEC service embeds AWS compute and software defined storage capabilities at the edge of Bell’s 5G network.

The Wavelength technology is then tied into AWS cloud regions that host the applications. This moves access closer to the end user or device to lower latency and increase performance for services such as real-time visual data processing, augmented/virtual reality (AR/VR), artificial intelligence and machine learning (AI/ML), and advanced robotics.

Source: Bell Canada

……………………………………………………………………………………………………………………………………………………………………………….

“Because that link between the application and the edge device is a completely controllable link – it doesn’t involve the internet, doesn’t involve these multiple hops of the traffic to reach the application – it allows us to have a very particular controlled link that can give you different quality of service,” explained George Elissaios, director and GM for EC2 Core Product Management at AWS, during a briefing call with analysts.

Network infrastructure is the backbone for Canadian businesses today as they innovate and advance in the digital age. Organizations across retail, transportation, manufacturing, media & entertainment and more can unlock new growth opportunities with 5G and MEC to be more agile, drive efficiency, and transform customer experiences.

Optimized for MEC applications, AWS Wavelength deployed on service providers’ 5G networks provides seamless access to cloud services running in AWS Regions. By doing so, AWS Wavelength minimizes the latency and network hops required to connect from a 5G device to an application hosted on AWS. AWS Wavelength is now available in Canada, the United States, the United Kingdom, Germany, South Korea, and Japan in partnership with global communications service providers.

Creating an immersive shopping experience with Bell Canada 5G:

Increasingly, retailers want to offer omni-channel shopping experiences so that consumers can access products, offers, and support services on the channels, platforms, and devices they prefer. For instance, there’s a growing appetite for online shopping to replicate the in store experience – particularly for apparel retailers. These kinds of experiences require seamless connectivity so that customers can easily and immediately pick up on a channel after they leave another channel to continue the experience. These experiences also must be optimized for high-quality viewing and interactivity.

Rudsak worked with Bell and AWS to deploy Summit Tech’s immersive shopping platform, Odience, to offer its customers an immersive and seamless virtual shopping experience with live sales associates and the ability to see merchandise up close. With 360-degree cameras at its pop-up locations and launch events, Rudsak customers can browse the racks and view a new product line via their smartphones or VR headsets from either the comfort of their own home or while on the go. To find out more, please click here.

Bell Canada Public MEC with AWS Wavelength is now available in the Toronto area, with additional Wavelength Zones to be deployed in the future. To find out more, please visit: Bell.ca/publicmec

AWS currently has Wavelength customers (see References below) in the United States, the United Kingdom, Germany, South Korea, Japan, and now Canada. It also has deals with Verizon, Vodafone, SK Telecom, and Dish Network.

Bell Canada explained that the service is targeted at enterprise customers. It will initially offer services to enterprises in Toronto, with expansion planned into other major Canadian markets.

“We’re excited to partner with AWS to bring together Bell’s 5G network leadership with the world’s leading cloud and AWS’ robust portfolio of compute and storage services. With general availability of AWS Wavelength Zones on Canada’s fastest network, it becomes possible for businesses to tap into all-new capabilities, reaching new markets and serving customers in exciting new ways. With our help, customers are thinking bigger, innovating faster and pushing boundaries like never before. Our team of experts are with customers every step of the way on their digital transformation journey. With our ongoing investments in supporting emerging MEC use cases, coupled with our end-to-end security built into our 5G network, we are able to give Canadian businesses a platform to innovate, harness the power of 5G and drive competitiveness for their businesses.”

– Jeremy Wubs, Senior Vice President of Product, Marketing and Professional Services, Bell Business Markets

“AWS Wavelength brings the power of the world’s leading cloud to the edge of 5G networks so that customers like Rudsak, Tiny Mile and Drone Delivery Canada can build highly performant applications that transform consumers’ experiences. We are particularly excited about our deep collaboration with Bell as it accelerates innovation across Canada, by offering access to 5G edge technology to the whole AWS ecosystem of partners and customers. This enables any enterprise or developer with an AWS account to power new kinds of mobile applications that require ultra-low latencies, massive bandwidth, and high speeds.”

– George Elissaios, Director and General Manager, EC2 Core Product Management, AWS

“With Bell’s Public MEC and AWS Wavelength we are able to offer new, fully immersive shopping experiences to our customers. Shoppers can virtually explore our new arrivals and interact in real-time with our staff and industry experts during interactive events and pop-ups. Thanks to the hard work, support and expertise of Bell, AWS and Summit Tech, we were able to successfully deliver our first immersive/interactive shopping event with the quality, innovation and excellence that our brand is known for.”

– Evik Asatoorian, President and Founder, Rudsak

“Canadian organizations across all industries are transforming their workflows by harnessing the power of new technologies to launch new products and services. In fact, 85% of Canadian businesses are already using the Internet of Things (IoT). In order to maximize the benefits of cloud computing, intelligent endpoints and AI, while adding emerging technologies like 5G, we need to modernize our digital infrastructure to embrace multi-access edge computing (MEC). Modernized edge computing interconnects core, cloud and diverse edge sites, enabling CIOs and business leaders to optimize their architectures to resolve technical challenges around latency, bandwidth and compute power, financial concerns about cloud ingress/egress and compute costs as well as governance issues such as regulatory compliance without losing advanced features like machine learning, AI and analytics. MEC offers the possibility of deploying modernized, cloud-like resources everywhere to support the ability to extract value from data.”

– Nigel Wallis, Research VP, Canadian Industries and IoT, IDC Canada

- Bell is the first Canadian telecommunications company to offer AWS-powered public MEC to business customers

- First AWS Wavelength Zone to launch in the Toronto region, with additional locations in Canada to follow

- Apparel retailer Rudsak among the first to leverage Bell Public MEC with AWS Wavelength to deliver an immersive virtual shopping experience

Bell is Canada’s largest communications company, providing advanced broadband wireless, TV, Internet, media and business communication services throughout the country. Founded in Montréal in 1880, Bell is wholly owned by BCE Inc. To learn more, please visit Bell.ca or BCE.ca.

References:

AWS looks to dominate 5G edge with telco partners that include Verizon, Vodafone, KDDI, SK Telecom

Verizon, AWS and Bloomberg media work on 4K video streaming over 5G with MEC

AWS deployed in Digital Realty Data Centers at 100Gbps & for Bell Canada’s 5G Edge Computing

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

European telcos need to address very high 5G energy consumption

by Angel Dobardziev, Senior Director at IDC (edited by Alan J Weissberger)

At this year’s Mobile World Congress in Barcelona, major wireless equipment vendors such as Ericsson, Huawei, and Nokia highlighted 5G portfolio announcements that emphasized the generation’s superior energy efficiency and sustainability, and indeed, recent IDC conversations with European CSPs underlined the fact that energy efficiency is a top priority for most network operations executives.

5G networks are incredibly high-power consumers (especially mmWave). They can provide downstream data rates of up to 1 Gbps at latencies of ~20ms to thousands of densely connected devices (smartphones, internet of things, machines, etc.). This massive performance uplift versus 4G is achieved with a powerful 5G RAN infrastructure that can include densely packed 64x or 128x massive MIMO (mMIMO) antennas (by comparison, 4G typically has 4x or 8x mMIMO antennas); denser network architectures with more cell sites in urban areas; and much “fatter” fiber backhaul/fronthaul networks that shuffle traffic between the RAN and core networks, among other things. These powerful features can make unoptimized 5G networks voracious energy beasts: a GSMA study cited Huawei research that 5G cell sites needed up to three times more energy than their 4G equivalents.

Of course, 5G networks support many new and existing energy-reducing features such as smart sleep mode, beamforming, C-RAN and a much more flexible architecture. These energy-saving elements make 5G a much more energy efficient technology per unit of mobile traffic versus 4G. This is a key point that is readily seized on by mobile infrastructure vendors to encourage CSPs to accelerate their 5G investments and deployments. But there is a bit more to the 5G energy and sustainability debate than just how efficient it is on a perbit basis or how much it can reduce carbon emissions in other industries.

First, mobile data traffic has been growing at more than 40% over the past few years and looks set to continue its exponential growth. In its latest mobility report, Ericsson estimates that global mobile traffic will increase by a factor of 4.6 over the next five years, from 80EB in 2021 to 370EB in 2027, 80% of which will be video related. So while 5G is much more efficient per bit, CSPs will move a lot more data bits through the air, which along with the higher density of base stations (due to higher carrier frequencies) will require a lot more energy than previous generations.

Second, mobile operators are deploying 5G networks on top of existing 4G (and often 3G and 2G) networks. Over a third of all mobile traffic in 2027 will still be carried over 3G and 4G networks. This means CSPs will typically have to spend on energy to power new 5G networks as well as existing 3G/4G networks in parallel for many years to come, which will also mean continued upward pressure on energy use and spend.

CSPs need to pull three 5G sustainability levers to address the energy issue:

IDC believes CSPs must ensure they lead the 5G energy and sustainability debate by focusing their efforts on three key areas:

- Establish C-suite accountability for accelerated 5G energy efficiency and sustainability

- Partner with 5G equipment vendors

- Define 5G sustainability impacts to stakeholders (regulators, investors, customers, partners) in a credible and realistic framework

While leading European CSPs, including Vodafone, BT, Telecom Italia, and Telenor have announced bold targets to achieve net-zero emissions by 2030, the task of reducing energy consumption in the short term almost entirely falls to network operations executives, whose agenda includes competing priorities of accelerating 5G deployments, maintaining network performance, lowering operating costs, reducing legacy network complexity, and supporting broader CSP transformation. Delivering more substantial energy savings requires concerted effort — and investment — to transform and upgrade network operations processes and equipment so they can minimize energy use per bit of traffic carried while maintaining or improving network capabilities and performance.

Such accelerated energy efficiency focus and investments need accountability from CSP C-suite executives to succeed. This is not always the case today given the current financial situation of the telco sector in Europe. A case in point is the switch to green and renewable energy to power mobile networks, including solar and wind, which often requires substantial focus and investment in new renewable energy infrastructures. For example, T-Mobile US announced in January 2022 that it reached its 100% renewable energy target at the end of 2021, one of the first in the world to do so. But this required a concerted effort over three years since it was announced in 2018 by then-CEO John Legere. At the time, the company said that this was not just the right thing to do, but it made excellent business sense, suggesting that it would save $100 million in energy costs in the next 15 years.

Second, CSPs must work much more closely with vendor partners, 5G equipment providers, and software vendors to improve the energy efficiency of equipment and monitor how they deliver on it. Leading 5G infrastructure vendors in Europe such as Ericsson and Nokia offer comprehensive energy optimization frameworks that focus on planning, deploying, and operating 5G networks to greatly reduce energy footprint without impacting performance. IDC is aware of only a few CSPs that have established commercial incentives for strict 5G energy efficiency targets on the equipment they procured to make sure vendors deliver on it. Some energy management specialist vendors can help with this task as well.

Finally, CSPs must take a decisive but realistic and credible position on potential of 5G for “downstream” energy reductions. These refer to energy saved and carbon emissions prevented in other industries via 5G use cases that can reduce carbon emissions. There is very little doubt that high-performing 5G networks are set to enhance existing use cases and enable new ones in different industries from manufacturing to transportation, energy, health, and agriculture that will minimize the need for people to move to specific locations and optimize the efficiency of assets, resources, and workforces in many ways depending on the vertical and enterprise. But the 5G downstream industry and societal impacts sustainability estimates must be realistic in order to be credible. There are, for example, highly optimistic estimates that 5G can help achieve a fifth of carbon reduction targets in some markets by 2025, even though many operators are just starting to get to grips with standalone access (SA) and network slicing technologies that are critical for many such use cases.

To sum up, sustainability will remain a major focus area for CSPs in 2022 and beyond and 5G networks’ energy use is a major issue in this debate. While European telcos net-zero goals to 2030 and beyond are worthy commitments, CSPs must clearly do more now. To this end, they can establish senior C-level accountability on this issue, work much more closely with vendor partners, and set realistic targets on downstream 5G sustainability gains.

About the Author:

Angel Dobardziev is a Senior Director at IDC and a judge of the World Communication Awards. He can be contacted at [email protected]

References:

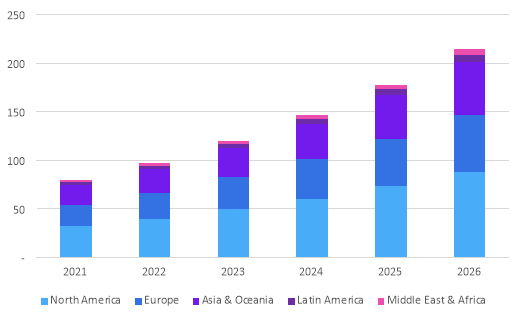

Omdia: Enterprise edge services market to hit $214 billion by 2026

According to a new report by Informa’s Omdia, revenue from edge services (where EXACTLY is the edge?) will reach $214 billion by 2026. That’s more than double the current size of the enterprise edge services market, which will reach $97.0 billion in 2022, says Omdia. With a compound annual growth rate (CAGR) of 20.4%, North America is predicted to dominate with 41% of global revenue share between 2021 and 2026.

This Omdia report discusses the latest global enterprise edge services forecast including edge consulting, integration, network, security, storage/compute and managed edge services considering use cases, verticals and edge deployment models.

Enterprise edge services forecast by region, 2021-26 ($ billions)

Source: Omdia (owned by Informa)

…………………………………………………………………………………………………………

While hyperscalers build out edge access points and systems integrators (SIs) design consulting and professional services for edge use cases, enterprises are looking to service providers to define business cases, run pilot projects and scope out different approaches to edge computing use cases, according to Omdia.

The Informa owned market research group outlines two main consumption models for edge services.

- In one model, enterprises will need consulting, systems integration and other support services to deploy physical edge infrastructure.

- The second method is a cloud-based, as-a-service and fully managed approach, where services provided by hyperscalers and independent software vendors (ISVs) are extended to the edge using local access points or gateways.

Omdia sees several opportunities for network providers to assist enterprises with the challenges that arise from implementing their edge strategies. The firm notes that telcos can help enterprises navigate data location and management considerations; regulatory compliance; network considerations such as the need for and availability of 5G, WAN/LAN and private networks; selecting the right edge setup and location; balancing use of internal skills with managed edge services; defining clear business cases; and more.

Edge consulting services from SIs, telcos, ICT solutions vendors and consulting firms form the largest part of the enterprise edge services market at 39.3% in 2022, says Omdia. While cybersecurity and network management subscriptions from service providers are critical to edge service packages, these subscription-based telco services are declining over time, the research group adds.

However, fully managed, cloud-delivered edge services, including multi-access edge computing (MEC) and workload and database management, are increasing in popularity. Omdia predicts that edge storage and compute services will be the strongest area of growth, with the services emerging as cloud services extensions to the edge provided by major hyperscalers, service providers and data center operators.

“As data volumes continue to grow and enterprises aim to move more workloads to the edge, they require more compute and storage capacity in the form of IaaS and PaaS at edge access points,”Omdia explained.

Edge locations will also shift from customers’ premises (53% in 2022 and 38% in 2026) to PoPs (point of presence) such as cloud access points and to a lesser extent, data centers.

“By 2026, over a third of edge services revenues will be realized as part of PoP deployments, which provides key opportunities and challenges for ICT service providers,” says Omdia.

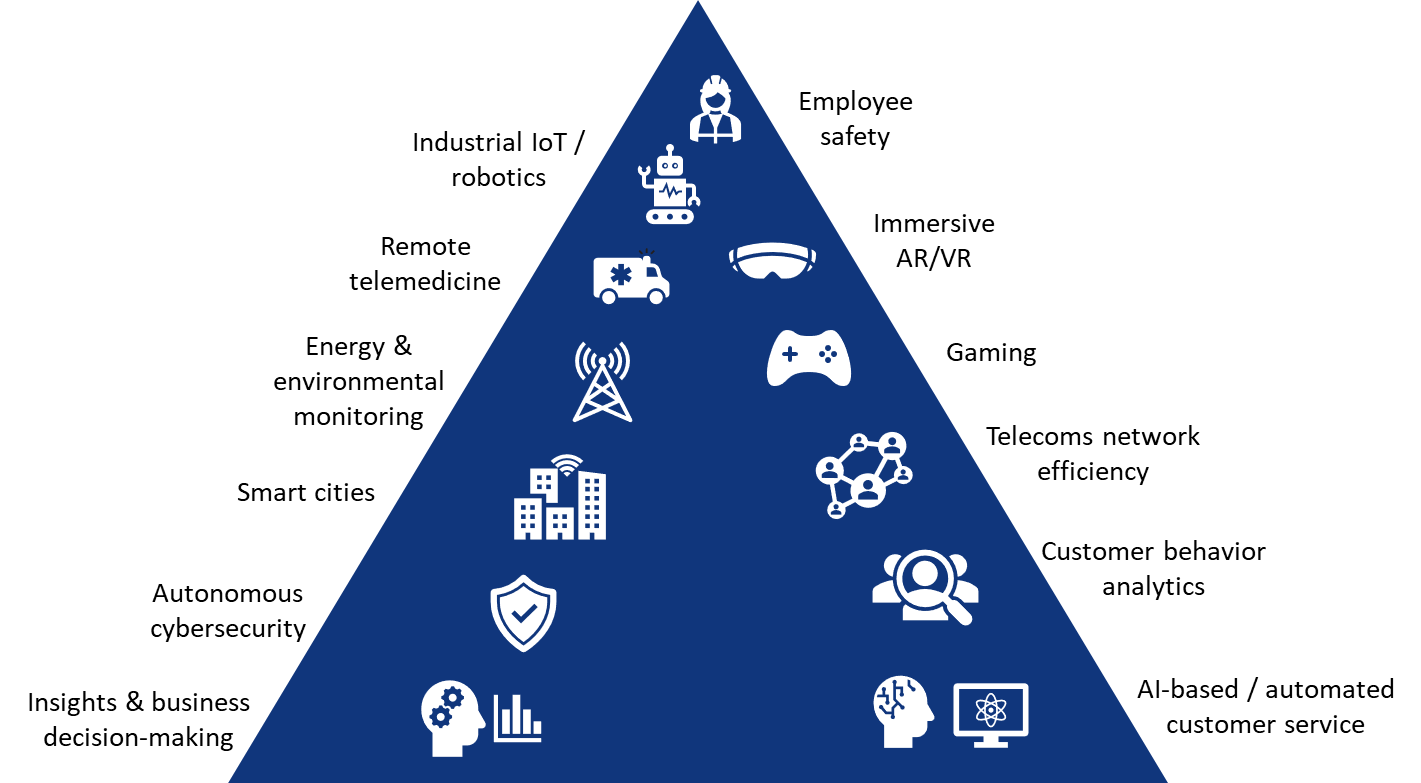

Emerging edge use cases

Edge use cases initially took flight in industrial applications and IoT use cases for worker safety, automated production lines, mining and logistics, explains Omdia. Over the next five years, the largest vertical forecasted to lead growth in edge services is the financial market, which could use AI-based analytics and cognitive systems for business decisions, market insight, risk assessment and customer service platforms.

Source: Omdia

Source: Omdia

…………………………………………………………………………………………………………………

Additional edge service use cases, which network operators could deliver as managed services, include smart meters for energy use and environmental monitoring; transport and container tracking; customer behavior analytics in retail; network efficiency; and data protection compliance and cybersecurity.

What applications do enterprises expect to run at the edge?

Omdia recommends several approaches for service providers, SIs, hyperscalers and ICT solutions vendors to consider when working with enterprises on edge services. Suggestions include developing vertical and workload-specific edge services that can be largely replicated to different customers, creating innovation hubs for edge solutions to test edge setups with customers, developing consulting services and creating a partner ecosystem to reduce vendor lock-in for customers.

References:

https://omdia.tech.informa.com/OM024012/Enterprise-Services-at-the-Edge–Forecast-202226

The Amorphous “Edge” as in Edge Computing or Edge Networking?

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

IBM says 5G killer app is connecting industrial robots: edge computing with private 5G

ONF’s Private 5G Connected Edge Platform Aether™ Released to Open Source

China’s telecom sector: stable growth in Q1-2022; cloud services revenue soared 138.1% YoY

China’s telecommunications sector posted steady expansion in the first quarter of 2022, with emerging businesses such as big data and cloud computing experiencing rapid growth, official data showed.

The combined industrial revenue rose 9.3 percent year on year to 393.5 billion yuan (about 60.92 billion U.S. dollars), a pace 2.8 percentage points faster than the same period last year, according to the Ministry of Industry and Information Technology.

Emerging businesses, such as big data, cloud computing, internet data centers and the Internet of Things, registered rapid expansion. The emerging business revenue of China’s three telecom giants — state owned China Telecom, China Mobile and China Unicom, surged 36.3 percent year on year to 79.7 billion yuan.

The revenue for cloud computing services soared 138.1 percent year on year, while that for big data and Internet of Things surged 59.1 percent and 23.9 percent, respectively.

Steady progress was also made in the construction of 5G base stations. By the end of March, China’s 5G base stations reached 1.56 million in number, with 134,000 built in the first three months of the year.

References:

China’s telecom sector sees stable growth in Q1 (ecns.cn)

Telecommunications industry in China – Wikipedia

Verizon faces tough times as 5G fails to generate a decent ROI

In 2021, Verizon spent more than $50 billion at FCC auctions to acquire mid-band C-band spectrum licenses for 5G. Along with AT&T, it negotiated a high-profile battle with the U.S. airline industry and FAA to put those spectrum licenses into commercial operations at the beginning of this year.

Verizon launched a C-band 5G network covering 130 million people – almost half of the U.S. population- in the 1st quarter of 2022. By the end of the first quarter, around 40% of Verizon‘s customers owned 5G gadgets capable of accessing the network, and it’s already carrying almost a third of all of Verizon‘s data traffic where it is available.

According to results from network-monitoring company Ookla, Verizon‘s 5G download speeds doubled via to its C-band network launch. However, the effort has been costly. Verizon‘s quarterly capital expenses (capex) spiked during the first quarter thanks to the $1.5 billion it spent during the period on the network equipment necessary to put its C-band licenses into action. That figure doesn’t include the extra money Verizon spent on its massive marketing campaign, which included $1,000 handset subsidies and a $1,000 switcher credit, during the quarter to promote the new network.

What does Verizon have to show for all its mid-band 5G investments? So very much as Moody wrote in a report skeptical on 5G monetization.

In the 1st quarter of 2022, Verizon lost 36,000 postpaid phone customers. While that’s certainly an improvement over the operator’s quarterly performance from a year ago, and also better than some financial analyst expectations, it stands in stark contrast to the 691,000 new postpaid phone customers AT&T netted during the period. AT&T, for its part, has delayed slightly its own big mid-band 5G network buildout until next year.

Moreover, Verizon executives acknowledged that the company saw a slowdown in new customers signing up for Verizon service starting in February and accelerating into March, just as the operator’s C-band marketing campaign ramped up.

David Barden, a financial analyst with Bank of America Merrill Lynch, called out the situation during Verizon‘s quarterly conference call on Friday. “There was a time when Verizon had the best network and could charge the highest prices. And on these calls we would talk about margins and obtainable market share,” he said. “You guys are now [market] share donors. And we’re celebrating how many 5G phones we have and how much C-band we’re deploying, but it’s not obvious that that’s translating into something tangible that investors can celebrate in terms of financial reward. So can we talk a little about that?”

Verizon‘s management team, including CEO Hans Vestberg, argued that “our focus over time is to grow this business.”

“We’re going to compete well,” Vestberg said, adding that “we see more excitement in the market where we offer C-band.”

“This is going to pay off big time in 5-10 years,” he said of Verizon‘s broad 5G investments.

However, he also conceded that Verizon could suffer from inflationary pressures on its labor and energy costs. And, like AT&T CEO John Stankey, he said Verizon may consider raising service prices as a result.

Verizon has lowered their 2022 guidance to the low end of their previous range on every key metric, and they cut their forecast for service and other revenue growth to flat (from +1.0-1.5% previously). The company warned that it now expects its full-year 2022 financial results to come in at the low end of its previously announced guidance. Nonetheless, “we remain well positioned to achieve our long-term growth targets,” Vestberg said.

Analysts don’t seem to agree with Vestberg’s optimism:

“Verizon is growing neither its subscriber base nor its ARPU [average revenue per user]. At a time of rising inflationary pressures, pricing power is nowhere to be found,” wrote the colleague Craig Moffett at MoffettNathanson in a note to clients following the release of Verizon‘s first-quarter results. “And on the unit side, Verizon is already losing share. Unless something changes for 5G revenues that still seem rather intangible (IoT, MEC [multiaccess edge computing], or private networks), the growth runway for Verizon would appear rather weak.”

“There are areas for concern outside of the Wireless segment. Again like AT&T, their Wireline segment is a drag on growth that is only getting worse (their results in Business Wireline, in particular, were – like AT&T’s yesterday – shockingly weak). That puts even more of an onus on the Wireless unit to grow.”

“Things aren’t likely to get easier. Consolidated operating revenue (as reported) of $33.6B was 0.3% below consensus of $33.7B. With such anemic growth, the inflation backdrop is a troubling one. Costs will rise faster than revenues.”

Moffett sees “no easy answers” for Verizon. It could “bow to the pressure” and increase promotions, but he noted that this would further constrain average revenue per user growth for both Verizon and the broader industry. The company could stay disciplined with its pricing and promotional strategies, but doing so would risk further subscriber losses at a time when Verizon’s network advantage over rivals is in jeopardy. “In summary, the path forward remains a challenging one,” Craig concluded.

Financial analysts with New Street Research wrote: “We do remain concerned about Verizon‘s longer-term prospects in wireless, fueled by T-Mobile‘s lead over Verizon on deploying upper mid-band [spectrum] and big lead on total holdings in mid-band spectrum. Verizon management’s aspirations for strong service revenue growth driven by rising ARPU and growing subscribers also still seem way too optimistic in the face of rising competition from a challenger [T-Mobile] with a similar (if not soon-to-be better) network offering priced at a steep discount.”

The New Street analysts also acknowledged that there are widespread expectations that overall growth in the U.S. wireless industry will start to slow sometime this year and that Verizon could be the first 5G operator to suffer from that trend that may eventually affect all of the market’s players.

References:

https://www.lightreading.com/5g/is-verizons-big-5g-gamble-falling-apart/d/d-id/776998?

Huawei to expand consumer products to include smartphones, PCs and other consumer-oriented devices

Huawei Technologies said on Wednesday it will step up efforts to expand its presence in the commercial hardware market in its latest effort to pursue new growth opportunities beyond smartphones amid foreign government restrictions. Richard Yu Chengdong, a member of Huawei‘s executive board, said: “The company has rebranded its consumer business group that includes smartphones, PCs and other consumer-oriented businesses, into a device business group, to showcase its determination to tap into enterprise-oriented businesses such as PCs used in offices, desktops and large displays for industry customers.”

Huawei‘s new group will focus on providing office hardware and software solutions for key sectors including education, healthcare, manufacturing, transportation, finance and energy, Huawei said. Huawei‘s consumer business group used to contribute the most to the overall revenue of the company. But due to tough US government restrictions on Huawei‘s access to crucial technologies including semiconductors, the company’s smartphone sales plunged.

In the fourth quarter of 2021, Huawei‘s consumer business group revenue dropped nearly 50 percent to 243.4 billion yuan ($38 billion).

According to market research company Counterpoint, the company’s global smartphone market share fell below 4 percent since the first quarter of 2021, compared with its peak of 20 percent in the second quarter of 2020.

Amid such a context, Huawei has been working hard to find new growth engines to offset its declining smartphone business.

At an online product launch on Wednesday, Huawei unveiled its latest commercial tablets, smart wearables and displays equipped with its self-developed HarmonyOS. Huawei also provides a customized full-scenario payment solution called Huawei Payment for government clients and small and medium-sized enterprises.

Xiang Ligang, director-general of the Information Consumption Alliance, an industry association, said sales channels constitute the biggest difference between consumer-oriented and enterprise-oriented businesses. The former relies on retail stores, while the latter depends on close partnerships with customers from industries.

Huawei‘s advantages in product performance, quality as well as research and development can still give it an edge in enterprise-oriented business, Xiang said, adding that Huawei has accumulated experience in targeting industrial customers in its 5G base station business. Huawei is also continuing its drive for development of the OpenEuler operating system as part of its broader push to solve China’s lack of homegrown operating systems for fundamental digital technologies.

OpenEuler is designed for enterprise customers and can be used in devices such as servers and cloud computing. Last year, Huawei donated its Euler operating system to the OpenAtom Foundation, a major open source foundation in China, to become an open-source OS.

Jiang Dayong, director of the OpenEuler Community, said the OpenEuler open source community has attracted more than 8,000 developers and 330 partners such as chip makers, software companies and hardware makers. At present, the cumulative installed capacity of OpenEuler stands at more than 1.3 million in industries such as finance, transportation and telecom, which means the system is ready for faster growth. Jiang said he expects about 2 million new installations of OpenEuler in 2022.

Computer products at a Huawei store in Foshan, Guangdong province, on April 4, 2022. Photo: VCG

……………………………………………………………………………………………………………………………………………………………………….

References:

Comcast Deploys Advanced Hollowcore Fiber With Faster Speed, Lower Latency

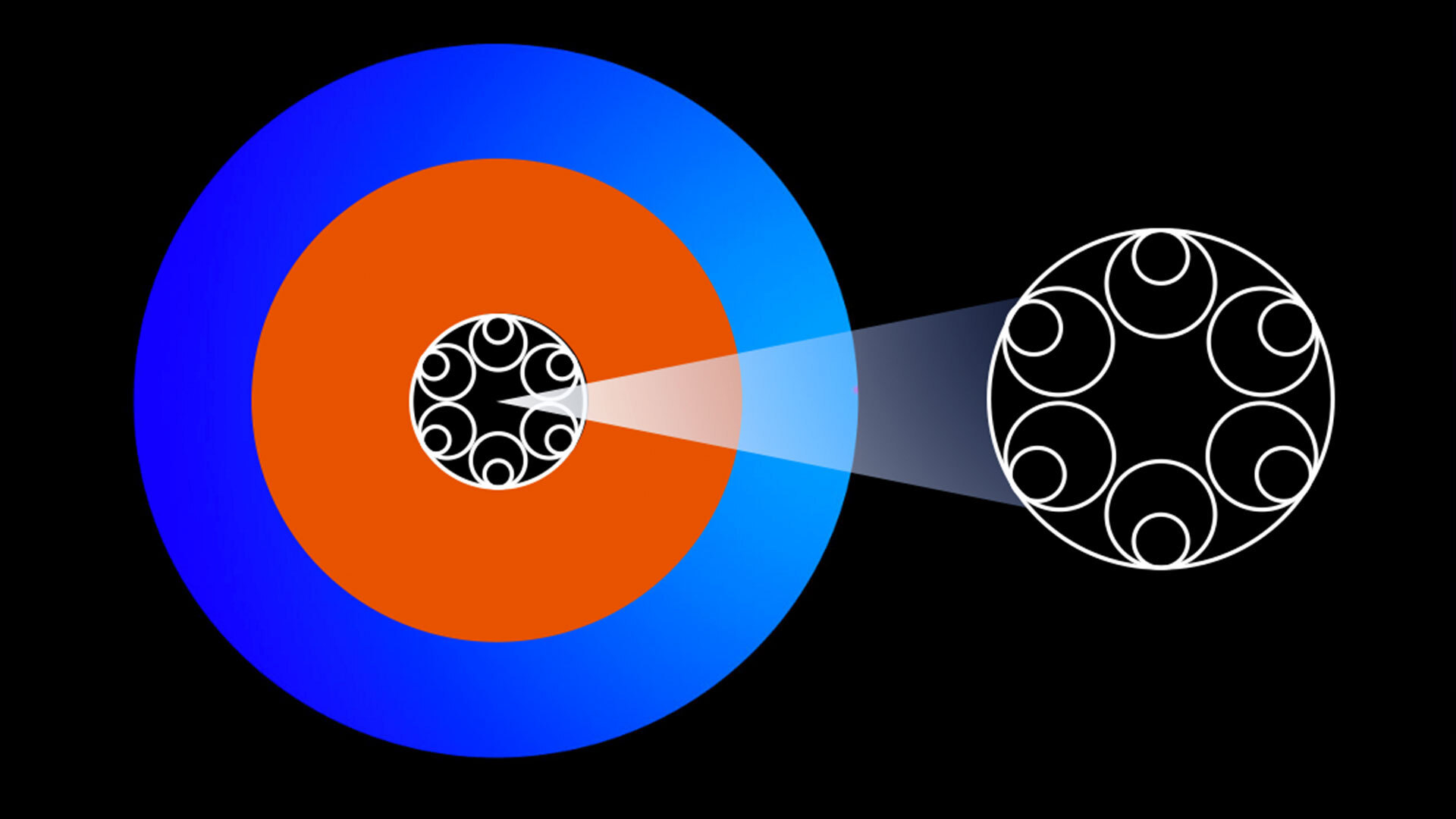

Comcast today announced what is believed to be the first-ever end-to-end deployment of advanced “hollowcore” fiber optics in the world by an Internet Service Provider (ISP). Hollowcore fibers deliver significantly lower latency than traditional fibers and over time will provide critical performance attributes. These fibers will help power Comcast’s network and support the delivery of multigigabit speeds through 10G b/sec.

Unlike traditional fibers, in which laser light travels over a solid glass core, “hollowcore” fibers are empty inside with air-filled channels. Since light travels nearly 50 percent faster through air than glass, data travels about 150 percent faster with up to 33 percent lower latency through “hollowcore” fiber compared to traditional fiber. The faster speed of light can be used to double the reach for latency critical applications or can speed up the transaction rates by around 47 percent.

For the deployment announced today, Comcast worked with hollowcore fiber cable solutions provider, Lumenisity.

“Hollowcore fiber is a leap forward in how we deliver ultra-fast, ultra-low latency and ultra-reliable services to customers,” said Elad Nafshi, EVP & Chief Network Officer at Comcast Cable. “As we continue to develop and deploy technology to deliver 10G, multigigabit performance to tens of millions of homes, hollowcore fiber will help to ensure that the network powering those experiences is among the most advanced and highest performing in the world.”

“The reality is that light travelling through air is about 50% faster than travelling through glass. The data throughput and the latency is greatly improved when you have a hollowcore fiber … The advantage is you can extend your reach at equal performance,” Nafshi said. Hollowcore fiber, like traditional fiber, can be used in the access, metro or core network, and is compatible with legacy fiber.

Comcast connected two locations in Philadelphia, which enables network engineers to continue to test and observe the performance and physical compatibility of hollowcore fiber in a real-world deployment. This 40-kilometer hybrid deployment of hollowcore and traditional fiber is believed to be the longest in the world by an Internet provider. Comcast successfully tested bidirectional transmission (upstream and downstream traffic traveling on a single fiber), used coherent and direct-detect systems (allowing for forward and backward technology compatibility), and produced traffic rates ranging from 10 gigabits per second (Gbps) to 400 Gbps all simultaneously on a single strand of hollowcore fiber.

“We are proud to be working with Comcast on the next generation hollowcore fiber, which we believe unlocks exciting new potential for connectivity around the world,” said David Parker, Executive Chairman of Lumenisity.

Hollowcore fiber will help to power the next generation of ultra-low latency technologies to support network virtualization, telemedicine, augmented and virtual reality, and other emerging services. Moving forward, Comcast is exploring opportunities to strategically deploy hollowcore fiber in select core- and access-network deployments. From 2017 to 2021, Comcast added more than 50,000 new route miles of fiber to its network and is actively building more fiber into cities and towns across the United States.

Comcast’s ongoing work to expand and evolve its fiber deployments – including this groundbreaking step forward with hollowcore fiber – helps to power Comcast’s ongoing 10G evolution, which will deliver reliable multigigabit upload and download speeds over the connections already installed in tens of millions of homes and businesses.

An illustration of the air-filled channels utilized in hollowcore fiber.

Source: Comcast

………………………………………………………………………………………………………………..

Comcast deployed more than 50,000 new route miles of fiber to its network from 2017 to 2021. The operator isn’t revealing how or when it might commercialize its use of hollowcore fiber, but the operator sees it playing a role for certain apps and use cases, such as telemedicine, AR/VR and network virtualization.

The operator might also use the technology to target new customer segments that are seeking greater throughputs and lower latencies.

From a broader standpoint, hollowfiber could provide a conduit for “10G,” an industry initiative focused on delivering symmetrical 10Gbit/s speeds, low latencies and enhanced security over fiber-to-the-premises (FTTP), hybrid fiber/coax (HFC) and wireless networks.

Citing its 40km connection in Philadelphia, Comcast is billing this as the world’s longest ISP deployment of hollowcore fiber so far.

But Comcast isn’t the only major operator working closely with Lumenisity. Last year, the startup announced BT was trialing its new optical fiber technology at its labs in Adastral Park, Ipswich. That trial involved a 10km-long hollowcore fiber from Lumenisity.

Lumenisity was spun out of the Optoelectronics Research Centre at the University of Southampton in 2017, with an aim to commercialize the development of hollowcore fiber.

In 2020, the startup closed a £7.5 million ($9.77 million) funding round from a group of investors that included BGF and Parkwalk Advisors and existing industrial strategic investors. Lumenisity has raised £12.5 million (US$16.28 million), according to Crunchbase.

Some key application areas Lumenisity has identified for its technology include financial, data center connectivity and connectivity for the separation of remote radio units and baseband units in 5G networks.

About Comcast Corporation:

Comcast Corporation (Nasdaq: CMCSA) is a global media and technology company that connects people to moments that matter. We are principally focused on broadband, aggregation, and streaming with 57 million customer relationships across the United States and Europe. We deliver broadband, wireless, and video through our Xfinity, Comcast Business, and Sky brands; create, distribute, and stream leading entertainment, sports, and news through Universal Filmed Entertainment Group, Universal Studio Group, Sky Studios, the NBC and Telemundo broadcast networks, multiple cable networks, Peacock, NBCUniversal News Group, NBC Sports, Sky News, and Sky Sports; and provide memorable experiences at Universal Parks and Resorts in the United States and Asia. Visit www.comcastcorporation.com for more information.

Media Contact:

David McGuire 215-422-2732

[email protected]

About Luminosity:

Lumenisity® Limited was formed in early 2017 as a spin-out from the world-renowned Optoelectronics Research Centre (ORC) at the University of Southampton (UK) to commercialize breakthroughs in the development of hollowcore optical fibre. We have built a team of industry leaders and experts to realise our goal to be the world’s premier high-performance Hollowcore fibre optic cable solutions provider, offering customers reliable, deployable, low latency and high bandwidth connections that unlock new capabilities in communication networks.

Lumenisity is well funded by a consortium of industrial and private investors. We recently relocated our headquarters to Romsey, UK after a substantial investment was made in developing a state of the art manufacturing and testing facility. Our vision is to be the world’s premier high-performance hollowcore fibre optic cable solutions provider offering our customers reliable, deployable, low latency and high bandwidth connections that unlock new capabilities in communication networks.

References:

Comcast 2021 Network Report: Data Traffic Increased Over Historic 2020 Levels; 10G Coming

Comcast broadband subscriber growth slows; Business services and Xfinity Mobile gain

Comcast Business Announces $28 Million Investment to Expand Fiber Broadband Network in Eastern U.S.

Comcast Earnings Report: Record Broadband Growth; 3 Core Strategy Tenets; Wireless Expansion

New broadcast TV standard ATSC 3.0 “Next Gen TV” to cover 82% of U.S. households by end of 2022

Pearl TV, a consortium of U.S. broadcasters operating more than 820 TV stations, said that it is making progress with hardware and software that wants to accelerate the rollout and adoption of ATSC 3.0, the new broadcast TV signaling standard that’s been branded as “NextGen TV.” ATSC 3.0 has been in the works for many years, but only now seems to be gaining a wide following.

Pearl TV has collaborated with Taiwan wireless telecom semiconductor company MediaTek on a reference design for smart TVs and other devices that support the new standard. On the software front, the consortium has formally introduced RUN3TV, a web-based platform that enables broadcasters to deliver interactive and on-demand apps and services over ATSC 3.0.

The new IP-based standard – which supports 4K video, enhanced audio and interactive apps – are expected to take center stage. Pearl TV’s members include Cox Media Group, the E.W. Scripps Company, Graham Media Group, Hearst Television, Nexstar Media Group, Gray Television, Sinclair Broadcast Group and Tegna.

Sinclair Broadcast Group and USSI Global said they will partner to offer the nation’s first commercial datacasting service using the NextGen Broadcast standard (ATSC 3.0). The pilot program will deliver local content, advertising, and data files to the rapidly growing Electric Vehicle Charging station market.

The ATSC 3.0 reference design – billed as the “FastTrack to NextGen TV” platform – includes a TV system-on-chip (SoC), ATSC 3.0 demodulators and a software stack. It will be pre-certified for compliance with the Consumer Technology Association’s (CTA’s) NextGen TV logo requirements, A3SA security (which uses IP-based encryption protocols, device certificates and rights management technology) and the RUN3TV application platform.

It’s hoped that the ATSC 3.0 reference design will open up the market for lower-cost ASTC 3.0-based TVs and drive more volume into the NextGen TV ecosystem. MediaTek already provides TV SoCs to about 90% of all TV brands, according to Pearl TV and MediaTek. The program stems from a partnership between them announced in January 2022. CTA expects NextGen TV sales to double this year, rise by 75% in 2023 and then double again in 2024.

About 70 TV models from Samsung, Sony and LG Electronics support ASTC 3.0 today, with Hisense on deck to build sets that utilize the new standard. More than 100 TV models are expected to support ATSC 3.0 by later this year, Anne Schelle, managing director of Pearl TV, recently told Light Reading.

The official launch of RUN3TV brings to market a web platform that supports interactive apps delivered via ATSC 3.0, such as targeted advertising, weather widgets, live sports scores, TV-based commerce and enhanced emergency alerts. It is arriving on the scene as the deployment of the new standard reaches about 60 markets.

Pearl TV is launching the RUN3TV platform through a subsidiary, ATSC 3.0 Framework Alliance LLC, with development partners that include Kineton, MadHive, IBM Weather, Freewheel (the Comcast-owned ad-tech company) and Google. Gray Television.

The E.W. Scripps Company, Graham Media, Tegna, Hearst and Howard University’s WHUT are among the platform’s early adopters.

“With NextGen TV and RUN3TV, broadcasters can now bring the OTA environment into the digital world,” Schelle said in a statement.

The reference design and interactive platform are coming together amid an ongoing expansion of ATSC 3.0. It’s expected that NextGen TV will cover about 82% of all U.S. households by the end of 2022. Large markets set for launches later this year include Boston, New York, Philadelphia, Chicago and Miami.

References: