Author: Alan Weissberger

ZTE PON ONT obtains EasyMesh R3 certification from WiFi Alliance

ZTE announced that its ZXHN F8648P became the first PON ONT in the industry to pass the EasyMesh R3 certification of the Wi-Fi Alliance. This certification is a validation of the product’s abilities to help operators remove the interoperability barrier between devices from different vendors in a smart mesh network, improving operational efficiency, and enhancing security guarantees.

Before this R3 certification, ZTE has also achieved other industry-first EasyMesh certifications, with its ZXHN F680 passing the R1 certification in June 2019 and its ZXHN F689 securing the R2 designation in September 2020. According to these certifications, ZTE proved that its home networking products have interoperability and technological functionalities to let operators provide multi-access point home network services.

During the EasyMesh R3 certification, the ZXHN F8648P PON ONT passed all the key functional tests in one go, including general EasyMesh items like link establishment, device discovery, topology display, automatic configuration and wireless roaming, as well as R3-specific items like Device Provisioning Protocol (DPP) authentication, network Quality of Service, mesh functionality extension through the addition of Wi-Fi 6 support, and network security.

Although the WFA has not officially issued EasyMesh R4, ZTE is carrying out research and verification of the new requirements that may be incorporated into the new specifications, such as Wi-Fi 6 adaptation, air interface QoS, and parameter collection for remote diagnostics.

The WFA EasyMesh certification program is a standards-based approach to multi-AP Wi-Fi networking products. It aims to promote industry standardisation and the rapid development of the home networking market by enabling multi-vendor interoperability and making possible the installation and use of mesh Wi-Fi networks.

Although the WFA has not officially issued EasyMesh™ R4, ZTE is carrying out research and verification of the new requirements that may be incorporated into the new specifications, such as Wi-Fi 6 adaptation, air interface QoS, and parameter collection for remote diagnostics.

………………………………………………………………………………………………………….

References:

ZTE obtains industry-first EasyMesh™ R3 certification for PON ONT

https://www.telecompaper.com/news/zte-obtains-first-easymesh-r3-certification-for-pon-ont–1420525

U.S. Department of Defense (DoD) and NTIA Launch 5G Challenge: RAN subsystem interoperability

The DoD, in collaboration with the National Telecommunications and Information Administration’s (NTIA) Institute for Telecommunication Sciences (ITS) [1.] have launched the 5G Challenge Preliminary Event: RAN Subsystem Interoperability. This competition aims to accelerate the development and adoption of open interfaces, interoperable components, and multi-vendor solutions toward the development of an open 5G ecosystem.

Note 1. ITS, the Nation’s Spectrum and Communications Lab, supports the Department of Defense 5G Initiative through a combination of its subject matter experts in 5G and its research, development, test, and evaluation (RDT&E) laboratory infrastructure in Boulder, Colorado, including the Advanced Communications Test Site at the Table Mountain Radio Quiet Zone.

“The Department is committed to supporting innovation efforts that accelerate the domestic development of 5G and Future G technologies. 5G is too critical a technology sector to relinquish to countries whose products and technologies are not aligned with our standards of privacy and security. We will continue our support of all necessary efforts to unleash innovation while developing secure 5G supply chains,” said Amanda Toman, Acting Principal Director, 5G-Future G.

“Increasing the resilience and security of our supply chain is at the heart of NTIA’s work to incentivize open and interoperable 5G networks and increase the diversity of suppliers in the 5G ecosystem,” said Alan Davidson, Assistant Secretary of Commerce for Communications and Information and NTIA Administrator. “NTIA and ITS are excited to collaborate with the Department of Defense on the 5G Challenge because it reinforces our joint understanding that cost-effective, secure 5G networks are key to both national and economic security.”

Today, most wireless networks are operated by mobile network operators and composed of many vendor-specific proprietary solutions. Each discrete element typically contains custom, closed-source software and hardware. This industry dynamic increases costs, slows innovation, and reduces competition, often making security issues difficult to detect and resolve. The 5G Challenge aims to foster a large, vibrant, and diverse vendor community dedicated to advancing 5G interoperability towards true plug-and-play operation, and unleashing a new era of technological innovation based on this critical technology.

This 5G Challenge Preliminary Event: RAN Subsystem Interoperability will award up to $3,000,000 to participants who submit hardware and/or software solutions for any or all of the following 5G network subsystems, which must be compliant with the 3GPP Release 15 and O-RAN Alliance specifications: Distributed Unit (DU), Central Unit (CU), and Radio Unit (RU). Interoperability is open for applications through May 5, 2022. For applications and additional information on this 2022 contest, please visit www.challenge.gov.

About NTIA:

The National Telecommunications and Information Administration (NTIA), located within the Department of Commerce, is the Executive Branch agency that is principally responsible by law for advising the U.S. President on telecommunications and information policy issues. NTIA’s programs and policymaking focus largely on expanding broadband Internet access and adoption in America, expanding the use of spectrum by all users, and ensuring that the Internet remains an engine for continued innovation and economic growth.

About USD(R&E):

The Under Secretary of Defense for Research and Engineering (USD(R&E) is the Chief Technology Officer of the Department of Defense. The USD(R&E) champions research, science, technology, engineering, and innovation to maintain the United States military’s technological advantage. Learn more at www.cto.mil, follow us on Twitter @DoDCTO, or visit us on LinkedIn at https://www.linkedin.com/company/ousdre.

Synopsys and Juniper Networks form new company to pursue “open” silicon photonics platform

Synopsys Inc. and Juniper Networks announced that they have closed a transaction to form a new, separate company that will provide the industry with an open silicon photonics platform to address the growing photonic requirements in applications such as telecom, data communications, LiDAR, healthcare, HPC, AI, and optical computing. The new company’s open silicon photonics platform will include integrated lasers, optical amplifiers, and a full suite of photonic components to form a complete solution that will be accessible through a Process Design Kit (PDK). The platform will enable a new level of integration at an unmatched price point, with the lowest power consumption for high-performance Photonic Integrated Circuits (PICs). The name of the new company will be announced at a later date.

The terms of the agreement have not been disclosed at this time. The new company will be jointly owned by Synopsys and Juniper, with Synopsys as the majority owner. The new company’s results will be consolidated into Synopsys financials. While Synopsys expects the investment to be slightly dilutive to fiscal 2022 earnings, the investment is not material and will not affect Synopsys’ fiscal second quarter and full year 2022 guidance ranges provided on February 16, 2022. There is no change to Juniper’s full year financial outlook as a result of this transaction.

The new company is being formed, in part, from the carve-out of integrated silicon photonics assets from Juniper, which includes more than 200 patents on photonic device design and process integration. While part of Juniper, the new company has closely collaborated with Tower Semiconductor to develop and qualify Tower Semiconductor’s PH18DA process technology to enable the industry’s first “laser-on-a-chip” open silicon photonics platform. To demonstrate capabilities of this platform and accelerate customer adoption of the technology, the new company has created 400G and 800G photonics reference designs with integrated lasers and expects first samples to be available in summer 2022.

“Silicon photonics is a rapidly growing market that is transforming many industries and creating exciting opportunities for new applications in the future,” said Sassine Ghazi, president and chief operating officer at Synopsys. “The new company’s open silicon photonics platform, combined with Synopsys’ existing investment in a unified electronic photonic design automation solution consisting of OptoCompiler™, OptSim™, PrimeSim™, Photonic Device Compiler and IC Validator™ products, will help reshape the optical computing industry, enabling companies to cost-effectively shift to integrated lasers and significantly accelerate development of photonic IC designs.”

“This revolutionary technology will change the economics of how people are going to build photonic systems,” said Rami Rahim, CEO of Juniper Networks. “We have been strong supporters of integrated silicon photonics and we believe the new company will drive development of these systems by using an advanced open platform that will dramatically reduce costs and increase the performance and reliability of designs across multiple use cases. We are excited to continue to collaborate with the new company to enable a broad ecosystem to efficiently develop next-generation optical transceiver and co-packaged designs.”

A key challenge for silicon photonics has been the cost of adding discrete lasers, which includes the manufacturing as well as the assembly and alignment of those lasers onto the photonic chip. This becomes more important as the number of laser channels and the overall bandwidth increases. By processing the Indium Phosphide (InP) materials directly onto the silicon photonics wafer, the PH18DA platform reduces the cost and time of adding lasers, enabling volume scalability and improved power efficiency. In addition, monolithically integrated lasers on silicon wafers improves overall reliability and simplifies packaging. This “Laser-on-a-Chip” open silicon photonics platform will bring integrated photonics to a host of new applications and markets that were previously not thought possible. The first Multi-Project Wafer (MPW) is scheduled to be taped out in Q2 2022.

“We have had a long history of successful collaboration with Juniper Networks on integrated photonics. The new company formed by Synopsys and Juniper will strengthen and accelerate the adoption of the silicon photonics platform,” said Russell Ellwanger, CEO of Tower Semiconductor. “Providing an open silicon photonics platform consisting of integrated lasers that has been qualified on Tower’s process will enable customers to create innovative products with the potential to transform the industry.”

Editor’s Note:

Intel has been working on Silicon Photonics for almost two decades.

- In 2004, Intel scientists created the first transistor-like device able to encode data onto a light beam.

- In 2011, the company announced a 50 Gb/s silicon photonics link created by multiplexing four hybrid silicon lasers.

- In December 2021, the company launched a Research Center for Integrated Photonics for Data Center Interconnects. The center’s mission is to accelerate optical input/output (I/O) technology innovation in performance scaling and integration with a specific focus on photonics technology and devices, CMOS circuits and link architecture, and package integration and fiber coupling.

“At Intel Labs, we’re strong believers that no one organization can successfully turn all the requisite innovations into research reality. By collaborating with some of the top scientific minds from across the United States, Intel is opening the doors for the advancement of integrated photonics for the next generation of compute interconnect. We look forward to working closely with these researchers to explore how we can overcome impending performance barriers.” –James Jaussi, senior principal engineer and director of the PHY Research Lab in Intel Labs

Intel has recently demonstrated progress in critical technology building blocks for integrated photonics. Light generation, amplification, detection, modulation, CMOS interface circuits and package integration are essential to achieve the required performance to replace electrical as the primary high-bandwidth off-package interface.

Additionally, optical I/O has the potential to dramatically outperform electrical in the key performance metrics of reach, bandwidth density, power consumption and latency. Further innovations are necessary on several fronts to extend optical performance while lowering power and cost.

The Intel Research Center for Integrated Photonics for Data Center Interconnects brings together universities and world-renowned researchers to accelerate optical I/O technology innovation in performance scaling and integration. The research vision is to explore a technology scaling path that satisfies energy efficiency and bandwidth performance requirements for the next decade and beyond.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

About Synopsys:

Synopsys, Inc. is the Silicon to Software™ partner for innovative companies developing the electronic products and software applications we rely on every day. As an S&P 500 company, Synopsys has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP and offers the industry’s broadest portfolio of application security testing tools and services. Whether you’re a system-on-chip (SoC) designer creating advanced semiconductors, or a software developer writing more secure, high-quality code, Synopsys has the solutions needed to deliver innovative products. Learn more at https://www.synopsys.com

About Juniper Networks:

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security, and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability, and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

Juniper Networks, the Juniper Networks logo, Juniper, Junos, and other trademarks listed here are registered trademarks of Juniper Networks, Inc. and/or its affiliates in the United States and other countries. Other names may be trademarks of their respective owners.

References:

Silicon Photonics – Cisco and Intel see “Light at the End of the Tunnel”

Capgemini: Enterprises with spectrum to have better control with 5G Private networks

French technology company Capgemini said that enterprises owning 5G spectrum will give them better control over their plans, thereby reducing dependency. It added that telecom operators will have a role to play for private enterprise networks as managing networks aren’t core competencies of enterprises.

“…even if the spectrum is available with an industry player, I don’t see the situation where the telcos will not be working with the industry in facilitating that. The industry will use 5G as a connectivity, and it’s just not 5G, it is with hybrid cloud, edge computing, IoT, and all other technologies together,” said Monika Gupta – Vice President, Group 5G & Edge lead for Industries & Partnerships, Capgemini.

Industries have key requirements which are very specific including safety, security and the protection of their data. A 5G private network is one solution which ensures that all the data with the connectivity which is there in the particular enterprise campus stays within the campus and doesn’t go out.

Ms Gupta added: “This is not possible in a macro network or in a telco network because in a telco network, it will be ubiquitously available, and anybody can use it or latch it. And hence private networks are one of the key solution offerings with respect to 5G for its adoption towards industries. 5G connectivity is not their [enterprises’] core operations or their core business. And the telcos will always have a role and some contribution to make in this irrespective of whether they own the spectrum, or the spectrum is with the industry. The adoption of 5G for industries is an ecosystem play.”

Capgemini is currently working with Bharti Airtel under a strategic partnership to develop 5G use cases for enterprises. “…two of our use cases have actually been deployed in Airtel Manesar’s lab,” Gupta said.

Capgemini also works with many of the industry clients in India, many of them being our global MNC clients who have large R&D setups, global R&D IT hubs or operations based out of India, she informed.On 5G, she said that while the launch has been delayed, India can still leverage 5G adoption-related learnings from other countries in terms of adopting certain use cases by localizing.

“…the advantage which India has both for telcos and industries is that there is so much learning which can come to India. Capgemini and many of these global MNCs play a crucial role because when we work on similar projects in other countries and in other regions like Europe, America and Asia Pacific, all of this knowledge is then kind of readily available to us in India,” she added.

A lot of 5G projects in other countries have been delivered out of India, she said, adding that the country already has skill sets and people’s capability for 5G deployment.“…the fine tuning which is required is what works for India. The local customization will happen. India has had a very short phase of 5G trials. Now whenever 5G is commercially available India will go straight into a rollout of 5G and will see a quick adoption,” she added.

Capgemini has a global network of labs. It recently opened a 5G lab in a strategic partnership with Swedish telecom gear maker Ericsson to test enterprise use cases.The company also has a similar lab in Paris, which is our headquarters. It has the third lab in Portugal, while the fourth one is coming up in America. Capgemini has developed the 5G Labs to help strategize, build and monetize what 5G brings next for their businesses.

“All of these labs are primarily industry focused labs. With the industry focus lab, we are primarily experimenting with innovating the application of 5G into industrial operations. So these labs actually replicate a lab environment of an enterprise architecture and 5G becomes an integral connectivity piece in that architecture,” Gupta concluded.

……………………………………………………………………………………………………………….

References:

Video of IEEE ComSoc/SCU SoE panel on Open RAN and Private 5G:

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

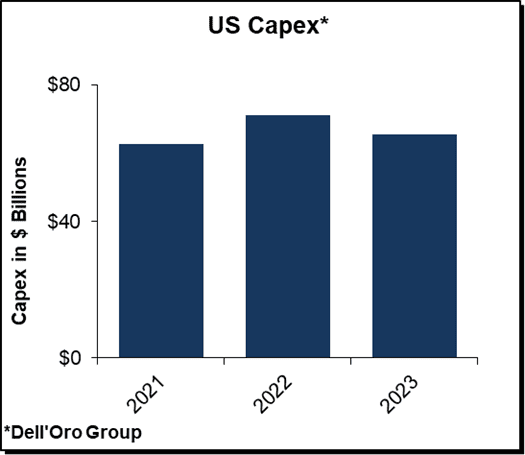

Dell’Oro Group forecasts that telco capex growth will taper off in 2023 and 2024 after increasing 9% year-over-year in nominal USD terms and on track to advance 3% in 2022.

The market research firm states that the top fifty carriers in the world collectively generated combined annual revenue and investments of well over $1.4 T this past year. They estimate that these carriers account for roughly 80% of worldwide capex and revenue.

Dell’Oro’s Telecom Capex bi-annual reports (previously called Carrier Economics bi-annual reports) track the revenue and capital expenditure (capex) trends for these fifty-plus carriers.

“Telco investments, in general, have shown remarkable resilience to external factors including Covid-19 containment measures, supply chain disruptions, and economic uncertainties,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “Surging wireless investments in the US taken together with non-mobile capex expansions in China will keep the momentum going in 2022,” continued Pongratz.

Stefan believes carrier revenue and capex trends can to some degree explain telecom equipment manufacturer revenue trends. The highly granular information provided in this report will enable carriers, system and component vendors, equity researchers, and regulatory bodies to assess growth opportunities and to observe performance practices in the telecom sector.

Additional highlights from the March 2022 3-year Telecom Capex forecast report:

- Global capex growth is expected to moderate from 9 percent in 2021 to 3 percent in 2022, before tapering off in 2023 and 2024.

- The coupling between carrier investments and manufacturing infrastructure revenues is expected to prevail over the short-term—capex and telecom equipment are on track to advance 3 percent and 4 percent in 2022, respectively.

- Short-term output acceleration is expected to be relatively broad-based, with investments growing in China and the US. At the same time, challenging comparisons in the US are expected to drag down the overall capex in the outer part of the forecast.

- Following a strong showing in 2021, capex growth prospects across Europe will be more muted in 2022.

Editor’s Note:

MTN Consulting estimates a nearly $325B annualized global capex in 2021, or nearly double the webscale total of $175B. The ratio of capex to revenues, or capital intensity, reached 17.2% in 2021, the highest level since 2015.

Excluding China/HK-based companies (which haven’t finished reporting), the top 10 biggest telco capex spenders in 2021 were AT&T, DT, Verizon, NTT, Comcast, Vodafone, Orange, Charter, America Movil, and Telefonica. The biggest capex gains in 2021 were seen at America Movil (+$2.54B versus 2020 total), Telecom Italia (+$2.49B), Verizon (+$2.09B), AT&T (+$1.93B), Deutsche Telekom (+$1.74B), BT (+$1.63B), and Rakuten ($1.47B). The DT jump is inflated slightly by its Sprint acquisition, which closed in April 2020.

MTN’s latest official global capex forecast is for $328B in 2022, a bit higher than 2021. “We are maintaining this target for now, but there is a high level of uncertainty and considerable downside risk.” No forecast beyond 2022 was provided.

The Dell’Oro Group Telecom Capex Report provides in-depth coverage of more than 50 telecom operators highlighting carrier revenue, capital expenditure, and capital intensity trends. The report provides actual and 3-year forecast details by carrier, by region by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). To purchase this report, please contact by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications and enterprise networks infrastructure, network security and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, please contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

China is already showing signs of slowing its 5G investment – China Telecom plans to reduce 5G investment by nearly 11% to 34 billion yuan (US$5.34 billion) this year, reported Light Reading’s Robert Clark in March. China Mobile has budgeted 110 billion yuan (US$17.3 billion) for spending on 5G networks in 2022, a 3.5% decline.

In the US, Dish Network is among service providers upping their 5G investments this year. Dish spent $1 billion on 5G-related capex in 2021 and plans to spend $2.5 billion in 2022 , reported Light Reading’s Jeff Baumgartner in February.

On the other hand, IDC doesn’t expect telecom capex to drop until 2024:

“COVID-19 has shown no long-term negative effects on telecommunications capex. IDC expects 2021 capex will grow versus 2020 and show no decline until at least 2024. If anything, COVID-19 has led to communications service providers increasing their network investments to sustain increase demand for connectivity and the speeds associated with it.” said Daryl Schoolar, IDC research director, Worldwide Telecommunications Insights.

References:

Worldwide Telecom Capex Growth to Taper Off in 2023, According to Dell’Oro Group

https://www.lightreading.com/5g/telco-capex-could-level-out-in-2023-delloro-reports/d/d-id/776610?

MTN Consulting: : 4Q2021 review of Telco & Webscale Network Operators Capex

https://www.idc.com/getdoc.jsp?containerId=US48465621

2022 Study of broadband pricing in 220 countries reveals vast global disparities

Cable.co.uk has released a report listing what it found were the cheapest and most expensive countries and regions for broadband internet access all over the world. The study was based on of 3,356 fixed-line broadband deals in 220 countries between 19 January 2022 and 30 March 2022.

- Syria had the cheapest fixed-line broadband with an average monthly cost of $2.15 per month, which the report attributes to a collapse of the Syrian Pound (SYP) against the U.S. dollar.

- Burundi was the most expensive with a whopping average package price of $429.95 per month.

Most expensive:

- Burundi (average cost $429.95 per month)

- Sierra Leone (average cost $316.69 per month)

- Brunei Darussalam (average cost $258.42 per month)

- Virgin Islands (British) (average cost $184.00 per month)

- Turks and Caicos Islands (average cost $170.50 per month)

Cheapest:

- Syria (average cost $2.15 per month)

- Sudan (average cost $4.80 per month)

- Belarus (average cost $7.40 per month)

- Ukraine (average cost $7.40 per month)

- Russian Federation (average cost $8.07 per month)

Here are the monthly rates for several developed countries: Germany = $27.81; France= $28.92; South Korea $29.54; Spain = $35.04; UK = $39.01; Japan = $47.23; U.S. = $55.00; Australia – $59.42.

For regions, the most expensive to cheapest is:

- North America (average cost $89.44 per month)

- Oceania (average cost $85.14 per month)

- Caribbean (average cost $78.44 per month)

- Sub-Saharan Africa (average cost $77.70 per month)

- Near East (average cost $60.62 per month)

- South America (average cost $55.17 per month)

- Western Europe (average cost $49.25 per month)

- Central America (average cost $43.87 per month)

- Asia (Excl. Near East) (average cost $40.29 per month)

- Northern Africa (average cost $22.41 per month)

- Eastern Europe (average cost $19.90 per month)

- Baltics (average cost $19.19 per month)

- CIS (Former USSR) (average cost $13.96 per month)

“This year we have noticed a greater weighting towards currency devaluation in the top half of the table,” said Dan Howdle, consumer telecoms analyst at Cable.co.uk. “For example, first-place Syria, whose Syrian Pound has lost three-quarters of its value against the US dollar in the last 12 months. Island nations such as those in the Caribbean and Oceania continue to present problems when it comes to providing cheap, fast connectivity options. Those lucky enough to have an undersea cable running close by tend to be able to offer it, where others have to lean into pricier hybrid satellite, 4G and/or WiMAX solutions.

“It’s hard to see how more affordable connectivity for the general population will be coming anytime soon to those countries at the bottom of the table, plagued as they are with limitations that are geographical and geopolitical, and where there is a lack of desire in the marketplace for fixed-line broadband solutions.”

This year’s excluded countries are: Cocos (Keeling Islands), Central African Republic, Western Sahara, Guinea, British Indian Ocean Territory, Kiribati, North Korea, Northern Mariana Islands, Malawi, Niger, Nauru, Solomon Islands, South Sudan, Chad, Tuvalu, Vatican and Venezuela.

References:

https://www.cable.co.uk/broadband/pricing/worldwide-comparison/#speed

https://telecoms.com/514570/broadband-prices-ranked-uk-is-92nd-cheapest-in-the-world/

Amazon to Spend Billions on 38 Space Launches for Project Kuiper

Amazon.com has signed contracts with Arianespace, Blue Origin, and United Launch Alliance to launch satellites for Project Kuiper – its planned constellation of low Earth orbit (LEO) satellites which will deliver high speed Internet service. The contracts cover up to 83 launches over a five-year period, providing capacity for the majority of the 3,236-satellite constellation planned.

Amazon claims it is the largest commercial procurement of launch vehicles in history. With 18 launches on the new Ariane 6 rocket in the initial agreement, it is also the largest contract ever for Arianespace.

One year ago, Amazon entered an agreement with United Launch Alliance (ULA) to secure nine Atlas V launch vehicles to support its Project Kuiper satellite fleet. The new ULA deal covers 38 launches on the Vulcan Centaur. [ULA is owned by Boeing Co. and Lockheed Martin Corp].

Jeff Bezos owned Blue Origin will provide 12 launches using New Glenn, with options for up to 15 more. The French company Arianespace SAS is expected to conduct 18 launches.

Amazon said the use of multiple launch providers will reduce risk and lower costs, with the large, heavy-lift rockets able to send multiple satellites into space at once. It confirmed plans for a first prototype launch mission later this year, and said it has over 1,000 staff working on the satellites project.

However, Amazon’s new planned launches depend on larger rockets still under development that must show they can fly as expected. The launch companies hired to take Project Kuiper’s satellites into orbit have faced delays in developing those rockets.

In addition, Amazon is working with Beyond Gravity (formerly RUAG Space), a Switzerland-headquartered space technology provider, to build low-cost, scalable satellite dispensers that will help deploy the Project Kuiper constellation. Beyond Gravity is opening a new production facility as a result of the partnership, doubling its production capacity in Linkoping, Sweden.

…………………………………………………………………………………………………….

SpaceX’s Starlink internet service has 250,000 subscribers, an executive said at a recent industry event, and has launched more than 1,900 satellites in what it calls its first-generation satellite system, according to a January regulatory filing.

SpaceX said in the filing that it has been making improvements to its Starlink satellites and to Starship, the large rocket SpaceX wants to use for Starlink deployments and other missions.

In 2020, the Federal Communications Commission authorized Project Kuiper to deploy 3,236 broadband satellites, according to a FCC filing. The agency required at least half to be operational by July 2026, or else Project Kuiper could lose the right to send up some satellites. The new launches the Amazon business bought would provide capacity to deploy most of the satellites the FCC allowed, according to the company.

Dave Limp, senior vice president at Amazon for devices and services, declined to specify how much the company would spend on the planned launches, but said the total outlay was in the billions. Project Kuiper bought the launches because of the 2026 deadline, and also as the unit has passed milestones for developing the business, he said.

Project Kuiper hired Blue Origin, the space company founded by Jeff Bezos, the former Amazon chief executive who serves as executive chair on the e-commerce company’s board, to conduct a dozen launches, along with options for another 15.

Jarrett Jones, a Blue Origin senior vice president for the New Glenn rocket, said the company plans to deliver engines to United Launch soon and is working to have four reusable New Glenn boosters by a 2025 time frame.

“Between these three providers, they all have obviously some risk associated with them and we’ve inspected that closely,” said Amazon’s David Limp. “We feel like they’re all on track.”

Project Kuiper has been working on deals for its planned service. An agreement it struck last year with Verizon Communications Inc. included providing satellite links meant to extend certain Verizon networks to reach rural and remote areas in the U.S. SpaceX’s Starlink has signed a similar deal with a Japanese telecom provider.

Starlink has a head start on Project Kuiper, according to satellite-industry analyst Chris Quilty of Quilty Analytics, but he said the Amazon business has the benefit of observing the challenges of the market leader. Kuiper hassn’t sent up any satellites yet, though it has said it will have two prototypes launched this year.

Amazon’s Mr. Limp said there is room for more than one satellite-broadband winner, in part because of the number of unconnected and underserved people around the world.

United Launch Chief Executive Tory Bruno said his company would launch Vulcan Centaur rockets for a national-security customer before Project Kuiper flights. “That pressure is already in place,” he said.

References:

https://www.cnn.com/2022/04/05/tech/amazon-satellite-internet-kuiper-launch-deal-scn/index.html

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

By Matt Walker

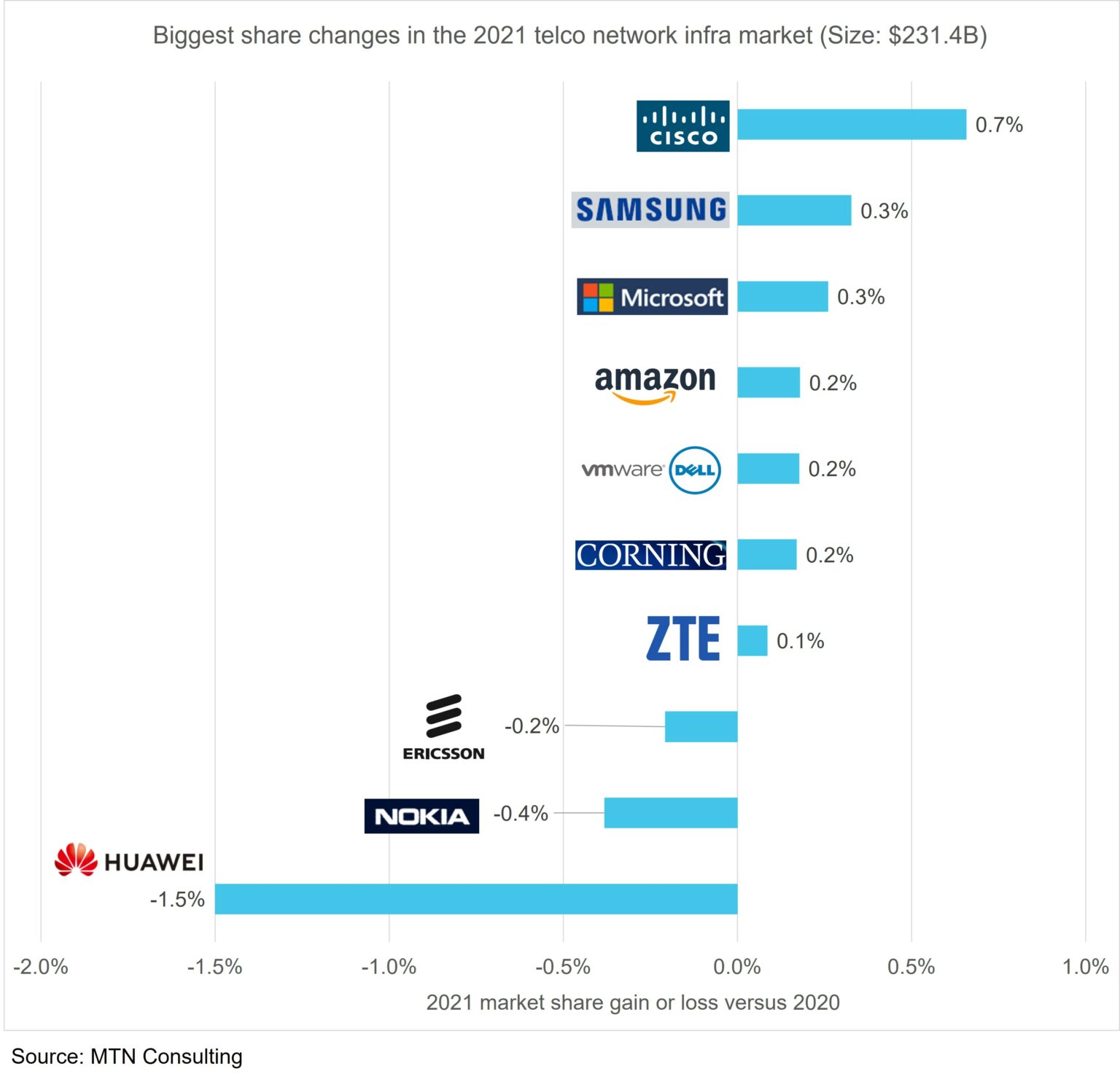

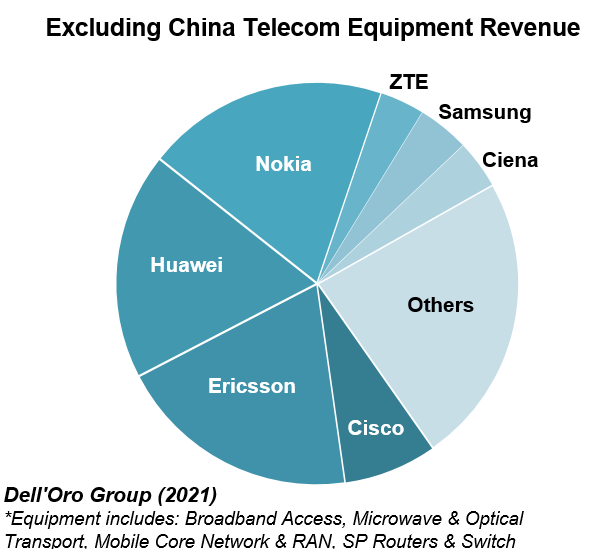

Cisco, Samsung, and ZTE benefit most from Huawei bans in 2021 in the telco Network Infrastructure market. (However, the market share gains were miniscule= <1% for each network equipment vendor).

Introduction:

2021 results for the 100+ vendors selling into the telco market are just about finalized. Contrasting 2021 telco network infrastructure (NI) market share with 2020, we note the following NI Equipment Vendor Market Share Changes:

Cisco clearly came out on top, gaining 0.7% share in a market worth $231.4 billion (B). Cisco was helped both by a telco shift in 5G spending towards core networks, and Huawei’s entity list troubles.

Samsung’s share growth of 0.3% was due to a big win with Verizon and a growing telco interest in seeking RAN alternatives beyond Ericsson and Nokia. ZTE, which has escaped the US entity list to date, also picked up some unexpected 5G wins but its growth is more broad-based due to optical, fixed broadband, and emerging market 4G LTE business.

Dell (including VMWare), Microsoft, and Amazon also picked up share as telcos have begun investing in 5G core and cloud technologies. Their growth has little to do with Huawei, and more due to telcos’ ongoing changes to network architecture and service deployment patterns. Corning was an unexpected winner in 2021, gaining 0.2% share on the back of fiber-rich wireless deployments and government support for rural fiber builds.

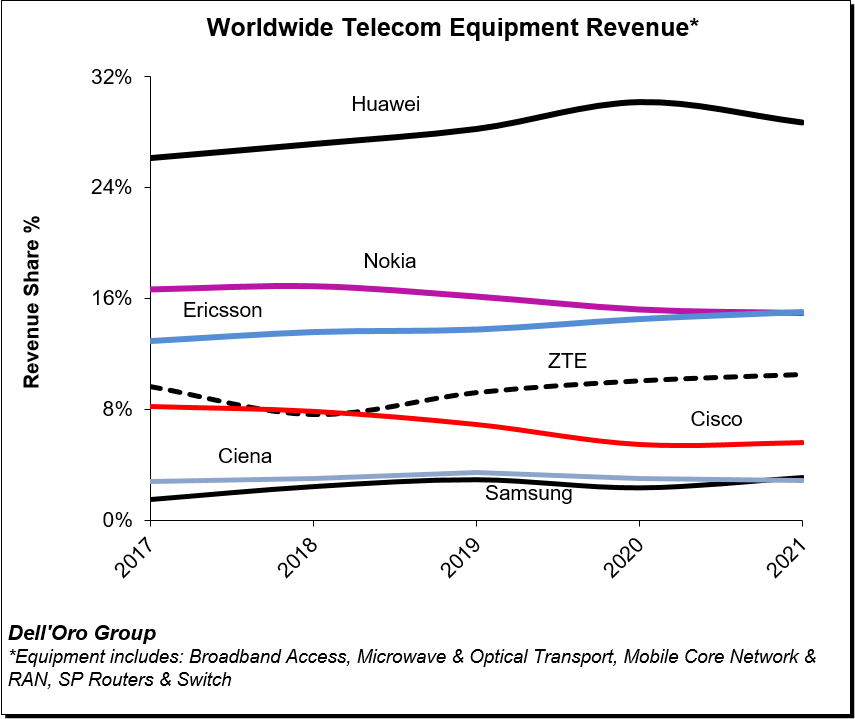

On the flip side, both Nokia and Ericsson lost share in the overall telco NI market in 2021. Their RAN revenues benefited from Huawei’s troubles in 2020 but telco spending has since shifted towards product areas with more non-Huawei competition. Both vendors are attempting to diversify beyond the telco market, with Nokia so far having more success; its non-telco revenues grew 12% in 2021.

Huawei’s share of telco NI declined to 18.9% in 2021, down from a bit over 20% in both 2019 and 2020. The US Commerce Department’s entity list restrictions were issued in May 2019 but hit the hardest in late 2020 and 2021, after Huawei’s inventory stockpiles began running out.

Huawei’s messaging on its recent fall is muddled. During its annual report webcast yesterday, it cited three factors behind its 2021 revenue decline: supply continuity challenges, a drop in Chinese 5G construction, and COVID. In MTN Consulting’s opinion, supply continuity was the main factor. A related factor were the many government-imposed restrictions on using Huawei gear around the world, especially in Europe where 5G spending was strong in 2021. The other two factors cited by Huawei’s CFO, however, are misleading. Chinese telco network spending, overall, was relatively strong in 2021: total capex for the big three telcos was $52.8B, up 8% from 2020. Without this rise, Huawei’s 2021 results would have been worse. As for COVID, few other vendors cite the pandemic as a factor restraining 2021 telco spend. More vendors cite the opposite: 2021 spending was strong in part because telcos were forced to delay many projects during COVID’s early spread.

To date, Huawei’s troubles have impacted RAN markets the most, but in 2022 and 2023 will begin spreading more clearly to IP infrastructure, optical, microwave, fixed broadband, and other areas. A number of vendors are eager to pursue new opportunities as this happens, including Adtran/ADVA, Ciena, Cisco, CommScope, DZS, and Infinera. The CEO of Infinera, in fact, said on its 4Q21 earnings call that “it was a nice taste, a nice appetizer in 2021, but…we said all along that we would see the design wins and RFPs really scaling and we thought that we’d see revenues from that really beginning to take hold as we got into 2023.”

To date, Huawei has been unable to fully adapt to the supply chain restrictions put in place in 2019. It remains the global #1 in telco NI, however, due to dominance in China and a huge installed base across the globe. The company is investing heavily in carrier services & software, Huawei Cloud and new product areas. One certainty is that it won’t simply fade away, despite the current decline.

……………………………………………………………………………………………….

Editor’s Note:

In contrast, Dell’Oro estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

References:

Cisco, Samsung, and ZTE benefit most from Huawei bans in 2021 telco NI market

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

MTN Consulting: : 4Q2021 review of Telco & Webscale Network Operators Capex

by Matt Walker

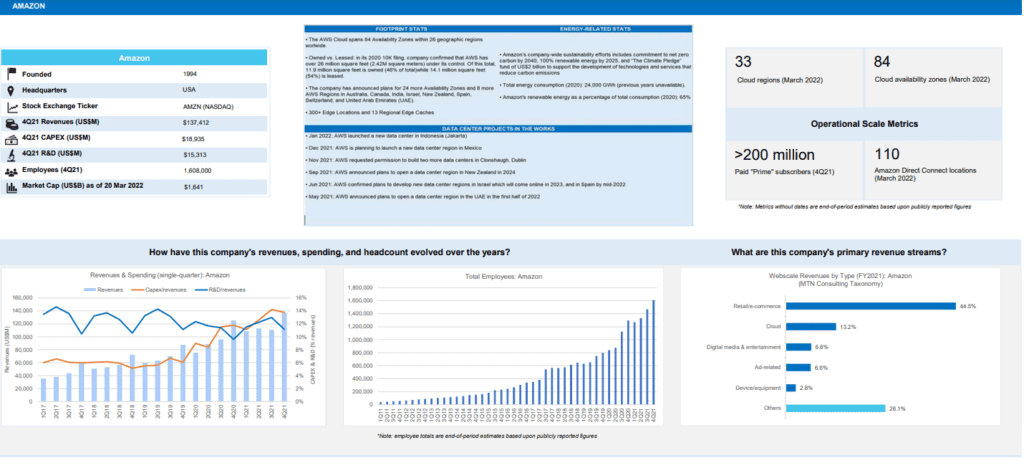

Webscale revenues surge 25% to $2.1 trillion in 2021; capex of $175B drives global data center demand.

Introduction:

Revenues for the webscale sector of network operators ended 2021 at $2.14 trillion. That’s up 25% from 2020, and nearly 3x the total recorded in 2011. One reason for this is a dramatic uptick in cloud services revenues: cloud revenues for the top 3 (AWS, GCP and Azure) climbed 42% YoY, to $120.3B (per MTN Consulting). Still, this accounts for less than 6% of total webscale sector revenues. Larger factors behind 2021’s growth include: digital ad revenues for Alphabet and Facebook (Meta); ecommerce sales at Amazon, JD.Com, and Alibaba; and, 5G device revenue sales at Apple. The webscale sector is now comfortably larger than telecom, which recorded just under $1.9 trillion in 2021 revenues.

Here’s the profile for Amazon:

Capex- Telcos vs Webscalers:

On a capex basis, telecom remains far ahead, with nearly $325B in 2021 annualized capex, or nearly double the webscale total of $175B. Excluding China/HK-based companies (which haven’t finished reporting), the top 10 biggest telco capex spenders in 2021 were AT&T, DT, Verizon, NTT, Comcast, Vodafone, Orange, Charter, America Movil, and Telefonica. The biggest capex gains in 2021 were seen at America Movil (+$2.54B versus 2020 total), Telecom Italia (+$2.49B), Verizon (+$2.09B), AT&T (+$1.93B), Deutsche Telekom (+$1.74B), BT (+$1.63B), and Rakuten ($1.47B). The DT jump is inflated slightly by its Sprint acquisition, which closed in April 2020.

However, webscale is gradually bridging the capex gap with telcos: webscale capex spiked 30% YoY in 2021, versus an approximate 10% rise for telco capex. Capex in 4Q21 for webscalers was $50B, up 23% YoY. Webscalers also invest heavily in R&D, and have bleeding-edge requirements for the technology they deploy in their network. That has led them to drive the creation of many new innovations in network infrastructure over the last few years. These span semiconductors, optical transmission and components, intent-based routing, network automation, and other areas.

Facebook (Meta) is perhaps the most influential of all webscalers due in part to its openness and support for the OCP and TIP organizations.

Asia Pacific records best recent revenue growth in 2021

Regionally, the strongest growth in 2021 was in Asia Pacific, where revenues grew 29% YoY. The more mature Americas region lagged, with growth of just over 21% YoY. That pushed Americas down to about 44% of global webscale revenues, from 45% in 2020. Asia Pacific follows, with a 36% global revenue share, then Europe (17%) and MEA (3%). The Americas still account for the majority of webscale capex, with the US at the center. For instance, both Alphabet and Facebook (Meta) say well over 70% of their “long-lived assets” are in the US. Going forward, the non-US portion should rise as the cloud providers within the webscale market build out their global data center footprints. In January 2022, for example, AWS launched its first data center in Jakarta, Indonesia, and is planning a new region in Mexico.

Profitability still relatively high, but weaker than 2020:

Using a standardized definition of free cash flow (cash from operations less capex), the webscale sector’s FCF was $347.4B in 2021, or 16.2% of revenues. That is down significantly from a 19.7% margin in 2020. This ratio is still high relative to many sectors, however. The decline is due largely to a webscaler choice to accelerate capex during the COVID dislocation; that should pay off over the long run. Oracle, for instance, saw its FCF drop from 30.8% in 2020 to 17.2% in 2021, due mainly to its rapid cloud expansion. Nonetheless, Oracle says it will continue capex at a roughly $1B per quarter run rate, as it aspires to be the fourth major cloud provider with global scope. Amazon is actually the worst hit company in terms of FCF margin drop, due directly to its enormous 2021 capex outlays: Amazon’s FCF in 2021 was -3.1%, from 6.7% in 2020. Amazon, however, says its 2022 infrastructure (AWS) capex will likely rise.

Cash on hand, including short-term liquid investments, amounted to $747B for the webscale sector at the end of 4Q21, down 2% from the end of 2020. Total debt increased by 7%, to $518B. As a result, net debt (debt minus cash) in Dec. 2021 was -$228B for the webscale sector, from -$280B in December 2020. The companies with the biggest stockpiles of cash (and equivalents) are Alphabet ($139.6B), Microsoft ($125.4B), Amazon ($96.0B), and Apple ($63.9B). Facebook has just $48B, but no debt at all. Apple, IBM, and Oracle all have significantly more debt than cash.

Top 8 webscalers remain the biggest spenders, but Oracle and Twitter also important

This webscale tracker considers a “Top 8” group of companies as being, traditionally, the most influential in the market’s overall technology development and investments. These include three Chinese Internet companies (Alibaba, Baidu and Tencent), the world’s leading smartphone provider (Apple), the world’s biggest social media company (Facebook), and the leading three cloud providers: Alphabet, Amazon, and Microsoft. Ranking webscalers based on their share of tech capex, Amazon tops the list easily, accounting for 27.0% of network/IT capex in 2021. Amazon is followed by Alphabet (16.2%), Microsoft (14.0%), Facebook (10.0%), Tencent (6.3%), Apple (5.0%), Alibaba (4.1%), Oracle (2.9%), Baidu (2.1%), IBM (1.7%), HPE (1.5%), and Twitter (1.3%). Amazon’s recent capex surge is well known, and has supported expansion of the company’s AWS footprint and service offerings. Oracle has been quieter but its capex growth is equally impressive, from a smaller base: 2021 capex was $3.1B, up 70% from 2020. Twitter, a new addition to our webscale coverage, spends more on network/IT capex as a percentage of revenues (over 19%) than all other webscalers, due to ongoing software development and construction of its first owned data center.

The facilities these webscale players are building can be immense. For instance, Microsoft started construction recently on two new data centers in Des Moines Iowa, each of which costs over $1B and measures over 167K square meters (1.8 million square feet). These two are part of a cluster in the area, as is often the case; Microsoft already has three facilities around Des Moines. Facebook is working on a project in DeKalb, Illinois, roughly half the size at 84.2K square meters, costing US$800M and spreading across 500 acres of land. This construction project was announced in 2020 but won’t complete until 2023. These are just two examples of the many big facilities in the works in the webscale sector.

Who benefits from webscale capex?

The network spending of big webscalers is centered around immense, “hyperscale” data centers and undersea cable systems that support network traffic from the tech companies’ online retail, video, and social media platforms, along with cloud services. Webscale network operators (WNOs) may also own access networks, typically using fiber, microwave or mmWave, and even fixed satellite. WNOs exploring outer space for providing connectivity include Amazon, Apple, Alphabet, Facebook, and Microsoft.

A broad set of vendors are benefiting from WNO capex spending – from semiconductor players selling into the data center market (Intel, AMD, Nvidia, Broadcom, etc), to optical components & transport vendors selling into data center interconnect markets (e.g. Infinera, II-VI, Lumentum/Neophotonics), to contract manufacturers of white box/OCP servers (e.g. Wistron and Quanta). Cisco, for instance, recorded approximately $4.0B in 2021 sales to the webscale sector, up from about $2.1B in 2020. The construction industry also sees webscale as important, as much of their capex is for development of data center properties.

Network investment outlook:

Our current forecast calls for $187B of webscale capex in 2022, and further growth in the out-years until capex hits about $252B in 2026. For now, we are maintaining these targets. Despite a modest slippage in profitability, cash/debt and top-line growth in 4Q21, the sector retains many strengths which won’t go away overnight. Cloud services revenue growth remains strong, as does profitability for most players. Moreover, 2022 capex guidance from the major webscalers suggests modest growth; a summary follows:

- Amazon: 4Q21 earnings call confirmed that network/IT (“infrastructure” for AWS) is about 40% of total, consistent with MTN Consulting assumptions. Other components are fulfillment/logistics and transportation. For future capex, it says “we’re still working through some of our plans for 2022, but it’s coming into focus a bit. We see the CapEx for infrastructure going up…we’re adding regions and capacity to handle usage that still exceeds revenue growth in that business. So we feel good about making those investments.”

- Facebook (Meta): still calling for 2022 capex, including principal payments on finance leases, in the range of $29-34 billion (2021 actual: $19.2 billion). Says capex is driven by investments in data centers, servers, network infrastructure, and office facilities, and next year’s figure “reflects a significant increase in our AI and Machine Learning investments, which will support a number of areas across our Family of Apps.”

- Alphabet: projects a “meaningful increase in CapEx” for 2022, due to both technical infrastructure (mainly servers) and office facilities, where the company says it is “reaccelerating investment in fit-outs and ground-up construction.”

- Microsoft: expects 1Q22 capex to decline sequentially versus 4Q21, a change from the prior year period when 1Q21’s total capex was up 22% versus 4Q20. Does not provide any longer-term guidance. Its pending acquisition of Activision Blizzard is likely a factor in future plans, for two reasons. First, the deal consumes a lot of cash, and second, absorbing Activision would likely come with some changes in data center strategy. Currently Activision does not have any of its own data centers, rather, it rents colocation space in third-party facilities. The combined company will clearly want to see benefits from Microsoft’s data center footprint.

- Oracle: expects capex to continue in the roughly $1B per quarter range through the end of its current fiscal year (May 2022).

- Tencent: no concrete guidance but has hinted at Facebook-like investments in the “metaverse,” says it has a lot of the building blocks needed, for example, “a lot of gaming experiences…very strong social networking experience…engine capability, we have AI capability, we have the capability to build a large server architecture that can serve a huge number of concurrent users. We are very experienced in managing digital content economies as well as real-life digital assets.”

- Apple: nothing concrete on capex specifically, but in April 2021 it announced “$430 billion in contributions to the US economy include direct spend with American suppliers, data center investments, capital expenditures in the US, and other domestic spend…”

- Alibaba: no concrete guidance but 4Q21 call said it will continue to “invest in expanding its international infrastructure,” saying it now provides cloud services in 25 regions globally and that it is “committed to serving the real economy for the long term and the digitalization of all industries”. At its Apsara conference in October 2021, the company unveiled several new proprietary products, including Yitian 710 server chip, the X-Dragon architecture, Panjiu cloud-native server series, Alibaba AI and big data platform and a new generation of PolarDB database. It has global aspirations for its IaaS and PaaS services.

- Baidu: hasn’t addressed capex recently but on 4Q21 earnings call cited strong cloud demand growth, and said it is “trying to retain rapid revenue growth for 2022 and beyond,” which will require infrastructure investments.

- Twitter: its capex appears to be moderating now that it has (largely) completed construction of its new data center.

While we are maintaining the forecast outlook as published in Dec 2021, Amazon is a wildcard. It provides no specific guidance, and is clearly the market leader. Its quarterly outlays will be watched carefully. Even if its total capex does moderate, it is possible that the network/IT % of total will rise.

Implications for carrier-neutral market segment:

Webscalers with cloud operations are building out their data center footprints, and most webscalers are deploying more complex functionality into their networks (video, gaming, AI, metaverse). However, webscalers do have some financial pressures, and more important have an increasingly rich range of options for how they expand. The carrier-neutral segment (CNNO) of data center players is investing heavily in larger, more hyperscale-friendly and energy efficient facilities. Further, the sector is consolidating with help from private equity. MTN Consulting expects webscalers to continue to lean heavily on these third-parties for expansion in 2022 and beyond. As a result, data center CNNOs like Digital Realty, Equinix and its JV partners, QTS/Blackstone, CyrusOne/KKR/GIP, American Tower/CoreSite, and GDS will become more attractive to vendors as they invest more in network technology of their own.

References:

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

MTN Consulting: Network operator capex forecast at $520B in 2025

Light Counting: Large majority of CSPs remain skeptical about Disaggregated Open Routers

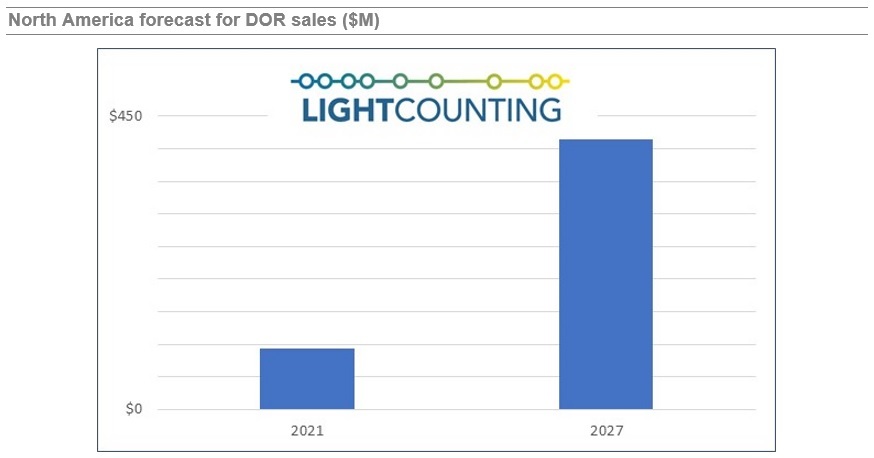

LightCounting’s second annual report provides an update on the emergence of the Disaggregated Open Routers (DOR) market in wireless infrastructure. DOR are white-box cell site, aggregation and core routers based on an open and disaggregated architecture for existing 2G/3G/4G and future 5G network architectures.

The DOR architecture was hailed as a new paradigm as early as 2012, using open source software for a centralized SDN Controller from the Open Network Foundation and Linux Foundation. The “open networking architecture” was envisioned to be used by tier 1 telcos and hyperscale cloud service providers and later extend to enterprise/campus networks. Well, that never happened!

Instead, hyperscalers developed their own proprietary versions of SDN, sometimes using a bit of open sourced software (e.g. Microsoft Azure). A few start-ups (e.g. Pica 8 and Cumulus Networks) developed their own software to run on white boxes and bare metal switches, including network operating systems, routing and network management.

One company that’s succeeded at customized software running over white boxes is

Israel based DriveNets. Indeed, the DriveNets software (see References below) is custom built- not open source! It’s an “unbundled” networking software solution, which runs over a cluster of low-cost white box routers and white box x86 based compute servers. DriveNets has developed its own Network Operating System (NOS), rather than use open source or Cumulus’ NOS as several other open networking software companies have done.

LightCounting’s research indicates that the overall DOR market remains incipient and unless proof of concept (PoC), testing and validation accelerate, volumes will take some time to materialize.

“Despite TIP’s (Facebook’s Telecom Infra Project) relentless efforts to push network disaggregation to all network elements and domains, and a flurry of communication service providers (CSPs) taking the lead with commercial DOR deployments like AT&T with DriveNets (NOS), UfiSpace (hardware) and Broadcom (networking silicon), a large majority of CSPs (Communications Service Providers) remain skeptical about the potential opex reduction, the maturity of transport disaggregation, and the impact on operations, administration, maintenance, procurement and support.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

Source: Light Counting

That quote is quite different from Stephane’s comment one year ago that the DOR market was poised for imminent growth:

“Still incipient, the DOR market is just about to take off and is here to stay but requires more CSPs (Communications Service Providers) to take the plunge and drive volumes. And with China’s lack of appetite for DOR, North America is taking the lead.”

Major findings in the report are the following:

- The open RAN ascension brought router disaggregation to the spotlight and paved the way to four fundamental routes. This phenomenon would have never happened without TIP’s initiative.

- Although NOS software vendors are mushrooming and by far outnumbering the white box hardware suppliers dominated by UfiSpace, there have been some casualties down the DOR road. In the networking silicon domain, Broadcom remains predominant.

- CSPs remain cautiously optimistic about router disaggregation but have yet to see more maturity and the full benefits. As AT&T is showing the DOR way, KDDI and LG U+ could be DriveNets’ next major customers.

- With all inputs from all vendors and CSPs with DOR rollout plans taken into consideration, our cell site-based model produced a forecast showing a slow start that reflects the early stage of this market and an uptick at the end of the 2021-2026 forecast period marked by a double digit CAGR.

About the report:

LightCounting’s Disaggregated Open Routers report explores the emergence of the Disaggregated Open Routers (DOR) market. Disaggregated open routers are white-box routers based on separated white box hardware and software with cloud enabled software functions for existing 2G/3G/4G and future 5G network architectures. The report analyzes the disaggregated open routers’ (aggregation and core) architectures and implementations in wireless infrastructure, including the emerging vendor ecosystem, and tracks white box hardware units and sales, and software sales, all broken down by region including North America, Europe Middle East Africa, Asia Pacific, and Caribbean Latin America. It includes the total number of cell sites worldwide and a 5-year market forecast.

Historical data accounts for sales of the following vendors:

| Vendor | Software | Hardware/White Box | Source of Information | |

| Adva | Ensemble Activator | Survey data and estimates | ||

| Altran | Intelligent Switching Solution (ISS) | |||

| Alpha Networks | Hardware platform | |||

| Arrcus | ArcOS | |||

| Aviat Networks & Metaswitch (Microsoft) | AOS | |||

| Cisco | IOS XR7 | |||

| Datacom | DmOS | |||

| Dell Technologies | NOS | Hardware platform | ||

| Delta Electronics | AGCXD40V1, AGCV208S/AGCV208SV1, AGC7008S | Estimates | ||

| DriveNets | DNOS | |||

| Edgecore Networks | AS7316-26XB, AS7315-27X, AS5915-18X | Survey data and estimates | ||

| Exaware | ExaNOS | |||

| IP Infusion | OcNOS, DANOS | Estimates | ||

| Infinera | CNOS | DRX Series | Survey data and estimates | |

| Niral Networks | NiralOS | |||

| UfiSpace | S9700-53DX, S9700-23D, S9705-48D, S9500-30XS | Survey data and estimates | ||

| Volta Networks (now in IBM) | VEVRE | |||

| Note: Not all vendors provide services |

References:

https://www.lightcounting.com/report/march-2022-disaggregated-open-routers-135