Author: Alan Weissberger

UK’s Manufacturing Technology Centre (MTC) installs a standalone 5G private network from BT and Nokia

BT is participating in a UK publicly funded 5G Standalone (SA) core network testbed project with Nokia. Officially unveiled this week, the project involves installation of Nokia’s 5G SA equipment at Coventry’s Manufacturing Technology Center (MTC).

This project is part of the West Midlands 5G (WM5G) initiative, which is supported by the UK government’s 5G Test Beds and Trials funding program. It will give SMEs, corporate members, neighboring universities, and the wider industry the opportunity to explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the programme.

The goal is to “explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the program,” according to the group’s announcement.

Businesses and universities, along with “wider industry,” are given the chance to use MTC facilities to test the technology. This includes the center’s recently launched “5G-enabled demonstrator system,” which provides features such as 5G-connected robotics, computer vision and edge computing.

One use case under review is an “automated inspection process” to prove how intelligent automation and advanced connectivity could enable manufacturing sites to maximize productivity and utilization of inspection technology (while also reducing footprint and product waste).

MTC points out that traditional in-person inspections can be time consuming and prone to human error. Neither are they automatically recorded.

BT Enterprise CEO Rob Shuter told Light Reading: “It’s why 5G conversations in the enterprise space are more around deploying a private network over a manufacturing facility, a harbor, a military base etc,” he said. “I’d say we’re in the early stages of that. The technology is still maturing and customer needs are sort of emerging in a co-creation phase. I think we’ll be in that phase for most of this year, and it’ll probably be industrial scaling in ’23, ’24 and ’25.”

BT’s new Division X is spearheading the company’s efforts to sell new solutions to enterprise customers. Marc Overton, former Sierra Wireless SVP, was recently appointed Division X managing director.

Quotes:

Andy Street, Mayor of the West Midlands, said: “This innovative collaboration between WM5G and MTC will enable some of our region’s most cutting-edge businesses to power forward their pioneering work in computing and robotics alongside our dynamic universities. Given the commitment to Innovation Accelerators set out in the Levelling Up White Paper, this announcement is wonderfully timed”.

Robert Franks, Managing Director at WM5G, said: “Manufacturing is at the heart of the economy in the West Midlands, and at WM5G we are working collaboratively with our partners to ensure that public and private sector organisations can remain competitive in the global marketplace and develop cutting edge technologies to advance their capabilities.

“We are so pleased to have delivered a successful trial in partnership with nexGworx and BT at the MTC, driving forward the transformation of manufacturing productivity for the region. The learnings and outcomes from our demonstration will now be used and applied across the sector to ensure best practice is carried forward, and to accelerate the adoption of 5G technology more widely.”

Alejandra Matamoros, Technology Manager in the MTC’s Digital Engineering Group, said: “Our connected facility at the MTC will allow manufacturers of all sizes, research, and technology suppliers to explore the benefits of 5G in manufacturing. Through our enduring collaboration with nexGworx and BT we are now planning to further build on the initial capability we’ve created here at the MTC to push the boundaries of what can be achieved with the help of 5G technology.

“We hope that this project will inspire further development of innovative solutions to solve real business challenges and develop new opportunities through advanced wireless connectivity.”

https://www.lightreading.com/5g/bt-gets-into-5g-sa-testbed-with-nokia/d/d-id/776162?

Dish Network to FCC on its “game changing” OpenRAN deployment

Through disaggregation of the Radio Access Network (RAN) into functional blocks/modules and defining open interfaces between those modules, OpenRAN technology promises to allow newer, smaller players to sell into the 4G/5G equipment market. The intent is to offer more choices for cellular network operators who buy most of their gear from 4 or 5 big base station vendors.

Open RAN has been endorsed by 5G upstarts like Dish Network and Rakuten in Japan, but also by five big European carriers – Deutsche Telekom, Orange, Telecom Italia (TIM), Telefónica and Vodafone – which want to build an Open RAN ecosystem in Europe. AT&T has also expressed interest in the technology. However, there remains a lot of skepticism, especially for brownfield carriers.

…………………………………………………………………………………………………………………..

On March 14th, Dish Network executives participated in a video conference with a several FCC officials to discuss the company’s plans to launch a nationwide 5G network using Open RAN technology. Present on behalf of DISH were Stephen Bye, Chief Commercial Officer; Marc Rouanne, Chief Network Officer; Jeffrey Blum, Executive Vice President, External and Legislative Affairs; Sidd Chenumolu, Vice President, Technology Development; Alison Minea, Vice President, Regulatory Affairs; William Beckwith, Director of Wireless Regulatory Affairs; Hadass Kogan, Director & Senior Counsel, Regulatory Affairs; and Michael Essington, Senior Manager, Public Policy.

According to a Dish filing, the FCC requested the meeting to learn more about how Dish plans to deploy OpenRAN, rather than traditional purpose built RAN equipment, to build their 5G cellular network.

Ahead of its June 14, 2022 buildout milestone, DISH is launching a first-of-its-kind, cloud native, virtualized O-RAN 5G network in several major metropolitan areas of the country. Because DISH is building a greenfield network, we have the flexibility to choose the best technology to enter the market. While legacy carriers built closed end-to-end networks, DISH chose O-RAN because, among other reasons, it offers lower capital and operating costs, and is more resilient, secure, and energy efficient. In cooperation with more than 30 technology partners, DISH will offer a real-world example of the benefits of O-RAN as our 5G network rolls out to customers this year.

If more American carriers see the benefits of O-RAN and are able to adopt it as their networks evolve, the United States will be a stronger competitor in the global market. O-RAN is a game changer, among reasons, because:

- O-RAN networks increase vendor diversity

- O-RAN enhances spectrum utilization and enables network slicing

- O-RAN supports national security and cybersecurity objectives

- O-RAN networks are more secure and more agileO-RAN networks are more secure and more agile

In February 2021, the FCC published an OpenRAN Notice of Inquiry, stating:

Some parties assert that open radio access networks (Open RAN) are a potential path to drive 5G innovation, with industry proponents arguing that it could provide opportunities for more secure networks, foster greater vendor diversity, allow for more flexible network architectures, lower capital and operating expenses, and lead to new services tailored to unique use cases and consumer needs; others contend that Open RAN is still in its most formative stages, and that while promising, significant work remains before the benefits of the concept can fully be realized.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

The financial analysts at New Street Research, say that U.S. government legislation could pave the way for “$1.5 billion for the Public Wireless Supply Chain Innovation Fund to deploy Open RAN equipment to spur movement toward open architecture, software-based wireless technologies and funding innovative leap-ahead technologies in the US mobile broadband market.”

The analysts added, “That provision might be of particular value to Dish, which is building out its network based on that technology.”

References:

https://www.lightreading.com/open-ran/fcc-calls-on-dish-about-open-ran/d/d-id/776166?

https://www.nokia.com/about-us/newsroom/articles/open-ran-explained/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.sdxcentral.com/articles/news/dish-missed-every-5g-commitment-it-made-in-2021/2021/12/

New Study: Internet and Mobile Services were less affordable in 2021

Internet connectivity became less affordable worldwide in 2021, according to new data from the ITU-D and the Alliance for Affordable Internet (A4AI).

The new study shows an increase in fixed and mobile broadband costs during the pandemic. Relative prices of fixed broadband services increased to 3.5 percent of gross national income (GNI) per capita worldwide in 2021, from 2.9 percent in 2020. The relative price of mobile broadband services worldwide increased from 1.9 percent to 2 percent of GNI per capita.

It shows that many people have sacrificed other services and goods to start connected during the pandemic, with those who can staying largely connected, even at relatively higher prices. The report shows that fewer economies worldwide meet the UN Broadband Commission’s affordable cost target of 2 percent of monthly GNI per capita for entry-level broadband.

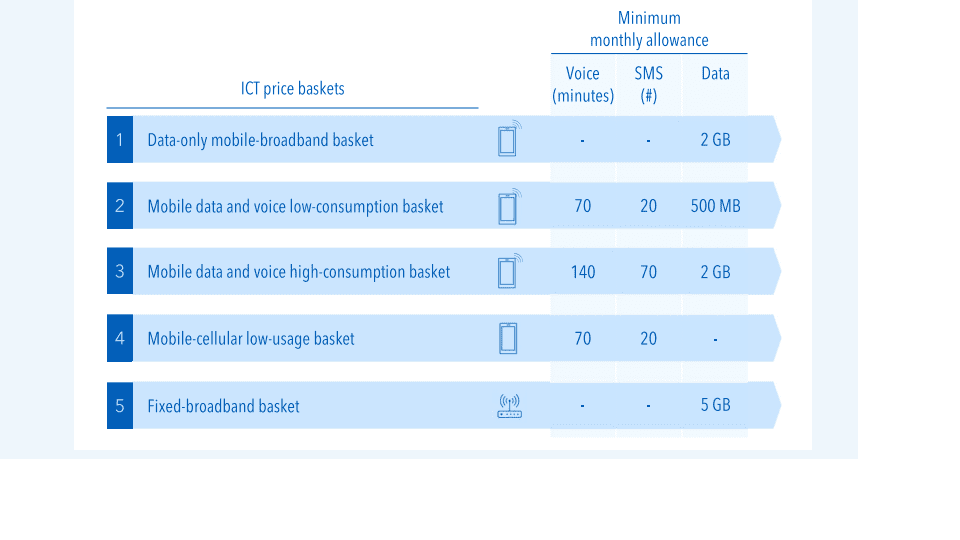

The policy brief analyzes the prices of five baskets: mobile broadband, fixed broadband, mobile data and voice low-usage, mobile data and voice high-usage and mobile cellular low usage. The figure below provides a simplified overview of the each of the five baskets used in the 2021 data collection.

https://www.itu.int/en/ITU-D/Statistics/Pages/ICTprices/default.aspx

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

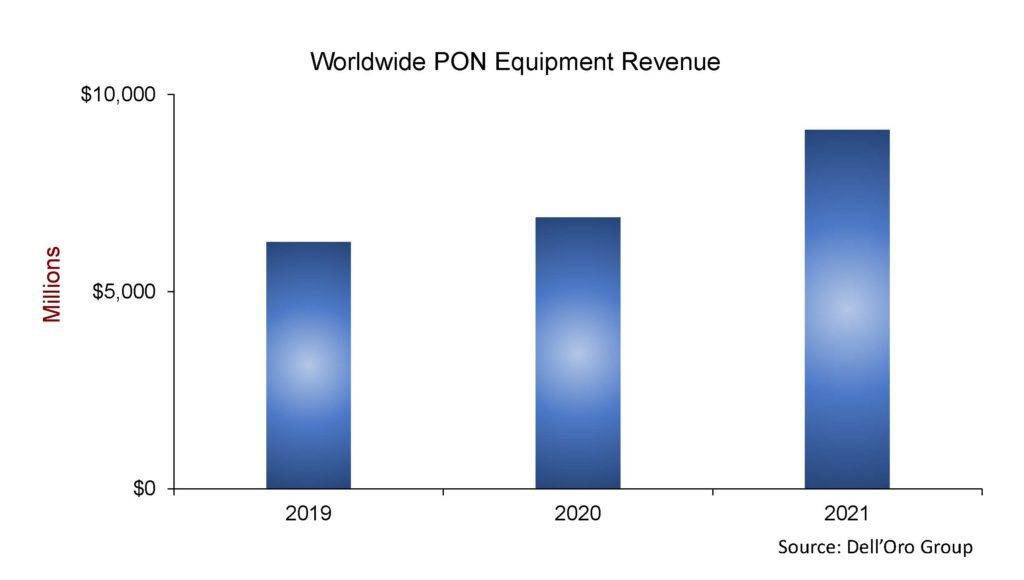

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $16.3B in 2021, up 12 percent year-over-year (Y/Y). Growth came once again from spending on both PON infrastructure and fixed wireless CPE.

“2021 was a record year for PON (Passive Optical Network) equipment spending, with some of the highest growth coming from the North American market, where expansion projects and fiber overbuilds are picking up considerably,” said Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “These fiber expansion projects show no signs of slowing heading into 2022.”

Additional highlights from the 4Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue increased 4 percent Y/Y to just over $1B. Steady growth in Distributed Access Architecture (DAA) deployments helps offset declines in traditional CCAP licenses.

- Total PON ONT unit shipments reached a record 140 M units for the year, bucking the supply chain constraints that have dogged the cable CPE market.

………………………………………………………………………………………………………..

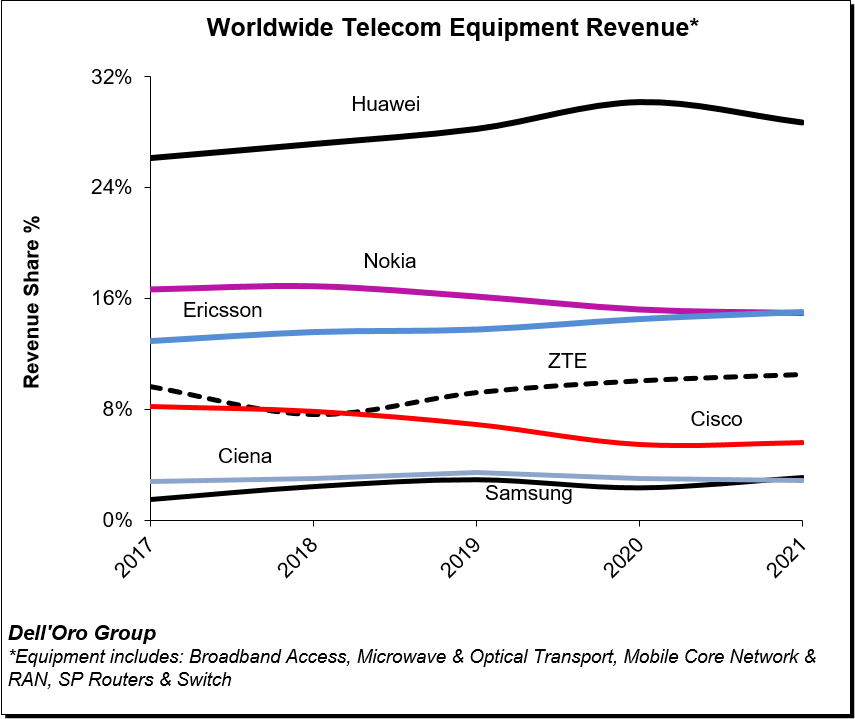

Separately, Dell’Oro just completed the 4Q2021 reports for all the Telecom Infrastructure programs covered, including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch. The data contained in these reports suggests that total year-over-year (Y/Y) revenue growth slowed in the fourth quarter to 2%, however, this was not enough to derail full-year trends.

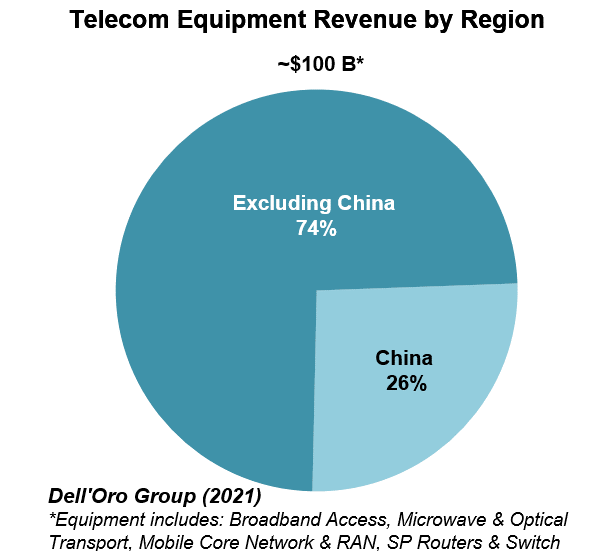

The market research firm estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

In addition to challenging comparisons, we attribute the weaker momentum in the fourth quarter to external factors including COVID-19 restrictions and supply chain disruptions.

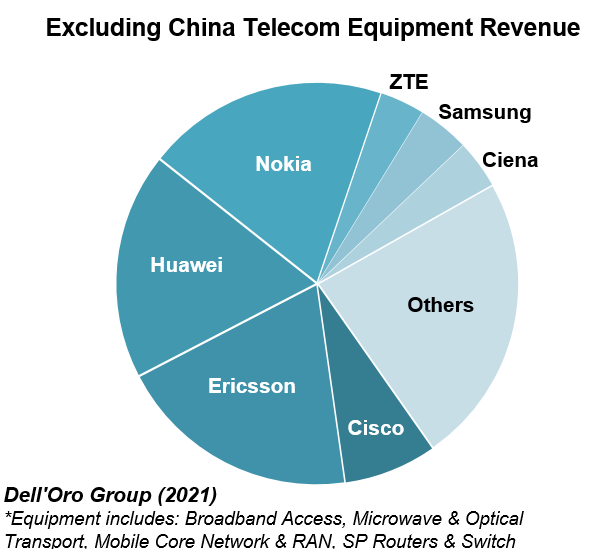

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 2021, with the top seven vendors comprising around 80% of the total market.

Despite U.S. sanctions, Huawei continued to lead the global market, underscoring its grip on the Chinese market, depth of its telecom portfolio, and resiliency with existing footprints. Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

The relative growth rates have been revised upward for 2022 to reflect new supply chain and capex data. Still, global telecom equipment growth is expected to moderate from 7% in 2021 to 4% in 2022.

Risks are broadly balanced. In addition to the direct and indirect impact of the war in Ukraine and the broader implications across Europe and the world, the industry is still contending with COVID-19 restrictions and supply chain disruptions. At the same time, wireless capex is expected to surge in the U.S. this year.

…………………………………………………………………………………………………..

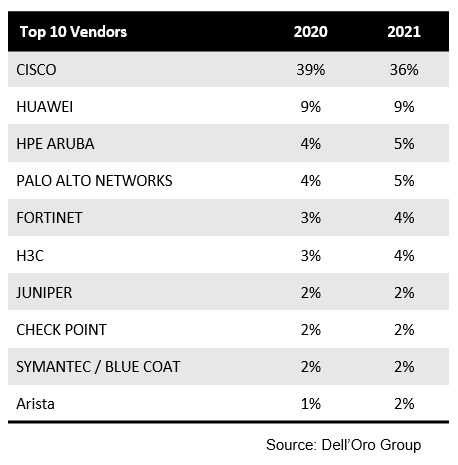

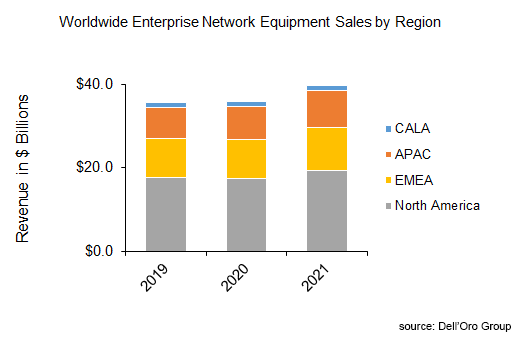

Top 10 Enterprise Network Equipment Vendors:

References:

Key Takeaways—2021 Total Enterprise Network Equipment Market

5G in India to be launched in 2023; air traffic safety a concern; 5G for agricultural monitoring to be very useful

Telecom Service Providers, informed India’s Minister of State for Communications Devusinh Chauhan on Wednesday that 5G mobile services are likely to be launched during the second half of the year 2022-23. The minister, in a written reply to Lok Sabha, also denied any impact of the 5G wave on airlines’ communication system. “The frequency band opened for International Mobile Telecommunications (IMT), including 5G Technology, in India has enough guard bands to ensure that there is no aeronautical interference. Therefore, the question of conducting study does not arise,” informed the minister.

In January, the 6,000-pilotstrong Federation of Indian Pilots wrote to Civil Aviation Minister Jyotiraditya M. Scindia and requested him to ask the Directorate General of Civil Aviation (DGCA) and the Telecom Regulatory Authority of India (TRAI ) work in tandem to develop a plan that enables the safe and efficient implementation of fifth generation (5G) mobile communications networks in the C-band. On the infrastructure required for 5G, Devusinh Chauhan said the infrastructure required for rolling out 5G services in the country is to be developed by the TSPs based on requirements and their business plan. The proposed 5G spectrum auction in the country is likely to be held before the month of August. At present, Telecom Regulatory Authority of India is expected to come out with its recommendations for the upcoming 5G auction by the end of this month. Once the Telecom Regulatory Authority of India submits its report, the department of telecommunications (DoT) will commence the process to auction the airwaves.

Separately, Dr P D Vaghela, Chairman of TRAI said that Hyderabad States will attract more investments and generate employment with a robust telecom infrastructure, which will lead to an enhanced economy.

“For the implementation of industrial automation (industry 4.0), precision agriculture, smart education, automation in healthcare, and many areas, the State governments must strive to have the best and latest telecom technology in their State such as 5G, IoT, AI, Augmented Reality, Virtual Reality, etc.,” he said. Addressing the Administrative Staff College of India’s (ASCI) online public lecture titled ‘5G: A Next-Generation Technology’, on Wednesday, he spoke on introduction to 5G and key performance indicators, use cases of 5G, role of State governments, the growth of telecom in India, and government initiatives in the broadband and telecom reforms.

In agriculture, he said that 5G was going to be helpful for monitoring along with sensor networks, precision farming, smart irrigation, climate change mitigation, livestock monitoring, and agricultural drones. Apart from being beneficial in smart mining through real-time condition monitoring, he said that in the field of online education and learning which requires high-speed data connectivity, 5G technology is capable of providing the requisite bandwidth for students and institutions. It also augments video surveillance and analytics, solid waste management, and intelligent parking in smart cities, and that the technology would create an immersive experience in video streaming, gaming and sports domain, where user/machine-generated content from smart devices could help users to share data in real time, which is likely to improve the user experience. Vaghela spoke about satellite- based communication being implemented in North- Eastern States and how it was helpful in far-flung hilly and rural areas. Observing that BharatNet project could change the scenario, he said that the last six years had seen a revolutionary change in rural areas in terms of growth of telecom and digital services.

References:

The New Indian Express newspaper

IDC Worldwide Private LTE/5G Wireless Infrastructure Forecast reveals 4G-LTE Dominates

The global private LTE/5G wireless infrastructure market is forecast to reach revenues of $8.3 billion by 2026, an increase compared to revenues of $1.7 billion in 2021, according to new research from International Data Corporation (IDC). IDC said that this market is expected to achieve a five-year compound annual growth rate (CAGR) of 35.7% over the 2022-2026 forecast period.

The report, Worldwide Private LTE/5G Infrastructure Forecast, 2022-2026 (IDC #US48891622), presents IDC’s annual forecast for the private LTE/5G wireless infrastructure market. The forecast includes aggregated spending on RAN, core, and transport infrastructure as well as spending by region; it excludes services or publicly owned and operated networks that carry shared data traffic. The report also provides a market overview, including drivers and challenges for technology suppliers, communication service providers, and cloud providers.

IDC defines private LTE/5G wireless infrastructure as any 3GPP-based cellular network deployed for a specific enterprise/industry vertical customer that provides dedicated access to private resources. (Yet IDC does not state what 3GPP Release(s) or whether necessary 5G capabilities, like specs for URLLC have been completed and performance tested). This could include dedicated spectrum, dedicated hardware and software infrastructure, and which has the ability to support a range of use cases spanning fixed wireless access, traditional and enhanced mobile broadband, IoT endpoints/sensors, and ultra-reliable, low-latency applications.

“Enterprise or industry verticals, such as manufacturing, retail, utilities, transport, and public safety are leading the charge for private LTE, and eventually private 5G networks, driven by a desire to capture productivity gains, enable automation, and improve customer experience. While the demand metrics are relatively understood, the emerging private cellular ecosystem presents several road maps, each with particular advantages and disadvantages. While an enterprise (within any industry vertical) will eventually need to assess its own needs internally, understanding the implications from each road map can provide a starting point,” said Patrick Filkins, IDC senior research analyst, IoT and Mobile Network Infrastructure.

“The private LTE/5G wireless market showcased in 2021 that although its growth is somewhat immune to macro challenges associated with the global pandemic, it still requires a significant amount of market-level solutioning to address the pain points associated with unlocking the full 5G solution. This includes curating and scaling a robust set of 5G device platforms, which still requires more work across the ecosystem, particularly as it relates to vertical-specific solutioning,” Filkins added.

IDC noted that the worldwide market for private LTE/5G wireless infrastructure continued to gain traction throughout 2021. The research firm highlighted that private 4G-LTE remained the predominant private cellular network revenue generator during 2021. However, Private 5G marketing, education, trials, and new private 5G products and services also began to see market availability. IDC also said that most private 5G projects to date remain as either trials or pre-commercial deployments.

“Heightened demand for dedicated or private wireless solutions that can offer enhanced security, performance, and reliability continue to come to the fore as both current and future applications, particularly those in the industrial sector, require more from their network and edge infrastructure. While private LTE/5G infrastructure continues to see more interest, the reality is 5G itself continues to evolve, and will evolve for the next several years. As such, many organizations are expected to invest in private 5G over the coming years as advances are made in 5G standards, general spectrum availability, and device readiness,” Filkins said.

The report forecasts that the market for 5G private networks will reach $47.5 billion in 2030, up from $221 million last year, while the total market for 4G private networks will go from $3.54 billion in 2021 to $66.88 billion in 2030. IDC also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

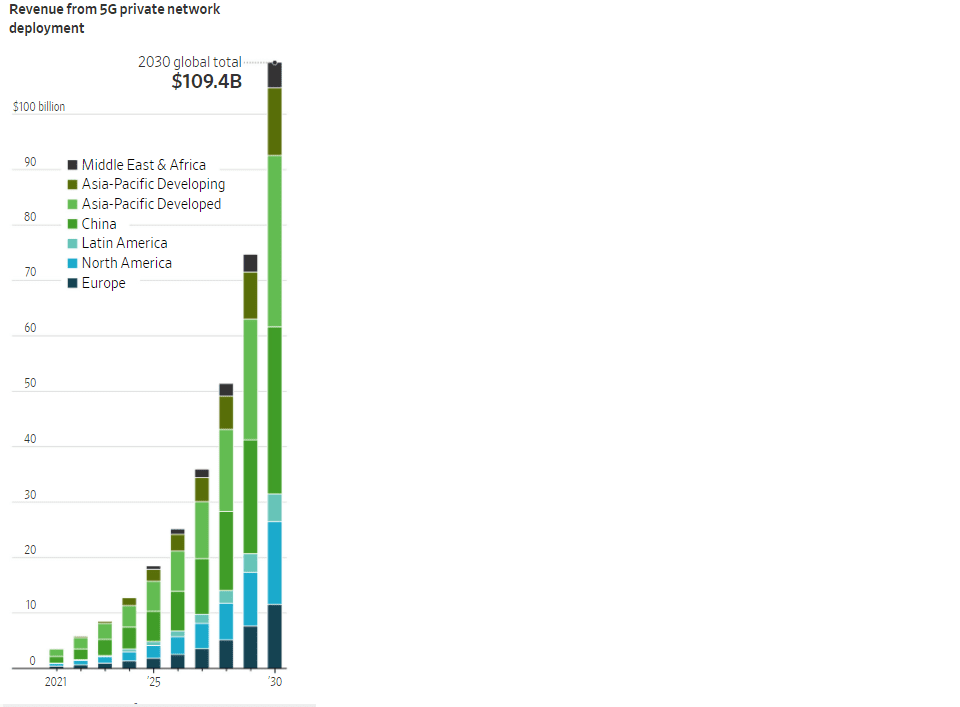

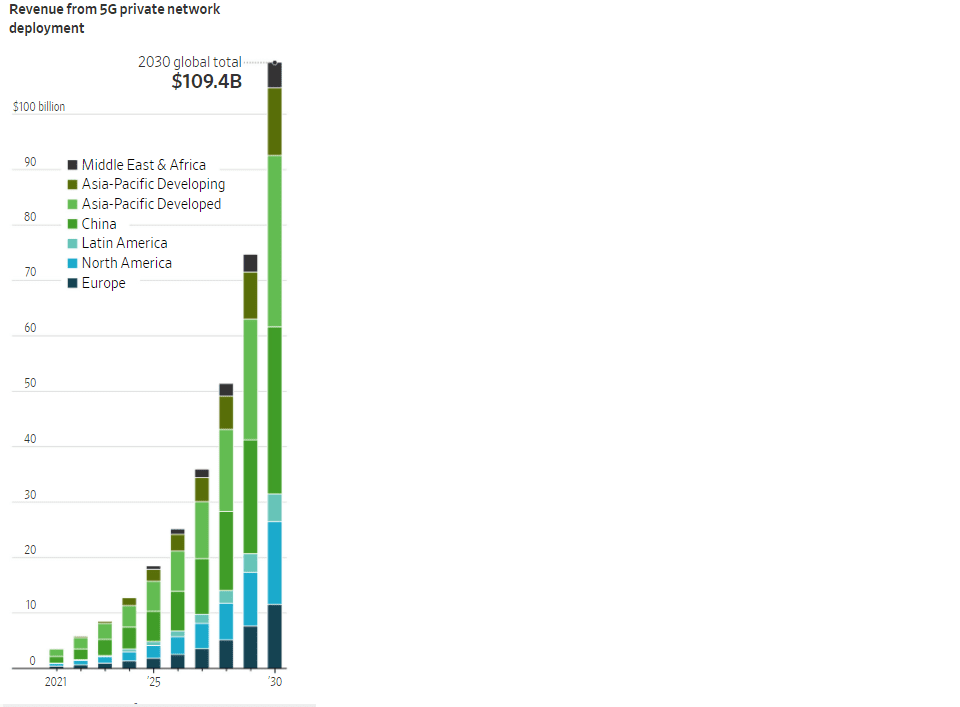

The total addressable market for private networks – including the Radio Access Network, Mobile-access Edge Computing (MEC), core, and professional services – is forecast to increase from $3.7 billion in 2021 to more than $109.4 billion in 2030, according to a recent report by ABI Research. However, a quote in the article introducing that report was dead wrong:

“While the Third Generation Partnership Project (3GPP) has frozen Release 16 (standardizing Ultra-Reliable Low-Latency Communication (URLLC)), Release 16-capable chipsets and devices have not yet emerged in the market. As enterprises require Time-Sensitive Networking (TSN), as well as high availability and reliability of their connection, they are reliant on Release 16 and are, therefore, waiting for compatible chipsets and infrastructure to enter the market. As this is not expected to happen until 2023, enterprise 5G will mature much more slowly than previously anticipate,” ABI Research said.

–>THAT IS BECAUSE EVEN THOUGH 3GPP RELEASE 16 WAS FROZEN IN JUNE 2020, “URLCC IN THE RAN” SPEC WAS NOT COMPLETED AT THAT TIME. Before that spec can be implemented, it must be independently tested to ensure it means the ITU-R M.2410 performance requirements for BOTH ultra high reliability and ultra low latency corresponding to the 5G URLLC use case. As of 16 March 2022 (today), 3GPP Release 16 URLLC in the RAN is only 74% complete!

| 830074 | NR_L1enh_URLLC | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | 74% | Rel-16 | RP-191584 |

ABI also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

Note: 2022 to 2030 are forecasts. Source: ABI Research

“As manufacturers advance their digital transformation initiatives, they drive up spending on smart manufacturing with investments in factories that adopt Industry 4.0 solutions like Autonomous Mobile Robots (AMRs), asset tracking, simulation, and digital twins,” ABI said. ” While most of the revenue today is attributed to hardware, the greater reliance on analytics, collaborative industrial software, and wireless connectivity (Wi-Fi 6, 4G, 5G) will drive value-added services revenue — connectivity, data and analytic services, and device and application platforms — to more than double over the forecast.”

Meanwhile, Dell’Oro Group VP Stefan Pongratz wrote in an email to this author,” We have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,200 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48948422

https://www.idc.com/getdoc.jsp?containerId=US48891622

Global market for private networks to exceed $109 billion in 2030: Study

https://www.3gpp.org/DynaReport/GanttChart-Level-2.htm (Release 16)

Nokia and Antofagasta Minerals deploy private wireless network to accelerate digital transformation in Chile

Nokia and Antofagasta Minerals deploy private wireless network to accelerate digital transformation of Minera Centinela operations in Chile.

Nokia said it has won a contract to provide industrial-grade private wireless network capability in one of the four copper mines run by Antofagasta Minerals in Chile.

- Nokia industrial-grade private wireless network to provide reliable, high-capacity and low latency connectivity for sensors and vehicles at the Centinela mine

- Private 4.9G/LTE network, deployed within four months, will support operations, including an autonomous fleet of trucks, as part of a five-year digitalization plan

- Antofagasta Minerals, one of the world’s leading copper miners, has four operations in Chile, Minera Centinela being one of them

The Minera Centinela facility mines sulphide and oxide deposits 1,350km north of Santiago in the Antofagasta region, one of Chile’s most important mining areas. Centinela produces copper concentrate (containing gold and silver) through a milling and flotation process, as well as molybdenum and gold. It also produces copper cathodes, using the solvent extraction and electrowinning (SX-EW) process.

In August 2021, Centinela obtained the Copper Mark, which certifies that the company operates under strict internationally recognised sustainable production standards.

The new 5G network is designed to not only support secure and reliable operations at the mine, but also to enable the mining group to accelerate its digital transformation.

A Nokia-sponsored IDC infobrief revealed that safety is a key consideration when identifying initiatives for transformation, and that sustainability tops miners’ strategic objectives. The report quotes IDC’s 2021 Worldwide mining decision maker survey, which highlighted the increasing adoption of digital transformation strategies in mining, with 86% of mining companies planning to invest in wireless infrastructure in the next 18 months.

Image Credit: Minera Centinela

……………………………………………………………………………………………………….

Gino Ivani, Technology Manager for Antofagasta Minerals, said: “We are transforming the way mining is done. We want to deliver excellence in everything we do, leveraging operational efficiencies to achieve the best results. We are committed to sustainable mining and to providing the safest and most efficient facilities. We are very pleased to leverage Nokia industrial-grade private wireless solutions and its experience in mining automation to support our efforts.”

Leonardo Serra, corporate head of IT projects at Antofagasta Minerals, said: “Copper is critical for the delivery of clean energy and consequently to reduce emissions. As demand for copper increases, we are deploying technology innovations, such as Nokia private wireless connectivity, allowing us to enhance productivity in a smart and sustainable way.”

Marcelo Entreconti, Head of Enterprise for Latin America at Nokia, said: “We are witnessing the first wave of Industry 4.0 projects in Latin America and it is very exciting to watch them become a reality for mining companies like Antofagasta Minerals. Nokia industrial-grade private wireless delivers the robust, secure, predictable and deep wireless coverage that mines require for large outdoor areas or underground complexes. Deploying these networks is considered the first and most important step in the digitalization journey of mining companies, and lays the groundwork for an expansion beyond connectivity where Nokia is already proposing solutions to the global mining community.”

Nokia designed and deployed the industrial-grade network based on a private 4.9G/LTE solution, including Nokia AirScale radio equipment, mobile packet core, IP/MPLS service aggregation routers, and Wavence microwave transmission.

Antofagasta’s Centinela open pit mine is located approximately 1,350 kilometers north of Santiago at an important mining zone with sulfur and oxides. The mine produces copper concentrate and cathodes, as well as molybdenum and gold. In August 2021, Centinela obtained the Copper Mark, which certifies that the company operates under strict internationally recognized sustainable production standards.

Additional resources:

Webpage: Nokia solutions for the mining industry

White paper: Mining and mission-critical wireless connectivity

References:

https://finance.yahoo.com/news/nokia-antofagasta-minerals-deploy-private-150600139.html

https://www.computerweekly.com/news/252514632/Nokia-Antofagasta-Minerals-dig-deep-for-private-5G-wireless-network

Gartner’s Magic Quadrant for 5G Network Infrastructure for Communications Service Providers

Gartner’s Magic Quadrant for 5G Network Infrastructure for Communications Service Providers is intended to help communications service providers identify and evaluate network equipment providers for their 5G network infrastructure. This end-to-end 5G network infrastructure includes RAN, core network, transport and network infrastructure services.

-

Radio access network equipment, including radio units (RUs), baseband units (BBUs) for 5G new radio and 4G LTE. Examples include the following:

-

Passive antennas, RU, AAU, virtualized BBU (vBBU), BBU, DU, CU, vDU, vCU and small cell

-

-

Core network equipment, including 5G next-generation core and evolved packet core (EPC):

-

UPF, AMF, SMF, PCF, AUSF, UDM, NSSF, NRF, NEF, NWDAF for 5G

-

MME, S-GW, P-GW, IMS, HSS, PCRF, EPC/virtualized EPC (vEPC) for 4G LTE

-

-

Transport network equipment: Fronthaul, midhaul, backhaul and wireless backhaul

-

Network infrastructure services: Design, build, run and support

- Ericsson is a Swedish multinational networking and telecommunications company that offers services, software and infrastructure in information and communications technology for CSPs. Ericsson has long had a strong focus on 3rd Generation Partnership Project (3GPP)-based mobile networks, and it was one of the leaders in terms of numbers of LTE deals. The company’s 5G offerings, including Ericsson Radio System, 5G Core, Orchestration and 5G Transport, together with its professional services, help it maintain a strong position to win 5G business.

- Huawei is a Chinese information and communications technology (ICT) provider, and its business spans carrier business, consumer business and enterprise business. The company’s 5G market success came from its end-to-end robust cellular network portfolio, including macrocells, small cells, single RAN BBUs, converged core, transport network and professional services, together with devices. Huawei continues investing in 5G R&D, with the focus on network performance, capacity and energy efficiency using innovative hardware and software. The company plans to contribute to CSPs by continuously providing an enhanced 5G product portfolio.

- Nokia is a Finnish multinational telecommunications and IT company. While Nokia’s telecom infrastructure business has grown through multiple acquisitions and mergers, such as Alcatel-Lucent, a new CEO took the helm of the company in August 2020 and announced a new operating model and strategy refresh. Its business focuses on mobile, fixed IP and optical networks, cloud, and network services, supported by patents and standards from Nokia Bell Labs. Nokia is one of the market leaders in terms of numbers of 4G LTE deals and is pursuing the same path with 5G contracts.

Visionaries: ZTE, Samsung, NEC, Mavenir

Niche Players: Fujitsu, Rakuten Symphony (?), FiberHome Telecommunication Technologies (China)

FCC: Over $640 Million for Rural Broadband in 26 States via Rural Digital Opportunity Fund

The FCC has announced that over $640 million of funding will be made available through the Rural Digital Opportunity Fund. The investment will be used for new broadband deployments in 26 states and will cover nearly 250,000 locations.

The Rural Digital Opportunity Fund has already provided over $4.7B in Broadband funding for nearly 300 carriers in 47 states serving over 2.6M U.S. locations.

On January 30, 2020, the Commission adopted the Rural Digital Opportunity Fund Report and Order, which establishes the framework for the Rural Digital Opportunity Fund, building on the success of the CAF Phase II auction by using reverse auctions in two phases. The Phase I auction, which began on October 29, 2020, and ended on November 25, 2020, awarded support to bring broadband to over five million homes and businesses in census blocks that were entirely unserved by voice and broadband with download speeds of at least 25 Mbps. Phase II will cover locations in census blocks that are partially served, as well as locations not funded in Phase I. The Rural Digital Opportunity Fund will ensure that networks stand the test of time by prioritizing higher network speeds and lower latency, so that those benefitting from these networks will be able to use tomorrow’s Internet applications as well as today’s.

- Sending letters to 197 applicants concerning areas where there was evidence of existing service or questions of waste. Bidders have already chosen not to pursue support in approximately 5,000 census blocks in response to the Commission’s letters.

- Denying waivers for winning bidders that have not made appropriate efforts to secure state approvals or prosecute their applications. These bidders would have otherwise received approximately $350 million.

- Conducting an exhaustive technical, financial, and legal review of all winning bidders.

- A list of the eligible census blocks covered by the winning bids announced today is available under the “Results” tab.

- For a list of RDOF providers and funding amounts by state is at: https://www.fcc.gov/auction/904.

March 25th Update:

The FCC has authorized more than $313 million through the Rural Digital Opportunity Fund to finance new broadband deployments in 19 states bringing service to over 130,000 locations. This is the eighth round of funding in the program, which to date has provided over $5 billion in funding for new deployments in 47 states to bring broadband to over 2.8 million locations.

“The funding announced today will help hundreds of thousands of Americans get access to high-speed, reliable broadband service,” said Chairwoman Jessica Rosenworcel. “We continue our expanded oversight of this program through the Rural Broadband Accountability Plan to make sure that applicants deliver services as promised to areas that truly need help.”

The Rural Digital Opportunity Fund aims to fund new broadband deployments in areas across the U.S. with limited or no connectivity.

The winning bidders from the latest round are:

- Carolina Telephone and Telegraph

- Central Telephone Company of Virginia

- Central Virginia Services

- CenturyLink of Louisiana

- CenturyTel of Alabama

- CenturyTel of Michigan

- CenturyTel of Montana

- CenturyTel of Northwest Arkansas

- CenturyTel of the Midwest – Wisconsin

- CenturyTel of Washington

- Co-Mo Comm

- Columbia Fiber

- Embarq Florida

- Jasper County Rural Electric Membership Corporation

- LigTel Communications

- OzarksGo

- Qwest Corporation

- South Central ConnectSpectra Communications Group

- Tri-County Electric Cooperative

https://www.fcc.gov/document/fcc-announces-313-million-through-rural-digital-opportunity-fund

………………………………………………………………………………………..

References:

https://www.fcc.gov/document/fcc-announces-over-640-million-rural-broadband-26-states

https://www.totaltele.com/512752/FCC-announces-640-funding-for-rural-broadband-deployment

https://www.fcc.gov/document/fcc-creates-ruralbroadband-accountability-plan

https://www.emarketer.com/content/fcc-announces-1-2b-rural-broadband-fund-32-states

https://www.fcc.gov/auction/904

https://www.fcc.gov/document/fcc-auction-bring-broadband-over-10-million-rural-americans

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

Editor’s Note on Private 5G:

Do you agree with the WSJ article below? We don’t, as we believe China’s 5G is fake news/mass propaganda!

WSJ:

China Leads the Way With Private 5G Networks at Industrial Facilities

–>Among the projects: a coal mine where 5G allows remote inspections of mines and the automation of mining activity

by Dan Strumpf

China is racing ahead in building the infrastructure of 5G networks, but it is inside factories, coal mines, shipyards and warehouses where the technology is really taking off.

The country is widely seen as being out front in the deployment of localized, high-powered 5G networks in sprawling industrial sites, which aim to use the technology to help automate labor-intensive or dangerous industrial processes, and hopefully boost productivity.

These sites include 5G coal mines with remote-operated drilling machinery, so-called smart factories that automate production and quality control, and seaports with internet-connected cameras that process and tally freight containers.

These 5G private networks are different from the consumer-oriented networks that blanket towns and cities, in that they are dedicated to specific enterprise sites with tailor-made hardware and software. Isolated from public networks, they can be adjusted to specific requirements and handle more complex jobs and processes.

Note: 2022 to 2030 are forecasts. Source: ABI Research

Many such projects are under construction in the U.S., Europe and other parts of the world. But analysts say the construction and deployment of private networks is further along in China, where the government has set aggressive targets for building high-tech work sites powered by next-generation networks.

“China is quite ambitious in terms of developing their 5G—basically putting 5G as a national priority and targeting the digital transformation and connectivity of the economy,” says Sihan Bo Chen, head of Greater China for the telecom industry group GSMA.

Last year, companies involved in their deployment generated $1.2 billion of revenue from 5G private networks serving businesses and governments in China, accounting for about a third of the global total and more than the revenue generated in Europe and North America combined, according to ABI Research, a technology research firm. The figure is a proxy for the scale of the deployments of such networks in China, says Leo Gergs, an analyst with ABI who studies the use of 5G networks by businesses.

The research firm expects China’s lead to widen in the coming years, given aggressive government targets. This year, it expects private-network revenue generated in China to rise about 60%. By 2025, it will top $5 billion, ABI forecasts.

China leads the world in 5G deployment in general. As of the end of last year, the country had installed more than 1.4 million 5G base stations, accounting for 60% of the world’s total, according to the Ministry of Industry and Information Technology, the government agency that oversees China’s tech sector.

In April last year, Beijing set out a series of goals for the country to meet in 5G by 2023. In a plan called “Set Sail,” it aims for more than 560 million individual 5G users across the country, with the 5G subscriber rate exceeding 40% of the population. For major industries, the government wants the penetration rate for 5G to exceed 35%. It also has a goal to build more than 3,000 private 5G networks by that year.

“This shows how deeply involved the government is” in China’s 5G deployment, Mr. Gergs says.

Huawei 5G equipment at the Xinyuan Coal Mine in China’s Shanxi province. PHOTO: QILAI SHEN/BLOOMBERG NEWS

Several such projects in China are already up and running. One example: the Xinyuan Coal Mine in China’s coal-rich Shanxi province. Last year, telecom vendor Huawei Technologies Co. and state-owned operator China Mobile developed an underground 5G network to allow remote inspections of mines and the automation of mining activity, with tunneling equipment operated by remote control deep underground.

Similar technology is at work at the Xiangtan Iron & Steel plant in the southern Chinese city of Xiangtan. In 2019, Huawei and China Mobile built 5G coverage for the plant, which now runs 5G-connected cranes and video surveillance cameras to help operate and monitor the plant, according to a report on the project by GSMA. At the port city of Ningbo, the companies built a similar 5G network to help automate the tallying of freight containers and power unmanned container trucks, GSMA says.

“Private network deployments are really just starting and China is already a bit of an outlier,” Mr. Gergs says.

Mr. Strumpf is a Wall Street Journal reporter in Hong Kong. He can be reached at [email protected].

References:

WSJ: U.S. Wireless Carriers Are Winning 5G Customers for the Wrong Reason