Author: Alan Weissberger

Nokia and Hong Kong Broadband Network Ltd deploy 25G PON

Nokia today announced that Hong Kong Broadband Network Ltd (HKBN), a leading telecom and technology solutions provider in Hong Kong, will deploy its 25G PON to provide customers with some of the fastest, most reliable broadband access speeds in the region. The 25G PON deployment will deliver 20Gb/s symmetrical broadband speeds essential for new applications and business services powering today’s digital economy.

Based on the Quillion chipset, Nokia’s 25G PON fiber broadband solution (more below) allows HKBN to reuse its existing fiber broadband equipment to immediately address demand for more capacity and enhanced broadband services.

William Yeung, HKBN Co-Owner, Executive Vice-chairman and Group CEO: “Since 2004, HKBN has been the market leader in introducing Hong Kong’s first fiber-to-the-home broadband service. With an unwavering commitment to innovation, we have joined forces with Nokia to achieve a groundbreaking upgrade, proudly providing customers with a revolutionary 25Gbps broadband speed that meets their ever-increasing demands for network connectivity. Looking ahead, we will continue to stay at the forefront of technological advancements, investing resources to expand network coverage and upgrade infrastructure. This will enable more households and businesses to benefit from our exceptional and high-quality services.”

Geert Heyninck, Vice President of Broadband Networks at Nokia: “Nokia’s technology enables HKBN to upgrade its existing fiber network quickly and efficiently, leveraging both passive and active assets. With Nokia’s technology and HKBN ‘s citywide network, we’re leading customers into a new era of seamless connectivity.”

Roland Montagne, Director and Principal Analyst for FTTH at IDATE: “The momentum behind 25G PON continues to build with the number of deployments growing substantially over the past year. Clearly the ability to quickly upgrade GPON and XGS-PON to deliver true 25Gbs without having to deploy additional network elements is attractive for large operators like HKBN that want to deliver 25G PON services to its customers.”

…………………………………………………………………………………………………….

Nokia recently deployed XGS-PON services with Baktelcom in Azerbaijan. That network can be upgraded in the future to 25G PON which would increase capacity and stay ahead of demand for higher bandwidth.

Nokia has also deployed with Global Fiber Peru a new subaquatic and future-proof Optical, IP and XGS-PON fiber broadband network in the Amazon rainforest, helping to reduce the digital divide. The extensive network connects over 400 communities to multi-gigabit broadband access that is critical in today’s digital economy.

About Nokia’s 25G PON Solution:

• Nokia’s 25G PON increases service agility with operational efficiency.

• The fiber access node supports multiple fiber technologies including GPON, XGS-PON, 25GS-PON and Point-to-Point Ethernet to deliver a wide range of services.

Resources and additional information:

…………………………………………………………………………………………………………………….

References:

https://x.com/nokia/status/1181473779320594433

Nokia’s launches symmetrical 25G PON modem

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

HPE Aruba Launches “Cloud Native” Private 5G Network with 4G/5G Small Cell Radios

HPE Aruba has launched an end-to-end private 5G network platform which is designed to help customers accelerate and simplify the deployment and management of private 5G networks, provide high levels of reliable wireless coverage across large campus and industrial environments, and open new, untapped use cases for private cellular. This integration follows HPE’s 2023 acquisition of private cellular technology provider Athonet.

Highlights:

- HPE Aruba Networking provides a comprehensive solution that removes the complexity of managing, deploying and purchasing enterprise private cellular networks.

- With this expansion of its secure edge-to-cloud portfolio, HPE Aruba Networking becomes the only global enterprise infrastructure vendor to provide comprehensive Wi-Fi and private 5G solutions.

- HPE Aruba Networking Enterprise Private 5G provides high levels of reliable wireless coverage across large campus and industrial environments, opening up new, untapped use cases for private cellular.

“Enterprise and industrial customers are increasingly seeking to deliver wireless coverage in demanding environments, including large outdoor areas, serving fast-moving clients, and providing deterministic access in dedicated spectrum,” said Stuart Strickland, wireless chief technology officer, HPE Aruba Networking.

“The complexity of conventional approaches to private cellular networks has held them back. Building on HPE Aruba’s networking history of wireless innovation and leadership, we have uniquely positioned ourselves to enable new applications for private cellular by integrating Athonet core cellular solutions with our traditional strengths in enterprise networking.”

With the debut of HPE Aruba Networking Enterprise Private 5G, enterprises can increase reliable, secure, high-performance connectivity with a fully integrated private 5G network that features:

- An end-to-end offering that includes a 4G/5G core, HPE ProLiant Gen11 servers, SIM/eSIM cards, 4G/5G small cells, and dashboard.

- New 4G/5G small cell radios from HPE that provide indoor/outdoor coverage, eliminating the need to integrate and use a separate management tool from a 3rd party vendor.

- Simplified cloud-native management and automation for subscriber management, deployment management, core monitoring and radio monitoring, with future plans for integration with HPE Aruba Networking Central.

- Expanded AI data capture and delivery for building AI data lakes and activating inference solutions.

- Interoperability with shared spectrum for private enterprise use: Citizens Broadband Radio Service (CBRS) spectrum in the US, and globally, where regulatory frameworks allow, beginning in 2025.

- Simplified configuration with pre-integrated, tested solution including everything needed to deploy an enterprise private 4G/5G network.

- Ability to deploy solutions in under 30 minutes with zero touch provisioning and configuration wizards that mask the 3GPP cellular complexity.

“HPE Aruba Networking Enterprise Private 5G is a significant step forward to solve for the complexity, cost, control, and management challenges associated with many private network deployments today,” said Patrick Filkins, Senior Research Manager, IoT and Telecommunications, IDC. “HPE Aruba Networking takes a grounded approach focusing on how to most efficiently integrate a private cellular network within an enterprise’s existing IT framework, streamlining network and device management through the use of familiar tools, as well as dynamically assigning and preserving device policy across 4G/5G, Wi-Fi, and wired LAN networks.”

“‘Many private network solutions are too complex, even for large enterprises with internal network expertise,” said Tom Rebbeck, Partner, Analysys Mason. “We expect customers to embrace solutions that can make private networks easier to deploy and manage.”

“For IronYun’s Vaidio Platform to be able to provide AI inferencing at the edge and drive accurate AI video search results, we needed an infrastructure that provided fast, available and reliable bandwidth without any complexity,” said Paul Sun, IronYun CEO. “We found it with HPE Aruba Networking, which provides us with all the components needed to deliver an end-to-end private 5G network for AI. HPE Aruba Networking’s private 5G network is the technical foundation for all Vaidio functions for real-time video analysis and AI inferencing that deliver AI insights to help improve security outcomes.”

“Private cellular, with its wide area, deterministic coverage, is the ideal fit for Disc Golf Network’s global live competition coverage of the Disc Golf Pro Tour,” said Baker Helton, DGPT Vice President of Business Administration. “The new HPE Aruba Networking Enterprise Private 5G offering will make it that much easier for companies to do what we’ve done and meet their requirements for pervasive coverage with an integrated offering using CBRS.”

5 Reasons to adopt HPE Aruba Networking Enterprise Private 5G

HPE completes acquisition of private 5G leader Athonet

HPE acquires private cellular network provider Athonet (Italy) to strengthen HPE Aruba’s networking portfolio

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

In a May 30th filing with the FCC, SpaceX wrote that it “looks forward to launching commercial direct-to-cellular service [1.] in the United States this fall.” That will presumably be only for text messages, because the company has stated that ONLY text will available in 2024. Voice and data won’t be operational until 2025.

Importantly, SpaceX did not identify the telco who would provide Direct-to Cell satellite service this fall.. Mike Dano of LightReading has suggested it might be T-Mobile US (more below), but there is nothing on the company’s news website to confirm that.

Note 1. “Direct to Cell works with existing LTE phones wherever you can see the sky. No changes to hardware, firmware or special apps are required, providing seamless access to text, voice and data,” according to the Starlink’s website. “Starlink satellites with Direct to Cell capabilities enable ubiquitous access to texting, calling, and browsing wherever you may be on land, lakes, or coastal waters. Direct to Cell will also connect IoT devices with common LTE standards.”

………………………………………………………………………………………………………………………….

SpaceX disclosed its commercial direct-to-cell launch plans in a filing with the FCC that urged the Commission to make changes to its initial supplemental coverage from space (SCS) ruling. SpaceX argued the FCC should create SCS rules that are specific to each band of spectrum used in such offerings

In its most recent FCC filing, SpaceX said that “supplemental coverage from space (“SCS”) will enable ubiquitous mobile coverage for consumers and first responders and will set a strong example for other countries to follow.”

Furthermore, SpaceX said the “FCC should reconsider a single number in the SCS Order—namely, the one-size-fits-all aggregate out-of-band power flux-density (“PFD”) limit of -120 dBW/m2 /MHz that it adopted in the new Section 25.202(k) for all supplemental coverage operations regardless of frequency band.

If the Commission decides to retain an aggregate limit, adopting band-specific limits that efficiently and transparently achieve the accepted ITU interference protection threshold for terrestrial networks of -6 dB interference-to-noise ratio (“I/N”) would better achieve the Commission’s goals of ensuring better service, broader coverage, and more choices for consumers.

By making this simple adjustment to the SCS Order, the Commission can potentially bring an order of magnitude better service to consumers who use supplemental coverage from space in higher frequencies, without causing any risk of harmful interference to terrestrial services in adjacent bands,” SpaceX added.

SOURCE: OFFICIAL SPACE X PHOTOS ON FLICKR, CC2.0

………………………………………………………………………………………………………..

SpaceX established a phone-to-satellite agreement with T-Mobile in 2022. That agreement called for the satellite launch vendor to add T-Mobile’s spectrum into its Starlink satellites. T-Mobile officials have suggested SpaceX’s satellite service might be included in its more expensive service plans for no extra charge, or through an extra fee on its other plans.

……………………………………………………………………………………………………………………….

Sidebar: SpaceX LEO Satellites in Orbit

SpaceX currently operates a constellation of more than 6,000 Starlink satellites. That web of satellites helps to keep Starlink’s services consistent for users on the ground. Each Starlink LEO satellite travels extremely fast such that it goes around the world every 90 minutes.

SpaceX has stated that it plans to have around 800 satellites capable of direct-to-cell connections in orbit within a few months.

According to one source, SpaceX has so far launched more than three dozen satellites that support those “direct-to-cell“ connections.

………………………………………………………………………………………………………………

References:

https://www.fcc.gov/ecfs/document/105311484428351/1

https://www.starlink.com/business/direct-to-cell

https://www.lightreading.com/satellite/spacex-says-t-mobile-s-direct-to-cell-service-launching-commercially-this-fall

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Telstra partners with Starlink for home phonetechblog.comsoc.org/…/spacex-launches-first-set-of-starlink-satellites-with-direct-to-cell-capabilities service and LEO satellite broadband services

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Musk’s SpaceX and T-Mobile plan to connect mobile phones to LEO satellites in 2023

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

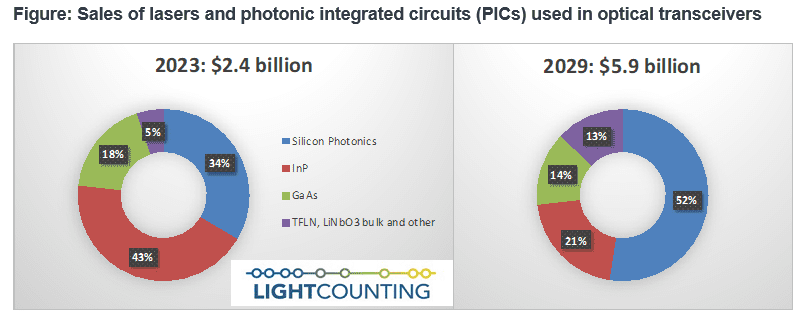

LightCounting: Silicon Photonics chip market to hit $3 billion in 2029

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile will buy almost all of regional carrier UScellular’s wireless operations including customers, stores and 30% of its spectrum assets [1.] in a deal valued at $4.4 billion, the company said on Tuesday. The announcement comes nearly ten months after UScellular and its parent company TDS disclosed that they were undertaking a strategic review of the mobile business, suggesting a possible sale.

Note 1. UScellular stated that it will retain around 70% of its spectrum assets following the T-Mobile deal “and will seek to opportunistically monetize these retained assets.”

The transaction, which is subject to the satisfaction of customary closing conditions and receipt of certain regulatory approvals, is expected to close in mid-2025.

T-Mobile’s 5G SA network will expand to provide millions of UScellular customers, particularly those in underserved rural areas, a superior connectivity experience, moving from a roaming experience outside of the UScellular coverage area to full nationwide access on the country’s largest and fastest 5G network. Additionally, UScellular customers will have the ability to fully participate in the T-Mobile’s industry-leading value-packed plans filled with benefits and perks, and best-in-class customer support with the opportunity to save UScellular customers hundreds of millions of dollars. T-Mobile customers will also get access to UScellular’s network in areas that previously had limited coverage and the benefit of enhanced performance throughout UScellular’s footprint from the addition of the acquired UScellular spectrum to T-Mobile’s network.

“With this deal T-Mobile can extend the superior Un-carrier value and experiences that we’re famous for to millions of UScellular customers and deliver them lower-priced, value-packed plans and better connectivity on our best-in-class nationwide 5G network,” said Mike Sievert, CEO of T-Mobile. “As customers from both companies will get more coverage and more capacity from our combined footprint, our competitors will be forced to keep up – and even more consumers will benefit. The Un-carrier is all about shaking up wireless for the good of consumers and this deal is another way for us to continue doing even more of that.”

“T-Mobile’s purchase and integration of UScellular’s wireless operations will provide best-in-class connectivity to rural Americans through enhanced nationwide coverage and service offerings at more compelling price points,” said Laurent Therivel, CEO of UScellular. “The transaction provides our customers access to better coverage and speeds, as well as unlimited texting in more than 215 countries, content offers, device upgrades and other T-Mobile benefits.”

Best-in-Class Network Experience

The combination of both companies’ spectrum and assets will provide UScellular customers a superior connected experience on T-Mobile’s industry-leading nationwide 5G network that offers best-in-class performance, coverage, and speed. Customers of both companies, particularly those in underserved rural areas, will receive access to faster and more reliable 5G service they would not otherwise have.

Value-Packed Plans

UScellular customers will have the option to stay on their current plans or move to an unlimited T-Mobile plan of their choosing with no switching costs, which include beloved Un-carrier benefits such as streaming and free international data roaming. If UScellular customers choose to switch to T-Mobile, they could save hundreds of millions of dollars combined annually. Some will also have access to plans with increased savings previously not available to them, including T-Mobile’s 5G Unlimited 55+ plans. All customers will be able to take advantage of T-Mobile’s award-winning customer service team, and have better, more accessible in-person and digital retail support.

More Choice and Increased Competition

This transaction will create a much-needed choice for wireless in areas with expensive and limited plans from AT&T and Verizon, and for those that have been limited to one or no options for home broadband connectivity. By tapping into the additional capacity and coverage created through the combined spectrum and wireless assets, T-Mobile will spur competition and expand its fast-growing home broadband offering and fixed wireless products to communities without competitive broadband options, further bridging the digital divide for hundreds of thousands of customers in UScellular’s footprint.

Proven Un-carrier Playbook

T-Mobile has a proven industry-leading track record of bringing companies together in the name of enhanced connectivity, choice, and value for consumers. The integrations of MetroPCS in 2013 and Sprint in 2020 have been noted as two of the most successful merger combinations in wireless history that resulted in competition-enhancing shifts benefiting millions of consumers. Leveraging its tried-and-true playbook for successful integrations, T-Mobile will continue to deliver exceptional value and experiences to more people across the country, while forcing others to follow suit, for the good of customers.

Transaction Details and Financial Profile

T-Mobile will pay approximately $4.4 billion for the assets being acquired from UScellular in the transaction in a combination of cash and up to $2.0 billion of debt to be assumed by T-Mobile through an exchange offer to be made to certain UScellular debtholders prior to closing. To the extent any debtholders do not participate in the exchange, their bonds will continue as obligations of UScellular and the cash portion of the purchase price will be correspondingly increased. Following the closing of the transaction, UScellular will retain ownership of its other spectrum as well as its towers, with T-Mobile entering into a long-term arrangement to lease space on at least 2,100 additional towers being retained.

T-Mobile does not expect the transaction to impact the company’s 2024 guidance or 2024 authorized shareholder return program. T-Mobile expects this transaction will yield approximately $1.0 billion in effective total opex and capex annual run rate cost synergies upon integration, with total cost to achieve the integration currently estimated at between $2.2 billion to $2.6 billion. The company plans to reinvest a portion of synergies toward enhancing consumer choice, quality and competition in the wireless industry.

References:

https://www.t-mobile.com/news/business/uscellular-acquisition-operations-assets

https://finance.yahoo.com/news/t-mobile-buy-uscellulars-wireless-114507766.html

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

Ghana’s Next-Gen Infrastructure Company to deploy shared 5G network

The Government of Ghana announced a partnership with seven tech companies to deploy a new shared infrastructure for affordable 5G mobile broadband services across Ghana. The seven partners are Ascend Digital, K-NET, Radisys, Nokia, and Tech Mahindra and two telcos – AT Ghana and Telecel Ghana.

The partners have established the Next-Gen Infrastructure Company (NGIC), which has been awarded a 5G license and is expected to launch 5G services across Ghana within the next six months, followed by expansion to other parts of Africa.

The company will be the first 5G Mobile Broadband Shared Infrastructure Entity to build a nationwide 4G/5G network. It will also work with the telcos to launch affordable 4G/5G-enabled FWA CPEs and smartphones in Ghana within this calendar year. Ghana’s largest telco, MTN Ghana, is missing from this all-important shared 5G infrastructure.

The partnership aims to enhance the lives of Ghanaians by introducing digital services in education, healthcare, and digital payment transactions through P2P (peer-to-peer), P2M (peer-to-merchant) and M2M (merchant-to-merchant) systems, thereby reducing -digital divide and promoting financial inclusion.

Additionally, the multiplayer partnership will support NGIC in the entire deployment of network infrastructure and associated services, as communications service providers (CSPs) are looking to address enterprise and consumer markets with enhanced digital services. To achieve this, Tech Mahindra will build a Cloud Native Core Network powered by leading OEM (original equipment manufacturer) platforms.

NGIC plans to adopt India’s successful model of affordable handsets, digital platforms, and localized content and applications. The goal is to replicate this high-speed mobile data model across Africa, beginning with Ghana.

Minister for Communications and Digitalization, Ursula Owusu-Ekuful said, “The creation of a shared 5G Mobile Broadband Infrastructure is critical for delivering affordable, high-speed data access to the people of Ghana and help achieve our Digital Ghana vision. The creation of NGIC as a neutral, shared platform, accessible to all mobile network operators and tower companies, will help to expand 5G services rapidly across the country. We are inspired by India’s digital infrastructure and low-cost mobile data usage and keen to replicate it in Ghana.”

Senior Vice President, of Middle East and Africa at Nokia, Mikko Lavanti said, “Ghana holds immense potential for mobile broadband growth on the back of an unmet demand for connectivity. Establishing an Open Access Network like NGIC will foster innovation and create numerous opportunities across various sectors. We are proud of our partnership with NGIC in helping Ghana realize its digital vision and unlock its full potential.”

CEO of Radisys, Arun Bhikshesvaran said, “Connectivity for all, through the use of open and disaggregated multi-access solutions, is a key component of Radisys’ initiatives to bridge the digital divide. By bringing Fixed Wireless Access alongside 4G and 5G cellular services to help drive economic growth and digital inclusion, Radisys looks forward to helping Ascend and NGIC build a disruptive and affordable shared broadband infrastructure across Ghana. In addition, our communications platform and digital applications will help create new digital experiences that empower the Ghanaian community and foster sustainable and inclusive development.”

Chief Technology Officer, Telecom & Global Business Head, Network Services, Tech Mahindra, Manish Mangal said, “Our partnership with Next Gen Infra Co. is based on a shared vision for digital connectivity and providing Network-as-a-Service to innovate and bring cost efficiency to the telecom market in Ghana and Africa. Echoing our promise to scale at speed, we aim to rapidly advance operations by building a Cloud Native Core Network with leading OEM platforms combined with Tech Mahindra’s automation platform, netOps.ai. Together with NGIC, we will support the complete network infrastructure deployment and introduce high-speed 4G/5G services in the region.”

CEO of Ascend Digital and Executive Director, of NGIC, Harkirit Singh said, “NGIC intends to launch its wholesale 4G/ 5G Network as a Service and make it available to all mobile network operators within the next six months. We have proven the strengths of our partners – Radisys, Nokia, and TechM, to scale the network and deliver affordable mobile broadband services to all Ghanaians. We intend to gradually expand to other parts of Africa as well. We will tap the capital markets and bring in strategic investors as and when required.”

COO of Telecel Ghana, Mohamad Ghaddar said, “NGIC’s neutral and ‘Network as a Service’ model creates a level-playing field for all telecom operators in Ghana. As an MNO our focus will be to enhance customer experience through innovative services, localized content, applications, and affordable devices. We are excited to be part of this venture and looking forward to working with NGIC in a shared vision of universal access to broadband and transforming Ghana into a Digital Economy”.

CEO of AT Ghana, Leo Skarlatos said, “This partnership will enable us to leverage a neutral, shared platform and scale up our services across Ghana. We are confident that our customers will experience the enhanced network quality and affordable services that they deserve. We look forward to working with NGIC and the MOCD, to contribute to the country’s digital transformation agenda.”

References:

https://citinewsroom.com/2024/05/ghana-govt-seven-others-partner-on-5g-shared-network/

https://www.deccanherald.com/business/companies/ghana-ties-up-with-reliance-jio-arm-others-for-building-4g-5g-telecom-infra-3040314

InterSAT extends Pan-African satellite services via Ku-band on Eutelsat 70B satellite

Eutelsat Group has extended its partnership with African satellite network service provider InterSat to support its growth in the pan-African enterprise and retail segments. Under the new multi-year deal, InterSAT will add Ku-Band capacity over Central and Eastern Africa on Eutelsat’s Eutelsat 70B satellite to its current portfolio, which already includes Ka-Band capacity on the Eutelsat Konnect satellite. The Eutelsat 70B offers wide beam coverage and four high-performance fixed beams, with a high degree of on-board connectivity. The partnership extension highlights the role of VSAT services delivered through powerful, geostationary capacity to reach remote areas.

“We are delighted to be able to rely on Eutelsat capacity once again to support our growth ambitions in Africa, home to some of the world’s most remote and underdeveloped regions which represent a challenging environment for building terrestrial communication networks. Leveraging our VSAT service expertise and our teleport infrastructure, we are able to use satellite communication to deliver reliable and cost-effective connectivity to remote and underserved areas while assuring a high-end user experience for our customers,” said Hanif Kassam, Chief Executive Officer of InterSAT.

“We are honoured to be selected by our long-standing partner, InterSAT, to accompany the further roll-out of its services in Africa. The growth of VSAT services in Africa is a testament to the potential of this technology to transform the continent’s ICT landscape, connecting more people and businesses than ever before, as well as the ongoing relevance of our powerful geostationary in-orbit assets to deliver a compelling and reliable connectivity service to the remotest areas,’’ commented Ghassan Murat, Eutelsat’s Regional Vice President (RVP) of the Africa, Middle East, and Asia (AMEA) region

Image Credit: EUTELSAT GROUP

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

On May 22nd, YahClick (the data solutions’ arm of UAE’s Al Yah Satellite Communications Company PJSC) and Eutelsat signed a Memorandum of Understanding (MOU) for YahClick to leverage capacity on Eutelsat’s geostationary satellite, EUTELSAT KONNECT. The collaboration between the two leading satellite operators is in line with Yahsat’s efforts to elevate its offerings and drive growth across its satellite broadband footprint in Africa to provide enhanced services and expand into new markets in Africa and beyond. As part of the agreement. Yahsat will enjoy exclusive rights to Eutelsat’s KONNECT capacity over Ethiopia, one of the fastest-growing African markets.

Sulaiman Al Ali, Chief Commercial Officer of Yahsat said: ‘We are delighted to partner with Eutelsat and have access to state-of-the-art orbital assets, to support our satellite network. This partnership shall enable us to further enhance our portfolio and drive growth of our ‘YahClick’ broadband services to consumer and enterprise markets. Yahsat supported Eutelsat in the early years of its African Broadband journey, and we are happy to be collaborating once again to ensure our existing and future customers benefit from the highest level of service and availability.”

Ghassan Murat, Eutelsat’s RVP of the AMEA region added: “We are honoured to further deepen our ties with our long-standing partner, Yahsat. Yahsat’s strong presence in Africa and the Middle East through the successful deployment of its YahClick satellite broadband service, together with the uptake we are seeing as we progressively transfer EUTELSAT KONNECT capacity to Africa highlight the buoyant demand for robust broadband services in the market, and the pertinence of satellite in connecting users, even in the most remote locations.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About Eutelsat Group:

Eutelsat Group is a global leader in satellite communications, delivering connectivity and broadcast services worldwide. The Group was formed through the combination of the Company and OneWeb in 2023, becoming the first fully integrated GEO-LEO satellite operator with a fleet of 36 Geostationary satellites and a Low Earth Orbit (LEO) constellation of more than 600 satellites. The Group addresses the needs of customers in four key verticals of Video, where it distributes more than 6,500 television channels, and the high-growth connectivity markets of Mobile Connectivity, Fixed Connectivity, and Government Services. Eutelsat Group’s unique suite of in-orbit assets and ground infrastructure enables it to deliver integrated solutions to meet the needs of global customers. The Company is headquartered in Paris and the Eutelsat Group employs more than 1,700 people across more than 50 countries. The Group is committed to delivering safe, resilient, and environmentally sustainable connectivity to help bridge the digital divide.

References:

Highlights of IEEE Triple Milestone Event – May 20, 2024 at CHM

Three very significant IEEE Milestones were celebrated May 20th at the Computer History Museum (CHM) in Mt. View, CA. They were as follows:

- Google’s PageRank Algorithm and the Birth of Google. The PageRank Algorithm shaped our access to digital content and put Google on the map as an established web search company.

- The 1974 IEEE Computer Society paper on TCP (“Transmission Control Protocol (TCP) Enables the Internet”) authored by Vint Cerf and Bob Kahn.

- The IEEE 802 LAN/MAN Standards Committee which generated and maintains the standards for IEEE 802.3 (Ethernet), 802.11 (Wi-Fi®), 802.15 (early Bluetooth), among others.

Among newer and important IEEE 802 projects:

- IEEE 802.1 Time Sensitive Networks Task Group provides standards for deterministic connectivity through IEEE 802 networks (i.e., guaranteed packet transport with bounded latency, low packet delay variation, and low packet loss). It’s being used at CERN’s Large Hadron Collider (LHC) – the world’s largest and most powerful particle accelerator.

- IEEE 802.19 Wireless Coexistence Working Group deals with coexistence between unlicensed wireless networks. Many of the IEEE 802 wireless standards use unlicensed spectrum and hence need to address the issue of coexistence when operating in the same unlicensed frequency band in the same location.

In addition, four other ground breaking IEEE milestones were briefly discussed:

- Development of the Commercial Laser Printer, 1971-1977 Ron Rider, VP of Digital Imaging (retired), Xerox PARC

- Xerox Alto Establishes Personal Networked Computing, 1972-1983 John Shoch, Office Systems Division President (retired), Xerox PARC

- Ethernet Local Area Network (LAN), 1973-1985.

- ALOHAnet Packet Radio Data Network, 1971 Bob Metcalfe, Co-Inventor of Ethernet at Xerox PARC and Frank Kuo, University of Hawaii.

Dedication of the above 4 Milestones:

The first three milestones were dedicated at SRI PARC on Friday, May 17th. The fourth milestone ALOHAnet led directly to the development of Ethernet.

………………………………………………………………………………………………………………..

You can watch a replay of this four hour event here.

………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………..

Of particular significance to IEEE Techblog readers:

- Vint Cerf, who co-authored the TCP (Transmission Control Protocol) paper with Bob Kahn and is often called a “father of the Internet,” described the history of the Internet. He said that Arpanet and ALOHAnet led the way to the Internet, which is celebrating its 50th anniversary this month with the IEEE Computer Society’s publication of the TCP paper.

- In addition to new enabling technologies (e.g. hollow core fiber and LEO satellite connectivity) Vint said we need new policies for economic, social and legal frameworks to make the Internet safer and more secure. Also, to hold bad actors responsible for malicious behavior. The Internet Society and others need to educate regulators to make these types of changes.

- Past and present executives of the IEEE 802 LAN/MAN Standards Committee discussed the success of Ethernet (802.3), Wi-Fi (IEEE 802.11), Wireless Specialty Networks (IEEE 802.15), MAC Bridging (IEEE 802.1) which were developed by IEEE 802 LMSC. The purpose and role of the Radio Regulatory Technical Advisory Group, which supports the work of various 802 wireless standards, was also explained.

- Ethernet co-inventor Bob Metcalfe provided a genesis of Ethernet which he co-invented with David Boggs while at Xerox in 1973. Working on Project MAC at MIT in 1970, Metcalfe used the Arpanet to connect dumb terminals to time shared computers. After he joined Xerox PARC, Bob read a paper about the ALOHAnet network at the University of Hawaii by Norm Abramson and was so intrigued that he visited there for one month to gain a deeper understanding of that innovative radio packet network. It used randomized retransmissions after a collision. The Ethernet MAC protocol (Carrier Sense Multiple Access with Collision Detection) he developed used similar ALOHAnet concepts. At 2.94 Mb/sec, the first Ethernet was 306.25 times faster than ALOHAnet (9.6 Kb/sec). That’s because it ran on 0.5 inch coaxial cable rather than radio airwaves. The 2.94 Mb/sec rate (vs 3 Mb/sec) was chosen due to the size limitation of the Ethernet circuit card which could not include a 3 Mb/sec crystal oscillator. That first 1973 version of Ethernet was used at Xerox to enable Alto GUI workstations (predecessor to the PC) to share a networked laser printer and for Xerox PARC engineers to communicate via in house email.

Addendum: Metcalfe did not mention that the hardware for the 10M b/sec version of Ethernet, which in 1985 became the IEEE 802.3 10Base5 CSMA/CD standard, was designed at Xerox by Robert Garner and Ron Crane, RIP.

In April 2022, IEEE SV Tech History committee (founded and initially chaired by this author 2013-2015), presented an event on the history of Ethernet at Xerox. The event description is here and the video is here. Unsung Hero of Ethernet Geoff Thompson moderated this superb panel session. It was originated by this author to provide well deserved recognition for another Unsung Hero- the late and great Ron Crane who (with Robert Garner) co-designed Xerox’s 10 Mb/sec Ethernet circuit card for the Xerox Star workstation as well as 3COMs breakout product – Etherlink circuit card (product # 3C100) for the IBM PC, which shipped in September 1982.

References:

https://ieeetv.ieee.org/

https://spectrum.ieee.org/ethernet-ieee-milestone

https://ethernethistory.typepad.com/my_weblog/2017/08/in-memory-of-ron-crane.html

IEEE ComSocSV/SCU SoE New Event (free): Inside a Telecom Chip Start-up and its 4G+5G Base Station SoC

Date & Time: May 30th, 2:30pm to 5pm

Venue: Santa Clara University – SCDI 1308

Register at: https://events.vtools.ieee.org/m/421628

Agenda/Timeline:

⦁ 2:30pm-3pm Registration & Networking

⦁ 3pm Opening Remarks

⦁ 3:05pm-4pm Presentation

⦁ 4pm-4:30pm Panel Discussion/Conversation

⦁ 4:30pm-4:50pm Audience Q & A

⦁ 4:50pm-4:55pm Closing Remarks & Acknowledgements

Abstract:

As 5G evolves for both public and private networks, edge demands will impact the fluidity and constructs of 5G infrastructure. Mobile network operators (public 5G) and enterprises (private 5G) are confronted with a daunting fundamental challenge:

How to deploy a wireless infrastructure that can effortlessly scale across all future upgrades (e.g. 5G Advanced) and demands, without incurring the traditional capital and operating expense of a system redesign and rip-and-replace costs?

This talk will cover the starting point of all wireless infrastructure – the 4G+5G baseband System on a Chip (SoC). We will discuss: how a”soft modem” can scale with evolving infrastructural demands across small cells and macro cells, new application use cases, emerging megatrends (such as 5G non-terrestrial networks), market fundamentals impacting 5G deployments, and personal insights into the starting and evolution of a 5G semiconductor startup company in the era of AI.

Five years in the making, EdgeQ emerged in 2018 as one of the very few semiconductor startups [1.] focusing on 5G wireless infrastructure. Led by executives from Qualcomm, Intel, and Broadcom, EdgeQ is pioneering converged connectivity and AI that is fully software-customizable and programmable. The company has raised multiple financing rounds, backed by world-renowned investors across all major continents. See below for awards EdgeQ has received.

Note 1. There’s been a significant decline in funding for semiconductor startups over the past 10 years due to a maturing industry, high capital requirements, and fewer exits. In 2021, chip startups globally raised $8.3 billion in 263 deals, but in 2023, U.S. startups have only raised $262 million in 17 deals. There have been EVEN FEWER semiconductor startups focusing on wireless telecommunications as EdgeQ has done.

Speakers and Panelists:

- Adil Kidwai, Head of Product Management, EdgeQ

- Edward Wu, Head of Marketing & Market Development, EdgeQ

Moderator: Alan J Weissberger, IEEE Techblog Content Manager, SCU SoE Scholar in Residence, IEEE GCN North American Correspondent

………………………………………………………………………………….

EdgeQ Awards:

2023 GLOMO Award Winner

CTO Choice Award for Outstanding Mobile Technology

Best Digital Technology Breakthrough for Companies with Under $10M Annual Global Revenue

2022 Mobile Breakthrough Award Winner Small Cell Technology Innovation of the Year

……………………………………………………………………………………………………………………………

Addendum:

Video recording is at https://www.youtube.com/watch?v=-v42TnNjIfM

“Qualcomm will be a tough competitor if they seriously enter into the wireless infrastructure market. They make good modems,” Adil said.

…………………………………………………………………………………………………………………

References:

https://www.edgeq.io/edgeq-debuts-worlds-first/

https://www.edgeq.io/static/Tech_Pcie_Explosion-f48f32134ee6e58752aab6683a63abf4.mp4