5G SA/5G Core network

Bouygues Telecom picks Ericsson for cloud native 5G SA core network

France’s Bouygues Telecom is setting the stage for the next phase of its 5G rollout by announcing that Ericsson will be supplying its 5G standalone (5G SA) core network. The strategic partnership between the companies will see the deployment of the cloud-native Ericsson Dual Mode 5G Core.

The French network operator indicated that it will launch 5G SA services in 2023, including solutions supported by 5G network slicing which requires a 5G SA network. Network slicing is a process whereby the amount of network connectivity needed for a task will be secured via a guaranteed ‘slice’ of the network – to help facilitate the broad range of expected use cases as the digitalization of France.

Sectors likely to benefit from the Ericsson-Bouygues Telecom Strategic Partnership include industry, logistics, smart transport, events and healthcare.

Bouygues Telecom’s 5G Standalone connectivity will also use network slicing – a process whereby the amount of network connectivity needed for a task will be secured via a guaranteed ‘slice’ of the network – to help facilitate the broad range of expected use cases as the digitalization of France, and the move to the fourth industrial revolution (4IE), accelerates.

Standalone 5G will also be central to use cases involving artificial intelligence (AI), augmented reality (AR) and automation. Sectors likely to benefit from the Ericsson-Bouygues Telecom Strategic Partnership include industry, logistics, smart transport, events and healthcare. Services resulting from the end-to-end 5G network strategic partnership are expected to be available from early 2023.

Network automation: 5G Core networks must be automated. Automation is required to handle the magnitude of tailor-made services and network slices that will be introduced with 5G. To manually or semi-automate all parts of the network is not feasible if SLAs are to be sustained. To keep up with latest software releases, it’s imperative to have a CI/CD mindset. The faster the latest network capabilities can be introduced, the faster new differentiating services can be rolled out and monetized.

………………………………………………………………………………………………………………………………………………..

Ericsson already provides radio access network (RAN) equipment to Bouygues Telecom. The operator had previously worked with Huawei, but was forced to explore alternative options after the nation’s government effectively banned Huawei from participating in 5G networks after 2028.

Rival operator Orange has already chosen its 5G standalone suppliers in Europe, plumping for Ericsson’s core network in Belgium, Spain, Luxembourg and Poland, and Nokia’s equivalent offering in France and Slovakia.

Iliad’s Free has selected Nokia for its 5G networks in France and Italy. (See Ericsson, Nokia at front of queue for Orange 5G contracts.)

France has not explicitly banned the use of equipment from China-based vendors such as Huawei in 5G networks.

ANSSI, France’s cybersecurity agency, set a very high bar for license authorizations in 5G and previously indicated it will not renew Huawei’s equipment licenses once they run their course.

This decision has posed a logistical and financial challenge to both Bouygues Telecom and rival SFR (Altice France), which have been heavily reliant on Huawei equipment in the past. Indeed, the operators were using Huawei equipment across about half their mobile footprint, according to data provided in 2020 by Strand Consult, a wireless telecom consulting group headed up by colleague John Strand.

In 2021, Bouygues Telecom and SFR began stripping out Huawei equipment from their networks, after unsuccessful legal efforts to challenge France’s stricter security policy for future 5G networks. Bouygues Telecom has said it would have to remove 3,000 Huawei antennas by 2028 in areas with very high population density and that it was prohibited from using Huawei antennas for 5G in Strasbourg, Brest, Toulouse and Rennes.

In a rather curious twist, French newspaper L’Express reported last year that Free filed a case at the Paris Administrative Court against permits given to Bouygues Telecom and SFR to use Huawei 5G antennas. Free claimed that its own request to ANSSI for clearance to use Huawei products was rejected, but Bouygues Telecom and SFR were given the greenlight, which it argued gave its two rivals an unfair advantage.

It seems that it’s not entirely clear the extent to which France’s operators might continue to use Huawei equipment in less sensitive parts of the networks in the coming years.

Meanwhile, Free is leading the charge when it comes to the deployment of 5G-enabled base stations in France. According to the latest update from Arcep, Free has over 14,400 sites compared to Bouygues Telecom’s 7,132; SFR’s 5,721; and Orange’s 3,491. Free’s sites are all in the 700Mhz/800MHz bands.

References:

https://www.ericsson.com/en/news/2022/6/end-to-end-ericsson-sa-5g-for-bouygues-telecom

https://www.lightreading.com/5g/bouygues-telecom-picks-ericsson-as-core-5g-buddy/d/d-id/778363?

T-Mobile Launches Voice Over 5G NR using 5G SA Core Network

T-Mobile has deployed commercial Voice over 5G (VoNR, or Voice Over (5G) New Radio) service in limited areas of Portland, Oregon and Salt Lake City, Utah. The Un-carrier plans to expand VoNR to many more areas this year. Now that Standalone 5G (5G SA) is beginning to carry voice traffic with the launch of VoNR, other real 5G services, such as network slicing and security are likely to be deployed. T-Mobile customers with Samsung Galaxy S21 5G smartphones can take advantage of VoNR today in select areas.

“We don’t just have the leading 5G network in the country. T-Mobile is setting the pace for providers around the globe as we push the industry forward – now starting to roll out another critical service over 5G,” said Neville Ray, President of Technology at T-Mobile. “5G is already driving new levels of engagement, transforming how our customers use their smartphones and bringing unprecedented connectivity to areas that desperately need it. And it’s just going to get better thanks to the incredible T-Mobile team and our partners who are tirelessly innovating and advancing the capabilities of 5G every day.”

Standalone 5G removes the need for an underlying 4G LTE network and 4G core, so 5G can reach its true potential. In other words, it’s “pure 5G”, and T-Mobile was the first in the world to deliver it nationwide nearly two years ago.

The addition of VoNR takes T-Mobile’s standalone 5G network to the next level by enabling it to carry voice calls, keeping customers seamlessly connected to 5G. In the near-term, customers connected to VoNR will notice slightly faster call set-up times, meaning less delay between the time they dial a number and when the phone starts ringing. But VoNR is not just about a better calling experience. Most importantly, VoNR brings T-Mobile one step closer to truly unleashing its standalone 5G network because it enables advanced capabilities like network slicing that rely on a continuous connection to a 5G core.

“VoNR represents the next step in the 5G maturity journey-an application that exists and operates in a complete end-to-end 5G environment,” says Jason Leigh, research manager, 5G & Mobility at IDC. “Migrating to VoNR will be a key factor in developing new immersive app experiences that need to tap into the full bandwidth, latency and density benefits offered by a 5G standalone network.”

“The commercial launch of the VoNR service is another important step in T-Mobile’s successful 5G deployment,” said Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson. “It demonstrates how we as partners can introduce 5G voice based on the Ericsson solution.”

“We are proud of our partnership with T-Mobile to bring the full capabilities of 5G to customers in the United States,” said Tommi Uitto, President, Nokia Mobile Networks. “Nokia’s radio and core solutions power T-Mobile’s 5G standalone network – and this VoNR deployment is a critical step forward for the new 5G voice ecosystem.”

“At Samsung, we want to give our users the best possible 5G experience on every device – and today’s announcement represents a big step forward,” said Jude Buckley, Executive Vice President, Mobile eXperience at Samsung Electronics America. “By supporting extensive integration and testing, and working alongside an industry leader like T-Mobile, we’re bringing to life all the benefits of 5G technology with the help of our Samsung Galaxy devices.”

VoNR is available for customers in parts of Portland, Ore. and Salt Lake City with the Samsung Galaxy S21 5G and is expected to expand to more areas and more 5G smartphones this year including the Galaxy S22.

T-Mobile is the U.S. leader in 5G with the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers nearly everyone in the country – 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year.

………………………………………………………………………………………………………………………………………………………

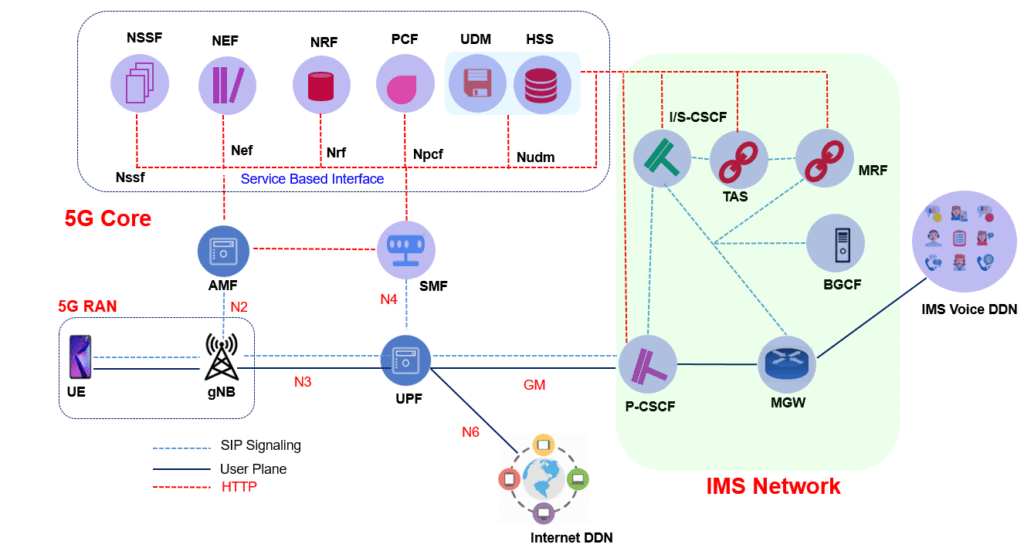

Voice Over NR Network Architecture:

Voice Over NR network Architecture is consist of 5G RAN, 5G Core and IMS network. A high level architecture is shown below. (Only major network functions are included). This network architecture supports Service based interface using HTPP protocol.

VoNR Key Pointers:

- VoNR rely upon IP Multimedia Subsystem (IMS) to manage the setup, maintenance and release or voice call connections.

- UE PDCP should support RTP and RTCP, RoHC compression and MAC layer should support DRX

- SIP is used for signaling procedures between the UE and IMS.

- VoNR uses a QoS Flow with 5QI= 5 for SIP signaling messages and QoS Flow with 5QI= 1

- QoS Flows with 5QI= 5 is non-GBR but should be treated with high priority to ensure that SIP signaling procedures are completed with minimal latency and high reliability.

- QoS Flow with 5QI= 1 is GBR. This QoS Flow is used to transfer the speech packets after connection establishment

- gNB uses RLC-AM mode DRB for SIP signaling and RLC-UM mode for Voice Traffic (RTP) DRBs

- 3GPP has recommended ‘Enhanced Voice Services’ (EVS) codecs for 5G

- EVS codec supports a range of sampling frequencies to capture a range of audio bandwidths.

- These sampling frequencies are categorized as Narrowband, Wideband, Super Wideband and Full band.

- VoNR UE provides capability information during the NAS: Registration procedure with IE ‘ UE’s Usage Setting’ indicates that the higher layers of the UE support the IMS Voice service.

- The AMF can use the UE Capability Request to get UE’s support for IMS Voice services. gNB can get UE Capability with RRC: UE Capability Enquiry and UE Capability response to the UE. The UE indicates its support for IMS voice service with following IEs

-

- ims-VoiceOverNR-FR1-r15: This field indicates whether the UE supports IMS voice over NR FR1

- ims-VoiceOverNR-FR2-r15: This field indicates whether the UE supports IMS voice over NR FR2

- within feature set support IE ims-Parameters: ims-ParametersFRX-Diff, voiceOverNR : supported

-

References:

https://www.techplayon.com/voice-over-nr-vonr-call-flow/

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

STC launches first 5G standalone (SA) core network in Bahrain via Huawei

STC Bahrain [1.] has announced the launch of the first 5G standalone (SA) core network in the kingdom using Huawei network equipment. This 5G SA network will enable new communication services for consumers and enterprises. Examples include high-resolution video, VR, AR, multimedia and online data communication.

The 5G standalone network will support the three ITU-R 5G Use Cases — enhanced mobile broadband (eMBB), ultra-reliable low latency communications (URLLC) and Massive Machine-Type Communications (mMTC) services. It will enable services in the public security, transportation, banking, consumer services, manufacturing, petroleum, port, healthcare and education sectors, among others.

5G SA supports multi-access edge computing (MEC) and uplink-centric broadband connectivity for both B2B and B2C services, STC said.

STC and Zain have deployed commercial 5G SA networks in Saudi Arabia, while STC has also launched 5G SA in Kuwait.

Note 1. STC Bahrain is a telecommunications service provider based in Bahrain. It is owned by the Saudi Telecom Company and started its commercial service in March 2010. The company is headquartered in Manama, Bahrain.

References:

http://www.abc-bahrain.com/News/1/334499

https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/05/GSMA_MENA_ME2022_R_WebSingles.pdf

Viavi’s State of 5G report finds 1,947 5G cities (635 new) -mostly NSA- at end of 2021

As of end-December, the number of cities worldwide with 5G networks was 1,947 , with 635 new cities added in 2021, according to the latest Viavi Solutions report ‘The State of 5G.’

By the end of January 2022, 72 countries had 5G networks, with Argentina, Bhutan, Kenya, Kazakhstan, Malaysia, Malta and Mauritius coming online in the second half of 2021.

Europe, Middle East & Africa (EMEA) passed Asia Pacific including Greater China (APAC), to become the region with the most 5G cities, at 839. APAC has 689 5G cities and the Americas has 419.

China has the most 5G cities (356), ahead of the US (296) and the Philippines (98). However, more than half of China’s so called 5G subscribers are on 4G networks. Robert Clark of Light Reading wrote: “China has tried to kick-start 5G with low prices, with the result that it has a huge population of 5G subscribers on 4G networks. Less than half of China Mobile’s 467 million 5G subs are actually using 5G – a ratio that has remained constant for the past year.”

Most 5G networks deployed are Non-Standalone (NSA) networks. There are only 24 5G Standalone (SA) networks. It is widely considered that many of the next-generation use cases and monetization models associated with 5G, beyond enhanced Mobile Broadband (eMBB) will only be possible when Standalone 5G networks built on new 5G core networks are in place.

![]()

The State of 5G also highlights the growing Open RAN ecosystem, combining mobile operators as well as software and infrastructure vendors, seeking to develop an open, virtualized Radio Access Network (RAN) with embedded Artificial Intelligence (AI) control. As of March 2022, 64 operators have publicly announced their participation in the development of Open RAN networks. This breaks down to 23 live deployments of Open RAN networks, 34 in the trial phase with a further seven operators that have publicly announced they are in the pre-trial phase.

As of March 2022, 64 operators publicly announced their participation in the development of Open RAN networks, of which 23 were live deployments, 34 in the trial phase and another 7 operators in the pre-trial phase.

“5G continued to expand, despite the headwinds of a global pandemic,” said Sameh Yamany, CTO, VIAVI Solutions. “What comes next in 5G is the reinforcement of networks. This will take a couple of forms. Firstly, we expect to see more Standalone 5G networks, which will deliver on much of the promise of 5G, both for the operator and for the wider ecosystem of users. And secondly, we expect to see Open RAN continue its rapid development and start to become a de facto standard. VIAVI will continue to play a central role in testing those new networks as they are built and expanded.”

References:

https://www.viavisolutions.com/en-us/literature/state-5g-may-2022-posters-en.pdf

https://www.lightreading.com/asia/consumers-still-seeking-reason-to-buy-5g/d/d-id/777250?

UK’s Manufacturing Technology Centre (MTC) installs a standalone 5G private network from BT and Nokia

BT is participating in a UK publicly funded 5G Standalone (SA) core network testbed project with Nokia. Officially unveiled this week, the project involves installation of Nokia’s 5G SA equipment at Coventry’s Manufacturing Technology Center (MTC).

This project is part of the West Midlands 5G (WM5G) initiative, which is supported by the UK government’s 5G Test Beds and Trials funding program. It will give SMEs, corporate members, neighboring universities, and the wider industry the opportunity to explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the programme.

The goal is to “explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the program,” according to the group’s announcement.

Businesses and universities, along with “wider industry,” are given the chance to use MTC facilities to test the technology. This includes the center’s recently launched “5G-enabled demonstrator system,” which provides features such as 5G-connected robotics, computer vision and edge computing.

One use case under review is an “automated inspection process” to prove how intelligent automation and advanced connectivity could enable manufacturing sites to maximize productivity and utilization of inspection technology (while also reducing footprint and product waste).

MTC points out that traditional in-person inspections can be time consuming and prone to human error. Neither are they automatically recorded.

BT Enterprise CEO Rob Shuter told Light Reading: “It’s why 5G conversations in the enterprise space are more around deploying a private network over a manufacturing facility, a harbor, a military base etc,” he said. “I’d say we’re in the early stages of that. The technology is still maturing and customer needs are sort of emerging in a co-creation phase. I think we’ll be in that phase for most of this year, and it’ll probably be industrial scaling in ’23, ’24 and ’25.”

BT’s new Division X is spearheading the company’s efforts to sell new solutions to enterprise customers. Marc Overton, former Sierra Wireless SVP, was recently appointed Division X managing director.

Quotes:

Andy Street, Mayor of the West Midlands, said: “This innovative collaboration between WM5G and MTC will enable some of our region’s most cutting-edge businesses to power forward their pioneering work in computing and robotics alongside our dynamic universities. Given the commitment to Innovation Accelerators set out in the Levelling Up White Paper, this announcement is wonderfully timed”.

Robert Franks, Managing Director at WM5G, said: “Manufacturing is at the heart of the economy in the West Midlands, and at WM5G we are working collaboratively with our partners to ensure that public and private sector organisations can remain competitive in the global marketplace and develop cutting edge technologies to advance their capabilities.

“We are so pleased to have delivered a successful trial in partnership with nexGworx and BT at the MTC, driving forward the transformation of manufacturing productivity for the region. The learnings and outcomes from our demonstration will now be used and applied across the sector to ensure best practice is carried forward, and to accelerate the adoption of 5G technology more widely.”

Alejandra Matamoros, Technology Manager in the MTC’s Digital Engineering Group, said: “Our connected facility at the MTC will allow manufacturers of all sizes, research, and technology suppliers to explore the benefits of 5G in manufacturing. Through our enduring collaboration with nexGworx and BT we are now planning to further build on the initial capability we’ve created here at the MTC to push the boundaries of what can be achieved with the help of 5G technology.

“We hope that this project will inspire further development of innovative solutions to solve real business challenges and develop new opportunities through advanced wireless connectivity.”

https://www.lightreading.com/5g/bt-gets-into-5g-sa-testbed-with-nokia/d/d-id/776162?

Cisco’s 5G pitch: Private 5G, 5G SA Core network, optical backhaul and metro infrastructure

At MWC 2022 in Barcelona, Cisco revealed its Private 5G market strategy together with partners. It was claimed to usher in “a new wave of productivity for enterprises with mass-scale IoT adoption.” Cisco’s 5G highlights:

- Cisco Private 5G as-a-Service delivered with global partners offers enterprise customers reduced technical, financial, and operations risks with managing enterprise private 5G networks.

- Cisco has worked in close collaboration with two leading Open RAN vendors to include O-RAN technology as part of Cisco Private 5G and is currently in customer trials with Airspan and JMA.

- Multiple private 5G pilots and projects are currently underway spanning education, entertainment, government, manufacturing, and real estate sectors.

- 5G backhaul and metro infrastructure via routed optical networking (rather than optical transceivers like those sold by Ciena)

Cisco Private 5G:

The foundation of the solution is built on Cisco’s industry-leading mobile core technology and IoT portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards. Open Radio Access Network (ORAN) technology is a key component of the solution. Cisco is working in close collaboration with ORAN vendors, JMA and Airspan, and is currently in customer trials utilizing their technology.

Key differentiators of Cisco Private 5G for Enterprises:

- Delivered as-a-Service: Delivered together with global service providers and system integration partners, the offer reduces technical, financial, and operational risks for enterprise private 5G networks.

- Complementary to Wi-Fi: Cisco Private 5G integrates with existing enterprise systems, including existing and future Wi-Fi versions – Wi-Fi 5/6/6E, making operations simple.

- Visibility across the network and devices: Using a simple management portal, enterprise IT teams can maintain policy and identity across both Wi-Fi and 5G for simplified operations.

- Pay-as-you-use subscription model: Cisco Private 5G is financially simple to understand. With pay-as-you-use consumption models, customers can save money with no up-front infrastructure costs, and ramp up services as they need.

- Speed time to productivity: Businesses can spare IT staff from having to learn, design, and operate a complex, carrier class private network.

Key Benefits of Cisco Private 5G for Partners:

- Path to Profitability for Cisco Partners: For its channel partners, Cisco reduces the required time, energy, and capital to enable a faster path to profitability.

- Private Labeling: Partners can private label/use their own brand and avoid initial capital expenses and lengthy solution development cycles by consuming Cisco Private 5G on a subscription basis. Partners may also enhance Cisco Private 5G with their own value-added solutions.

“Cisco has an unbiased wireless strategy for the future of hybrid work. 5G must work with Wi-Fi and existing IT environments to make digital transformation easy,” said Jonathan Davidson, Executive Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Businesses continuing their digitization strategies using IoT, analytics, and automation will create significant competitive advantages in value, sustainability, efficiency, and agility. Working together with our global partners to enable those outcomes with Cisco Private 5G is our unique value proposition to the enterprise.”

The concept of private networks running on cellular spectrum isn’t new — about 400 private 4G LTE networks exist today — but Cisco expects “significantly more than that in the 5G world,” Davidson said. “We think that in conjunction with the additional capacity or also the need for high-value asset tracking is really important.”

During a MWC interview with Raymond James, Davidson said, “Mobile networks aren’t mobile for very long. They have to get to a wired infrastructure,” and therein lies multiple roles for Cisco to play in the telco market.

Cisco’s opportunity in the telco space includes the buildout of new backhaul and metro infrastructure to handle increased capacity and bandwidth, its IoT Control Center, private networks, and the core of mobile network infrastructure.

“We continue to be a market leader in that space,” Davidson said, referring to Cisco’s 4G LTE and 5G network core products. More than a billion wireless subscribers are connected to Cisco’s 4G LTE core, and it plays a central role on T-Mobile’s 5G standalone core, which serves more than 100 million subscribers on a converged 4G LTE and 5G core, he added.

Davidson also expects Cisco’s flattened infrastructure, or routed optical networking, to gain momentum in wireless networks. But first, a definition. For Cisco, optical refers to the technology that moves bits from point A to point B, not optical transceivers.

“Our belief is there is going to be a transition in the market towards what we call routed optical networking. And this means that takes traditional transponders and moves them from being a shelf, or a separate box, or a device, and turns them into a pluggable optic, which you then plug into a router,” he said.

That’s where Cisco’s $4.5 billion acquisition of Acacia Communications comes into play. In October 2021, we reported that Cisco’s Acacia unit is working together with Microschip to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The second phase of this type of network transformation involves the replacement of modems that exist in optical infrastructure with routers that carry pluggable transponders, Davidson added. The third phase places private line emulation onto that same infrastructure.

Supporting Comments:

“DISH Wireless is proud to partner with Cisco to bring smart connectivity to enterprise customers through dedicated private 5G networks. Together, we have the opportunity to drive real business outcomes across industries. We’re actively collaborating with Cisco on transformational projects that will benefit a variety of sectors, including government and education, and we’re working to revolutionize the way enterprises can manage their own networks. As DISH builds America’s first smart 5G network™, we’re offering solutions that are open, secure and customizable. Teaming with Cisco is a great next step, and we look forward to offering more innovative solutions for the enterprises of today and beyond.”

— Stephen Bye, Chief Commercial Officer, DISH Wireless

“Cisco is busting the myth that enterprises can’t cross Wi-Fi, private 5G and IoT streams. Enterprises are now tantalizingly closer to full visibility over their digital and physical environments. This opens up powerful new ways to innovate without compromising the robust control that enterprises require.”

— Camille Mendler, Chief Analyst Enterprise Services, Omdia

“Developing innovative, customized 5G private network solutions for the enterprise market is a major opportunity to monetize the many advantages of 5G technology. Airspan is proud to be one of the first leading Open RAN partners to participate in the Cisco Private 5G solution and offer our cutting edge 5G RAN solutions including systems and software that are optimized for numerous enterprise use cases.”

— Eric Stonestrom, Chairman and CEO, Airspan

“This partnership opens a world of new possibilities for enterprises. With simple downloaded upgrades, our all-software RAN can operate on the same physical infrastructure for 10+ years—no more hardware replacements every 36 months. And as the only system in the world that can accommodate multiple operators on the same private network, it eliminates the need to build separate networks for new licensed band operators.”

— Joe Constantine, Chief Technology & Strategy Officer, JMA

“5G marks a milestone in wireless networking. For organizations, it opens many new opportunities to evolve their business models and create a completely new type of digital infrastructure. We see strong demand in all types of sectors including manufacturing and mining facilities, the logistics and automotive industries, as well as higher education and the healthcare sector. As a leading Cisco Global Gold Partner, we are excited to help drive this evolution. Thanks to our deep expertise, international capability, and close partnership with Cisco, we can support companies in integrating Private 5G into their enterprise networks,”

— Bob Bailkoskiis, Logicalis Group CEO.

“NEC Corporation is working on multiple 5G initiatives with Cisco. We have a Global System Integrator Agreement (GSIA) partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. Work is in progress to connect Cisco’s Mobile Core and NEC’s radio over Cisco’s 5G Showcase in Tokyo, a world leading 5G services incubation hub. Leveraging NEC’s applications, Cisco and NEC will investigate expanding the technical trials including Private 5G in manufacturing, construction, transportation, and others.”

—Yun Suhun, General Manager, NEC Corporation

Industry Projects Underway

Cisco is working together with its partners on Private 5G projects for customers across a wide range of industries including Chaplin, Clair Global, Colt Technology Services, ITOCHU Techno-Solutions Corporation, Madeira Island, Network Rail, Nutrien, Schaeffler Group, Texas A&M University, Toshiba, Virgin Media O2, Zebra Technologies and more. See news release addendum for project details and supporting comments.

Final Thoughts:

“Radio access networks themselves are between $30 billion and $40 billion a year. Depending on who you talk to, optical (networking) can be between $10 billion and $15 billion a year. And then routing is below $10 billion a year,” Davidson said. “Our belief is that the optical total addressable market will start to shift over time as routed optical networks become more prevalent, because it will move from the optical domain into the optic transceiver market,” he added.

Finally, although Cisco repeatedly insists it has no interest in becoming a RAN supplier, it remains strongly supportive of Open RAN. The RAN market “is still closed, it’s locked in, even though there are standards,” he said.

“People do not do any interoperability testing between vendors, which is fundamentally changing with open RAN” because operators are forcing vendors to make their equipment interoperate with open RAN implementations, Davidson concluded.

References:

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Additional Resources:

- Cisco Private 5G

- Blog: Private 5G Delivered on Your Terms, Masum Mir, Vice President and General Manager, Mobile, Cable and IoT

Bloomberg: 5G in the U.S. Has Been a $100 Billion Box Office Bomb

From the very start of 5G deployments three years ago, there have been challenges with the technology, like when AT&T confusingly branded 4G as “5G E.” Conspiracy theorists have tagged 5G as a source of harmful radiation and a spreader of the coronavirus.

More recently, airlines and the FAA have complained that C-Band frequencies could interfere with radar and jeopardize air safety. To date, the biggest knock against 5G is that it’s been a nonevent. And, by the time it’s in full force, big tech companies including Amazon, Microsoft, and Google may have beaten the wireless carriers to the kinds of data-hungry applications that superfast 5G networks have been expected to spawn. At FCC auctions, U.S. carriers spent $118B on 5G spectrum- about twice as much as they spent on 4G.

Source: FCC

The higher speeds and greater capacity of 5G are needed to meet growing demand for services such as high-definition video streaming. However, the big improvement with 5G technology was supposed to be Ultra High Reliability and Ultra Low Latency (URLLC), which was to spawn a wide variety of new mission critical and real time control applications. That hasn’t happened because the ITU-R M.2150 RAN standard (based on 3GPP release 15 and 16) doesn’t meet the URLLC performance requirements in ITU M.2410 while the 3GPP Release 16 URLLC in the RAN spec (which was to meet those requirements) has not been completed or performance tested.

Also, all the new 5G features, such as network slicing, can only be realized with a 5G SA core network, but very few have actually been deployed. Adjunct capabilities, like virtualization, automation, and multi-access edge computing also require a “cloud native” 5G SA core network. Finally, the highly touted 5G mmWave services (like Verizon’s Ultra-Wideband) consume a tremendous amount of power, require line of sight communications, and have limited range/coverage.

Lacking a compelling reason to persuade customers to upgrade, carriers have been offering $1,000 5G phones for free to help jump-start the conversion process. Such promotions are needed because 5G isn’t even among the top four reasons people switch carriers, according to surveys by Roger Entner of Recon Analytics Inc. Those reasons typically include price or overall network reliability.

Ironically, one area where 5G has had early success is in providing wireless home broadband service (aka Fixed Wireless Access or FAA). That’s because 5G was designed for mobile- not fixed- communications and FAA was not even a targeted use case by either ITU-R or 3GPP. Nonetheless, as faster 5G mid-band frequencies are built out, customers are finding a wireless alternative to landline providers. This threat to cablecos is likely to spark price battles as the cable operators respond by offering cheaper mobile phone service of their own.

This was not the way 5G was envisioned or promoted. Carriers were rolling out 5G to deliver an “oh, wow” experience that customers would willingly pay extra for. Instead the technology has become a standard feature in an arena where mobile phone companies and cable operators are battling it out with similar packages. As that reality started to take hold, the carriers pointed to bigger, more immediate opportunities such as selling 5G to large companies and governments. “It became apparent a while ago that the most compelling use cases for 5G would revolve around businesses rather than consumers,” GlobalData’s Parker said.

To help make that happen, the major carriers formed partnerships with the so-called webscalers, the big cloud service providers including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

To help make that happen, the major carriers formed partnerships with the so-called webscalers, the big cloud service providers including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

The wireless carriers are staking their futures on these workplace roles. But because no 5G hyperconnected, cloud-powered commercial ecosystem has been built before, tech giants and telecommunications companies are collaborating to tackle the challenge.

While new partnerships are still being announced and big 5G projects are moving through the planning stages, executives at the wireless companies say they’re confident they can play a role in the information technology infrastructure of the future. “I’m proud to be the only carrier in the world that has partnership agreements with all three of the big webscalers,” says Verizon Communications Inc.’s business services chief Tami Erwin. “We’re creating the platform for the metaverse to really accelerate.”

As 4G showed, the carriers could create a higher-functioning network, but it was other companies such as Uber, Netflix, and Facebook that cashed in on the connectivity. 5G is set to expand the overall pie again, but the size of the carriers’ slice isn’t certain—bad news because they spent $118.4 billion on 5G airwave auctions, almost double the $61.8 billion they paid for 4G spectrum.

T-Mobile US Inc., which has taken the lead in U.S. 5G deployment, plans to focus on its core network strength as the tech giants sort things out, says Neville Ray, T-Mobile’s president of technology. “Facebook, Apple, Microsoft, Google—all of these massive companies are lining up huge investments in this space, and they need mobile networks in a way that they never did before,” he says. “They will need network capabilities that they simply don’t have any desire to build.”

That’s led a bunch of would-be competitors to work arm-in-arm to create a collective business model. “We have a great partnership with Microsoft,” says AT&T’s Sambar. “We’re a customer of Amazon, and they’re a customer of ours. We’re all friends today, we keep a close eye on each other. You have to cooperate to make this happen.”

The carriers provide businesses with a roster of services including voice, data, network management, and security, and they’ll want to keep control of those relationships as services emerge in 5G, says longtime Wall Street industry analyst Peter Supino. But as the cloud providers gain a bigger role in a business’s network infrastructure, running everything from robotics on the production floor to in-office wireless data systems, the carriers’ role may shift to more of a wholesale supplier of network capacity and mobile cellular service to the cloud companies, according to Supino.

“Over time, I’m confident that the cloud operators will provide too much convenience to be ignored,” he says. “The benefits of 5G will be significant, and they will mostly accrue to people who aren’t the telco carriers.”

References:

https://www.verizon.com/about/news/power-verizon-5g-ultra-wideband-coming

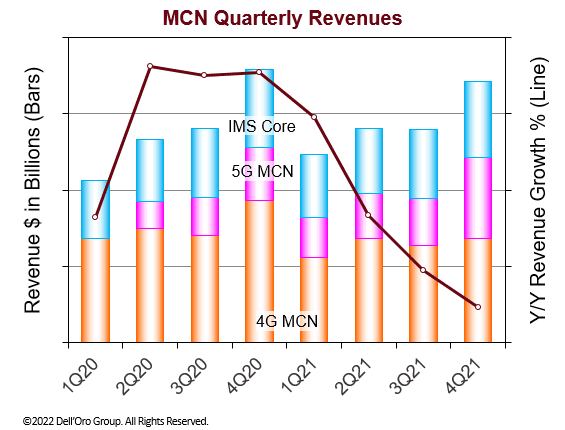

Dell’Oro: Mobile Core Network and MEC Stagnant in 2021; Will Growth in 2022

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market 2021 revenue growth slowed to the lowest rate since 2017. The growth rate is expected to go higher in 2022 with the expansion of the 21 commercial 5G Standalone (5G SA) MBB networks that were deployed by the end of 2021, coupled with new 5G SA networks readying to launch throughout the year.

“MCN revenues for 2021 were lower than expected due to an unexpectedly poor fourth quarter performance. The revenues for 4Q 2021 were lower than in 4Q 2020. The last time that happened was in 4Q 2017,” stated Dave Bolan, Research Director at Dell’Oro Group. “The poor performance in 4Q 2021 was due to negative year-over-year revenue performance for the China region. The performance for the rest of the world was almost flat but still negative and obviously was not enough to offset the decline in China.

“The growth in 2021 came from the 5G MCN segment and was not enough to offset the decline in 4G MCN and IMS Core. Of the 21 5G SA networks commercially deployed Huawei is the packet core vendor in seven of the networks, including the three largest networks in the world located in China, and Ericsson is the packet core vendor in 10 of the networks. Not surprisingly, of the top five vendors, only Huawei and Ericsson gained overall MCN revenue market share during 2021.

“Looking at the MEC market, MEC is still a fraction of the overall MCN market, but we believe two recent announcements by Ericsson are noteworthy because, in our opinion, Ericsson will accelerate the adoption of MEC and help 5G MNOs monetize their networks by coalescing MEC implementations around the 3GPP standards. Ericsson claims to be the first to leverage recent advancements by the 3GPP standards body for edge exposure, and network slicing all the way through to a smartphone,” continued Bolan.

Additional highlights from the 4Q 2021 Mobile Core Network Report:

- Top-ranked MCN vendors based on revenue in 2021 were Huawei, Ericsson, Nokia, ZTE, and Mavenir.

- The EMEA region was the only region to grow in revenue in 2021.

- The APAC region was the largest region in revenue for 2021.

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

References:

https://www.delloro.com/news/mobile-core-network-stagnant-in-2021-poised-for-growth-in-2022/

https://techblog.comsoc.org/2021/12/01/delloro-5g-sa-core-network-launches-accelerate-14-deployed/

Explaining the 5G SA Core network as distinct from 5G RAN (5G NR)

At this week’s ITU-R WP5D meeting, a Russian contribution (5D/998) proposed a liaison statement to Global Core Specification (GCS) Proponents to clarify 5G NSA (Non-Stand Alone) and 5G SA (Stand Alone) architectures in Recommendation ITU-R M.2150 (formerly know as IMT 2020.specs). Those architectures are described in 3GPP TR 21.915 (Summary of Rel-15 Work Items). While 5G NSA uses LTE for everything other than the RAN (5G NR), 5G SA introduces the 5G Core network which facilitates new 5G features and functions. 3GPP has decided NOT to liaison their 5G SA Core network TR’s to ITU-T for consideration as ITU recommendations for 5G non radio aspects.

Here’s the functional split between the 5G RAN (5G NR) and the 5G core network, as per 3GPP Release 15:

From 3GPP TR 21.915:

5.5.2 The 5G Core Network

5.5.2.1 Main Network Functions (NFs)

The AMF (Access and Mobility management Function) support UEs with different mobility management needs. It performs the following main tasks:

– The Non-Access Stratum (NAS) signalling termination;

– The NAS signalling security;

– The Access Stratum (AS) Security control;

– Inter CN node signalling for mobility between 3GPP access networks;

– Idle mode UE Reachability (including control and execution of paging retransmission);

– Registration Area management;

– Support of intra-system and inter-system mobility;

– Access Authentication;

– Access Authorization including check of roaming rights;

– Mobility management control (subscription and policies);

– Support of Network Slicing;

– SMF selection.

The SMF (Session Management Function) can support, together with the AMF, customized mobility management schemes such as “Mobile Initiated Connection Only” (MICO) or RAN enhancements like “RRC Inactive” state. It performs the following main tasks:

– Session Management;

– UE IP address allocation and management;

– Selection and control of UPF;

– Configures traffic steering at UPF to route traffic to proper destination;

– Control part of policy enforcement and QoS;

– Downlink Data Notification.

The UPF (User Plane Function) performs the following main tasks:

– Anchor point for Intra-/Inter-RAT mobility (when applicable);

– External PDU session point of interconnect to Data Network;

– Packet routing & forwarding;

– Packet inspection and User plane part of Policy rule enforcement;

– Traffic usage reporting;

– Uplink classifier to support routing traffic flows to a data network;

– Branching point to support multi-homed PDU session;

– QoS handling for user plane, e.g. packet filtering, gating, UL/DL rate enforcement;

– Uplink Traffic verification (SDF to QoS flow mapping);

– Downlink packet buffering and downlink data notification triggering.

The other main Network Functions are:

– The “Network Repository Function” (NRF): it provides support for NF services management including registration, deregistration, authorization and discovery.

– The “Network Exposure Function” (NEF): it provides external exposure of the capabilities of the network functions. External exposure can be categorized as Monitoring capability, Provisioning capability, Application influence of traffic routing and Policy/Charging capability.

– The “Unified Data Management” (UDM): the 5GC supports Data Storage architecture for Compute and Storage separation. The Unified Data Repository (UDR) is the master database. The Unstructured Data Storage Function (UDSF) is introduced to store dynamic state data.

5.5.2.2 Specificities of the 5G Core Network and associated NFs

5.5.2.2.1 Local hosting of services and Edge Computing

5.5.2.2.2 Network slicing

5.5.2.2.3 Unified access control

5.5.2.2.4 Support of 3GPP and non-3GPP access

5.5.2.2.5 Policy framework and QoS support

5.5.2.2.7 Other specific services

The following services are also supported by 5G SA core network:

– Short Message Service (SMS). This is supported by “SMS over NAS” (including over non-3GPP access).

– IP-Multimedia Subsystem (IMS) and its services, although, this might not be available in all initial 5G deployments. If IMS services are invoked by a UE connected to an IMS-less 5GS, this triggers a network-based handover towards an appropriate RAT and related EPS. This applies also to the support of IMS emergency services.

– Multi-Operator Core Network (MOCN), in which a RAN is shared by multiple core networks.

– Public Warning System (PWS). This is supported by either using Service-based interfaces between the Cell Broadcast Centre (CBC) Function (CBCF) and the AMF, or using an interworking function between the CBC and the AMF.

– Multimedia Priority Services (MPS). They are supported by MPS-specific exemptions for 5GS mobility management and 5GS session management.

– Mission Critical Services (MCS). They are supported by having a subscription in place for both 5G QoS profile and the necessary policies. Some standardized QoS characteristics are defined for MCS.

– PS Data Off. The 5G’s “PS data off” functionality is backward-compatible and provides Control Plane Load Control, Congestion and Overload control. This includes AMF Load balancing, AMF Load-rebalancing, TNL (Transport Network Layer between 5GC and 5G-AN) Load (re-)balancing, as well as AMF Overload Control, SMF Overload Control.

It should be noted that, in 5GS Phase 1 (3GPP Release 15), Location Services are optional and restricted to regulatory (emergency) services. 5GS Phase 2 (3GPP Release 16) was frozen in June 2020 without either URLLC in the RAN or URLCC in the Core specs completed.

References:

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3389

IMT 2020: Concept of Global Core Specification (GCS) and Transposing Organization(s)

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Japan’s KDDI is claiming to have turned on the world’s first commercial 5G Standalone (SA) Open Radio Access Network (Open RAN) site, using equipment and software from Samsung Electronics and Fujitsu. KDDI used O-RAN Alliance compliant [1.] technology, including Samsung’s 5G virtualized CU (vCU) and virtualized DU (vDU) as well as Fujitsu’s radio units (MMU: Massive MIMO Units).

Note 1. O-RAN Alliance specifications are being used for RAN module interfaces that support interoperation between different Open RAN vendors’ equipment.

The first network site went live in Kawasaki, Kanagawa today. KDDI, together with its two partners, will deploy this Open RAN network in some parts of Japan and continue its deployment and development, embracing openness and virtualization in KDDI’s commercial network. Note that both Rakuten-Japan and Dish Network/Amazon AWS have promised 5G SA Open RAN but neither company seems close to deploying it.

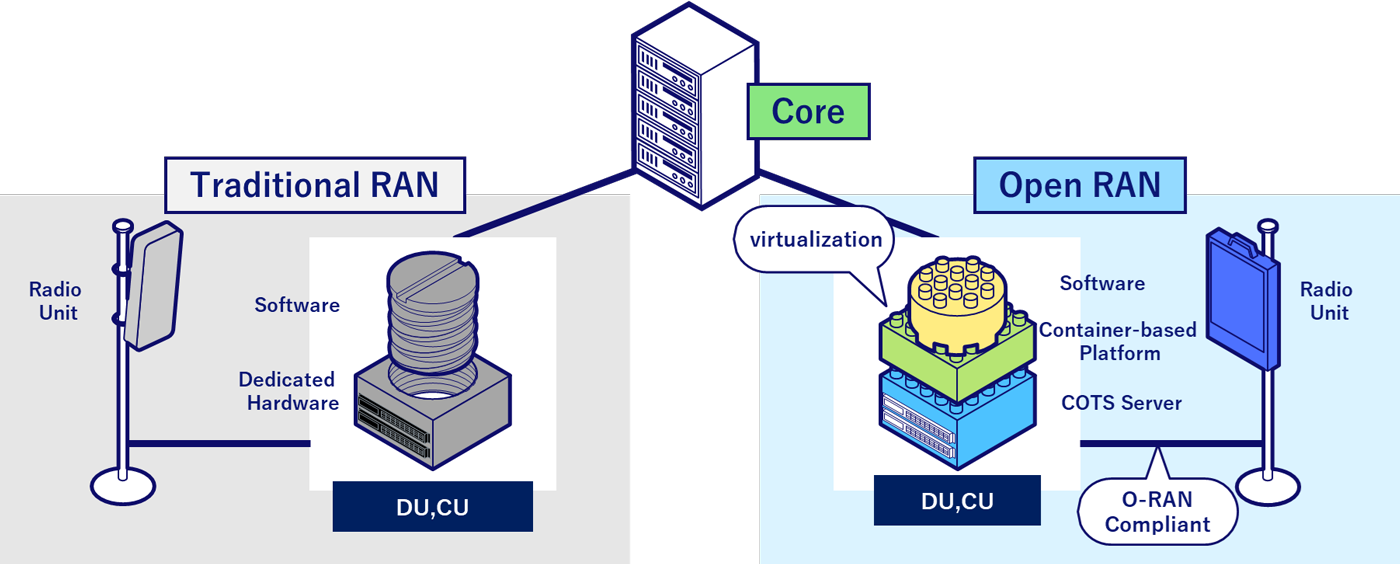

Virtualization and O-RAN technology replaces dedicated hardware with software elements that can run on commercial off-the-shelf (COTS) servers. This brings flexibility and agility to KDDI’s network, allowing the operator to offer enhanced mobile services to its users. KDDI says this architecture will deliver reliability, while accelerating deployment of Open RAN throughout Japan, including in rural areas. Meanwhile, 5G SA will deliver superior performance, higher speeds and lower latency and make possible advanced services/applications, such as network slicing, automation, service chaining and Multi-access Edge Computing (MEC).

Traditional RAN vs. Open RAN Configuration. Source: KDDI

Characteristics of this site:

This Open RAN site leverages fully-virtualized RAN software, provided by Samsung, that runs on commercial off-the-shelf (COTS) servers. Furthermore, by pursuing an open network approach between radio units and baseband unit, KDDI used Samsung’s baseband and Fujitsu’s Massive MIMO Units, which are connected with an open interface.

- Fully-virtualized 5G RAN software can be swiftly deployed using existing hardware infrastructure, which brings greater flexibility in deployment. New 5G SA technologies―such as network slicing, Multi-access Edge Computing (MEC) and others―powered by 5G vRAN, will deliver superior performance, higher speeds and lower latency, allowing KDDI users to experience a range of new next-generation services and immersive applications.

- Using an open interface between radio units and baseband unit, Open RAN not only ensures security and reliability but also enables operators to implement best-of-breed solutions from different partners and build an optimal network infrastructure for maximized performance.

- The virtualized network allows the use of general-purpose hardware (COTS servers) across the country, which will greatly increase deployment efficiencies. Additionally, by leveraging system automation, fully-virtualized RAN software can reduce deployment time, enabling swift nationwide expansion, including rural areas.

Comments from Kazuyuki Yoshimura, Chief Technology Officer, KDDI Corporation:

“Together with Samsung and Fujitsu, we are excited to successfully develop and turn on the world’s first commercial 5G SA Open RAN site powered by vRAN. Taking a big step, we look forward to continue leading network innovation and advancing our network capabilities, towards our vision of delivering cutting-edge 5G services to our customers.”

Comments from Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics:

“Leveraging our industry-leading 5G capabilities, we are excited to mark another milestone with KDDI and Fujitsu. Samsung stands out for its leadership in 5G vRAN and Open RAN with wide-scale commercial deployment experiences across the globe. While KDDI and Samsung are at the forefront of network innovation, we look forward to expanding our collaboration towards 5G SA, to bring compelling 5G services to users.”

Note: Samsung released its first 5G vRAN portfolio in early 2021 following its blockbuster RAN deal with Verizon, which was the first operator to commercially deploy the new equipment. Samsung also gained a foothold in Vodafone’s plan to deploy 2,500 open RAN sites in the southwest of England and most of Wales. Samsung’s open RAN compliant vRAN hardware and software were previously deployed in 5G NSA commercial networks in Japan and Britain, but this is the first 5G SA deployment. We wonder if it is “cloud native?” Hah, hah, hah!

Comments from Shingo Mizuno, Corporate Executive Officer and Vice Head of System Platform Business (In charge of Network Business), Fujitsu Limited:

“The Open RAN-based ecosystem offers many exciting possibilities and this latest milestone with KDDI and Samsung demonstrates the innovative potential of next-generation mobile services with Massive MIMO Units. Fujitsu will continue to enhance this ecosystem, with the goal of providing advanced mobile services and contributing to the sustainable growth of our society.”

The companies will continue to strengthen virtualized and Open RAN leadership in this space, bringing additional value to customers and enterprises with 5G SA.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Addendum: As of December 31, 2021 there were only 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

SOURCE: Dave Bolan, Dell’Oro Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2022/02/18/5896.html

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks