fiber optics

NeoPhotonics CFP2-DCO Module Transmission of 400Gbps over 1500 km

Optical components maker NeoPhotonics said it was able to transmit data at 400 Gbps over a distance of 1500 km, using its Multi-Rate CFP2-DCO coherent pluggable transceivers, in a 75 GHz-spaced DWDM network.

The demonstration was done in NeoPhotonics Transmission System Testbed using production modules with enhanced firmware and 19 in-line erbium-doped fiber amplifiers (EDFA).

To achieve 1,500 km reach and a 400G data rate, the modules were operated at 69 Gbaud using 16 QAM modulation. NeoPhotonics added that the modules each consumed considerably less electrical power than line card systems operating at comparable data rates and distances. These 400G CFP2-DCO coherent pluggable transceiver modules use NeoPhotonics Indium Phosphide-based coherent components, along with its ultra-narrow linewidth tunable laser. These components include Class 40 CDM, Class 40 Micro-ICR and Nano-ITLA.

These 400G CFP2-DCO coherent pluggable transceiver modules use NeoPhotonics high performance Indium Phosphide-based coherent components, along with its ultra-narrow linewidth tunable laser. These components are all shipping in high volume into multiple coherent system applications, and include:

- Class 40 CDM: NeoPhotonics Class 40, polarization multiplexed, quadrature coherent driver modulator (CDM) features a co-packaged InP modulator with a linear, high bandwidth, differential driver, and is designed for low V-Pi, low insertion loss and a high extinction ratio. The compact package is designed to be compliant with the form factor of the OIF Implementation Agreement #OIF-HB-CDM-01.0.

- Class 40 Micro-ICR: NeoPhotonics Class 40 High Bandwidth Micro-Intradyne Coherent Receiver (Micro-ICR) is designed for >60 GBaud symbol rates. The compact package is designed to be compliant with the OIF Implementation Agreement OIF-DPC-MRX-02.0.

- Nano-ITLA: NeoPhotonics Nano-ITLA is based on the same proven and reliable high performance external cavity architecture as NeoPhotonics’ industry leading Micro-ITLA and maintains comparable ultra-narrow linewidth, low frequency phase noise and the low power consumption in a compact package approximately one half the size.

NeoPhotonics Multi-Rate CFP2-DCO modules are fully qualified. Telcordia testing has been successfully extended to 2000 hours of High Temperature Operating Life (HTOL) testing, showing the high reliability and performance of NeoPhotonics CFP2-DCO platform.

Multi-Rate CFP2-DCO modules supporting Metro (64G baud/DP-16 QAM) and Long Haul (64 G baud/DP-QPSK) applications are shipping in General Availability.

“Coupled with our recent demonstration of 800 km 400 Gbps transmission using our 400ZR+ QSFP-DD, our CFP2-DCO 400G 1500 km transmission brings the use of pluggable modules in regional and long haul networks closer to reality,” said Tim Jenks, Chairman and CEO of NeoPhotonics. “The ability to implement a long haul coherent transponder in the size and power envelope of a pluggable module is a testament to the progress that has been made in photonic integration and DSP development, and has the potential to be a game changer for telecom as well as DCI networks,” concluded Mr. Jenks.

June 8, 2021 Update:

NeoPhotonics announced that its QSFP-DD and OSFP 400ZR pluggable modules are in General Availability and shipping to customers.

These products utilize NeoPhotonics Silicon Photonics Coherent Optical Subassembly (COSA) and low power consumption, ultra-narrow linewidth Nano-ITLA tunable laser, combined with the latest generation of 7 nm node DSP (digital signal processing) technology, to provide full 400ZR transmission in a standard data center QSFP-DD or OSFP form factor that can be plugged directly into switches and routers. This greatly simplifies and cost reduces data center interconnect (DCI) networks by enabling the elimination of a layer of network equipment and a set of short reach client-side transceivers, and paves the way for similar benefits in metro networks.

These 400G modules are compliant with the OIF 400ZR Implementation Agreement and are interoperable with other manufacturers’ 400ZR modules that utilize a standard forward error correction (FEC) encoder and decoder. These modules are capable of tuning to and transmitting within 75 GHz or 100GHz spaced wavelength channels, as specified in the OIF agreement, and operate in 400ZR mode for Cloud DCI applications. For longer metro reaches, the modules are designed to support 400ZR+ modes.

NeoPhotonics QSFP-DD and OSFP modules have completed reliability qualification and have passed 2000 hours of High Temperature Operating Life (HTOL) as well as other critical tests per Telcordia requirements.

The company recently announced that it had used its QSFP-DD coherent pluggable transceiver to transmit at a 400 Gbps data rate over a distance of 800 km in a 75GHz-spaced DWDM system with more than 3.5 dB of OSNR margin in the optical signal while remaining within the power consumption envelope of the QSFP-DD module’s power specification.

“This demonstration of high data rates over longer distances shows the potential of these game-changing products, and we expect to see increasing deployment of coherent pluggable modules with different use cases, from data center interconnect to metro and regional applications as well as 5G wireless backhaul,” said Tim Jenks, Chairman and CEO of NeoPhotonics. “Since the beginning of coherent transmission, NeoPhotonics has been at the forefront in meeting the volume needs of our customers, as is indicated by our recent announcement that we had shipped a cumulative total of more than two million ultra-narrow linewidth tunable lasers,” concluded Mr. Jenks.

About NeoPhotonics:

NeoPhotonics is a leading developer and manufacturer of lasers and optoelectronic solutions that transmit, receive and switch high-speed digital optical signals for Cloud and hyper-scale data center internet content provider and telecom networks. The Company’s products enable cost-effective, high-speed over distance data transmission and efficient allocation of bandwidth in optical networks. NeoPhotonics maintains headquarters in San Jose, California and ISO 9001:2015 certified engineering and manufacturing facilities in Silicon Valley (USA), Japan and China. For additional information visit www.neophotonics.com.

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON

Nokia and Proximus turned on what they call the world’s fastest fiber access network at a media event in Antwerp attended by the Belgian Minister of Telecommunications, the Mayor of Antwerp and executives and engineers from the two companies.

Operating over existing fiber with Nokia equipment deployed in the Proximus network, the first ever 25G PON live network connects the Havenhuis building in the Port of Antwerp with the Proximus central office in the middle of the city. The network speed exceeded 20 Gbps, making it the fastest fiber network in the world.

Proximus is the leading provider of fixed broadband networks in Belgium with 45.9% market share. The operator is accelerating the move to fiber, adding 10% coverage each year and is on target to reach at least 70% of homes and business by 2028. As part of its inspire 2022 vision, it is creating a high capacity open network which will be available to all operators, eliminating the need for fiber overbuild.

Rupert Wood, Research Director for Fiber Networks at Analysys Mason, said: “Today’s 25G PON achievement demonstrates the unlimited potential of fiber. This next evolution in fiber technology will provide enterprises with greater than 10 Gbs connectivity and the capacity needed to support 5G transport along with future next generation services such as massive scale Virtual Reality and real time digital twins.”.

Guillaume Boutin, CEO Proximus, said: “The activation of the first 25G PON network worldwide shapes our bold ambition to be a trendsetter, to become a reference operator in Europe and, why not, across the globe. Together with Nokia, we have achieved a technological leap forward that will become a key enabler of the digital and economy and society that we stand for. Today’s announcement is also an occasion to stand still and look at the pace at which we connect the citizens of Antwerp to the technology of the future. Thanks to huge investments, we are realizing an acceleration that is unseen in Europe, and I am convinced this will be crucial to remain competitive for us as a company, but also for Antwerp as a city and for our entire economy.”

Federico Guillén, President Network Infrastructure Nokia, said: “10 years ago our companies launched the technology which enabled a switch to HD TV. Today we make history again with a network that is 200x faster. We are proud to support Proximus in enabling the world’s first 25G PON network, powered by Nokia’s Quillion chipset, which supports three generations of PON technologies. Quillion has been adopted by more than 100 operators since its launch last year and all operators deploying the Quillion based GPON and XGS-PON solution today have the capabilities to easily evolve to 25G PON.”

Nokia’s 25G PON solution utilizes the world’s first implementation of 25GS-PON technology and includes Lightspan access nodes, 25G/10G optical cards and fiber modems.

Nokia Lightspan FX and MX are high-capacity access nodes for massive scale fiber roll-outs. Usually located in telecom central office, they connect thousands of users via optical fibre, aggregate their broadband traffic and send it deeper in the network. The fiber access nodes can support multiple fiber technologies including GPON, XGS-PON, 25GS-PON and Point-to-Point Ethernet to deliver l wide range of services with the best fit technology..

Nokia ONT (Optical Network Termination) devices, or fiber optic modems, are located at the user location. They terminate the optical fiber connection and delivers broadband services within the user premises or cell sites.

Nokia supplied PON line cards with their Quillion chipset, which can handle 25 Gbps. The chipset can grow with gradual updates on an operator’s network. Nokia is already shipping the technology to 100 customers worldwide.

Nokia executives admitting during a webcast press conference today that its 25G PON tech still needed some work for large-scale deployments, but that it would be ready for large, prime-time rollouts in 2022, with enterprise and 5G backhaul applications expected to fuel initial demand.

PON (Passive Optical Networking) eliminates the need for active equipment on the connection, between the control panel and the end user’s network connection point. On the last mile, there is system of optical splitters that breaks the light signal into different wavelengths. This means the 25G connection can be shared by up to 32 households. Since end users do not constantly use the full connection, a high bandwidth per connection is still achievable.

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

References:

FTTH Council Europe: FTTH/B reaches nearly 183 million (>50% of all homes)

Europe has passed over half of homes able to receive fiber broadband. According to the latest figures compiled by Idate for the FTTH Council Europe, 52.5% of homes will be covered by FTTH/B at the end of September 2020. That’s up from 49.9% a year earlier.

FTTH Council Europe revealed the following:

• Number of homes passed by fiber (FTTH/B) reaches nearly 183 million homes in EU39.

• Europe’s fiber footprint (number of homes passed) expanded the most in the past year in France (+4.6M homes passed), Italy (+2.8M), Germany (+2.7M) and the UK (+1.7M).

• Three countries are accounting for almost 60% of homes left to be passed with fiber in the EU27+UK region.

• FTTH/B Coverage in Europe surpasses more than half of total homes.

• 16.6% growth in the number of fiber subscribers.

• Iceland leads the European FTTH/B league table second year in a row. 70.7% of its households having fiber connections. Belarus (70.4%) and Spain (62.6%) came in second and third.

• Belgium, Israel, Malta and Cyprus enter the FTTH/B ranking for the first time.

The above figures cover 39 countries across Europe, where nearly 183 million homes have fibre access. For the EU and UK alone, penetration reached 43.8 percent in September, up from 39.4 percent a year earlier.

The report also shows fiber take-up is accelerating, with a subscriber penetration of 44.9 percent of lines in the 39 countries, compared to 43 percent in September 2019. In total there were 81.9 million FTTH/B subscribers in September 2020, up 16.6 percent from a year earlier. Annual growth was again strongest in France, with nearly 2.8 million subscribers added in the 12 months, followed by Russia with 1.7 million and Spain with 1.4 million.

The countries with the highest fiber penetration across Europe are Iceland and Belarus, with over 70 percent of households using fiber broadband. Spain and Sweden are at over 60 percent, and Norway, Lithuania and Portugal over 50 percent.

“The telecoms sector can play a critical role in Europe’s ability to meet its sustainability commitments

by reshaping how Europeans work, live and do business. As the most sustainable telecommunication

infrastructure technology, full fibre is a prerequisite to achieve the European Green Deal and make the

European Union’s economy more sustainable. Competitive investments in this technology should,

therefore, remain a high political priority and we look forward to working with the EU institutions,

national governments and NRAs towards removing barriers in a way to full-fibre Europe” said Vincent

Garnier, Director General of the FTTH Council Europe.

About the FTTH Council Europe:

The FTTH Council Europe is an industry organization with a mission to advance ubiquitous full fibre based connectivity to the whole of Europe. Our vision is that fiber connectivity will transform and

enhance the way we live, do business and interact, connecting everyone and everything,

everywhere.

Fiber is the future-proof, climate-friendly infrastructure which is a crucial prerequisite for

safeguarding Europe’s global competitiveness while playing a leading global role in sustainability.

The FTTH Council Europe consists of more than 150 member companies.

Contacts:

Eric Joyce, Chair, Market Intelligence Committee

[email protected]

Sergejs Mikaeljans. Communications and Public Affairs Officer

[email protected] Tel: +32 474 81 04 54

……………………………………………………………………………………………………………………

Separately, BT has increased its its total FTTP network build target from 20 million to 25 million premises by December 2026, with Openreach working to connect up to 4 million premises a year.

……………………………………………………………………………………………………………………..

References:

https://www.ftthcouncil.eu/documents/Fibre_Market_Panorama_2021_PR_final.pdf

https://register.gotowebinar.com/register/2424555495368131344 (webinar registration)

Echo and Bifrost: Facebook’s new subsea cables between Asia-Pacific and North America

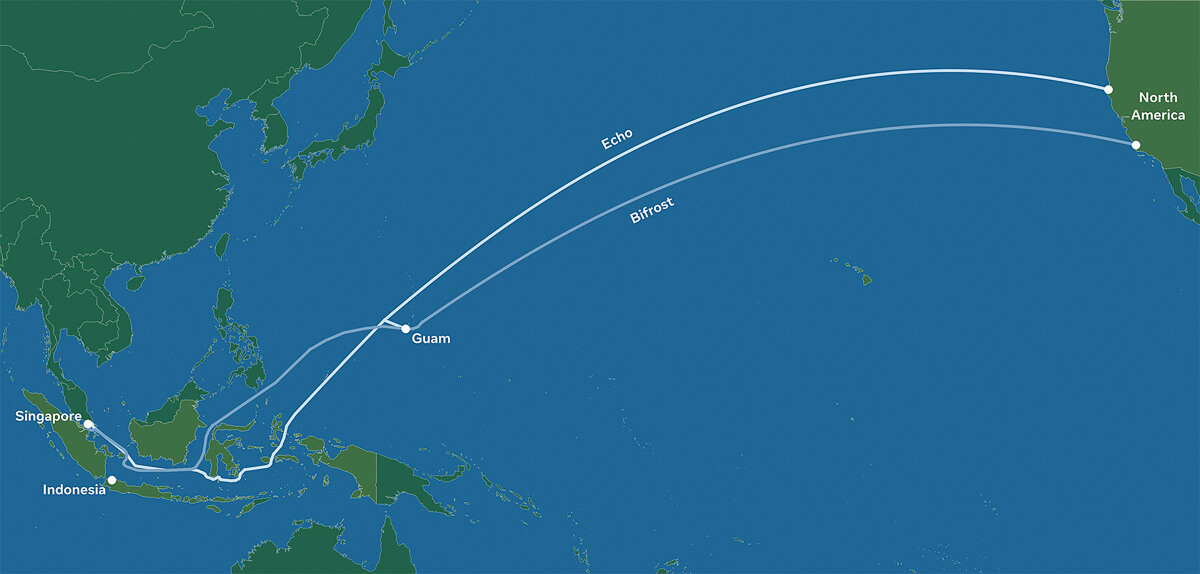

Facebook has revealed plans to build two new subsea cables between the Asia-Pacific region and North America, called Echo and Bifrost. The social media giant also revealed partnerships with Google as well as Asian telecoms operators for the project.

Although these projects are still subject to regulatory approvals, when completed, these cables will deliver much-needed internet capacity, redundancy, and reliability. The transpacific cables will follow a “new diverse route crossing the Java Sea, connecting Singapore, Indonesia, and North America,” and are expected to increase overall transpacific capacity by 70%.

Facebook says Echo and Bifrost will support further growth for hundreds of millions of people and millions of businesses. Facebook said that economies flourish when there is widely accessible internet for people and businesses.

Echo and Bifrost be the first transpacific cables through a new diverse route crossing the Java Sea. Connecting Singapore, Indonesia, and North America, these cable investments reflect Facebook’s commitment to openness and our innovative partnership model. The social media company works with a variety of leading Indonesian and global partners to ensure that everyone benefits from developing scale infrastructure and shared technology expertise.

Facebook will work with partners such as Indonesian companies Telin and XL Axiata and Singapore-based Keppel on these projects.

Image Credit: Facebook

………………………………………………………………………………………………..

Kevin Salvadori, VP of network investments at Facebook, provided further details in an interview with Reuters. He said Echo is being built in partnership with Alphabet’s Google and XL Axiata. It should be completed by 2023. Bifrost partners include Telin, a subsidiary of Indonesia’s Telkom, and Keppel. It is due to be completed by 2024.

Aside from the Southeast Asian cables, Facebook was continuing with its broader subsea plans in Asia and globally, including with the Pacific Light Cable Network (PLCN), Salvadori said.

“We are working with partners and regulators to meet all of the concerns that people have, and we look forward to that cable being a valuable, productive transpacific cable going forward in the near future,” he said.

Indonesia

Facebook noted that Echo and Bifrost will complement the subsea cables serving Indonesia today. These investments present an opportunity to enhance connectivity in the Central and Eastern Indonesian provinces, providing greater capacity and improved reliability for Indonesia’s international data information infrastructure. Echo and Bifrost complement the subsea cables serving Indonesia today, increasing service quality and supporting the country’s connectivity demands.

This is all part of Facebook’s continued effort to collaborate with partners in Indonesia to expand access to broadband internet and lower the cost of connectivity. Facebook has partnered with Alita, an Indonesian telecom network provider, to deploy 3,000 kilometers (1,8641 miles) of metro fiber in 20 cities in Bali, Java, Kalimantan, and Sulawesi. In addition, we are improving connectivity by expanding Wi-Fi with Express Wi-Fi.

While 73% of Indonesia’s population of 270 million are online, the majority access the web through mobile data, with less than 10 percent using a broadband connection, according to a 2020 survey by the Indonesian Internet Providers Association. Swathes of the country, remain without any internet access.

Singapore

In Singapore, Echo and Bifrost are expected to provide extra subsea capacity to complement the APG and SJC-2 subsea cables. Building on Facebook’s previously announced Singapore data center investments, Echo and Bifrost will provide important diverse subsea capacity to power Singapore’s digital growth and connectivity hub. Singapore is also home to many of Facebook’s regional teams.

The Asia-Pacific region is very important to Facebook. In order to bring more people online to a faster internet, these new projects add to Facebook’s foundational regional investments in infrastructure and partnerships to improve connectivity to help close the digital divide and strengthen economies.

……………………………………………………………………………………………………………………………………

References:

Advancing connectivity between the Asia-Pacific region and North America

https://www.reuters.com/article/us-facebook-internet-southeastasia-idUSKBN2BL0CH

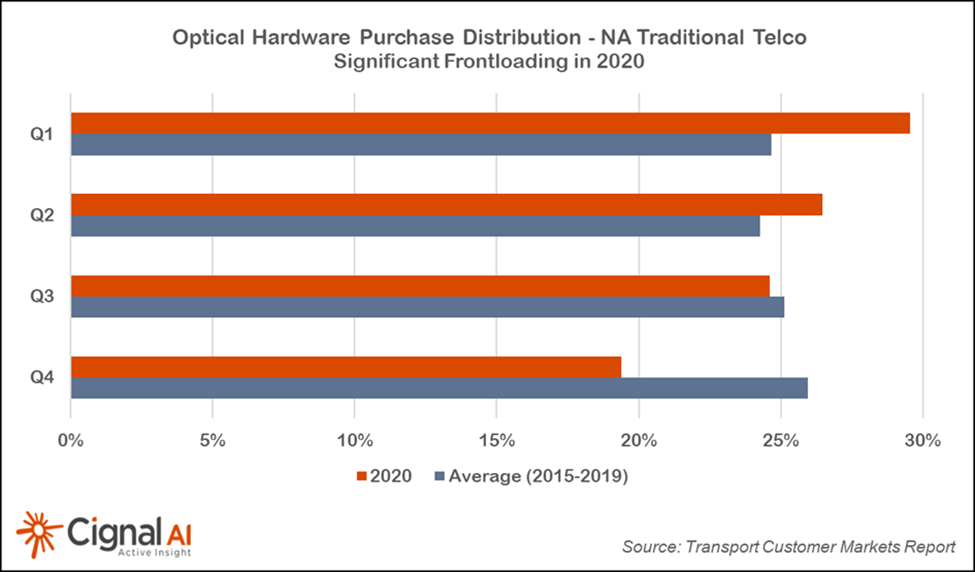

North American Cloud and Traditional Telco CapEx Drops in 4th Quarter 2020

Subhead: Exceptional 4Q Cloud & Colo Operator Spending in APAC

|

||||

|

||||

More Key Findings from the 4Q20 Transport Customer Markets Report:

Separately, Cignal AI said on March 16th that Ciena’s revenue decline this quarter was steeper than forecast, but the company is poised to grow revenues based on the success of its WaveLogic 5e fifth generation coherent technology. On March 2nd, Cignal AI said that Infinera originally expected its ICE6 technology to enter the market in the second half of 2020. The company’s current guidance now indicates a 2H21 arrival. Infinera reports a strong order pipeline, but has not specified exactly when the first ICE6 will ship for revenue. About the Transport Customer Markets Report:

About Cignal AI:

References:https://cignal.ai/opteq-hw-dashboard/https://cignal.ai/free-articles/

|

AT&T Provides Update on Fiber Rollouts, 5G Expansion, and Financial Outlook

Here are the highlights of AT&T Investor Day Announcements:

3 million new fiber locations:

AT&T plans to deploy fiber-to-the-premises (FTTP) to another 3 million-plus residential and business locations across more than 90 metro areas in 2021, and is already sizing up plans to push that to an additional 4 million locations in 2022, Jeff McElfresh, CEO of AT&T Communications, said today during the company’s investor day event.

“The margin economics are attractive. These areas are adjacent to our current footprint, driving cost efficiencies in our build as well as our marketing and distribution efforts.”

McElfresh expects its fiber subscriber volumes increase in the second half of the year after the initial buildouts, but noted that he likes what AT&T is seeing in the early part of 2021. The company noted that about 70% of its gross broadband adds in fiber buildout areas are new AT&T customers.

“And if we keep up with that pace, our vision would be to have over half of our portfolio, or 50% of our network, covered by that fiber asset. As our integrated fiber plan improves the yield performance on that fiber it will further give us conviction on continuing that investment in the coming years.”

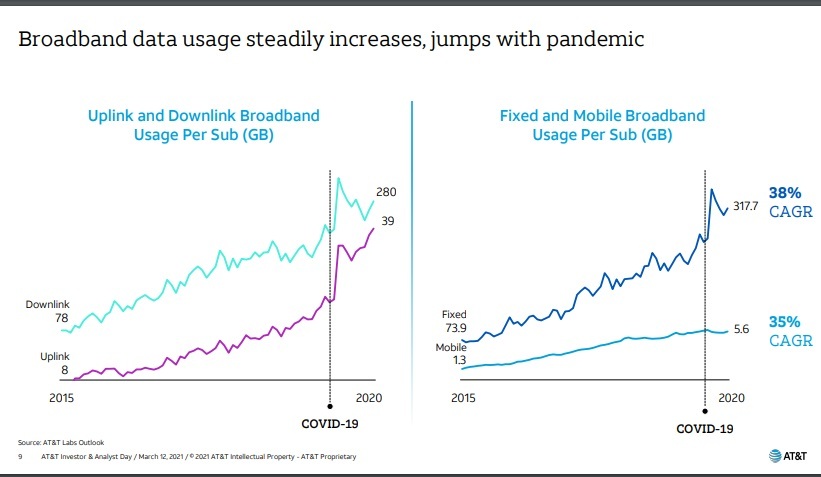

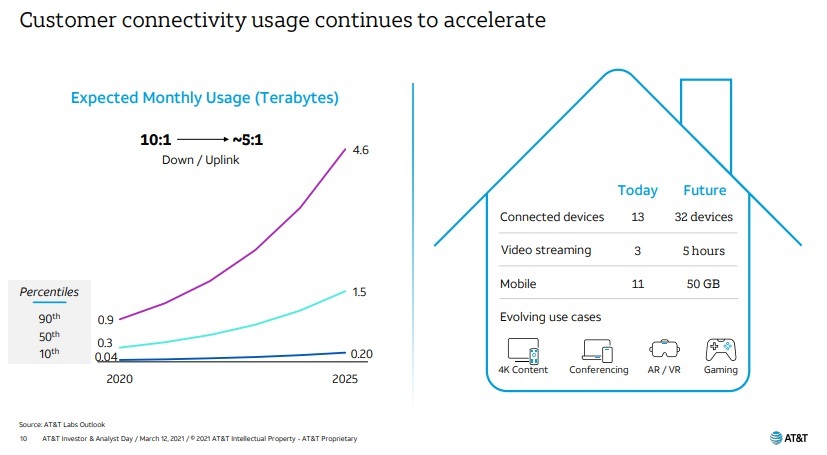

AT&T is also looking to broaden its reach of fiber amid rising data demand and network usage that has occurred during the pandemic, and isn’t expected to stop any time soon. That’s shown in the graph’s below:

References:

………………………………………………………………………………………………………………………………….

AT&T’s 5G Strategy:

AT&T’s 5G network now covers 230M Americans in 14,000 cities and towns and AT&T 5G+ is now available in parts of 38 cities in the U.S.

Note: AT&T may temporarily slow data speeds if the network is busy.

“Connectivity is at the heart of everything we do – 140 years and counting. From our fiber network backbone to the layers of wireless spectrum technology, we provide 5G network coverage that delivers the speeds, security and lower latency connections that customers and businesses need,” said Jeff McElfresh, CEO – AT&T Communications. “Over the past five years, AT&T has invested more capital in the U.S. than any other public company.”

Here is what the company said about its 5G Strategy:

AT&T has planned a balanced approach to 5G. Our strategy of deploying 5G in both sub-6 (5G) and mmWave (5G+) spectrum bands provides a great mix of speeds, latency and coverage for consumers and businesses. We rolled out nationwide 5G that now covers 230 million people, and offer 5G+ providing ultra-fast speeds to high-density areas where faster speeds can have huge impacts for our customers. So far, AT&T has deployed 5G+ nodes in parts of 38 cities across the U.S.

AT&T 5G is opening up some impressive opportunities for businesses and consumers and mid-band and mobile edge computing will help us go even further. There is an emerging multi-sided business model across 5G, edge computing and a variety of use cases from healthcare to gaming.

Our mobile edge computing plus 5G network will help satisfy the need for ultra-responsive networks and open up new possibilities for consumers and businesses. With our investments, we will take advantage of new technologies like spatial computing to enable applications across industries from manufacturing automation to watching immersive sports.

Reference: https://about.att.com/story/2021/5g_strategy.html

…………………………………………………………………………………………………………………………………

C-band spectrum deployment to begin in 2021:

- AT&T acquired 80 MHz of C-band spectrum in the FCC’s Spectrum Auction 107. The company plans to begin deploying the first 40 MHz of this spectrum by the end of 2021.

- AT&T expects to spend $6-8 billion in capex deploying C-band spectrum, with the vast majority of the spend occurring from 2022 to 2024. Expected C-band deployment costs are already included in the company’s 2021 capex guidance and in its leverage ratio target for 2024.

- AT&T expects to deliver 5G services over its new C-band spectrum licenses to 70 to 75 million people in 2022 and 100 million people in “early” 2023.

- Funding C-band spectrum: AT&T’s investment in C-band spectrum via Auction 107 totals $27.4 billion, including expected payments of $23 billion in 2021.

- To meet this commitment and other near-term priorities, in 2021 the company expects to have access to cash totaling at least $30 billion, including cash on hand at the end of 2020 of $9.7 billion, commercial paper issued in January 2021 of $6.1 billion and financing via a term loan credit agreement of $14.7 billion.

Jeff McElfresh, CEO of AT&T Communications, explained the operator’s focus on both 5G and fiber: “Our value proposition is to serve customers how they want to be served with enough bandwidth and capacity and speed, and we’ll let the technology service architecture meet that demand or that need.”

“When you get up into the midband segment of spectrum, while it offers us really wide bandwidth for speed and capacity, its coverage characteristics don’t penetrate [buildings and other locations] as effectively as the lowband does,” he said. “And so as we design our network and our offers in the market, you will see us densify our wireless network on the top of our investments in fiber.”

–>Yet McElfresh didn’t really address how AT&T Communications would overcome those challenges.

References:

https://about.att.com/story/2021/att_analyst_day.html

………………………………………………………………………………………………………………………………….

Financial Targets and Guidance:

- End-of-year 2021 debt ratio target of 3.0x. The company expects to end 2021 with a net debt-to-adjusted EBITDA ratio of about 3.0x,3 reflecting an anticipated increase in net debt of about $6 billion to fund the C-band spectrum purchase.

- 2024 debt ratio of 2.5x or lower. During 2024, AT&T expects to reach a net debt-to-adjusted EBITDA ratio of 2.5x or lower.3 To achieve this target, the company expects to use all cash flows after total dividends to pay down debt and will continue to look for opportunities to monetize non-strategic assets. The company also does not plan to repurchase shares during this period.

- 2021 guidance unchanged. AT&T’s 2021 financial guidance, announced in January 2021, is unchanged on a comparative basis. For the full year, the company continues to expect:

- Consolidated revenue growth in the 1% range

- Adjusted EPS to be stable with 20204,5

- Gross capital investment6 in the $21 billion range, with capital expenditures in the $18 billion range

- 2021 free cash flow7 in the $26 billion range, with a full-year total dividend payout ratio in the high 50’s% range

References:

https://about.att.com/story/2021/att_analyst_day.html

PON’s Vulnerability to Denial of Service (DoS) Attacks

by Shrihari Pandit

Introduction:

The dominant architecture used in fiber optic deployment -Passive Optical Networks (PONs) may be vulnerable to attack. It is important to bring attention to this under-appreciated weakness and discuss what steps are possible to protect fiber infrastructure.

As various PON technologies are long standing and widely deployed, this is a matter of no small concern. PONs are widely deployed by Verizon FiOS, AT&T U-verse and many others.

The PON architecture is a hodgepodge of old and new technologies, hardware and strategy, limited budget and often is not overseen by a single team.

In this article we describe how fiber optic infrastructure based on PONs may be open to potential denial of service (DoS) attacks via optical signal injections. Security experts warn that this is a growing issue, which could take down entire sectors of PON segments.

Considering the ever increasing state-sponsored and non-state-actor cyber attacks, these types of vulnerabilities that allow for massive disruption for large groups of people are very attractive targets.

PON Overview:

The cost advantages of PON architecture make it the overwhelming choice for FTTH deployments. PON allows wireline network providers to deliver service to businesses and homes without having to install costly active electronics on roads, curb-side or even within buildings themselves.

Active electronics, on the other hand, add cost and create operational complexity as deployments scale. The conveniences and differentiators of PONs are precisely what opens up the floodgates to serious vulnerabilities.

PONs are fundamentally susceptible due to the architecture from the passive optical splitter (POS) to the optical network unit (ONU) within the overall network infrastructure. The POS component of the network functions like a bridge, allowing any and all communications to transverse without the ability to filter, limit or restrict flow.

The fiber optic market currently boasts 585.9 million subscribers worldwide, with that number set to grow to 897.8 million subscribers by 2021.

The industry has moved to upgrade 1st generation GPONs and EPONs to next-generation PONs, like NG-PON2 (the favorite), XG-PON1 and XGS-PON. For example, Verizon uses the Calix AXOS E9-2 Intelligent Edge System for large-scale NG-PON2 deployments that began in the first quarter of 2018.

However, with subscriber density significantly increasing per PON segment, the risks increase as more subscribers are affected by a cyber attack on a single fiber.

Sidebar: NG-PON2

NG-PON2 combines multiple signals onto a single optical fiber by using the different wavelengths of laser light (wave division multiplexing), and then splits transmission into time slots (time division multiplexing), in order to further increase capacity. NG-PON2 is illustrated in the figure below.

Legend:

OLT =Optical Line Termination ONT =Optical Network Termination

NGPON2 has three key advantages for operators:

1. Cost

Firstly, it can co-exist with existing GPON and NGPON1 systems and is able to use existing PON-capable outside plant. Since the cost of PON FTTH roll out is 70 per cent accounted for by the optical distribution network (ODN), this is significant. Operators have a clear upgrade path from where they are now, until well into the future.

2. Speed

Initially NGPON2 will provide a minimum of 40 Gb/s downstream capacity, produced by four 10 Gb/s signals on different wavelengths in the O-band multiplexed together in the central office with a 10 Gb/s total upstream capacity. This capability can be doubled to provide 80 Gb/s downstream and 20 Gb/s upstream in the “extended” NGPON2.

3. Symmetrical upstream/downstream capacity

Both the basic and extended implementations are designed to appeal to domestic consumers where gigabit downstream speeds may be needed but more modest upstream needs prevail. For business users with data mirroring and similar requirements, a symmetric implementation will be provided giving 40/40 and 80/80 Gb/s capacity respectively.

………………………………………………………………………………………

The Essence of a PON Cyber Attack:

Given the flashpoints around the globe, it doesn’t take much imagination to envision how state and non-state actors might want to cause such a chaotic and widespread disruption.

If a “cyber criminal” gains access to the underlying fiber, they could inject a wideband optical signal to disrupt communications for all subscribers attached to the PON segment.

Alternatively, at your home the adversary could manipulate the ONU’s optical subsystem to transmit abnormal PON signals and impact service to all subs on that segment. Communications including internet, voice and even analog TV signals that operate on nearby wavelengths would be susceptible to these serious DoS attacks.

Possible Solutions, Preventive Methods and Procedures:

So, what can be done with current equipment without a massive and costly fiber optic network overhaul? The unfortunate answer is that an overarching vulnerability will always exist as long as the passive components are in place. A reactionary process is the best and only option.

The current primary solution for operators is to reduce the number of subscribers per PON segment as a way to manage risks. If an attack was detected, the network operator would be able to localize the source and identify and disconnect the bad actor from the network. But it’s easier said than done.

This sort of manual process is not ideal. Extensive PON outages means spending the time and money to send personnel to optical line terminals to check each individual port until the attacker is found. The installation of active electronics on each PON segment or near PON subscribers is unrealistic and impractical. That undertaking would actually be more costly in terms of time, money and location.

The best ongoing solution is that operators should consider installing passive tap points per PON segment. Each can be independently routed back and managed at a provider’s operations center and allow operators to effectively analyze segments and detect unusual optical light levels that may signal an attack.

At that point the operator could physically dispatch techs on-site to continue the localization and resolution process while ensuring other non-threatening users remain unaffected. This solution is to effectively take a reactionary restriction and make it as automatic and proactive as currently possible.

Conclusions:

P2MP (point to multi-point) architecture has become the most popular solution for FTTH and FTTP. Yet there needs to be a severe increase in awareness to potential PON vulnerability into the next generation.

If we can catalyze the telecom industry to develop methods and measures to protect infrastructure, such crippling network security issues will be stopped before widespread exploits occur.

The industry needs to address these concerns sooner rather than later or else be left without effective countermeasures against these very real threats.

………………………………………………………………………………………………..

References:

https://www.paloaltonetworks.com/cyberpedia/what-is-a-denial-of-service-attack-dos

https://s2.ist.psu.edu/paper/ddos-chap-gu-june-07.pdf

https://www.youtube.com/watch?v=G93I_v2pa24

……………………………………………………………………………….

About Shrihari Pandit:

Shrihari Pandit is the President and CEO of Stealth Communications, the NYC-based ISP he co-founded in 1995. Stealth, having built its own fiber-optic network throughout the city, provides high-bandwidth connectivity services to a broad roster of customers in business, education and government.

Prior to Stealth, Mr. Pandit was a network-security consultant to various software and telecom companies, including MCI, Sprint and Sun Microsystems. He also served as an independent consultant to several U.S. agencies, including NASA and the National Infrastructure Protection Center (NIPC), now part of the Department of Homeland Security.

Telefonica in 800 Gbps trial and network slicing pilot test

With this initiative the intention is also to begin building services for customers to be marketed via Telefónica’s 5G network. The project will thus enable Telefónica to obtain key results that will serve to drive the ecosystem and promote the interoperability and standardisation of this technology with a view to its marketing towards the end customer. Some of the sectors that can benefit the most from Network Slicing are the State Security Corps and Forces, media and communication, cars, industry and hotels.

Fiber optic coverage in Brazil to reach 5.5K municipalities by 2024; telcos want fiber over underground sewage ducts and systems

By 2024, optical fiber should reach 5,500 Brazilian municipalities that do not now have fiber coverage. This is one of the new objectives of Brazil’s General Plan for Universalization Goals. On Thursday, Brazil’s Communications Ministry approved the issuance of debentures for investments in the telecommunications infrastructure, taking the total initiatives to stimulate the development of the sector to seven. The document was published in the Federal Official Gazette and gathers the obligations that fixed-line operators must fulfill in the next five years.

According to the plan, fiber optic connections should have a minimum capacity of 10 GB per second from the beginning to the end of the stretch that serves the municipality, and cover at least 10% of its territory by December 31, 2021. If the new target is met, the estimate is that internet coverage by fiber optics will reach around 5.500 cities by 2024. This would be equivalent to 99% of Brazilian municipalities.

Anatel (the National Telecommunications Agency in Brazil) has a period of 3 months to draw up the list of cities that will be covered. In Brazil, fiber connections already account for almost a third of total fixed broadband connections, according to data from regulator Anatel. All major carriers are expanding their FTTH network.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Brazilian telecom operators want to be allowed to pass critical telecom transport networks, namely fiber optics, over underground sewage ducts and systems. The topic was discussed during a 5G event held by the Lide group on Thursday, where sector executives called for the issue to be included in the new rules for the sanitation sector. With the aim of making the sector more attractive to private investors, last year saw a new sanitation framework approved by congress and signed into law by President Jair Bolsonaro.

“It’s hard to pass fiber on the surface and sewer systems can be a lever for telecom infrastructure,” said Leonardo Capdeville, chief technology officer at TIM Brasil. “The systems can even be used to pass fiber up to homes and buildings. We could take advantage of the sanitation framework,” he said.

It is a “win-win” relationship, according to the CTO. On the one hand, it generates additional revenue for the sanitation company, while at the same time allowing it to benefit from connectivity that can help improve operating control and management, by preventing leaks in a timely manner for example.

Operators have sought to find alternatives to the obstacles they claim to face in the form of bureaucracy, excessive costs and licenses for rolling out fiber along highways, and also high fees charged by power utilities for the use of lampposts.

Echoing Capdeville, TIM’s regulatory affairs director, Mario Girasole, defended advances in fiber backhaul (transport networks) by joint construction and deployment with power distributors, road concessionaires and sanitation companies. The idea of using sewage systems and other forms of infrastructure sharing was also defended by the CEO of local telco Oi, Rodrigo Abreu, and Ericsson’s Eduardo Ricotta.

“Optical fiber needs a very large investment and we see this [sharing] trend as a way of no return,” said Ricotta, who is head of the Southern Cone at the Swedish telecom infra provider. In São Paulo, state utility Sabesp is currently discussing ways to deploy 5G transport infra via sewage systems, according to Adriano Stringhini, the company’s corporate management officer.

References:

LG U+ first to deploy 600G backbone network in Korea with Ciena’s ROADM equipment

South Korea network operator LG U+ today announced it is the first carrier in South Korea to deploy 600Gb/sec on a single wavelength for long haul, using Ciena’s WaveLogic 5 technology. LG U+ made this upgrade to support remote experiences.

The company will establish a ROADM (Re-configurable Optical Add-Drop Multiplexer) backbone network to strengthen the competitiveness of business. LG U+’s newly constructed and dedicated nationwide ROADM backbone network will satisfy the needs of customers and preemptively respond to increased traffic following the introduction of the remote era. For this network transformation, LG U+ has selected Ciena’s WaveLogic 5 Extreme and WaveLogic Ai coherent optical solutions.

Sung-cheol Koo who’s in charge of LG U+’s wired business said, “Amid the expansion of cloud services such as telecommuting, video conferencing and remote classes, we are building a new backbone network that can accommodate the needs of various corporate customers. With a flexible and stable transmission network, we expect that companies can provide a higher level of service.”

LG U+ also applied the Optical Time Domain Reflectometer (OTDR) technology, which measures the loss of optical lines, disconnection points, and distances across the entire section of the new backbone network. By intuitively monitoring the condition of the line in real time, it is possible to shorten the response time in case of a failure.

With rapidly increasing traffic, Ciena will enable LG U+ to transmit single-carrier 600G wavelengths over the new flexible grid backbone that has six times the network capacity compared to the existing network. The new backbone network will provide enhanced availability through low-latency, multiple route diversity and direct connections between large cities without the need for regeneration.

LG U+ is in the process of implementing a major capacity upgrade, including multi-terabits of additional capacity, to accommodate large-capacity customers and enable stable traffic management. By applying OTDR (Optical Time Domain Reflectometer) technology to all sections of the backbone network, real-time and intuitive line condition monitoring is possible to shorten troubleshooting time and enable smooth network management and operations.

In addition, Ciena’s 6500 ROADM equipment can reliably configure DR (Disaster Recovery) line services to public government, financial institutions and compute centers of large enterprises through third party interworking certification. LG U+ can also provide a dedicated line service with enhanced security through optical transport encryption.

In addition, Ciena’s 6500 ROADM equipment can reliably configure DR (Disaster Recovery) line services to public government, financial institutions and compute centers of large enterprises through third party interworking certification. LG U+ can also provide a dedicated line service with enhanced security through optical transport encryption.

LGU+ will be using Ciena’s Manage, Control and Plan (MCP) SDN controller to be able to automate service delivery via next-generation OPEN APIs to improve customer experience and increase operational efficiencies.

References:

https://www.ciena.com/about/newsroom/press-releases/lg-u-builds-new-nationwide-backbone-network.html