Uncategorized

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

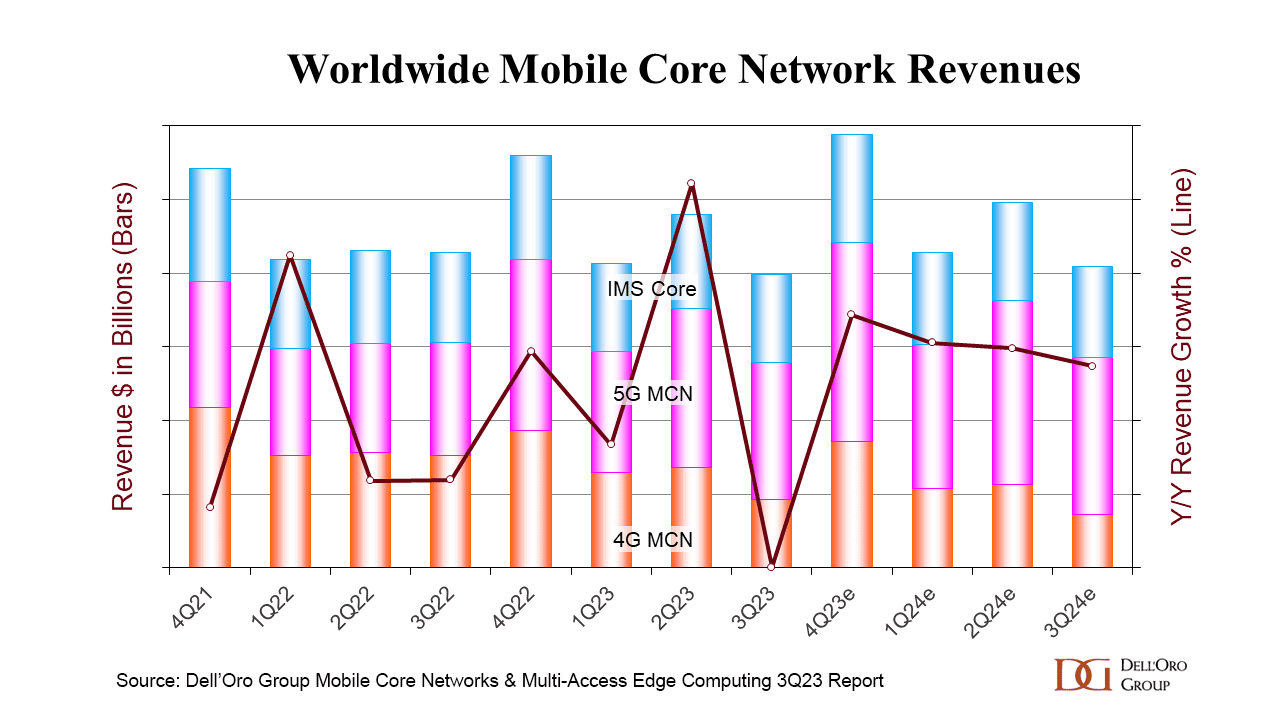

The global mobile core network (MCN) market has just turned in its lowest quarterly growth rate for almost six years, hit by a difficult political and economic climate, as well as by slow rollouts of 5G standalone core networks. Dell’Oro Group reports that the MCN market has become erratic, with the lowest growth rate since 4Q 2017. Europe, Middle East, and Africa (EMEA), and China were the weakest performing regions in 3rdQ 2023.

“It has become quite obvious the MCN market has entered into a very unpredictable phase after breaking the highest growth rate in 2ndQ 2023 since 1stQ 2021, and now hitting the lowest performing growth rate in 3rdQ 2023 since 4thQ 2017. Last quarter, EMEA and China were the strongest performing regions and flipped this quarter, becoming the weakest performing regions,” stated Dave Bolan, Research Director at Dell’Oro Group.

“Many vendors state that the market is volatile, attributing this phenomenon to macroeconomic conditions such as the fear of higher inflation rates, unfavorable currency foreign exchange rates, and the geopolitical climate.

“Besides subscriber growth, the growth engine for the MCN market is the transition to 5G Standalone (5G SA), which employs the 5G Core. But after five years into the 5G era, we are still seeing more 5G Non-Standalone (5G NSA) networks being launched than 5G SA, and the pace of 5G SA networks has slowed from 17 launched in 2022 to only seven so far in 2023. However, we expect more 5G SA networks to be deployed in 2024 than in 2023, and we expect 2024’s market performance to be better than 2023,” continued Bolan.

Additional highlights from the 3Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- Two new MNOs launched commercial 5G SA networks in 3Q23: Telefónica O2 in Germany and Etisalat in the UAE.

- Ericsson is the vendor of record for the 5G packet core for all seven 5G SA networks launched in 2023.

- As of 3Q 2023, 45 MNOs have commercially deployed 5G SA eMBB networks.

- The top MCN vendors worldwide for 3Q 2023 [1.] were: Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 3Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

Note 1. Dell’Oro did not supply any actual MCN market share percentages or numbers.

……………………………………………………………………………………………………………………………….

In August the Global mobile Suppliers Association (GSA) released Q2 figures that showed just 36 operators worldwide has launched public 5G SA networks, including two soft launches, by the end of June, an increase of just one on the previous quarter.

In total, the GSA said that 115 operators in 52 countries had invested in public 5G SA networks – that includes actual deployments as well as planned rollouts and trials – by the end of Q2, with no new names added during the quarter, and an increase of just three on the end of 2022.

About the Report:

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

About Dell’Oro Group:

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Dell’Oro: RAN market declines at very fast pace while

Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

GSA 5G SA Core Network Update Report

5G SA networks (real 5G) remain conspicuous by their absence

Dell’Oro: Market Forecasts Decreased fo

r Mobile Core Network and Private Wireless RANs

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT‘s latest research report indicates that annual spending on 5G NR and LTE-based small cell RAN (Radio Access Network) equipment operating in shared and unlicensed spectrum will account for nearly $3 Billion by the end of 2026.

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum – frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have either launched or are in the process of releasing innovative frameworks to facilitate the coordinated sharing of licensed spectrum.

Examples include (but are not limited to): the three-tiered CBRS (Citizens Broadband Radio Service) spectrum sharing scheme in the United States, Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks, United Kingdom’s shared and local access licensing model, France’s vertical spectrum and sub-letting arrangements, Netherlands’ geographically restricted mid-band spectrum assignments, Switzerland’s 3.4 – 3.5 GHz band for NPNs (Non-Public Networks), Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks, Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band, Poland’s spectrum assignment for local government units and enterprises, Bahrain’s private 5G network licenses, Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses, South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands, Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks, Hong Kong’s LWBS (Localized Wireless Broadband System) licenses, Australia’s apparatus licensing approach, Canada’s planned NCL (Non-Competitive Local) licensing framework and Brazil’s SLP (Private Limited Service) licenses.

Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA (General Authorized Access) tier of the 3.5 GHz CBRS band in the United States and Japan’s 1.9 GHz sXGP (Shared Extended Global Platform) band. In addition, vast swaths of globally and regionally harmonized license-exempt spectrum – most notably, the 600 MHz TVWS (TV White Space), 5 GHz, 6 GHz and 60 GHz bands – are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled LTE and 5G NR networks for a diverse array of use cases – ranging from mobile network densification, FWA (Fixed Wireless Access) in rural communities and MVNO (Mobile Virtual Network Operator) offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

SNS Telecom & IT estimates that global investments in 5G NR and LTE-based RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

The “Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2023 to 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 15 frequency bands, seven use cases and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The report will be of value to current and future potential investors into the shared and unlicensed spectrum LTE/5G network market, as well as LTE/5G equipment suppliers, system integrators, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

Key Findings:

- SNS Telecom & IT estimates that global investments in LTE and 5G NR-based RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

- Breaking away from traditional practices of spectrum assignment for mobile services that predominantly focused on exclusive-use national licenses, telecommunications regulatory authorities across the globe have either launched or are in the process of releasing innovative frameworks to facilitate the coordinated sharing of licensed spectrum. Examples include but are not limited to:

- The three-tiered CBRS spectrum sharing scheme in the United States

- Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks

- United Kingdom’s shared and local access licensing model

- France’s vertical spectrum and sub-letting arrangements

- Netherlands’ geographically restricted mid-band spectrum assignments

- Switzerland’s 3.4 – 3.5 GHz band for NPNs (Non-Public Networks)

- Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks

- Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band

- Poland’s spectrum assignment for local government units and enterprises

- Bahrain’s private 5G network licenses

- Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses

- South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands

- Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks

- Hong Kong’s LWBS (Localized Wireless Broadband System) licenses

- Australia’s apparatus licensing approach

- Canada’s planned NCL (Non-Competitive Local) licensing framework

- Brazil’s SLP (Private Limited Service) licenses

- Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA tier of the 3.5 GHz CBRS band in the United States and Japan’s 1.9 GHz sXGP band. In addition, vast swaths of globally and regionally harmonized license-exempt spectrum – most notably, the 600 MHz TVWS, 5 GHz, 6 GHz and 60 GHz bands – are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

- Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled LTE and 5G NR networks for a diverse array of use cases – ranging from mobile network densification, FWA in rural communities and MVNO offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

- In particular, private LTE and 5G networks operating in shared spectrum are becoming an increasingly common theme. Hundreds of local and priority access licenses – predominantly in mid-band spectrum – have been issued in the United States, Germany, United Kingdom, France, Finland, Sweden, Japan, South Korea, Taiwan and other pioneering markets to facilitate the operation of purpose-built wireless networks based on 3GPP standards.

- Airbus, ArcelorMittal, Bayer, BBC (British Broadcasting Corporation), BMW, Bosch, Dow, EDF, Ferrovial, Groupe ADP, Holmen Iggesund, Hoban Construction, Hsinchu City Fire Department, Inventec, John Deere, KEPCO (Korea Electric Power Corporation), Lufthansa, Mercedes-Benz, Mitsubishi, NAVER, NFL (National Football League), Osaka Gas, Ricoh, SDG&E (San Diego Gas & Electric), Siemens, SVT (Sveriges Television), Tesla, Toyota, Volkswagen, X Shore and the U.S. military are just a few of the many end user organizations investing in shared spectrum-enabled private cellular networks.

- In some national markets, neutral host solutions based on shared spectrum small cells are being employed as a cost-effective means of coverage enhancement inside office spaces, public venues and other indoor environments. One prominent example is social media and technology giant Meta’s in-building wireless network that uses small cells operating in the GAA tier of CBRS spectrum and MOCN (Multi-Operator Core Network) technology to provide multi-operator cellular coverage at its properties in the United States.

- Although the uptake of 5G NR equipment operating in high-band mmWave (Millimeter Wave) frequencies has been slower than initially anticipated, practical cases of 5G networks based on locally licensed 26/28 GHz spectrum are steadily piling up in multiple national markets – examples range from private 5G installations at HKIA (Hong Kong International Airport), SMC (Samsung Medical Center) and various manufacturing facilities to Japanese cable TV operator-led deployments of 28 GHz local 5G networks.

- The very first deployments of 5G NR-U technology are also beginning to emerge. For example, the SGCC (State Grid Corporation of China) has deployed a private NR-U network – operating in license-exempt Band n46 (5.8 GHz) spectrum – to support video surveillance, mobile inspection robots and other 5G-connected applications at its Lanzhou East and Mogao substations in China’s Gansu province. In the coming years, with the technology’s commercial maturity, we also anticipate seeing NR-U deployments in Band n96 (6 GHz) and Band n263 (60 GHz) for both licensed assisted and standalone modes of operation.

References:

https://www.snstelecom.com/shared-spectrum

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

WSJ: Has 5G Lived Up to Expectations?

Hundreds of billions of dollars have been invested worldwide in 5G. What was the return on that huge investment? As we forecasted five years ago and ever since then, 5G hasn’t revolutionized whole swaths of the economy the way past mobile technologies did.

…………………………………………………………………………………………………………………………….

Opinion: Network operators and 5G vendors promised too much and under delivered. 3GPP and ITU-R WP 5D are partially to blame for the commercial failure of 5G.

In particular, URLLC- the key 5G use case- could not be realized because 3GPP Release 16 spec for Enhancements for URLLC in the RAN wasn’t complete and so could not be implemented. Those enhancements were to enable URLLC end points to realize ITU-R M.2410 performance requirements, e.g. <1 ms latency in the data plane and <10 ms latency in the control plane.

Also, the 3GPP specs for 5G Architecture did not include implementation of 5G SA Core network, but instead provided many options. Hence, there are many versions of 5G SA Core networks, with many major network operators, e.g. AT&T and Verizon, still using 5G NSA (with LTE infrastructure for everything but the RAN).

ITU-R M2150, the terrestrial 5G RIT/SRIT recommendation, did not meet the M.2410 URLLC performance requirements (due to absence of 3GPP Rel 16 URLLC in the RAN spec), Also, it was not accompanied by the companion recommendation M.1036 issue 6 IMT Frequency Arrangements, which could not be agreed upon till a few months ago (it’s expected to be approved by ITU-R SG 5 meeting this November). As a result, there were no standard frequencies for 5G. That resulted in a “frequency free for all” where administrations like the FCC chose frequencies for 5G that were not agreed upon at WRC’19 and assigned to ITU-R WP 5D to specify the frequency arrangements.

For sure, the U.S. wireless carriers offering 5G service have not had anywhere near a good ROI. That’s indicative of the decline in their stock prices this year. Despite an 8.67% dividend, Verizon (VZ) stock has lost -16.39% YTD through Friday Oct 13th. AT&T (T) stock has performed slightly worse with a -16.74% YTD total return. The Dow Jones U.S. Telecommunications Index is -17.34% YTD through Friday.

…………………………………………………………………………………………………………………………….

In markets with widespread 5G, cellphone users often fail to notice a difference in service compared with 4G-LTE. This author has had a 5G Samsung Galaxy phone for over one year and does not notice any difference from 4G-LTE.

A key growth opportunity for 5G—businesses installing private networks in places such as manufacturing plants and arenas—has yet to take off.

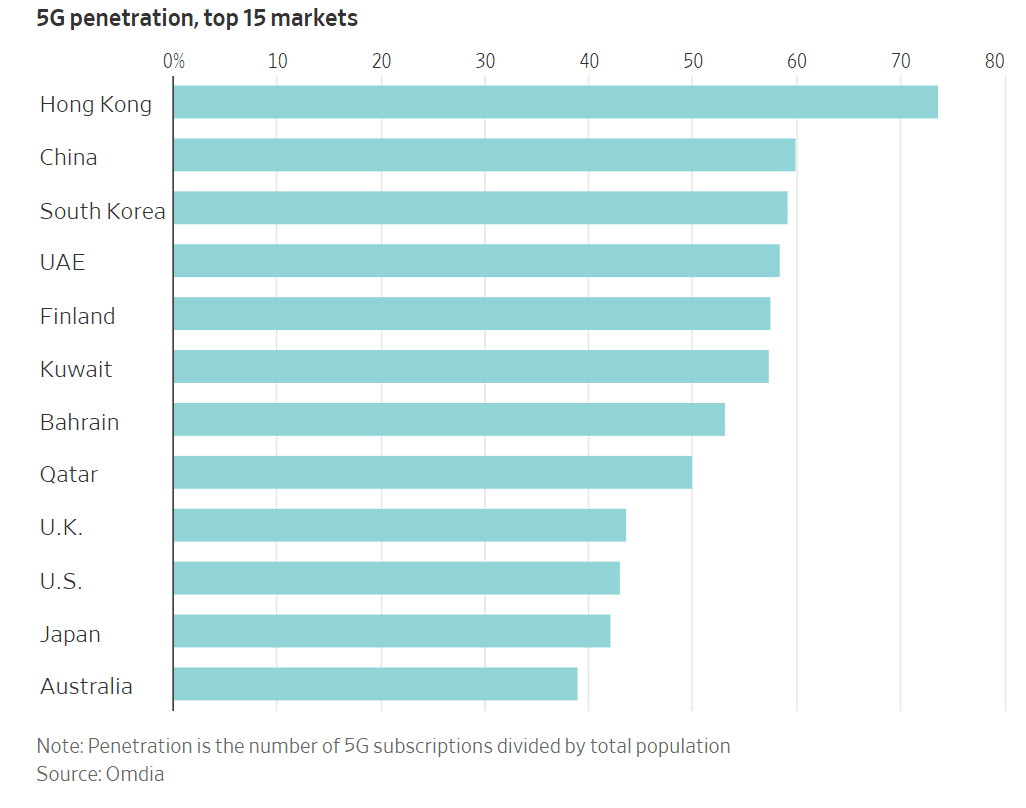

In the U.S., about 43% of people had 5G mobile subscriptions as of June, ranking 10th worldwide, according to estimates from research firm Omdia. Hong Kong had the world’s highest 5G penetration rate, with 74% of its population subscribed to the mobile service. Ranked second- and third-highest in the world were mainland China and South Korea, which registered 5G mobile-subscription rates of 60% and 59%, respectively.

The high uptake in China and its neighbors is no accident. Smartphone users in several Asian countries have benefited from affordable next-generation devices, strong fiber-optic infrastructure and government policies that encouraged broad 5G cellular coverage. China and South Korea also host technology giants like Huawei and Samsung that are spearheading the wireless technology’s advancement.

Finland had the highest 5G penetration rate in Europe, at 58%, while the United Arab Emirates led the Middle East, also with 58%.

Getting “4G for all, not 5G for few,” has been the mantra for the past two years at Veon, a network operator that serves cash-strapped markets from Ukraine to Bangladesh.

The Amsterdam-based company has already covered 90% of the six countries it serves with 4G signals. Some areas lack the fiber-optic-cable infrastructure to support 5G-capable cellphone towers, and roughly half of the population in those markets lacks even a smartphone, let alone one capable of picking up 5G connections. Some countries also impose high taxes on smartphones, which puts the devices out of reach for many consumers, says Veon Chief Executive Kaan Terzioğlu.

“This is really matching the needs of the markets with the technologies that are available,” Terzioğlu told the WSJ. Spending money on 5G infrastructure before the people it covers are ready to tap it “would be irresponsible,” he added.

Business owners and executives in many poorer countries say they wouldn’t plan around ultrafast wireless connections in places where 2010 technology is still the norm. “There’s not enough coverage or towers here,” says Nicholas Lutchmiah, retail manager at Topbet, a licensed gambling bookmaker and sports-betting company in South Africa, which has most of its shops in poorer townships and rural areas. “That’s the biggest problem that we face. In rural areas and townships, we get 3G, which is rather slow.”

Business owners and executives in many poorer countries say they wouldn’t plan around ultrafast wireless connections in places where 2010 technology is still the norm. “There’s not enough coverage or towers here,” says Nicholas Lutchmiah, retail manager at Topbet, a licensed gambling bookmaker and sports-betting company in South Africa, which has most of its shops in poorer townships and rural areas. “That’s the biggest problem that we face. In rural areas and townships, we get 3G, which is rather slow.”

Despite the limitations, some developing countries have invested heavily in 5G technology. Indian telecom companies have committed tens of billions of dollars to the latest network technology and making a push for ultracheap smartphones, for instance. Domestic conglomerate Reliance Industries has led much of its country’s aggressive telecom investments through its Jio brand, the spearhead of leader Mukesh Ambani’s ambition “to connect everyone and everything, everywhere.”

The wireless companies that invested in 5G technology early paid handsomely to refresh their networks. and they have the balance sheets to prove it. The world’s biggest wireless companies—excluding China’s state-backed operators—carried $1.211 trillion of corporate debt at the end of 2022, up from $1.072 trillion four years earlier, according to Moody’s Investors Service.

The credit-rating service said that those companies spent more than in past years building up their wireless networks and issued more debt to finance big spectrum purchases. The price of that spectrum has varied but generally risen. One auction raised $19 billion in India while another group of licenses fetched $81 billion in the U.S.

Debt is nothing new to big telephone networks. The capital-intensive companies have historically run through cycles of heavy upfront spending on new equipment and installation before paying down the tab over time through reliable subscription fees; phone and internet service is a modern necessity, after all.

But securing airwaves for new 5G signals has forced companies to speed up their borrowing. “There’s a lot of debt on these companies,” Moody’s analyst Emile El Nems says. “We’re not ringing the alarm bells, but we’re saying there’s limited flexibility for an accident.”

Executives at telecom companies that borrowed the most to amass 5G-friendly spectrum licenses have said that they made prudent investments to meet customers’ demand for mobile bandwidth, and that their biggest spending is behind them, at least in the near term.

China moved early to enhance its national infrastructure, blanketing the country with 5G base stations as soon as manufacturers started making them. The country’s three major mobile-phone carriers anchored those transmitters to a dense network of fiber-optic cables and encouraged a range of businesses from seaports to coal mines to use the ultrafast connections. It has also provided subsidies and regulatory support to telecom operators and tech companies, facilitating their growth and enabling them to compete on a global scale.

At the end of June, 5G base stations in the country connected 676 million 5G phones and more than 2.12 billion Internet of Things devices, China’s central-government officials said in a press conference in July.

U.S. officials offered their national cellphone carriers fewer direct subsidies than their Beijing counterparts, but policy makers granted many requests on the companies’ wish lists. Trump administration appointees fast-tracked auctions of 5G-capable wireless frequencies and consolidated the wireless sector by approving T-Mobile’s takeover of rival Sprint, a deal that the company and government leaders said would accelerate long-planned network upgrades.

At the same time, the U.S. has tried to persuade other countries to not buy Chinese gear—an effort that prompted some governments to ban its telecom equipment. But China’s homegrown supplier, Huawei, has weathered the U.S. efforts and played a pivotal role in both the domestic and global 5G markets. At the same time, they have turned away from Western suppliers like Qualcomm for some components and are now relying on domestic suppliers.

Huawei remains the world’s largest seller of telecom equipment, commanding about a third of the global market, with sales about twice those of the second- and third-ranked suppliers, Nokia and Ericsson, according to market-research firm Dell’Oro Group.

What happened to businesses being big 5G consumers?

One of 5G’s most alluring promises remains the private network: a system built to the same standard as a high-speed cellphone service but tailored for a business operating in a smaller area like an office, farm or factory. Those networks can connect a range of computers, sensors and robotics without the hassle and cost of hooking them up with wires.

For now, though, companies have been slow to adopt private networks. Consider “the factory of the future” that Ford and Vodafone previewed outside London in 2020. The companies detailed plans for a swarm of mobile robot welders receiving orders over superfast 5G connections, so they could assemble electric cars more quickly and precisely than traditional equipment.

Three years later, the factory of the future is still just a concept. Ford doesn’t use the high-tech wireless standard on its production line, and Vodafone says it ended its proof-of-concept project with the American automaker. A Ford spokesman didn’t respond to a request for comment.

In total, organizations have built more than 750 private cellular networks around the world, according to Besen Group, a private-network consultancy. Installations run the gamut from college campuses to open-pit mines, though many of them use less-advanced 4G gear instead of the latest-generation electronics.

That is partly because of a chicken-or-the-egg problem with private networks. A device maker might not want to create 5G gear for factories until more factories have installed cellular networks. But factory owners don’t want to invest in those networks unless there are enough 5G-ready devices on the market to justify the upgrade.

“This is actually fairly typical for new network equipment,” says Vodafone cloud and private-network chief Jenn Didoni. “The devices will certainly come, but there aren’t as many as in 4G, and they aren’t as tested and understood.”

Dell’Oro estimates that private networks make up less than 1% of the market for the relevant 5G equipment, but the research firm predicts that early revenue will grow, on average, at a 25% annual rate over the next five years as more connected gadgets hit the market.

“In the beginning, a lot of the conversations used to be about feasibility,” says Durga Malladi, a senior vice president at chip maker Qualcomm. “If I am interested in moving robots and overhead cranes using 5G, can I even get the same level of reliability and latency that I have expected from just wired? And the answer to that is, in almost all instances, absolutely yes.”

Many industries have yet to experience the market disruption that 5G’s boosters promised. A notable exception: Some telecom companies are enjoying a windfall from wireless bandwidth improvements at the expense of their cable-internet rivals.

Mobile network carriers like T-Mobile and Verizon have used new high-speed wireless equipment to beam internet service straight into customers’ homes, racking up more than five million new subscriptions altogether in under three years. The over-the-air service has dented cable-industry revenue and forced companies to compete in areas where they were once the only game in town.

Telecom companies have long known how to beam internet connections into people’s homes without the considerable expense of new wires and equipment. But wireless companies faced an uphill fight against their hard-wired competitors until 5G improvements brought advances such as more-efficient signals that could run through the same cell-tower antennas that companies were already installing to connect cellphones.

That helped mobile-network operators quickly rack up home-internet customers at much lower variable costs, especially in America, where cable companies’ dissatisfied customers offer a juicy target.

“The U.S. is very unusual because we pay so much for home broadband,” says Jeff Heynen, an analyst for Dell’Oro. “The way T-Mobile and Verizon are addressing the service, clearly you know who they’re going after.”

Markets with many far-flung customers, like Australia and Saudi Arabia, could soon follow the U.S. lead in 5G home-internet service, Heynen adds. Industry experts warn that the booming wireless-broadband business isn’t going to replace cable soon, however.

Capacity is the main factor holding back wireless internet services. A single cellular tower can only handle so many videogames, TV streams and Zoom calls at once, even after 5G upgrades offer those towers more bandwidth to go around.

T-Mobile CEO Mike Sievert has even played down his company’s booming home-internet business, telling investors at a Goldman Sachs conference in September that the service would eventually reach a customer base in the single-digit millions. That is a sliver of the more than 100 million U.S. households that could use broadband service. “It’s a very mainstream offer, but we don’t think it’s going to take over cable and fiber,” Sievert said.

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

5G is a big letdown and took a “back seat” at CES 2023; U.S. national spectrum policy in the works

Another Opinion: 5G Fails to Deliver on Promises and Potential

3GPP Release 16 5G NR Enhancements for URLLC in the RAN & URLLC in the 5G Core network

Rogers Communications activates 5G service in Toronto subways

Canadian telco Rogers Communications has announced that it has activated 5G services in the busiest sections of the Toronto subway system for customers of all major Canadian mobile networks.

Rogers conducted extensive testing, including live calls with Toronto Maple Leafs Defenceman Morgan Rielly, who FaceTimed his father while riding the subway underground. See video here.

In April, Rogers announced its plans to introduce full 5G connectivity services to the entire Toronto subway system, including access to 911 for all riders. Also in April, Rogers acquired the Canadian operations of BAI Communications, which had owned the rights to provide wireless service on the Toronto subway.

Rogers stated that it conducted extensive testing, including live calls, to prepare the network for all riders. Beginning on October 2nd, customers of all major Canadian carriers can now connect to 5G and engage in voice calls, texting, and streaming within the Toronto Transit Commission (TTC) subway system in the following areas:

- On Line 1, including all stations and tunnels in the Downtown U, as well as Spadina and Dupont stations

- On Line 2, encompassing thirteen stations from Keele to Castle Frank, along with the tunnels between St George and Yonge stations.

“We are very pleased to bring 5G connectivity to all subway riders,” said Tony Staffieri, President and CEO of Rogers. “Our team has been working around the clock to introduce an immediate solution so all riders can connect when travelling on the busiest sections of the TTC subway system. I am so proud of our Rogers technology team who continue to bring innovation, ingenuity, and leading solutions to Canadians. Today’s announcement is another milestone in our plan to make wireless services available throughout the entire subway system.”

“Our dedicated team of technologists designed and introduced an immediate solution that added capacity, so Bell and Telus could join the network,” said Ron McKenzie, Chief Technology and Information Officer at Rogers. “For over 10 years, subway riders have been without mobile phone services and the Rogers team is pleased to step up and make 5G a reality for all riders today.”

https://telecomtalk.info/rogers-5g-enhanced-network-toronto-ttc-subway/860378/

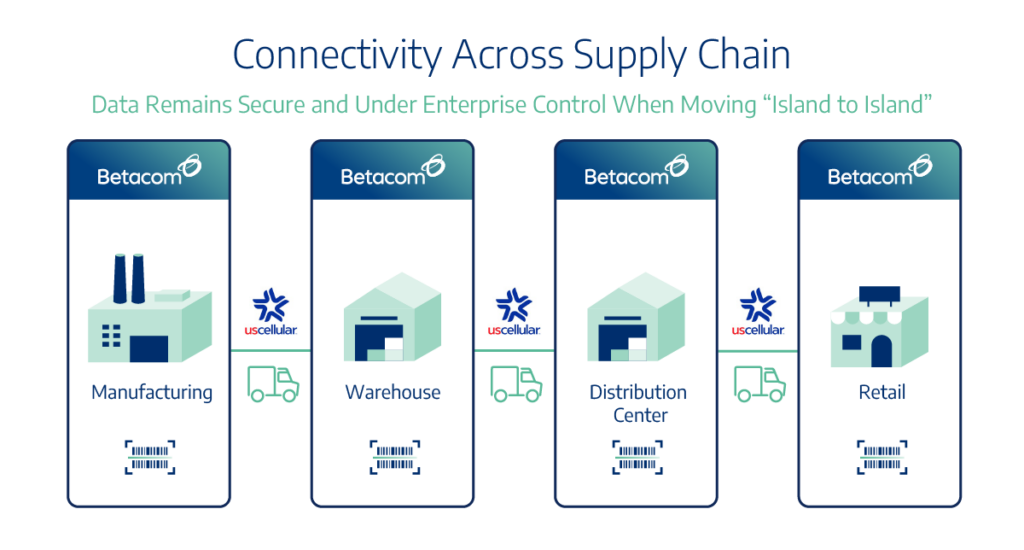

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

Private wireless network provider Betacom today announced a partnership with UScellular to deliver the industry’s first private/public hybrid 5G networks, advancing Industry 4.0 initiatives across the United States. The service provides security and control over business data, both on-premises and while roaming among company facilities. This seems to be similar to the “hybrid cloud” concept where a public cloud is used for general computing while a private cloud is used for mission critical applications and secure storage.

The private/public hybrid 5G network service allows organizations with multiple sites across numerous locations to maintain connectivity between locations. Enterprises working to modernize their operations across dispersed locations now have a cohesive mobility strategy with trusted partners for Industry 4.0. Uptime and performance are assured for improved operational efficiency and productivity with Betacom-backed Service Level Agreements (SLAs).

“This relationship with Betacom helps to establish a new bar for how the entire wireless industry thinks about, builds, delivers and utilizes wireless networks,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “These new capabilities significantly accelerate the return on investment for digital transformation and modernization initiatives for organizations of all types, from enterprise to retail to government, and move the industry as a whole forward, faster.”

Nationwide Mobility:

UScellular’s network and extensive access agreements give customers connectivity across the United States. UScellular also provides data backhaul between sites. Enabling devices to use a single SIM with profiles for both Betacom private CBRS networks and the UScellular network ensures mobility, while integrated communication and coordination between the two companies’ 5G network cores enables seamless roaming across the country.

“Betacom and UScellular are breaking new ground for their customers and setting new precedents for the industry,” said Joe Madden, Founder and President, Mobile Experts Inc. “Enabling device mobility from facility to facility with a transition from CBRS to cellular in both directions has never been solved. This makes private/public hybrid 5G networks extremely valuable for a wide range of industries.”

Michael Davies, VP of business partner strategy and 5G-as-a-service at Betacom, explained in an interview that Betacom’s authentication system is the “secret sauce” to securing this seamlessness within an “island” environment. “We have joined together to provide a single SIM that is authenticated within the static network and then is accepted, secured and maintained throughout the mobile network into the next static environment of the island,” Davies said.

David Allen, director of emerging technologies at UScellular, added that this approach also is key to how the operator segments the private network service. “We treat that private cellular network as a peer of ours, and so when we see that SIM in the public cellular domain, whether it’s on our native network or it’s on one of our roaming partners network, we will authenticate against that private [home subscriber server], that private cellular network, get the corresponding authentication, accept or deny and then that device can proceed with the policy controls that that private network has put in place for it,” Allen said.

“You may see other people claim hybridization. We’ve been early in that messaging of hybridization of networks, the public-private hybrid networks. Others have started saying that as well, but it’s really when you peel back the layers it’s typically a two-SIM solution. That’s for the most part, historically, the way that solution’s gone. We’re working together to drive toward that single-SIM solution so that we’re authenticating a private SIM and a private device that happens to be in the public network against that private network.”

Improved Security and Control:

The solution establishes and maintains end-to-end security, utilizing virtual private networks (VPNs) to ensure that all data effectively remains on the customer premises while devices and sensors are in transit between locations. It also provides unmatched resiliency by using the cellular network for failover in cases where the CBRS network or local internet service providers (ISPs) suffer an outage. The new network architecture utilized for this service facilitates mission-critical Command, Control, Communication, Computers, and Intelligence (C4I) services and solutions which require the highest degrees of data and device security. Reducing dependency on public clouds for data transfer by creating a private network through the carrier network results in fewer vulnerabilities and fewer attacks.

“The service we are announcing today recognizes that the wireless world is changing, and that connectivity, in all of its forms, must change with it,” said Betacom CEO Johan Bjorklund. “Organizations today need seamless mobility with incredibly high densities of sensors and devices to accelerate their Industry 4.0 initiatives. This new service acknowledges and uniquely meets that need.”

About Betacom:

Betacom offers the first fully-managed private 5G network, building on its long history as a wireless infrastructure provider to AT&T, T-Mobile, and Verizon. Founded in 1991 and headquartered in Bellevue, Washington, the company has regional offices throughout the country. Having completed more than 800 large-scale design and deployment projects, Betacom inspires confidence among their customers who have worked closely with them to meet their pressing high-performance connectivity needs. Its secure private 5G wireless service is the first managed service of its kind in the United States.

Betacom earlier this year expanded the ecosystem around its platform with more than a dozen partners. This included mobile edge compute work with Google Cloud, Ingram Micro and Intel; application work with ADB SAFEGATE Americas, Evolon, Ingram Micro and Solis Energy; industrial IoT devices from Axis Communications, Ingram Micro, Qualcomm Technologies, SVT Robotics and Vecna Robotics; 5G work with Airspan, Druid Software, FibroLAN and Qualcomm; and system integration work with CDW, Ingram Micro and QuayChain.

The vendor at that time said the expanded ecosystem alleviates ongoing concerns by enterprise IT departments that they will need to manage a disparate combination of equipment, services and connectivity to deploy a private network. This should be beneficial to those enterprise IT staffs that have so far eschewed potential network complexity by going with a private network platform.

For more information, visit https://www.betacom.com.

References:

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

MediaTek will use TSMC to make its Dimensity SoC’s in 2024

Taiwan’s MediaTek, one of the few 5G merchant semiconductor vendors, has successfully developed its first chip using TSMC’s leading-edge 3nm technology, taping out MediaTek’s flagship Dimensity system-on-chip (SoC) with volume production expected in 2024. MediaTek joins Apple as an early adopter of TSMC’s 3-nanometer tech, a rare joint statement by a chip developer and chip manufacturer.

This marks a significant milestone in the long-standing strategic partnership between MediaTek and TSMC, with both companies taking full advantage of their strengths in chip design and manufacturing to jointly create flagship SoCs with high performance and low power features, empowering global end devices.

“We are committed to our vision of using the world’s most advanced technology to create cutting edge products that improve our lives in meaningful ways,” said Joe Chen, President of MediaTek. “TSMC’s consistent and high-quality manufacturing capabilities enable MediaTek to fully demonstrate its superior design in flagship chipsets, offering the highest performance and quality solutions to our global customers and enhancing the user experience in the flagship market.”

“This collaboration between MediaTek and TSMC on MediaTek’s Dimensity SoC means the power of industry’s most advanced semiconductor process technology can be as accessible as the smartphone in your pocket,” said Dr. Cliff Hou, Senior Vice President of Europe and Asia Sales at TSMC. “Throughout the years, we have worked closely with MediaTek to bring numerous significant innovations to the market and are honored to continue our partnership into the 3nm generation and beyond.”

Image Credit: AP

TSMC’s 3nm process technology provides enhanced performance, power, and yield, in addition to complete platform support for both high performance computing and mobile applications. Compared with TSMC’s N5 process, TSMC’s 3nm technology currently offers as much as 18% speed improvement at same power, or 32% power reduction at same speed, and approximately 60% increase in logic density.

MediaTek’s Dimensity SoCs, built with industry-leading process technology, are designed to meet the ever-increasing user experience requirements for mobile computing, high-speed connectivity, artificial intelligence, and multimedia. MediaTek’s first flagship chipset using TSMC’s 3nm process is expected to empower smartphones, tablets, intelligent cars and various other devices starting in the second half of 2024.

References:

Mediatek Dimensity 6000 series with lower power consumption for affordable 5G devices

Samsung-Mediatek 5G uplink trial with 3 transmit antennas

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

MediaTek Introduces Global Ecosystem of Wi-Fi 7 Products at CES 2023

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

Nokia, China Mobile, MediaTek speed record of ~3 Gbps in 3CC carrier aggregation trial

Electromagnetic Signal and Information Theory (ESIT): From Fundamentals to Standardization-Part II.

Part I of this two part article may be accessed here:

From ESIT Theory to Standardization:

In addition to fundamental research, several technologies originating from ESIT are currently being considering by standardization bodies (aka SDOs). This is especially true for Reconfigurable Intelligent Surfaces (RIS).

RIS relates to a new type of system node that is made with surfaces which may have reflection, refraction, and absorption properties through many small antennas or metamaterials elements which can be adapted to a specific radio channel environment.

The European Telecommunications Standards Institute (ETSI) Industry Specification Group (ISG) on RIS was officially launched on September 30, 2021 for a two-year duration. It was recently renewed for two more years.

ETSI ISG RIS set out to explore RIS and its applications across the wide spectrum of use cases and deployments to identify any specification needs that may be required, thus paving the way for future standardization of the technology.

This ISG identifies and describes RIS related use cases and deployment scenarios, specifies requirements and identifies technology challenges in several areas including fixed and mobile wireless access, fronthaul and backhaul, sensing and positioning, energy and EMF exposure limits, security and privacy.

After two years of work, ETSI ISG RIS has completed and published reports from three work items (WIs), following a consensus-based and contribution-driven working format. The contributions and discussions from ISG members and participants in this first phase of the ISG have been focused on studies related to RIS fundamental, potential, and maturity. The ETSI ISG RIS supports and encourages other standards developing organizations (SDOs) to use the group reports as baseline text for further study or their own specifications

Here’s the list of group reports approved and published by the ETSI ISG RIS as of September 2023:

GR RIS 001: Use Cases, Deployment Scenarios and Requirements

The scope of the report is on the identification and definition of relevant use cases with corresponding general key-performance-indicators (KPIs), deployment scenarios wherein RIS technology will play a role and potential requirements for each identified use case with the aim of promoting interoperability with existing and upcoming wireless technologies and networks. Aspects around system/link performance, spectrum, coexistence, and security are analyzed as part of the report.

GR RIS 002: Technological Challenges, Architecture and Impact on Standardization

The scope of the report is on the technological challenges to deploy RIS as a new network entity, the potential impacts on internal architecture, framework and the required interfaces of RIS, the potential impacts on architecture, framework and the required interfaces of RIS-integrated network, and the potential recommendations and specification impacts to standardization to support RIS as a network entity.

GR RIS 003: Communication Models, Channel Models, Channel Estimation and Evaluation Methodology

The scope of the report is on communication models that strike a suitable trade-off between electromagnetic accuracy and simplicity for performance evaluation and optimization; channel models that include path-loss and multipath propagation effects, as well as the impact of interference for application to different frequency bands; channel estimation, including reference scenarios, estimation methods, and system designs; and key performance indicators and evaluation methodology of RIS for application to wireless communications, including the coexistence between different network operators, and for fairly comparing different transmission techniques, communication protocols, and network deployments.

Further information on the ISG RIS terms of reference, work program, planned group reports, and other documentation are available through the ISG portal.

Editor’s Note: A study item related to RIS has been proposed by the industry in Release 18 (2022) and will be discussed for future plans in Release 19. The results have not yet been released.

Conclusions:

In conclusion, although ESIT may appear a pure theoretical subject, it is an essential tool for modeling, understanding, analyzing, and optimizing emerging communications technologies.

While implementation may be premature at this time, ESIT will surely be used to guide essential technology specifications in standards development organizations (SDO’s).

………………………………………………………………………………………………………………………………..

References:

Electromagnetic Signal and Information Theory: From Fundamentals to Standardization-Part I.

https://www.etsi.org/committee/1966-ris

https://www.etsi.org/committee-activity/activity-report-ris

https://portal.etsi.org/tb.aspx?tbid=900&SubTB=900#/50611-work-programme

ETSI releases first Report on Reconfigurable Intelligent Surfaces communication and channel models

Electromagnetic Signal & Information Theory (ESIT): From Fundamentals to Standardization-Part I.

by Marco Di Renzo, Université Paris-Saclay, CNRS, CentraleSupélec, Laboratoire des Signaux et Systèmes, 3 Rue Joliot-Curie, 91192 Gif-sur-Yvette, France,,,,,,,,,,,,,,,,AND

Marco Donald Migliore, University of Cassino and Southern Lazio, Cassino Viale dell’Università, 03043 Cassino FR, Italy

Edited by Boya Di and Alan J Weissberger

…………………………………………………………………………………………………………………………

Introduction:

The notion of communications channel capacity* as well as the methods, algorithms, and protocols to achieve it have been fundamental questions that have driven the design of wireless communications and will continue to do so.

* Channel capacity is the highest rate at which communications can be made with only a small number of transmission errors.

Communication and information are inherently physical phenomena. Most of the literature, however, abstracts the physics of wave propagation, often treating the generation, transmission, and manipulation of electromagnetic waves as pure mathematical operators.

While mathematical abstractions and engineering approximations are necessary to design advanced or complex communications systems and to gain so-called “engineering insights,” much is lost in understanding the true and physically consistent fundamental limits of wireless communications. The disciplines of information and communications theory, wave propagation, and signal processing are all inter-related and are consistent with the fundamental laws of physics and electromagnetism [1].

…………………………………………………………………………………………………………………

Electromagnetic field theory provides the physics of radio communications, while information theory approaches the problem from a purely mathematical point of view. While there is a law of conservation of energy in physics, there is no such law in information theory. In information theory, when reference is made (as it frequently is) to terms like energy, power, noise, or antennas, it is by no means guaranteed that their use is consistent with the physics of the communication system.

………………………………………………………………………………………………………………….

Emerging communication paradigms and technologies are pushing the boundaries of wave and information manipulation far beyond what was thinkable a few years ago. Among the technologies under evaluation for being integrated in future telecommunication standards, Reconfigurable Intelligent Surfaces (RIS) [2] have been under intense research during the last few years. It is interesting to note that these two technologies put forth a vision of information generation and processing that is not digital-oriented anymore but is analog-oriented and entails the processing of electromagnetic waves either through the scattering objects available in the network or at the end points of communication links.

Editor’s Note: In the past few years, various evaluation and field tests have been delivered to explore the applicability of RIS in future telecommunication standards. For example, ZTE Corporation had conducted outdoor and indoor trials that the deployment of RIS can increase the RSRP by 15 to 35 dB depending on the detail test setup in 2022. NTT Docomo has also performed communication tests based on transparent dynamic meta-surfaces in 2020.

Reconfigurable Intelligent Surfaces:

The basic premise of reconfigurable intelligent surfaces (RIS) is to be able to modify the scattering from objects coated with this technology as one desires. However, modeling such a device as a simple diagonal matrix is neither capacity achieving from a pure information-theoretic standpoint, i.e., assuming that the model being utilized is correct [4], nor strictly correct from an electromagnetic standpoint [5]. Also, the use of such devices just for channel shaping is known not to be capacity achieving [6].

The relationship between information theory and the physics of wave propagation is essential. Understanding these relationships entails a redefinition of the Physical layer in communication systems, which goes beyond the concept of manipulation of bits. The interplay between information theory and physics of wave propagation can only be captured by embedding the wave propagation into the physical layer – a concept known as the “deep physical layer” [10], where electromagnetic field processing is performed using specialized devices.

Electromagnetic Signal and Information Theory (ESIT) Explained:

In order to extend the mathematical notions of information/communication theory and statistical signal processing to incorporate the notion of physics of wave propagation, the term electromagnetic signal and information theory (ESIT) has recently emerged.

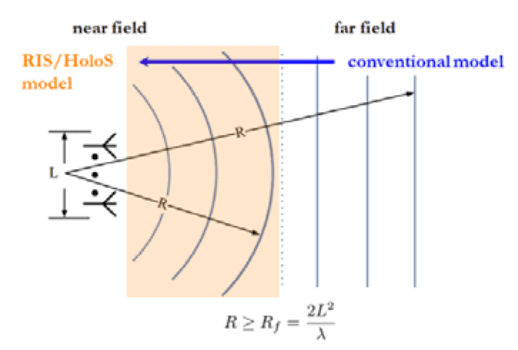

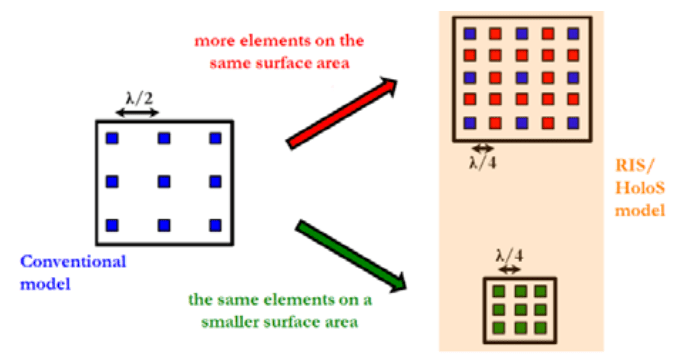

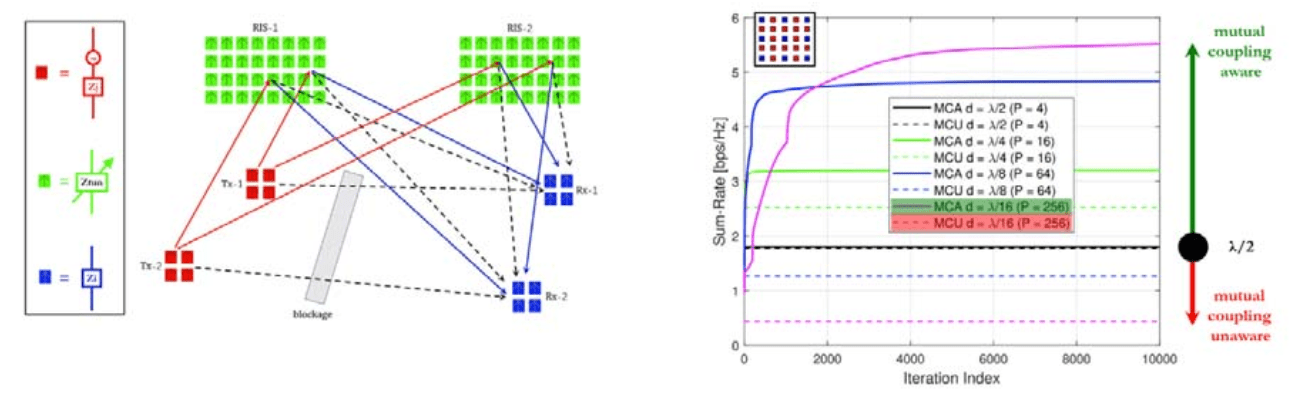

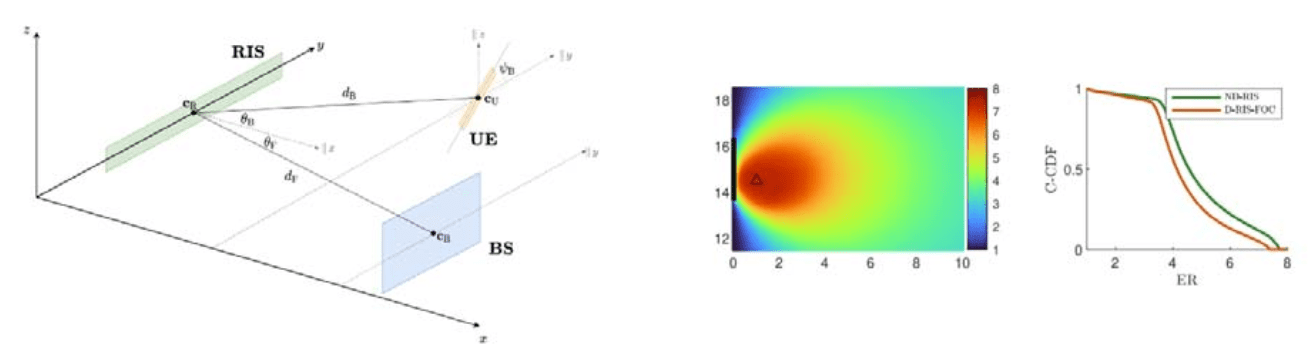

ESIT is a broad research field that is concerned with the mathematical treatment and information processing of electromagnetic fields governing the transmission and processing of messages through communication systems. One of the main objectives of ESIT is, for example, the development of communication models that are electromagnetically consistent and that overcome current assumptions in wireless communications, including considering scalar fields, assuming far-field planar wave fronts, and ignoring electromagnetic coupling, as illustrated in the following two figures:

Fig. 1 From far-field planar-wavefronts to near-field spherical wavefronts

Fig. 2 From mutual coupling-free designs to mutual coupling-aware optimization

………………………………………………………………………………………………………………………..

ESIT makes it possible to quantify the ultimate performance limits of wireless communications, by considering realistic electromagnetic models.

Fig. 3. and Fig. 4. show the great benefits of exploiting the mutual coupling at the design stage and the increased number of communication models that can be transmitted in near-field multiple antenna communication channels.

Recent results on the impact of mutual coupling and the fundamental performance limits in the near-field communications can be found in [13] and [14], respectively.

Fig. 3 ESIT: Mutual coupling aware design [11]

Fig. 4 ESIT: Multi-mode communications in line-of-sight [4]

Editor’s Note: Modelling the influence of the near-far field and coupling effects naturally builds up a bridge between the real-world practice and theoretical analysis.

……………………………………………………………………………………………………………………….

Part II to follow: “From ESIT Theory to Standardization” by ETSI

………………………………………………………………………………………………………………………..

References:

[1] M. Franceschetti. Wave Theory of Information. Cambridge University Press, 2018.

[2] M. Di Renzo et al., “Smart Radio Environments Empowered by Reconfigurable Intelligent Surfaces: How It Works, State of Research, and The Road Ahead,” in IEEE Journal on Selected Areas in Communications, vol. 38, no. 11, pp. 2450-2525, Nov. 2020.

[3] C. Huang et al., “Holographic MIMO Surfaces for 6G Wireless Networks: Opportunities, Challenges, and Trends,” in IEEE Wireless Communications, vol. 27, no. 5, pp. 118-125, October 2020.

[4] G. Bartoli et al., “Spatial Multiplexing in Near Field MIMO Channels with Reconfigurable Intelligent Surfaces”, IET Signal Processing, 2023 (https://arxiv.org/abs/2212.11057).

[5] M. Di Renzo, F. H. Danufane and S. Tretyakov, “Communication Models for Reconfigurable Intelligent Surfaces: From Surface Electromagnetics to Wireless Networks Optimization,” in Proceedings of the IEEE, vol. 110, no. 9, pp. 1164-1209, Sept. 2022.

[6] R. Karasik et al., “Adaptive Coding and Channel Shaping Through Reconfigurable Intelligent Surfaces: An Information-Theoretic Analysis,” in IEEE Transactions on Communications, vol. 69, no. 11, pp. 7320- 7334, Nov. 2021.

[7] D. Dardari and N. Decarli, “Holographic Communication Using Intelligent Surfaces”, IEEE Commun. Mag. 59(6): 35-41 (2021).

[8] M. Di Renzo, D. Dardari, and N. Decarli, “LoS MIMO-Arrays vs. LoS MIMO-Surfaces”, IEEE EuCAP 2023 (https://arxiv.org/abs/2210.08616).

[9] M. Di Renzo, V. Galdi, and G. Castaldi, “Modeling the Mutual Coupling of Reconfigurable Metasurfaces”, IEEE EuCAP 2023 (https://arxiv.org/abs/2210.08619).

[10] M. D. Migliore, “The World Beneath the Physical Layer: An Introduction to the Deep Physical Layer”, IEEE Access 9: 77106-77126 (2021).

[11] Andrea Abrardo, Davide Dardari, Marco Di Renzo, Xuewen Qian, “MIMO Interference Channels Assisted by Reconfigurable Intelligent Surfaces: Mutual Coupling Aware Sum-Rate Optimization Based on a Mutual Impedance Channel Model”, IEEE Wirel. Commun. Lett. 10(12): 2624-2628 (2021).

[12] https://portal.etsi.org/tb.aspx?tbid=900&SubTB=900#/

[13] A. Abrardo, A. Toccafondi, and M. Di Renzo, “Analysis and Optimization of Reconfigurable Intelligent Surfaces Based on -Parameters Multiport Network Theory”, arXiv:2308.16856.

[14] J. C. Ruiz-Sicilia, M. Di Renzo, M. D. Migliore, M. Debbah, and H. V. Poor, “On the Degrees of Freedom and Eigenfunctions of Line-of-Sight Holographic MIMO Communications”, arXiv:2308.08009.

……………………………………………………………………………………………………………………

About Marco Di Renzo, PhD:

Marco Di Renzo (Fellow, IEEE) received the Laurea (cum laude) and Ph.D. degrees in electrical engineering from the University of L’Aquila, Italy, in 2003 and 2007, respectively, and the Habilitation à Diriger des Recherches (Doctor of Science) degree from University Paris-Sud (currently Paris-Saclay University), France, in 2013. Currently, he is a CNRS Research Director (Professor) and the Head of the Intelligent Physical Communications group in the Laboratory of Signals and Systems (L2S) at Paris-Saclay University – CNRS and CentraleSupelec, Paris, France. Also, he is an elected member of the L2S Board Council and a member of the L2S Management Committee. At Paris-Saclay University, he serves as the Coordinator of the Communications and Networks Research Area of the Laboratory of Excellence DigiCosme, as a Member of the Admission and Evaluation Committee of the Ph.D. School on Information and Communication Technologies, and as a Member of the Evaluation Committee of the Graduate School in Computer Science. He is a Founding Member and the Academic Vice Chair of the Industry Specification Group (ISG) on Reconfigurable Intelligent Surfaces (RIS) within the European Telecommunications Standards Institute (ETSI), where he serves as the Rapporteur for the work item on communication models, channel models, and evaluation methodologies. He is a Fellow of the IEEE, IET, and AAIA; an Ordinary Member of the European Academy of Sciences and Arts, an Ordinary Member of the Academia Europa; and a Highly Cited Researcher. Also, he holds the 2023 France-Nokia Chair of Excellence in ICT, and was a Fulbright Fellow at City University of New York, USA, a Nokia Foundation Visiting Professor, and a Royal Academy of Engineering Distinguished Visiting Fellow. His recent research awards include the 2021 EURASIP Best Paper Award, the 2022 IEEE COMSOC Outstanding Paper Award, the 2022 Michel Monpetit Prize conferred by the French Academy of Sciences, the 2023 EURASIP Best Paper Award, the 2023 IEEE ICC Best Paper Award (wireless), the 2023 IEEE COMSOC Fred W. Ellersick Prize, the 2023 IEEE COMSOC Heinrich Hertz Award, and the 2023 IEEE VTS James Evans Avant Garde Award. He served as the Editor-in-Chief of IEEE Communications Letters during the period 2019-2023, and he is now serving in the Advisory Board.

About Marco Donald Migliore, PhD.:

Marco Donald Migliore (Senior Member, IEEE) received the Laurea degree (Hons.) and the Ph.D. degree in electronic engineering from the University of Naples, Naples, Italy. He was a Visiting Professor with The University of California at San Diego, La Jolla, CA, USA, in 2007, 2008, and 2017; the University of Rennes I, Rennes, France, in 2014 and 2016; the Centria Research Center, Ylivieska, Finland, in 2017; the University of Brasilia, Brazil, in 2018; and the Harbin Technical University, China, in 2019. He was a Speaker with the Summer Research Lecture Series of the UCSD CALIT2 Advanced Network Science, in 2008. He is currently a Full Professor with the University of Cassino and Southern Lazio, Cassino, Italy, where he is also the Head of the Microwave Laboratory and the Director of studies of the ITC Courses. He is also a member of the ELEDIA@UniCAS Research Laboratory, the ICEMmB – National Interuniversity Research Center on the Interactions between Electromagnetic Fields and Biosystems, where he is the Leader of the 5G Group, the Italian Electromagnetic Society (SIEM), and the National Interuniversity Consortium for Telecommunication (CNIT). His current research interests include connections between electromagnetism and information theory, analysis, synthesis and characterization of antennas in complex environments, antennas and propagation for 5G, ad hoc wireless networks, compressed sensing as applied to electromagnetic problems, and energetic applications of microwaves. He serves as a referee for many scientific journals and has served as an Associate Editor for IEEE Transactions on Antennas and Propagation.

EdgeCore Digital Infrastructure and Zayo bring fiber connectivity to Santa Clara data center

EdgeCore Digital Infrastructure, a wholesale data center developer, owner and operator, today announced its partnership with Zayo, a leading global communications infrastructure provider, to connect EdgeCore’s Silicon Valley data center campus in Santa Clara, CA to Zayo’s global network, providing customers with resilient, diverse routes for current use and future expansion.

Editor’s Note: The main reason for so many wholesale data centers/colocation facilities in Santa Clara (CoreSight, Digital Realty, Cologix, Cyxtera, NTT, Tata, etc) is cheaper electricity rates. That makes a huge difference as the IT equipment in the data centers consume a tremendous amount of power. Dark fiber access is abundant with multiple providers offering fiber ring access to regional carrier hotels / MMRs.

……………………………………………………………………………………..

“We are pleased to bring Zayo on-net in our Silicon Valley data centers,” said Clint Heiden, Chief Commercial Officer, EdgeCore. “The scale of EdgeCore’s campus is made more valuable for customers with the addition of Zayo’s future-proofed network and global reach.”

Through Zayo’s expansive, Tier-1 fiber network—including over 200 IP points of presence (PoPs) across the United States—customers at EdgeCore’s Silicon Valley campus will have access to fast, diverse, and reliable connectivity with guaranteed bandwidth to support their business needs. Zayo’s future-ready network infrastructure accommodates EdgeCore customers’ evolving needs for scale, rapid deployment of additional bandwidth, cloud connectivity, customer end-point connectivity, and more.

“Zayo is excited to be a part of EdgeCore’s expansion and provide the connectivity their customers need to be successful in today’s digital business era,” said Derek Gillespie, Chief Sales Officer, Enterprise at Zayo. “As customer bandwidth demands increase with the rapid growth of technologies like AI, partnerships like this will be hugely important in providing the supporting infrastructure. We look forward to staying at the forefront of this trend and continuing to connect what’s next with EdgeCore.”

In January, EdgeCore announced the groundbreaking of its Silicon Valley data center campus. Upon completion, the LEED-designed campus will support 72 MW of critical load across 540,000 square feet of space. In April, EdgeCore also announced the expansion of its Phoenix data center campus in Mesa, Arizona, for which Zayo also provides connectivity. Both companies look forward to building on their partnership in future EdgeCore markets.

About EdgeCore Digital Infrastructure

EdgeCore Digital Infrastructure serves the world’s largest cloud, internet, and technology companies with both ready-for-occupancy and build-to-suit data center capacity supported by best-in-class service-delivery capabilities. Privately held and supported by committed equity to fund an initial aggregate amount of over USD $4 billion in development, EdgeCore supports customer requirements by proactively investing in land, power, and vertical development in key data center locations, with buildings that highlight density engineering and meet key performance specifications, safety metrics, and sustainability objectives. EdgeCore has four markets with power and shovel ready campuses, operational data center buildings, and the ability to expand investment into new markets. For more information, please visit edgecore.com.

About Zayo

For more than 15 years, Zayo has empowered some of the world’s largest and most innovative companies to connect what’s next for their business. Zayo’s future-ready network spans over 16.5 million fiber miles and 141,000 route miles. Zayo’s tailored connectivity and edge solutions enable carriers, cloud providers, data centers, schools, and enterprises to deliver exceptional experiences, from core to cloud to edge. Discover how Zayo connects what’s next at www.zayo.com and follow us on LinkedIn and Twitter.

SOURCE EdgeCore Digital Infrastructure

………………………………………………………………………………………………..

References:

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

5G network slicing [1.] use cases are still few and far between, mainly because so few 5G telcos have deployed the 5G SA core network which is mandatory for ALL 3GPP defined 5G features and functions, such as network slicing and 5G security.

ABI’s 5G network slicing and cloud packet core market data report found that growing ecosystem complexity and ongoing challenges with cloud-native tooling adoption have placed increased pressure on new service innovation, like 5G network slicing. ABI expects the 5G network slicing market to be worth US$19.5bn in value by 2028. Considering existing market activities, a growing force behind 5G slicing uptake is enhanced mobile broadband (eMBB) and fixed wireless access (FWA). To that end, there is growing market activity and commercial engagements from network equipment vendors (NEVs) Ericsson, Huawei, Nokia, and ZTE, among other vendors. ABI regards these market engagements as representing a good foundation for the industry to match 5G slicing technology to high-value use cases, such as enhanced machine-type communication and ultra-reliable low-latency communications.

Note 1. A network slice provides specified network capabilities and characteristics – or multiple, isolated virtual networks – to fit a user’s needs. Although multiple network slices run on a single physical network, network slice users are sometimes (depending upon the access level of the individual) authenticated for only one network level, enabling data and security isolation and a much higher degree of security. Individuals can be sanctioned for more than network level. Each slice spans multiple connected components that form a network, components that include physical computing, storage and networking infrastructure. These are virtualized, and protocols are set in place to create a specific network slice for each user or application. This means that varying types of 5G traffic, such as video streaming, industrial automation and mission-critical applications, all can be accommodated on the same network, yet each has its own dedicated resources and performance guarantees.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

“5G Slicing continues to promise new value creation in the industry. However, as reflected in multiple ABI Research’s market intelligence reports, a solid software and cloud-native foundation must be in place for that promise to materialize. That, in turn, is a prerequisite for a wider diffusion of 5G core adoption, an architecture that provides native support for 5G slicing,” explains Don Alusha, Senior Analyst at ABI Research.

Image Credit: Viavi Solutions

From a network architecture perspective, ABI said two modalities are emerging to deploy 5G slicing. The first one is to share the whole infrastructure spanning radio access network (RAN), core, physical devices and physical servers. This, said the analyst, constitutes a unified resource pool, the basis of which can be used to instantiate multiple logical connectivity transmissions.

A second approach is to provide hardware-based logical slices by slicing the physical equipment. The analyst cautions that this is a time-consuming, resource-intensive endeavor, but said it may be the best option for mission-critical services. It requires slicing the physical transmission network and oftentimes a dedicated user plane.

“Horizontal integration for cross-domain interoperability is critical going forward. Equally important is vertical integration for 5G slicing lifecycle management of multi-vendor deployments. There is ongoing market activity for the 5G core network penetration and maturity of 5G slice management functions. To that end, enterprises will seek to create and reserve slices statically and on-demand. They also want to efficiently integrate with cloud providers through open and programmable Application Program Interfaces (APIs) to enable hybrid cloud/cellular slice adoption. NEVs and other suppliers (e.g., Amdocs, Netcracker, etc.) offer solutions enabling CSPs to create fully automated and programmatic slicing capability over access, transport, and core network domains,” Alusha concludes.

These findings are from ABI Research’s 5G Network Slicing and Cloud Packet Core market data report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Market Data spreadsheets comprise deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight into where opportunities lie.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

T-Mobile US, the only U.S. carrier that has deployed 5G SA core network, has recently shared details of what it claims is “first use of 5G network slicing for remote video production on a commercial network,” which took place during Red Bull’s cliff diving event in Boston, MA. This customized slice gave the broadcast team supercharged wireless uplink speeds so they could easily and quickly transfer high-resolution content from cameras and a video drone circling the event to the Red Bull production team in near real-time over T-Mobile 5G. The uplink speed was up to 276 Mbps!

T-Mobile says they can also use network slicing for specific application types for enterprise customers across the U.S. Earlier this month they launched a first-of-its-kind network slicing beta for developers who are working to supercharge their video calling applications with the power of 5G SA. With a customized network slice, developers can sign up to test video calling applications that require consistent uplink and downlink speeds along with increased reliability. In the weeks since, we’ve seen tremendous interest from the developer community with dozens of companies large and small signing up to join the likes of Dialpad, Google, Webex by Cisco, Zoom and more.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Vodafone recently worked with Ericsson to provision network slices optimized for cloud gaming. In January, Samsung and KDDI announced the successful demonstration of Service Level Agreements (SLA) assurance network slicing in a field trial conducted in Tokyo, Japan. Yet there’s hardly a flood of real-world use cases (see References below).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.abiresearch.com/market-research/product/market-data/MD-SLIC/

https://www.computerweekly.com/news/366550353/5G-network-slicing-value-hits-19bn-but-growth-stalls

https://www.t-mobile.com/news/network/its-time-to-unleash-network-slicing

https://www.viavisolutions.com/en-us/5g-network-slicing

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

GSA 5G SA Core Network Update Report