AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

Backgrounder -5G SA Core Network:

5G SA core is the heart of a 5G network, controlling data and control plane operations. The 5G core aggregates data traffic, communicates with UE, delivers essential network services and provides extra layers of security, and all 3GPP defined 5G features and functions. There are no standards for implementation of 3GPP defined 5G SA core network architecture, which is said to be a service based architecture, recommended to be “cloud native.” Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

A 5G NSA network is a LTE network with a 5G NR, i.e. the 5G NR Access Network is connected to the 4G Core Network.

AT&T Yet to Deploy 5G SA Core Network but is “charging forward to advance 5G SA ecosystem readiness:

It’s been a long wait for AT&T’s 5G SA core network, which is required to realize ALL 5G functions defined by 3GPP, including network slicing, network virtualization, security, and edge computing (MEC).

- The U.S. mega network operator initially said they would launch 5G SA core network in 2020 but that never happened.

- On June 30, 2021, AT&T said their mobile network traffic will be managed using Microsoft Azure technologies. “The companies will start with AT&T’s 5G core, the software at the heart of the 5G network that connects mobile users and IoT devices with internet and other services.” Almost two years later, that hasn’t happened either!

- In an April 18, 2022 blog post on the company’s website, AT&T now says they are “Taking 5G to the Next Level with Standalone 5G.” AT&T has said that they “plan to deploy Standalone 5G when the ecosystem is ready, and AT&T is charging forward to advance 5G SA ecosystem readiness. Businesses and developers will be some of the first to take advantage of the new technologies standalone 5G enables as we continue to move from research & development to their deployment.”

However, AT&T did not provide a date or even a timeframe when its 5G SA core network would be deployed. Instead, the telco lauded several 5G advances they’ve recently made. Those include:

1. Completed the first 5G SA Uplink 2-carrier aggregation data call in the U.S.

Carrier aggregation (CA) means we are combining or “aggregating” different frequency bands to give you more bandwidth and capacity. For you, this means faster uplink transmission speeds. Think of this as adding more lanes in the network traffic highway.

The test was conducted in our labs with Nokia’s 5G AirScale portfolio and MediaTek’s 5G M80 mobile test platform. AT&T aggregated their low-band n5 and our mid-band n77 spectrum. Compared to the low-band n5 alone, AT&T realized a 100% increase in uplink throughput by aggregating the low-band n5 with 40MHz of AT&T’s mid-band n77. Taking it a step further, AT&T achieved a 250% increase aggregating 100MHz of n77. The bottom line: AT&T achieved incredible upload speeds of over 70 Mbps on n5 with 40MHz of n77 and over 120 Mbps on n5 with 100MHz of n77.

2. Using a two-layer uplink MIMO on time division duplex (TDD) in our mid-band n77. MIMO combines signals and data streams from multiple antennas (“vehicles”) to improve signal quality and data rates. This feature will not only improve uplink throughput but also enhance cell capacity and spectrum efficiency.

3. Last fall, AT&T completed a 5G SA four component carrier downlink call by combining two FDD carriers and two TDD carriers. These capabilities allow AT&T devices to aggregate our mid-band n77 in the C-Band and 3.45GHz spectrum ranges. Compared with low band and mmWave spectrum, mid-band n77 provides a good balance between coverage and speed. This follows the 5G SA three component carrier downlink feature that we introduced last year to 2022 AT&T Flagship devices which combines one frequency division duplex (FDD) carrier and two TDD carriers.

4. In the coming months, AT&T will enable 5G New Radio Dual Connectivity (NR-DC), aggregating our low and mid-band spectrum with our high-band mmWave spectrum on 5G SA. Our labs have achieved 5G NR-DC downlink throughput speeds of up to 5.3Gbps and uplink throughput speeds of up to 670Mbps. This technology will help provide high-speed mobile broadband for both downlink and uplink in stadiums, airports, and other high-density venues.

5. Here are some features that are on the horizon for 5G SA (how far away is the horizon?):

- Specialized Network Services – think network slicing, precision location, private routing, etc. – for tailored network solutions to meet specific user requirements;

- Non-terrestrial network solutions to supplement coverage in remote locations ; and

- Reduced capability 5G (RedCap) for a new generation of 5G capable wearables, industrial IoT or wireless sensors and other small form factor consumer devices.

In conclusion, AT&T’s Jason Sikes wrote, “The 5G SA ecosystem is rapidly evolving, with new technologies and capabilities being introduced to set the foundation for next generation applications and services.” Yet no information was provided on the status of AT&T’s 5G SA network running on Microsoft Azure cloud technology!

AT&T to run its mobility network on Microsoft’s Azure for Operators cloud, delivering cost-efficient 5G services at scale.

Image Credit: Microsoft

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

In the U.S., T-Mobile launched 5G SA core network nationwide last year, while Verizon began shifting its own traffic onto its 5G SA core in 2022. More recently, Verizon officials have begun hinting at interest in selling SA-powered network slices to public safety customers and others.

At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks. “Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” said Dave Bolan, Research Director at Dell’Oro Group.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/atandt-to-launch-standalone-5g-later-this-year/d/d-id/764109

https://about.att.com/blogs/2023/standalone-5g-innovations.html

https://about.att.com/story/2021/att_microsoft_azure.html

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

China Mobile explores buyout of Hong Kong telecom firm HKBN

China Mobile Ltd is exploring a buyout of Hong Kong’s leading telecoms company HKBN Ltd, four people with knowledge of the matter said That could spark a bidding war for the firm currently valued at $1 billion.

China Mobile in recent weeks sent a request for proposal (RFP) to a small group of banks to advise on acquiring and taking-private the Hong Kong telecom provider, which offers services including broadband and Wi-Fi management, the people said.

HKBN shares jumped more than 17% after the Reuters report and closed at HK$6.57 a piece Tuesday, valuing the company at HK$8.6 billion ($1.1 billion). HKBN declined to comment. China Mobile did not respond to a request for comment.

China Mobile’s potential takeover interest in HKBN comes after infrastructure investor I Squared Asia Advisors submitted a non-binding letter of interest for the Hong Kong telecoms services provider in March.

HKBN said at that time the infrastructure investor would make an offer via its portfolio company HGC Global Communications and or one of its affiliates, should it proceed with the deal.

There could be other potential suitors for HKBN, said one of the people and a separate person with knowledge of the matter, including Hong Kong-based private equity firm PAG who declined to comment.

North Asia-focused private equity firm MBK Partners and buyout firm TPG Capital, which are among the top shareholders of HKBN, will seek to fully exit in any potential buyout of the company, separate sources have told Reuters.

…………………………………………………………………………………………………………………….

HKBN reported it had a 34 per cent share of Hong Kong’s residential broadband market and 37 per cent of the enterprise market at end-2022. In late March, HKBN’s board said it was approached about a potential take over by I Squared Asia Advisors, the same asset management company that owns Hong Kong ISP HGC Global Communications.

Others showing interest include global investment company PAG, Bloomberg wrote, noting potential buyers may team with HKBN management for a buy out.

A sale in 2022 was halted by potential buyers including KKR and PAG due to concerns over the valuation.

HKBN was sold to CVC Capital Partners in 2012 in a management buy out and was listed in 2014.

References:

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Qualcomm announces 4 new SoC’s for IoT applications and use cases

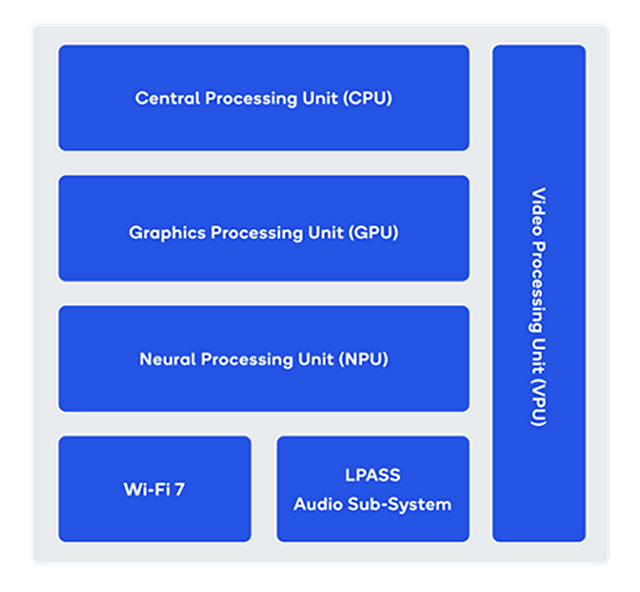

Qualcomm has launched four system on a chip (SoC) “solutions.” The QCS8550 and QCM8550 are the higher powered ones, designed for uses such as drones and cloud gaming. The only difference seems to be that the ‘M’ variant has an embedded modem. Both are made for manufacturers and designers of IoT products that demand the highest performance in a single processor. Ideal use cases include, but are not limited to:

- Autonomous mobile robots: Implement simultaneous location and mapping (SLAM), with a richer sensor set and AI at the network edge

- Industrial drones: Run multiple cameras with the real-time AI processing needed for drones

- Edge AI devices: Enable multiple concurrent machine learning modules per stream

- Video collaboration: Premium performance for delivering some of the most engaging meeting experiences using video and audio AI, multiple high-resolution cameras and abundant compute and graphics processing unit (GPU) power

- Video transcoding: Convert live video to multiple formats simultaneously — especially useful for short video applications

- Cloud gaming: Run multiple cloud-based games concurrently with visually richer game content and deeper player engagement

- Camera applications: Build cameras for sports/action, security, automobile dashes and multi-camera with improved IQ and cognitive ISP

- Retail: Apply AI to reduce friction in retail scenarios like unattended smart carts, smart cameras, on-shelf product identification and bar codes

The Qualcomm® QCS4490 and QCM4490 SoC’s are IoT optimized SoC’s for Android handheld devices. The QCM4490 system on chip (SoC) delivers key, advanced features now required by industrial handheld, industrial computing, and other IoT devices. It comes loaded with 5G NR connectivity, Wi-Fi 6E for multi-gigabit speeds, extended range, and low latency, and powerful, efficient processing to handle complex computing tasks. With planned support for Android releases through version 18, you can use this SoC for industrial designs through 2030, helping save costs and development time. We’ve designed a mid-tier solution packed with a lot of purpose.

“Qualcomm Technologies is uniquely positioned to take the IoT ecosystem forward,” said Dev Singh, vice president, business development and head of building, enterprise & industrial automation, Qualcomm Technologies, Inc. “Our new solutions bring together the industry’s leading technologies across edge AI processing, innovative power efficiency, crystal-clear video, 5G connectivity, and more to fuel the next-generation of resilient, high-performing IoT applications.”

Qualcomm likes to coincide its new silicon announcements with trade shows. This one was made at Hannover Messe 2023, a general industry show that seems to be what CeBIT turned into.

References:

https://www.qualcomm.com/products/technology/processors/qcm4490

https://telecoms.com/520064/qualcomm-launches-a-new-iot-platform/

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

Qualcomm Introduces the World’s First “5G NR-Light” Modem-RF System for new 5G use cases and apps

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Viettel Group and Qualcomm collaborate on 5G Radio Unit with massive MIMO

Vodafone Idea (Vi) to launch 5G services “soon;” Awards optical network equipment contract to ZTE

Hindustan Times: Although India telco competitors Reliance Jio and Airtel have launched and made fully operational their 5G services in several regions, the Aditya Birla Group and Vodafone Group collaboration telco is yet to announce the launch of next generation service. However, Kumar Mangalam Birla, chairman of the Aditya Birla Group, indicated that the Vi will soon launch 5G services. Speaking on the side-lines of the AIMA Awards to CNBC -TV18, Birla said, “5G rollout will begin soon.” He did not, however, provide a specific launch date.

Kumar Mangalam Birla is chairman of Aditya Birla Group.(YouTube/@IIT Bombay Official Channel)

Vi is now lagging far behind in the race to 5G with being the only private telecom operator to not have this next-gen services. In October of last year, Bharti Airtel launched its Airtel 5G Plus service in select areas. Reliance Jio, its competitor, is also offering Jio True 5G in multiple locations. The state-owned telecom operator BSNL is also planning to launch 5G by this August.

Vodafone Idea has been losing subscribers. The debt-ridden telco lost 2.47 million subscribers in December 2022. During the same period, Mukesh Ambani-led Reliance Jio gained 1.7 million subscribers, followed by Airtel, which gained 1.52 million subscribers, reported Business Insider.

Airtel, like its rival Reliance Jio, is offering 5G services at the same tariff levels as 4G, luring users away from competitors, primarily Vodafone Idea. According to data from the Telecom Regulatory Authority of India, the number of porting requests increased over the last year to more than 12 million in November.

References:

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Adani Group to launch private 5G network services in India this year

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

Nokia Executive: India to Have Fastest 5G Rollout in the World; 5Gi/LMLC Missing!

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Vodafone Idea earlier this month awarded a fresh optical transmission equipment network order worth around Rs 230 crore to Chinese company ZTE for Gujarat, Maharashtra, and Madhya Pradesh-Chhattisgarh. The telco is upgrading its network, and for a fresh network deployment or upgrade and maintenance, telcos have to take approval from the National Security Council Secretariat (NSCS) and provide information regarding vendors and their technology. Notably, ZTE hasn’t been given the trusted sources approval by the NSCS (India’s National Security Council), said an ET report. Vodafone Idea’s optical transmission network has deployments from both Huawei and ZTE across all telecom circles.

Airtel, another Indian telecom operator, had last year awarded a telecom infrastructure expansion contract worth Rs 150 crore to Huawei. Under the deal, Huawei upgraded and expanded Airtel’s National Long Distance (NLD) network. Airtel awarded a similar contract to Huawei worth Rs 300 crore in 2021. Both these contracts were given to Huawei despite the latter not having the trusted sources approval.

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

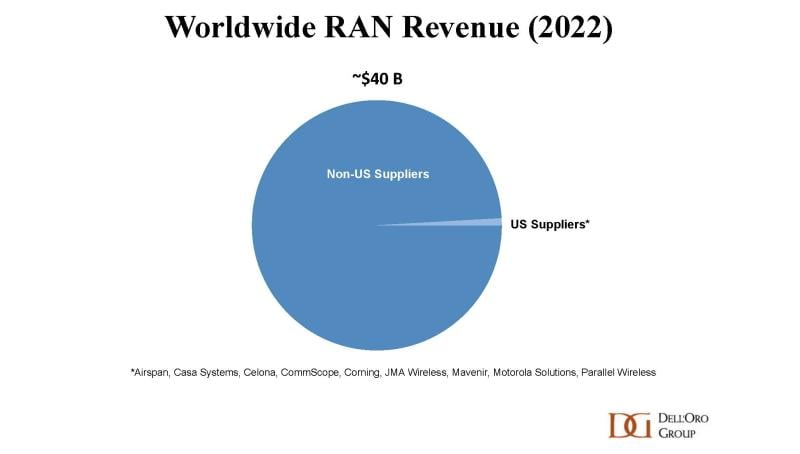

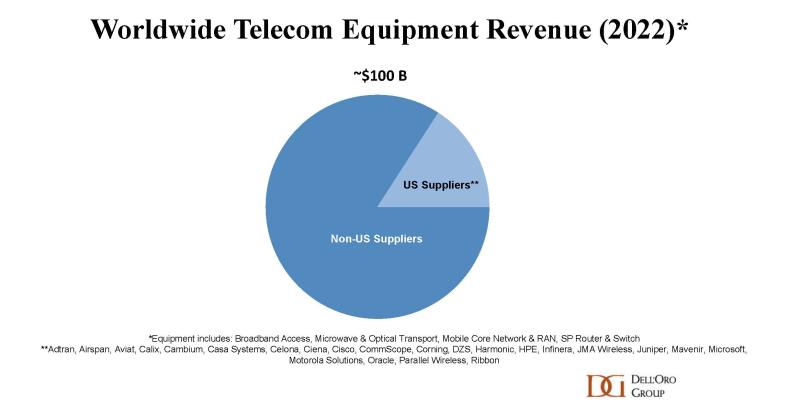

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

NTIA’s Wireless Innovation Fund to stimulate open 5G and future-gen wireless markets; OpenRAN rebuttal

The U.S. Commerce Department’s National Telecommunications and Information Administration (NTIA) has officially launched its Wireless Supply Chain Innovation Fund, which has a budget of $1.5 billion and a mandate to spend it on stimulating the development of new and exciting telco technology. It’s mission is to “open 5G and future-gen wireless markets to innovation and entrepreneurship in the U.S., as well as by our partners and allies.”

NTIA will work to catalyze the development and adoption of open, interoperable, and standards-based networks through the Innovation Fund. Authorized under the Fiscal Year 2021 National Defense Authorization Act and funded through the CHIPS and Science Act of 2022, this ten-year grant program will help drive wireless innovation, foster competition, and strengthen supply chain resilience. It will also help unlock opportunities for companies from the United States and its global allies, particularly small and medium enterprises, to compete in a market historically dominated by a few suppliers, including high-risk suppliers that raise security concerns.

On Wednesday, NTIA announced its first notice of funding opportunity (NOFO), which invites interested parties to apply for some of that money. This first tranche of grants, worth up to $140.5 million, has been earmarked for projects focused on OpenRAN R&D. By demonstrating the viability of new, open-architecture approaches to wireless networks, this initial round of funding will help to ensure that the future of 5G and next-gen wireless technology is built by the U.S. and its global allies and partners –not vendors from nations that threaten America’s national security.

“The Innovation Fund is a critical step toward securing 5G wireless networks while driving innovation at home and abroad,” said Commerce Secretary Raimondo. “Investing in the next generation of innovation will unlock opportunities for new and emerging companies to compete in the global telecom market, strengthen our telecom supply chains and provide our allies and friends with trusted choices and innovative technologies to compete in the 21st Century. We look forward to bringing the best of industry, academia, and the public together to deliver on this initiative.”

NTIA’s first NOFO aims to expand and improve testing to demonstrate the viability of new approaches to wireless like open radio access networks (OpenRAN) and remove barriers to adoption. NTIA anticipates it will award up to $140.5 million during this first tranche of grants. The first round of awards will provide for a range of R&D and testing activities in this critical field, including:

- Expanding industry-accepted testing and evaluation (T&E) activities to assess and facilitate the interoperability, performance, and/or security of open and interoperable, standards-based 5G radio access networks; and

- Developing new or improved testing methodologies to test, evaluate, and validate the interoperability, performance, and/or security of these networks, including their component parts.

Later NOFOs will build upon the foundational work of this first NOFO, creating an ecosystem for wireless innovation built by the U.S. and its global allies.

“This fund is a critical down payment on our efforts to reshape the global wireless infrastructure supply chain towards secure and trusted vendors,” said Sen. Mark Warner (VA). “I look forward to seeing how the Department – working with U.S. and allied innovators and network operators – helps encourage this market to move towards security, interoperability, and greater wireless innovation.”

“With the investments from this initiative, the US can help facilitate much-needed competition in the global wireless market and create a more resilient and secure wireless supply chain,” said Assistant Secretary of Commerce Alan Davidson.

“Today’s announcement marks critical new progress toward strengthening the security of our wireless networks,” added energy and commerce committee ranking member Frank Pallone. “This program is a win for both U.S. national security and innovation, and with it, we will help level the playing field against untrusted actors attempting to use our communications networks against us.”

This announcement comes the same week as the U.S. moved forward with its plan to name and punish any ally that permits the use of network equipment developed by Chinese vendors Huawei and ZTE. The ‘Countering Untrusted Telecommunications Abroad Act’ is reportedly due to have its second reading this week.

Separately, the NOFO announcement came a day after the UK unveiled its own strategy for driving innovation in the telecoms sector. The UK government seems to have implied that it wouldn’t necessarily oppose consolidation in the mobile market, insisting that there is no magic number of operators.

……………………………………………………………………………………………………………..

Comment and Analysis – OpenRAN Rebuttal:

This author and several of his colleagues have been negative on OpenRAN for a very long time. The main reason is that Open RAN specs (which are to ensure multi-vendor interoperability) are being developed by the O-RAN Alliance, with test scripts from the TIP OpenRAN project. Neither of those entities are Standards Development Organizations (SDOs). While O-RAN did forge an alliance with ATIS, that won’t help much as ATIS has not developed any cellular standards on its own.

The two organizations that develop all the cellular specs and standards are 3GPP and ITU-R IMT yet O-RAN Alliance does not have a liaison with either of them!

Here is the opinion of our colleague John Strand, Principal of StrandConsult on why Open RAN is popular in some countries and with selected media, but really has no serious market potential:

The U.S. State Department spends a lot of energy promoting OpenRAN as an alternative to Chinese vendors like Huawei and ZTE. It is described quite well in this article. I had a meeting with those people at the State Department in Washington on December 8th last year, and they understand that OpenRAN was not a product that operators were buying.

In Europe, operators such as Deutsche Telecom and Vodafone have bet big on Huawei. That’s described in our reports: Understanding the Market for 4G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 102 Mobile Networks – Strand Consult and The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries – Strand Consult

Europe has also agreed that it is not smart to build vital telecom infrastructure using network equipment from China, the EU 5G tool box. For Vodafone and DT, OpenRAN is their excuse to stick with the Chinese vendors. Their story is that when OpenRAN is ready, we will replace Huawei equipped with OpenRAN vendors- when it is ready for mass market.

- The vendors who bet on OpenRAN spend a lot of money on sponsoring events with media that subsequently write a lot of positive stories, praising the technology. When I joke, I refer to TelecomTV as “OpenRAN TV.” I would guess that 95% of the OpenRAN events are sponsored events, and a lot of the articles is related to the same events.

- There are a number of politicians in countries that have 2G, 3G, 4G and 5G and they all want to dominate 6G. They have not realized that innovation is happening in global companies such as Nokia, Ericsson, Qualcomm, Samsung and Huawei/ZTE that built their own proprietary network equipment.

- The 5G and 6G standards work with 3G, 4G, 5G, and 6G happens in 3GPP and ITU-R (ATIS carries 3GPP contributions into ITU-R WP5D directed at ITU-R IMT standards (i.e. reccommendations). The next G does not come from a nation or a company, but from a group of global companies.

- For some people believe OpenRAN is the next G, but that’s total nonsense! Only ITU-R (WP 5D) is responsible for all the cellular G’s as part of International Mobile Telecommunications (IMT) recommendations and there is NO WORK IN ITU-R on OpenRAN!!!

- There are a number of companies that make their living selling market information, companies which over the last 20 years have been hit financially because there has been a consolidation of the infrastructure industry. It is in their interest that the number of suppliers is increased, it gives them access to a larger customer base. OpenRAN is a new product segment and represent around 30 – 40 potential customers with a budget.

- GSMA, along with some of their members, has marketed a narrative that there are not many suppliers in this industry and that there is a need for more supplier diversity. It’s not a true story if you look at how many vendors are exhibiting at Mobile World Congress. It is also a story that does not seem credible when these same operators are crying out for the possibility of consolidating the market. The consolidation there has been when it comes to infrastructure, it is driven by mobile operators who have changed their purchasing habits and bet on fewer suppliers.

–>To put it very simply, the less people know about the cellular communications market, the happier they are about OpenRAN.

References:

https://ntia.gov/page/public-wireless-supply-chain-innovation-fund

https://www.federalregister.gov/documents/2022/12/13/2022-26938/public-wireless-supply-chain-innovation-fund-implementation

https://telecoms.com/521184/us-dangles-1-5bn-in-front-of-open-ran-community/

Chunghwa Telecom: 14.4% profit growth due to 5G and non-traditional telecom services; Taiwan telecom consolidation in 2023

Chunghwa Telecom, Taiwan’s largest network operator reported double digit net profits last month, as more people sign up for 5G services and nontraditional offerings (see below). Net profits last month expanded 14.4 percent annually to NT$3.22 billion (US$105.56 million) from NT$2.82 billion in March last year, the company said in a statement on Tuesday. That brought first-quarter net profit to NT$9.64 billion, up 6.4 percent from NT$9.06 billion in the same period last year. Earnings per share (EPS) rose to NT$1.24 from NT$1.17 in first quarter of last year, making Chunghwa Telecom the most profitable telecom in Taiwan. First-quarter revenue expanded 5.7 percent year-on-year to NT$54.21 billion, the company said, adding that the results exceeded its expectations. Its average revenue per post-paid mobile subscriber climbed 5.3 percent year-on-year last month, the telecom said, attributing the trend to more 5G subscriptions.

Last month’s robust performance came amid 50 percent annual growth in revenue from its nontraditional telecom services, including Internet data center leasing, cloud-based services, artificial intelligence of things services and private networking, it said. Meanwhile, Taiwan Mobile Cos net profit fell 0.3 percent to NT$2.72 billion in the first quarter, with earnings per share dropping to NT$0.96, the company said yesterday, adding that its bottom line was affected by unfavorable foreign exchange rates. However the companys average revenue per post-paid mobile subscriber last month rose 3.5 percent annually to NT$664, marking 22 straight months of growth, it said. First-quarter revenue increased 8.1 percent annually to NT$43.02 billion from NT$39.79 billion, it said. About 58 percent of last quarter’s revenue came from its e-commerce subsidiary Momo.com Inc.

Chunghwa Telecom Co signage is pictured at an outlet in Taipei Photo Credit: CNA

……………………………………………………………………………………………………………………………………………………………………

Separately, Far EasTone Telecommunications Co said that its first-quarter net profit surged 18.4 percent annually to NT$2.75 billion, with EPS of NT$0.85, both surpassing the companys expectations. Revenue in the first quarter expanded 1.8 percent to NT$22.31 billion from a year earlier. Far EasTone attributed the robust growth to its number of mobile users expanding to 7.17 million last month, while its average revenue per user increased 2.3 percent, marking the best performance in about 25 months, it said.

…………………………………………………………………………………………………………………………………………………………………….

Research and Markets “Taiwan Telecoms Industry Report – 2023-2030” report states that the Taiwanese telecoms market is set to see a wave of consolidation in 2023 By the end of the year, the number of mobile operators could decline from five to three, which is considered a reasonable number for market competition globally. Two of the three major players are set to acquire two smaller companies. Taiwan Mobile is set to merge with Taiwan Star, and FET will take over Asia Pacific Telecom, a smaller operator. Both deals are expected to conclude by late 2023, reflecting a trend of consolidation by private players that we have witnessed in other Asian markets such as Malaysia, Thailand and Indonesia.

Further market consolidation is likely to occur over the forecast period as many telecom players confront the task of creating returns in a growing and capital-intensive industry and are therefore considering ways to grow industry revenues and profitability.

The publisher forecasts that mobile subscriptions will continue to grow in the 2023-30 period and fixed broadband subscribers will also continue to grow but lower its household penetration over the same period due to fixed-wireless substitution. The ratio of the telecommunications sector revenue to GDP is declining from a peak in 2015, sliding down every year since then. Following the market contraction over the last 5 years, the publisher forecasts flat revenue growth to 2030, as long as data pricing stays rational amid the mergers from five to three mobile operators due in 2023.

Mobile subscriptions are growing faster than mobile service revenue leading to ARPU decline after 3 years of intense competition with the market transitioned completely transitioned to 4G after shutting down 2G and 3G networks in 2017 and 2019 respectively.

The publisher expects the overall Taiwan telecoms market to remain flat through to 2025 after a marked decline from 2016 due to mobile service revenue pressure partially offset by fixed broadband and enterprise data growth.

Mobile Subscribers and Revenue:

As the rate of growth of net additions in mobile subscriptions slows, telecommunications providers are channelling their efforts into reducing their cost base and stabilising ARPU through new value-added services using mobile data and bundling fixed and mobile services. The proportion of postpaid subscriptions remained stable at about 81% between 2016 and 2022 while the postpaid segment is growing in popularity with SIM-only offerings and reducing the number of people holding multiple SIMs.

According to our benchmark study of mobile data pricing, India has the lowest rate per GB at just a few cents per GB, while Australia and China had the biggest cost reduction per GB mostly due to increased data allowance in plans while Singapore remains expensive. Taiwan mobile users pay for competitively priced data as mobile users recorded the largest monthly download in the Asia Pacific region.

Broadband Subscribers – FTTH Push and Fixed Wireless:

The fixed broadband market is experiencing a subdued growth with Chunghwa Telecom losing share to HFC cable operators such as KBro, Taiwan Mobile, TBC and CNS. Chunghwa Telecom invested early in the 2010s in FTTx technologies while migrating its DSL subscribers to its HiNet network. Competing cable operators also invested in upgrading their cable networks bundling mobile, IPTV and e-Commerce services but falling short of upgrading to full-fiber networks limiting opportunities for gigabit speeds. Fixed broadband penetration is forecasted to decline as fixed-wireless substitution is increasing supporting a rising number of lone-occupancy households.

References:

https://www.taipeitimes.com/News/biz/archives/2023/04/13/2003797810

https://www.yahoo.com/lifestyle/taiwan-telecoms-industry-report-2023-172800956.html

Omdia: Consumer Telco Opportunity Challenged by Global Tech Giants

Market research firm Omdia (owned by Informa) says all growth areas for telcos will experience significant competition from hyperscalers – specifically the global tech giants Google, Amazon, Meta/Facebook, and Apple.

Omdia’s Quantifying the Consumer Telco Opportunity – 2023 report is an in-depth report providing analysis and insights drawn from Omdia’s related data tools as well as individual operator case studies. The market research firm says that other than core fixed-line and mobile data services, almost all of the potential growth for telcos in the consumer sector over the next few years will come from ‘non-traditional categories. Those include video streaming, digital gaming, streaming music, and smart home (whatever that means).

“Service providers must look beyond data and diversify into adjacent digital markets to enable continued growth of their telco consumer businesses,” said Omdia’s Jonathan Doran. “Many have already invested in TV and online video entertainment, but there are other fast-growing markets telcos can also explore. Adopting the right go-to-market strategy and business model for each individual service area will be critical to striking the balance between achieving market success and mitigating financial risk. In many areas, telcos will need to accept that competing head-on is unrealistic and developing partnerships with such players is not only more pragmatic but will also serve to strengthen their own products and brands” observes Doran.

“Omdia’s Digital Consumer Operator Strategy Benchmark shows that the more service providers actively invest in a given service area – including through partnerships – the bigger market impact they have, which in turn better positions them to take a bigger slice of overall market revenue”

Big tech is already there and doing a decent job of selling all these digital goodies direct to consumers without the help of operators. Every time telcos have tried to compete directly in adjacent markets is has all gone horribly wrong so, as well as picking their fights more carefully, they are advised to consider an ‘if you can’t beat em, join em’ approach.

“In many areas, telcos will need to accept that competing head-on is unrealistic and developing partnerships with such players is not only more pragmatic but will also serve to strengthen their own products and brands,” said Doran. “Omdia’s Digital Consumer Operator Strategy Benchmark shows that the more service providers actively invest in a given service area – including through partnerships – the bigger market impact they have, which in turn better positions them to take a bigger slice of overall market revenue.”

The Omdia chart below illustrates product types by growth potential (horizontal axis), relevance to the Communications Service Provider (CSP) core proposition (vertical axis) and forecasted relative 2027 market size. As you can see, most consumer digital products are pretty far from the CSP core proposition, but Omdia forecasts they will collectively amount to a $500 billion market by 2027. How much of that will find its way into the pockets of telcos as a result of partnering with Big Tech remains to be seen, but even a small fraction is better than nothing.

Amazon, Microsoft and Google are not only three of the biggest players in the digital consumer space, they also dominate the public cloud market, which network operators are constantly urged to turn to for its efficiencies and flexibility. It’s possible to imagine a time most of what we get from and operator is actually supplied, and monetized, buy one of a small number of hyperscalers. It’s not clear whether that represents a positive development for the telecoms industry.

References:

https://telecoms.com/521154/study-highlights-increasing-dependence-of-operators-on-hyperscalers/

Disaggregation of network equipment – advantages and issues to consider

Introduction (by Alan J Weissberger):

Through network disaggregation of hardware and modular software, as proposed by the OCP, TIP, and O-RAN Alliance, network operators can select cheaper/commodity hardware from Taiwanese and/or Chinese manufacturers (ODMs)while using open source software or purchasing software from a trusted source.

For example, open source or proprietary software can turn a bare-metal-switch into an Internet gateway or a 5G core router. That software will also provide network management and security. It can easily be changed if the network operator, or the national government, decides the security landscape has evolved – without the need to replace any physical equipment.

IEEE and SCU SoE are sponsoring a virtual panel session which is described here.

Disaggregation Issues (by Richard Brandon, VP of Strategy at RtBrick):

As you move closer towards the core, disaggregation will certainly result in more physical boxes being used than traditional network systems, but closer to the edge it is usually a one-for-one replacement, substituting a single proprietary box with an open one. Even in the core though, this won’t necessarily mean many more outward facing physical interfaces. For example, a white box switch really just takes the place of a line-card in a conventional chassis-based router, with the same number of outward facing networking ports. So at that level, little changes.

Q & A (Alan and Richard):

1. Which of the consortiums (OCP, TIP, O-RAN) are doing a good job of specifying disaggregated hardware modules and the exposed interfaces between them?

We’ve been working closest with TIP and its operator members, specifically on the Open BNG initiative. They’ve issued a set of requirements for different use-cases, which have been driven by several operators. There is always the risk that this requirements list can become a superset of everything that’s ever been implemented, but the process is doing its best to manage that challenge.

2. Any success stories of multi-vendor interoperability of those disaggregated network modules?

For Open BNG, TIP selected several hardware and software vendors that met their criteria, which includes interoperability. For example, RtBrick’s routing software can run on nine different hardware platforms from three different vendors, and those platforms can be mixed and matched to optimize for scale and cost. RtBrick’s BNG software has been deployed in Deutsche Telekom’s production network, working on different vendor switches.

3. The cyber attack surface is greatly increased with many more exposed interfaces. What extra cyber security is needed to prevent attacks?

Of course, there are more distinct switching entities, but in some ways, this is actually an advantage because if any individual switch is compromised by a DDos Attack, for example, the blast radius of the attack is actually reduced with disaggregation.

Either way, it is usually the software where any vulnerabilities may lie. Here, disaggregation opens up some interesting dynamics when it comes to security threats, particularly those security concerns that derive from equipment provided by ‘untrusted nation states.’ Up until now, telcos have had a choice between lower-cost equipment from these untrusted states, or using trusted vendors with higher cost-bases.

Conclusions:

Disaggregation brings the best of both worlds. The hardware can be sourced from countries with low manufacturing costs, but the software, which is where the vulnerabilities may be, can be supplied by vendors from open democratic countries.

Richard Brandon is a strategic and operational IT marketeer who is focused on results for his customers. He has experience within the networking, telecoms and TV industries.

References:

https://www.rtbrick.com/products-and-technology

https://www.rtbrick.com/news-and-events/rtbrick-wins-gold-at-the-merit-awards?c=press-releases

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

The video recording: https://www.youtube.com/watch?v=RWS39lyvCPI

Light Counting: Large majority of CSPs remain skeptical about Disaggregated Open Routers

Nokia in multi-year deal with Zain to provide 5G RAN equipment throughout Jordan

Nokia has announced a multi-year deal with Zain Jordan to provide 5G Radio Access Network (RAN) equipment throughout Jordan. The contract is aimed at supporting the digital transformation of the country by offering advanced 5G services with improved connectivity and capacity to customers.

As part of the agreement, Nokia will deploy the latest generation of its AirScale Baseband, Massive MIMO radios, and Remote Radio Head products to over 3,000 sites nationwide. These latest generation products are all powered by Nokia’s energy-efficient ReefShark System on Chip (SoC) technology and are designed to provide superior coverage and capacity.

In addition to deploying 5G, Nokia will also upgrade Zain’s existing 4G infrastructure. The deployment of 5G is expected to accelerate the growth of new technologies and industries in Jordan, contributing to the country’s economic growth and development.

Nokia has a longstanding partnership with Zain across several territories, including the Kingdom of Saudi Arabia. The deal is expected to be completed during 2023, with the majority of the deployment scheduled to take place during the year.

Tommi Uitto, President of Mobile Networks at Nokia, said: “We are delighted to be partnering with Zain Jordan on this project to modernize their complete Radio Access Network and introduce 5G technology, and by doing so, support the Jordanian Government’s digital transformation objectives. The deployment of 5G is expected to stimulate the incubation and growth of new technologies and industries.”

Resources and additional information:

5G Radio Access Networks (RAN)

AirScale Radio Access

Nokia 5G

References:

Comcast selects Nokia’s 5G SA Core software to support its mobile connectivity efforts

Nokia introduces new Wavence microwave solutions to extend 5G reach in both urban and rural environments

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

Nokia to open 5G and 6G research lab in Amadora, Portugal

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial