Dell’Oro Group

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

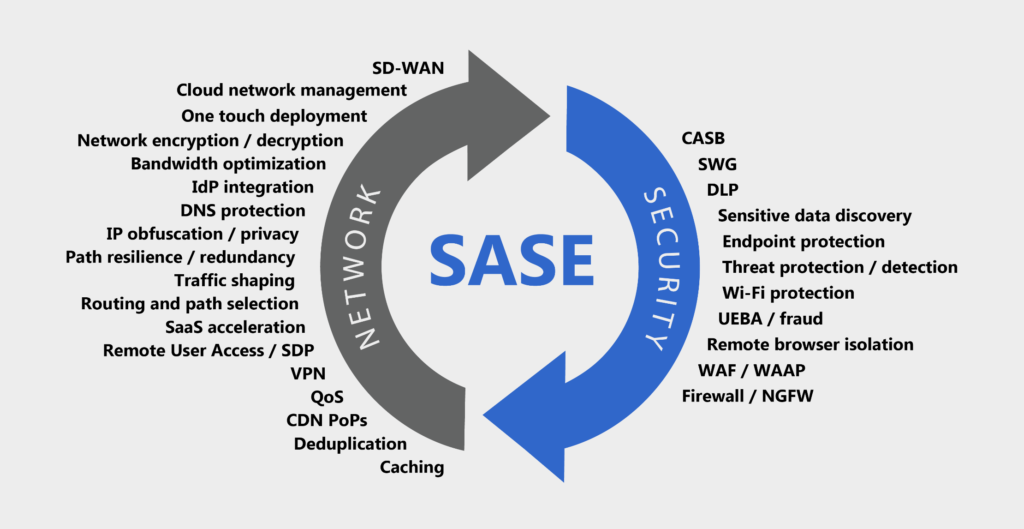

The secure access service edge (SASE) market is expected to triple by 2026, exceeding $13 billion, representing a very healthy CAGR, according to a new forecast by Mauricio Sanchez, Research Director at the Dell’Oro Group. The report further divides the total SASE market into its two technology components, Security Service Edge (SSE) and SD-WAN with SSE expected to double the SD-WAN revenue for SASE. The report further breaks down the SSE market into FWaaS, SWG, CASB, and ZTNA.

Sanchez wrote in a blog post:

“Today, enterprises are thinking differently about networking and security. Instead of considering them as separate toolsets to be deployed once and infrequently changed, the problem and solution space is conceptualized along a continuum in the emerging view. The vendor community has responded with a service-centric, cloud-based technology solution that provides network connectivity and enforces security between users, devices, and applications.

SASE utilizes centrally-controlled, Internet-based networks with built-in advanced networking and security-processing capabilities. By addressing the shortcomings of past network and security architectures and improving recent solutions—in particular, SD-WAN and cloud-based network security—SASE aims to bring networking and security into a unified service offering.

While the networking technologies underpinning SASE are understood to be synonymous with well-known SD-WAN, the security facet of SASE consists of numerous security technologies, such as secure web gateway (SWG), cloud access security broker (CASB), zero-trust network access (ZTNA), and firewall-as-a-service (FWaaS). Recently, a new term, security services edge (SSE), emerged to describe this constellation of cloud-delivered network security services that is foundational in SASE.”

As noted above, Dell’Oro divides the total SASE market into two technology components: Security Service Edge (SSE) and SD-WAN with SSE. Security features such as Firewall-as-a-Service (FWaaS), Secure Web Gateway (SWG), Cloud Access Security Broker (CASB) and Zero Trust Network Access (ZTNA) fall under the umbrella of SSE, according to Dell’Oro. In addition, Dell’Oro predicts that the security component to SASE “will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Dell’Oro’s Sanchez wrote, “We see SASE continuing to thrive independent of the ongoing macro-economic uncertainty as enterprises strategically invest for the new age of distributed applications and hybrid work that need a different approach to connectivity and security. We anticipate that security will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Additional highlights from SASE and SD-WAN 5-Year Forecast Report:

- Within SSE, Secure Web Gateway (SWG) and Cloud Access Security Broker (CASB) are expected to remain the most significant revenue components over the five-year forecast horizon, but Zero Trust Network Access (ZTNA) and Firewall-as-a-Service (FaaS) are estimated to flourish at a faster rate.

- Unified SASE is expected to exceed disaggregated SASE by almost 6X.

- Enterprise access router revenue is expected to decline at over 5 percent CAGR over the forecast horizon.

Dell’Oro expects that under the umbrella of SSE, Secure Web Gateway and Cloud Access Security Broker will continue as the most significant revenue components over the five-year forecast horizon. However, Zero Trust Network Access and Firewall-as-a-Service are expected to grow at a faster rate.

Unified SASE, which Dell’Oro qualifies as the portion of the market that delivers SASE as an integrated platform, is expected to exceed disaggregated SASE by almost a factor of six over the next five years. The disaggregated type is defined as a multi-vendor or multi-product implementation with less integration than unified type. Dell’Oro also predicts that enterprise access router revenue could decline at over 5% CAGR by 2026.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Gartner has a more optimistic forecast of SASE revenue, predicting the market to reach $14.7 billion as early as 2025. “Gartner predicts that global spending on SASE will grow at a 36% CAGR between 2020 and 2025, far outpacing global spending on information security and risk management,” reported VentureBeat last month. According to Gartner, top SASE vendors include Cato Networks, Fortinet, Palo Alto Networks, Versa Networks, VMware and Zscaler.

These disparate predictions could be a result of the nascent nature of the SASE market, a convergence of networking and security services coined by Gartner in 2019. To address the varying definitions for SASE and resulting confusion on the part of enterprise customers, industry forum MEF plans to release SASE (MEF W117) standards this year. MEF started developing its SASE framework in 2020 to clarify service attributes and definitions. (See MEF adds application, security updates to SD-WAN standard and MEF’s Stan Hubbard on accelerating automation with APIs.)

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Omdia’s [1.]research also shows security is a major driver for SASE adoption, according to Fernando Montenegro, senior principal analyst with Omdia. “Our own research indicates that end-user organizations value secure web browsing use cases (SWG, CASB, browsing isolation) particularly as they go further into their deployments of SASE projects,” said Montenegro in an email to Light Reading.

Note 1. Omdia and Light Reading are owned by Informa in the UK

Security is critical for organizations in what Omdia calls the age of “digital dominance” and by how the “demands on security teams – both in terms of time and expertise – make the delivery of security functionality via a services model particularly attractive,” Montenegro said.

SASE services also provide “good performance characteristics” when compared to enterprises utilizing their own VPN headends, and especially when hybrid work continues to be popular, added Montenegro.

References:

Total SASE Market to Nearly Triple by 2026, According to Dell’Oro Group

https://start.paloaltonetworks.com/gartner-2022-report-roadmap-for-sase-convergence.html

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

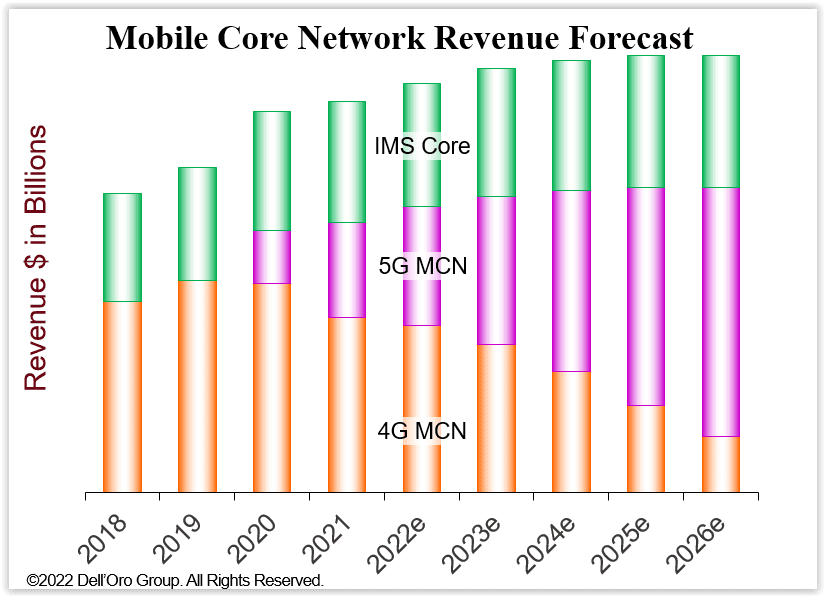

According to a newly published Dell’Oro Group report, Mobile Core Network (MCN) market growth will be decreasing. Worldwide MCN 5-year growth is now forecasted at a 2% compounded annual growth rate (CAGR), compared to our January 2022 forecast of 3% CAGR.

“The July 2022 forecast is more conservative than the January 2022 forecast due to industry headwinds, including supply chain challenges, higher inflation, an impending recession, Mobile Network Operators’ (MNO) challenges to increase revenues, and regional political conflicts,” said Dave Bolan, Research Director at Dell’Oro Group. “As a result, we reduced the 2022 to 2026 cumulative revenue forecast by 6 percent, decreasing revenues by $3.2 B. The July 2022 cumulative revenue forecast (2022-2026) is now $50.3 B resulting in a 2 percent CAGR.

“We are tracking the number of 5G Standalone (5G SA) MBB networks that have been launched commercially by MNOs. In the first half of 2022, only three new 5G SA networks were launched, KDDI in Japan, DISH Wireless in the US, and China Broadnet in China bringing the total deployed around the world to 27 MNO 5G SA MBB networks,” Bolan added.

Additional highlights from the MCN 5-Year July 2022 Forecast report:

- Year-over-year (Y/Y) MCN revenue growth rates for each year in the forecast are positive but will decrease each year; by 2026, Y/Y revenues will be essentially flat.

- MCN market CAGR forecast by industry segments we expect 5G MCN to be 21 percent, 4G MCN -20 percent, IMS Core 2 percent, and the User Plane Function (UPF) required for Multi-access Edge Computing (MEC) 67 percent.

- The North America and China regions are expected to have the lowest CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific without China regions are expected to have the highest CAGRs.

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year January Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected]

………………………………………………………………………………………………………………………………………………

In a related Dell’Oro “Private Wireless Advanced Research Report,” Stefan Pongranz states that private wireless radio access network (RAN) shipments and revenues are coming in below expectations, resulting in another decreased forecast.

“We have not made any changes to the potential market calculations and still estimate private wireless is a massive opportunity,” said Stefan Pongratz, Vice President at Dell’Oro Group. “At the same time, the message we have communicated for some time still holds – we still envision the enterprise and industrial play is a long game. This taken together with the fact that the standalone LTE/5G market is developing at a slower pace than previously expected forms the basis for the near-term downgrade,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward to reflect weaker than expected progress with private wireless LTE and 5G small cells.

- Total private wireless RAN revenues, including macro and small cells, are projected to roughly double between 2022 and 2026.

- Standalone private LTE/5G is now expected to account for a low single-digit share of the total RAN market by 2026.

Dell’Oro Group’s Private Wireless Advanced Research Report with a 5-year forecast includes projections for Private Wireless RAN by RF Output Power, technology, spectrum, and region. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, enterprise networks, data center infrastructure, and network security markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Industry Headwinds to Decrease Mobile Core Network Market Growth, According to Dell’Oro Group

Private Wireless Forecast Adjusted Downward, According to Dell’Oro Group

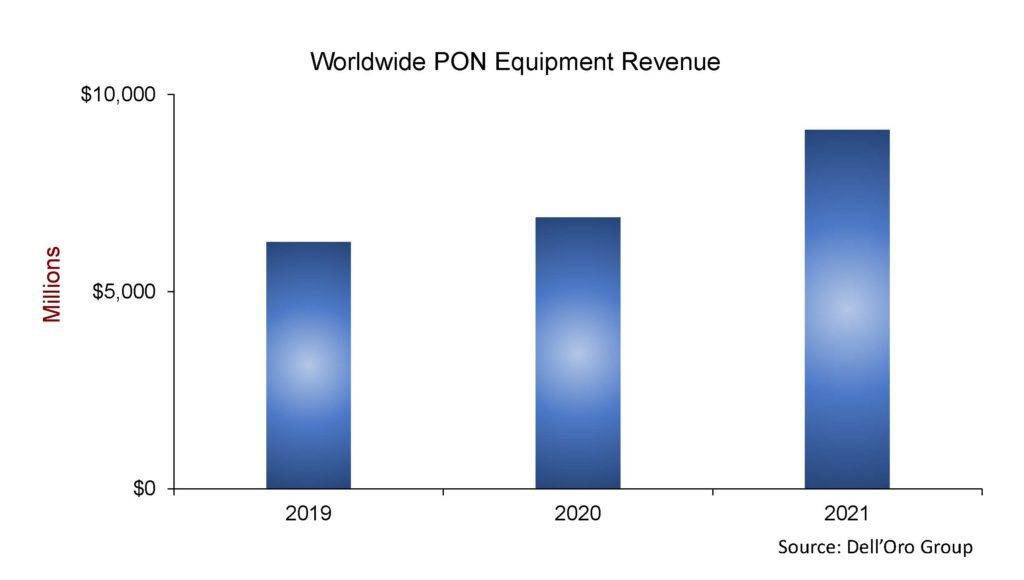

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $16.3B in 2021, up 12 percent year-over-year (Y/Y). Growth came once again from spending on both PON infrastructure and fixed wireless CPE.

“2021 was a record year for PON (Passive Optical Network) equipment spending, with some of the highest growth coming from the North American market, where expansion projects and fiber overbuilds are picking up considerably,” said Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “These fiber expansion projects show no signs of slowing heading into 2022.”

Additional highlights from the 4Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue increased 4 percent Y/Y to just over $1B. Steady growth in Distributed Access Architecture (DAA) deployments helps offset declines in traditional CCAP licenses.

- Total PON ONT unit shipments reached a record 140 M units for the year, bucking the supply chain constraints that have dogged the cable CPE market.

………………………………………………………………………………………………………..

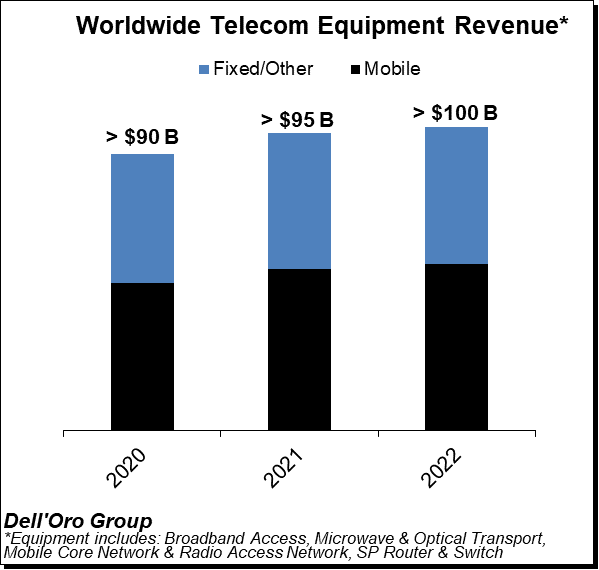

Separately, Dell’Oro just completed the 4Q2021 reports for all the Telecom Infrastructure programs covered, including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch. The data contained in these reports suggests that total year-over-year (Y/Y) revenue growth slowed in the fourth quarter to 2%, however, this was not enough to derail full-year trends.

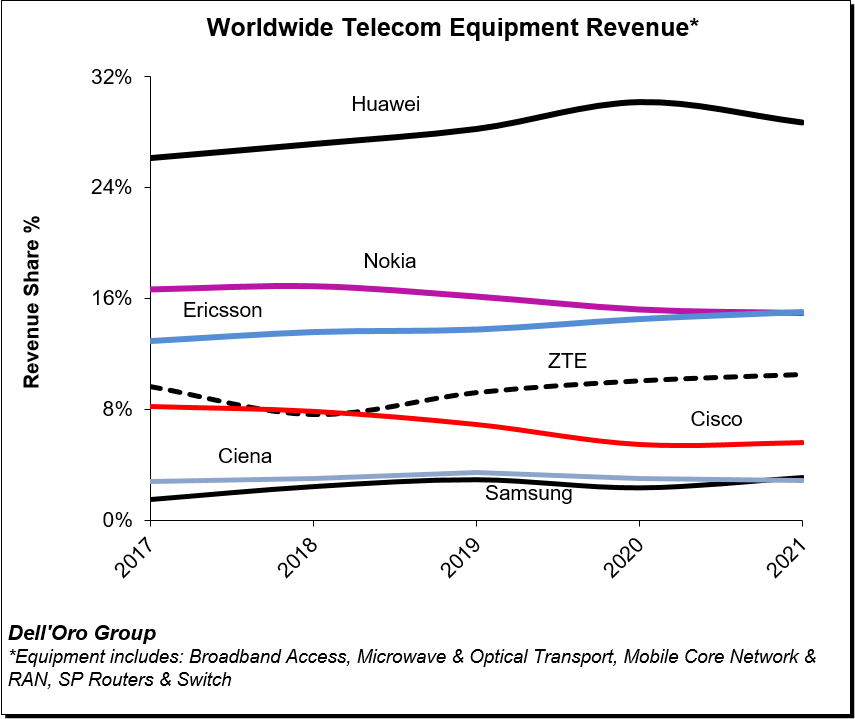

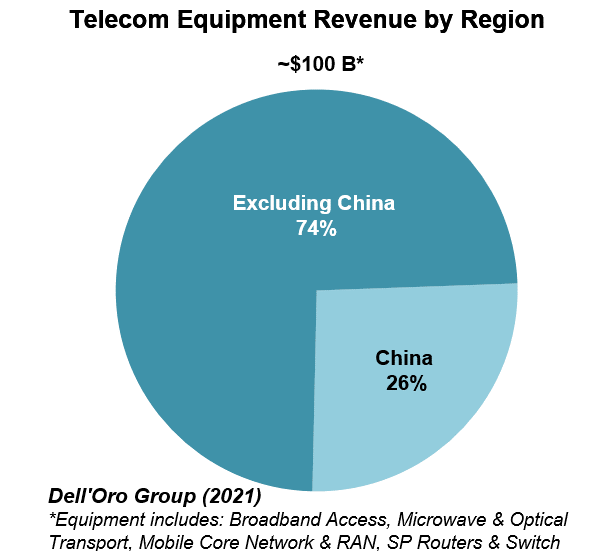

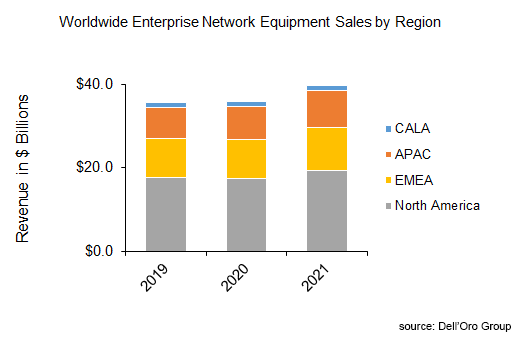

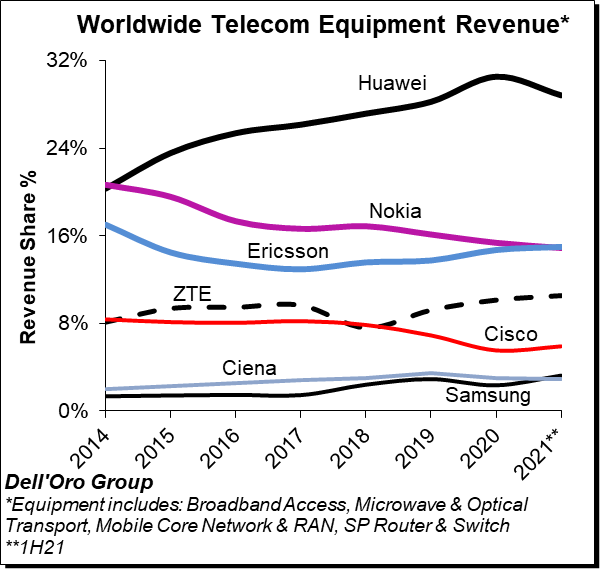

The market research firm estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

In addition to challenging comparisons, we attribute the weaker momentum in the fourth quarter to external factors including COVID-19 restrictions and supply chain disruptions.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 2021, with the top seven vendors comprising around 80% of the total market.

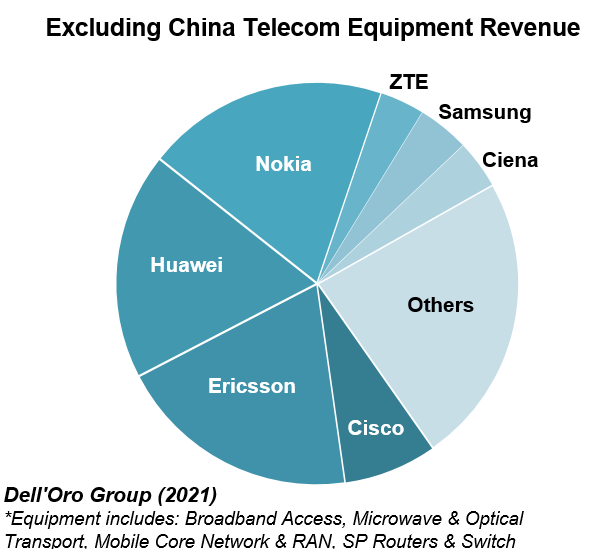

Despite U.S. sanctions, Huawei continued to lead the global market, underscoring its grip on the Chinese market, depth of its telecom portfolio, and resiliency with existing footprints. Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

The relative growth rates have been revised upward for 2022 to reflect new supply chain and capex data. Still, global telecom equipment growth is expected to moderate from 7% in 2021 to 4% in 2022.

Risks are broadly balanced. In addition to the direct and indirect impact of the war in Ukraine and the broader implications across Europe and the world, the industry is still contending with COVID-19 restrictions and supply chain disruptions. At the same time, wireless capex is expected to surge in the U.S. this year.

…………………………………………………………………………………………………..

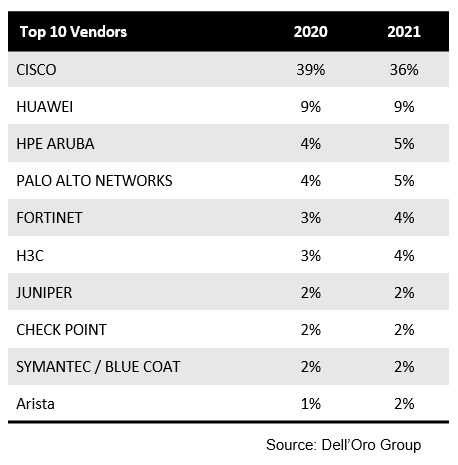

Top 10 Enterprise Network Equipment Vendors:

References:

Key Takeaways—2021 Total Enterprise Network Equipment Market

Dell’Oro Group: Open RAN Momentum Is Solid; RAN equipment prices to increase

by Stefan Pongratz, VP at Dell’Oro Group

Introduction:

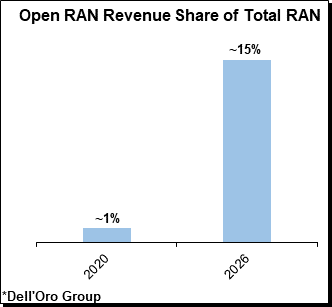

Open RAN ended 2021 on a solid footing. Preliminary estimates suggest that total Open RAN revenues—including O-RAN and OpenRAN radios and baseband—more than doubled for the full year 2021, ending at a much higher level than had been expected going into the year. Adoption has been mixed, however. In this blog, we review three Open RAN-related topics: (1) a recap of 2021, (2) Mobile World Congress (MWC) takeaways, and (3) expectations for 2022.

2021 Recap:

Looking back to the outlook we outlined a year ago, full-year Open RAN revenues accelerated at a faster pace than we originally expected. This gap in the output ramp is primarily the result of higher prices. LTE and 5G macro volumes were fairly consistent with expectations, but the revenue per Open RAN base stations was higher than we modeled going into 2021, especially with regard to brownfield networks. Asymmetric investment patterns between the radio and the baseband also contributed to the divergence, though this is expected to normalize as deployments increase. In addition, we underestimated the 5G price points with some of the configurations in both the Japanese and US markets.

Not surprisingly, the Asia-Pacific (APAC) region dominated the Open RAN market in 2021, supported by large-scale greenfield OpenRAN and brownfield O-RAN deployments in Japan.

From a technology perspective, LTE dominated the revenue mix initially but 5G NR is now powering the majority of investments, reflecting progress both in APAC and North America.

Mobile World Congress (MWC) Barcelona 2022:

Open RAN revenues are coming in ahead of schedule, bolstering the narrative that operators want open interfaces. Meanwhile, the progress of the technology, especially with some of the non-traditional or non-top 5 RAN suppliers has perhaps not advanced at the same pace. This, taken together with the fact that the bulk of the share movements in the RAN market is confined to traditional suppliers, is resulting in some concerns about the technology gap between the traditional RAN and emerging suppliers. A preliminary assessment of Open RAN-related radio and baseband system, component, and partnership announcements at the MWC 2022 suggests this was a mixed bag, with some suppliers announcing major portfolio enhancements.

Among the announcements that most stood out is the one relating to Mavenir’s OpenBeam radio platform. After focusing initially on software and vRAN, Mavenir decided the best way to accelerate the O-RAN ecosystem is to expand its own scope to include a broad radio portfolio. The recently announced OpenBeam family includes multiple O-RAN 7.2 macro and micro radio products supporting mmWave, sub 6 GHz Massive MIMO, and sub 6 GHz Non-Massive MIMO.

NEC announced a major expansion of its O-RAN portfolio, adding 18 new O-RUs, covering both Massive MIMO and non-Massive MIMO (4T4R, 8T8R, 32T32R, 64T64R). NEC also recently announced its intention to acquire Blue Danube.

Another major announcement was Rakuten Symphony’s entry into the Massive MIMO radio market. Rakuten Symphony is working with Qualcomm, with the objective of having a commercial Massive MIMO product ready by the end of 2023.

Recent Massive MIMO announcements should help to dispel the premise that the O-RAN architecture is not ideal for wide-band sub-6 GHz Massive MIMO deployments. We are still catching up on briefings, so it is possible that we missed some updates. But for now, we believe there are six non-top 5 RAN suppliers with commercial or upcoming O-RAN Sub-6 GHz Massive MIMO GA: Airspan, Fujitsu, Mavenir, NEC, Rakuten Symphony, and Saankhya Labs.

Putting things into the appropriate perspective, we estimate that there are more than 20 suppliers with commercial or pending O-RAN radio products, most prominently: Acceleran*, Airspan, Askey*, Baicells*, Benetel*, BLiNQ*, Blue Danube, Comba, CommScope*, Corning*, Ericsson, Fairwaves, Fujitsu, JMA*, KMW, Mavenir, MTI, NEC, Nokia, Parallel Wireless, Rakuten Symphony, Saankhya Labs, Samsung, STL, and Verana Networks* (with the asterisk at the end of a name indicating small cell only).

The asymmetric progress between basic and advanced radios can be partially attributed to the power, energy, and capex tradeoffs between typical GPP architectures and highly optimized baseband using dedicated silicon. As we discussed in a recent vRAN blog, both traditional and new macro baseband component suppliers—including Marvell, Intel, Qualcomm, and Xilinx—announced new solutions and partnerships at the MWC Barcelona 2022 event, promising to close the gap. Dell and Marvell’s new open RAN accelerator card offers performance parity with traditional RAN systems, while Qualcomm and HPE have announced a new accelerator card that will allegedly reduce operator TCO by 60%.

2022 Outlook:

Encouraged by the current state of the market, we have revised our Open RAN outlook upward for 2022, to reflect the higher baseline. After more than doubling in 2021, the relative growth rates are expected to slow somewhat, as more challenging comparisons with some of the larger deployments weigh on the market. Even with the upward short-term adjustments, we are not making any changes at this time to the long-term forecast. Open RAN is still projected to approach 15% of total RAN by 2026.

In summary, although operators want greater openness in the RAN, there is still much work ahead to realize the broader Open RAN vision, including not just open interfaces but also improved supplier diversity. Recent Open RAN activities—taken together with the MWC announcements—will help to ameliorate some of these concerns about the technology readiness, though clearly not all. Nonetheless, MWC was a step in the right direction. The continued transition from PowerPoint to trials and live networks over the next year should yield a fuller picture.

Addendum:

“Following twenty years of average macro base station price declines in the 5% to 10% range, we are now modeling RAN [radio access network] prices to increase, reflecting a wide range of factors,” Stefan Pongratz, an analyst at research and consulting firm Dell’Oro Group, wrote in response to questions from Light Reading. “In addition to the changing vendor landscape and regional aspects coming into play with China’s overall share expected to decline going forward, we have also assumed there will be some COGS [cost of goods sold] inflation due to supply-demand mismatches, though the ability for everyone to pass this on [to their customers] remains limited.”

About the Author:

Stefan Pongratz joined Dell’Oro Group in 2010 and is responsible for the firm’s Mobile RAN market and Telecom Capex research programs. While at the firm, Mr. Pongratz has expanded the RAN research and authored multiple Advanced Research Reports to ensure the program is evolving to address new RAN technologies and opportunities including small cells, 5G, Open RAN, Massive MIMO, mmWave, IoT, private wireless, and CBRS. He built the Telecom Capex coverage detailing revenues and investments of over 50 carriers worldwide.

RAN growth slowed in 4Q-2021, but full year revenues rose to ~$40B – $45B; Open RAN market highlights

- Global RAN rankings did not change with Huawei, Ericsson, Nokia, ZTE, and Samsung leading the full year 2021 market.

- Ericsson, Nokia, Huawei, and Samsung lead outside of China while Huawei and ZTE continue to dominate the Chinese RAN market.

- RAN revenue shares are changing with Ericsson and Samsung gaining share outside of China.

- Huawei and Nokia’s RAN revenue shares declined outside of China.

- Relative near-term projections have been revised upward – total RAN revenues are now projected to grow 5 percent in 2022.

Open RAN Market – Highlights

- While 5G offers superior performance over 4G, both will coexist comfortably into the 2030s as the bedrock of next-generation mobile networks. There are three perspectives that help to underline this point. Firstly, unlike voice-oriented 2G and 3G (which were primarily circuit-switched networks with varying attempts to accommodate packet-switching principles), 4G is a fully packet-switched network optimized for data services. 5G builds on this packet switching capability. Therefore, 4G and 5G networks can coexist for a long while because the transition from 4G to 5G does not imply or require a paradigm shift in the philosophy of the underlying technology. 5G is expected to dominate the OPEN RAN market with $22B TAM in 2030 with a growth rate of 52% as compared to a 4G growth rate of 31% between 2022 and 2030

- Within OPEN RAN radio unit (RU), Small cells and macrocells are likely to contribute $7.5B and $2.4B TAM by 2030 respectively. It is going to be a huge growth of 46% from the current market size of $327M for such cells in the OPEN RAN market

- The sub-6GHz frequency band is going to lead the market with a 70% share for OPEN RAN although the mmWave frequency band will have a higher CAGR of 67% as compared to 37% CAGR of Sub-6GHz. Most focus has been on the 3.5 GHz range (i.e., 3.3-3.8 GHz) to support initial 5G launches, followed by mmWave awards in the 26 GHz and 28 GHz bands. In the longer term, about 6GHz of total bandwidth is expected for each country across two to three different bands

- Enterprises are adopting network technologies such as private 5G networks and small cells at a rapid rate to meet business-critical requirements. That’s why public OPEN RAN is expected to have the majority share of round ~95% as compared to the small market for the private segment

- At present, it is relatively easy for greenfield service providers to adopt 5G open RAN interfaces and architectures and it is extremely difficult for brownfield operators who have already widely deployed 4G. One of the main challenges for brownfield operators is the lack of interoperability available when using legacy RAN interfaces with an open RAN solution. Still, Mobile network operators (MNOs) throughout the world, including many brownfield networks, are now trialling and deploying Open RAN and this trend is expected to grow with time to have a larger share of brownfield deployments

- Asia Pacific is expected to dominate the OPEN RAN market with nearly 35% share in 2030. OPEN RAN market in the Asia Pacific is expected to reach USD 11.5 billion by 2030, growing at a CAGR of 34% between 2022 and 2030. Japan is going to drive this market in the Asia Pacific although China will emerge as a leader in this region by 2030. North America and Europe are expected to have a higher growth rate of more than 45% although their share will be around 31% and 26% respectively in 2030

References:

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

Dell’Oro Group recently published the January 2022 edition of its Open RAN report. Preliminary findings suggest that total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G (this author disagrees).

- The Asia Pacific region is dominating the Open RAN market in this initial phase and is expected to play a leading role throughout the forecast period, accounting for more than 40 percent of total 2021-2026 revenues.

- Risks around the Open RAN projections remain broadly balanced, though it is worth noting that risks to the downside have increased slightly since the last forecast update.

- The shift towards Virtualized RAN (vRAN) is progressing at a slightly slower pace than Open RAN. Still, total vRAN projections remain mostly unchanged, with vRAN on track to account for 5 percent to 10 percent of the RAN market by 2026.

-Market.jpg)

The global open radio access network (O-RAN) market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Amongst the market in these regions, the market in the Asia Pacific generated the largest revenue of $70 Million in the year 2020 and is further expected to hit $8200 Million by the end of 2028. The market in the region is further segmented by country into Japan, South Korea, India, and the Rest of Asia Pacific. Amongst the market in these countries, the market in India is expected to grow with the highest CAGR of 102% during the forecast period, while the market in Japan is projected to garner the second-largest revenue of $1900 Million by the end of 2028. Additionally, in the year 2020, the market in Japan registered a revenue of $60 Million.

The market in North America generated a revenue of $50 Million in the year 2020 and is further expected to touch $7000 Million by the end of 2028. The market in the region is further segmented by country into the United States and Canada. Out of these, the market in the United States is expected to display the highest market share by the end of 2028, whereas the market in Canada is projected to grow with the highest CAGR of 137% during the forecast period.

Key companies covered in the Open Radio Access Network (O-RAN) Market Research Report are: Metaswitch Networks, Mavenir, NTT DOCOMO, INC., Sterlite Technologies Limited, Huawei Technologies Co., Ltd., Radisys Corporation, Casa Systems, VIAVI Solutions Inc., Parallel Wireless, Inc., NXP Semiconductors, and other key market players.

Reference:

https://www.kennethresearch.com/report-details/open-radio-access-network-o-ran-market/10352259

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The latest Heavy Reading Open RAN Operator Survey indicates a positive outlook with real signs of momentum over the past year. Network operators and the wider RAN ecosystem are making steady progress, according to the survey results.

The first question in the survey was designed to help understand how operator sentiment toward open RAN has changed over the past year, in light of better knowledge of the technology, experience from trials, the increased maturity of solutions and changes in the policy environment. The figure below shows just over half (54%) of survey respondents say their company has not changed the pace of its planned open RAN rollout in the past year. There has been movement in the other half, split between those accelerating their plans (20%) and those slowing down (27%). This volatility essentially cancels out, and the overall finding is therefore that operators as a group are working at a steady, measured pace toward open RAN.

A steady outlook is a positive outlook at this stage of the market because it recognizes that open RAN is a major change in RAN architecture and is a long-term, multiyear exercise. After several years of inflated expectations, it is encouraging to see a measured perspective on open RAN coming to the fore.

n=82 Source: Heavy Reading

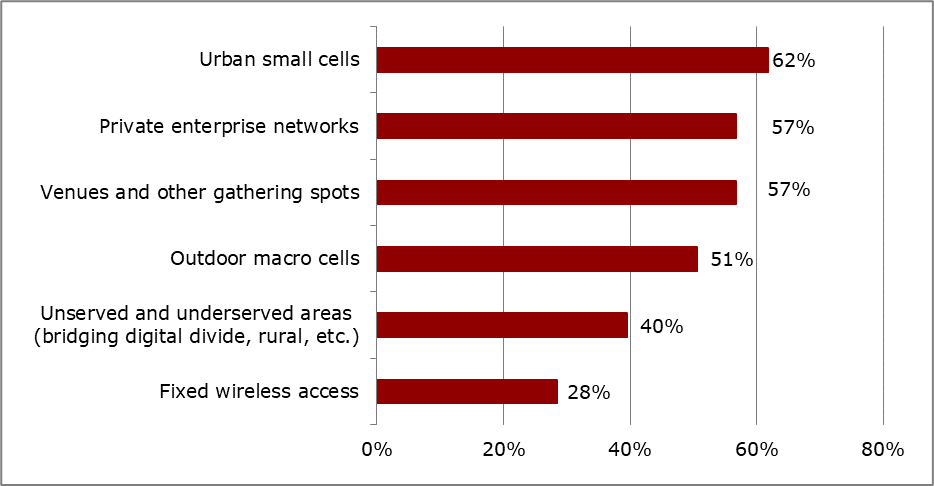

Another area of interest that helps gauge sentiment toward open RAN development relates to operators’ preferred use cases. The figure below reveals that operator intentions for how they will use open RAN are varied. Asked to select their top three use cases, 81 respondents representing 39 operators placed a total of 294 votes for an average of 3.6 per respondent, showing that there is no single open RAN use case or deployment scenario that stands out. Urban small cells (62%), private enterprise networks (57%) and venues and other gathering spots (also 57%) lead the responses.

n=81 Source: Heavy Reading

A positive way to interpret this finding is that open RAN is being pursued across a broad base of mobile communication scenarios. Once these models solidify and become “product ready,” then the market might see widespread adoption. Over time, open RAN could become the predominant mode of operation.

A less positive analysis, but one nevertheless worth considering, is that open RAN is a technology still in search of a solution. That is, the industry has committed to open RAN, and now it needs to find ways to make it work. Pursuing a diversity of use cases will help identify which are most promising and warrant investment and deployment at a wider scale.

It is notable that operator preferences for open RAN use cases have not changed much since Heavy Reading’s first survey in 2018; the same three use cases also led at that time. This reinforces the key message that open RAN progress is steady and consistent.

To download a copy of the 2021 Heavy Reading Open RAN Operator Survey, click here.

— Gabriel Brown, Principal Analyst, Heavy Reading

Reference:

https://www.lightreading.com/open-ran-steady-as-she-goes-/a/d-id/774765?

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

The slow uptake of 5G Standalone (SA) networks is decreasing the growth for the overall Mobile Core Network (MCN), which also includes IMS Core and 4G Core (EPC). Dell’Oro Group [1.] forecasts worldwide MCN 5-year growth will be at a 3% compounded annual growth rate (CAGR).

- 5G MCN, IMS Core, and Multi-Access Network Computing (MEC) will have positive growth rates for the forecast period while 4G MCN will experience negative growth.

- By 2026, 99% of the revenue for network functions will be from cloud native Container-based CNFs.

Via email, Dave wrote: The journey for network virtualization started in 2015 with ETSI NFV. We went from Physical Network Functions (PNFs) to Virtual Network Functions (VNFs) to cloud-ready VNFs, to Cloud- Native VNFs (CNF), to Container-Based Cloud-Native VNFs. Container-Based (CNF) enable microservices.

…………………………………………………………………………………………………………………

Separately, the Global mobile Suppliers Association (GSA) recently wrote that only 99 operators in 50 countries are investing in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks.

The GSA said at least 20 network operators (Dell’Oro says 13) in 16 countries or territories are believed to have launched public 5G SA networks. Another five have deployed the technology, but not yet launched commercial services or have only soft-launched them. So only 20.6% of the 481 5G network operators (investing in 5G licenses, trials or deployments of any type) have deployed 5G and that percentage is lower if you go by Dell’Oro’s 13 5G SA network operators.

From GSA’s The Power of Standalone 5G – published 19th January 2022:

Importantly, the 5G standalone core is cloud-native and is designed as a service-based architecture, virtualizing all software network functions using edge computing and providing the full range of 5G features. Some of these are needed in the enterprise space for advanced uses such as smart factory automation, smart city applications, remote control of critical infrastructure and autonomous vehicle operation. However, 5G standalone does mean additional investment and can bring complexity in running multiple cores in the network.

This will be a potential source of new revenue for service providers, as digital transformation — with 5G standalone as a cornerstone — will enable them to deliver reliable low-latency communications and massive Internet of things (IoT) connectivity to customers in different industry sectors. The low latency and much higher capacity needed by those emerging service areas will only be feasible with standalone 5G and packet core network architecture.

In addition, the service-based architecture opens up the ability to slice the 5G network into customized virtual pieces that can be tailored to the needs of individual enterprises, while maximizing the network’s operational efficiency. Advanced uses for 5G NR aren’t backward- compatible with LTE infrastructure, so all operators will eventually need to get to standalone 5G.

Standalone 5G metrics:

- Volume: Gbps per month

- Speed: Mbps (peak), Mbps (guaranteed)

- Location: Network Slice, service per location

- Latency per service or location (dependent on URLLC in the 5G RAN and 5G Core)

- Reliability or packet loss

- Number of devices per square km

- Dynamic service-level agreements per location

- Full end-to-end encryption and authentication

Source: CCS Insight

……………………………………………………………………………………………………………….

Note 1. Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

………………………………………………………………………………………………………………….

Feb 8, 2022 Update from Dave Bolan of Dell’Oro Group:

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

References:

Slow Uptake for 5G Standalone Drags on Mobile Core Network Growth, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

T-Mobile US: 5G SA Core network to be deployed 3Q-2020; cites 5G coverage advantage

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

Dell’Oro: 3Q21 Total Telecom Equipment Market up 6% year-over-year & 9% year-to-date

Dell’Oro Group just completed their 3Q21 reporting period for all the Telecommunications Infrastructure programs covered. Those include: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), SP Router & Switch.

The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market in the first half of 2021 extended into the third quarter, propelling the overall telecom equipment market to a sixth consecutive quarter of year-over-year (Y/Y) growth in revenues.

Preliminary estimates suggest the overall telecom equipment market advanced 6% Y/Y in the quarter and 9% Y/Y year-to-date (YTD). The growth in the quarter was underpinned by healthy demand for both wireless and wireline equipment.

While the majority of the suppliers were able to navigate the supply chain situation fairly well in the first half, supply chain disruptions had a greater impact in the third quarter, though clearly this was not enough to derail the positive momentum that has characterized the market over the past six quarters.

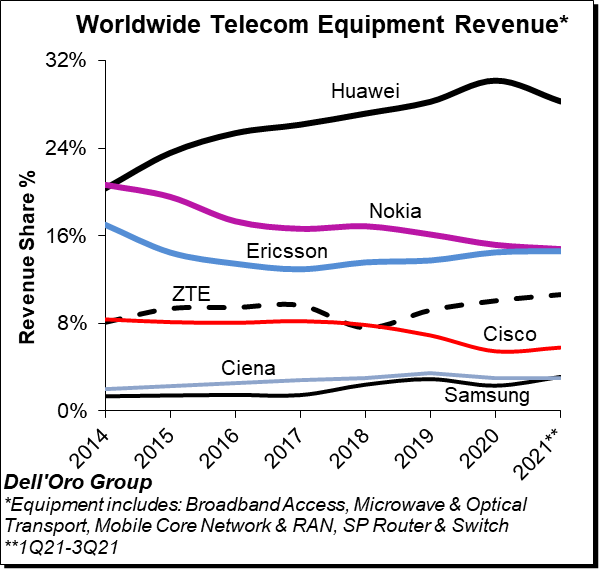

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1Q21-3Q21, with the top seven vendors comprising around ~80% of the total market.

Ongoing efforts by the US government to curb the rise of Huawei is starting to show in the numbers, especially outside of China. At the same time, Huawei continued to dominate the global market, still nearly as large as Ericsson and Nokia combined.

Overall, we believe ZTE and Samsung are trending upward while Huawei is losing some ground YTD relative to 2020.

Additional key takeaways from the 3Q21 reporting period include:

- Positive market sentiment in the third quarter was driven by strong growth in RAN and Broadband Access, which was more than enough to offset weaker trends in Optical Transport.

- RAN and Broadband Access are also the strongest growth vehicles for the YTD period, fueled by surging demand for 5G, PON, and FWA CPEs.

- With the pandemic resurging and the visibility surrounding the supply chain weakening, the Dell’Oro analyst team is expecting near-term growth to decelerate – the overall telecom equipment market is now projected to advance 2% in 2022, down from 8% in 2021.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.

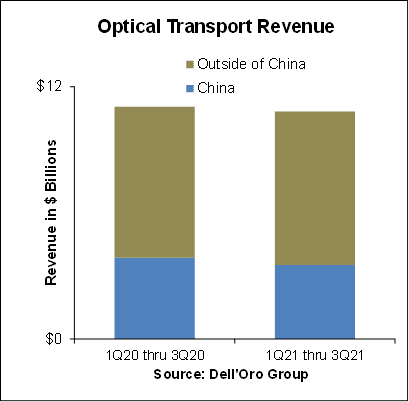

Dell’Oro: Optical Transport Market Down 2% in 1st 9 Months of 2021

According to a recently published report from Dell’Oro Group, the Optical Transport equipment market contracted 2 percent year-over-year in the first nine months of 2021 due to lower sales in China. Outside of China, however, the demand for optical equipment continued to increase, outpacing supply.

“Optical equipment revenue in China took a sharp turn for the worse in 3Q 2021,” said Jimmy Yu, Vice President at Dell’Oro Group. “As a result, optical revenue in China declined at a double-digit rate in the quarter, resulting in a 9 percent decline for the first nine months of 2021. At this rate, we are expecting a full year optical market contraction in the country. Something that has not occurred since 2012. Helping to offset some of this lower equipment revenue from China was the robust demand in North America, Europe, and Latin America.”

“We estimate that Optical Transport equipment revenue outside of China grew 6 percent year-over-year in the third quarter. However, we believe this growth rate could have been higher, closer to 10 percent, if it was not for component shortages and other supply issues plaguing the industry. So, fortunately while optical demand is hitting a rough patch in China, it seems to be accelerating in other parts of the world,” added Yu.

The optical transport market is predicted to reach $18 billion by 2025, primarily as a result of demand for WDM equipment, Dell’Oro reported in July 2021. In addition, Dell’Oro says the ZR pluggable optics market could exceed $500 million in annual sales by 2025.

In a 2Q-2021 report by market research firm Omdia, analysts noted that 5G investment, cloud service growth and demand for “infotainment-at-home” are among the drivers increasing demand in the optical networking market. “The twin dynamics of increasing optical capillarity and increasing end-point capacity continue to drive the optical core,” Omdia wrote in a note to clients.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Jimmy Yu, Vice President, Dell-Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Optical Transport Market Down 2 Percent in First Nine Months of 2021, According to Dell’Oro Group

Disaggregated DWDM Equipment Market Up 36 Percent in 2Q 2021, According to Dell’Oro Group

5-Year Forecast: Optical Transport Market Reaches $18 Billion by 2025

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Dell’Oro Group has completed its 1H2021 reports on “Telecommunications Infrastructure programs” including Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), Service Provider Router & Switch markets. The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market extended into the second quarter, even if the pace of the growth slowed somewhat between the first and the second quarter.

Preliminary estimates suggest the overall telecom equipment market advanced 10% year-over-year (Y/Y) during 1H21 and 5% Y/Y in the quarter, down from 16% Y/Y in the first quarter. The growth in the first half was primarily driven by strong demand for both wireless and wireline equipment, lighter comparisons, and the weaker US Dollar (USD). Helping to explain the Y/Y growth deceleration between 1Q and 2Q is slower growth in China.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1H21, with the top seven vendors comprising around ~81% of the total market.

Huawei is still the overall market leader by some margin, despite its sales and marketing challenges in many other parts of the world. Huawei’s market share slid below 30%, though that still almost double the share of its nearest rivals Ericsson and Nokia. Within the mix, Dell-Oro estimates Huawei and Nokia lost some ground between 2020 and 1H21 while Cisco, Ericson, Samsung, and ZTE recorded minor share gains over the same period.

Additional key takeaways from the 1H2021 reporting period include:

- Following the Y/Y decline in 1Q20, our analysis suggests the overall telecom equipment market recorded a fifth consecutive quarter of growth in the second quarter.

- The improved market sentiment in the first half was relatively broad-based, underpinned by single-digit growth in SP Routers and double-digit advancements in Broadband Access, Microwave Transport, Mobile Core Networks, and RAN.

- Aggregate 2Q21 revenues were in line with expectations, however, within the programs both Broadband Access and Microwave Transport were surprised on the upside while Optical Transport and SP Routers came in below expectations.

- From a regional perspective, China underperformed in the quarter, impacting the demand for both wireless and wireline-related infrastructure.

- Ongoing efforts by the US government to curb the rise of Huawei are starting to show in the numbers outside of China, not just for RAN but in other areas as well.

- Though Huawei is not able to procure custom ASICs for its telecom products, the supplier is assuring the analyst community its current inventory levels is not a concern over the near term for its infrastructure business.

- The majority of the vendors have through proactive measures been able to navigate the ongoing supply chain shortages and minimize the infrastructure impact. At the same time, the supply constraints appear more pronounced with higher volume residential and enterprise products including CPE and WLAN endpoints.

- Even with the unusual uncertainty surrounding the economy, the supply chains, and the pandemic, the Dell’Oro analyst team remains optimistic about the second half – the overall telecom equipment market is projected to advance 5% to 10% for the full-year 2021, unchanged from last quarter.

Two of the key telecom revenue drivers will be the RAN and Broadband Access markets, both of which have been growing at a strong pace this year so far: The RAN market is set to grow at between 10% and 15% this year, which means it could be worth as much as $40 billion, while the increasing number and size of investments in fibre broadband access networks around the world is driving growth in the Broadband Access market, which Dell’Oro reports was worth $3.6 billion during the second quarter alone.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.