Month: December 2021

Nokia exec talks up “5G Advanced” (3GPP release 18) before 5G standards/specs have been completed

Nokia said it is working with Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) in 5G field trials in advance of India’s repeatedly delayed 5G spectrum auction, now scheduled for April-May, 2022. India’s big three telecos are using government spectrum to conduct their 5G field trials.

Nokia’s chief strategy and technology officer Nishant Batra said Wednesday at India Mobile Congress that his company expects to bring in advanced 5G solutions (?):

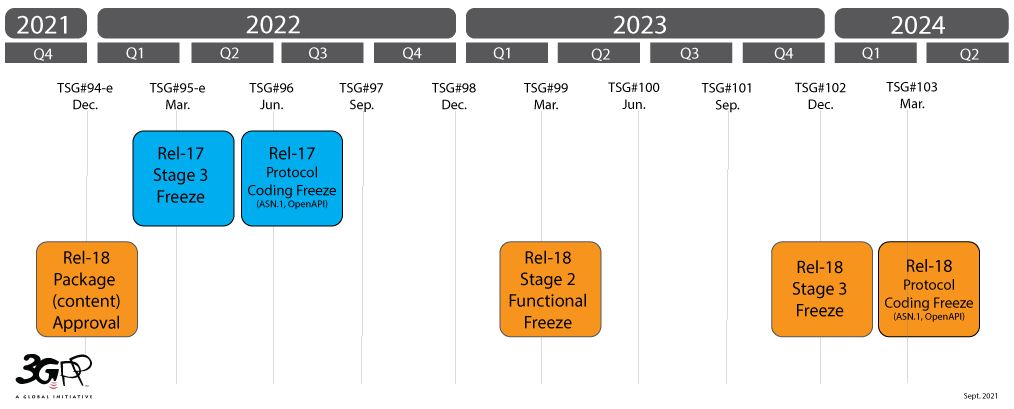

“We have active engagements with Bharti, VI, and Jio for 5G field trials and have made several public announcements on the milestones achieved. 5G will open up new possibilities that will have a massive impact on society, industry and consumers in India…in the coming years and beyond the 5G era,” said Batra. By the end of 2023, we expect to see release 18 of 3GPP (see the actual 3GPP Timeline below)….or as we prefer to call it: 5G-Advanced. This version of the 5G evolution will develop 5G to its fullest capabilities and is an important stepping-stone to the new interactive use cases we will see on a large scale in the coming 6G era,” he added.

Nishant Batra, Nokia’s Chief Strategy and Technology Officer

3GPP Timeline for Release 17 and 18

………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telcos so far have highlighted that 5G use cases (what are they without URLLC?) can bring in transformation in healthcare, agriculture, education related areas. Batra also gave a glimpse of how human technology interfaces will change in the future and the internet used via smartphones will be “less exciting.”

“By 2030, we expect two of the biggest drivers of network evolution will be human augmentation and digital/physical fusion. Consumer broadband will still be the biggest service, and video will still drive the bulk of Internet traffic,” Batra opined. India is one of the biggest data consumers. “Practically speaking, digital/physical fusion means that by 2030 every physical thing that makes sense to connect digitally will be connected to the Internet,” he added. Nokia, which has its “Conscious Factory” in Chennai, is betting big on machine learning, automation, cloud services and automation. “As enterprises, governments and networks invest in their digital transformations, Nokia is well-positioned to provide the critical networking solutions they need,” Batra said.

Author’s Opinion:

It is premature to start thinking of 5G-Advanced when so many of the needed 5G ITU-R recommendations/standards and 3GPP specs are incomplete. These include: URLLC in the RAN and updates to ITU-R M.2150 for URLLC (to meet the 5G minimum performance requirements specified in ITU-R M.2410), implementation specs/agreements for 5G SA Core network (cloud native/microservices/containers, etc or otherwise), frequency arrangements for terrestrial 5G (ITU-R M.1036 revision to include mmWave frequencies approved at WRC’19), network management, security, roaming, interworking with WiFi 6E, etc.

References:

IMT towards 2030 and beyond (“6G”): Technologies for ubiquitous computing and data services

ATIS: Next G Alliance leadership and 6G Roadmap – Is it premature?

FAA order to avoid interfering with 5G C-Band services; RootMetrics touts coverage vs performance advantages for 5G

The FCC’s C-Band spectrum (between 3.7 GHz and 4.2 GHz) auction earlier this year raised a staggering gross total of $81.17 billion [1.], smashing the previous auction record of $44 billion raised in the AWS-3 auction that ran in 2014-2015 and raised nearly $45 billion. The mid-band spectrum acquired by AT&T, Verizon, and T-Mobile, could mark a fundamental shift to the 5G landscape in the U.S.

Note 1. Verizon spent a jaw dropping $45B at the C-Band auction, AT&T invested about $23B, while T-Mobile spent $9B to augment its already substantial mid-band holdings.

However, there is a huge controversy over use of that band by wireless telcos. The FAA and aviation industry groups say the new 5G service could interfere with radar or radio altimeters, gauges that measure the distance between aircraft and the ground. Information from those aviation devices feeds a number of cockpit safety systems used to land planes, avoid crashes and prevent midair collisions.

Today, the FAA warned that interference from planned use of 5G wireless spectrum posed an air safety risk and could result in flight diversions.

FAA outlined flight restrictions that will take effect on January 5, 2022 when new 5G C-Band services make their debut, even as regulators work with telecom and aerospace companies to avoid U.S. air traffic disruptions. The FAA order would restrict pilots from operating automatic landing and other cockpit systems commonly used in poor weather, to avoid possible interference from 5G in the spectrum range known as the C-band.

The airports that would face potential disruptions will be identified in future notices, according to the FAA order, known as an airworthiness directive. Regulators and technical experts have been working to address concerns about potential safety risks to resolve a long-running dispute between the aviation and telecom industries.

“The FAA plans to use data provided by telecommunications providers to determine which airports within the United States have or will have C-band base stations or other devices that could potentially impact airplane systems,” the agency’s order said.

Data pertaining to 5G signals’ power levels and location are expected to help air-safety regulators limit disruptions, current and former government officials have said. Aviation industry groups have warned of potentially “debilitating impacts” from such flight restrictions, saying in a Nov. 18 letter to the FCC: “Air cargo and commercial air travel will likely cease at night and in any weather where the pilot cannot see the runway.”

- The FAA said it was coordinating with the Federal Communications Commission and wireless companies and has made progress “toward safely implementing the 5G expansion.”

- The FCC said it looks forward to further guidance from the FAA that takes into account a recently proposed solution from telecom companies.

The FAA said the new 5G service could interfere with gauges that measure the distance between aircraft and the ground.

PHOTO: RANDALL HILL/REUTERS

…………………………………………………………………………………………………………………………………………………………………………………………….

AT&T and Verizon previously agreed to delay by a month their activation of the fifth-generation wireless service, which provides faster broadband speeds for a range of mobile devices. The 5G C-Band services had previously been due to go live Dec. 5, but the companies agreed to hold off because of the FAA’s aviation safety concerns.

On November 24th, AT&T and Verizon offered to limit the signal power of certain 5G base stations as an additional safeguard. On Monday, a representative from the Aerospace Industries Association told the FCC in a letter the carriers’ proposed limits were “inadequate and far too narrow” to address flight safety concerns.

The U.S. telecom industry has maintained that the new 5G service doesn’t pose a safety threat to aircraft, pointing to other countries’ experience with similar wireless services.

- A Verizon spokesman said today that “there is no evidence that 5G operations using C-band spectrum pose any risk to aviation safety, as the real-world experience in dozens of countries already using this spectrum for 5G confirms.” The person added it was confident the FAA ultimately will conclude C-Band 5G use “poses no risk to air safety.” Verizon says it’s on track to reach 100 million Americans with the new service in the first quarter of 2022 and was confident the FAA’s further analysis will find C-band service “poses no risk to air safety.”

- An AT&T spokeswoman said today that the carrier recognizes the “paramount importance of air safety, and our use of the C-band spectrum will not undermine that imperative.”

In its order, the FAA said it determined that “no information has been presented that shows radio altimeters are not susceptible to interference” by the new 5G service. The FAA’s order said it affected an estimated 6,834 U.S.-registered airliners and other aircraft. A similar FAA order, also issued Tuesday, affects an estimated 1,828 helicopters.

The FAA also warned that interference from planned use of 5G wireless spectrum posed an air safety risk and could result in flight diversions. Another FAA directive on Tuesday said the “unsafe condition” posed by the planned use required immediate action before the Jan. 5 deployment “because radio altimeter anomalies that are undetected by the aircraft automation or pilot, particularly close to the ground … could lead to loss of continued safe flight and landing.”

The FCC said it “continues to make progress working with the FAA and private entities to advance the safe and swift deployment of 5G networks … We look forward to updated guidance from the FAA in the coming weeks that reflects these developments.”

…………………………………………………………………………………………………………………………………………………………………..

| Carrier | Low-band | C-Band/mmWave | Smartphone icon |

|---|---|---|---|

| AT&T | Nationwide 5G | 5G+ | 5G+ |

| T-Mobile | Extended Range 5G | Ultra Capacity 5G | 5G UC |

| Verizon | 5G Nationwide | Ultra Wideband 5G | 5G UW |

As the table shows, the carriers’ branding strategies combine mid-band (including C-band) and mmWave into one moniker, which is a logical choice as both mid-band and mmWave 5G can deliver much faster speeds than the low-band 5G networks that carriers currently use to provide nationwide 5G service. In simple terms, when users see those icons on their phones, they should also see faster speeds.

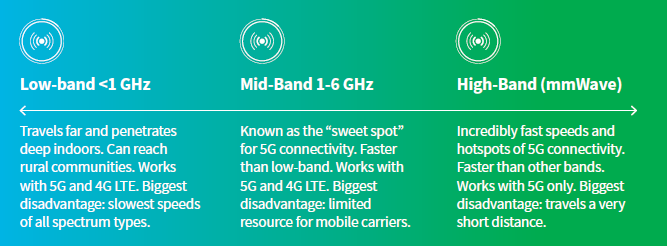

Here’s a look at the three frequency bands being used for 5G services:

Andersen says, “mid-band spectrum can give users a level of 5G service that other types of spectrum can’t: a combination of broad coverage plus excellent speeds, rather than just one or the other, which is the case with low-band (broad coverage but slower speeds) or mmWave (super-fast speeds but small coverage areas).”

Looking ahead to when C-Band might become the dominant spectrum for 5G, Andersen wrote (emphasis added):

C-Band has always been a few years away from becoming the dominant flavor of 5G in the US, and its rollout has been delayed for a bit as the FAA analyzes any possible effects the spectrum could have on aviation. That said, the good news for AT&T and Verizon users is that both carriers will soon begin C-Band deployments, as they pledged to minimize power output from C-Band base stations, especially those close to airports.

The bottom line is that while C-Band will likely be available in some cities in early-to-mid 2022, before it can be rolled out on a broad scale, wireless carriers will need to add new towers, install new hardware and software, and update existing network infrastructure in cities across the country.

All of that takes time, so users likely won’t see a major boost in 5G performance from the C-Band auction for another year or two. But given the results we’ve already recorded on mid-band 5G in the US and other countries, the performance gains C-Band can offer could very well be worth the wait.

We’re looking forward to testing C-Band as rollouts begin and seeing its impact on the end-user 5G experience. In the meantime, keep checking back with RootMetrics for more 5G and mobile performance insights.

Picocom PC802 SoC: 1st 5G NR/LTE small cell SoC designed for Open RAN

5G open RAN semiconductor and software upstart Picocom has announced the PC802 SoC (system on a chip), which the company calls the world’s first 4G/5G device for use in small cells with integrated support for open RAN specifications (there are no Open RAN standards). It supports disaggregated 5G small cell platforms, including indoor residential, enterprise and industrial networks, neutral host networks and outdoor networks.

The PC802 is a purpose-designed PHY SoC for 5G NR/LTE small cell disaggregated and integrated RAN architectures that includes support for 4G. The SoC supports Open RAN specifications and interfaces with a layer 2/3 stack via the SCF FAPI interface over PCIe. The PC802 supports interfacing to Radio Units (O-RU) via the O-RAN Open Fronthaul (eCPRI) interface or directly to RFICs with a standardised JESD204B high-speed serial interface.

The PC802 SoC is optimized for disaggregated small cells. It employs the FAPI protocol (defined by the Small Cell Forum) to communicate with and provide physical layer services to the MAC. It has an integrated O-RAN Alliance Open Fronthaul interface (based on eCPRI) to connect and communicate with Open RAN (remote) radio units, as well as JESD204B interfaces to connect with commonly available radio transceivers.

The PC802 supports 3GPP 5GNR releases 15 and 16, with flexibility for future releases. The PC802 also supports simultaneous 5GNR/LTE mode, flexible multi-RAT, multi-carrier component configurations and Dynamic Spectrum Sharing (DSS) support.

“We believe we’ve hit the ‘sweet spot’ in addressing the need for optimized silicon to power Open RAN,” commented said Oliver Davies, VP of marketing at Picocom. “We are delighted with the pre-launch interest in PC802 and the positive feedback we’ve received on its specification. For successful deployments, it’s clear that Open RAN needs optimized silicon, and PC802 SoC delivers. We expect to see PC802 in end-products commencing field trials during 2022.”

Key Features:

◆Silicon runs Picocom’s 5GNR and LTE PHY (lower and upper) software

◆SCF FAPI interfaces

◆Ceva XC12 5G-optimised 1280-bit vector signal processors

◆RISC-V scalar processor clusters

◆Codecs: LDPC, Turbo and Polar

◆Fourier transforms: FFT, iFFT

◆Equalisers: MMSE/MMSE-IRC/MLD

◆Digital Front End (DFE)

◆O-RAN eCPRI Open Fronthaul

◆IQ compression/decompression

◆Secure on-chip boot capability

◆Debug and device monitoring

References:

https://picocom.com/products/socs/pc802/

https://picocom.com/wp-content/uploads/2021/11/PC802-Product-Brief.pdf

Picocom introduces the industry’s first 5G NR small cell system on chip designed for Open RAN

Picocom hits the ‘sweet spot’ with new small cell SoC for Open RAN

Malaysia’s DNB to offer free 5G services to telcos during initial rollout

Malaysian state agency Digital Nasional Berhad (DNB) said on Monday that it will offer wholesale 5G services to mobile carriers at no cost during an initial rollout set to begin next week, amid concerns from telecom operators (telcos) over its pricing plans. DNB, a government agency tasked with building and managing the entire fifth-generation (5G) telecommunications network, has yet to sign long-term deals with any mobile operator, with telecoms firms raising concerns over transparency and pricing issues, Reuters reported last month.

DNB said 5G services will be commercially available from Dec. 15th in three central areas, including parts of the capital Kuala Lumpur (KL). The free 5G wholesale services will be available to telcos until 31 March 2022, as DNB seeks to finalize its wholesale agreements with carriers. DNB has said it hopes to sign long-term contracts in early 2022.

Telekom Malaysia Bhd on Saturday became the first operator to sign up for 5G trials with DNB. Malaysia’s top telco said it will be participating in the pilot trials in some parts of the capital, Kuala Lumpur, and two other urban centers.

Photo of Kuala Lumpur at night

…………………………………………………………………………………………………………………………

Other mobile network operators in Malaysia include: Maxis Berhad (Maxis), Celcom Axiata Berhad (Celcom), Digi Telecommunications Sdn Bhd (Digi), U Mobile Sdn Bhd (U Mobile), Altel Communications Sdn Bhd, Merchantrade Asia Sdn Bhd, Service Providers Service Fixed Broadband Mobile Broadband Telekom Malaysia (TM) √ √ Maxis Berhad (Maxis), Celcom Axiata Berhad (Celcom), Digi Telecommunications Sdn Bhd (Digi), U Mobile Sdn Bhd (U Mobile), Macro Lynx Sdn Bhd, MyISP Dot Com Sdn Bhd, Telekomunikasi Indonesia International (Malaysia) Sdn Bhd (Telin), and several other smaller players.

…………………………………………………………………………………………………………………………

A “reference access offer” – a public document that will cover the details of the DNB’s 5G wholesale model, including pricing and service commitments – will be approved by Malaysia’s communications regulator soon following extensive feedback from the industry, DNB said. Operators that sign up to its wholesale plan before March 31 will receive further free access to all additional 5G capacity during the initial period of operation, it said. DNB also reiterated that its 5G pricing plan would be cheaper for mobile carriers than the cost they have incurred for 4G.

Telcos have said under the proposed pricing plan, they could end up paying more than they would have if they introduced 5G on their own, as the plan did not take into account additional requirements related to issues such as traffic volume and contingency costs.

The Malaysian Communications and Multimedia Commission (MCMC) had earlier stated that: “The technical requirement for a 5G rollout is predicated by a strong foundation of 4G coverage and fiber rollout, without which, 5G rollout will not realize the optimal benefits of the new technology…..Rushing into a 5G rollout, which includes the early award of the spectrum does not make for a focused approach and a better use of financial and technical resources. Hence, the measured approach towards a 5G rollout and spectrum award.”

With the operators still adamant that the government’s approach to 5G with DNB is anti-competitive – a view notably shared by the GSMA – it will be interesting to see how many of them take up DNB’s offer over the first quarter of 2022.

………………………………………………………………………………………………………………………………………………………………………………………….

Research and Markets forecasts that revenues from mobile data services in Malaysia are set to grow at a 2.9% CAGR over 2020-2025 supported by expansion of 4G networks and roll-out of 5G networks over the forecast period. In addition:

- Mobile services revenue accounted for an estimated 61.7% of the total telecom service revenue in 2020.

- Mobile data accounted for a majority 38.7% share of the total telecom service revenue in 2020.

- Top three operators Maxis, Digi, and Celcom accounted for 69.7% share of the total mobile subscriptions in 2020.

References:

https://www.totaltele.com/511878/Malaysias-national-5G-network-to-offer-telcos-access-for-free

https://www.researchandmarkets.com/reports/5125298/malaysia-telecom-operators-country-intelligence

https://www.digitalnewsasia.com/insights/malaysias-5g-spectrum-conundrum-blessing-disguise

Nokia to provide 5G SA core network for Volkswagen (private) and KDDI (public)

Nokia has deployed a 5G standalone (SA) core network at Volkswagen’s plant in Wolfsburg, Germany. The 5G private campus network covers the production development center and pilot hall at the plant. This network uses the Nokia Digital Automation Cloud (DAC) system to provide reliable and secure connectivity. Nokia’s DAC provides high-bandwidth and low-latency connectivity for sensors, machines, vehicles and other equipment.

Volkswagen will use the network to improve efficiency in production. The company is initially testing the wireless upload of data to manufactured vehicles and intelligent networking of robots and wireless assembly tools.

“By deploying private wireless to explore and develop its potential in manufacturing, Volkswagen underscores its leading position in leveraging digitalization to enhance efficiency and productivity,” commented Chris Johnson, head of Global Enterprise business for Nokia. “We are delighted to support this effort with the Nokia Digital Automation Cloud and our extensive experience in private wireless networks.”

The pilot network will allow Volkswagen to test whether 5G technology helps the company meet the demanding requirements of vehicle production, as well as increases efficiency and flexibility in series production of the future.

“Predictable wireless performance and the real-time capabilities of 5G have great potential for smart factories in the not-so-distant future. With this pilot deployment, we are exploring the possibilities 5G has to offer and are building our expertise in operating and using 5G technology in an industrial context,” said Dr.-Ing. Klaus-Dieter Tuchs, network planning at Volkswagen.

Nokia’s work with Volkswagen at its main German plant aligns with the vendor’s private 5G ambitions, as reported by German newspaper Handelsblatt in 2019. The company said at the time that it expects to provide 5G networks for German companies following the opening of the application procedure for local firms intending to use 5G frequencies on industrial campuses, highlighting not only its intention to offer its service for network planning, but also aims to operate the networks.

Nokia’s private network reach extends beyond Germany of course. The vendor has worked with industrial-type partners on LTE, 5G-ready and IP/MPLS networks around the world including at the Zeebrugge port in Belgium, the Irish Aviation Authority and the Société du Grand Paris (SGP), the state owned industrial company responsible for the Grand Paris Express metro project.

Resources:

Nokia Industrial Private Wireless

https://www.nokia.com/networks/industry-solutions/private-wireless/industry/

Nokia Digital Automation Cloud | Nokia

……………………………………………………………………………………………………………………….

On December 2nd, Nokia announced that Japanese network operator KDDI selected Nokia’s 5G Core and Converged Charging software to support its transition to a fully automated, cloud-native 5G SA Core network architecture.

Nokia’s cloud-native 5G Core’s near zero-touch automation capabilities help operators drive greater scale and reliability. Following the evolution of KDDI’s networks to 5G standalone core, subscribers will experience lower latency, increased bandwidth and higher capacity.

Nokia’s open 5G Core architecture gives KDDI the flexibility to be responsive to market demands while controlling costs by streamlining operations and unlocking crucial capabilities, such as network slicing. Developed around DevOps principles, Nokia’s 5G Core will automate the lifecycle management of KDDI’s networks, as well as enable continuous software delivery and integration.

Nokia will also deploy 5G monetization and data management software solutions including cloud-native Converged Charging, Signaling, Policy Controller, Mediation and Registers to capture new 5G revenue opportunities, enhance business velocity and agility, and streamline the operator’s network operations.

References:

Nokia deploys 5G private network at Volkswagen plant in Germany

Mobile Experts on the state of Fixed Mobile Convergence in the U.S. telecommunications market

Mobile Experts released a report that explores the state of Fixed Mobile Convergence (FMC) [1.] in the U.S. telecommunications market through 2024.

Note 1. Fixed mobile convergence refers to the ability of telecommunications companies to provide their subscribers with services that interact with and use both the fixed networks incumbent wire line and/or cable operators and the mobile/cellular networks of mobile operators.

………………………………………………………………………………………………………………….

The 60-page report provides a five-year forecast of the fixed and mobile broadband market, including service revenue, subscriber connections, fixed and mobile cost-per-GB, and pricing trends. The report focuses on the premium pricing for mobile services, or the ‘mobility premium.’

“Large tier-1 operators have long been exploring ways to interwork fixed and mobile networks for seamless voice, data, and video services. As mobile transitions to 5G, those tier-1 operators are driving the FMC architecture framework deeper into the network with 5G Core as the “anchor” and as fixed and mobile access networks get disaggregated and virtualized,” commented Principal Analyst Kyung Mun.

According to the report, the average U.S. household consumes more than 11 times more data over the fixed network as compared to mobile access. The COVID pandemic contributed to a peak in this trend last year as more Americans relied on their fixed networks at home. Despite this, U.S. consumers place roughly 20x more value on mobile broadband over fixed access according to the study from Mobile Experts, which compared service revenue generated from actual GB delivered.

“The FMC outlook in the U.S. is relatively modest, but based on the current dynamic in the market, technical FMC will grow gradually over the next few years as FMC leverages mobile network architecture as the framework,” stated Principal Analyst Kyung Mun.

“Key motivations for service providers to engage with FMC include cost savings, churn reduction, new convergent services, service bundling, and seamless handover between mobile and fixed services. This new report includes detailed breakdowns of each of these aspects of the growing market.”

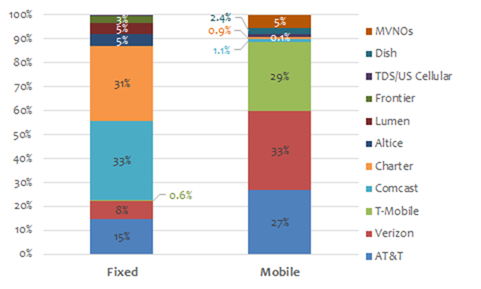

As the Mobile Experts chart below shows, the leading carriers and cable operators dominate the percentage share of fixed and mobile broadband connections in the U.S. in their respective sectors.

Mun said that even though most consumers spend the majority of time indoors in a stationary environment, the data captures how people are willing to spend more on the idea of being able to consume data while on the go. “It’s kind of like an insurance plan,” he told Fierce Wireless. When users are at home connectivity is almost considered a given, but when out and about consumers want to ensure they’re not left without it. For example, if they were to get in an accident, Mun added.

“At this point, the dominant Fixed and Mobile operators have established ‘beach heads’ in each other’s ‘turfs’,” Mun said. “The fixed-mobile convergence (FMC) intensity will likely grow as each side gain[s] a more significant share over time.”

Mobile Experts expects the trend of deeper integration of 5G network elements to grow gradually over the next few years, particularly leveraging 5G core networks as the so-called anchor.

In the LTE days, Mun noted the IMS network – which can be thought of as the application layer network – was used to piece mobile and fixed networks together. Now in the days of 5G, major global operators are leading a push to anchor the two access networks via the 5G SA core network.

“5G core in the long-term becomes the anchor point to manage both fixed network services and mobile network services,” Mun said.

“We believe it’s a very long game between the fixed operators and the mobile operators, but at some point in the future we expect there will be a convergence,” Mun said. That’s from an M&A perspective or for those operators that have both fixed and mobile networks to converge the elements.

For example, Verizon is using their 5G network both for mobile and to extend fixed wireless access (FWA) service. It disclosed adding 55,00 FWA customers in Q3 for a total of 150,000. Earlier this week, Verizon expanded its 5G FWA service to homes and businesses in Dayton, Ohio and Jacksonville, Florida.

Mun believes the concept of fixed mobile convergence “is probably more applicable for AT&T at this point.” That’s because AT&T has a larger fixed network footprint and has been vocal about plans to expand their fiber footprint. AT&T expects to increase the number of homes passed with fiber to 16.5 million by the end of the year and currently has 5.7 million fiber customers.

Mun said legacy wireline telcos, such as AT&T, Lumen (formerly CenturyLink) and Frontier, aren’t as competitive as cable for fixed line access because they have networks utilizing legacy copper and DSL. But again, each have been making public statements about concerted fiber investments over the next few years. In particular, AT&T has touted its big fiber build-out for some time now.

Even though mobile carriers are already building out massive 5G core networks, Mun believes it’s a trend that’s just as applicable for cable operators.

“Even for their MVNO business, it’s more advantageous for [cable MVNOs] to have their own 5G core over the long-term,” he said. “Because if you have your own 5G core you have a little more direct control over how you provision and direct traffic for their mobile subscribers, even though their base is very small today.”

It’s a long-term trend – Mun suggests a 5 to 10-year timeline. The reason isn’t technology, which he categorized as a small part of the conversation, since open RAN, software-defined networking and virtualization trends help facilitate convergence by providing the opportunity to reconfigure when network elements are disaggregated and reconstituted, Mun said. Instead, Mun sees the timeframe as mostly driven by competitive dynamics and the regulatory environment, noting the current administration likely wouldn’t favor major market consolidation moves.

Over time, as mobile carriers make more inroads in the fixed wireless market and cable operators introduce more disruptive pricing on the wireless side “that dynamic could certainly change,” Mun added.

About Mobile Experts Inc:

Mobile Experts provides insightful market analysis for the mobile infrastructure and mobile handset markets. Our analysts are true Experts, who remain focused on topics where each analyst has 25 years of experience or more.

Research topics center on technology introduction for radio frequency (RF) and communications innovation. Recent publications include:Fixed Mobile Convergence, Edge Computing, In-Building Wireless, CIoT, URLLC, Macro Base Station Transceivers, Small Cells, VRAN, and Private LTE.

Mun noted operators spend billions of dollars in capex to keep their networks up to snuff to handle data demands, as Mobile Experts detailed the competitive dynamics between fixed broadband and mobile operators as well as the trend of fixed mobile convergence (FMC).

Cable operators like Comcast and Charter hold the dominant share of fixed broadband connections, but they’re looking to expand in mobile with respective MVNO offerings. In Q3, cable MVNOs Altice USA, Charter and Comcast collectively gained 530,00 subscribers, ending the quarter with a total of 7.03 million mobile customers.

“They’re slowly growing that base,” Mun said. “So they’re in essence, one can postulate that they’re setting up their ‘beachhead’ if you will on the wireless side.”

References:

https://mobile-experts.net/reports/p/fixedmobileconvergence21

https://www.fiercewireless.com/wireless/consumers-ascribe-20x-more-value-mobile-broadband-fixed

AT&T Communications CEO optimistic about wireless revenue and fiber buildout

https://techblog.comsoc.org/2021/09/21/att-ceo-john-stankeys-30m-locations-could-be-passed-by-fiber/

AWS Cloud WAN preview: a global network that spans multiple physical networks and geographic locations

On the heels of announcing the AWS 5G Private network earlier this week, the world’s largest tech conglomerate described another new blockbuster network service. AWS Cloud WAN is a managed wide area networking (WAN) service that simplifies the way enterprise end users build, manage, and monitor a global network that connects resources running across Amazon’s cloud and on-premises environments.

With Cloud WAN, customers use a central dashboard (the AWS portal) and network policies to create a global network that spans multiple geographically dispersed locations and networks—eliminating the need to configure and manage different networks individually using different technologies. Network policies can be used to specify which of the customer’s Amazon Virtual Private Clouds (VPCs) and on-premises locations you wish to connect through AWS VPN or third-party software-defined WAN (SD-WAN) products. The Cloud WAN central dashboard generates a complete view of the network to monitor network health, security, and performance.

Cloud WAN automatically creates a global network across AWS Regions using Border Gateway Protocol (BGP) so customers can easily exchange routes around the world.

Like all AWS services, Cloud WAN is designed to be managed through the AWS portal, which has become a single point to manage the “full stack” of AWS services – from the network through application. Through the console, IT professionals can configure connections to all company locations including branches, data centers, headquarter locations as well as Amazon Virtual Private Clouds (VPCs) though a graphical interface.

Businesses will connect into the network through a VPN or a direct connect (private line) for the “last mile” and then will have access to the global AWS network. AWS customers have been using the network already for setting up transit gateways or cloud connection, but this can now be extended to some or all of the corporate network.

“Imagine you’re a large global company with dozens of manufacturing sites round the world… — you need to connect them all to AWS,” Amazon CTO Werner Vogels said during his re:Invent keynote address. Cloud WAN “actually builds it for you in minutes using the big AWS backbone for you, to give you a highly reliable, highly available, software-defined wide area network running over AWS infrastructure,” Vogels added.

Source: Amazon blog post on Cloud WAN

Cloud WAN is available in ten AWS Regions in Public Preview; US East (Northern Virginia), US West (Northern California), Africa (Cape Town), Asia Pacific (Mumbai), Asia Pacific (Singapore), Asia Pacific (Sydney), Asia Pacific (Tokyo), Europe (Ireland), Europe (Frankfurt), and South America (São Paulo).

Cloud WAN will have a consumption-based pricing model. The Cloud-WAN site shows there are three pricing factors – the number of cloud network edge (CNE) locations deployed, the number of attachments to each CNE and data processing charges for traffic sent through each CNE. This is a new type of pricing model for telecom services and may result in customers paying less than they do now. That’s because the current telco industry pricing is based on a flat fee up to a certain data traffic capacity and then an “over-charge” for additional data transmitted over the network.

AWS has been working with industry leading partners at the launch of Cloud WAN. Here are some of the things they have been doing and saying:

- Aviatrix – blog post >>

- Cisco Systems – announcement >>

- Fortinet – blog post >>

- Prosimo – quick start guide >>

- VMware – blog post >>

- Aruba – blog post >>

- Alkira – blog post >>

- Intercloud – blog post >>

- DXC Technologies – blog post >>

Source: Amazon blog post on Cloud WAN

………………………………………………………………………………………………………………..

Analysis by Zeus Kerravala of ZK Research:

The rise of distributed clouds, combined with containers and microservices is making workloads and applications much more ephemeral in nature requiring connectivity that is equally ephemeral. Legacy networks are not nearly dynamic enough to meet the needs of a business running modernized clouds, so AWS is building a service to change the network. While not known as a network provider, AWS has a very sophisticated network that’s highly available with per region fault isolation built into it and those benefits would be passed on to the customer.

The initial use case for a product like this would be for the customer to continue to use their existing telco network for the primary network and use AWS Cloud WAN for offload, backup connections or alternative paths. In this case, the telco networks would still be managed through the AWS console in a “bring your own carrier” model, making the console the single control point for the global network.

For telcos, this kind of “co-opetition” is new as many have a near monopoly in some regions, which is why this group of companies isn’t known for their innovation. It will be interesting to see how the network operators respond. I do know, now that AWS has jumped into networking, it will continue to deliver innovative features that improve network reliability, make it easier to operate and improves application performance. Some will embrace this, change their operating model and benefit from this. I suspect many won’t and will view AWS as a bigger threat.

While Cloud WAN may be negative to the service providers, it should be a positive for its SD-WAN partners, which include Aruba, Cisco, Palto Alto Networks and VMware. AWS told me it has no intention of getting into making SD-WAN appliances but would rather leverage partners. Customers will be able to manage these appliances through the AWS Console as well as the network services.

References:

https://aws.amazon.com/about-aws/whats-new/2021/12/introducing-aws-cloud-wan/

https://aws.amazon.com/blogs/networking-and-content-delivery/introducing-aws-cloud-wan-preview/

https://www.fiercetelecom.com/cloud/aws-adds-more-network-muscle-cloud-wan-kerravala

Learn more by visiting the product overview page and documentation.

To get started, visit the Cloud WAN console or read AWS’ technical blog post and FAQ page

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

The Wireless Broadband Alliance (WBA) today announced results from a new field trial using technology from CableLabs®, Intel, and Asus. The purpose was to highlight the benefits of using Low Power Indoor Wi-Fi 6E for a wide variety of demanding residential applications, including video collaboration for telecommuting, multiplayer gaming, augmented and virtual reality, streaming video and more.

Since the 6 GHz band is higher frequency range than 2.4 GHz or 5 GHz typically used for Wi-Fi, signals have more of a challenge with obstruction the trial took place in a 3,600-square-foot, two-story home with a basement and the drywall, wood and other building materials typically found in a suburban residence. The Wi-Fi 6E enabled laptops with Intel® Wi-Fi 6E AX210 wireless cards were placed in various locations throughout the home and tests were conducted using a Wi-Fi 6E enabled access point from Asus.

The trial featured a range of tests on the downlink and uplink comparing throughput achieved on the 5 GHz and 6 GHz bands for wide channels (80 MHz and 160 MHz). CableLabs and Intel also analyzed the Wi-Fi 6E performance compared to Wi-Fi 6 on the 5 GHz band in the presence of overlapping neighbouring access points.

The trial’s key results include 1.7 TCP Gbps downlink and 1.2 TCP Gbps uplink speeds when using 160 MHz channels on Wi-Fi 6E in locations close to the access point. The larger channel bandwidth and the associated increase in total EIRP transmit power based on the channel bandwidth helped maximize both coverage and speed throughout the home.

These results clearly demonstrate the real-world benefits of using Wi-Fi 6E enabled devices over 6 GHz rather than 5 GHz. It is important to note that although Wi-Fi 6 devices perform better than Wi-Fi 5 devices over 5 GHz, next-level user experiences are possible with Wi-Fi 6E and the additional bandwidth available in the 6 GHz spectrum.

Tiago Rodrigues, CEO of the Wireless Broadband Alliance, said: “This field trial by CableLabs and Intel shows how Wi-Fi 6E and 6 GHz spectrum maximize coverage, capacity, throughput and the user experience in one of the most demanding real-world environments: people’s homes. Between HD and 4K streaming video, multiplayer gaming, dozens of smart home devices and videoconferencing for remote work, today’s home Wi-Fi networks are the foundation for how people live, work and play. This trial highlights that Wi-Fi 6E is more than capable of shouldering that load, especially when paired with 6 GHz spectrum.”

Lili Hervieu, Lead Architect of Wireless Access Technology at CableLabs, said: “CableLabs has been a proponent of making the 6 GHz band available for unlicensed use, and we were honored to conduct the Wi-Fi 6E trial in one of our employee’s homes for a truly real-world experience. The results confirmed the benefit of Wi-Fi 6E for increased capacity and data rate that will support the growing demand we are seeing for a large variety of applications and for new emerging technologies.”

Eric A. McLaughlin, VP Client Computing Group, GM Wireless Solutions Group, Intel Corporation, said: “Intel’s mission is to enable great PC experiences with industry leading platform capabilities like Wi-fi 6E. The wireless trial, in collaboration with CableLabs and the Wireless Broadband Alliance, helps demonstrate the versatility of Wi-fi 6E on Intel platforms. The speed, latency, and reliability improvements enabled by the new 6 GHz spectrum, with larger channels and freedom from legacy Wi-Fi interference, will help dramatically enhance user communication, entertainment, and productivity.”

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the Wireless Broadband Alliance (WBA) is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. WBA’s mission is to enable collaboration between service providers, technology companies, cities, regulators and organizations to achieve that vision. WBA’s membership is comprised of major operators, identity providers and leading technology companies across the Wi-Fi ecosystem with the shared vision.

WBA undertakes programs and activities to address business and technical issues, as well as opportunities, for member companies. WBA work areas include standards development, industry guidelines, trials, certification and advocacy. Its key programs include NextGen Wi-Fi, OpenRoaming, 5G, IoT, Testing & Interoperability and Policy & Regulatory Affairs, with member-led Work Groups dedicated to resolving standards and technical issues to promote end-to-end services and accelerate business opportunities.

The WBA Board includes Airties, AT&T, Boingo Wireless, Broadcom, BT, Cisco Systems, Comcast, Deutsche Telekom AG, GlobalReach Technology, Google, Intel, Reliance Jio, SK Telecom and Viasat. For the complete list of current WBA members, click here.

AT&T Communications CEO optimistic about wireless revenue and fiber buildout

Speaking at Wells Fargo (Virtual) TMT Summit, AT&T Communications CEO Jeff McElfresh discussed momentum in AT&T’s wireless business, noting that AT&T’s consistent go-to-market strategy has driven improved market position supported by healthy wireless service revenue and EBITDA growth. McElfresh noted that over the past five quarters the company has delivered its best subscriber results in a decade, with nearly 4 million postpaid phone net additions, and 1.4 million fiber net additions. At the same time, wireless delivered its best-ever EBITDA in the third quarter of 2021, up 3.6% year over year.

McElfresh said his company added over 1.4 million fiber net adds in the last five quarters. That was based on AT&T’s conviction to reinvest in what they believe is a very future-forward technology in fiber that’s got superior advantages to any other kind of broadband connectivity offering (e.g. FWA, bundled copper pairs, cable, etc).

McElfresh told the audience that the company’s fiber expansion is “rekindling” its consumer broadband business and that he has a high degree of confidence that the company is hitting “game speed” when it comes to the number of homes passed with fiber that it is achieving every month.

AT&T had approximately 14 million homes passed with fiber as of year-end 2020 and is expected to increase that to 16.5 million homes passed by the end of this year. The company now has 5.7 million fiber to the premises/home customers, including Internet access, VPN, private line, virtual private line, etc.

McElfresh said that he believes AT&T has enough “weight” in the industry that it can work with vendors to overcome any supply chain delays (which the company warned about in July). He added that he has no concerns about achieving the 30 million locations by 2025 goal based upon the company’s current buildout pace. “I have no concerns about hitting the pace that we need to reach that,” he said.

“What I am focused on more than penetration levels is that we are demonstrating that we can step up our net add performance quarter to quarter.” In the third quarter, AT&T added 289,000 fiber customers which was down year-on-year from 357,000. However, the company also said that 70% of its net adds were new to AT&T.

To help entice consumers to switch to AT&T’s fiber network, McElfresh said that the company has a dedicated fiber team within its consumer wireline business that is working in neighborhoods to sell fiber optic based Internet access. He added that the telco is measuring the number of fiber net adds they can achieve in 30 days, 60 days and 90 days in those local markets. The company sees those fiber net add numbers accelerating during each of those time periods.

……………………………………………………………………………………………….

Looking forward, McElfresh is encouraged by underlying mobile industry trends and sees limited signs that suggest a near-term shift in demand levels. He said he believes AT&T’s momentum is sustainable with the company’s simplified plans, targeted subsegment approach, improved customer experience and network performance all helping AT&T retain and attract subscribers, leading to lower churn and increased customer lifetime value. Reiterating recent comments by CFO Pascal Desroches, McElfresh indicated that AT&T’s outlook for 2022 and beyond does not assume a continuation of outsized industry net adds. Should recent mobile industry trends continue, he believes the changes made to AT&T’s go-to-market strategy puts the company in a better position to capitalize on healthier than anticipated demand.

McElfresh noted that AT&T continues to see postpaid phone ARPU stabilizing in 2022 with an improvement in international roaming and subscribers adopting higher-ARPU plans balancing the impact of amortization accounting for device promotions. McElfresh said that fewer than a quarter of gross adds and upgrades in the third quarter traded in newer devices for premium promotional offers. As previously noted, only about 20% of AT&T’s postpaid smartphones are on Unlimited Elite – the company’s highest-ARPU and fastest-growing rate plan.

With postpaid phone ARPU stabilizing in 2022, AT&T expects higher wireless service revenues from a growing postpaid subscriber base. McElfresh also indicated that he believes AT&T can continue to profitably increase its wireless market share going forward and reiterated that the company continues to expect fourth-quarter EBITDA growth to exceed third-quarter levels.

When asked about fiber penetration levels, McElfresh responded, “What I am focused on more than penetration levels is that we are demonstrating that we can step up our net add performance quarter to quarter.” In the third quarter, AT&T added 289,000 fiber customers which was down year-on-year from 357,000. However, the company also said that 70% of its net adds were new to AT&T.

To help entice consumers to switch to AT&T’s fiber network, McElfresh said that the company has a dedicated fiber team within its consumer wireline business that is working in neighborhoods to sell fiber. He added that they are measuring the number of net adds they can achieve in 30 days, 60 days and 90 days in those local markets and they are seeing those numbers accelerate.

References:

https://about.att.com/story/2021/mcelfresh-wells-fargo-conference.html

https://www.fiercetelecom.com/broadband/atts-mcelfresh-company-hitting-game-speed-fiber-build

https://techblog.comsoc.org/2021/09/21/att-ceo-john-stankeys-30m-locations-could-be-passed-by-fiber/

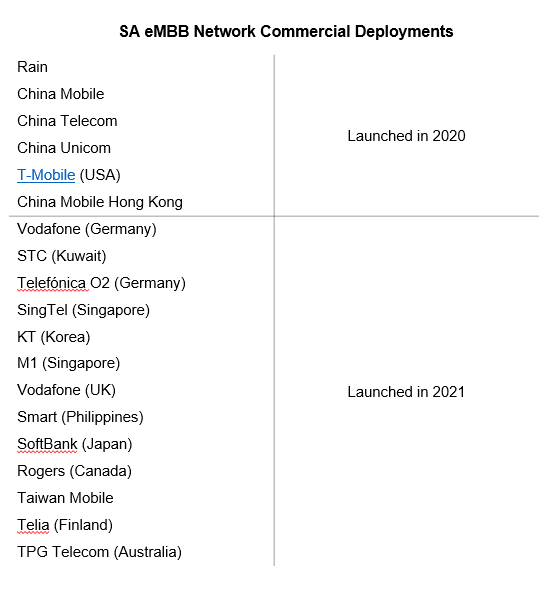

Dell’Oro: 5G SA Core network launches accelerate; 14 deployed

According to a recently published report from Dell’Oro Group, revenues for the Mobile Core Network (MCN) market are poised for growth in 2022. The outlook has turned positive, starting in 4Q 2021, as 5G Standalone (SA) commercial launches begin to accelerate.

“The expected growth rate for 2022 is more optimistic than reported last quarter with the commercial deployments of more 5G SA enhanced Mobile Broadband (eMBB) networks,” stated Dave Bolan, Research Director at Dell’Oro Group. “We count 14 commercial 5G SA networks deployed by Communication Service Providers for eMBB services. Five of the 14 5G SA networks went commercial after the close of 3Q 2021 quarter. Europe had a surprising uptick in 3Q 2021 with 5G SA network commercial launches primarily in Germany,” Bolan added.

Additional highlights from the 3Q 2021 Mobile Core Network Report:

- MCN market revenues declined into negative growth year-over-year and quarter-over-quarter.

- The slowdown is attributed to a slowing of the 5G SA network buildouts in China.

- 5G Packet Core revenues for the quarter were spread across only six vendors: Ericsson, Huawei, Mavenir, NEC, Nokia, and ZTE.

13 January 2022 Update (SA=Stand Alone; eMBB=Enhanced Mobile Broadband 5G use case):

The Dell’Oro Group Mobile Core Network Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

Opinion:

It’s this author’s belief that the 5G SA core network market will be dominated by the hyperscale cloud service providers. In particular, Amazon AWS, Microsoft AZURE, Google Cloud, Oracle Cloud. 5G SA core network enables many hyped capabilities, such as network slicing, MEC, VoNR, automation, virtualization and others.

Addendum:

Please refer to Dave Bolan’s COMMENT in the box below this article. You can download a free whitepaper from the link there.

References:

5G Standalone Commercial Launches Accelerate Mobile Core Market, According to Dell’Oro Group

The Sorry State of 5G SA Core Networks- Smart Communications in Phillipines

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share