Month: December 2022

OneWeb, Jio Space Tech and Starlink have applied for licenses to launch satellite-based broadband internet in India

On December 13th, the chairman of Telecom Regulatory Authority of India (TRAI), PD Vaghela, said that India will be the first country in the world to auction spectrum for satellite communications. Noting that India’s telecom regulator (DoT was working on the matter, he added that TRAI will soon come out with ‘some sort of a model’ for the auction of space spectrum.

Addressing the Broadband India Forum summit, Vaghela said that TRAI has received a reference from the Department of Telecommunications (DoT) on the allocation of the spectrum and other allied aspects. He added that TRAI plans to streamline the process of seeking permissions from multiple ministries. In this regard, the regulator will make recommendations to the Ministry of Information and Broadcasting, Communications and the Ministry of Space to ensure ease of doing business in the sector. “Any system that we will be bringing is to actually encourage and promote investment in the sector, and not increase any burden,” added Vaghela.

Responding to questions about the status of the consultation paper on the spectrum action for satellite communication, TRAI chief said that the telecom authority was deliberating with experts and regulators globally to arrive at a suitable framework. The paper could see the light of the day only after these discussions are over. He reiterated that nanosatellites coupled with other emerging technologies would drive innovation and bridge the digital divide.

“Nanosatellites and satellite Internet of Things (IoT) would drive the next generation of technology and such innovations are expected to enable connectivity across industries and empower it and the upcoming 6G capability. Innovations in satellite ground stations, orbital services, payloads, operational systems and artificial intelligence would enable satellites to perform more complex functions,” the chairman said.

TRAI chairman’s comments have come at a time when the satellite communications arena is witnessing rapid developments. In the recently released Telecommunications Bill, 2022, the government has sought to extend the scope of telecommunication services to include satellite-based communication services.

Alongside, the center is also looking at new technologies to increase the penetration of the internet. Recently, Minister of State for Electronics and Information Technology Rajeev Chandrasekhar said that satellite communications would play a key role in delivering internet services to 1.2 Bn Indians by 2025-26.

The government recently also announced a slew of reforms for the satcom space. The center has relaxed norms for obtaining the Global Mobile Personal Communication by Satellite (GMPCS) license, which is mandatory to operate as a Satcom player in India.

So far, usual telecom players are looking to grab a pie of this burgeoning space. In the race are Airtel-backed OneWeb and Jio Space Tech. Besides, Elon Musk‘s Starlink has also applied for a license to launch satellite-based broadband in India.

As per a report, the global demand for satellite applications is expected to soar to $7 Bn by 2031. On similar lines, the overarching Indian space industry is projected to grow to $13 Bn by 2025, with the satellite launch services segment expected to garner the fastest growth.

TRAI Chairman PD Vaghela addressing Broadband India Forum

………………………………………………………………………………………………………………………………………………………

In summary:

- TRAI is said to have already received a reference from DoT for the auction of the spectrum

- TRAI will send recommendations to multiple ministries to streamline the process of permissions and enhance ease of doing business

- The government targets to deliver internet services to 1.2 B India residents by 2025-26

References:

https://inc42.com/buzz/india-to-be-first-country-to-auction-satcom-spectrum-trai-chairman/

India creates 6G Technology Innovation Group without resolving crucial telecom issues

Telecoms.com Survey Report assesses telecom industry in 2022 and outlook for 2023

Telecoms.com newly published survey report assesses the telecom industry’s performance over this year, as well as the views of the professionals participating in the survey on the outlook of 2023 and beyond. A general sense of optimism and achievement comes through as 63% of respondents believe that the business performance of telecoms in 2022 has been ‘excellent’ or ‘good’ while also reaching consensus on a positive outlook for next year.

Here are some of the key findings from the survey:

- More than two thirds view the industry’s business outlook for 2023 as positive, including about a third that believe the outlook to be very positive.

- Around two out of three respondents believe the industry’s performance in 2022 has been either excellent or good

- The majority of respondents believe 5G standalone (SA) core network will have a materially favorable effect on the adoption of 5G, but there remain many obstacles for deployment.

- Around one in three respondents report they have many service concepts to monetise as their capabilities evolve, but they find configuration and testing of services challenging.

- One in four respondents will upgrade existing BSS and charging stack to support new use cases for enterprise and B2B2X.

- Legacy infrastructure is considered the largest barrier to automated zero-touch services.

- Most respondents consider video delivery key for their telecom businesses, including more than a third who consider it a top priority.

- Healthcare and connected vehicles are the top two most interesting IoT use-cases.

- Nearly two thirds of respondents either plan to or have already deployed Open RAN commercially.

The survey report states that Security, Digital Transformation, IoT, and Broadband will be the top four areas for telecom businesses in 2023. 5G standalone core is identified as having a materially positive impact on the wider adoption of 5G. Nonetheless, high costs in network equipment and network deployment are still seen as the biggest key challenge for deploying standalone 5G.

Other challenges identified with broadband network and service automation include legacy infrastructure and siloed operations across technologies. Lack of skills and resources is also flagged as a key barrier to the deployment of IoT and also Open RAN technologies.

In terms of emerging services and technologies, Metaverse is identified with 60% as the most hyped emerging technology while more than half of respondents also view it as ‘not commercially interesting’. Meanwhile, the survey reports that more than four in five telecom professionals find video delivery as key for telecom businesses, including a third who consider it ‘top priority’.

References:

2022 has been a great year for telecoms, industry professionals say

Microsoft acquires Lumenisity – hollow core fiber high speed/low latency leader

Executive Summary:

Microsoft announced it has acquired Lumenisity® Limited, a leader in next-generation hollow core fiber (HCF) solutions. Lumenisity’s innovative and industry-leading HCF product can enable fast, reliable and secure networking for global, enterprise and large-scale organizations.

The acquisition will expand Microsoft’s ability to further optimize its global cloud infrastructure and serve Microsoft’s Cloud Platform and Services customers with strict latency and security requirements. The technology can provide benefits across a broad range of industries including healthcare, financial services, manufacturing, retail and government.

Organizations within these sectors could see significant benefit from HCF solutions as they rely on networks and datacenters that require high-speed transactions, enhanced security, increased bandwidth and high-capacity communications. For the public sector, HCF could provide enhanced security and intrusion detection for federal and local governments across the globe. In healthcare, because HCF can accommodate the size and volume of large data sets, it could help accelerate medical image retrieval, facilitating providers’ ability to ingest, persist and share medical imaging data in the cloud. And with the rise of the digital economy, HCF could help international financial institutions seeking fast, secure transactions across a broad geographic region.

Types of Hollow Core Fiber:

Various types of hollow-core photonic bandgap fibers:

(a) Photonic crystal fiber featuring small hollow core surrounded by a periodic array of large air holes.

(b) Microstructured fiber featuring medium-sized hollow core surrounded by several rings of small air holes separated by nano-size bridges.

(c) Bragg fiber featuring large hollow core surrounded by a periodic sequence of high and low refractive index layers

Lumenisity HCF benefits:

Lumenisity’s hollow core fiber technology replaces the standard glass core in a fiber cable with an air-filled chamber. According to Microsoft, light travels through air 47% faster than glass. Lumenisity’s next generation of HCF uses a proprietary design where light propagates in an air core, which has significant advantages over traditional cable built with a solid core of glass, including:

- Increased overall speed and lower latency as light travels through HCF 47% faster than standard silica glass.[1]

- Enhanced security and intrusion detection due to Lumenisity’s innovative inner structure.

- Lower costs, increased bandwidth and enhanced network quality due to elimination of fiber nonlinearities and broader spectrum.

- Potential for ultra-low signal loss enabling deployment over longer distances without repeaters.

Lumenisity was formed in 2017 as a spinoff from the world-renowned Optoelectronics Research Centre (ORC) at the University of Southampton to commercialize breakthroughs in the development of hollow core optical fiber. In 2021 and 2022, the company won the Best Fibre Component Product for their NANF® CoreSmart® HCF cable in the European Conference on Optical Communication (ECOC) Exhibition Industry Awards. As part of the Lumenisity acquisition, Microsoft plans to utilize the organization’s technology and team of industry-leading experts to accelerate innovations in networking and infrastructure.

Lumenisity said: “We are proud to be acquired by a company with a shared vision that will accelerate our progress in the hollow-core space. This is the end of the beginning, and we are excited to start our new chapter as part of Microsoft to fulfill this technology’s full potential and continue our pursuit of unlocking new capabilities in communication networks.”

………………………………………………………………………………………………………………………………………………………………..

Analysis:

The purchase is also noteworthy in light of Microsoft’s other recent acquisitions in the telecommunications sector, which include Affirmed Networks, Metaswitch Networks and AT&T’s core network operations (including 5G SA Core Network).

Microsoft isn’t the only company interested in HCF technology and Lumenisity. Both BT in the UK and Comcast in the US have tested Lumenisity’s offerings.

Comcast announced in April it was able to support speeds in the range of 10 Gbit/s to 400 Gbit/s over a 40km “hybrid” connection in Philadelphia that utilized legacy fiber and the new hollow core fiber. Comcast worked with Lumenisity.

“As we continue to develop and deploy technology to deliver 10G, multigigabit performance to tens of millions of homes, hollow core fiber will help to ensure that the network powering those experiences is among the most advanced and highest performing in the world,” said Comcast networking chief Elad Nafshi in the release issued in April.

References:

https://www.datacenterdynamics.com/en/news/microsoft-acquires-hollow-core-fiber-firm-lumenisity

Comcast Deploys Advanced Hollowcore Fiber With Faster Speed, Lower Latency

Another Opinion: 5G Fails to Deliver on Promises and Potential

Introduction:

For many years now, this author has repeatedly stated that 5G would be the biggest train wreck in all of tech history. That is still the case. It’s primarily due to the lack of ITU standards (really only one- ITU M.2150) and 5G core network implementation specs (vs 5G network architecture) from 3GPP.

We’ve noted that the few 5G SA core networks deployed are all different with no interoperability or roaming between networks. I can’t emphasize enough that ALL 3GPP defined 5G functions and features (including security and network slicing) require a 5G SA core network. Yet most of the deployed 5G networks are NSA which use a 4G infrastructure for everything other than the RAN.

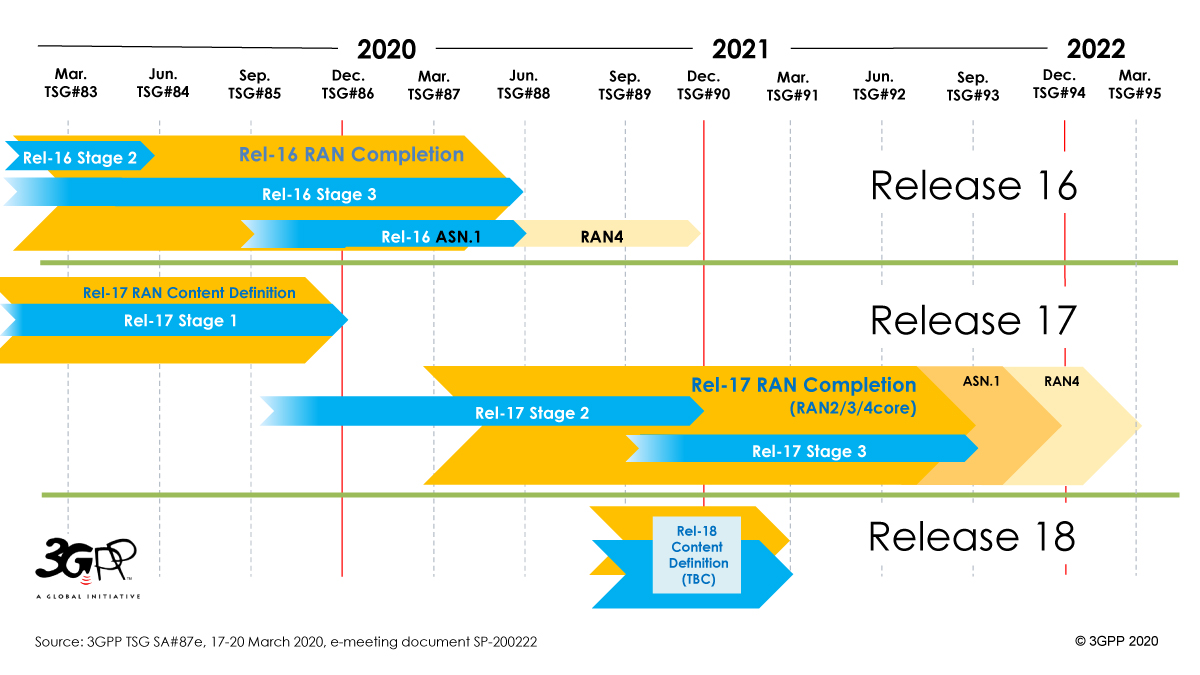

It also must be emphasized that the 5G URLLC Physical layer specified in ITU-R M.2150 does not meet the performance requirements in ITU-R M.2410 as the URLLC spec is based on 3GPP Release 15. Astonishingly, the 3GPP Release 16 work item “URLLC in the RAN” has yet to be completed, despite Release 16 being “frozen” in June 2020 (2 1/2 years ago). The official name of that Release 16 work item is “Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC)” with the latest spec version dated June 23, 2022. That work item is based on the outcome of the study items resulting in TR 38.824 and TR 38.825. It specifies PDCCH enhancements, UCI enhancements, PUSCH enhancements, enhanced inter UE TX prioritization/multiplexing and enhanced UL configured grant transmission.

Finally, revision 6 of ITU-R recommendation M.1036 on terrestrial 5G frequency arrangements (especially for mmWave), still has not been agreed upon by ITU-R WP5D. That has resulted in a “frequency free for all,” where each country is defining their own set of 5G mmWave frequencies which inhibits 5G end point device interoperability.

……………………………………………………………………………………………………………………………………………………………………..

In an article titled, 5G Market Growth, Mohamad Hashisho provides his view of why 5G has not lived up to its promise and potential.

Standalone 5G Is Yet to Breakout:

5G market growth still needs to feel as imposing as many imagined it. A technology created to replace previous generations still relies on their infrastructure. Standalone (SA) 5G is unrestricted by the limits of the prior generation of telecommunications technology because it does not rely on the already-existing 4G infrastructure. As a result, it can deliver the fast speeds and low latency that 5G networks have consistently promised. Clearly, standalone(SA) 5G is the way to go, so why do we not see effective implementation and marketing for it?

The numerous challenges businesses encounter while using SA are alluded to in the various telco comments about device availability, carrier aggregation, and infrastructure upgrades. The 5G New Radio system is connected to the current 4G core, the network’s command center, with older NSA. As its name suggests, SA sweeps this crutch aside and substitutes a new 5G core. But operators face several difficulties when they push it out, according to Brown. The first is the challenge of creating “cloud-native” systems, as they are known in the industry. Most operators now want to fully utilize containers, microservices, and other Internet-world technologies rather than simply virtualizing their networks. With these, networks risk being less efficient and easier to automate, and new services may take longer to launch. But the transition is proving to be challenging.

Overpromising, Yet to Deliver:

5G came out of the corner swinging. Huge promises were thrown around whenever the subject of 5g was discussed. It has been a while since 5G came to fruition, yet its market growth remain humble. Some might say that the bark was way more extensive than the bite. While some of these promises were delivered, they weren’t as grand as the ones yet to happen.

Speed was one of the main promises of 5G. And while some argue that this promise is fulfilled, others might say otherwise. Speeds are yet to reach speeds that can eclipse those of 4G. It is not only about speeds, though. It is about the availability of it. The high-speed services of 5G networks are only available in some places. Its been years and many regions are yet to receive proper 5G services. Simply put, a large portion of the dissatisfaction surrounding 5G can be attributed to the failure to fully deploy the infrastructure and the development of applications that fully utilize 5G.

5G of Tomorrow Struggles With Its Today:

5G is, without a doubt, the way to go for the future, but does its present state reflect that? Maybe. That is the issue. Years into its adoption, the answer should be decisive. Telcos might see potential in the maybes and work based on tomorrow’s potential. Consumers won’t be as patient. The consumers need the promised services now. You need to keep your customer base around with promises of the future. Especially when 4G LTE did the job well, really well.

Moreover, some areas in the US, not in struggling countries, have speeds slower than 4G LTE. Some 5G phones struggle to do the minimum tasks. Phones have to stick to specific chips capable of 5G support. But it is not about the small scale. Let’s think big, going back to the big promises 5G made. Smart cities, big-scale internet activities happening in real-time. IoT integration everywhere, controlling drones and robots from across the world. Automated cars as well, 5G was promised to deliver on all that, today and not tomorrow, but here we are.

Finally, the marketing was hit and miss, more miss, to be frank. Most consumers pay more to be 5G ready, while 5G still needs to be truly prepared. It’s hard to keep people interested when 4G is doing great. The only thing that the people needed was consistency, and sadly 5G is less consistent than some would hope.

Concluding Thoughts:

Lastly, innovation waits for none. This even includes 5G and 5G market growth. There are talks, even more than talks, about 6G. China is pushing for 6G supremacy, while Nokia and japan are starting the conversation about 7G. A major oversight that 5G missed was range. 5 G does great over small distances.

When the promises were massive in scale and global, you practically shot yourself in the foot. Time is running out for 5G, or is it pressuring 5G to live up to its potential?

……………………………………………………………………………………………………………………………………………………………………………

References:

https://insidetelecom.com/5g-market-growth/

https://www.itu.int/rec/R-REC-M.2150/en

https://www.itu.int/pub/R-REP-M.2410

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf

https://www.3gpp.org/specifications-technologies/releases/release-16

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Introduction:

Telco cloud has evolved from the much hyped (but commercially failed) NFV/Virtual Network Functions or VNFs and classical SDN architectures, to today’s more robust platforms for managing virtualized and cloud-native network functions that are tailored to the needs of telecom network workloads. This shift is bringing many new participants to the rapidly evolving telco cloud [1.] landscape.

Note 1. In this instance, “telco cloud” means running telco network functions, including 5G SA Core network on a public, private, or hybrid cloud platform. It does NOT imply that telcos are going to be cloud service providers (CSPs) and compete with Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud, IBM, Alibaba and other established CSPs. Telcos gave up on that years ago and sold most of their own data centers which they intended to make cloud resident.

………………………………………………………………………………………………………………………………………………………………………………..

In its recent Telco Cloud Evolution Survey 2022, Omdia (owned by Informa) found that both public and private cloud technology specialists are shaping this evolution. In July 2022, Omdia surveyed 49 senior operations and IT decision makers among telecom operator. Their report reveals their top-of-mind priorities, optimism, and strategies for migrating network workloads to private and public cloud.

Transitioning from VNFs to CNFs:

The existing implementations of telco cloud mostly take the virtualization technologies used in datacenter environments and apply them to telco networks. Because telcos always demand “telco-grade” network infrastructure, this virtualization of network functions is supported through a standard reference architecture for management and network orchestration (MANO) defined by ETSI. The traditional framework was defined for virtual machines (VMs) and network functions which were to be packaged as software equivalents (called network appliances) to run as instances of VMs. Therefore, a network function can be visualized as a vertically integrated stack consisting of proprietary virtualization infrastructure management (often based on OpenStack) and software packages for network functions delivered as monolithic applications on top. No one likes to admit, but the reality is that NFV has been a colossal commercial failure.

The VNFs were “lift & shift” so were hard to configure, update, test, and scale. Despite AT&T’s much publicized work, VNFs did not help telcos to completely decouple applications from specific hardware requirements. The presence of highly specific infrastructure components makes resource pooling quite difficult. In essence, the efficiencies telcos expected from virtualization have not yet been delivered.

The move to cloud native network functions (CNFs) aims to solve this problem. The softwardized network functions are delivered as modern software applications that adhere to cloud native principles. What this means is applications are designed independent of the underlying hardware and platforms. Secondly, each functionality within an application is delivered as a separate microservice that can be patched independently. Kubernetes manages the deployment, scaling, and operations of these microservices that are hosted in containers.

5G Core leads telcos’ network workload containerization efforts:

The benefits of cloud-native are driving telcos to implement network functions as containerized workloads. This has been realized in cloud native 5G SA core networks (5G Core), the architecture of which is specified in 3GPP Release 16. A key finding from the Telco Cloud Evolution Survey 2022, was that over 60% of the survey respondents picked 5G core to be run as containerized workloads. The vendor ecosystem is maturing fast to support the expectations of telecom operators. Most leading network equipment providers (NEPs) have built 5G core as cloud-native applications.

Which network functions do/will you require to be packaged in containers? (Select all that apply):

This overwhelming response from the Omnia survey respondents is indicative of their growing interest in hosting network functions in cloud environments. However, there remain several important issues and questions telcos need to think about which we now examine:

The most challenging and frequent question is whether telcos should run 5G core functions and workloads in public cloud (Dish Network and AT&T) or in their own private cloud infrastructure (T-Mobile)? The choice is influenced by multiple factors including understanding the total cost of running network functions in public vs private cloud, complying with data regulatory requirements, resilience and scalability of infrastructure, maturity of cloud platforms and tools, as well as ease of management and orchestration of resources across distributed environments.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ericsson says the adoption of cloud-native technology and the new 5G SA Core network architecture will impact six strategic domains of a telco network, each of which must be addressed and resolved during the telco’s cloud native transformation journey: Cloud infrastructure, 5G Core, 5G voice, automation and orchestration, operations and life cycle management, and security.

In the latest version of Ericsson’s cloud-native 5G Core network guide (published December 6, 2022), the vendor has identified five key insights for service providers transitioning to a cloud native 5G SA core network:

- Cloud-native transformation is a catalyst for business transformation. Leading service providers make it clear they view the transformation to cloud-native as a driver for the modernization of the rest of their business. The company’s ability to bring new products and solutions to market faster should be regarded as being of equal importance to the network investment.

- Clear strategy and planning for cloud-native transformation is paramount. Each individual service provider’s cloud-native transformation journey is different and should be planned accordingly. The common theme is that the complexity of transforming at this scale needs to be recognized, and must not be underestimated. For maximum short-and-long-term impact tailored, effective migration strategies need to be in place in advance. This ensures that investment and execution in this area forms a valuable element of an overall transformation strategy and plan.

- Frontrunners will establish first-mover advantage. Time should be a key factor in driving the plans and strategies for change. Those who start this journey early will be leading the field when they’re able to deploy new functionalities and services. A common frontrunner approach is to start with a greenfield 5G Core deployment to try out ideas and concepts without disrupting the existing network. Additionally, evolving the network will be a dynamic process, and it is crucial to bring application developers and solution vendors into the ecosystem as early as possible to start seeing faster, smoother innovation.

- Major potential for architecture simplifications. The standardization of 5G Core has been based on architecture and learnings from IT. The telecom stack should be simplified by incorporating cloud native principles into it – for example separating the lifecycle management of the network functions from that of the underlying Kubernetes infrastructure. While any transformation needs to balance both new and legacy technologies, there are clear opportunities to simplify the network and operations further by smart investment decisions in three major areas. These are: simplified core application architecture (through dual-mode 5G Core architecture); simplified cloud-native infrastructure stack (through Kubernetes over bare-metal cloud infrastructure architecture); and Automation stack.

- Readiness to automate, operate and lifecycle manage the new platform must be accelerated. Processes requiring manual intervention will not be sufficient for the levels of service expected of cloud-native 5G Core. Network automation and continuous integration and deployment (CI/CD) of software will be crucial to launch services with agility or to add new networks capabilities in line with advancing business needs. Ericsson’s customer project experience repeatedly shows us another important aspect of this area of change, telling us that the evolution to cloud-native is more than a knowledge jump or a technological upgrade – it is also a mindset change. The best platform components will not deliver their full potential if teams are not ready to use them.

Monica Zethzon, Head of Solution Area Core Networks, Ericsson said: “The time is now. Service providers need to get ready for the cloud-native transformation that will enable them to reach the full potential of 5G and drive innovation, shaping the future of industries and society. We are proud to be at the forefront of this transformation together with our leading 5G service providers partners. With this guide series we want to share our knowledge and experiences with every service provider in the world to help them preparing for their successful journeys into 5G.”

Ericsson concludes, “The real winners of the 5G era will be the service providers who can transform their core networks to take full advantage of what 5G Standalone (SA) and cloud-native technologies can offer.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Omdia says another big challenge telcos need to manage is the fragmentation in cloud-native tools and approaches adopted by various technology providers. Again, this is nothing new as telcos have faced and lived through similar situations while evolving to the NFV era. However, the scale and complexity are much bigger as network functions will be distributed, multi-vendor, and deployed across multiple clouds. The need for addressing these gaps by adopting clearly defined specifications (there are no standards for cloud native 5G core) and open-source projects is of utmost importance.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Overcoming the challenges telcos face on their journey to containerized network functions

https://omdia.tech.informa.com/OM023495/Telco-Cloud-Evolution-Survey–2022

https://www.ericsson.com/en/news/2022/10/ericsson-publishes-the-cloud-native

https://www.t-mobile.com/news/network/t-mobile-lights-up-standalone-ultra-capacity-5g-nationwide

U.S. cable commercial revenue to grow 6% in 2022; Comcast Optical Network Architecture; HFC vs Fiber

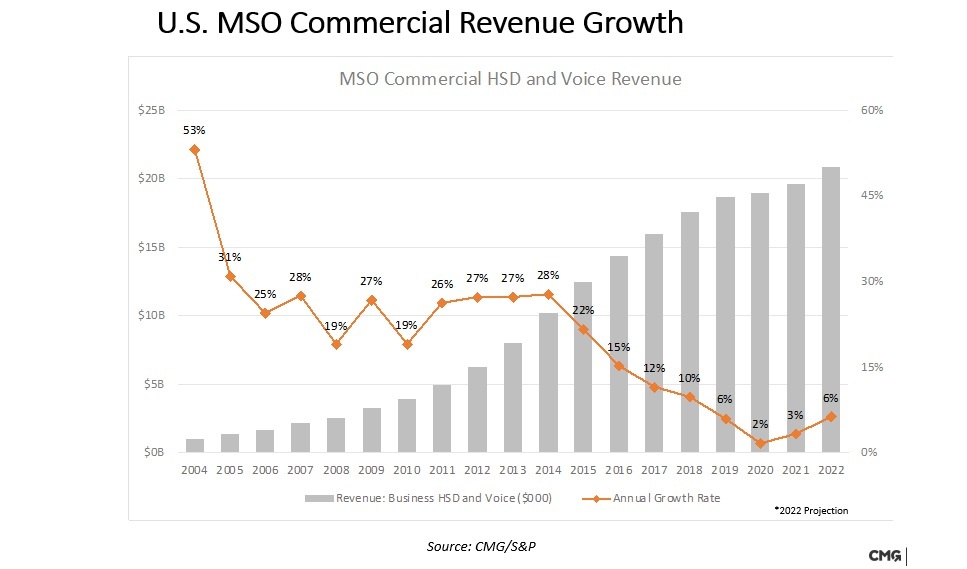

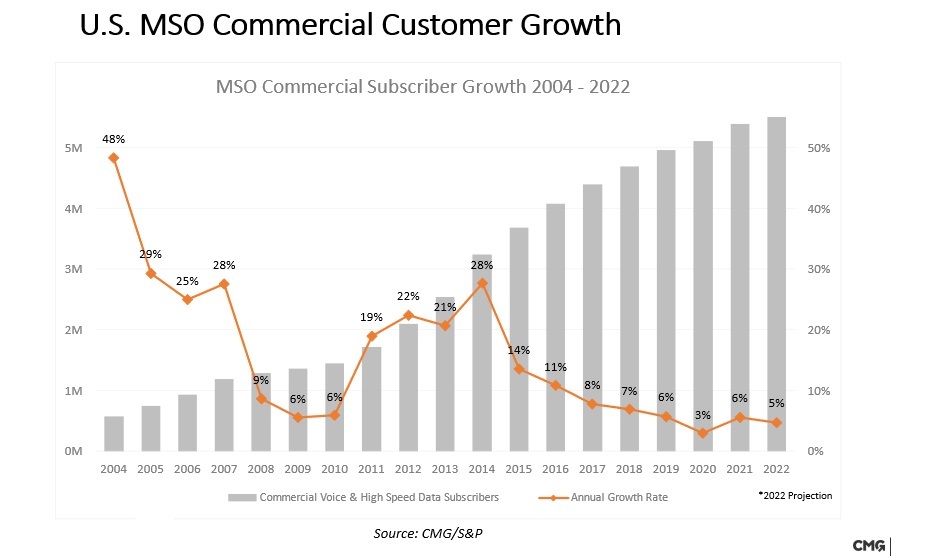

U.S. cable multi-service operators (MSO’s) now generate more than $20 billion a year in business services revenues as the sector has emerged as one of the most profitable for the industry. However, cablecos face major challenges in maintaining their growth pace because of the economic meltdown wrought by COVID-19 and the emergence of new all-fiber and wireless competitors.

Cable business service revenues and customer growth each slowed during the first two years of the COVID-19 pandemic, but they are clearly increasing again at the end of 2022.

U.S. cablecos commercial revenue growth is set to hit 6% in 2022, up from just 2% in 2020 and 3% in 2021, Alan Breznick, cable/video practice leader at Light Reading and a Heavy Reading analyst said in opening remarks at Light Reading’s 16th-annual CABLE NEXT-GEN BUSINESS SERVICES DIGITAL SYMPOSIUM, which focused on cable business services. [The source of that data is CMG/S&P.]

“There are signs of things pointing up again for the [cable] industry,” Breznick told the virtual audience.

U.S. cable is expected to bring in $20.5 billion in total commercial services revenues in 2022. Broken down by segment, small businesses (up to 19 employees), at $14.6 billion, will continue to represent the lion’s share, followed by medium businesses (20-99 employees), at $3.3 billion, and large businesses (100-plus employees), at $2.6 billion.

Commercial customer growth is estimated to reach 5% in 2022, down slightly from 2021 levels, but almost doubling the growth rate seen in 2020, when businesses across the country were hit by pandemic-driven shutdowns and lockdowns. Breznick estimates that US cable has about 5.5 million commercial customers.

Christopher Boone, senior VP of business services and emerging markets at Cable One, acknowledged that the commercial services market is returning to a faster rate of growth. However, businesses – and smaller businesses, particularly – are feeling labor and inflationary pressure as things continue to open up.

“Everything is expensive, including labor, and it’s hard to find [workers],” Boone explained. “For the small business owner, I think it’s pretty tough right now.”

During the earlier phases of the pandemic, Boone said Cable One didn’t emphasize new work-from-home products but instead focused on the broader customer experience. For example, Cable One put some customers on a seasonable pause for the first time, forgave early termination fees, issued credits and, where appropriate, helped customers move to lower-level services.

“We really threw the rulebook out and just said, do what it takes to take care of the customers,” he said. Even if some small businesses fail, the hope is that those entrepreneurs will return and choose Cable One again, remembering that the company did right by them when times were tough. Moving forward, he said Cable One will stick to its knitting and focus on connectivity rather than look to expand its product line for the business segment.

“I think our product menu needs to look like In-N-Out and not The Cheesecake Factory,” Boone said, noting that Cable One has opted to sit on the sidelines with product categories such as SD-WAN. “We’re pretty cautious in terms of new product launches … We feel that connectivity is really our sweet spot.”

…………………………………………………………………………………………………………………………………………………………………………………………..

Comcast Business now serves, small, mid-range and enterprise-level customers with a variety of services including Metro Ethernet, wavelength services and Direct Internet Access. An important piece of the firm’s broader strategy revolves around a “unified optical network architecture” initiative that enables the MSO to serve a broad range of customer types, including those requiring that services are delivered to multiple locations in multiple markets.

Comcast’s unified optical architecture combines the access and metro optical networks using a set of items: network terminating equipment (NTE), a Wave Integration Shelf (WIS) and OTN (Optical Transport Network – ITU standard) “tails.”

The NTE is a small, optical shelf that today supports 10-Gig and 100-Gig up to a 400-Gig wavelength, and can reside at a single customer site or a data center. The WIS resides in the Comcast headend or hub, co-located with the metro optical line system, and serves as the demarcation point for commercial services. The OTN Tails are the key to connecting the access network to the metro network.

“We needed a way to provide commercial services to customers that were located in the access [network], but needed to reach the metro network to get to one of our routers for Internet access or possibly another segment of the access to connect their locations together,” Stephen Ruppa, senior principal engineer, optical architecture for Comcast’s TPX (technology, product and experience) unit, said this week during his keynote presentation.

The combining/meshing of the access and metro networks enables features such as remote management, performance monitoring data, alarming and a full “end-to-end circuit view,” including the customer sites themselves. “We use the same hardware, standards, configurations, designs, procurement, processes … in all the networks, regardless of the vendor,” Ruppa said.

And while there was once little need to connect two non-Comcast sites that resided in different areas or to provide connections greater than 10 Gbit/s, customer demands have changed. Ruppa said two products drove that demand and the desire to create the company’s unified optical architecture: wavelength services and high-bandwidth Metro Ethernet.

A modular, simplified, commoditized and easily repeatable architecture enables Comcast Business to “easily offer the next gen of 400-Gig wavelengths and Ethernet services with a very light lift,” he added.

………………………………………………………………………………………………………………………………………………….

Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia presented the final keynote.

The panel session “Fighting Fiber with Fiber” was moderated by Breznick with panelists:

- Christian Nascimento, VP, Product Management & Strategy, Comcast Business

- Brian Rose, Assistant VP, Product Internet, Networking & Carrier Services. Cox Communications

- Steve Begg, VP/GM, Business Services, Armstrong Business Solutions

- Mark Chinn, Partner, CMG Partners

- Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia

Decades old hybrid fiber-coax networks (HFC) drive fiber to the node outside of the premises, which is then hooked up using older cable (coaxial) technology. However, due to advances in cable technology such as the latest DOCSIS 4.0 technology, the cable industry has touted its newly developed technological capacity to support multi-gig symmetrical speeds over those hybrid networks. DOCSIS 4.0 currently supports speeds of up to 10 Gigabits (Gbps) per second download and 6 Gbps upload – its predecessor, DOCSIS 3.1, offered only 5 Gbps * 1.5 Gbps.

Christian Nascimento of Comcast stated that hybrid networks that deliver multi-gigabit speeds are “adequate” for smaller enterprises. “This is matter of matching the technology up with…the customer’s needs,” he said, adding that Comcast delivers these services in a “cost-effective way.”

For Cox Communications, the hybrid model is “an ‘and,’ not an ‘or,’” said Brian Rose, the assistant vice president of product internet for the cable company. While Cox may invest more heavily in fiber networks going forward, Rose said it will continue to invest in its cable networks as well. Rose said he welcomes market challenges from insurgent fiber deployers. “Competition is good for customers and the industry overall,” he said. “It pushes people to be better and to push the envelope.”

The panel wasn’t unanimously bullish on older cable technology, however. Ed Harstead of Nokia argued that a widespread transition to fiber is inevitable. “I don’t doubt that mom-and-pop businesses will be perfectly fine on [cable]. But to the extent that you need higher speeds and symmetrical speeds…it’s going to be fiber.”

The cable broadband industry faces an onslaught of criticism from fiber advocates. Organizations like the Fiber Broadband Association say their preferred technology performs better, last longer, and costs less in the long term than the competition. FBA President Gary Bolton has strongly opposed government support for all manner of non-fiber technology, including satellite and wireless.

……………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cable-tech/cable-business-services-bounce-back/d/d-id/782175

Cable Providers Back Hybrid Fiber-Coax Networks in Face of Pure Fiber

AWS, Google, Microsoft, Oracle win $9B DoD cloud computing contract (JWCC)

The U.S. Department of Defense (DoD) finally revealed the awards for its revamped cloud contract “Joint Warfighting Cloud Capability (JWCC),” with Amazon Web Services (AWS), Microsoft, Google and Oracle collectively getting $9 billion to improve the agency’s IT operations. The contracts run through 2028 the Pentagon said in a news release.

JWCC is a multiple-award contract vehicle that will provide the DoD the opportunity to acquire commercial cloud capabilities and services directly from the commercial Cloud Service Providers (CSPs) at the speed of mission, at all classification levels, from headquarters to the tactical edge.

This Indefinite-Delivery, Indefinite-Quantity (IDIQ) contract vehicle offers commercial pricing, or better, and streamlined provisioning of cloud services. With JWCC, warfighters will now have the opportunity to acquire the following capabilities under one contract:

- global accessibility

- available and resilient services

- centralized management and distributed control

- ease of use

- commercial parity

- elastic computing, storage, and network infrastructure

- advanced data analytics

- fortified security

- tactical edge devices

To get started using JWCC or to learn more, visit to contact the Defense Information Systems Agency (DISA) Hosting and Compute Center (HaCC) or to log-in to the JWCC Customer Portal. DISA has developed user-friendly cloud accelerators to make it easier for DOD customers to purchase, provision, and onboard into the cloud.

Photo of the U.S. Pentagon/DoD

The decision to award contracts to four companies was a shift for the Pentagon, three years after it had given a $10 billion cloud-computing contract to Microsoft. That contract, for the Joint Enterprise Defense Infrastructure, known as JEDI, became part of a legal battle over claims that President Donald J. Trump interfered in a process that favored Microsoft over its rival bidder, Amazon. In 2021, the Defense Department said it would not move forward with the Microsoft contract, as it “was developed at a time when the department’s needs were different and our cloud conversancy less mature.”

Instead, the Pentagon said, it would seek bids from multiple technology companies for the Joint Warfighting Cloud Capability. While market research indicated that Microsoft and Amazon would be best positioned to meet the needs, officials said they would also reach out to IBM, Oracle and Google.

“This is the biggest cloud Beltway deal in history and was a key deal to win for all the software vendors in this multiyear soap opera,” Dan Ives, a tech analyst with Wedbush Securities, said in an email. “It’s good to finally end this chapter and get a cloud deal finally done for the Pentagon after years of a roller coaster,” he added.

An AWS spokesperson said in an email, “We are honored to have been selected for the Joint Warfighting Cloud Capability contract and look forward to continuing our support for the Department of Defense. From the enterprise to the tactical edge, we are ready to deliver industry-leading cloud services to enable the DoD to achieve its critical mission.”

References:

Gartner: SASE tops Gartner list of 6 trends impacting Infrastructure & Operations over next 12 to 18 months

At its IT Infrastructure, Operations & Cloud Strategies Conference this week, Gartner identified six trends anticipated to have a significant impact on infrastructure and operations (I&O) over the next 12 to 18 months. Secure Access Service Edge (SASE) topped the list with Sustainable technology coming in second and Wireless Value Innovation (see below) in third place.

SASE is a single-vendor product that is sold as an integrative service which enables digital transformation. This trend connects and secures users, devices, and locations as they work to access applications from anywhere. Gartner forecasts that total worldwide end-user spending on SASE will reach $9.2 billion in 2023, a 39% increase from 2022. Gartner coined SASE as a technology framework for the convergence of network access and security in cloud-native environments. Earlier this year, Gartner released its first Market Guide for Single-Vendor SASE, revealing to I&O leaders that interest in the framework has exploded since its introduction in 2019 – and particularly toward single-vendor solutions.

Gartner VP Analyst Jeffrey Hewitt attributed the fast adoption of SASE to “the need to secure the access of devices and elements at the edge,” as well as hybrid work and a “relentless shift to cloud computing.” Hewitt noted the primary benefits of the framework are that it allows users to securely connect to applications and improves the efficiency of management. “Hybrid work and the relentless shift to cloud computing has accelerated SASE adoption,” said Hewitt. “SASE allows users to connect to applications in a secure fashion and improves the efficiency of management. I&O teams implementing SASE should prioritize single-vendor solutions (1.) and an integrated approach.”

Note 1. Single-vendor SASE means the selected service provider owns and delivers all the essential SASE components—software-defined WAN (SD-WAN), secure web gateway (SWG), cloud access security broker (CASB), network firewalling, and zero trust network access (ZTNA)—using a cloud-centric architecture, according to Gartner, which created the term SASE. The service is meant to address shortcomings of legacy methods of securing access to enterprise resources.

Source: Lanner

“Leaders are going to be looking at this and saying, we want to implement this,” Hewitt told SDxCentral. “They’re going to be assessing and determining what providers can offer.” I&O teams implementing SASE should prioritize single-vendor solutions, Hewitt added.

Hewitt noted SASE is still an “immature” market and technology framework. “It’s not something that you can just run out and have a large list of vendors – at this point – that you could select from,” he said. While many vendors still can only supply components of SASE, Gartner recognizes nine that offer complete solutions with both networking and Secure Service Edge (SSE) capabilities – Cato Networks, Cisco, Citrix, Forcepoint, Fortinet, Netskope, Palo Alto Networks, Versa Networks, and VMware.

The biggest benefits of a single-vendor solution are improved security posture, administrative simplicity with fewer consoles to manage and troubleshoot, and traffic efficiency due to single-pass encryption and optimal routing decisions instead of needing to integrate between two pieces, Analyst Andrew Lerner told SDxCentral in an earlier interview. Lerner recommended I&O leaders look for single-vendor SASE offerings that provide single-pass scanning, a single unified console, and data lakes covering all functions to improve user experience and staff efficacy.

By 2025, Gartner predicts 65% of enterprises will have consolidated individual SASE components into one or two explicitly partnered SASE vendors, up from 15% in 2021.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Regarding Wireless Value Innovation, Gartner wrote: I&O can leverage multiple wireless technologies to extend business disruption opportunities beyond connectivity. Overlaps between various technologies including Wi-Fi, 5G, Bluetooth and high frequency (HF) facilitates connectivity solutions and creates innovation opportunities.

Hewitt said, “Wireless value innovation creates a scalable return on wireless investment and makes networks a strategic innovation platform. However, there is significant complexity at play and several new skills that are required to achieve this innovation, such as wireless integration capabilities and wireless tracking implementation experience.”

At its recent IT Symposium/Xpo 2022 Gartner included wireless among in its 10 top strategic technology trends for 2023. In that report, Gartner stated that no single wireless technology will dominate, but enterprises will use a variety of them to support a range of environments, including Wi-Fi in the office, services for mobile devices, low-power protocols, and even radio connectivity, Gartner stated. Gartner predicts that by 2025, 60% of enterprises will be using five or more wireless technologies simultaneously.

“We’re going to see a spectrum of solutions in the enterprise—that includes 4G, 5G, LTE, WIFI 5, 6, 7—all of which will create new data enterprises can use in analytics, and low-power systems will harvest energy directly from the network,” Gartner stated.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Gartner’s top six trends impacting I&O in 2023:

Trend No. 1: Secure Access Service Edge (SASE)

Trend No. 2: Sustainable Technology

Trend No. 3: Platform Engineering

Trend No. 4: Wireless Value Innovation

Trend No. 5: Industry Cloud Platforms

Trend No. 6: Heated Skills Competition

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/sase-tops-gartners-io-trends-for-2023/2022/12/

Secure Access Service Edge – SASE Appliances Enable the Most Agile Edge Security

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

MEF survey reveals top SD-WAN and SASE challenges

New Findings in Aryaka’s 2022 State of the WAN Report: Cloud Adoption, Hybrid Workplaces, Convergence of Network and Security with SASE

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

Enterprises Deploy SD-WAN but Integrated Security Needed

MEF New Standards for SD-WAN Services; SASE Work Program

Bharti Airtel and Meta extend 2Africa Pearls subsea cable system to India

Bharti Airtel (“Airtel”) and Meta Platforms, Inc. (“Meta” – previously Facebook) today announced a collaboration to support the growth of India’s digital ecosystem. Airtel and Meta will jointly invest in global connectivity infrastructure and Communications Platform as a Service (CPaaS) based new-age digital solutions to support the emerging requirements of customers and enterprises in India.

Foundational connectivity infrastructure such as subsea cable systems are crucial for supporting the rising demand for high-speed data and digital services as India prepares to roll out 5G networks later this year. With the constant endeavor to augment the nation’s infrastructure, Airtel will partner with Meta and STC to extend 2Africa Pearls to India.

2Africa is the world’s longest subsea cable system and is expected to provide faster internet connectivity to almost 3 billion people globally. Airtel and Meta will extend the cable to Airtel’s landing station in Mumbai and also pick up dedicated capacity to further strengthen its submarine network portfolio. The 2Africa cable will significantly boost India’s cable capacity and empower global hyper-scalers and businesses to build new integrated solutions and provide a high-quality seamless experience to customers.

Airtel says the 2Africa cable will significantly boost India’s cable capacity and ‘empower global hyper-scalers and businesses to build new integrated solutions and provide a high-quality seamless experience to customers.’

Facebook/Meta announced it was building out a subsea cable extension called 2Africa Pearls last year, and that it would connect Africa, Europe, and Asia. This new bit of cable brings the total length of the 2Africa system to more than 45,000 kms, which is apparently the longest subsea cable system ever deployed. The goal of the wider project is certainly ambitious – with the addition of Pearls we’re told it will provide connectivity to an additional 1.8 billion people – 3 billion in total.

As members of the Telecom Infra Project (TIP) Open RAN project group, Airtel and Meta have been pioneers of Open RAN technologies with the shared goal of increasing ecosystem diversity, driving innovation, and cost-efficiency in connectivity networks. Airtel has signed an agreement to help increase operational efficiency of Open RAN and facilitate energy management and automation in radio networks using advanced analytics and AI/ML models. Airtel is currently conducting trials for 4G and 5G Open RAN solutions on select sites in the state of Haryana and will commercially deploy the solution across several locations in India over the next few quarters. Airtel will share its learnings with wider ecosystem partners within the TIP community, including Meta, to help accelerate the deployment of Open RAN based networks across the world.

Businesses in India are rapidly shifting to cloud-based solutions to serve their customers digitally. Airtel IQ, the world’s first network embedded Communications Platform as a Service (CPaaS) ecosystem, offers cloud communication across voice, messaging and video channels to help enterprises transform their customer engagement and drive profitability by leveraging automation and boosting revenue. Airtel will integrate Meta’s WhatsApp within its CPaaS platform. With this integration, businesses will now be able to use WhatsApp’s rich features and reach to provide an unparalleled omni-channel customer engagement to enterprises.

Vani Venkatesh, CEO – Global Business, Bharti Airtel said: “We, at Airtel, are delighted to deepen our partnership with Meta to serve India’s digitally connected economy by leveraging the technology and infrastructure strengths of both companies. With our contributions to the 2Africa cable and Open RAN, we are investing in crucial and progressive connectivity infrastructure which is needed to support the increasing demand for high-speed data in India. We look forward to working closely with Meta to deliver best-in-class digital experiences to our customers in India.”

Francisco Varela, vice president of mobile partnerships for Meta said: “Subsea cables and open, disaggregated networks continue to play a huge role in the foundational infrastructure needed to support network capacity and fuel innovation. We look forward to continuing our collaboration with Airtel to further advance the region’s connectivity infrastructure that will enable a better network experience for people and businesses across India.”

About Bharti Airtel:

Headquartered in India, Airtel is a global communications solutions provider with over 500 Mn customers in 17 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India’s largest integrated communications solutions provider and the second largest mobile operator in Africa. Airtel’s retail portfolio includes high speed 4G/5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1 Gbps with convergence across linear and on-demand entertainment, streaming services spanning music and video, digital payments and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cyber security, IoT, Ad Tech and cloud based communication. For more details, visit www.airtel.com

About Meta:

Meta builds technologies that help people connect, find communities, and grow businesses. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.

References:

Echo and Bifrost: Facebook’s new subsea cables between Asia-Pacific and North America

https://mobile-magazine.com/connectivity/2africa-cable-become-longest-ever-latest-expansion

AWS enabling edge computing, supports mobile & IoT devices, 5G core network and new services

In an AWS re-Invent Leadership session titled “AWS Wherever You Need It,” [1.] Wayne Duso, vice president of engineering and product at AWS, expressed similar goals. “Today, customers want to use AWS services in a growing range of applications, operating wherever they want, whenever they require. And they’re striving to do so to deliver the best possible customer experience they can, regardless of where their customers or users happen to be located. One way AWS helps customers accomplish this is by bringing the AWS value to our regions, to metro areas, to on-premises, and to the furthest and evolving edge.”

Note 1. You can watch the 1 hour “AWS Wherever You Need It” session here (top right).

“We’re helping customers by providing the same experience from cloud to on-prem to the evolving edge, regardless of where your application may need to reside,” Duso explained. “AWS is enabling customers to use the same infrastructure, services and tools to accomplish that. And we do that by providing a continuum of consistent cloud-scale services that allow you to operate seamlessly across this range of environments.”

Duso explained how AWS is enabling edge computing by adding capabilities for mobile and IoT devices. “There are more than 14 billion smart devices in the world today. And it’s often in things we think about, like wristwatches, cameras, cellphones and speakers,” he said.

“But more often, it’s the stuff that you don’t see every day powering industries of all types and for all types of customers.” Duso cited the example of Hilcorp, a leading energy producer, which is using smart devices to monitor the health of its wells, optimize production and proactively predict failures so it can minimize capital expenditures.

With IoT devices becoming common among energy providers, edge computing is on the rise to handle the volume of data these devices generate. “Now, AWS IoT provides a deep and broad set of services and partner solutions to make it really simple to build secure, managed and scalable IoT applications,” Duso added.

Duso pointed to Couchbase as a use case for flexible AWS services: “Couchbase is a non-SQL database company that uses AWS hybrid edge services such as Local Zones, Wavelength, Outposts and the Snow Family to deploy its applications and highly scalable, reliable and performant environments to reduce latency by over 18 percent for its customers.” Each of these AWS managed services enables Couchbase to move data from the edge to the cloud or manage and process it where it’s generated.

“What we built on these AWS compute environments was a highly distributed, managed or self-managed database,” Duso explained. “For the cloud, an internet gateway for accessing that data securely over the web and synchronizing that data down to the edge. And that works across cloud, edge and on the offline, first-compute environments.”

“Our goal is I want to make AWS the best place to run 5G networks. That is the overarching objective. How can I make AWS, whether we are running it in the region, in a Local Zone, on an Outposts, on a Snow device, how do we make it the best place to run a 5G network, and then provide that infrastructure.”

AWS’ 5G network efforts include a cloud architecture that can support an operator’s 5G SA core network and applications, similar to what AWS is doing with greenfield U.S. wireless network operator Dish Network. Sidd Chenumolu, VP of technology development and network services at Dish Network, recently explained that the wireless carrier’s 5G core network was using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the Local Zones, but most were deployed with Nokia applications across AWS around the country.”

AWS is also working with Verizon to support a part of that carrier’s public MEC system. This includes use of AWS’ Outposts and Wavelengths, the latter of which AWS recently expanded in the United Kingdom with Vodafone.

Hofmeyr continued, “I think you have a spectrum (of different wireless carrier networks), from the total greenfields like what we did with Dish to the large tier-ones. The one thing that’s common across the board is the desire to modernize and become more cloud-like. That is common. Everyone wants that. Each one has a very unique job. There’s not one way that they all are executing in the same way. They’re taking this one workload and then building, so all of them are focusing on different workloads in the network and put it in the cloud.”

In conclusion Hofmeyr said, “I think all over the edge we find these use cases for which purpose-built systems were designed to handle that. And our goal is how do you make that available in the cloud.”

References:

https://reinvent.awsevents.com/leadership-sessions/

https://reinvent.awsevents.com/on-demand/?trk=www.google.com#leadership-sessions

https://www.sdxcentral.com/articles/analysis/aws-wants-to-be-the-best-place-for-5g-edge/2022/12/

https://biztechmagazine.com/article/2022/12/aws-reinvent-2022-harvesting-data-cloud-edge