Year: 2022

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro Group preliminary findings suggest the Radio Access Network (RAN) market is weakening. The overall 2G-5G RAN infrastructure equipment market – including hardware and software – declined in the second quarter, recording the first year-over-year contraction in more than two years and the third consecutive quarter of RAN coming in below expectations. Although the RAN market is not immune to external risks, initial readings suggest that the RAN impact from deteriorating macro conditions, high levels of inflation, and supply chain disruptions were limited in the quarter.

“The shift in the pendulum is not a surprise, but admittedly it has swung a bit faster toward the negative than initially expected”, said Stefan Pongratz, Vice President at Dell’Oro Group. “Slower momentum is not a sign that the 5G deployment phase is over. The message we have communicated for some time now, namely that the 5G cycle will be longer than previous technology cycles, still holds. At the same time, market conditions in the quarter were impacted by APAC excluding China, Russia, and foreign exchange,” continued Pongratz.

Additional highlights from the 2Q 2022 RAN report:

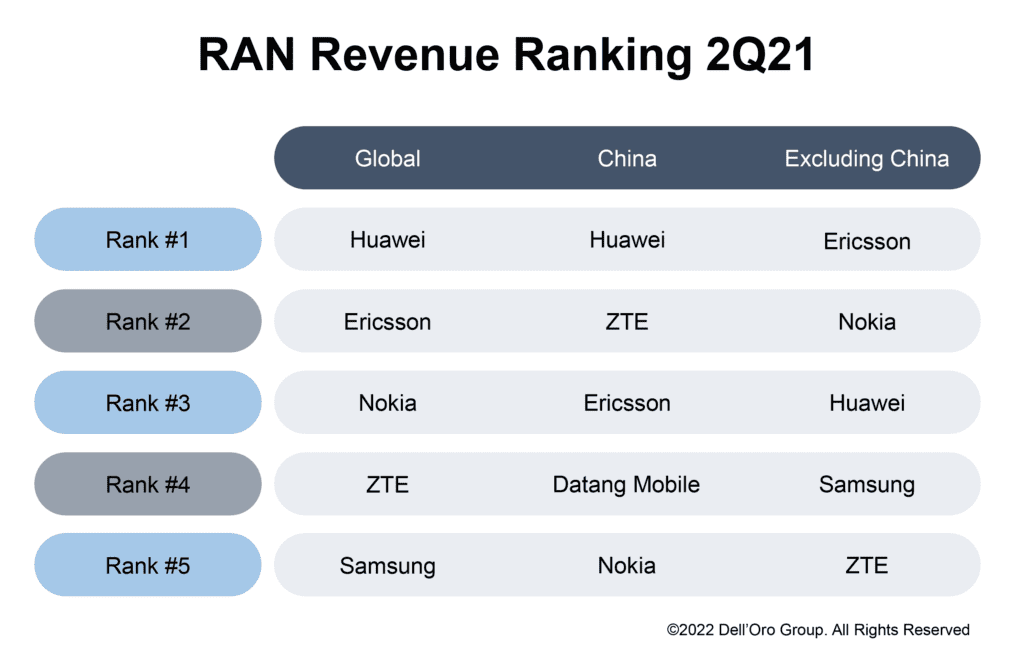

- Top 5 global suppliers in the quarter include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Top 4 suppliers outside of China in the quarter include Ericsson, Nokia, Huawei, and Samsung.

- Huawei and ZTE continued to dominate in China, together accounting for 90 to 95 percent of 1H 2022 revenues. Note that state owned Datang Mobile is ranked #4 in China’s RAN market.

- Ericsson maintained its top position in the RAN market outside of China, accounting for 39 percent of the revenues for the 1H 2022.

- Nokia’s RAN position outside of China improved between 1Q and 2Q 2022.

- Samsung’s 1H 2022 RAN share improved both in North America and globally.

- Even though RAN results disappointed in the quarter and first half revenues are tracking below expectations, RAN is still projected to record a fifth consecutive year of growth in 2022.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-6 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

…………………………………………………………………………………………………………………………..

Dell’Oro’s RAN vendor rankings come as no surprise.

- Ericsson in the second quarter reported a 13% increase in net sales compared with the year-earlier period.

- Nokia reported an 11% increase in net sales during the same period.

- Huawei, which has long been the world’s biggest supplier of RAN equipment, posted revenues in the first half of 2022 that were down 5.9% from last year, its lowest such results in five years.

References:

MoffettNathanson: accelerating rise of Cable Wireless; Business Wireline status; AT&T’s overlooked assets

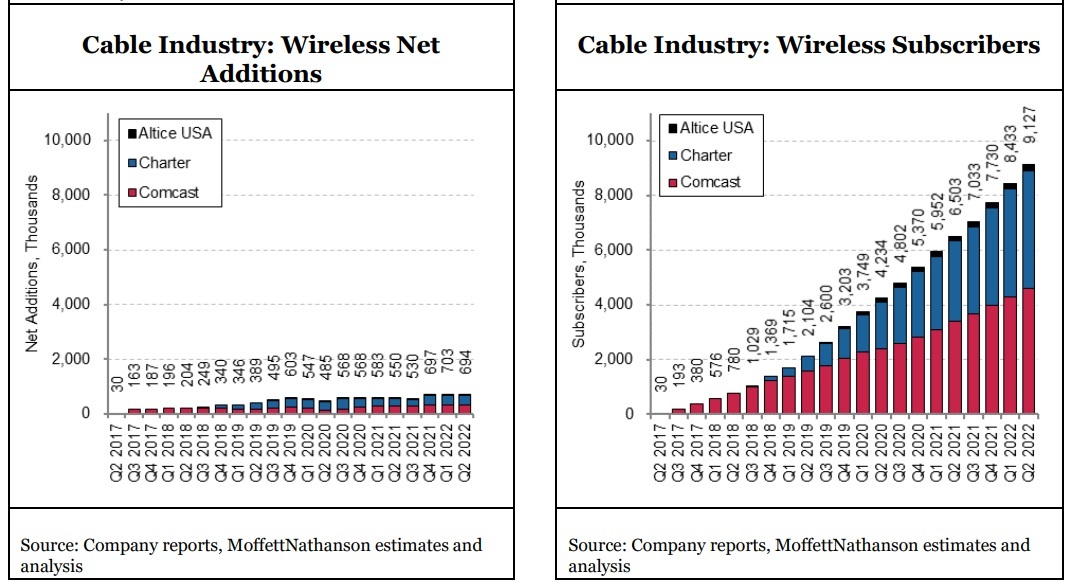

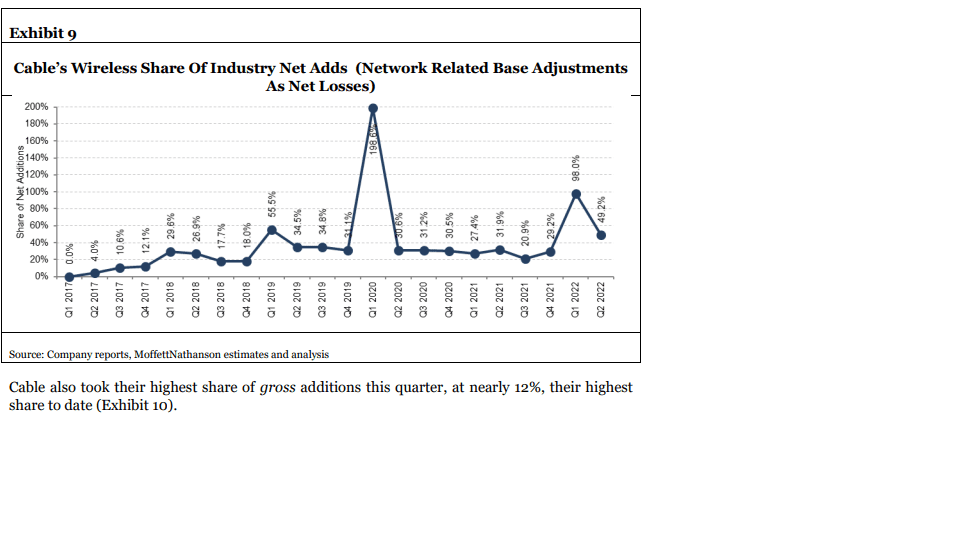

To the surprise of many, the Cable industry (Cablecos/MSOs) has captured an accelerating share of gross and net wireless subscriber additions, forcing incumbent wireless telcos (AT&T, Verizon, T-Mobile) to respond by offering lower priced alternatives. In the second quarter of the year, with cable taking nearly half (49.2%) of industry net additions in the period (after adjusting for 3G network shutdowns), according to MoffettNathanson’s latest report (subscription required) on the mobile sector. Cable’s Q2 2022 take was up from approximately 31.9% in the year-ago period.

MoffettNathanson’s analysis also showed that cable took its highest share of gross mobile subscriber adds in Q2 2022, at 11.9%. That compared to T-Mobile (30.1%), AT&T (29%) and Verizon (27.8%). Comcast, Charter and Altice USA combined to add 694,000 mobile lines in the second quarter, ending the period with 9.12 million.

Comcast, Charter, and Altice collectively added 694K new subscribers in Q2, up more than 100K from the corresponding quarter last year. That takes Cable’s subscriber base beyond 9M, or still just ~3% of the U.S. industry as per the graph below.

- Comcast disclosed that wireless penetration of its residential broadband base has reached 7.9% (or about 2.4M homes), suggesting they’ve reached nearly 2 lines per home, up from ~1.6 lines per account just a year ago.

- Privately held Cox Communications is now in beta testing on its MVNO service, and we expect it will offer pricing similar to Comcast’s and Charter’s. That will only add to the pressure on the wireless telco incumbents.

“Cable Wireless offers have been more successful than anyone had expected when they were first introduced,” MoffettNathanson analyst Craig Moffett wrote. Of note, it appears that Comcast ‘s Xfinity Mobile service has reached nearly two lines per home per mobile sub, up from about 1.6 mobile lines per account just a year ago.

Citing data from Navi, a firm that aggregates data on service plans and promos from major postpaid carriers, original equipment manufacturers and large retailers, Moffett says there’s a “clear and growing interest in Cable Wireless as a potential service provider.”

Citing data from Navi, a firm that aggregates data on service plans and promos from major postpaid carriers, original equipment manufacturers and large retailers, Moffett says there’s a “clear and growing interest in Cable Wireless as a potential service provider.”

“Lower industry growth means a more challenging path forward for all carriers… particularly given the rapid share gains of the cable operators,” Craig wrote. “While Cable wireless collectively took nearly 700K net adds during the quarter, they would presumably have taken even more had the incumbents’ new basic entry plans not been introduced,” he added.

……………………………………………………………………………………………………………………………………………………………………

Business Wireline Status:

“While wireless is inarguably the core business for both Verizon and AT&T, the worsening conditions of the Business Wireline segment, which accounts for some 19% of revenues at AT&T and 11% at Verizon, cannot be ignored. Deterioration in the sector overall is bad enough, particularly in light of high prevailing inflation. Industry revenues are now shrinking by 3.7% per year. Excluding USF and IP sales, AT&T saw Business Wireline revenues fall by 7.6% YoY in Q2, and Verizon saw Business Wireline revenues fall by an estimated 8.2%,” wrote Craig Moffett.

AT&T’s Overlooked Assets:

MoffettNathanson is missing two key growing revenue streams for AT&T:

- Increasing fiber optic network sales to both business and residential customers: AT&T added 316,000 net AT&T Fiber subscribers during the second quarter of 2022, resulting in fiber penetration of nearly 37% with about 6.6 million total fiber subscribers. AT&T has already added nearly 2 million AT&T Fiber (brand name) locations this year. AT&T’s fast-growing fiber revenues now make up nearly half of our consumer wireline broadband revenues.”

- FirstNet network which covers more first responders than any other network. FirstNet now reaches more than 2.81 million square miles across the U.S. That is 50,000+ more square miles than the largest commercial networks (about the size of Alabama) – giving more first responders access to an entire ecosystem of innovative solutions to keep them mission ready.

References:

https://www.fiercetelecom.com/broadband/att-adds-316000-fiber-subs-q2-2022

https://about.att.com/story/2022/fn-covers-more-first-responders-than-any-network.html

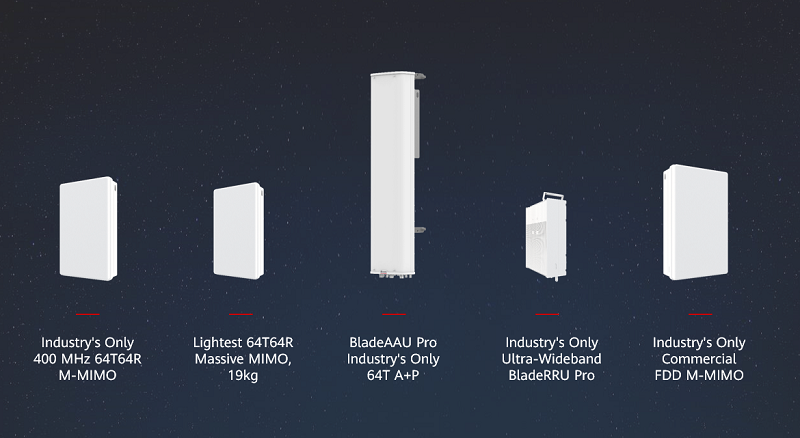

China Unicom to deploy Huawei’s 64T64R MetaAAU product-an upgrade of Huawei MetaAAU

China Unicom Beijing will commercial Huawei’s 64T64R MetaAAU product in a pilot urban residential area in Tongzhou District. China Unicom says the rollout of 64T64R MetaAAU resulted in a significant increase in user-perceived rates. Even at a building near the cell edge, the downlink user-perceived rate was able to reach 100 Mbps on every floor, China Unicom added.

64T64R MetaAAU is an upgrade of the Huawei MetaAAU series that adopts extremely large antenna array (ELAA) technology. The number of channels has grown from 32T32R to 64T64R, meaning this new green 5G base station Massive MIMO product can deliver upgrade coverage and capacity.

China Unicom Beijing and Huawei have created a commercial MetaAAU network as part of a project that has deployed MetaAAUs at over 1,000 rural network sites on the outskirts of Beijing. According to China Unicom, this new network has already seen a 38 percent increase in traffic per site by improving 5G services in rural areas.

The MetaAAUs used by this network are also designed to reduce site energy consumption by 5 percent under the same network load compared with previous-generation AAUs. MetaAAUs are the third-generation of 5G AAU developed by Huawei. They use the company’s new extreme-large antenna array (ELAA) architecture to double the scale of arrays compared with the previous-generation AAU. According to Huawei, this innovation results in extended coverage because channel beams are narrower and energy is more focused.

China Unicom Beijing has leveraged these advancements to hit its 2022 5G construction targets for small towns and rural areas which face unique challenges when it comes to inter-site distance, gigabit user experience, and green networking. China Unicom Beijing deployed these MetaAAUs at over 1,000 sites in July in towns and rural areas including the Shunyi, Huairou, and Pinggu districts of Beijing.

The company claims the MetaAAUs have delivered a 40 percent increase in coverage area, increased uplink and downlink user-perceived rates by 10 percent, and lowered network energy consumption by 5 percent over previous-generation AAUs. Since their deployment, user traffic has increased by 38 percent in their coverage areas and the operator’s user base has increased by 37 percent.

References:

https://www.telecompaper.com/news/china-unicom-deploys-1000-metaaaus-with-huawei–1430843

DriveNets raises $262M to expand its cloud-based alternative to core network routers

Israel based DriveNets provides software-based internet routing solutions to service providers to run them as virtualized services over a “network cloud” based architecture using “white box” hardware. Founded in 2016 by serial entrepreneur Ido Susan, with the objective of developing a cloud-based virtual router platform as an alternative to the chassis-based IP routers from companies like Cisco, Juniper Networks, Nokia and Huawei.

Today, the company announced it has secured $262 million in a Series C venture capital funding round, considerably increasing the company’s valuation over its January 2021 Series B round. The funding from this latest round of investment will be used to develop future technology solutions, pursue new business opportunities, and expand the company’s global operations and support teams to support growing customer demand.

The round was led by D2 Investments with the participation of DriveNets’ current investors, including Bessemer Venture Partners, Pitango, D1 Capital, Atreides Management, and Harel Insurance Investments & Financial Services. With this round, DriveNets has now raised just over $580 million.

“DriveNets’ approach of building networks like cloud allows telecom providers to take advantage of technological efficiencies available to cloud hyperscalers, such as cloud-native software design and optimal utilization of shared resources across multiple services,” said Ido Susan, DriveNets founder and CEO. “This latest round of investment demonstrates our investors and customers’ confidence in us and will enable us to expand the value and global operational support we offer them.”

“Most of our customers are tier 1 and 2 service providers and we found that Asian operators are early adopters and open to new technologies that can accelerate growth and lower their cost,” said Susan this week. A lot of initial engagement is around cost-cutting.

DriveNets first big announced sale was to AT&T in 2020 as we noted in this IEEE Techblog post. DriveNets disaggregated core routing solution has been deployed over AT&T’s IP-MPLS backbone network. AT&T recently said that it plans to have 50 per cent of its core backbone traffic running on white box switches and open hardware by the end of 2022.

“DriveNets has demonstrated its ability to move the networking industry forward and has gained the trust of tier-1 operators,” said Adam Fisher, Partner at Bessemer Venture Partners. “While other solution providers are facing challenging headwinds, DriveNets continues to innovate and execute on its vision to change the future of the networking market.”

“DriveNets has already made a big impact in the high-scale networking industry and its routing solutions are adopted by tier-1 operators for their quality and the innovation they enable,” said Aaron Mankovski, Managing Partner at Pitango. “This investment will allow DriveNets to expand its footprint in the market and develop additional offerings.”

DriveNet’s claim to fame is that it can replace costly core router hardware with its proprietary sophisticated operating system which runs on cheaper “white box” equipment that resides in the service provider’s own cloud resident data center. That works out to a cost savings on average of 40%, Susan previously told Tech Crunch.

The operating system has a lot of different functionality, covering core, aggregation, peering, cable, data center interconnection, edge computing and cloud services, and this means, Susan said, that while customers come for the discounts, they stay for the services, “since our model is software-based we enable faster innovation and service rollout.”

Since its last funding round in 2021, DriveNets has gained significant market traction:

- Growing network traffic running on the DriveNets’ Network Cloud solution by 1,000 percent

- Engaging with nearly 100 customers and doubled bookings year over year

- Establishing key strategic partnerships to speed up the deployment of next-generation networks worldwide, including agreements with Itochu Techno-Solutions Corporation (CTC), EPS Global, Wipro Limited, and KGPCo.

- Growing its overall employee base by 30 percent, significantly expanding its operations and deployment teams, and its global reach.

“During the COVID-19 pandemic they grew their existing networks based by simply buying more of the same to minimize the operational burden,” said Susan. That’s now changing, though, in the current economic climate.

“Now, post pandemic they are starting to refresh these networks and with the growing interest of Cloud Hyperscalers in networking service, operators are looking at more innovative ways to stay competitive and accelerate innovation, by building networks in more like cloud. These are the big customers that we are seeing now — transformative large operators who are expanding the capacity of their networks and are looking to rollout newer services at a wide scale,” he said.

“We have seen in the past couple of years some of the incumbent networking vendors starting to adopt our model,” said Susan. He credits the company’s “huge success” at AT&T as a proof that “the model works. You can build networks like cloud at a very high scale and reliability and both lower network cost and accelerate service rollout.”

“Now it is not a matter of ‘if’ but of ‘when’ since incumbent vendors have more to lose over that transition,” he added. He believes that DriveNets will emerge a leader in the networking vendor space nonetheless, not least due to being able to invest in further development on the back of funding rounds like this one.

“We are investing in our current solution to ensure that we keep ahead of the market but also continue to add expected capabilities,” said Susan. He notes that the company was the first to support Broadcom’s latest chipset and more than triple the network capacity but also lead the transition to 400Gig. “In parallel, we are already investing in additional solution offerings that will provide additional value to our customers and expand our TAM,” he said.

“DriveNets has already made a big impact in the high-scale networking industry and its routing solutions are adopted by tier-1 operators for their quality and the innovation they enable,” said Aaron Mankovski, managing partner at Pitango, in a statement. “This investment will allow DriveNets to expand its footprint in the market and develop additional offerings.”

The biggest challenge is not technological, per se, but one of talent, “recruiting quality people to support our engineering efforts and our global expansion. At the end of the day, it is all about the people,” Susan explained. The company has been recruiting software engineers to fuel its growth. DriveNets also recently announced the addition of three cloud and networking industry veterans to its leadership team.

However, there are still a lot of skeptics as LightCounting pointed out in this IEEE Techblog post. LightCounting’s research indicates that “the overall Disaggregated Open Router (DOR) market remains incipient and unless proof of concept (PoC), testing and validation accelerate, volumes will take some time to materialize.”

About DriveNets:

DriveNets is a leader in cloud-native networking software and network disaggregation solutions. Founded in 2015 and based in Israel, DriveNets offers communications service providers (CSPs) and cloud providers a radical new way to build networks, substantially growing their profitability by changing their technological and economic models. DriveNets’ solution – Network Cloud – adapts the architectural model of cloud to telco-grade networking. Network Cloud is a cloud-native software that runs over a shared physical infrastructure of standard white-boxes, radically simplifying the network’s operations, offering telco-scale performance and elasticity at a much lower cost.

Learn more at www.drivenets.com

References:

https://drivenets.com/news-and-events/press-release/drivenets-secures-262-million/

DriveNets connects with $262M as demand booms for its cloud-based alternative to network routers

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

Light Counting: Large majority of CSPs remain skeptical about Disaggregated Open Routers

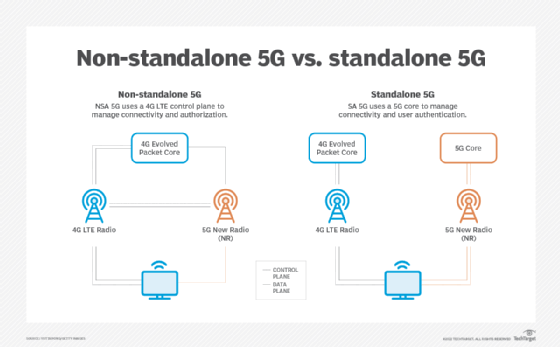

Global Data: Wireless telcos don’t know how to market 5G SA

A study by leading data and analytics company GlobalData reveals that network operators don’t seem to know how to market this new phase of the technology to their customers. The study by GlobalData Technology was a July 2022 audit of around 30 standalone 5G (5G SA) commercial deployments worldwide.

The conclusion was that although operators are keen to promote the adoption of 5G SA in general marketing messages—largely focusing on the improved network quality and capabilities for enterprises—the number of 5G SA references within consumer 5G service portfolios are few and far between. GlobalData found “many operators marketed 5G SA very similarly to how operators have been marketing non-standard 5G for years,” which itself has yet to be a financial success for wireless telcos.

Emma Mohr-McClune, Service Director at GlobalData, comments: “The lack of effective standalone 5G promotion is a real problem for the future of 5G monetization. Standalone 5G will be a vital requirement for a lot of the more exciting 5G use cases, from autonomous devices to commercial augmented and virtual reality.”

The research found that there were a few exceptional cases of standalone 5G marketing and branding, but many operators marketed standalone 5G very similarly to how operators have been marketing non-standard 5G for years.

Mohr-McClune continues: “The few exceptional cases—in Singapore, but also in Germany and elsewhere—make for fascinating study. In the future, we could see more operators position standalone 5G as greener, safer and more reliable than future generations of wireless technology, but the current industry is still waiting for signature use cases to give the upgrade meaning to consumers. In the meantime, we believe that most operators will focus on marketing the technology to the business sector, where there are more immediate and distinctive use cases emerging.

“In the Enterprise sector, it’s an entirely different story. Standalone 5G enables enterprises to set up their own, closed Private 5G networks, to better manage the connectivity in ultra-connected working set-ups, such as ports and mines – or even ‘slice’ the network for prioritized levels of service for mission-critical operations. The benefits, use cases and ROI are far clearer. But in selling Standalone 5G to consumers, operators are going to have to make sure they don’t repeat the same promises they spun out for non-standalone 5G, or risk appearing to contradict themselves.

The GlobalData report echoed one recently put forth by LightCounting, which tied the tepid deployment pace of 5G SA networks to the industry’s inability to produce compelling use and business cases.

The firm noted that ongoing “headwinds” have limited the deployment of 5G SA networks to just 20 at the end of last year. This was just 10% of the 200 5G non-standalone (NSA) commercial networks deployed worldwide.

Those headwinds are led by “the lack of 5G business cases beyond enhanced mobile broadband combined with some network architecture issues” that continue “to inhibit 5GC SBA [5G core service-based architecture] rollouts.”

“Communications service providers are just sweating their EPC/vEPC [evolved packet core/virtualized evolved packet core] assets, in such conditions, there is no rush to move to 5GC SBA,” the firm explained.

Here’s a simplified block diagram of 5G non-standalone vs 5G standalone networks:

References:

Intelsat and OneWeb partnership brings multi-orbit connectivity to airlines worldwide

UK backed satellite communications company OneWeb and U.S. based Intelsat have signed a global distribution partnership agreement to offer airlines a seamless inflight connectivity (IFC) solution with the best combination of performance, coverage and reliability on the market. The partnership enables Intelsat to distribute OneWeb’s ground-breaking low Earth orbit (LEO) satellite services to airlines worldwide, coupled with Intelsat’s extensive IFC experience and existing geo-stationary (GEO) satellite service. The result is a truly multi-orbit solution for the aviation community, leveraging the benefits of both networks.

By harnessing the power of multi-orbit capabilities, Intelsat will ensure airlines and their passengers are able to enjoy the best IFC, without compromise. Airlines and their passengers will no longer have to accept significant gaps in IFC coverage or capacity – even at busy hubs, across oceans and over polar routes. Intelsat will seamlessly manage connectivity, allowing passengers to remain connected no matter where they are. The companies expect the multi-orbit solution to be in service by 2024.

“This level of connectivity will enable airlines to maximise brand affiliation with passengers through all their onboard services – delivering a truly connected end-to-end passenger journey,” said Jeff Sare, Intelsat’s President, Commercial Aviation. “The hybrid service offering further allows the global airline community to plan their suite of next-generation onboard services with confidence – not only ensuring a future-proofed passenger inflight connectivity experience, but also the implementation of a connected airline digitalisation strategy.”

“This is a watershed moment for the inflight connectivity market, and we’re excited to work together with Intelsat to bring our multi-orbit solution to commercial aviation. We’re committed to delivering the most differentiated and innovative solution for airlines,” said Ben Griffin, OneWeb Vice President, Mobility Services. “We are proving that, through the power of partnership, a superior suite of multi-orbit capabilities can be offered to better serve the growing connectivity needs of the commercial aviation industry, delivering the highest value coupled with the lowest risk.”

Intelsat and OneWeb have previous history: in 2015, Intelsat engaged in a $500 million round of funding in the then satellite communications startup. Much has changed since that time, with both satellite providers subsequently filing for bankruptcy. OneWeb emerged from Chapter 11 bankruptcy in 2020, while Intelsat only formally emerged from its bankruptcy earlier in 2022. Meanwhile, the two partners are also apparently pursuing mergers with other companies.

Telstra to build 3 new teleports for OneWeb in Southern Hemisphere

France’s Eutelsat nears deal to buy UK satellite internet company OneWeb

BT in new distribution partner agreement with OneWeb for LEO satellite connectivity

New developments from satellite internet companies challenging SpaceX and Amazon Kuiper

DNA has fastest 5G network in Finland

Finnish network operator DNA [1.] said it achieved the highest average 5G download speed in seven out of eight cities measured in Omnitele’s latest benchmark of local mobile networks. Speeds were compared in Helsinki, Espoo, Vantaa, Tampere, Turku, Jyvaskyla, Lahti and Pori. All of those cities showed a generally high level of performance due to the expansion of DNA’s 5G network.

Note 1. DNA Oyj (DNA Plc) is a Finnish telecommunications group that provides voice, data and TV services. In December 2020, it had over 3.5 million subscription customers.

………………………………………………………………………………………………………………………………………………..

DNA achieved average scores over 30 percent faster than its nearest competitor in Helsinki, Espoo and Vantaa, and its lead was even greater in Lahti, at over 50 percent faster.

Across all the measurements, DNA had the highest speed, at 588 Mbps, followed by Elisa with 460 Mbps and Telia at 413 Mbps. The research was conducted in June and July 2022.

DNA says, “With the DNA Koti 5G connection, you get guaranteed fast internet and congestion-free access to your Nettikaista turnkey installation. Our installer brings all the equipment with him, installs the external receiver and ensures that the 5G internet works.”

DNA’s 5G network already covers half of Finns – and the network is expanding to new areas all the time. In a study conducted by Omnitele, the average download speed of DNA’s mobile network was the highest in the cities : Helsinki, Espoo, Vantaa, Lahti, Pori, Turku and Tampere.

References:

https://www.dna.fi/5g-liittymat

https://www.telecompaper.com/news/dna-claims-fastest-mobile-network-in-finnish-cities–1433913

The rebirth of Google Fiber?

After a long pause on network expansions and reducing some of its original commitments in 2016 (including Santa Clara, CA), Google Fiber has once again building out it fiber network. Google Fiber CEO Dinni Jain [1.] wrote in a recent blog post:

“We’ve been steadily building out our network in all of our cities and surrounding regions, from North Carolina to Utah. We’re connecting customers in West Des Moines – making Iowa our first new state in five years – and will soon start construction in neighboring Des Moines. And of course, we recently announced that we’ll build a network in Mesa, Arizona.

And that’s just the stuff we’ve been talking about. For the past several years, we’ve been even busier behind the scenes, focusing on our vision of providing the best possible gigabit internet service to our customers through relentless refinements to our service delivery and products.”

Note 1. Dinni Jain is a former cable industry executive with MSO’s such as Time Warner Cable and Insight Communications,

Google Fiber says it’s talking to city leaders in the following states, with the objective of bringing Google Fiber’s fiber-to-the-home service to their communities:

- Arizona, starting in Mesa as announced in July

- Colorado

- Nebraska

- Nevada

- Idaho

Jain also opened the door to communities interested in building their own fiber networks, pointing to the municipal-focused model Google Fiber has established with cities such as Huntsville, Alabama, and West Des Moines. “We’ll continue to look for ways to support similar efforts,” wrote Jain, who took the helm of Google’s access business unit in 2018.

Google Fiber’s current high-end service provides 2 Gbit/s down by 1 Gbit/s up for $100 per month. Google Fiber has all but phased out its own managed IPTV service, but instead promotes several virtual multichannel video programming distribution (vMVPD) services, including DirecTV Stream, FuboTV, Sling TV and Google’s own YouTube TV.

Google Fiber’s current and planned network and service deployments using FTTP or Webpass, its fixed-wireless platform is depicted in the table below:

| Google Fiber Market | FTTP or Webpass |

| Atlanta, Georgia | FTTP |

| Austin, Texas | FTTP |

| Charlotte, North Carolina | FTTP |

| Chicago, Illinois | Webpass |

| Colorado | FTTP* |

| Denver, Colorado | Webpass |

| Des Moines, Iowa | FTTP |

| Huntsville, Alabama | FTTP |

| Idaho | FTTP* |

| Kansas City, Kansas and Missouri | FTTP |

| Miami, Florida | Webpass |

| Nebraska | FTTP* |

| Nevada | FTTP* |

| Nashville, Tennessee | FTTP |

| Oakland, California | Webpass |

| Orange County, California | FTTP |

| Provo, Utah | FTTP |

| Salt Lake City, Utah | FTTP |

| San Antonio, Texas | FTTP |

| San Diego, California | Webpass |

| San Francisco, California | Webpass |

| Seattle, Washington | Webpass |

| The Triangle, North Carolina | FTTP |

| *Google Fiber FTTP deployments coming to cities yet to be announced. (Source: Google Fiber) |

|

References:

https://fiber.googleblog.com/2022/08/whats-next-for-google-fiber.html

https://www.fiercetelecom.com/telecom/google-fiber-taps-former-twc-exec-jain-as-ceo

https://www.wired.com/2017/03/google-fiber-was-doomed-from-the-start/

Google Fiber drops 100Mb/s; Goes ‘All In’ on 1 Gig Internet Access

BT tests 4CC Carrier Aggregation over a standalone 5G network using Nokia equipment

BT announced Monday that it has successfully tested four component-carrier (4CC) carrier aggregation on a 5G Standalone (SA) network in commercial frequencies. Using EE’s live network, BT said it and Nokia were able to combine four low-band and mid-band radio channels in and 2 GHz and 3 GHz range. BT claims to be the first operator in Europe to achieve this feat, calling this particular demonstration of advanced carrier aggregation “a major leap forward” for the evolution of 5G. Carrier aggregation is seen as the key to achieving optimal data transmission speeds for 5G.

“As we migrate to a 5G standalone core network, this technology milestone is vital to giving our customers the best experience” commented Greg McCall, Managing Director of Service Platforms at BT.

Working in collaboration with Nokia, BT’s Networks team have successfully combined four low-band and mid-band radio channels, (2.1, 2.6, 3.4, 3.6 GHz), using Nokia’s 5G Radio Access Network technology in EE’s live network spectrum.

The trial was conducted in two stages; it was first performed in BT’s Radio Lab in Bristol, and then moved outdoors, onto a radio mast at BT’s Adastral Park in Suffolk, where the team successfully achieved 4CC on 5G SA radiating in EE’s regular radio spectrum. Not only is it the first time in Europe that a network operator has achieved 4CC on 5G SA using commercial spectrum, but it is also the first time it has been achieved outside of a lab in Europe.

Most 5G networks today are Non-Standalone (“NSA”), meaning 5G is supported by existing 4G infrastructure. 5G Carrier Aggregation (“CA”) over a standalone 5G network represents a major leap forward in the evolution of 5G infrastructure, effectively combining several transmission bands into one connection. Every new carrier added allows for higher capacity and speed directly to customer devices.

Greg McCall, Managing Director Service Platforms BT, commented: “Our trial with Nokia is another demonstration of building the most advanced network for our customers. 5G Standalone, coupled with edge compute, will unlock new opportunities for customers looking to develop new services. Furthermore, this technology showcases what’s possible for devices in the future in terms of supporting carrier aggregation, which is an important part of customer experience.”

“Carrier Aggregation (CA) means combining or aggregating several carriers within or across available frequency bands – referred to as component carriers – for achieving higher data rates. Each additional component carrier increases the available bandwidth and, therefore, improves throughput. In the case of carrier aggregating Frequency-Division Duplex (FDD) and Time-Division Duplex (TDD) spectrum together, this also enables a value-adding solution that “stretches” the site coverage area that can offer those higher data rates,” said Nokia.

Mark Atkinson, SVP, Radio Access Networks PLM, Nokia, commented: “We are once again delighted to be deepening our partnership with BT, supporting them with our industry-leading Carrier Aggregation technology for this trial. Nokia and BT have a long history in investing in cutting-edge technologies and this trial is another example of what our companies can achieve together.”

Greg McCall, managing director of service platforms at BT, said the test showcases demonstrates his company’s commitment to building out the most advanced mobile network.

“5G Standalone, coupled with edge compute, will unlock new opportunities for customers looking to develop new services,” said McCall.

In May, Australian mobile operator Optus, Nokia, and Samsung Electronics Australia announced a successful test of three-component-carrier (3CC) CA technology over a 5G SA network. At the time, Nokia noted its commitment to prioritize the development of 5G carrier aggregation across the sub-6 GHz 5G spectrum. At the time, Nokia used its latest commercial AirScale Baseband and radio portfolio over Optus’ commercial network. The trial combined the FDD band (2.1 GHz) with the TDD band (2.2 GHz + 3.5 GHz) using CA technology.

References:

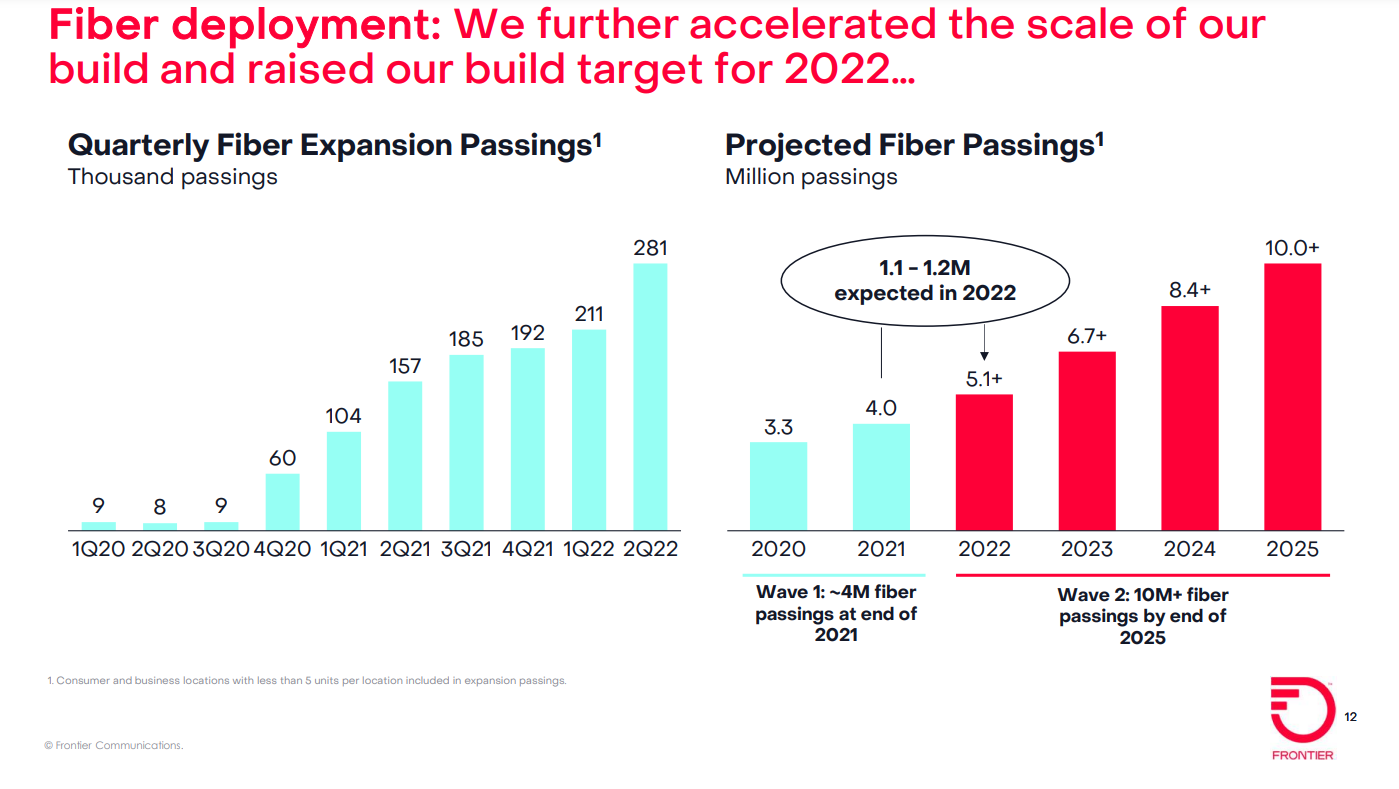

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

Frontier Communications reported better than expected 2nd quarter 2022 results on Friday. Operating income was $166 million and net income was $101 million for the 2nd quarter 2022. Adjusted EBITDA was $535 million, representing sequential growth of 5.1% from the first quarter of 2022, driven by the sequential increase in Consumer revenue, accelerating cost reductions, and a one-time $8 million sales tax refund. Adjusted EBITDA declined from $628 million in the second quarter of 2021 primarily due to subsidy-related revenue declines, partially offset by lower operating expenses and cost savings initiatives.

The fiber facilities based telco set another fiber network buildout record in the second quarter of 2022. Frontier also raised its fiber-to-the-premises (FTTP) buildout target for the full year to a range of 1.1 million to 1.2 million locations, up 10% to 20% from an earlier target of about 1 million locations.. Capital expenditures were $641 million, an increase from $385 million in the second quarter of 2021, as fiber expansion initiatives accelerated. Frontier’s fiber network passed 4.4 million locations (out of a total fiber footprint of 15 million locations covering parts of 25 states), a marker on the way to a grander plan to build FTTP to at least 10 million locations by 2025.

“Frontier is Building Gigabit America. We are deploying fiber and connecting people to the digital society at a record pace,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “We have the second-largest fiber build in the country and this expansion is unlocking new opportunities to meet increased consumer demand for blazing-fast fiber broadband while driving efficiencies across our business.”

Mr. Jeffery continued, “In the second quarter, we saw the impact of our operational success translate into financial growth, and we delivered sequential EBITDA growth ahead of schedule. Our team’s operational discipline over the last year has improved Frontier’s financial trajectory and positioned us as the preferred digital partner for customers across our footprint.”

Second-quarter 2022 Highlights:

- Built fiber to a record 281,000 locations

- Added 54,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 13.4% compared with the second quarter of 2021

- Revenue of $1.46 billion, net income of $101 million, and Adjusted EBITDA of $535 million

- Capital expenditures of $641 million, including $325 million of non-subsidy-related build capital expenditures

- Net cash from operations of $229 million, driven by healthy operating performance and increased focus on working capital management

- Raised $1.20 billion of debt in May, contributing to liquidity of approximately $3.70 billion

Frontier was able to accelerate its Q2 fiber buildout and expand its full 2022 target in the face of a “challenging supply chain and macroeconomic environment,” Jeffery said on the company’s Q2 earnings call on Friday August 5th. Jeffery noted that Frontier has diversified its fiber build into six additional states and plans to be building in at least 12 states by the end of the year. “This geographic diversity expands our opportunity to build fiber and provides redundancy for maintaining our build pace,” he said. Frontier is pairing that with additional contracts for both labor and equipment and realizing cost efficiencies using a blend of “cluster density” and new construction techniques – moves that are helping the company manage through both inflation and labor-related challenges, Jeffery added.

Frontier’s current FTTP buildout plan covering 10 million locations focuses on a portion of its footprint referred to as Wave 1 and Wave 2. The telco is also piecing together a plan for Wave 3 – a portion of its footprint with 5 million locations in rural areas deemed to be financially less attractive to build fiber.

However, Frontier execs said a fresh analysis indicates that between 1 million to 2 million of those Wave 3 locations can be converted to FTTP economically without government subsidies.

John Stratton, Frontier’s executive chairman, said the other 3 million to 4 million remaining locations in Wave 3 could also meet the company’s return-on-investment thresholds depending on how the distribution of some $42 billion in federal infrastructure funding pans out in the coming years. However, the overall funding plan for a Wave 3 build is still being ironed out. Frontier is also exploring other options for Wave 3, including partnerships and joint ventures.

As US cable operators and telcos struggled to gain broadband subs in Q2 2022, Frontier bucked the trend, adding 9,000 total broadband subs in the period when a loss of 41,000 legacy DSL/copper subs were included. Jeffery estimated that between 45% to 50% of all new Frontier fiber subs selected speeds of 1-Gig or more. Frontier launched a symmetrical 2-Gig fiber service in February.

Copper-to-fiber migrations are part of Frontier’s subscriber total, but the “vast majority” of those additions are coming from new customers, CFO Scott Beasley said.

“I think it’s clear to see from recent results that, as we’ve always said, fiber is a superior product to cable,” Jeffery said. “And while the cable and fiber market remains competitive, it’s also worth reminding ourselves that in our specific footprint, we have 84% of that where we have one or fewer competitors today. That said, in this quarter, we gained share against every competitor in every geography we operate in.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Comments from Nick Del Deo, Senior Analyst at MoffettNathanson:

Frontier’s overall results in Q2 were solid, particularly with respect to financial metrics. On the subscriber front, Frontier continues to expand its fiber broadband base, adding 54K total fiber broadband customers (consumer and business), the same as in Q1, with a nice uptick in SMB adds (1K in Q4, 2K in Q1, and 4K in Q2). Gains came from both base markets and expansion markets. Copper losses also ticked up, but the company still added broadband customers overall, the third consecutive quarter it has done so. The company achieved this despite Q2 seasonality (primarily snowbirds in its Florida markets) and churning out nonpaying copper customers with the expiration of COVID-era requirements. Frontier is not seeing any deterioration in bad debt or customer payment trends with shifts in the macro environment.

In Q2, the cable industry posted total broadband net adds that were approximately zero, the first time this has happened since cable broadband was introduced about 25 years ago. Frontier’s telco peers reported weak results, too, with little change in fiber adds and heightened DSL losses. The management teams pegged the performance, to varying degrees, on: low gross connects stemming from low move rates; a return of seasonality that disappeared during the pandemic (e.g., college students); competition, most notably from fixed wireless (though this was not uniformly described as material); a pull-forward of some demand due to COVID over the past couple of years; and disconnects associated with government support programs rolling off. [Rightly or wrongly, market saturation has not been cited as a possible headwind.]

Frontier has banked the future of the company on broadband net adds, with a plan to upgrade a large portion of its footprint to FTTH and take share, primarily from the cable operators. The accelerating growth of Frontier’s fiber footprint offers some protection from market-wide trends, since it should mechanically gain net subscribers where it upgrades from copper to fiber. But Frontier has something else going for it, too: an ongoing transition from a company with weak management, a poorly received brand (to be generous), bad customer service, and no strategic focus to the opposite. These “softer” attributes matter.

Frontier stepped up the pace of its fiber expansion in Q2, adding 281K locations vs. 211K last quarter, and expects to reach 1.1-1.2M homes this year. While it remains early, Frontier’s expansion fiber cohort penetration rates remain encouraging; the 2020 build cohort stands at 22% at 12 months and 44% at 24 months, albeit on a small base of “golden” trials, while its larger 2021 build cohort stands at 17% at 12 months, right in the middle of its target range. While acknowledging “pockets” of expense pressure, the company remains confident in its $900-1,000 cost per location target. Management indicated that it now believes 1-2M of its 5M wave three locations, which have been set aside from an upgrade perspective, can be profitably converted to fiber without government subsidies (the 3-4M latter require support). The company did not announce specific changes to its fiber build plans with this update, but did note that some of these locations may be sprinkled in to the plans it has previously laid out. Management suggested these 1-2M locations would have a somewhat lower return profile than its wave two locations, in mid-teens rather than mid-to-high-teens. Financial results in Q2 were better than expected. Revenue was 0.8% ahead of consensus, with the effects of sustained fiber net adds and a jump in copper broadband ARPU driving the outperformance. EBITDA was 4.7% higher than consensus and was up sequentially.

References:

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts