Author: Alan Weissberger

China Telecom, ZTE jointly build spatiotemporal cognitive network for digital transformation

ZTE Corporation and the Zhejiang Branch of China Telecom have jointly built a self-adaptive spatiotemporal cognitive network based on ZTE’s Radio Composer, improving dynamic user experiences in high-capacity scenarios. Under the collaboration with intelligent user navigation, the network solution matches network resources with traffic distribution more precisely and efficiently through on-demand elastic coverage of two-layer network, adapting to user group flow in space over different time periods.

The spatiotemporal cognitive network intelligently predicts traffic distribution in the first place. According to location change of user groups in different time periods within base station coverage, the network solution, by virtue of LSTM (long short-term memory) algorithms, performs in-depth study and prediction of traffic distribution on physical grid level and analyses the traffic space distribution trend in different periods.

Based on the traffic distribution trend in both time and frequency, the spatiotemporal cognitive network implements the intelligent carrier power scaling function through power sharing, to achieve flexible coverage adjustment. Below is an example of Traffic distribution of different periods in one area over time:

When the traffic loads within coverage of the two carriers are both high, the solution balances the two carriers with the same coverage to guarantee capacity. When the traffic loads within coverage of the two carriers differentiates obviously, the solution adjusts the coverage mode. It adopts high power to cover the high-load area and decreases power in the low-load area, therefore precisely matching radio resources to ensure user experiences.

The spatiotemporal cognitive network focuses on intelligent experience collaboration and establishes AI logic grid knowledge base of base stations, in order to further balance network efficiency and user experiences.

Moving forward, the Zhejiang Branch of China Telecom and ZTE will keep innovating together to provide superb network performance and boost digital transformation.

References:

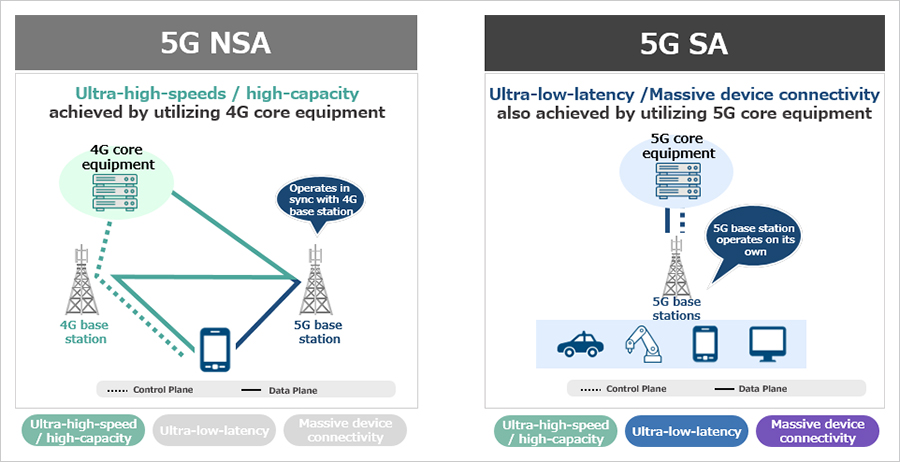

Softbank launches 5G MEC in Japan using its 5G SA core network

SoftBank announced that it has deployed a 5G Multi-access Edge Computing (MEC) site in the Kanto region of Japan. The multi-national conglomerate said it has started the nationwide deployment of MEC servers in Japan this month (May 2022). SoftBank claims its 5G MEC delivers a low-latency and secure service experience by using its 5G SA core network with compute servers at the network’s edge. The 5G MEC offering now makes it possible for customers to experience high-speed services through the deployment of applications close to user devices within the 5G SA network, which significantly reduces server access times.

SoftBank’s 5G MEC platform provides a Kubernetes-based container environment [1.] which is a de facto platform for application development. From physical infrastructure set-up to application deployment and distribution, 5G MEC sites are automated. Such features make applications on the 5G MEC platform more fault-tolerant, and they also enable faster service rollout with reduced complexity, improving a variety of industry services such as emergency notifications, in-building IoT-based network deployments, factory automation, multi-user network gaming and automated driving, among others.

Note 1. Kubernetes is a portable, extensible, open source platform for managing containerized workloads and services, that facilitates both declarative configuration and automation.

“This deployment of 5G MEC is a major milestone for SoftBank. Its compatibility with SRv6 MUP and network slicing, along with its automation of operation features, make it unique across the industry. With our partners, we’ll develop a multi-industry ecosystem to become a complete digital platform provider by harnessing the capabilities of our 5G MEC solution,” said Keiichi Makizono, SoftBank Corp. Senior Vice President and Chief Information Officer (CIO).

Source: GSMA

Source: Softbank

……………………………………………………………………………………………………………………………………………………………………………………………

Comments from partners supporting Softbank’s 5G MEC are as follows:

“SoftBank is committed to enabling the digital transformation of companies and organizations across all sectors, and we are honored to have been selected as a cloud partner in this aim. We share with SoftBank a vision where modern applications must integrate seamlessly with cloud operations to create exceptional end user experiences. We look forward to further enabling SoftBank to execute on this vision, for their cloud native customers’ use cases in and beyond 5G,” said Ankur Singla, SVP, Security & Distributed Cloud Product Group, F5. [F5 is a strategic partner for SoftBank that has worked jointly on strategic initiatives including SRv6 and 5G MEC, commented on 5G MEC].

“Corezero is excited to join SoftBank’s 5G MEC initiative. Corezero enables Logging-as-a-Service. Our flagship product FFWD is a real-time observability system built using cutting edge software to achieve true Ingest-Query-Separation, and Compute-Storage-Separation: an architecture type that best serves the modern high-volume log flows and query profiles in highly distributed cloud environments. We are looking forward to working with SoftBank to provide Logging-as-a-Service (LaaS) starting from their 5G MEC enhanced with low-cost programmability,” said Yee Soon, CEO, Corezero.

“Niantic has been working with SoftBank on promotions for our AR/location-based game titles, as well as network optimization at our live events, etc. We believe that SoftBank’s nationwide deployment of 5G MEC will open up new possibilities not only for our game titles but also for developers and creators who use Niantic Lightship ARDK, which will lead to the creation of an innovative AR experience from Japan to the world in the future,” said Setsuto Murai, President, Niantic Japan.

“Vantiq is excited to be part of SoftBank’s 5G MEC program, which is bringing significant value to the communications industry. The combination of SoftBank’s Digital Platform, which provides the necessary edge-computing infrastructure, and Vantiq’s real-time distributed processing capabilities, will help drive market innovation and disruption through the creation of mission-critical, ultra low-latency business applications,” said Marty Sprinzen, CEO, Vantiq.

“We are very excited about the Kubernetes (k8) container technology-based SoftBank 5G MEC roll out. MIXI is actively utilizing the k8-based container platform for future microservice based application development. By utilizing 5G MEC distributed all over Japan with a high affinity with mobile networking, we aim for further innovation in the sports entertainment area along with other futuristic applications,” said Junpei Yoshino, Chief General Manager, Development Operations, mixi, Inc.

“Yahoo! JAPAN is proactively trying to adopt new technologies to provide safe, secure, and comfortable services to a wide range of customers. Therefore, we are paying close attention to the expansion of SoftBank 5G MEC, which will enhance the possibility of our services by providing CSP infrastructure closer to our customers’ mobile devices with higher network reliability, significantly reduced processing speed, and ease of deployment through container infrastructure. We also expect MEC sites distributed around the world to be a powerful advantage when we, the content service providers, expand our business all over the world. We have high expectations for SoftBank to lead this important platform,” said Masahiko Kokubo, Director, EVP, Managing Corporate Officer, CTO, Yahoo Japan Corporation.

“The JCV face recognition platform is widely adopted at thousands of retail shops and entertainment venues. To provide customers with highly accurate AR experiences using spatial image recognition at commercial facilities and stadiums Real-time computing processing using SoftBank’s upcoming 5G MEC will enable us to provide our customers with increased accuracy and ultra-low latency. We are confident that, with SoftBank 5G MEC, this will fuel the creation of a metaverse platform linking online and offline,” said Andrew Schwabecher, CEO of Japan Computer Vision Corp.

“We are very much excited about SoftBank’s 5G MEC deployment which will play a vital role in realizing distributed computing necessary for advanced digital society. Using SRv6 for networking will make SoftBank’s 5G MEC even more optimal and easy to deploy at remote locations. By utilizing our regional Internet eXchanges (IX), BBIX with its valued partners will deliver the optimal network platform for the Digital Twin [2.] era,” said Hidetoshi Ikeda, Representative Director, President & CEO, BBIX, Inc.

- Note 2. Digital twin is a technology that collects information in real space via IoT, etc. and reproduces real space in cyber space based on the transmitted data.

- ……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

- Other Notes:

- In October 2021, SoftBank announced that it had started to offer 5G Standalone (SA) network services. With this new launch, SoftBank claimed to be the first carrier in Japan to offer 5G SA commercial services. At that time, the company said that the most important features of 5G SA networks are their ability to deliver network slicing and Private 5G networks, which are customized networks tailored to individual enterprise needs, and other connectivity features based on advanced technologies.

- Softbank had initially launched commercial 5G services in Japan through NSA architecture in March 2020.

- In April 2021, Softbank launched Japan’s first 5G global roaming service.

- According to Statistica, Softbank had a 20.8% share (# 3) of Japan’s mobile subscribers in 2021. NTT DoComo led with a 37% market share, while KDDI was in second place with a 27.2% market share.

- Softbank’s history is here.

References:

https://www.softbank.jp/en/corp/news/press/sbkk/2022/20220526_01/

https://www.softbank.jp/en/corp/news/press/sbkk/2021/20211019_01/

Broadcom confirms bid for VMware at a staggering $61 billion in cash and stock; “Cloud Native” reigns supreme

Broadcom has confirmed its plan to acquire VMware for USD 61 billion in cash and stock. VMware will become the new name of the Broadcom Software Group, with just under half the chipmaker’s revenues coming from software following completion of the takeover.

Building on its previous acquisitions of CA Technologies and the Symantec enterprise business, Broadcom will create a new division focused on enterprise infrastructure software and the VMware brand. A pioneer in virtualization technology, VMware has expanded to offer a wide range of cloud software, spanning application modernization, cloud management, cloud infrastructure, networking, security and anywhere workspaces. The company was spun off from Dell Technologies last year, regaining its own stock market listing.

VMware shareholders will have a choice of USD 142.50 cash or 0.2520 shares of Broadcom common stock for each VMware share. This is equal to a 44% premium on VMware’s share price the day before news of a possible deal broke. The cash and stock elements of the deal will each be capped at 50 percent, and Broadcom will also assume around USD 8 billion in VMware debt.

Michael Dell and Silver Lake, which own 40.2% and 10% of VMware shares respectively, have agreed already to support the deal, so long as the VMware Board continues to recommend the sale to Broadcom.

Broadcom has obtained commitments from banks for USD 32 billion in new debt financing for the takeover. The company pledged to maintain its dividend policy of paying out 50% of annual free cash flow to shareholders, as well as an investment-grade credit rating after the acquisition. Completion of the deal is expected to take at least a year, with a target of the end of Broadcom’s fiscal year in October 2023. VMware will have 40 days, until July 5th, to consider alternative offers.

The news was accompanied by the publication of quarterly results by the two companies. VMware reported revenues of USD 3.1 billion for the three months to April, up 3% from a year earlier, while net profit fell over the same period to USD 242 million from USD 425 million. Subscription and SaaS revenue was up 21%, leading to a subsequent fall in licensing revenue and higher costs for managing the transition to a SaaS model.

Over the same period, Broadcom revenues grew 23% to USD 8.1 billion, better than its forecast, and net profit jumped to USD 2.6 billion from USD 1.5 billion. Infrastructure software accounted for nearly USD 1.9 billion in revenue, up 5 percent year-on-year. With free cash flow at nearly USD 4.2 billion during the quarter and cash of USD 9.0 billion at the end of April, the company said it returned USD 4.5 billion to shareholders during the quarter in the form of dividends and buybacks. It also authorised a new share buyback program for up to USD 10 billion, valid until the end of December 2023.

The transaction is important to telecom network operators for a variety of reasons. Broadcom supplies some of the core chips for cable modems and other gadgets, including those that run Wi-Fi. Meanwhile, VMware is an active player in the burgeoning “cloud native” space, whereby network operators run their software in the cloud. Indeed, VMware supplies a core part of the cloud platform that Dish Network plans to use to run its forthcoming 5G network in the U.S.

In its press release, Broadcom explained the benefits of the transaction:

“By bringing together the complementary Broadcom Software portfolio with the leading VMware platform, the combined company will provide enterprise customers an expanded platform of critical infrastructure solutions to accelerate innovation and address the most complex information technology infrastructure needs. The combined solutions will enable customers, including leaders in all industry verticals, greater choice and flexibility to build, run, manage, connect and protect applications at scale across diversified, distributed environments, regardless of where they run: from the data center, to any cloud and to edge-computing. With the combined company’s shared focus on technology innovation and significant research and development expenditures, Broadcom will deliver compelling benefits for customers and partners.”

As Reuters reported, Broadcom doesn’t have a history of investing heavily in research and development, which could cast a cloud over VMware supporters hoping to use the company to navigate the tumultuous market for cloud networking. That is why the U.S. blocked Broadcom’s attempt to acquire Qualcomm in 2018.

“VMware should take heed of Symantec and CA Technologies’ experiences following their acquisition by Broadcom. CA Technologies reportedly saw a 40% reduction in U.S. headcount and employee termination costs were also high at Symantec,” analyst David Bicknell, with research and consulting firm GlobalData, said in a statement. “VMware currently has a strong reputation for its cybersecurity capability in safeguarding endpoints, workloads, and containers. Broadcom’s best shot at making this deal work is to let profitable VMware be VMware.”

References:

https://www.vmware.com/content/dam/digitalmarketing/vmware/en/pdf/company/vmware-broadcom.pdf

Cable companies big gains in wireless threaten incumbent cellular telcos

by Craig Moffett of MoffettNathanson (edited by Alan J Weissberger)

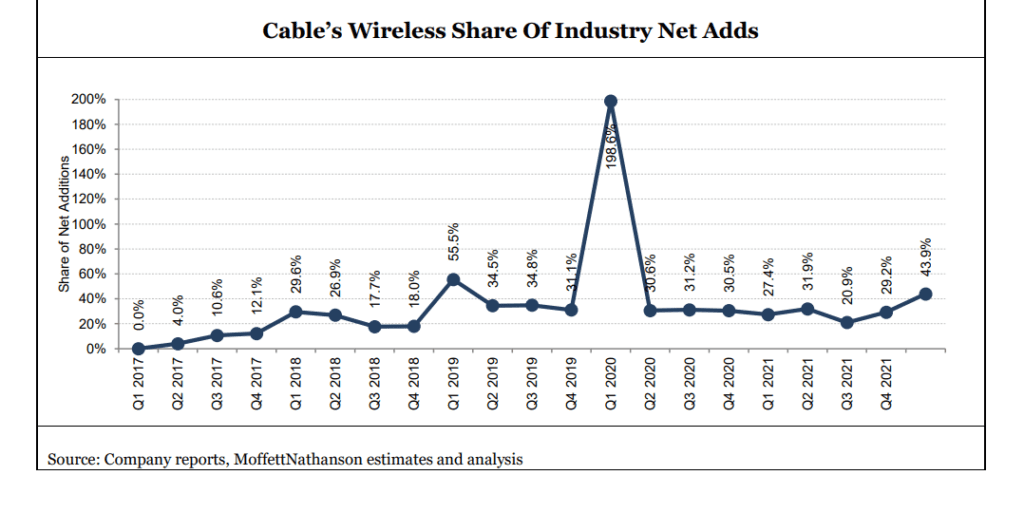

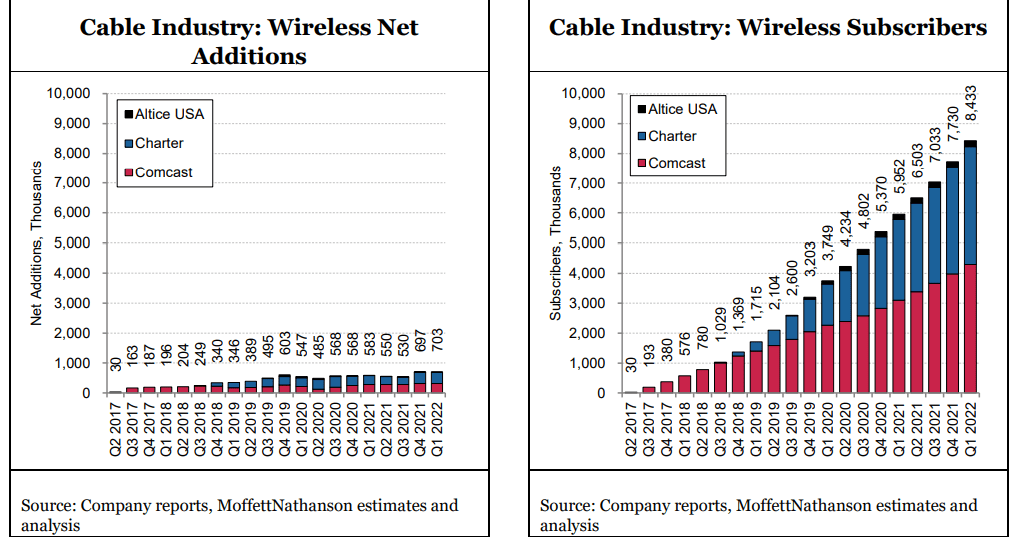

Cable company’s 98% share of the wireless industry subscriber growth in Q1-2022 is a little known fact. And that does not include the free WiFi they offer to their customers, e.g. Xfinity WiFi and CableWiFi® (created through a collaboration of U.S. Cable and Internet Service Providers including Cox Communications, Optimum, Spectrum, and XFINITY. It allows each other’s eligible Internet customers free access to a collective network of more than 500,000 WiFi hotspots across the nation).

Until Q1-2022, Cable’s gains were almost exclusively from Comcast and Charter. Altice has now renegotiated its contract with T-Mobile, and they have moved to pricing that is even more aggressive than Comcast and Charter. [Interestingly, Altice’s contract allows Altice to name T-Mobile in their advertising as the underlying network, a contract term we’ve not seen before.]

Cox Communications, the nation’s third largest cable operator, is poised to join Cable’s ranks in offering wireless service, as well. The company won a Delaware Supreme Court decision in March, reversing a lower court decision that had previously upended their launch plans by finding they were bound to launch using T-Mobile’s instead of Verizon’s network, even if doing so was under less favorable contract terms. [They have not yet announced precise timing for their expected wireless relaunch.]

The pending addition of a wireless offering from Cox, and the more aggressive posture from Altice, will certainly compound the pressure Cable is putting on cellular telcos (e.g. Verizon, AT&T, T-Mobile, US Cellular, etc).

Cable’s 703K combined net additions were their best ever, and they have grown their subscriber base to 8.4M customers incredibly quickly. But those 8.4M subscribers still represent less than 3% market share of the U.S. market. They have a very long runway ahead.

Cable has achieved these gains without offering handset subsidies, something that seems inevitable sometime before the end of the year (Cable’s originally-BYOD subscribers will eventually demand new devices). Handset subsides from Cable, if and when they come, will only put more pressure on the cellular telco incumbents.

It is through this lens that one must view Verizon’s attempt to lead the industry to higher pricing [1.]. Subscriber growth is slowing. Cable’s share gains are accelerating. Cable has made clear that they do not plan to increase pricing. Nor does the industry price leader, T-Mobile. And Cable’s promotionality is likely to increase. That is a very tough backdrop against which to assume that price increases will “stick.”

Note 1. Verizon’s price increase, which will drop directly to the bottom line, will increase Verizon’s

service revenue and EBITDA by roughly $750M over the balance of the year, and by approximately $1.5B for next year, neither of which was contemplated in their previous guidance.

After accounting for 3G terminations, AT&T’s growth fell to just 360K net additions, leaving T-Mobile once again the industry’s fastest growing cellular telco. Not only is T-Mobile taking the industry’s largest share of gross additions – the best measure of customer choice – their churn rate is falling faster than any in the industry, as well, as they complete the transition of Sprint subscribers to their T-Mobile Magenta network. T-Mobile’s falling churn rate starves the industry gross add pool of what had been a critical source of “supply.”

The company is now most of the way through their migration of Sprint customers, and they have repeatedly suggested that churn on their Magenta network is the lowest in the industry, suggesting that churn should continue to fall, even if at a slightly slower pace going forward.

Only T-Mobile is growing ARPU at the moment, as more customers opt for higher value plans (Magenta Max). In contrast to the positive ARPU trend at T-Mobile, ARPU growth has been negative for eight straight quarters at AT&T (with the moderation in the rate of decline in Q1 largely attributable to the aforementioned extension of customer lives, which reduced amortization of historical promotional subsidies, and an easier comp against the same period last year).

ARPU growth at Verizon is not only negative, it is accelerating downward. For Verizon to post both negative subscriber growth and ARPU growth is a shock, and it points to the challenge facing the industry in getting ARPU increases to stick. Absent their wholesale contract with Cable, Verizon’s anemic 1.5% service revenue growth would be close to zero.

Verizon’s price increase comes at a time when industry unit growth is slowing, and at a time when Cable’s market share gains are accelerating both at the gross addition and net addition level. Without broad industry buy-in, and with subscribers looking harder to come by, we find it unlikely that Verizon’s price increases – even if AT&T does initially follow – will “stick.”

If wireless industry growth continues to decelerate, and Cable’s growth rate remains high, Cable’s share of growth will remain elevated, and the wireless industry will increasingly resemble a zero sum game for the Big Three incumbents, where one player’s gain (T-Mobile’s) will necessarily be another’s (Verizon’s and AT&T’s) loss. Huge losses at Dish Network’s Boost unit, and losses at U.S. Cellular, have helped soften the blow, but they are only so big. The pressure of falling industry growth and falling market share unavoidably falls on the cellular telco incumbents.

References:

Wireless Q1 2022: The Elephant in the Room, MoffettNathanson report to clients

MEF survey reveals top SD-WAN and SASE challenges

The Metro Ethernet Forum (MEF) conducted a survey which showed that the top SD-WAN and SASE challenges are focused on coping with operating a multi-vendor environment. That’s to be expected since there are no standards for multi-vendor interoperability for either of those technologies. MEF surveyed 36 worldwide service provider experts to obtain its results.

The complexity of operating and managing multi-vendor SD-WAN, integrating security options and defining end-to-end service level agreements (SLAs) were the top three challenges.

The top Secure Access Service Edge (SASE) challenges focus more on education and standardization. The top challenges service providers face with SASE are the lack of industry standards, customer education and migration, vendors not offering a complete solution and operating in a multi-vendor environment.

MEF’s research also shows that both SD-WAN and SASE markets are on track to hit analyst expectations. “The global SD-WAN services market should hit double-digit revenue growth in 2022, while most providers who offered SASE in 2021 expect 50%-plus revenue growth in 2022 due to a significant uptick in rollout of SASE services and features,” MEF Principal Analyst Stan Hubbard told SDxCentral via email.

All service providers surveyed already have elements of a SASE offering or plan to introduce a SASE solution in 2022, according to this MEF survey.

“The top SD-WAN and SASE service provider challenges are in line with expectations for the different stages of these markets, On the SD-WAN front, one of the biggest aggravations for providers is the complexity of operating a multivendor environment, which is primarily due to the absence of interoperability among SD-WAN technology vendors. Providers have told us that their need to develop and maintain expertise on various SD-WAN vendor solutions increases skills and training burdens, creates operational inefficiencies, and adds costs. The situation is made worse today because the terminology, architectures, performance metrics, etc., of vendors differ since they do not all adhere to common standards,” Hubbard wrote.

“The SASE services market is in its very early days, confusing, and full of a host of challenges related to customer education, customer migration, lack of industry standards, the lack of complete SASE vendor solutions and more. Multiple service providers agreed the organizational challenge of integrating networking and security is ‘huge’ for customers migrating to a SASE solution. As a large service provider stated, “SASE will be a failure without organizational change” within both customers and service providers,” Hubbard added.

References:

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

57% of European homes can now get FTTH/B internet access; >50% growth forecast over next 5 years

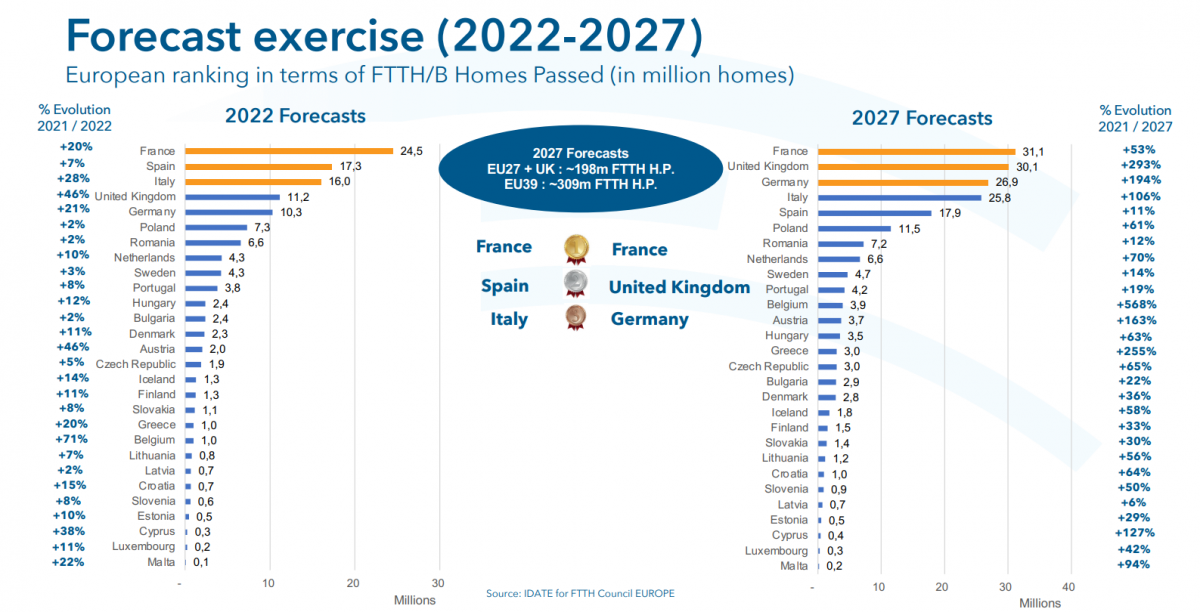

Europe has reached 200 million (M) homes that are now able to access FTTH/B services. That number is forecast to grow over 50 percent in the next five years, to more than 300 million homes passed, according to the latest research commissioned by the FTTH Council Europe. The new figures were released at its annual conference in Vienna, along with fiber subscriber numbers and research intro rural coverage.

The latest research by Idate for the council shows nearly 198.4 million homes were passed by FTTH or FTTB as of September 2021, up from 176.3 million a year earlier. The annual expansion was led by France (+4.3 M), the UK (+3.4 M), Germany (+2.4 M) and Italy (+1.5 M), all countries with a strong copper network footprint that previously held back fiber optic deployments.

The figures cover 39 countries across Europe and equal 57 percent of total households in the area, up by 4.5 percent points from a year earlier. In the 27 EU countries plus the UK, the coverage reached 48.5 percent of homes, up by 4.6 percent over the 12 months.

The number of subscribers on the fiber networks reached 96 million. The fastest growing markets in terms of new subscribers were France (+3.8 M), Spain (+1.2 M), Romania (+1 M), Italy (+820 K) and the UK (+765K). In total, 48.5 percent of households able to receive fibre services actually subscribed to the services, an increase of 3.6 percent in the network penetration rate. In the EU plus UK, take-up was at 52.4 percent, up 5.6 percent year-on-year.

Alternative operators still account for the majority of the FTTH/N coverage (57%), with incumbent operators taking 39 percent and 4 percent built by municipalities and utilities. Overall, there is a strong acceleration in fiber deployment, with a firm commitment to cover both urban and rural areas, the researchers said.

Idate also updated its five-year forecast for the FTTH/B market. It expects 199 million homes passed in 2027 in the EU+UK region and 309 million in the wider EU 39 region. Over the same period, the number of subscribers is expected to reach respectively 124 million and 190 million, equal to network penetration of over 62 percent in the EU and UK and more than 61 percent in the EU 39.

Further research shows that only 30 percent of rural inhabitants could enjoy fibre network access as of September 2021. Rural FTTH/B coverage is highest in Denmark (76%), Latvia (74%), Spain (66%), Romania (62%) and Luxembourg (55%). The report emphasized that immediate action should be oriented towards the rural regions, with increased public support through subsidies and partnerships to cover every European premise with high-speed broadband.

At the conference, the FTTH Council also announced several awards for contributions to the industry’s progress. UK wholesale operator CityFibre received the operator award; Jacek Wisniewski, CEO of Polish operator Nexera received the individual award; and Eurofiber CEO Alex Goldblum was winner of the Charles Kao award, named after the eponymous scientist who won a Nobel prize for physics for his research into fiber-optic communications.

References:

https://www.fibre-systems.com/news/europe-track-meet-connectivity-targets-rural-areas-gaining-focus

STC launches first 5G standalone (SA) core network in Bahrain via Huawei

STC Bahrain [1.] has announced the launch of the first 5G standalone (SA) core network in the kingdom using Huawei network equipment. This 5G SA network will enable new communication services for consumers and enterprises. Examples include high-resolution video, VR, AR, multimedia and online data communication.

The 5G standalone network will support the three ITU-R 5G Use Cases — enhanced mobile broadband (eMBB), ultra-reliable low latency communications (URLLC) and Massive Machine-Type Communications (mMTC) services. It will enable services in the public security, transportation, banking, consumer services, manufacturing, petroleum, port, healthcare and education sectors, among others.

5G SA supports multi-access edge computing (MEC) and uplink-centric broadband connectivity for both B2B and B2C services, STC said.

STC and Zain have deployed commercial 5G SA networks in Saudi Arabia, while STC has also launched 5G SA in Kuwait.

Note 1. STC Bahrain is a telecommunications service provider based in Bahrain. It is owned by the Saudi Telecom Company and started its commercial service in March 2010. The company is headquartered in Manama, Bahrain.

References:

http://www.abc-bahrain.com/News/1/334499

https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/05/GSMA_MENA_ME2022_R_WebSingles.pdf

Lumen: DDOS attacks on the rise with telcos accounting for 76% in 1Q-2022

Telecommunications companies continued to be key targets for distributed denial of service (DDoS) attacks in Q1 2022, as the number of attacks jumped 32% year on year, according to a new Lumen report. Of the top 500 largest attacks, the telecom industry accounted for a whopping 76%. That compares to just 9% of the biggest attacks in Q1 2021.

Key Findings:

- The number of DDoS attacks that Lumen scrubbed in Q1 2022 increased by 66% compared to Q4 2021, and by 32% compared to Q1 2021.

- Of the 500 largest attacks in Q1, 97% targeted the Telecommunications, Gaming, Software and Technology, Hosting, and Government verticals.

- Lumen protected one organization from more than 1,300 DDoS attacks – more than 20% of the total number of attacks scrubbed during the entire quarter.

- The same organization accounted for the largest bandwidth attack that has ever passed through Lumen’s scrubbing centers at 775 Gbps.

“Our first-quarter data shows just how important it is for businesses to maintain solid cyber defense strategies,” said Beth Kohler, senior director of Security Product Management for Lumen. “Anyone can be the target of a large attack at any time. Even a few minutes of downtime can cause serious damage to a company’s operations, revenue and reputation. Because the highly targeted customer uses Lumen’s Always-On DDoS Mitigation Service with Rapid Threat Defense, many attacks are blocked before they can do any damage. We can only imagine the harm these criminals could have caused to our customer (and their customers) had these attacks succeeded.”

Mark Dehus, director of threat intelligence for Lumen Black Lotus Labs, told Fierce the growing size of both the bandwidth and packet attacks is significant because such threats affect the network in different ways.

“Bandwidth per second can just overwhelm and flood a particular link or connection, especially if done in a certain way, such that nothing else can make it through that pipe,” he explained. “Instead of saturating the actual bandwidth that can be transmitted through the pipe, with packets per second you can overwhelm the gear that’s doing the processing itself.”

That includes things like CPUs and routers and other equipment tasked with helping maintain a firewall, Dehus said. “So, the continued growth we’re seeing on both fronts is alarming and concerning,” he added.

Other Findings:

- The largest packet rate-based attack scrubbed in Q1 was 127 Mpps, which was more than double what Lumen mitigated in Q4.

- The longest DDoS attack period Lumen mitigated for an individual customer in Q1 2022 lasted five days.

- Thirty two percent of all DDoS mitigations were single-vector, TCP SYN flooding attacks. This indicates that many actors are still relying on simple, tried-and-true attack methods.

- Multi-vector attacks seem to be the tactic of choice for the gaming and telecommunications sectors represented 38% of all DDoS mitigations.

References:

https://tinyurl.com/Q1DDoSReport

https://www.fiercetelecom.com/telecom/single-telecom-accounted-20-ddos-attacks-q1-lumen-finds

https://www.fiercetelecom.com/telecom/lumen-finds-a-third-largest-ddos-attacks-q3-targeted-telecoms

Viettel Group and Qualcomm collaborate on 5G Radio Unit with massive MIMO

Vietnam’s Viettel Group and Qualcomm Technologies, Inc. announced plans to collaborate and develop a next-generation 5G Radio Unit (RU) with massive MIMO capabilities and distributed units (DUs). This focuses on helping to expedite the development and roll-out of 5G network infrastructure and services in Vietnam and globally.

Using the Qualcomm® X100 5G RAN Accelerator Card and Massive MIMO Qualcomm® QRU100 5G RAN Platform combined with its own advanced hardware and software systems, Viettel expects to accelerate the development and commercialization of high-performance Open RAN massive MIMO solutions, which simplify network deployment and lower total cost of ownership (TCO).

Viettel is one of four global partners trusted and selected by Qualcomm to participate in the development and application of this new 5G chipset of Qualcomm. According to Qualcomm, the partnership will help advance the cellular ecosystem and accelerate the innovation cycle.

Present in 11 countries and territories, the digital services provided by Viettel serves a customer base of more than 270 million people worldwide from Asia, Africa and the Americas. Viettel has successfully tested 5G in 15 provinces and cities across Vietnam.

“Viettel has been a pioneer in adopting new telecommunications technologies including 5G. We are delighted to have Qualcomm Technologies as a key technology provider in our 5G gNodeB project,” said Nguyen Vu Ha, general director, Viettel High Technology. “This collaboration between Qualcomm Technologies and Viettel Group will be the cornerstone of Vietnam’s national strategy for Made in Vietnam 5G infrastructure.”

“Qualcomm Technologies, as a global technology leader in 5G, is looking forward to collaborating with Viettel for the development of Open RAN solutions that will establish the foundation for Vietnam’s next-generation of wireless networks,” said Durga Malladi, senior vice president and general manager, Cellular Modems and Infrastructure, Qualcomm Technologies, Inc.

About Viettel:

Viettel has built a large 4G telecommunications infrastructure covering 97% of Vietnam population and has become a pioneer in 5G adoption in Vietnam. Viettel’s 5G services are available in 16 cities and provinces in Vietnam to date. Viettel develops full network elements including Devices, Radio Access Network (RAN), Transmission Network, and Core Network which are forming a strong foundation for digital society.

About Qualcomm:

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering, research and development functions, and substantially all of our products and services businesses, including our QCT semiconductor business.

References:

https://viettel-com-vn.translate.goog/vi/?_x_tr_sl=vi&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

CELLSMART: 5G upload speeds are insufficient for industrial/enterprise applications

Research conducted by CELLSMART, a division of French managed services provider SmartCIC, has found that 5G upload speeds are in many cases insufficient to support data transfer for enterprise applications. The Global Cellular Performance Survey was based on independent field tests conducted by 2,536 telecoms network engineers in 51 countries to capture network performance data and then analyzed by the CELLSMART team.

The CELLSMART Global Cellular Performance Survey collects data from telecoms network engineers working in the field to provide an up-to-date snap shot of actual performance across cellular technologies. It is using the data it collects in its planning, network selection and service development and monitoring for fixed wireless enterprise customers.

Top 5 Metro Markets – 5G Average Download Speed

• Cannes (France)

• Munich (Germany)

• Nashville (US)

• Oslo (Norway)

• Singapore

“The research shows how MNOs have prioritized 5G download speeds in their initial rollouts and now there’s an opportunity to focus on enterprise demand for rapid upstream data transfer. 5G networks are showing upload speeds that are 13% of their download speeds while 4G has a balanced download/upload symmetry with 36%. Based on the research sample, we saw 5G delivering higher latency than 4G in some cases. This may be due to a number of the 5G tests being run on low-band networks. Where results have been taken in areas with mmWave, there are dramatically different results including downloads in excess of 800mbps, uploads in excess of 250mbps and latencies of sub 10ms,” said Toby Forman, CEO at SmartCIC.

For capturing network performance data, speed tests were run by 2,536 telecoms network engineers across 51 countries in 331 unique locations globally. Each engineer conducted the tests independently in the field and submitted result anonymously between March 25, 2022 and May 6, 2022. Data samples were collected from Africa, Asia, Australia, the Americas and Europe. The CELLSMART team did the data analysis.

Top 5 Mobile Network Operators – Maximum Download Speeds (All Technologies)

• du (UAE)

• Telia (Sweden)

• Deutsche Telekom (Germany)

• EE (UK)

• Singtel (Singapore)

However, upload speeds were on average only 31.27 Mbps – just 55% better than the 4G global average.

“We went out to our global network of 25,000 engineers and asked them to log network performance wherever they were operating. Over time, as we see more results added to our database and we’ll be able to provide an accurate and evolving snapshot of how cellular technologies are performing in the field. This initial cut of data is just the start of the process. As we begin to see greater density of results globally we will those into insights for our customers and the broader market,” said Forman. “We did this because this information simply didn’t exist on a global scale and we believe the market needs intelligent cellular solutions,” he added.

References: