Author: Alan Weissberger

Ericsson: 660 million global 5G subscriptions at end of 2021 (?)

In its new Mobility Report, Ericsson has updated its forecast for 5G subscribers at the end of 2021, to a total of close to 660 million. The increase is due to stronger-than-expected demand in China and North America (?), driven in part by falling prices for 5G devices. Ericsson forecasts 5G to become the dominant mobile technology by 2027.

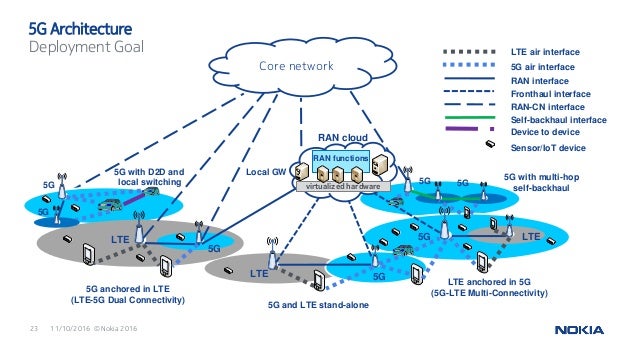

Opinion: For that to happen, this author believes many of the unfinished parts of 5G must be completely standardized and proven in the field. That list includes: URLLC in the RAN, URLLC in the core network, 5G SA core network, 5G security, reduction of very high 5G power consumption, deployment of hundreds of thousands of small cells, frequency arrangements for terrestrial (ITU-R M.1036 revision), industrial and consumer use cases, fiber optics and LEO satellite backhaul, etc.

………………………………………………………………………………………………………….

In Q3 2021, nearly twice as many 5G subscriptions were added around the world as new 4G connections, at respectively 98 million and 48 million. Ericsson expects that 5G networks will cover more than 2 billion people by the end of this year.

Ericsson’s latest forecasts put 5G on track to become the dominant mobile access technology by 2027. 5G is expected to account for around 50 percent of all mobile subscriptions worldwide in 2027, covering 75 percent of the world’s population and carrying 62 percent of the global smartphone traffic by the same date.

Not to be forgotten, Ericsson says fixed wireless access (FWA) will provide broadband access for 800 million people by 2027.

Ericsson’s latest report also looks back on the past ten years of mobile networks. According to the research, around 5.5 billion smartphone users have joined the market in the past ten years, and mobile data traffic has increased almost 300-fold in the same period.

In Q3 2021 alone, there was more mobile data traffic than the entire period up until the end of 2016.

Note that Ericsson has tended to over-estimate total mobile subscriptions but under-estimate the uptake of newer technologies, especially in their early stages. This is shown in the table below:

Fredrik Jejdling, Head of Networks at Ericsson, wrote:

“Mobile communication has had an incredible impact on society and business over the last ten years. When we look ahead to 2027, mobile networks will be more integral than ever to how we interact, live and work. Our latest Ericsson Mobility Report shows that the pace of change is accelerating, with technology playing a crucial role.”

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

Global 5G subscriptions to hit 660 million this year – Ericsson

https://www.telecompaper.com/news/ericsson-upgrades-global-5g-subscriber-forecasts–1406019

Cowen Analysts: Telcos to lead FTTH buildout; total 82M homes to be passed by 2027

According to a new report titled Fiber to the Home: Navigating the Road to Gigabit America, a multi-sector by Cowen analysts, forecasts that telco fiber-to-the-home (FTTH) lines will pass 82 million American households by 2027, nearly double the 44 million households passed today. The four biggest U.S. wireline telcos (AT&T, Verizon, Frontier and Lumen) will account for the lion’s share of those deployments, together passing more than 71 million homes with fiber.

The Cowen report also projects that cable operators (cablecos or MSOs) will pass another 5 million homes with fiber lines over the next six years, largely because of Altice USA’s current big push in the New York metro area to match Verizon’s Fios rollout. Cable operators already pass about 5 million homes with fiber.

Overall, Cowen estimates that the US now has 50 million homes passed by fiber lines, with the telcos accounting for most of them. Here are a few other highlights from the report:

- Cowen expects state/federal funding of $130B for various broadband initiatives.

- That will close the digital divide and expand the addressable market for broadband access.

- FTTH will gain market share (compared to other fixed broadband access) to take ~70% of the net positive broadband subscriber adds by 2027.

- As a result, 35M FTTH subscribers (26% market share) are expected by 2027; up from 16M (14%) today.

- FTTH subs take speeds that are 54% faster than non-FTTH broadband subs.

- The increase in FTTH subs will lead to exciting next-gen home applications (not specified) and ARPU growth.

- FTTH subs have 13% higher ARPU compared to non-FTTH subs.

Large, midsized and small telcos will all participate in this massive fiber deployment, using FTTH to reverse nearly two decades of broadband market share losses to the cable industry, the Cowen analysts say. For instance, they project the nation’s biggest telcos will add a combined 7.7 million fiber subs over the next five years.

“The next few years will be historic in terms of telco FTTH upgrades, providing consumers speeds of 1 Gbit/s, closing the digital divide, expanding the total addressable market and achieving a ‘Gigabit America’,” the analysts wrote. “After years of hemorrhaging subscribers, we expect Big Telco to stem the tide of losses to Cable…”

However, the report does not say that telcos will be gaining broadband customers from cable operators. Instead, telcos will achieve broadband subscriber gains mainly by upgrading their own remaining 15 million DSL subs to FTTH.

“The cable decade of dominance of DSL-share stealing is over,” the analysts wrote, forecasting that the telcos will overtake the cable companies in broadband sub net gains by 2024. “Cable’s days of stealing DSL subs are over, though only losing modest share (DSL taking the brunt), as the focus will be on defense.”

The Cowen analysts expect cable’s broadband market share to drop very slightly from 61% today to 58% in 2027 while the telcos’ market share creeps up from 25% now to 27% in 2027.

“It’s far from doom-and-gloom for cable operators,” the analysts note. “With cable’s effective marketing plan and speed upgrades, the vast majority of subscriber losses will be from the 15 million DSL subscribers, not cable.”

The analysts expect fixed wireless access (FWA) to play a notable tole in the US broadband market by the middle of the decade, accounting for a small but increasing fraction of high-speed data customers throughout the 2020s. “FWA will establish a solid but niche foothold,” they wrote.

Cowen now expects U.S. service providers to add a collective 17 million broadband subs by 2027, enough to reach 97% penetration of occupied homes and 90% penetration of overall homes, up from 90% and 82% today. The analysts believe that broadband could achieve utility-like penetration levels of 98% or more, like wired phone service did at its peak last century.

All this fiber optic spending will be a boon for optical network equipment vendors. Specifically, the Cowen analysts single out Calix, Adtran, Ciena, Cisco, MasTec, Nokia and Juniper as likely beneficiaries.

The analysts also see potential for further market consolidation. Some scenarios they envision are Charter buying the Suddenlink portion of Altice USA’s footprint and Charter or Altice USA merging with T-Mobile to form a third converged player in the national market.

References:

Telcomp (Brazil): 5G infrastructure (cabling, antennas, small cells, etc) to be ~5x greater than 4G

A few weeks after the 5G auction in Brazil, the industry is calculating the energy demand required to implement this technology. The hope of the market and specialists, is to have a low-impact investment that provides greater efficiency – both in data exchange and in industrial procedures. The infrastructure required for companies to operate 5G – cabling and antennas, etc – should be around five times greater in comparison with 4G, says Luiz Henrique Barbosa da Silva, CEO of Telcomp (Brazilian Association of Competitive Telecom Service Providers). We assume that estimate is for the RAN – not the core network (5G SA core vs 4G EPC).

Vivo’s solar power plant (see photo below) in Quissamã, Rio de Janeiro – Deway Matos/Divulgação The 5G antennas are smaller than the ones currently used and have the average size of a shoe box, according to Conexis, an association that represents telecommunication companies. The number of antennas to be installed depends on different factors, including population density and geographical elements, such as the presence of tunnels and hills, explains Barbosa da Silva, of Telcomp. Spaces with very high population density need more towers.

Vivo’s solar power plant

Despite the need for a larger number of antennas, the network is gaining efficiency. “Imagine a dark room. You put a light in the center: that’s the 1G network. It covers the whole room, but to get good lighting, you need to increase the power. With 2G you put one more bulb in, and when we get to 5G, I have more bulbs on the ceiling, but they are lower wattage. And that is more efficient,” he says. Furthermore, the technology is able to transport data with more efficient energy consumption than 4G, says Marcelo Zuffo, professor at the Polytechnic School at USP (University of São Paulo). In terms of energy consumption, the implementation of the 5G structure does not generate a very different impact from 4G, says Fabro Steibel, executive director of ITS (Institute of Technology and Society). “If you think in terms of carbon [footprint], perhaps the impact is greater, since there is a new standard, a new mesh to be installed,” says Steilbel.

In addition to new antennas, different equipment will need to be installed from those used to operate the 4G frequency, since in Brazil a so-called “standalone” model has been defined for 5G. “We will use a new technology and have to replace equipment because, in theory, companies cannot take what they have today and adapt it to a higher speed. But this is always within the concept of energy efficiency,” says Marcos Ferrari, CEO of Conexis, which represents the operators Algar, Claro, Oi, Sercomtel, Tim and Vivo.

Gains from 5G are not expected to reach the entire population, say experts. “When we compare our investment with other infrastructure sectors, such as highways and airports, we see that it is clean. We are talking about running a robust cabling system in the country. In urban centers, you have to pierce sidewalks to pass a pipeline, but that does not compare to investments that cross, for example, a forest reserve,” he says.

Furthermore, there is an expectation of a reduction in energy waste when devices other than mobile phones are connected to 5G – such as equipment used in a productive plant or in agribusiness, which will allow, for example, activities such as more precise irrigation. Ferrari says it is still too early to have an exact estimate of the impact of energy consumption for the implementation of 5G, but says that operators have environmental commitments both from the point of view of the current technology and the technology to come. According to data from the entity, Claro, for example, one of the winners of the auction of the main bands of the network, has since 2017 a program that provides for the use of clean energy (solar, wind, hydroelectric and biogas) to fuel the company’s operations. With 58 plants and generating plants in states such as Bahia, Minas, Pará, Paraná, Santa Catarina, Rio and São Paulo, the initiative serves more than 50% of the existing antennas with renewable energy. Also according to Conexis data, Algar, which won a regional lot of the auction that covers the Minas Gerais triangle and parts of Mato Grosso do Sul and Goiás, has today 66% of energy consumed originated from renewable sources, with a goal of reaching 85% in 2022 and 95% by 2024.

Vivo is carbon-neutral in direct emissions and since last year has been expanding its distributed energy generation project, which includes the installation of 83 solar, hydro and biogas plants (19 of which are already in operation). The operator’s program will account for 89% of its consumption in low voltage, serving structures such as administrative buildings, base stations and data centers until 2022, when it should be completed.

TIM [1.] states that it intends to extend renewable energy generation to the 5G network when it is already in operation in the country – one of the objectives of the environmental layer of its ESG program (good social, governance and environmental practices) is to increase the ratio between renewable energy use and total energy use. The company has 38 renewable energy plants (including solar, hydroelectric and biogas generators) in operation and wants to reach 60 by the end of 2022.

“Embarking on a new technology is not only a matter of providing a faster Youtube. It is also something I can do with less cost, with industrial efficiency,” says Mario Girasole, vice president of Regulatory and Institutional Affairs of TIM.

For the president of Telcomp, Luiz Henrique Barbosa da Silva, the agenda of clean energy generation is also linked to other issues – for example, hardly companies whose projects are not sustainable will be able to raise funds. Besides the concern with the principles of ESG, a positive impact for companies is the improvement of economic results, he says. “Many operators have invested in renewable energy generation parks. But they are also big consumers. So investing in that is also financially a good business.”

Note 1. TIM started operations in Brazil in 1998 and consolidated ourselves as a national company in 2002, making us the first mobile operator to have a presence in all states of Brazil.

References:

Vodafone Idea to use 5Gi (ITU M.2150-LMLC) in trials

Vodafone Idea (Vi) is working with a “few companies” to prepare for trials using India’s own 5G standard 5Gi, which is included in ITU-R M.2150 as 5G Radio Interface Technology (RIT) for LMLC- Low Mobility Large Cell. The third largest telco in India said that once the telecom equipment is ready, it will conduct trials using the 5G LMLC technology.

“We are already working with a few companies. As and when the product is ready, we will be keen and will be doing trials and deploy accordingly” Jagbir Singh, chief technology officer (CTO) of Vi said on Friday. He didn’t divulge details of the partners are.

5Gi is currently being evaluated by India’s Telecommunication Engineering Center (TEC) for commercial adoption in India. Experts believe that 5Gi is a better option for setting up rural connectivity as it is cost-effective, improves spectral efficiency, and reduces spectrum wastage of up to 11 per cent compared to its global counterpart — the 3GPP approved 5G standard. However, existing telecom operators and equipment vendors are not in favor of adopting the local standard as they say 5Gi is yet to show any of these performance gains at a commercial scale.

Vodafone Idea has partnered with L&T Smart World and Communications, Athornet, Vizzbee Robotics, Tweek labs, Athonet, Nokia and Erricson to provide enterprise solutions. Arvind Nevatia, Chief Enterprise Officer, Vodafone Idea, also said that Vi will be looking to partner with other enterprises now that they have been granted a six month extension on 5G trials.

Vi has been allocated 26 GHz and 3.5 GHz spectrum in the mmWave band by the DoT, for 5G network trials and use cases. Vi has achieved peak speeds in excess of 1.5 Gbps on 3.5 GHz, more than 4.2 Gbps on 26 GHz and up to 9.8 Gbps on backhaul spectrum of E-bands.

Indian telcos, network equipment and chipset vendors along with handset have opposed the incorporation of 5Gi as a national standard citing compatibility issues with 3GPP’s global 5G standard, which has already been adopted globally for commercial live networks. Telcos had urged the Department of Telecom (DoT) and the TEC to merge 5Gi with 3GPP’s global 5G NR spec to achieve scale and bring down costs, but that has not happened yet.

“We follow the 3gpp standards (they are specs- not standards– and have no official standing) for the core network…along with the firewalls. We are going to ensure whatever we do for our IT and network platform specific for the core data protection policy in coordination with 3GPP. Network slicing ensures data protection for each enterprise…all customers are equally protected in terms of security,” he added.

On Friday, Vodafone Idea (Vi) demonstrated some of the 5G technology solutions and use cases as a part of its ongoing 5G trials on government allocated 5G spectrum in Pune, Maharashtra and Gujarat. These tests come at a time when the three rivals -Bharti Airtel, Reliance Jio. and Vi are trying to keep pace with each other in the race towards next generation technology.

Singh added that Vi has 30-35% fiber for backhaul for its wireless network, which it is increasing in urban areas. “5G will be a combination of fiber and E band.”

The company is now preparing to expand the scope of 5G trials and is in talks with its and is in talks with its existing customers and startups. Rival Airtel became the first telco to test 5G technology in the 700Mhz band on Thursday. The telco will be working with start-ups for more use cases.

“We were not aware that we will be getting an extension for trials till 3-4 weeks back. We were not doing that on a very high intensity basis, but now with the clarity we will restart the process of engagement,” Arvind Nevatia, Chief enterprise business officer, Vi.

The telco highlighted new revenue models, as a result of 5G. “What we are seeing is evolving models from fixed commission basis to subscription models whether it is in the consumer space or the SAAS space , a lot of new revenue models are emerging in the country…. ,” said Nevatia.

However, prices of 5G have been a contentious issue between the sector and the government. Chief regulatory officer P Balaji said the decision will be taken by the government, which is setting up the auction process process including consultation on prices with the regulator.

“We see Vodafone Idea as an active partner in the digital vision of the government and as India develops its own 5G plans , we will be happy to participate”, said Balaji.

The current base price of Rs 492 crore for a unit of 5G spectrum in the 3.3-3.6 GHz band has been deemed too expensive by all three Indian telcos.

Many experts believe that adoption of the ITU-R M.2150 5Gi standard in India by the government will enable India to leap-frog in the 5G space, with key innovations introduced by Indian entities accepted as part of global wireless standards for the first time. The nation stands to gain enormously both in achieving the required 5G penetration in rural and urban areas as well as in nurturing the nascent Indian R&D ecosystem to make global impact. TSDSI’s efforts are aligned with the national digital communication policy that promotes innovation, equipment design and manufacturing out of India for the world market. The TSDSI 5G standard also has the potential to make a significant impact in several countries with poor rural broadband wireless coverage. TSDSI remains committed to the development of globally harmonized 5G standards with substantial innovations to address hitherto neglected needs of countries such as India. TSDSI-RIT is a step in the right direction so that our indigenous technologies for rural coverage and connectivity find their rightful place in the 5G eco-system that will be deployed in India and elsewhere.

Vodafone evaluating wind-powered mobile masts for remote area connectivity

UK based network operator Vodafone is examining one solution for connecting remote areas which use mobile masts that power themselves. Vodafone has been working with a company called Crossflow Energy, which has a very interesting clean technology called Transverse Axis Wind Turbines. The turbines look more like something you’d find on a paddle steamer, but they’re apparently more efficient and reliable than regular ones. Vodafone’s plan is to use them, in combination with solar and battery technologies to make self-powering masts.

Vodafone has developed self-powered cell towers and aims to deploy them across the UK. This is the latest part of its plan to expand its reach and offer new services while reducing energy consumption in its future networks, supporting its target of achieving net-zero for UK operations by 2027.

Vodafone regards the adoption of technologies such as the self-powered site as essential to meeting its energy-saving ambitions. As well as reducing Vodafone’s energy consumption, self-powered sites remove the need to connect to the electricity grid, overcoming what the operator says can be an insurmountable civil engineering challenge when building new sites in the most rural parts of the UK.

Other potential benefits of the Eco-Towers cited by Vodafone include: the use of locally generated renewable power to reduce the environmental impact of the site; increased renewable contribution by combining wind and solar with battery storage systems on site, which could remove reliance on diesel generators for back-up power; the quiet, bird-friendly turbine could make the Eco-Tower viable for the most sensitive of sites, including areas of outstanding natural beauty; and on-site power generation that is independent from the electricity grid may improve security of supply.

“We are committed to improving rural connectivity, but this comes with some very significant challenges,” said Andrea Dona, chief network officer at Vodafone UK. “Connecting masts to the energy grid can be a major barrier to delivering this objective, so making these sites self-sufficient is a huge step forward for us and for the mobile industry.

“Our approach to managing our network as responsibly as possible is very simple: we put sustainability at the heart of every decision. There is no silver bullet to reducing energy consumption, but each of these steps forward takes us closer to achieving net-zero for our UK operations by 2027.”

Martin Barnes, CEO at Crossflow Energy, added: “We are really excited to be working with Vodafone. It’s a fantastic opportunity to show how our self-powered Eco-Tower solves the problem of harnessing ‘small wind’ to offer not just that all-important carbon reduction, but also significant commercial benefits.

“In the case of Vodafone, it will help to accelerate the expansion of rural connectivity, transform energy consumption patterns and deliver significant economic and carbon savings. Our turbine technology has equally strong applications for so many other industries, but to have such a high-profile player as Vodafone deploying our Eco-Tower is a major endorsement for us and our technology.”

https://www.computerweekly.com/news/252510074/Vodafone-announces-trial-of-self-powered-mobile-masts

https://telecoms.com/512340/vodafone-looks-into-wind-powered-mobile-masts/

https://www.capacitymedia.com/articles/3830223/vodafone-to-launch-self-powered-mobile-towers

Chile plans submarine cable to Antarctica

Infrastructure association Desarrollo País, Chile telecoms regulator Subtel and Magallanes region have signed an agreement on the deployment of a submarine cable between Antarctica and Chile. The agreement involves a market consultation process for the preparation of a technical, legal, economic, and financial feasibility study.

“As a government we are determined to carry out this enormous project and, in this way, contribute strategically to the concerns of the international community and to expand the development of scientific cooperation,” Chile transport and telecommunications minister Gloria Hutt said in a press release.

Earlier this year, Argentine company Silica Networks had also announced a US$ 2M investment for an Antarctic cable feasibility study that includes its subsidiaries in Brazil and Chile.

The deal paves the way for a market consultation process on the future preparation of a technical, legal, economic and financial feasibility study, said Subtel, adding that the proposed route would cover a distance of around 1,000 kilometers from Puerto Williams to King George Island.

According to Subtel, Chile’s existing infrastructure in Puerto Williams on the Tierra del Fuego archipelago gives it a clear advantage over other continents, in that the facilities already available at the corresponding landing station provide a unique opportunity for the deployment of an undersea fibre-optic cable across the Southern Ocean.

The infrastructure is part of the country’s ‘Fibra Optica Austral‘ backbone project to roll out nearly 4,622 km of fiber-optic infrastructure in the Patagonia region, allowing the construction of a high-capacity digital channel for the development of all types of activities in Antarctica.

In October 2020, Subtel announced that local operator Entel had successfully connected the town of Puerto Williams in the far south of the country to the Fibra Optica Austral (FOA) fiber optic system. Hundreds of inhabitants in the digitally isolated locality in the Tierra del Fuego archipelago can now access reliable mobile broadband services for the first time thanks to the public-private initiative between the operator and Subtel.

The aim of the FOA project is to boost telecommunications for the 300,000 Chileans who live in the underserved Patagonia region, bringing much-needed economic, tourism and trade benefits to around 30 percent of the Chilean territory. A 3,000km submarine cable is being rolled out from Puerto Montt to Puerto Williams with landings at Caleta Tortel and Punta Arenas plus a land-based stretch from Puerto Natales to Porvenir in Magallanes.

Puerto Williams is the second town to be connected to FOA after a 4G base station was activated in Caleta Tortel in the Aysen region earlier this year.

References:

https://www.bnamericas.com/en/news/chile-plans-submarine-cable-to-antarctica

https://www.telecompaper.com/news/chile-consults-on-first-undersea-cable-to-antarctica–1405703

Hyperscalers Outpace Network Operators in Private 5G

Microsoft is the most innovative private network provider globally, according to enterprises already using a private LTE and 5G network, finds a new study from Omdia.

AT&T and Deutsche Telekom are also singled out as industry pace setters, according to Omdia’s latest Private LTE and 5G Networks research which surveyed enterprises globally. Two thirds of enterprises require private network suppliers to demonstrate integration with their existing cloud platform before they will buy. Similar demands apply to enterprises’ IoT and application management platforms.

“Enterprises have needs beyond connectivity when they buy a private network,” advises Omdia principal analyst for Private Networks Pablo Tomasi. “The top two reasons enterprises invest in private networks are better security and digital transformation. They need partners that can service those needs. Telcos may lose out if they don’t step up.”

Enterprises also want these results to be achieved promptly. 55% of enterprises expect a two-year return on their private network investment, but almost a fifth of those already deployed expect ROI in only a year.

Consumption preferences are changing fast: three quarters of enterprises now planning a private network prefer a hybrid model instead of the fully dedicated private networks that dominate 70% of deployments today.

The findings are from an annual survey conducted by Omdia on enterprises using, trialling, or planning to deploy private LTE and 5G networks in six key verticals, part of the Private Networks Intelligence Service. A total of 451 respondents from seven countries participated in the survey.

Full analysis of the survey is available in Omdia’s Private LTE and 5G Network Enterprise Survey Insight – 2021 report.

………………………………………………………………………………………………………………….

What is Private Wireless?

One of the challenges with the private wireless concept is that it is not a specific technology but rather more of a broad term encompassing a wide range of technologies. Marketing departments will have some wiggle room, as the meaning of private wireless varies significantly across the ecosystem.

Some Wi-Fi suppliers, for example, believe they provide private wireless connectivity to enterprises. Smaller radio access network (RAN) suppliers without macro footprints typically associate private wireless with dedicated standalone connectivity for enterprises, while some of the more established macros RAN suppliers envision private wireless as encompassing a broader set of technologies, including both macro and small cell networks.

Suppliers focused on mission-critical and public safety networks see private LTE and NR combined with a new spectrum as an opportunity to upgrade existing private narrowband communications equipment. With the number of LoRa end nodes surpassing 0.2 B, LoRa base station suppliers believe they are dominating the private wireless IoT market.

The operators are also positioning the concept differently, with some focusing on the benefits with broader coverage, while others are capitalizing on some of the new local concepts.

While definitions or interpretations vary widely on the part of both suppliers and operators, there appears to be a greater consensus among customers.

For end-users, private wireless typically means consistent, reliable, and secure connectivity, not accessible by the public, to foster efficiency improvements. For industrial sites, private wireless typically means low latency and high reliability. It is less about the underlying technology, spectrum, or business model and more about solving the connectivity challenge. In other words, end-users don’t care what is under the hood.

From a Dell’Oro perspective, we consider private wireless as nearly synonymous with 3GPP’s vision for NPNs. According to 3GPP, NPNs are intended for the sole use of a private entity, such as an enterprise. NPNs can be deployed in a variety of configurations, utilizing both virtual and physical elements located either close to or far away from the site. NPNs might be offered as a network slice of a Public Land Mobile Network (PLMN), be hosted by a PLMN, or be deployed as completely standalone networks.

From an end-user perspective, private wireless is also a broader term, generally including not just the RAN but also transport, mobile core network (MCN), Multi-Access Edge Computing (MEC), and corresponding services.

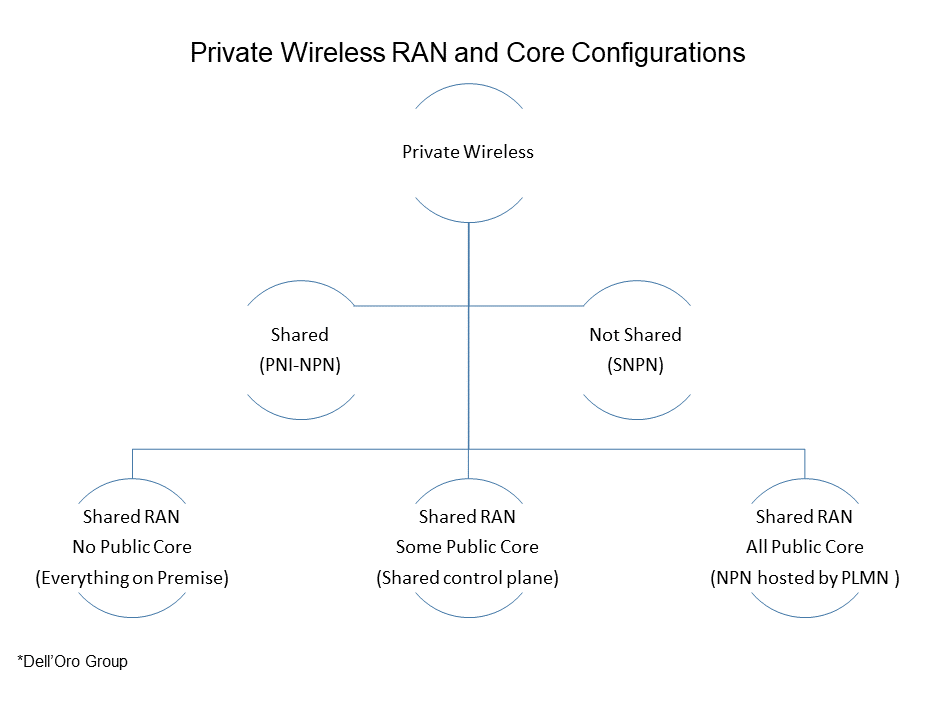

Private Wireless RAN and Core Configurations

There is no one-size-fits-all when it comes to private wireless. We are likely looking at hundreds of deployment options available when we consider all the possible RAN, Core, and MEC technology, architectures, business, and spectrum models.

At a high level, there are two main private wireless deployment configurations, Shared (between public and private) and Not Shared:

- The shared configuration, also known as Public Network Integrated-NPN (PNI-NPN), shares the resources between the private and public networks.

- Not Shared, also known as Standalone NPN (SNPN), reflects dedicated on-premises RAN and core resources. No network functions are shared with the Public Land Mobile Network (PLMN).

Market Status

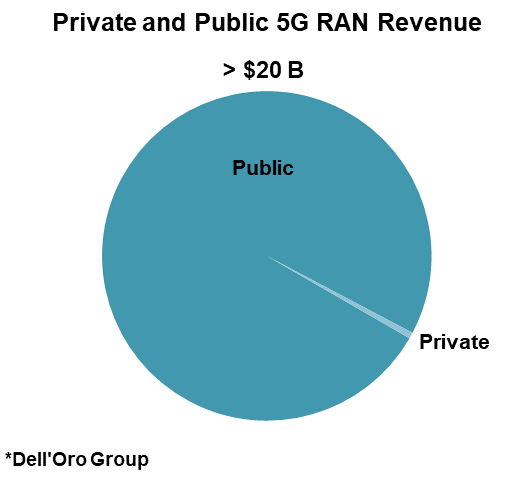

Preliminary 3Q21 estimates suggest the high-level trends remain unchanged with MBB and FWA dominating the 5G capex while private RAN revenues remain small —leading RAN vendors are reporting that private 5G revenues are still negligible relative to the overall public and private 5G RAN market.

Meanwhile, private wireless activity using both macro and local base stations is rising:

- Huawei estimates there are now around 10 K 5G B2B projects globally and the supplier is engaged in thousands of trials focusing on various 5G private use cases.

- Ericsson is currently involved in hundreds of private wireless customer engagements, including pilots with time-critical use cases.

- Even though Nokia’s enterprise business declined year-over-year in 3Q21, Nokia’s private wireless segment continued to gain momentum in the quarter–Nokia now has 380+ private wireless customers.

- ZTE has developed more than 500 cooperative partners in 15 industries, including industrial engineering, transportation, and energy. They have jointly explored 86 innovative 5G application scenarios and successfully carried out more than 60 demonstration projects worldwide supporting multiple 5G IoT use cases.

- Federated Wireless, one of the leading CBRS SAS providers, is working on hundreds of CBRS-based private wireless trials in multiple vertical domains, including warehouse logistics, agriculture, distance learning, and retail applications.

Market Opportunity and Forecast

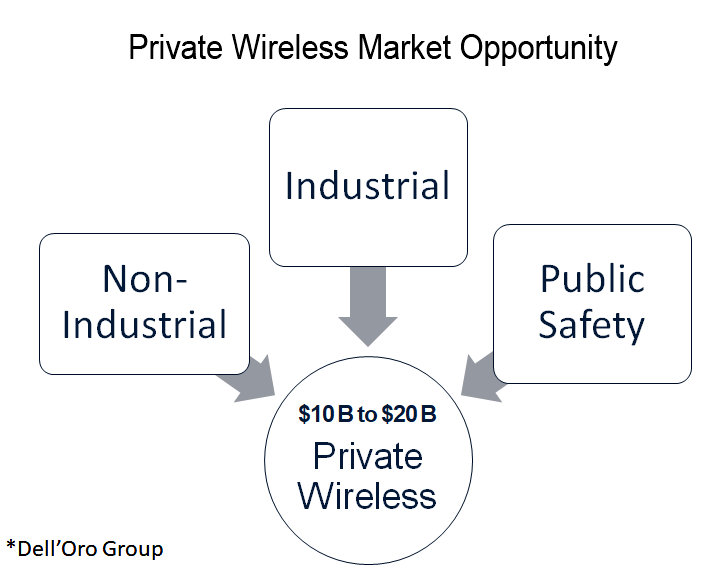

One of the more compelling aspects with private wireless is that we are talking about new revenue streams, incremental to the existing telco capex. More importantly, the TAM is large, approaching $10–20 B when we include Non-Industrial, Industrial, and Public Safety driven applications.

At the same time, it is important to separate the TAM from the forecast. Here at the Dell’Oro Group, we continue to believe that it will take some time for enterprises to fully conceptualize the value of 5G relative to Wi-Fi. And as much as we want 5G to be as easy to deploy and manage as Wi-Fi, the reality is that we are not yet there.

Still, the uptick in the activity adds confidence the industry is moving in the right direction. And although LTE is dominating the private wireless market today, private 5G NR revenues remain on track to surpass $1 B by 2025.

Bharti Airtel conducts 5G SA trial in 700 MHz band with Nokia

Indian network operator Bharti Airtel on Thursday said it has conducted India’s first 5G SA network trial [1.] in the 700 MHz spectrum band in partnership with Nokia. The demonstration was conducted on the outskirts of Kolkata. It also marked the first 5G trial in the eastern India, the company said in a statement.

Note 1. No 5G commercial service can commence in India till the government auctions 5G spectrum which is scheduled for in the second half of 2022. However, it has been delayed time after time after time. Airtel has been allotted test spectrum in multiple bands by India’s Department of Telecommunications for the validation of 5G technology and use cases.

Using the 700 MHz band, Airtel and Nokia were able to achieve high speed wireless broadband network coverage of 40 Km between two 5G sites in real life conditions. Airtel used equipment from Nokia’s 5G portfolio, which included Nokia AirScale radios and Standalone (SA) core network. [Nokia provides a common core network which supports the 4G – EPC and a 5G Core.]

Randeep Singh Sekhon, CTO – Bharti Airtel said: “Back in 2012, Airtel launched India’s first 4G service in Kolkata. Today, we are delighted conduct India’s first 5G demo in the coveted 700 MHz band in the city to showcase the power of this technology standard. We believe that with the right pricing of 5G spectrum in the upcoming auctions, India can unlock the digital dividend and build a truly connected society with broadband for all.”

Naresh Asija, VP and Head of Bharti CT, Nokia, said: “5G deployment using 700Mhz spectrum is helping communications service providers across the world to cost-effectively provide mobile broadband in remote areas, where typically it is challenging for them to set up the network infrastructure. Nokia is at the forefront in the development of the global 5G ecosystem, and we look forward to supporting Airtel on its 5G journey.”

Airtel says they are “spearheading 5G in India.” Earlier this year Airtel demonstrated India’s first 5G experience over a live 4G network. It also demonstrated India’s first rural 5G trial as well as the first cloud gaming experience on 5G. As part of #5GforBusiness, Airtel has joined forces with leading global consulting and technology companies and brands to test 5G based solutions.

About Airtel:

Headquartered in India, Airtel is a global communications solutions provider with over 480 Mn customers in 17 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India’s largest integrated communications solutions provider and the second largest mobile operator in Africa. Airtel’s retail portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1 Gbps with convergence across linear and on-demand entertainment, streaming services spanning music and video, digital payments and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cyber security, IoT, Ad Tech and cloud based communication.

For more details visit www.airtel.com

Nokia Contact:

Mohammed Shafeeq, Media Relations

Phone: +91 9167623398

E-mail: [email protected]

References:

Are China’s huge 5G numbers to be believed?

Disclosure:

Many experts believe you can not trust any economic numbers reported by China’s government. China has a long history of opaqueness when it comes to reporting economic statistics. Here’s a reference: https://www.heritage.org/international-economies/commentary/the-problem-false-chinese-economic-data

…………………………………………………………………………………………………………………………….

Summary:

Xie Cun, Director of China’s Information and Communication Development Department of the Ministry of Industry and Information Technology (MIIT), stated last week that China has built more than 1.15 million 5G base stations, accounting for more than 70% of the world.

Prefectural-level cities, more than 97% of counties and 40% of towns and towns have achieved 5G network coverage. China’s network operators report they have a total of 450 million 5G terminal users, accounting for 27% of all mobile subscribers in China and more than 80% of the world.

210 million 5G smartphones have been sold in China so far this year, up 69% over 2020 and representing nearly three-quarters of all handsets sold in China.

………………………………………………………………………………………………………………………….

Analysis:

The overarching factor in China’s spectacular 5G statistics is the role of the national government. In addition to its direct control of the three state owned network operators [1.], the CCP has ensured – through its high-profile national plans, the supportive Chinese media, and the now-ubiquitous enterprise party committees – that the entire industry is in sync with its prolific 5G ambitions.

Note 1. China Mobile, China Telecom and China Unicom are together allocating 185 billion yuan ($29 billion) for 5G capex this year alone. 5G plans are available at ultra-low prices, with China Mobile’s entry-level package around $12 a month.

According to the China telecom operators’ numbers, the total number of ‘5G package’ subscribers is 667 million – more than 50% higher than the number of actual 5G users. That’s because there are a tremendous number of 4G subscribers buying the bigger 5G packages.

Light Reading’s Robert Clark wrote:

The operators and the MIIT do not disclose the kind of meaningful network rollout data used by operators in the rest of the world, like percentage of population covered.

So we know nothing about the actual reach of China’s giant 5G project. Most likely, the two giant networks – China Mobile’s and the shared China Telecom-China Unicom network – each covers exactly the same population.

Which leads to the second problem – the distortions of a top-down plan driven by bureaucratic dynamics rather than market needs.

Major cities have rushed to offer rent and tax rebates to speed up rollouts and, of course, to catch the eye of their Beijing bosses.

According to Light Reading’s count, a year ago the wealthy cities of Shanghai, Beijing and Shenzhen accounted for nearly a third of the total 5G rollout.

That is why the MIIT’s new five-year plan makes a point of demanding that 5G be extended to 80% of all rural administrative villages by 2025. Currently, 5G is available in exactly 0% of them.

The other problem in this approach is the built-in irrational exuberance. Since launching 5G, the telcos have worked tirelessly to build out a portfolio of enterprise use cases, as anticipated by the national 5G plans. China Mobile, for one, has developed 470 enterprise apps and nine industry platforms.

But the operators are now tapping out, acknowledging the futility of developing thousands of customized applications, most of which they now admit are “showroom-only.” That’s without getting into the complexities of telco generalists trying to sell into highly specialized segments.

At first look, the scale of China’s government mandated 5G project seems quite impressive. However, in reality it’s a story of fake numbers, rapid rollouts and low subscriber prices.

…………………………………………………………………………………………………………………………………..

References:

https://www.finet.hk/newscenter/news_content/61944e4dbde0b33639732370

https://spectrum.ieee.org/how-america-can-prepare-to-live-in-chinas-5g-world

AT&T, Verizon Propose C Band Power Limits to Address FAA 5G Air Safety concerns

AT&T and Verizon said today that they would limit some of their 5G wireless services for six months while federal regulators review the signals’ effect on aircraft sensors, an effort to defuse a conflict about C band interference that has roiled both industries.

The cellphone carriers detailed the proposed limits Wednesday in a letter to the Federal Communications Commission (FCC). The companies said they would lower the signals’ cell-tower power levels nationwide and impose stricter power caps near airports and helipads, according to a copy reviewed by The Wall Street Journal. This comes after, both companies agreed to push back their 5G C band rollouts by an additional month to January 5, 2022 after the FAA issued a Nov. 2 bulletin warning that action may be needed to address the potential interference caused by the 5G deployment.

“While we remain confident that 5G poses no risk to air safety, we are also sensitive to the Federal Aviation Administration‘s desire for additional analysis of this issue,” the companies said in the letter to FCC Chairwoman Jessica Rosenworcel.

“Wireless carriers, including AT&T and Verizon, paid over $80 billion for C-band spectrum—and have committed to pay another $15 billion to satellite users for early access to those licenses—and made those investments in reliance on a set of technical ground rules that were expressly found by the FCC to protect other spectrum users.”

AT&T and Verizon said they had committed for six months to take “additional steps to minimize energy coming from 5G base stations – both nationwide and to an even greater degree around public airports and heliports,” and said that should address altimeter concerns.

Wireless industry officials have held frequent talks with FCC and FAA experts to discuss the interference claims and potential fixes, according to people familiar with the matter. An FCC spokesman said the agreed-upon limits “represent one of the most comprehensive efforts in the world to safeguard aviation technologies” and the agency will work with the FAA “so that 5G networks deploy both safely and swiftly.” Wireless groups argue that there have been no C-Band aviation safety issues in other countries using the spectrum.

Earlier this month, the Federal Aviation Administration (FAA) warned it could restrict U.S. airspace in bad weather if the networks were turned on as planned in December. The FAA warning came in the thick of cellphone carriers’ network upgrade projects. A spokesman for the FAA called the proposal “an important and encouraging step, and we are committed to continued constructive dialogue with all of the stakeholders.” The FAA believes that aviation and 5G service in the band telecom companies have planned to use can safely coexist, he said.

AT&T and Verizon said they would temporarily lower cell-tower power levels for their 5G wireless services nationwide.

Photo Credit: GEORGE FREY/AGENCE FRANCE-PRESSE/GETTY IMAGES

Wireless industry executives don’t expect the temporary limits to seriously impair the bandwidth they provide customers because networks already direct signals away from planes and airport tarmacs, according to another person familiar with the matter.

Still, the voluntary limits are a rare step for wireless companies that place a high value on the spectrum licenses they hold. U.S. carriers spent $81 billion to buy licenses for the 5G airwaves in question, known as the C-band, and spent $15 billion more to prepare them for service this winter.

The carriers earlier this month delayed their rollout plans until early January after FAA leaders raised concerns about the planned 5G service. Air-safety officials worried the new transmissions could confuse some radar altimeters, which aircraft use to measure their distance from the ground.

At an industry event last week, FAA Administrator Steve Dickson said conducting flights in a safe manner and tapping spectrum for 5G services can both occur. He said the question was how to “tailor both what we’re doing in aviation so that it dovetails with the use of this particular spectrum.” Mr. Dickson said another focus is the use of the spectrum in other parts of the world and how it differs compared with the U.S. “That’s what the discussions are that we’re having with the telecoms right now.”

U.S. wireless companies send 5G signals over lower frequencies than the altimeters, but air-safety officials worried that some especially sensitive sensors could still pick up cell-tower transmissions. Regulators in Canada and France have also imposed some temporary 5G limits.

The carriers’ letter said the mitigation measures would provide more time for technical analysis “without waiver of our legal rights associated with our substantial investments in these licenses.”

C-band limits are most relevant to AT&T and Verizon, which paid premiums to grab licenses for the new signals ready for use in December 2021. The companies still plan to launch their service, subject to the new limits, in January 2022. The proposed limits would extend to July 6, 2022 “unless credible evidence exists that real world interference would occur if the mitigations were relaxed.”

Rival carrier T-Mobile US Inc. is less vulnerable to delay because it spent a smaller amount for licenses that are eligible for use in December 2023. It also controls a swath of licenses suitable for 5G that aren’t subject to air-safety claims.

It’s not yet clear whether the proposal will be accepted by the FAA, which has warned pilots of the possibility that “interference from 5G transmitters and other technology could cause certain safety equipment to malfunction, requiring them to take mitigating action that could affect flight operations.” After July 6th, both carriers say they’ll set everything back to normal “unless credible evidence exists that real-world interference would occur if the mitigations were relaxed.”

“Our use of this spectrum will dramatically expand the reach and capabilities of the nation’s next-generation 5G networks, advancing US leadership, and bringing enormous benefits to consumers and the US economy,” Verizon and AT&T claimed in their joint letter sent to the FCC.

The federal agencies and the companies they oversee are meanwhile stuck in what New Street Research analyst Blair Levin called “a deep state game of chicken” guided by each regulator’s particular interest, with no clear path towards resolution.

References:

https://www.wsj.com/articles/at-t-verizon-propose-5g-limits-to-break-air-safety-standoff-11637778722

Analysis: FCC’s C band auction impact on U.S. wireless telcos