Author: Alan Weissberger

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

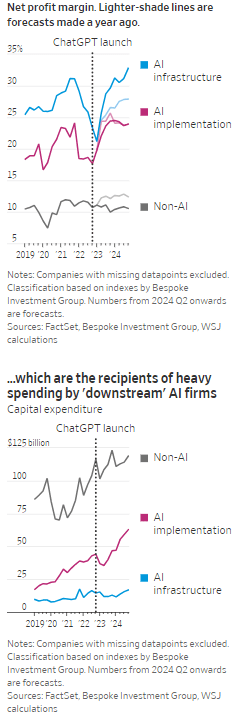

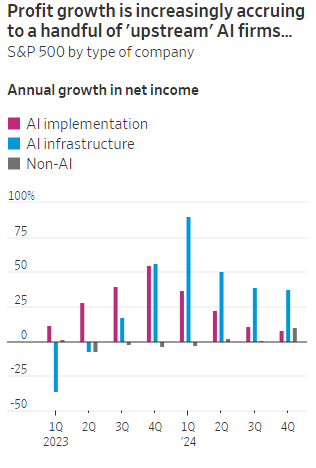

According to the Wall Street Journal, the AI industry has become an “Echo Chamber,” where huge capital spending by the AI infrastructure and application providers have fueled revenue and profit growth for everyone else. Market research firm Bespoke Investment Group has recently created baskets for “downstream” and “upstream” AI companies.

- The Downstream group involves “AI implementation,” which consist of firms that sell AI development tools, such as the large language models (LLMs) popularized by OpenAI’s ChatGPT since the end of 2022, or run products that can incorporate them. This includes Google/Alphabet, Microsoft, Amazon, Meta Platforms (FB), along with IBM, Adobe and Salesforce.

- Higher up the supply chain (Upstream group), are the “AI infrastructure” providers, which sell AI chips, applications, data centers and training software. The undisputed leader is Nvidia, which has seen its sales triple in a year, but it also includes other semiconductor companies, database developer Oracle and owners of data centers Equinix and Digital Realty.

The Upstream group of companies have posted profit margins that are far above what analysts expected a year ago. In the second quarter, and pending Nvidia’s results on Aug. 28th , Upstream AI members of the S&P 500 are set to have delivered a 50% annual increase in earnings. For the remainder of 2024, they will be increasingly responsible for the profit growth that Wall Street expects from the stock market—even accounting for Intel’s huge problems and restructuring.

It should be noted that the lines between the two groups can be blurry, particularly when it comes to giants such as Amazon, Microsoft and Alphabet, which provide both AI implementation (e.g. LLMs) and infrastructure: Their cloud-computing businesses are responsible for turning these companies into the early winners of the AI craze last year and reported breakneck growth during this latest earnings season. A crucial point is that it is their role as ultimate developers of AI applications that have led them to make super huge capital expenditures, which are responsible for the profit surge in the rest of the ecosystem. So there is a definite trickle down effect where the big tech players AI directed CAPEX is boosting revenue and profits for the companies down the supply chain.

As the path for monetizing this technology gets longer and harder, the benefits seem to be increasingly accruing to companies higher up in the supply chain. Meta Platforms Chief Executive Mark Zuckerberg recently said the company’s coming Llama 4 language model will require 10 times as much computing power to train as its predecessor. Were it not for AI, revenues for semiconductor firms would probably have fallen during the second quarter, rather than rise 18%, according to S&P Global.

………………………………………………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………………………………………………..

A paper written by researchers from the likes of Cambridge and Oxford uncovered that the large language models (LLMs) behind some of today’s most exciting AI apps may have been trained on “synthetic data” or data generated by other AI. This revelation raises ethical and quality concerns. If an AI model is trained primarily or even partially on synthetic data, it might produce outputs lacking human-generated content’s richness and reliability. It could be a case of the blind leading the blind, with AI models reinforcing the limitations or biases inherent in the synthetic data they were trained on.

In this paper, the team coined the phrase “model collapse,” claiming that training models this way will answer user prompts with low-quality outputs. The idea of “model collapse” suggests a sort of unraveling of the machine’s learning capabilities, where it fails to produce outputs with the informative or nuanced characteristics we expect. This poses a serious question for the future of AI development. If AI is increasingly trained on synthetic data, we risk creating echo chambers of misinformation or low-quality responses, leading to less helpful and potentially even misleading systems.

……………………………………………………………………………………………………………………………………………

In a recent working paper, Massachusetts Institute of Technology (MIT) economist Daron Acemoglu argued that AI’s knack for easy tasks has led to exaggerated predictions of its power to enhance productivity in hard jobs. Also, some of the new tasks created by AI may have negative social value (such as design of algorithms for online manipulation). Indeed, data from the Census Bureau show that only a small percentage of U.S. companies outside of the information and knowledge sectors are looking to make use of AI.

References:

https://deepgram.com/learn/the-ai-echo-chamber-model-collapse-synthetic-data-risks

https://economics.mit.edu/sites/default/files/2024-04/The%20Simple%20Macroeconomics%20of%20AI.pdf

AI wave stimulates big tech spending and strong profits, but for how long?

AI winner Nvidia faces competition with new super chip delayed

SK Telecom and Singtel partner to develop next-generation telco technologies using AI

Telecom and AI Status in the EU

Vodafone: GenAI overhyped, will spend $151M to enhance its chatbot with AI

Data infrastructure software: picks and shovels for AI; Hyperscaler CAPEX

KT and LG Electronics to cooperate on 6G technologies and standards, especially full-duplex communications

In a joint statement, KT (South Korea’s #2 mobile network operator) and LG Electronics will work together to promote 6G technology research and technology standardization. The two companies plan to develop full-duplex communication technology, global standardization cooperation (presumably in 3GPP and ITU-R WP5D for IMT-2030), and 6G application services and next-generation transmission technologies. The companies had previously announced partnerships to develop AI service platforms and AI service robots.

Full-duplex communications will be introduced as part of the 5G-Advanced Release 18 and is expected to increase spectrum efficiency by enabling uplink and downlink data to be simultaneously transmitted and received over a single frequency band. The companies said it can increase frequency efficiency by up to two times. They will design technologies that operate in the 6G candidate frequency bands and transmit and receive simultaneously to verify actual performance. The duo also plan to promote global standardization of 6G (that can only be done by ITU-R IMT-2030 recommendations).

“Through this 6G research and development collaboration with LG Electronics, KT expects to lead the development of 6G mobile communication technology and strengthen its global standardization leadership,” said Lee Jong-sik, executive director of KT Network Research Institute. “We will do our best to secure innovative network technology and capabilities for providing differentiated services.”

Je Young-ho, executive director of LG Electronics C&M Standard Research Institute added: “LG Electronics has been proactively leading research and development to discover core 6G technologies since 2019,” and added, “Through our collaboration with KT, we expect to contribute greatly to not only leading 6G standardization, but also discovering core services.”

…………………………………………………………………………………………………………………………………………………………………………………………………

Singtel and SK Telecom announced a partnership last month to collaborate on 6G research, including new network slicing capabilities, a fully disaggregated network, and new telco APIs based on Open Gateway. Earlier this year, Samsung and Arm began conducting joint research into parallel packet processing technology, which it described as one of the ‘key software technologies in next-generation communications’ to accelerate 6G software development, while Nvidia launched its 6G Research Cloud Platform, which includes a a digital twin that can simulate 6G systems, a software-defined, full RAN stack that researchers can play around with the Nvidia Sionna Neural Radio Framework which enables developers to use Nvidia GPUs to generate and capture training data.

…………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.koreaittimes.com/news/articleView.html?idxno=133845

https://www.telecoms.com/5g-6g/kt-and-lg-looking-to-take-the-lead-in-6g

https://news.koreaherald.com/view.php?ud=20210406000119

https://www.koreatimes.co.kr/www/tech/2024/06/129_334571.html

South Korea government fines mobile carriers $25M for exaggerating 5G speeds; KT says 5G vision not met

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

SK Telecom (SKT) and Nokia to work on AI assisted “fiber sensing”

SK Telecom (SKT) and Nokia have agreed to work on artificial intelligence (AI) assisted “fiber sensing,” a wired network technology that employs AI to monitor the environment around optical cables. The two companies signed a memorandum of understanding (see photo below) last Wednesday, with a plan to “accumulate empirical data based on machine learning” from SKT’s commercial network. SKT, South Korea’s largest mobile network carrier, said on Monday that it will utilize Nokia’s product to detect earthquakes, climate changes and other unexpected situations that might arise from nearby construction areas in order to stabilize network conditions. The objective is nationwide deployment in South Korea by the end of this year.

In a joint statement, the companies explained when data runs through an optical cable, the phase of the light can change due to various factors like temperature fluctuations or physical strain on the cable. The changes can be detected and analyzed to provide precise measurements of the environmental conditions affecting the fiber. Using AI-based technology, SKT and Nokia aim to stabilize fiber optic networks in advance by tracking the impact of weather conditions and construction on optical cables. The statement added “fiber sensing” has no distance limitations, unlike some existing wired network monitoring technologies, making it possible to quickly apply the new technology to major backbone networks.

SKT-Nokia monitors wired network status with AI:

– Tracking the impact of weather, earthquakes, construction, etc. on optical cables with ‘fiber sensing’ technology

– Immediately applicable to existing networks and no distance restrictions, making it easy to apply to backbone networks

– Both companies’ capabilities will be combined to quickly internalize new AI-based wired network technology

A signing ceremony for the memorandum of understanding took place at SK Telecom’s headquarters Wednesday in central Seoul. SK Telecom’s Ryu Jung-hwan, head of infrastructure strategy and technology, and John Harrington, Nokia’s senior vice president and head of network infrastructure sales for the Asia-Pacific region, attended the event.

SK Telecom’s Ryu Jung-hwan, head of infrastructure strategy and technology, right, and John Harrington, Nokia’s senior vice president and head of network infrastructure sales for the Asia-Pacific region, pose for a photo after a signing ceremony at SK Telecom’s headquarters in central Seoul on Wednesday, August 7th. Photo Credit: SK TELECOM

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

In July, SKT and Singtel announced that they have signed a Memorandum of Understanding (MoU) to collaborate on building next-generation telecommunications networks that will drive innovation, improve network performance and security and deliver enhanced customer experiences over the next two years. The partners will explore the use of artificial intelligence (AI), orchestration tools, and deepen the domain knowledge of network virtualization and other technologies – central to laying the necessary building blocks for progressing to 6G.

References:

https://www.linkedin.com/feed/update/urn:li:activity:7228552138988134402/

Cisco to lay off more than 4,000 as it shifts focus to AI and Cybersecurity

Reuters reports that Cisco Systems will cut thousands of jobs in its second round of layoffs this year. The number of people affected could be similar to or slightly higher than the 4,000 employees Cisco laid off in February, and will likely be announced as early as Wednesday with the company’s fourth-quarter results.

The San Jose, CA headquartered networking company plans to shift its product focus to higher-growth areas, such as AI and cybersecurity. It’s current set of products and services are listed here.

Cisco has been contending with weakening demand and persistent supply chain issues in its core business – routers and switches – that are used by ISPs and enterprise private networks. Two reasons for that are: 1.] the major cloud service providers design their own switch/routers or use bare metal switches (made by ODMs in Taiwan and China), and 2.] enterprise private/virtual private networks are being replaced by cloud network solutions.

- Global enterprise network sales have been declining. Dell’Oro Group reported sales contractions in Branch Routing and Campus Switching in 4Q-2023 and that is expected to continue throughout most of 2024. On premises data centers (which use Cisco Ethernet switches) are not growing. In its place……

- Enterprise spending on cloud infrastructure services is growing by leaps and bounds. It’s now nearing $80 billion per quarter. Cloud customers increased their spending on cloud services by $14.1 billion to $79.1 billion in the 2Q-2024, an increase of 22% year-over-year. It’s the third consecutive quarter in which the year-over-year growth rate was 20% or more, with generative AI being one of the factors behind the market acceleration.

……………………………………………………………………………………………………………………………………………

As a result of stagnant sales of its core networking products, Cisco has been pursuing a strategy aimed at diversifying its revenue streams. One of the most significant moves in this direction was the $28 billion acquisition of Splunk, a cybersecurity firm, which was finalized in March. This purchase is expected to boost Cisco’s subscription-based services, reducing its dependence on one-time hardware sales, which have been increasingly susceptible to market volatility.

Cisco’s major shift towards AI is a key part of its long-term strategy. In May, the company reiterated its ambitious goal of achieving $1 billion in AI-related product orders by 2025. This target is supported by a $1 billion fund launched in June, aimed at investing in AI startups such as Cohere, Mistral AI, and Scale AI. Over the past few years, Cisco has made over 20 AI-focused acquisitions and investments, highlighting its commitment to integrating AI into its product offerings.

……………………………………………………………………………………………………………………………………………..

Over 126,000 employees have been laid off across 393 tech companies since the start of the year, according to data from tracking website Layoffs.fyi. That surely reflects their need to cut costs to balance huge investments in AI, analytics and related technologies.

……………………………………………………………………………………………………………………………………………..

References:

https://www.cisco.com/c/en/us/products/index.html#~products-by-technology

Cisco to Implement Second Round of Layoffs Amidst Strategic Shift to AI and Cybersecurity

Worldwide Enterprise Network Spending Follows Roller Coaster Trajectory

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Nokia’s 760 global private networking contracts are mostly 4G-LTE Advanced

Backgrounder:

Private Wireless Radio Access Network (RAN) revenue growth slowed in the fourth quarter of 2023 on a year-over-year basis. However, full-year revenues accelerated by approximately 40% in 2023, propelling private wireless to comprise around 2% of the overall RAN market.

“Private wireless RANs are now growing at a formidable pace, in contrast to public RAN and enterprise WLAN – both segments are projected to contract in 2024,” said Stefan Pongratz, Vice President at Dell’Oro Group in April.

The top 3 Private Wireless RAN suppliers in 2023 were Huawei, Nokia, and Ericsson. Excluding China, they were Nokia, Ericsson, and Samsung.

……………………………………………………………………………………………………………………………………………..

Nokia leads in Private RANs:

Nokia recently told Fierce Network that it signed 30 new private networking contracts in the second quarter of 2024. Nokia has said that it has signed more than 760 private network contracts around the world. NGIC, Sigma Lithium and Solis are some of the most recent names it has signed.

Nokia said that 78% of its private network business is based on 4G LTE-Advanced [1.], compared to 18% being 5G only, and the remaining 4% combining the two broadband cellular technologies.

Note 1. In October 2010, LTE-Advanced successfully passed the ITU-R’s evaluation process and was found to meet or exceed IMT-Advanced requirements. It was standardized a “IMT Advanced,” which support low to high mobility applications and a wide range of data rates in accordance with user and service demands in multiple user environments. IMT Advanced also has capabilities for high quality multimedia applications within a wide range of services and platforms, providing a significant improvement in performance and quality of service.

Image courtesy of Research Gate

…………………………………………………………………………………………………………………………………………….

David de Lancellotti, VP of enterprise campus edge business at Nokia talked to Fierce about Nokia’s performance in the private networking space. “Thirty in Q2, and roughly 50 — a little more than 50 — in the first half,” he said of contracts signed.

“We kind of jumped into this a bit earlier than anybody else,” Nokia’s de Lancellotti explained. “I think we’ve always taken a real service provider approach in terms of quality, in terms of feature set [and] in terms of roadmap,” while noting Nokia’s “real drive to pick up the enterprise space.”

Industry verticals – transportation, energy and manufacturing – continue to “lead the way” for private networking contracts in Q2. “When we talk about transportation, I think that’s the port side of business, which continues to be strong for us,” David said.

References:

https://www.fierce-network.com/wireless/nokia

Private Wireless RAN Revenues up ~40 Percent in 2023, According to Dell’Oro Group

https://en.wikipedia.org/wiki/LTE_Advanced

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-adv/Pages/default.aspx

https://www.researchgate.net/figure/Network-architecture-of-LTE-Advanced_fig1_333886291

Highlights of FiberConnect 2024: PON-related products dominate

The Fiber Broadband Association’s flagship conference, FiberConnect 2024, concluded July 31, 2024, in Nashville, Tennessee. It featuring 275 speakers and 286 exhibitors in the Expo Hall, with about half the attendees from operators and half representing vendors. The show provided a great opportunity to gauge the pulse of the fiber based broadband industry in North America.

China Unicom-Beijing and Huawei build “5.5G network” using 3 component carrier aggregation (3CC)

Huawei says it has deployed an “ultra large-scale 5.5G network” (there is no definition, 3GPP approved specs, or ITU-R recommendations/standards for 5.5G) operated by China Unicom in Beijing. The network uses three component carrier (3CC) aggregation to provide 70 percent coverage within Beijing’s 4th urban ring road. Huawei says China Unicom will offer comprehensive 5.5G service (again undefined) across stadiums, metro stations and tunnels, residential areas, scenic spots, business districts, and universities in key areas within the city’s 4th Ring Road and Beijing Municipal Administrative Center.

Editor’s Note: At the 5G Advanced Forum during MWC Shanghai 2023, Huawei’s President of ICT Products & Solutions, Yang Chaobin said, “In 2024, Huawei will launch a complete set of commercial 5.5G network equipment to be prepared for the commercial deployment of 5.5G.” Many believe that 5.5G is another name for 3GPP defined 5G Advanced, which is expected to bring new wireless technology innovations that improve speed, coverage, mobility, power efficiency, and sustainability. 3GPP Release 18 in 2024 is the beginning of 5G Advanced. The second and major release of 5G Advanced, Release 19, will be completed by the end of 2025. This release will focus on enhanced performance and the 5G system’s ability to meet commercial deployment needs.

In the Beijing Action Plan for Promoting 5G-A Technology Evolution and Application Innovation (2024-2026), Beijing Municipal Communications Administration hammered home the importance of Beijing’s role in pioneering 5.5G development. China Unicom Beijing is striving to do its part, with a large-scale 5.5G network demonstration at the beginning of 2024 followed by the ultra-large-scale commercial 5.5G network deployment of recent months, in helping Beijing become a “dual 10 Gbps” city that sets the bar for network construction, device development, and industry enablement. With the first version of 5.5G standards frozen in June 2024 and more than 20 commercial 5.5G devices now on the market, a mature 5.5G industry ecosystem is taking shape.

“Full 5.5G coverage” in Beijing’s core urban areas and the Beijing Municipal Administrative Center. Photo: Huawei

……………………………………………………………………………………………………………………………………………………..

In August 2022, China Unicom Beijing and Huawei commercialized the world’s largest 3.5 GHz 2CC network, which has brought 200 MHz 2CC coverage to more than 85% of Beijing’s urban area while providing comprehensive coverage for Beijing’s core areas and the Beijing Municipal Administrative Center. In 2023, this was further augmented when China Unicom Beijing and Huawei completed a 2.1 GHz band deployment targeting key urban scenarios. These deployments substantially improved the network experience of users in Beijing while laying a solid foundation for the future evolution to 5.5G, and this year’s 5.5G 3CC deployment paves the way for larger-scale 5.5G deployments in the coming years.

The ultra-large commercial 5.5G 3CC network consists of more than 4,000 base stations and covers well-known landmarks in Beijing, such as Wukesong, Capital Indoor Stadium, Workers’ Stadium, Beijing Railway Station, Guijie Street, Panjiayuan, and Beijing University of Technology. Featuring 5.5G capabilities, the network provides powerful support for services such as immersive video, UHD live streaming, and cloud gaming. In addition to consumer scenarios, China Unicom Beijing is proactively pursuing innovations in UHD shallow compression encoding, IoT, and XR split rendering, unlocking the full potential of 5.5G networks to enable various industries.

Yang Lifan, Deputy General Manager of China Unicom Beijing, remarked: “We have the world’s largest 200 MHz 5G network and it makes our 3CC carrier aggregation much easier. 5.5G 3CC coverage will be extended to match that of our current 200 MHz 5G network. With Huawei’s advanced technologies and our smart operations, we will provide users with a much better network experience.”

David Li, President of Huawei Wireless Network 5G<E TDD Product Line, said: “We are honored to mark a groundbreaking milestone in 5.5G network construction with China Unicom Beijing — large-scale commercial 5.5G. We will continue to innovate and provide more efficient, smarter, and greener network solutions, enabling users to enjoy a superior, smooth experience with 5.5G networks.”

References:

https://www.huawei.com/en/news/2024/7/5ga-beijing-3cc#

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

https://blog.huawei.com/en/post/2023/11/14/5-5g-whats-in-a-number

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Verizon Business sees escalating risks in mobile and IoT security

Verizon Business released its 2024 Mobile Security Index (MSI) report outlining the top threats to mobile and IoT device security. This year’s report, in its seventh iteration, goes beyond employee-level mobile usage and extends into the usage of IoT devices and sensors and the security concerns the growth of these devices can present especially as remote work continues to be a trend. This expanded view of mobile security concerns for organizations showcases the evolving threat landscape that CIOs and other IT decision makers must contend with.

This annual report surveyed 600 people responsible for security strategy, as well as employee-level mobile usage, the report looked at the use of IoT devices and sensors and the security concerns that come with them as remote work continues to be a trend.

Highlights:

- 80% of responding organizations consider mobile devices critical to their operations, while 95% are actively using IoT devices.

- 96% of critical infrastructure respondents use IoT devices, with % having experienced a significant mobile or IoT device-related security incident.

- 77% of respondents anticipate that AI-assisted attacks, such as deep fakes and SMS phishing, are likely to succeed.

Employees are using more mobile and IoT devices, leading to increased cyber risks

The survey finds that 80% of respondents consider mobile devices critical to their operations, while 95% are actively using IoT devices. However, this heavy reliance comes with significant security concerns. In critical infrastructure sectors, where 96% of respondents report using IoT devices, more than half state that they have experienced severe security incidents that led to data loss or system downtime.

“These findings highlight the continued friction that employers face as more and more work is done on personal mobile devices,” said Phil Hochmuth Research VP, enterprise mobility at IDC. “This is why we are seeing more and more employers move from a pure bring-your-own-device model to employer provided devices where CIO’s can have greater governance to protect critical infrastructure from cyber attacks.”

Additionally, Hochmuth says, organizations should adopt robust frameworks such as Zero Trust and the National Institute of Standards and Technology’s Cybersecurity Framework (NIST CSF) 2.0, and comply with mandates like the European Union’s NIS2 Directive.

Emerging AI cyberthreats meet new AI defenses

Emerging artificial intelligence (AI) technologies are expected to exacerbate the mobile threat landscape, but it also presents opportunities for defense. A striking 77% of respondents anticipate that AI-assisted attacks, such as deepfakes and SMS phishing, are likely to succeed. At the same time, 88% of critical infrastructure respondents acknowledge the growing importance of AI-assisted cybersecurity solutions.

Accounting for IoT growth in cybersecurity planning

With companies increasingly deploying IoT devices, their digital landscapes are evolving, creating a need for cybersecurity strategies to evolve in kind.

“The Industrial Internet of Things (IIoT) is giving rise to a massive expansion in mobile device technology that goes well beyond phones, tablets and laptops. Enterprise networks now include all sorts of sensors and purpose-built devices that monitor, measure, manage and control commercial tasks and data flow,” said TJ Fox, SVP of Industrial IoT and Automotive, Verizon Business. “That IIoT growth brings with it a proportionate need for more knowledge, awareness and IT solutioning to ensure the security of those increasingly sophisticated networks. The growing importance that IoT plays in our customer’s technology ecosystem underscores why it should be a component in any sound cybersecurity program.”

What business leaders should know

The 2024 MSI helps inform cybersecurity decisions for leaders of businesses of all sizes and in key sectors. As mobile and IoT threats rise, the need for robust security measures has never been greater. In response to these growing threats, 84% of respondents have increased their mobile device security spending over the past year, with 89% of critical infrastructure respondents planning further increases.

This year’s MSI includes contributions from Verizon’s partners including Ivanti, Lookout, Jamf among others. Help your organization lower cyber risks by deploying comprehensive security protections, continuous employee education and advanced threat detection capabilities.

……………………………………………………………………………………………………………………………………….

Quotes:

Phil Hochmuth Research VP at IDC said: “These findings highlight the continued friction that employers face as more and more work is done on personal mobile devices. This is why we are seeing more and more employers move from a pure bring-your-own-device model to employer-provided devices where CIOs can have greater governance to protect critical infrastructure from cyber attacks.”

TJ Fox, SVP of Industrial IoT and Automotive, Verizon Business added: “The Industrial Internet of Things (IIoT) is giving rise to a massive expansion in mobile device technology that goes well beyond phones, tablets and laptops. Enterprise networks now include all sorts of sensors and purpose-built devices that monitor, measure, manage and control commercial tasks and data flow.

“That IIoT growth brings with it a proportionate need for more knowledge, awareness and IT solutions to ensure the security of those increasingly sophisticated networks. The growing importance that IoT plays in our customer’s technology ecosystem underscores why it should be a component in any sound cybersecurity program.”

References:

Verizon Business 2024 Mobile Security Index

https://www.telecoms.com/security/verizon-warns-of-escalating-risks-in-mobile-and-iot-security

IEEE/SCU SoE Virtual Event: May 26, 2022- Critical Cybersecurity Issues for Cellular Networks (3G/4G, 5G), IoT, and Cloud Resident Data Centers

IoT Sensor Standards Are Absolutely Essential for Security

IoT Disappoints: Security, Connectivity and Device Onboarding Cited as Top Challenges

AI winner Nvidia faces competition with new super chip delayed

The Clear AI Winner Is: Nvidia!

Strong AI spending should help Nvidia make its own ambitious numbers when it reports earnings at the end of the month (it’s 2Q-2024 ended July 31st). Analysts are expecting nearly $25 billion in data center revenue for the July quarter—about what that business was generating annually a year ago. But the latest results won’t quell the growing concern investors have with the pace of AI spending among the world’s largest tech giants—and how it will eventually pay off.

In March, Nvidia unveiled its Blackwell chip series, succeeding its earlier flagship AI chip, the GH200 Grace Hopper Superchip, which was designed to speed generative AI applications. The NVIDIA GH200 NVL2 fully connects two GH200 Superchips with NVLink, delivering up to 288GB of high-bandwidth memory, 10 terabytes per second (TB/s) of memory bandwidth, and 1.2TB of fast memory. The GH200 NVL2 offers up to 3.5X more GPU memory capacity and 3X more bandwidth than the NVIDIA H100 Tensor Core GPU in a single server for compute- and memory-intensive workloads. The GH200 meanwhile combines an H100 chip [1.] with an Arm CPU and more memory.

Photo Credit: Nvidia

Note 1. The Nvidia H100, sits in a 10.5 inch graphics card which is then bundled together into a server rack alongside dozens of other H100 cards to create one massive data center computer.

This week, Nvidia informed Microsoft and another major cloud service provider of a delay in the production of its most advanced AI chip in the Blackwell series, the Information website said, citing a Microsoft employee and another person with knowledge of the matter.

…………………………………………………………………………………………………………………………………………

Nvidia Competitors Emerge – but are their chips ONLY for internal use?

In addition to AMD, Nvidia has several big tech competitors that are currently not in the merchant market semiconductor business. These include:

- Huawei has developed the Ascend series of chips to rival Nvidia’s AI chips, with the Ascend 910B chip as its main competitor to Nvidia’s A100 GPU chip. Huawei is the second largest cloud services provider in China, just behind Alibaba and ahead of Tencent.

- Microsoft has unveiled an AI chip called the Azure Maia AI Accelerator, optimized for artificial intelligence (AI) tasks and generative AI as well as the Azure Cobalt CPU, an Arm-based processor tailored to run general purpose compute workloads on the Microsoft Cloud.

- Last year, Meta announced it was developing its own AI hardware. This past April, Meta announced its next generation of custom-made processor chips designed for their AI workloads. The latest version significantly improves performance compared to the last generation and helps power their ranking and recommendation ads models on Facebook and Instagram.

- Also in April, Google revealed the details of a new version of its data center AI chips and announced an Arm-based based central processor. Google’s 10 year old Tensor Processing Units (TPUs) are one of the few viable alternatives to the advanced AI chips made by Nvidia, though developers can only access them through Google’s Cloud Platform and not buy them directly.

As demand for generative AI services continues to grow, it’s evident that GPU chips will be the next big battleground for AI supremacy.

References:

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

https://www.theverge.com/2024/2/1/24058186/ai-chips-meta-microsoft-google-nvidia/archives/2

https://news.microsoft.com/source/features/ai/in-house-chips-silicon-to-service-to-meet-ai-demand/

AI wave stimulates big tech spending and strong profits, but for how long?

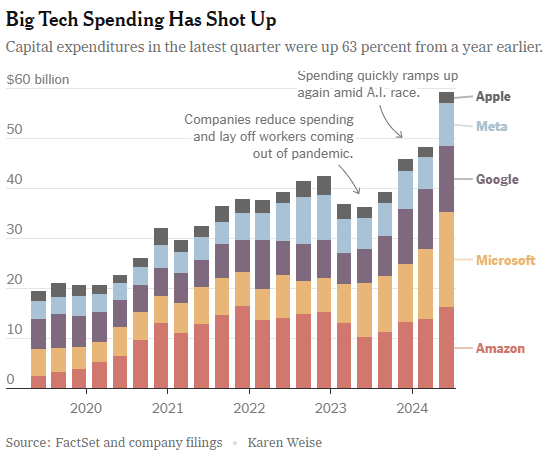

Big tech companies have made it clear over the last week that they have no intention of slowing down their stunning levels of spending on artificial intelligence (AI), even though investors are getting worried that a big payoff is further down the line than most believe.

In the last quarter, Apple, Amazon, Meta, Microsoft and Google’s parent company Alphabet spent a combined $59 billion on capital expenses, 63% more than a year earlier and 161 percent more than four years ago. A large part of that was funneled into building data centers and packing them with new computer systems to build artificial intelligence. Only Apple has not dramatically increased spending, because it does not build the most advanced AI systems and is not a cloud service provider like the others.

At the beginning of this year, Meta said it would spend more than $30 billion in 2024 on new tech infrastructure. In April, he raised that to $35 billion. On Wednesday, he increased it to at least $37 billion. CEO Mark Zuckerberg said Meta would spend even more next year. He said he’d rather build too fast “rather than too late,” and allow his competitors to get a big lead in the A.I. race. Meta gives away the advanced A.I. systems it develops, but Mr. Zuckerberg still said it was worth it. “Part of what’s important about A.I. is that it can be used to improve all of our products in almost every way,” he said.

………………………………………………………………………………………………………………………………………………………..

This new wave of Generative A.I. is incredibly expensive. The systems work with vast amounts of data and require sophisticated computer chips and new data centers to develop the technology and serve it to customers. The companies are seeing some sales from their A.I. work, but it is barely moving the needle financially.

In recent months, several high-profile tech industry watchers, including Goldman Sachs’s head of equity research and a partner at the venture firm Sequoia Capital, have questioned when or if A.I. will ever produce enough benefit to bring in the sales needed to cover its staggering costs. It is not clear that AI will come close to having the same impact as the internet or mobile phones, Goldman’s Jim Covello wrote in a June report.

“What $1 trillion problem will AI solve?” he wrote. “Replacing low wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions I’ve witnessed in my 30 years of closely following the tech industry.” “The reality right now is that while we’re investing a significant amount in the AI.space and in infrastructure, we would like to have more capacity than we already have today,” said Andy Jassy, Amazon’s chief executive. “I mean, we have a lot of demand right now.”

That means buying land, building data centers and all the computers, chips and gear that go into them. Amazon executives put a positive spin on all that spending. “We use that to drive revenue and free cash flow for the next decade and beyond,” said Brian Olsavsky, the company’s finance chief.

There are plenty of signs the boom will persist. In mid-July, Taiwan Semiconductor Manufacturing Company, which makes most of the in-demand chips designed by Nvidia (the ONLY tech company that is now making money from AI – much more below) that are used in AI systems, said those chips would be in scarce supply until the end of 2025.

Mr. Zuckerberg said AI’s potential is super exciting. “It’s why there are all the jokes about how all the tech C.E.O.s get on these earnings calls and just talk about A.I. the whole time.”

……………………………………………………………………………………………………………………

Big tech profits and revenue continue to grow, but will massive spending produce a good ROI?

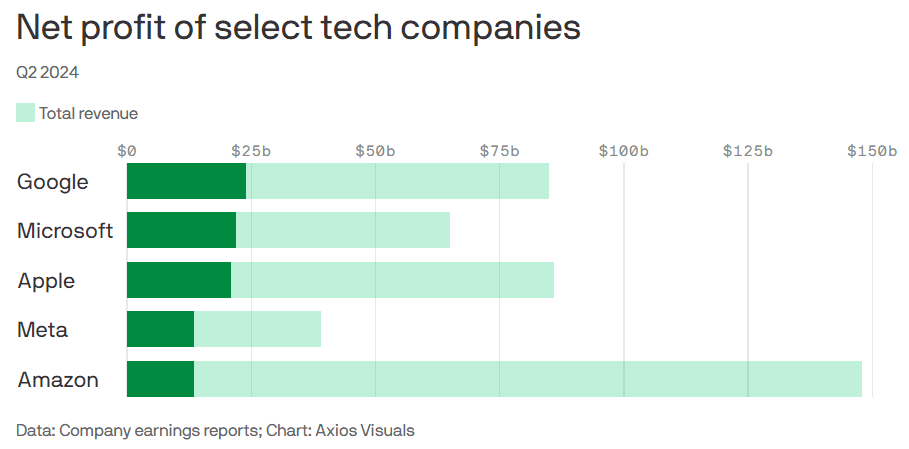

Last week’s Q2-2024 results:

- Google parent Alphabet reported $24 billion net profit on $85 billion revenue.

- Microsoft reported $22 billion net profit on $65 billion revenue.

- Meta reported $13.5 billion net profit on $39 billion revenue.

- Apple reported $21 billion net profit on $86 billion revenue.

- Amazon reported $13.5 billion net profit on $148 billion revenue.

This chart sums it all up:

………………………………………………………………………………………………………………………………………………………..

References:

https://www.nytimes.com/2024/08/02/technology/tech-companies-ai-spending.html

https://www.axios.com/2024/08/02/google-microsoft-meta-ai-earnings

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions