Author: Alan Weissberger

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Complete Event Description at:

https://scv.chapters.comsoc.org/event/open-source-vs-proprietary-software-running-on-disaggregated-hardware/

The video recording is now publicly available:

https://www.youtube.com/watch?v=RWS39lyvCPI

……………………………………………………………………………………………………………………………………………….

Backgrounder – Open Networking vs. Open Source Network Software

Open Networking was promised to be a new paradigm for the telecom, cloud and enterprise networking industries when it was introduced in 2011 by the Open Networking Foundation (ONF). This “new epoch” in networking was based on Software Defined Networking (SDN), which dictated a strict separation of the Control and Data planes with OpenFlow as the API/protocol between them. A SDN controller running on a compute server was responsible for hierarchical routing within a given physical network domain, with “packet forwarding engines” replacing hop by hop IP routers in the wide area network. Virtual networks via an overlay model were not permitted and were referred to as “SDN Washing” by Guru Parulkar, who ran the Open Networking Summit’s for many years.

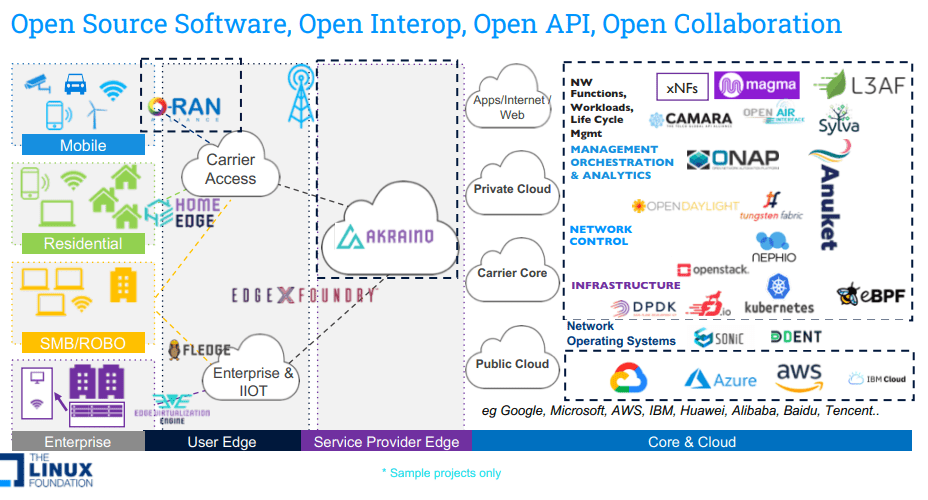

Today, the term Open Networking encompasses three important vectors:

A) Beyond the disaggregation of hardware and software, it also includes: Open Source Software, Open API, Open Interoperability, Open Governance and Open collaboration across global organizations that focus on standards, specification and Open Source software.

B) Beyond the original Data/Control plane definition, today Open Networking covers entire software stack (Data plane, control plane, management, orchestration and applications).

C) Beyond just the Data Center use case, it currently covers all networking markets (Service Provider, Enterprise and Cloud) and also includes all aspects of architecture (from Core to Edge to Access – residential and enterprise).

Open Source Networking Software refers to any network related program whose source code is made available for use or modification by users or other developers. Unlike proprietary software, open source software is computer software that is developed as a public, open collaboration and made freely available to the public. There are several organizations that develop open source networking software, such as the Linux Foundation, ONF, OCP, and TIP.

Currently, it seems the most important open networking and open source network software projects are being developed in the Linux Foundation (LF) Networking activity. Now in its fifth year as an umbrella organization, LF Networking software and projects provide the foundations for network infrastructure and services across service providers, cloud providers, enterprises, vendors, and system integrators that enable rapid interoperability, deployment and adoption.

Event Description:

In this virtual panel session, our distinguished panelists will discuss the current state and future directions of open networking and open source network software. Most importantly, we will compare open source vs. proprietary software running on disaggregated hardware (white box compute servers and/or bare metal switches).

With so many consortiums producing so much open source code, the open source networking community is considered by many to be a trailblazer in terms of creating new features, architectures and functions. Others disagree, maintaining that only the large cloud service providers/hyperscalers (Amazon, Microsoft, Google, Facebook) are using open source software, but it’s their own versions (e.g. Microsoft SONIC which they contributed to the OCP).

We will compare and contrast open source vs proprietary networking software running on disaggregated hardware and debate whether open networking has lived up to its potential.

Panelists:

- Roy Chua, AvidThink

- Arpit Joshipura, LF Networking

- Run Almog, DriveNets

Moderator: Alan J Weissberger, IEEE Techblog, SCU SoE

Host: Prof. Ahmed Amer, SCU SoE

Co-Sponsor: Ashutosh Dutta, IEEE Future Networks

Co-Sponsor: IEEE Communications Society-SCV

Agenda:

- Opening remarks by Moderator and IEEE Future Networks – 8 to 10 minutes

- Panelist’s Position Presentations – 55 minutes

- Pre-determined issues/questions for the 3 panelists to discuss and debate -30 minutes

- Issues/questions that arise from the presentations/discussion-from Moderator & Host -8 to 10 minutes

- Audience Q &A via ZOOM Chat box or Question box (TBD) -15 minutes

- Wrap-up and Thanks (Moderator) – 2 minutes

Panelist Position Statements:

1. Roy will examine the open networking landscape, tracing its roots back to the emergence of Software Defined Networking (SDN) in 2011. He will offer some historical context while discussing the main achievements and challenges faced by open networking over the years, as well as the factors that contributed to these outcomes. Also covered will be the development of open networking and open-source networking, touching on essential topics such as white box switching, disaggregation, OpenFlow, P4, and the related Network Function Virtualization (NFV) movement.

Roy will also provide insight into the ongoing importance of open networking and open-source networking in a dynamic market shaped by 5G, distributed clouds and edge computing, private wireless, fiber build-outs, satellite launches, and subsea-cable installations. Finally, Roy will explore how open networking aims to address the rising demand for greater bandwidth, improved control, and strengthened security across various environments, including data centers, transport networks, mobile networks, campuses, branches, and homes.

2. Arpit will cover the state of open source networking software, specifications, and related standards. He will describe how far we have come in the last few years exemplified by a few success stories. While the emphasis will be on the Linux Foundation projects, relevant networking activity from other open source consortiums (e.g. ONS, OCP, TIP, and O-RAN) will also be noted. Key challenges for 2023 will be identified, including all the markets of telecom, cloud computing, and enterprise networking.

3. Run will provide an overview of Israel based DriveNets “network cloud” software and cover the path DriveNets took before deciding on a Distributed Disaggregated Chassis (DDC) architecture for its proprietary software. He will describe the reasoning behind the major turns DriveNets took during this long and winding road. It will be a real life example with an emphasis on what didn’t work as well as what did.

……………………………………………………………………………………………………………….

References:

https://lfnetworking.org/

https://lfnetworking.org/how-

https://lfnetworking.org/

https://lfnetworking.org/open-

Telekom Malaysia Berhad launches fiber optic network hub

Telekom Malaysia Berhad (TM) [1.] announced the completion of its new fiber optic network hub or point of presence (PoP) project phase one installations, across northern region, Sabah and Sarawak.

Note 1. Telekom Malaysia Berhad (TM) is a Malaysian telecommunications company founded in 1984. Beginning as the national telecommunications company for fixed line, radio, and television broadcasting services, it has evolved to become the country’s largest provider of broadband services, data, fixed line, pay television, and network services.

………………………………………………………………………………………………………………………………..

The launch ceremony, which was officiated by YB Fahmi Fadzil, Minister of Communications and Digital, took place at SMK Padang Terap, Kuala Nerang, Kedah. Also present were Dato’ Haji Pkharuddin Bin Haji Ghazali, Director-General of Education and Dato’ Sri Haji Mohammad Bin Mentek, Secretary-General, Ministry of Communications and Digital.

PoP is the location where different devices connect to each other and to the internet. In simple terms, PoP brings fiber optics closer to users. By setting up PoP locations near schools, people in rural and remote areas can get better and faster internet services in their homes, instead of relying on mobile internet. This will improve internet access and connectivity for more people in the community.

During the ceremony, YB Fahmi highlighted the significant benefits and opportunities that the new PoPs would bring. The new PoPs represent a major step forward in the Government’s efforts to narrow the digital gap and promote digital inclusion across Malaysia.

A total of 4,370 PoPs had been planned under the 12th Malaysia Plan (12MP) where 4,323 PoPs will be installed near rural schools and 47 PoPs near industrial area.

Phase one of the project, involves 677 sites. The remaining will be implemented under phase two over the span of three years, 2022-2025. A total of 233 PoP circuits were installed under phase 1, with 100% completion achieved by TM, ahead of other industry players.

“We are thrilled to see the progress and achievements of this project, which will bring significant benefits and opportunities to the community, including improved internet quality, economic development and the development of new infrastructures,” said Shazurawati Abdul Karim, Executive Vice President of TM One.

The PoP will create a more balanced and inclusive regional development, boosting the growth of new technologies like 5G and future generations of communication technologies. Through this initiative, users in TM’s PoP area have now reached over 9,000 and are increasing. A total of 58 of its users are schools that have subscribed to Unifi services. The widespread internet accessibility will not only help to develop the rural economy but more importantly allow learning materials to be downloaded, to improve the quality of education in schools, equipping the future generations with a wealth of knowledge.

“As the nation’s telecommunications leader, and enabler of Digital Malaysia, TM is committed to support the nation’s development agenda through the benefits brought by hyperconnectivity and digital solutions, which will accelerate digital adoption and new economic growth,” added Shazurawati.

“The presence of PoP can attract technology companies, start-ups and other businesses that require a high-speed internet connection to operate. This can create more job opportunities, increase innovation, and stimulate economic growth in local communities,” Shazurawati concluded.

The collaboration between TM and the Government demonstrates the shared commitment to deliver digital inclusivity throughout Malaysia. For phase two of PoP project, TM has been awarded with 174 sites in the central region. This phase is expected to further boost digital connectivity and economic development for Malaysia.

The extensive internet access that PoP provides will not only enhance the rural economy but also enable the download of educational materials, elevating the quality of education in schools and equipping the younger generation with a vast range of knowledge.

References:

https://www.tm.com.my/news/TM%E2%80%99S%20NEW%20FIBRE%20OPTIC%20NETWORK%20HUB

Telekom Malaysia Completes Fibre Optic Network Hub Across Sabah and Sarawak

Comcast Business expands SD-WAN portfolio for SMBs and single location customers

Comcast Business is expanding its SD-WAN portfolio to give more options to SMB customers. The MSO/ cableco on Friday announced two new solutions geared toward standalone business locations. Comcast says the new solutions cater to partners who need to connect to cloud and Software-as-a-Service (SaaS) applications.

The SD-WAN solutions enable small and medium businesses, with either a single location or multiple standalone locations, to help securely connect and manage their network, applications, and users. These businesses rely on SaaS applications and cloud services to operate, making secure networking a critical requirement. Comcast Business’ full range of global secure networking solutions provide connectivity, security, application optimization and control, as well as threat monitoring and response for single and multi-site customers.

![]()

In today’s digital economy, companies of all sizes need to provide their users fast, reliable, and secure connectivity to applications everywhere. This includes delivering high-quality, consistent, and predictable quality of experience for critical applications residing in the Cloud or SaaS and accessed via the public Internet. With the addition of these tailored SD-WAN solutions, Comcast Business can bring the benefits of secure networking to standalone and multi-site businesses around the world.

“Comcast Business’ global SD-WAN solutions are a central component of our secure network solutions strategy,” said Shena Seneca Tharnish, Vice President, Cybersecurity Products, Comcast Business. “With the addition of capabilities that support standalone sites, we are more prepared than ever to partner with businesses of all sizes to tailor solutions that meet their unique needs. At Comcast Business, we’re committed to preparing every business for what’s next.”

The enhancements to Comcast Business’ SD-WAN solutions enable secure networking and application optimization for single or multi-site businesses who need to connect to the Cloud or SaaS applications but may not require site-to-site networking. These solutions provide businesses with resiliency and visibility, as well as intelligent application prioritization and traffic steering, with advanced managed service. Key features include:

- Diverse connectivity, intelligent traffic steering, and direct connections to Cloud services enhance application performance and resiliency

- Advanced security capabilities to help protect against cyberthreats

- 24×7 Security Operations Center (SOC)

- Low-touch deployment capabilities provide easy installation

- Highly competitive pricing

These solutions are ideal for companies that lack IT budgets or a corporate network but need to support single locations with cloud connectivity using public Internet services.

Comcast Business was recognized as a leader by market research firm Frost & Sullivan in its 2022 Managed SD-WAN Services in North America report [1.]. At the time, Comcast was touted as the second-largest provider of SD-WAN connections in North America. Frost & Sullivan noted that the provider is “especially successful among enterprise customers with 250 or more sites.” The market research firm also gave a nod to Comcast’s strategic acquisition of SD-WAN leader Masergy and “the resultant portfolio enhancements and expanded partner ecosystem for SD-WAN and cloud solutions it has enabled.”

Note 1. Frost & Sullivan assessed 12 leading network and managed service providers in the North American market, analyzing their SD-WAN portfolios based on factors including partnerships with SD-WAN equipment vendors, breadth of underlay network technologies, self-service customer portals, and ability to offer value-added virtualized network functions (e.g., firewalls and routers) and other security solutions such as SASE.

…………………………………………………………………………………………………………………………………………………………………..

Previously, Aryaka announced enhanced SD-WAN and SASE products specifically designed to meet the needs of SMEs with a new entry pricing of under $150 per site. Aryaka Chief Product Officer Renuka Nadkarni told SDxCentral that ease of management is another key concern for many small businesses, which is why so many prefer managed services. Dell’Oro Group predicted the untapped networking and security SMB market will grow significantly this year on the backs of providers who can offer managed services.

…………………………………………………………………………………………………………………………………………………………………..

About Comcast Business:

Comcast Business offers a suite of Connectivity, Communications, Networking, Cybersecurity, Wireless, and Managed Solutions to help organizations of different sizes prepare for what’s next. Powered by the nation’s largest Gig-speed broadband network, and backed by 24/7 customer support, Comcast Business is the nation’s largest cable provider to small and mid-size businesses and one of the leading service providers to the Enterprise market. Comcast Business has been consistently recognized by industry analysts and associations as a leader and innovator, and one of the fastest growing providers of Ethernet services.

References:

To learn more about Comcast Business SD-WAN solutions: https://business.comcast.com/enterprise/products-services/sd-wan-solutions/sd-wan

https://www.sdxcentral.com/articles/news/comcast-tailors-sd-wan-portfolio-to-smbs/2023/03/

https://store.frost.com/frost-radartm-managed-sd-wan-services-in-north-america-2022.html

Gartner: changes in WAN requirements, SD-WAN/SASE assumptions and magic quadrant for network services

Arista’s WAN Routing System targets routing use cases such as SD-WANs

Have we come full circle – from SD-WAN to SASE to SSE? MEF’s SD-WAN and SASE standards

Enterprises Deploy SD-WAN but Integrated Security (SASE) Needed

Google Fiber offers 8 Gig symmetric service in Mesa, AZ; Chandler, AZ next in line

Google Fiber is using its service launch in the Westwood neighborhood of Mesa, Arizona, market to also serve as the initial launch point for its new symmetrical 8 Gbit/s broadband service. Residential customers in Mesa can sign up for Google Fiber’s 8 Gig service for $150 per month. 8 Gig offers symmetrical uploads and downloads of up to 8 Gbps with a wired connection, along with a Wi-Fi 6 router (which allows for up to 800 mbps over Wi-Fi) and up to two mesh extenders.

The 8-Gig tier, now Google Fiber’s fastest, sells for $150 per month and comes with a Wi-Fi 6 router and two Wi-Fi mesh extenders. There are three other symmetrical broadband service tiers:

- 1-Gig: $70 per month

- 2-Gig: $100 per month

- 5-Gig: $125 per month

Google Fiber’s debut in the Westwood neighborhood of Mesa arrives about eight months after the city council there approved the buildout. Mesa, the first city in Arizona to get service from Google Fiber, is also being served by primary incumbent providers Cox Communications and Lumen.

Amid the revamp of its network expansion strategy, Google Fiber expects to start construction later this year in Chandler, Arizona, Ashley Church, GM for Google Fiber’s west region, said in a blog post.

As announced last fall, Google Fiber is also in the process of launching new 5-Gig and 8-Gig tiers in additional markets in 2023. Its new 5-Gig service is already available in several Google Fiber markets, including Kansas City, West Des Moines, Iowa, and all the cities it provides service to in Utah.

Google Fiber will start construction later this year in Chandler, AZ. As new segments are completed, we’ll offer service in those neighborhoods. Residents who want to keep up on the construction process or service availability in their area can sign up here. Google Fiber has also conducted lab tests in Kansas City that produced downstream speeds of 20.2 Gbps.

.jpg)

Here’s an updated snapshot of where Google Fiber currently provides or plans to provide via FTTP or fixed-wireless Webpass services:

Table 1:

| Market | FTTP or Webpass |

| Atlanta, Georgia | FTTP |

| Austin, Texas | FTTP |

| Chandler, Arizona | FTTP |

| Charlotte, North Carolina | FTTP |

| Chicago, Illinois | Webpass |

| Council Bluffs, Iowa | FTTP |

| Denver, Colorado | Webpass |

| Des Moines, Iowa | FTTP |

| Huntersville, North Carolina | FTTP |

| Huntsville, Alabama | FTTP |

| Idaho | FTTP* |

| Kansas City, Kansas and Missouri | FTTP |

| Lakewood, Colorado | FTTP |

| Miami, Florida | Webpass |

| Nevada | FTTP* |

| Nashville, Tennessee | FTTP |

| Oakland, California | Webpass |

| Omaha, Nebraska | FTTP |

| Orange County, California | FTTP |

| Provo, Utah | FTTP |

| Salt Lake City, Utah | FTTP |

| San Antonio, Texas | FTTP |

| San Diego, California | Webpass |

| San Francisco, California | Webpass |

| Seattle, Washington | Webpass |

| *Google Fiber FTTP deployments coming to cities yet to be announced. (Source: Google Fiber and Light Reading research) |

|

References:

https://fiber.googleblog.com/2023/03/mesa-here-we-come-and-superfast-too.html

Global Cloud VPN Market Report: Rising Demand for Cloud-based Security Services

The Global Cloud Virtual Private Network (VPN) Market Size, Share, Trends, Product Type (Services and Software), Connectivity Type (Site-To-Site and Remote Access), Company Size, End-user, and Region – Forecast to 2030 report has been published by ResearchAndMarkets.com.

The global cloud Virtual Private Network (VPN) market is expected to experience rapid growth in the coming years, with an estimated market size of USD 40.78 Billion by 2030 and a projected revenue compound annual growth rate (CAGR) of 21.6%.

This growth can be attributed to various factors, including the increased demand for cloud VPN technologies in security products and services, the rising adoption of secure remote access, and the growing acceptance of private clouds.

Cloud VPNs are becoming increasingly popular among businesses due to their ability to provide high security without sacrificing usability. They are cost-effective and easy to set up, and provide secure, encrypted web browsing capabilities. Compared to traditional VPNs, the new generation of cloud-based VPNs offers more flexibility, cost efficiency, and security features. This makes them ideal for businesses that regularly share sensitive or confidential information over private networks.

Cloud VPNs protect against both internal and external threats, and offer faster access to applications, ensuring smooth business operations. Major tech companies are investing in cloud VPN-based services, which is contributing significantly to market revenue growth. For example, GoodAccess recently secured a $1 million seed funding round to expand its cloud-based VPN services. Similarly, HMD Global, the manufacturer of Nokia smartphones, has partnered with ExpressVPN to offer secure digital connections on mobile devices using 3G, 4G, and 5G networks.

Market Dynamics

The market for cloud VPN services is expected to grow due to the increased adoption of secure remote access and the widespread acceptance of private clouds. Leading cloud VPN service providers are focusing on replacing traditional VPNs with cloud VPNs to meet the growing demand for more secure and sophisticated technologies that support privacy protection in a reliable and streamlined manner. Businesses that have already adopted cloud services have seen significant improvements in process efficiency, time to market, and IT spending reduction.

Cloud computing investment is expected to reach $160 billion worldwide by 2020, nearly twice what it was in 2017, and cloud solutions are expected to account for 80% of all IT investments by 2019. Cloud VPNs enable secure connections between offices located anywhere in the world over an open network and can connect any number of branch offices with the main office, supply chain, and partners. The VPN technology also enables user-to-office connections, making remote working simple.

The revenue growth in this industry is driven by an increase in product launches by leading tech companies that target secure remote access and widespread acceptance of cloud computing. For instance, Google has released BeyondCorp Remote Access, a zero-trust remote-access service that allows remote teams to access their companies’ internal web-based services without the use of a VPN.

The use of VPNs is restrained by stringent government regulations, which limit the growth potential of the market. Governments worldwide have implemented severe restrictions and regulations against using VPNs to prevent criminal use and increase the visibility of online activity. Cybercriminals can use VPNs to conceal their illegal activity and maintain their anonymity. New regulations mandate that all VPN service providers keep customer data for at least five years.

For example, India has approved a law requiring all VPN service providers to retain user data, including names, email addresses, phone numbers, and IP addresses, for at least five years. These regulations are focused on strict VPN regulations, and the national order mandates the collection of specific, substantial customer data even after users delete their accounts or cancel their subscriptions. These regulations apply not only to VPN providers but also to cloud service providers, data centers, and cryptocurrency exchanges.

Product Type Insights

The global Cloud Virtual Private Network (VPN) market is divided into two product types: software and services. In 2021, services dominated the market, with Managed Security Service Providers (MSSPs), Virtual Private Network as a Service (VPNaaS), and cloud-based remote access being some of the frequently used services. The need for managed cloud VPN-as-a-service solutions has risen as businesses require secure and remote connections to their corporate network through the Internet.

Additionally, cloud-based services have gained popularity among businesses as they offer cost-effectiveness. On the other hand, the software segment is predicted to experience rapid growth during the forecast period. Many businesses have realized that using a VPN provides an extra layer of protection and privacy for their remote workers. Cloud-based VPN software allows users to access systems through an internet-based software deployment approach. This eliminates the need for businesses to maintain physical servers or infrastructure.

Connectivity Type Insights

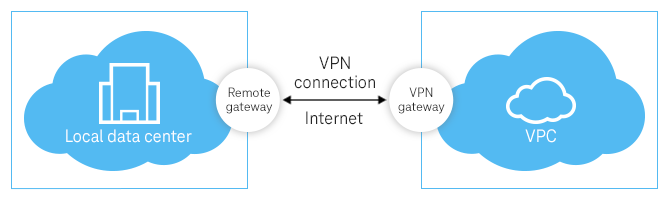

The global Cloud Virtual Private Network (VPN) market is also segmented based on connectivity type: site-to-site and remote access. Site-to-site VPNs held the largest revenue share in 2021 due to their secure IPsec protocols that encrypt communication transmitted through the VPN tunnel. They are used to establish encrypted links between VPN gateways located at different geographical sites, which require secure inter-site communication.

The site-to-site VPN tunnel also prevents any attempts to intercept traffic from the outside. Recent innovations in site-to-site VPN services, such as IPSec VPN connections through Direct Connect, are driving revenue growth of this segment. On the other hand, remote access VPNs are predicted to grow at a steady rate during the forecast period. The coronavirus pandemic has led to the increased popularity of remote access VPNs, allowing remote employees to connect safely to company networks. Cloud-based solutions are preferred to control costs, and major tech companies are launching innovative remote VPN solutions to drive revenue growth of this segment.

End-User Insights

Based on end-users, the telecom and IT sector held the largest revenue share in 2021. New demands for fast and secure VPN networks by the telecom industry have led to the growth of cloud VPNs. Operators and vendors in the telecom industry are adopting cloud-native technologies, while public cloud and IT companies have been using them for some time. Cloud-based VPNs have experienced tremendous growth over the past five years, leading to a rise in global spending on cloud computing. Cloud VPNs offer virtual private branch exchange capabilities, improving employee accessibility while maintaining cost management.

Regional Insights

In terms of regional analysis, the Cloud Virtual Private Network (VPN) market in North America has dominated the global market in 2021 with the highest revenue share. This can be attributed to the increasing partnerships between major companies and government agencies to address data protection and privacy issues. Furthermore, the presence of leading market players in the region has been a driving factor for market growth. For example, Google, a subsidiary of Alphabet Inc., has announced its plans to launch a VPN service for its users that will be bundled with certain Google One subscription levels. The VPN service has been introduced in the United States in 2020 for Android users through the Google One app, with plans to expand to other nations and operating systems such as iOS, Windows, and Mac.

Europe is anticipated to experience steady revenue growth during the forecast period. According to NordLayer’s Global Remote Work Index, Germany is the top country for remote work followed by Denmark, the USA, Spain, Lithuania, the Netherlands, Sweden, Estonia, Singapore, and France. Consequently, there has been a rising demand for privacy protection, and businesses are choosing cloud-based solutions to provide their remote access to Virtual Private Networks to efficiently manage costs. Major IT companies are releasing their own advanced remote VPN solutions, which is driving revenue growth in the region. For instance, Deutsche Telekom has launched a cloud VPN service for small and medium-sized organizations in Croatia, Hungary, and Slovakia, providing easy access to highly secure and scalable internet services. The cloud VPN option includes cloud-managed IT solutions, firewalls, online protection, and remote access through encrypted VPNs. Additionally, Cisco and Deutsche Telekom are collaborating on this project.

About ResearchAndMarkets.com:

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

References:

MTN and Microsoft Azure accelerate Africa’s digital transformation via the public cloud

South Africa-based network operator MTN has joined the growing list of telcos that are making the move to public cloud. Following the signing of a five-year strategic partnership in September 2022, MTN and Microsoft are in the process of delivering a program of work that will see the latest technologies deployed for the benefit of MTN’s customers, starting with South Africa and Nigeria.

The company announced it has embarked on a program of work to migrate various back end systems to Microsoft Azure. It is called Project Nephos, and its principle aim is to deliver maximum value as early as possible by identifying the workloads most suited to being redeployed on Azure. It’s initiating the project by transferring the BSS and OSS applications used by MTN’s opcos in South Africa and Nigeria. This approach has already enabled MTN to complete a proof of concept for the world’s first 5G standalone core network solution deployed in Microsoft’s Azure public cloud in just a few weeks!

Under the program, MTN will also migrate EVA, its core big data platform. In addition to putting it existing workloads on Azure, MTN also plans to leverage its capabilities in AI and machine learning to come up with new use cases that, in MTN’s own words, “bridge typical divides across network, IT and commercial domains.”

MTN and Microsoft have hired Accenture to provide technology implementation, integration and support services in hopes of making the whole thing go smoothly. They have also launched a staff training program that covers cloud technologies, devsecops (development, security, and operations), and data management.

MTN and Microsoft first announced they were working together in November last year. Their five-year strategic partnership centres on transforming and modernising MTN’s comms and technology infrastructure, and building what MTN hopes will be the largest and most valuable platform business with a clear focus on Africa.

Given MTN’s scale – it serves more than 270 million subscribers across 19 markets in Africa and the Middle East – it is a pretty big deal. It has echoes of Dish deploying its greenfield 5G network on Amazon Web Services (AWS), or AT&T announcing plans to move its 5G network onto Azure.

In addition to Monday’s OSS/BSS migration, MTN and Microsoft last week showed off what they claim to be the world’s first proof-of-concept (PoC) of a 5G standalone (SA) core network deployed on Microsoft Azure.

Every element, including the control plane, user plane and management nodes was fully deployed on Microsoft’s South Africa Azure Region, giving MTN a taste of what it can expect from a cloud-native 5G network, i.e., rapid deployment and scalability. These two capabilities are particularly important to MTN, which aims to reach 10-30% population coverage with its 5G network in the medium term.

“Our strategic partnership with Microsoft will enable us to transform the way we deliver products and services to our customers. We will bring the power of cloud computing to life, driving development and innovation with speed, flexibility and predictable investments and operations. We remain focused on nurturing the digital skills within MTN and in the societies we operate in, and building digital platforms to drive digital transformation across Africa and the Middle East,” said Nikos Angelopoulos, MTN Group’s CIO, in a statement.

“Harnessing the power of MTN, Microsoft and Accenture, we will be working closely together to build the next wave of compressed digital transformation across the continent. We see this program becoming a global standard in the industry for years to come” Nitesh Singh Communications, Media and Technology Lead for Accenture Africa.

References:

MTN and Microsoft accelerate Africa’s digital transformation in the public cloud

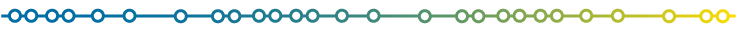

LightCounting: Open RAN/vRAN market is pausing and regrouping

Cisco 800G line card for Cisco 8000 Series Routers powered by Silicon One ASIC

Cisco today announced 800G innovations that continue to transform the economics and sustainability of the Internet for the Future, to help its customers connect the nearly 40% of the world’s population that remains unconnected or underserved.

As IoT devices grow from billions to trillions, demand for bandwidth grows not only from connecting devices with 5G and Wi-Fi, but also from the AI/ML workloads required to drive insights from IoT. Applications such as generative AI, search, language processing, and recommendation engines, are driving rapid growth of AI/ML clusters in data center environments that require more bandwidth over traditional workloads. AI/ML fabrics need to scale with denser spines that are critical to support the massive number of processors with low latency, in addition to capacity expansion in Data Center Interconnect.

While bandwidth growth seems unlimited, space and power are limited. Dense and power-efficient platforms are required. Cisco is doubling the capacities of communication service provider and Webscale customer backbones, metro core, and data center networks compared to 400G/100G modular solutions.

The new 28.8Tbps / 36 x 800G line card for Cisco 8000 Series Routers is powered by Cisco Silicon One [1] and lowers operational costs while protecting investments as communication service providers and cloud operators transform networks from 100G to 400G, and 800G capacities. Customers can benefit from carbon savings by using less hardware to scale, and equipment reuse.

Note 1. Cisco Silicon One is claimed to be the only unifying architecture enabling customers to deploy the best-of-breed silicon from Top of Rack (TOR) switches all the way through the web scale data centers and across the service provider networks with a fully unified routing and switching portfolio.

“We continue to expand 800G to more use cases, from AI/ML fabrics to the core, to help our customers meet their performance and sustainability goals,” said Kevin Wollenweber, Senior Vice President and General Manager, Cisco Networking, Data Center and Provider Connectivity. “With our dense core and spine solutions using new double density line cards with Cisco Silicon One, we have accelerated the transition to 800G anywhere.”

Key Benefits of Modular Cisco 8000 Series Router Systems Powered by Cisco Silicon One P100:

- Economics: With up to 83% space savings, customers can build denser networks using much of the same infrastructure to support use cases such as 5G, IoT, broadband and AI/ML. Other benefits include:

- By doubling the capacity in the same chassis footprint, the Cisco 8000 Series Router platform has up to twice the space efficiency over 400G single chassis systems.

- These 800G single chassis systems can now support equivalent traffic loads with up to 6x more space efficiency compared to current 400G distributed chassis solutions, by delivering up to 15 Tbps per Rack Unit.

- New 800G modular systems can also provide the equivalent bandwidth capacity with up to an estimated 68% savings in power compared to 400G solutions to help reduce operational costs.

- Sustainability: With up to 68% power savings, the 800G systems can help customers meet their sustainability goals.

- Assuming a single 800G system is in use 24 hours per day, 365 days per year, the potential energy savings over 400G systems would reduce GHG emissions by up to 215,838 CO2e per year.

- This amount of carbon savings is estimated to be equivalent to reducing carbon emissions from charging 40 million smartphones or burning 366,923 pounds of coal a year [1]

- Customers can also reuse common equipment when upgrading to 800G systems to help cut down on e-waste.

- Architectural Innovations: Powered by Cisco Silicon One P100 ASICs and Cisco pluggable optics, the new line card offers massive throughput for Cisco 8800 Series modular systems. Key features include:

- Advanced 100G SerDes technology allows customers to double current 400G port densities and increase by 8-fold current 100G port densities in the same form factor, supporting 72 x 400G and 288 x 100G ports per slot.

- Ability to scale up to 800G to support increasing traffic demands with four, eight, twelve, and 18-slot chassis. Customers can scale up to 518 Tbps capacity with a single 18-slot modular 800G system.

- Pay-as-you-grow Flexible Consumption Model helps customers futureproof their deployments by right-sizing the network, adding capacity over time to better align to business outcomes.

- Cisco’s new generation of pluggable optics provide investment protection through backwards compatibility with existing QSFP pluggable transceivers.

- Operational Simplicity: With advanced visualization dashboards, services monitoring with actionable insights, and closed-loop network optimization customers can detect issues and troubleshoot faster.

- With the latest enhancements in Crosswork Network Automation the speed at which network elements and services can be added has been significantly improved.

- New IOS XR Path Tracing provides hop-by-hop visibility of the packet’s path through the network.

Industry Response:

“Based on our extensive market research and traffic analysis, we are forecasting continued growth in data traffic with fixed and mobile services, including for 5G, broadband, IoT and cloud. These trends are putting networks under increasing pressure, which is why scaling to 800G throughput in the future with solutions such as Cisco 8000 will be in demand, while helping service providers and cloud providers improve operational efficiency, sustainability, and user experience.” — Simon Sherrington, Research Director, Analysys Mason

“Together with Cisco, we seek new approaches to drive market differentiation and deliver business outcomes through agile, secure infrastructure at every stage of the technology journey. As a key enabler of the kingdom’s Vision 2030, we must ensure that our technology stays at the forefront of technological Innovations. With modular 800G innovations and Silicon One P100 on the Cisco 8000 Series, we continue to push towards new levels of cloud connectivity and digital transformation while benefiting from operational efficiencies that allow stc group to maintain providing a high-performing, lower cost-per-bit service to our customers.” — Bader Allhieb – stc Infrastructure, stc

“Colt is working towards ESG By Design, which means our firm commitment to sustainability spans every part of our business. It’s imperative that we work with partners that share our values and strive to build a better, cleaner planet. Cisco’s latest routing innovation shows its dedication to finding powerful and effective ways of scaling capacity, whilst mitigating the environmental impact. It marks an exciting next stage in the future of sustainable digital infrastructure.” — Kelsey Hopkinson, VP-ESG, Colt Technology Services

“With the implementation of Florida LambdaRail’s new FLRnet4 400G backbone, space becomes one of our primary concerns as we had exhausted our existing footprint in many of our sites. The combination of unbelievable forwarding capacity, operational efficiency, and the dependable IOS XR network operating system made the Cisco 8000 Series the obvious choice for our new network. We couldn’t be more pleased with our choice. We not only have a state-of-the-art network, but the Cisco 8000 series solution ensures there is enough opex savings to scale our network for years to come.” — Chris Griffin, Chief Network Architect, Florida LambdaRail

Supporting Resources:

- Read the Blog: Scaling the Internet for the Future with 800G Innovation, by Satish Surapaneni

- https://blogs.cisco.com/sp/scaling-the-internet-for-the-future-with-800g-innovationsMass-Scale Infrastructure for Core

- Cisco 8000 Series

- Cisco Silicon One

- Cisco Optics

- Crosswork Network Automation

- Cisco IOS XR Path Tracing

References:

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Comcast has about 22 million Wi-Fi hotspots which are available free of charge for its Comcast Business and Xfinity customers (including this author who has used their WiFi hotspots in Santa Clara, CA and Pacifica, CA).

Xfinity Communities serves about 250,000 properties from multi-dwelling units (MDUs) to single-family communities, assisted living residences, hospitals and college dormitories. Xfinity Communities has six special account managers to handle its top 40-50 largest property owners. Some of the properties it serves are spread out so the company is providing Wi-Fi not just to specific units but also in the lobbies, on the grounds and at the pool, etc.

Although Comcast has the technology to provide Wi-Fi to a whole building without wiring multiple individual units, it seems to prefer the more traditional model. “To serve individuals best you need some kind of wired technology,” said Mike Mancini, director of sales engineering for Xfinity Communities. “Every unit gets wired to make sure we can deliver the highest speeds possible,” he added.

Xfinity Communities can and does wire the dormitory building, but not every individual unit. “We do hook up entire buildings as well, and people don’t have gateways, they have an access point up on the wall. We can provide connectivity both ways, it really depends on the property. We’re very flexible,” Mancini said.

Xfinity Communities serves selected apartment buildings. With pre-installed xFi Gateways in every unit, residents get instant access to WiFi after moving in. They can sign up for Xfinity Internet upon arrival, lease the xFi Gateway, and get connected on the spot — all from the provider of the largest gig-speed network.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, Charter Communications this week announced the availability of its Advanced Wi-Fi for Spectrum Business customers across its 41-state footprint. Charter’s Advanced Wi-Fi includes its Red Dot Design router, which can support up to 200 devices simultaneously. And it includes greater coverage with Spectrum Wi-Fi Pods, which are additional access points for extended Wi-Fi coverage and more consistent speed to all corners of the business.

“Small businesses rely on technology, specifically the Internet and WiFi, to compete in today’s marketplace,” said Dave Rodrian, Group Vice President, WiFi Products, for Charter. “Now, with the launch of Advanced WiFi throughout our footprint, we can offer small and medium-sized businesses faster and more secure WiFi connections, giving them additional control over their network so they can improve their efficiency and productivity.”

More information about Advanced WiFi and other Spectrum Business connectivity services is available here.

References:

https://www.xfinity.com/multifamily

https://www.fiercewireless.com/wireless/comcast-touts-its-xfinity-communities-wi-fi

https://corporate.charter.com/newsroom/advanced-wifi-available-to-spectrum-business-customers

ABI Research: Major contributors to 3GPP; How 3GPP specs become standards

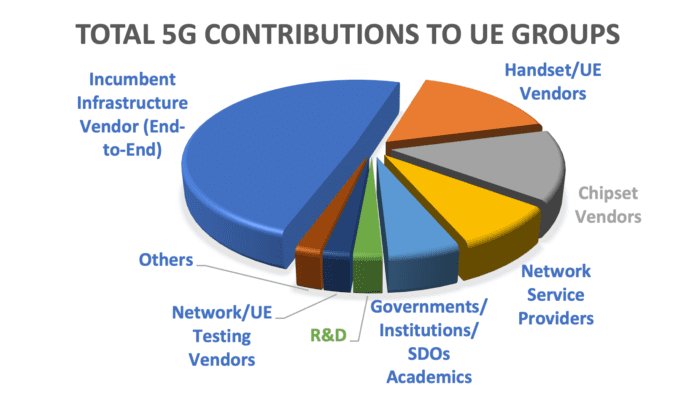

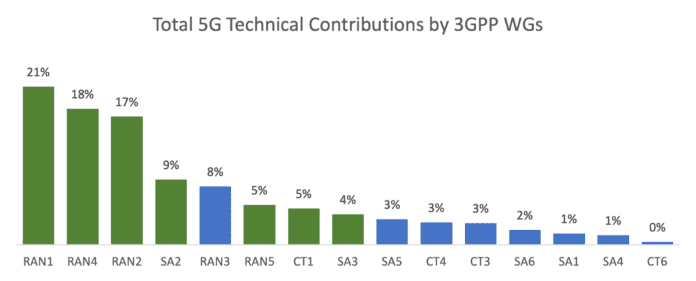

Three large network equipment vendors (Huawei, Ericsson, and Nokia) have been leading in both the number of contributions and approved contributions for 5G technologies to The 3rd Generation Partnership Project (3GPP). This is particularly the case with specifications related to User Equipment (UE) specifications and functionalities that are developed under RAN1, RAN2, RAN4, RAN5, SA2, SA3, and CT1 Working Groups (WGs).

Editor’s Note:

The 3GPP Organizational Partners (OP) are the seven Standards Developing Organizations (SDOs) – from China, Europe, India, Japan, Korea and the United States. The OPs are:

ARIB The Association of Radio Industries and Businesses, Japan

ATIS The Alliance for Telecommunications Industry Solutions, USA

CCSA China Communications Standards Association

ETSI The European Telecommunications Standards Institute

TSDSI Telecommunications Standards Development Society, India

TTA Telecommunications Technology Association, Korea

TTC Telecommunication Technology Committee, Japan

Participation in 3GPP is made possible by companies and organizations becoming Individual Members (IM) of one of the OPs.

- 3GPP specifications are not standards, they have no legal standing. They become “official” standards once one or more of the OPs transposes them, as ETSI has done many times.

- 3GPP specs become ITU-R recommendations when they are submitted to ITU-R WP5D by ATIS, discussed and agreed upon, then sent to WP5 plenary in November for final approval. That procedure was followed to create the ITU-R M.2150 recommendation which features 5G-NR.

……………………………………………………………………………………………………………………………………………………………………………………………………………….

The list of the most active companies within 5G 3GPP standards is listed in the table below:

| Top Ranked by Total Contributions | Approved Contributions | Total Contributions | Company Category |

| Huawei | 15,266 | 43,753 | Incumbent Infrastructure Vendor (End-to-End) |

| Ericsson | 11,601 | 36,375 | Incumbent Infrastructure Vendor (End-to-End) |

| Nokia | 7,553 | 23,112 | Incumbent Infrastructure Vendor (End-to-End) |

| Qualcomm | 5,523 | 18,471 | Chipset |

| Samsung | 3,548 | 16,464 | Incumbent Infrastructure Vendor (End-to-End) |

| ZTE | 3,415 | 15,291 | Incumbent Infrastructure Vendor (End-to-End) |

| Intel | 2,151 | 10,770 | Chipset |

| LGE | 1,396 | 10,139 | Handset/UE Vendor |

| CATT | 1,934 | 9,792 | Government/Institution/SDO/Academics |

| vivo | 1,205 | 8,367 | Handset/UE Vendor |

| MediaTek | 1,848 | 7,766 | Chipset |

Source: ABI Research

Key Takeaways:

- Counting contributions alone is insufficient to identify leaders in 3GPP standardization processes. However, it is a crucial step in recognizing active contributors and identifying innovation.

- More than 400 companies from the industry have participated in 3GPP standardization; however, only a handful of companies are consistently active in driving 3GPP 5G standards.

- Huawei, Ericsson, and Nokia have, so far, been leading in both the number of total and approved contributions for 5G technologies to 3GPP.

- Network infrastructure vendors are significantly more active than any other company categories, followed by handset vendors, chipset vendors, network service providers, and government research institutions.

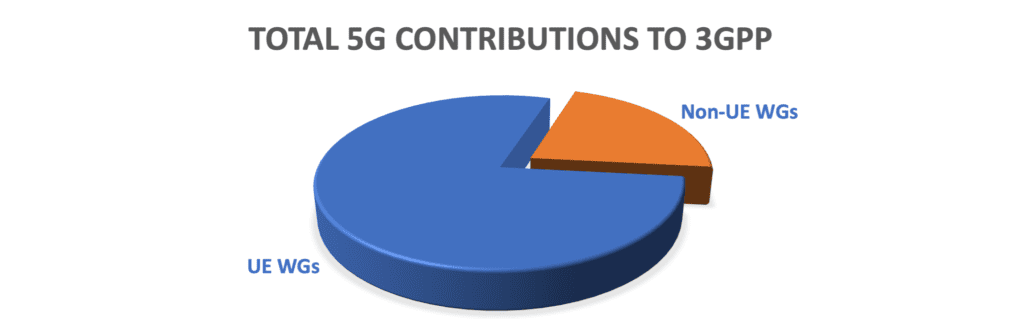

- UE-related WGs (i.e., RAN1, RAN2, RAN4, RAN5, SA2, SA3, and CT1) take 80% of total contributions. RAN1, RAN2, RAN4, and SA2 are the most important WGs, impacting the entire mobile industry and receiving massive interest.

References:

https://www.3gpp.org/about-us/partners

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

Busting a Myth: 3GPP Roadmap to true 5G (IMT 2020) vs AT&T “standards-based 5G” in Austin, TX