Author: Alan Weissberger

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

Multiple factors have slowed down the transition to 5G such as lower handset sales driven by cost-of-living crisis and inflation, poor network coverage, low performance gain perception, and lack of 5G specific applications. Furthermore, an increasing portion of mobile connections – approximately 30% – are not handsets and will be slower to convert to 5G (e.g., IoT, connected tablets/laptops, wearables).

Omdia Senior Market Forecaster, Garinder Shankrowalia, said: “5G subscription reporting in 2022 has led us to reduce our 2023 forecast by 7.2% -approximately 150 million subscriptions. We anticipate the industry will regain this loss from 2025, once global market conditions are improved.”

Omdia believes it is important for mobile operators to continue investing in next generation mobile networks to enable the application emergence and the overall digital economy to grow. However, having multiple cellular technologies running concurrently on mobile networks is having an adverse effect on operators whereby launching 5G increases complexity and cost for little return in the short term.

Omdia Research Director Ronan de Renesse said: “There needs to be a ‘net-zero’ approach to network development, removing the old as the new gets deployed. Operators are already starting to move capital from next generation network deployment to 3G decommission projects and digital transformation. Key stakeholders should remain realistic about the prospects for 5G and re-evaluate the business case before moving on to the next step.”

Omdia forecasts 5G will account for 5.9 billion subscriptions in 2027 equivalent to a population penetration of 70.9%.

Another Opinion: 5G Fails to Deliver on Promises and Potential

5G is a big letdown and took a “back seat” at CES 2023; U.S. national spectrum policy in the works

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

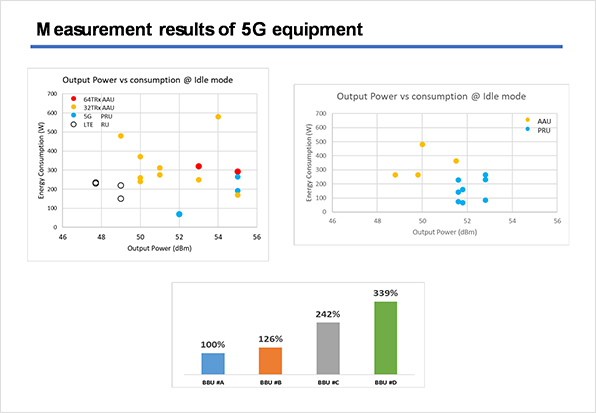

- Possibilities to achieve greater energy savings based on energy consumption levels measured in the two companies’ respective base stations

- Technical analysis of candidate energy-saving technologies, including both hardware and software

- The roles that operators and equipment vendors should play, including the need for greater coordination, in the effort to achieve greater energy savings

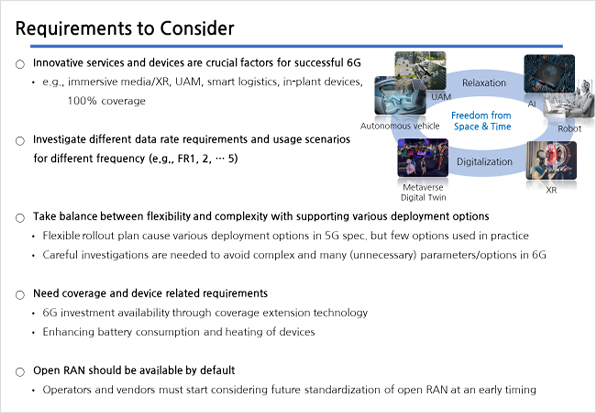

For 6G, the paper reviews requirements and challenges including specific performance levels and implementation scenarios, focusing on technical issues of particular importance to mobile operators:

- Performance requirements and implementation scenarios for each frequency band, taking into account the characteristics of each frequency

- Issues concerning coverage and devices in high-frequency bands

- Standardization for migration to 6G architecture and application of cloud-native / open architecture

Going forward, NTT DOCOMO and SKT will continue to collaborate in various technical fields, aiming to enhance the competitiveness and operational efficiency of 5G as well as support the global standardization and technical verification of 6G. They will also collaborate with global telecom operators on 6G standardization and R&D with the goal of building a global ecosystem that encompasses advanced industries and technologies.

“The white papers carry a significant meaning as they mark the first tangible result since entering into a strategic partnership with NTT DOCOMO last year,” said Yu Takki, Vice President and Head of Infra Tech Office of SKT. “Based on our experience and knowhow in 5G, we will continue to collaborate with world-leading operators such as NTT DOCOMO to lead 5G evolution towards 6G.”

Takehiro Nakamura, Chief Technology Architect, NTT DOCOMO, said: “We are delighted to jointly announce two white papers on green mobile networks and 6G requirements as our collaborative achievements with SKT started in November 2022. We will continue to enhance cooperation among the two major Asian mobile operators and promote superior concepts and innovative technologies to the world for the 6G deployment.”

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

In addition to Telco Network Builder, AWS today announced its Integrated Private Wireless that acts as an infrastructure bridge for network operators that want to offer a private network service tapping into AWS’ infrastructure to end users. This allows AWS to connect incoming customers interested in a private network platform with the #1 cloud service provider’s telecom partners.

“We are really just connecting the customer with the telco, then that relationship is between the two of them,” said Jan Hofmeyr,VP of Amazon EC2. Initial telecom partners include Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica. Enterprise customers shopping for private wireless services will be able to purchase an installation from one of those participating operators. “The relationship is directly between the customer and the telco,” Hofmeyr said, noting that the resulting private wireless network will then run atop the AWS cloud.

Hofmeyr said that AWS’ goal is to provide customers with an easy set of options that will allow them to deploy or operate a private network in a manner that meets their needs and abilities. “Right now this is their ask, [it’s] helping us make this onboarding easier, and that’s exactly what we’re focusing on. In the future, we’ll continue to listen to what their needs are and continue to support that,” Hofmeyr added.

This new private network offering is different from AWS’ Private 5G platform that it initially unveiled in late 2021, and has since updated. That platform integrates small cell radio units, AWS’ Outposts servers, a 5G core, and radio access network (RAN) software running on AWS-managed hardware. AWS also handles the spectrum management of this service.

AWS will act as the portal, but telcos will be the managed service providers for the network on behalf of those enterprises or smaller service providers, the company said. As with the telco network builder, AWS will provide a dashboard for monitoring performance and modifying it as needed.

“That’s one of the friction points we saw as we started looking at the private network space,” said Ishwar Parulkar, chief technologist for the telco industry at AWS, in an interview. “There are a lot of enterprise customers who really don’t care about all of this. They just want to be able to use the network and run some applications on top. That’s one of the primary values that we bring with this: lifting that undifferentiated work away from them and managing it in the cloud.”

For Amazon, telcos represent a prime business opportunity: as carriers build new networks with increasing reliance on software and cloud services, Amazon is positioning itself as a tech and cloud partner to help run those services better and more cheaply. It’s been interesting to watch how it has worked to build trust among a group of businesses that have at times been very wary of big tech and the threat of being reduced to “dumb pipes” as tech companies lean on their own architecture and technology advances to build faster and cheaper services that compete directly with what carriers have and plan to roll out. As one example, the company is clear to call these new products “offerings” and not services to make clear that it is not the managed service provider, the carriers’ role.

“We’ve been on this journey for a few years now in terms of really getting the cloud to run telco networks,” said Parulkar. “Our goal here is to make AWS the best place to host 5g networks for both public and private. And on that journey, we’ve been making steady progress.”

For carriers, they are now in a world where arguably communications is just another tech service, so many of them believe that running them with less costs and in more flexible ways will be the key to winning more business, introducing more services and getting better margins. Whether carriers want to wholesale work closer with Amazon, or with any of the cloud providers, for such services, will be the big question.

References:

https://www.sdxcentral.com/articles/news/aws-expands-5g-telecom-private-wireless-work/2023/02/

https://au.finance.yahoo.com/news/amazons-aws-cozies-carriers-launches-170645578.html

AWS Telco Network Builder: managed service to deploy, run, and scale telco networks on AWS

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Amazon Web Services, Inc. (AWS) today announced the general availability of AWS Telco Network Builder, a fully managed service that helps customers deploy, run, and scale telco networks on AWS. Now, communications service providers (CSPs) can use their familiar telecom industry standard language to describe the details of their network (e.g., connection points, networking requirements, compute needs, and geographical distribution) in a template uploaded to the service.

AWS Telco Network Builder translates the template into a cloud-based network architecture and provisions the necessary AWS infrastructure, shortening the deployment of an operational, cloud-configured telco network from days to hours. As customers update their networks, AWS Telco Network Builder automatically adjusts compute and storage resources, allowing CSPs to focus on business operations and deliver new services.

AWS Telco Network Builder provides a centralized dashboard to monitor and manage the network running on AWS infrastructure – whether on premises or in AWS Regions. There are no upfront commitments or fees to use AWS Telco Network Builder, and customers pay only for the AWS services used to manage their network.

CSPs want to take advantage of the cloud’s performance, elasticity, and scale to build modern telco networks that support emerging use cases like smart cities, autonomous vehicles, and robotics. However, designing and scaling a telco network in the cloud can be a laborious, time-intensive process due to the iterative nature and breadth of network use cases, such as business support systems, mobile core, and radio networks. CSPs must first deploy and securely interconnect hundreds of specialized network functions (NFs)—containerized network appliances, like routers and firewalls—across dozens of vendors and thousands of locations, often hardcoding the infrastructure’s parameters when replicating across deployment locations.

Once the NFs are deployed, the CSP must update each NF individually to incorporate new software capabilities or make configuration changes, which is time-consuming work that strains resources. Building and running the network also requires skilled network architects with experience in cloud design and management. Additionally, CSPs must often purchase, setup, and maintain separate monitoring tools to observe the health of their on-premises and cloud-based infrastructures, making it challenging to obtain a complete view of their networks and address issues. As a result, CSPs can sometimes allocate too many resources to the undifferentiated heavy lifting of network management instead of focusing on innovating new experiences.

AWS Telco Network Builder is a fully managed network automation service that enables CSPs to deploy, run, and scale their telco networks on AWS faster and more easily. To start, a CSP populates their network architecture (e.g., routing requirements, location of deployment, specific NFs) as a template in the service’s console using telecom industry standard language, making it intuitive and easy to begin. AWS Telco Network Builder translates the customer’s network specifications into a cloud-based network architecture, streamlining programming requirements across multiple software vendors and accounting for the network’s geographic footprint. AWS Telco Network Builder automatically maps the provided topology to network services, provisions the necessary compute and storage resources, and connects the NFs to create an operational telco network. Customers can then reuse the uploaded templates to replicate that network architecture in new regions. As customers change their network configuration or run software updates, AWS Telco Network Builder handles lifecycle management for the NFs, performs updates to the NFs, and adjusts related infrastructure.

AWS Telco Network Builder is being sold to both public and private network operators, including those with existing network operations as well as those launching new networks.

Jan Hofmeyr, VP of Amazon EC2 said telcos those network functions in the format that telecom network operators have can continue to run their networks in the way they have in the past, even as they shift network functions into the AWS cloud. “It’s really an attempt to make it easier for them,” Hofmeyr said of the new product. “It doesn’t require them to be cloud experts on day one.”

Together, AWS Telco Network Builder and Amazon CloudWatch provide a comprehensive view of the NFs and AWS infrastructure, so customers can efficiently monitor and manage their networks to identify and remediate issues more quickly. AWS Telco Network Builder also integrates with popular third-party, end-to-end orchestrators for CSPs to maintain continuity across existing telco network operations and business systems. With AWS Telco Network Builder, customers only pay for the AWS products and services they use, so they can quickly scale their network based on business requirements.

“The telecom industry is undergoing a transformation as CSPs navigate building their telco networks in the cloud,” said Jan Hofmeyr, vice president of Amazon Elastic Compute Cloud (Amazon EC2). “Some of the biggest challenges CSPs face as they look to migrate include manually configuring and then managing these complex networks, which impedes growth and stifles innovation. Groundbreaking in the value it provides to the telecom industry, AWS Telco Network Builder removes the burden of translating a customer’s desired telco network into a cloud architecture, empowering them to easily modernize and quickly scale to meet demand while freeing time and capital to build new offerings, expand coverage, and refocus on invention.”

AWS Telco Network Builder is generally available today in U.S. East (N. Virginia), US West (Oregon), Asia Pacific (Sydney), Europe (Frankfurt), and Europe (Paris), and with availability in additional AWS Regions coming soon.

Amdocs is a leading provider of software and services to communications and media companies. “The current era of 5G cloud-based networks creates an opportunity for communications service providers to deliver accelerated value at unparalleled scale and efficiency,” said Anthony Goonetilleke, group president at Amdocs Technology. “Amdocs Intelligent Networking Suite takes advantage of AWS Telco Network Builder’s support of telecom interfaces to simplify service and network orchestration while bringing agility to network planning, deployment and operations.”

Cloudify is an open source, multi-cloud orchestration platform that packages infrastructure, networking, and existing automation tools into self-service environments. “We’ve observed the challenges the industry faces in bridging the gap between applications and cloud environments,” said Nati Shalom, CTO and founder of Cloudify. “Our work with AWS Telco Network Builder will help communications service providers more easily manage their network services by automating network planning, deployment, and operations activities using standard DevOps and IT service management tools. We are excited to use AWS Telco Network Builder to simplify the orchestration of network workloads using standard European Telecommunications Standards Institute-based interfaces.”

Infosys is a global leader in next-generation digital services and consulting. “The cloud’s scalability and efficiency are key to enabling innovation and reducing the complexity of managing telco network operations, which arms us with the tools to deliver new services for our end users continuously,” said Anand Swaminathan, executive vice president and global industry leader – Communications, Media, and Technology at Infosys. “As we look to build and operate cloud-based networks for our clients with Infosys Cobalt, we are excited to leverage AWS Telco Network Builder to increase the operational efficiency of mobile and private networks, ultimately enabling a streamlined operational model across Multi-G technologies.”

Mavenir is a network software provider building the future of networks with leading 4G, 5G, Core, and IP Multimedia Subsystem cloud-native software. “Managing 4G, 5G, Core, and IP Multimedia Subsystem networks is complex. Often these networks are distributed across the edge continuum,” said Bejoy Pankajakshan, chief strategy officer at Mavenir. “AWS Telco Network Builder allows us to create repeatable network templates that speed up the definition, provisioning, deployment, and upgrading of network services for our customers. The collaboration between Mavenir and AWS offers customers flexibility and agility in the deployment of network functions, furthering us toward our goal of building a single, software-based automated network.”

O2 Telefónica is a leading telecommunications provider in Germany, with around 47 million mobile telephone lines and 2.3 million broadband lines. “As we transition our telco network to the cloud, we strive to achieve greater operational simplicity while accelerating the roll-out of our network and services,” said Bas Hendrikx, head of Cloud Center of Excellence at O2 Telefónica. “We are exploring AWS Telco Network Builder to enable us to leverage automation to deliver new 5G network services faster and manage our networks more efficiently. At O2 Telefónica, we are committed to shaping digital change that benefits everyone, and our investments in building cloud-native networks and using AWS services help to provide greater value and performance to our customers.”

Dish Network in the U.S., Swisscom in Switzerland, and Spark in New Zealand are among the operators that have agreed to put their 5G SA core network functions into the AWS cloud.

To learn more, visit aws.amazon.com/tnb

References:

https://www.businesswire.com/news/home/20230221005644/en/AWS-Announces-AWS-Telco-Network-Builder

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References:

Info-Tech: Cloud Network Design Must Evolve to Meet Both Current and Future Organizational Needs

Cloud adoption among organizations has increased dramatically over the past few years, both in the range of services used and the extent to which they are employed. However, network builders tend to overlook the vulnerabilities of network topologies, which leads to complications down the road, especially since the structures of cloud network topologies are not all of the same quality. To help organizations build a network design that suits their current needs and future state, global IT research and advisory firm Info-Tech Research Group has published its latest advisory deck, Considerations for a Hub and Spoke Model When Deploying Infrastructure in the Cloud.

The new research deck states that for organizations considering migrating their resources to the cloud, careful planning and decision making is required. This includes selecting the right topology, designing the cloud infrastructure for efficient management, and providing access to shared services. The advisory deck further highlights that one of the main challenges of cloud infrastructure planning is finding the right balance between governance and flexibility, which is often overlooked.

“Evaluating and selecting the right cloud network topology is crucial for optimizing performance. It also enables easier management and resource provisioning,” says Nitin Mukesh, senior research analyst at Info-Tech Research Group. “An ‘as the need arises’ strategy will not work efficiently since network design changes can significantly impact data flows and application architectures, which becomes more complicated as the number of cloud-hosted services grows. Designing a network strategy early on will give more control over networks and prevent the need for significant infrastructure changes later.”

Info-Tech’s research indicates that when organizations move to the cloud, many often retain the mesh networking topology from their on-prem design, or they choose to implement the mesh design using peering technologies in the cloud without considering the potential changes in business needs. Although there are various network topologies for on-prem infrastructure, the network design team may not be aware of the best approach in cloud platforms for their requirements, or a cloud networking strategy may even go overlooked during the migration.

The new resource explores a hub and spoke model for organizations deciding between governance and flexibility in network design. A hub and spoke network design involves connecting multiple networks to a central network, or a hub, that facilitates intercommunication between them. The hub can be used by multiple workloads for hosting services and managing external connectivity.

Other networks connected to the hub through network peering are called spokes and host workloads. Communications between workloads, servers, or services on the spokes pass through the hub, where they are inspected and routed. The spokes can be centrally managed from the hub using IT rules and processes. This design allows for a larger number of virtual networks to be interconnected, with only one peered connection needed to communicate with any other network in the system.

Organizations that choose to deploy the hub and spoke model face a dilemma in choosing between governance and flexibility for their networks. Info-Tech recommends that organizations consider the following design options when developing a cloud network strategy:

- PEERING: Peering Virtual Private Clouds (VPCs) into a mesh design can be an easy way to get onto the cloud, but it shouldn’t be the networking strategy for the long run.

- HUB AND SPOKE: Hub and spoke network design offers more benefits than any other network strategy to be adopted only when the need arises. Organizations should plan for the design and strategize to deploy it as early as possible.

- HYBRID: A mesh and hub and spoke hybrid can be instrumental in connecting multiple large networks, especially when they need to access the same resources without having to route the traffic over the internet.

- GOVERNANCE VS. FLEXIBILITY: Governance vs. flexibility should be a key consideration when designing for hub and spoke to leverage the best out of the infrastructure.

- DOMAINS: Distribute domains across the hub or spokes to leverage costs, security, data collection, and economies of scale and foster secure interactions between networks.

The firm advises that the advantages of using a hub and spoke model far exceed those of using a mesh topology in the cloud. However, organizations, especially large ones, are complex entities, and choosing only one model may not serve all business needs. In such cases, a hybrid approach may be the best strategy.

To learn more, download the complete Considerations for a Hub and Spoke Model When Deploying Infrastructure in the Cloud advisory deck.

Info-Tech Research Group is one of the world’s leading information technology research and advisory firms, proudly serving over 30,000 IT professionals. The company produces unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. For 25 years, Info-Tech has partnered closely with IT teams to provide them with everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

Media professionals can register for unrestricted access to research across IT, HR, and software and over 200 IT and Industry analysts through the ITRG Media Insiders Program. To gain access, contact [email protected].

SOURCE Info-Tech Research Group

……………………………………………………………………………………………………………………

References:

For more information about Info-Tech Research Group or to access the latest research, visit infotech.com and connect via LinkedIn and Twitter.

European Space Agency & UK Space Agency chose EnSilica to develop satellite communications chip for terminals

UK based EnSilica, a fabless ASIC and mixed signal chip maker, has announced a contract to develop a new chip to address the next generation of mass market satellite broadband user terminals.

The contract has been awarded through the European Space Agency’s (ESA) Advanced Research in Telecommunications Systems Core Competitiveness program (“ARTES CC”), through the support of the UK Space Agency.

The chip in development will enable a new generation of lower-cost, low-power satellite broadband user terminals, which track the relative movement of low-earth orbit satellites and allow users to access high bandwidth connectivity when out of reach of terrestrial networks.

Use cases include satellite communication-on-the-move (SOTM) for automotive, maritime, and aerospace connectivity as well as extending broadband access to users without internet access.

Dietmar Schmitt, Head of Technologies & Products Division at ESA, said “ESA is pleased to continue our collaboration with EnSilica through the ARTES Core Competitiveness programme and to support this important technology development, which will facilitate the provision of high capacity connectivity across a wide range of use cases.”

Henny Sands, Head of Telecoms at the UK Space Agency, described EnSilica’s satellite broadband user terminals chip as “a brilliant example of the diversity of expertise in the UK’s leading satellite communications sector.”

Henny added: “Through the ARTES CC programme the UK Space Agency aims to champion UK companies that have the right expertise and ambition to become global players in this market and lead on ground-breaking technologies that will enhance the wider UK space sector, create jobs and generate further investment. That’s why we recently announced £50 million of funding for ambitious and innovative projects that will supercharge the UK’s satellite communications industry.”

Paul Morris, VP RF and Communications BU, commented: “We are delighted to be continuing our successful partnerships with both UKSA and ESA to further develop innovative semiconductor solutions for the next generation of satellite broadband user terminals.”

…………………………………………………………………………………………………………………………………………………………………

About EnSilica:

EnSilica is a leading fabless design house focused on custom ASIC design and supply for OEMs and system houses, as well as IC design services for companies with their own design teams. The company has world-class expertise in supplying custom RF, mmWave, mixed signal and digital ICs to its international customers in the automotive, industrial, healthcare and communications markets. The company also offers a broad portfolio of core IP covering cryptography, radar, and communications systems. EnSilica has a track record in delivering high quality solutions to demanding industry standards. The company is headquartered near Oxford, UK and has design centres across the UK and in India and Brazil.

Recent ASICs and Case Studies:

- 40nm Ka-band transceiver and beamformer for satellite terminals

- 180nm BCD H-bridge controller for automotive chassis control

- 55nm low-power mobile phone sensor interface

- 180nm BCD industrial MCU for safety critical applications

- 180nm BCD multi-channel 2GHz phase controller 600nm gyro sensor amplifier

- 28nm audio processor for smart microphone

- 28nm multi-standard GNSS receiver

- 40nm multi-standard analog and digital broadcast receiver

- 40nm 60GHz Radar sensor 65nm medical vital signs sensor with 2.4GHz radio

- 40nm NFC energy harvesting processor

About ESA’S ARTES Core Competitiveness Program:

ESA’s ARTES (Advanced Research in Telecommunications Systems)

program is unique in Europe and aims to support the competitiveness of European and Canadian industry on the world market. Core Competitiveness is dedicated to the development, qualification and demonstration of products (“Competitiveness and Growth”), or long-term technology development (“Advanced Technology”). Products in this context can be equipment for the platform or payload of a satellite, a user terminal, or a full telecom system integrating a network with its space segment.

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

With 5G deployed in more than 90 countries globally, network operators are increasingly considering 5G Fixed Wireless Access (FWA) to enable more homes and businesses can connect and enjoy the power of connected broadband experiences.

This week, Qualcomm unveiled its 5G Fixed Wireless Access Platform Gen 3, the world’s first fully-integrated 5G advanced-ready FWA platform. Besides benefitting from Snapdragon X75 capabilities, Qualcomm FWA Gen 3 key features include:

- Extended-range mmWave and Sub-6 GHz

- Qualcomm Tri-Band Wi-Fi 7 with expert Multi-Link operation for blazing-fast lower latency, reliable connections, and mesh capability for seamless coverage

- Quad-core central processing unit (CPU) and hardware acceleration boosts

- Self-install capabilities facilitated by Qualcomm Dynamic Antenna Steering technology

- Qualcomm RF Sensing Suite to enable indoor mmWave Customer Premises Equipment (CPE) deployments

- Support for 5G Dual-SIM Dual Active (DSDA) and Dual-SIM Dual Standby (DSDS) configurations

Qualcomm FWA Gen 3 is claimed to be the world’s first fully-integrated 5G advanced (???)-ready FWA platform, which includes support for Sub-6 GHz, mmWave, and Wi-Fi 7 connectivity, and boosted with quad-core CPU and hardware acceleration to drive a wide range of applications and value-added services.

The new platform features:

- The recently announced Snapdragon X75 5G Modem-RF, enabling breakthrough 5G performance to achieve unmatched speeds, coverage, and link robustness

- Qualcomm QTM567 mmWave Antenna Module, providing reliable and extended mmWave coverage

- Wi-Fi 7 with 10Gb ethernet, delivering multi-gigabit speeds and wire-like latency to virtually every device in the home

- Converged mmWave-sub 6 hardware architecture, reducing footprint, cost, board complexity, and power consumption

These capabilities will help OEMs accelerate time to launch, improve performance, and lower development effort for building cutting-edge FWA CPEs at scale. The Qualcomm FWA Gen 3 provides a fully-integrated solution that enables product development for multiple mobile broadband product categories and enables OEMs to offer a diverse product portfolio to their customers.

Qualcomm FWA Gen 3 includes the following features:

- Increased coverage through extended range mmWave and extended-range sub-6GHz with eight receiver antennas and support for power class 1.5 (PC 1.5)

- Enhanced self-install capabilities with Qualcomm Dynamic Antenna Steering Gen2

- Qualcomm RF Sensing Suite to help accelerate indoor mmWave CPEs deployments

- Flexible software architecture with support for multiple frameworks, including OpenWRT and RDK-B

- The Qualcomm FWA Gen 3 encapsulates the next-gen modem-RF system technologies intended to springboard 5G forward with superior 5G speeds and flexibility. This breakthrough connectivity is enabled by several capabilities including:

- Unrivalled spectrum aggregation

- Multi-Gigabit speed

- Improved uplink coverage with FDD uplink MIMO and uplink carrier aggregation (CA)

- Significant performance increase with Wi-Fi 7 advanced features:

- Tri-Band support in the 2.4GHz, 5GHz, and 6GHz spectrum bands with 320MHz and 4K QAM modulation

- Multi-Link technology enabling lower latency in heavily congested home environments

With WiFi 7 (IEEE 802.11be) and 5G connectivity, the platform offers consumers a faster and more reliable internet connection in the home. They can tap into the increased capacity and bandwidth offered by Wi-Fi and 5G to deliver multi-gigabit speeds, enabling consumers to connect all their devices and enjoy improved user experiences.

Qualcomm Resources:

Learn more about Fixed Wireless Access and its benefits here and here. Additionally, check out more on our latest Snapdragon X75 5G Modem-RF System enabling this technology here. Solutions such as this, powered by our one technology roadmap, including foundational 5G technologies, further position Qualcomm as the edge partner of choice for the cloud economy. Qualcomm makes an intelligently connected world possible.

…………………………………………………………………………………………………………………………………

FWA and a Converged Mobile Core Network:

In a blog post today, Matt Price of Cisco states that FWA is a great tool for reducing the digital divide when it comes to accessibility and affordability. The economics for providing Internet services were in need of a change and FWA offers some good ones – reducing trenching requirements, increasing serviceable area, offering self-install customer equipment (CPE), and even providing a common wireless network architecture that can serve both Fixed Wireless Access and Mobile Access services. To achieve these goals, Cisco strongly recommends 5G service providers deploy 5G SA core networks, which the vendor has implemented as a converged 4G/5G core for T-Mobile US.

Other carriers, like Verizon [1.] have deployed a 5G NSA FWA network.

Note 1. Verizon has increasingly come to view FWA as an integral part of their broadband access offering everywhere that FiOS isn’t available. At the same time, the telco has argued (with increasing confidence) that the often-assumed capacity constraints on FWA are not only addressable, but that they are not an issue. Verizon views 5G FWA as a major growth opportunity- much more so than 5G mobile services, according to Sowmyanarayan Sampath, Executive Vice President and CEO of Verizon Business. It’s also interesting that Telkom in South Africa and Safaricom in Kenya have deployed 5G NSA networks for FWA but NOT yet for 5G mobile service.

……………………………………………………………………………………………………………………………………………………………..

5G SA’s network architecture can flexibly deploy User Plane Function (UPF) nodes to anchor a FWA subscriber’s user plane traffic for peering at the nearest edge aggregation point. Unlike a typical mobile device such as a cell phone, fixed wireless devices are meant to be always-on and connected for serving end user devices. Meaning that the latency and reliability we commonly expect from traditional wireline services is expected from fixed wireless services too.

In 2022, T-Mobile US became the fastest growing U.S. Internet Service Provider—doubling their number of FWA customers in the past six months. With over 2 million FWA subscribers and counting, the scalability and flexibility of having a Converged Core has proven invaluable to T-Mobile. Being able to deploy UPF nodes for Fixed Wireless Access in remote locations while managing the Session Management Function (SMF) nodes at a central site(s) is effective for scaling the network, optimizing the usage of the transport infrastructure to deliver better end-user latency.

Scaling and extending Fixed Wireless Access with the flexible deployment of UPF nodes, optimizing the routing for user plane traffic. Source: Cisco

…………………………………………………………………………………………………………………………………………………………………

It’s estimated that around 70% of communication service providers today offer a form of Fixed Wireless Access services, most of them still using 4G LTE, which delivers a fraction of the performance of fiber. Upgrading network architectures to meet the needs of new 5G services needs a smooth plan for the transition. Cisco believes that can begin in the mobile core network. With a Converged 4G/5G Core, communication service providers can migrate from 4G to 5G without disruption while scaling to serve the needs of millions of new subscribers.

For More Information:

Learn more about the Cisco Converged Core, and how we are helping rural communities bridge the digital divide. Find out how T-Mobile and Cisco Launched the World’s Largest Cloud Native Converged Core Gateway, read the December 2022 press release.

……………………………………………………………………………………………………………………….

References:

Next-level connectivity: Unveiling our new 5G FWA Platform | Qualcomm

https://blogs.cisco.com/sp/getting-to-the-core-of-the-digital-divide-with-5g-fixed-wireless-access

https://www.verizon.com/about/blog/fixed-wireless-access

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Taiwan’s 5G services assisting in manufacturing and arts

Although the consumer penetration rate of 5G services remains low, more businesses are using 5G technology to develop applications that offer more diverse content and facilitate production processes, according to Taiwan’s National Communications Commission.

Kaohsiung Music Center has become the nations first exhibition venue to offer performances combining music and 5G artificial intelligence (AI) of things, the commission said. The V Future Party this year is set to become the nations largest performance integrating virtual reality and real-time performance, the commission said. The performances are to combine Chunghwa Telecoms 5G network, AI technology and high-end facilities at the center, it added. Participants in the V Future Party would see AI manga characters perform with live dancers.

The party integrates online and offline performances by utilizing high-speed and low-latency characteristics of the 5G system and multiple high-speed cameras to capture real-time actions in three dimensions, it said. The new form of performance brings new possibilities to performing arts, it added.

Meanwhile, China Steel Corp has used the 5G enterprise private network technology developed by Chunghwa Telecom to monitor its operations along a 900m-long steel slag transportation track and remote-control slag receiving operations, the commission said. This assists greatly in avoiding industrial safety accidents, it said. Through the 5G system, on-site images and data can be sent immediately to the vehicle dispatch center. In addition, the safety of the steel factory is enhanced by the driving safety assistance system.

“When the slag-receiving vehicle is moving for a long distance in the factory area, a foreign object intruding after a level crossing is lowered would immediately trigger a warning sound and automatically notify the slag-receiving vehicle to stop,” the commission said.

Previously, Taiwan network operator Far EasTone Telecommunications expects its 5G subscriber penetration rate to reach 40% by the end of this year from more than 30% last year, Taipei Times reported. It would be reasonable to see an increase of 10 percentage points this year, Far EasTone president Chee Ching (井琪)

References:

https://www.taipeitimes.com/News/taiwan/archives/2023/02/17/2003794528

https://www.ncc.gov.tw/english/

https://www.taipeitimes.com/News/biz/archives/2023/01/14/2003792552

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications and AT&T today announced a deal that will enable AT&T cell towers to connect to Frontier’s ultra-fast fiber network. Specifically, AT&T will use Frontier’s fiber infrastructure [1.] in areas where AT&T doesn’t currently own fiber. This will improve the resiliency, reliability and speed of the wireless service that AT&T offers to its customers. AT&T is the first tenant to rent space in Frontier’s hyper-local offices and will utilize Frontier’s fiber-optic network to connect with its cell towers that are in Frontier’s network.

Note 1. Frontier’s fiber network is available in 25 states.

Frontier’s footprint is complementary to AT&T’s existing network, which will help accelerate the company’s 5G deployment. AT&T will tap into Frontier’s fiber-to-the-tower (FTTT) infrastructure to connect to AT&T’s wireless cell towers. AT&T is the first tenant to rent space in Frontier’s local central office facilities, they said.

This deal is an extension of AT&T and Frontier’s 2021 agreement that brought the two complementary fiber networks together to power business customers nationwide. That multi-year agreement, focused on Frontier service territories in parts of 25 states, also mentioned support for deployment of AT&T’s 5G network.

The deal comes together as Frontier pushes ahead with a fiber upgrade and buildout plan. Frontier announced late last year that it had neared the halfway point toward a goal of reaching at least 10 million locations with fiber by the end of 2025. While a good portion of that work is focused on delivering services to Frontier’s own residential and business customers, the agreement with AT&T highlights the buildout’s wholesale opportunity.

Fiber backhaul is increasingly critical to support the data demands of wireless networks, including 5G. This agreement enables AT&T to stay ahead of those demands and build on an existing relationship between the two companies. Also, fiber backhaul could help spark a wholesale business that’s been in decline. Frontier’s overall business and wholesale revenues dropped 7.5% in Q3 2022 year-over-year, primarily due to declines in its copper footprint. Meanwhile, business and wholesale fiber revenues rose 1.1%, to $267 million, sequentially.

As illustrated in the figure below, backhaul comprises the Transport network, that connects the Tower / Access Point (mobile base station), which is part of the Radio Access Network (RAN), to the Core Network, where most computing resources are located.

“We’re excited to collaborate with AT&T in strengthening their wireless service with our fiber infrastructure,” said Vishal Dixit, Frontier’s Chief Strategy Officer & EVP Wholesale. “As one of the largest fiber builders in the country, our fiber infrastructure offers an attractive opportunity for tech companies to use this future-proof foundation for their wireless services. This is another example of how innovation is helping to transform Frontier.”

”Fiber is central to our wireless strategy and to our overall connectivity approach,” said Cheryl Choy, Senior Vice President, Network Planning & Engineering, AT&T. “This expanded collaboration with Frontier is a win for both companies, as they can fully utilize their fiber infrastructure, and we can continue to ensure our wireless services are powered by the unparalleled capacity of fiber optic networks.”

About Frontier:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

About AT&T:

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Media Contacts:

Chrissy Murray

VP, Corporate Communications

[email protected]

Anne Tidrick

Director, Corporate Communications

+1 469-516-5862

[email protected]

References: