5G SA/5G Core network

Ericsson Mobility Report touts “5G SA opportunities”

State of 5G SA:

“It’s been exciting to see the industry evolve in the last decade or so, and see first-hand the massive growth of 4G and the arrival of 5G,” said Fredrik Jejdling Executive Vice President and Head of Business Area Networks and Publisher of Ericsson Mobility Report.

The latest edition of Ericsson’s Mobility Report opens with the assertion that “5G standalone brings new opportunities,” which sounds promising, but there’s nothing in the report which shows what those opportunities are.

Ericsson says that 40 service providers have deployed or launched 5G SA in public networks, which agrees with Analysys Mason’s findings. To put that in context, around 280 service providers globally have launched commercial 5G with the overwhelming being 5G NSA.

Dell’Oro counted just seven 5G SA launches to date in 2023, while the GSA – which worked with Ericsson on the stats for its Mobility Report – shared data that also showed little growth in 5G SA this year.

………………………………………………………………………………………………………………………………………….

- 1. 6 bn Global 5G mobile subscriptions are projected to reach 1.6 billion by the end of 2023.

- 30% 5G mid-band population coverage outside mainland China has increased from 10 percent in 2022 to around 30 percent at the end of 2023.

- 56 GB Global mobile data traffic consumption per smartphone is expected to reach 56 GB per month at the end of 2029.

Ericsson predicts that there will be 1.6 billion 5G subs in the world by the end of this year, or 18% of all mobile subscriptions, driven by North America, where 5G penetration will reach 61%. As recently as June, the network equipment vendor forecast that the year-end 5G total would hit 1.5 billion, so clearly the market is increasing faster than expected. In the third quarter there were 163 million 5G subscriber additions taking the total to 1.4 billion by the end of September. As such, the year-end target look eminently achievable.

Ericsson puts total global 5G subscriptions at 5.3 billion by the end of 2029, by which date 5G network coverage should reach 85% of the population, up from 45% at the end of this year.

“With more than 600 million 5G subscriptions added globally this year, and rising in every region, it is evident that the demand for high performance connectivity is strong,” said Fredrik Jejdling, Executive Vice President and Head of Networks, at Ericsson. “The roll-out out of 5G continues and we see an increasing number of 5G standalone networks being deployed, bringing opportunities to support new and more demanding applications for both consumers and enterprises,” he added.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.telecoms.com/5g-6g/5g-subs-exceed-expectations-but-they-re-not-standing-alone

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

GSA 5G SA Core Network Update Report

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

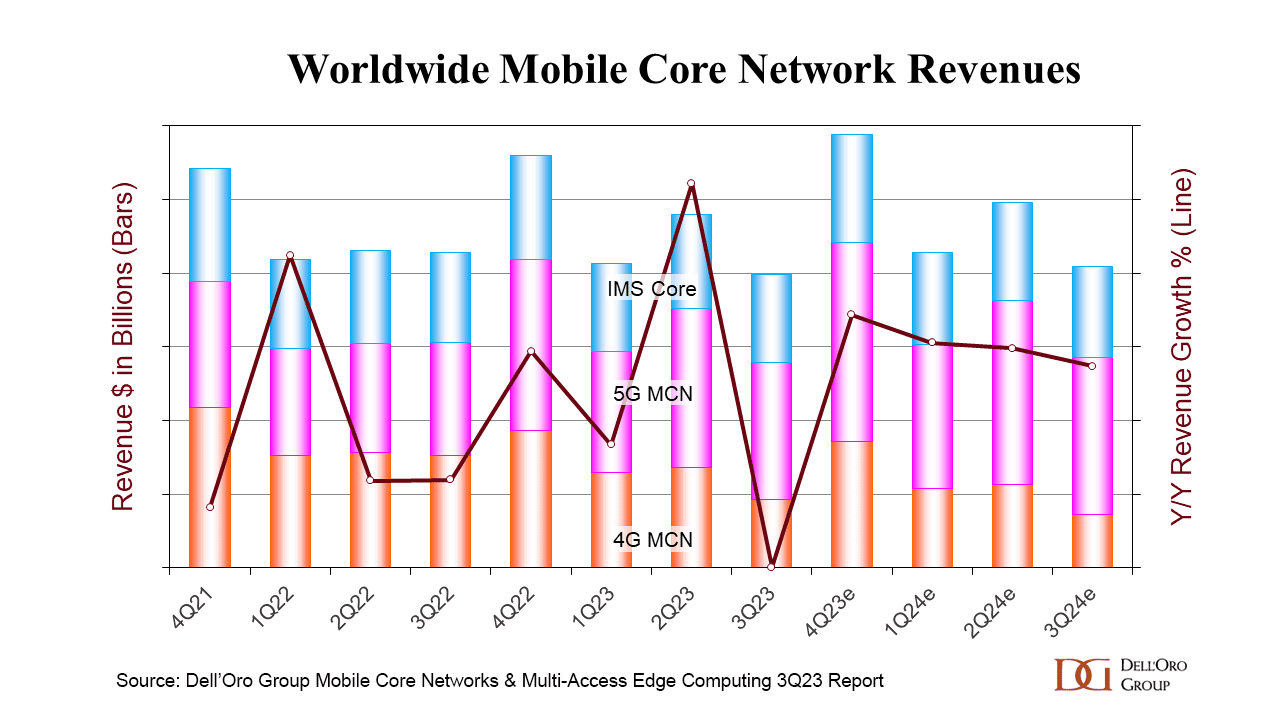

The global mobile core network (MCN) market has just turned in its lowest quarterly growth rate for almost six years, hit by a difficult political and economic climate, as well as by slow rollouts of 5G standalone core networks. Dell’Oro Group reports that the MCN market has become erratic, with the lowest growth rate since 4Q 2017. Europe, Middle East, and Africa (EMEA), and China were the weakest performing regions in 3rdQ 2023.

“It has become quite obvious the MCN market has entered into a very unpredictable phase after breaking the highest growth rate in 2ndQ 2023 since 1stQ 2021, and now hitting the lowest performing growth rate in 3rdQ 2023 since 4thQ 2017. Last quarter, EMEA and China were the strongest performing regions and flipped this quarter, becoming the weakest performing regions,” stated Dave Bolan, Research Director at Dell’Oro Group.

“Many vendors state that the market is volatile, attributing this phenomenon to macroeconomic conditions such as the fear of higher inflation rates, unfavorable currency foreign exchange rates, and the geopolitical climate.

“Besides subscriber growth, the growth engine for the MCN market is the transition to 5G Standalone (5G SA), which employs the 5G Core. But after five years into the 5G era, we are still seeing more 5G Non-Standalone (5G NSA) networks being launched than 5G SA, and the pace of 5G SA networks has slowed from 17 launched in 2022 to only seven so far in 2023. However, we expect more 5G SA networks to be deployed in 2024 than in 2023, and we expect 2024’s market performance to be better than 2023,” continued Bolan.

Additional highlights from the 3Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- Two new MNOs launched commercial 5G SA networks in 3Q23: Telefónica O2 in Germany and Etisalat in the UAE.

- Ericsson is the vendor of record for the 5G packet core for all seven 5G SA networks launched in 2023.

- As of 3Q 2023, 45 MNOs have commercially deployed 5G SA eMBB networks.

- The top MCN vendors worldwide for 3Q 2023 [1.] were: Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 3Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

Note 1. Dell’Oro did not supply any actual MCN market share percentages or numbers.

……………………………………………………………………………………………………………………………….

In August the Global mobile Suppliers Association (GSA) released Q2 figures that showed just 36 operators worldwide has launched public 5G SA networks, including two soft launches, by the end of June, an increase of just one on the previous quarter.

In total, the GSA said that 115 operators in 52 countries had invested in public 5G SA networks – that includes actual deployments as well as planned rollouts and trials – by the end of Q2, with no new names added during the quarter, and an increase of just three on the end of 2022.

About the Report:

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

About Dell’Oro Group:

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Dell’Oro: RAN market declines at very fast pace while

Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

GSA 5G SA Core Network Update Report

5G SA networks (real 5G) remain conspicuous by their absence

Dell’Oro: Market Forecasts Decreased fo

r Mobile Core Network and Private Wireless RANs

Verizon once again delays 5G Standalone (SA) commercial service

Like AT&T, Verizon has promised 5G standalone (SA) core network for a very long time. The mostly wireless U.S. carrier initially said it would launch standalone 5G in 2020. Some in the industry thought it did so in 2022. But the company said the technology ‘is in testing now’ and is still not available commercially.

“We have it in trials only at this point. We don’t have it commercially available for our customers,” Verizon’s chief networking executive, Joe Russo, said on a podcast last month hosted by Recon Analytics. “So more to come in the next several months as Verizon will be entering the standalone core game.”

“It is absolutely a capability that we think will be another enabler to new use cases. But … the reliability and performance of Verizon’s network is what we stand for, and I don’t put technology out into the network that is a step back. It has to be a step forward. And all of the data that I see – both internal testing and with external testing that happens out there in the market – tells me that SA [standalone] needs a little bit more time.”

“We’re doing significant developing and testing to make sure that both the data session and the voice sessions in a standalone world are as good or better than what you would expect in our 4G network today. So we see that in the next several months we’re going to get there, but it was not my goal to be first in deploying standalone. It’s my goal to be best in deploying standalone.”

……………………………………………………………………………………………………………………………..

Verizon spokesperson Kevin King clarified that “we have commercial traffic running on our 5G non standalone core. That is what we announced earlier in the year. Joe was referring to our 5G standalone core which is in testing now.”

That cop-out was contradicted by a statement made during a webinar for analysts on September 29th, which was obtained by Light Reading. “People talk about the standalone core. Just terminology-wise, that’s the 5G core essentially. If you guys have read the stuff we’ve said publicly, certainly we serve some customers on portions of our 5G core,” said Mike Haberman, Verizon’s SVP of strategy and transformation, And then we have some internal stuff going on with other functionality on the core. We’re in the process of rolling out (5G SA) in a very smart fashion.”

“Here’s the deal: When you go to the standalone core, you can’t aggregate your LTE carriers. With the non standalone core I’m aggregating together both 5G and 4G. So when you go standalone you start to bifurcate the spectrum. So that’s the impact to the RAN [radio access network]. So you better be sure that your mobile [customer] distribution, where they are geography, makes sense. Or what will happen is those customers will experience a lower service level. No good. We want to be careful of that. So that’s why, when you do the standalone core, you have to pay very close attention to your radio access network because they are directly attached.”

On April 27th Verizon issued a press release describing the benefits of 5G standalone (SA) technology and how it’s “what sets Verizon apart.” However, the release doesn’t specifically say that Verizon launched the technology. That despite Verizon last year announced it had begun moving traffic onto its new 5G core, which supports both the non standalone (NSA) and standalone (SA) versions of the technology.

Last year, Mobile World Live reported that Verizon was migrating “commercial traffic onto SA 5G core.” The article cited an unnamed Verizon representative. Mobile World Live also reported that Ericsson, Casa Systems, Oracle and Nokia supply Verizon’s 5G core.

Dell’Oro Group, in January 2023, listed Verizon among the few North American wireless providers that had commercially launched the technology.

“This is a moving target,” Recon Analytics analyst Roger Entner told Light Reading. But Entner said Verizon’s position on the standalone version of 5G makes sense. “The benefits you can get today from standalone are limited.”

–>This author totally disagrees with Mr. Entner, because TRUE 5G=5G SA. IN OTHER WORDS, ALL OF THE 3GPP DEFINED 5G FEATURES REQUIRE 5G SA! That includes 5G security and network slicing.

…………………………………………………………………………………………………………………………………

Light Reading’s Mike Dano wrote:

Verizon now appears to be roughly three years behind its initial standalone 5G rollout plans. In the summer of 2020, Verizon said it would begin moving traffic onto its standalone 5G core “in the second half of 2020 with full commercialization in 2021.”

Then, in early 2022, Verizon CTO Kyle Malady suggested that the operator would begin moving some of its fixed wireless access (FWA) traffic onto its standalone 5G core by June of that year. He also said at the time that Verizon would start putting smartphone traffic onto that core in 2023.

………………………………………………………………………………………………………….

T-Mobile US and Dish Wireless are the only two 5G carriers that have launched commercial 5G SA. AT&T has made a lot of noise about it’s 5G SA plans but has yet to launch.

AT&T’s chief networking executive, Chris Sambar, wrote in a September 29th blog post that AT&T was moving some customers to standalone 5G. “Many of the newest mobile devices are ready for 5G standalone, and we continue to move thousands of customers every day. We also recently launched AT&T Internet Air home fixed wireless service, and from the start, this product rides on standalone 5G.”

https://www.lightreading.com/5g/verizon-surprises-with-ongoing-delays-in-5g-standalone-rollout

https://www.verizon.com/about/news/5g-standalone-why-it-matters

https://about.att.com/blogs/2023/network-ready.html

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

GSA 5G SA Core Network Update Report

5G subscription prices rise in U.S. without killer applications or 5G features (which require a 5G SA core network)

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

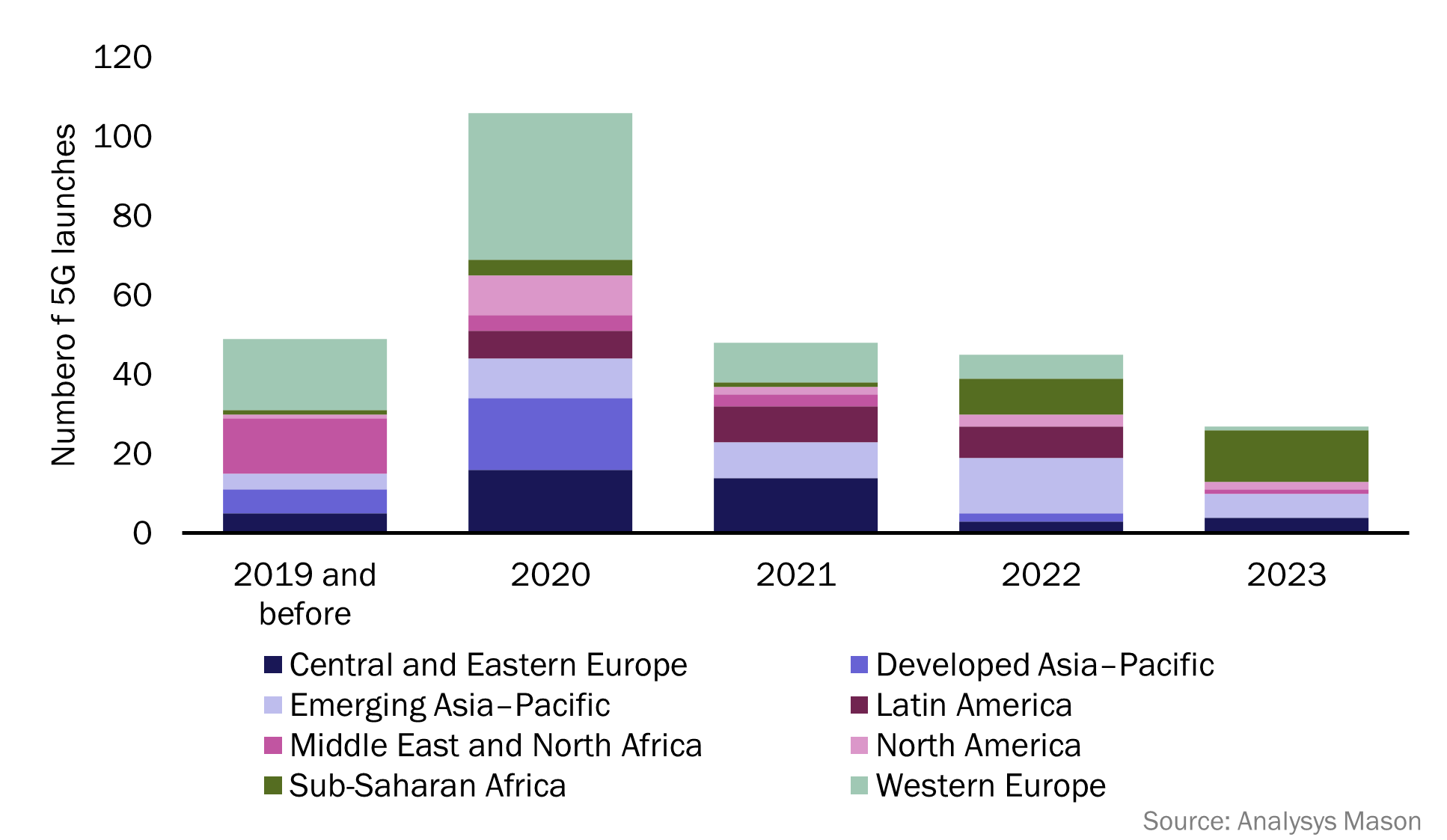

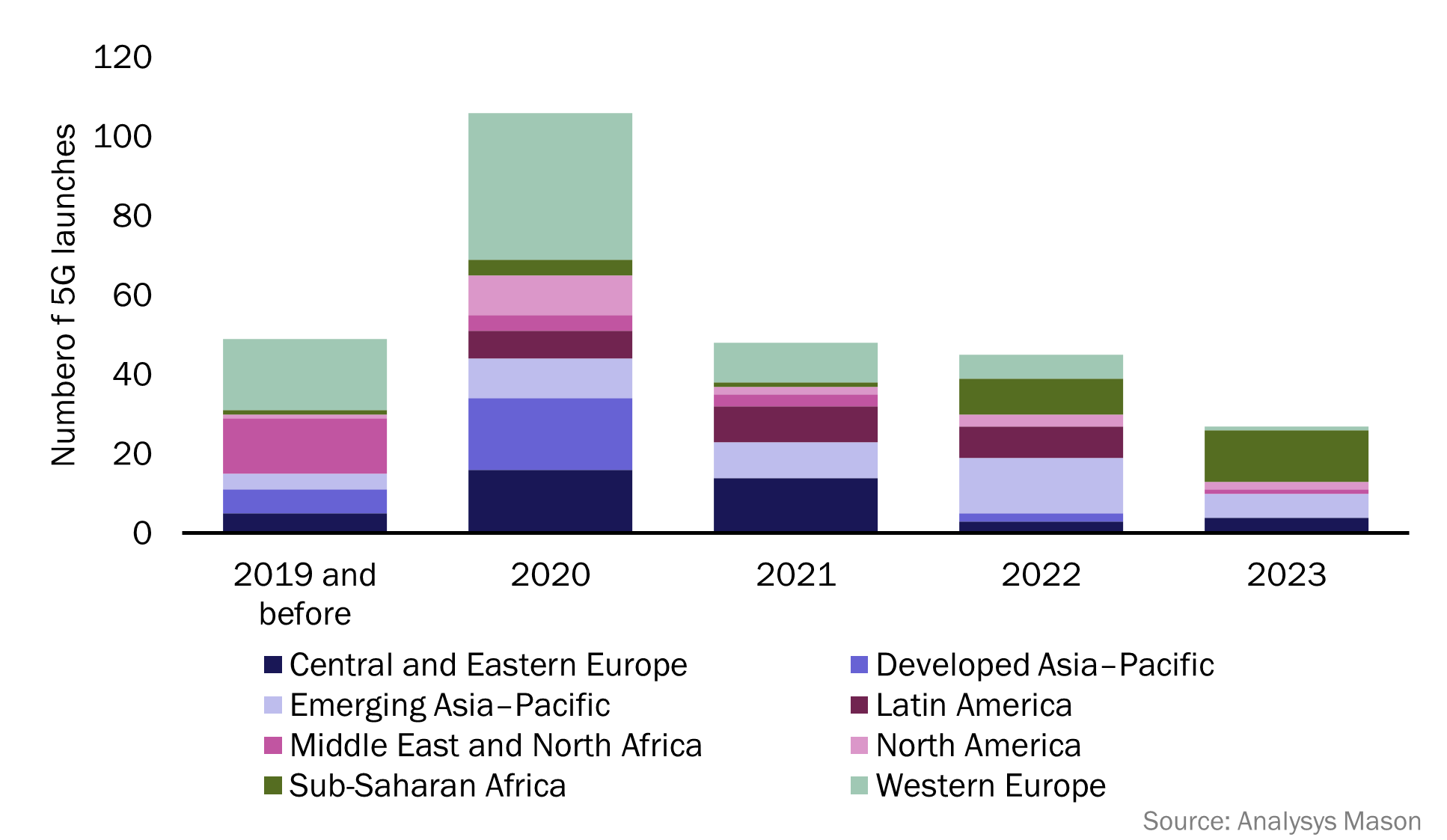

According to the latest edition of Analysys Mason’s 5G deployment tracker, 26 new 5G networks have been commercially launched across 22 countries so far in 2023, with an additional 55 5G networks either in deployment or scheduled for launch later this year.

Sub-Saharan Africa (SSA) has dominated 5G launch figures in 2023, with 13 new launches across 10 countries, accounting for over 48% of 5G launches during the period. Emerging Asia–Pacific (EMAP) has recorded 6 new 5G launches in 2023 so far, while Central and Eastern Europe (CEE) recorded 4 new 5G launches, respectively. Additionally, North America (NA) recorded 2 new 5G launches, while Western Europe (WE) and the Middle East and North Africa (MENA) each reported one new 5G launch in the same period. 5G standalone (SA) launches for the last 12 months (August 2022–2023) have continued to grow steadily, with 11 new operators commercially launching 5G SA networks. Five of these launches have occurred in 2023, with 3 operators launching in WE and 2 launching in MENA.

The market research firm’s 5G deployment tracker includes 338 entries from 2018 to 1H 2023, with 274 confirmed launches of 5G networks and 40 commercial launches of 5G SA networks, worldwide.

According to the latest edition of Analysys Mason’s 5G deployment tracker, 26 new 5G networks have been commercially launched across 22 countries so far in 2023, with an additional 55 5G networks either in deployment or scheduled for launch later this year.

Sub-Saharan Africa (SSA) has dominated 5G launch figures in 2023, with 13 new launches across 10 countries, accounting for over 48% of 5G launches during the period. Emerging Asia–Pacific (EMAP) has recorded 6 new 5G launches in 2023 so far, while Central and Eastern Europe (CEE) recorded 4 new 5G launches, respectively. Additionally, North America (NA) recorded 2 new 5G launches, while Western Europe (WE) and the Middle East and North Africa (MENA) each reported one new 5G launch in the same period. 5G standalone (SA) launches for the last 12 months (August 2022–2023) have continued to grow steadily, with 11 new operators commercially launching 5G SA networks. Five of these launches have occurred in 2023, with 3 operators launching in WE and 2 launching in MENA.

The 5G deployment tracker includes 338 entries from 2018 to 1H 2023, with 274 confirmed launches of 5G networks and 40 commercial launches of 5G SA networks, worldwide.

Figure 1: 5G network launches, worldwide, 2019 (and before)–2023

Network operators in SSA have long prioritised investment in 4G networks over 5G. This is due to the lower cost of 4G devices and infrastructure, and the high number of users on legacy networks, such as 2G and 3G, across the region. As a result, operators have prioritised the migration of these users to 4G networks over new 5G deployments. In 2021, 79.8% of all mobile connections in SSA were 2G or 3G connections, and there were only 6 operational 5G networks in the region. This changed in 2022, with operators launching 9 new 5G networks across the region.1 This number has continued to climb so far in 2023, with a total of 13 new 5G network launches since January.

SSA now accounts for over 48% of all 2023 5G launches, with the region now having more operational 5G networks than MENA, NA, Latin America (LATAM) and developed Asia–Pacific (DVAP). Airtel has launched the most 5G networks in SSA so far in 2023, with the group launching 4 new 5G networks in 4 different countries. These include:

- Kenya: Airtel became the second operator to launch a 5G network in Kenya, following Safaricom’s launch in October 2022. Airtel claims coverage across 370 areas including Mombasa, Nakuru, Nairobi and Kakamega.

- Nigeria: Airtel launched its 5G network in June 2023, with coverage in multiple areas including Abuja, Port Harcourt and Lagos. Airtel is the third operator to launch a 5G network in Nigeria, following MTN (2022) and Mafab (January 2023).

- Uganda: Airtel launched its 5G services in various areas of Kampala in August 2023, one month after MTN launched the first 5G network in Uganda.

- Zambia: Airtel became the second operator to launch a 5G network in Zambia in July 2023, following MT’s 5G launch in November 2022.

Other notable launches across SSA include:

- French Guiana: Orange Caraibe and SFR Caraibe both launched their 5G networks in 2023 in the 3.5GHz band. These are the first 5G networks in French Guiana.

- The Gambia: QCell became the first operator to launch 5G in The Gambia in June 2023, launching in selected areas of the capital city, Banjul.

- South Africa: Telkom South Africa launched their 5G network in 2023, becoming the fourth operator to launch 5G in South Africa after Rain, MTN and Vodacom.

…………………………………………………………………………………………………………………………………

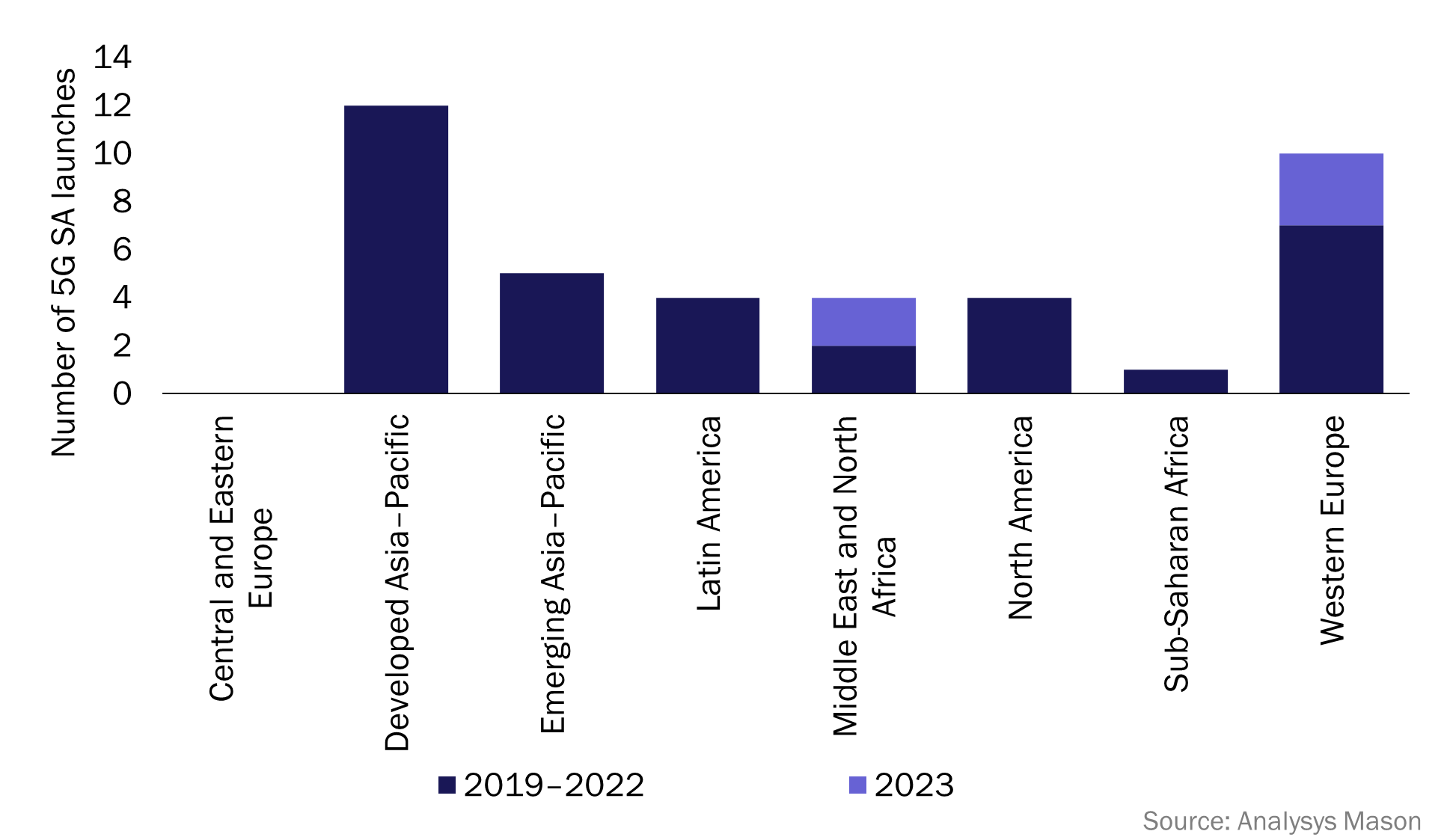

There are now 40 operational 5G SA networks worldwide, spanning 24 countries and 34 different operators. In the previous 12 months (from September 2022 to September 2023) there have been 11 new 5G SA launches, with 5 of these occurring in 2023. These 5 launches were spread across WE (3 new launches) and MENA (2 new launches). More 5G SA launches are expected in 2023, as launch figures have historically peaked in the second half of a calendar year. 5G SA launch figures are expected to accelerate over the next few years, and operators that have already launched 5G SA networks are likely to continue to expand their standalone coverage.

Analysys Mason predicts that by 2024, 5G SA will be the main source of revenue for vendors.

…………………………………………………………………………………………………………………………….

Editor’s Note: We strongly disagree with that 5G SA forecast and we don’t know if the “vendors,” like Ericsson, Nokia, Huawai, ZTE, Samsung, NEC, also provide 5G RAN equipment. Other 5G SA core network vendors, don’t make RAN equipment, e.g. Amazon AWS, Microsoft Azure, Cisco, VMware, Parallel Wireless and Mavenir

In the U.S., only T-Mobile and Dish Network have deployed 5G SA core networks. AT&T and Verizon have been talking the talk about 5G SA core networks but have no commercial deployments. UScellular 5G SA is in test mode. UScellular’s CTO Mike Irizarry said it’s now testing Nokia’s 5G SA core, but doesn’t plan to rush headlong into the SA 5G future.

Also, because there are no specification for 5G SA core network interoperability or roaming, 5G SA endpoint mobility will be extremely limited.

…………………………………………………………………………………………………………………………….

With three new launches so far in 2023, WE is beginning to compete with DVAP for the total number of 5G SA network launches. DVAP has led the total 5G standalone network launch figures since 2021 (see Figure 2), with 11 new launches in the last 2 years across Australia, Japan, Singapore and South Korea. Western Europe now accounts for 25% of all 5G SA networks worldwide, 5 percentage points less than DVAP which accounts for 30%. All regions have now launched at least one 5G SA network, excluding CEE (see Figure 2).

Figure 2: 5G SA launches, worldwide, 2019–2023

In 2023, notable deployments of standalone networks have included:

- Saudi Arabia: Zain launched the first 5G SA network in Saudi Arabia in March 2023, making Saudi Arabia the third country in MENA to have an operational 5G SA network, after Bahrain and Kuwait.

- Spain: Orange and Telefónica both launched 5G SA networks in 2023. These are the first two 5G SA networks in Spain.

- United Arab Emirates (UAE): E& (formerly Etisalat) launched its 5G SA network in February 2023, becoming the fourth operator to launch 5G SA services within MENA and the first in the UAE.

- United Kingdom: Vodafone launched the first 5G SA network in the UK, in June 2023, with coverage across Cardiff, Glasgow, London and Manchester. Vodafone has branded its 5G SA as ‘5G Ultra’.

References:

https://www.analysysmason.com/research/content/articles/5g-deployment-launches-rma18/

GSA 5G SA Core Network Update Report

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Counterpoint Research – 5G SA Core Deployments Decelerate in H1 2023

Samsung and VMware Collaborate to Advance 5G SA Core & Telco Cloud

Samsung and VMware are continuing their collaboration to offer a powerful and comprehensive 5G solution—combining Samsung 5G Core and VMware Telco Cloud Platform 5G [1.]. This partnership makes it easier for telecom operators using the VMware platform to deploy Samsung’s 5G components. The validation supports Samsung’s ongoing attempts to boost its 5G core market share and further enhances VMware’s telecom efforts.

Note 1. VMware’sTelco cloud is a next-generation network architecture that combines software-defined networking, network functions virtualization, and cloud native technology into a distributed computing network. Since the network and the computing resources are distributed across sites and clouds, automation and orchestration are required.

………………………………………………………………………………………………………………………..

Joining Samsung’s expertise in 5G Core with the power of the VMware Telco Cloud, the combined 5G solution improves the performance and reliability of core networks. In addition, the collaboration offers increased agility and scalability for network infrastructure, enabling operators to rapidly adapt to changing market conditions and customer demands.

The companies have been involved in continuous testing, certification and validation efforts to ensure that Samsung’s 5G Core network functions are fully compatible with VMware Telco Cloud Platform 5G. After validation, Samsung received certification for its 5G Core network functions by the VMware Ready for Telco Cloud program, ensuring compatibility and reliability with VMware technology.

VMware Ready for Telco Cloud certification has been granted to Samsung’s Core network functions, including UPF, NSSF, SMF, AMF, and NRF. The Ready for Telco Cloud certification ensures that network functions are ready for deployment and lifecycle operations with VMware technology. These certified network functions will deliver improved performance, enhanced security features and increased agility and scalability for core networks.

VMware initially rolled out its overarching Telco Cloud Platform in early 2021, which itself was an expansion of its reorganized and repacked stack of technologies for network operators. It has since updated that specific platform as well as expanded its reach into other 5G markets like private 5G and mobile edge compute.

Specific to its work with Samsung, VMware began those efforts in late 2020. That move called for Samsung to integrate its network core, edge, and radio access network (RAN) offerings with VMware and for Samsung to extend its support for cloud-native architecture by adapting its suite of products for containerized network functions (CNFs) and virtual network functions (VNFs) on VMware’s software stack and network automation services.

earlier this year announced the first commercial collaboration with Samsung, which involved integrating Samsung’s virtualized RAN (vRAN) with VMware’s Telco Cloud Platform as part of Dish Network’s ongoing 5G network deployment.

That work built on Dish Network’s plan to deploy 24,000 Samsung open RAN-compliant radios and 5G vRAN software systems running on VMware’s platform that underlines Dish Network’s nascent 5G network.

The companies’ continued collaboration will accelerate the advancement of 5G Core networks and help operators to introduce innovative services that will lead to revenue growth and enhanced customer experiences.

References:

https://www.vmware.com/in/topics/glossary/content/telco-cloud.html

Ericsson and U.S. PAWR 5G SA network for rural agricultural research

Ericsson in cooperation with the U.S. National Science Foundation’s (NSF) Platforms for Advanced Wireless Research (PAWR) program announced the launch of its 5G SA network for public research together with the Agriculture and Rural Communities (ARA) team at Iowa State University (ISU). Powered by Ericsson, the network is part of ARA’s multi-modal platform for wireless research, based on the ISU campus with coverage extending to local crop and livestock farms and parts of the city of Ames.

The Ericsson-powered 5G SA network will be used to support precision agriculture applications, along with other research initiatives, and is already connecting farm sites that previously had little to no broadband access. ARA is partnering with the ISU Department of Agriculture and Biosystems Engineering as well as the College of Agriculture of Life Sciences for initial precision agriculture research projects.

Ericsson and PAWR light up 5G network for rural agricultural research

Image Credit: Ericsson

“As we continue to unlock 5G’s full potential, we’re excited to support ARA’s cutting-edge research on precision agriculture, rural broadband, renewable energy, and public safety for smart and connected rural communities,” said Per Wahlen, Vice President and Head of Business Development, Ericsson North America.

Sample agriculture research will include using connected robots (PhenoBots) to collect plant phenotyping data with stereoscopic cameras generating 800 megabits per second worth of sensor data per camera. It will also include livestock monitoring with high-resolution cameras, as well as agriculture automation.

The Ericsson-powered network consists of a 5G core operating in SA mode and NR radios which operate in both mid-band and millimeter wave spectrum bands with a high aggregate throughput up to 3Gbps. The outdoor network will run 5G SA with mid and high band New Radio-Dual Connectivity (NR-DC) with a downlink exceeding 2.5Gbps in outdoor live testing. With ultra-low latency, increased capacity and coverage, and support for end-to-end network slicing, Ericsson’s 5G SA solutions ensure instant response times and enable new use cases.

ARA is part of the National Science Foundation-funded Platforms for Advanced Wireless Research (PAWR) program that works to create wireless testbeds through public-private partnerships to accelerate the nation’s wireless ecosystem.

“As ARA aims to help close the gap between academic and industry research in the wireless and agricultural sectors, we’re excited to announce the Ericsson network component, which is open for joint opportunities for both academic and industry research endeavors,” said Hongwei Zhang, Principal Investigator of ARA and Director of the Center for Wireless, Communities and Innovation, Iowa State University.

Andrew Wooden of telecoms.com wrote:

The concept of the smart farm – like the smart city – made up part of the hype fodder for the initial 5G launch. Since 5G SA is considered ‘proper’ 5G the line seems to now be that it will be the required driving force behind all sorts of industries being revolutionised by high bandwidth and low latency mobile connectivity.

How large a commercial market applications like this represents for kit vendors like Ericsson in the near future remains to be seen, but if it does represent a teaser of how food can be grown better or more abundantly – as is presumably the end goal – we can think of much more frivolous use cases presented over the years.

These 5G SA networks my play an important role in the future of the U.S. agricultural ecosystem. ARA and Ericsson are in forward-leaning positions to support the realization of recently proposed bipartisan legislation surrounding the issue of broadband access to unserved rural farms, through applied research and innovative use case development to assist farmers and rural communities.

TDC NET with Ericsson launch first 5G Standalone network in Denmark

Danish digital infrastructure provider TDC NET, together with Ericsson, have launched the first 5G Standalone (5G SA) network in Denmark. The transition to high-performance 5G SA technology will enhance the regional 5G ecosystem, accelerate innovation across industries, and unlock exciting possibilities for consumers.

In September 2020, TDC NET went live with the first non-standalone (NSA) 5G network in Denmark, which worked alongside the existing 4G infrastructure provided by Ericsson.

Ericsson press release states: “This milestone signifies a monumental leap forward in connectivity, enabling transformative advancements and placing Denmark at the forefront of technological progress.”

“A 5G Standalone network provides lower latency, higher efficiency, better spectrum utilization, more reliable connectivity, and lower device battery consumption than other networks. It unlocks more use cases for consumers, critical IoT, enterprises and industrial automation. 5G SA also facilitates network slicing benefits for multiple customer segments, offering an infrastructure for businesses to enable, for instance, smart manufacturing and IoT-driven innovation, while giving consumers better and more consistent service experience. It is also a big step forward for communications service providers as it enables a more flexible approach to service creation and provision for subscribers.”

–>Those are all nice features but do any of them represent a monumental leap forward? 5G SA, aka true 5G (vs fake 5G=5G NSA=4G infrastructure/core with a 5G NR RAN) has yet to prove that in its limited global deployments. Where are the new 5G SA revenue streams?

Jakob Dirksen CTO of TDC NET, says: “We were the first to introduce 5G in Denmark and now we are taking the next big step by switching on 5G Standalone. This will offer consumers, enterprises and industries enhanced efficiency, safety, and a range of opportunities across everything from self-driving cars, remote work, healthcare, as well as mission-critical operations by authorities. In addition, 5G Standalone will also enable energy efficiency improvements thanks to more data being transmitted with the same amount of energy and faster access to content.”

One of the key benefits of 5G SA will be improved speed capabilities. Over a 5G SA network, TDC NET and Ericsson have already achieved an impressive 7Gbps downlink peak throughput in a live site environment that has been equipped with Ericsson Radio System products supporting millimeter wave and mid-band spectrum. Enabling New Radio Dual Connectivity (NR-DC) mode through Ericsson’s 5G Core and high modulation scheme have been key to this achievement.

A 5G trial at the Tour de France 2022 in Copenhagen, Denmark used Ericsson Massive MIMO radios on 5G TDD (time division duplex) spectrum. It delivered up to 13 times more data with the same energy consumption compared to LTE FDD (frequency division duplex).

Niclas Backlund, Country Manager for Ericsson Denmark, says: “With the 5G Standalone network, we are now able to accelerate the Danish 5G ecosystem and provide a world-class mobile network with a range of new opportunities for consumers and businesses by enabling slicing, and thereby providing service differentiation. By modernizing legacy networks and then upgrading to 5G, communication service providers can lower operating costs thanks to greater energy efficiency and thus reduce total cost of ownership. And, at the same time, they can future-proof their networks for anticipated higher capacity needs and offer customers value through new services and capabilities.”

In addition, 5G SA uses a dedicated 5G core network, which means that data transmission requires less signaling than with 5G NSA. This is because 5G SA devices do not need to switch between the 4G and 5G core networks, which can reduce latency and improve performance.

The 5G Standalone deployment in TDC´s commercial network is expected to contribute to the service provider’s roadmap towards Net Zero emissions target by 2030, says Ericsson. Also, the 5G SA network was said to signal major overall progress in TDC NET’s technological transformation as it adopts cloud-native software architecture, leading to fast and reliable service innovation for subscribers with service providers using TDC NET’s 5G network, while maintaining improved efficiency and network performance.

References:

Ericsson and Vodafone enable Irish rugby team to use Private 5G SA network for 2023 Rugby World Cup

BT and Ericsson wideband FDD trial over live 5G SA network in the UK

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Bouygues Telecom picks Ericsson for cloud native 5G SA core network

Ericsson powers Singtel 5G SA core network; lightest and smallest Massive MIMO radio

BT, Nokia and Qualcomm demonstrate 2CC CA on uplink of a 5G SA network

UK incumbent telco BT announced today that it has successfully demonstrated two component carrier aggregation (2CC CA) on the uplink of a 5G SA network at its Adastral Park research centre. The 5G SA technology was supplied by Nokia and Qualcomm.

BT also simultaneously achieved 4CC CA on the downlink, and claims it is the first telco in Europe to have demonstrated 5G SA uplink and downlink carrier aggregation at the same time. In terms of throughput, BT recorded a peak download speed of 1 Gbps and peak upload of 230 Mbps.

- BT Group and Nokia demonstrated enhanced 5G SA uplink performance through aggregation of two spectrum carriers in field trial in live network spectrum

- Aggregation of two frequency bands for uplink boosts performance for EE’s future 5G SA network, key to supporting growing customer use-cases such as gaming and live-streaming

- BT Group first in Europe to achieve both 2CC CA uplink and 4CC CA downlink simultaneously

When BT detailed its wideband FDD trial, it noted that the 5G SA specification from 3GPP is currently based on a single uplink carrier, so why try and aggregate uplink carriers? BT said that uplink carrier aggregation is something to have handy in future, when data demand inevitably calls for ever more uplink capacity.

5G Carrier Aggregation over a 5G SA network, which combines several transmission bands into one connection, is a key capability to deliver the high-performance 5G service that customers expect. Every new carrier added allows for higher capacity and speed directly to customer devices.

Last year, BT and Nokia announced 5G SA 4CC CA downlink. Now, by achieving both 5G SA 2CC CA uplink and 4CC CA downlink simultaneously, BT can deliver significant uplift in connections performance from the device to the network by increasing throughput and capacity, as well as unlocking scope to push uplink performance further in the future.

The tests were conducted at BT Group’s facility in Adastral Park, UK, using Nokia’s 5G AirScale portfolio and a device powered by a Snapdragon® 5G Modem-RF System from Qualcomm Technologies, Inc., following initial lab-based trials.* Speeds of over 230 Mbps in the uplink were reached — including the wider 5G FDD carrier at 40 MHz in 2600 MHz — as well as over 1 Gbps in the downlink. The demonstration was conducted with 15, 30 and 40 MHz NR2600 carrier independently aggregated with a 40 MHz NR3500 carrier component.

The work is part of BT Group’s efforts to ensure that, when 5G SA services are launched over EE, it maintains its unbeatable 5G network for customers.**

Greg McCall, Chief Networks Officer, BT Group, commented: “Carrier aggregation will be key to delivering the very best 5G experience to our customers, with this latest trial in partnership with Nokia demonstrating significant performance increases in terms of uplink speeds. This builds on last year’s success of achieving 4CA in 5G SA downlink, and we look forward to achieving further milestones in this space as we continue to progress towards 5G SA.”

Mark Atkinson, SVP, Radio Access Networks PLM at Nokia, said: “This successful trial with our long-standing partner BT, is another great example of Nokia’s unrivalled leadership in 5G carrier aggregation technology. Multi-component carrier aggregation helps mobile operators to maximise their radio network assets and provide the highest 5G data rates to subscribers in more locations.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA, Qualcomm Europe Inc, said: “We are proud of our continued collaboration with BT to bring our latest 5G technologies to consumers. 2CC uplink carrier aggregation is expected to improve uplink speeds by up to 2X, to give a better user experience overall. Consumers would potentially be able to upload and share higher quality videos faster online, such as when attending concerts and when watching and streaming games online. We look forward to the future and what else is to come with our continued collaboration with BT.

* Snapdragon is a trademark or registered trademark of Qualcomm Incorporated.

** ‘Unbeatable 5G network’: Based on analysis from the RootMetrics® UK RootScore® Report, H1 (Jan – June) 2023. Tested at locations across the UK with the best commercially available smartphones on 4 national mobile networks across all available network types. Your experiences may vary. The RootMetrics award is not an endorsement of EE. Visit ee.co.uk/claims for more details.

BT Group is the UK’s leading provider of fixed and mobile telecommunications and related secure digital products, solutions and services. We also provide managed telecommunications, security and network and IT infrastructure services to customers across 180 countries.

BT Group consists of three customer-facing units: Business covers companies and public services in the UK and internationally; Consumer serves individuals and families in the UK; Openreach is an independently governed, wholly owned subsidiary wholesaling fixed access infrastructure services to its customers – over 650 communications providers across the UK.

British Telecommunications plc is a wholly owned subsidiary of BT Group plc and encompasses virtually all businesses and assets of the BT Group. BT Group plc is listed on the London Stock Exchange.

For more information, visit www.bt.com/about

References:

https://telecoms.com/523289/bt-and-nokia-reach-new-5g-sa-carrier-aggregation-milestone/

BT tests 4CC Carrier Aggregation over a standalone 5G network using Nokia equipment

https://telecoms.com/523069/bt-teases-5g-sa-progress-with-wideband-fdd-trial/

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

T-Mobile US achieves speeds over 3 Gbps using 5G Carrier Aggregation on its 5G SA network

Nokia, China Mobile, MediaTek speed record of ~3 Gbps in 3CC carrier aggregation trial

3GPP Release 16 5G NR Enhancements for URLLC in the RAN & URLLC in the 5G Core network

Introduction:

3GPP Release 16 was “frozen” July 3, 2022. However, two key work items were not completed: Enhancement of the 5G RAN and the 5G Core network to support ultra-high reliability and low-latency communications (URLLC).

The enhancements, especially in the RAN, are essential for 3GPP New Radio (NR) to meet the ITU-R M.2410 Minimum Performance Requirements for the URLLC use case. That was to enable a whole new set of mission critical applications that required either ultra high reliability or ultra low latency (< or =1 ms in the data plane and < or =10ms in the control plane) or both.

Yet URLLC in the RAN and the associated URLLC in the RAN Conformance Test specification still have not been completed (more below)!

Overview of URLCC Enhancements:

The main functionalities introduced were the support of redundant transmission, QoS monitoring, dynamic division of the Packet Delay Budget, and enhancements of the session continuity mechanism.

The 3GPP Rel 16 URLLC in the RAN spec, once complete and performance tested, is needed to meet the ITU-R M.2410 URLLC Performance Requirements.

The 5G NR Physical Layer is improved for the support of URLLC in the RAN in several ways: new DCI formats, Enhanced PDCCH monitoring capability, Sub-slot based HARQ-ACK feedback, Two HARQ-ACK codebooks constructed simultaneously, PUSCH enhancements, Enhanced inter UE Tx prioritization/multiplexing and Multiple active configured grant configurations for a BWP.

3GPP Rel-17 URLLC work is mostly contained in the feature “Enhanced Industrial IoT and URLLC support for NR.” This covers mostly some “Physical Layer feedback enhancements for HARQ-ACK and CSI reporting” and the “Intra-UE multiplexing and prioritization of traffic with different priority.”

Current Status:

The most recent URLLC in the RAN spec dated December 2022 is 96% complete as per:

| 830074 | NR_L1enh_URLLC | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | Rel-16 | R1 | 22/12/2022 | RP-191584 | history | 2019/03/26 | 26/06/2019 | 26/6/19: WID:RP-190726->RP-191584 |

The URLLC in the RAN Conformance Test spec is only 90% complete as per:

| 900054 | NR_L1enh_URLLC-UEConTest | … UE Conformance Test Aspects – Physical Layer Enhancements for NR URLLC | Rel-16 | R5 | 22/12/2022 | RP-202566 | history | 2021/01/06 | 20/06/2022 | 22/3/22: Compl:16 ; 20/6/22: Rapporteur: Huawei->Chunying GU, Huawei; Rap eMail: ->guchunying@huawei. |

……………………………………………………………………………………………………..

Here are the key 3GPP Rel16 URLLC work items from https://www.3gpp.org/dynareport?code=WI-List.htm

- 830074 NR_L1enh_URLLC Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC)

- 800095 FS_NR_L1enh_URLLC… Study on physical layer enhancements for NR UR Low Latency Cases

- 830174 NR_L1enh_URLLC-Core… Core part: Physical Layer Enhancements for NR URLLC

- 830274 NR_L1enh_URLLC-Perf… Perf. part: Physical Layer Enhancements for NR URLLC (R4)

- 900054 NR_L1enh_URLLC-UEConTest… UE Conformance Test Aspects – Physical Layer Enhancements for NR URLLC (R5)

References:

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3498

https://www.3gpp.org/dynareport?code=WI-List.htm

https://www.3gpp.org/dynareport?code=status-report.htm

https://www.3gpp.org/dynareport?code=FeatureOrStudyItemFile-830074.htm

https://www.3gpp.org/technologies/urlcc-2022

https://techblog.comsoc.org/category/3gpp-release-16

Executive Summary: IMT-2020.SPECS defined, submission status, and 3GPP’s RIT submissions

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Another Opinion: 5G Fails to Deliver on Promises and Potential

Ericsson and Vodafone enable Irish rugby team to use Private 5G SA network for 2023 Rugby World Cup

Ericsson and Vodafone Ireland have partnered to install a cutting-edge 5G Standalone Mobile Private Network (MPN) solution for the Irish rugby team to supply fast and reliable in-play data analysis ahead of the 2023 Rugby World Cup in September.

Previously the team relied on standard WiFi across stadiums and training facilities both at home and away. Now giving instant feedback on team plays and tactics, the 5G Standalone MPN solution and artificial intelligence technology ensures faster download and upload speeds and lower latency, which can be utilised for real-time performance analysis and decisions on the pitch.

Using this reliable connectivity, up to eight high-resolution video streams are captured by multiple cameras and a 5G connected drone and then analysed in real-time to collate data on team performance. The technology helps to improve the communication between management, coaches and players and maximises the time on pitch where the smallest tweak to a running line or defensive position, can have a significant impact on the weekend’s game.

Vodafone Ireland and Ericsson have worked closely with the IRFU and their Head of Analytics and Innovation, Vinny Hammond and his analysis team of John Buckley, Alan Walsh and Jack Hannon. This collaboration has led to a clear understanding of the specific performance outcomes sought by such an elite sports team and has supported the design and installation of the Ericsson Private 5G solution, which now enables the management team, coaches and players to feel the real benefit of instant feedback to enhance the ability to make decisions quikcly.

The new solution has been tested at the Irish team’s High Performance Centre and will be brought to France in a bespoke 5G connected van for the World Cup in September.

Vodafone Ireland Network Director, Sheila Kavanagh says: “At Vodafone, we are so proud of our support for the Irish Rugby team, so we’re delighted to bring further value through the delivery of this cutting-edge technology solution. Performance analysis has experienced massive changes in the past couple of decades. What started with pen and paper-based methods for collecting notational data has evolved to using cutting-edge computer-based technologies and artificial intelligence to collect ever increasing amounts of real-time information. Distilling and delivering this data back to the team at top speed requires a reliable, secure and scalable connectivity solution.”

“This 5G MPN, drone and additional technology will support Vinny Hammond and his analytics team to quickly breakdown and organise unstructured data and present it back in a clear manner to other coaching staff and management – helping them understand the performance of the plays and overall team, without delay. It’s fantastic to see it in use in the HPC, but we’re also really excited to support the team with 5G connectivity throughout their time at the World Cup in France with our fully kitted Connected Van. Our 5G MPN technology is a demonstration of how technology and connectivity innovation can enhance the business of sport and the performance of teams, bringing added layers of data and analysis to coaches, management, and their players.”

IRFU Head of Analytics and Innovation, Vinny Hammond says: “So much of our roles revolve around moving large quantities of data so we can analyse performance to understand what is working and what is not. Vodafone’s 5G MPN stretches the boundaries of what we can do in terms of how quickly we can analyse multiple high-resolution cameras and drone footage which ultimately informs our strategic decision making. The work John and Alan have done on this project in conjunction with Vodafone and Ericson has enabled us to push new boundaries at this years RWC. Being on our own 5G network also gives us that level of security and reliability that we really need, and we’ll have the added benefit of that connectivity with our 5G Connected Van, linking back to our High Performance centre, to reduce reliance on third party connectivity.”

John Griffin, Head of Ericsson Ireland, says: “5G is the ultimate platform of future innovation and our successful partnership with Vodafone continues to ensure new organisations like the IRFU can benefit from the low latency, high bandwidth, and secure connectivity of a 5G standalone private network. Our global leadership in 5G technology and accelerated software availability mean the IRFU will be one step ahead of their competitors on and off the field, giving them the best chance of success at an elite level of performance and revolutionizing the future of a key function within the sports industry.”

References:

https://www.ericsson.com/en/news/3/2023/ericsson-and-vodafone-help-irish-rugby-team-adopt-5g-technology-to-get-fast-in-play-data-analysis