Cloud Service Providers

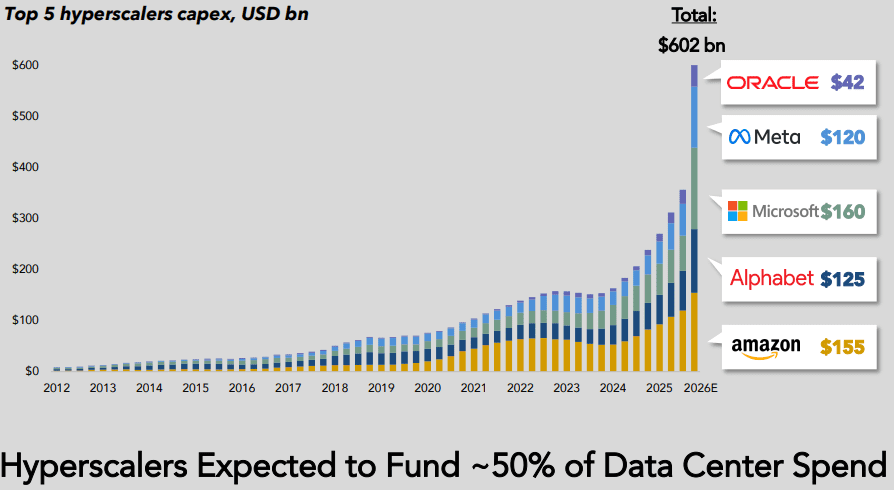

Hyperscaler capex > $600 bn in 2026 a 36% increase over 2025 while global spending on cloud infrastructure services skyrockets

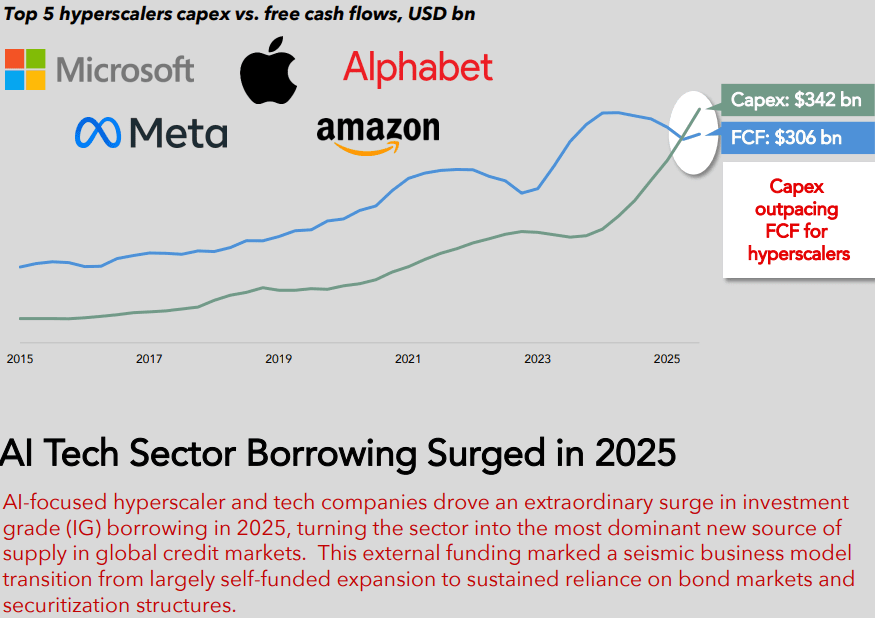

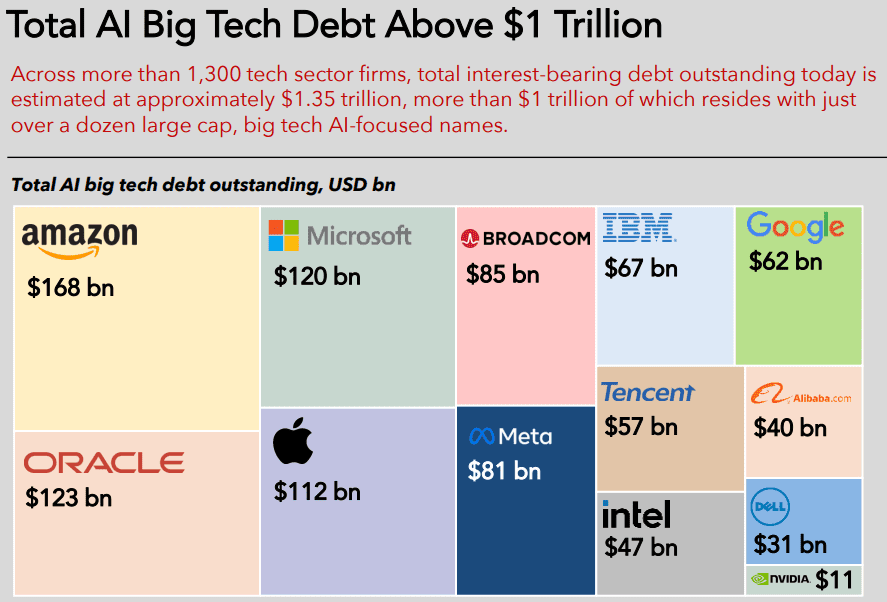

Hyperscaler capex for the “big five” (Amazon, Alphabet/Google, Microsoft, Meta/Facebook, Oracle) is now widely forecast to exceed $600 bn in 2026, a 36% increase over 2025. Roughly 75%, or $450 bn, of that spend is directly tied to AI infrastructure (i.e., servers, GPUs, datacenters, equipment), rather than traditional cloud. Hyperscalers are increasingly leaning on debt markets to bridge the gap between rapidly rising AI capex budgets and internal free cash flow, transforming historically cash-funded business models into ones utilizing leverage, albeit with still very strong balance sheets. Aggregate capex for “the big five”, after buybacks and dividends are included, are now above projected cash flows, thereby necessitating external funding needs.

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

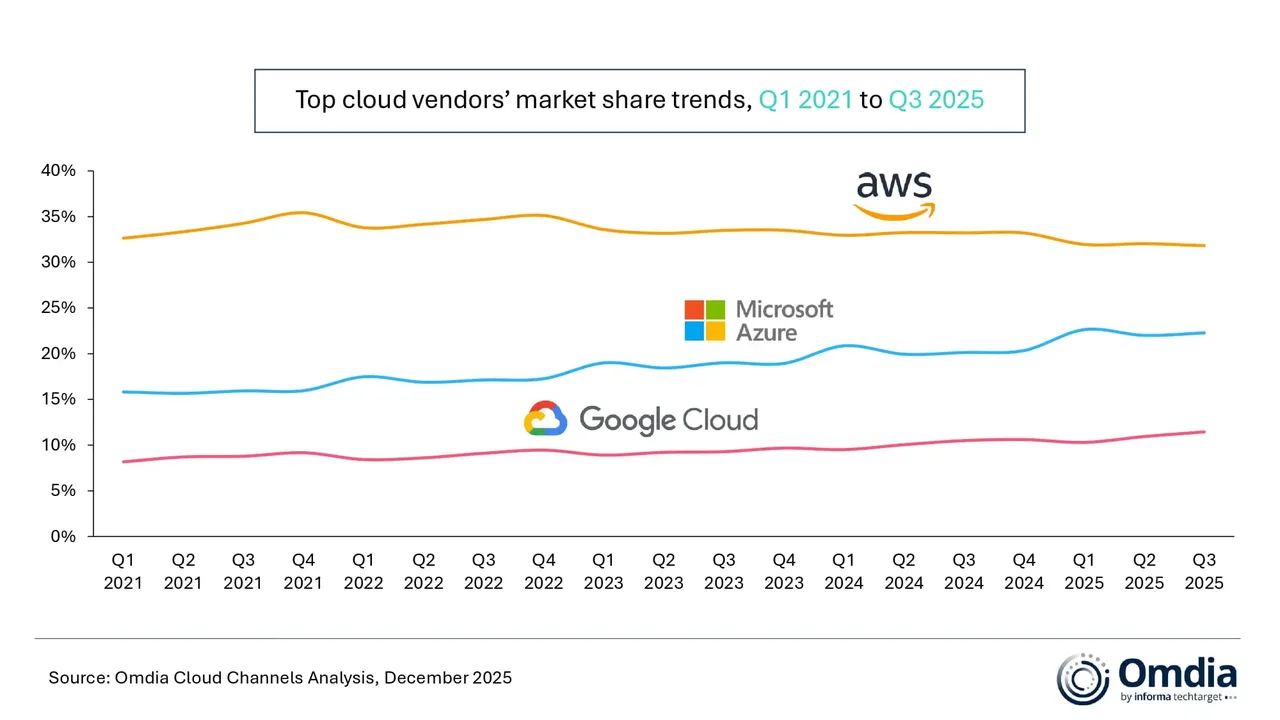

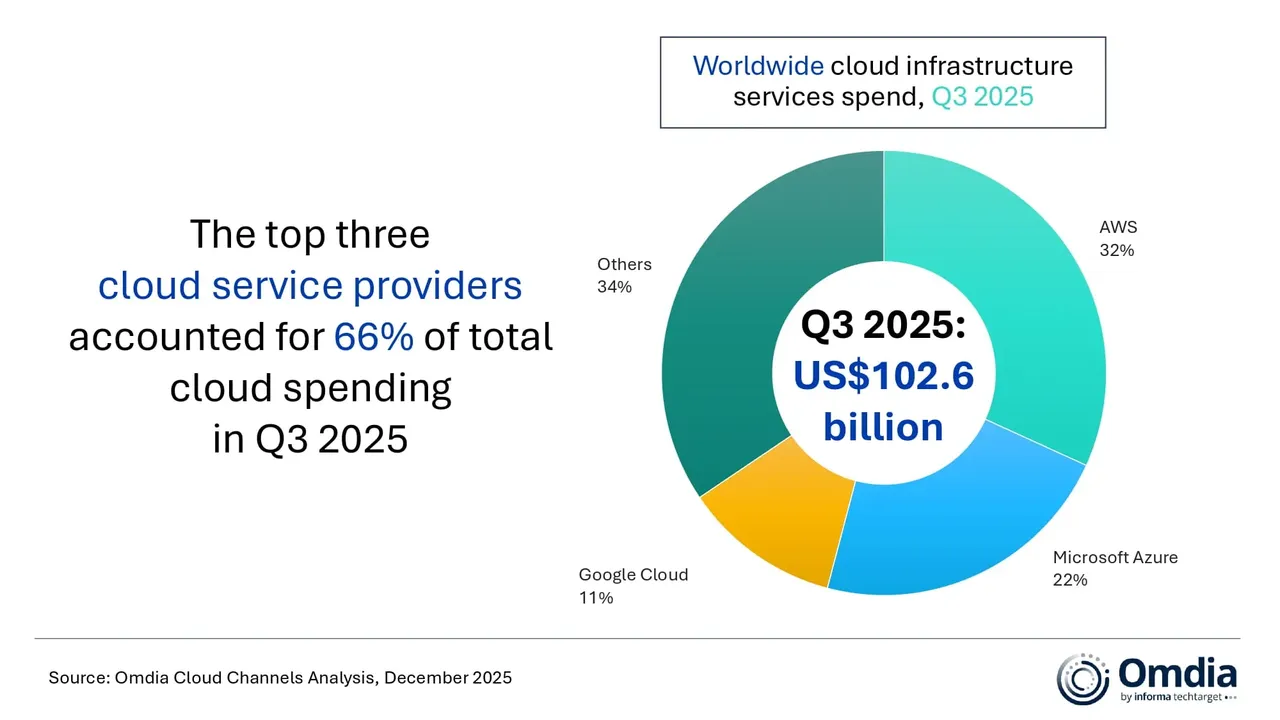

According to market research from Omdia (owned by Informa) global spending on cloud infrastructure services reached $102.6 billion in Q3 2025 — a 25% year-on-year increase. It was the fifth consecutive quarter in which cloud spending growth remained above 20%. Omdia says it “reflects a significant shift in the technology landscape as enterprise demand for AI moves beyond early experimentation toward scaled production deployment.” AWS, Microsoft Azure, and Google Cloud – maintained their market rankings from the previous quarter, and collectively accounted for 66% of global cloud infrastructure spending. Together, the three firms had 29% year-on-year growth in their cloud spending.

Hyperscaler AI strategies are shifting from a focus on incremental model performance to platform-driven, production-ready approaches. Enterprises are now evaluating AI platforms based not solely on model capabilities, but also on their support for multi-model strategies and agent-based applications. This evolution is accelerating hyperscalers’ move toward platform-level AI capabilities. According to the report, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are integrating proprietary foundation models with a growing range of third-party and open-weight models to meet these new demands.

“Collaboration across the ecosystem remains critical,” said Rachel Brindley, Senior Director at Omdia. “Multi-model support is increasingly viewed as a production requirement rather than a feature, as enterprises seek resilience, cost control, and deployment flexibility across generative AI workloads.”

Facing challenges with practical application, major cloud providers are boosting resources for AI agent lifecycle management, including creation and operationalization, as enterprise-level deployment proves more intricate than anticipated.

Yi Zhang, Senior Analyst at Omdia, said, “Many enterprises still lack standardized building blocks that can support business continuity, customer experience, and compliance at the same time, which is slowing the real-world deployment of AI agents. This is where hyperscalers are increasingly stepping in, using platform-led approaches to make it easier for enterprises to build and run agents in production environments.”

This past October, Omdia released a report forecasting that growth of cloud adoption among communications service providers (CSPs) will double this year. It also forecasted a compound annual growth rate (CAGR) of 7.3% to 2030, resulting in the telco cloud market being worth $24.8 billion.

………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Editor’s Note: Does anyone remember the stupendous increase in fiber optic spending from 1998-2001 till that bubble burst? Caveat Emptor!

………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecoms.com/public-cloud/global-cloud-infrastructure-spend-up-25-in-q3

https://www.telecoms.com/public-cloud/telco-investment-in-cloud-infrastructure-is-accelerating-omdia

AI infrastructure spending boom: a path towards AGI or speculative bubble?

Expose: AI is more than a bubble; it’s a data center debt bomb

Can the debt fueling the new wave of AI infrastructure buildouts ever be repaid?

AI spending boom accelerates: Big tech to invest an aggregate of $400 billion in 2025; much more in 2026!

Gartner: AI spending >$2 trillion in 2026 driven by hyperscalers data center investments

AI spending is surging; companies accelerate AI adoption, but job cuts loom large

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

Sovereign AI infrastructure for telecom companies: implementation and challenges

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

Custom AI Chips: Powering the next wave of Intelligent Computing

Palo Alto Networks and Google Cloud expand partnership with advanced AI infrastructure and cloud security

- End-to-End AI Security from Code to Cloud: Customers can protect live AI workloads and data on Google Cloud, including instances on Vertex AI and Agent Engine, using Palo Alto Networks Prisma AIRS. Securing key developer tools like the Agent Development Kit (ADK) with Prisma AIRS provides a secure foundation for developing next-generation AI applications on Google Cloud. This includes capabilities such as AI Posture Management, AI Runtime Security™, AI Agent Security for autonomous systems, AI Red Teaming, and AI Model Security.

- AI-Driven, Next-Generation Software Firewall (SWFW): Palo Alto Networks VM-Series firewalls, designed for securing cloud and virtualized environments via deep packet inspection and Threat Prevention, will feature deep integrations with Google Cloud to help customers maintain robust security policies and accelerate cloud adoption.

- AI-Driven Secure Access Service Edge (SASE) Platform: Palo Alto Networks Prisma SASE platform secures access and networking for remote users and branch offices. Deeper integration with Google Cloud’s native AI services will improve the user experience by leveraging Google’s network for Prisma Access execution and utilizing Google Cloud Interconnect for consistent security policies across multi-cloud WAN infrastructure.

- Simplified and Unified Security Experience: The deep engineering alignment ensures that joint solutions are pre-vetted and optimized for seamless interoperability, reducing integration complexity and operational overhead for security teams. This enables faster deployment of protective measures, simplified compliance, and a unified security posture across the entire hybrid multicloud ecosystem.

- BJ Jenkins, President, Palo Alto Networks: “The critical question for modern governance boards is how to leverage AI without introducing undue risk. This partnership provides the definitive answer. We are eliminating the operational friction between security and development, delivering a unified platform where cutting-edge security is an inherent component of innovation. By embedding our AI-powered security deeply into the Google Cloud infrastructure, we are transforming the platform into a proactive defense system.”

- Matt Renner, President and Chief Revenue Officer, Google Cloud: “Enterprises increasingly rely on the combined capabilities of Google Cloud and Palo Alto Networks for seamless application and data security. This partnership expansion guarantees our joint clientele access to the necessary solutions for securing their most critical AI infrastructure and developing secure-by-design AI agents from inception.”

About Palo Alto Networks:

As the global AI and cybersecurity leader, Palo Alto Networks (NASDAQ: PANW) is dedicated to protecting our digital way of life via continuous innovation. Trusted by more than 70,000 organizations worldwide, we provide comprehensive AI-powered security solutions across network, cloud, security operations and AI, enhanced by the expertise and threat intelligence of Unit 42®. Our focus on platformization allows enterprises to streamline security at scale, ensuring protection fuels innovation. Explore more at www.paloaltonetworks.com.

Palo Alto Networks, Prisma, Prisma AIRS, and the Palo Alto Networks logo are trademarks of Palo Alto Networks, Inc. in the United States and in jurisdictions throughout the world. All other trademarks, trade names, or service marks used or mentioned herein belong to their respective owners.

About Google Cloud:

Google Cloud is the new way to the cloud, providing AI, infrastructure, developer, data, security, and collaboration tools built for today and tomorrow. Google Cloud offers a powerful, fully integrated and optimized AI stack with its own planet-scale infrastructure, custom-built chips, generative AI models and development platform, as well as AI-powered applications, to help organizations transform. Customers in more than 200 countries and territories turn to Google Cloud as their trusted technology partner.

- Learn more about Palo Alto Networks and the Google Cloud partnership here.

- Please see References below for Google Cloud initiatives

……………………………………………………………………………………………………………………………………………………………….

References:

https://www.paloaltonetworks.com/engage/global-multi-platform-security/palo-alto-devops-in

NTT Data and Google Cloud partner to offer industry-specific cloud and AI solutions

Google Cloud targets telco network functions, while AWS and Azure are in holding patterns

Deutsche Telekom and Google Cloud partner on “RAN Guardian” AI agent

Google Cloud announces TalayLink subsea cable and new connectivity hubs in Thailand and Australia

Ericsson and Google Cloud expand partnership with Cloud RAN solution

Google Cloud infrastructure enhancements: AI accelerator, cross-cloud network and distributed cloud

T-Mobile and Google Cloud collaborate on 5G and edge compute

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

Casa Systems and Google Cloud strengthen partnership to progress cloud-native 5G SA core, MEC, and mobile private networks

Google Cloud expands footprint with 34 global regions

Cisco to lay off more than 4,000 as it shifts focus to AI and Cybersecurity

Reuters reports that Cisco Systems will cut thousands of jobs in its second round of layoffs this year. The number of people affected could be similar to or slightly higher than the 4,000 employees Cisco laid off in February, and will likely be announced as early as Wednesday with the company’s fourth-quarter results.

The San Jose, CA headquartered networking company plans to shift its product focus to higher-growth areas, such as AI and cybersecurity. It’s current set of products and services are listed here.

Cisco has been contending with weakening demand and persistent supply chain issues in its core business – routers and switches – that are used by ISPs and enterprise private networks. Two reasons for that are: 1.] the major cloud service providers design their own switch/routers or use bare metal switches (made by ODMs in Taiwan and China), and 2.] enterprise private/virtual private networks are being replaced by cloud network solutions.

- Global enterprise network sales have been declining. Dell’Oro Group reported sales contractions in Branch Routing and Campus Switching in 4Q-2023 and that is expected to continue throughout most of 2024. On premises data centers (which use Cisco Ethernet switches) are not growing. In its place……

- Enterprise spending on cloud infrastructure services is growing by leaps and bounds. It’s now nearing $80 billion per quarter. Cloud customers increased their spending on cloud services by $14.1 billion to $79.1 billion in the 2Q-2024, an increase of 22% year-over-year. It’s the third consecutive quarter in which the year-over-year growth rate was 20% or more, with generative AI being one of the factors behind the market acceleration.

……………………………………………………………………………………………………………………………………………

As a result of stagnant sales of its core networking products, Cisco has been pursuing a strategy aimed at diversifying its revenue streams. One of the most significant moves in this direction was the $28 billion acquisition of Splunk, a cybersecurity firm, which was finalized in March. This purchase is expected to boost Cisco’s subscription-based services, reducing its dependence on one-time hardware sales, which have been increasingly susceptible to market volatility.

Cisco’s major shift towards AI is a key part of its long-term strategy. In May, the company reiterated its ambitious goal of achieving $1 billion in AI-related product orders by 2025. This target is supported by a $1 billion fund launched in June, aimed at investing in AI startups such as Cohere, Mistral AI, and Scale AI. Over the past few years, Cisco has made over 20 AI-focused acquisitions and investments, highlighting its commitment to integrating AI into its product offerings.

……………………………………………………………………………………………………………………………………………..

Over 126,000 employees have been laid off across 393 tech companies since the start of the year, according to data from tracking website Layoffs.fyi. That surely reflects their need to cut costs to balance huge investments in AI, analytics and related technologies.

……………………………………………………………………………………………………………………………………………..

References:

https://www.cisco.com/c/en/us/products/index.html#~products-by-technology

Cisco to Implement Second Round of Layoffs Amidst Strategic Shift to AI and Cybersecurity

Worldwide Enterprise Network Spending Follows Roller Coaster Trajectory

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Data infrastructure software: picks and shovels for AI; Hyperscaler CAPEX

For many years, data volumes have been accelerating. By 2025, global data volumes are expected to reach 180 zettabytes (1 zettabyte=1 sextillion bytes), up from 120 zettabytes in 2023.

In the age of AI, data is viewed as the currency for large language models (LLMs) and AI–enabled offerings. Therefore, demand for tools to integrate, store and process data is a growing priority amongst enterprises.

The median size of datasets required to train AI models increased from 5.9 million data points in 2010 to 750 billion in 2023, according to BofA Global Research. As demand rises for AI-enabled offerings, companies are prioritizing tools to integrate, store, and process data.

In BofA’s survey, data streaming/stream processing and data science/ML were selected as key use cases in regard to AI, with 44% and 37% of respondents citing usage, respectively. Further, AI enablement is accelerating data to the cloud. Gartner estimates that 74% of the data management market will be deployed in the cloud by 2027, up from 60% in 2023.

Data infrastructure software [1.] represents a top spending priority for the IT department. Survey respondents cite that data infrastructure represents 35% of total IT spending, with budgets expected to grow 9% for the next 12 months. No surprise that the public cloud hyper-scaler platforms were cited as top three vendors. Amazon AWS data warehouse/data lake offerings, Microsoft Azure database offerings, and Google BigQuery are chosen by 45%, 39% and 35% of respondents, respectively.

Note 1. Data infrastructure software refers to databases, data warehouses/lakes, data pipelines, data analytics and other software that facilitate data management, processing and analysis.

………………………………………………………………………………………………………………..

The top three factors for evaluating data infrastructure software vendors are security, enterprise capabilities (e.g., architecture scalability and reliability) and depth of technology.

BofA’s Software team estimates that the data infrastructure industry (e.g., data warehouses, data lakes, unstructured databases, etc.) is currently a $96bn market that could reach $153bn in 2028. The team’s proprietary survey revealed that data infrastructure is 35% of total IT spending with budgets expected to grow 9% over the next 12 months. Hyperscalers including Amazon and Google are among the top recipients of dollars and in-turn, those companies spend big on hardware.

Key takeaways:

- Data infrastructure is the largest and fastest growing segment of software ($96bn per our bottom-up analysis, 17% CAGR).

- AI/cloud represent enduring growth drivers. Data is the currency for LLMs, positioning data vendors well in this new cycle

- BofA survey (150 IT professionals) suggests best of breeds (MDB, SNOW and Databricks) seeing highest expected growth in spend

………………………………………………………………………………………………………….

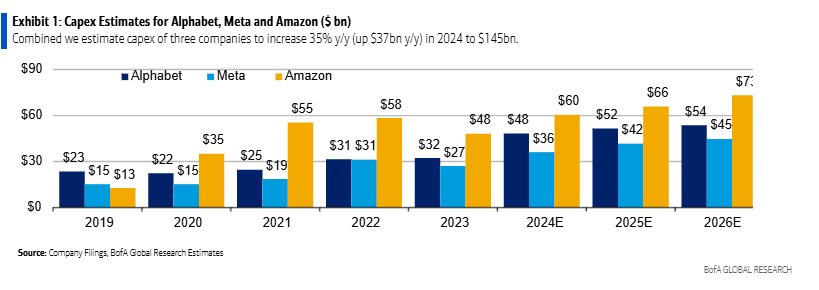

BofA analyst Justin Post expects server and equipment capex for mega-cap internet companies (Amazon, Alphabet/Google, Meta/Facebook) to rise 43% y/y in 2024 to $145bn, which represents $27bn of the $37bn y/y total capex growth. Despite the spending surge, Mr. Post thinks these companies will keep free cash flow margins stable at 22% y/y before increasing in 2025. The technical infrastructure related capex spend at these three companies is expected to see steep rise in 2024, with the majority of the increase for servers and equipment.

Notes:

- Alphabet categorizes its technical infrastructure assets under the line item ‘Information Technology Assets‘

- Amazon take a much a broader categorization and includes Servers, networking equipment, retail related heavy equipment & fulfillment equipment under ‘Equipment‘.

- Meta gives more details and separately reports Server & Networking, and Equipment assets.

In 2024, BofA estimates CAPEX for the three hyperscalers as follows:

- Alphabet‘s capex for IT assets will increase by $12bn y/y to $28bn.

- Meta, following a big ramp in 2023, server, network and equipment asset spend is expected to increase $7bn y/y to $22bn.

- Amazon, equipment spend is expected to increase $8bn y/y to $41bn (driven by AWS, retail flattish). Amazon will see less relative growth due to retail equipment capex leverage in this line.

On a relative scale, Meta capex spend (% of revenue) remains highest in the group and the company has materially stepped up its AI related capex investments since 2022 (in–house supercomputer, LLM, leading computing power, etc.). We think it‘s interesting that Meta is spending almost as much as the hyperscalers on capex, which should likely lead to some interesting internal AI capabilities, and potential to build a “marketing cloud“ for its advertisers.

From 2016-22, the sector headcount grew 26% on average. In 2023, headcount decreased by 9%. BofA expects just 3% average. annual job growth from 2022-2026. Moreover, AI tools will likely drive higher employee efficiency, helping offset higher depreciation.

…………………………………………………………………………………………………………

Source for all of the above information: BofA Global Research

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Global spending on public cloud services is projected to reach $1.35 trillion in 2027, according to IT market research firm IDC. Although annual cloud spending growth is expected to slow slightly over the 2023-2027 forecast period, the market is forecast to achieve a five-year compound annual growth rate (CAGR) of 19.9%.

IDC forecasts that the U.S. will be the largest geographic public cloud market and will reach $697 billion in 2027. Western Europe is predicted to be in second place with $273 billion, followed by China at $117 billion in 2027.

Eileen Smith, program VP for data & analytics at IDC, said cloud is dominating spending in the tech sector across infrastructure, platforms and applications. She wrote:

“Cloud now dominates tech spending across infrastructure, platforms, and applications. Most organizations have adopted the public cloud as a cost-effective platform for hosting enterprise applications and for developing and deploying customer-facing solutions. Looking forward, the cloud model remains incredibly well positioned to serve customer needs for innovation in application development and deployment, including as data, artificial intelligence/machine learning (AI/ML), and edge needs continue to define the forefront of innovation.”

Of the 28 industries* covered in the IDC Spending Guide, the three largest in 2027 – Banking, Software and Information Services, and Telecommunications – will together represent $326 billion in public cloud services spending.

IDC forecasts that software-as-a-service (SaaS) applications to be the largest cloud computing category, garnering about 40% of all public cloud spending. Next largest is infrastructure as a service (IaaS) with a CAGR of 23.5%, followed by platform as a service (PaaS) with a five-year CAGR of 27.2%. SaaS – system infrastructure software (SIS) is forecast to be the smallest category of cloud spending, cornering about 15% of the market.

…………………………………………………………………………………………………………………….

References:

https://www.idc.com/getdoc.jsp?containerId=prUS51179523

https://www.idc.com/getdoc.jsp?containerId=IDC_P33214

IDC: Public Cloud software at 2/3 of all enterprise applications revenue in 2026; SaaS is essential!

https://techblog.comsoc.org/2022/02/09/gartner-accelerated-move-to-public-cloud-to-overtake-traditional-it-spending-in-2025/

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

Google Cloud infrastructure enhancements: AI accelerator, cross-cloud network and distributed cloud

Google is selling broad access to its most powerful artificial-intelligence technology for the first time as it races to make up ground in the lucrative cloud-software market. The cloud giant now has a global network of 38 cloud regions, with a goal to operate entirely on carbon-free energy 24/7 by 2030.

At the Google Cloud Next conference today, Google Cloud announced several key infrastructure enhancements for customers, including:

- Cloud TPU v5e: Google’s most cost-efficient, versatile, and scalable purpose-built AI accelerator to date. Now, customers can use a single Cloud TPU platform to run both large-scale AI training and inference. Cloud TPU v5e scales to tens of thousands of chips and is optimized for efficiency. Compared to Cloud TPU v4, it provides up to a 2x improvement in training performance per dollar and up to a 2.5x improvement in inference performance per dollar.

- A3 VMs with NVIDIA H100 GPU: A3 VMs powered by NVIDIA’s H100 GPU will be generally available next month. It is purpose-built with high-performance networking and other advances to enable today’s most demanding gen AI and large language model (LLM) innovations. This allows organizations to achieve three times better training performance over the prior-generation A2.

- GKE Enterprise: This enables multi-cluster horizontal scaling ;-required for the most demanding, mission-critical AI/ML workloads. Customers are already seeing productivity gains of 45%, while decreasing software deployment times by more than 70%. Starting today, the benefits that come with GKE, including autoscaling, workload orchestration, and automatic upgrades, are now available with Cloud TPU v5e.

- Cross-Cloud Network: A global networking platform that helps customers connect and secure applications across clouds. It is open, workload-optimized, and offers ML-powered security to deliver zero trust. Designed to enable customers to gain access to Google services more easily from any cloud, Cross-Cloud Network reduces network latency by up to 35%.

- Google Distributed Cloud: Designed to meet the unique demands of organizations that want to run workloads at the edge or in their data center. In addition to next-generation hardware and new security capabilities, the company is also enhancing the GDC portfolio to bring AI to the edge, with Vertex AI integrations and a new managed offering of AlloyDB Omni on GDC Hosted.

Google’s launch on Tuesday puts it ahead of Microsoft in making AI-powered office software easily available for all customers,” wrote WSJ’s Miles Kruppa. Google will also open up availability to its large PaLM 2 model, which supports generative AI features, plus AI technology by Meta Platforms and startup Anthropic, reported Kruppa.

The efforts are Google’s latest attempt to spark growth in the cloud business, an important part of CEO Sundar Pichai’s attempts to reduce dependence on its cash-cow search engine. Recent advances in AI, and the computing resources they require, have added extra urgency to turn the technology into profitable products.

Google’s infrastructure and software offerings produce $32 billion in annual sales, about 10% of total revenue at parent company. Its cloud unit turned a quarterly operating profit for the first time this year. That still leaves Google firmly in third place in the cloud behind AWS and Microsoft Azure. However, Google Cloud revenue is growing faster – at 31% – than its two bigger cloud rivals.

Google will make widely available its current large PaLM 2 model, which powers many of the company’s generative-AI features. It was previously only available for handpicked customers. The company also will make available AI technology developed by Meta Platforms and the startup Anthropic, in which it is an investor.

Google Cloud CEO Thomas Kurian who gave the keynote speech at Google Cloud Next 2023 conference. Image Credit: Alphabet (parent company of Google)

……………………………………………………………………………………………………………………………

Google Cloud’s comprehensive AI platform — Vertex AI — enables customers to build, deploy and scale machine learning (ML) models. They have seen tremendous usage, with the number of gen AI customer projects growing more than 150 times from April-July this year. Customers have access to more than 100 foundation models, including third-party and popular open-source versions, in their Model Garden. They are all optimized for different tasks and different sizes, including text, chat, images, speech, software code, and more.

Google also offer industry specific models like Sec-PaLM 2 for cybersecurity, to empower global security providers like Broadcom and Tenable; and Med-PaLM 2 to assist leading healthcare and life sciences companies including Bayer Pharmaceuticals, HCA Healthcare, and Meditech.

Partners are also using Vertex AI to build their own features for customers – including Box, Canva, Salesforce, UKG, and many others. Today at Next ‘23, we’re announcing:

- DocuSign is working with Google to pilot how Vertex AI could be used to help generate smart contract assistants that can summarize, explain and answer what’s in complex contracts and other documents.

- SAP is working with us to build new solutions utilizing SAP data and Vertex AI that will help enterprises apply gen AI to important business use cases, like streamlining automotive manufacturing or improving sustainability.

- Workday’s applications for Finance and HR are now live on Google Cloud and they are working with us to develop new gen AI capabilities within the flow of Workday, as part of their multi-cloud strategy. This includes the ability to generate high-quality job descriptions and to bring Google Cloud gen AI to app developers via the skills API in Workday Extend, while helping to ensure the highest levels of data security and governance for customers’ most sensitive information.

In addition, many of the world’s largest consulting firms, including Accenture, Capgemini, Deloitte, and Wipro, have collectively planned to train more than 150,000 experts to help customers implement Google Cloud GenAI.

………………………………………………………………………………………………………………………

“The computing capabilities are improving a lot, but the applications are improving even more,” said Character Technologies CEO Noam Shazeer, who pushed for Google to release a chatbot to the public before leaving the company in 2021. “There will be trillions of dollars worth of value and product chasing tens of billions of dollars worth of hardware.”

………………………………………………………………………………………………………………

References:

https://cloud.google.com/blog/topics/google-cloud-next/welcome-to-google-cloud-next-23

https://www.wsj.com/tech/ai/google-chases-microsoft-amazon-cloud-market-share-with-ai-tools-a7ffc449

https://cloud.withgoogle.com/next

Banned in the U.S., China Telecom Americas launches eSurfing Cloud services in Brazil

China Telecom do Brasil (“CTB”) today announced the launch of eSurfing Cloud services in Brazil. Through on-demand purchases that aim to simplify the process for more targeted service, the new offering provides businesses with the flexibility of accessing public and private cloud services, combined with the security and control of private cloud.

CTB’s eSurfing Cloud services enable enterprises in Brazil to take advantage of the latest cloud technologies, with the added benefit of local support and expertise. With this new offering, businesses in Brazil can optimize their cloud environments, reduce costs, and improve efficiency, all while maintaining high levels of security and compliance. The eSurfing Cloud services in São Paulo will allow customers to connect on a global multi-cloud network of more than nine public cloud nodes, 30 proprietary edge cloud nodes, and more than 200 CDN nodes.

“We are excited to bring our world-class cloud solutions to businesses in Brazil,” said Luis Fiallo, the officer of China Telecom do Brasil. “Our eSurfing Cloud services deliver flexible and scalable solutions that can meet the unique evolving needs of businesses in the region. The launch of this new offering is our continued commitment to helping our customers achieve their business goals and succeed in today’s digital landscape.”

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XHTL5542J5O7ZMXAOZFOUJSSVI.jpg)

Brazil is one of the most active cloud markets in Latin America, with high demand for the critical services that connect LATAM to the global market. Cloud adoption in Brazil has increased nearly 40% since 2019 and is expected to grow nearly 19% by 2033. While eSurfing Cloud provides customers with access to public cloud, private cloud, hybrid cloud, and edge cloud, its advantages in cloud-network integration, security, and extensive customization make it the choice digital transformation accelerator for businesses of any size.

About China Telecom do Brasil:

China Telecom do Brasil is the largest subsidiary of China Telecom Americas in Latin America and a leading provider of Internet and cloud computing services in Brazil. With a focus on customer satisfaction, the company delivers reliable, scalable, and secure solutions that enable businesses to connect their networks within Brazil and internationally, while thriving in today’s digital landscape. The company is the largest Chinese Internet provider in Brazil with network POPs and backbone connecting the state of Sao Paulo, State of Rio De Janeiro, State of Parana and State of Rio Grande do Sul to the China Telecom global network.

SOURCE: China Telecom Americas

………………………………………………………………………………………………………………………………………

China Telecom still banned in U.S.:

The Federal Communications Commission (FCC) has raised mounting concerns about Chinese telecom companies in recent years which had won permission to operate in the United States decades ago. On October 26, 2021 the FCC revoked and terminated China Telecom America’s authority to provide Telecom Services in America. The FCC said that China Telecom (Americas) “is subject to exploitation, influence and control by the Chinese government.”

On December 20, 2022, a U.S. federal appeals court rejected China Telecom Corp’s challenge to the order withdrawing the company’s authority to provide services in the United States.

…………………………………………………………………………………………………………………………………………

References:

https://www.fcc.gov/document/fcc-revokes-china-telecom-americas-telecom-services-authority

Analysis and Implications: China’s 3 Major Telecom Operators to be delisted by NYSE

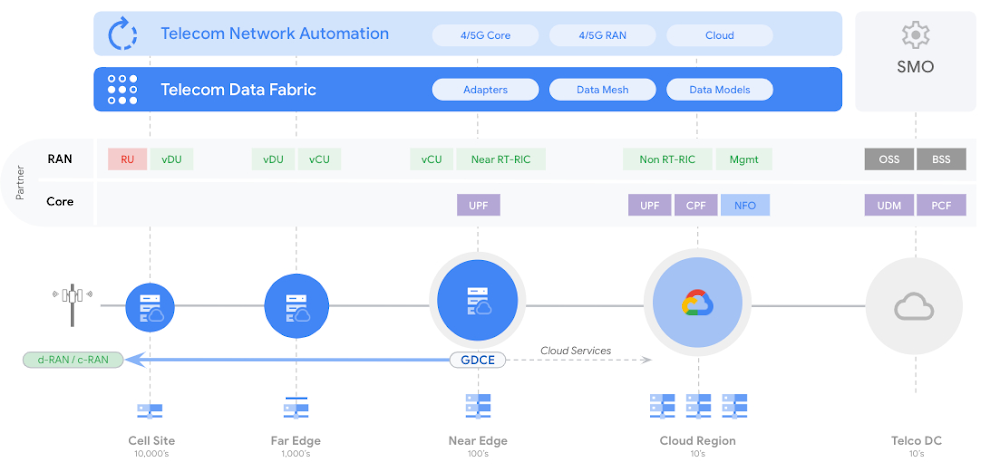

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

At MWC 2023 Barcelona, Google Cloud announced that they can now run the radio access network (RAN) functions as software on Google Distributed Cloud Edge, providing communications service providers (CSPs- AKA telcos) with a common and agile operating model that extends from the core of the network to the edge, for a high degree of programmability, flexibility, and low operating expenses. CSPs have already embraced open architecture, open-source software, disaggregation, automation, cloud, AI and machine learning, and new operational models, to name a few. The journey started in the last decade with Network Functions Virtualization, primarily with value added services and then deeper with core network applications, and in the past few years, that evolved into a push towards cloud-native. With significant progress in the core, the time for Cloud RAN is now, according to Google. However, whether for industry or region-specific compliance reasons, data sovereignty needs, or latency or local data-processing requirements, most of the network functions deployed in a mobile or wireline network may have to follow a hybrid deployment model where network functions are placed flexibly in a combination of both on-premises and cloud regions. RAN, which is traditionally implemented with proprietary hardware, falls into that camp as well.

In 2021,the company launched Google Distributed Cloud Edge (GDC Edge), an on-premises offering that extends a consistent operating model from our public Google Cloud regions to the customer’s premises. For CSPs, this hybrid approach makes it possible to modernize the network, while enabling easy development, fast innovation, efficient scale and operational efficiency; all while simultaneously helping to reduce technology risk and operational costs. GDC Edge became generally available in 2022.

Google Cloud does not plan to develop its own private wireless networking services to sell to enterprise customers, nor does the company plan to develop its own networking software functions, according to Gabriele Di Piazza, an executive with Google Cloud who spoke at MWC 2023 in Barcelona. Instead, Google Cloud would like to host the networking software functions of other vendors like Ericsson and Mavenir in its cloud. It would also like to resell private networking services from operators and others.

Rather than develop its own cloud native 5G SA core network or other cloud networking software (like Microsoft and AWS are doing), Google Cloud wants to “avoid partner conflict,” Di Piazza said. Google has been building its telecom cloud story around its Anthos platform. That platform is directly competing against the likes of AWS and Microsoft for telecom customers. According to a number of analysts, AWS appears to enjoy an early lead in the telecom industry – but its rivals, like Google, are looking for ways to gain a competitive advantage. One of Google’s competitive arguments is that it doesn’t have aspirations to sell network functions. Therefore, according to Di Piazza, the company can remain a trusted, unbiased partner.

Image Credit: Google Cloud

Last year, the executive said that moving to a cloud-native architecture is mandatory, not optional for telcos, adding that telecom operators are facing lots of challenges right now due to declining revenue growth, exploding data consumption and increasing capital requirements for 5G. Cloud-native networks have significant challenges. For example, there is a lack of standardization among the various open-source groups and there’s fragmentation among parts of the cloud-native ecosystem, particularly among OSS vendors, cloud providers and startups.

In recent years, Google, Microsoft, Amazon, Oracle and other cloud computing service providers have been working to develop products and services that are specifically designed to allow telecom network operator’s to run their network functions inside a third-party cloud environment. For example, AT&T and Dish Network are running their 5G SA core networks on Microsoft Azure and AWS, respectively.

Matt Beal, a senior VP of software development for Oracle Communications, said his company offers both a substantial cloud computing service as well as a lengthy list of network functions. He maintains that Oracle is a better partner for telecom network operators because of it. Beal said Oracle has long offered a wide range of networking functions, from policy control to network slice management, that can be run inside its cloud or inside the cloud of other companies. He said that, because Oracle developed those functions itself, the company has more experience in running them in a cloud environment compared with a company that hasn’t done that kind of work. Beal’s inference is that network operators ought to partner with the best and most experienced companies in the market. That position runs directly counter to Google’s competitive stance on the topic. “When you know how these things work in real life … you can optimize your cloud to run these workloads,” he said.

While a number of other telecom network operators have put things like customer support or IT into the cloud, they have been reluctant to release critical network functions like policy control to a cloud service provider.

References:

https://cloud.google.com/solutions/telecommunications

https://cloud.google.com/blog/topics/telecommunications

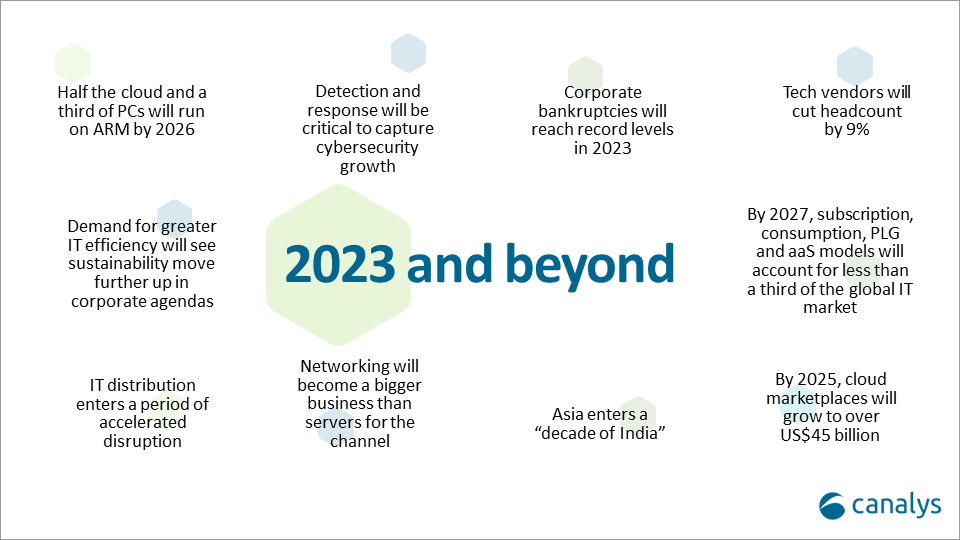

Canalys: Cloud marketplace sales to be > $45 billion by 2025

Canalys now expects that by 2025, cloud marketplaces will grow to more than $45 billion, representing an 84% CAGR. That was one of the market research firm’s predictions for 2023 and beyond (see chart below).

Cloud marketplaces [1.] are accelerating as a route to market for technology, led by hyperscale cloud vendors such as Alibaba, Amazon Web Services, Microsoft, Google and Salesforce, which are pouring billions of development dollars into the sector.

Note 1. A cloud marketplace is an online storefront operated by a cloud service provider. A cloud marketplace provides customers with access to software applications and services that are built on, integrate with or complement the cloud service provider’s offerings. A marketplace typically provides customers with native cloud applications and approved apps created by third-party developers. Applications from third-party developers not only help the cloud provider fill niche gaps in its portfolio and meet the needs of more customers, but they also provide the customer with peace of mind by knowing that all purchases from the vendor’s marketplace will integrate with each other smoothly.

…………………………………………………………………………………………………………………………………………………………………….

“The marketplace route to market is on fire and cannot be ignored by any channel leader,” said Canalys Chief Analyst, Jay McBain. “Marketplaces grew more in the first three months of the pandemic than in the previous decade and have just kept growing,” he added.

“We under-called it,” explained Steven Kiernan, vice president at Canalys. “Cloud marketplaces are accelerating at such a dizzying speed that we’ve doubled our pre-pandemic forecast.

Some software vendors that are active on marketplaces, in particular cybersecurity vendors, are publicly reporting as much as 600% year-on-year growth via this channel, according to McBain.

In addition, the hyperscalers are now reporting growing numbers of billion-dollar customer commitments through enterprise cloud consumption credits, which cover more than just software.

The large cloud marketplaces have lowered fees from upwards of 20% down to 3%, enabling vendors to fund multi-partner offers inside the transaction.

Private equity is funding billions more into marketplace development firms such as AppDirect, Mirakl, Vendasta and CloudBlue to enable hundreds of niche marketplaces across different buyers, industries, geographies, customer segments, product areas and business models.

Canalys Chief Analyst, Alastair Edwards:

“The rise of this route to market represents a threat to both resellers and two-tier distribution. But as more complex technologies are consumed via marketplaces, end customers are also turning to trusted partners to help them discover, procure and manage marketplace purchases. The hyperscalers are increasingly recognizing the value of channel partners, allowing them to create customized vendor offers for end-customers, and supporting the flow of channel margins through their marketplaces. Hyperscalers’ cloud marketplaces are becoming a growing force in global IT distribution as a result.”

By 2025, Canalys conservatively forecasts that almost a third of marketplace procurement will be done via channel partners on behalf of their end customers.

Canalys key predictions for 2023 and beyond:

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://canalys.com/newsroom/cloud-marketplace-forecast-2023

https://www.canalys.com/resources/Canalys-outlook-2023-predictions-for-the-technology-industry

https://www.techtarget.com/searchitchannel/definition/cloud-marketplace

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

Microsoft acquires Lumenisity – hollow core fiber high speed/low latency leader

Executive Summary:

Microsoft announced it has acquired Lumenisity® Limited, a leader in next-generation hollow core fiber (HCF) solutions. Lumenisity’s innovative and industry-leading HCF product can enable fast, reliable and secure networking for global, enterprise and large-scale organizations.

The acquisition will expand Microsoft’s ability to further optimize its global cloud infrastructure and serve Microsoft’s Cloud Platform and Services customers with strict latency and security requirements. The technology can provide benefits across a broad range of industries including healthcare, financial services, manufacturing, retail and government.

Organizations within these sectors could see significant benefit from HCF solutions as they rely on networks and datacenters that require high-speed transactions, enhanced security, increased bandwidth and high-capacity communications. For the public sector, HCF could provide enhanced security and intrusion detection for federal and local governments across the globe. In healthcare, because HCF can accommodate the size and volume of large data sets, it could help accelerate medical image retrieval, facilitating providers’ ability to ingest, persist and share medical imaging data in the cloud. And with the rise of the digital economy, HCF could help international financial institutions seeking fast, secure transactions across a broad geographic region.

Types of Hollow Core Fiber:

Various types of hollow-core photonic bandgap fibers:

(a) Photonic crystal fiber featuring small hollow core surrounded by a periodic array of large air holes.

(b) Microstructured fiber featuring medium-sized hollow core surrounded by several rings of small air holes separated by nano-size bridges.

(c) Bragg fiber featuring large hollow core surrounded by a periodic sequence of high and low refractive index layers

Lumenisity HCF benefits:

Lumenisity’s hollow core fiber technology replaces the standard glass core in a fiber cable with an air-filled chamber. According to Microsoft, light travels through air 47% faster than glass. Lumenisity’s next generation of HCF uses a proprietary design where light propagates in an air core, which has significant advantages over traditional cable built with a solid core of glass, including:

- Increased overall speed and lower latency as light travels through HCF 47% faster than standard silica glass.[1]

- Enhanced security and intrusion detection due to Lumenisity’s innovative inner structure.

- Lower costs, increased bandwidth and enhanced network quality due to elimination of fiber nonlinearities and broader spectrum.

- Potential for ultra-low signal loss enabling deployment over longer distances without repeaters.

Lumenisity was formed in 2017 as a spinoff from the world-renowned Optoelectronics Research Centre (ORC) at the University of Southampton to commercialize breakthroughs in the development of hollow core optical fiber. In 2021 and 2022, the company won the Best Fibre Component Product for their NANF® CoreSmart® HCF cable in the European Conference on Optical Communication (ECOC) Exhibition Industry Awards. As part of the Lumenisity acquisition, Microsoft plans to utilize the organization’s technology and team of industry-leading experts to accelerate innovations in networking and infrastructure.

Lumenisity said: “We are proud to be acquired by a company with a shared vision that will accelerate our progress in the hollow-core space. This is the end of the beginning, and we are excited to start our new chapter as part of Microsoft to fulfill this technology’s full potential and continue our pursuit of unlocking new capabilities in communication networks.”

………………………………………………………………………………………………………………………………………………………………..

Analysis:

The purchase is also noteworthy in light of Microsoft’s other recent acquisitions in the telecommunications sector, which include Affirmed Networks, Metaswitch Networks and AT&T’s core network operations (including 5G SA Core Network).

Microsoft isn’t the only company interested in HCF technology and Lumenisity. Both BT in the UK and Comcast in the US have tested Lumenisity’s offerings.

Comcast announced in April it was able to support speeds in the range of 10 Gbit/s to 400 Gbit/s over a 40km “hybrid” connection in Philadelphia that utilized legacy fiber and the new hollow core fiber. Comcast worked with Lumenisity.

“As we continue to develop and deploy technology to deliver 10G, multigigabit performance to tens of millions of homes, hollow core fiber will help to ensure that the network powering those experiences is among the most advanced and highest performing in the world,” said Comcast networking chief Elad Nafshi in the release issued in April.

References:

https://www.datacenterdynamics.com/en/news/microsoft-acquires-hollow-core-fiber-firm-lumenisity

Comcast Deploys Advanced Hollowcore Fiber With Faster Speed, Lower Latency