Non Terrestrial Network (NTN

Analysis: SpaceX FCC filing to launch up to 1M LEO satellites for solar powered AI data centers in space

SpaceX has applied to the Federal Communications Commission (FCC) for permission to launch up to 1 million LEO satellites for a new solar-powered AI data center system in space. The private company, 40% owned by Elon Musk, envisions an orbital data center system with “unprecedented computing capacity” needed to run large-scale AI inference and applications for billions of users, according to SpaceX’s filing entered late on Friday.

Credit: Blueee/Alamy Stock Photo

The proposed new satellites would operate in “narrow orbital shells” of up to 50 kilometers each. The satellites would operate at altitudes of between 500 kilometers and 2,000 kilometers, and 30 degrees, and “sun-synchronous orbit inclinations” to capture power from the sun. The system is designed to be interconnected via optical links with existing Starlink broadband satellites, which would transmit data traffic back to ground Earth stations.

“Fortunately, the development of fully reusable launch vehicles like Starship that can deploy millions of tons of mass per year to orbit when launching at rate, means on-orbit processing capacity can reach unprecedented scale and speed compared to terrestrial buildouts, with significantly reduced environmental impact,” SpaceX said.

- Energy Density & Sustainability: By tapping into “near-constant solar power,” SpaceX aims to utilize a fraction of the Sun’s output—noting that even a millionth of its energy exceeds current civilizational demand by four orders of magnitude.

- Thermal Management: To address the cooling requirements of high-density AI clusters, these satellites will utilize radiative heat dissipation, eliminating the water-intensive cooling loops required by terrestrial facilities.

- Opex & Scalability: The financial viability of this orbital layer is tethered to the Starship launch platform. SpaceX anticipates that the radical reduction in $/kg launch costs provided by a fully reusable heavy-lift vehicle will enable rapid scaling and ensure that, within years, the lowest LCOA (Levelized Cost of AI) will be achieved in orbit.

- Vacuum-Speed Data Transmission: In a vacuum, light propagates roughly 50% faster than through terrestrial fiber optic cables. By utilizing Starlink’s optical inter-satellite links (OISLs)—a “petabit” laser mesh—data can bypass terrestrial bottlenecks and subsea cables. This potentially reduces intercontinental latency for AI inference to under 50ms, surpassing many long-haul terrestrial routes.

- Edge-Native Processing & Data Gravity: Current workflows require downlinking massive raw datasets (e.g., Synthetic Aperture Radar imagery) for terrestrial processing, a process that can take hours. Shifting to orbital edge computing allows for “in-situ” AI inference, processing data onboard to deliver actionable insights in minutes rather than hours. This “Space Cloud” architecture eliminates the need to route raw data back to the Earth’s internet backbone, reducing data transmission volumes by up to 90%.

- LEO Proximity vs. Terrestrial Hops: While terrestrial fiber remains the “gold standard” for short-range latency (typically 1–10ms), it is often hindered by inefficient routing and multiple hops. SpaceX’s LEO constellation, operating at altitudes between 340km and 614km, currently delivers median peak-hour latencies of ~26ms in the US. Future orbital configurations may feature clusters at varying 50km intervals to optimize for specific workload and latency tiers.

………………………………………………………………………………………………………………………………………………………………………………………

The SpaceX FCC filing on Friday follows an exclusive report by Reuters that Elon Musk is considering merging SpaceX with his xAI (Grok chatbot) company ahead of an IPO later this year. Under the proposed merger, shares of xAI would be exchanged for shares in SpaceX. Two entities have been set up in Nevada to facilitate the transaction, Reuters said. Musk also runs electric automaker Tesla, tunnel company The Boring Co. and neurotechnology company Neuralink.

………………………………………………………………………………………………………………………………………………………………………………………

References:

Google’s Project Suncatcher: a moonshot project to power ML/AI compute from space

Blue Origin announces TeraWave – satellite internet rival for Starlink and Amazon Leo

China ITU filing to put ~200K satellites in low earth orbit while FCC authorizes 7.5K additional Starlink LEO satellites

Amazon Leo (formerly Project Kuiper) unveils satellite broadband for enterprises; Competitive analysis with Starlink

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

AST SpaceMobile to deliver U.S. nationwide LEO satellite services in 2026

GEO satellite internet from HughesNet and Viasat can’t compete with LEO Starlink in speed or latency

How will fiber and equipment vendors meet the increased demand for fiber optics in 2026 due to AI data center buildouts?

Subsea cable systems: the new high-capacity, high-resilience backbone of the AI-driven global network

From LPWAN to Hybrid Networks: Satellite and NTN as Enablers of Enterprise IoT – Part 2

By Afnan Khan (ML Engineer) and Mehsam Bin Tahir (Data Engineer)

Introduction:

This is the second of two articles on the impact of the Internet of Things (IoT) on the UK Telecom industry. The first is at

Enterprise IoT and the Transformation of UK Telecom Business Models – Part 1

Executive Summary:

Early Internet of Things (IoT) deployments relied heavily on low power wide area networks (LPWANs) to deliver low-cost connectivity for distributed devices. While these technologies enabled initial IoT adoption, they struggled to deliver sustainable commercial returns for telecom operators. In response, attention has shifted towards hybrid terrestrial–satellite connectivity models that integrate Non-Terrestrial Networks (NTN) directly into mobile network architectures. In 2026, satellite connectivity is increasingly positioned not as a universal coverage solution but as a resilience and continuity layer for enterprise IoT services (Ofcom, 2025).

The Commercial Limits of LPWAN-Based IoT:

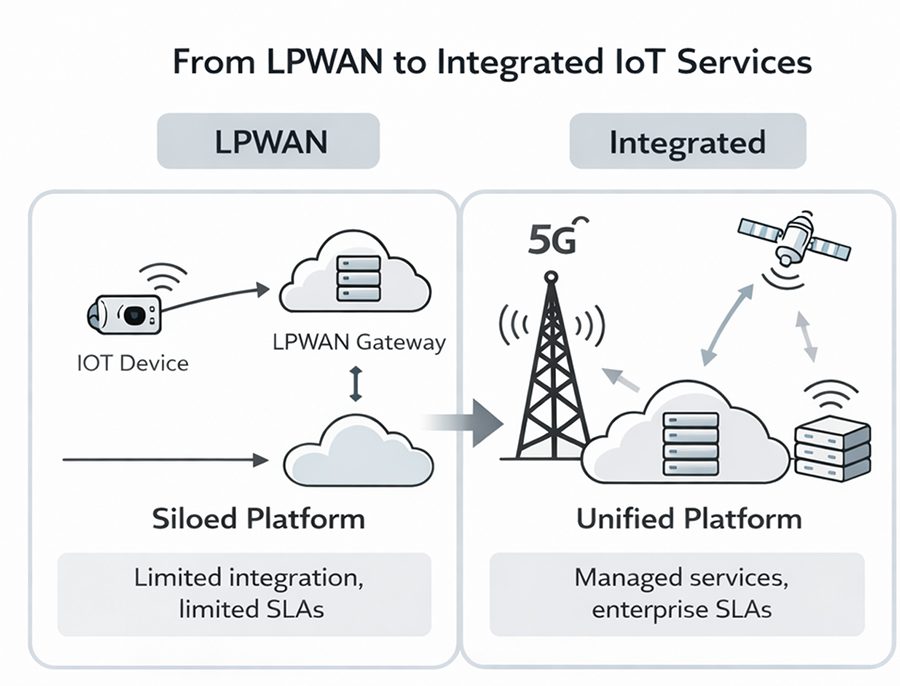

LPWAN technologies enabled low-cost connectivity for specific IoT use cases but were typically deployed outside mobile core architectures. This limited their ability to support quality of service guarantees, enterprise-grade security and integrated billing models. As a result, LPWAN deployments often remained fragmented and failed to scale into durable enterprise business models, restricting their long-term commercial value for telecom operators (Ofcom, 2025).

Satellite and NTN as Integrated Mobile Extensions:

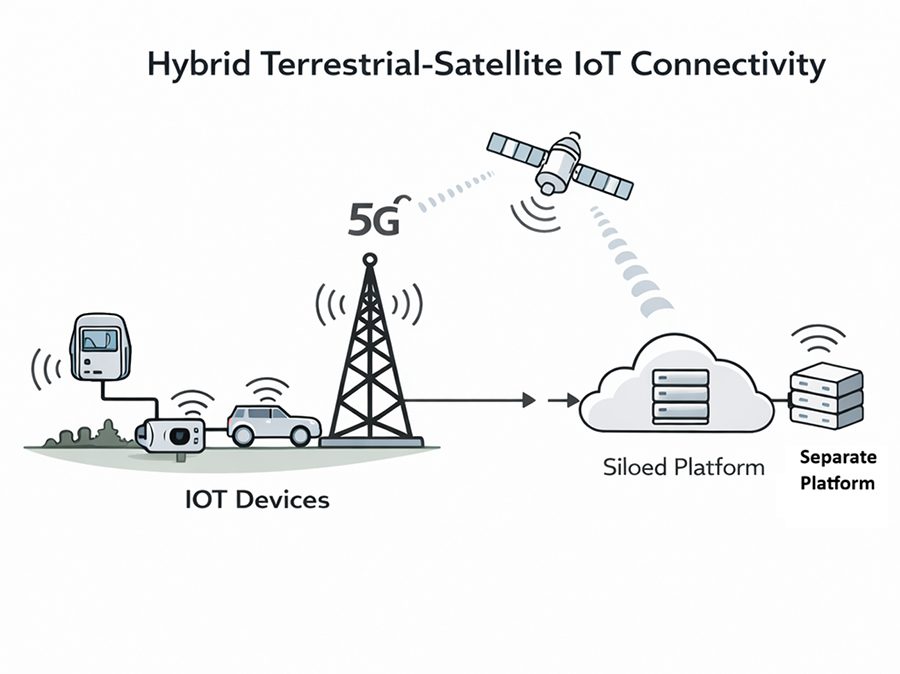

In contrast, satellite and NTN connectivity extends existing mobile networks rather than operating as a parallel IoT layer. When non-terrestrial connectivity is integrated into 5G core infrastructure, telecom operators are able to deliver managed IoT services with consistent security, performance and billing models across both terrestrial and remote environments. This architectural shift allows satellite connectivity to be packaged as part of a unified enterprise service rather than sold as a standalone or niche connectivity product (3GPP, 2023). Figure 1 illustrates this hybrid terrestrial–satellite model, showing how satellite connectivity functions as an extension of mobile networks to support continuous IoT services across urban, rural and remote environments.

Figure 1: Hybrid terrestrial–satellite connectivity supporting continuous IoT services across urban, rural and remote environments.

Industrial Use Cases and Hybrid Connectivity

In sectors such as offshore energy, agriculture, logistics and remote infrastructure monitoring, IoT deployments prioritise coverage continuity and service resilience over peak data throughput. Hybrid terrestrial–satellite connectivity enables operators to offer coverage guarantees and service level agreements that LPWAN-based models could not reliably support. In 2026, Virgin Media O2 launched satellite-enabled services aimed at supporting rural connectivity and improving resilience for IoT-dependent applications, reflecting a broader operator strategy to monetise non-terrestrial coverage where reliability is a core requirement (Real Wireless, 2025).

The commercial implications of this transition are further illustrated in Figure 2, which contrasts siloed LPWAN deployments with integrated mobile and satellite IoT services delivered through a unified network core.

Figure 2: Transition from siloed LPWAN deployments to integrated mobile and satellite IoT services delivered through a unified network core.

Satellite Connectivity and Enterprise IoT at Scale:

The UK Space Agency has identified hybrid terrestrial–satellite connectivity as an enabling layer for remote industrial operations, environmental monitoring and agricultural IoT systems. UK-based firms such as Open Cosmos are contributing to this model by integrating Low Earth Orbit satellite connectivity with existing mobile core networks. This approach allows telecom operators to deliver end-to-end managed connectivity for enterprise customers without deploying separate IoT network stacks, converting coverage limitations from a cost burden into chargeable, service-based revenue opportunities (Open Cosmos, 2024; UK Space Agency, 2025).

Conclusion

In 2026, IoT is reshaping the UK telecom sector primarily by enabling new revenue models rather than by driving incremental network expansion. Following the limited commercial success of LPWAN-based IoT strategies, satellite and Non-Terrestrial Network integration is increasingly deployed as an extension of mobile networks to provide coverage continuity and service guarantees for industrial and remote use cases. When integrated into 5G core architectures, satellite connectivity enables telecom operators to monetise resilience and reliability as part of managed enterprise services rather than offering standalone connectivity. Taken together, these developments show that satellite and NTN integration has become a critical enabler of scalable, enterprise-led IoT business models in the UK (Ofcom-2025; 3GPP-2023).

…………………………………………………………………………………………………………………………………………………………………………

References:

Ofcom. (2025). Connected Nations UK report.

https://www.ofcom.org.uk

Real Wireless. (2025). Satellite to mobile connectivity and the UK market.

https://real-wireless.com

UK Space Agency. (2025). Connectivity and space infrastructure briefing

https://www.gov.uk/government/organisations/uk-space-agency

Open Cosmos. (2024). Satellite solutions for IoT and Earth observation.

https://open-cosmos.com

3GPP. (2023). Non-Terrestrial Networks (NTN) support in 5G systems.

https://www.3gpp.org/news-events/ntn

Non-Terrestrial Networks (NTNs): market, specifications & standards in 3GPP and ITU-R

Keysight Technologies Demonstrates 3GPP Rel-19 NR-NTN Connectivity in Band n252 (using Samsung modem chip set)

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

China ITU filing to put ~200K satellites in low earth orbit while FCC authorizes 7.5K additional Starlink LEO satellites

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

China ITU filing to put ~200K satellites in low earth orbit while FCC authorizes 7.5K additional Starlink LEO satellites

- Purpose: The planned systems are intended to provide global broadband connectivity, data relay, and positioning services, directly competing with U.S. efforts like SpaceX’s Starlink network.

- Filing Entities: The primary filings were submitted by the state-backed Institute of Radio Spectrum Utilization and Technological Innovation, along with other commercial and state-owned companies like China Mobile and Shanghai Spacecom.

- Status: These filings are an initial step in a long international regulatory process and serve as a claim to limited spectrum and orbital slots. They do not guarantee all satellites will ultimately be built or launched. The actual deployment will be a gradual process over many years.

- Context: The move is part of an escalating “space race” to dominate the LEO environment. Early filings are crucial for securing priority access to orbital resources and avoiding signal interference. The sheer scale of the Chinese proposal would, if realized, dwarf most other planned constellations.

- Regulations: Under ITU rules, operators must deploy a certain percentage of the satellites within seven years of the initial filing to retain their rights.

- Shanghai Yuanxin (Qianfan), currently China’s most advanced LEO satellite operator, has submitted a regulatory request for an additional 1,296 satellites.

- Telecommunications giant China Mobile is planning two separate constellations totaling 2,664 satellites.

- ChinaSat, the established state-owned satellite provider, is focusing on a 24-satellite medium-Earth orbit (MEO) system.

- GalaxySpace, a private satellite manufacturer based in Beijing, has applied for 187 satellites, and China Telecom has applied for 12.

Image Credit: Klaus Ohlenschlaeger/Alamy Stock Photo

“This gives SpaceX what they need for the next couple of years of operation. They’re launching a bit over 3,000 satellites a year, so 7,500 satellites being authorized is potentially enough for SpaceX to do what they want to do until late 2027,” said Tim Farrar, satellite analyst and president at TMF Associates.

SpaceX has plans for a larger D2D satellite constellation that would use the AWS-4 and H-block spectrum it is acquiring from EchoStar. It is awaiting FCC approval for the US$17 billion deal, but the spectrum is not expected to be transferred until the end of November 2027.

The FCC noted that the changes will allow the Starlink system to serve more customers and deliver “gigabit speed service.” Along with permission for another tranche of satellites, the FCC has set new parameters for frequency use and lower orbit altitudes. The modified authorizations will also apply to new satellites to be launched.

Starlink’s LEO satellite network competitors are Amazon Leo, OneWeb and AST Space Mobile.

………………………………………………………………………………………………………………………………………………………..

References:

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Amazon Leo (formerly Project Kuiper) unveils satellite broadband for enterprises; Competitive analysis with Starlink

NBN selects Amazon Project Kuiper over Starlink for LEO satellite internet service in Australia

GEO satellite internet from HughesNet and Viasat can’t compete with LEO Starlink in speed or latency

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

Vodafone and Amazon’s Project Kuiper to extend 4G/5G in Africa and Europe

Keysight Technologies Demonstrates 3GPP Rel-19 NR-NTN Connectivity in Band n252

Keysight Technologies, Inc. has demonstrated the first end-to-end New Radio Non-Terrestrial Network (NR-NTN) connection in 3GPP band n252 under Release 19 specifications, achieved in collaboration with Samsung Electronics using Samsung’s next-generation commercial NR modem chipset (part number not stated). The live trial, conducted at CES 2026 in Las Vegas, validated satellite-to-satellite (SAT-to-SAT) mobility and cross-vendor interoperability, establishing a key milestone for direct-to-cell (D2C) satellite communications and NTN commercialization.

The successful validation of band n252 marks the first public confirmation of this spectrum band in an operational NTN system. Band n252 is expected to be a foundational component for upcoming low Earth orbit (LEO) constellations targeting global broadband and IoT coverage. This result demonstrates tangible progress toward large-scale NTN integration supporting ubiquitous, standards-based connectivity for consumers, connected vehicles, IoT devices, and critical communications.

Together with earlier demonstrations in bands n255 and n256, Keysight and Samsung have now validated all major NR-NTN FR1 frequency bands end-to-end. This consolidation enables ecosystem participants—including modem vendors, satellite network operators, and device manufacturers—to analyze cross-band mobility, inter-satellite handovers, and radio performance under consistent, controlled NTN emulation conditions.

The demonstration leveraged Keysight’s NTN Network Emulator Solutions to replicate multi-orbit LEO scenarios, emulate SAT-to-SAT mobility, and execute complete end-to-end routing while supporting live user traffic over the NTN link. When paired with Samsung’s chipset, the setup verified standards compliance, user throughput performance, and multi-vendor interoperability, providing a high-fidelity validation environment that accelerates system testing and time-to-market for NR-NTN deployments targeted for global scaling in 2026.

This integration underscores the readiness of 3GPP Release 19-compliant NTN technologies to transition from proof-of-concept trials to operational field testing, supporting the broader industry goal of realizing seamless terrestrial–non-terrestrial 5G networks within the Rel-19 framework and paving the way for future 6G NTN evolution.

For network operators, device OEMs, and satellite providers, this consolidation of NTN FR1 coverage provides a reference environment to evaluate cross‑band handovers, inter‑satellite mobility, and multi‑vendor interoperability before field deployment. By moving live NR‑NTN testing with commercial‑grade silicon into an emulated LEO constellation environment, the solution is positioned to reduce integration risk, compress trial timelines, and accelerate commercialization of direct‑to‑cell NTN services anticipated to scale from 2026.

Peng Cao, Vice President and General Manager of Keysight’s Wireless Test Group, Keysight, said:

“Together with Samsung’s System LSI Business, we are demonstrating the live NTN connection in 3GPP band n252 using commercial-grade modem silicon with true SAT-to-SAT mobility. With n252, n255, and n256 now validated across NTN, the ecosystem is clearly accelerating toward bringing direct-to-cell satellite connectivity to mass-market devices. Keysight’s NTN emulation environment enables chipset and device makers a controlled way to prove multi-satellite mobility, interoperability, and user-level performance, helping the industry move from concept to commercialization.”

Resources:

About Keysight Technologies:

At Keysight (NYSE: KEYS), we inspire and empower innovators to bring world-changing technologies to life. As an S&P 500 company, we’re delivering market-leading design, emulation, and test solutions to help engineers develop and deploy faster, with less risk, throughout the entire product life cycle. We’re a global innovation partner enabling customers in communications, industrial automation, aerospace and defense, automotive, semiconductor, and general electronics markets to accelerate innovation to connect and secure the world. Learn more at Keysight Newsroom and www.keysight.com.

………………………………………………………………………………………………………………………………………….

References:

https://www.telecoms.com/satellite/samsung-and-keysight-show-off-continuous-ntn-connectivity

Starlink doubles subscriber base; expands to to 42 new countries, territories & markets

Starlink, the satellite internet service by SpaceX, has nearly doubled its internet subscriber base in 2025 to over 9 million global customers. This rapid expansion from approximately 4.6 million subscribers at the end of 2024 has been driven by new service launches in 42 countries and territories, new subscription options, and the company’s focus on bridging the digital divide in remote and underserved areas.

- Total Subscribers: As of December 2025, Starlink connects over 9 million active customers across 155 countries.

- Growth Rate: The company added its most recent million users in just under seven weeks, a record pace of over 20,000 new users daily. Overall internet traffic from users more than doubled in 2025.

- Geographic Expansion: Starlink’s growth is heavily fueled by international markets where traditional broadband is limited. The U.S. subscriber base alone reached over 2 million by mid-2025.

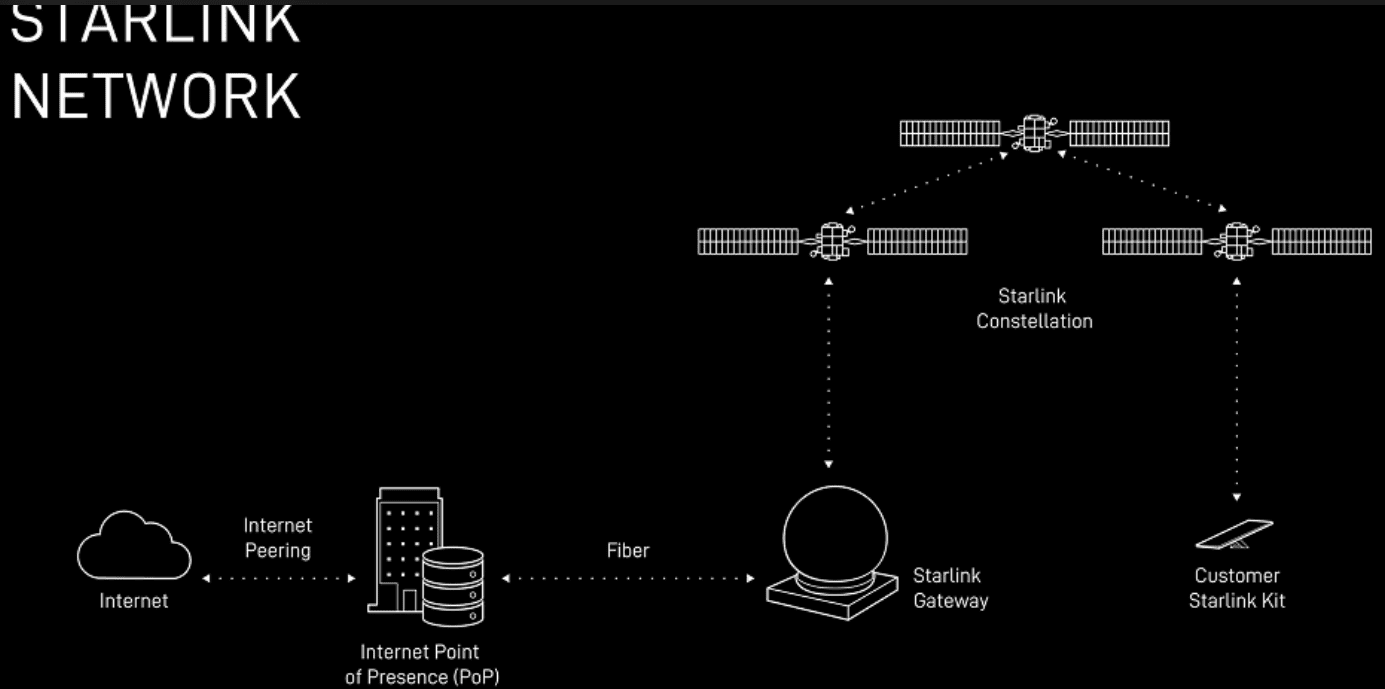

- Infrastructure: SpaceX has focused heavily on scaling its network capacity, operating more than 9,000 active satellites in orbit and investing heavily in ground infrastructure.

Starlink’s Ground Network:

Starlink has also deployed the largest satellite ground network with more than 100 gateway sites in the United States alone – comprising a total of over 1,500 antennas – are strategically placed to deliver the lowest possible latency, especially for those who live in rural and remote areas.

Starlink produces these gateway antennas at our factory in Redmond, Washington where they rapidly scaled production to match satellite production and launch rate.

Network Resilience:

With more than 7,800 satellites in orbit, Starlink customers always have multiple satellites in view, as well as multiple gateway sites and internet points-of-presence locations (PoPs). As a result, Starlink customers benefit from continuous service even when terrestrial broadband is suffering from fiber cuts, subsea cable damage, and power outages that can deny service to millions of individuals for days.

Additionally, each Starlink satellite is equipped with cutting-edge optical links that ensure they can relay hundreds of gigabits of traffic directly with each other, no matter what happens on the ground. This laser network enables Starlink satellites to consistently and reliably deliver data around the world and route traffic around any ground conditions that affect terrestrial service at speeds that are physically impossible on Earth.

Starlink’s Latency:

To measure Starlink’s latency, the company collects anonymized measurements from millions of Starlink routers every 15 seconds. In the U.S., Starlink routers perform hundreds of thousands of speed test measurements and hundreds of billions of latency measurements every day. This high-frequency automated measurement assures consistent data quality, with minimal sampling bias, interference from Wi-Fi conditions, or bottlenecks from third-party hardware.

As of June 2025, Starlink is delivering median peak-hour latency of 25.7 milliseconds (ms) across all customers in the United States. In the US, fewer than one percent of measurements exceed 55 ms, significantly better than even some terrestrial operators.

- Addressing the Digital Divide: Starlink has positioned itself as a critical solution for rural and remote communities, offering high-speed, low-latency internet where fiber or cable is unfeasible.

- New Services: The company is expanding beyond individual households to include services for airlines, maritime operators, and businesses. There are also plans for a direct-to-cell service in partnership with mobile carriers like T-Mobile.

- Next-Generation Satellites: To manage the growing user base and increasing congestion, SpaceX plans to launch its larger, next-generation V3 satellites in 2026, which are designed to offer gigabit-class connectivity and dramatically increase network capacity.

- IPO Considerations: Starlink’s significant growth and role as SpaceX’s primary revenue driver have positioned the parent company for a potential initial public offering (IPO) in 2026.

Competition:

Starlink’s main LEO competitors are Amazon Leo (Project Kuiper) and OneWeb (Eutelsat), aiming for similar high-speed, low-latency service, while established providers Hughesnet and Viasat (mostly GEO) offer more traditional, affordable satellite options but with higher lag, though they’re adapting. Starlink leads in consumer availability and speed currently, but Amazon and OneWeb are rapidly scaling to challenge its dominance with LEO constellations, offering faster speeds and lower latency than older satellite tech.

……………………………………………………………………………………………………………..

References:

https://starlink.com/updates/network-update

Elon Musk: Starlink could become a global mobile carrier; 2 year timeframe for new smartphones

Amazon Leo (formerly Project Kuiper) unveils satellite broadband for enterprises; Competitive analysis with Starlink

NBN selects Amazon Project Kuiper over Starlink for LEO satellite internet service in Australia

GEO satellite internet from HughesNet and Viasat can’t compete with LEO Starlink in speed or latency

KDDI unveils AU Starlink direct-to-cell satellite service

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Non-Terrestrial Networks (NTNs): market, specifications & standards in 3GPP and ITU-R

Introduction:

A recent survey showed that Non-Terrestrial Networks (NTNs) are viewed by the telecom industry as reinforcing service reliability and adding an extra layer of network redundancy to 5G. This view increasingly makes the convergence of satellites and 5G (and fiber) a mainstream application in telecoms. With LEO constellation service revenues forecast to reach $15 billion next year, the industry is expected to experience unprecedented growth.

However, that growth will depend on interoperability to realize economies of scale. To achieve that goal NTN standards, regulatory and policy frameworks must evolve to keep pace and ensure equitable access to space for all. As such, we examine the status and future NTN work in 3GPP and ITU-R in this article.

…………………………………………………………………………………………………………………………………………………

3GPP (3rd Generation Partnership Project) has established NTNs as a key part of 5G and future 6G by defining standards in Release 17, which introduced support for satellites and High-Altitude Platforms (HAPS) for direct-to-device (D2D) communication, enabling ubiquitous connectivity. Current work in Release 18 and beyond (including ongoing Release 19 studies) focuses on enhancing performance, expanding spectrum, improving security, and integrating NTNs seamlessly with terrestrial networks for better resource management, leading towards a unified, hybrid telecom ecosystem for global coverage.

- Release 15 & 16 (Foundational): Established NTN use cases, system architectures, and channel models for satellite-based systems.

- Release 17 (First Standardized Release): Introduced the first normative specifications for 5G NR and NB-IoT NTNs, covering GEO and LEO/MEO satellites, addressing technical hurdles like propagation delay and Doppler shift for mass-market devices.

- Release 18 (Enhancements): Studied security aspects, improved 5G NR NTN for higher frequencies (above 10 GHz), and focused on resource management for efficient integration.

- Release 19 & Beyond (Ongoing): Continues to evolve NTNs, introducing features like regenerative payloads, Ku-band support, and further integration for future 5G-Advanced and 6G networks, with studies on 6G architecture.

- Hybrid Networks: Creating a unified framework for seamless terrestrial and non-terrestrial operation.

- Direct-to-Device (D2D) Evolution: Expanding services beyond basic IoT to support smartphones for voice and data in remote areas.

- Technical Refinements: Addressing RF performance, spectrum coordination, and operational complexity for LEO/MEO systems.

- 6G Foundation: Building architectural principles for ubiquitous connectivity that will underpin future 6G systems.

The International Telecommunication Union Radiocommunication Sector (ITU-R) Working Party 4B is actively shaping NTN’s by developing reports and recommendations to integrate satellites (LEO, MEO, GEO) and High-Altitude Platforms (HAPs) with 5G and future 6G cellular networks. The aim is to enable ubiquitous coverage, Direct-to-Device (D2D) services, and seamless hybrid networks, with ongoing work focusing on radio interface specifications, spectrum harmonization, and performance enhancements for reliable connectivity.

- Standardization: ITU-R is finalizing Recommendation ITU-R M.IMT-2020-SAT.SPECS (based on 3GPP’s Release 17/18 specs) to standardize 5G satellite-to-ground communication, supporting IoT and advanced mobile services.

- Working Groups: WP 4B (Satellite services) and other groups are key to defining NTN requirements, spectrum usage, and interoperability.

- Focus Areas:

- Hybrid Networks: Creating seamless service continuity between terrestrial and space/aerial segments.

- Direct-to-Device (D2D): Enabling smartphones to connect directly to satellites.

- Spectrum: Harmonizing spectrum for NTNs, including Ku-band, for expanded services.

- Performance: Addressing challenges like Doppler shift, propagation delay, and handover management for LEO/MEO constellations.

- 3GPP is a crucial partner, introducing NTN frameworks in Release 17 (IoT) and Release 18 (enhanced 5G), with continuous updates for 6G and beyond, closely coordinating with ITU-R.

- ITU-R’s reports discuss future trends, including AI-driven interfaces, diverse terminals (wearables, implants), and the role of NTNs in achieving global, resilient connectivity, supporting Sustainable Development Goals (SDGs).

References:

https://www.gsma.com/solutions-and-impact/technologies/networks/gsma_resources/non-terrestrial-networks-opportunities-and-challenges/

https://www.telecoms.com/satellite/key-non-terrestrial-network-developments-in-2025

https://www.3gpp.org/technologies/ntn-overview

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

GSMAi: key telecom developments in 2025; major trends to watch in 2026

Deutsche Telekom: successful completion of the 6G-TakeOff project with “3D networks”

AST SpaceMobile to deliver U.S. nationwide LEO satellite services in 2026

MTN Consulting: Satellite network operators to focus on Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

EchoStar has entered into a definitive agreement to sell its entire portfolio of prized AWS-4 [1.] and H-block spectrum licenses to SpaceX in a deal valued at approximately $19 billion. The spectrum purchase allows SpaceX to start building and deploying upgraded, laser-connected satellites that the company said will expand the cell network’s capacity by “more than 100 times.”

This deal marks EchoStar/Dish Network’s exit as a mobile network provider (goodbye multi-vendor 5G OpenRAN) which once again makes the U.S. wireless market a three-player (AT&T, Verizon, T-Mobile) affair. Despite that operational failure, the deal helps EchoStar address regulatory pressure and strengthen its financial position, especially after AT&T agreed to buy spectrum licenses from EchoStar for $23 billion.

The companies also agreed to a deal that will enable EchoStar’s Boost Mobile subscribers to access Starlink direct-to-cell (D2C) service to extend satellite service to areas without mobile network service.

……………………………………………………………………………………………………………………………………………………………

Note 1. The AWS-4 spectrum band (2000-2020 MHz and 2180-2200 MHz) is widely considered the “golden band” for D2C services. Unlike repurposed terrestrial spectrum, the AWS-4 band was originally allocated for Mobile Satellite Service (MSS).

…………………………………………………………………………………………………………………………………………………………..

The AWS-4 spectrum acquisition transforms SpaceX from a D2C partner into an owner that controls its dedicated MSS spectrum. The deal with EchoStar will allow SpaceX to operate Starlink direct-to-cell (D2C) services on frequencies it owns, rather than relying solely on those leased from mobile carriers like T-Mobile and other mobile operators it’s working with (see References below).

Roger Entner wrote that SpaceX is now a “kingmaker.” He emailed this comment:

“With 50 MHz of dedicated spectrum, the raw bandwidth that Starlink can deliver increases by 1.5 GBbit/s. This is a substantial increase in speed to customers. The math is 30 bit/s/hz which is LTE spectral efficiency x 50 MHz = 1.5 Gbit/s. “This agreement makes Starlink an even more serious play in the D2C market as it will have first hand experience with how to utilize terrestrial spectrum. It is one thing to have this experience through a partner, this a completely different game when you own it.”

The combination of T-Mobile’s terrestrial network and Starlink’s enhanced D2C capabilities allows T-Mobile to market a service with virtually seamless connectivity that eliminates outdoor dead zones using Starlink’s spectrum.

“For the past decade, we’ve acquired spectrum and facilitated worldwide 5G spectrum standards and devices, all with the foresight that direct-to-cell connectivity via satellite would change the way the world communicates,” said Hamid Akhavan, president & CEO, EchoStar. “This transaction with SpaceX continues our legacy of putting the customer first as it allows for the combination of AWS-4 and H-block spectrum from EchoStar with the rocket launch and satellite capabilities from SpaceX to realize the direct-to-cell vision in a more innovative, economical and faster way for consumers worldwide.”

“We’re so pleased to be doing this transaction with EchoStar as it will advance our mission to end mobile dead zones around the world,” said Gwynne Shotwell, president & COO, SpaceX. “SpaceX’s first generation Starlink satellites with Direct to Cell capabilities have already connected millions of people when they needed it most – during natural disasters so they could contact emergency responders and loved ones – or when they would have previously been off the grid. In this next chapter, with exclusive spectrum, SpaceX will develop next generation Starlink Direct to Cell satellites, which will have a step change in performance and enable us to enhance coverage for customers wherever they are in the world.”

EchoStar anticipates this transaction with SpaceX along with the previously announced spectrum sale will resolve the Federal Communications Commission’s (FCC) inquiries. Closing of the proposed transaction will occur after all required regulatory approvals are received and other closing conditions are satisfied.

The EchoStar-Space X transaction is structured with a balanced mix of cash and equity plus interest payments:

-

Cash and Stock Components: SpaceX will provide up to $8.5 billion in cash and an equivalent amount in its own stock, with the valuation fixed at the time the agreement was signed. This 50/50 structure provides EchoStar with immediate liquidity to address its creditors while allowing SpaceX to preserve capital for its immense expenditures on Starship and Starlink development. A pure stock deal would have been untenable for EchoStar, which is saddled with over $26.4 billion in debt, while a pure cash deal would have strained SpaceX.

-

Debt Servicing: In a critical provision underscoring EchoStar’s dire financial state, SpaceX has also agreed to fund approximately $2 billion of EchoStar’s cash interest payments through November 2027.

-

Commercial Alliance: The deal establishes a long-term commercial partnership wherein EchoStar’s Boost Mobile subscribers will gain access to SpaceX’s next-generation Starlink D2C service. This provides a desperately needed lifeline for the struggling Boost brand. More strategically, this alliance serves as a masterful piece of regulatory maneuvering. It allows regulators to plausibly argue that they have preserved a “fourth wireless competitor,” providing the political cover necessary to approve a deal that permanently cements a three-player terrestrial market.

The move comes amid rapidly increasing U.S. mobile data usage. In 2024, Americans used a record 132 trillion megabytes of mobile data, up 35% over the prior all-time record, industry group CTIA said Monday.

About EchoStar Corporation:

EchoStar Corporation (Nasdaq: SATS) is a premier provider of technology, networking services, television entertainment and connectivity, offering consumer, enterprise, operator and government solutions worldwide under its EchoStar®, Boost Mobile®, Sling TV, DISH TV, Hughes®, HughesNet®, HughesON™, and JUPITER™ brands. In Europe, EchoStar operates under its EchoStar Mobile Limited subsidiary and in Australia, the company operates as EchoStar Global Australia. For more information, visit www.echostar.com and follow EchoStar on X (Twitter) and LinkedIn.

©2025 EchoStar, Hughes, HughesNet, DISH and Boost Mobile are registered trademarks of one or more affiliate companies of EchoStar Corp.

About SpaceX:

SpaceX designs, manufactures, and launches the world’s most advanced rockets and spacecraft. The company was founded in 2002 to revolutionize space technology, with the ultimate goal of making life multiplanetary. As the world’s leading provider of launch services, SpaceX is leveraging its deep experience with both spacecraft and on-orbit operations to deploy the world’s most advanced internet and Direct to Cell networks. Engineered to end mobile dead zones around the world, Starlink’s satellites with Direct to Cell capabilities enable ubiquitous access to texting, calling, and browsing wherever you may be on land, lakes, or coastal waters.

………………………………………………………………………………………………………………………………………………………………………………………………

References:

Mulit-vendor Open RAN stalls as Echostar/Dish shuts down it’s 5G network leaving Mavenir in the lurch

AT&T to buy spectrum Licenses from EchoStar for $23 billion

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier? (T-Mobile)

KDDI unveils AU Starlink direct-to-cell satellite service

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

Telstra partners with Starlink for home phone service and LEO satellite broadband services

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

Telecoms.com survey results, presented in the report Private networks and NTNs: Transcending the boundaries of 5G, highlight the reinforcement of service reliability and additional layer of network redundancy as the most frequently selected impact of the convergence of 5G and Non Terrestrial Networks (NTN)s, according to nearly half of respondents. Engineers and developers are the biggest proponents of this impact with more than three in five respondents highlighting its value from a technical perspective. The extra network redundancy is backup connectivity from NTNs to existing 5G networks (e,g, dye to a cell tower failure or massive power outage) and the ability to ensure continued service whether in times of crisis or otherwise.

Meanwhile, two in five C-Suite executives think it’s either too early to determine the benefits or that NTNs will only achieve a minimal impact on 5G performance, hinting that they may need more convincing to achieve full buy-in.

‘Deployment costs’ are identified as the top concern when converging NTNs with 5G for many organisations in telecoms and particularly so for CSPs, while ‘cost of infrastructure’ is the most frequently selected key challenge slowing down the large-scale adoption of private 5G.

The cost barrier is neither new nor surprising for these topics, or for many other telecom topics being surveyed, but what this is compounded with now is a global economy that hasn’t been stable for some time, whether due to the global pandemic, or the ever-growing number of wars around the world.

On private 5G, the report also highlights several 5G standalone features that are considered most important to enterprises. Here, network responsiveness (low latency, handover time, and ultra-low data rates) is flagged as the top feature closely followed by network slicing in radio (that is, reserving capacity for specific applications).

The report argues that “while these results shed light on key technical capabilities that telecom professionals consider to be critical for the use of enterprises in a private 5G environment, it is also important to note that focusing on business outcomes and use cases versus technical capabilities is likely more meaningful in discussions with enterprises.”

………………………………………………………………………………………………………………………………………

3GPP introduced NTN into its Release 17, which provided an initial framework and Release 18 which included enhancements. 3GPP continues to work on NTN in Release 19 and beyond, focusing on aspects like onboard satellite processing, Ku-band frequencies, and integration with terrestrial networks.

-

Release 17: This release introduced the initial framework for 5G NTN, including support for NB-IoT and 5G NR NTN.

-

Release 18: This release focused on performance enhancements and additional frequency bands for 5G NTN.

-

Release 19 and beyond: Future releases, including 19, will continue to build on the NTN standard, with plans to enhance onboard satellite processing, expand to Ku-band frequencies for 5G NTN, and improve the integration between terrestrial and non-terrestrial networks.

3GPP looks forward to the continuous collaboration with ITU-R WP 4B for the finalization of Recommendation ITU-R M.[IMT-2020-SAT.SPECS], which will be the official standard for 5G satellite to ground communications.

………………………………………………………………………………………………………………………………………………………

References:

https://tc-resources.telecoms.com/free/w_defa8859/

https://www.3gpp.org/technologies/ntn-overview

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Momentum builds for wireless telco- satellite operator engagements

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

Backgrounder:

Non-terrestrial networks (NTN) are networks or segments of networks that use either Uncrewed Aircraft Systems (UAS) operating typically between 8 and 50km altitudes, including High Altitude Platforms (HAPs) or satellites in different constellations to carry a transmission equipment relay node or a base station:

- LEO (Low Earth Orbit): Circular orbit in altitudes of typ. 500-2.000km (lower delay and better link budget but larger number of satellites needed for coverage)

- MEO (Medium Earth Orbit): Circular orbit in altitudes of typ. 8.000-20.000km

- GEO (Geostationary Earth Orbit): Circular orbit 35.786 km above the Earth’s equator (Note: Due to gravitational forces a GEO satellite is still moving within a range of a few km around its nominal orbital position).

- HEO (Highly Elliptical Orbiting): Elliptical orbit around the earth.

Figure 1: Illustration of the classes of orbits of satellites [source: TR 22.822]

……………………………………………………………………………………………………………………………………

Future ITU-R NTN standard – Recommendation ITU-R M.[IMT-2020-SAT.SPECS]:

ITU-R SG04 Circular 134 invited proposal submissions for candidate radio interface technologies for the satellite component of the radio interface(s) for IMT-2020 (ITU-R M.2150 recommendation) and invitation to participate in their subsequent evaluation. Acting on behalf of 3GPP (which it is a member of), ATIS recently submitted three 3GPP documents to ITU-R WP’s 5B and 5D for consideration. The submitted material consists of 3GPP Releases 17 and 18 and it is provided in the following documents:

1. 3GPP 5G-NTN: RIT

o NR-NTN

2. 3GPP 5G-NTN: SRIT

o Component RIT: NR-NTN

o Component RIT: IoT-NTN

Legend:

NTN=Non Terrestrial Network

RIT: Radio Interface Technology

SRIT: Set of Radio Interface Technologies

…………………………………………………………………………………………………………………………………………………………..

3GPP looks forward to the continuous collaboration with ITU-R WP 4B for the finalization of Recommendation ITU-R M.[IMT-2020-SAT.SPECS], which will be the official standard for 5G satellite to ground communications.

…………………………………………………………………………………………………………………………………………………………..

-

Release 17:

- Foundation for 5G NTN: Established the foundation for integrating 5G with non-terrestrial networks (NTNs), enabling satellite connectivity for 5G services.

- Focus on Transparent Architecture: Rel-17 NTN was based on a transparent (bent-pipe) architecture, where the satellite acts as a radio repeater, limiting payload complexity and enabling early deployment.

- Initial Standardization: 3GPP pursued a range of solutions for 5G non-terrestrial networking (NTN) based on options for the type of non-terrestrial platform and the use cases supported.

- IoT-NTN: Introduced IoT-NTN, enabling satellite connectivity for Internet of Things devices.

- Frequency Bands: Focused on L-band and S-band in FR1 for NTN.

- Foundation for 5G NTN: Established the foundation for integrating 5G with non-terrestrial networks (NTNs), enabling satellite connectivity for 5G services.

-

Release 18 (5G-Advanced):

- NTN-IoT Enhancements: Further optimized NTN for IoT, including enhancements for Machine-Type Communication (MTC).

- New Service and Traffic Models: Introduced new service and traffic models to better support NTN applications.

- New Frequency Bands: Expanded frequency support to include Frequency Range 2 (FR2), spanning 17,300 MHz to 30,000 MHz.

- Focus on Ka-band: Prioritized the use of Ka-band for NR NTN deployment.

- Uplink Coverage and Mobility Enhancements: Improved uplink coverage and mobility/service continuity between NTN and terrestrial networks (NTN-TN) and between NTN networks (NTN-NTN).

- Network Verified UE Location: Enabled the network to verify UE location as per regulatory requirements.

- RedCap Enhancements: RedCap solutions were further optimized to reduce device cost and power consumption.

- Support for Store & Forward (S&F) operation based on regenerative payload: Release 18 and beyond will support Store & Forward operation based on regenerative payload, including the support of feeder link switchover.

- NTN-IoT Enhancements: Further optimized NTN for IoT, including enhancements for Machine-Type Communication (MTC).

References:

2 ATIS contributions to ITU-R WP 5D and 5B (only available to ITU TIES account members)

https://www.3gpp.org/technologies/ntn-overview

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Momentum builds for wireless telco- satellite operator engagements

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

China Telecom and China Mobile invest in LEO satellite companies

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

China Telecom and China Mobile invest in LEO satellite companies

Two of China’s state-owned telcos have taken stakes in new LEO satellite companies.

- China Telecom has set up a new fully owned subsidiary, Tiantong Satellite Technology Co., registered in Shenzhen with 1 billion Chinese yuan (US$138 million) paid-in capital. China Telecom, which is currently the only operator with a mobile satellite license, operates three Tiantong Geo orbit satellites, launched between 2016 and 2021, covering China, the western Pacific and its neighbors.

- In April China Mobile took a 20% stake in a new RMB4 billion ($551 million) state-owned company, China Shikong Xinxi Co., registered in Xiongan. China Satellite Network Group, the company behind Starnet, China’s biggest LEOsat project, will own 55%, and aerospace contractor Norinco, a 25% shareholder.

China Telecom will shutter its legacy satellite subsidiary, established in 2009, and transfer the assets into the new company.

The other new business, China Shikong, lists its scope as satellite communication, satellite navigation and remote sensing services.

The two investments come as China Starnet is readying to launch its first satellites in the second half of the year. It is aiming to build a constellation of 13,000, with the first 1,300 going into operation over the next five years, local media has reported.

In addition to Starnet, two other mass constellations are planned – the state-owned G60 and a private operator, Shanghai Hongqing. Neither has set a timetable. They will be playing catch up with western operators like Starlink and OneWeb, which are already operating thousands of commercial satellites.

Since foreign operators are forbidden from selling into China, it is not yet clear how China is going to structure its LEO satellite industry and what role precisely the new operators are going to play.

References:

Chinese telcos tip cash into satellite (lightreading.com)

China Mobile launches LEO satellites to test 5G and 6G – Developing Telecoms

Very low-earth orbit satellite market set to reach new heights | TelecomTV

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

LEO operator Sateliot joins GSMA; global roaming agreements to extend NB-IoT coverage

Momentum builds for wireless telco- satellite operator engagements

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?