Optical Transceivers

Dell’Oro: Optical Transport Systems market +15% year-over-year in 3Q2025 driven by Cloud Service Providers

Dell’Oro Group recently published its 3Q25 Optical Transport report, highlighting continued strength in the market as demand accelerates across customer segments and technology areas. Below is a summary of the key findings from this latest research.

The Optical Transport Systems market increased by 15% year-over-year (Y/Y) in 3Q2025, driven by robust demand across all major customer groups and technology segments. The most significant growth was seen in Cloud Service Providers (CSPs) which grew +58% Y/Y and the DWDM Long Haul segment which grew +24% Y/Y. Direct sales for data center interconnect (DCI) continued to be the driving application for optical transport equipment sales, growing 34% Y/Y. Non-DCI also performed well, rising 7% Y/Y, driven by increased spending by communication service providers (CSPs).

In the first nine months of 2025, two vendors—Ciena and Nokia—gained more than one percentage point of market share. Other vendors that gained some market share included 1Finity, Adtran, Cisco, and Smartoptics. Note that Nokia acquired Infinera -a fiber optic equipment company on February 28, 2025.

Image Source: Jimmy Yu, Dell’Oro Group

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, and unit shipments (by speed up to 1.6 Tbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), data center interconnect (metro and long haul), disaggregated WDM systems, and IPoDWDM ZR/ZR+ Optics. To purchase this report, please contact us at [email protected].

…………………………………………………………………………………………………………………………………………………………………………………………

Backgrounder:

- Optical Transceivers: Convert electrical signals into optical signals for transmission over fibers, and vice versa, at the endpoints of a link.

- Wavelength Division Multiplexers (WDM/DWDM): Devices that combine multiple optical signals (each on a different wavelength) into a single fiber for transmission, and separate them at the receiving end, maximizing fiber capacity.

- Optical Add/Drop Multiplexers (OADMs): Allow specific wavelengths (channels) to be added or removed from a fiber link at intermediate points in the network without interrupting the other channels.

- Optical Cross-Connects (OXCs) / Optical Switches: Used to route optical signals from one incoming fiber to a different outgoing fiber in the optical domain, often used in core networks.

- Regenerators / Optical Amplifiers (EDFAs): Used to amplify or regenerate optical signals over long distances to maintain signal strength and quality.

- OTN Terminal Equipment / Muxponders & Transponders: These devices package client signals (like Ethernet, Fibre Channel, or even SONET/SDH signals) into the standard OTN frame format (ITU G.709) for efficient transport.

- SONET/SDH: These are legacy, connection-oriented, circuit-switched technologies originally designed for carrying voice traffic in North America (SONET) and globally (SDH). They operate at the physical layer (Layer 1) and use Time Division Multiplexing (TDM).

- Usage: They are still widely deployed in existing network infrastructure, especially where high reliability and stringent latency requirements for legacy TDM services are necessary.

- OTN: OTN (ITU-T G.709 standard) is the modern successor, designed to combine the management and protection capabilities of SONET/SDH with the bandwidth efficiency of WDM.

- Usage: OTN has largely replaced SONET/SDH in new core and metro networks due to its ability to transparently carry multiple types of traffic (Ethernet, IP, Fibre Channel, and SONET/SDH frames) over a single, high-capacity infrastructure. It offers enhanced performance monitoring, Forward Error Correction (FEC) for longer reach, and greater scalability.

- Huawei has consistently maintained a leading position in the global optical networking market.

- Ciena is a major leader, particularly in North America (holding nearly 50% share in the U.S. market) and among cloud providers, benefiting from strong demand for its WaveLogic 6e and 400ZR/ZR+ solutions.

- Nokia has significantly strengthened its position, becoming the second-largest optical networking vendor globally (with approximately 20% market share) following its acquisition of Infinera in February 2025. The combined company saw substantial growth in revenue from cloud customers.

- Cisco saw a 31% increase in revenue from cloud operators in Q2 2025, a key driver of market growth.

- ZTE and FiberHome are also among the top six, often noted for their competitive solutions in global and emerging markets.

- Excluding sales into China, the leading vendors are Ciena, Huawei, Nokia, Infinera (now part of Nokia), and Fujitsu, accounting for around 80% of that specific market segment.

References:

Optical Transport Market Surges 15% in 3Q25, According to Dell’Oro Group

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

LightCounting: Q1 2024 Optical Network Equipment market split between telecoms (-) and hyperscalers (+)

Highlights of LightCounting’s December 2023 Quarterly Market Update on Optical Networking

Dell’Oro: Optical Transport Market Down 2% in 1st 9 Months of 2021

Dell’Oro: Optical Transport Equipment Market Stagnant in 1Q 2021; Jimmy Yu’s Take

Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020

AI infrastructure investments drive demand for Ciena’s products including 800G coherent optics

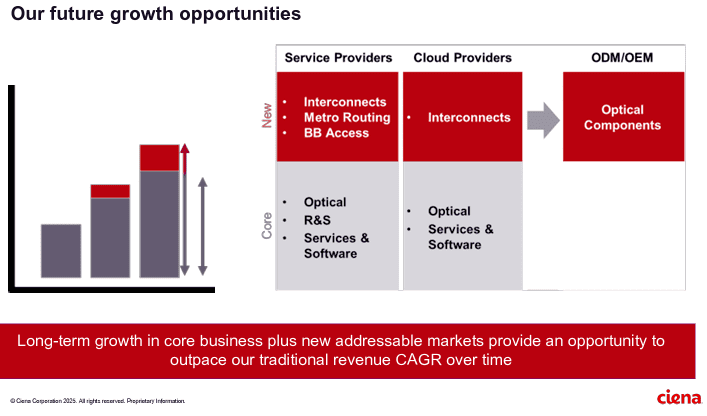

Artificial Intelligence (AI) infrastructure investments are starting to shift toward networks needed to support the technology, rather than focusing exclusively on computing and power, according to Ciena Chief Executive Gary Smith. The trends helped Ciena swing to a profit and post a 24% jump in sales in the recent quarter.

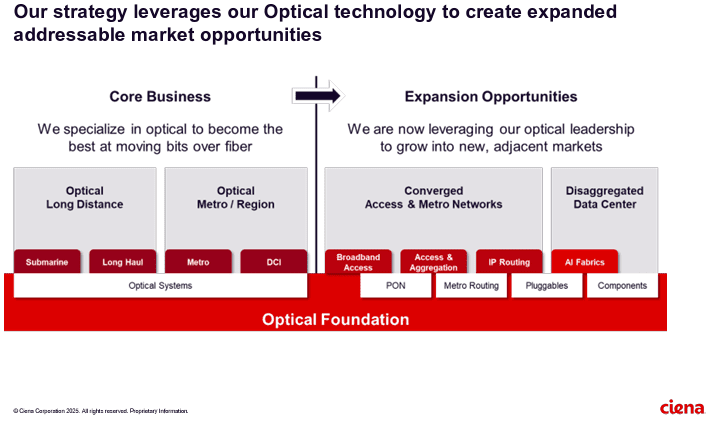

The company enables high-speed fiber optic connectivity for telecommunications and data centers, helping hyper-scalers such as Amazon and Microsoft support AI initiatives via data center interconnects and intra-data center networking. Currently, the company is ramping up production to meet surging demand fueled by cloud and AI investments.

“There’s no point in investing in these massive amounts of GPUs if we’re going to strand it because we didn’t invest in the network,” Smith said Thursday.

……………………………………………………………………………………………………………………………………………………..

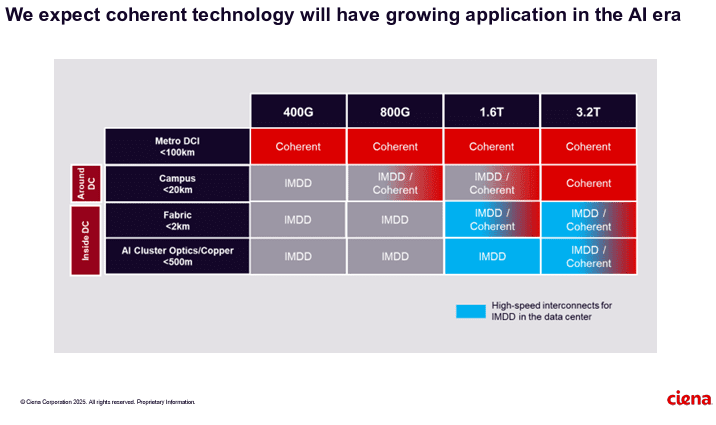

Ciena sees a bright future in 800G coherent optics that can accommodate AI traffic. Smith said a global cloud provider has selected Ciena’s coherent 800-gig pluggable modules and Reconfigurable Line System (RLS) photonics for investing in geographically distributed, regional GPU clusters. “With our coherent optical technology ideally suited for this type of connectivity, we expect to see more of these opportunities emerge as cloud providers evolve their data center network architectures to support their AI strategies,” he added.

It’s still early innings for 800G adoption, but demand is climbing due to AI and cloud connectivity. Vertical Systems Group expects to see “a measurable increase” in 800G installations this year. Dell’Oro optical networking analyst Jimmy Yu noted on LinkedIn Ciena’s data center interconnect win is the first he’s heard of that involves connecting GPU clusters across 100+ kilometer spans. “It was a hot topic of discussion for nearly 2 years. It is now going to start,” Yu said.

……………………………………………………………………………………………………………………………………………………

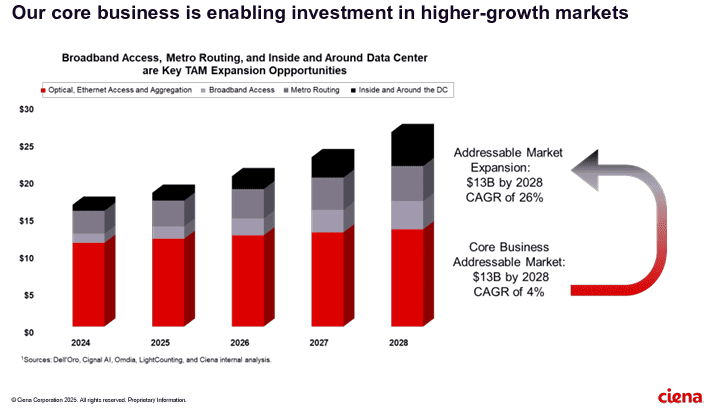

Ciena’s future growth opportunities include network service and cloud service providers as well as ODM/OEM sales of optical components.

References:

https://www.wsj.com/business/earnings/ciena-swings-to-profit-as-ai-investments-drive-demand-0195f30c

https://investor.ciena.com/static-files/d964ccac-74b3-43d9-a73e-ecf67fab6060

https://www.fierce-network.com/broadband/ciena-now-expects-tariff-costs-10m-quarter

Quintessent: Supporting “newer AI workloads” with lasers and DWDM

Integrated-photonics companies have increasingly seized on the opportunities in advanced AI. Many are building high-speed optical interconnects for data centers, with the electrical–optical conversion as close as possible to the number-crunching GPU or application-specific integrated circuit (ASIC).

However, Goleta, CA based startup Quintessent, is focusing on solving what it says is a major bottleneck hindering commercial deployment of such high-speed optical interconnects for AI – the light source or laser, which is currently the “weakest link” in system reliability and scalability, according to co-founder and CEO, Alan Liu.

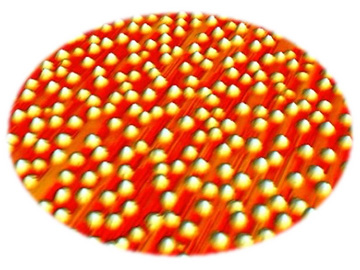

Quintessent’s answer lies in part in its laser technology, incorporating quantum dots (QDs)—the semiconductor nanocrystals celebrated in the 2023 Nobel Prize in Chemistry—and multiwavelength comb lasers. The firm believes that combination can boost bandwidth, improve efficiency and cut latency by enabling highly parallel dense wavelength-division multiplexed (DWDM) optical links for computing clusters and data centers. And in late March, the company announced that it had secured US$11.5 million in new seed funding to push its vision closer to commercialization.

Quintessent was co-founded in 2019 by Optica Fellow John Bowers of the University of California, Santa Barbara (UCSB), USA, who serves as the company’s board chairman, and Liu, formerly a student in Bowers’ lab. In a conversation with OPN in November 2023, Liu noted that his Ph.D. work in the lab, which spanned the years from 2011 to 2017, focused on what he called “one of the glaring holes in silicon photonics”: how to integrate the light source. His work specifically involved integration of QD lasers with silicon photonics, which subsequently became “one of the core technologies for Quintessent.”

Quintessent co-founders Alan Liu (left) and John Bowers. Image: Courtesy of A. Liu.

Even at that time, Liu had some stirrings in the direction of commercializing the technology. Ultimately, though, after earning his Ph.D. in 2017, he left Santa Barbara for a two-year stint at a consulting firm in the Washington, DC, area. There, he worked as a subject-matter expert in photonics on projects for the US Department of Defense’s advanced-research arm, DARPA, and the US Department of Energy’s counterpart, ARPA-E.

Still, the entrepreneurial itch never quite left Liu. Nor did his fascination with the promise of QD laser technology, as he saw subsequent work done in Bowers’ lab to further advance the performance of those lasers and demonstrate new functions with them, including multiwavelength comb sources.

In 2019, Liu says, he got a call from Bowers, who noted that he was seeing “a lot of interest” from industry in the technology the lab was developing, but that there was “no company to sell it.” When Bowers asked if he wanted to help start one up, Liu recalls, “it didn’t take me long to sign on and say yes.” In the course of the next few years, they built Quintessent’s core team, drawing on numerous other contacts both within and outside of Bowers’ UCSB lab, and pulled in a mix of government R&D and venture funding, including the $11.5 million seed round announced in March 2024. The business case for Quintessent, Liu says, rests largely on “some of the newer AI workloads that were coming into the fray” beginning in the late 2010s, and their immense appetite for computing resources and power.

“If you’re going to be optimizing for power efficiency and bandwidth and latency, the required architecture is one that’s wide and parallel,” he explains. And for optics, at some point, trying to achieve that level of parallelism by adding more and more spatial or fiber channels becomes unwieldy.

The alternative solution, Liu says, is a highly parallel DWDM architecture—using not lots of fibers but “lots of lambdas.” For the crushing workloads of advanced AI, DWDM is optimal, as it “allows you to both simultaneously optimize bandwidth and minimize power and latency,” without relying on digital signal processing or a potential rat’s nest of individual fiber interconnects to boost overall bandwidth.

One key for achieving that vision was “enabling a new kind of laser, and using that laser to enable new communication and transceiver architectures,” according to Liu. “That was a common gap I saw across the industry.” Particularly in the context of AI, Liu observes, a big argument for better lasers has to do with reliability.

Particularly in the context of AI, Liu observes, a big argument for better lasers—and especially for Quintessent’s concept of simplifying wavelength scaling using multiwavelength comb sources fabricated from InAs/GaAs QD material—has to do with reliability. “Optical solutions for AI are going to have to be at least an order of magnitude more reliable than what we see today in existing transceivers,” he maintains. “If you imagine a scenario where there’s 10 times more optics deployed, and your failure rates stay the same, then you’ve got 10 times more failures you’re asking the customer to deal with. That gets a little dicey.”

An atomic force microscopy (AFM) image of InAs/GaAs quantum dots. Image: Courtesy of A. Liu

Getting to better overall reliability will require much more reliable lasers, Liu believes, as lasers are “kind of the weakest link at the moment.” And he and the Quintessent team think that QD lasers offer a way forward, as they are “intrinsically more reliable than quantum well materials today.”

Tobias Egle, a materials scientist who works with M Ventures, one of the partners in the most recent Quintessent funding round, explained the difference further in a separate call with OPN. “These QD lasers are not as affected by material defects, dislocations and so on,” Egle says. “Simply put, a single dislocation through the facet or active region of a traditional laser can lead to complete failure. In contrast, when you have billions of QDs which are independent of one another, the presence of a single dislocation has a negligible impact on your overall performance.”

Quintessent experienced a milestone a year ago, when the company and Tower Semiconductor—the Israel-based global foundry firm with which Quintessent had partnered since 2021—announced that they had achieved what they called the world’s first heterogenous integration of GaAs quantum dot lasers in a commercial foundry silicon photonics process. The pair also unveiled a foundry silicon platform, PH18DB, targeted for the telecom and datacom optical transceiver market, and an accompanying process development kit (PDK).

Meanwhile, on the funding side, Quintessent announced an oversubscribed US$11.5 million seed round in March 2024, with an investment group led by Osage University Partners (OUP) and including, in addition to M Ventures, participation by previous Quintessent funders Sierra Ventures, Foothill Ventures and Entrada Ventures. In a press release accompanying the recent funding announcement, Liu said the new money would let the company “grow our team and accelerate the development of highly scalable and highly reliable optical interconnects that transcend the scaling limitations of incumbent solutions,” based on the firm’s core technology of QD-enabled multiwavelength comb lasers.

Operationally, Liu told OPN that—having “checked off all of the fundamental technology questions” regarding the laser technology’s feasibility—Quintessent is now focused on optimizing the laser design, which he calls “a key Lego block,” and of other pieces of the overall architecture to validate system-level functionality. Then, an important next step will be getting chips into customers’ hands for ground-truthing and feedback, and using that feedback to “drive forward the commercialization roadmap.”

“So samples, then low-volume pilots, then high-volume manufacturing—simple, right?” he laughs. Liu seems exhilarated by the challenge. “I’m one of those people that liked to play video games in the hard, hard mode,” he says. “If it’s too easy, you don’t get much enjoyment out of it.”

References:

https://www.optica-opn.org/Home/Industry/2024/April/Quintessent_Targets_Lasers_for_AI

Co-Packaged Optics to play an important role in data center switches

Ranovus Monolithic 100G Optical I/O Cores for Next-Generation Data Centers

Dell’Oro: DWDM equipment market to exceed $17 billion by 2026

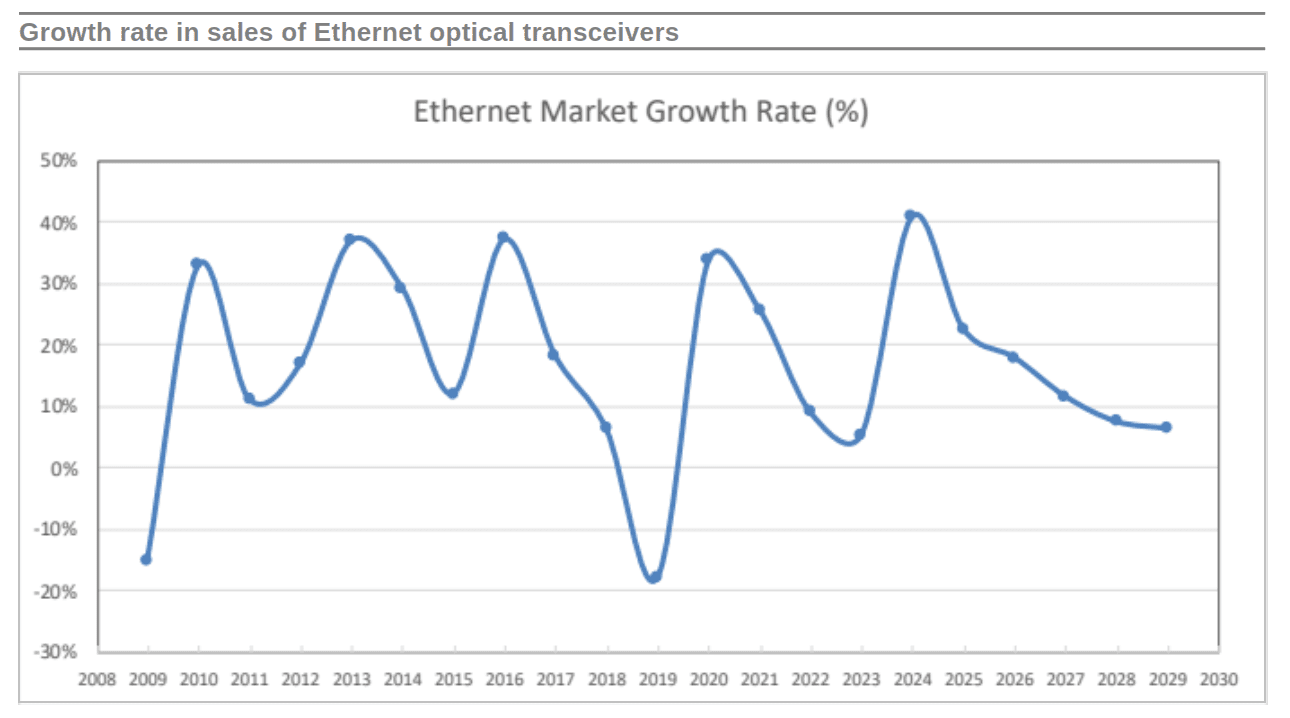

LightCounting: Optical Ethernet Transceiver sales will increase by 40% in 2024

LightCounting expected sales of Ethernet optical transceivers to decline by 5-10% in 2023, but surging demand from Google and Nvidia kept the market growing, albeit at single digits.

Sales of Optical Ethernet transceivers declined in 2019 as a result of lower spending by the Cloud companies, which now dominate demand for those parts. Cloud companies reduced their spending again in the end of 2022 and the market outlook was dire in early 2023. Yet, one year later the market has bounced back.

The market research firm has sharply increased their forecast for sales of 400G/800G transceivers and now expect: 40% growth in 2024, more than 20% in 2025 and double digit growth in 2026-2027, as illustrated in the figure below.

Source: LightCounting

………………………………………………………………………………………………………………….

The growth will not continue indefinitely. Any slowdown in purchases of optics by Nvidia or Cloud companies can reverse the market dynamics. Timing of such a decline is unpredictable. All we know, it will happen at some point. Our model suggests a soft landing with single digit growth rates in 2028-2029, but it is more likely that we will see another sharp drop followed by a recovery, conforming to the rocky history of the past 15 years.

Fears of an economic recession have subsided, but they continue to weigh on spending of telecom operators, which see no revenue growth. Yet, we will not know for sure if a recession is coming until it actually starts and it will take another half a year after that for the economists to formally declare it. By that time, we will be busy discussing the timing of a recovery.

What remains certain is that optics are critical for data centers and for the rest of the global networking infrastructure. Recent progress in generative AI makes the future even more exciting. Keep this in mind, while navigating the markets volatility as shown in the above graph.

……………………………………………………………………………………………………………….

About LightCounting:

The market research firm was established in 2004 with an objective of providing in-depth coverage of market and technologies for high speed optoelectronic interfaces employed in communications. By now, the company employs a team of industry experts and offers comprehensive coverage of optical communications supply chain.

……………………………………………………………………………………………………………….

References:

https://www.lightcounting.com/report/march-2024-ethernet-optics-287

https://www.lightcounting.com/report/march-2024-quarterly-market-update-288

Highlights of LightCounting’s December 2023 Quarterly Market Update on Optical Networking

LightCounting: Sales of Optical Transceivers will decline in 2023

LightCounting: Optical components market to hit $20 billion by 2027+ Ethernet Switch ASIC Market Booms

Highlights of LightCounting’s December 2023 Quarterly Market Update on Optical Networking

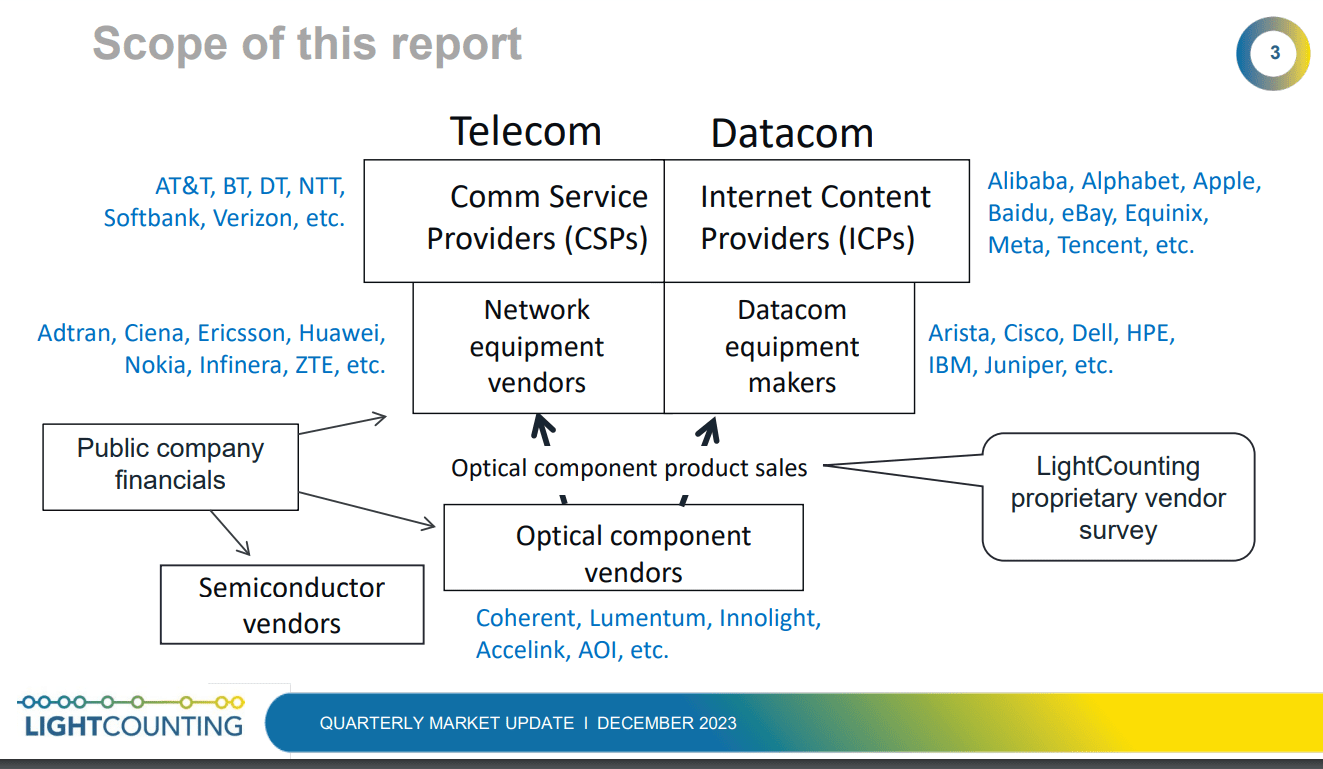

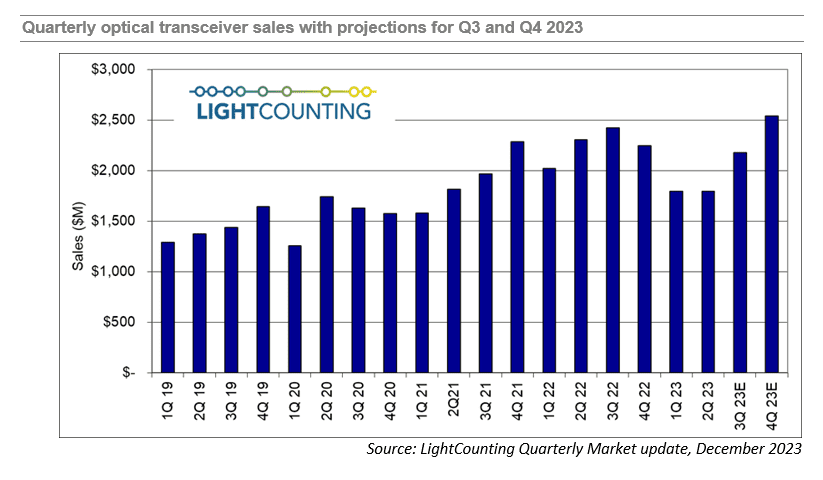

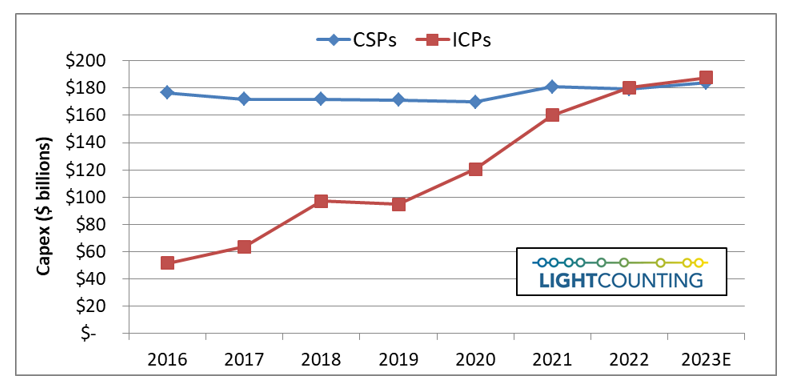

LightCounting’s Quarterly Market Update report [1.] for Q3 2023 revealed that the optical communications industry financial results were disappointing.

Every financial market indicator that the market research firm tracks – ICP (Integrated Communications Provider) and CSP (Communications Service Provider) capex, datacom and networking equipment, and semiconductor (x-Nvidia) and optical components sales – all had negative growth compared to Q3 2022.

Note 1. LightCounting’s Quarter Market Update reports are designed to provide an easy-to-digest snapshot of optical transceiver growth trends, backed up by detailed quarter-by-quarter sales data collected via LightCounting’s proprietary vendor survey. Performance metrics and commentary for top-tier telecom and internet service providers, network and datacom equipment makers, and optical component and semiconductor vendors are also included to provide an understanding of what drives sales trends at the transceiver level.

- Alphabet and Microsoft had record capital expenditures.

- Arista, Broadcom, Calix, Innolight, and Nvidia all reported record revenues.

LightCounting is projecting, based on its current analysis, that sales increased in Q3 and will increase further in Q4, to a new record high, as shown in the figure below. This data includes estimates for 400G and 800G transceivers manufactured by Nvidia internally.

The expectation of growth in Q4 carries over to 2024 as well and is consistent with the guidance given by several companies ranging from Alphabet and Amazon to Coherent and Lumentum. The big caveat is that growth in 2024 will be tightly focused on AI-related infrastructure, and growth in demand for those products is expected to far outstrip demand in other segments like traditional telco and enterprise networks. Most of the growth in the optical components and modules market will come from sales of 800G transceivers.

References:

https://www.lightcounting.com/report/december-2023-quarterly-market-update-199

LightCounting: Will Network Transformation resolve telecom’s paradox?

Industry Analysts: Important Optical Networking Trends for 2023

MTN Group and NEC XON deploy Africa’s first 400G optical transponder using TIP’s Phoenix

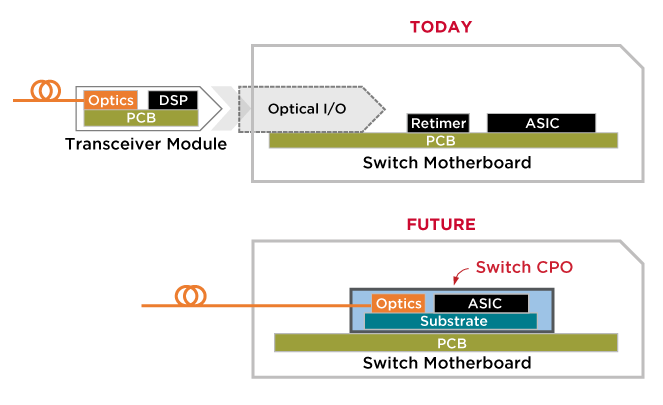

Co-Packaged Optics to play an important role in data center switches

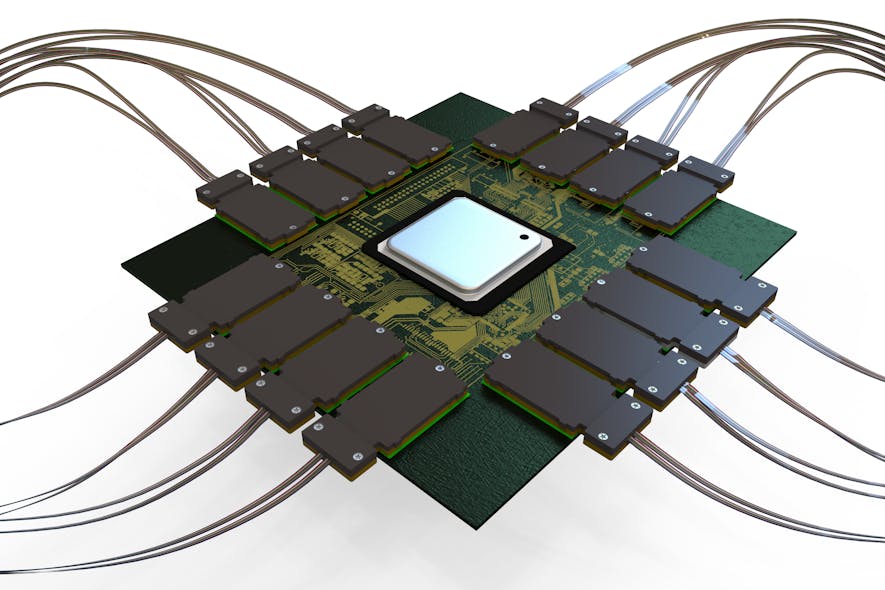

The commercialization of co-packaged optics (CPO) has been long anticipated but is becoming increasingly desirable as data needs accelerate. Co-Packaged Optics are an advanced heterogeneous integration of optics and silicon on a single packaged substrate aimed at addressing next generation bandwidth and power challenges.

As the bandwidth of data center switches increases, a disproportionate amount of power is becoming dedicated to the switch – optics interface. Reducing the physical separation between these two components by co-packaging enables system power savings which is essential to continued bandwidth scaling.

CPO brings together a wide range of expertise in fiber optics, digital signal processing (DSP), switch ASICs, and state-of-the-art packaging and test to provide disruptive system value for the data center and cloud infrastructure.

The companies and institutions working on CPO have made great strides in developing suitable electronic components. But hundreds of meters of fiber will be packed into the switch box for the first time, and faceplate connections will have unprecedented densities. As a result, the design and development of optical system solutions will also be critical elements in the success of CPO. Optical components with performance tailored to the CPO application and effective solutions for managing the fiber in the switch box are vital in optimizing the complete optical system. Three aspects of CPO deployment, in particular, hinge on the properties of the fiber and the optical interfaces: optical power loss, the trade-off between minimizing bend loss and controlling for MPI and maintaining the polarization state if external lasers are used.

Image Courtesy of Broadcom

……………………………………………………………………………………………………………………………………….

Data centers face substantial challenges as they scale, particularly in reducing power dissipation and cost per bit. CPO will play a significant role in helping to meet those challenges. In today’s data center switches, external fiber optic connections that carry data terminate on pluggable transceivers on the housing faceplate. The optical data stream is coupled to the electrical signals at that interface.

With a CPO realization of a 51.2 Tbps switch, the substrate connects a central regulator ASIC to 16 optoelectronic (O/E) tiles on the substrate perimeter. These tiles are connected to optical fiber signal cables that run to the switch box faceplate and receive power from external lasers that they modulate to produce the outgoing optical signal stream.

They communicate between the transceiver and the switch application-specific integrated circuit (ASIC) via copper traces on printed circuit boards. Under the CPO paradigm, as the optoelectronic conversion is pushed back from the faceplate to the switch substrate, long electrical traces are replaced with virtually loss-free optical fiber.

With CPO, the fiber path continues past a connector at the faceplate and into the switch box, ending at photonic integrated circuits (PICs) on optical tiles attached to the switch substrate. This shift presents the novel challenge of routing and connecting hundreds of optical fibers within a compact and crowded space, creating a need to minimize the footprint of the optics while still achieving performance and reliability targets.

CPO will soon be a reality that relies on a system of complex, interconnected components working well together. For optimum overall performance, these components must be designed with the specific requirements of CPO in mind, which for the optical subsystem include efficient and unobtrusive deployment within a crowded switch box, low power losses, absence of MPI impairments, and good reliability. Some CPO realizations also need optical polarization state control.

The familiar fiber and connectivity products, while having impressive attributes, are not optimum for the CPO application, and there is great scope for enhancing the performance of the optics by moving beyond default solutions to those specifically designed for the role.

References:

https://www.broadcom.com/info/optics/cpo

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Rochester, N.Y., based Precision Optical Technologies (OT) has struck a multi-year “strategic partnership” with Charter Communications to upgrade the latter’s optical network. In alignment with Charter’s Distributed Access Architecture (DAA) network expansion and operational enhancement initiatives, this collaboration will see the deployment of nearly all of Precision OT’s active and passive portfolio of solutions; to include 10G DWDM tunable optics, 100G and 400G optics, Bluetooth® DWDM tuning modules, passive connectivity solutions and more. Precision OT didn’t announce the financial terms of the agreement.

Charter plans to upgrade about 85% of its HFC plant using a distributed architecture paired with a virtual cable modem termination system (vCMTS) and “high-split’ upgrades that dedicate more spectrum to the DOCSIS upstream. About 50% of Charter’s HFC plant will be upgraded to 1.2GHz of capacity and 35% will upgrade to 1.8GHz and a full deployment of DOCSIS 4.0. The remaining 15% of Charter’s footprint will be moved to 1.2GHz with a high-split but forgo DAA and a vCMTS.

Greg Mott, SVP Field Operations Engineering at Charter Communications said of the partnership, saying: “The team at Precision OT has a clear understanding of Charter’s broadband network evolution — cost, scale, and speed — and their mix of solutions will help us deliver on our commitments across our 41-state service area.”

Charter has also tapped Harmonic for the vCMTS component and selected Vecima Networks’ DAA platform, including remote PHY nodes. ATX Networks, which recently introduced a 1.8GHz platform that can be used to upgrade legacy Cisco nodes, is also expected to be in the mix at Charter. Teleste, a Finnish supplier that is boosting its investment in the North American cable market as operators push ahead with DAA and D4.0 upgrades, also has projects underway with Charter, according to industry sources.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

With a global footprint, Precision OT currently serves a diverse range of customers across various industries worldwide. Among its clientele are leading broadband service providers in North America, Europe, Latin America, and beyond. This partnership further solidifies Precision OT’s reputation as a trusted partner and solutions provider in the telecommunications and optical technology sectors.

“We are pleased that Charter Communications has chosen Precision OT as a trusted technology partner to deploy cutting-edge optical networking solutions,” said Keith Habberfield, SVP of Sales & Marketing at Precision OT. “Optics and their components are the integration point that enables networks to communicate. We provide a suite of solutions that work in all of Charter’s identified use-cases; this drives measurable operational simplicity and speeds deployments for their project.”

About Charter Communications:

Charter Communications, Inc. (NASDAQ:CHTR) is a leading broadband connectivity company and cable operator serving more than 32 million customers in 41 states through its Spectrum brand. Over an advanced communications network, the Company offers a full range of state-of-the-art residential and business services including Spectrum Internet®, TV, Mobile and Voice.

For small and medium-sized companies, Spectrum Business® delivers the same suite of broadband products and services coupled with special features and applications to enhance productivity, while for larger businesses and government entities, Spectrum Enterprise® provides highly customized, fiber-based solutions. Spectrum Reach® delivers tailored advertising and production for the modern media landscape. The Company also distributes award-winning news coverage and sports programming to its customers through Spectrum Networks. More information about Charter can be found at corporate.charter.com.

About Precision OT:

Precision OT is a systems integration company focused on end-to-end optical networking solutions, network design services and cutting-edge product development advancements. Backed by our extensive experience and robust R&D efforts, we play an integral role in enabling next-generation optical networks worldwide. For more information, visit www.precisionot.com.

References:

https://www.fiercetelecom.com/broadband/charter-plots-3-year-upgrade-deploy-docsis-40-2025

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

European Internet Exchange operators to use new 100G LR-1 (single laser/PAM4) transceivers

With the increasing demand for higher bandwidth and better performance, the world’s leading Internet Exchange (IX) operators DE-CIX, LINX, AMS-IX & BCIX, will be introducing a new generation of optical transceivers, the 100G LR-1 (referred to as LR), to their platforms, starting in Frankfurt, London, Amsterdam, and Berlin.

While the existing 100G LR-4 uses four lasers, each carrying a signal of 25 Gbps, the new 100G LR technology uses only a single laser and uses pulse amplitude modulation (PAM4) to transmit data at 100 Gbps. The reduction in transceiver design complexity of the increasingly deployed 100G LR technology will result in power savings as well as better transceiver pricing. These advances not only provide advantages in the short to mid-term but will also unlock new transceiver form factors that open up the potential for even greater performance and efficiency improvements in the future. The 100G LR technology is already available with a wide range of compatible routers from all major vendors and is compatible with current fiber technology. In order to satisfy today’s customer demand for 100G LR, DE-CIX, LINX, AMS-IX, and BCIX will provide support in the upcoming months.

“With the new 100G LR technology, we are paving the way for the next generation of transceiver technology that will dominate the market for years to come. The future design of our DE-CIX interconnection platform will not only bring better programmability and higher scalability, commercial flexibility, and wider geographical reach, it will also make interconnection even easier for our customers through simplified technical processes,” says Dr. Thomas King, Chief Technology Officer at DE-CIX.

Richard Petrie, CTO at LINX stated, “For LINX, we will be enabling our London locations first after approving the solution in our lab. We will roll out as demand grows and as we see that LINX members need support in the shift to the improved optics. This will realise both benefits in cost and power for us and the LINX member base.”

Ruben van den Brink, CTO at AMS-IX says, “Offering 100G LR makes perfect sense, both for AMS-IX and for its customers. The lab tests proved that the new optics can be used for all the switches that are currently deployed in our Amsterdam PoPs. I appreciate the fact that we were able to collaborate with our partners in pushing this new standard. When Internet Exchanges join efforts, customers benefit, so I hope many more exchanges will start offering 100G LR soon.”

“After testing 100G LR and other 100G single-lambda standards in our lab, we have already introduced this new technology into our production network. By doing so we have built a very cost-efficient interconnection between data centers on the same campus. Offering the same benefits to our peers is just the next logical step,” says André Grüneberg, CTO at BCIX.

……………………………………………………………………………………………………………………………………………………………

About DE-CIX:

DE-CIX (German Commercial Internet Exchange) is the world’s leading operator of Internet Exchanges (IXs). DE-CIX offers its interconnection services in more than 50 metro-markets in Europe, Africa, North America, the Middle East, and Asia. Accessible from data centers in over 600 cities world-wide, DE-CIX interconnects thousands of network operators (carriers), Internet service providers (ISPs), content providers and enterprise networks from more than 100 countries, and offers peering, cloud, and interconnection services. DE-CIX in Frankfurt, Germany, is one of the largest Internet Exchanges in the world, with a data volume of almost 34 Exabytes per year (as of 2022) and close to 1100 connected networks. More than 200 colleagues from over 30 different nations form the foundation of the DE-CIX success story in Germany and around the world. Since the beginning of the commercial Internet, DE-CIX has had a decisive influence – in a range of leading global bodies, such as the Internet Engineering Task Force (IETF) – on co-defining guiding principles for the Internet of the present and the future. As the operator of critical IT infrastructure, DE-CIX bears a great responsibility for the seamless, fast, and secure data exchange between people, enterprises, and organizations at its locations around the globe. Further information at www.de-cix.net.

About the London Internet Exchange (LINX):

With over 900 ASNs connecting from over 80 different countries worldwide, members of The London Internet Exchange (LINX) have access to direct routes from a large number of diverse international peering partners. LINX is much more than just the UK’s leading peering community. LINX can also connect you to cloud services, help you create closed user groups and private VLANs, and gain access to colocated infrastructure. With direct routes between your infrastructure and your most important customers and services, you can manage all your connectivity instances with confidence. Discover the flexibility and transparency of a member-owned organisation, and the reliability of trusting your traffic to critical national infrastructure. For additional information about LINX, please visit linx.net

About AMS-IX:

AMS-IX (Amsterdam Internet Exchange) is a neutral member-based association that operates multiple interconnection platforms around the world. Our leading platform in Amsterdam has been playing a crucial role at the core of the internet for almost 30 years and is one of the largest hubs for internet traffic in the world with over 11 Terabits per second (Tbps) of peak traffic. Connecting to AMS-IX ensures customers such as internet service providers, telecom companies and cloud providers that their global IP traffic is routed in an efficient, fast, secure, stable and cost-effective way. This allows them to offer low latency and engaging online experiences for end-users. AMS-IX interconnects more than 1000 IP-networks in the world. AMS-IX also manages the world’s first mobile peering points: the Global Roaming Exchange (GRX), the Mobile Data Exchange (MDX) and the Internetwork Packet Exchange (I-IPX) interconnection points.

About BCIX:

BCIX is the leading Internet Exchange Point in Berlin, Germany. We operate a distributed infrastructure between 11 data centers across the city of Berlin, providing peering and interconnection services to our partners. We serve nearly 150 connected networks with a peak bandwidth of 900 Gigabits per second (Gbps). As a community we form a nexus for Berlin’s rapidly growing and highly creative Internet scene, organized in a neutral, not-for-profit association. Our friends and associates from businesses and academic institutions support us in serving the internet at large. We are pleased to meet each other regularly at our roundtables.

References:

https://www.de-cix.net/en/about-de-cix/media/press-releases/next-generation-ix

LightCounting: Sales of Optical Transceivers will decline in 2023

|

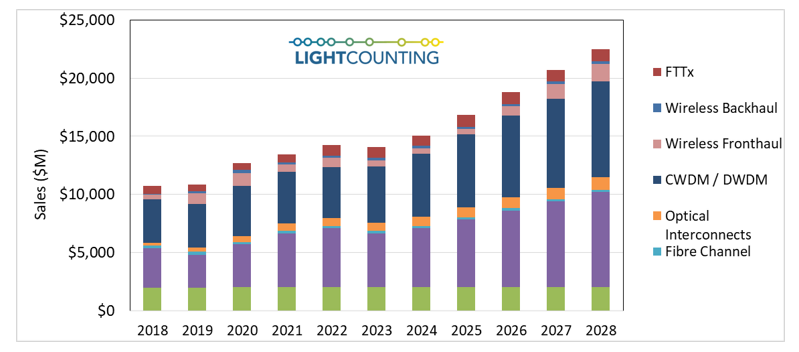

The optical communications industry entered 2020 with very strong momentum. Demand for DWDM, Ethernet, and wireless fronthaul connectivity surged at the end of 2019, and major shifts to work-at-home and school-at-home in 2020 and 2021 due to the COVID-19 pandemic created even stronger demand for faster, more ubiquitous, higher reliability networks. While supply chain disruptions continued, the industry was able to largely overcome them, and the market for optical components and modules saw strong growth in 2020-2022, as shown the figure in below.

We believe the optical transceiver market will be down slightly (1% or so) in 2023 due to declines in the sales of Ethernet and wireless fronthaul transceivers of 10% and 30%, respectively, offsetting growth in all other market segments in 2023.

|

|

|

Amazon and other cloud companies plan to moderate their investments in 2023 and beyond, even if there is no economic recession. The Cloud companies benefited from the COVID-19 pandemic, but they were forced to reassess their plans at the end of 2022, as growth slowed. Their capex almost doubled between 2019 and 2022 but future investments will be more conservative. We expect the Top 15 ICP’s capex to be up only 4% in 2023, essentially flat, after several years of double-digit growth. Investments in AI infrastructure will remain a priority.

Telecom service providers plan to reduce their capex in 2023 also but they will continue to upgrade access networks. Connecting business and consumers to the Cloud is a priority now. Their customers are willing to pay more for secure and low-latency broadband services and it is a great opportunity for revenue growth. Telecom service providers plan to digitize their operations and offer Network-as-a-Service (NaaS) to an increasing number of end users, not just a few of their largest customers.

|

|

|

Despite a slower than expected growth in revenues of the leading Cloud companies, AI infrastructure remains a priority. This new focus will sustain the market for high bandwidth and low latency Ethernet and InfiniBand switches in the next 5 years. We also expect the deployments of optical circuit switches in AI clusters to expand beyond Google’s datacenters.

Other notable forecast changes include increased sales of 50G and 100G fronthaul transceivers in the 2026-2028 timeframe, as we believe they will be needed for early 6G deployments, and increased sales of PON optics as deployments of FTTx are increasing due to government stimulus in the US and elsewhere.

LightCounting’s Market Forecast Report presents our forecast for optical transceivers used in the telecom and datacom sectors, and includes chapters reviewing the health and spending outlook for both CSPs and ICPs, as well as explanations of forecast drivers and assumptions for each of the six product segments covered: Ethernet, WDM, Fronthaul, Backhaul, FTTX, and Optical Interconnects. The accompanying Excel database includes unit and sales forecasts for over 200 product categories.

More information on the report is available at ttps://www.lightcounting.com

|

Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Adtran®, Inc., a leading provider of open and disaggregated networking solutions, today announced that its latest coherent innovation is being showcased at OFC 2023, as part of OFCnet. The demo reveals how the Adtran FSP 3000 open line system (OLS) can bring new levels of flexibility to optical networks by enabling optimized, tailored spectrum services. In collaboration with Acacia, Cisco, Coherent Corp., Corning, EXFO, Nokia and VIAVI Solutions, Adtran will showcase 100ZR, 200Gbit/s, 400Gbit/s OpenZR+ and 800Gbit/s connectivity. The FSP 3000 DCI OLS is also playing a key role in the OIF 400ZR demo at OFC.

“Our demo shows how the spectrum-as-a-service concept has the potential to revolutionize the way operators utilize their fiber resources. It highlights how it’s possible to slice up the network even in a metro environment. With fully flexible spectrum allocation, operators can provide a wide variety of differentiated services and ensure they leverage the full capacity of their infrastructure. Not only will this help tackle ever-increasing data demand, but it also offers a new route to revenue growth. Our compact FSP 3000 OLS is the key to realizing the full benefits of this open and flexible approach. It removes the limits of fixed channel grids so that untapped spectrum can be put to work,” said Jörg-Peter Elbers, head of advanced technology at Adtran.

…………………………………………………………………………………………………………………………..

Adtran also demonstrated its QSFP28 pluggable Coherent 100ZR [1.], which provides 100G coherent edge network connectivity. There was a live display of a 100ZR QSFP28 pluggable operating over a DWDM metro ring. The objective was to show how fiber based network operators can benefit from efficient and cost-effective deployment of coherent 100Gbit/s services with minimal power consumption and low footprint increase. The trial uses the multi-vendor OFCnet network setup with equipment at the Adtran booth as well as the Coherent and OFCnet booths.

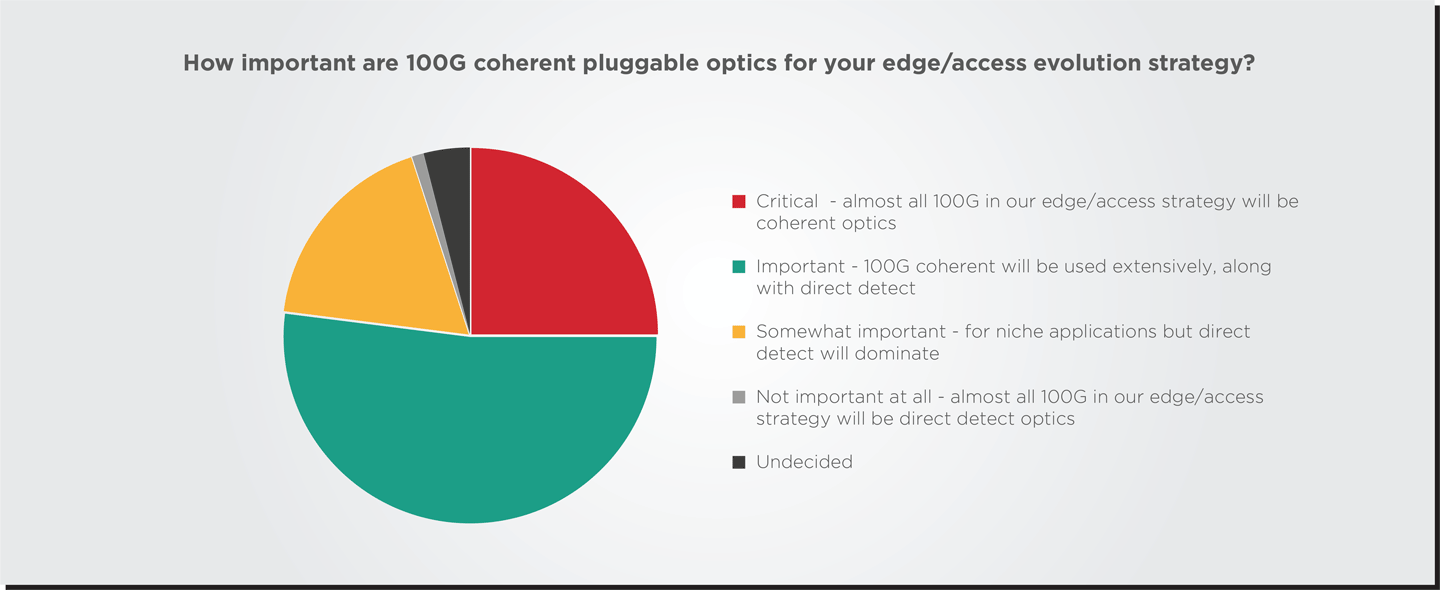

Note 1. In June 2022, transceiver developer II‐VI Incorporated (now Coherent Corp.) and optical networking solutions provider ADVA (now owned by Adtran) announced the launch of the industry’s first 100ZR pluggable coherent transceiver. A recently released Heavy Reading survey (see pie chart below) revealed that over 75% of network operators surveyed believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, this interest had not really materialized into a 100ZR market because no affordable or power-efficient products were available. The most the industry could offer was 400ZR pluggables that were “powered-down” for 100G capacity.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Adtran’s Coherent 100ZR is purpose-built for the optical network edge. With its QSFP28 form factor and power specification, it enables easy and cost-effective upgrades to 100Gb/s data rates by plugging directly into existing head-ends, switches and routers. Co-developed by Adtran and Coherent, the DSP offers a range of deployment options, from local exchanges and central offices to harsh outdoor conditions such as street cabinets. These benefits are achieved thanks to the transceiver‘s features, which include a cost-, space- and power-optimized DSP specifically engineered for 100ZR. Adtran is also developing low-power silicon photonics integrated circuits that will enable faster and more energy-efficient solutions across a wide range of applications.

Quotes:

Saeid Aramideh, VP of Business Development at Optical Engines, Adtran said: “This demo is a significant milestone for network operators looking to expand their business capabilities. It highlights how our Coherent 100ZR can be easily and affordably integrated into a metro aggregation network, eliminating the need for costly infrastructure changes. This showcase reveals a valuable solution for operators seeking to support higher data rates at the network edge and highlights the potential for widespread adoption of 100Gbit/s coherent technology. We can’t wait to bring these benefits to our customers.”

Ross Saunders, GM of Optical Engines, Adtran said: “The technology we’re showcasing here will be a game-changer for service providers. It offers the ability to easily deploy coherent 100Gbit/s connectivity with compact footprint and lowest power consumption. By bringing coherent technology to the optical edge, we’re providing operators with a cost-efficient solution to upgrade edge aggregation networks to 100Gbit/s. Our Coherent 100ZR will also boost sustainability by lowering our customers’ carbon footprint. What’s more, it offers a way to deliver an improved experience for end-users by supporting higher data rates and improved service reliability.”

…………………………………………………………………………………………………………………………………………….

According to a recent Heavy Reading survey, 75% of operators believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, market adoption has yet to materialize since affordable and power-efficient 100ZR-based products are currently not available due to stringent size and power consumption requirements that cannot be fulfilled by today’s tunable laser solutions.

Distribution of responses to a Heavy Reading survey question: How important are 100G coherent pluggable optics for your edge/access evolution strategy? The sample was composed of 87 people who work for network operators worldwide and are involved in network planning or purchasing network equipment.

Source: Heavy Reading

References:

https://www.fibre-systems.com/news/ofc-2023-adtran-demonstrates-coherent-100zr-qsfp28