Part-2: Unleashing Network Potentials: Current State and Future Possibilities with AI/ML

By Vinay Tripathi with Ajay Lotan Thakur

Introduction

In the dynamic realm of networking, AI/ML has emerged as a transformative force to reshape the networking world by making it more secure, reliable, efficient and optimized. In this blog we will dive into characteristics, possibilities, use cases and challenges of AI/ML in the networking.

About AI and ML

Definitions of AL/ML

AI and ML are often used interchangeably, but there are some key differences between the two.

- AI is the ability of machines to perform tasks that would normally require human intelligence, such as understanding natural language, recognizing objects, and making decisions.

- ML is a subfield of AI that allows machines to learn from data and improve their performance over time.

- DL = Uses neural networks for complex structured models and greater insights.

Types of AI/ML

AI/ML encompass a wide range of techniques and algorithms that can be used to solve a variety of problems. In the context of networks, AI/ML technologies can be broadly categorized into the following types:

Key Points:

- AI/ML taxonomy is continuously evolving due to industry growth and various methodologies and algorithms.

- The choice of AI/ML algorithm significantly influences business outcomes, including training time, prediction accuracy, and resource usage.

- The selection of algorithms depends on the type and volume of available data for a specific use case.

Popular ML Types:

- Supervised/Unsupervised: When available data is simple or significant pre-processing has resulted in high data quality:

- Neural Networks and Deep Learning: When you have substantial amounts of unstructured/structured data or unclear features these may offer superior accuracy over Classical ML methods

- AutoML: When you need to streamline machine learning model development, especially with limited expertise, time, or resources.

- NLP: When tasks involve text or language data and require automation, understanding, or generation of natural language content.

- Reinforcement learning: Suitable when you need to train agents to make sequential decisions in dynamic environments, optimizing for long-term rewards, and when there is a need for autonomous decision-making, such as in robotics, game playing, or autonomous systems.

Figure-1: Hierarchy of AI, ML and DL

Applications of AI/ML

AI and ML technologies provide a diverse array of applications in networks, encompassing security, engineering, capacity planning, and operations. These technologies have the capability to augment network security, optimize network design and performance, forecast traffic demand, and automate network tasks. This leads to enhanced efficiency, reliability, and overall network performance. Here are some specific examples:

Network Security

- Intrusion Detection System (IDS): AI-powered IDS can detect and respond to cyberattacks in real-time, providing a more robust defense against threats.

- Thread Detection and Prevention (TDP): AI can analyze network traffic to identify and prevent threats before they can cause damage.

- Anomaly Detection: AI can detect deviations from normal network behavior, indicating potential security incidents.

Network Engineering

- Quality of Service (QoS): AI can optimize network resources to ensure consistent and reliable performance for critical applications.

- Routing and Traffic Management: AI can optimize routing decisions and manage traffic flow to avoid congestion and improve network performance.

- Optimized Traffic Flow: AI can analyze traffic patterns and make real-time adjustments to optimize traffic flow, reducing latency and improving overall network performance.

- Load Balancing: AI can distribute traffic across multiple servers or network links to balance the load and prevent bottlenecks.

Network Capacity Planning

- Improved Capacity Forecasting: AI can analyze historical data and predict future traffic demand, enabling network operators to plan for future capacity needs.

- Efficient Uses of Resources: AI can identify and allocate network resources more efficiently, reducing costs and improving network performance.

Network Maintenance, Troubleshooting, Operations and Monitoring

- Real-time Monitoring: AI can continuously monitor network performance and identify potential issues before they cause outages or disruptions.

- Quicker Resolutions of Vendor/Hardware Issues: AI can diagnose and resolve vendor and hardware issues more quickly, minimizing downtime.

- Faster Root Cause Analysis: AI can analyze large amounts of data to identify the root cause of network issues, enabling faster resolution.

- Quick Mitigations of Network Issues: AI can automatically implement mitigations for network issues, reducing the impact on users and applications.

AI/ML Based Network in Action

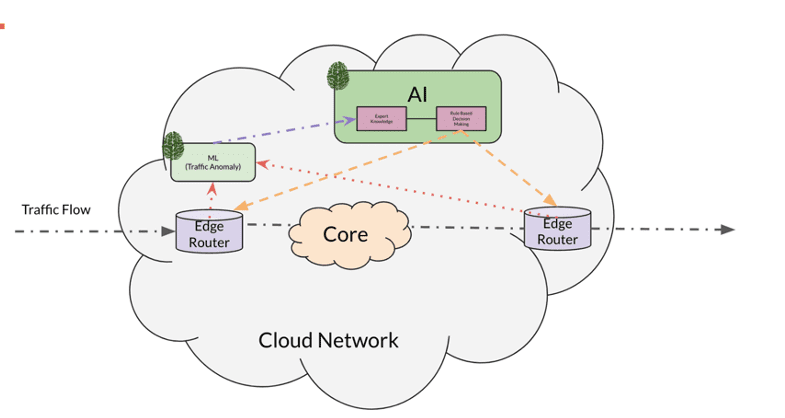

The seamless integration of AI/ML components at various levels of the network (edge, core, management, etc.) enhances its reliability, efficiency, and security by optimizing performance and safeguarding against vulnerabilities.

The diagram illustrates a practical application of AI/ML within one of the extensive networks.

Figure-2: AI/ML in action in a cloud network

Trends in AI/ML

AI/ML are revolutionizing the field of networks. These technologies are being used to improve the performance, security, and reliability of networks.

Here are some of the key trends in AI/ML for networks:

- Simplify and scale data operations.

AI/ML can be used to automate and simplify many of the tasks involved in managing and analyzing network data. This can free up network administrators to focus on more strategic tasks.

- Increase accuracy of forecasts.

AI/ML can be used to predict network traffic patterns, identify potential problems, and plan for future capacity needs. This can help organizations to avoid costly downtime and improve the quality of service for their users.

- Decrease time to market.

AI/ML can be used to automate the process of designing, deploying, and managing new network services. This can help organizations to bring new products and services to market faster.

- Enable insights on otherwise unusable data

AI/ML can be used to extract insights from network data that would otherwise be too complex or voluminous to analyze manually. This can help organizations to identify security threats, optimize network performance, and improve customer experience.

Figure-3: Trends in ML

AI/ML Use Cases

The introduction of AI/ML use cases in network functions has revolutionized the field of networking. AI/ML technologies are being leveraged to enhance network security, optimize network design and performance, anticipate traffic demand, and automate network tasks. This integration leads to improved efficiency, reliability, and overall network performance.

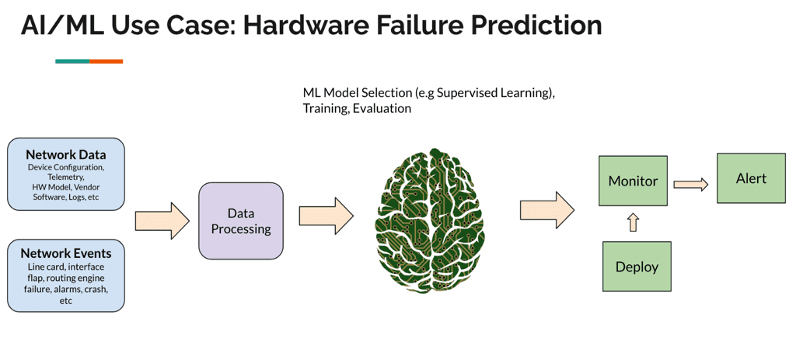

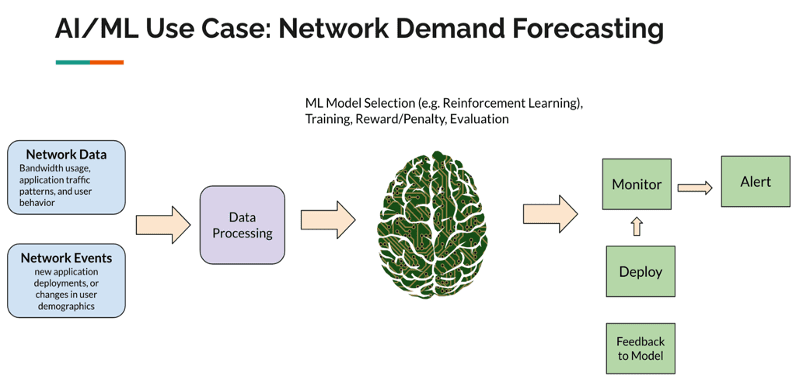

Examples of the popular use cases of AI/ML in large networks.

Figure-4: AI/ML Use Case: Hardware Failure Prediction

Figure-5: AI/ML Use Case: Network Demand Forecasting

ML vs Non-ML Networks

The comparison of ML-based and non-ML-based networks provides valuable insights into the advantages and limitations of each approach. By examining the key aspects such as scalability, flexibility, accuracy, and security, organizations can make informed decisions about the most suitable solution for their specific networking needs. This comparison can guide network engineers, architects, and decision-makers in selecting the optimal approach to meet their performance, efficiency, and security requirements.

A comparison between ML-based and non-ML-based solutions is provided in the followingtable:

Figure-6: Comparison of ML and non-ML solutions

Reasons Not to Use AI/ML

While AI/ML technologies offer significant benefits for networks, there are certain scenarios where their application may not be suitable or feasible. Several factors, such as data availability, use case definition, cost considerations, the need for customized models, and the effectiveness of existing automation, can influence the decision to refrain from using AI/ML in networks. Understanding the limitations and potential drawbacks of AI/ML is crucial for organizations to make informed choices about the most appropriate approach for their specific networking needs.

- Not enough data sets to train the model:

- AI/ML models require large amounts of high-quality data to train effectively. In the context of networks, it may be challenging to collect and prepare sufficient data. Factors such as network size, traffic patterns, and security considerations can make data collection a complex and time-consuming process.

- The lack of adequate data can lead to models that are not well-generalized and may not perform well in real-world scenarios.

- Use case is not defined well:

- AI/ML models are designed to solve specific problems or achieve specific goals. If the use case for AI/ML in networks is not clearly defined, it can be difficult to develop a model that effectively addresses the desired outcomes.

- A poorly defined use case can lead to misalignment between the model’s capabilities and the actual requirements of the network.

- High cost is a problem:

- Implementing AI/ML solutions in networks can be expensive. Factors such as hardware requirements, software licenses, and the cost of hiring skilled professionals contribute to the overall cost.

- Organizations need to carefully evaluate the cost-benefit analysis before investing in AI/ML for their networks. In some cases, the cost of deploying and maintaining an AI/ML solution may outweigh the potential benefits.

- Customized AI/ML model is required:

- Off-the-shelf AI/ML solutions may not always be suitable for specific network scenarios. Organizations may require customized models that are tailored to their unique requirements.

- Developing customized AI/ML models requires specialized expertise and resources, which can further increase the cost and complexity of the project.

- Existing automation is already serving the requirement:

- Many networks already have existing automation solutions in place, such as network management systems (NMS) and configuration management tools. These solutions provide a range of automation capabilities that may already be sufficient for the organization’s needs.

- Implementing AI/ML in such scenarios may not offer significant additional benefits or may require a substantial investment to achieve incremental improvements.

AI/ML Challenges in Networks

AI/ML in networks has benefits but also challenges. Complexity arises from numerous interconnected components and interactions, which AI/ML further complicates. Data limitations and algorithmic bias are additional concerns. Regulatory compliance adds another layer of complexity. Some of the challenges are described in detail below:

Complexity

- As networks become increasingly complex, it can be difficult to troubleshoot issues that arise. This is due to the large number of interconnected components and the complex interactions between them.

- For example, a problem with a single router can have a cascading effect on the entire network, making it difficult to identify the root cause of the issue.

- Additionally, the use of AI and ML in networks can further increase complexity by introducing new layers of abstraction and decision-making.

Data Requirements

- AI and ML algorithms require large amounts of data to train and operate effectively. This can be a challenge for networks, as they may not have access to sufficient data to train their models.

- For example, a network security system may not have enough data on recent attacks to train a model to detect and prevent future attacks.

- Additionally, the data that is available may be biased or incomplete, which can lead to inaccurate or unfair models.

Algorithmic Bias

- AI and ML algorithms can be biased, which can lead to unfair or discriminatory outcomes. This is because the algorithms are trained on data that may contain biases, such as racial or gender bias.

- For example, a facial recognition system may be biased towards certain ethnicities, leading to false identifications or denials of service.

- It is important to address algorithmic bias in networks to ensure that AI and ML are used in a fair and responsible manner.

Regulatory Compliances

- Networks are subject to a variety of regulatory compliance requirements, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

- These regulations impose strict requirements on how data is collected, stored, and used.

- AI and ML can add additional complexity to compliance, as they can introduce new data processing and decision-making processes.

- Organizations need to carefully consider the regulatory implications of using AI and ML in networks to ensure that they are compliant with all applicable regulations.

Ethical Concerns

- The use of AI and ML in networks raises several ethical concerns, such as the misuse of data and job replacement.

- For example, AI-powered surveillance systems could be used to track and monitor people without their consent, raising concerns about privacy and civil liberties.

- Additionally, AI and ML could lead to job automation, which could displace workers and have a negative impact on the economy.

- It is important to consider the ethical implications of using AI and ML in networks to ensure that they are used in a responsible and ethical manner.

Networks: AI/ML Benefits

In today’s digital world, networks are becoming increasingly complex and interconnected. To manage and operate these networks effectively, organizations are turning to AI/ML. AI/ML can automate repetitive tasks, identify, and mitigate network threats, and optimize network performance. AI/ML can also help organizations to gain more insights from their network data, which can lead to better decision-making and improved business outcomes. Some of the top benefits are described below:

Lower Cost:

- Automated tasks: AI/ML can automate repetitive and time-consuming network tasks, such as configuration, monitoring, and troubleshooting. This can free up staff to focus on more strategic initiatives.

- Efficient customer support: AI/ML-powered chatbots and virtual assistants can provide 24/7 customer support, answering common questions and resolving simple issues. This can reduce the need for human customer support representatives, saving costs.

- Improved performance: AI/ML can be used to optimize network performance by identifying and resolving bottlenecks and inefficiencies. This can lead to reduced latency, improved throughput, and better overall network performance while minimizing the network operation cost.

Reduced Network Risk:

- Resilient network: AI/ML can be used to create more resilient networks that are better able to withstand outages and attacks. This can be done by predicting and preventing network failures, and by quickly identifying and resolving issues.

- Identify and mitigate threats: AI/ML can be used to detect and mitigate network threats, such as malware, DDoS attacks, and phishing attempts. This can help to protect sensitive data and systems from being compromised.

- Accurate network trends and forecast: AI/ML can be used to analyze network data to identify trends and forecast future needs. This information can be used to make informed decisions about network planning and investment.

- Network outage prediction: AI/ML can be used to predict network outages before they occur. This can help to prevent downtime and lost productivity.

More Revenue:

- Enhanced network and capacity planning: AI/ML can be used to optimize network and capacity planning, ensuring that the network has the resources it needs to meet current and future demands. This can help to avoid costly over-provisioning or under-provisioning of network resources.

- Faster time to market: AI/ML can help to accelerate time to market for new network services and applications. This can be done by automating the testing and deployment process, and by identifying and resolving potential issues early on.

- Better customer experience: AI/ML can be used to improve the customer experience by providing personalized and proactive support. This can lead to increased customer satisfaction and loyalty.

Networks: AI/ML Innovation Catalysts

The convergence of AI/ML with networks is revolutionizing various industries. Here are some key factors driving this transformation:

- Increase in Data/Compute and Storage:

- The proliferation of IoT devices has led to an exponential growth in data generation, fueling AI/ML innovation.

- High-performance computing (HPC) clusters and cloud platforms provide the necessary compute and storage resources for complex AI/ML models.

- Edge Computing:

- Edge computing brings AI/ML capabilities closer to data sources, enabling real-time decision-making.

- Edge devices, such as sensors and gateways, collect and process data locally, reducing latency and bandwidth requirements.

- Cloud Infrastructure:

- Cloud platforms offer scalable and elastic infrastructure for deploying and managing AI/ML workloads.

- Cloud-based AI/ML services provide pre-built tools and frameworks for developers, accelerating the development and deployment of AI/ML applications.

- Increase in Devices Running AI:

- Smartphones, smart home devices, and autonomous vehicles are increasingly equipped with AI capabilities.

- These devices generate vast amounts of data and use AI to perform tasks such as image recognition, natural language processing, and predictive analytics.

- Pre-trained Models:

- Pre-trained models, such as open-source BERT and ResNet, provide a starting point for developing custom AI models.

- These models have been trained on large datasets and can be fine-tuned for specific tasks, reducing the time and resources required for model development.

- Human and AI Cooperation:

- AI/ML is augmenting human capabilities, enabling collaboration between humans and machines.

- Human-AI teams can leverage their respective strengths to solve complex problems and make better decisions.

Conclusion

AI and ML are revolutionizing the field of networking, bringing efficiency, automation, and significant performance improvements. As networks continue to grow and complexity, traditional management methods are becoming increasingly ineffective. AI and ML offer a powerful solution by enabling networks to self-configure, self-optimize, and self-heal, leading to a more agile, resilient, and cost-effective network infrastructure. The use of AI and ML in networks is still in its early stages, but it has the potential to transform the way networks are designed, built, and operated. As AI and ML technologies continue to evolve, we can expect to see even more innovative applications that will further unleash the potential of networks.

References

- https://cloud.google.com/blog/products/infrastructure/google-network-infrastructure-investments

- https://www.cisco.com/c/en/us/solutions/collateral/executive-perspectives/ai-ml-overview-of-industry-trends.html

**** This blog post was written with the assistance of Google’s Gemini. The AI was used to generate initial draft, rephrasing, and brainstorming, which I then refined, edited, and expanded upon.

Part1: Unleashing Network Potentials: Current State and Future Possibilities with AI/ML

By Vinay Tripathi with Ajay Lotan Thakur

Introduction

We live in an era of rapid digitization and ubiquitous connectivity where networks touch every aspect of our lives. From the global telecommunication infrastructure enabling seamless voice and data communication to the diverse social media platforms facilitating instant global interactions, the way we collaborate, communicate, and access information is heavily dependent on the seamless operation of networks. However, as networks continue to evolve, expanding in size and complexity, managing, provisioning, and optimizing them efficiently poses significant challenges.

Introducing Artificial Intelligence (AI) and Machine Learning (ML), offering a transformative solution to simplify network provisioning, streamline operations, enhance network performance, and unlock valuable insights from the vast amounts of network data. AI and ML empower network administrators, architects, planners, engineers, and managers with a range of capabilities that significantly improve network efficiency and effectiveness.

Type of Networks

Networks can be classified into various types based on their purpose, size, and geographical coverage. Some common types of networks include:

1. Core Networks:

- Form the backbone of the internet, connecting large geographical regions and major network providers.

- Characterized by high-speed data transmission, typically fiber optic cables, and redundant paths for reliability.

- Responsible for routing traffic between different parts of the internet and carrying large amounts of data.

2. Data Center Networks:

- Designed to support the infrastructure of data centers, where large amounts of data are processed and stored.

- Highly interconnected and optimized for low latency and high bandwidth to facilitate efficient communication between servers and storage systems.

- Often utilize specialized networking technologies such as Ethernet and InfiniBand.

3. Enterprise Networks:

- Connect devices and resources within an organization or company.

- Include local area networks (LANs) for devices within a building or campus and wide area networks (WANs) for connecting geographically dispersed sites.

- Provide secure and reliable connectivity for employees, customers, and partners.

4. Cellular Networks:

- Provide wireless connectivity for mobile devices such as smartphones, tablets, and IoT devices.

- Consists of cellular towers or base stations that communicate with mobile devices using radio waves.

- Offer various cellular technologies such as 2G, 3G, 4G, and 5G, each providing different levels of speed and capacity.

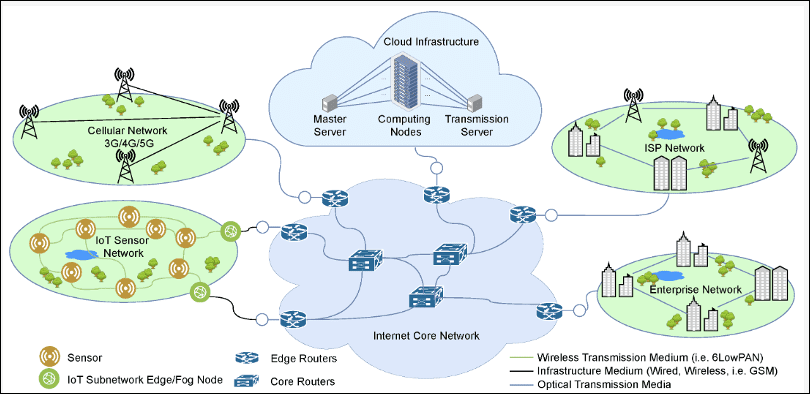

Here’s an example that demonstrates various types of networks:

Figure-1: Various types of Networks

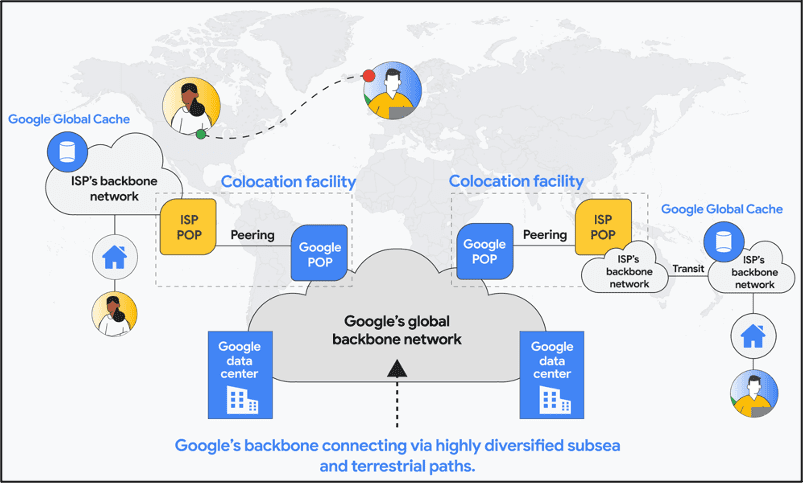

Figure-2: Google Network Infrastructure

Network Functions

Networks are designed to achieve specific goals, for example, edge networks can have very different routing and switching requirements when compared to core networks. However, there are some functions which are common to all networks.

- Engineering:

Deals with design, optimization, provision and development of the network infrastructure and services. Engineering teams ensure the network operates efficiently, reliability and meets all the performance and scale requirements.

- Capacity Planning & Forecasting:

Estimates future demand of network resources such as routers, switches, servers, storage and bandwidth. It helps in network planning and scaling by analyzing history consumptions and future demand.

- Implementation:

Physically deploys the network components like routers, switches, servers, etc. It integrates the systems to the rest of the network and services based on the designs and plans developed by the engineering team.

- Monitoring:

Another critical function of network infrastructure which provides vital insights to the current state of network infrastructure. Data collected from the systems can be used by other network functions to improve network performance, reliability, and security.

- Operation:

A crucial function of the network which focuses on day-to-day management, maintenance and support of network infrastructure and services. It ensures the network operates smoothly, efficiently and with least disruptions.

- Security:

Maintains confidentiality and integrity of information and systems. It uses firewall, intrusion detection systems and access control lists to keep the network secure.

Network Without AI/ML

Many large-scale network outages result from human manual errors or automated system malfunctions. Avoiding such issues is difficult when humans are involved in daily operational decision-making. Many network functions have been automated in recent years, but they still rely on predefined values or actions that require continuous system or service updates. Additionally, there are still many networks or functions that are not automated due to a lack of expertise, resources, or willingness. Even in automated networks, operators must perform manual operations in certain situations, such as tooling infrastructure failures or recoveries. Some scenarios where automated and/or manual operations are performed in a network include:

- Manual/automated security provisions:

- Manual security provisions involve tasks such as manually configuring firewalls, intrusion detection systems, and other security devices.

- Automated security provisions involve using software tools to automate security tasks, such as vulnerability scanning, patch management, and threat detection.

- Manual/automated configuration of network devices (switches, routers, etc.):

- Manual configuration involves manually configuring network devices, such as switches and routers, using command-line interfaces or web-based interfaces.

- Automated configuration involves using software tools to automate the configuration of network devices, which can save time and reduce errors.

- Manual/automated monitoring dashboard with predefined values:

- Manual monitoring involves manually monitoring network performance and security metrics using technologies such as Telemetry, SNMP, and syslog.

- Automated monitoring involves using software tools to automate the monitoring of network metrics and generate alerts when predefined thresholds are exceeded.

- Manual/automated troubleshooting of network issues:

- Manual troubleshooting involves manually diagnosing and resolving network issues, such as connectivity problems, performance issues, and security breaches.

- Automated troubleshooting involves using software tools to automate the diagnosis and resolution of network issues, which can reduce the time it takes to resolve problems.

- Manual/automated mitigation of network events:

- Manual mitigation involves manually responding to network events, such as security breaches, denial-of-service attacks, and natural disasters.

- Automated mitigation involves using software tools to automate the response to network events, which can help to minimize the impact of these events.

- Manual/automated capacity planning process:

- Manual capacity planning involves manually forecasting network traffic demand and planning for future capacity needs.

- Automated capacity planning involves using software tools to automate the forecasting of network traffic demand and the planning of future capacity needs, which can help to ensure that the network has sufficient capacity to meet future demand. Automated solutions can save time, reduce errors, and improve efficiency.

NextGen Network Requirements

Next-generation networks must meet diverse use cases and deliver exceptional customer experiences. Network applications and use cases constantly evolve, necessitating adjustments in network design, technologies, and operations. Continuous optimization is needed to unleash the network’s full potential. For example, existing data center networks require redesign and optimization to meet the demands of AI/ML applications. Critical requirements that must be fulfilled by next-generation networks are as follows:

- Increased performance, reliability, and security: Networks must handle massive data volumes and complex workloads with high performance and low latency. Reliability and security are paramount, ensuring uninterrupted operations and safeguarding sensitive information.

- Customer-centric focus: Delivering a seamless and delightful customer experience is crucial. Networks must facilitate seamless coordination across business functions, enabling personalized services and addressing customer needs effectively.

- Managing massive complexity: The convergence of 5G, Internet of Things (IoT), AI/ML loads and edge computing introduces unprecedented complexity. Networks need to be equipped with advanced orchestration and management capabilities to handle this complexity efficiently.

- Value beyond connectivity: Networks should not be limited to providing mere connectivity. They must deliver value-added services and capabilities such as real-time analytics, edge computing, and network slicing to meet diverse customer requirements.

- Improved service assurance and issue prediction: Networks must proactively monitor and analyze network performance to predict potential issues before they impact customers. Fault detection and self-healing mechanisms are essential to ensure uninterrupted service availability.

- Measuring and optimizing customer experience: Networks should have built-in capabilities to measure and analyze customer experience metrics such as latency, packet loss, and jitter. This data can be leveraged to optimize network performance and rectify areas of improvement.

- Understanding customer expectations: Networks must provide insights into customer expectations and evolving needs. This can be achieved through surveys, feedback mechanisms, and real-time monitoring of customer interactions.

- Increased efficiency and intelligence: Networks should incorporate AI and ML technologies to automate tasks, optimize resource allocation, and enhance overall network efficiency and intelligence.

Conclusion

Future networks need AI/ML integration to fulfill the next generation of requirements. AI/ML can make networks more efficient, secure, reliable, and scalable. AI/ML can effectively monitor and alert operators, utilizes resources efficiently, make network customer centric and faster delivery of services. In the next blog, we will discuss AI/ML use cases, benefits, limitations, and projections.

References

- https://www.mdpi.com/1424-8220/21/11/3898

- https://cloud.google.com/blog/products/infrastructure/google-network-infrastructure-investments

**** This blog post was written with the assistance of Google’s Gemini. The AI was used to generate initial draft, rephrasing, and brainstorming, which I then refined, edited, and expanded upon.

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

UScellular has added NetCloud Private Networks from Cradlepoint (part of Ericsson) to expand its portfolio of private cellular solutions. The company now offers Ericsson Private 5G and Ericsson’s Mission Critical Networks to its customers. By building on these capabilities, UScellular is able to support even more customers across varying areas of business.

Some existing private cellular network ecosystems are pulled together piece by piece from different providers, which requires additional training and agreements. This makes it difficult for enterprise IT teams to have seamless visibility across the entire network. NetCloud Private Networks is an end-to-end private cellular network solution that removes these complexities to simplify building and operating 5G private networks.

“With the addition of NetCloud Private Networks to our portfolio, we can better address business challenges for customers of all sizes to connect business, industry and mission critical applications,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “The agility, flexibility and scalability of NetCloud Private Networks helps improve coverage, security, mobility, and reliability for applications where Wi-Fi may not be enough.”

NetCloud Private Networks supports enterprises who need more scalable, reliable and secure connectivity than they are getting today with traditional Wi-Fi solutions. There is significant opportunity in warehouses, logistics facilities, outdoor storage yards, manufacturing and retail operations environments to provide more connectivity. This will alleviate manual work, improve safety, and provide increased visibility.

“UScellular is a leader in this space by showing how a public carrier enhances the value of private network solutions,” said Manish Tiwari, head of private cellular networks, Cradlepoint and Ericsson Enterprise Wireless Networks.

“By adding NetCloud Private Networks to their portfolio of Ericsson private networks solutions, UScellular unlocks new opportunities for organizations to have local network coverage and address their reliability and security challenges. With solutions available to cater to both OT and IT in industrial and business environments, their customers have a choice in adopting the right private network solution for their use-cases with secure, policy-based wireless connectivity at scale.”

………………………………………………………………………………………………………………………..

Separately, The Wall Street Journal reported Thursday that T-Mobile is seeking to buy $2 billion worth of UScellular and take over some operations and wireless spectrum licenses. A deal could be announced this month, according to people familiar with the matter.

Meanwhile, Verizon is considering a deal for some of the rest of the company which is 80% owned by Telephone & Data Systems (TDS). Last year, TDS put the wireless company’s operations up for sale, as it struggled with competition from national wireless telco rivals and cable-broadband providers.

Verizon is the biggest U.S. cellphone carrier by subscribers, while T-Mobile became the second largest soon after it bought rival Sprint. T-Mobile gained more customers this month after it completed its purchase of Mint Mobile, an upstart brand.

The rising value of wireless licenses is a driving force behind the deal. U.S. Cellular’s spectrum portfolio touches 30 states and covers about 51 million people, according to regulatory filings.

U.S. companies have spent more than $100 billion in recent years to secure airwaves to carry high-speed fifth-generation, or 5G, signals and are hunting for more. But the Federal Communications Commission has lacked the legal authority to auction new spectrum for more than a year. The drought has driven up the price of spectrum licenses at companies that already hold them.

The U.S. wireless business has also matured: Carriers have sold a smartphone subscription to most adults and many children, which leaves less room for expansion as the country’s population growth slows. AT&T and Verizon have meanwhile retreated from expensive bets on the media business to focus on their core cellphone and home-internet customers.

A once-crowded field of small, midsize and nationwide cellphone carriers in the U.S. is now split among Verizon, T-Mobile and AT&T, leaving few players left to take over. As one of the last pieces left on the board, U.S. Cellular has long been an attractive takeover target. For many years, the home of the Chicago White Sox has been UScellular field.

………………………………………………………………………………………………………………………..

About UScellular:

UScellular offers wireless service to more than four million mostly rural customers across 21 states from Oregon to North Carolina. It also owns more than 4,000 cellular towers that weren’t part of the latest sale talks. The company has a market value of about $3 billion.

UScellular provides a range of solutions from public/private hybrid networks, MVNO models, localized data (aka CUPS) and custom VPN approaches. Private 5G offers unparalleled reliability, security and speed, enabling seamless communication and automation. For more information:

https://business.uscellular.com/products/private-cellular-networks/

References:

https://www.wsj.com/business/telecom/t-mobile-verizon-in-talks-to-carve-up-u-s-cellular-46d1e5e6

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

This 3GPP May 8-10,2024 workshop held in Rotterdam, Nederlands brought the 3GPP community closer to the initiatives of regional and global research organizations, market partners (MRPs), operators’ associations and the ITU.

The workshop presented the opportunity for different communities to share their views on 6G/IMT2030 Use Cases. Those communities are Operators; Verticals; Regional Alliances and ITU.

The workshop was co-chaired by Mr. Jose Almodovar, SA1 Chair, and by Mr. Puneet Jain, SA Chair. It was supported by ETSI MCC, coordinated by Mr. Alain Sultan.

3GPP WG SA1 now has the task to define the 6G stage 1 requirements to be met by future 3GPP specifications.

Among the more important sessions were:

Day 1: Opening, Operators, Verticals

Speakers: Puneet Jain (Intel), SA Chair and Jose Almodovar (TNO), SA1 Chair

Operators:

- GSMA – GSMA Proposal on 6G – Speaker: Barbara Pareglio (GSMA)

- NGMN – NGMN’s 6G Vision – Speakers: Sparsh Singhal & Quan Zhao (NGMN)

Panel#1: “6G Drivers for Operators”

Panel#2 : “6G Drivers for Verticals”

Potential Drivers for 6G include:

•Security. Used in different contexts, both about network security and user data confidentiality (interesting to note that 5G Security is not widely deployed. It requires a 5G SA network few of which are commercially available).

• Maintaining continuity of service and robust security, especially crucial in times of crisis

• Identify all relevant new threat-factors for 6G, and develop mitigation solution (e.g. detection and protection against electromagnetic threats)

• Quantum-safe security mechanisms

• Network-design/performance: network optimization and automation (Intelligent Network management, Network Performance)

• Energy efficiency/saving/ sustainability

• AI-assisted air interface/ Radio Performance

• AI for improving positioning

• Enabling AI at the application level

• AI data management, model distribution for all AI-assisted “smart” areas (cities, industries, surgeries, robot control, manufacturing plant, rescue missions etc.

• AI as a Service (AIaaS)

• To implement a range of media’s personalization and customization (sport TV program, etc)

ITU & 3GPP:

- ITU-R – Update from ITU-R on IMT-2030 – Speaker: Uwe Loewenstein (ITU)

- 3GPP – 3GPP Intro & 6G Planning – Speaker: Puneet Jain (Intel), SA Chair

Panel#4: ITU & 3GPP synergies for 6G

Closing:

Speakers: Puneet Jain (Intel), SA Chair; Jose Almodovar (TNO), SA1 Chair; Alain Sultan (ETSI MCC), SA1 Secretary & 3GPP Work Plan Coordinator

…………………………………………………………………………………………………………..

References:

https://www.3gpp.org/component/content/article/stage1-imt2030-uc-ws?catid=67&Itemid=101

https://www.3gpp.org/ftp/workshop/2024-05-08_3GPP_Stage1_IMT2030_UC_WS/Docs

https://www.3gpp.org/ftp/workshop/2024-05-08_3GPP_Stage1_IMT2030_UC_WS

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

Juniper Research: Global 6G Connections to be 290M in 1st 2 years of service, but network interference problem looms large

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

New ETSI Reports: 1.] Use cases for THz communications & 2.] Frequency bands of interest in the sub-THz and THz range

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

SK Telecom, Intel develop low-latency technology for 6G core network

ETSI Integrated Sensing and Communications ISG targets 6G

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

How Network Repository Function Plays a Critical Role in Cloud Native 5G SA Network

NRF (Network Repository Function) facilitates cloud-native 5G networks by enabling dynamic and efficient discovery of peer Network Functions, enhancing scalability.

Ajay Lotan Thakur

Introduction:

DNS (Domain Name Service) has been widely used by networks to discover 3G and 4G Network Functions (NFs). Every time there is a change in the network, this entails adding or updating records in the DNS server. This solution was not cohesive. The 5G Network Repository Function (NRF), which was introduced in the 5G specification, addresses this issue. Every Network Function needs to register its profile with NRF when it’s ready to service the APIs. Every NF type contains unique information in the NF profile. For example, Session Management Function (SMF) might provide the set of Data Network Names (DNN) it serves.

It’s important to note is that SMF may still choose User Plane Function (UPF) using proprietary logic because the UPF interface to NRF is still optional. In this article we shall see various advantages provided by 3GPP’s NRF network function over traditional 3G/4G networks.

Advantages of 5G NRFs:

Using 5G Network Resource Function (NRF) for discovering peer Network Functions (NFs) compared to relying on DNS servers in 4G networks brings several advantages:

- Efficiency in Resource Discovery: NRF offers a more efficient and dynamic way of discovering peer NFs within the network. Unlike DNS servers, which rely on static records and hierarchical lookup mechanisms, NRF enables direct discovery of available NFs, reducing latency and enhancing resource utilization. NRF can search the NFs based on many parameters like load, slice Ids, DNN name etc.

- Enhanced Security: NRF can incorporate security features such as authentication and authorization mechanisms, ensuring that only authorized NFs can be discovered and accessed. This helps in mitigating security threats such as DNS spoofing or cache poisoning, which are concerns in traditional DNS-based architectures.

- Support for Network Slicing: NRF is well-suited for 5G network slicing, where multiple virtualized networks coexist on the same physical infrastructure. It allows for efficient discovery and allocation of NFs specific to each network slice, enabling tailored services and resource optimization.

- Service Orchestration: NRF facilitates service orchestration by providing real-time information about the available NFs and their capabilities. This enables dynamic service composition and adaptation based on changing network conditions and application requirements. NRF can be used to put some of the NFs under maintenance mode as well.

- Low Latency: With NRF, the latency in discovering and connecting to peer NFs is significantly reduced compared to DNS-based approaches. This is crucial for applications requiring real-time communication or low-latency services, such as edge computing or autonomous vehicles. In case NRF is overloaded then it can scale-out to bring down the latency.

- Scalability: NRF architecture is designed to handle the scalability demands of 5G networks, where the number of NF instances and their dynamic nature can be high. It allows for efficient scaling of network resources without relying on centralized DNS servers, which may face scalability challenges under heavy loads. This allows Network Functions to implement dynamic scale in & scale out without touching any DNS servers.

- Dynamic Network Updates: NRF supports dynamic updates of network information, allowing for real-time changes in the availability and status of NF instances. These are NRF notifications supported as per 3gpp specification. In contrast, DNS records may require time to propagate changes across the network, leading to potential inconsistencies or delays in service discovery. Each NF can update its profile as and when it sees changes.

Conclusions:

Overall, leveraging NRF for NF discovery in 5G networks offers improved efficiency, scalability, low latency, security, and support for advanced network functionalities compared to relying solely on DNS servers in 4G networks.

References:

3GPP TS 23.501 – System Architecture for the 5G System

3GPP TS 29.510 – Network Function Repository Services

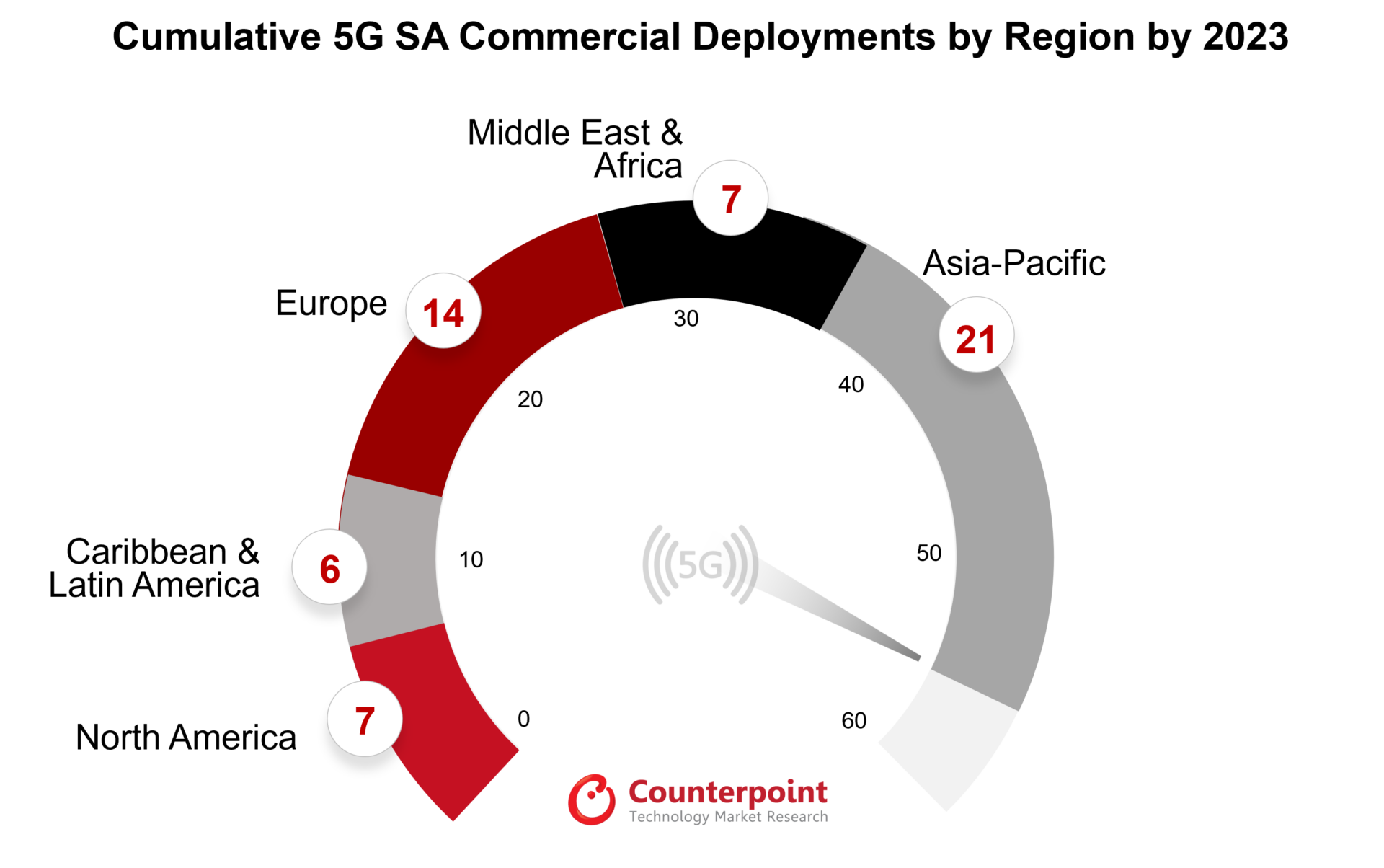

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Ericsson Mobility Report touts “5G SA opportunities”

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

Samsung and VMware Collaborate to Advance 5G SA Core & Telco Cloud

5G SA networks (real 5G) remain conspicuous by their absence

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

About the Author:

Ajay Lotan Thakur, Senior IEEE Member, IEEE Techblog Editorial Board Member, BCS Fellow, TST Member of ONF’s open source Aether (Private 5G) Project, Cloud Software Architect at Intel Canada.

Blog post edited by Alan J Weissberger

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Findings from the latest GSA report on the 5G standalone (SA) ecosystem include:

- 1,764 announced devices with claimed support for 5G SA, up 43.7% from 1,227 at the end of 2022.

- Devices with support for 5G SA account for 68.1% of all 5G devices, as of the end of March 2024, up from 43.3% in December 2019.

- 97 modems or mobile processors/platform chipsets state support for 5G SA, 93 of which are understood to be commercially available.

………………………………………………………………………..

Other Estimates of deployed 5G SA core networks:

According to a recent LinkedIn post by Kaneshwaran Govindasamy, at least 49 network 29 have launched or deployed public 5 , one of which has only soft-launched their 5G SA networks.

A February 2024 report from Counterpoint Research in February 2024 states that only 55 operators have commercially implemented 5G SA, with many more in testing and trial stages.

As of January 2024, Dell’Oro Group has identified 50 5G SA enhanced Mobile BroadBand (eMMB) networks that have been deployed worldwide. Dell’Oro Group’s Research Director, Dave Bolan, stated that the build-out of 5G SA networks is slower than expected, and that the number of new 5G SA networks deployed in 2023 (12) was lower than in 2022 (18). However, Bolan predicts that 2024 will see more 5G SA launches than 2022, and that 5G SA launches will occur in almost all global markets except Africa.

……………………………………………………………………………………………………

It should be noted that there is only one 5G SA network deployed in the U.S. from T-Mobile. AT&T and Verizon have promised 5G SA for years but it’s not commercially deployed by either operator at this time.

5G SA networks support higher-density device deployments and improved network performance. Without a 5G SA network, there are no 3GPP defined 5G features available, such as 5G Security, Network Slicing, MEC, etc.

References:

GSA 5G SA Core Network Update Report – Technology Blog

Building and Operating a Cloud Native 5G SA Core Network

Mobile Core Market Stagnant Due to Lack of 5G Standalone Deployments, According to Dell’Oro Group

https://www.ericsson.com/en/5g/5g-sa

Summit Broadband deploys 400G using Ciena’s WaveLogic 5 Extreme

Florida-based fiber optic telecommunications provider Summit Broadband has launched 400G services following a network upgrade with Ciena. Summit Broadband is leveraging Ciena’s WaveLogic 5 Extreme (WL5e) [1.] to offer 400 Gbps wavelength services to enterprise customers in Central and Southwest Florida, Ciena said last week.

Summit Broadband owns and operates over 4,300 fiber-route miles of infrastructure and serves industries and communities throughout the state with voice, video, data, internet, and Ethernet services, as well as dark fiber transport.

Note 1. Summit Broadband is deploying Ciena’s WaveLogic Ai coherent optics across a flexible 6500 ROADM network, delivering 400GbE wave services to increase capacity and reach more users. Summit Broadband is also utilizing Ciena’s 3926 and 5164 Routing and Switching platforms for cost effective service delivery, as well as Adaptive IP Apps and Manage, Control and Plan (MCP) domain controller for real-time visibility and analysis of routing behaviors to optimize network performance and identify issues with greater ease for faster resolution.

Ciena noted that Summit Broadband has rolled out 400 Gbps wavelength to support the rise in data consumption of high-bandwidth applications such as cloud computing, IoT devices, video streaming, and enterprise services. This upgrade builds on the longstanding relationship between both companies, with Ciena powering Summit’s optical network.

In his first year as CEO, Kevin Coyne has transformed Summit Broadband’s network to create data superhighways encircling the Florida peninsula, serving customers in Central, West, and Southwest Florida. This recent network expansion gives Summit Broadband even greater flexibility and adaptability to respond to the increasing needs of its customers, including school districts and municipalities.

“The past year has shown us how having access to high-quality connectivity is a necessity for everyday life,” said Coyne. “We chose to invest in deploying Ciena’s cutting edge solutions to bring an enhanced digital experience across Florida, connecting more people and businesses using higher speeds and lower latency services.”

“The demand for bandwidth shows no signs of slowing down, and our new 400 Gbps service ensures that our business customers have the high performance and scalability essential for applications like data center interconnect, which require fast speeds and low latency.”

Additionally, the upgrade will allow Summit to deliver more data per unit of energy over our existing infrastructure, maximizing network utilisation and providing capex and opex savings, Summit Broadband added.

…………………………………………………………………………………………………………………….

In January, BW Digital, the owner of the Hawaiki Submarine Cable, confirmed the availability of commercial 400 GbE services on the Hawaiki trans-Pacific cable, powered by Ciena’s GeoMesh Extreme subsea network solution.

References:

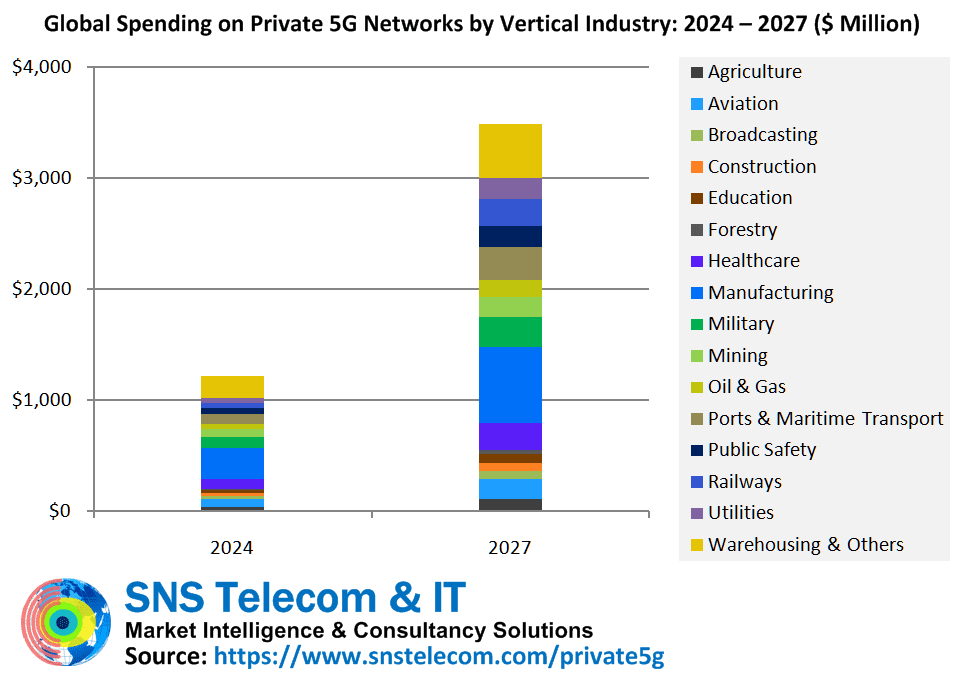

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT’s new “Private 5G Networks: 2024 – 2030” report exclusively focuses on the market for private networks built using the 3GPP-defined 5G specifications (there are no ITU-R recommendations for private 5G networks or ITU-T recommendations for 5G SA core networks). In addition to vendor consultations, it has taken us several months of end user surveys in early adopter national markets to compile the contents and key findings of this report. A major focus of the report is to highlight the practical and tangible benefits of production-grade private 5G networks in real-world settings, as well as to provide a detailed review of their applicability and realistic market size projections across 16 vertical sectors based on both supply side and demand side considerations.

The report states report that the real-world impact of private 5G networks – which are estimated to account for $3.5 Billion in annual spending by 2027 – is becoming ever more visible, with diverse practical and tangible benefits such as productivity gains through reduced dependency on unlicensed wireless and hard-wired connections in industrial facilities, allowing workers to remotely operate cranes and mining equipment from a safer distance and significant, quantifiable cost savings enabled by 5G-connected patrol robots and image analytics in Wagyu beef production.

SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Although much of this growth will be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries, sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced becomes a commercial reality. Among other features for mission-critical networks, 3GPP Release 18 – which defines the first set of 5G Advanced specifications – adds support for 5G NR equipment operating in dedicated spectrum with less than 5 MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz and 900 MHz bands for public safety broadband, smart grid modernization and FRMCS (Future Railway Mobile Communication System).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Private LTE networks are a well-established market and have been around for more than a decade, albeit as a niche segment of the wider cellular infrastructure segment – iNET’s (Infrastructure Networks) 700 MHz LTE network in the Permian Basin, Tampnet’s offshore 4G infrastructure in the North Sea, Rio Tinto’s private LTE network for its Western Australia mining operations and other initial installations date back to the early 2010s. However, in most national markets, private cellular networks or NPNs (Non-Public Networks) based on the 3GPP-defined 5G specs are just beginning to move beyond PoC (Proof-of-Concept) trials and small-scale deployments to production-grade implementations of standalone 5G networks, which are laying the foundation for Industry 4.0 and advanced application scenarios.

Compared to LTE technology, private 5G networks – also referred to as 5G MPNs (Mobile Private Networks), 5G campus networks, local 5G or e-Um 5G systems depending on geography – can address far more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density. In particular, 5G’s URLLC (Ultra-Reliable, Low-Latency Communications) and mMTC (Massive Machine-Type Communications) capabilities, along with a future-proof transition path to 6G networks in the 2030s, have positioned it as a viable alternative to physically wired connections for industrial-grade communications between machines, robots and control systems. Furthermore, despite its relatively higher cost of ownership, 5G’s wider coverage radius per radio node, scalability, determinism, security features and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years.

It is worth noting that China is an outlier and the most mature national market thanks to state-funded directives aimed at accelerating the adoption of 5G connectivity in industrial settings such as factories, warehouses, mines, power plants, substations, oil and gas facilities and ports. To provide some context, the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN (Radio Access Network) nodes supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability and security requirements. For example, home appliance manufacturer Midea’s Jingzhou industrial park hosts 2,500 indoor and outdoor 5G NR access points to connect workers, machines, robots and vehicles across an area of approximately 104 acres, steelmaker WISCO (Wuhan Iron & Steel Corporation) has installed a dual-layer private 5G network – spanning 85 multi-sector macrocells and 100 small cells – to remotely operate heavy machinery at its steel plant in Wuhan (Hubei), and Fujian-based manufacturer Wanhua Chemical has recently built a customized wireless network that will serve upwards of 8,000 5G RedCap (Reduced Capability) devices, primarily surveillance cameras and IoT sensors.

As end user organizations in the United States, Germany, France, Japan, South Korea, Taiwan and other countries ramp up their digitization and automation initiatives, private 5G networks are progressively being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, distributed PLC (Programmable Logic Controller) environments, AMRs (Autonomous Mobile Robots) and AGVs (Automated Guided Vehicles) for intralogistics, AR (Augmented Reality)-assisted guidance and troubleshooting, machine vision-based quality control, wireless software flashing of manufactured vehicles, remote-controlled cranes, unmanned mining equipment, BVLOS (Beyond Visual Line-of-Sight) operation of drones, digital twin models of complex industrial systems, ATO (Automatic Train Operation), video analytics for railway crossing and station platform safety, remote visual inspections of aircraft engine parts, real-time collaboration for flight line maintenance operations, XR (Extended Reality)-based military training, virtual visits for parents to see their infants in NICUs (Neonatal Intensive Care Units), live broadcast production in locations not easily accessible by traditional solutions, operations-critical communications during major sporting events, and optimization of cattle fattening and breeding for Wagyu beef production.

Despite prolonged teething problems in the form of a lack of variety of non-smartphone devices, high 5G IoT module costs due to low shipment volumes, limited competence of end user organizations in cellular wireless systems and conservatism with regards to new technology, early adopters are affirming their faith in the long-term potential of private 5G by investing in networks built independently using new shared and local area licensed spectrum options, in collaboration with private network specialists or via traditional mobile operators. Some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings and worker safety – are becoming increasingly evident. Notable examples include but are not limited to:

- Tesla’s private 5G implementation on the shop floor of its Giga-factory Berlin-Brandenburg plant in Brandenburg, Germany, has helped in overcoming up to 90 percent of the overcycle issues for a particular process in the factory’s GA (General Assembly) shop. The electric automaker is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics and quality operations across its global manufacturing facilities.

- John Deere is steadily progressing with its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the United States, South America and Europe. In a similar effort, automotive aluminum die-castings supplier IKD has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network, thereby reducing cable maintenance costs to near zero and increasing the product yield rate by ten percent.

- Lufthansa Technik’s 5G campus network at its Hamburg facility has removed the need for its civil aviation customers to physically attend servicing by providing reliable, high-resolution video access for virtual parts inspections and borescope examinations at both of its engine overhaul workshops. Previous attempts to implement virtual inspections using unlicensed Wi-Fi technology proved ineffective due to the presence of large metal structures.

- The EWG (East-West Gate) Intermodal Terminal’s private 5G network has increased productivity from 23-25 containers per hour to 32-35 per hour and reduced the facility’s personnel-related operating expenses by 40 percent while eliminating the possibility of crane operator injury due to remote-controlled operation with a latency of less than 20 milliseconds.

- The Liverpool 5G Create network in the inner city area of Kensington has demonstrated significant cost savings potential for digital health, education and social care services, including an astonishing $10,000 drop in yearly expenditure per care home resident through a 5G-connected fall prevention system and a $2,600 reduction in WAN (Wide Area Network) connectivity charges per GP (General Practitioner) surgery – which represents $220,000 in annual savings for the United Kingdom’s NHS (National Health Service) when applied to 86 surgeries in Liverpool.

- NEC Corporation has improved production efficiency by 30 percent through the introduction of a local 5G-enabled autonomous transport system for intralogistics at its new factory in Kakegawa (Shizuoka Prefecture), Japan. The manufacturing facility’s on-premise 5G network has also resulted in an elevated degree of freedom in terms of the factory floor layout, thereby allowing NEC to flexibly respond to changing customer needs, market demand fluctuations and production adjustments.

- A local 5G installation at Ushino Nakayama’s Osumi farm in Kanoya (Kagoshima Prefecture), Japan, has enabled the Wagyu beef producer to achieve labor cost savings of more than 10 percent through reductions in accident rates, feed loss, and administrative costs. The 5G network provides wireless connectivity for AI (Artificial Intelligence)-based image analytics and autonomous patrol robots.

- CJ Logistics has achieved a 20 percent productivity increase at its Ichiri center in Icheon (Gyeonggi), South Korea, following the adoption of a private 5G network to replace the 40,000 square meter warehouse facility’s 300 Wi-Fi access points for Industry 4.0 applications, which experienced repeated outages and coverage issues.

- Delta Electronics – which has installed private 5G networks for industrial wireless communications at its plants in Taiwan and Thailand – estimates that productivity per direct labor and output per square meter have increased by 69% and 75% respectively following the implementation of 5G-connected smart production lines.

- An Open RAN-compliant standalone private 5G network in Taiwan’s Pingtung County has facilitated a 30 percent reduction in pest-related agricultural losses and a 15 percent boost in the overall revenue of local farms through the use of 5G-equipped UAVs (Unmanned Aerial Vehicles), mobile robots, smart glasses and AI-enabled image recognition.

- JD Logistics – the supply chain and logistics arm of online retailer JD.com – has achieved near-zero packet loss and reduced the likelihood of connection timeouts by an impressive 70 percent since migrating AGV communications from unlicensed Wi-Fi systems to private 5G networks at its logistics parks in Beijing and Changsha (Hunan), China.

- Baosteel – a business unit of the world’s largest steelmaker China Baowu Steel Group – credits its 43-site private 5G deployment at two neighboring factories with reducing manual quality inspections by 50 percent and achieving a steel defect detection rate of more than 90 percent, which equates to $7 Million in annual cost savings by reducing lost production capacity from 9,000 tons to 700 tons.

- Dongyi Group Coal Gasification Company ascribes a 50 percent reduction in manpower requirements and a 10 percent increase in production efficiency – which translates to more than $1 Million in annual cost savings – at its Xinyan coal mine in Lvliang (Shanxi), China, to private 5G-enabled digitization and automation of underground mining operations.

- Sinopec’s (China Petroleum & Chemical Corporation) explosion-proof 5G network at its Guangzhou oil refinery in Guangdong, China, has reduced accidents and harmful gas emissions by 20% and 30% respectively, resulting in an annual economic benefit of more than $4 Million. The solution is being replicated across more than 30 refineries of the energy giant.

- Since adopting a hybrid public-private 5G network to enhance the safety and efficiency of urban rail transit operations, the Guangzhou Metro rapid transit system has reduced its maintenance costs by approximately 20 percent using 5G-enabled digital perception applications for the real-time identification of water logging and other hazards along railway tracks.

Some of the most technically advanced features of 5G Advanced – 5G’s next evolutionarily phase – are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For instance, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

The “Private 5G Networks: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, 16 vertical industries and five regional markets. The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,000 global private cellular engagements – including more than 2,200 private 5G installations – as of Q2’2024.

The key findings of the report include:

- SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Much of this growth will be driven by highly localized 5G networks covering geographically limited areas for high-throughput and low-latency Industry 4.0 applications in manufacturing and process industries.

- Sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced – 5G’s next evolutionarily phase – becomes a commercial reality.

- As end user organizations ramp up their digitization and automation initiatives, some private 5G installations have progressed to a stage where practical and tangible benefits are becoming increasingly evident. Notably, private 5G networks have resulted in productivity and efficiency gains for specific manufacturing, quality control and intralogistics processes in the range of 20 to 90%, cost savings of up to 40% at an intermodal terminal, reduction of worker accidents and harmful gas emissions by 20% and 30% respectively at an oil refinery, and a 50% decrease in manpower requirements for underground mining operations.

- Some of the most technically advanced features of 5G Advanced are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For example, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Spain, Netherlands, Switzerland, Finland, Sweden, Norway, Poland, Slovenia, Bahrain, Japan, South Korea, Taiwan, Hong Kong, Australia and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a significant presence in the private 5G network market, even in countries where shared and local area licensed spectrum is available. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to sliced hybrid public-private networks that integrate on-premise 5G infrastructure with a dedicated slice of public mobile network resources for wide area coverage.

New classes of private network service providers have also found success in the market. Notable examples include but are not limited to Celona, Federated Wireless, Betacom, InfiniG, Ataya, Smart Mobile Labs, MUGLER, Alsatis, Telent, Logicalis, Telet Research, Citymesh, Netmore, RADTONICS, Combitech, Grape One, NS Solutions, OPTAGE, Wave-In Communication, LG CNS, SEJONG Telecom, CJ OliveNetworks, Megazone Cloud, Nable Communications, Qubicom, NewGens and Comsol, and the private 5G business units of neutral host infrastructure providers such as Boldyn Networks, American Tower, Boingo Wireless, Crown Castle, Freshwave and Digita.

NTT, Kyndryl, Accenture, Capgemini, EY (Ernst & Young), Deloitte, KPMG and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) acquisition of Italian mobile core technology provider Athonet.

The service provider segment is not immune to consolidation either. For example, Boldyn Networks has recently acquired Cellnex’s private networks business unit, which largely includes Edzcom – a private 4G/5G specialist with installations in Finland, France, Germany, Spain, Sweden and the United Kingdom.

Among other examples, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – an Australian pioneer in private LTE and 5G networks, while mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless solutions provider Aqura Technologies.

The report will be of value to current and future potential investors into the private 5G network market, as well as 5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies and vertical applications.

References:

https://www.snstelecom.com/private5g

What is 5G Advanced and is it ready for deployment any time soon?

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

https://www.kyndryl.com/us/en/about-us/news/2024/02/it-ot-convergence-in-manufacturing

India Telcos say private networks will kill their 5G business

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Tech companies have been consistently laying off employees since late 2022. As of April 25th, some 266 tech companies have laid off nearly 75,000 workers in 2024, according to the independent layoff-tracking site layoffs.fyi. A total of 262,682 workers in tech lost their jobs in 2023 compared with 164,969 in 2022. The volume of layoffs in 2023 — a total of 1,186 companies — also surpassed 2022, when 1,061 companies in tech laid off workers — and that total was more than in 2020 and 2021 combined.

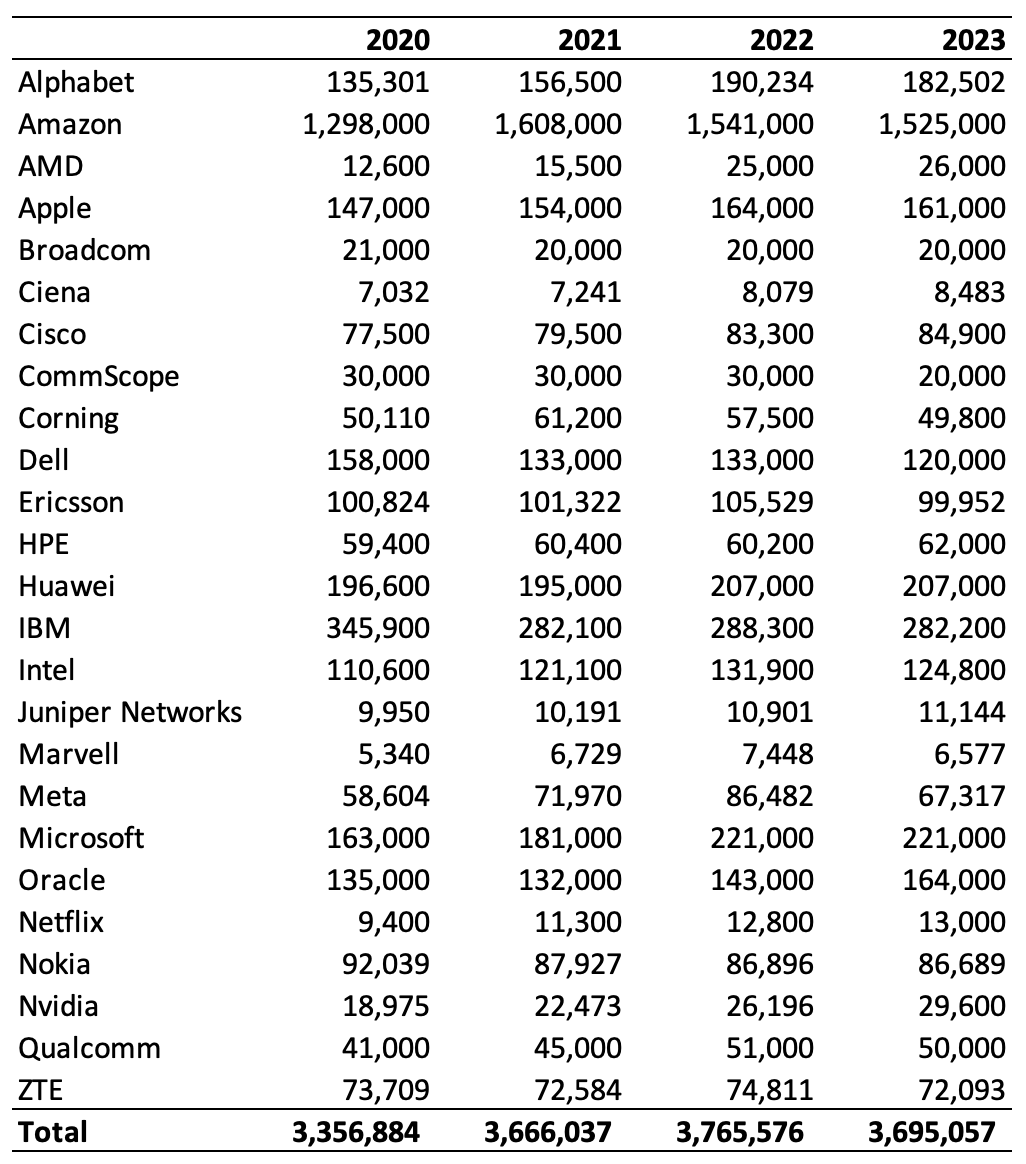

Big Tech companies Alphabet (Google’s parent), Amazon, Apple, Meta, Microsoft and Netflix, collectively cut nearly 45,500 jobs in their most recent full fiscal year. Since 2020, however, they have added more than 358,500, bringing total headcount to nearly 2,170,000. Excluding Amazon, which accounts for 70% of that figure, job numbers fell by around 29,700 last year but have grown by 131,500 since 2020 (data from earnings reports and SEC filings – see chart below).

- Today, Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. Operating income soared more than 200% in the period to $15.3 billion, far outpacing revenue growth, the latest sign that the company’s cost-cutting measures and focus on efficiency is bolstering its bottom line. AWS accounted for 62% of total operating profit. Net income also more than tripled to $10.4 billion, or 98 cents a share, from $3.17 billion, or 31 cents a share, a year ago. Sales increased 13% from $127.4 billion a year earlier.

- Google parent Alphabet also posted robust profits, with net income in the latest quarter soaring 57% to $23.7 billion while revenue grew 15% in the quarter. That’s despite job cuts of 12,115 and net headcount reduction of ~8,000 in 2023.

- Microsoft last week managed 20% year-over-year growth in third-quarter net income, to around $21.9 billion, on 17% growth in sales, to $61.9 billion. The number of Microsoft employees was unchanged in 2023 from the previous year, despite the company laying off 11,158 employees. Future headcount reductions may be necessary to help pay for Microsoft’s multi-billion-dollar splurge on AI and the data centers needed to train the Large Language Models and associated generative AI technology. But few expect job cuts to slow Microsoft down.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

As expected, telecom vendors, which have many fewer employees, than Big Tech had a higher percentage of job reductions. CommScope, Corning, Dell, Ericsson, and Nokia, suppliers to some of the world’s biggest telcos, shed nearly 36,500 jobs last year as large IT customers spent less on new equipment.

The following table shows the total number of jobs per year for many vendors/cloud service providers.

Source: Light Reading & company reports/SEC filings