Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

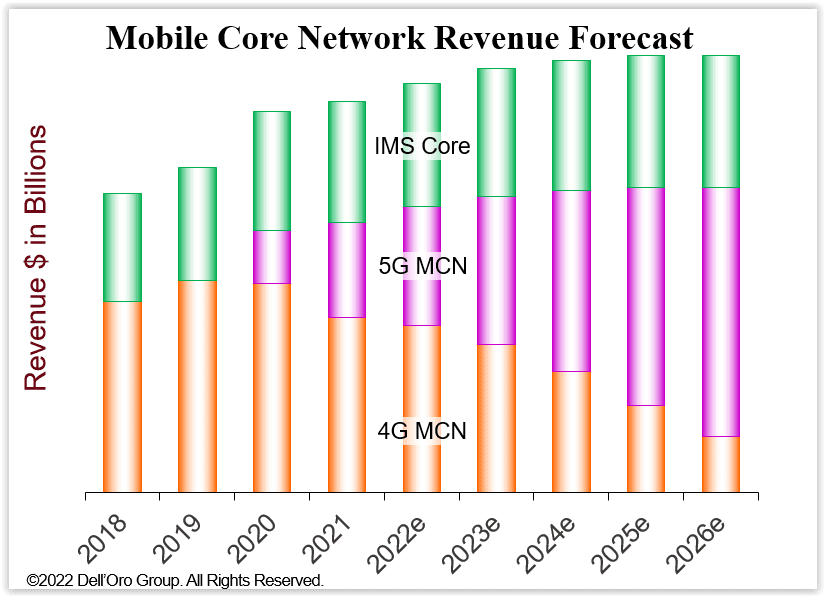

According to a newly published Dell’Oro Group report, Mobile Core Network (MCN) market growth will be decreasing. Worldwide MCN 5-year growth is now forecasted at a 2% compounded annual growth rate (CAGR), compared to our January 2022 forecast of 3% CAGR.

“The July 2022 forecast is more conservative than the January 2022 forecast due to industry headwinds, including supply chain challenges, higher inflation, an impending recession, Mobile Network Operators’ (MNO) challenges to increase revenues, and regional political conflicts,” said Dave Bolan, Research Director at Dell’Oro Group. “As a result, we reduced the 2022 to 2026 cumulative revenue forecast by 6 percent, decreasing revenues by $3.2 B. The July 2022 cumulative revenue forecast (2022-2026) is now $50.3 B resulting in a 2 percent CAGR.

“We are tracking the number of 5G Standalone (5G SA) MBB networks that have been launched commercially by MNOs. In the first half of 2022, only three new 5G SA networks were launched, KDDI in Japan, DISH Wireless in the US, and China Broadnet in China bringing the total deployed around the world to 27 MNO 5G SA MBB networks,” Bolan added.

Additional highlights from the MCN 5-Year July 2022 Forecast report:

- Year-over-year (Y/Y) MCN revenue growth rates for each year in the forecast are positive but will decrease each year; by 2026, Y/Y revenues will be essentially flat.

- MCN market CAGR forecast by industry segments we expect 5G MCN to be 21 percent, 4G MCN -20 percent, IMS Core 2 percent, and the User Plane Function (UPF) required for Multi-access Edge Computing (MEC) 67 percent.

- The North America and China regions are expected to have the lowest CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific without China regions are expected to have the highest CAGRs.

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year January Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected]

………………………………………………………………………………………………………………………………………………

In a related Dell’Oro “Private Wireless Advanced Research Report,” Stefan Pongranz states that private wireless radio access network (RAN) shipments and revenues are coming in below expectations, resulting in another decreased forecast.

“We have not made any changes to the potential market calculations and still estimate private wireless is a massive opportunity,” said Stefan Pongratz, Vice President at Dell’Oro Group. “At the same time, the message we have communicated for some time still holds – we still envision the enterprise and industrial play is a long game. This taken together with the fact that the standalone LTE/5G market is developing at a slower pace than previously expected forms the basis for the near-term downgrade,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward to reflect weaker than expected progress with private wireless LTE and 5G small cells.

- Total private wireless RAN revenues, including macro and small cells, are projected to roughly double between 2022 and 2026.

- Standalone private LTE/5G is now expected to account for a low single-digit share of the total RAN market by 2026.

Dell’Oro Group’s Private Wireless Advanced Research Report with a 5-year forecast includes projections for Private Wireless RAN by RF Output Power, technology, spectrum, and region. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, enterprise networks, data center infrastructure, and network security markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Industry Headwinds to Decrease Mobile Core Network Market Growth, According to Dell’Oro Group

Private Wireless Forecast Adjusted Downward, According to Dell’Oro Group

JD Power: US cellular network quality declines – users cite slow or failure to load content

US cellular network quality has recently declined, according to a new study released this week by J.D. Power. That metric comes as as more devices were loaded onto their respective networks and used for streaming and other types of data-hungry applications. The most common reported problem is slow or failure to load content.

“An uptick in wireless and device usage was bound to catch up to network quality,” said Ian Greenblatt, managing director at J.D. Power. “Wireless customers are increasingly adept in data usage and streaming, meaning they’re less inspired and more aware of problems. While the number of problems is significantly lower when 5G is available, the most influential problems on network quality ratings continue to be streaming audio and video quality, low loading times and calls not going through.”

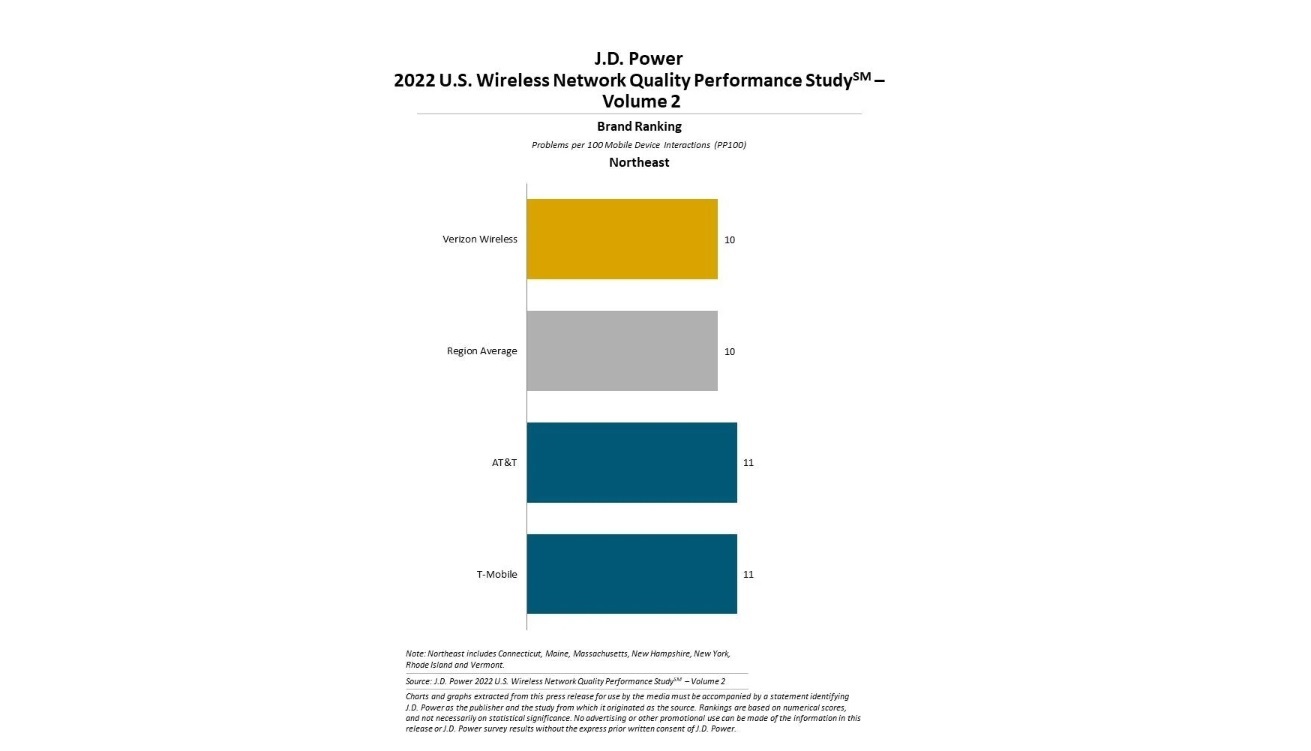

Verizon Wireless ranks highest in five regions evaluated in the study, achieving the fewest network quality problems per 100 connections (PP100) in call quality; messaging quality; and data quality in the Mid-Atlantic, North Central, Northeast, Southeast and West regions.

AT&T ranks highest or is tied in all factors in the Southwest region with a score of 11 PP100, achieving the fewest network quality problems in call quality in the region.

The 2022 U.S. Wireless Network Quality Performance Study—Volume 2 is based on responses from 34,174 wireless customers. Carrier performance is examined in six regions: Mid-Atlantic, North Central, Northeast, Southeast, Southwest and West. In addition to evaluating the network quality experienced by customers with wireless phones, the study also measures the network performance of tablets and mobile broadband devices. The study was fielded from January through June 2022.

By region, here’s how the network quality numbers compared:

- Mid Atlantic: regional average in V2 is 10; regional average in V1 was 9.

- North Central: regional average in V2 is 10; regional average in V1 was 9.

- Northeast: regional average in V2 is 10; regional average in V1 was 9.

- Southeast: regional average in V2 is 11; regional average in V1 was 10.

- Southwest: regional average in V2 is 12; regional average in V1 was 11.

- West: regional average in V2 is 11; regional average in V1 was 9.

For more information about the U.S. Wireless Network Quality Performance Study, visit

https://www.jdpower.com/business/resource/jd-power-wireless-network-quality-performance-study.

About J.D. Power:

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world’s leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

References:

Media Relations Contacts:

Geno Effler, J.D. Power; West Coast; 714-621-6224; [email protected]

John Roderick; East Coast; 631-584-2200; [email protected]

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network is just a month into the commercial launch of its cloud native based 5G core network, but is already planning how it will expand that architecture to take advantage of multi-cloud and hybrid cloud environments. DIsh is using Nokia’s cloud-native, 5G standalone core software which is deployed on the AWS cloud. This includes software for subscriber data management, device management, packet core, voice and data core, and integration services

During a Dish-Nokia fireside chat this Tuesday (sponsored by Nokia) on LinkedIn, Jitin Bhandari – CTO and VP, Cloud and Network Services, Nokia interviewed Sidd Chenumolu, VP of technology development and network services at Dish Wireless, provided some insight into the carrier’s current use of Amazon Web Services (AWS) public cloud resources.

Chenumolu said Dish’s 5G core was currently using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the local zones, but most were deployed with Nokia applications across AWS around the country.”

[AWS Outposts GM Joshua Burgin had previously explained to SDxCentral that Dish would be using a mixture of AWS Regions, Local Zones, and Outposts, specifically the smaller form factor AWS Outposts servers, to power its network. This includes the deployment of single 1U Outpost servers, some with an accelerator card, to run network functions in single-digit milliseconds at cell sites, he said in a phone interview.]

AWS Local Zones, which are built on Outpost racks and span 15 locations around the U.S., some of which were deployed to meet Dish’s demands, run Dish’s less latency-sensitive functions, Burgin explained. Dish’s operations and business support systems will run on AWS Regions.

“How to we deploy 5G SA core network on multi-cloud,” Sidd asked but did not answer. He then started to turn the tables and interview Jitin via a series of questions.

Chenumolu did not provide an update on Dish’s use of AWS’ Wavelength platform, which the cloud giant initially launched in partnership with Verizon to marry the network operators’ 5G networks with AWS’ edge compute service. Burgin had previously stated that support “could come down the line.”

The usual hype and back slapping/praise with glib expressions like “disintegrated disruptor, uncharted territory, automate learning with AI, cloud RAN,” etc. characterized the session.

References:

https://www.linkedin.com/video/event/urn:li:ugcPost:6945794807772438528/

https://www.sdxcentral.com/articles/news/dish-eyes-5g-multicloud-hybrid-cloud-expansion/2022/07/

Is AI the driving force behind the metaverse?

The metaverse is expected to become the next big breakthrough in the Internet’s evolution, with seemingly endless potential to transform how we live, transact, learn, and even benefit from government services.

Most current definitions for the metaverse include a long list of technologies and principles.

One definition tech experts seem to agree on is “an online 3D virtual world in which real people interact in real time to do an unlimited variety of virtual activities such as work, travel and play, all supported by its own digital economy.”

But making the metaverse a functional – albeit virtual – reality still requires significant advances in many different underlying technologies.

In some cases, these essential innovations are already underway. Meta (previously Facebook), for instance, introduced an AI supercomputer in January 2022, claiming a range of uses from ultrafast gaming to instant, accurate and simultaneous translation of large amounts of text, images and videos. The computer will also be key in developing next-generation AI models and become a foundation which future metaverse technologies can look to and build upon.

At the same time, consumer devices such as virtual reality (VR) headsets or smart glasses still fail to capture or transmit the full metaverse experience despite being available on the market today. New devices will need to be designed to provide a truly seamless experience for metaverse users. Another Meta invention, the haptic glove, is designed to enable users to touch and feel virtual objects in the metaverse.

Experts predict that the metaverse will be based on seven essential technologies: 5G communication, extended reality, brain-computer interfaces, cloud computing, blockchain, digital twins, and artificial intelligence.

Of these emerging technologies, AI may be the most crucial piece of the metaverse puzzle thanks to its potential to enable the metaverse to scale.

Deep learning-based software will likely power most interactions autonomously, with chatbots along with other types of natural language processing (NLP) technologies supporting all kinds of exchanges in this new extended reality space.

AI will also enable machines behind the metaverse to not only understand user inputs, from text to images and even videos, but also to respond correctly regardless of the user’s input language. However, this will require huge amounts of data and training such advanced NLP models is likely to take years.

In metaverse development, AI is not only a necessary technology in the areas of computer vision and natural language processing, but also in VR and augmented reality (AR). For example, in AR technology AI is used in camera calibration, detection, tracking, camera pose estimation, immerse rendering, real-world object detection, virtual object detection, and 3D object reconstruction, helping to guarantee the variety and usability of AR applications.

Eventually, most 3D images, animations, and speech in the metaverse will likely be generated by AI. Machine learning models could also be used to automate smart contracts, distributed ledgers and support other blockchain technologies to allow virtual transactions.

AI technology is also expected to help expand the metaverse by supporting object detection, improving rendering, and enabling cybersickness control and measurement. However, despite its promise and potential, the metaverse still has many challenges to overcome such as security risks and online abuse. Still, AI is likely to be among the technological tools that could be instrumental in overcoming those challenges.

To find out how current research is making the metaverse a reality, join ITU’s fourteenth academic conference: Kaleidoscope 2022: Extended reality – How to boost quality of experience and interoperability, taking place in Accra, Ghana, from 7 to 9 December at the Ghana-India Kofi Annan Centre of Excellence in ICT.

References:

Lumen Technologies expands Edge Computing Solutions into Europe

Lumen Technologies announced the expansion of its edge computing services into Europe. The low-latency platform businesses need to extend their high-bandwidth, data-intensive applications out to the cloud edge. This expansion is part of Lumen’s continued investment in next-generation solutions that transform digital experiences and meet the demands of today’s global businesses.

“Edge computing is a game-changer. It will drive the next wave of business innovation and growth across virtually all industries,” said Annette Murphy, regional president, EMEA and APAC, Lumen Technologies. “Customers in Europe can now tap into the power of the Lumen platform, underpinned by Lumen’s extensive fiber footprint, to deploy data-heavy applications and workloads that demand ultra-low latency at the cloud edge. This delivers peak performance and reliability, as well as more capability to drive amazing digital experiences. Customers can focus efforts on developing applications and bringing them to market, rather than on time-consuming infrastructure deployment.”

Today, Lumen Edge Computing Solutions can meet approximately 70% of enterprise demand within 5 milliseconds of latency in the UK, France, Germany, Belgium, and the Netherlands. Additional locations are planned by end of year. Lumen Edge Computing Solutions bring together the power of the company’s expansive global fiber network, on-demand networking, integrated security, and managed services, with edge facilities and compute and storage services. This allows for quick and efficient deployment of applications and workloads at the edge, closer to the point of digital interaction. Customers can procure Lumen Edge Computing Solutions online, and within an hour gain access to high-powered computing infrastructure on the Lumen platform.

Lumen offers several edge infrastructure and services solutions to support enterprise innovation and applications of the 4th Industrial Revolution. These include:

- Lumen Edge Bare Metal offers dedicated, pay-as-you-go server hardware hosted in distributed locations and connected to the Lumen global fiber network. Edge Bare Metal delivers enhanced security and connectivity with dedicated, single tenancy servers designed to isolate and protect data and deliver high-performance.

- Lumen Network Storage enables customers to take advantage of secure, scalable, and fast storage where and when they need it. The service allows enterprises and public sector organizations to ingest and update data at the edge using whatever file storage protocol meets their needs.

- Lumen Edge Private Cloud provides pre-built infrastructure for high performance private cloud computing connected to the Lumen global fiber network. Lumen Edge Private Cloud is fully managed by Lumen and helps businesses go-to-market quickly with the capacity needed for interaction-intensive applications.

- Lumen Edge Gateway is a scalable Multi-access Edge Compute (MEC) platform for the premises. The service offers a compute platform for the delivery of virtualized wide area networking (WAN), security, and IT applications from multiple vendors on the premises edge.

Key Facts:

- Lumen Edge Computing Solutions meet approximately 97% of U.S. enterprise demand and approximately 70% of enterprise demand in the UK, France, Germany, Belgium, and the Netherlands within 5 milliseconds of latency.

- For a current list of live and planned Lumen edge locations, visit: https://www.lumen.com/en-uk/resources/network-maps.html#edge-roadmap

- As part of the Edge Computing Solutions deployment in Europe, Lumen enabled an additional 100G MPLS and IP network connectivity, as well as increased power and cooling at key edge data center locations.

- Lumen manages and operates one of the largest, most connected, most deeply peered networks in the world. It is comprised of approximately 500,000 (805,000 km) global route miles of fiber and more than 190,000 on-net buildings, seamlessly connected to 2,200 public and private third-party data centers and leading public cloud service providers.

- In EMEA, the Lumen network is comprised of approximately 42,000 (67,000 km) route miles of fiber and connects to more than 2,500 on-net buildings and 540 public and private third-party data centers.

Additional Resources:

- Lumen Edge Computing Solutions: https://www.lumen.com/en-us/solutions/edge-computing.html

- Lumen Edge Bare Metal: https://www.lumen.com/en-us/edge-computing/bare-metal.html

- Lumen Network Storage: https://www.lumen.com/en-us/hybrid-it-cloud/network-storage.html

- Lumen Edge Private Cloud: https://www.lumen.com/en-us/hybrid-it-cloud/private-cloud.html

- Lumen Edge Gateway: https://www.lumen.com/en-us/edge-computing/edge-gateway.html

About Lumen Technologies and the People of Lumen:

Lumen is guided by our belief that humanity is at its best when technology advances the way we live and work. With approximately 500,000 route fiber miles and serving customers in more than 60 countries, we deliver the fastest, most secure platform for applications and data to help businesses, government and communities deliver amazing experiences.

References:

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Despite no work even started by ITU-R WP 5D (responsible for all IMT xG’s), global technology intelligence firm ABI Research expects that 75% of 5G base stations will be upgraded to 5G-Advanced by 2030, five years after the estimated commercial launch in 2025.

3GPP approved their Release-18 package in December 2021, making the official start of 5G-Advanced with the planned freeze date in December 2023.

But that really doesn’t mean much since Release-16 was frozen in June 2020, yet 2+ years later the spec for URLLC in the RAN has not been completed. As a result, neither 3GPP or ITU-R recommendation M.2150 (formerly IMT 2020) meets the ITU-R M.2410 performance requirements for URLLC use case. Also, less than 5% of deployed 5G networks are 5G SA with a 5G Core network, which is required for implementation of ALL 5G features, e.g. network slicing, security, automation, as well as MEC.

Some network operators like Verizon have already admitted that it could take up to a decade before they profit from their 5G investments.

ABI Research claims that 5G-Advanced will bring continuous enhancements to mobile network capabilities and use case-based support to help mobile operators with 5G commercialization, long-term development of Artificial Intelligence (AI)/Machine Learning (ML), and network energy savings for a fully automated network and a sustainable future.

“In 5G-Advanced, Extended Reality (XR) applications will promise monetary opportunities to both the consumer markets with use cases like gaming, video streaming, as well as enterprise opportunities such as remote working and virtual training. Therefore, XR applications are a major focus of 3GPP working groups to significantly improve XR-specific traffic performance and power consumption for the mass market adoption,” explains Gu Zhang, 5G & Mobile Network Infrastructure Principal Analyst at ABI Research. “Another noticeable feature is AI/ML which will become essential for future networks given the predictive rapid growth in 5G network usage and use case complexities which can’t be managed by legacy optimization approaches with presumed models. System-level network energy saving is also a critical aspect as operators need to reduce the deployment cost but assure network performance for various use cases.”

The upgrade of 5G network infrastructure is expected to be faster in the consumer market than in enterprises. ABI Research forecasts that 75% of 5G base stations will be upgraded to 5G-Advanced, while in the enterprise market the ratio is about half. 5G-Advanced devices per radio base station will quickly gain traction around 2024 to 2026 at the early stage of the commercial launch because devices will grow more aggressively than network deployments over the period.

“The commercial launch of 5G-Advanced will take two or three years, but the competition has already started, Zhang points out. “Taking AI/ML development as an example, industrial leaders such as Ericson, Huawei, Nokia, ZTE, and Qualcomm have trialed their solutions with mobile operators across the world. Ongoing development in this area will continue to bring improvements on traffic throughputs, network coverage, power saving, anomaly detection, etc.”

Different from previous generations, 5G creates an ecosystem for vertical markets such as automotive, energy, food and agriculture, city management, government, healthcare, manufacturing, and public transportation. “The influence on the domestic economy from the telco players will be more significant than before and that trend will continue for 5G-Advanced onward. Network operators and vendors should keep close to the regulators and make sure all parties involved grow together when the time-to-market arrives,” Zhang concludes.

These findings are from ABI Research’s 5G-Advanced and the Road to 6G application analysis report. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and ABI Insights. Application Analysis reports present in-depth analysis on key market trends and factors for a specific technology.

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.sdxcentral.com/articles/analysis/5g-advanced-evolution-advances-abi-says/2022/07/

WOW now offers 1.2G bps download speeds in all markets it serves

WOW! Internet, Cable & Phone, a leading broadband services provider, today announced the launch of its 1.2 Gig high speed data tier in all markets it serves. This highest speed tier is available for all new WOW! residential customers and available as an upgrade for existing residential customers.

The new speed tier offers 1.2 G Mbps download speeds and 50 Mbps upload speeds to support even faster Internet capabilities for residential customers – for work, entertainment, connecting with friends and family, and more – enabling simultaneous streaming, instantaneous downloads, professional-level gaming, and frictionless livestreaming.

“As part of our dedication to bringing customers the fastest, most reliable broadband speeds available, we’re now able to offer our fastest speeds yet across our markets with 1.2 Gig service,” said Henry Hryckiewicz, chief technology officer for WOW!. “Our ability to offer these speeds is just the latest demonstration of the deep capabilities available with our robust fiber network. Our customers now have even more options for staying connected and we look forward to seeing them benefit from it.”

Ongoing effects from the pandemic have reinforced WOW!’s commitment to bring even faster speeds to customers. With changing dynamics for how we work, learn and play, consumers need a reliable internet connection, with 81 percent of adults saying they’ve used bandwidth-hungry video calls since the onset of the pandemic according to Pew Research Center.

Along with its blazing fast 1.2 Gig speeds, WOW! is offering a free modem for the duration that the customer is subscribed to the plan, unlimited data usage where applicable and a $5.00 AutoPay discount.

WOW! is one of the nation’s leading broadband providers, with an efficient, high-performing network that passes 1.9 million residential, business and wholesale consumers. WOW! provides services in 14 markets, primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia. With an expansive portfolio of advanced services, including high-speed Internet services, cable TV, phone, business data, voice, and cloud services, the company is dedicated to providing outstanding service at affordable prices. WOW! also serves as a leader in exceptional human resources practices, having been recognized eight times by the National Association for Business Resources as a Best & Brightest Company to Work For, winning the award for the last four consecutive years. SOURCE WideOpenWest, Inc. Please visit wowway.com or call 800-560-1824 for more information. Areas served by WOW:

References:

More KPN customers use fiber vs copper for broadband services in Nederlands

Dutch network operator KPN announced a new milestone on its fixed network: more customers are using fiber services than the old copper infrastructure for the first time. The disclosure was made in an internal announcement obtained by Telecompaper. KPN is seeing a steady increase in fiber orders in its consumer/residential market. The company said around 65% of orders are fiber and 35% for services on copper lines (DSL or POTs).

According to the Q1 Dutch Consumer Broadband report [1.], KPN had roughly the same number of residential DSL and fiber subscribers at the end of March, with just over 1.3 million lines each. While it has been adding fiber optic subscribers steadily each quarter, DSL losses remain slightly greater when including its second brand. The total consumer fixed broadband base has been flat (0% growth) over the past year.

Note 1. This Telecompaper report analyses developments in the first quarter of 2022 in the Dutch market for broadband internet access, focusing on consumer connections. The report further includes data on developments, fixed market revenues and broadband revenues. The findings are compared with results from previous periods. The analysis is based on Telecompaper’s continuous research into the development of the Dutch broadband communication services market. The focus is on cable network operators (Ziggo, Delta, Caiway), DSL providers (KPN, T-Mobile, Tele2, Online.nl, Budget Thuis) and FTTH providers (including KPN, T-Mobile, Caiway, Delta, Tele2, Online.nl, Budget Thuis).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Babak Fouladi, KPN’s Chief Technology & Digital Officer and member of the Board of Management, spoke at the Telecom Insights 2022 conference in May. He said:

“Telecom networks are essential and vital, and we do not only literally ensure that the world remains connected to everything and everyone. Our networks also support massive digitization, essential in crisis situations since online access is often the only door to the outside world and contact with others. Our networks enable people to work from home, study online or continue doing business. In addition, the digital infrastructure contributes to the global economy and to keeping healthcare and education affordable. And our infrastructure makes a structural contribution to reducing CO2 emissions, the use of fossil fuels and cleaner air. Digitization is more and more important as accelerator for sustainability.”

He concluded his speech with an appeal to the Dutch telecom sector: “Let’s make the Netherlands the best connected country in the world! Let’s make it happen, together.”

References:

https://www.overons.kpn/nieuws/en/lets-make-the-netherlands-the-best-connected-country-in-the-world/

Swisscom tests 50G PON technology on a live network

State-owned network provider Swisscom has begun testing 50G PON technology in the live network of an unnamed Swiss municipality, after putting it through its paces in a laboratory in 2020 – the first telco in the world to do so, it claims. Swisscom believes 50G PON will lead to increased flexibility for its business customers, facilitating, for example, additional security features.

Swisscom claims that “50G-PON will lead to a new kind of flexibility in high-speed connectivity, chiefly for business customers, paving the way for additional security service features or connection service attributes. For example, the technology significantly reduces latency compared to today’s standards, and guaranteed transmission speeds can be defined by network slicing (NOTE: network slicing requires a 5G SA Core network and is not intended for fiber optics networks). These are just a few examples that, thanks to 50G-PON, can be included in considerations for new products and services aligned to business customer requirements in the coming years.”

Swisscom plans to introduce the technology by 2025 at the latest. PON technologies can be used in both point-to-point and point-to-multipoint networks. The passive splitter is placed in a point-to-point network rather than in the cable conduit at the control center.

References:

https://www.swisscom.ch/en/about/news/2022/07/11-neuster-glasfasertechnologie.html

https://www.swisscom.ch/en/about/network.html

USTelecom Broadband Pricing Index (BPI): substantial price reductions for broadband access

While U.S. inflation in 2022 has soared to a 40+ year high (at 8.6% YoY), the price of broadband internet access is still falling and consumers are getting even more for less.

USTelecom’s latest analysis of the broadband marketplace: 2022 Broadband Pricing Index (BPI). This year’s report finds pricing for the most popular and highest-speed broadband internet services continues to decline while value continues to increase. The research compares prices over two time periods: the year-over-year price difference from 2021-2022; and a longer-term view of price changes between 2015 and 2022.

The third installment of the USTelecom Broadband Pricing Index (BPI) reveals continued substantial price reductions for both the most popular and highest-speed broadband internet services.

As in previous years, the BPI uses FCC and other public data sources to assess recent trends in residential fixed broadband pricing in the United States. The 2022 edition of the BPI compares prices over two time intervals:

- The price difference from 2021-2022

- A longer-term view in price changes between 2015 and 2022

In both cases, as in the past, the BPI creates an index that allows comparisons between the most popular speed tiers in each year (BPI-Consumer Choice) and the highest speed tiers in each year (BPI-Speed).

Key Findings of the Report:

Broadband Pricing Ran Counter to Significant Overall Inflation in the Past Year

- Real BPI-Consumer Choice broadband prices dropped by 14.7% from 2021-2022

- Real BPI-Speed broadband prices dropped by 11.6% from 2021-2022

- In contrast, the cost of overall goods and services rose by 8% from 2021-2022

Historical Broadband Pricing Analysis Shows Real Broadband Prices Have Been Cut in Half from Seven Years Ago

- Real BPI-Consumer Choice tier prices dropped by 44.6% from 2015-2022

- Real BPI-Speed tier prices dropped by 52.7% from 2015-2022

The Consumer Value of Broadband Service Has Never Been Higher

- Providers have increased the speeds of their broadband offerings. When combined with the price drops for that service, the overall value to customers (measured on a dollars/megabit basis) shows a dramatic improvement over the past seven years.

- The real cost per megabit of both the most popular and fastest service offerings have dropped by around 75% since 2015. This gives the consumers a boost in their wallet and in their daily online performance.

References:

https://ustelecom.org/wp-content/uploads/2022/06/USTelecom-Broadband-Pricing-Report2022.pdf