Analysys Mason Open Network Index: survey of 50 tier 1 network operators

Open networks apply proven cloud concepts to the networking domain while enabling components to be sourced from a broad ecosystem of vendors. Open networks boast high levels of automation and programmability and are built around the concept of utilizing a common, horizontal cloud platform that supports cloud-native network functions from multiple vendors and from multiple network domains. Network operators can enhance the flexibility, agility, composability, innovation and operational efficiency of their networks by implementing open architectures and open operating models.

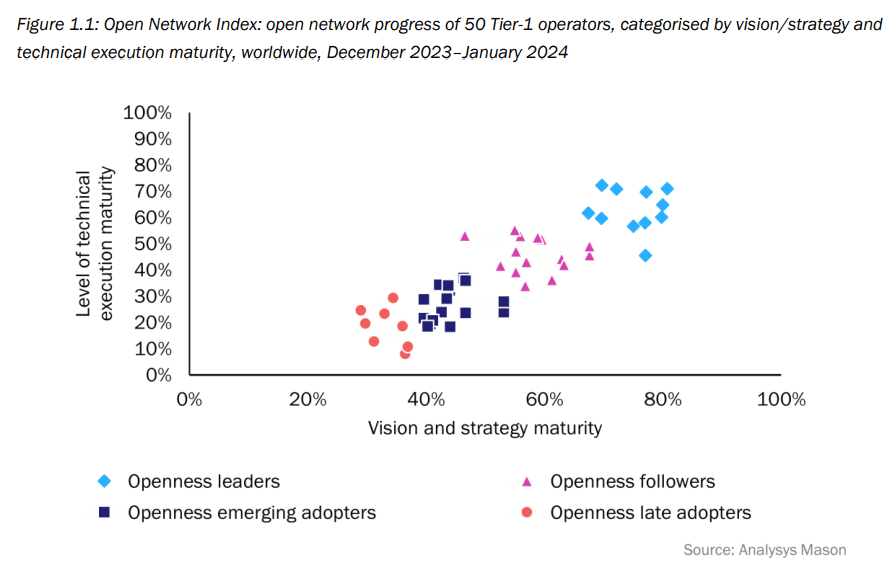

According to a survey conducted by Analysys Mason, ninety percent of global telecom service providers believe open networks are critical to their survival. However, only 20% have an open network strategy in place. Analysys Mason surveyed 50 leading Tier-1 operators worldwide between December 2023 and January 2024.

The analysts then benchmarked operator progress from a vision/strategy perspective and a technical perspective to form the first iteration of Analysys Mason’s Open Network Index (ONI). The survey and report were commissioned by Dell Technologies, but Analysys Mason says it does not endorse any of the vendor’s products or services.

The market research firm defines open networks as those based on non-proprietary technologies and standards, including open hardware and software developed by open communities, as well as software technologies that individual vendors are exposing, typically through open application programming interfaces (APIs), to anyone who wants to use them.

“Operators need to urgently develop an openness strategy and ensure that they approach openness in the right way,” the report authors said.

The analysts said that overall, survey respondents displayed a strong willingness to align themselves with open networking principles. But the technical implementation of open network architectures remains challenging.

The survey results partitioned the 50 network operators into four distinct categories:

- Openness leaders have a deep commitment to open networks and are supported at the highest levels of the organization. This category includes a higher proportion of operators from developed Asia–Pacific (APAC) than in any of the following categories.

- Openness followers are implementing aspects of open networks, but they take a more tactical approach because they lack the strong level of senior executive support that the openness leaders enjoy.

- Openness emerging adopters are operators that are just starting their journey. The category includes operators from developing markets that have a vision but have not yet started to deploy the architectures. The category also includes cautious adopters with lower ambitions for open networks.

- Openness late adopters do not have a clear concept of what an open network is, and they have not yet started to formulate a strategy for achieving openness or to win senior executive support. They have a low appetite for risk and perceive significant risks associated with moving away from incumbent vendors.

Many operators have strong engagements with well-established telecoms industry bodies such as the GSMA and the TM Forum. These bodies have traditionally aimed to improve standardisation and foster multi-vendor interoperability, but their activities in the areas of open cloud platforms and open operating models have been somewhat peripheral. Operators should deepen their involvement with initiatives such as the Cloud Native Computing Foundation (CNCF), Nephio and Sylva, which champion open infrastructure and open operations, and support the fundamentals of horizontal cloud platforms.

In addition, operators should engage with the O-RAN Alliance (which is NOT a standards body/SDO), which is leading multi-vendor Open RAN interface and interoperability standards, with these standards leveraging distributed, cloud-native-based architectures. Participation in these initiatives facilitates knowledge sharing, enables operators to shape future standardization efforts and empowers operators to exert greater influence over their vendors.

References:

https://www.analysysmason.com/operator-network-index-rma16-rma18

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

China Telecom and China Mobile invest in LEO satellite companies

Two of China’s state-owned telcos have taken stakes in new LEO satellite companies.

- China Telecom has set up a new fully owned subsidiary, Tiantong Satellite Technology Co., registered in Shenzhen with 1 billion Chinese yuan (US$138 million) paid-in capital. China Telecom, which is currently the only operator with a mobile satellite license, operates three Tiantong Geo orbit satellites, launched between 2016 and 2021, covering China, the western Pacific and its neighbors.

- In April China Mobile took a 20% stake in a new RMB4 billion ($551 million) state-owned company, China Shikong Xinxi Co., registered in Xiongan. China Satellite Network Group, the company behind Starnet, China’s biggest LEOsat project, will own 55%, and aerospace contractor Norinco, a 25% shareholder.

China Telecom will shutter its legacy satellite subsidiary, established in 2009, and transfer the assets into the new company.

The other new business, China Shikong, lists its scope as satellite communication, satellite navigation and remote sensing services.

The two investments come as China Starnet is readying to launch its first satellites in the second half of the year. It is aiming to build a constellation of 13,000, with the first 1,300 going into operation over the next five years, local media has reported.

In addition to Starnet, two other mass constellations are planned – the state-owned G60 and a private operator, Shanghai Hongqing. Neither has set a timetable. They will be playing catch up with western operators like Starlink and OneWeb, which are already operating thousands of commercial satellites.

Since foreign operators are forbidden from selling into China, it is not yet clear how China is going to structure its LEO satellite industry and what role precisely the new operators are going to play.

References:

Chinese telcos tip cash into satellite (lightreading.com)

China Mobile launches LEO satellites to test 5G and 6G – Developing Telecoms

Very low-earth orbit satellite market set to reach new heights | TelecomTV

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

LEO operator Sateliot joins GSMA; global roaming agreements to extend NB-IoT coverage

Momentum builds for wireless telco- satellite operator engagements

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Overview and Backgrounder:

Exolaunch, a global leader in launch mission management, integration, and satellite deployment services, today announced a new launch and deployment services agreement with Sateliot [1.], which claims to be the first company to operate a low Earth orbit (LEO) 5G NB-IoT satellite constellation. It’s the first collaboration between the two companies.

Note 1. Sateliot is based in Barcelona, Spain and San Diego, CA. The start-up company is backed by strong investors such as Evonexus (investment arm of Qualcomm and Verizon among others), Banco Santander, CELLNEX and INDRA, and partners of the GSMA and the ESA (European Space Agency).

Sateliot claims to be a “trailblazer in facilitating connectivity for all current narrowband IoT (NB-IoT) devices via satellite through its constellation.”

Sateliot is building a constellation of 250 unique satellites enabling 5G NB-IoT connectivity from space, revolutionizing connectivity solutions globally. Under the terms of this agreement, Sateliot is set to deploy four additional satellites to join its growing 5G IoT constellation, utilizing Exolaunch’s industry-leading services and hardware.

The constellation of LEO satellites will enable Sateliot to offer services at comparable costs to those of terrestrial cellular networks, a significant stride towards widespread adoption of IoT in previously inaccessible regions.

Sateliot’s four 6U satellites, named Sateliot_1, Sateliot_2, Sateliot_3, and Sateliot_4, are manifested via Exolaunch on the Transporter-11 Rideshare mission with SpaceX, which is slated to launch in mid-2024. Sateliot will benefit from Exolaunch’s renowned mission management services and integration support, and will leverage Exolaunch’s innovative and flight-proven containerized satellite separation system, the EXOpod Nova, for the deployment of its satellites.

………………………………………………………………………………………………………..

About Sateliot’s Technology:

Sateliot’s solution is based on 5G NB-IoT in 3GPP Rel 17 NTN (Non Terrestrial Network). The company says that is “a clear minimum workable solution under 5G ecosystem.” The claim “5G from space,” is based on the use of LEO satellites for connectivity- not HAPS or other NTN types.

While 3GPP Rel 19 (to be completed December 2025) will provide a complete solution, Sateliot says that is not needed now to offer a minimum workable solution, via 3GPP Rel 17 NTN. This minimum workable Rel 17 NTN solution is related to NB-IoT only, so, there is no need to wait for Rel 18 or Rel 19. Sateliot has already found a commercially available chipset and RF module from its main vendor.

………………………………………………………………………………………………………………..

Non-Terrestrial Networks (NTN) for Internet of Things (IoT) Phase 3:

With IoT-NTN specified in 3GPP RAN Rel-17, with optimizations following in Rel-18, commercial deployments are now ongoing. Now, further evolution of IoT-NTN is underway with a dedicated Rel-19 work item, focusing in on three areas:

- Support of Store & Forward (S&F) operation based on regenerative payload, including the support of feeder link switchover.

- Uplink capacity enhancements.

3GPP R19 is part of the 3GPP’s “5G Advanced” releases, which are intended to improve network performance and support new applications and use cases.

…………………………………………………………………………………………………………..

Quotes:

“Partnering with Exolaunch marks a significant milestone for Sateliot as we continue our mission to revolutionize 5G IoT connectivity from space. With Exolaunch’s expertise and industry-leading services, we are confident in the successful launch and deployment of our next four satellites, further advancing our vision of ubiquitous IoT connectivity,” remarked Jaume Sanpera, chief executive officer at Sateliot.

“We are delighted to welcome Sateliot as our newest customer and partner,” said Pablo Lobo, mission manager at Exolaunch. “This agreement highlights Exolaunch’s dedication to facilitating the growth and success of innovative European companies like Sateliot. Exolaunch is proud to provide our industry-leading services and technology to support Sateliot’s vision of advancing 5G IoT connectivity from space. With the launch campaign underway, our team’s excitement for this mission is palpable and we look forward to a smooth and successful deployment of these satellites later this year.”

……………………………………………………………………………………………………

References:

https://www.3gpp.org/news-events/3gpp-news/5g-ntn

LEO operator Sateliot joins GSMA; global roaming agreements to extend NB-IoT coverage

Momentum builds for wireless telco- satellite operator engagements

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

Point Topic forecasts 1.39 billion fixed broadband connections by the end of the decade in the 29 largest broadband markets in the world. Fiber to the Premises (FTTP) is already dominating most of the markets and it will be the preferred option for most consumers, where it is available.

Between 2023 and 2030 Point Topic projects a 15% growth in total fixed broadband subscribers in the top 29 markets. The growth will come mainly from FTTP – although the increase in the total fiber lines will be lower than that in Fixed Wireless Access lines – 25% and 61% respectively, the sheer number of already existing and new FTTP connections will drive the total growth.

Figure 1. Fixed broadband lines by technology (Top 29 markets)

………………………………………………………………………………………………………..

Split by technology we estimate that by 2030 there will be 1.12 billion FTTP, 149 million cable, 79 million FTTX, 16 million FWA[1] and only 28 million DSL lines in these markets.

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)Cable is a term used as a proxy for those legacy MSOs/cablecos (e.g. Charter, VMO2, Comcast, etc.) that still have significant networks based on coaxial cable, mainly DOCSIS 3.0 and 3.1. We forecast some decline (-6%) in cable broadband lines by the end of the decade as these networks are being replaced with full fibre. The new generation DOCSIS4, which is in development, will match the capabilities of FTTH with XGPON, so markets with established cable networks will see a slight growth or stable take-up figures for ‘cable’ broadband lines.

FTTX (where fibre is present in the local loop with copper, mainly fiber to the cabinet) will decline over the next seven years (-19%). Some modest growth from new subscribers will remain in a few markets where legacy infrastructure is still widespread. Also, it will remain a cheaper option even where other technologies are available as it still offers enough bandwidth for some users.

DSL will see the largest decline at -44%. However, while being a slower and less reliable solution, it can provide enough bandwidth at a low price to some single or older households that are reluctant to upgrade. Besides, some of them will not have a choice of other technologies, especially in certain regions and markets.

………………………………………………………………………………………………………………

Figure 3. Fixed broadband penetration, 2023 and 2030 (top 29 markets)

…………………………………………………………………………………………………………………………

Point Topic only included FWA in its data in significant markets and where it was able to source reliable figures, such at the U.S., Canada, and Italy. Therefore, the total number of FWA subscribers could end up higher if FWA takes off in other markets.

In the U.S., T-Mobile US and Verizon are the FWA leaders with 8.6 million connections between them as of March 2024. T-Mobile recently added a new FWA service offer to its portfolio aimed at customers who might need a back-up for unreliable fiber or cable connections.

……………………………………………………………………………………………………………………..

China will be among the 16 markets with 90%-plus broadband penetration in seven years time. The potential for signing up new customers in those markets will shrink, leaving broadband providers with the task of converting existing customers to higher bandwidths and more advanced technologies for growth.

At the other end of the scale, there is still lots of room for broadband growth. India will have the lowest percentage of premises with a fixed broadband connection by 2030 at 33%, up from just 11% last year.

“There is significant growth to come in the ‘youthful’ markets with low fixed broadband penetration, with plenty of consumers in India, Indonesia and other fast-growing economies hungry for the advantages offered by fixed broadband and full fibre in particular,” Point Topic said.

……………………………………………………………………………………………………………………..

References:

https://www.point-topic.com/post/fttp-broadband-subscriber-forecasts-q4-2023

https://www.telecoms.com/fibre/fibre-to-drive-15-broadband-growth-by-2030

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

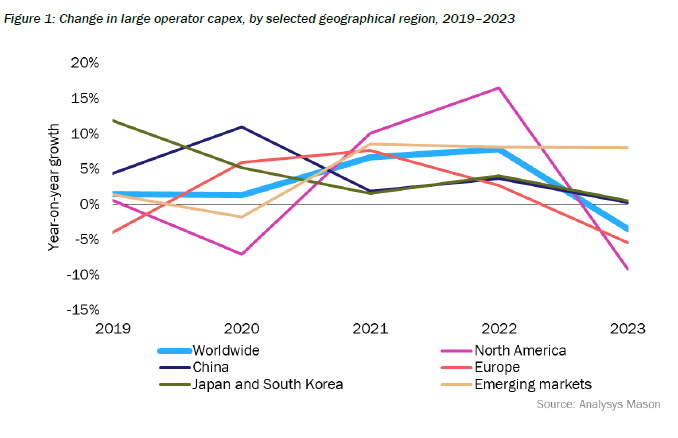

Telco capex declined worldwide in 2023, and predictions in end-of-financial year results indicate further declines this year. Analysys Mason warns that a “long decline” in capital expenditure has now started. “There will not be a cyclical recovery,” says one subhead (see below). Analysys Mason crunched a lot of numbers to arrive at this conclusion, processing historical data for about 50 of the largest operators in the world. Importantly, it also looked at the long-term guidance issued by those companies. Capex has peaked partly because telcos in many regions have completed or are near completing a once-in-a-lifetime upgrade to full-fiber networks. Clearly, that’s bad news for companies selling the actual fiber. Operators will continue to invest in the active electronics for these lines, but that represents a “tiny fraction” of the initial cost.

This new Analysys Mason gloomy CAPEX forecast comes after Dell’Oro and Omdia (owned by Informa) previously forecast another sharp fall in telco spending on mobile network products this year after the big dip of 2023.

Figure 1. below aggregates change in capex, excluding spectrum, in 2023 (or FY2023/2024) for 50 of the largest operators in the world, all with annual capex of over USD1 billion in 2023. These operators account for about 78% of telecoms capex worldwide. Of the 42 operators that provided guidance on capex in 2024, 28 forecast a fall. A notable class of exceptions consisted of cable operators and latecomers to FTTP upgrade, but most of the emerging-market-focused operators indicated a decline.

The steepest decline was in North America. The decline was steeper for the three largest mobile network operator (MNO) groups (–18.1%). This was offset by rises in capex by the two large US cablecos, for which upgrades of HFC plant are now an imperative. The obvious reason for the sharp decline is the near-completion of 5G roll-out, although FTTP capex remains flat.

In China, capex was flat overall. This disguises a decline in 5G and fixed broadband capex, which, taken together with transmission, fell 7% in 2023. The delta of capex has gone on what operators call ‘computility’ (compute power in data centers and edge) and capabilities (developing the ability to serve mainly the industrial enterprise). Together these two items now account for about 35% of operator capex.

In Japan and South Korea, capex was also more or less flat (+0.5%). As in China, a high proportion of capex in Japan now goes on adjacent lines of business.

Capex declined by 5.5% in Europe. The European figure disguises the impact of the large number of smaller players in the continent. 5G spending has peaked, but so too has FTTP spending. FTTP spend represents a very high share of capex in Europe (about one half), although this is distributed differently across individual countries. Countries like France and Spain have passed that peak, but even in the UK, a relatively late starter, spend has plateaued. Among operators in emerging markets, the smallest group in absolute capex terms, there was a rise of 8%, steady now for three years running, driven almost entirely by India, and offset by declines elsewhere.

There will not be cyclical recovery of capex:

Operators’ longer-term projections of capex suggest, if anything, steepening declines in capex. Our forecasts indicate that capital intensity (capex/revenue) will fall from around 20% now to 12–14% by the end of the decade. Capex will fall basically because customers do not need more than the 1Gbit/s fibre and unlimited 5G that the current networks are easily capable of delivering, and growth in measurable demand slows every year. This will have the following effects:

•Fall in fixed access spend. Capex on FTTP is essentially a one-off investment in passive assets with very long useful lives. Future capex on upgrades (in effect replacements) of FTTP actives will come at a tiny fraction of this cost. The pipeline of plans for commercial build is running dry, although this is offset by some hefty subsidies for rural build, particularly in the USA. Those cablecos that have not already started will have to brace themselves for programs of replacement of HFC/DOCSIS by FTTP/xPON.

•We expect only limited uplift for 5G SA/5G Advanced. This is in part because some operators will not be able to justify a further upgrade after 5G NSA, in part because of slack demand, and in part because the sums involved will be lower than for the roll-out of 5G NSA.

•6G will not be capex-intensive. There is little appetite in free-market economies without centralised planning (and perhaps not so much even there) for a capex-intensive generational upgrade to 6G. There will be no cyclical uplift.

•There will be more outsourcing, i.e. replacement of capex by an opex line. This occurs mainly in infrastructure, but also in migrations of operations (IT capex) to the cloud. Yet this does not mean that capex is simply shifting from one class of business to another; infra companies exist in a world with similar constraints.

•In these circumstances there is a clear case for capex investment in anything that maximizes the efficient (and sustainable) use of the physical assets as they stand, and unlocks any opportunities that exist in new business-models. This is prominent in many operator outlooks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

William Webb, an independent consultant and former executive at UK telecom regulator Ofcom, forecasts an S-curve flattening by 2027. In a forthcoming book called “The end of telecoms history,” Webb returns to predictions he first made in 2016 to gauge their accuracy. Using recent historical data from Barclays, he was able to show a close alignment with the S-curve he drew about eight years ago. If this behavior continues, growth rates “will fall to near zero by around 2027, with significant variations by country,” says Webb in his book, giving a sneak preview to Light Reading.

Webb’s broad rationale is that there is an upper limit on daily gigabyte consumption, just as there is only so much the average person can eat or drink. All Webb had to do was assume there will be some future gorging by customers on high-quality video, the most calorific meal for any smartphone. “Once they are watching video for all their free moments while downloading updates and attachments there is little more that they could usefully download,” he writes.

What of future services people do not currently enjoy? Outside virtual reality – which, for safety reasons, will probably always happen in a fixed-line environment – no app seems likely to chew through gigabytes as hungrily as moving images do in high definition. Webb clearly doubts the sort of artificial intelligence (AI) services being advertised by Apple will have much impact whatsoever.

“There may be substantially more traffic between data centers as models are trained but this will flow across high-capacity fiber connections which can be expanded easily if needed,” he told Light Reading by email. “At present AI interactions are generally in the form of text, which amounts to miniscule amounts of traffic.”

“Indeed, if time is diverted from consuming video to AI interactions, then AI may reduce the amount of network traffic,” he continued. Even if AI is used in future to create images and videos, rather than words, it will probably make no difference given the amount of video already consumed, merely substituting for more traditional forms of content, said Webb.

For those confident that data traffic growth stimulates investment, the other problem is the lack of any correlation between volumes and costs. Advanced networks are designed to cope with usage up to a certain high threshold before an upgrade is needed. Headline expenses have not risen in lockstep with gigabytes.

References:

https://www.lightreading.com/5g/ericsson-and-nokia-may-be-stuck-with-skinflint-customers-for-years

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

“The “5G Train Wreck” we predicted five years ago has come to pass. With the possible exception of China and South Korea, 5G has been an unmitigated failure- for carriers, network equipment companies, and subscribers/customers. And there haven’t been any significant performance advantages over 4G.”

Infinera, DZS, and Calnex Successfully Demonstrate 5G Mobile xHaul with Open XR

Infinera announced today a successful multi-vendor demonstration of 5G mobile broadband xHaul using coherent open XR optics point-to-multipoint optical transmission. The multi-vendor interoperability testing, conducted with DZS and Calnex, represents a key step toward enabling mobile operators to greatly simplify and cost-reduce 5G and next-generation mobile transport network rollouts through the reduction of the number of optical transceivers, resulting in significant total cost of ownership savings.

Hosted in the European Open Test & Integration Center in Torino by TIM, the high-capacity xHaul application testing included fronthaul, midhaul, and backhaul transport scenarios with XR-based coherent pluggable optics deployed in third-party hosts supporting point-to-point and point-to-multipoint optical transmission. Results of the performance testing included successful demonstration of xHaul synchronization and timing distribution in a point-to-multipoint optical transport architecture.

“It is not only the significant bandwidth demands of 5G that create challenges for mobile operators, but also the fundamental misalignment between actual 5G network traffic patterns and the underlying transport technology,” said Ron Johnson, SVP and General Manager, Optical Subsystems and Global Engineering Group, Infinera. “Working in close collaboration with industry-leading mobile operators such as TIM, this testing validates the critical role that XR optics innovation can play in transforming the economics of 5G transport and paving the way for efficient 6G networks.”

Equipment used in the interoperable xHaul testing included Infinera ICE-X intelligent coherent pluggables, the DZS Saber 2200, and Calnex Paragon-NEO. Part of the work carried out by TIM and Infinera was supported by the EU project ALLEGRO, GA No. 101092766.

About DZS:

DZS (Nasdaq: DZSI) is a developer of Network Edge, Connectivity and Cloud Software solutions enabling broadband everywhere.

About Infinera:

Infinera is a global supplier of innovative open optical networking solutions and advanced optical semiconductors that enable carriers, cloud operators, governments, and enterprises to scale network bandwidth, accelerate service innovation, and automate network operations. Infinera solutions deliver industry-leading economics and performance in long-haul, submarine, data center interconnect, and metro transport applications. To learn more about Infinera, visit www.infinera.com, follow us on X and LinkedIn, and subscribe for updates.

References:

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Fiber Build-Out Boom Update: GTT & Ziply Fiber, Infinera in Louisiana, Bluebird Network in Illinois

LightCounting: Q1 2024 Optical Network Equipment market split between telecoms (-) and hyperscalers (+)

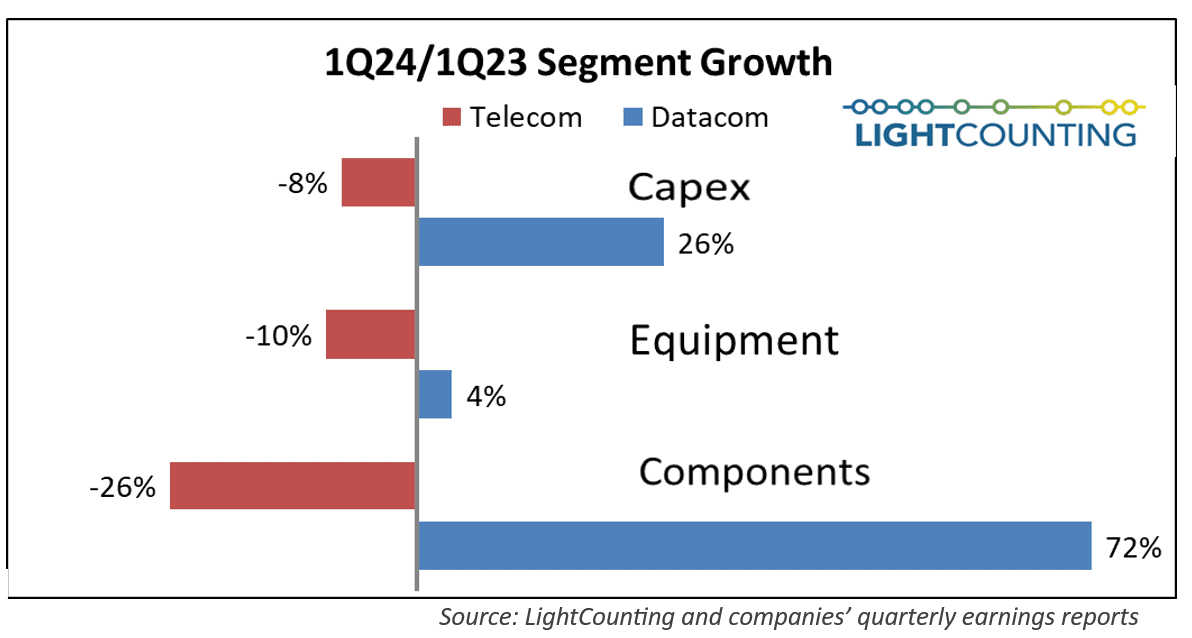

As has been the trend for the past several quarters, Q1 2024 results for the optical communications market were sharply split between very weak sales in the telecom segment (Communications Service Providers or CSPs) and continued strong demand by the hyperscalers (cloud giants). The combined capex of the Top 15 CSPs declined year-over-year for the sixth quarter in a row, while the Top 15 ICPs spending grew for the second quarter in a row, paced by Alphabet (+91%) and Microsoft (+66%). Chinese ICPs spending also increased dramatically, suggesting the AI boom is hitting China too.

FWA a bright spot in otherwise gloomy Internet access market

Parks Associates’ newly launched Broadband Market Tracker, states that U.S. Fixed Wireless Access (FWA) adoption from a mobile network operator hit 7.8 million U.S. residential home internet connections in Q1-2024. That’s in comparison to 106.3 million U.S. households that had home internet service at the end of 2023.

Kristen Hanich, director of research at Parks Associates, told Fierce Network FWA and satellite internet are the “fastest growing” segments of the broadband market, “attracting consumers who were previously unserved or underserved by traditional providers.” She noted for the past several years, the FWA base has grown by 700,000 to 900,000 subscribers per quarter while cable connections have declined.

T-Mobile in Q1-2024 passed the 5 million mark for FWA subscribers and Verizon reported a total FWA tally of 3.4 million subscribers. These figures include both residential and business FWA customers.

Key FWA Findings from OpenSignal:

- 5G FWA has reshaped the U.S. broadband market. It has allowed U.S. mobile operators to rapidly expand their broadband footprints for minimal incremental network investment. This has seen 5G FWA absorb all broadband subscriber growth in the market since mid-2022.

- FWA is the secret sauce for 5G monetization. FWA benefits from lower prices compared to wireline competition, access to existing mobile retail channels and subscribers, and the ability to deliver a “good enough” broadband service.

- U.S. mobile networks have proven to be resilient. Despite adding millions of 5G FWA subs since 2021, 5G speeds on T-Mobile and Verizon’s mobile networks have continued to improve. Their success in managing FWA traffic is due to a variety of factors, including plentiful access to mid-band spectrum, localized load management, and differences in peak usage time of day patterns between mobile and FBB usage.

- Elsewhere, there are mixed results. In India, Jio is seeing no discernible impact from FWA on the mobile experience of its users, while in Saudi Arabia Zain is seeing the additional load on its network from FWA having a greater influence on mobile users’ experience, depending on the time of day or the level of FWA penetration.

“Despite adding more than eight million 5G FWA subs using 400+ GB per month of data since Q1 2021, the overall mobile network experience on T-Mobile and Verizon’s mobile networks has not been compromised,” Opensignal analyst Robert Wyrzykowski wrote in the firm’s new assessment of FWA technology.

In its new report, Opensignal found that areas in the U.S. with a larger number of FWA customers actually showed better networking performance than areas with fewer FWA customers. Meaning, Verizon and T-Mobile offered increasingly speedy connections even in geographic locations with higher concentrations of FWA users.

“We would expect low-FWA penetration areas to see better mobile and FWA performance because of less load on the network. However, our data demonstrates the opposite trend,” Wyrzykowski explained.

Other Opensignal findings:

- Around 6% of urban Internet customers subscribe to FWA; in rural areas that figure is 7%.

- Some 74% of FWA customers pay less than $75 per month for their services.

- 35% of FWA customers are between 18-34 years old, whereas that age range is 25% for cable.

Opensignal’s findings provide an important view into the FWA industry in the US as its subscriber growth begins to slow. For example, T-Mobile added 405,000 FWA customers during the first quarter, far less than the 541,000 FWA customers it added during the fourth quarter of 2023.

“5G FWA services have been on a dramatic growth trajectory in the U.S., absorbing all broadband subscriber growth in the market since mid-2022 and amassing more than 600-700 thousand net adds per quarter,” wrote Opensignal’s Wyrzykowski. “This is despite the USA being a mature broadband market with nearly 97% broadband adoption and modest household growth.”

…………………………………………………………………………………………………………….

U.S. cable companies have recorded historic declines in their core Internet businesses amid the growth of FWA in the U.S. Financial analysts at TD Cowen predict the U.S. cable industry will collectively lose more than half a million customers in the second quarter of this year. They attribute that decline to FWA competition as well as other factors including the end of the U.S. government’s Affordable Connectivity Program (ACP).

The situation for cable might get even worse if FWA providers like T-Mobile and Verizon decide to invest further into their fixed wireless businesses.

“The pain for cable may continue for longer than expected as the ability for cable to return to broadband subscriber growth may take longer (if ever),” wrote the TD Cowen analysts in a recent note to investors.

Others agree. For example, the analysts at S&P Global wrote that cable service providers in general have been losing value to wireless network operators despite cable’s efforts to bundle mobile services into cable offerings.

………………………………………………………………………………………………………

Parks’ Hanich said fiber optic access technology is on an upswing and Parks is seeing “excellent growth in the markets where it is available and high customer satisfaction with the customers who have it.”

“But the numbers are not quite as dramatic as what’s been going on with T-Mobile, Verizon and Starlink,” she said, noting the “growing convergence” of satellite and mobile networks is something else to keep an eye on.

Asked whether the demise of the Affordable Connectivity Program has had any impact on Parks’ findings, Hanich said, “we are concerned that the end of the program will result in households and families needing to disconnect from the internet for financial reasons.”

“For a good percentage of Americans, household budgets have been hit by rising inflation and lower-income families especially are having to cut back,” she said. “Thankfully we are seeing ISPs step up, try and transition people onto other plans and initiatives.”

…………………………………………………………………………………………………………….

Separately, Parks found adoption of mobile virtual network operator (MVNO) services reached over 15 million residential customer mobile lines in the quarter. In an MVNO model, broadband operators lease spectrum capacity from a wireless network to stand up their own mobile offering.

NTIA published some findings from its latest Internet Use Survey. Unsurprisingly, internet usage in the U.S. has gone up, with 13 million more people using the internet in 2023 compared to 2021. However, a lot of that usage is coming from lower-income households. Specifically, internet adoption among households making less than $25,000 per year increased from 69% in 2021 to 73% in 2023.

References:

https://www.fierce-network.com/broadband/fixed-wireless-continues-its-climb-among-us-homes-parks

https://www.lightreading.com/fixed-wireless-access/fwa-in-the-usa-getting-ready-for-phase-2

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon’s 2023 broadband net additions led by FWA at 375K

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Deutsche Telekom offers 5G mmWave for industrial customers in Germany on 5G SA network

Deutsche Telekom (DT) has successfully trialed 5G millimeter wave (mmWave) frequencies at 26 gigahertz (GHz) with industrial use cases and is now offering them commercially to industrial customers. For the customer Ger4tech Mechatronik Center, autonomous industrial machines and robots were networked with a router in the 5G campus environment of the Werner-von-Siemens Centre for Industry and Science in Berlin. In addition to the 5G standalone (SA) network in the industrial spectrum at 3.7 GHz, this router also supports mmWave spectrum for the first time. With low latency times of three to four milliseconds RTT (round trip time) and a data rate of over 4 gigabits per second in download and 2 gigabits in upload, mmWave has huge potential in data-intensive applications in the manufacturing industry. The 5G mmWave communications are enabled by Telit Cinterion, a global end-to-end IoT solutions provider.

5G mmWave is playing an increasingly important role in wireless communication technology and imaging, among others. It is characterized by short coverage range and high bandwidth and speeds. It has enormous potential for development within 5G campus networks and for applications in the field of autonomous vehicles and the manufacturing industry. The special ability of mmWave lies in its ability to transmit large amounts of data in real time. The frequency spectrum around 26 GHz is allocated exclusively to interested parties in Germany by the Federal Network Agency. It can currently only be used for local applications.

“It is important for our industrial customers in the age of artificial intelligence to be able to upload data from machines and thus make it available and analyzable in real time,” explains Klaus Werner, Managing Director Business Customers at Telekom Deutschland GmbH. “This is the only way for companies to introduce AI applications sensibly and efficiently and derive great benefits for their business,” he added.

“We’re enabling customers to access unparalleled levels of efficiency, productivity and innovation. Through the seamless integration of 5G mmWave into their operations, every device and process can achieve connectivity at an unprecedented scale,” said Marco Contento, VP of Product Management, Mobile Broadband at Telit Cinterion. “Collaboratively, we’re helping to pave the way for industries to streamline operations, anticipate maintenance needs, and a multitude of future possibilities.”

The 5G standalone campus network at the Werner-von-Siemens Centre operates separately from Telekom’s public mobile network. The entire infrastructure, from the antennas and active system technology to the core network, comes from Ericsson. Based on this network, a fleet of autonomously driving and operating robots works on various use cases at the center. The 5G standalone network is often sufficient to control the robots. The 5G millimeter waves come into play when the requirements for communication and data transmission increase, and therefore also when solving more complex tasks. For example, in a computer vision application: the robot picks up an order and checks whether the ordered goods are complete on the way to the next destination. If there is a discrepancy, it immediately reorders the goods.

In addition to these, many other scenarios are mapped in the Werner-von-Siemens Centre. Here, industry, research institutions (including TU Berlin and Fraunhofer), small and medium-sized enterprises and start-ups work on practical solutions for companies – including for autonomous production logistics and other challenges in industrial manufacturing.

In the UK, regulator Ofcom launched a new consultation in April and the sector is awaiting the details of when and in what form an auction will take place.

Additional Resources:

About Ger4Tech Mechatronik Center

About Telit Cinterion

……………………………………………………………………………………………………………………………………………………

References:

https://www.telecoms.com/5g-6g/deutsche-telekom-looking-to-flog-5g-mmwave-to-industrial-sector

Daryl Schoolar: 5G mmWave still in the doldrums!

Momentum builds for wireless telco- satellite operator engagements

Over the past two years, the wireless telco-satellite market has seen significant industry-wide growth, driven by the integration of Non-Terrestrial Networks (NTN) in 5G New Radio as part of 3GPP Release 17. GSMA Intelligence reports that 91 network operators, representing about 5 billion global connections (60% of the total mobile market), have partnered with satellite operators. Although the regulatory landscape and policy will influence the commercial launch of these services in various regions, the primary objective is to achieve ubiquitous connectivity through a blend of terrestrial and non-terrestrial networks.

Recent developments include:

- AT&T and AST SpaceMobile have signed a definitive agreement extending until 2030 to create the first fully space-based broadband network for mobile phones. This summer, AST SpaceMobile plans to deliver its first commercial satellites to Cape Canaveral for launch into low Earth orbit. These initial five satellites will help enable commercial service that was previously demonstrated with several key milestones. These industry first moments during 2023 include the first voice call, text and video call via space between everyday smartphones. The two companies have been on this path together since 2018. AT&T will continue to be a critical collaborator in this innovative connectivity solution. Chris Sambar, Head of Network for AT&T, will soon be appointed to AST SpaceMobile’s board of directors. AT&T will continue to work directly with AST SpaceMobile on developing, testing, and troubleshooting this technology to help make continental U.S. satellite coverage possible.

- SpaceX owned Starlink has officially launched its commercial satellite-based internet service in Indonesia and received approvals to offer the service in Malaysia and the Philippines. Starlink is already available in Southeast Asia in Malaysia and the Philippines. Indonesia, the world’s largest archipelago with more than 17,000 islands, faces an urban-rural connectivity divide where millions of people living in rural areas have limited or no access to internet services. Starlink secured VSAT and ISP business permits earlier in May, first targeting underdeveloped regions in remote locations.Jakarta Globe reported the service costs IDR750,000 ($46.95) per month, twice the average spent in the country on internet service. Customers need a VSAT (very small aperture terminal) device or signal receiver station to use the solution.Internet penetration in Indonesia neared 80% at the end of 2023, data from Indonesian Internet Service Providers Association showed. With about 277 million people, Indonesia has the fourth largest population in the world. The nation is made up of 17,000 islands, which creates challenges in deploying mobile and fixed-line internet nationwide.Starlink also in received approvals to offer the service in Malaysia and the Philippines. The company aims to enable SMS messaging directly from a network of low Earth orbit satellites this year followed by voice and data starting in 2025. In early January, parent SpaceX launched the first of six satellites to deliver mobile coverage.

- Space X filed a petition with the FCC stating that it “looks forward to launching commercial direct-to-cellular service in the United States this fall.” That will presumably be only for text messages, because the company has stated that ONLY text will available in 2024 via Starlink. Voice and data won’t be operational until 2025. Importantly, SpaceX did not identify the telco who would provide Direct-to Cell satellite service this fall.

In August 2022, T-Mobile and SpaceX announced their plans to expand cellular service in the US using low-orbit satellites. The service aims to provide direct-to-cell services in hard-to-reach and underserved areas such as national parks, uninhabited areas such as deserts and mountain ranges, and even territorial waters. Traditional land-based cell towers cannot cover most of these regions.

- SpaceX said that “supplemental coverage from space (“SCS”) will enable ubiquitous mobile coverage for consumers and first responders and will set a strong example for other countries to follow.” Furthermore, SpaceX said the “FCC should reconsider a single number in the SCS Order—namely, the one-size-fits-all aggregate out-of-band power flux-density (“PFD”) limit of -120 dBW/m2 /MHz that it adopted in the new Section 25.202(k) for all supplemental coverage operations regardless of frequency band.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AT&T, AST SpaceMobile draw closer to sat-to-phone launch

Starlink sat-service launches in Indonesia

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?