China Mobile reports record operating revenues in 1st Quarter 2024

China Mobile, the world’s largest operator in terms of subscribers, recorded operating revenues of CNY263.7 billion ($36.4 billion) in the first quarter of the year, an increase of 5.2% year-on-year, the carrier said in its earnings statement. The company’s net profit increased 5.5% year-on-year to CNY29.6 billion. Also, the telco reported that revenue from telecommunications services was CNY219.3 billion, up by 4.5% year-on-year. The telco ended the first quarter of the year with a total of 488 million 5G subscribers. China Mobile had reported a net addition of 138 million 5G subscribers during 2023. In the mobile segment, the telco reached a total of 996 million subscribers at the end of March 2024, after an addition of 5 million customers during the first quarter.

Highlights:

- Adopt a strategy-led approach, driving new milestones in business performance

- Leverage innovation, deepening strategic transformation with remarkable results

- Expedite further business upgrade, facilitating mutual advancement of the “two new elements”

- Achieve breakthroughs amidst adversity, yielding fruitful results from innovation and reform Dedicated to enhancing shareholder returns, using a multi-pronged approach Forge ahead with determination, accelerating the building of a world-class enterprise

Mr. Yang Jie, Chairman of the Company commented, “In 2023, despite various challenges faced by the Company in a complex and severe macro- environment, we seized the opportunities emerging from accelerated economic and social digital transformation. This helped anchor us in our position as a world class information services and sci-tech innovation enterprise. Our efforts were focused on fully implementing our “1-2-2-5” strategy and strengthening innovation and core competitiveness to promote high-quality and sustainable development. Our business results reached new milestones, with revenue surpassing the RMB trillion mark for the first time in our history of development, and net profit attaining a record high. In terms of operations, our strategic transformation, reforms and innovation all advanced to a new level, underscoring our solid progress in establishing a world-class enterprise that takes pride in outstanding products, reputable brands, leading innovation and modern governance.”

“The Group will continue to pursue stable progress while forging ahead with a steadfast focus on integrity and innovation. We will enhance core functions, improve core competitiveness, expedite the cultivation and growth of emerging sectors of strategic importance, develop new quality productive forces at an accelerated pace, and establish ourselves as a world-class information services and sci-tech innovation enterprise to a high standard. With these efforts, we will consistently create greater value for our shareholders and customers,” the China state owned telco said.

China Mobile plans to launch 5G-Advanced (5G-A) technology in over 300 cities across China this year, according to local press reports. The telco, which claims a leading role in the development of 5G-A 3GPP specifications, also plans to promote the release of over 20 5G-A compatible phones within the year. To showcase its new 5G-A network, China Mobile has established 5G-A demonstration halls in various locations across China.

China Mobile’s vice president, Gao Tongqing, stated that this launch will further accelerate the development of new information infrastructure and unlock the full potential of 5G technology. The carrier also said it aims to achieve widespread adoption of 5G-A technology in China through partnerships with manufacturers and chip suppliers.

Beijing, Shanghai and Guangzhou are among the first cities where China Mobile will activate the new technology.

China had a total of 11.6 million mobile communication base stations as of the end of last year, of which 3.4 million were 5G base stations. 5G base stations currently account for nearly 29% of total mobile base stations in China. The ratio is 7.8 percentage points higher compared to the end of 2022.

Future Outlook:

The impact of the new wave of technological revolution and industrial reforms will continue to grow, so will the importance of integrated innovation. The three aspects of this integrated innovation will be highlighted in the power of information, the new generation information technology, and the merger of information service and social operation systems. At the same time this integrated innovation will deepen in three directions – the applications of a new generation of information technology to rapidly form new growth momentum, the collaboration of industry, academia, research and application to foster a new innovation paradigm, and the integration of digital and real economy to open up new development opportunities.

China Mobile sees valuable opportunities as they expand our information services. With the advocacy of the national “AI+” initiative and the further accelerated advancement of Digital China, the industry experiences new growth potential from the development of new quality productive forces. This progress brings forth the emergence of data as a new factor of production, computility as a new fundamental energy source and AI as a new instrument of production. The information services industry has not only in itself become an important sector for the development of new quality productive forces, but also a strong support for other sectors in this pursuit. General AI, particularly represented by AI large models, is developing robustly.

The role of AI is also fast changing from an assisting tool that helps different industries improve quality and efficiency, to an indispensable infrastructure and core capability that supports economic and social transformation and development. While AI brings forth disruptive applications, “AI+” opens up vast blue-ocean of opportunities. Fixating the vision of building a world-class information services and sci-tech innovation enterprise, we will capture opportunities arising from the development of “AI+” and extending our “5G+” initiatives towards 6 this direction. We will identify a new roadmap of transformation and upgrade through comprehensive, systematic and deep-dived integrated innovation. In doing so, we will drive more creation to enrich life, enhance quality production and support precise governance powered by digital intelligence. We will satisfy, drive and create demand to form a new for value growth trajectory and fuel the future development of the Company.

References:

p240321.pdf (chinamobileltd.com)

https://www.rcrwireless.com/20240423/carriers/china-mobile-q1-revenues-up-5-year-on-year

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

China Mobile verifies optimized 5G algorithm based on universal quantum computer

China Mobile to deploy 400G QPSK by the end of 2023

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

du (UAE) deploys Microchip’s TimeProvider 4100 Grandmaster clock for advanced 5G network services

Du, the United Arab Emirates Integrated Telecommunications Company (EITC), announced that it has deployed Microchip’s TimeProvider 4100 Grandmaster clock for advanced 5G network services. Du said the deployment, as part of its investment in 5G technology, aims to provide its customers with best-in-class broadband services and network performance.

Microchip’s end-to-end timing solutions generate, distribute and apply precise time for multiple industries, including communications, aerospace and defense, IT infrastructure, financial services, power utilities and more. The company provides a broad range of clock and timing solutions ranging from MEMS oscillators to active hydrogen masers.

Image Credit: Microchip

Ericsson on 5G use cases: remote surgery, augmented and virtual reality with AI agent all depend on 3GPP URLLC specs

5G for Remote Surgery:

This year, surgeons in Florida working with Ericsson, were able to operate on remote patients in Dubai and Shanghai, using 5G technology, according to Mischa Dohler, Ericsson vice president-emerging technologies.

A hospital in China used a 5G-enabled robot to perform spinal surgery on patients, and doctors used VR headsets to livestream the operation. The robot implanted over 62 pedicle screws in the patients’ spinal cord. Here’s a pic of that:

Photo by Wang Fei/For China Daily

Dohler said he’s working with the White House, FCC, NTIA, Food and Drug Administration and others to make remote surgery “a reality.” More widespread use of the technology won’t happen unless smaller carriers also get involved. We will have not only humans using your networks, but also machines more and more,” Dohler added.

Gartner’s market research underscores the importance of 5G SA, predicting that by 2025, it will be the foundation for the majority of applications demanding sub-10 millisecond latency. This transition is not merely a technical upgrade but a strategic enabler for industries poised to benefit from real-time data processing and decision-making. However, the ultra low latency depends on two 3GPP Release 16 specs – 1.] 5GNR enhancements for URLLC in the RAN and 2.]URLLC in the 5G SA core network– being completed, performance tested and implemented. That has not happened yet and without it there can’t be any 5G URLLC use cases like remote surgery!

Real-time remote surgeries, once a concept of futuristic medicine, are becoming a reality. The ability to perform surgical procedures from thousands of miles away, with real-time response and precision, could revolutionize healthcare accessibility and outcomes. For example, a pilot project involving 5G SA-enabled remote surgery successfully demonstrated how surgeons could operate with millisecond-level precision, mitigating geographical barriers to specialized medical care.

……………………………………………………………………………………………………………….

Ericsson’s Dohler predicted growing use of augmented and virtual reality and AI “agents,” computer programs capable of performing tasks autonomously, which people will use as part of their daily lives. New technology will require networks that can handle increased traffic, he said. New data traffic patterns “will hit you at some point this decade,” he said. “You will need to do some bold moves.”

………………………………………………………………………………………………………..

References:

https://www.ericsson.com/en/blog/2024/3/cutting-the-cord-lifesaving-telesurgery-in-the-age-of-5g

https://www.chinadaily.com.cn/a/201908/29/WS5d670e17a310cf3e355686fa.html

https://www.linkedin.com/pulse/dawn-new-era-navigating-shift-from-5g-nsa-sa-tayroni-fkvre/

Frontier Communications recovering from unknown cyberattack!

Frontier Communications provides fiber optic based gigabit Internet access to millions of consumers and businesses across 25 states. Frontier Communications said on Thursday that it’s ‘experiencing technical issues with our internal support platforms.’ Frontier’s mobile apps are also down, with the same warning message being displayed after launching the application. A company representative did not respond to questions about the situation.

The Texas-based telecommunications company reported a cyberattack to the Securities and Exchange Commission (SEC) on Thursday. Frontier said it detected unauthorized access to its IT systems on April 14th and began instituting “containment measures” that included “shutting down certain of the Company’s systems.” The shutdowns caused operational disruption that the company said “could be considered material.”

“Based on the Company’s investigation, it has determined that the third party was likely a cybercrime group, which gained access to, among other information, personally identifiable information,” the company said in the SEC filing.

“As of the date of this filing, the Company believes it has contained the incident and has restored its core information technology environment and is in the process of restoring normal business operations. Based on the company’s investigation, it has determined that the third party was likely a cybercrime group, which gained access to, among other information, personally identifiable information,” the company said.

Investigations into the incident are ongoing and they have hired cybersecurity experts to help with the incident. Law enforcement agencies have been notified.

Despite saying that the shutdowns could be considered material, Frontier later wrote that it “does not believe the incident is reasonably likely to materially impact the Company’s financial condition or results of operations.”

According to Leichtman Research Group, Frontier is the seventh largest broadband Internet supplier in the US, with almost 3 million customers. The company’s copper and fiber network stretches across large portions of the East and West Coasts.

Light Reading reported on Thursday of warnings from Frontier. “We’re experiencing technical issues with our internal support platforms,” said a message on the company’s website homepage. “Our residential and business networks are not affected by this issue. In the meantime, please call for assistance.”

……………………………………………………………………………………………………………………………

Last week, AT&T reported that more than 51 million people were affected by a recently-disclosed data breach that included troves of customer information including Social Security numbers, AT&T account numbers and AT&T passcodes.

EchoStar’s Dish Network last year reported a “cybersecurity incident” that impacted its ability to install services, take payments and provide customer care for several weeks.

Fierce reported this week about an intentional cable cut in AT&T’s network that interrupted services at Sacramento Airport.

……………………………………………………………………………………………………………………..

The Federal Communications Commission (FCC) updated its data breach rules for the first time in 16 years in December, expanding regulations on how telecommunication companies report cybersecurity incidents. FCC Chairwoman Jessica Rosenworcel argued that the rules the agency created more than 15 years ago are no longer compatible with a modern world where telecommunication carriers have access to a “treasure trove of data about who we are, where we have traveled, and who we have talked to.”

References:

https://therecord.media/telecom-giant-frontier-cyberattack-sec

https://www.sec.gov/ix?doc=/Archives/edgar/data/20520/000119312524100764/d784189d8k.htm

https://www.lightreading.com/security/frontier-we-were-probably-hacked

Nokia (like Ericsson) announces fresh wave of job cuts; Ericsson lays off 240 more in China

- Nokia Oyj’s Q1 2024 results showed a 26% decrease in net sales and a decrease in operating margins from Network Infrastructure.

- Nokia Technologies saw a doubling of net sales, benefiting from licensing deals and aiming to raise annual net sales to EUR 1.4-1.5 billion.

- Mobile Networks experienced a nearly 40% decrease in net sales, with speculation that telecom firms will prioritize debt repayment over equipment spending.

On a call with reporters today, Nokia said it will cut ~11,500 jobs and end up with a workforce of approximately 74,500 employees at the end of 2026. Like Ericsson, it has responded to the global telecom market contraction by announcing a fresh wave of job cuts. Having already eliminated 16,000 jobs since 2016 (the year of that Alcatel-Lucent acquisition), Nokia last year said up to 14,000 jobs would disappear, and no fewer than 9,000, by the end of 2026. The aim is to save between €800 million ($854 million) and €1.2 billion ($1.3 billion) in annual expenses. That newest layoff round follows Ericsson’s announcement that it will lay off ~1,200 employees in Sweden as part of cost-cutting measures announced earlier this year as telco customers reduce their spending on 5G network equipment.

“We are progressing toward this target and currently looking at somewhere around the midpoint of that range,” Lundmark said when asked by Light Reading if there is now more certainty about the ultimate size of the company at the end of the program. “That will then finally depend on the development of the market situation.”

North American customers that previously gorged on supplies have seen little need in the last year to replenish inventory. The pace of a 5G rollout in India has dramatically slowed. Denied the opportunity to consolidate, European telcos still underinvest in 5G, complain vendors. After managing a €137 million ($146 million) mobile operating profit for the first quarter of 2023, Nokia slid a year later to a €42 million ($45 million) loss.

Nokia’s network infrastructure business group – including fixed residential, optical and Internet Protocol activities – sales were down 26%, to less than €1.7 billion ($1.8 billion). An engine of sales growth during Lundmark’s first years in charge, it registered a 42% fall in operating income, to €82 million ($88 million). At cloud and network services, meanwhile, revenues dropped 14%, to €652 million ($696 million), and losses widened 35%, to €27 million ($29 million).

“We have said that we are continuously doing active portfolio management – you have seen some our recent moves that we did last year,” Lundmark said. Disposals included the €185 million ($198 million) sale of a device management business to Canada’s Lumine Group and the earlier transfer of about 350 employees working on cloud platforms to IBM-owned Red Hat.

“We are pleased with the strategy that we have in place in mobile networks,” said Lundmark. “We have a strong value proposition there, we have increased our market share in recent years, and we have a good strategy to deliver value to our shareholders,” he added.

After Intel’s failure to deliver 10-nanometer microprocessors, Nokia resorted to field programmable gate arrays (FPGAs) and its competitiveness suffered. But Nokia’s Mobile Networks boss Tommi Uitto subsequently introduced the well-regarded Broadcom and Marvell Technology as chip suppliers alongside Intel, and the FPGAs have now been replaced. Outside China and the U.S., Nokia’s market share has recently grown, say independent analysts.

In mobile, the full-year outlook remains relatively bleak, even if the second half brings some improvement. “The market has been really, really weak, which is not a Nokia issue,” said Lundmark, in his detailed answer to that question about a sale of mobile assets. “It is an industry issue. It has to be a matter of time before operators again will have to start investing, and, once that happens, we will be in a strong position,” he concluded.

……………………………………………………………………………………………………………………………………………………………………………

Update: Ericsson has laid off 240 employees in China, part of a restructuring in the country that will affect one of its largest research hubs globally. Ericsson said the positions would be cut in line with the company’s effort to diversify its research and development footprint to better align with its sales globally. The employees impacted would be in its core network R&D division in China, a spokesman said.

The Swedish telecommunications-equipment company told employees at an internal meeting in early March that it was embarking on a transformation of its China operations that would continue into 2025, several people who attended the meeting told The Wall Street Journal. The company has plans to reduce headcount further in the coming months, people familiar with the company said. One of the people said the R&D team recently had been excluded from working on at least two large projects in the U.S. and Australia.

Ericsson’s market share has been dwindling in China in the 5G era amid intensified competition from local players like Huawei and heightened geopolitical tensions. In its 2023 annual report, Ericsson cautioned that a further escalation of trade tensions between the U.S. and China could hurt its operations in China.

Ericsson had 9,950 employees in China last year, down from 13,783 in 2019, according to company data.

References:

https://www.lightreading.com/5g/nokia-ceo-bids-to-revive-loss-making-mobile-unit-amid-sale-rumors

https://www.wsj.com/tech/ericsson-lays-off-more-than-200-employees-in-china-f4ab7db3″ rel=”noopener” target=”_blank”>https://www.wsj.com/tech/ericsson-lays-off-more-than-200-employees-in-china-f4ab7db3

Huawei to revolutionize network operations and maintenance

Huawei rotating chair Eric Xu kicked off the company’s annual analyst summit in Shenzhen underlining a near ubiquitous focus on AI and outlined a broad strategy designed to improve the competitiveness of its products and operations, without sharing specifics or targets.

Xu explained the company is pursuing a number of initiatives across multiple tracks to take advantage of new opportunities in AI. In addition to driving advancements in AI to build “thriving ecosystems for shared success”, he said Huawei is actively integrating the technology into its internal management to improve operating efficiency.

The company aims to “revolutionize network operations and maintenance” with its autonomous driving network offering, but Xu didn’t provide an update on the ongoing initiative. He added it is working to upgrade its Celia smart assistant, launched in 2018, which is connected to its evolving Pangu AI models developed for a number of sectors.

Eric Xu speaking at 2024 Huawei Analyst Summit

With the company facing tight restrictions on the import of advanced chips and other equipment as well as curbs in many western markets on its networking gear, Xu avoided talking about its core network carrier group and any mention of handsets now sporting high-end domestic chips.

Steven Zhao, Vice President of Huawei’s Data Communication Product Line, delivered a speech entitled “Accelerating Network Transformation Towards All Intelligence”. Mr. Zhao shed light on how Huawei introduced AI technologies to upgrade network capabilities at case-, process-, and system-levels and accelerate network intelligence. Participants, including industry partners, also explored the current trends and future prospects of the Net5.5G industry.

Despite broad trade sanctions, Huawei last August secured 7nm processors for its Mate 60 Pro from state-owned Semiconductor Manufacturing International Corp, raising concerns among U.S. officials if the Chinese chipmaker bypassed export controls.

During the 21st Huawei Analyst Summit, the “Building F5.5G All-Optical Target Network, and Ushering in 10 Gbps UBB Intelligent Era” forum was held, where industry stakeholders deliberated on how to apply F5.5G optical technologies to build home and industry intelligence. Also at this forum, Bob Chen, President of Huawei Optical Business Product Line, said, “To stride to the intelligent era in the next 10 years, a high-quality computing bearer network, that is, F5.5G all-optical premium computing network, needs to be built to ensure that computing power is always-on with 99.9999% availability and instantly-accessible with 1 ms latency. With its ubiquitous 10 Gbps access, the network makes computing power accessible everywhere and connects ubiquitous intelligence, enabling intelligence in various industries.”

…………………………………………………………………………………………………………………

Huawei’s net profit in 2023 increased 144.5% year-on-year to CNY86.9 billion ($12 billion), with revenue rising 9.6% to CNY704.2 billion, driven by a 17.3% increase in consumer revenue to CNY251.5 billion.

Last year, the company combined revenue from its carrier network business and enterprise unit into a single figure. In 2022, Huawei’s carrier group accounted for 44.2% of total revenue.

References:

https://www.huawei.com/en/news/2024/4/has-net-5-point-5g-ai

https://www.huawei.com/en/news/2024/4/has-net-5-point-5g-ai

https://www.huawei.com/en/news/2024/4/has-f5-point-5g-all-optical

FCC legal advisor: Potential End of ACP Is the ‘Biggest Challenge’ Facing the Broadband Marketplace

On Wednesday April 17th, broadband officials and experts called for continued pressure to replenish the FCC’s Affordable Connectivity Program (ACP) [1.]. Some panelists during Next Century Cities’ bipartisan tech policy conference also urged community leaders to engage with their state broadband offices as NTIA approves states’ plans for the broadband, equity, access and deployment program.

Note 1. The Affordable Connectivity Program (ACP) is a benefit program from the FCC that helps households pay for broadband for work, school, and healthcare. The program is separate from the FCC’s Lifeline Program. The ACP is targeted at low-income families and individuals, and may include a one-time benefit of up to $100 for a phone or internet-capable device like a tablet, laptop, or desktop computer. The program also offers a monthly service discount and one device discount per household. The FCC said that unless lawmakers act to give the program additional funding, the full $30 discount will end at the end of April. The loss of ACP will hit poor people very hard and significantly widen the digital divide.

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

The biggest challenge facing the broadband marketplace right now is “the potential end of ACP next month,” said Hayley Steffen, legal adviser to Commissioner Anna Gomez. Ensuring the program is funded and continues is Gomez’s “highest priority right now,” Steffen said. FCC Consumer and Governmental Affairs Bureau Chief Alejandro Roark agreed, noting the program has “accomplished more over the past two years to bridge our country’s digital opportunity divide than any other standalone effort in our nation’s history.”

On Monday, a coalition of 271 civil-society groups and local, state and Tribal governments sent a letter to the U.S. House of Representatives that urges all members to sign a discharge petition to support the Affordable Connectivity Program (ACP) Extension Act. The legislation would provide an additional $7 billion to save a successful broadband-subsidy initiative.

Rep. Yvette Clarke, D-N.Y., is circulating a discharge petition (House Resolution 1119) in a bid to force a floor vote on her Affordable Connectivity Program (ACP) Extension Act (HR-6929/S-3565), which would appropriate $7 billion to keep the ailing FCC broadband fund running through the end of FY 2024. ACP “has been a transformative force, empowering nearly 23 million American households in rural and urban communities with reliable, high-speed, and affordable broadband access,” Clarke said Wednesday in a statement.

“To continue this progress, I implore my colleagues to join me by signing the discharge petition. This will ensure [HR-6929] receives the vote it deserves” on the House floor. “We cannot turn our back on the progress made in closing the digital divide,” she said.

“Advocating in numbers is powerful,” said TDI CEO AnnMarie Killian. ACP “really requires that we take a stance and bring forth the importance of digital inclusion for all,” Killian said. DigitalC CEO Joshua Edmonds agreed, but “at the same time, we should walk and chew gum here and look at the value and potential of community-based networks, too.”

Affordability is “a key factor” for individuals with disabilities who rely on broadband for telecom relay services, Killian said, and the end of ACP could have a “significant impact on our economically disadvantaged consumers.” Fort Collins, Colorado, Broadband Executive Director Chad Crager encouraged local officials to start considering “another solution” to addressing affordability in their communities if ACP ends. “We hope it’s renewed” and extended, Crager said, but “the reality will not be forever.”

“This really is the moment for us to not give up” on advocating for ACP’s future, Roark said. ACP has been the FCC’s “best and most successful” effort at broadband affordability, Steffen said. Many households enrolled in the program will be eligible for the Lifeline benefit should ACP end, she said, but Lifeline is “definitely no replacement for ACP.” Roark also encouraged discussions on “how potentially ACP could be integrated into the USF framework.”

NTIA is “actively reviewing” states’ BEAD applications, Senior Policy Adviser Lukas Pietrzak said, noting that 48 states’ volume I proposals have already been approved (see 2403060046). “I have great expectations” for the states’ plans because “at the bare minimum, they did include Black community anchor institutions,” said Fallon Wilson, Multicultural Media, Telecom and Internet Council vice president-policy, citing states with several historically Black colleges and universities. The challenge now is ensuring the states’ plans are executed so that those institutions actually receive funding, Wilson said.

NTIA is also preparing to announce “in the next few weeks” how many applications it received for the second round of tribal broadband connectivity program funding, said Pietrzak. Projects funded by the middle-mile infrastructure grant program are “also starting to break ground in the spring and summer,” Pietrzak said, “which is exciting to see here.” He also noted that 20,000 devices have been distributed through the connecting minority communities program.

References:

https://communicationsdaily.com/article/view?search_id=853996&id=1940601

https://communicationsdaily.com/reference/2404100075?BC=bc_66205df7037e5

https://www.lexology.com/library/detail.aspx?g=aabc18cb-3e53-4085-bda8-42a894e71a08

WSJ: China’s Telecom Carriers to Phase Out Foreign Chips; Intel & AMD will lose out

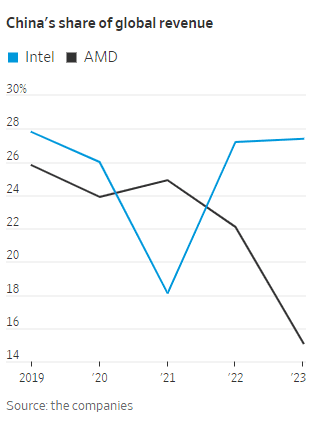

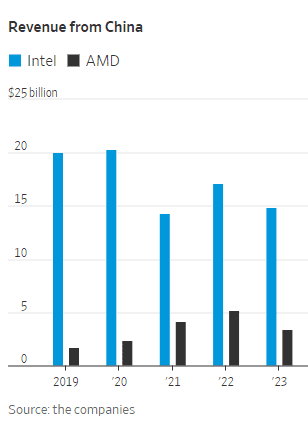

China’s largest telecom firms were ordered earlier this year to phase out foreign computer chips from their networks by 2027. That news confirms and expands on reports from recent months. It was reported in the Saturday print edition of the Wall Street Journal (WSJ). The move will hit U.S. semiconductor processor companies Intel and Advanced Micro Devices. Asia Financial reported in late March that these retaliatory bans would cost the U.S. chip firms billions.

The deadline given by China’s Ministry of Industry and Information Technology (MIIT) aims to accelerate efforts by Beijing to halt the use of such core chips in its telecom infrastructure. The regulator ordered state-owned mobile operators to inspect their networks for the prevalence of non-Chinese semiconductors and draft timelines to replace them, the people said.

In the past, efforts to get the industry to wean itself off foreign semiconductors have been hindered by the lack of good domestically made chips. Chinese telecom carriers’ procurements show they are switching more to domestic alternatives, a move made possible in part because local chips’ quality has improved and their performance has become more stable, the people said.

Such an effort will hit Intel and AMD the hardest, they said. The two chip makers have in recent years provided the bulk of the core processors used in networking equipment in China and the world.

China’s MIIT, which oversees the regulation of the wireless, broadcasting and communication industries, didn’t respond to WSJ’s request for comment. China Mobile and China Telecom , the nation’s two biggest telecom carriers by revenue, also didn’t respond.

In March 2023, the Financial Times reported China is seeking to forbid the use of Intel and AMD chips, as well as Microsoft’s operating system, from government computers and servers in favor of local hardware and software. The latest purchasing rules represent China’s most significant step yet to build up domestic substitutes for foreign technology and echo moves in the US as tensions increase between the two countries. Among the 18 approved processors were chips from Huawei and state-backed group Phytium. Both are on Washington’s export blacklist. Chinese processor makers are using a mixture of chip architectures including Intel’s x86, Arm and homegrown ones, while operating systems are derived from open-source Linux software.

Beijing’s desire to wean China off American chips where there are homemade alternatives is the latest installment of a U.S.-China technology war that is splintering the global landscape for network equipment, semiconductors and the internet. American lawmakers have banned Chinese telecom equipment over national-security concerns and have restricted U.S. chip companies including AMD and Nvidia from selling their high-end artificial-intelligence chips to China.

China has also published procurement guidelines discouraging government agencies and state-owned companies from purchasing laptops and desktop computers containing Intel and AMD chips. Requirements released in March give the Chinese entities eight options for central processing units, or CPUs, they can choose from. AMD and Intel were listed as the last two options, behind six homegrown CPUs.

Computers with the Chinese chips installed are preapproved for state buyers. Those powered by Intel and AMD chips require a security evaluation with a government agency, which hasn’t certified any foreign CPUs to date. Making chips for PCs is a significant source of sales for the two companies.

China Mobile and China Telecom are also key customers of both chip makers in China, buying thousands of servers for their data centers in the country’s mushrooming cloud-computing market. These servers are also critical to telecommunications equipment working with base stations and storing mobile subscribers’ data, often viewed as the “brains” of the network. Intel and AMD have the lion’s share of the overall global market for CPUs used in servers, according to data from industry researcher TrendForce. In 2024, Intel will likely hold 71% of the market, while AMD will have 23%, TrendForce estimates. The researcher doesn’t break out China data.

China’s localization policies could diminish Intel and AMD’s sales in the country, one of the most important markets for semiconductor firms. China is Intel’s largest market, accounting for 27% of the company’s revenue last year, Intel said in its latest annual report in January. The U.S. is its second-largest market. Its customers also include global electronics makers that manufacture in China.

In the report, Intel highlighted the geopolitical risk it faced from elevated U.S.-China tensions and China’s localization push. “We could face increased competition as a result of China’s programs to promote a domestic semiconductor industry and supply chains,” the report said.

References:

https://www.wsj.com/tech/china-telecom-intel-amd-chips-99ae99a9 (paywall)

https://www.ft.com/content/7bf0f79b-dea7-49fa-8253-f678d5acd64a

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China’s telecom industry business revenue at $218B or +6.9% YoY

IDC: Worldwide Smartphone Shipment +7.8% YoY; Samsung regains #1 position

According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments increased 7.8% year over year to 289.4 million units in the first quarter of 2024 (1Q24). This marks the third consecutive quarter of smartphone shipment growth, a strong indicator that a recovery is well underway.

“As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter. While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we’re likely to see the top companies gain share as the smaller brands struggle for positioning.”

“The smartphone market is emerging from the turbulence of the last two years both stronger and changed,” said Nabila Popal, research director with IDC’s Worldwide Tracker team. “Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters.”

| Top 5 Companies, Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q1 2024 (Preliminary results, shipments in millions of units) | |||||

| Company | 1Q24 Shipments | 1Q24 Market Share | 1Q23 Shipments | 1Q23 Market Share | Year-Over-Year Change |

| 1. Samsung | 60.1 | 20.8% | 60.5 | 22.5% | -0.7% |

| 2. Apple | 50.1 | 17.3% | 55.4 | 20.7% | -9.6% |

| 3. Xiaomi | 40.8 | 14.1% | 30.5 | 11.4% | 33.8% |

| 4.Transsion | 28.5 | 9.9% | 15.4 | 5.7% | 84.9% |

| 5. OPPO | 25.2 | 8.7% | 27.6 | 10.3% | -8.5% |

| Others | 84.7 | 29.3% | 79.0 | 29.4% | 7.2% |

| Total | 289.4 | 100.0% | 268.5 | 100.0% | 7.8% |

| Source: IDC Quarterly Mobile Phone Tracker, April 15, 2024 | |||||

Notes:

• Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS52032524

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Swisscom (with Ericsson) to offer the world’s best and most sustainable mobile network

Swisscom, the leading network operator in Switzerland, is planning to transform its wireless 3G/4G/5G network into a “smart network” by extending its partnership with Ericsson for another three years. Under the partnership, Ericsson will continue to supply the hardware and software for Swisscom, enabling it to enhance its customer experience and further develop the mobile network with a focus on sustainability.

The strategic partnership between Swisscom and Ericsson dates back to 2015 and has been underscored by a series of wins in mobile network tests from key trade magazines.

Swisscom is extending its strategic partnership with Ericsson for another three years, aiming to transform its network into a smart network. Through automation, the use of artificial intelligence (AI), and increased innovation, the network will be modernized to continue providing the best customer experience now and in the future.

Another important development stream is marked by continuous spectrum refarming to New Radio (NR), with which the service provider prepares its network for 5G Standalone deployment with the possibility of launching new services.

Ericsson has long provided Swisscom with its cloud based Network Functions Virtualization Infrastructure (NFVI) solution to support its telecom applications. With this new deal the service provider will now take on Ericsson’s Cloud Native Infrastructure solution (CNIS). For Swisscom, this means further enhancing the network’s well-established reliability and expanding the ability to host cloud-native telecom applications from Ericsson as well as from third-party providers. It will also help reduce overheads needed to manage the cloud platform and infrastructure, introduce further energy efficiencies, and optimize the total cost of ownership (TCO) overall. The deployment will bring together a close collection of telecom partner companies such as Extreme Networks and Dell Technologies, which contribute components, infrastructure and capabilities to the solution, all collaboratively engaged to ensure Swisscom and its subscribers enjoy the best possible network performance.

Image Credit: Ericsson

Gerd Niehage, CTIO Swisscom, explains, ” We’ve been working closely with Ericsson for over 10 years with a great amount of trust and success. We are now taking the next step in this long-standing strategic partnership as we endeavour to turn Switzerland’s best network into its smartest one. This will enable us to not only offer our customers the best customer experience, but also to place an even greater focus on sustainability and innovation.”

Daniel Leimbach, Head of Customer Unit Western Europe at Ericsson, adds, “In this innovative partnership, Swisscom’s characteristically Swiss pursuit of perfection meets the global technology leadership from Sweden’s Ericsson. Our common goal is to raise the bar even higher and continue to develop Switzerland’s best network into its smartest one. We have already set important benchmarks for the global development of the telecommunications market from within Switzerland in recent years.”

The far-reaching agreement, with a special focus on innovation, performance, and energy efficiency will see the introduction of Ericsson’s lightweight dual-band Radio 4490 as well as the company’s next-generation RAN processor from Ericsson’s RAN Compute portfolio, designed to serve all technologies from a single box and supporting real-time AI processing.

The agreement also includes deployment of Ericsson’s Massive MIMO portfolio across multiple sites as a part of the continued effort to expand coverage. It also will bring network improvements from the introduction of Ericsson’s Cloud Native Infrastructure Solution (CNIS) to support telecom applications across the business, and which enables software upgrades during operation and is also highly energy-efficient. Ericsson’s Intelligent Automation Platform (EIAP) and it’s open rApp (automation applications) ecosystem will also be introduced, offering the Swisscom network access to a wide range of new and innovative applications from Ericsson and other ecosystem members which will bring access to a host of new capabilities to create and maintain world-beating services. Here too, the focus is on performance and efficiency.

Swisscom aims to offer its customers the best and most sustainable network, so the new focus of the strategic partnership is to make the Swisscom network one of the most efficient mobile networks in the world.

Swisscom’s network is already fully powered by renewable energy, and the partners have taken a step further with the launch of an Energy Sustainability Programme (UK spelling) to intelligently reduce the energy consumption of mobile communications systems.

To maximize the partnership, Ericsson and Swisscom employees collaborate in mixed teams to drive innovations and projects forward for the continuous development of the mobile network. This close cooperation offers both companies opportunities to expand their competitive position and customer centricity. With the best network in Switzerland, Swisscom aims to strengthen the competitiveness of the Swiss economy and drive the country’s digital transformation.

References:

https://www.ericsson.com/en/news/2024/4/swisscom-selects-ericsson-to-future-proof-mobile-network

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Ericsson and ACES partner to revolutionize indoor 5G connectivity in Saudi Arabia

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network