Multi-G Initiative to drive Open RAN Software Interfaces and increase innovation

Cohere Technologies, Intel, Juniper Networks, Mavenir and VMware intend to collaborate to develop the industry’s first framework for a multi-generational (Multi-G), software-based Open RAN architecture. The Multi-G initiative would define frameworks, interfaces, interoperability testing, and evaluation criteria that would provide the interfaces to support full coexistence of 4G, 5G, and future waveforms.

Intel’s FlexRAN platform is used by most current virtualized RAN (vRAN) deployments; Mavenir has a strong presence in providing open RAN equipment and software; and Juniper Networks and VMware are both contributing their work with the RAN intelligent controller (RIC). Cohere’s contribution is through its Universal Spectrum Multiplier software that can be integrated by RAN vendors or as an “app” into a telco cloud platform.

Intel’s involvement in this initiative is significant from an industry perspective due to the breadth of FlexRAN adoption. It also puts the chip giant a step ahead of competitors like Qualcomm, Arm and AMD that are aggressively targeting the Open RAN silicon market.

The new Multi-G framework would disaggregate RAN intelligence and scheduling functions, enabling future code releases of Intel’s FlexRAN reference architecture to support higher capacity, software-defined deployments for 4G, 5G and next generation wireless waveforms and standards.

This effort would help drive higher performance and connectivity across satellite, private and ad-hoc networks, and autonomous vehicles, increasing new service and revenue opportunities for telecommunications and mobile operators.

“This is going to make the network programmable all the way from layer one to the highest layers of the architecture,” said Cohere Technologies’ CEO Ray Dolan. “It’s not that open RAN is incomplete or not vibrant or not working, it is.” Right now, it has opened most of the parts that are what I’ll say are less controversial than the E2 interface. It’s opened the radio interfaces and the antenna interfaces, and so it’s established. But it hasn’t established the proper E2 interfaces completely. And that’s widely accepted as a fact. And in order for, I believe, for open RAN to really achieve its full vision, it needs to open that E2 interface because that’s where the innovation will come. Because that’s where all of the complexity in the marketplace is.”

The E2 work basically taps into the near real-time xApps running in a RIC to monitor and optimize an operator’s RAN deployment – typically either a vRAN or open RAN – and across different spectrum bands. This in turn allows an operator to support more stringent service-level agreements (SLAs) and private network deployments that can generate more revenues.

Ahead of the group’s first meeting in May 2023, telecommunications leaders worldwide are already sharing support for the collaborative initiative:

Vodafone Group

“This commitment from Intel, Mavenir, Juniper Networks, and Cohere, with a software programmable L1 stack, is fully aligned with the vision of Open RAN and will bring us one step closer to the scale deployment of software-defined RAN,” said Yago Tenorio, Vodafone Fellow and Director of Network Architecture, and Chairman of the Telecom Infra Project (TIP). “This has huge potential for significant performance and capacity benefits for all existing cellular networks. We strongly endorse this initiative, and we look forward to seeing the critical interfaces published into the relevant O-RAN Alliance and TIP Working Groups.”

Telstra

“Cohere’s Universal Spectrum Multiplier technology has the potential to unlock new architectural capabilities and opportunities for the RAN beyond today’s architecture,” said Iskra Nikolova, Network and Infrastructure Engineering Executive at Telstra. “We’re pleased to support this initiative and look forward to working with Cohere and the group to define the framework and accompanying critical interfaces.”

Bell

“A genuine Multi-G framework will enhance the benefits of Cohere’s Universal Spectrum Multiplier, strengthen Open RAN vendor flexibility down to the silicon layer, and allow old and new waveforms to coexist— beyond 5G,” said Mark McDonald, Bell’s Vice President, Wireless Access. “Bell looks forward to working with Cohere and partners later this year to further test this architecture.”

Hear from the Collaborators:

Intel Corporation

“This Multi-G framework, enabled by Intel FlexRAN – which is fully software programmable down to L1 – will enable faster O-RAN adoption and unlock new innovations,” said Sachin Katti, senior vice president and general manager of the Network and Edge Group at Intel Corporation.

Mavenir

“As the leading Open RAN partner, we’re excited to be part of the Multi-G initiative which promises to bring 4G and 5G spectral efficiencies gains not possible with incumbent solutions,” said Bejoy Pankajakshan, EVP-Chief Technology and Strategy Officer at Mavenir. “Unlike traditional DSS (Dynamic Spectrum Sharing) techniques which reduces 4G and 5G performance, with our Multi-G collaboration with Cohere and Intel, Mavenir can provide a true spectrum co-existence solution, which deploys 5G on the same spectrum assets as 4G dramatically improving the ROI per Hz on the existing 4G spectrum.”

Juniper Networks

“As more 5G deployments are underway, there is still a large installed base of 4G networks that can benefit from the intelligence, control and automation enabled by an Open RAN Intelligent Controller (RIC) architecture,” said Raj Yavatkar, CTO of Juniper Networks. “Juniper Networks has already demonstrated innovative 4G and 5G use cases with our Juniper Non-RealTime RIC and Near-RealTime RIC that can provide more flexibility to network operators. We are excited to add our expertise and join the Multi-G framework initiative, which will not only help to accelerate Open RAN adoptions but will also spur further innovation across multiple generations of mobile networks to enhance the network operator experience.”

VMware

“VMware is already paving the way for more programmable and intelligent Open RAN networks with our VMware RIC and our Service Management Orchestration Framework (SMO) for end-to-end RAN automation, assurance and optimization,” said Sanjay Uppal, GM & SVP, Service Provider Business Unit, VMware. “We are pleased to join other industry leaders to pioneer in the development of the industry’s first framework for a Multi-G, software-programmable architecture that will further encourage innovation and fast-track the adoption of Open RAN globally.”

Open RAN Policy Coalition

“Defining new interfaces that supercharge developing and future networks is critical for the success of open networks,” said Diane Rinaldo, Executive Director of the Open RAN Policy Coalition. “This will foster innovation and add flexibility, which will improve our competitiveness.”

Cohere Technologies

“We are pleased to work with world-class partners and operators to accelerate the deployment of Multi-G, open networks with significant performance improvements,” said Ray Dolan, CEO of Cohere Technologies. “Cohere is committed to a software-based, open architecture that can drive faster innovation and deliver critical revenue growth and profitability for the industry.”

………………………………………………………………………………………………………………………………………………………….

About Cohere Technologies:

Cohere is the innovator of Universal Spectrum Multiplier (USM) software for 4G, 5G, and Multi-G O-RAN. USM improves mobile networks up to 2x by MU-MIMO, enabling existing devices in any FDD and TDD spectrum band. Cohere is the creator of the Orthogonal Time Frequency Space (OTFS) wireless system, and is headquartered in San Jose, Calif. (USA). Website: www.cohere-tech.com Twitter: @Cohere_MultiG

References:

https://www.cohere-tech.com/press-releases/multi-g-initiative

LightCounting: Open RAN/vRAN market is pausing and regrouping

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

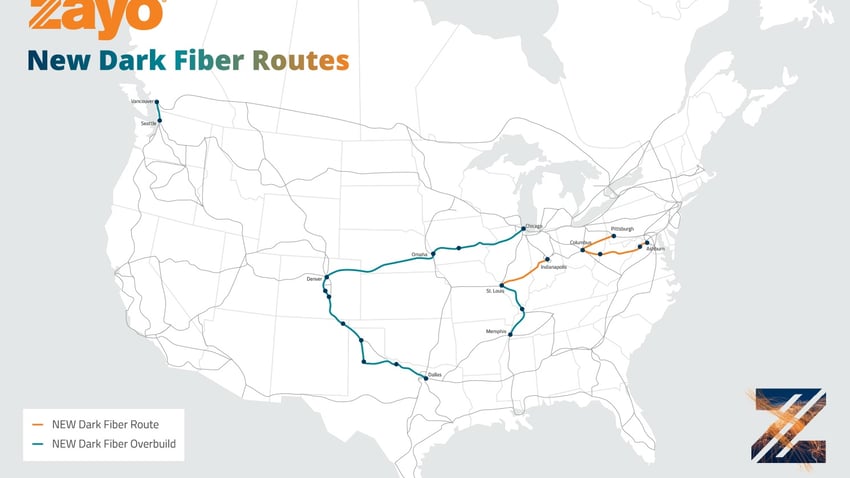

Zayo announces “Waves on Demand,” security enhancements, and network growth

Zayo Group Holdings, Inc (Zayo) today announced a series of expansions and enhancements to its network and services. These include enhanced network protection and an industry-first, on-demand connectivity service, as well as significant growth of its long-haul dark fiber and 400G-enabled routes and modernization of its IP core network. In particular, Zayo plans to build eight new long-haul fiber routes and debuted a new Waves on Demand service for customers looking to rapidly light up added bandwidth. Waves on Demand will initially focus on providing 100G services across eight routes, though a 400G route between Newark, NJ and New York is available. Five additional routes are planned. More details below.

“Yesterday’s network can’t deliver tomorrow’s ideas,” said Andrés Irlando, President of Zayo. “Zayo’s global network provides game-changing performance, scale, security, resilience and value for our customers. Our goal is to revolutionize the industry by constantly improving our network and prioritizing our customers’ needs. Our teams are focused on providing them with the best possible experience.”

Providing an On-Demand Network:

For large bandwidth customers who need data center connectivity quickly and easily, Zayo is launching Waves on Demand to enable same-day turn-up on the most in-demand routes, with significantly shortened delivery times. Zayo will be the only provider to enable customers to provision wavelengths within a day.

This industry-first means customers can quickly provision “Wavelength on Demand” between key data center locations across its market-leading network footprint, including its highest-demand routes. In 2023, Zayo launched 8 new Waves on Demand routes, with 5 additional routes planned for the future.

Zayo’s Completed Waves on Demand routes include:

- Newark, NJ – New York, NY (up to 400G)

- Ashburn, VA – New York, NY

- Hillsboro, OR – Seattle, WA

- Ashburn, VA – Newark, NJ

- Atlanta, GA – Dallas, TX

- Los Angeles, CA – San Jose, CA

- Inter-Los Angeles, CA

- Los Angeles, CA – San Jose, CA (alt)

Zayo’s Planned Waves on Demand Routes include:

- Toronto, ON – Chicago, IL

- San Jose, CA – Seattle, WA

- Newark, NJ – Chicago, IL

- Chicago, IL – Secaucus, NJ

- Englewood, FL – Chicago, IL

Chaz Kramer, Zayo’s VP of Product Management, told Fierce that Waves on Demand will cut the time required to add wavelengths from 45 days or more to just hours. said, “80% of our services right now are 100G services at the moment. Our focus is trying to solve the customer requirement for that time lag in terms of service delivery,” he said.

“The only way to stay ahead of the digital curve is to continuously transform. Transformative ideas need a reliable, resilient and on-demand network,” said Bill Long, Chief Product Officer at Zayo. “Zayo is leading the industry with network automation and self-service options, ensuring customers have unprecedented speed and resilience with more flexibility and elasticity, while enhancing security and value, so our customers can focus on making progress toward their business goals instead of worrying about their network.”

Security Enhancements:

Security has never been more important across the tech industry, and beyond. As more and more companies face the realities of route hijacking, Zayo has taken security protection for customers one step further.

In addition to deploying Resource Public Key Infrastructure (RPKI) filtering – a component of Mutually Agreed Norms for Routing Security (MANRS) compliance designed to secure the internet’s routing infrastructure – Zayo now requires two-factor authentication process for Border Gateway Protocol (BGP) route management. As one of the first communications infrastructure providers to implement a two-factor authentication process for BGP updates, this will provide improved security for the broader internet community and prevent inadvertent or malicious route hijacks from bad actors.

Network Growth and Modernization

This year Zayo began IP Core upgrades to support 400G connectivity, providing better routing performance, stability, high bandwidth and reduced pricing for customers. Zayo has partnered with Juniper Networks®, a global leader in IP networking, cloud and connected security solutions for next-gen IP Core connectivity.

“Juniper Networks is dedicated to delivering state-of-the-art solutions, including systems optimized for our customers’ current and future core throughput demands. We are pleased to partner with Zayo as they construct and fortify their next-generation IP Core network, equipped with 400G,” said Sally Bament, Vice President of Service Provider Marketing at Juniper Networks. “By employing Juniper’s core routers, Zayo can ensure their customers enjoy high-speed bandwidth services that can support growing performance and capacity demands of end users.”

The Growth of Zayo’s Network:

- In 2022, Zayo added 5,200 route miles to its network, resulting in more than 1.35M fiber miles.

- Zayo now has 224 400G-enabled wavelength points of presence (PoPs) and 145 100G-enabled PoPs.

- Zayo deployed 24 long-haul waves routes in 2022 with 926TB of wavelength capacity, enabling 400G services across these routes, spanning more than 20,000 route miles. In 2023, Zayo will exceed the number of new Long Haul Dark Fiber routes deployed in 2022.

- Zayo will complete 8 long-haul construction projects in 2023, totaling 2,951 route miles and 708,000 fiber miles.

- Zayo is estimated to complete 32 400G routes in 2023 with 14 completed in the first half of the year.

Zayo’s 2023 planned new and augmented dark fiber routes:

- New – St. Louis, MO to Indianapolis, IN

- Overbuild – Denver, CO to Dallas, TX

- Overbuild – Chicago, IL to Omaha, NE

- Overbuild – Omaha, NE to Denver, CO

- Overbuild – Seattle, WA to Vancouver, WA

- New – Columbus, OH to Pittsburgh, PA

- Overbuild – St. Louis, MO to Memphis, TN

- New – Columbus, OH to Ashburn, VA

Zayo’s New Tier 1 400G Routes:

- Albany, NY – Newark, NJ

- Bend, OR – Umatilla, OR

- Chicago, IL – Cleveland, OH

- Albany, NY – Boston, MA

- Atlanta, GA – Washington, DC

- Dallas, TX – St. Louis, MO

- Denver, CO – Dallas, TX

- Kansas City, MO – Indianapolis, IN

- Las Vegas, NV – Phoenix, AZ

- Montreal, QC (Canada) – Quebec City, QC (Canada)

- Columbus, OH – Ashburn, VA

- Columbus, OH – Cleveland, OH

- Columbus, OH – Pittsburg, PA

- Chicago, IL – Clinton, KY

- Clinton, KY – Ponchatoula, LA

- Toronto, ON (Canada) – Waterloo, ON (Canada) (Crosslake)

- Toronto, ON (Canada) – Montreal, QC (South) (Canada)

- Toronto, ON (Canada) – Montreal, QC (North) (Canada)

- Indianapolis, IN – Columbus, OH

- Ashburn, VA – Baltimore, MD

- Salt Lake City, UT – Seattle, WA

- Los Angeles, CA – San Jose, CA

Additional tier 2 and 3 routes will also be added throughout 2023, totaling 32 new routes.

“We believe that technology plays a critical role in preparing students for the future. We chose Zayo’s future-ready network because of its resilience and performance,” said Dr. Thomas Weeks, Chief Technology Officer at Hillsborough County Public Schools. “We trust Zayo because they invest in their world-class network. The Zayo team worked with us to tailor a solution that met the unique needs of our school district and enhances our effectiveness to help students and staff achieve.”

Enhancing Service Delivery and Customer Experience:

Zayo has also set out to change the trajectory of customer experience. Zayo optimized its service delivery with rebuilt processes that utilize automation to make working with Zayo easier for customers. Since implementing these changes, Zayo had its largest install quarter in history in Q4 2022.

To learn more about Zayo’s network and how it can help you connect what’s next, please visit https://www.zayo.com/info/network-expansion/

About Zayo Group Holdings, Inc:

For more than 15 years, Zayo has empowered some of the world’s largest and most innovative companies to connect what’s next for their business. Zayo’s future-ready network spans over 16 million fiber miles and 139,000 route miles. Zayo’s tailored connectivity and edge solutions enable carriers, cloud providers, data centers, schools, and enterprises to deliver exceptional experiences, from core to cloud to edge. Discover how Zayo connects what’s next at www.zayo.com and follow us on LinkedIn and Twitter.

References:

https://www.fiercetelecom.com/telecom/zayo-slashes-time-turn-bandwidth-waves-demand

Zayo to deploy 400G b/s network across North America and Western Europe

Digital Realty & Zayo plan next gen fiber interconnection and security capabilities

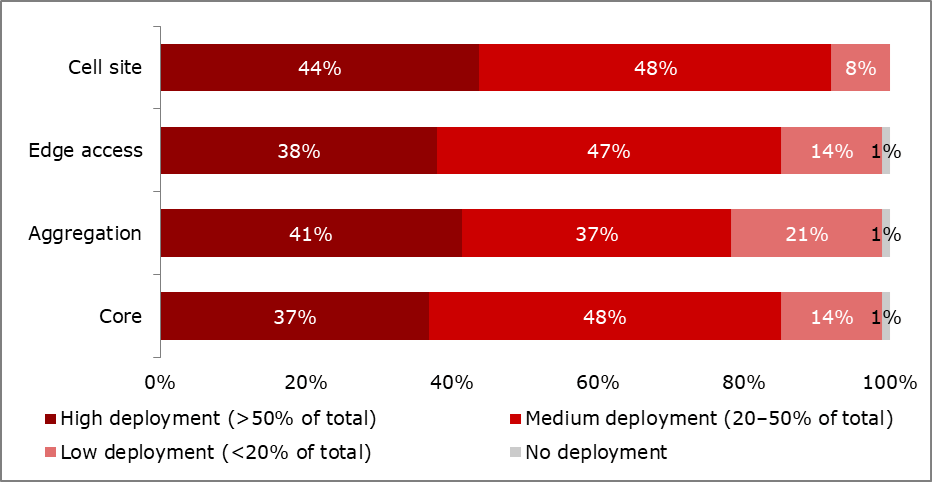

Heavy Reading Survey: Network White Boxes and Cell Site Backhaul Connectivity

Heavy Reading’s (owned by Informa) 2023 survey attracted 87 qualified network operator responses from around the world who shared their views on transport deployment issues and timelines, fronthaul networks and RAN centralization, routing and synchronization, and 5G edge connectivity.

Network disaggregation has been defined as “The separation of networking equipment into functional components and allowing each component to be individually deployed.” The disaggregated network approach first gained major attention in 2012 when standards organization ETSI formed a working group to define how telecom operators could move to a cloud-native model for deploying networking and services.

White Box Deployment Model:

In the disaggregated network model, the network operating system/software is separate from the underlying hardware (white boxes), with each supplied by different vendors. White boxes can be bare metal switches, routers, packet-optical equipment or DWDM transponders. They are mostly used by cloud service providers and large network operators.

Network operators surveyed by Heavy Reading expect white box elements to have their highest deployments in cell sites and aggregation nodes. 44% of operators expect high deployments in cell sites (defined as greater than 50% of total elements), followed closely by aggregation, with 41% expecting high deployments.

Among the top benefits of white box cell site and aggregation deployments are easy integration into the RAN, compact footprint where space is at a premium and scaling from 10G to 400G on the same platform.

How extensively does your organization expect to deploy white box optical transport platforms over the next three years for the following 5G transport segments?

Source: Heavy Reading

…………………………………………………………………………………………………………………………………………………………………..

Cell Site Backhaul:

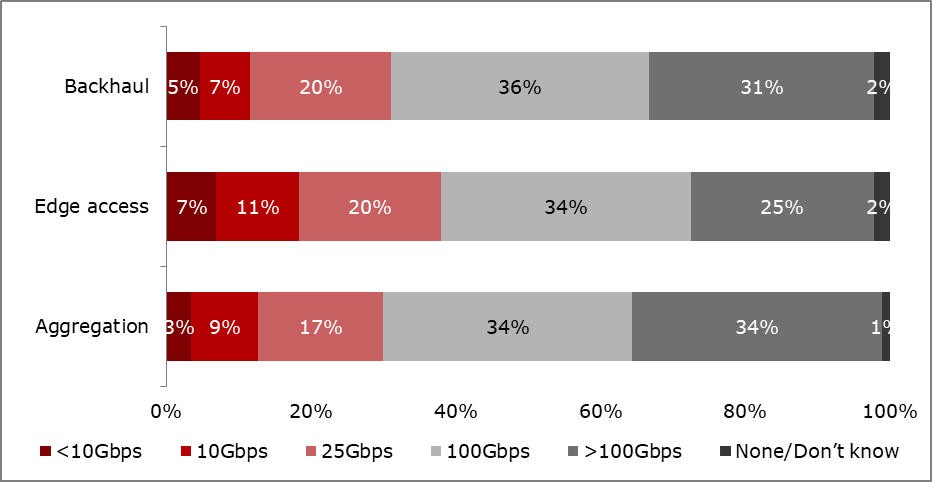

5G requires a huge increase in capacity per cell site, with 10 Gbps replacing 1 Gbps as the standard for cell site backhaul speed. This tenfold jump in capacity is needed to meet initial 5G cell site requirements, as well as to provide room to grow for future increases. But the impact on 5G transport segments goes well beyond 10G, based on Heavy Reading survey results. Just over two-thirds of operators expect at least 100Gbps of capacity will be required in backhaul (67%) and aggregation (68%), while just under two-thirds of respondents (59%) expect that greater than 100 Gbps will be needed in edge access.

Heavy Reading found that 10Gbps to the individual cell site will be sufficient. However, network operators will often carry traffic from multiple cell sites, such as when using ring topologies for backhaul or when aggregating traffic coming in from multiple cell site locations. These survey results provide strong support that 100 Gbps and even 400 Gbps will play major roles in edge, aggregation and backhaul networks over the medium term.

What is your average expected bandwidth capacity in each of the following segments over the next three years (i.e., end of 2025)?

Source: Heavy Reading

………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g-and-beyond/transport-priorities-for-next-phase-of-5g/a/d-id/784462?

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Disaggregation of network equipment – advantages and issues to consider

CTIA commissioned study: U.S. running out of licensed spectrum; 5G FWA to be impacted first by network overloads

5G networks may begin to run out of spectrum capacity within the next five years, according to a new study commissioned by CTIA and done by the Battle Group. Absent any new spectrum, by 2027, the U.S. is expected to have a spectrum deficit of nearly 400 megahertz. In ten years, by 2032, this deficit could more than triple to approximately 1,400 megahertz. To avoid this deficit, work needs to begin now on filling the spectrum pipeline.

The Executive Summary of the report states:

“Mobile data demand is exploding, with aggregate data downloaded quadrupling in the last seven years. New and innovative uses enabled by 5G, as well as the prospect of 6G applications, point towards further increases in expected demand for mobile network capacity. Unfortunately, the U.S. spectrum landscape appears to be stalled, with no clear prospects for significant spectrum reallocations this year and insufficient bands under consideration for reallocation in the coming years. This lack of a spectrum pipeline, coupled with the lapse of the Federal Communications Commission (FCC) auction authority, has raised the prospect of significant capacity constraints in the terrestrial wireless space, and concern that this may limit the U.S.’s ability to be a leader in this area. This paper investigates this capacity constraint and estimates the likely spectrum deficit the U.S. will face over the next decade absent policymakers allocating additional full power, licensed spectrum.”

Source: Battle Group

………………………………………………………………………………………………………………………………………………

The Battle Group analysis indicates that additional mobile spectrum allocations are necessary if U.S. wireless networks are to be able to supply enough capacity to meet growing demand. It is infeasible to expect non-spectrum inputs to cover the capacity deficit, even using conservative inputs and under the most optimistic scenarios. With aggressive investment in infrastructure and reasonably expected improvements to spectral efficiency, we estimate that in order to meet demand in five years industry will still require approximately 400 megahertz of spectrum in the next 5 years, and over 1,400 megahertz in ten years. This estimate is normalized to exclusively licensed, wide-area, full-power spectrum, with propagation characteristics of 1-2 GHz. Spectrum with other characteristics would change the analysis—for example, if spectrum were only made available with lower power levels, much more would be required to meet demand.

Recent growth in popularity of fixed wireless access (FWA), which provides home broadband over licensed mobile spectrum, will increase the capacity load on licensed networks. In particular, “Fixed wireless access would likely be the first service to be impacted [by network overloads]. Already today home broadband over 5G is only offered in locations where operators have available capacity in the network to provide sufficient quality of service for a home connection. Without additional spectrum, fixed wireless access will not be able to reach its potential scale, limiting the opportunity for additional competition to be injected into the home broadband market.”

“Our analysis indicates that, given the pace of the demand growth, technological solutions and deploying more cell sites are insufficient to ease the capacity constraint currently facing the US cellular networks,” the report concludes. That conclusion is in stark contrast to FWA capacity assurances from the Verizon and T-Mobile (AT&T has yet to offer 5G FWA). “We’re adding far more capacity to our network than the peak usage increase we’re expecting in the fixed wireless market,” Verizon CEO Hans Vestberg proclaimed earlier this year.

“The report’s findings underscore the growing risk to America’s 5G and innovation leadership,” the CTIA warned, citing the Brattle Group report. “Currently the United States has no plan to allocate more midband spectrum for 5G and Congress allowed the FCC’s ability to auction spectrum for licensed, commercial use, to lapse for the first time in its 30-year history. This inaction in the face of a looming spectrum deficit contrasts with other countries: Today the United States trails other countries in 5G spectrum by 378 megahertz on average – a deficit expected to grow to 518 megahertz in five years.”

“Even accounting for extremely optimistic improvements in spectral efficiency and additional infrastructure deployment, the (Battle Group) analysis makes clear that additional 5G-ready spectrum is the only realistic way to meet projected growth in demand.

“The inability to provide adequate capacity to support projected usage growth would lead to poor customer experience, network overload, and otherwise risk forfeiting U.S. leadership in 5G and beyond,” said Dr. Coleman Bazelon, Principal, The Brattle Group.

“Coleman’s report helps define the risk of continued inaction on spectrum. We need more 5G spectrum to meet increasing data demand, support new innovation and enable the speeds and capacity necessary to fuel future innovation,” said CTIA President and CEO Meredith Attwell Baker. “We now have a target for future action. More full-powered, exclusive-licensed spectrum is key to both our economic and national security. Letting auction authority lapse sent the wrong signal to the rest of the world. We need to restore it quickly with a defined set of new auctions.”

“Our analysis indicates that, given the pace of the demand growth, technological solutions and deploying more cell sites are insufficient to ease the capacity constraint currently facing the U.S. cellular networks. Spectrum availability is the key to solving the capacity shortfall and Congress, the FCC, and other policymakers should work to allocate more spectrum for licensed mobile uses in a timely manner,” said co-author Dr. Paroma Sanyal, Principal, The Brattle Group.

CTIA said that the U.S. now trails other countries in 5G spectrum by 378 megahertz on average—a deficit expected to grow to 518 megahertz in five years. One of CTIA’s top goals this year is to generate support among lawmakers for rules that would take the 3.1-3.45GHz band from the DoD and reallocate it to 5G network operators.

“Spectrum repurposing is a difficult and time-consuming process, and unfortunately there is not an adequate pipeline of spectrum anticipated to meet wireless demand today. Our analysis gives a glimpse of the stunted wireless future if policymakers do not act,” said Dr. Bazelon.

Another mechanism to increase wireless network capacity involves building more cell sites, including small cells. In its report, the Brattle Group estimated a total of 298,001 macro cell sites in the US in 2022 alongside 150,399 small cells. (Those figures don’t quite dovetail with the 209,500 macrocell sites and 452,200 outdoor small cell nodes counted in a study commissioned by the Wireless Infrastructure Association, the main trade association for the US cell tower industry.) Regardless, the Brattle Group predicts those figures will grow to 324,943 macro cell sites and 364,428 small cells by 2027.

But the report argues that cell site growth won’t keep pace with user’s data demands. “Therefore, if historical technology trends hold and forecasted traffic patterns are realized, these solutions are unlikely to be sufficient to meet rapidly growing traffic,” according to the report.

Therefore, the report concludes that the only way to prevent network overloads is to release more licensed spectrum to 5G network operators – which is CTIA’s main political goal.

References:

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

Backgrounder -5G SA Core Network:

5G SA core is the heart of a 5G network, controlling data and control plane operations. The 5G core aggregates data traffic, communicates with UE, delivers essential network services and provides extra layers of security, and all 3GPP defined 5G features and functions. There are no standards for implementation of 3GPP defined 5G SA core network architecture, which is said to be a service based architecture, recommended to be “cloud native.” Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

A 5G NSA network is a LTE network with a 5G NR, i.e. the 5G NR Access Network is connected to the 4G Core Network.

AT&T Yet to Deploy 5G SA Core Network but is “charging forward to advance 5G SA ecosystem readiness:

It’s been a long wait for AT&T’s 5G SA core network, which is required to realize ALL 5G functions defined by 3GPP, including network slicing, network virtualization, security, and edge computing (MEC).

- The U.S. mega network operator initially said they would launch 5G SA core network in 2020 but that never happened.

- On June 30, 2021, AT&T said their mobile network traffic will be managed using Microsoft Azure technologies. “The companies will start with AT&T’s 5G core, the software at the heart of the 5G network that connects mobile users and IoT devices with internet and other services.” Almost two years later, that hasn’t happened either!

- In an April 18, 2022 blog post on the company’s website, AT&T now says they are “Taking 5G to the Next Level with Standalone 5G.” AT&T has said that they “plan to deploy Standalone 5G when the ecosystem is ready, and AT&T is charging forward to advance 5G SA ecosystem readiness. Businesses and developers will be some of the first to take advantage of the new technologies standalone 5G enables as we continue to move from research & development to their deployment.”

However, AT&T did not provide a date or even a timeframe when its 5G SA core network would be deployed. Instead, the telco lauded several 5G advances they’ve recently made. Those include:

1. Completed the first 5G SA Uplink 2-carrier aggregation data call in the U.S.

Carrier aggregation (CA) means we are combining or “aggregating” different frequency bands to give you more bandwidth and capacity. For you, this means faster uplink transmission speeds. Think of this as adding more lanes in the network traffic highway.

The test was conducted in our labs with Nokia’s 5G AirScale portfolio and MediaTek’s 5G M80 mobile test platform. AT&T aggregated their low-band n5 and our mid-band n77 spectrum. Compared to the low-band n5 alone, AT&T realized a 100% increase in uplink throughput by aggregating the low-band n5 with 40MHz of AT&T’s mid-band n77. Taking it a step further, AT&T achieved a 250% increase aggregating 100MHz of n77. The bottom line: AT&T achieved incredible upload speeds of over 70 Mbps on n5 with 40MHz of n77 and over 120 Mbps on n5 with 100MHz of n77.

2. Using a two-layer uplink MIMO on time division duplex (TDD) in our mid-band n77. MIMO combines signals and data streams from multiple antennas (“vehicles”) to improve signal quality and data rates. This feature will not only improve uplink throughput but also enhance cell capacity and spectrum efficiency.

3. Last fall, AT&T completed a 5G SA four component carrier downlink call by combining two FDD carriers and two TDD carriers. These capabilities allow AT&T devices to aggregate our mid-band n77 in the C-Band and 3.45GHz spectrum ranges. Compared with low band and mmWave spectrum, mid-band n77 provides a good balance between coverage and speed. This follows the 5G SA three component carrier downlink feature that we introduced last year to 2022 AT&T Flagship devices which combines one frequency division duplex (FDD) carrier and two TDD carriers.

4. In the coming months, AT&T will enable 5G New Radio Dual Connectivity (NR-DC), aggregating our low and mid-band spectrum with our high-band mmWave spectrum on 5G SA. Our labs have achieved 5G NR-DC downlink throughput speeds of up to 5.3Gbps and uplink throughput speeds of up to 670Mbps. This technology will help provide high-speed mobile broadband for both downlink and uplink in stadiums, airports, and other high-density venues.

5. Here are some features that are on the horizon for 5G SA (how far away is the horizon?):

- Specialized Network Services – think network slicing, precision location, private routing, etc. – for tailored network solutions to meet specific user requirements;

- Non-terrestrial network solutions to supplement coverage in remote locations ; and

- Reduced capability 5G (RedCap) for a new generation of 5G capable wearables, industrial IoT or wireless sensors and other small form factor consumer devices.

In conclusion, AT&T’s Jason Sikes wrote, “The 5G SA ecosystem is rapidly evolving, with new technologies and capabilities being introduced to set the foundation for next generation applications and services.” Yet no information was provided on the status of AT&T’s 5G SA network running on Microsoft Azure cloud technology!

AT&T to run its mobility network on Microsoft’s Azure for Operators cloud, delivering cost-efficient 5G services at scale.

Image Credit: Microsoft

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

In the U.S., T-Mobile launched 5G SA core network nationwide last year, while Verizon began shifting its own traffic onto its 5G SA core in 2022. More recently, Verizon officials have begun hinting at interest in selling SA-powered network slices to public safety customers and others.

At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks. “Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” said Dave Bolan, Research Director at Dell’Oro Group.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/atandt-to-launch-standalone-5g-later-this-year/d/d-id/764109

https://about.att.com/blogs/2023/standalone-5g-innovations.html

https://about.att.com/story/2021/att_microsoft_azure.html

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

China Mobile explores buyout of Hong Kong telecom firm HKBN

China Mobile Ltd is exploring a buyout of Hong Kong’s leading telecoms company HKBN Ltd, four people with knowledge of the matter said That could spark a bidding war for the firm currently valued at $1 billion.

China Mobile in recent weeks sent a request for proposal (RFP) to a small group of banks to advise on acquiring and taking-private the Hong Kong telecom provider, which offers services including broadband and Wi-Fi management, the people said.

HKBN shares jumped more than 17% after the Reuters report and closed at HK$6.57 a piece Tuesday, valuing the company at HK$8.6 billion ($1.1 billion). HKBN declined to comment. China Mobile did not respond to a request for comment.

China Mobile’s potential takeover interest in HKBN comes after infrastructure investor I Squared Asia Advisors submitted a non-binding letter of interest for the Hong Kong telecoms services provider in March.

HKBN said at that time the infrastructure investor would make an offer via its portfolio company HGC Global Communications and or one of its affiliates, should it proceed with the deal.

There could be other potential suitors for HKBN, said one of the people and a separate person with knowledge of the matter, including Hong Kong-based private equity firm PAG who declined to comment.

North Asia-focused private equity firm MBK Partners and buyout firm TPG Capital, which are among the top shareholders of HKBN, will seek to fully exit in any potential buyout of the company, separate sources have told Reuters.

…………………………………………………………………………………………………………………….

HKBN reported it had a 34 per cent share of Hong Kong’s residential broadband market and 37 per cent of the enterprise market at end-2022. In late March, HKBN’s board said it was approached about a potential take over by I Squared Asia Advisors, the same asset management company that owns Hong Kong ISP HGC Global Communications.

Others showing interest include global investment company PAG, Bloomberg wrote, noting potential buyers may team with HKBN management for a buy out.

A sale in 2022 was halted by potential buyers including KKR and PAG due to concerns over the valuation.

HKBN was sold to CVC Capital Partners in 2012 in a management buy out and was listed in 2014.

References:

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Qualcomm announces 4 new SoC’s for IoT applications and use cases

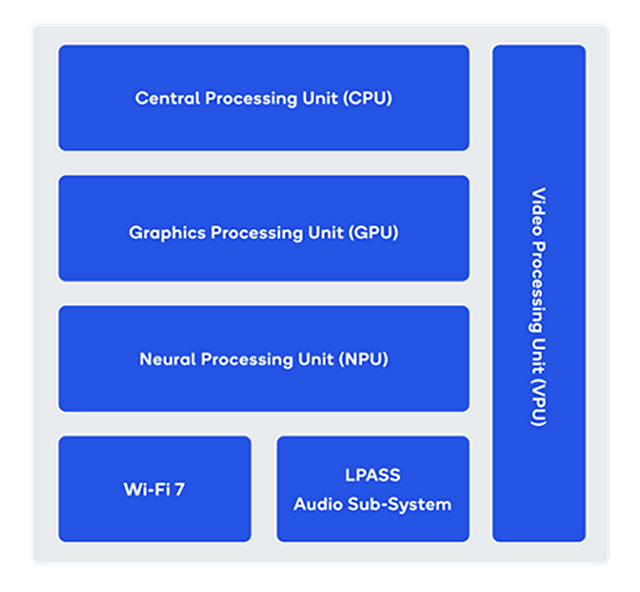

Qualcomm has launched four system on a chip (SoC) “solutions.” The QCS8550 and QCM8550 are the higher powered ones, designed for uses such as drones and cloud gaming. The only difference seems to be that the ‘M’ variant has an embedded modem. Both are made for manufacturers and designers of IoT products that demand the highest performance in a single processor. Ideal use cases include, but are not limited to:

- Autonomous mobile robots: Implement simultaneous location and mapping (SLAM), with a richer sensor set and AI at the network edge

- Industrial drones: Run multiple cameras with the real-time AI processing needed for drones

- Edge AI devices: Enable multiple concurrent machine learning modules per stream

- Video collaboration: Premium performance for delivering some of the most engaging meeting experiences using video and audio AI, multiple high-resolution cameras and abundant compute and graphics processing unit (GPU) power

- Video transcoding: Convert live video to multiple formats simultaneously — especially useful for short video applications

- Cloud gaming: Run multiple cloud-based games concurrently with visually richer game content and deeper player engagement

- Camera applications: Build cameras for sports/action, security, automobile dashes and multi-camera with improved IQ and cognitive ISP

- Retail: Apply AI to reduce friction in retail scenarios like unattended smart carts, smart cameras, on-shelf product identification and bar codes

The Qualcomm® QCS4490 and QCM4490 SoC’s are IoT optimized SoC’s for Android handheld devices. The QCM4490 system on chip (SoC) delivers key, advanced features now required by industrial handheld, industrial computing, and other IoT devices. It comes loaded with 5G NR connectivity, Wi-Fi 6E for multi-gigabit speeds, extended range, and low latency, and powerful, efficient processing to handle complex computing tasks. With planned support for Android releases through version 18, you can use this SoC for industrial designs through 2030, helping save costs and development time. We’ve designed a mid-tier solution packed with a lot of purpose.

“Qualcomm Technologies is uniquely positioned to take the IoT ecosystem forward,” said Dev Singh, vice president, business development and head of building, enterprise & industrial automation, Qualcomm Technologies, Inc. “Our new solutions bring together the industry’s leading technologies across edge AI processing, innovative power efficiency, crystal-clear video, 5G connectivity, and more to fuel the next-generation of resilient, high-performing IoT applications.”

Qualcomm likes to coincide its new silicon announcements with trade shows. This one was made at Hannover Messe 2023, a general industry show that seems to be what CeBIT turned into.

References:

https://www.qualcomm.com/products/technology/processors/qcm4490

https://telecoms.com/520064/qualcomm-launches-a-new-iot-platform/

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

Qualcomm Introduces the World’s First “5G NR-Light” Modem-RF System for new 5G use cases and apps

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Viettel Group and Qualcomm collaborate on 5G Radio Unit with massive MIMO

Vodafone Idea (Vi) to launch 5G services “soon;” Awards optical network equipment contract to ZTE

Hindustan Times: Although India telco competitors Reliance Jio and Airtel have launched and made fully operational their 5G services in several regions, the Aditya Birla Group and Vodafone Group collaboration telco is yet to announce the launch of next generation service. However, Kumar Mangalam Birla, chairman of the Aditya Birla Group, indicated that the Vi will soon launch 5G services. Speaking on the side-lines of the AIMA Awards to CNBC -TV18, Birla said, “5G rollout will begin soon.” He did not, however, provide a specific launch date.

Kumar Mangalam Birla is chairman of Aditya Birla Group.(YouTube/@IIT Bombay Official Channel)

Vi is now lagging far behind in the race to 5G with being the only private telecom operator to not have this next-gen services. In October of last year, Bharti Airtel launched its Airtel 5G Plus service in select areas. Reliance Jio, its competitor, is also offering Jio True 5G in multiple locations. The state-owned telecom operator BSNL is also planning to launch 5G by this August.

Vodafone Idea has been losing subscribers. The debt-ridden telco lost 2.47 million subscribers in December 2022. During the same period, Mukesh Ambani-led Reliance Jio gained 1.7 million subscribers, followed by Airtel, which gained 1.52 million subscribers, reported Business Insider.

Airtel, like its rival Reliance Jio, is offering 5G services at the same tariff levels as 4G, luring users away from competitors, primarily Vodafone Idea. According to data from the Telecom Regulatory Authority of India, the number of porting requests increased over the last year to more than 12 million in November.

References:

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Adani Group to launch private 5G network services in India this year

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

Nokia Executive: India to Have Fastest 5G Rollout in the World; 5Gi/LMLC Missing!

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Vodafone Idea earlier this month awarded a fresh optical transmission equipment network order worth around Rs 230 crore to Chinese company ZTE for Gujarat, Maharashtra, and Madhya Pradesh-Chhattisgarh. The telco is upgrading its network, and for a fresh network deployment or upgrade and maintenance, telcos have to take approval from the National Security Council Secretariat (NSCS) and provide information regarding vendors and their technology. Notably, ZTE hasn’t been given the trusted sources approval by the NSCS (India’s National Security Council), said an ET report. Vodafone Idea’s optical transmission network has deployments from both Huawei and ZTE across all telecom circles.

Airtel, another Indian telecom operator, had last year awarded a telecom infrastructure expansion contract worth Rs 150 crore to Huawei. Under the deal, Huawei upgraded and expanded Airtel’s National Long Distance (NLD) network. Airtel awarded a similar contract to Huawei worth Rs 300 crore in 2021. Both these contracts were given to Huawei despite the latter not having the trusted sources approval.

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

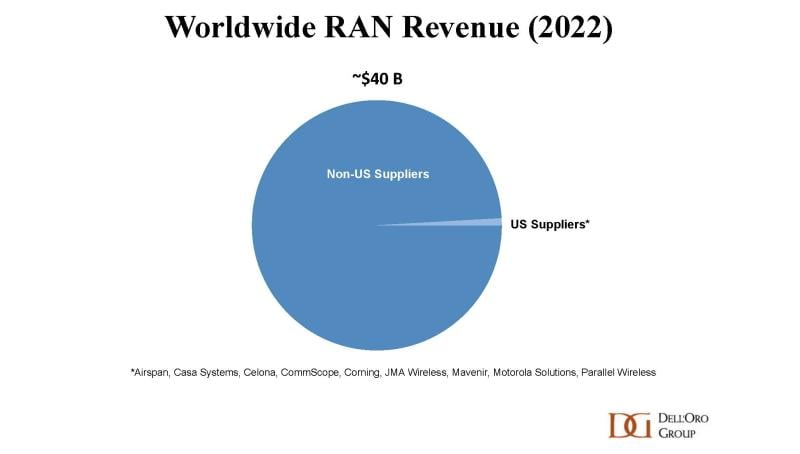

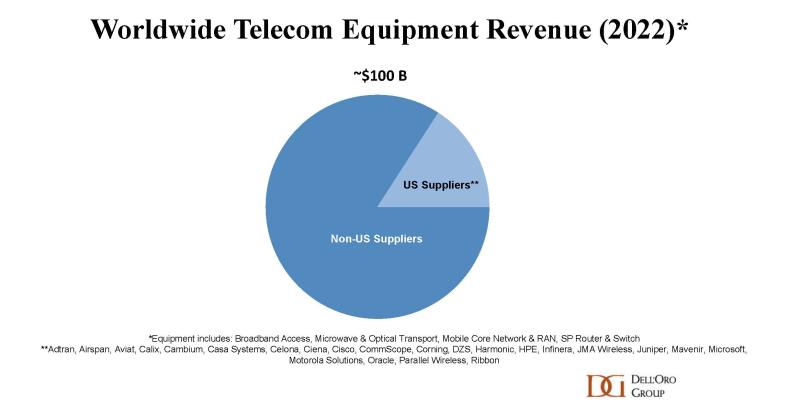

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

NTIA’s Wireless Innovation Fund to stimulate open 5G and future-gen wireless markets; OpenRAN rebuttal

The U.S. Commerce Department’s National Telecommunications and Information Administration (NTIA) has officially launched its Wireless Supply Chain Innovation Fund, which has a budget of $1.5 billion and a mandate to spend it on stimulating the development of new and exciting telco technology. It’s mission is to “open 5G and future-gen wireless markets to innovation and entrepreneurship in the U.S., as well as by our partners and allies.”

NTIA will work to catalyze the development and adoption of open, interoperable, and standards-based networks through the Innovation Fund. Authorized under the Fiscal Year 2021 National Defense Authorization Act and funded through the CHIPS and Science Act of 2022, this ten-year grant program will help drive wireless innovation, foster competition, and strengthen supply chain resilience. It will also help unlock opportunities for companies from the United States and its global allies, particularly small and medium enterprises, to compete in a market historically dominated by a few suppliers, including high-risk suppliers that raise security concerns.

On Wednesday, NTIA announced its first notice of funding opportunity (NOFO), which invites interested parties to apply for some of that money. This first tranche of grants, worth up to $140.5 million, has been earmarked for projects focused on OpenRAN R&D. By demonstrating the viability of new, open-architecture approaches to wireless networks, this initial round of funding will help to ensure that the future of 5G and next-gen wireless technology is built by the U.S. and its global allies and partners –not vendors from nations that threaten America’s national security.

“The Innovation Fund is a critical step toward securing 5G wireless networks while driving innovation at home and abroad,” said Commerce Secretary Raimondo. “Investing in the next generation of innovation will unlock opportunities for new and emerging companies to compete in the global telecom market, strengthen our telecom supply chains and provide our allies and friends with trusted choices and innovative technologies to compete in the 21st Century. We look forward to bringing the best of industry, academia, and the public together to deliver on this initiative.”

NTIA’s first NOFO aims to expand and improve testing to demonstrate the viability of new approaches to wireless like open radio access networks (OpenRAN) and remove barriers to adoption. NTIA anticipates it will award up to $140.5 million during this first tranche of grants. The first round of awards will provide for a range of R&D and testing activities in this critical field, including:

- Expanding industry-accepted testing and evaluation (T&E) activities to assess and facilitate the interoperability, performance, and/or security of open and interoperable, standards-based 5G radio access networks; and

- Developing new or improved testing methodologies to test, evaluate, and validate the interoperability, performance, and/or security of these networks, including their component parts.

Later NOFOs will build upon the foundational work of this first NOFO, creating an ecosystem for wireless innovation built by the U.S. and its global allies.

“This fund is a critical down payment on our efforts to reshape the global wireless infrastructure supply chain towards secure and trusted vendors,” said Sen. Mark Warner (VA). “I look forward to seeing how the Department – working with U.S. and allied innovators and network operators – helps encourage this market to move towards security, interoperability, and greater wireless innovation.”

“With the investments from this initiative, the US can help facilitate much-needed competition in the global wireless market and create a more resilient and secure wireless supply chain,” said Assistant Secretary of Commerce Alan Davidson.

“Today’s announcement marks critical new progress toward strengthening the security of our wireless networks,” added energy and commerce committee ranking member Frank Pallone. “This program is a win for both U.S. national security and innovation, and with it, we will help level the playing field against untrusted actors attempting to use our communications networks against us.”

This announcement comes the same week as the U.S. moved forward with its plan to name and punish any ally that permits the use of network equipment developed by Chinese vendors Huawei and ZTE. The ‘Countering Untrusted Telecommunications Abroad Act’ is reportedly due to have its second reading this week.

Separately, the NOFO announcement came a day after the UK unveiled its own strategy for driving innovation in the telecoms sector. The UK government seems to have implied that it wouldn’t necessarily oppose consolidation in the mobile market, insisting that there is no magic number of operators.

……………………………………………………………………………………………………………..

Comment and Analysis – OpenRAN Rebuttal:

This author and several of his colleagues have been negative on OpenRAN for a very long time. The main reason is that Open RAN specs (which are to ensure multi-vendor interoperability) are being developed by the O-RAN Alliance, with test scripts from the TIP OpenRAN project. Neither of those entities are Standards Development Organizations (SDOs). While O-RAN did forge an alliance with ATIS, that won’t help much as ATIS has not developed any cellular standards on its own.

The two organizations that develop all the cellular specs and standards are 3GPP and ITU-R IMT yet O-RAN Alliance does not have a liaison with either of them!

Here is the opinion of our colleague John Strand, Principal of StrandConsult on why Open RAN is popular in some countries and with selected media, but really has no serious market potential:

The U.S. State Department spends a lot of energy promoting OpenRAN as an alternative to Chinese vendors like Huawei and ZTE. It is described quite well in this article. I had a meeting with those people at the State Department in Washington on December 8th last year, and they understand that OpenRAN was not a product that operators were buying.

In Europe, operators such as Deutsche Telecom and Vodafone have bet big on Huawei. That’s described in our reports: Understanding the Market for 4G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 102 Mobile Networks – Strand Consult and The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries – Strand Consult

Europe has also agreed that it is not smart to build vital telecom infrastructure using network equipment from China, the EU 5G tool box. For Vodafone and DT, OpenRAN is their excuse to stick with the Chinese vendors. Their story is that when OpenRAN is ready, we will replace Huawei equipped with OpenRAN vendors- when it is ready for mass market.

- The vendors who bet on OpenRAN spend a lot of money on sponsoring events with media that subsequently write a lot of positive stories, praising the technology. When I joke, I refer to TelecomTV as “OpenRAN TV.” I would guess that 95% of the OpenRAN events are sponsored events, and a lot of the articles is related to the same events.

- There are a number of politicians in countries that have 2G, 3G, 4G and 5G and they all want to dominate 6G. They have not realized that innovation is happening in global companies such as Nokia, Ericsson, Qualcomm, Samsung and Huawei/ZTE that built their own proprietary network equipment.

- The 5G and 6G standards work with 3G, 4G, 5G, and 6G happens in 3GPP and ITU-R (ATIS carries 3GPP contributions into ITU-R WP5D directed at ITU-R IMT standards (i.e. reccommendations). The next G does not come from a nation or a company, but from a group of global companies.

- For some people believe OpenRAN is the next G, but that’s total nonsense! Only ITU-R (WP 5D) is responsible for all the cellular G’s as part of International Mobile Telecommunications (IMT) recommendations and there is NO WORK IN ITU-R on OpenRAN!!!

- There are a number of companies that make their living selling market information, companies which over the last 20 years have been hit financially because there has been a consolidation of the infrastructure industry. It is in their interest that the number of suppliers is increased, it gives them access to a larger customer base. OpenRAN is a new product segment and represent around 30 – 40 potential customers with a budget.

- GSMA, along with some of their members, has marketed a narrative that there are not many suppliers in this industry and that there is a need for more supplier diversity. It’s not a true story if you look at how many vendors are exhibiting at Mobile World Congress. It is also a story that does not seem credible when these same operators are crying out for the possibility of consolidating the market. The consolidation there has been when it comes to infrastructure, it is driven by mobile operators who have changed their purchasing habits and bet on fewer suppliers.

–>To put it very simply, the less people know about the cellular communications market, the happier they are about OpenRAN.

References:

https://ntia.gov/page/public-wireless-supply-chain-innovation-fund

https://www.federalregister.gov/documents/2022/12/13/2022-26938/public-wireless-supply-chain-innovation-fund-implementation

https://telecoms.com/521184/us-dangles-1-5bn-in-front-of-open-ran-community/