Month: July 2024

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Dell’Oro has just cut its outlook for mobile core spending for the fifth consecutive time. Not a single operator has adopted 5G SA this year.

“It bears repeating, this is the fifth consecutive time we have reduced the growth rate of the MCN market as the build-out of 5G SA networks continue to wane compared to 5G Non-standalone networks,” said Dave Bolan, Research Director at Dell’Oro Group. “This is the first 5-year forecast out of the last five where the 5-year CAGR (2023-2028) has fallen into negative territory. The count of 5G SA networks commercially deployed by MNOs remains the same as it was at the end of 2023, about 50 5G SA networks.

“For the same reasons outlined for the MCN market, we reduced the 5-year cumulative revenue forecast for the Multi-Access Edge Computing (MEC) market, a sub-segment of the MCN market, by 18 percent. In the case of MEC, the adoption rate is slowed much more dramatically than the overall MCN market. The industry is addressing these concerns with several initiatives such as open gateway application programmable interfaces (APIs) to attract the application development community to develop applications for the mobile industry that can easily be leveraged across all MNOs. Release 18 is introducing capabilities for new use cases, and Reduced Capability (RedCap) RAN software to bring more 5G IoT devices to market. However, these will take time to bring solutions to market and more importantly at scale to have an impact on the overall market growth,” Bolan added.

Additional highlights from the Mobile Core Network & Multi-Access Edge Computing 5-Year July 2024 Forecast Report:

- The CAGR is negative for all product segments—Packet Core, Policy, Signaling, Subscriber Data Management, and IMS Core.

- The CAGR for the market segments is positive for 5G MCN and MEC, and negative for 4G MCN and IMS Core.

- The CAGR by regions is positive for Asia Pacific excl. China, Europe, Middle East and Africa (EMEA), and Worldwide excluding China. The regions with negative CAGRs are North America, CALA, China, and Worldwide excluding North America.

Dell’Oro has called the RAN market as “a disaster.” “It’s difficult to find a silver lining in the first quarter,” said Stefan Pongratz, Vice President and analyst at the Dell’Oro Group. “We’ve been monitoring the RAN market since the year 2000, and the contraction experienced in the first quarter marked the steepest decline in our entire history of covering this market. In addition to the known coverage related challenges that the market is dealing with when comps in the advanced 5G markets are becoming more challenging, there are now serious concerns about the timing of the capacity upgrades given current network utilization levels and data traffic growth rates,” continued Pongratz.

While the overarching RAN sentiment appears to be mostly aligned over the long term, it is worth noting that internal expectations across the key players vary quite a bit over the short term. In addition to the coupling between coverage capex and the state of the 5G networks (per Ericsson’s Mobility report, 5G POP coverage is lower in CALA/MEA/APAC excl China&India), the dynamics between urban and rural sites also impact growth prospects. The Chinese RAN vendors are generally more optimistic about 2024 than the leading non-Chinese RAN suppliers.

It’s no secret that telecom operators are scaling back their investments in 5G. Preliminary findings show that worldwide telecom capex, the sum of wireless and wireline/other telecom carrier investments, declined for the full year 2023 in nominal USD terms, recording the first contraction since 2017. This deceleration in the broader capex spend is consistent with the aggregate telco equipment slump previously communicated for the six Dell’Oro telecom programs (Broadband Access, Microwave Transmission & Mobile Backhaul, Optical Transport, Mobile Core Network, Radio Access Network, Service Provider Routers & Switch).

“The fundamental challenges have not changed. Operators have a fixed capital intensity budget and capex is largely constrained by the revenue trajectory,” said Stefan Pongratz, Vice President and analyst with Dell’Oro Group. “What is complicating the situation is that the revenue pie remains fixed. Following some positive developments amidst the peak of the Covid-19 pandemic, our analysis shows that operator revenue growth slowed in 2023 and has more or less remained stagnant over the past decade. And based on the guidance, operators, in general, are not overly optimistic that emerging opportunities with generative AI, edge computing, enterprise 5G, FWA, and 5G-Advanced will expand the pie,” continued Pongratz.

Additional highlights from the Dell’Oro March 2024 Telecom Capex report:

- Global carrier revenues are expected to increase at a 1 percent CAGR over the next 3 years.

- Market conditions are expected to remain challenging in 2024. Worldwide telecom capex is now projected to decline at a mid-single-digit rate in 2024 and at a negative 2 to 3 percent CAGR by 2026.

- The mix between wireless and wireline remains largely unchanged, reflecting challenging times still ahead for wireless. Wireless related capex is on track to decline at a double-digit rate in the US in 2024.

- 5G era capital intensity ratios peaked in 2022 and are on track to approach 15 percent by 2026, down from 18 percent in 2022.

The market research firm and also forecasts optical transport spending (which includes 5G backhaul) to decline as well.

………………………………………………………………………………………………………………………………………………………………………………………………………………….

What’s more important is that mobile network traffic growth is slowing. In the latest Ericsson mobility report, the authors cut mobile data traffic figures for the second half of 2023, yet declared that the growth outlook was virtually unchanged.

William Webb, a consultant and senior advisor at Access Partnership, is one who’s called out the authors of the report for this leap in logic. “If lower numbers are being reported for 2023 … then why should the traffic growth rate predicted remain the same?” he posted on LinkedIn. He denounces the forecast as “a mess,” pointing out that the report, without any explanation, has somehow introduced a 10% jump in growth over 2023-24 to bring its new forecast into line with the old.

Separately, a new Analysys Mason paper says the telecom industry is running up against the limits of growth and faces a “crisis of bandwidth overproduction.” It says the telco responses to this looming crisis – volume price discounts and untried business models – replicate every other other industry in the same predicament. “Growth rates are not declining because of supply-side constraints such as spectrum or coverage; access networks have never been emptier,” the author argues. “Rather, the two principal drivers of traffic growth, smartphone usage and broadcast-to-streaming migration on mobile and fixed networks, respectively, have both run up against human limits; limited hours for engagement and the limits of human vision.”

If demand does not revive, then the lower unit costs brought about by over-investment in capacity will result in further deflation of margins and profitability, the paper maintains. It calls on telcos to reduce CAPEX to make available more resources to invest in M&A, into other adjacent infrastructure businesses, or in some key non-connectivity B2B segments.

………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.lightreading.com/6g/the-specter-of-a-capex-drought-looms-over-6g

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Chinese engineers field test a “6G” network with semantic communications on 4G infrastructure

According to the Xinhua news agency, Chinese telecom engineers have established the world’s first field test network for 6G communication and intelligent integration. That’s before 6G is even defined let alone specified by ITU-R WP5D or 3GPP Release 21. The experimental network has demonstrated that semantic communication [1.] can reach the transmission capabilities of 6G on existing 4G infrastructure.

Note 1. Semantic communication aims at the successful transmission of information conveyed by the source rather than the accurate reception of each single symbol or bit regardless of its meaning.

The network has achieved a remarkable tenfold improvement in key communication metrics, including capacity, coverage and efficiency, according to a team from Beijing University of Posts and Telecommunications who unveiled their work at a seminar on July 10th. The network serves as a platform which facilitates the efforts of research institutions in conducting theoretical research and initial verification of 6G pivotal technologies. It can effectively lower the entry threshold for 6G research, making it more accessible for innovation, according to the team.

“The integration of the two will accelerate the formation of new business forms of the digital economy,” Professor Zhang Ping, who heads the university’s research team, reportedly said at the conference where the 6G field test network was unveiled. “AI will improve the perception and semantic understanding of communication, while the ubiquitous communication of 6G will in turn extend the reach of artificial intelligence to all corners of all fields,” Zhang was quoted as saying.

Existing 4G and 5G infrastructure has potential to ramp up to 6G, according to the results of a test network. Photo: Shutterstock

China is working to commercialize 6G, the next-generation wireless technology after 5G, by around 2030, the same time at which 6G standards are expected to be completed. The ITU-R says 6G could promote the growth of a range of advances, allowing communication to be immersive and connectivity universal. But with existing communication technology reaching its theoretical bandwidth limit, there are a series of big problems that have to be overcome. These include the difficulty of increasing capacity, the high cost of coverage, and high energy consumption.

The 6G technology market is also expected to enable major improvements in imaging, presence technology and location awareness. In conjunction with AI, the 6G computing infrastructure should be able to determine the best location for computing, including decisions about data storage, processing and sharing.

References:

https://english.news.cn/20240711/5dd430b4f66141d6a75a7fc505597fb3/c.html

https://www.lightreading.com/6g/china-builds-world-s-first-6g-field-test-network

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

What is 5G Advanced and is it ready for deployment any time soon?

Comcast frequent, intermittent internet outages + long outage in Santa Clara, CA with no auto-recovery!

For over one year now, many U.S. Comcast customers have experienced frequent, but short Xfinity internet and pay TV outages several times per week.

Here is what two customers wrote on the Xfinity Community Forum:

- Outages being reported CONSTANTLY: “I have intermittent outages several times a day for over a month. I work from home and this is inconvenient as I have been kicked out of important meetings and even streaming movies at night is a challenge with these frequent outages.”

For the last month, my Xfinity internet service has REPEATEDLY been dropping, and outages of over 100 people have been getting reported on Xfinity’s website.

It was every day for 10-14 days, then stopped for about a week, and now it’s back to every other day. I contact tech support, and they do the “reset your modem” dance, but inevitably reach the end of their binder of answers. I’ve had two techs out, one told me I needed a new modem, didn’t fix the problem.

But inevitably, a little while after I notice problems, I check Status Center and see there is an outage in my area due to “Network Damage”, affecting 100-500 people. It gets fixed…then in a day or two, it’s dropping me again,and another “Network Damage” outage affecting 100s of people.

Is there a local or regional rep I can speak to who can explain to me why this service I pay for is suddenly the victim of repeated outages every day/every other day due to “network damage”?? I haven’t had issues in years with service, and now I don’t know if this is a coordinated terrorist attacking on the network, the squirrels have declared war on the wires, or what is causing repeated failures. I had more than one person at Xfinity tell me that their techs are just unplugging people in the middle of the day to do network upgrades. My wife and I both use the Internet for work, we are losing money when this happens.

Can anyone recommend next steps for obtaining more information on why Comcast can’t go more than 48 hours without an area outage for the last month?

2. From a Seattle, WA Xfinity internet customer posted on Reddit:

“Looks like there’s a widespread Comcast internet outage. In the image below, Each of the dots represents 500-2000+ reports of internet problems. I know Comcast had some scheduled overnight maintenance to “upgrade the systems,” which has now been updated to “damaged network with no ETA for fixing.”

A much longer Xfinity outage report on Reddit:

“Service out for 36 hours, Xfinity keeps blaming power outage. The only support I can receive is Bots via the chat or a prompt goodbye when I call the phone support. What gives?”

……………………………………………………………………………………………………………..

And there are many, many more social media reports of Xfinity outages, which also takes down the company’s nearby WiFi hot spots, which could be a backup when you lose Xfinity wireline internet service.

………………………………………………………………………………………………………………..

Personal Experience:

On Friday, June 21st, most Xfinity customers in Santa Clara, CA (including this author) experienced a severe and long service outage, which (for me) lasted 17 hours, It was due to a fiber backbone cut by vandals. Here’s one of many text messages I received:

“Hi, it’s Xfinity Assistant. We’re aware you’re experiencing an interruption due to damage to our fiber lines in your area. We’re still working to get you back up and running. We apologize for the inconvenience.”

That outage was a killer for me, as I could not participate in two webinars that morning and had to cancel a 3pm Zoom call with my Doctor (for which I had to pay for since I cancelled <24 hours before the scheduled session). Obviously, my four smart Amazon/Google speakers didn’t work, nor did either of my two Amazon internet TVs. I had to use my cell phone to make voice calls as VoIP was also down.

For three weeks, I’ve been urgently trying to get an explanation from Comcast for why the Santa Clara outage lasted so long. In particular, why wasn’t there protection switching (1:1 or 1:n), self healing rings, router restoration via a standby fiber facility available for auto-switch over of the backbone traffic?

As that did not happen, the fiber cable had to be manually repaired, which took a very long time. Despite endless voicemail tag, I never received an answer to that question.

The only written response was the following:

“As I think you know now, that outage was caused by vandalism to our network. Vandals inflicted severe, significant damage to our system that required extensive, complex and time consuming repairs to our fiber. On behalf of our entire team I want you to know how sorry we are that this caused your services to be down for a lengthy duration.”

Here is what the Fiber Optic Association recommends:

In the case of fiber optic network restoration, nothing is more important than having complete, up-to-date documentation on the network. If possible, design a network with backup options. Many users run dual links, one transmitting data and one “hot back-up” ready to switch over in milliseconds. Electronics must be installed with duplicate links and all power must be backed up with batteries, generators or fuel cells.

Critical systems should add in geographic diversity; two links available running paths that are as widely separated as possible to ensure that if one suffers a failure due to damage to the fiber optic cable plant itself, the other can be switched in immediately. Rings provide a logical way to have route diversity, but simply being able to patch fibers manually to switch over to another fiber/cable is still quicker than repair. Even with backup, a failure requires immediate restoration, as one should never depend on a single link any longer than necessary.

All cables should have spare fibers, especially since fiber is extremely inexpensive compared to installation or restoration costs. Fibers tend to get broken at the ends where terminated or inside splice closures during splicing or re-entry. Having spare fibers makes it easy to simply switch fibers to restore operation. Whenever possible, store extra cable in service loops that can be pulled together for splicing. This can save immense amounts of restoration time for cables installed indoors or pulled in conduit outdoors.

OSP underground cables should be buried sufficiently deep (~1m/3 feet) that it is protected from casual digging and marker tapes that show up on cable locators buried above them. (See OSP Underground Construction in the FOA Guide) Bright colored conduits also help visibility. Cables should be listed in the “Dial 811, Call Before You Dig” database and markers installed where possible.

………………………………………………………………………………………………….

This post will be updated if and when I get an answer from Comcast as to why it took so long to restore service after the fiber cut.

References:

https://www.thefoa.org/tech/ref/restoration/rest.html

https://en.wikipedia.org/wiki/Self-healing_ring

https://www.advsyscon.com/blog/self-healing-it-operations/

Comcast’s DOCSIS 4.0 Deployment: Multi-Gig Symmetrical Speeds to be offered across the U.S.

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

A Mobile World Live webinar on 5G-advanced upgrades identified new opportunities for network operator revenue streams, mostly due to improved network efficiencies and reduced costs. 5G Advanced, the next step in 5G evolution, will be specified in 3GPP Release 18 and 19. There is no work on it in ITU-R which is now focused on IMT-2030 (6G).

Egil Gronstad, T-Mobile senior director-technology development and strategy, said 5G Advanced will present opportunities for new revenue streams: 5G IoT will have lower cost and lower power consumption of endpoint devices (Redcap). Another 5G Advanced capability will be Ambient IoT (coming in Rel 19) which has a lot of opportunities via lower cost and no battery required in IoT devices. A bit further out is Integrated sensing and communications -using the network as a radar system to detect objects of interest. Improved spectrum efficiency will be improved using AI/ML for beam management.

Egil said 3GPP should develop specs for fixed wireless access (FWA). He’s disappointed with 3GPP not pursuing 5G FWA. “We haven’t really done anything in the 3GPP specs to specifically address fixed wireless,” he said. Neither has ITU-R WP 5D, which is responsible for developing all ITU-R recommendations for IMT (3G, 4G, 5G, 6G). FWA was not identified as an ITU use case for 5G and that hasn’t changed with 5G Advanced.

References:

https://www.nokia.com/about-us/newsroom/articles/5g-advanced-explained/

What is 5G Advanced and is it ready for deployment any time soon?

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

MediaTek overtakes Qualcomm in 5G smartphone chip market

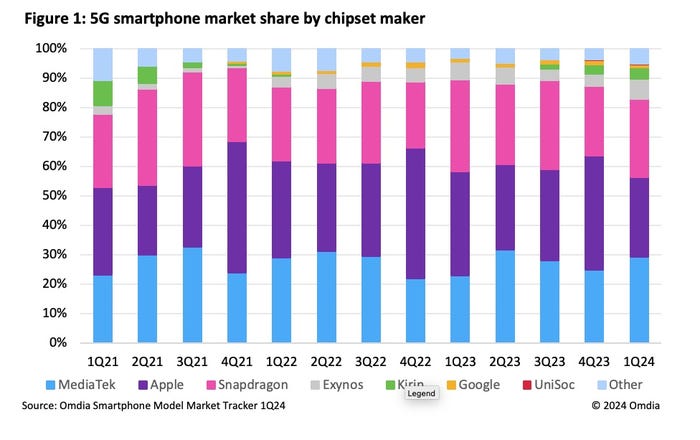

According to new figures from Omdia’s Smartphone Model Market Tracker, shipments of 5G smartphones powered by Taiwan based MediaTek reached 53 million in the first three months of the year, representing an impressive 53% uptick on Q1 2023. Shipments of smartphones with Qualcomm’s Snapdragon inside were comparatively flat, inching up to 48.3 million from 47.2 million.

MediaTek’s market share in 5G smartphones rose to 29.2% in 1Q24, up from 22.8% in 1Q23, while Qualcomm Snapdragon’s share decreased from 31.2% to 26.5% over the same period.

As a result, MediaTek’s market share in the 5G smartphone chipset market increased to 29.2% from 22.8%, while Qualcomm’s fell to 26.5% from 31.2%. Apple is third, while a Samsung owned Exynos, Huawei-owned HiSilicon’s Kirin, Google Tensor and Shanghai-based Unisoc make up the rest (see chart below).

Notes:

- It’s not clear whether Omdia includes both processors and 5G modem chip sets in their statistics.

- Apple uses in-house processors for its iPhones, but it still relies on Qualcomm for the 5G modem chips.

- Both MediaTek and Qualcomm sell SoC’s which include both a 4G/5G modem and an ARM processor.

……………………………………………………………………………………………………………………………

According to Omdia, Q1 shipments of 5G smartphones below $250 surged by 62% year-on-year to 62.8 million. This favors MediaTek as the preferred choice for this segment. Furthermore, in June, Omdia also reported in booming demand for sub-$150 phones, with shipments in this category growing to 120 million in the first quarter, up from 90 million a year earlier.

“The smartphone chipset industry is primarily shaped by two major trends: the widespread adoption of 5G and the expanding low-end segment. As 5G technology becomes more affordable and is integrated into smartphones priced below $250, MediaTek stands to benefit the most,” explained Aaron West, senior analyst in Omdia’s smartphone group.

The premium end of the market, where prices start at $600, is also growing – albeit not as rapidly. According to Omdia, shipments increased to 73 million from 70 million, driven by the launch of Samsung’s Galaxy S24 series, and the iPhone 15 Pro Max.

The popularity of premium devices should help Qualcomm come roaring back – it has spent much of this year promoting the on-device AI capabilities of its latest Snapdragon chipset, features that will be incorporated first and foremost into pricier handsets.

“On-device AI capabilities are becoming increasingly important to smartphone OEMs, with Snapdragon emerging as a key innovator and preferred choice for premium devices,” West said.

……………………………………………………………………………………………………………………………

Other Voices:

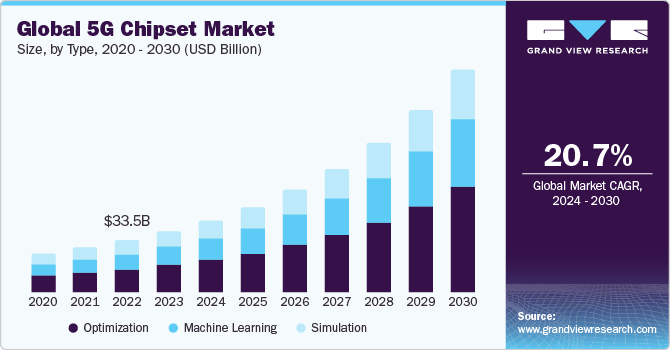

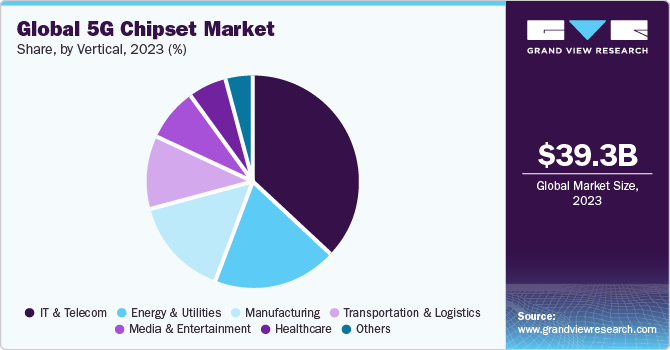

- According to Markets and Markets, the global 5G chipsets market size is estimated to be USD 36.29 billion in 2023 and is projected to reach USD 81.03 billion by 2028 at a CAGR of 17.4%.

- Grandview Markets says the global 5G chipset market size was estimated at USD 39.32 billion in 2023 and is expected to grow at a CAGR of 20.7% from 2024 to 2030.

Illustrations:

References:

https://www.lightreading.com/5g/mediatek-outgrowing-qualcomm-snapdragon-in-the-5g-smartphone-market-omdia

https://www.telecoms.com/mobile-devices/rise-of-cheaper-5g-phones-lifts-mediatek-above-qualcomm

https://www.marketsandmarkets.com/Market-Reports/5g-chipset-market-150390562.html

https://www.grandviewresearch.com/industry-analysis/5g-chipset-market

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Mediatek Dimensity 6000 series with lower power consumption for affordable 5G devices

Nokia and Google Fiber trial 50G PON – first in the U.S.

Nokia and Google Fiber have tested 50Gb/s PON over Google’s fiber optic network. The partners say it’s the first live network demonstration of that technology in the US. The trial comes after last year’s partnership between Nokia and Google Fiber to enhance broadband services with 25G PON.

As fiber facility based network operators continue to push for increased speeds and reliability from their broadband networks, 50G PON acts as a catalyst to meet connectivity demands – unleashing further opportunity for growth and innovation. Capable of being easily built upon existing 25G PON solutions, it also enables flexibility for the operators to add future 50Gb/s with the fiber in place.

Nokia claims to be the only vendor that can support all next-generation PON options, with 10G and 25G products available today, 50G in trials, and 100G PON as a technology demonstrator.

With Nokia’s Lightspan fiber access platform, operators can choose a PON solution that best meets a specific use case or business need. The 50G PON trial with Nokia showcases how Google Fiber is looking at the future and what’s needed for new broadband services that foster innovation and growth. Leveraging Nokia’s fiber solution, Google Fiber was able to simultaneously run 10/25G PON along with 25/50G PON broadband service over its fiber network. This showcased the network flexibility and scalability it can deliver to keep pace with the growing demand for multi-gigabit services in the future. Google Fiber is already at the forefront of the multi-gigabit evolution, having launched the first 25G PON commercial services with Nokia in 2023.

Liz Hsu, Senior Director, Product & Billing, at Google Fiber, said: “We are always looking for ways to push the capabilities of our fiber network to deliver the best possible experience to our customers. This test with Nokia builds on the 25G PON deployment we announced together last year, paving the way for future improvements to our network that enhance customer experience in terms of speed, reliability, innovation and support for future business cases that have yet to be defined.”

Geert Heyninck, vice president of broadband networks at Nokia, said: “Service providers need to be able to select the right technology, based on their needs and business case. It is why we already offer 10G and 25G today, are trialing 50G, and developing 100G – ultimately leading to a full range of PON technologies that can be mixed and matched on the same platform and the same fiber. Our expansive toolkit of fiber solutions allows Google Fiber to future-proof their network and flexibly address their evolving network demands.”

Resources and additional information:

Video: Nokia and GFiber Labs trial 50G PON on live network

Website: Nokia Altiplano Access Controller

Website: Nokia Lightspan MF

Website: Accelerating to gigabit with fiber

Website: Fiber for Everything

- GFiber Labs is the second 50G PON trial Nokia has run globally in the past 4 months and the first to occur in the U.S.

- Nokia is the first vendor to show all PON technologies (10G, 25G & 50G) in a live fiber network.

- Nokia is the number one vendor for XGS-PON technology globally according to 2023 market share figures from Dell’Oro and Omdia.

- There are more than 12 operators around the world who are already gaining the benefits of 25G PON, and the eco-system is maturing with more than 5 ONT vendors bringing 25G PON solutions to the market.

- Some operators currently deploying 25G PON include Google Fiber, EPB, Vodafone Qatar and OGI.

- The ecosystem for 25G PON is mature, with more than 60 operators, system vendors, chipset, and optical suppliers part of an MSA focused on standardizing and accelerating the technology.

- Nokia is a key contributor to 50G PON industry standard and introduced the industry’s first true 50G platform in 2020 with the Lightspan MF platform.

- Once the 50G PON industry matures, the step to 100G is straight forward.

………………………………………………………………………………………………………………

In March, Türk Telekom and ZTE carried out their own 50G PON trial in Turkey, which clocked speeds in excess of 50 Gbps in the downstream over a single fibre. It was apparently done so in a way that was compatible with existing PON generations already deployed in Türk Telekom’s network.

Meanwhile In April, Australia’s NBN demoed Nokia 100G PON tech to reach 83 Gbps on its live full fibre access network, eclipsing the previous trial the October before which achieved symmetrical throughput of 21 Gbps and was a new speed record for PON in Australia at the time.

………………………………………………………………………………………………………………

References:

https://www.telecoms.com/fixed-networks/nokia-and-google-fiber-trial-50g-pon-in-us

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Nokia and Hong Kong Broadband Network Ltd deploy 25G PON

Nokia’s launches symmetrical 25G PON modem

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

SK Telecom and Singtel partner to develop next-generation telco technologies using AI

SK Telecom (South Korea) and Singtel (Singapore) have initiated a two-year project to develop advanced telecommunication networks. This collaboration aims to drive innovation, improve network performance and security, and enhance customer experiences through the use of artificial intelligence (AI), orchestration tools, and network virtualization.

The project will focus on creating innovative solutions like Edge-AI Infrastructure to enhance connectivity and provide unique AI service offerings. A white paper will describe advancements to assist other global telcos to harnessing the capabilities of 5G and preparing for 6G.

This MOU initiative is expected to not only enhance connectivity but also provide customers with unique AI service offerings and enable the operators to restore services faster, thus improving the customer experience.

Additionally, SKT and Singtel will be putting together a white paper on their advancements in areas such as virtualization, slicing and network evolution that can help other telcos globally to capitalize on the capabilities of 5G and to prepare for 6G in 2030.

SK Telecom (SKT) has signed a Memorandum of Understanding (MOU) with Singtel, Singapore’s leading telecommunications provider, to collaborate on the application of AI technology in communication networks, the development of use cases for 5G network slicing technology, and preparation for 6G technology, aimed at fostering advancements in 5G and next-generation communication technologies. Photo Courtesy of SKT

……………………………………………………………………………………………………………………

Kang Jong-ryeol, SKT’s Head of ICT Infra(CSPO) stated, “The collaboration between SKT and Singtel marks a significant first step in shaping the future of the global telecommunications industry.” He further emphasized, “By combining the strengths of both companies, we aim to achieve efficient high-performance network construction, enhance network stability, and discover new network-based services. Additionally, we will strive to make significant advancements in next-generation communication technologies, including AI-powered wired and wireless infrastructure.”

Tay Yeow Lian, Singtel’s Managing Director, Networks, said, “As a global leader in 5G technology, we’re keen to capitalize on the myriad of capabilities this technology has to offer, especially in the areas of network slicing and with the inclusion of AI. With SKT, we’re looking to not only enhance the experience of our customers but to also drive industry innovation and help us prepare for the evolution to 6G.”

ANNEX: Singtel’s 5G advancements

· Developed Paragon, the industry’s first all-in-one aggregation and business orchestration platform, which allows enterprises to interact with and manage networks, clouds and multi-access edge computing (MEC) infrastructure and applications

· Developed Singtel CUBΣ, a Network-as-a-Service (NaaS) that makes it easier for enterprises to subscribe and manage desired services and multiple vendors as well as gain insights on network utilisation, workload performance and sustainability metrics via a single sign-on digital portal. CUBΣ leverages and integrates AI into its network management systems to deliver enhanced services such as proactive user experience monitoring, incident automation and predictive analytics to anticipate, detect and address incidents faster. This results in improved network performance, optimised resource allocation, enhanced security protocols, elevated the overall user experience, and the development of a network that learns, evolves and self-improves over time – all of which enable faster digital transformation for greater economic growth and innovation.

Major 5G developments from Singtel:

2022

· Launched first public multi-access edge compute for enterprises in Asia with Microsoft

· Launched iSHIP to provide critical satellite-enabled connectivity and digital services for the maritime industry

2023

· Singapore’s first 5G-enabled smart retail showcase

· Achieved 5G upload speed of more than 1.6Gbps in an enterprise deployment

· Completed more than 30 5G trials at Sentosa

· Successfully trialed RedCap technology for better energy savings for IoT devices

2024

· Addition of Starlink satellites for maritime connectivity

· Offered the 5G Express Pass service to concertgoers for Coldplay and Taylor Swift

· Pioneered app-based network slicing, aka User Equipment Route Selection Policy

· Singtel Paragon integrated into Telkomsel’s enterprise product portfolio

· Launch of Paragon-S to spur digital transformation for satellite operators

About SK Telecom:

SK Telecom has been leading the growth of the mobile industry since 1984. Now, it is taking customer experience to new heights by extending beyond connectivity. By placing AI at the core of its business, SK Telecom is rapidly transforming into an AI company with a strong global presence. It is focusing on driving innovations in areas of AI Infrastructure, AI Transformation (AIX) and AI Service to deliver greater value for industry, society, and life.

References:

https://www.koreaittimes.com/news/articleView.html?idxno=132974

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

SK Telecom, Intel develop low-latency technology for 6G core network

SK Telecom and Thales Trial Post-quantum Cryptography to Enhance Users’ Protection on 5G SA Network

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

ITU-R vs 3GPP – 5G and 6G Standards and Specifications:

For new IEEE Techblog readers, ITU-R is responsible for radio interfaces with WP 5D making the ITU-R recommendations (standards) for IMT Radio Interface Technologies (RITs) and Set of Radio Interface Technologies (SRITs).

For 5G, it was called IMT 2020 (M.2150 recommendation) and for 6G, it’s called IMT-2030. 3GPP contributions towards those standards have been presented to WP5D by ATIS – one of the organizational partners of 3GPP.

While ITU-T was supposed to standardize non-radio aspects of 5G, 5G Advanced and 6G, that did not happen. Instead, those specifications, including the 5G and 6G core networks, are being developed by 3GPP. Those 3GPP 5G and 6G non-radio specs have to be transposed and adopted by official standards bodies, such as ETSI.

Please see References and Comments below for more information.

…………………………………………………………………………………………………….

Backgrounder:

In February 2021, the ITU started the development of ITU-R Framework Recommendation for IMT-2030 (6G) which was approved by the Radio Assembly 2023 and published as Recommendation ITU‑R M.2160 – Framework and overall objectives of the future development of IMT for 2030 and beyond. Based on this Recommendation, the ITU has started the process of the development of IMT-2030. The IMT-2030 terrestrial radio interface specification is expected to be completed in 2030. M.2160 describes these motivation and societal considerations, potential user and application trends, technology trends, spectrum harmonization and envisaged frequency bands. Also ITU-R Report M.2156 “Future technology trends of terrestrial IMT systems towards 2030 and beyond” and Report ITU-R M.2541 “Technical feasibility of IMT in bands above 100 GHz” details these expected trends and phenomena for IMT-2030.

The framework and objectives including overall timeframes for the future development of IMT for 2030 and beyond are described in some detail in Recommendation ITU-R M.2160.

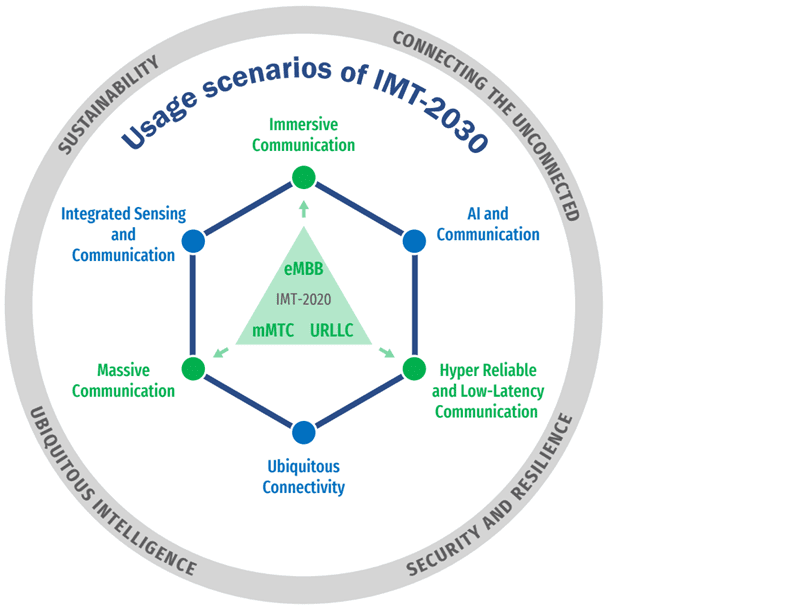

In order to fulfil these varied demands, Usage scenarios of IMT-2030 are envisioned to expand on those of IMT-2020 (i.e., eMBB, URLLC, and mMTC introduced in Recommendation ITU-R M.2083) into broader use requiring evolved and new capabilities. In addition to expanded IMT‑2020 usage scenarios, IMT-2030 is envisaged to enable new usage scenarios arising from capabilities, such as artificial intelligence and sensing, which previous generations of IMT were not designed to support. Figure 1. below illustrates the usage scenarios for IMT-2030.

Figure 1. Usage scenarios and overarching aspects of IMT-2030:

Capabilities of IMT-2030:

IMT-2030 is expected to provide enhanced capabilities compared to those described for IMT-2020 in Recommendation ITU-R M.2083, as well as new capabilities to support the expanded usage scenarios of IMT-2030. In addition, each capability could have different relevance and applicability in the different usage scenarios.

The range of values given for capabilities are estimated targets for research and investigation of IMT-2030. All values in the range have equal priority in research and investigation. For each usage scenario, a single or multiple values within the range would be developed in future in other ITU-R Recommendations/Reports. These values may further depend on certain parameters and assumptions including, but not limited to, frequency range, bandwidth, and deployment scenario. Further these values for the capabilities apply only to some of the usage scenarios and may not be reached simultaneously in a specific usage scenario.

The capabilities of IMT-2030 include:

1) Peak data rate

Maximum achievable data rate under ideal conditions per device. The research target of peak data rate would be greater than that of IMT-2020. Values of 50, 100, 200 Gbit/s are given as possible examples applicable for specific scenarios, while other values may also be considered.

2) User experienced data rate

Achievable data rate that is available ubiquitously[1] across the coverage area to a mobile device. The research target of user experienced data rate would be greater than that of IMT-2020. Values of 300 Mbit/s and 500 Mbit/s are given as possible examples, while other values greater than these examples may also be explored and considered accordingly.

3) Spectrum efficiency

Spectrum efficiency refers to average data throughput per unit of spectrum resource and per cell[2]. The research target of spectrum efficiency would be greater than that of IMT-2020. Values of 1.5 and 3 times greater than that of IMT-2020 could be a possible example, while other values greater than these examples may also be explored and considered accordingly.

4) Area traffic capacity

Total traffic throughput served per geographic area. The research target of area traffic capacity would be greater than that of IMT-2020. Values of 30 Mbit/s/m2 and 50 Mbit/s/m2 are given as possible examples, while other values greater than these examples may also be explored and considered accordingly.

5) Connection Density

Total number of connected and/or accessible devices per unit area. The research target of connection density could be 106 – 108 devices/km2.

6) Mobility

Maximum speed, at which a defined QoS and seamless transfer between radio nodes which may belong to different layers and/or radio access technologies (multi-layer/multi-RAT) can be achieved. The research target of mobility could be 500 – 1 000 km/h.

7) Latency

Latency over the air interface refers to the contribution by the radio network to the time from when the source sends a packet of a certain size to when the destination receives it. The research target of latency (over the air interface) could be 0.1 – 1 ms.

8) Reliability

Reliability over the air interface relates to the capability of transmitting successfully a predefined amount of data within a predetermined time duration with a given probability.

The research target of reliability (over the air interface) could range from 1-10−5 to 1-10−7.

9) Coverage

Coverage refers to the ability to provide access to communication services for users in a desired service area. In the context of this capability, coverage is defined as the cell edge distance of a single cell through link budget analysis.

10) Positioning

Positioning is the ability to calculate the approximate position of connected devices. Positioning accuracy is defined as the difference between the calculated horizontal/vertical position and the actual horizontal/vertical position of a device.

The research target of the positioning accuracy could be 1 – 10 cm.

11) Sensing-related capabilities

Sensing-related capabilities refer to the ability to provide functionalities in the radio interface including range/velocity/angle estimation, object detection, localization, imaging, mapping, etc. These capabilities could be measured in terms of accuracy, resolution, detection rate, false alarm rate, etc.

12) Applicable AI-related capabilities

Applicable AI-related capabilities refer to the ability to provide certain functionalities throughout IMT-2030 to support AI enabled applications. These functionalities include, distributed data processing, distributed learning, AI computing, AI model execution, and AI model inference, etc.

13) Security and resilience

In the context of IMT-2030:

− Security refers to preservation of confidentiality, integrity, and availability of information, such as user data and signalling, and protection of networks, devices and systems against cyberattacks such as hacking, distributed denial of service, man in the middle attacks, etc.

− Resilience refers to capabilities of the networks and systems to continue operating correctly during and after a natural or man-made disturbance, such as the loss of primary source of power, etc.

14) Sustainability

Sustainability, or more specifically environmental sustainability, refers to the ability of both the network and devices to minimize greenhouse gas emissions and other environmental impacts throughout their life cycle. Important factors include improving energy efficiency, minimizing energy consumption and the use of resources, for example by optimizing for equipment longevity, repair, reuse and recycling.

Energy efficiency is a quantifiable metric of sustainability. It refers to the quantity of information bits transmitted or received, per unit of energy consumption (in bit/Joule). Energy efficiency is expected to be improved appropriately with the capacity increase in order to minimize overall power consumption.

15) Interoperability

Interoperability refers to the radio interface being based on member-inclusivity and transparency, so as to enable functionality(ies) between different entities of the system. The capabilities of IMT-2030 are shown in Figure 2. below.

FIGURE 2. Capabilities of IMT-2030:

NOTES:

[1] The term “ubiquitous” is related to the considered target coverage area and is not intended to relate to an entire region or country.

[2] The coverage area over which a mobile terminal can maintain a connection with one or more units of radio equipment located within that area. For an individual base station, this is the coverage area of the base station or of a subsystem (e.g., sector antenna).

Relationship between existing IMT and IMT-2030:

In order to support emerging usage scenarios and applications for 2030 and beyond, it is foreseen that development of IMT-2030 would be required to offer enhanced capabilities as described in § 3. The values of these capabilities go beyond those described in Recommendation ITU-R M.2083. The minimum technical requirements (and corresponding evaluation criteria) are to be defined by ITU‑R based on these capabilities for IMT-2030. They could potentially be met by adding enhancements to existing IMT, incorporating new technology components and functionalities, and/or the development of new radio interface technologies. Furthermore, IMT-2030 is envisaged to interwork with existing IMT.

……………………………………………………………………………………………………………….

Separately, ATIS’ Next G Alliance (NGA) recently announced publication of Spectrum Needs for 6G, which assesses 6G spectrum needs based on scenario-specific key performance indicators and application-specific technical performance requirements.

The methodology used for estimating spectrum needs is based on the data rate requirements of 6G applications, with an emphasis on North American context and needs. The applications considered reflect the NGA’s collective efforts in establishing a comprehensive 6G roadmap.

“Proactively understanding next G spectrum needs and planning for them is essential to U.S. leadership in critical and emerging technologies,” said Next G Alliance Managing Director, David Young. “Decisions about the use of spectrum depend on multiple aspects and require time to be implemented. This paper achieves an understanding of 6G spectrum needs so that these needs are considered in the development of data-driven policies, regulatory decisions, and technical solutions.”

References:

https://www.itu.int/en/mediacentre/Pages/PR-2023-12-01-IMT-2030-for-6G-mobile-technologies.aspx

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/Pages/default.aspx

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

ATIS’ Next G Alliance Maps the Spectrum Needs for the 6G Future

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

BT claims to be the first European network operator to achieve 5G carrier aggregation with five component carriers (5G CC CA). Led by BT Networks team at Adastral Park, with support from BT Research, this is the latest milestone in 5G innovation for us, and promises to deliver potentially even faster 5G SA downlink speeds in the future, of up to nearly 2 Gbps. What this means for customers is a significant boost in performance in areas of high demand when the 5G SA device requires a high-speed connection, for example when watching live sport at a train station in rush hour.

The 5G CC CA trial used Nokia’s 5G AirScale portfolio and a device powered by a Snapdragon® 5G Modem-RF system from Qualcomm Technologies, Inc., a pioneer and global leader in 5G technology. Here are the highlights:

- BT Group becomes first European operator to achieve 5G 5CC carrier aggregation, boosting 5G standalone (SA) performance ahead of network launch later this year.

- Combines three FDD and two TDD carriers with 150 MHz total bandwidth, delivering greater capacity and downlink speeds in areas of high demand.

- Follows 5G SA downlink 4CC carrier aggregation breakthrough in 2022, and concurrent two carrier uplink aggregation in 2023.

5CC CA will significantly boost the data rates available to customers in areas of high demand by combining all mid-band radio spectrum when the 5G SA device requires a high-speed connection. Set to launch later this year, EE’s 5G SA network will also have the capability to leverage a low frequency sixth carrier to provide a superior experience in more places, including indoors.

In 2023, BT Group and Nokia successfully demonstrated 4CC CA in 5G SA downlink with concurrent 2CC CA in 5G SA uplink. With today’s announcement, the companies reached the next milestone, achieving further performance uplift in connections from the device to the network by increasing throughput and capacity.

The tests were conducted in the field on live network spectrum at Adastral Park, BT Group’s headquarters for R&D, using Nokia’s 5G AirScale portfolio and a device powered by a Snapdragon® 5G Modem-RF system from Qualcomm Technologies. Downlink speeds of 1.85 Gbps were reached, using three FDD carriers NR2600 (30MHz), NR2100 (20MHz), NR1800 (20MHz) aggregated with two TDD carriers NR3600 (40+40MHz).

Greg McCall, Chief Networks Officer at BT Group, said: “This latest milestone achieved with Nokia and Qualcomm Technologies enhances 5G SA performance as we work towards the launch of our network, building further on the benefits of carrier aggregation in delivering greater throughput and speeds to customers. This is particularly important as more and more devices come to market with 5CC CA capabilities. We are focused on maximizing our spectrum assets to deliver the very best experience to our customers with that in mind.”

Mark Atkinson, SVP and Head of RAN at Nokia, said: “This successful trial with our long-standing partner, BT is another great example of Nokia’s clear leadership in 5G carrier aggregation technology. Multi-component carrier aggregation helps mobile operators to maximize their radio network assets and provide the highest 5G data rates at more locations to subscribers.”

Dino Flore, Vice President, Technology, Qualcomm Europe, Inc. said: “Qualcomm Technologies is committed to pushing the boundaries of 5G connectivity, and our Snapdragon 5G Modem-RF Systems are designed to unlock the full potential of 5G, delivering unparalleled speed, efficiency and capacity for networks and their users. We are proud to work with Nokia and BT Group to play a key role in bringing this enhanced 5G experience to European consumers.”

This follows on from previous carrier aggregation ‘firsts’ aimed at boosting 5G SA performance across both downlink and uplink, where demand for greater speeds is growing in importance for a number of both existing and emerging use-cases, including live-streaming and video calls.

Today’s achievement has been delivered with one eye on the future, too. The 5G SA handset ecosystem right now is relatively small, but we expect to see more and more devices come to market by the early part of next year which are capable of supporting this technology. So we’re laying down a marker to say that at EE, as the UK’s best and most reliable network1, we are building capabilities into our network to support both the devices of today and the future.

We want to ensure that we really deliver on the promise of 5G SA for our customers, and an ongoing focus on innovation and research will be key to achieving this. Whether that’s through carrier aggregation advancements like today’s, demonstrating network slicing capabilities for guaranteed quality of service, or exploring how we can support the emerging IoT ecosystem through the likes of 5G RedCap technology, we’ll continue to prioritize advancements in network quality to support the evolution of the 5G services ecosystem.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

In January, T-Mobile conducted a six-component carrier (6CC) aggregation download using sub-6-GHz spectrum on its live 5G network saying it was the first time that’s ever been done. The test involved aggregating two channels of 2.5 GHz, two channels of PCS spectrum and two channels of AWS spectrum, according to T-Mobile US, which produced an “effective 245 MHz of aggregated 5G channels.”

T-Mo said that they were able to “achieve download speeds of 3.6 Gbps in sub-6 GHz spectrum. That’s fast enough to download a two-hour HD movie in less than 7 seconds!”

Resources and additional information:

Website: Nokia AirScale

Website: Nokia 5G RAN

Website: 5G Carrier Aggregation explained

Website: Multi-Gigabit 5G with Carrier Aggregation | Nokia

References:

https://newsroom.bt.com/delivering-seamless-standalone-in-the-busiest-locations/

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

https://www.nokia.com/about-us/newsroom/articles/5g-carrier-aggregation-explained/

Telecom and AI Status in the EU

By Afnan Khan with Ajay Lotan Thakur

Introduction

In the eerie silence of deserted streets and amidst the anxious hum of masked conversations, the world found itself gripped by the rapid proliferation of COVID-19. Soon labelled a global pandemic due to the havoc wreaked by soaring death tolls, it brought unprecedented disruption and accelerated the inevitable rise of the digital age. The era of digital transformation has swiftly transitioned, spawning a multitude of businesses catering to every human need. Today, our dependence on digital technology remains steadfast, with remote work becoming the norm and IT services spending increasing from $1.071 trillion in 2020 to $1.585 trillion. [1]

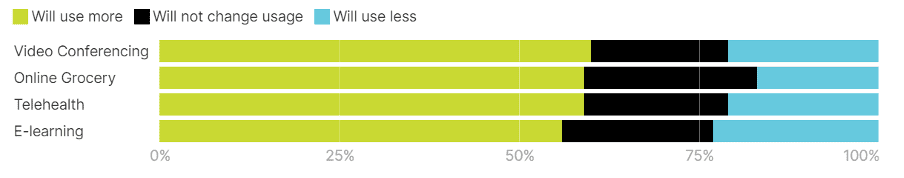

The chart below, sourced from Oliver Wyman Forum Analysis,[2] vividly illustrates our increasing dependence on technology. It presents findings from a survey conducted in the latter half of 2020 across eight countries – US, UK, France, Germany, Italy, Spain, Singapore, and China. The survey reveals that 60% of respondents favoured increased use of video conferencing, while online grocery shopping and telehealth services each garnered 59% approval, and E-learning showed a strong preference at 56%. This data underscores how swiftly digital solutions integrated into our daily lives during the pandemic.

Source: Olive Wyman Forum Analysis [2]

Advancements in Telecom and AI Applications Across EU

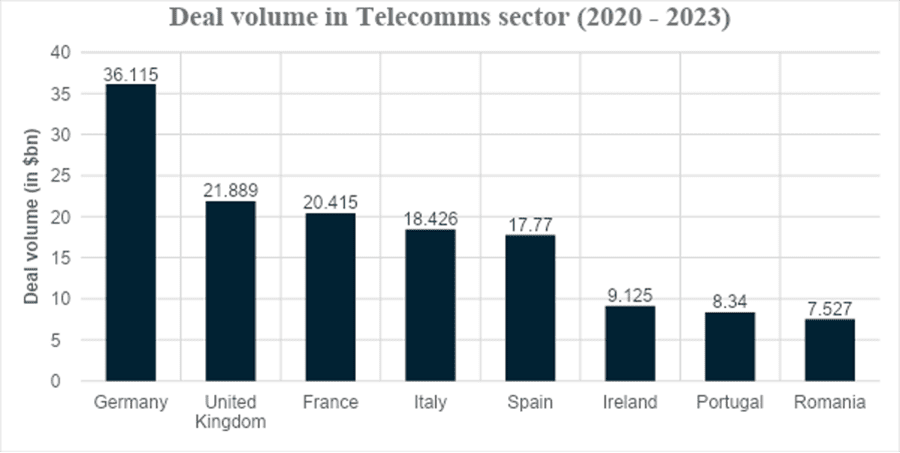

The graph below represents the project and infrastructure finance deal volume in the telecommunications sector from 2020 to 2023. The dominance of Germany is evident, with the deal volume reported to be $36.115 billion, followed by the UK at $21.889 billion. France follows closely in third place with a deal volume of $20.415 billion, representing significant market potential. The only other two countries with substantial figures are Italy and Spain, although there have been some promising deals closing in Ireland, Portugal, and Romania with large new financing deals in the project finance sector.

Source: Proximo Intelligence [5]

Deutsche Telekom, the national provider, has spearheaded advancements with AI-powered network optimisation tools. These tools leverage real-time analytics, resulting in a notable 20% enhancement in network performance and a 15% reduction in customer complaints. [14] While 2022 marked a pivotal year for the industry in Germany, the evolution of German fibre optics infrastructure has continued apace. Germany led Europe’s FTTH (Fibre to the Home) initiative, with significant financings closing throughout the year. According to Proximo Data, 16 European FTTH financings concluded in 2022, amassing nearly $26 billion in deal volume, with German deals accounting for almost $9 billion of that total.

Spain’s Telefónica has deployed an advanced AI-driven fraud detection system that effectively blocks over 95% of fraudulent activities. This initiative not only protects Telefónica from financial losses but also enhances security for its customers. [15] The adoption of AI for cybersecurity underscores a broader trend in the telecom industry towards leveraging advanced technologies to bolster trust and safeguard digital transactions.

Orange has introduced AI-driven chatbots that autonomously handle more than 90% of customer queries in France, resulting in a significant reduction in customer service costs by 40% and a notable increase in customer satisfaction rates by 25%. [16] This innovation represents a paradigm shift in customer service automation within the telecom sector, demonstrating the effectiveness of AI in improving operational efficiency and enhancing the overall customer experience.

Telecom Italia (TIM) has implemented AI-powered network security solutions to proactively detect and mitigate cyber threats in real-time, achieving a remarkable 60% reduction in cybersecurity. [17]

This strategic deployment of AI highlights TIM’s commitment to enhancing network resilience and safeguarding critical infrastructure from evolving cyber threats, setting a precedent for cybersecurity strategies in the telecommunications industry.

Predictive Analysis Enhancing Telecom Resilience

Interference mitigation strategies are essential for smooth digital operations in the post-pandemic world. Picture digital experts rapidly addressing problems from rogue networks and environmental noise, creating a digital shield against disruptions, and ensuring a seamless user experience. These strategies propel telecom companies towards better connectivity and user satisfaction.

These examples highlight the trend of using AI and predictive analytics to boost network performance in cities. As urban areas contend with population growth and increasing digital demands, telecom companies invest in advanced technologies. These reduce network congestion, enhance service reliability, and support sustainable urban development. This trend not only improves customer experience but also positions telecom providers as leaders in developing future smart cities.

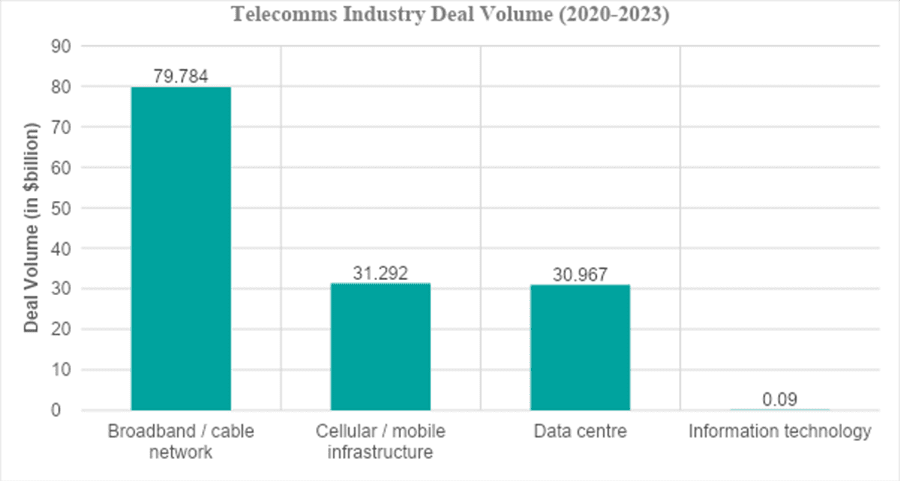

The chart below, from the Proximo Intelligence database, shows European deal volumes over the past three years, categorised by sub-sectors. The broadband and cable network sector leads with a deal volume of $79.784 billion from 86 deals out of a total 137 in project and infrastructure finance. Cellular and mobile infrastructure follows with $31.292 billion across 25 deals. Data centres, a growing trend, also report a deal volume of $30.967 billion across 25 deals.

Source: Proximo Intelligence [5]

In the post-COVID era, the adoption of predictive maintenance and real-time monitoring has accelerated, becoming a critical component of the new normal for businesses. These technologies enable companies to build more resilient infrastructures, proactively mitigate risks, and enhance operational efficiency. As businesses continue adapting to a rapidly changing environment, the integration of predictive maintenance solutions plays a pivotal role in sustaining long-term growth and stability.

Europe has seen profound impacts from these advancements, setting a precedent for global telecom strategies moving forward.

Future Trends and The Way Forward

European telecommunications face challenges shaped by regulatory frameworks, economic conditions, and technological advancements:

- Brexit introduces regulatory uncertainties for UK telecoms. [18]

- Germany’s GDPR compliance challenges demand heavy investment. [19]

- Spain faces economic instability affecting telecom investments. [20]

- France’s 5G deployment is delayed by regulatory barriers. [21]

- Italy’s 5G rollout is hindered by spectrum allocation challenges. [22]

- The Netherlands invests in cybersecurity for evolving threats. [23]

- Sweden focuses on bridging rural connectivity gaps. [24]

- Switzerland navigates complex regulatory landscapes for innovation. [25]

In the wake of COVID-19, with masks now a thing of the past and streets deserted only due to construction, digital technologies are transforming European telecommunications amidst regulatory shifts and economic uncertainties. Investments in infrastructure and AI innovations are pivotal, shaping the industry’s future and its adaptation to rapid change while driving economic recovery across Europe. How will the industry sustain innovation and meet growing digital demands ahead? Only time will tell.

References

- https://www.statista.com/statistics/203291/global-it-services-spending-forecast/

- https://www.oliverwyman.com/our-expertise/perspectives/health/2021/mar/why-4-technologies-that-boomed-during-covid-19-will-keep-people-.html

- https://www.worldometers.info/coronavirus/

- https://www.gov.uk/government/news/new-data-shows-small-businesses-received-213-billion-in-covid-19-local-authority-business-support-grants#:~:text=Press%20release-,New%20data%20shows%20small%20businesses%20received%20%C2%A321.3%20billion%20in,and%20arts%2C%20entertainment%20and%20recreation.

- Proximo Intelligence Data: www.proximoinfra.com

- Vodafone Press Release, 2022.

- “McKinsey & Company. “Predictive maintenance: The rise of self-maintaining assets.”

- Deloitte. “Predictive maintenance: Taking proactivity to the next level.”

- Forbes. “Why Virtual Assistants Are Becoming Essential for Businesses.”

- Statista. “Growth in Demand for Virtual Assistants in Europe.”

- TechRadar. “Vodafone’s AI traffic prediction cuts network congestion by 25% in London.”

- The Guardian. “BT/EE’s AI traffic prediction cuts network congestion by 30% in London.”

- FCC (2023). Spectrum Efficiency Report. Federal Communications Commission. Available at: https://www.fcc.gov/reports-research/reports/fcc-research/spectrum-efficiency.

- Deutsche Telekom’s AI-Powered Network Optimization,” TechInsights

- “Telefónica’s AI-Driven Fraud Detection,” TelecomsToday. Available at: TelecomsToday AI Fraud Detection

- “Orange’s AI-Enabled Customer Support,” AI Insider. Available at: AI Insider AI Customer Support

- “TIM’s AI-Powered Cybersecurity Measures,” CyberTechNews. Available at: CyberTechNews AI Cybersecurity

- TelecomsInsight. “Brexit’s Regulatory Impact on UK Telecoms.”

- DataPrivacyToday. “GDPR Compliance Challenges for German Telcos.”

- BusinessWire. “Spain’s Economic Recovery Challenges.”

- TelecomsObserver. “France’s Regulatory Roadblocks to 5G Deployment.”

- SpectrumInsight. “Italy’s Spectrum Allocation Challenges.”

- CyberDefenseMag. “Netherlands’ Cybersecurity Imperatives.”

- DigitalInclusionHub. “Sweden’s Rural Connectivity Initiatives.”

- RegTechInsights. “Switzerland’s Regulatory Adaptation Challenges.”

Afnan Khan is a Machine Learning Engineer specialising in Marketing Analytics, currently working as a Marketing Analyst at the Exile Group in London. He is involved in various projects, research, and roles related to Machine Learning, Data Science, and AI.

Ajay Lotan Thakur is a Senior IEEE Member, IEEE Techblog Editorial Board Member, BCS Fellow, TST Member of ONF’s Open-Source Aether (Private 5G) Project, Cloud Software Architect at Intel Canada.