Author: Alan Weissberger

NTT’s IOWN provides ultra low latency and energy efficiency in Japan and Hong Kong

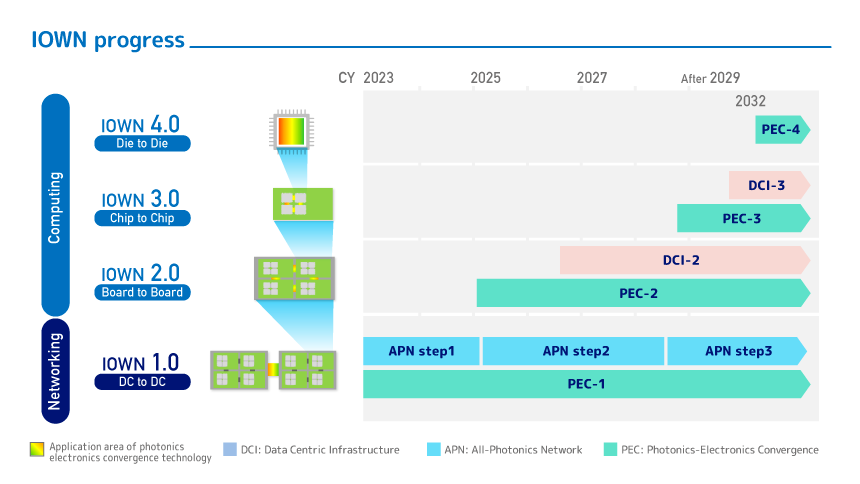

The rapid uptake of generative AI in data centers and semiconductor factories is causing a surge in power consumption, which is predicted to reach 11 times the current level by 2033. To address this issue, the NTT Group has proposed the “IOWN (Innovative Optical and Wireless Network)” concept, which aims to improve energy efficiency and achieve ultra-low latency and high-capacity communications through innovative optical communications technology.

By utilizing optical communications technology, IOWN aims to achieve dramatically low-power, high-quality, high-capacity, and low-latency communications by migrating from conventional electronics-based networks to photonics (optical)-based networks.

“Our research and development efforts are focused on achieving 1/200th the current level of latency, 125x the current level of capacity, and 100x the current level of power efficiency by 2032,” said NTT’s Tetsushi Shoji.

NTT Group is working toward “IOWN 1.0,” a goal that will see the network become all-optical. Even with current networks using optical fiber, data is repeatedly converted into electrical signals through routers and switches. However, if communication from terminal to terminal were to be entirely optical, the power consumption required for conversion would be significantly reduced.

Furthermore, communication latency is expected to be reduced. “Traditional communications involve delays because data passes through multiple nodes. However, with the IOWN APN (All Photonics Network), data reaches its destination directly, dramatically improving communication latency,” says Shoji.

On August 29, 2024, a 2,893-km IOWN APN demonstration experiment connecting Tokyo and Taiwan. The optical transport connection linked the Chunghwa Telecom Headquarter in Taipei City with the Musashino R&D Center in Musashino, Japan, achieving an ultra-low latency of approximately 17 milliseconds over an approximately 3,000 km network. Latency fluctuations were also extremely small, The innovative application was showcased publicly at the NTT R&D Forum 2024 in November 2024.

NTT Group is also considering optical fiber inside computers as part of its IOWN 2.0 and beyond concept.

Currently, the wiring inside computers uses electrical signals, and as processing speeds increase, problems with power consumption and heat generation become more serious. To solve this, the goal is to opticalize communication between boards and chips, dramatically improving data transfer efficiency.

“Ultimately, by utilizing optical fiber even inside computers, we believe it will be possible to improve power efficiency by 100 times and communication speeds by 125 times,” says Shoji.

Source: NTT Group

………………………………………………………………………………………………………………………………………………

Nearly two weeks ago, NTT Docomo Business and NTT Com Asia launched the APN InterLink service, which is targeted at Hong Kong’s financial services sector. This all optical/photonic network, promised in the late 1990s, eliminates Optical to Electrical to Optical (OEO) repeaters, thereby greatly improving transmission performance.

“As an all-photonic solution, data is transmitted entirely at the speed of light with minimal conversion, resulting in significantly reduced latency and jitter. This capability enables mission-critical applications such as real-time trading and advanced AI workloads,” said Steven So, chief technology officer at NTT Com Asia.

So noted that recent performance tests have shown that an all-photonic network substantially improves upon a traditional setup.

In Japan, NTT Data and NTT West collaborated with MUFG Bank to conduct a successful test of APN during a live IT migration involving multiple data centers situated 50km to 100km apart. The demonstration included long-distance, synchronous database management system replication between locations up to 2,500km apart. The results showed less than one second of downtime.

“This highlights how APN addresses next-generation infrastructure requirements of the financial services sector,” So said. ” IOWN APN can deliver ultra-low latency, high-capacity, and energy-efficient network photonics-based connectivity to address their needs – where every millisecond counts in the digital world.”

References:

https://www.ntt.com/business/services/xmanaged/lp/itsmf/202511-nttcom.html

https://group.ntt/en/group/iown/function/

NTT pins growth on IOWN (Innovative Optical and Wireless Network)

Sony and NTT (with IOWN) collaborate on remote broadcast production platform

RAN silicon rethink – from purpose built products & ASICs to general purpose processors or GPUs for vRAN & AI RAN

The global RAN market has been declining for several years, putting pressure on network equipment vendors to cut costs and rethink their commitment to purpose built/custom RAN silicon products or ASICs. In 2022, the market for RAN equipment and software generated about $45 billion in revenues, according to research by Omdia, an Informa company. By 2024, annual revenue had tumbled to $35 billion – a 22.22% drop (and even worse in real dollars when you include inflation). As a result. it has become harder to justify the cost of expensive purpose-built silicon for the shriveling RAN market sector.

The Radio Access Network (RAN) is the segment of the mobile network interfacing the end-users and the mobile core network. In it’s IMT 2020 and IMT 2030 recommendations, ITU-R refers to the interface between a wireless endpoint and RAN equipment (base station or small cell) as the Radio Interface Technology or RIT). The core network specifications all come from 3GPP which has ETSI rubber stamp them.

……………………………………………………………………………………………………………………………………………………………………..

Ericsson and Samsung appear increasingly reliant on Intel for RAN silicon, while Nokia has been dependent on Marvell, but is planning to use NVIDIA GPUs in the near future (much more below). Let’s look at RAN silicon offerings from Intel, Marvell and NVIDIA:

-

Key RAN silicon offerings from Intel include:

- Intel Xeon with Intel vRAN Boost: The primary processors for network and edge applications include specific Intel Xeon 6 SoCs (System-on-Chips) that integrate Intel’s vRAN Boost accelerators directly on the die. This integration helps offload demanding Layer 1 (physical layer) processing, such as forward error correction, from the general-purpose CPU cores.

- Integrated Accelerators: These built-in accelerators are designed to improve performance-per-watt and increase capacity for RAN workloads. Intel’s approach is to provide high performance using common, off-the-shelf hardware with specialized acceleration, contrasting with other approaches that might rely entirely on general-purpose CPUs.

- FPGAs (Field Programmable Gate Arrays): Through its acquisition of Altera, Intel offers FPGAs which can also be used in some RAN applications, allowing for flexible, programmable hardware solutions.

- Intel has a significant market share in 5G base station silicon and its upcoming Granite Rapids processors (part of the Xeon 6 family) are being developed to maintain its strong position in this market, including for Massive MIMO applications. The company faces strong competition, but its next-generation processors aim to improve performance and efficiency for both core and edge computing in 5G networks. massive MIMO into future chips, such as the upcoming Granite Rapids generation.

- OCTEON Fusion Processors: These are baseband processors optimized for cost, power, and programmability, widely used in both traditional and Open RAN (O-RAN) architectures. The latest iteration, the OCTEON 10 Fusion processor, provides comprehensive in-line 5G Layer 1 acceleration, enabling RAN virtualization in cloud data centers.

- OCTEON Data Processing Units (DPUs): The OCTEON TX2 and OCTEON 10 families are multi-core ARM-based processors that handle 5G transport processing, security, and edge inferencing for the RAN Intelligent Controller (RIC). They incorporate hardware accelerators for AI/ML functions, enabling optimized edge processing.

- AtlasOne Chipset: This is a 50Gbps PAM4 DSP (Digital Signal Processor) and TIA (Transimpedance Amplifier) chipset solution for 5G fronthaul, optimized for high performance and power efficiency in integrated, O-RAN, and vRAN architectures.

- Ethernet Switches and PHYs: Marvell’s Prestera switches and Alaska Ethernet physical layer (PHY) devices are used in carrier infrastructure to provide the necessary networking connectivity for 5G base stations and data centers.

- Marvell also works with partners to integrate its technology into accelerator cards, such as the Dell Open RAN Accelerator Card powered by the OCTEON Fusion platform, to provide carrier-grade vRAN solutions. Furthermore, Marvell offers custom ASIC design services for hyper-scalers and telecom customers who need highly optimized, specific silicon solutions for their unique 5G and AI infrastructure requirements.

3. NVIDIA’s new silicon platform for AI Radio Access Networks (AI-RAN) is the NVIDIA Aerial RAN Computer, which is built on the next-generation Blackwell architecture. The primary system for AI-RAN deployment is the NVIDIA Aerial RAN Computer-1, which utilizes the NVIDIA GB200 NVL2 platform.

Key NVIDIA RAN components and features include:

- NVIDIA Blackwell GPU: The core graphics processor that features 208 billion transistors and provides significant performance improvements for AI and data processing workloads compared to previous generations.

- NVIDIA Grace CPU: The GB200 NVL2 platform combines two Blackwell GPUs with two NVIDIA Grace CPUs, connected by a high-speed NVLink-C2C (Chip-to-Chip) interconnect to form a powerful, unified superchip.

- NVIDIA Aerial Software: The hardware runs a full software stack that includes NVIDIA Aerial CUDA-Accelerated RAN libraries and NVIDIA AI Enterprise software for 5G and future 6G networks.

- Specialized Networking: The platform uses NVIDIA BlueField-3 Data Processing Units (DPUs) for real-time data transmission and precision timing, and NVIDIA Spectrum-X Ethernet for high-speed networking, which are critical for RAN performance.

- The goal of this platform is to enable wireless telcos to run both traditional RAN and AI workloads concurrently on a common, energy-efficient, software-defined infrastructure, thereby creating new revenue opportunities and preparing for 6G.

……………………………………………………………………………………………………………………………………………….

To many stakeholders, piggybacking on the general purpose processors used in PCs and data centers might be more sensible, but that would require Virtual RAN (vRAN), which replaces custom silicon with such general-purpose processors. However, it is a very small share of the RAN compute or baseband subsector. Omdia says it was just 10% in 2023, but the market research firm expects that share to more than double by 2028. It that forecast pans out, vRAN could conceivably replace some of the custom RAN silicon business with general purpose processors.

Lat year, Ericsson allocated approximately $5.7 billion of its R & D budget to design and development of ASICs for Layer 1 (PHY), the most demanding part of the baseband. It relies on Intel for other RAN silicon functionality. If virtual RAN claims a bigger share of a low- or no-growth market, Ericsson’s returns on the same level of investment in ASICs would decline because they wouldn’t be needed for vRAN. Also, Intel’s Granite Rapids could markedly narrow the performance and cost gap with purpose-built RAN chips.

“We are doing trials on many platforms,” said Per Narvinger, the head of Ericsson’s mobile networks business group, in reference to that taste testing of different chips. “But the more important thing is that we have actually created this disaggregation of and separation of hardware and software.”

The aim is to have a set of RAN software deployable on multiple hardware platforms. However, that is not achievable with ASICs, which create a tight union between hardware and software (they are inextricably tied together). The general-purpose options identified by Narvinger were AMD, Intel and Nvidia. Currently, Intel remains Ericsson’s sole silicon commercial vendor. Despite Ericsson’s professed enthusiasm for )single vendor) open RAN, its business today is nearly all about purpose-built 5G.

In sharp contrast, Samsung’s retreat from custom RAN silicon has appeared rapid. It is without doubt the biggest mainstream vendor of virtual RAN products, and there is barely interest in the purpose-built 5G technology it has developed with Marvell. The RAN that Samsung has built for Verizon in the US is entirely virtual. It is about to do the same in parts of Europe for Vodafone. Canada’s Telus purchases both virtual and purpose-built 5G products from Samsung. But Bernard Bureau, the operator’s vice president of wireless strategy, says the virtual now outperforms the traditional and is also significantly less expensive. The processors, as in the case of Ericsson, come exclusively from Intel.

- Ericsson’s primary concern likely centers on the hardware architecture utilized for Forward Error Correction (FEC), a resource-intensive Layer 1 function. While Intel’s Granite Rapids and preceding platforms integrate the FEC accelerator directly within the main processor, AMD provides this functionality via an external accelerator card. Ericsson has historically favored integrated solutions, citing the use of separate cards as an added expense.

- Samsung is evaluating virtualized RAN software that potentially obviates the need for a dedicated hardware accelerator when deployed on AMD’s high-core-count processors. Samsung is confident that the increased core density of AMD’s offerings can manage the computational load of a software-only FEC implementation, and a commercial offering may be imminent. Samsung’s transition to AMD processors from Intel would require minimal changes to existing software written for Intel’s x86 instruction set architecture.

Nokia’s situation is more complicated due to NVIDIA’s recent $1 billion investment in the company. An apparent condition is that Nokia will designing 5G and 6G network equipment that uses Nvidia’s GPUs. As we noted in yesterday’s IEEE Techblog post, many telcos regard those GPUs as an expensive and energy-hungry component, which makes using them a risky move by Nokia. Presumably, Nokia cannot use the money it has received from NVIDIA to develop 5G Advanced and 6G software specifically for Marvell’s special purpose RAN silicon. If Nokia develops RAN software that runs on NVIDIA GPUs it conceivably could be repurposed for another GPU platform rather than specialized RAN silicon or an ASIC. And the only viable GPU alternative to NVIDIA at this time (outside of China) is AMD.

References:

https://www.lightreading.com/5g/slow-death-of-custom-ran-silicon-opens-doors-for-amd

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

China gaining on U.S. in AI technology arms race- silicon, models and research

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Indosat Ooredoo Hutchison, Nokia and Nvidia AI-RAN research center in Indonesia amongst telco skepticism

Indosat Ooredoo Hutchison (Indosat) Nokia, and Nvidia have officially launched the AI-RAN Research Centre in Surabaya, a strategic collaboration designed to advance AI-native wireless networks and edge AI applications across Indonesia. This collaboration, aims to support Indonesia’s digital transformation goals and its “Golden Indonesia Vision 2045.” The facility will allow researchers and engineers to experiment with combining Nokia’s RAN technologies with Nvidia’s accelerated computing platforms and Indosat’s 5G network.

According to the partners, the research facility will serve as a collaborative environment for engineers, researchers, and future digital leaders to experiment, learn, and co-create AI-powered solutions. Its work will centre on integrating Nokia’s advanced RAN technologies with Nvidia’s accelerated computing platforms and Indosat’s commercial 5G network. The three companies view the project as a foundation for AI-driven growth, with applications spanning education, agriculture, and healthcare.

The AI-RAN infrastructure enables high-performance software-defined RAN and AI workloads on a single platform, leveraging Nvidia’s Aerial RAN Computer 1 (ARC-1). The facility will also act as a distributed computing extension of Indosat’s sovereign AI Factory, a national AI platform powered by Nvidia, creating an “AI Grid” that connects datacentres and distributed 5G nodes to deliver intelligence closer to users.

Nezar Patria, vice minister of communication and digital affairs of the Republic of Indonesia said: “The inauguration of the AI-RAN Research Centre marks a concrete step in strengthening Indonesia’s digital sovereignty. The collaboration between the government, industry, and global partners such as Indosat, Nokia, and Nvidia demonstrates that Indonesia is not merely a user but also a creator of AI technology. This initiative supports the acceleration of the Indonesia Emas 2045 vision by building an inclusive, secure, and globally competitive AI ecosystem.”

Vikram Sinha, president director and CEO of Indosat Ooredoo Hutchison said: “As Indonesia accelerates its digital transformation, the AI-RAN Research Centre reflects Indosat’s larger purpose of empowering Indonesia. When connectivity meets compute, it creates intelligence, delivered at the edge, in a sovereign manner. This is how AI unlocks real impact, from personalised tutors for children in rural areas to precision farming powered by drones. Together with Nokia and Nvidia, we’re building the foundation for AI-driven growth that strengthens Indonesia’s digital future.”

From a network perspective, the project demonstrates how AI-RAN architectures can optimize wireless network performance, energy efficiency, and scalability through machine learning–based radio signal processing.

Ronnie Vasishta, senior vice president of telecom at Nvidia added: “The AI Grid is the biggest opportunity for telecom providers to make AI as ubiquitous as connectivity and distribute intelligence at scale by tapping into their nationwide wireless networks.”

Pallavi Mahajan, chief technology and AI officer at Nokia said: “This initiative represents a major milestone in our journey toward the future of AI-native networks by bringing AI-powered intelligence into the hands of every Indonesian.”

………………………………………………………………………………………………………………………………………………………..

Wireless Telcos are Skeptical about AI-RAN:

According to Light Reading, the AI RAN uptake is facing resistance from telcos. The problem is Nvidia’s AI GPUs are very costly and not GPUs power-efficient enough to reside in wireless base stations, central offices or even small telco data centers.

Nvidia references 300 watts for the power consumption of ARC-Pro, which is much higher than the peak of 40 watts that Qualcomm claimed more than two years ago for its own RAN silicon when supporting throughput of 24 Gbit/s. How ARC-Pro would measure up on a like-for-like basis in a commercial network is obviously unclear.

Nvidia also claims a Gbit/s-per-watt performance “on par with” today’s traditional custom silicon. Yet the huge energy consumption of GPU-filled telco data centers does not bear that out.

“Is there a case for a wide-area indiscriminate rollout? I am not sure,” said Verizon CTO Yago Tenorio, during the Brooklyn 6G Summit, another telecom event, last week. “It depends on the unit cost of the GPU, on the power efficiency of the GPU, and the main factor will always be just doing what’s best for the basestation. Don’t try to just overcomplicate the whole thing monetizing that platform, as there are easier ways to do it.”

“We have no way to justify a business case like that,” said Bernard Bureau, the vice president of wireless strategy for Canada’s Telus, at FYUZ. “Our COs [central offices] are not necessarily the best places to run a data center. It would mean huge investments in space and power upgrades for those locations, and we’ve got sunk investment that can be leveraged in our cell sites.”

Light Reading’s Iain Morris wrote, “Besides turning COs into data centers, operators would need to invest in fiber connections between those facilities and their masts.”

How much spectral efficiency can be gained by using Nvidia GPUs as RAN silicon?

“It’s debatable if it’s going to improve the spectral efficiency by 50% or even 100%. It depends on the case,” said Tenorio. Whatever the exact improvement, it would be “really good” and is something the industry needs, he told the audience.

In April, Nokia’s rival Ericsson said it had tested “AI-native” link adaptation, a RAN algorithm, in the network of Bell Canada without needing any GPU. “That’s an algorithm we have optimized for decades,” said Per Narvinger, the head of Ericsson’s mobile networks business group. “Despite that, through a large language model, but a really small one, we gained 10% of spectral efficiency.”

Before Nvidia invested in Nokia, the latter claimed to have sufficient AI and machine-learning capabilities in the custom silicon provided by Marvell Technology, its historical supplier of 5G base station chips.

Executives at Cohere Technology praises Nvidia’s investment in Nokia, seeing it as an important AI spur for telecom. Yet their own software does not run on Nvidia GPUs. It promises to boost spectral efficiency on today’s 5G networks, massively reducing what telcos would have to spend on new radios. It has won plaudits from Vodafone’s Pignatelli as well as Bell Canada and Telstra, both of which have invested in Cohere. The challenge is getting the kit vendors to accommodate a technology that could hurt their own sales. Regardless, Bell Canada’s recent field trials of Cohere have used a standard Dell server without GPUs.

Finally, if GPUs are so critical in AI for RAN, why has neither Ericsson or Samsung using Nvidia GPU’s in their RAN equipment?

Morris sums up:

“Currently, the AI-RAN strategy adopted by Nokia looks like a massive gamble on the future. “The world is developing on Nvidia,” Vasishta told Light Reading in the summer, before the company’s share price had gained another 35%. That vast and expanding ecosystem holds attractions for RAN developers bothered by the diminishing returns on investment in custom silicon.”

“Intel’s general-purpose chips and virtual RAN approach drew interest several years ago for all the same reasons. But Intel’s recent decline has made Nvidia shine even more brightly. Telcos might not have to worry. Nvidia is already paying a big 5G vendor (Nokia) to use its technology. For a company that is so outrageously wealthy, paying a big operator to deploy it would be the next logical step.

…………………………………………………………………………………………………………………………………………………

References:

https://capacityglobal.com/news/indosat-nokia-and-nvidia-launch-ai-ran-research-centre-in-indonesia/

https://www.telecoms.com/ai/indosat-nokia-and-nvidia-open-ai-ran-research-centre-in-indonesia

https://www.lightreading.com/5g/nokia-and-nvidia-s-ai-ran-plan-hits-telco-resistance

https://resources.nvidia.com/en-us-aerial-ran-computer-pro

Nvidia pays $1 billion for a stake in Nokia to collaborate on AI networking solutions

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

The case for and against AI-RAN technology using Nvidia or AMD GPUs

AI RAN Alliance selects Alex Choi as Chairman

AST SpaceMobile to deliver U.S. nationwide LEO satellite services in 2026

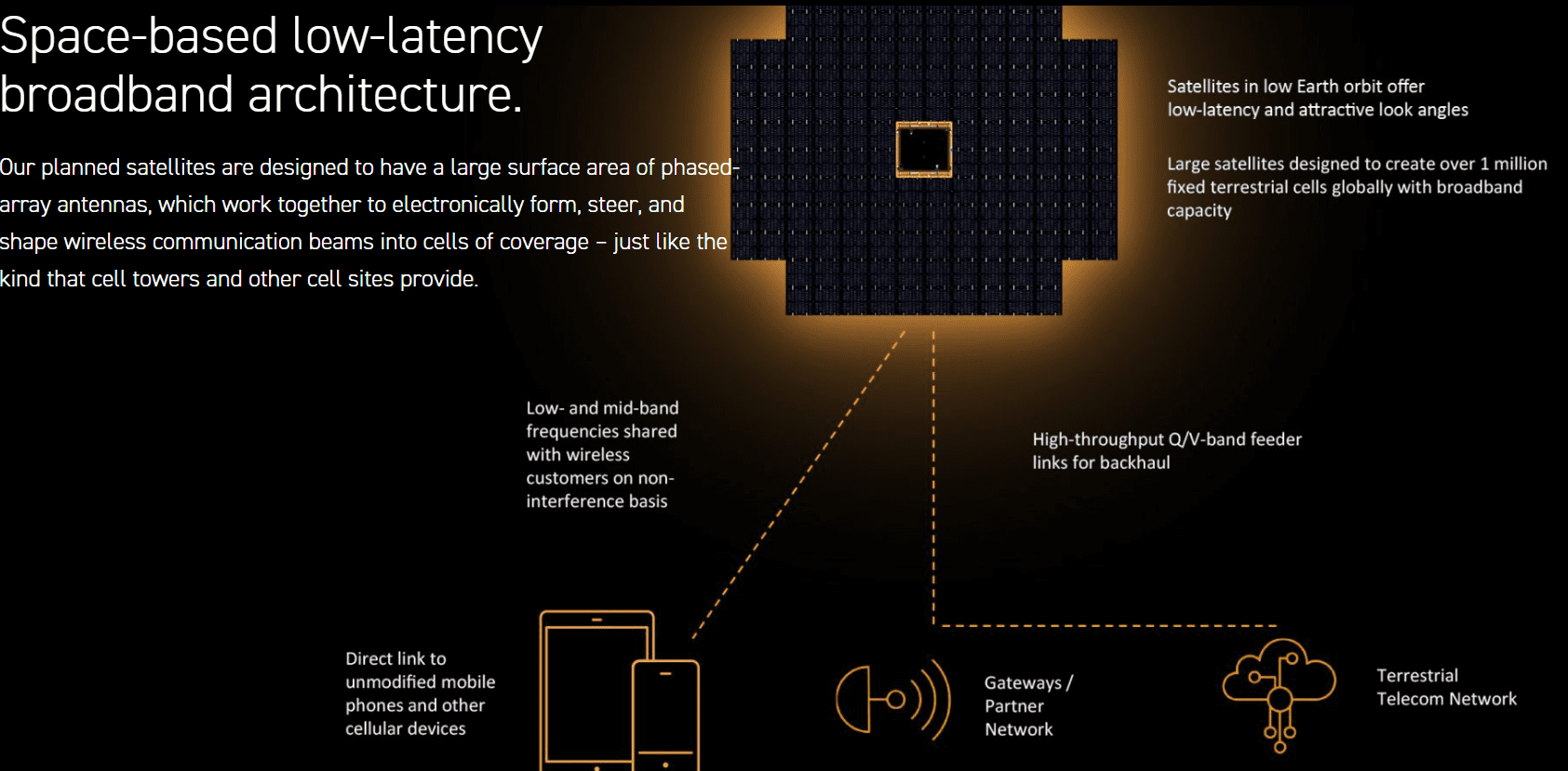

LEO satellite broadband startup AST SpaceMobil Inc. has secured over $1 billion in total contracted revenue commitments from commercial partners, demonstrating strong commercial traction. The company has signed definitive commercial agreements with major telecom operators such as Verizon, AT&T and Saudi Telecom Group (stc) for direct-to-device (D2D) services, thereby expanding its commercial ecosystem. All told, AST has commercial agreements with over 50 mobile network operators with nearly 3 billion subscribers globally.

The company has strengthened its financial position with over $3.2 billion in cash and liquidity, ensuring funding for its satellite constellation and global service expansion. While it has yet to generate revenue from its LEO satellite broadband service, it reported $14.7 million revenue in the third quarter, up from $1.1 million in the previous year, driven by gateway sales to operators and US government contracts.

Importantly, AST said it expects to deliver “intermittent nationwide” LEO satellite service in selected markets in early 2026 with “continuous” service planned for later in 2026 as more satellites are added, according to CEO Abel Avellan, speaking on the company’s third quarter earnings call. In particular:

“We expect to continue scale deployment efforts early next year as we progress activation of an intermittent nationwide service by early 2026 and prepare for continued service later in 2026.”

AST remains committed to its target to have 45 to 60 BlueBird satellites in orbit by the end of 2026, which would enable continuous service across the US, Europe, Japan and “other strategic markets.” Longer-term, the aim is to expand the service to “all targeted” markets with 90 satellites.

Five launches for AST’s next generation BlueBird satellites are planned to take place by the end of the first quarter in 2026, after which launches will be once every one or two months to meet the goal of 45 to 60 satellites in orbit. Of the initial five launches, the first is scheduled for mid-December from India and the remaining four will be from Cape Canaveral with partners SpaceX and Jeff Bezos’ Blue Origin. The latter’s New Glenn rocket can take up to eight BlueBird satellites while SpaceX’s Falcon 9 can carry up to three satellites.

Source: AST SpaceMobile website

……………………………………………………………………………………………………………………………………………………………….

Avellan also said on the call:

“We showcased Canada’s first successful space-based direct-to-cell voice-over LTE call, video call, and other broadband data and video streaming activations. We believe Canada will represent another attractive market for our direct-to-device cellular broadband service. Space-based cellular broadband connectivity is an industry that we invented, and a recent technology milestone with Verizon and Bell follows several breakthroughs using our direct-to-device technology, including the first-ever 4G and 5G voice calls, voice-over LTE calls, live video calls, streaming, full internet access, and tactical non-terrestrial network connectivity for military and defense purposes, from space to modified smartphones.”

“Our direct-to-device cellular broadband network will help our partners deliver on one of their highest priorities, which is extending connectivity for their customers as part of our effort to deliver on those priorities. We are advancing partners and ecosystem network integration as we progress towards service activation in key partner markets.”

AST has ramped up manufacturing capacity so that it will produce six satellites per month from December, adding that these are “the largest satellites ever launched” into low Earth orbit (LEO). “We’re breaking a world record every time that we take a satellite out of the factory,” Avellan said.

The AST CEO is “very confident in the launch campaign.” The company has built 19 satellites so far and will have built 40 by around the end of March next year. “That matches very well with the launches that we had already financially committed and are in the manifest of our launch partners to take them,” Avellan added.

……………………………………………………………………………………………………………………………………………

It should be noted that T-Mobile US started offering Starlink-based D2D services (called T-Satellite) in July this year. Therefore, AT&T and Verizon D2D services with AST will be many months behind their arch rival.

……………………………………………………………………………………………………………………………………………

Andy Johnson, AST’s chief financial officer, described the company’s performance in 2025 as a time of “rapid growth” as it gets closer to its ambition to build its broadband satellite constellation. “The transition from an emerging R&D-focused startup to an operating company on the path to optimizing our manufacturing and launch cadence has been hard yet invigorating and gratifying work for our now nearly 1,800-person worldwide workforce,” he added.

………………………………………………………………………………………………………………………………………………

References:

https://investors.ast-science.com/quarterly-results

https://ast-science.com/spacemobile-network/our-technology/

AT&T deal with AST SpaceMobile to provide wireless service from space

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

FCC Grants Experimental License to AST SpaceMobile for BlueWalker 3 Satellite using Spectrum from AT&T

Highlights and Summary of the 2025 Brooklyn 6G Summit

Last week’s Brooklyn 6G Summit, hosted by Nokia and the NYU Wireless research center, explored two critical pillars of 6G development: artificial intelligence (AI) and value creation. Speakers and panelists from technology, business, academia and regulation organizations came together to shape the future of wireless in a three-day event on the campus of the NYU Tandon School of Engineering.

More than 300 participants, including more than 60 speakers and panelists, attended this year’s gathering at the New York University (NYU) Brooklyn campus, and many more tuned in for the livestream, to provide an eclectic gathering of academia, industry analysts, service providers, equipment vendors and startups from various corners of the telecom industry. These included a wide swath of customers, partners, engineers and innovators, as well as representatives from Verizon Wireless, KDDI Research, Intel, NTT DOCOMO, Qualcomm, Axiom Space and more.

A series of keynote addresses, lively panels and physical demonstrations showcased a wide range of 6G topics surrounding AI and value creation, such as energy efficiency, security, network digital twins, the integration of Non-Terrestrial Networks and more.

Nokia President and CEO Justin Hotard (x-Intel) led off in a recorded fireside chat with Nokia’s new chief technology and AI officer Pallavi Mahajan, in which he described how Nokia will be at the heart of a new hyper-digital 6G world and the AI Super-cycle and AI-Native networks that will accompany it. “What’s going to change as we look ahead is the opportunity for AI to be a bridge between the physical and the digital world. We realize that for networks to be valuable in this world they need to actually be different. They need to be designed from the start for AI.”

The evolution from 5G (IMT 2020) to 6G (IMT 2030) is expected to generate faster speeds, lower latency and better performance. But 6G looks to offer much more value in creating a fusion of the digital, physical and human worlds, according to Summit participants.

NVIDIA Senior Vice President Ronnie Vasishta highlighted the centrality of AI to the 6G future: “6G really distributes AI to the entire population and enterprises. It’s the connectivity fabric for AI, and it cannot be underestimated how important that is,” he said. “When you look at a dynamic world and you also start to use the network as a sensor, AI becomes essential. It’s very different from the 5G world.”

Arpit Mehta, the Head of Americas Carrier Product Management at Meta, discussed the future of immersive experience with AI glasses, while wearing a pair of futuristic spectacles on his face as he described what they could do.

“6G, so far, in my view needs to solve two priorities: the uplink problem and the device problem,” said Yago Tenorio, SVP Strategy at Verizon Wireless, explaining what needed to be done to unlock the vast 6G potential. “What matters to the customer is: give him a native, cellular, connected sensor network that he can deploy around him in any way he wants.”

Lively panel discussions included those on AI data, the role of verticals in 6G value creation and the impact of large telco models and network digital twins.

There was also a special segment devoted to the Nokia Bell Labs centennial celebration, in which Nokia Bell Labs President for Core Research Peter Vetter outlined how the 6G advancements of today stand on the shoulders of giants from the past 100 years of Bell Labs technology. “The big innovations that happened at Bell Labs in our 100-year history shaped our wireless industry,” Vetter said. “But we are not only reflecting on what happened in the past, we reflect and highlight what we are doing to shape the next 100 years. And that starts for the 6G era in the next decade.”

The summit included nearly 40 demonstrations from Nokia and participating companies, showcasing the vast potential of future 6G networks. It also featured an Open House, where NYU Wireless students showcased a wide range of cutting-edge technologies on campus, such as nanotech labs, various robotic arms, robots and even robotic dogs. Later, some of these same students took on their professors in the first 6G Brooklyn Summit Game Show. The Jeopardy-style game included categories such as history, fundamentals, spectrum, 6G, AI/ML and Non-Terrestrial Networks. In a crowd-pleasing upset, which bode well for the future of technology, the students emerged victorious by a decisive margin. In was an outcome that did not trouble in the least one of the professors who participated.

“We always want our students to do better than we did, so I’m delighted they beat us,” said NYU Wireless founder Ted Rappaport. One of the main characteristics of the Brooklyn 6G Summit is the focus on strong collaboration between industry and academia to shape the future 6G-era together. Appropriately, the opening panel was devoted to the U.S. academic view of 6G. “When you bring people together when there is a new technology, you can make great strides,” Rappaport added. “It’s how you build a comfort level and a consensus on what’s most important. We are doing that for 6G.”

The summit honored several trailblazers in telecommunication technology. The annual Pioneer Award was presented to Dave Forney, namesake of the influential Forney algorithm in coding theory and the inventor of the modern modem. The Lifetime Academic Achievement Award was bestowed upon Prof. Andrea Goldsmith, the president of Stony Brook University (SBU) and the former Dean of Engineering and Applied Science at Princeton, who shared her captivating life story and trailblazing path as a female technologist in a celebratory dinner in her honor.

It all added up to what Head of Nokia Standards Peter Merz said was a hopeful message for the future. “We had candid discussions with excellent people that are moving the ecosystem forward. There is still a lot of work to be done but I am confident that we as a community will make it happen,” he concluded.

References:

https://www.nokia.com/blog/the-12th-brooklyn-summit-marks-a-tipping-point-toward-the-6g-era/

Nokia Bell Labs and KDDI Research partner for 6G energy efficiency and network resiliency

Nokia and Rohde & Schwarz collaborate on AI-powered 6G receiver years before IMT 2030 RIT submissions to ITU-R WP5D

Nvidia pays $1 billion for a stake in Nokia to collaborate on AI networking solutions

Nokia Bell Labs and KDDI Research partner for 6G energy efficiency and network resiliency

Nokia Bell Labs and KDDI Research have partnered to advance 6G technology, focusing on improving network energy efficiency and resilience. The collaboration combines KDDI’s real-world network data and operational insights with Nokia Bell Labs’ expertise in energy consumption models and programmable network architectures. This joint research agreement, signed on November 5, 2025, builds on a long history of cooperation and aims to accelerate the development and deployment of sustainable, intelligent 6G networks.

Under this new agreement, the two companies are conducting research in two key areas of 6G:

- mMIMO energy efficiency: New techniques for reducing base-station energy consumption while enhancing communication, specifically targeted at proposed 6G spectrum.

- Distributed programmable core network services for 6G: New mobile core technologies that will ensure continuous communication during infrastructure failures and natural disasters.

KDDI Research and Nokia Bell Labs will demonstrate their initial work in mMIMO energy efficiency at the Brooklyn 6G Summit Nov 5 – 7.

Peter Vetter, President, Core Research, Nokia Bell Labs:

“Tackling the inherent challenges in a new generation of networking requires close collaboration in the industry. Working side by side, KDDI Research and Nokia Bell Labs can advance the state of the art in networking thanks to different perspectives on the problems and possible solutions. Ultimately, the joint outcomes will make 6G a more resilient, efficient and intelligent technology.”

Satoshi Konishi, President and CEO, KDDI Research:

“Through our strategic and close collaboration with Nokia Bell Labs, we aim to accelerate R&D initiatives and further strengthen the ‘Power to Connect’ toward 6G. We strive to continuously deliver new value to our customers and make meaningful contributions to societal progress.”

References:

KDDI unveils AU Starlink direct-to-cell satellite service

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

KDDI Deploys DriveNets Network Cloud: The 1st Disaggregated, Cloud-Native IP Infrastructure Deployed in Japan

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Nokia’s Bell Labs to use adapted 4G and 5G access technologies for Indian space missions

Nokia and Rohde & Schwarz collaborate on AI-powered 6G receiver years before IMT 2030 RIT submissions to ITU-R WP5D

Highlights of Nokia’s Smart Factory in Oulu, Finland for 5G and 6G innovation

Will the wave of AI generated user-to/from-network traffic increase spectacularly as Cisco and Nokia predict?

Nokia Bell Labs claims new world record of 800 Gbps for transoceanic optical transmission

Nokia Bell Labs sets world record in fiber optic bit rates

IDC Report: Telecom Operators Turn to AI to Boost EBITDA Margins

Worldwide spending on telecommunication and pay TV services will reach $1,532 billion in 2025, representing an increase of +1.7% year-on-year, according to the International Data Corporation (IDC) Worldwide Semiannual Telecom Services Tracker. The latest forecast is slightly more optimistic compared to the forecast published earlier this year, as it assumes a 0.1 percentage point higher growth of the total market value.

“The regional dynamics remain mixed, with inflationary effects, competition, and Average Revenue per User (ARPU) trends playing a central role in shaping market trajectories,” said Kresimir Alic, research director, Worldwide Telecom Services at IDC.

Global telecom operators are strategically adopting AI to drive significant business improvements across several key areas. The integration of AI technology is enhancing network operations, refining customer service interactions, and strengthening fraud prevention mechanisms which are reduce losses, reinforcing customer trust and regulatory compliance. With AI accelerating time-to-market for new services, telecoms can better monetize emerging technologies like 5G and edge computing.

“In the longer term, as AI continues to evolve, it will be increasingly recognized not as a mere technological enhancement, but as a strategic enabler poised to drive sustainable growth for telecommunications operators,” according to the report. This strategic adoption is accelerating time-to-market for new services, enabling better monetization of technologies like 5G and edge computing (which requires a 5G SA core network). It represents cautious optimism for a global connectivity services market that has been stagnant for many years.

- Network Planning and Operations: AI is heavily used to optimize network performance and manage the complexity of modern networks, including 5G and future 6G technologies. This involves:

- Predictive Maintenance: Anticipating hardware failures and network issues to ensure uninterrupted service and reduce downtime.

- Automation and Orchestration: Automating complex tasks and managing physical, virtual, and containerized network functions.

- Energy Efficiency: Making intelligent choices about radio access network (RAN) energy consumption and resource allocation to increase efficiency.

- Customer Experience (CX) and Service: Enhancing customer engagement and service is a top priority. This is achieved through:

- Personalized Services: Analyzing customer behavior and preferences to offer tailored products and marketing campaigns.

- Intelligent Virtual Assistants/Chatbots: Automating customer interactions and improving self-service capabilities.

- Churn Reduction: Using AI to predict customer churn and implement retention strategies.

- Business Efficiency and Productivity: Operators are focused on driving agility and productivity across the organization. This includes:

- Employee Productivity: Streamlining workflows and automating tasks using generative AI (GenAI) and agentic AI.

- Cost Reduction: Driving efficiency in operations to lower overall costs.

- Fraud Prevention: Deploying AI-enhanced systems to detect and mitigate fraud, protecting revenue streams and customer trust.

- New Revenue Opportunities: AI is seen as a cornerstone for developing new services, such as AI-as-a-Service, and monetizing existing network assets like 5G capabilities.

| Global Regional Services Revenue and Year-on-Year Growth (revenues in $B) | |||

| Global Region | 2024 Revenue | 2025 Revenue | 25/24

Growth |

| Americas | $568 | $574 | 1.0% |

| Asia/Pacific | $476 | $481 | 1.0% |

| EMEA | $462 | $477 | 3.2% |

| Grand Total | $1,507 | $1,532 | 1.7% |

| Source: IDC Worldwide Semiannual Services Tracker – 1H 2025 | |||

Mobile continues to dominate, driven by rising data consumption and the expansion of M2M applications, which are offsetting declines in traditional voice and messaging revenues.

Fixed data services are also expected to grow steadily, fueled by increasing demand for high-bandwidth connectivity.

In summary, IDC forecasts that the global connectivity services market is projected to grow at a compound annual rate of 1.5% over the next five years, maintaining a cautiously optimistic outlook. As highlighted by recent IMF forecasts, the overall market environment is expected to be less stimulating than in previous years, shaped by rising protectionism and persistent economic uncertainty in key regions. While declining inflation may ease cost pressures, it is also likely to reduce the inflation-driven boost to telecom service spending seen in recent cycles. Political instability in areas such as Eastern Europe and the Middle East adds further complexity to the growth landscape. Most notably, saturation in mature telecom markets continues to be the primary constraint on expansion, limiting upside potential in traditional service segments.

………………………………………………………………………………………………………………………………………………………….

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Semiannual Telecom Services Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 100 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.

………………………………………………………………………………………………………………………………………………………….

References:

https://my.idc.com/getdoc.jsp?containerId=prUS53913925&

https://my.idc.com/getdoc.jsp?containerId=prEUR253369525

https://my.idc.com/getdoc.jsp?containerId=US53765725

Market research firms Omdia and Dell’Oro: impact of 6G and AI investments on telcos

Verizon to build new, long-haul, high-capacity fiber pathways to connect AWS data centers

Verizon Business has announced a new Verizon AI Connect deal with Amazon Web Services (AWS) to provide resilient high-capacity, low-latency network infrastructure essential for the next wave of AI innovation. As part of the deal, Verizon will build new, long-haul, high-capacity fiber pathways to connect AWS data center locations. This will enable AWS to continue to deliver and scale its secure, reliable, and high-performance cloud services for customers building and deploying advanced AI applications at scale.

These new fiber segments mark a significant commitment in Verizon’s network buildout, to enable the AI ecosystem to intelligently deliver the exponential data growth driven by generative AI. The Verizon AI Connect solution will provide AWS with resilient network paths that will enhance the performance and reliability of AI workloads underpinned by Verizon’s award-winning network. The Verizon-AWS collaboration also encompasses joint development of private mobile edge computing solutions that provide secure, dedicated connectivity for enterprise customers. These existing collaborations have delivered significant value across multiple industries, from manufacturing and healthcare to retail and entertainment, by combining Verizon’s powerful network infrastructure with AWS’s comprehensive cloud services.

“AI will be essential to the future of business and society, driving innovation that demands a network to match,” said Scott Lawrence, SVP and Chief Product Officer, Verizon Business. “This deal with Amazon demonstrates our continued commitment to meet the growing demands of AI workloads for the businesses and developers building our future.”

“The next wave of innovation will be driven by generative AI, which requires a combination of secure, scalable cloud infrastructure and flexible, high-performance networking,” said Prasad Kalyanaraman, vice president, AWS Infrastructure Services. “By working with Verizon, AWS will enable high-performance network connections that ensure customers across every industry can build and deliver compelling, secure, and reliable AI applications at scale. This collaboration builds on our long-standing commitment to provide customers with the most secure, powerful, and efficient cloud infrastructure available today.”

This initiative strengthens Verizon’s long-standing strategic relationship with AWS. The companies have already established several key engagements, including Verizon’s adoption of AWS as a preferred strategic public cloud provider for its digital transformation initiatives. Previous engagements have targeted use cases across sectors such as manufacturing, healthcare, retail and media, pairing Verizon’s network capabilities with AWS’s cloud stack. It should be noted, however, that AWS also uses other major carriers and dark fiber providers, such as Lumen Technologies, Zayo, AT&T, and others, to ensure a highly redundant and diverse global inter-data center network.

This deal highlights how telecommunications companies are becoming critical enablers of the AI-driven economy by investing in the foundational fiber optic infrastructure required for large-scale AI processing.

References:

https://www.verizon.com/about/news/verizon-business-and-aws-new-fiber-deal

Verizon transports 1.2 terabytes per second of data across a single wavelength

Verizon, AWS and Bloomberg media work on 4K video streaming over 5G with MEC

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

Lumen deploys 400G on a routed optical network to meet AI & cloud bandwidth demands

Google’s Project Suncatcher: a moonshot project to power ML/AI compute from space

Overview:

Google’s Project Suncatcher will equip solar-powered satellite constellations with TPUs and free-space optical links to one day scale machine learning (ML) and AI compute in space. The sun is the ultimate energy source and solar panels can be much more productive in orbit, thereby significantly reducing the need for heavy batteries. With energy use being a key consideration for terrestrial data centers, especially with the ongoing and seemingly relentless need to scale up for ML/AI, space might be the right location for AI.

Goals and Objectives of Project Suncatcher:

References:

https://research.google/blog/exploring-a-space-based-scalable-ai-infrastructure-system-design/

https://blog.google/technology/research/google-project-suncatcher/

https://services.google.com/fh/files/misc/suncatcher_paper.pdf

Muon Space in deal with Hubble Network to deploy world’s first satellite-powered Bluetooth network

Nokia’s Bell Labs to use adapted 4G and 5G access technologies for Indian space missions

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Hubble Network Makes Earth-to-Space Bluetooth Satellite Connection; Life360 Global Location Tracking Network

AT&T deal with AST SpaceMobile to provide wireless service from space

Nokia and Rohde & Schwarz collaborate on AI-powered 6G receiver years before IMT 2030 RIT submissions to ITU-R WP5D

Nokia and the test and measurement firm Rohde & Schwarz have created and successfully tested a “6G” radio receiver that uses AI technologies to overcome one of the biggest anticipated challenges of 6G network rollouts, coverage limitations inherent in 6G’s higher-frequency spectrum.

–>This is truly astonishing as ITU-R WP5D doesn’t even plan to evaluate 6G RIT/SRITs till February 2027 when the first submissions are invited to be presented.

Nokia Bell Labs developed the receiver and validated it using 6G test equipment and methodologies from Rohde & Schwarz. The two companies will unveil a proof-of-concept receiver at the Brooklyn 6G Summit on November 6, 2025. Nokia says, “the machine learning capabilities in the receiver greatly boost uplink distance, enhancing coverage for future 6G networks. This will help operators roll out 6G over their existing 5G footprints, reducing deployment costs and accelerating time to market.”

Image Credit: Rohde & Schwarz

Nokia Bell Labs and Rohde & Schwarz have tested this new AI receiver under real world conditions, achieving uplink distance improvements over today’s receiver technologies ranging from 10% to 25%. The testbed comprises an R&S SMW200A vector signal generator, used for uplink signal generation and channel emulation. On the receive side, the newly launched FSWX signal and spectrum analyzer from Rohde & Schwarz is employed to perform the AI inference for Nokia’s AI receiver. In addition to enhancing coverage, the AI technology also demonstrates improved throughput and power efficiency, multiplying the benefits it will provide in the 6G era.

“One of the key issues facing future 6G deployments is the coverage limitations inherent in 6G’s higher-frequency spectrum. Typically, we would need to build denser networks with more cell sites to overcome this problem. By boosting the coverage of 6G receivers, however, AI technology will help us build 6G infrastructure over current 5G footprints,” said Peter Vetter, President, Core Research, Bell Labs, Nokia.

“Rohde & Schwarz is excited to collaborate with Nokia in pioneering AI-driven 6G receiver technology. Leveraging more than 90 years of experience in test and measurement, we’re uniquely positioned to support the development of next-generation wireless, allowing us to evaluate and refine AI algorithms at this crucial pre-standardization stage. This partnership builds on our long history of innovation and demonstrates our commitment to shaping the future of 6G,” said Michael Fischlein, VP, Spectrum & Network Analyzers, EMC and Antenna Test, Rohde & Schwarz.

…………………………………………………………………………………………………………………………………………………………………………………………

Last month, Nokia teamed up with rival kit vendor Ericsson to work on video coding standardization in preparation for 6G. The project, which also involved Berlin’s Fraunhofer Heinrich Hertz Institute (HHI), demonstrated a new video codec which they claim has higher compression efficiency than the current standards (H.264/AVC, H.265/HEVC, and H.266/VVC) without significantly increasing complexity, and its wider aim is to strengthen Europe’s role in next generation standardization, we were told at the time.

…………………………………………………………………………………………………………………………………………………………………………………………

About Nokia:

At Nokia, we create technology that helps the world act together.

As a B2B technology innovation leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks. In addition, we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs, which is celebrating 100 years of innovation.

With truly open architectures that seamlessly integrate into any ecosystem, our high-performance networks create new opportunities for monetization and scale. Service providers, enterprises and partners worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to create the digital services and applications of the future

About Rohde & Schwarz:

Rohde & Schwarz is striving for a safer and connected world with its Test & Measurement, Technology Systems and Networks & Cybersecurity Divisions. For over 90 years, the global technology group has pushed technical boundaries with developments in cutting-edge technologies. The company’s leading-edge products and solutions empower industrial, regulatory and government customers to attain technological and digital sovereignty. The privately owned, Munich-based company can act independently, long-term and sustainably. Rohde & Schwarz generated a net revenue of EUR 3.16 billion in the 2024/2025 fiscal year (July to June). On June 30, 2025, Rohde & Schwarz had more than 15,000 employees worldwide.

References: