Author: Alan Weissberger

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Australian telco Telstra announced this week that it has achieved a 5G uplink speed of 350 Mbps over 5G Standalone (SA) using sub-6 GHz frequencies in a live commercial network in partnership with Ericsson and Qualcomm. Telstra claims this as a new global record for 5G uplink speed, which is 100 times faster than the average 3G uplink speed.

Telstra’s new 5G SA uplink capability combines its mid-band spectrum holdings to create a 140MHz channel for sending data from the device to the network.

The tests were completed using a mobile test device powered by Qualcomm Technologies’ latest Snapdragon® 5G modem-RF System and an existing in-market NetGear Nighthawk M6 Pro Mobile Broadband device in the live commercial network on the Gold Coast.

The latest software from Ericsson brings together different combinations of frequency ranges and types to enable a single 5G uplink and downlink data channel.

By aggregating carrier bands, it considerably increases the uplink speeds, while the ability to use low band carriers in these combinations of frequencies delivers improved coverage and performance enhancements for the 5G SA Network.

Mr Amirthalingam says: “The uplink and downlink 5G data channels work together to provide a seamless and almost symmetrical like 5G service, meeting the increasing demand for data-intensive applications such as augmented and virtual reality, or sharing photos and memorable movie moments with friends.

“The technology also includes advanced features in the base station that can prioritise different types of data and applications and can support future differentiated services, like network slicing.”

“On top of this, Telstra also has the option to use the n5 (850MHz) carrier that is currently serving its 3G Network. “

“Our latest 5G Standalone uplink speed achievement is 100 times faster than the typical 3G uplink speed, which is great news for customers. Enterprise Applications such as these are increasingly becoming more uplink heavy with things like such as high-definition video surveillance cameras and the faster speeds and coverage will all provide a much better experience.”

“The ability to use low band frequencies and repurpose our 3G low band 850 MHz frequency to deliver 5G SA coverage when the 3G network closes on 30 June 2024, has the benefit of providing improved depth of coverage and enhancing the 5G experience for customers.”

“It’s a further example of how we are leading the way in 5G innovation and investment, and how we are committed to delivering the best and most advanced network for Australia.”

To test and validate this capability, Telstra worked with long-term partners Ericsson, the global leader in 5G network equipment, and Qualcomm, one of the world’s leading wireless chipset companies.

Emilio Romeo, Head of Ericsson Australia and New Zealand, says: “Ericsson’s latest software features enables Telstra to capitalize the full spectrum portfolio for a wider coverage whilst providing far superior data rates. Customers will be empowered to explore new experiences offered with 5G Standalone such as differentiated services and a range of applications, which will in turn drive network monetization.”

Durga Malladi, Senior Vice President and General Manager, Technology Planning & Edge Solutions Qualcomm Technologies, Inc., says: This live test proves that uplink carrier aggregation on 5G Standalone network has the potential to significantly increase upload speeds and capacity, thus unlocking new experiences for consumers.”

This latest achievement takes Telstra’s World-First count to 53 since the launch of 3G. It is only through its collaboration efforts with industry and its strategic partners, like Ericsson and Qualcomm, that it can deliver the technology innovation and leadership that its customers can benefit from.

……………………………………………………………………………………………………………………

Telstra has also implemented Ericsson’s Dynamic Network Slicing software for automated network orchestration. This software gives the operator a fully automated and monetizable network slicing orchestration capability to sell slicing services to enterprise customers.

………………………………………………………………………………………………………………

References:

Telstra’s T25 to extend 5G coverage and offer enhanced customer experiences

Telstra wins most lots in Australia’s 5G mmWave auction

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

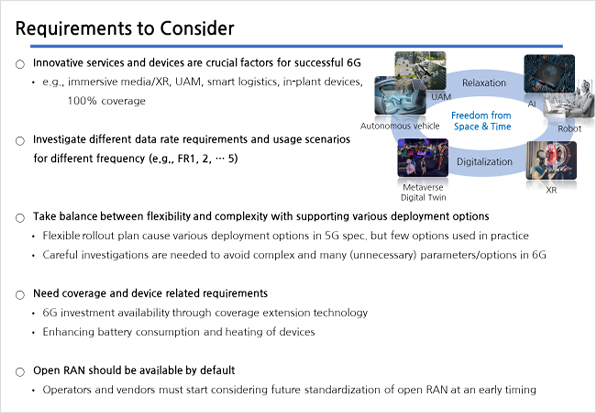

The NGMN Alliance has issued the “ITU-R Framework for IMT-2030: Review and Future Direction.” In this essential publication, NGMN welcomes the recent ITU-R report on the ‘Framework and overall objectives of the future development of IMT for 2030 and beyond.’ This ITU-R report ( Recommendation ITU-R M. 2160) sets an important framework for future technology discussions towards 6G.

“Our publication underlines the importance of investment confidence for operators in order to deliver tangible value to customers while ensuring the commercial sustainability of current and future networks,” said Luke Ibbetson, Member of the NGMN Alliance Board and Head of Group R&D at Vodafone. “The capabilities identified for IMT-2030 should be able to be deployed as and when required, without compromising existing core connectivity services, and reflect a customer need that generates new value.”

There is close alignment between NGMN’s vision for 6G and the IMT-2030 framework. This close alignment covers vision, usage scenarios and essential capabilities, particularly related to practical and sustainable deployment and emphasizing harmonised global standards for mobile networks. NGMN goes on to provide recommendations and guidance on ITU-R aspects as it moves forward in the next stage of the IMT-2030 process, including:

- New features should be able to be deployed as and when required, without compromising existing core connectivity services, which reflect customer needs and generate new values.

- Evaluation should include interworking of IMT-2030 candidates with non-IMT systems.

- Reinforcement of the importance of global standards for mobile networks within industry consensus-based standards organisations (e.g., 3GPP).

- Consideration that advanced features introduced with the IMT-2020 network and/or a new radio interface might be candidates for IMT-2030.

- Any new radio interface must demonstrate significant benefits over and above IMT-2020 in key metrics such as spectral and/or energy efficiency, overall energy consumption reduction and/or cost advantages.

- Further work would be beneficial, as input to the process and next steps, to understand the commercial imperative for any extreme requirements of IMT-2030.

- IMT-2030 should continue to evolve based on IP communications, considering cloud native solutions, disaggregation, and service-based architecture, ensuring both forward and backward compatibility. Support for self-organisation to manage complexity and emerging capabilities.

“This publication provides a realistic evaluation of IMT-2030 technologies”, said Michael Irizarry, Member of the NGMN Alliance Board and Executive Vice President and Chief Technology Officer, Engineering and Information Technology, UScellular. “For a new IMT-2030 radio technology to become widely adopted for 6G, it must demonstrate significant benefits across key metrics such as energy efficiency, traffic capacity and cost reduction”.

“We at NGMN look forward to collaborative efforts with the ITU-R and subsequent phases of activity to shape the future of IMT-2030,” said Madam Yuhong Huang, Member of the NGMN Alliance Board and General Manager China Mobile Research Institute. She added, “We hope the industry will prioritize the development needs outlined by NGMN on behalf of its operator members and actively participate in 6G research, contributing novel technologies, unlocking innovative business opportunities, and enabling the sustainable development of the society for the benefit of our customers.”

Following the NGMN publications “6G Position Statement, an Operator View”, “6G Use Cases and Analysis”, “6G Drivers and Vision” and “6G Requirements and Design Considerations”, this latest publication “Analysis of ITU-R Framework for IMT-2030” marks the next step towards guidance for E2E requirements for 6G.

The publication can be downloaded here.

About NGMN Alliance:

The NGMN Alliance (NGMN) is a forum founded by world-leading Mobile Network Operators and open to all Partners in the mobile industry. Its goal is to ensure that next generation network infrastructure, service platforms and devices will meet the requirements of operators and ultimately will satisfy end user demand and expectations. The vision of NGMN is to provide impactful industry guidance to achieve innovative, sustainable and affordable mobile telecommunication services for the end user with a particular focus on Mastering the Route to Disaggregation / Operating Disaggregated Networks, Green Future Networks and 6G, whilst continuing to support 5G’s full implementation.

NGMN seeks to incorporate the views of all interested stakeholders in the telecommunications industry and is open to three categories of participants/NGMN Partners: Mobile Network Operators (Members), vendors, software companies and other industry players (Contributors), as well as research institutes (Advisors).

Collaboration is key to driving the industry’s most important subjects such as NGMN’s Strategic Focus Topics: Mastering the Route to Disaggregation, Green Future Networks and 6G. NGMN invites all parties across the entire value chain to join the Alliance in these important endeavors.

…………………………………………………………………………………………………………….

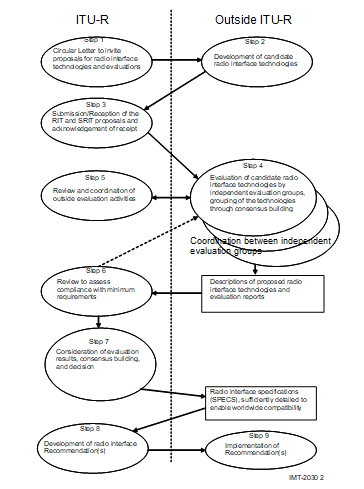

At its February 2024 meeting, ITU-R WP 5D produced a working document on the IMT-2030 process for standardization. The document describes the process and activities identified for the development of the IMT‑2030 terrestrial components radio interface Recommendations.

The time schedule for candidate RITs (Radio Interface Technologies) or SRITs (Set of Radio Interface Technologies is as follows:

Submission of proposals may begin at 54th meeting of Working Party (WP) 5D (currently planned to be 10-17 February 2027) and contribution to the meeting needs to be submitted by 1600 hours UTC, 12 calendar days prior to the start of the meeting.

The final deadline for submissions is 1600 hours Coordinated Universal Time (UTC), 12 calendar days prior to the start of the 59th meeting of WP 5D in February 2029. The evaluation of the proposed RITs and SRITs by the independent evaluation groups and the consensus-building process will be performed throughout this time period and thereafter.

…………………………………………………………………………………………………………………..

Editor’s Note: Don’t expect ITU-R M.[IMT-2030.SPECS] recommendation to be approved before sometime in 2031. The detailed specifications of each of IMT-2030 technology is scheduled for completion at ITU-R WP5D meeting #63 in June 2030. Draft revisions/spec updates are scheduled to be completed at 5D meeting #64 in October 2030.

Just as with 5G/IMT-2020, IMT-2030.SPECS will only cover the 6G RIT/SRIT (radio interfaces). 3GPP will do all the work on the 6G non-radio/systems aspects.

……………………………………………………………………………………………………………………

The seven steps in the IMT-2030 standardization process is shown in this Figure:

References:

NGMN publishes ITU-R Framework for IMT-2030: Review and Future Direction

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/Pages/default.aspx

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

IMT Vision – Framework and overall objectives of the future development of IMT for 2030 and beyond

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

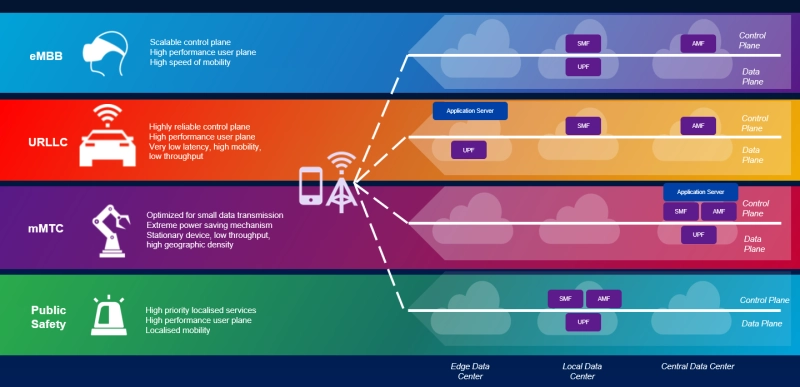

Years after 5G network slicing was hyped to the sky (see References below dating from 2028), BT Group, Ericsson and Qualcomm Technologies, Inc. have successfully demonstrated end-to-end consumer and enterprise 5G differentiated connectivity enabled by 5G network slicing on Ericsson’s 5G Core and Radio Access Network technology in the UK with devices powered by the Snapdragon ® 8 Gen 2 for Galaxy Mobile Platform.

The trial, which took place at Adastral Park, BT Group’s home of research and innovation, established network slices for Gaming, Enterprise and Enhanced Mobile Broadband (eMBB), and showed how, by allocating a portion of the 5G SA network to provide dynamic partitions for specific use-cases, optimal performance can be maintained for bandwidth-heavy activities including mobile gaming and video conferencing even during peak times.

Mobile gaming is experiencing relentless growth, with traffic on EE’s network almost doubling since the beginning of 2023 to more than two petabytes of data every month. With consistent low-latency, jitter-free and immersive experiences increasingly essential to the gaming experience, network slicing is expected to be a key enabler of performance and growth in the 5G SA era.

Together, BT Group, Ericsson and Qualcomm Technologies demonstrated an optimal mobile cloud gaming experience on Nvidia’s GeForce Now, maintaining a throughput comfortably in excess of the recommended 25 Mbps at 1080p even when a background load was generated. The companies initiated a gaming session on Fortnite using the Samsung S23 Ultra device, equipped with the Snapdragon 8 Gen 2 for Galaxy Mobile Platform, and Ericsson implemented Network slicing along with the Ericsson RAN feature Radio Resource Partitioning on EE’s Network to achieve a smooth experience. The experience was simultaneously compared to a non-optimised eMBB RAN partition, which was congested by the background load, resulting in a less than optimal gaming experience.

The trial also validated the potential of network slicing for BT Group’s business customers. Using the enterprise and eMBB slices, configured via URSP rules which enables a device to connect to multiple network slices simultaneously depending on the application, it demonstrated consistent 4K video streaming and enterprise use-cases using the Samsung S23 Ultra device, powered by Snapdragon 8 Gen 2 for Galaxy. Enterprise communications platforms and video applications such as YouTube require a stable connection and low jitter to work well. The Ericsson 5G RAN Slicing feature, Radio Resource Partitioning, was enabled to ensure the enterprise traffic to achieve an optimal experience.

5G network slicing requires a 5G SA core network. It supports these diverse services and reassigns resources as needed from one virtual network slice to another, making the one-size-fits-all approach to service delivery obsolete.

Image courtesy of Viavi

Greg McCall, Chief Networks Officer, BT Group, said: “Network slicing will enable us to deliver new and improved capabilities for customers in the 5G SA era. As we work diligently towards the launch of our own 5G SA network, today’s successful demonstration of how slicing enables us to differentiate Quality of Service to guarantee performance for different segments is a significant milestone, and illustrative of the new services that will be enabled by 5G SA.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA of Qualcomm Europe, Inc., said: “We are proud to collaborate with BT Group and Ericsson on the network slicing trial, which used a device powered by the Snapdragon 8 Gen 2 for Galaxy mobile platform. Together, we showcased the enhanced performance and flexibility 5G Standalone capabilities, such as network slicing, will bring to consumers and enterprise experiences.”

Katherine Ainley, CEO, Ericsson UK & Ireland, said: “5G standalone and network slicing demonstrates that leading operators like EE will be able to offer customers tailored connectivity with different requirements on speed, latency and reliability for specific applications, such as video streaming and gaming. This ultimate next step in connectivity will enable new service offerings for consumers and businesses who require premium performance, while helping to drive future market growth and innovation for the UK in a wide range of new industries.”

References:

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

https://www.viavisolutions.com/en-us/5g-network-slicing

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

With Ericsson and Qualcomm doing the “heavy lifting,” Finland network operator Elisa conducted a live test of uplink carrier aggregation (CA) on its commercial 5G standalone (SA) network. Elisa operates commercial 5G SA networks, starting with its home market of Finland and following it up last year by deploying it in Estonia.

The three partners achieved an upload speed of 230 Mbps in a live 5G network using Uplink Carrier Aggregation. For this test, a 25MHz 2.6 GHz FDD (frequency division duplex) band was combined with a 100MHz 3.5 GHz TDD (time division duplex) band running on a mobile test device powered by Snapdragon® X75 5G Modem-RF System.

Ericsson’s Uplink Carrier Aggregation software combines mid-band FDD and mid-band TDD within the frequency range 1 (FR1), boosting speeds to enable uplink-heavy applications such as live streaming, broadcasts, cloud gaming, extended reality, and video-based use cases.

Uplink-heavy consumer applications on the rise:

According to Ericsson’s most recent Mobility Report, uplink accounted for a modest 8% of total traffic on a sample of four mobile networks analyzed. The applications that generated the largest volume of uplink traffic were personal cloud storage services, followed by comms services and video.

While 8% doesn’t seem like much, Ericsson emphasised that uplink volume is highly context dependent. For instance, there is likely to be more of it at a live event, like a concert or a sporting event, where users enthusiastically film and then share as much action as possible.

A growing amount of data traffic generated today is in the uplink, highlighting the need for new network capabilities to boost uplink speed and capacity and deliver seamless 5G user experience. For instance, concertgoers are recording and streaming videos live on their social media accounts. With fast uplink speeds, they can share their most exciting moments in real-time with friends and family without worrying about lags, congestion, or poor network quality.

In addition to Elisa, Vodafone has also been testing out uplink CA recently, as have Dish, BT and Telefónica.

………………………………………………………………………………………………………………….

Quotes:

Mårten Lerner, Head of Product Area Networks, Ericsson, says: “This latest technology milestone with our partners Elisa and Qualcomm Technologies unlocks high upload speeds in commercial 5G Standalone networks. With this game-changing software capability, we are enabling unparalleled user experience for applications such as live streaming, video conferencing, augmented reality/virtual reality and cloud gaming.”

Sami Rajamäki, Vice President, Network Services, Elisa, says: “We continue as a pioneer of 5G in Finland and develop our network services with our customers’ future needs in mind. The use of augmented reality and development towards metaverse will increase the demand for fast uplink connections. Therefore the top speeds achieved together with Ericsson and Qualcomm are an important step in the development of 5G Standalone network.”

Dino Flore, Vice President, Technology at Qualcomm Europe, Inc. says: “The uplink speed achieved with Elisa and Ericsson is a testament to the breakthrough performance of the Snapdragon X75 5G Modem-RF System. We are excited to see the innovative use cases Elisa can unlock for customers with their 5G Standalone network.”

Ericsson has a robust portfolio of software features that provide a boost in the uplink, and the feature deployed in this demo with Elisa and Qualcomm – FR1 Uplink Carrier Aggregation – became commercially available in the fourth quarter of 2023.

Visit the Ericsson booth in Hall 2 at MWC 2024 in Barcelona to see how a superior uplink performance is being enabled for use cases such as live streaming.

References:

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

BT tests 4CC Carrier Aggregation over a standalone 5G network using Nokia equipment

Telenor installs base station in Antarctica; reports strong growth in Q4 and full year 2023

Nordic network operator Telenor yesterday announced the opening of the world’s southernmost commercial base station in Antarctica, setting a new benchmark for connectivity in the harshest of environments. The Norwegian Polar Institute’s research station in Antarctica,

The base station has extended reach, connecting a vast area to the outside world with mobile connectivity. The base station was put into operation in February. What makes this base station truly unique, aside from being the southernmost in the world, is that it’s operated from the world’s northernmost base station at Ny Ålesund which is located on the Svalbard archipelago (formerly known as Spitsbergen). Should the mobile signal fail, a satellite link from Troll to the KSAT-owned TrollSat satellite can also be used to provide wireless connectivity.

Head of Telenor Svalbard, Christian Skottun, emphasizes that a strong collaboration with the Norwegian Polar Institute is the foundation for establishing mobile coverage in Antarctica. “There has been a fruitful dialogue with the Norwegian Polar Institute regarding the possibilities offered by a base station in Antarctica. Telenor, with its presence in Svalbard, has extensive experience in building and operating mobile networks in Arctic regions. Mobile coverage is crucial for both Arctic poles. For research communities, the ability to utilize mobile IoT in gathering data from fieldwork is particularly attractive. Additionally, mobile coverage opens up new possibilities for research and environmental monitoring in the Antarctic oceanic area.”

The primary motivation behind this audacious project is to provide essential mobile coverage to the Norwegian Polar Institute’s research station, Troll, located in Antarctica. Troll serves as a hub for scientific exploration and environmental research, making reliable communication crucial for the success of ongoing projects and the safety of researchers working in the region.

This base station also provides a new dimension of safety as we now are able to offer mobile coverage in the area where the polar research station is located.

Telenor’s base station in Antarctica is claimed to be the world’s most southern commercial base station. (SOURCE: TELENOR)

……………………………………………………………………………………………………………………………………………………………………………

“Mobile coverage is a step forward for technological development at Troll. In addition, it provides new opportunities for research and monitoring in Queen Maud Land,” says the Director of the Polar Institute, Camilla Brekke.

In addition to close collaboration with the Norwegian Polar Institute, Telenor Svalbard also collaborates with Kongsberg Satellite Services (KSAT), which is responsible for the communication service from the Troll station. KSAT owns and operates TrollSat, one of the world’s most important ground stations for collecting data from climate and environmental monitoring satellites, co-located with the research station at Troll. KSAT is responsible for transmitting satellite-based information from Troll to users worldwide.

“Full mobile coverage at Troll also helps our users and simplifies communication with the outside world. We are therefore pleased that the satellite link from Troll also can be used for mobile phone traffic,” says Rolf Skatteboe, CEO of KSAT.

Birgitte Engebretsen, CEO of Telenor Norway, is proud and delighted that Telenor has contributed to establishing mobile connectivity between the poles.

“Our societal mission includes providing technology that makes research work easier. We see that the emergence of our new technological solutions opens up new possibilities for research,” says Engebretsen.

……………………………………………………………………………………………………………………………………………………………………………………………..

Telenor today announced that it ended 2023 strongly with solid top-line growth and strong cash flow both in the fourth quarter and for the full year. Service revenues for the full year 2023 ended up at NOK 62.5 billion, corresponding to an organic increase of 4.0 per cent compared to last year. EBITDA ended at NOK 34.6 billion, corresponding to organic growth of 2.8 per cent compared to the year before. Total free cash flow amounted to NOK 15 billion.

Service revenues for the fourth quarter were NOK 16.1 billion, up 4.9 per cent compared with the same period last year. EBITDA ended at NOK 8.5 billion, corresponding to an organic increase of 3.9 per cent. Free cash flow for the quarter was NOK 4.9 billion before M&A.

“I am very pleased that we continue to deliver growth with new and better products to our customers, at the same time as customer surveys show that we have Norway’s best and fastest network,” says Sigve Brekke, CEO of Telenor. “The fourth quarter was yet another strong quarter for Telenor,” Brekke added.

Telenor Nordics and Telenor Asia delivered four and seven per cent growth in service revenues, respectively, in the final quarter of the year, while organic EBITDA growth ended at five and four per cent.

Fraud is on the rise. In the fourth quarter, Telenor stopped around 300 million attempts at digital crime against Norwegian customers, which is an increase of around 30 percent compared to the previous quarter. In 2023, Telenor stopped 280 million fraud calls globally, out of which 31 million in Norway and 63 million in the Nordic region.

With artificial intelligence, criminal groups have gained access to a new toolbox that creates increased unpredictability. “Whether you’re an individual or a business owner, we are all targets. Therefore, we must adapt, be vigilant and take action to protect our digital lives and values”, says Brekke.

Telenor’s Financial outlook for 2024:

- Low single-digit organic growth in Nordic service revenues.

- Medium single-digit organic growth in both Nordic and Group EBITDA.

- Nordic capex to sales ratio of around 17 per cent.

- Free cash flow of between NOK 9-10 billion before M&A and potential items related to prior years’ activities.

References:

https://www.telenor.com/media/newsroom/press-releases/solid-year-and-fourth-quarter-for-telenor/

Telenor expands cloud-based core network with AWS to deliver 5G and edge services for customers

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

Telenor trial of multi-vendor 5G Standalone (SA) core network on vendor neutral platform

Telenor deploys first commercial 5G network in Norway

Juniper Research: Global 6G Connections to be 290M in 1st 2 years of service, but network interference problem looms large

A new study from Juniper Research, a leading telecommunications research firm, forecasts 290 million connections globally by 2030; the year after its initial expected launch in 2029 (this author doesn’t think standards for 6G will be completed by 2030). To achieve this early growth, the report cautions operators must solve various technological challenges, including the issue of network interference arising from the use of high-frequency spectrum.

This use of high-frequency spectrum in 6G will be the key enabling technology to provide throughput speeds 100 times greater than current 5G networks. However, as cellular technologies have never used spectrum bands in this range before, the most pressing concern for operators is minimizing this network interference, or risk creating an unreliable 6G network.

RIS Identified as Key Emerging 6G Technology:

To achieve this, the report urges operators to invest in RIS (Reconfigurable Intelligent Surfaces); a technology that will mitigate the impact of interference from large obstacles, including buildings, on network services. This is accomplished by purposefully reflecting and refracting 6G mobile signals to enable data packets to move around physical obstacles.

As 6G standards become clearer in 2025, RIS technology must become an immediate priority for development. However, the report warns that given the wide geographical areas of some 6G networks, operators must implement AI to monitor and adjust RIS configuration in real-time to maximize the technology’s benefits.

Research author Alex Webb remarked: “Initial 6G coverage will occur in the most densely populated geographical areas to serve as many users as possible. Therefore, RIS technology will be key to providing a valuable 6G service to both consumer and enterprise customers in the first few years of network operation.”

In 2030, when Juniper Research expects 6G to reach 290 million connections, GSMA Intelligence predicts in its 2023 mobile economy report that 5G will have surpassed 5 billion connections. We believe both of those forecasts are way off the mark. In fact, we forecast ZERO 6G subscribers in 2030, because the ITU-R IMT 2030 radio standards and 3GPP 6G specs won’t be completed by then.

About the Research Suite:

The new research suite offers the most comprehensive assessment of 6G development to date, including insightful market analysis, and in-depth forecasts for 60 countries. The dataset contains almost 21,000 market statistics over a nine-year period.

Juniper Research has, for two decades, provided market intelligence and advisory services to the global telecommunications sector, and is retained by many of the world’s leading network operators and communications platforms.

Find out more about the new report: Global 6G Development 2024-2032, or download a free sample.

References:

Global 6G Connections to Reach 290m in First Two Years of Service (juniperresearch.com)

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

SK Telecom, Intel develop low-latency technology for 6G core network

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

ETSI Integrated Sensing and Communications ISG targets 6G

Ericsson’s India 6G Research Program at its Chennai R&D Center

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

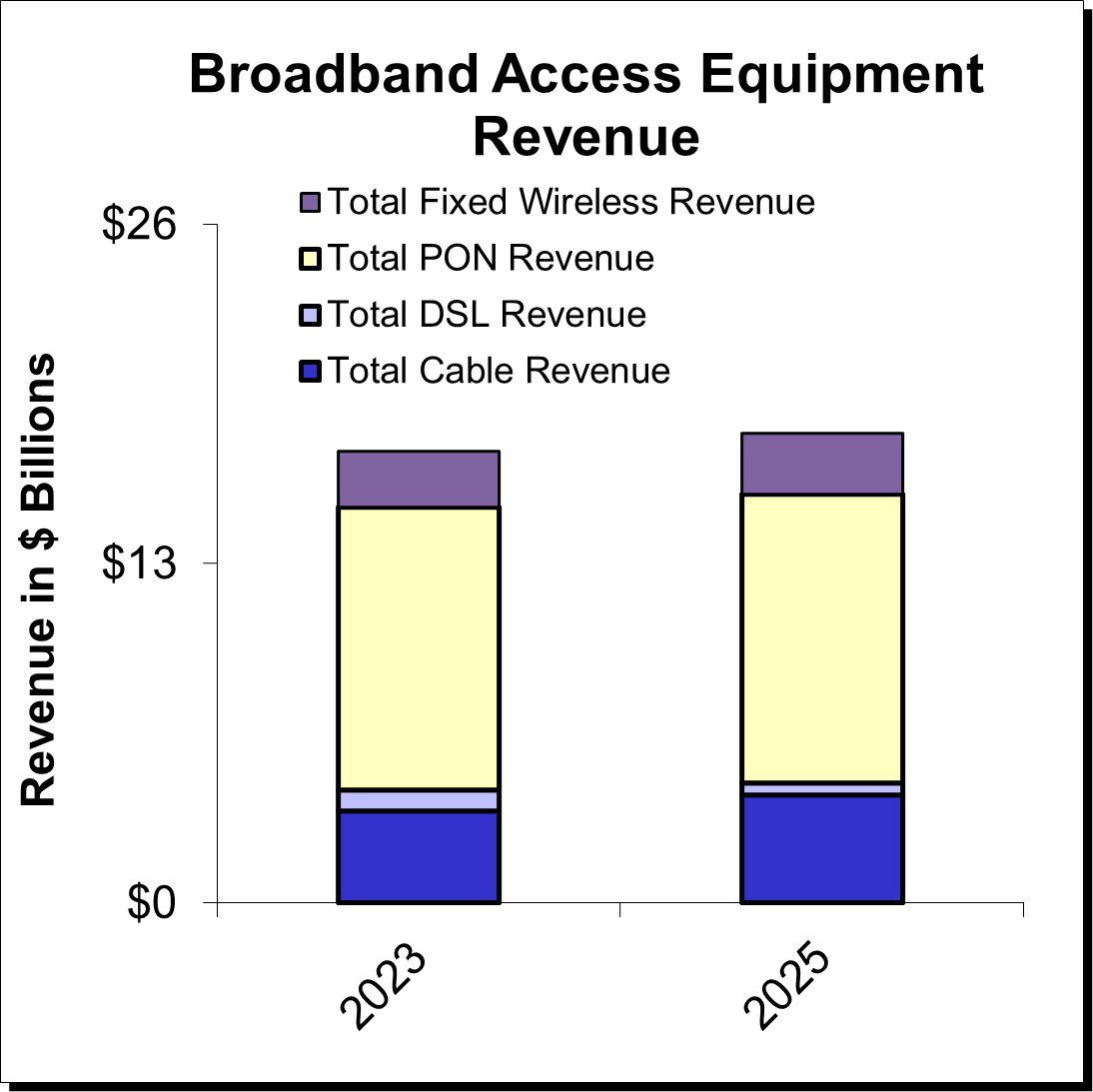

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro Group expects broadband access equipment sales to decline by 1% in 2024 versus 2023, with the first half of 2024 seeing continued weakness followed by a surge in spending in the second half of the year. The first half of 2024 will continue to see some of the inventory corrections that marked a tough 2023 that saw a spending decline of 8% to 10%, according to Dell’Oro VP Jeff Heynen.

“Although the inventory corrections seen in 2023 will continue through the first half of 2024, the second half of the year is expected to be the turning point towards renewed growth,” said Jeff Heynen, Vice President at Dell’Oro Group. “Service providers still have the same goals of increasing their fiber footprint, increasing the bandwidth they can offer their customers, and improving the reliability of their broadband services through the distribution of intelligence closer to subscribers,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2024 Forecast Report:

- PON equipment revenue is expected to grow from $10.8 B in 2023 to $11.8 B in 2028, driven largely by XGS-PON deployments in North America, EMEA, and CALA and early 50 Gbps deployments in China.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MAC/PHY Devices, and Remote OLTs) is expected to reach $1.3 B by 2028, as operators continue their DOCSIS 4.0 and early fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.5 B by 2028, led by shipments of 5G sub-6GHz and a growing number of 5G Millimeter Wave units.

- Revenue for Wi-Fi 7 residential routers and broadband CPE with WLAN will reach $9.3B by 2028, as the technology is rapidly adopted by consumers and service providers alike.

Source: Dell’Oro Group

About the Report:

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

References:

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References:

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

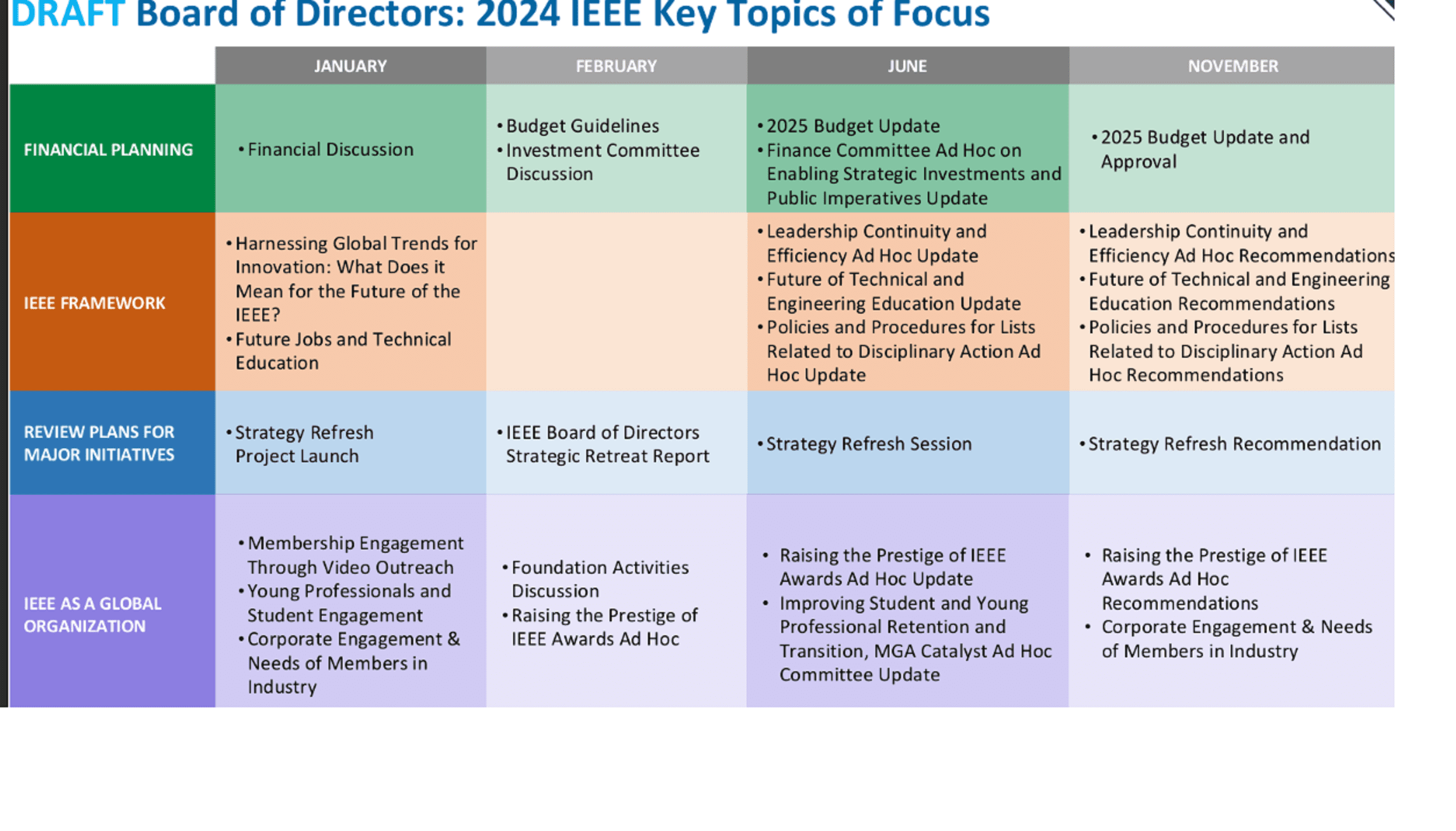

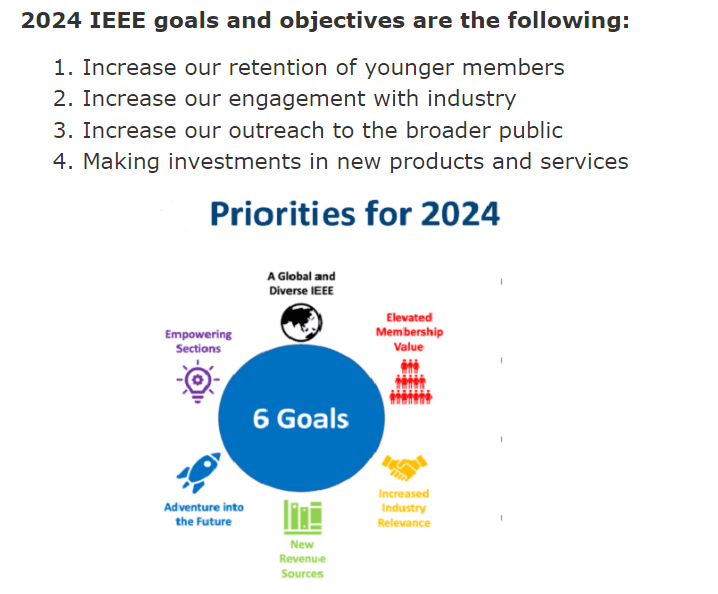

IEEE President’s Priorities and Strategic Direction for 2024

by Tom Coughlin, 2024 IEEE President; edited & augmented by Alan J Weissberger, IEEE Techblog Content Manager

Let’s examine each of these issues and initiatives for IEEE this year:

Let’s examine each of these issues and initiatives for IEEE this year:

1. IEEE has a lot of college student members but, like many other professional organizations, the majority of these student members don’t continue as full IEEE members. One reason is the much higher cost – $218/yr for full IEEE membership vs. $32/yr for IEEE student membership. This is a big financial burden as many college graduates carry student loans after graduation. Another reason is they don’t see much if any value in being an IEEE member. We need to change that perception by revitalizing IEEE such that is relevant to young members careers in both industry and academia.

In order for the IEEE to remain vital and relevant we need to convert more of our student members to full IEEE members and then engage and retain them. One thought is to encourage them to volunteer at the section, chapter, or global level.

I am creating a special task force in the IEEE to address this problem and do surveys, focus groups and pilot programs to find ways that we can attract and retain our younger members.

2. IEEE needs to create stronger ties and provide greater value to industry and to those engineers and scientists who work in industry. This goal is closely related to the first goal since most of our student members end up working in industry.

IEEE has an Industry Engagement Committee and I have asked them to work with the IEEE Student Activities Committee and IEEE Young Professionals to find value in the IEEE for younger people working in industry. In addition, I am personally reaching out to companies to speak with senior technical people about how IEEE is useful now and what else we can do to provide value, particularly for younger people working in industry.

3. IEEE needs to reach out to the broader world to let them know who we are and what we do. Today, most people that have heard of IEEE think of it as ONLY a standards organization, e.g. for IEEE 802.11 WiFi and IEEE 802.3 Ethernet. They don’t realize that IEEE is by far, the largest tech non-profit organization.

We have in our IEEE membership experts in all technologies, who can provide insights and guidance for public policy, convene meetings and create new and valuable standards.

IEEE is by far the most cited source for prior art in patents worldwide, it has created documents and standards on ethical design of intelligent and autonomous systems (AI) and our volunteers write, review and publish much of the worlds technical literature and put on conferences on every conceivable technical topic.

IEEE also creates future directions committees on emerging technologies, pursue technical megatrends and create and publish technology roadmaps on semiconductor and other important technologies.

4. IEEE needs to invest in new products and services. In particular, applying AI and other computer algorithms to IEEE content that will enable new ways to find, understand and advance technologies that can serve our members and our customers.

In 2024, IEEE will start an Ad hoc committee, working with relevant groups outside of the IEEE, on educating future generations of workers who will be using new tools such as AI, working in outer space and in virtual environments and who will work for many organizations and technologies during their career.

IEEE should be able to leverage technical tools to help people learn in the best way for them and to provide lower costs for continuous education which can enable those from underserved communities to participate in and benefit from technical education.

……………………………………………………………………………………………………………………

2024 IEEE Key Topics of Focus Overview:

- Provides a roadmap for the year in terms of areas of focus and provides year over year continuity.

- Discussed and adopted on an annual basis by the IEEE Board of Directors at the January meeting.

- A living document that evolves throughout the year and is updated for every Board meeting as progress is reported.

I know the time will go by fast in my one year term as IEEE President. I look forward to meeting more of our members in more places and having the chance to understand and support these members. I also hope that I can help create stronger ties to those who work in industry and keep more of our younger members and provide greater value to the world. Most of all I will support the IEEE’s mission to advance technology for the benefit of humanity!

……………………………………………………………………………………………………………….

References:

IEEE President Elect: IEEE Overview, 2024 Priorities and Strategic Plan

SK Telecom, Intel develop low-latency technology for 6G core network

In collaboration with Intel, SK Telecom (SKT) has successfully developed technology to reduce communication delays necessary for the evolution of 6G Core Network Architecture. The Core network is the gateway through which all voice and data traffic generated from a customer’s mobile device passes through to access the Internet network. It is a mobile communication service system that is responsible for security and service quality through the inter-connection of various systems.

Editor’s NOTE: Of course, 6G is currently undefined with only the features and functions being defined by ITU-R WP 5D which is meeting this week in Geneva. The 6G core network specifications will be done by 3GPP and NOT ITU-T as was the case for 5G core.

…………………………………………………………………………………………………………..

The 6G Core Architecture is required to have higher flexibility and safety than previous generations of wireless communications, and to provide stable AI service quality and technologies to customers by embedding intelligent and automation technologies.

As Core network technology continues to develop, the various systems that make up the network and the detailed functions that provide various services are also explosively increasing. As network complexity continues to increase, the process of sending and receiving messages is frequently recreated. Therefore, communication delays will increase compared to before. It is difficult to address these limitations with communication standard technologies (service communication proxies) for interconnection between unit functions within the existing Core network.

Inline Service Mesh, a low latency technology the two companies developed utilizing Intel Xeon processors with built in AI, is capable of increasing the communication speed within the Core network by reducing latency between unit function without Proxy.

Through this technology development, AI, which requires a large amount of computation, can be applied to the Core network in a wider variety of models. SKT has already commercialized a technology that reduces wireless resources by 40% and improves connectivity by analyzing movement patterns of real users in real time. Through this cooperation, the two companies will be able to reduce communication delays by 70% and increase service efficiency by 33% in the Core network through the application of the 6G Core Architecture.

SKT aims to apply the results of this study to commercial equipment next year. A technical white paper has been published by Intel that describes the technology, development process and benefits.

SKT and Intel have been continuing to cooperate for research on the development of key wired/wireless mobile communication technologies for the past 10 years. Based on the results of this study, the two companies plan to continue research and development for traffic processing improvement technologies incorporating AI technology in various areas of the Core network.

“We have made another technical achievement through continuous technology development cooperation with Intel to secure leadership in 6G,” said Yu Takki, Vice President and Head of Infra Tech at SKT. “We will continue our research and make efforts to commercialize AI-based 6G Core Architecture.”

“Our research and development efforts with SK Telecom continue to deliver innovations that have been deployed by Communications Service Providers worldwide”, said Dan Rodriguez, Corporate Vice President of Intel Network & Edge Solutions Group. “By leveraging the latest Intel Xeon processors with built in AI features, our companies are able to drive both performance and efficiency improvements that will be vital to the future Core networks.

Last March, SKT and NTT DOCOMO released a white paper addressing the requirements for future 6G networks.

The South Korean carrier said the new white paper contains its views on 6G key requirements and 6G evolution methodology, along with its opinions on the latest trends in frequency standardization. The 6G white paper also provides analysis, development directions and methodologies pertaining to promising 6G use cases, technology trends as well as and candidate frequencies.

The 6G White Paper reviews the following:

- Performance requirements and implementation scenarios for each frequency band, taking into account the characteristics of each frequency

- Issues concerning coverage and devices in high-frequency bands

- Standardization for migration to 6G architecture and application of cloud-native / open architecture

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1597¤tPage=1&type=&keyword=

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

https://www.docomo.ne.jp/english/corporate/technology/rd/docomo6g/whitepaper_dcmskt.html#title02