Author: Alan Weissberger

Fiber Build-Out Boom Update: GTT & Ziply Fiber, Infinera in Louisiana, Bluebird Network in Illinois

This week GTT Communications, Infinera, and Bluebird Network all announced network expansions within the U.S. The various announcements follow AT&T’s deal last month with venture capital firm BlackRock to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform.

GTT Communications, Inc., a leading global provider of managed network and security services to multinational organizations, has announced that it has expanded its partnership with Ziply Fiber, a provider of fiber networks purpose-built for the internet, to establish a new network Point of Presence (PoP) to serve the fast-growing data center market in Portland, Oregon. The two companies linked in hopes to “serve the fast-growing data center market” in the city, according to the announcement.

The new PoP is providing an initial 400G of capacity to customers in the U.S. Pacific Northwest region and will expand the power of GTT’s global Tier 1 IP network by offering an additional option for customers to connect in 11 major data centers and the Hillsboro subsea cable landing station, expanding the reach of GTT via Ziply Fiber’s high-count Silicon Forest fiber cross connection service.

“We are pleased to expand our partnership with GTT to establish a new network PoP in Portland to help customers in the region and beyond to connect to area data centers as well as other geographies,” said Mike Daniel, vice president of Enterprise Sales at Ziply Fiber. “Our regional fiber network, combined with GTT’s global Tier 1 network and suite of leading managed networking and security services, will give enterprises new options to improve connectivity securely and reliably.”

GTT’s global Tier 1 IP backbone is ranked among the largest in the industry1 and connects more than 260 cities on six continents. With the addition of the new Portland PoP, GTT customers in the region can benefit from the improved connectivity, security and scalability available through GTT’s suite of managed connectivity services.

Ziply Fiber’s network was architected to meet today’s increasing digital demands and was engineered to be fully redundant, with a dual infrastructure that maintains customer connections even when issues arise. Ziply Fiber maintains a four-state footprint in Washington, Oregon, Idaho and Montana and has built redundancies into its network to avoid service interruptions, while updating routing to steer clear of congestion across the broader internet. This ensures content is accessible directly on the fiber backbone and can be accessed more quickly.

“This new PoP deployment creates an exciting opportunity to use the Ziply Fiber network to allow our regional data center customers to easily connect to and take advantage of GTT’s global Tier 1 IP network and our full suite of managed services offerings,” said Jim Delis, president, Americas Division, GTT. “Our work with Ziply Fiber demonstrates GTT’s continued focus on investment to expand the reach of our network for customers with locations in the Pacific Northwest.”

GTT will offer additional customer options to connect in 11 data centers and the Hillsboro subsea cable landing station. Jim Delis, president for GTT’s Americas Division, stated the PoP deployment will enable the network provider’s data center customers to link into its tier-one IP network.

………………………………………………………………………………………………………………………………………………..

Infinera announced today that the Louisiana Board of Regents, acting on behalf of the statewide Louisiana Optical Network Infrastructure (LONI) and the Board of Supervisors of Louisiana State University (LSU) and Agricultural and Mechanical College, has selected and deployed Infinera’s advanced coherent optical networking solutions to upgrade LONI. Also announced today is the initial deployment of four 400G optical channels along a 220-mile intrastate route in Louisiana.

LONI connects 38 university campuses and data centers and provides connectivity to additional research and education networks in other states. The solution, which increases LONI’s network capacity by a factor of 10, comprises Infinera’s XTM Series open line system and GX Series transponders. The upgraded network expands the ability for the research and education community to share and access information, resources, and remote instruments in real time.

LONI promotes scientific computing and technology across Louisiana and is the backbone infrastructure to the state’s heroic research efforts. These efforts are made possible by utilizing cutting-edge technology to push the limits of scientific discovery at leading university campuses and achievable with LONI’s high-bandwidth optical network. Infinera’s XTM Series line system coupled with GX Series high-performance transponders equips LONI with a 200G/400G/600G solution that offers unmatched high-bandwidth services to its customers today and is scalable to 800G in the future. Infinera’s combined solution delivers superior performance, increasing LONI’s service offering with more bandwidth, greater flexibility, and faster data transfer capabilities.

“A high-capacity state-of-the-art network is critical to enabling breakthrough discoveries that can only be achieved through multi-site collaboration and cloud connectivity,” said Lonnie Leger, LONI’s Executive Director. “We are committed to offering our members up to 100G and deploying Infinera’s innovative solutions, which exceeded both our expectations and commitment, enabling us to exceed what other state universities can offer.”

“LONI operates with a small staff, which requires a highly automated network and cost-effective solution that enables them to meet their bandwidth growth requirements,” said Nick Walden, Senior Vice President, Worldwide Sales, Infinera. “The Infinera team worked closely with LONI to deliver a solution that met their needs now and positions them to meet future bandwidth needs with minimal maintenance and manpower to operate.”

“As bandwidth continues its relentless growth driven by new high-speed applications such as 5G, [augmented reality], [virtual reality], and cloud services, legacy copper-based networks – such as DSL and cable – are simply not capable [of] meeting the bandwidth requirements,” Robert Shore, SVP of marketing at Infinera, told SDxCentral.

Shore added that the current fiber boom “reinforces Infinera’s focus on continuing to innovate and manufacture optical transport solutions that can help network operators effectively leverage their fiber deployments from the core of their network all the way to the very edge.”

Infinera also announced that its ICE6 solution was deployed along the trans-Pacific Unity Submarine Cable System connecting Japan and the U.S., doubling the capacity of that connection.

……………………………………………………………………………………………………………………………………………………….

Bluebird Network completed a 126-mile fiber buildout in Illinois. The route connects the towns of Aurora, Dixon, DeKalb, Sterling, and Rock Falls to Bluebird’s network and services, and provides a “diverse route” to Chicago, the company stated.

Bluebird’s management noted the deployment builds on its recently acquired middle-mile fiber network assets from Missouri Telecom, and expansion into Salina, Kansas, and Waterloo, Iowa.

“Bluebird has no plans to slow down its fiber expansions any time soon,” Bluebird Network President and CEO Michael Morey stated in the release tied to its Kansas and Iowa expansion. “To foster even more growth and strengthen connectivity for businesses in the Midwest, we have builds underway for additional expansions coming online this summer.”

Those moves come on the heels of the AT&T/BlackRock JV that is looking to deploy fiber to more than 30 million locations within AT&T’s 21-state wireline footprint by the end of 2025, and positions the newly created Gigapower entity to boost its reach outside of those initial 21 states.

The deal also prompted a predication from Analysys Mason, saying the move further indicates “that the [U.S.] wireline market is entering a period of profound transformation that will leave it more aligned with the market structures seen in Europe.”

…………………………………………………………………………………………………………………………………………………

References:

https://www.sdxcentral.com/articles/news/us-fiber-build-booms/2023/01/

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

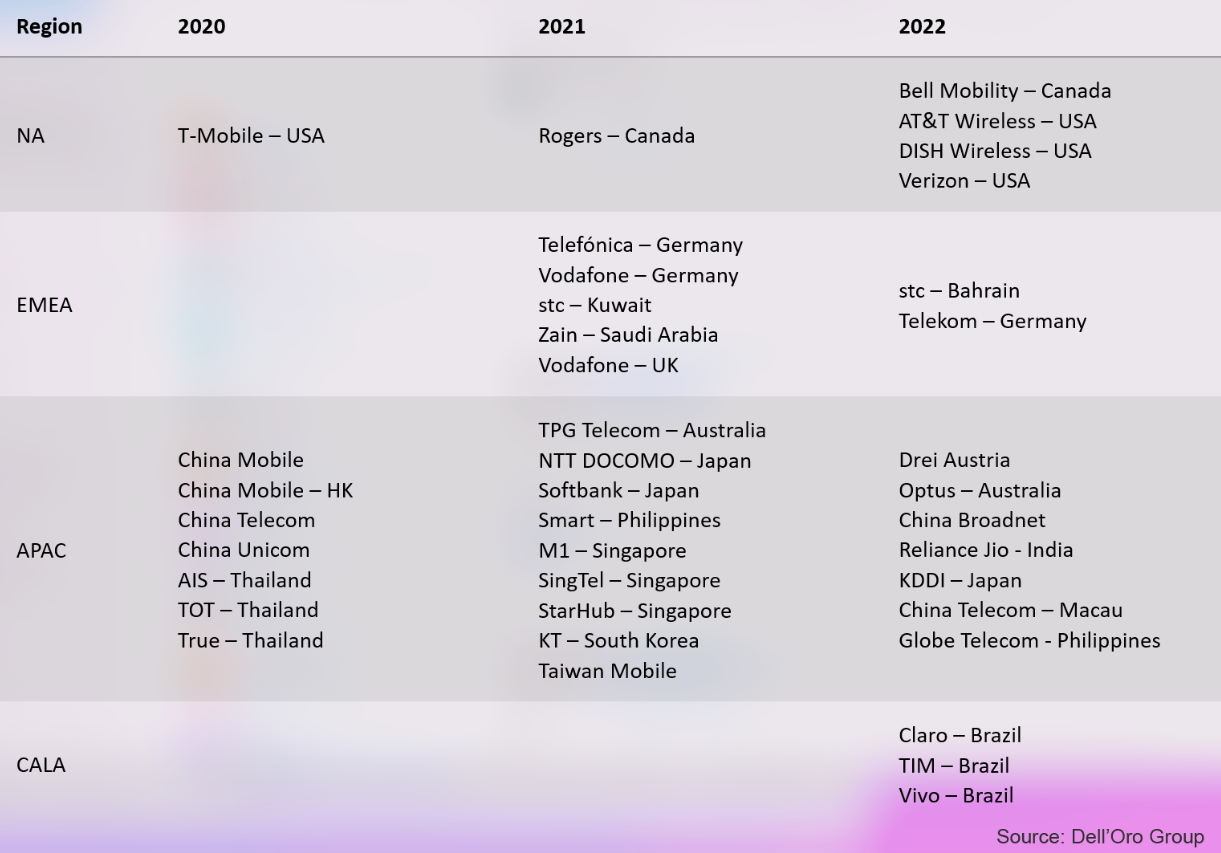

According to a recently published report from Dell’Oro Group, the Mobile Core Networks (MCN) [1.] and Multi-access Edge Computing (MEC) market revenues are expected to reach over $50 billion by 2027.

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

…………………………………………………………………………………………………………………………………………………………………

“The MNC and MEC market revenues are expected to grow at a 2 percent CAGR (2022-2027). We expect the MCN market for the China region to reach maturity first—due to its early start on 5G SA deployments—and is projected to have -4 percent CAGR throughout the forecast period,” stated Dave Bolan, Research Director at Dell’Oro Group.

“The worldwide market, excluding China, is projected to have a 3 percent CAGR. The Asia Pacific (APAC) and the Europe, Middle, East, and Africa (EMEA) region are expected to have the highest CAGRs throughout the forecast period as MNOs accelerate the deployments of 5G SA networks and expand their respective coverage footprints.

“There were hopes early in the year that many more [SA networks] would be launched in 2022, but the hopes were lowered as the year progressed,” Bolan explained. At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks.

“Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” added Bolan.

Additional highlights from the January 2023 MCN and MEC 5-Year forecast report:

- The MEC segment of the MCN market will have the highest CAGR, followed by the 5G MCN market and the IMS Core market.

- As networks migrate to 5G SA, the 4G MCN market is expected to decline at a double-digit percentage CAGR.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

………………………………………………………………………………………………………………………………………………………………

From Deloitte:

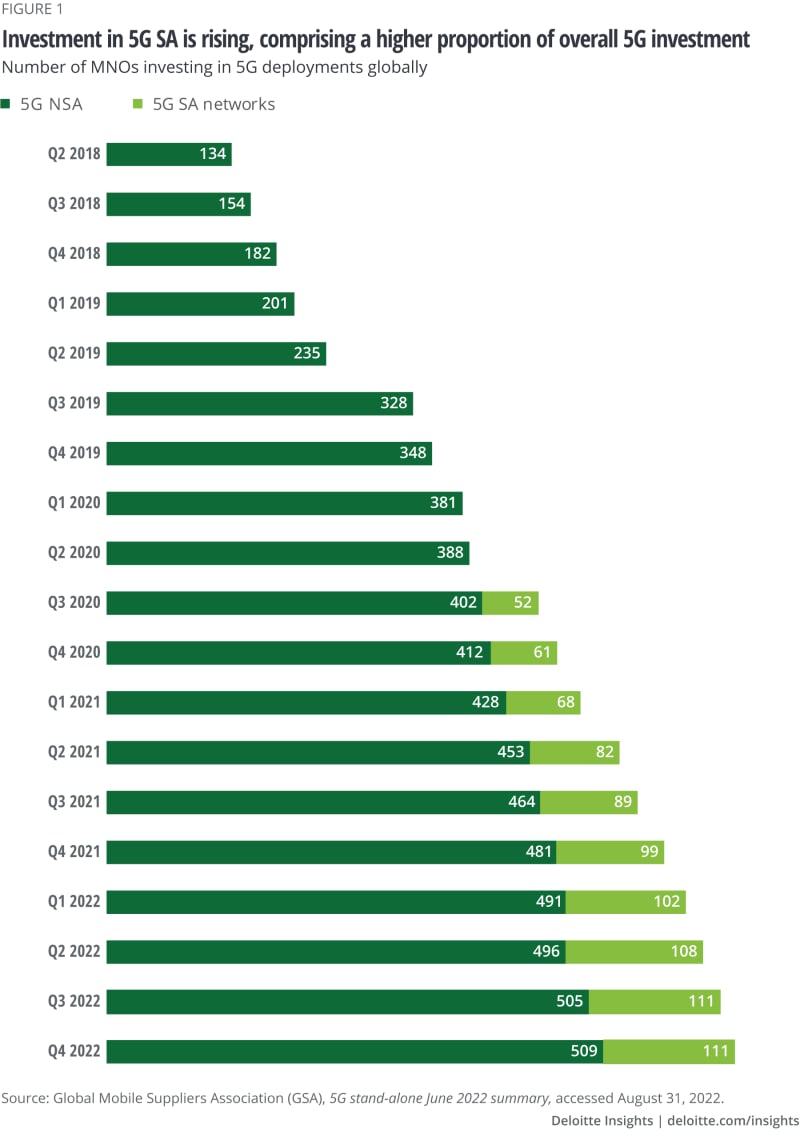

“The coming migration to 5G standalone core networks is expected to allow for increased device density, reliability, and latency, opening the door to advanced enterprise applications,” according to several analysts from Deloitte’s Technology, Media & Telecommunications industry group.

“5G SA’s big attraction for MNOs are the new service and revenue opportunities it creates, Along with near-zero latency and massive device density, 5G SA enables MNOs to provide customers – specifically enterprise customers – access at scale to fiber-like speeds, mission-critical reliability, precise location services, and tailored network slices with guaranteed service levels.”

Deloitte expects the number of mobile network operators investing in 5G SA networks – with trials, planned deployments, or rollouts – to double from more than 100 operators in 2022 to at least 200 by the end of 2023.

References:

Mobile Core Network Market to Reach over $50 billion by 2027, According to Dell’Oro Group

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Hawaiian carrier Mobi to deploy a cloud-native 4G/5G core network as a fully managed service on AWS

Mobi, a leading wireless network provider in Hawaii, is now expanding into the continental United States and beyond. Mobi is one of only four full mobile virtual network operators (MVNOs) in the United States. According to Mike Dano of Light Reading, they have approximately 55,000 customers.

To support a cost-effective, scalable and innovation-friendly expansion strategy, Mobi partnered with Oslo, Norway based Working Group Two (WG2) to move its core network to the cloud. The WG2 mobile core runs cloud-natively on Amazon Web Services (AWS) and empowers Mobi to build a compelling, app-first customer experience on the largest 5G nationwide network (which is assumed to be the AWS cloud native 5G core network). Mobi plans to use its nationwide capabilities to ensure that its Hawaiian customer base won’t need to sign up for another cellular network provider if they move to the continental U.S.

A pilot solution goes live today – January 17, 2022.

By choosing a scalable and flexible cloud architecture, Mobi can offer more competitive rates and faster time-to-market with new services. The Network-as-a-Service approach reduces the time it takes to develop and deploy new features and upgrades. In contrast to legacy solutions, which include only a few network updates per year, Mobi will benefit from continuous, daily upgrades. Further, with a mobile core from WG2 that is agnostic to any generation of wireless, Mobi can future-proof its network with no end-of-life and continuous maintenance and support.

With a programmable, cloud-native core, Mobi will gain unprecedented flexibility, and will realize significantly faster time-to-market with new services. Once the WG2 mobile core is integrated with the radio network, Mobi can leverage simple APIs to determine which services to activate for every SIM or user. The network is delivered fully as-a-service and the cost is based on consumption, defined by the number and type of users/SIM cards, changing as needs and traffic fluctuate. This allows for lower barriers of entry, and a core network that can scale from single users to hundreds of millions of users.

WG2 says their core offers a full MNO core for 4G and 5G, as well as a full MVNO functionality for 2G/3G. This allows operators to build full modern 4G/5G core networks while leveraging national roaming for 2G/3G where necessary. WG2’s 4G/5G/IMS mobile core network provides Mobi with a web-based portal, through which the company can quickly and easily manage existing services and offer new ones. The WG2 core offers the full set of capabilities related to authentication and provisioning, voice, messaging, and data services.

Quotes:

Justen Burdette, CEO of Mobi:

“Our ambition is to disrupt and challenge the status quo in the wireless industry by delivering a seamless, app-first, and engaging customer experience. By working with WG2 and AWS, we not only get access to a scalable, secure, and future-proof core network, we also improve our ability to meet the demands of our customers. It’s all about making it simple to join, affordable to use, and fun to explore what our network can offer. We’re building a brand that resonates with our customers by working with a strong ecosystem of partners.”

“We’re able to do a modern, cloud-based, AWS-focused core from WG2. It’s a sight to behold.”

“You have complete API [application programming interface] control of the core. That makes it really amazing for us because we built our stack around APIs.”

Erlend Prestgard, CEO of WG2:

“Mobi is a standout example of a carrier that’s ready to unlock the benefits of a network-as-a-service, achievable with a consistent, programmable mobile core running on the cloud. This allows them to go live in new geographical markets in record time. The simplicity of the as-a-service operating model means that Mobi can focus on meeting customer expectations and spend their time dreaming about innovation, rather than managing complexity. We’re truly excited about joining Mobi on this journey.”

Fabio Cerone, Managing Director EMEA, Telco Business Unit at AWS:

“Embracing the cloud helps carriers simplify network operations, deploy networks more rapidly, scale more easily – while still retaining full control over the network and gaining additional agility and innovation capabilities. Now the core network is only one API away from the global community of developers, which can help deliver new value for Mobi’s customers.”

As an app-first company, wholly focused on user experience, Mobi embraces an open, API-enabled core network approach. Access to WG2’s global ecosystem of developers offers Mobi a selection of pre-integrated, ready-to-deploy applications for voice, messaging and data services, built by WG2’s development partners from all over the world. Following the continental U.S. rollout, Mobi also plans to leverage the same model to expand to markets including Canada, Puerto Rico and the U.S. Virgin Islands.

About Mobi:

Mobi, Inc. launched as the regional wireless provider for Hawaii in 2005 — becoming the first carrier in the United States to offer affordable, simple, unlimited mobile service at a time when activation, overage, and hidden fees were the norm. Anyone can switch to Mobi in just seconds using the Mobi app, Apple Pay, and eSIM — with smart, friendly Mobi customer care geeks ready to help at any time digitally and at Mobi stores in Hawaii. All Mobi team members are proudly represented by the Communications Workers of America (the CWA). Learn more at mobi.com, or on Facebook, Twitter, or LinkedIn.

About Working Group Two:

Working Group Two has rebuilt the mobile core for simplicity, innovation, and efficiency – leveraging the web-scale playbook and operating models. Today, Working Group Two innovation enables MVNO, MNO, and Private Network Operators a secure, scalable, and reliable telco connectivity backbone that scales across all generations of mobile technologies. Our mission is to create programmable mobile networks to allow our customers and their end users to create more valuable and useful products and services.

Media Contact:

Tor Odland

Working Group Two

+47 9909 0872

[email protected]

References:

https://www.wgtwo.com/blog/mobi-expansion-with-wg2-aws/

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China’s government has selected 6G as one of its priority projects for 2023. At a national conference on industry and information technology, the Ministry for Industry and IT (MIIT) Jin Zhuanglong, said China intends to push forward in “comprehensive” development of 6G this year. In 2023, China will introduce policies and measures to promote coordinated development of new information infrastructure construction and accelerate the construction of 5G and gigabit optical networks, Jin said. MIIT will also improve policies on telecom market development, and strengthen the protection of personal information and users’ rights and interests.

Editor’s Note: Work on 6G has not yet started in either 3GPP or ITU-R WP 5D. The latter SDO is progressing draft reports on the vision of IMT for 2030 and Beyond, but no 6G requirements will be identified.

…………………………………………………………………………………………………………………………………………………………..

More than 2.3 million 5G base stations have been put into service, and notable progress has been made in the construction of new data centers, according to the conference.

In recent years, China has intensified efforts to promote the construction of new information infrastructure, deepen the construction of 5G, gigabit optical network and industrial internet, and promote the deep integration of the digital economy and the real economy.

Image Credit: Alan Novelli/Alamy Stock Photo

At the end of last year China Telecom issued a white paper setting out its vision for 6G. Written by the China Telecom Research Institute, the paper proposes a distributed and intelligent programmable RAN (P-RAN) network architecture and what it calls a “three-layer and four-sided” framework. The white paper notes that because of the cost of building out the dense mmWave or terahertz-band networks, it will be essential to provide device-to-device connectivity.

Six months ago, heavyweight China Mobile issued its own 6G vision, calling for “three bodies, four layers and five sides.”

China’s other 6G news is a call for proposals on potential key technologies from the national coordinating body, the IMT-2030 6G Promotion Group. According to an English-language statement posted by CAICT, the main objectives are “to inspire university-academy-industry-association entities for technology innovations, gather and form a rich reserve of 6G potential key technologies, and support 6G research, standardization, and industrial R&D.”

Non-Chinese universities and research organizations are welcome to apply ahead of the deadline in November 2023. The proposed solutions should have “application and promotion value for 6G innovation and development,” and the key technical indicators should be capable of being evaluated and verified, the statement said.

References:

https://www.lightreading.com/6g/chinese-government-confirms-focus-on-6g-development/d/d-id/782727?

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

https://www.lightreading.com/6g/the-6g-mess-is-getting-out-of-hand/a/d-id/782245

Summary of ITU-R Workshop on “IMT for 2030 and beyond” (aka “6G”)

IMT towards 2030 and beyond (“6G”): Technologies for ubiquitous computing and data services

Excerpts of ITU-R preliminary draft new Report: FUTURE TECHNOLOGY TRENDS OF TERRESTRIAL IMT SYSTEMS TOWARDS 2030 AND BEYOND

Development of “IMT Vision for 2030 and beyond” from ITU-R WP 5D

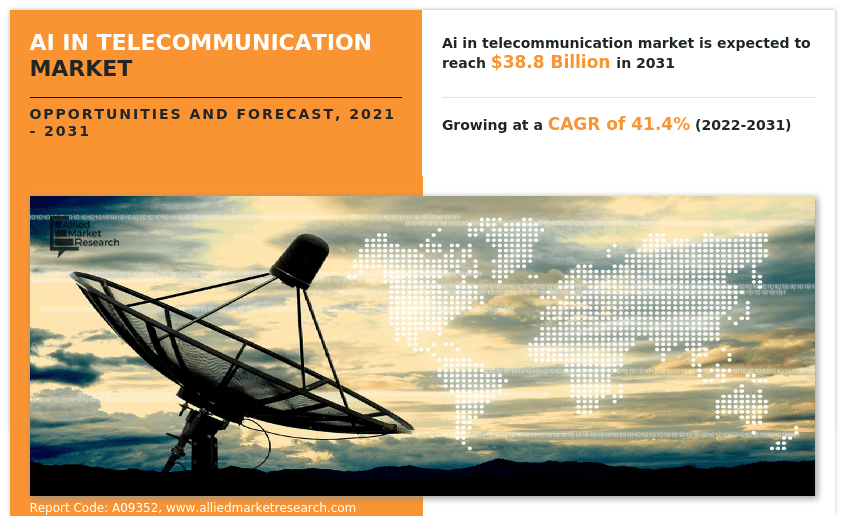

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

Executive Summary:

Artificial Intelligence (AI) in telecom uses software and algorithms to estimate human perception in order to analyze big data such as data consumption, call record, and use of the application to improve the customer experience. Also, AI helps telecommunication operators to detect flaws in the network, network security, network optimization & offer virtual assistance. Moreover, AI enables the telecom industry to extract insights from their vast data sets and made it easier to manage the daily business and resolve issues more efficiently and also provide improved customer service and satisfaction.

The growing adoption of AI solutions in various telecom applications is driving market growth. The rising number of AI-enabled smartphones with a number of features such as image recognition, robust security, voice recognition and many as compared to traditional phones is boosting the growth of AI in the telecommunication market. Furthermore, to cater to complex processes or telecom services, AI provides a simpler and easier interface in telecommunication. In addition, growing Over-The-Top (OTT) services, such as video streaming, have transformed the dissemination and consumption of audio and video content. With more consumers turning to OTT services, consumer demand for bandwidth has grown considerably. Carrying such ever-growing traffic from OTT services leads to high operational Expenditure (OpEx) for the telecommunication industry. Hence, AI helps the telecom industry to reduce operational costs by minimizing the human intervention needed for network configuration and maintenance. However, the major restraint of the AI in telecommunication market is the incompatibility between telecommunication systems and AI technology. Contrarily, the increasing penetration of AI-enabled smartphones in the telecommunication industry, and the advent of 5G technology in smartphones are expected to provide major growth opportunities for the growth of the market. Since advancements such as 5G technology in mobile and the rising need to monitor content on the tale communication network to eliminate human error from telecommunication are driving the growth of the market. For an instance, the Chinese government trying to improve its network services and telecommunication services; hence China Telecom Corporation has started a new 5G base station in Lanzhou city. Therefore, these factors are expected to provide numerous opportunities for the expansion of the AI in telecommunication market during the forecast period.

Allied Market Research published a report, titled, “AI in Telecommunication Market by Component (Solution, Service), by Deployment Model (On-Premise, Cloud), by Technology (Machine Learning, Natural Language Processing (NLP), Data Analytics, Others), by Application (Customer Analytics, Network Security, Network Optimization, Self-Diagnostics, Virtual Assistance, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031.”

According to the report, the global AI in telecommunication industry generated $1.2 billion in 2021, and is estimated to reach $38.8 by 2031, witnessing a CAGR of 41.4% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chain, regional landscape, and competitive scenario.

Drivers, Restraints, and Opportunities:

Growing adoption of AI solutions in various telecom applications, the ability of AI to provide a simpler and easier interface in telecommunication and reduce the human intervention needed for network configuration and maintenance, and the growing demand for high bandwidth with more consumers turning to OTT services drive the growth of the global AI in telecommunication market. However, the incompatibility between telecommunication systems and AI technology hampers the global market growth. On the other hand, the increasing penetration of AI-enabled smartphones in the telecommunication industry, and the advent of 5G technology in smartphones likely to create potential opportunities for growth of the global market in the coming years.

Covid-19 Scenario:

- The global artificial intelligence in telecommunication market saw a stable growth during the COVID-19 pandemic, owing to the increasing digital penetration and rise in automation.

- Moreover, the pandemic led the telecommunications infrastructure to keep businesses, governments, and communities connected and operational. The social and financial disruption caused by the pandemic forced people to depend on technology such as AI for information and remote working.

- AI also helped the telecom industry to reinvent customer relationships by identifying personalized needs and engaging with customers through hyper-personalized one-to-one contacts. It also helped configure fixed-line and mobile-network bundles that combine VPN, teleconferencing, and productivity apps.

The solution segment to dominate in terms of revenue during the forecast period:

Based on component, the solution segment was the largest market in 2021, contributing to more than two-thirds of the global AI in telecommunication market, and is expected to maintain its leadership status during the forecast period. This is due to the adoption of solutions by various end users for the automated processes. On the other hand, the service segment is projected to witness the fastest CAGR of 44.9% from 2022 to 2031, due to surge in the adoption of managed and professional services.

The on-premise segment to garner the largest revenue during the forecast period:

Based on deployment model, the on-premise segment held the largest market share of nearly three-fifths of the global AI in telecommunication market in 2021 and is expected to maintain its dominance during the forecast period. This is because it provides added security of data. The cloud segment, however, is projected to witness the largest CAGR of 43.8% from 2022 to 2031, as cloud provides flexibility, scalability, complete visibility, and efficiency to all processes.

The machine learning segment to exhibit a progressive revenue growth during the forecast period:

Based on technology, the machine learning segment held the largest market share of more than two-fifths of the global AI in telecommunication market in 2021, and would maintain its dominance during the forecast period. This is because machine learning algorithms are designed to keep improving accuracy and efficiency. The data analytics segment, however, is projected to witness the largest CAGR of 46.1% from 2022 to 2031, as it helps telecom companies to increase profitability by optimizing network usage and services.

Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/9717

Asia-Pacific to maintain its leadership in terms of revenue by 2031:

Based on region, North America was the largest market in 2021, capturing more than one-third of the global AI in telecommunication market. The growth in the region can be attributed to the infrastructure development and technology adoption in countries like the U.S. and Canada. However, the market in Asia-Pacific is expected to lead in terms of revenue and manifest the fastest CAGR of 45.7% during the forecast period, owing to the growing digital and economic transformation of the region.

Leading Market Players:

- Intel Corporation

- Nuance Communications, Inc.

- AT&T

- Infosys Limited

- ZTE Corporation

- IBM Corporation

- Google LLC

- Microsoft

- Salesforce, Inc.

- Cisco Systems, Inc.

The report analyzes these key players of the global AI in telecommunication market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, product portfolio, and developments by every market player.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Download free sample of this report at:

https://www.alliedmarketresearch.com/request-sample/9717

You may buy this report at:

https://www.alliedmarketresearch.com/checkout-final/a6dc279b20c4a61f8a7f328812bfd76c

……………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.alliedmarketresearch.com/ai-in-telecommunication-market-A09352

Global AI in Telecommunication Market at CAGR ~ 40% through 2026 – 2027

The case for and against AI in telecommunications; record quarter for AI venture funding and M&A deals

Emerging AI Trends In The Telecom Industry

Fortinet and Palo Alto Networks are leaders in Gartner Magic Quadrant for Network Firewalls

Gartner defines the network firewall market as the market for firewalls that use bidirectional stateful traffic inspection (for both egress and ingress) to secure networks. Network firewalls are enforced through hardware, virtual appliances and cloud-native controls. Network firewalls are used to secure networks. These can be on-premises, hybrid (on-premises and cloud), public cloud or private cloud networks. Network firewall products support different deployment use cases, such as for perimeters, midsize enterprises, data centers, clouds, cloud-native and distributed offices.

-

Cloud firewalls: These firewalls from cloud infrastructure vendors are designed for cloud-native deployment as separate virtual instances or in containers. Container firewalls can also secure connections between containers.

-

Hybrid mesh firewalls: These are platforms that help secure hybrid environments by extending modern network firewall controls to multiple enforcement points, including FWaaS and cloud firewalls, with centralized management via a single cloud-based manager.

-

Firewall as a service (FWaaS): A FWaaS is a multifunction security gateway delivered as a cloud-based service, often to protect small branch offices and mobile users.

-

Networking: This includes support for routing tables with destination network address translation (DNAT) and static network address translation (SNAT) capability.

-

Stateful inspection: This enables inspection of traffic based on stateful firewall rules.

-

Threat detection and inspection: This includes intrusion prevention system (IPS) and malware inspection capabilities.

-

Web filtering: This includes filtering of outbound traffic for HTTP and HTTPS and applications.

-

Advanced logging and reporting: All actions of firewall administrators can be logged, and reports can be customized and run based on different object types and traffic types. Threat-based and web-filtering-based granular reports can be generated.

-

Internet of Things (IoT) security: This is achieved either using a module built into threat detection controls or via a dedicated subscription integrated within network firewall offerings. Specific features may include discovery of IoT devices, risk analysis and dedicated rules to block attacks related to these devices. Also, IoT signatures as a part of IPS signature base.

-

Network sandboxing: Network sandboxing monitors network traffic for suspicious objects and automatically submits them to the sandbox environment, where they are analyzed and assigned malware probability scores and severity ratings.

-

Zero trust network access (ZTNA): Zero trust network access (ZTNA) makes possible an identity- and context-based access boundary between any user and device to applications.

-

Operational technology (OT) security: This includes integrated or dedicated features related to protecting an OT environment. Stand-alone OT security offerings are not considered here. Features may include dedicated OT-related threat intelligence, dedicated IPS signatures for OT devices, support for supervisory control and data acquisition (SCADA) applications and threat inspection.

-

Domain Name System (DNS) security: This secures traffic to DNS by offering monitoring, detection and prevention capabilities against DNS layer attacks.

-

Software-defined wide-area network (SD-WAN): This provides dynamic path selection, based on business or application policy, centralized policy and management of appliances, virtual private network (VPN), and zero-touch configuration

As network firewalls evolve into hybrid mesh firewalls with the emergence of cloud firewalls and firewall-as-a-service offerings, selecting the most suitable vendor is a challenge. Gartner assessed 17 Network Firewall vendors to help security and risk management leaders make the right choice for their organization.

…………………………………………………………………………………………………………………………………………………….

Fortinet was recognized in 2022 Gartner® Magic Quadrant™ for Network Firewalls for the 13th time. It leads for appliance-based distributed-office use cases, thanks to its offer of mature SD-WAN and firewall capabilities in a single box.

The company’s FortiGate Next-Generation Firewalls deliver seamless AI/ML-powered security and networking convergence over a single operating system (FortiOS) and across any form factor. This includes hardware appliances, virtual machines, and SASE services.

-

Integrated SD-WAN: Fortinet offers built-in advanced SD-WAN and routing capabilities in FortiGate firewall appliances. Fortinet offers a complete SD-WAN package, with features including forward error correction, packet duplication, and intelligent and dynamic app routing.

-

Hybrid ZTNA deployment: Fortinet offers flexible ZTNA deployment modes. ZTNA enforcement is part of the FortiGate operating system (FortiOS) and can be deployed on-premises or as a service as part of FortiSASE (a stand-alone offering). The vendor has also introduced an in-line CASB integrated with ZTNA capabilities.

-

Product portfolio: Fortinet has a large product portfolio. It offers products for networking, network security and security operations. The majority of its products can be managed through a single management interface and offer integration through the Fortinet Security Fabric.

-

Centralized management: Fortinet offers mature on-premises and cloud-based centralized management through FortiManager and FortiCloud, respectively. These offerings have feature parity and support centralized management of the majority of Fortinet’s devices. FortiGate customers like the ease of management and configuration of Fortinet’s firewalls.

FortiGate NGFWs offer (Source: Fortinet):

- Powerful security and networking convergence. Secure networking services like SD-WAN, ZTNA, and SSL decryption are included – no need for extra licensing.

- Best price-per-performance. Our unique ASIC architecture delivers the highest ROI plus hyperscale support and ultra-low latency.

- AI/ML-powered threat protection. Multiple AI/ML-powered security services stop advanced threats and prevent business disruptions.

……………………………………………………………………………………………………………………………………

Palo Alto Networks was among the 17 vendors that Gartner evaluated for its 2022 Magic Quadrant for Network Firewalls, which evaluates vendors’ Ability to Execute as well as their Completeness of Vision. Palo Alto Networks believes its vision of offering best-in-class security as part of an integrated network security platform, combined with its commitment to customer success, has helped the company earn a Leader position for the 11th consecutive year.

“From the industry’s first Next-Generation Firewall in 2007 to the most recently announced PAN-OS 11.0 Nova, Palo Alto Networks relentless innovation helps provide powerful protection for customers. We are honored to be recognized as a Leader in eleven consecutive Gartner Magic Quadrant for Network Firewalls reports,” said Anand Oswal, senior vice president for Products, Network Security. “We believe this recognition by Gartner is a testament to both our innovation, using ML and AI to stop the most evasive threats, and our ability to simplify network security for our customers with a consolidated platform approach.”

Palo Alto Networks believes its leader position in network firewalls is fueled by:

- Best-in-class security that prevents zero-day threats: Modern malware is now highly evasive and sandbox-aware. To address this, the recently announced PAN-OS 11.0 Nova introduced the new Advanced WildFire® cloud-delivered security service, which provides unprecedented protection against evasive malware. Advanced Threat Prevention (ATP) now helps protect against zero-day injection attacks in addition to highly evasive command-and-control communications. Additionally, Advanced URL Filtering offers industry-first prevention of zero-day web attacks with inline machine learning capabilities.

- Strength in SASE: The industry’s most complete SASE solution, Prisma® SASE simplifies secure access by connecting all users and locations with all apps from a single product. The superior security of ZTNA 2.0 protects both access and data to dramatically reduce the risk of a data breach, while a cloud-native architecture with integrated Autonomous Digital Experience Management (ADEM) provides exceptional user experiences.

- Helping customers improve their security posture: Palo Alto Networks AIOps helps customers adopt best practices with guided recommendations, reduce misconfigurations that can lead to security breaches, and predict network-impacting issues before they occur. AIOps, launched earlier this year, now processes 49 billion metrics monthly across 60,000 firewalls and proactively shares 24,000 misconfigurations and 17,000 firewall health and other issues with customers for resolution every month.

- A comprehensive product portfolio offered as a platform: Palo Alto Networks offers multiple cloud-delivered security services that work together to prevent attacks at every stage of the attack lifecycle. These security services are offered as part of a network security platform, which makes it easy for customers to consume these services while consistently protecting their data centers, branch offices and mobile workers as well as applications in multicloud and hybrid environments with best-in-class security everywhere.

Since the Gartner evaluation, Palo Alto Networks has further strengthened its NGFW capabilities with the announcement of the latest version of its industry-leading PAN-OS® software, PAN-OS 11.0 Nova. The innovations announced also included the new Advanced WildFire cloud-delivered security service, which brings unparalleled protection against evasive malware, enhancements in the Advanced Threat Prevention service and new fourth-generation ML-powered NGFWs. The company has also taken strides to enhance its customer support experience and grown its Global Customer Service organization.

To learn more about Palo Alto Networks recognition in the 2022 Gartner Magic Quadrant for Network Firewalls, please visit:

https://www.paloaltonetworks.com/blog/2022/12/gartner-leader-11-straight-times/

To read a complimentary copy of the 2022 Gartner Magic Quadrant for Network Firewalls, please visit:

https://start.paloaltonetworks.com/gartner-mq-for-firewalls.html

Register for the Palo Alto Networks PAN-OS 11.0 Nova launch event here:

https://start.paloaltonetworks.com/nova

To learn more about the Palo Alto Networks Next-Generation Firewall platform, visit:

https://www.paloaltonetworks.com/products/secure-the-network/next-generation-firewall

References:

https://www.gartner.com/reviews/market/network-firewalls

https://www.gartner.com/doc/reprints?id=1-2C62ETHZ&ct=230103&st=sb

https://www.fortinet.com/solutions/gartner-network-firewalls

IDC: Public Cloud software at 2/3 of all enterprise applications revenue in 2026; SaaS is essential!

IDC forecasts that worldwide revenue for enterprise applications will grow from $279.6 billion in 2022 to $385.2 billion in 2026 with a five-year compound annual growth rate (CAGR) of 8.0%. Nearly all this growth will come from investments in public cloud software, which is expected to represent nearly two thirds of all enterprise applications revenue in 2026.

While the process of migrating from on-premises applications to the cloud can take years, enterprise software vendors and their customers will continue the transition to the cloud as this is an essential part of business operations in the digital world. Companies that do not pursue this technology will sustain losses due to profound opportunity costs as their competitors adopt cloud technologies and the use of application programming interfaces (APIs), moving beyond the reach of technological holdouts with on-premises or homemade solutions.

“It’s no longer enough for businesses to sit back and rely on their technological debt of software and hardware assets to keep the company running. In the digital world, enterprise software needs to constantly innovate to keep up with demand for speed, scale, and a resilient business,” said Heather Hershey, research director, Worldwide Digital Commerce at IDC. “Organizations must invest in new tools to keep their application portfolio up to date as they move into the digital era, automating all processes while also leveraging innovation and a wealth of data to become a more creative and resilient company in the digital realm.”

In addition to the ongoing cloud migration, IDC has identified a number of other significant market developments that are driving growth in the enterprise applications market.

- SaaS and cloud-based, modular, and intelligent applications are no longer “nice to have” but are instead essential for business. Organizations that want to stay in business need AI-driven software that is cloud enabled, modular, and intelligent.

- Application programmable interface technology will continue to be the backbone of the enterprise applications market. APIs will always resonate as a sound investment to companies that understand the pivotal role they play in connecting all the disparate code bases that make up the modern world.

- Phasic migration to cloud with TaskApps augmentation will continue, particularly in B2B enterprises. TaskApps and low-code/no-code development tools are being used to close gaps, extend processes, or change up the business at a faster pace throughout the transition to digital first.

- New global regulations around data privacy and ethics have changed the way organizations collect and use data, pushing governance to the forefront of the conversation. Compliance has become a differentiating factor for enterprises that prioritize trustworthiness.

“The digital world is completely altering the way software is utilized and incorporated into the organization from modularity to APIs to low code/no code to business process automation to TaskApps and even with innovation,” said Mickey North Rizza, group vice president, Enterprise Software at IDC. “Organizations are stretching their visions from filling technology gaps to optimizing processes globally to going the last mile with complete differentiators for their clients. The business world is finally starting to leverage the opportunity technology brings to it.”

Photo Credit: Unsplash

The enterprise applications market is a competitive market that includes software specific to certain industries as well as software that can handle requirements for multiple industries. Enterprise applications can be delivered as a pre-integrated suite of applications (featuring common data and process models across functional areas) or as standalone applications that automate specific functional business processes, such as accounting, human capital management, or supply chain execution. The enterprise applications market consists of the following secondary markets: enterprise resource management, customer relationship management, engineering applications, supply chain management applications, and production applications.

The IDC report, Worldwide Enterprise Applications Software Forecast, 2022–2026: Digital Era Software on the Rise (Doc #US48563522), presents a five-year forecast for worldwide enterprise applications revenues, including spending by geographic region and deployment type (public cloud and on premises). The report also provides insight into the market’s evolution through 2026, including deployment models, trends, and significant market developments.

…………………………………………………………………………………………………………………………………………………………

In a separate report titled Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, IDC sas that spending on compute and storage infrastructure products for cloud deployments, including dedicated and shared IT environments, increased 24.7% year over year in the third quarter of 2022 (3Q22) to $23.9 billion. Spending on cloud infrastructure continues to outgrow the non-cloud segment although the latter had strong growth in 3Q22 as well, increasing at 16.5% year over year to $16.8 billion. The market continues to benefit from high demand and large backlogs, coupled with an improving infrastructure supply chain.

Spending on shared cloud infrastructure reached $16.8 billion in the quarter, increasing 24.4% compared to a year ago. IDC expects to see continuous strong demand for shared cloud infrastructure with spending expected to surpass non-cloud infrastructure spending in 2023. The dedicated cloud infrastructure segment grew 25.3% year over year in 3Q22 to $7.1 billion. Of the total dedicated cloud infrastructure, 45.2% was deployed on customer premises.

For the full year 2022, IDC is forecasting cloud infrastructure spending to grow 19.6% year over year to $88.1 billion – a noticeable increase from 8.6% annual growth in 2021. Non-cloud infrastructure is expected to grow 10.7% to $64.7 billion. Shared cloud infrastructure is expected to grow 19.0% year over year to $60.9 billion for the full year while spending on dedicated cloud infrastructure is expected to grow 21.2% to $27.3 billion for the full year.

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

References:

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

ATIS today announced it has executed a memorandum of understanding (MoU) with the O-RAN ALLIANCE to further both organizations’ mutual objectives to advance the industry towards more intelligent, open, virtualized and global standards-compliant mobile networks.

The MoU notes that ATIS and the O-RAN ALLIANCE will collaborate on advancing the state-of-the-art of open radio access network, including Open RAN security and stakeholder requirements for Open RAN. It also addresses the opportunity for ATIS translation of O-RAN ALLIANCE specifications to Open RAN standards to advance the adoption of Open RAN in North America.

“This agreement with the O-RAN ALLIANCE brings the power of ATIS’ 3GPP leadership and its contributions to the continued evolution of 5G, coupled with ATIS’ leadership for 6G and beyond as part of its Next G Alliance, to advance the development of open RAN technologies,” said ATIS President and CEO Susan Miller. “The MoU combines the forces of ATIS and the O-RAN ALLIANCE to connect the present to the future for the open RAN ecosystem, advancing the promise of a robust open RAN marketplace.”

“Continuing the work toward open radio access networks is critical in unlocking the full potential of 5G in North America and will lay the foundation for future generations of wireless technology,” said Igal Elbaz, Chair of ATIS Board of Directors and Network CTO of AT&T. “ATIS and the O-RAN ALLIANCE combining their expertise and resources and ATIS’ adoption of O-RAN specifications to ATIS Open RAN standards will help accelerate the industry’s implementation of open RAN.”

The MoU also addresses participation, by invitation, in meetings of each other’s working groups where appropriate, and promoting and endorsing each other’s events (e.g., conferences and plugfests) or activities (e.g., publication of work results) in areas of mutual interest and with prior consent of the other party.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Analysis:

ATIS’ board is composed of top executives from AT&T, Verizon, T-Mobile, Ciena and Comcast. It’s the group that has previously addressed topics including secure supply chain, robocalls and hearing aid compatibility for cellphones. And it’s also the association behind the new Next G Alliance, which is working to organize a comprehensive U.S. strategy around future 6G technologies.

Also note that ATIS represents 3GPP in ITU-R WP 5D and presents all their IMT contributions on 5G/IMT 2020/ITU-R M.2150. If 3GPP ever includes Open RAN in its specifications, it’s very likely that those will be presented by ATIS to ITU-R for 5G or even 4G LTE.

“Standards-based open RAN will help create a more receptive marketplace for open RAN technology, advance its development and drive adoption in North America,” added ATIS’ VP of technology and solutions, Mike Nawrocki, in a statement to Light Reading.

In the U.S., Dish Network is in the midst of building a nationwide 5G network that adheres to Open RAN specifications. However, it’s unclear whether Dish will be able to profit from its embrace of open RAN. AT&T has told this author they are interested in deploying Open RAN for 5G if it is more economical than legacy RANs. Neither Verizon or T-Mobile has expressed interest in Open RAN.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About ATIS:

As a leading technology and solutions development organization, the Alliance for Telecommunications Industry Solutions (ATIS) brings together the top global ICT companies to advance the industry’s business priorities. Our Next G Alliance is building the foundation for North American leadership in 6G and beyond. ATIS’ 160 member companies are also currently working to address 5G, illegal robocall mitigation, quantum computing, artificial intelligence-enabled networks, distributed ledger/blockchain technology, cybersecurity, IoT, emergency services, quality of service, billing support, operations and much more. These priorities follow a fast-track development lifecycle from design and innovation through standards, specifications, requirements, business use cases, software toolkits, open-source solutions and interoperability testing.

ATIS is accredited by the American National Standards Institute (ANSI). The organization is the North American Organizational Partner for the 3rd Generation Partnership Project (3GPP), a founding partner of the oneM2M global initiative, a member of the International Telecommunication Union (ITU) and a member of the InterAmerican Telecommunication Commission (CITEL). For more information, visit www.atis.org. Follow ATIS on Twitter and on LinkedIn.

About O-RAN ALLIANCE:

The O-RAN ALLIANCE is a world-wide community of more than 300 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. As the RAN is an essential part of any mobile network, the O-RAN ALLIANCE’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN specifications enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN based mobile networks at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators. To achieve this, the O-RAN ALLIANCE publishes new RAN specifications, releases open software for the RAN, and supports its members in integration and testing of their implementations.

For more information, please visit www.o-ran.org.

References:

https://www.lightreading.com/open-ran/open-ran-gets-helping-hand-in-us/d/d-id/782703?

https://www.lightreading.com/open-ran/the-growing-pains-of-open-ran-/a/d-id/782247

https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9946966

Dish Network to FCC on its “game changing” OpenRAN deployment

China to launch world’s first 5G cruise ship via China Telecom Corp Ltd Shanghai Branch

China will debut the world’s first cruise ship covered by a 5G network later this year, due to a collaboration between CSSC Carnival Cruise Shipping Ltd’s own cruise brand Adora Cruises and China Telecom Corp Ltd Shanghai Branch. Adora Cruises [1.] has partnered with Shanghai Telecom, a major 5G network service provider in China, to bring 5G connectivity to its first China-built large cruise ship. This partnership marks a major milestone, as it is the first time a 5G network has been installed on a cruise ship in the world and sets a new standard for connectivity and convenience, according to a press release on Thursday.

Note 1. Adora Cruises is part of CSSC Carnival Cruise Shipping Limited, a joint venture between shipbuilder China State Shipbuilding Corp (CSSC) and U.S.-based leisure travel company Carnival Corporation.

“From network layout, satellite communication, to various digital applications, our goal is to deliver seamless multimedia interactions and consistent mobile connectivity for guests and crew, allowing them to stay connected with loved ones and the world while at sea,” said Chen Ranfeng, Managing Director of CSSC Carnival Cruise Shipping Limited. “By seizing a first-mover advantage in the cruise industry’s 5G market, we hope to set a new standard for digital communication in the marine travel sector.”

Adora Cruises is working towards a future where guests can enjoy an enhanced cruise experience with 5G connectivity and access to all-around multimedia and real-time interaction, the company said.

Image Courtesy of CSSC Carnival Cruise Company

“Combining 5G and satellite technology, we will focus on network communication, digital high-definition, AR/VR and other content services to further improve our guest experience and jointly promote high-quality development of the tourism economy,” said Gong Bo, general manager of Shanghai Telecom. “By seizing a first-mover advantage in the cruise industry’s 5G market, we hope to set a new standard for digital communication in the marine travel sector,” said Ranfeng.

The cruise company’s first two China-built large cruise ships are currently under construction at Shanghai Waigaoqiao Shipbuilding Corp, and will be operated under the brand name of Adora in the future.

The first 135,500-gross-ton Adora cruise ship is expected to start its journey by the end of 2023, while the second vessel is currently still being designed and constructed.

References:

http://www.ecns.cn/news/sci-tech/2023-01-13/detail-ihcircrp9799635.shtml

5G hits the open water with Adora Cruises, China Telecom partnership

DZS Inc: 2023 Telecom Trends & Applications Changing the Broadband Industry

by Geoff Burke, DZS Inc. (a global provider of access networking infrastructure, service assurance and consumer experience software solutions). Edited by Alan J Weissberger

There are a handful of significant trends that will emerge over the next several months as service providers navigate their transformation and seek to find their Competitive EDGE. This post will focus on the increasing shift to multi-gigabit services, the growing importance of the network edge and how service providers are being transformed into “experience providers..

- Multi-Gigabit Broadband Services are Becoming the New Standard – The shift to gigabit services was both widespread and well suited for Gigabit Passive Optical Networking (GPON) However, new advanced applications will require symmetrical multi-gigabit speeds. The proliferation of multiple devices using these bandwidth-hungry apps is pushing service providers to begin to think 10 gig services and beyond for both business and residential services. The emergence of the metaverse, with Ultra High Definition (UHD) Augmented Reality/Virtual Reality/Extended Reality (AR/VR/XR) and gaming applications will continue push these boundaries.

- The Network Edge Continues to Rise as a Strategic Location – The rise of 10 Gigabit Symmetrical (XGS)-PON and multi-gigabit services that support the above mentioned applications and more is creating new challenges in the network – especially as these apps require symmetrical bandwidth. Service providers realize that they must push equipment as close to the subscriber as possible to optimize traffic management, but also to minimize latency, which is becoming increasingly important in the world of the metaverse and AR/VR/XR apps. Additionally, leveraging intelligence at the edge moves it closer to where data is actually created and consumed and where the subscriber experience is defined giving service providers increased agility in monitoring, managing and optimizing performance.

- Service Providers are Rapidly Transforming into Experience Providers – As the network becomes increasingly software defined and intelligent equipment is deployed closer to the edge, the ability for carriers to both gather meaningful information that can reflect and provide actionable insights into user experience grows dramatically. As a result, the concept of a true “experience provider” is emerging where subscriber problems can be anticipated and proactively addressed, and user needs can be addressed remotely and immediately in an extraordinarily personalized manner. This transformation is proving to have profound impacts on carrier performance, with dramatically reduced churn, faster responsiveness, better performance, and higher Average Revenue Per User (ARPU).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

DZS Inc says these Applications are Changing the Broadband Industry:

- Connected Home: WiFi everywhere

- Connected Business: Passive Optical LAN

- MDUs: delivering multi-gigabit services

- Multi-gigabit services: they are becoming a major source of differentiation for service providers

References:

https://dzsi.com/resources/blog/the-broadband-trends-that-will-define-2023-part-1/