AT&T’s leads the pack of U.S. fiber optic network service providers

AT&T and Verizon are spending billions of dollars to grow their existing fiber-optic networks and add to the millions of broadband clients they already serve, mostly in regions covered by their historical landline-telephone infrastructure. Meanwhile, T-Mobile has five partnerships with fiber-optic internet providers that could serve millions of customers in the coming years. There are other fiber based internet providers that mostly serve business customers. Those include Comcast Business, Frontier Communications, Lumen, and Google Fiber (which also serves residential customers).

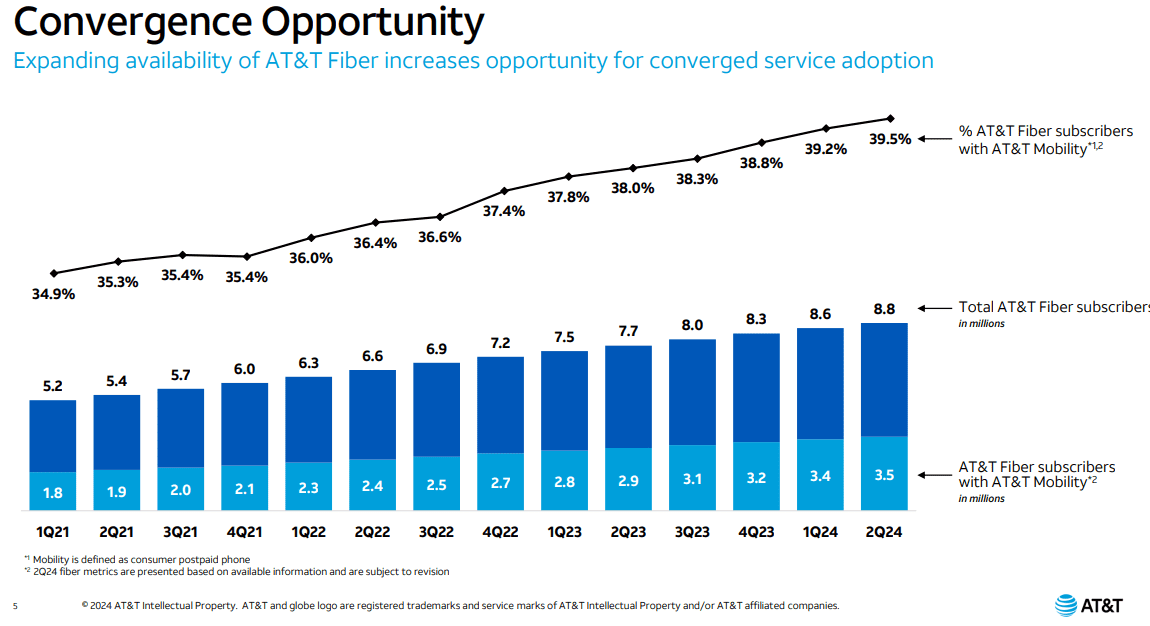

AT&T’s fiber business has remained incredibly strong, with fiber revenues growing almost 18% YoY. That led to strong top line EBITDA and EBITDA margin growth in 2Q-2024. There were 239,000 AT&T Fiber net adds in the quarter. AT&T has posted 200,000+ net fiber adds for 18 consecutive quarters – quite an enviable record. The company has managed to grow to 8.8 million total fiber subscribers, as average fiber revenue has gone up to almost $2 billion quarterly.

According to Seeking Alpha (subscription required), AT&T is substantially more reliable than Comcast, offers symmetric up and down bandwidth, and has no data caps. That makes it a much more pleasing experience. The company has worked to chase synergies with its AT&T mobility business, with not only fiber subscriptions growing, but the % of customers with AT&T mobility has grown as well. That ratio is now almost 40%.

“For the past four years, we’ve delivered consistent, positive results that have repositioned AT&T. Our solid performance this quarter demonstrates the durable benefits of our investment-led strategy,” said John Stankey, AT&T CEO. “AT&T is leading the way in converged connectivity as customers increasingly seek one provider who can seamlessly connect them in their home, at work and on the go. This is proving to be a winning strategy. Today, nearly four of every 10 AT&T Fiber households also choose AT&T wireless service. As the nation’s largest consumer fiber builder, we see this as an opportunity to continue to grow subscribers and revenues, while deepening customer relationships.”

Fiber investment drives valuable convergence opportunities:

• Wireless penetration of fiber subscribers has increased more than 400 bps since 2Q21

• Expansion of fiber footprint enables increased opportunities to sell into high quality cohort

• Converged customers are valuable and durable, with longer customer lives

“Our combined customers are happier customers,” AT&T CEO John Stankey said on a call with analysts. “Why a race to convergence? Because that’s a good way to make money, and it’s a good way to keep customers in the fold.”

AT&T CEO John Stankey meeting with fiber-optic workers at an Evansville, Ind., job site in 2022. Photo: Scotty Perry/Bloomberg News

References:

https://www.labs.att.com/story/2024/q2-earnings.html

https://seekingalpha.com/article/4708956-att-earnings-highlights-continued-recovery-potential

https://www.wsj.com/business/telecom/t-mobile-fiber-optic-internet-connection-380957ef

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

AT&T Internet Air FWA home internet service now available in 16 markets

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile US today reported a 4% year-over-year YoY) increase in service revenues, to about $16.4 billion, for the recent second quarter. Total sales increased 3%, to almost $19.8 billion. The un-carrier’s profitability metrics were even better. Adjusted earnings (before interest, tax, depreciation and amortization) rose 9%, to nearly $8.1 billion. T-Mobile’s adjusted free cash flow rocketed 54%, to about $4.4 billion. There were also several positive changes to full-year guidance, which included raising the outlook for free cash flow by $150 million (at the midpoint), to $16.8 billion.

“It was another industry-leading quarter for T-Mobile as our continued focus on delivering customers more value and a superior network experience enabled us to outperform our peers in the marketplace and translated into outsized financial growth,” said Mike Sievert, CEO of T-Mobile. “Our formula is continuing to work and we’ve got a lot of room to run including pursuing new growth opportunities that bring the Un-carrier experience to more customers and new markets. This incredible momentum makes us even more excited for what’s next for T-Mobile, and our confidence is reflected in our raised guidance for the full year ahead.”

Peter Osvaldik, T-Mobile’s chief financial officer, boasted “unmatched capital efficiency” on today’s call with analysts. “While our longer-term expectations continue to be in the $9 to $10 billion range annually, as we discussed before, 2024 is a bit lower given certain capital-efficient network activities such as spectrum re-farming and deploying additional 2.5GHz licenses from Auction 108, benefiting from the significant 5G radio deployments during our merger integration,” he said, referring to a previous frequency sale and the $26 billion merger with Sprint in 2020. Site upgrades and build activity is planned in the fourth quarter, he said.

Other T-Mo Highlights:

Industry-Leading Customer Growth Fueled by Best Network and Best Value Combination (1)

- Postpaid net account additions of 301 thousand, best in industry

- Postpaid net customer additions of 1.3 million, best in industry, crossed 100 million postpaid customers milestone

- Postpaid phone net customer additions of 777 thousand, best in industry, highest Q2 in company history, and postpaid phone churn of 0.80%

- High Speed Internet net customer additions of 406 thousand, best in industry, highest share of industry net additions ever

Translating Industry-Leading Customer Growth Into Industry-Leading Financial Performance

- Service revenues of $16.4 billion grew 4% year-over-year, best in industry growth

- Postpaid service revenues of $12.9 billion grew 7% year-over-year, best in industry growth

- Net income of $2.9 billion grew 32% year-over-year, best in industry growth

- Diluted earnings per share (“EPS”) of $2.49 grew 34% year-over-year, best in industry growth

- Core Adjusted EBITDA (2) of $8.0 billion grew 9% year-over-year, best in industry growth

- Net cash provided by operating activities of $5.5 billion, record high and grew 27% year-over-year

- Adjusted Free Cash Flow (2) of $4.4 billion, record high and grew 54% year-over-year

- Returned $3.0 billion to stockholders in Q2 2024, including repurchases of $2.3 billion of common stock and a quarterly dividend payment of $759 million

Overall Network Leader with Largest, Fastest and Most Advanced 5G Network:

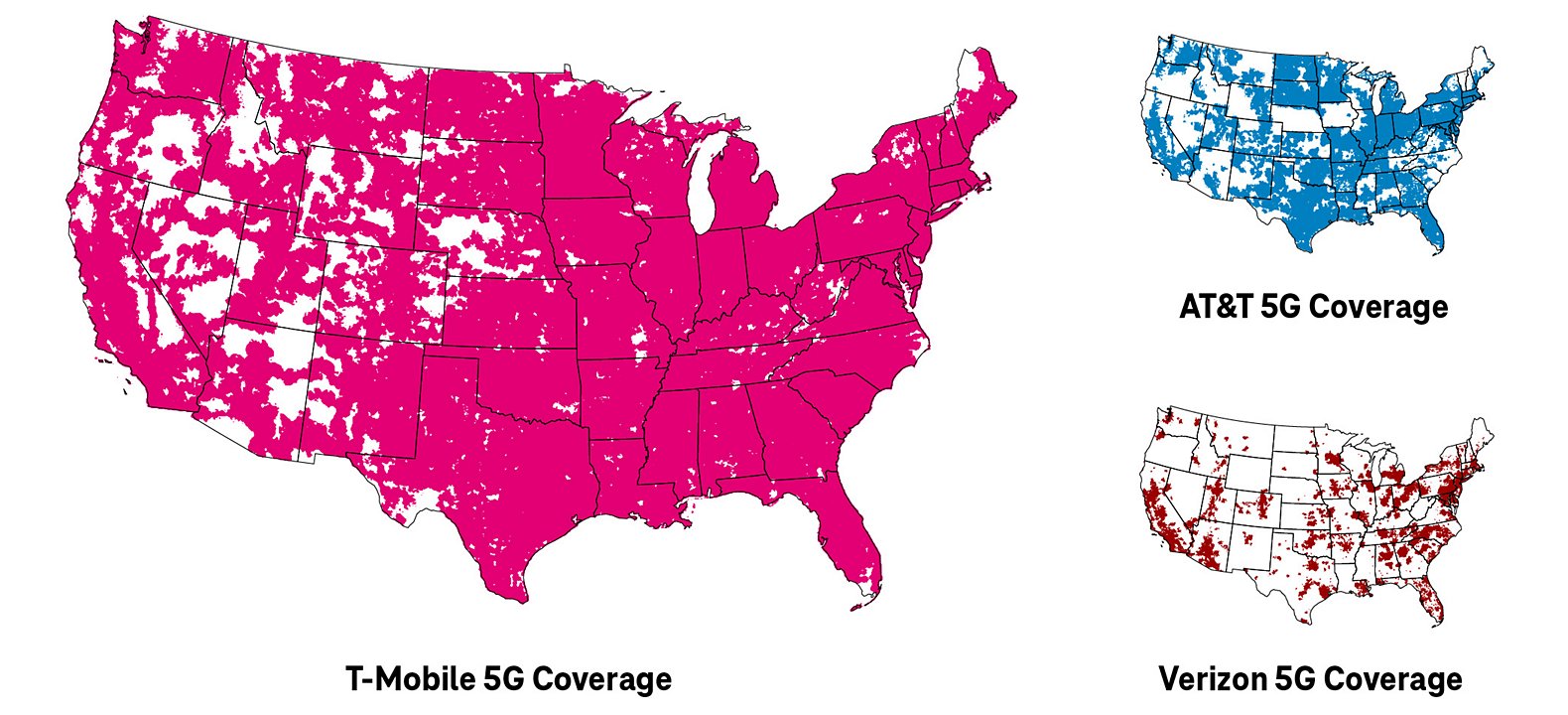

T-Mobile’s network breadth, depth and technology leadership is expected to keep the company years ahead of the competition with total 5G and Ultra Capacity 5G coverage area that continues to far exceed that of the next closest competitor. The company’s unique multi-layer approach to 5G, with dedicated standalone 5G deployed nationwide across 600MHz, 1.9GHz, and 2.5GHz, delivers customers a consistently strong experience and 87% of 5G traffic is on sites with all three spectrum bands deployed.

T-Mobile’s 5G leadership has translated into overall network leadership, with the company continuing to earn third-party recognition for its overall network performance:

- Ookla: In its Speedtest Connectivity United States 1H 2024 report, T-Mobile ranked as the top network performer in seven categories, including wins for fastest overall and 5G network and most consistent overall network, along with best overall and 5G mobile video experience, best gaming experience and highest ranking consumer sentiment.

- Opensignal: In its latest USA Mobile Network Experience report, T-Mobile ranked first for all overall network experience metrics while also earning additional wins for 5G with the fastest 5G download speeds, best 5G coverage experience and best 5G availability.

|

Notes: See 5G device, coverage, and access details at T-Mobile.com. Ookla awards: Based on analysis by Ookla® of Speedtest Intelligence® data for the U.S., 1H 2024. Ookla trademarks used under license and reprinted with permission. Opensignal Awards: USA: Mobile Network Experience Report July 2024, based on independent analysis of mobile measurements recorded during the period March 1 – May 29, 2024. © 2024 Opensignal Limited. |

- The 5G availability gap between T-Mobile and its competitors measures “what proportion of time people have a network connection, in places they most commonly frequent.” T-Mobile scored 67.9% on average. AT&T managed only 11.8%, while Verizon was on a lousy 7.7%. That gap between one player and the other two on such a seemingly important metric may concern investors in AT&T and Verizon.

- 87% of T-Mo’s 5G traffic is now carried at sites where equipment supports all three of the 600MHz, 1.9GHz and 2.5GHz spectrum bands. AT&T and Verizon, by contrast, rely partly on airwaves in much higher ranges, including frequencies in and around the 3.5GHz band. Often described as a sweet spot for 5G, combining decent propagation with sufficient capacity, this “C-band” has come in for heavy criticism from Moffett. “Put simply, C-band isn’t very good spectrum,” he said in a research note issued earlier this month.

- T-Mo’s CAPEX had decreased and likely will continue to do so. That’s partly why free cash flow is high and rising. Capital expenditure fell from $14 billion in 2022, to $9.8 billion last year, and a dip below the $9 billion mark is now forecast for 2024.

- Net postpaid phone additions were up 777,000 in the second quarter, which resulted in T-Mobile having more than 77.2 million postpaid subs in total. For comparison, AT&T has 88 million postpaid subscribers and 19.3 million prepaid subscribers. Verizon has 94 million wireless retail +30.2 million business postpaid connections for a total of 124.2 million postpaid subs.

………………………………………………………………………………………………………………………………………………………..

Fiber Optic Network Opportunity:

Historically a pure-play wireless company, T-Mobile is on a fiber binge. In April, it announced intentions to acquire Lumos through a joint venture with investment firm EQT. More recently, it’s teaming with KKR to invest $4.9 billion for a 50% equity stake in Metronet in a joint venture with KKR. When combined, these deals position T-Mobile to reach about 10 million homes with fiber by the end of 2030. That’s on top of the fiber foray it’s doing with open access network operators like Intrepid Fiber, SiFi Networks and Tillman FiberCo.

T-Mo’s fiber appetite is an adjunct to its fixed wireless access (FWA) service. That’s its high-speed internet service that uses extra capacity on its mobile network. T-Mobile ended Q2 with 5.6 million high-speed internet customers. “We sell fixed wireless access in places in the network where we have excess capacity that won’t be consumed either now or in the future by normal mobile usage,” said T-Mobile Marketing President Mike Katz on the earnings call.

“That’s where we sell fixed wireless. In places where we deploy fiber, there’s an opportunity for us take some of the demand that we’re seeing in fixed wireless where those excess capacity pockets don’t exist and move them to fiber, so there’s really a bunch of complementary features to it,” he continued.

“One thing we feel very strongly about is that these (fiber optic network) transactions are not defensive of our mobile business,” CEO Sievert said. “We believe that our mobile business stands strongly alone. Consumer choice has been made very clear that wireless is a deeply considered sale. It’s the primary purchase decision in a connected life and that people will choose the wireless company that is right for them and we believe we will compete effectively as a pure play wireless company regardless of our simultaneous participation in broadband.”

Put together with its 5G broadband service, T-Mobile’s expanding web of physical fiber lines could help the company reach more than 17 million homes by 2030, according to New Street Research. That would trail AT&T and Verizon, which could respectively cover 38 million and 25 million homes with a fixed-line or wireless broadband offering, the research firm says.

“Because they’re in the game, they’re closing the gap with Verizon and AT&T, but they’re well behind,” New Street analyst Jonathan Chaplin said of T-Mobile. “If they really want to build a business the size of AT&T, they’d have to buy a Comcast or a Charter [Communications].”

“It’s kind of a land grab,” said BNP Paribas telecom analyst Sam McHugh, adding that telecom companies are rushing into neighborhoods where residents aren’t happy with their cable provider and don’t yet have fiber-optic service available. “Investors are worried that the more they invest in fiber, the more they become like AT&T and Verizon both in terms of financial profile and business mix,” McHugh said. Any aggressive moves could also drive up the prices of potential deal targets.

“If the whole fiber industry realizes, ‘Hey we have this big monster coming in and buying up fiber,’ it’s probably not the word they want on the street,” said Armand Musey, president of telecom advisory firm Summit Ridge Group. “Suddenly, all the sellers would have their antennas up.”

………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/t-mobile-results-pile-5g-humiliation-onto-at-t-and-verizon

https://www.verizon.com/about/sites/default/files/Verizon_Fact_Sheet.pdf

https://www.t-mobile.com/news/network/t-mobile-kkr-joint-venture-to-acquire-metronet

https://www.wsj.com/business/telecom/t-mobile-fiber-optic-internet-connection-380957ef

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

Despite U.S. sanctions, Huawei has come “roaring back,” due to massive China government support and policies

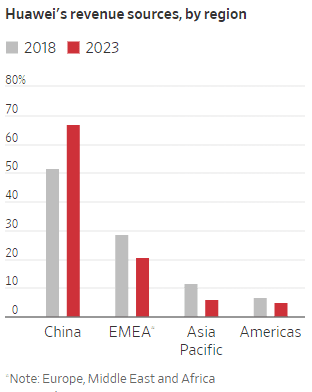

On March 30th we wrote that Huawei Technologies was back, with its net profit more than doubled from the same period last year (2023). Today, a Wall Street Journal (WSJ) news story reaffirmed that with reasons which were really no surprise! Huawei’s profit more than doubled last year, the largest jump in at least two decades. Roughly two-thirds of its revenue comes from domestic (China) clients.

Five years ago, the U.S. sanctioned Huawei, cutting off the Chinese company’s access to advanced U.S. technologies like semiconductors and the Android OS for its smartphones. Initially, the company struggled. In 2021, its revenue dropped almost 30% from the year before. Its core telecom equipment business was suffering. Apple’s iPhone was taking over Huawei market share in smartphones.

Yet in the last year, Huawei has come roaring back, boosted by billions of dollars in China government support. Huawei has expanded into new businesses, boosted its profitability and found fresh ways to curb its dependence on U.S. suppliers. It has held on to its leading position in the global telecom-equipment market, despite American efforts to squeeze Huawei out of its allies’ networks. Also, it’s making a big comeback in high-end smartphones, using sophisticated new chips developed in-house, such that it has captured 15% market share in China (knocking Apple out of the top five smartphone brands).

“The U.S. government’s campaign against Huawei is inadvertently bolstering the company’s resilience, echoing the age-old adage that what doesn’t kill you makes you stronger,” said Sameh Boujelbene, an analyst at research firm Dell’Oro Group.

China state support has paid off big time! After the U.S. imposed restrictions, Huawei and China’s government grew closer. Soon, Huawei leaders declared that every product they made going forward should be able to rely entirely on components developed by Chinese companies. China government contracts and company registration records, as well as WSJ interviews with former and current employees, reveal that billions of dollars flowed from the Chinese government to Huawei through preferential buying contracts and subsidies. State-owned enterprises, government agencies and Communist Party bodies sought Huawei chips, smartphones, cloud services and software, with some procurement contracts calling for Huawei gear by name.

Local governments have bought Huawei businesses, providing cash injections. Once reliant on Google’s Android for its consumer devices, Huawei built its own operating system. It has even made a foray into electric vehicles, a task that Apple gave up on, and developed its own version of Bluetooth. Huawei still faces challenges. Its most advanced semiconductors remain a step behind industry leaders such as Nvidia, whose chips are made by TSMC in Taiwan, which Huawei no longer has access to due to U.S. sanctions. U.S. export restrictions, which effectively barred Huawei from using American technology anywhere along the chipmaking process, meant the Chinese company could no longer source its chips from TSMC. Some analysts believe it will be hard for Huawei to keep innovating without access to more advanced Western technologies, especially chip making equipment and software.

One current U.S. official said Washington is closely tracking Huawei’s efforts to make its own semiconductors, in case more actions are needed to block China from manufacturing artificial-intelligence-focused chips that can give Beijing a military edge.

On May 16, 2019, China’s local government in Shenzhen, where Huawei is based, registered an investment company Shenzhen Major Industry Investment Group (SMII), focused on semiconductors, investing in foundries, manufacturing equipment and materials that would help ensure Huawei was supplied with enough domestically made chips and other technologies. Two companies established by SMII, including a chip foundry, employed former Huawei executives, according to people familiar with the matter. One received around a dozen patented technologies transferred from Huawei. Huawei human-resources managers had asked company researchers if they would work at that entity, promising them they could keep their benefits if they moved, according to people familiar with the matter. Shenzhen’s imports of semiconductor manufacturing equipment surged after SMII’s inception, official data shows. Through various state-backed funds, the Chinese government has invested in more than two dozen chip-related startups, over the past five years, according to corporate database Tianyancha.

That’s in addition to government investments in Huawei’s HiSilicon chip unit (more below), which made the silicon used in the company’s popular Mate 60 Pro smartphone. HiSilicon became an independent, wholly owned Huawei subsidiary in 2004. It was founded in 1991 as Huawei’s ASIC Design Center.

A majority-owned Shenzhen company also bought Huawei’s Honor smartphone business, which was struggling because of the U.S. sanctions. The deal was worth several billions of dollars, a person familiar with the transaction said. The cash allowed Huawei to focus on other businesses, including its higher-end Mate series of phones.

“We’ve been through a lot over the past few years. But through one challenge after another, we’ve managed to grow,” Huawei said in a written statement, adding that the company owed its survival and development to the trust and support of global customers, partners and “all sectors of society.” Sustaining R&D investment will be crucial going forward, the company said.

“We’ve been through a lot over the past few years, but through one challenge after another, we’ve managed to grow,” Huawei said in a written statement, adding that the company owed its survival and development to the trust and support of global customers, partners and “all sectors of society.” Sustaining R&D investment will be crucial going forward, the company said.

Huawei focused on building out more of its own supply chain and expanding into new areas that could generate revenue to help keep the company going, including cloud computing and other services, according to Chris Peirera, a former Huawei senior director in public affairs. “In the past, we chased the ideal of globalization, determined to serve mankind. What are our goals now? It’s to survive. We will make money wherever we can,” Huawei founder Ren Zhengfei later told the company’s staff in an internal letter.

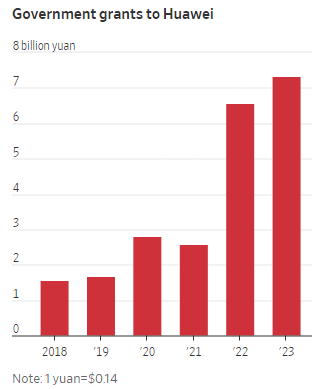

Huawei received over $1 billion in China government grants in 2023, more than quadruple the amount it received in 2019, according to Huawei’s financial reports. In all, Huawei received nearly $3 billion in the past five years, accounting for 3% of its total R&D expenses.

Source: Huawei via WSJ

China’s government directed state agencies to buy more of Huawei’s software, chips and mobile devices, a policy that boosted Huawei while reducing China’s reliance on American companies, including Apple, whose iPhones are no longer allowed in the workplace for many government employees. A Chinese government research unit named Huawei as one of four tech giants spearheading the nation’s push to wean itself off foreign technology, while another government body singled out Huawei as a preferred state supplier of AI chips, servers and other enterprise software.

Though Huawei is still seeking to sell its products abroad in places such as Southeast Asia and Africa, it is more reliant on China’s market than ever, with 67% of revenue last year coming from domestic clients. The company often portrays itself as a national champion that gives priority to serving China.

Source: Huawei via WSJ

A WSJ investigation found more than 300 government procurement contracts worth around $5 billion specifically calling for the purchase of servers and other tech infrastructure powered by Huawei’s Kunpeng central processing units, or CPUs, in 2023. Other contracts listed Huawei CPUs among a handful of preferred local vendors. All of this was a sharp contrast to five years ago, when government agencies specifically requested products from U.S. chip makers Intel or AMD.

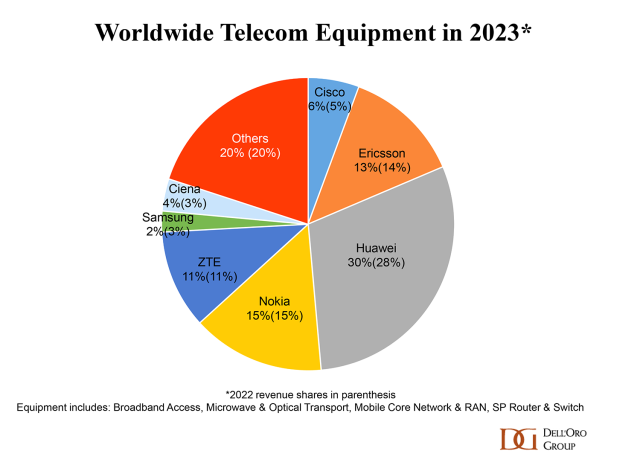

China’s buy-local policy is even more pronounced in the telecom-equipment space, Huawei’s largest revenue source. State-owned Chinese wireless carriers have largely stopped buying equipment from Huawei’s foreign rivals, Sweden’s Ericsson and Finland’s Nokia, even when one of them priced their contracts more cheaply than Chinese companies. The shift came while Sweden and other European countries indicated that they would cut Huawei and another Chinese equipment maker, ZTE, from their networks. Ericsson and Nokia held about 15% of China’s cellular network equipment market before 5G began rolling out in 2019. In China’s current 5G cellular-equipment market, Huawei holds about 4% to 5%, according to market research firm Dell’Oro.

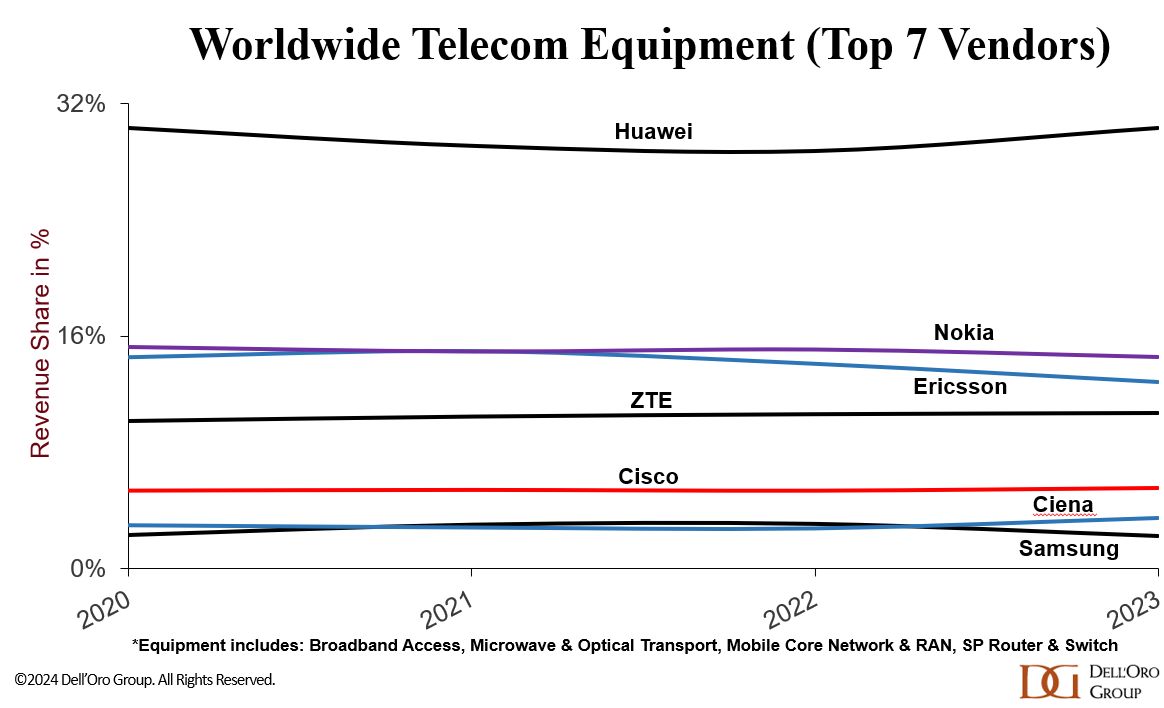

They peg Huawei’s 2023 global telecom market share (#1) at 30% – double that of #2 Nokia as per this pie chart:

With so much government support, Huawei was able to avoid massive job and spending cuts that would have gutted its R&D or led to a talent exodus. Huawei boosted R&D spending to almost 165 billion yuan, or $23 billion, last year, up from 102 billion yuan in 2018. More than half of Huawei’s 207,000 employees are in R&D.

Huawei is now at the vanguard of China’s push to develop cutting-edge chips to wean reliance on Nvidia and Intel, as the Biden administration seeks to curb China’s ability to develop advanced chips and technology that could aid its warfare and surveillance. U.S. chip juggernaut Nvidia singled out Huawei as a top competitor in February.

Huawei is leading a government-funded project to develop memory units for advanced AI chips, people familiar with the matter said, with at least 11 national AI data centers now using Huawei chips. WSJ reports that last summer, a group of Huawei researchers gathered at a barbecue restaurant on the outskirts of Beijing to congratulate engineers who worked on the Mate 60 Pro chip set at Huawei owned HiSilicon.

![]()

“You HiSilicon people kick ass,” one of the Huawei researchers said, according to a person who attended. “Managers tell us daily that our work helps the country fight against foreign oppression,” a HiSilicon engineer who was present responded. “We’re becoming more and more like a state-owned company, aren’t we?” another researcher chimed in.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.wsj.com/business/telecom/huawei-china-technology-us-sanctions-76462031

Huawei is back – net profits more than doubled in 2023!

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Huawei to revolutionize network operations and maintenance

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

China Telecom with ZTE demo single-wavelength 1.2T bps hollow-core fiber transmission system over 100T bps

China Telecom, along with its partners [1.], says it has launched the world’s first live single-wavelength 1.2T bps hollow-core fiber optics transmission system with unidirectional capacity over 100T bps.

Note 1. ZTE, Yangtze Optical Fibre, Cable Joint Stock Limited Company and Huaxin Design Institute were also involved in the project, which was deployed over a transmission distance of 20km in the live network of the All-Optical Network Technology and Application in the Intelligent Computing Era seminar of the CCSA TC618/NGOF.

ZTE optical transport equipment was used for project, alongside some improvements in spectral efficiency, baud rate optimization, and amplification optimization technologies. The system extends 41 C-band 1.2T bps and 64 L-band 800G bps wavelengths, and archives unidirectional transmission capacity of over 100T bps and a transmission distance of 20km in the field network.

This demonstration completed the hollow-core fiber deployment and large-capacity transmission between China Telecom’s Hangzhou Intelligent Computing Center and Yiqiao IDC. As a key node of China Telecom’s intelligent computing power layout “2+3+7+M”, the Hangzhou Intelligent Computing Center has been deployed with the 1k GPUs computing power of the China Telecom Cloud. It also hails ‘breakthroughs in hollow-core fiber fusion splicing technologies,’ such as low-power discharge and mode field matching related to the demonstration.

To meet the requirements for distributed computing power with large bandwidth and low latency of optical networks, ZTE used its advanced high-speed optical transport equipment. Combined with improvements in spectral efficiency, baud rate optimization, and amplification optimization technologies, the system extends 41 C-band 1.2Tbit/s wavelengths and 64 L-band 800Gbit/s wavelengths. It achieves a unidirectional transmission capacity of over 100Tbit/s and a transmission distance of 20km in the field network.

The hollow-core fiber cable, independently developed by YOFC, is deployed in the field network with multiple waterproofing solutions. For instance, water-blocking glue and double-layer plastic caps are used at the cable ends to isolate the atmosphere, a pulling unit with a swivel is employed for cable deployment to minimize wear on the end caps, and a horizontal waterproof cable closure is utilized at the fusion splice point. Additionally, breakthroughs in hollow-core fiber fusion splicing technologies, such as low-power discharge and mode field matching, have achieved 0.05dB fusion splice loss between hollow-core fibers and 0.25dB fusion splice loss with 54dB return loss between hollow-core fibers and standard solid-core single-mode fibers.

China Telecom’s Zhejiang branch said: “We have always maintained the leading position in the field of basic transmission networks. By undertaking the national key R&D project, we have demonstrated and verified the hollow-core fiber and 1.2Tbit/s transport system in the field network, and can offer detailed engineering data and demonstration applications. In the future, we will further cooperate with the industry to conduct research on a larger scope, and provide practical scenarios for the interconnection of distributed intelligent computing centers.”

China Telecom says they will continue to expand the hollow-core optical cable environment and build a platform for testing and verifying new technologies and applications oriented towards intelligent computing scenarios. This effort aims to continuously promote technological innovation and application expansion in the telecommunications industry.

……………………………………………………………………………………………………………………………………………

Separately, China Telecom received four awards at the “Asia’s Best Managed Companies Poll 2024” by FinanceAsia, a reputable financial magazine in Asia:

⚫ “Best Investor Relations in China” – Gold Award

⚫ “Best Managed Company in China” – Silver Award

⚫ “Best Telecommunication Services Company” – Silver Award

⚫ “Best Large-Cap Company in China” – Bronze Award

……………………………………………………………………………………………………………………………

References:

https://www.telecoms.com/fibre/china-telecoms-claims-a-world-s-first-hollow-core-fibre-demonstration

https://www.chinatelecom-h.com/en/media/news/p240730.pdf

ZTE reports higher earnings & revenue in 1Q-2024; wins 2023 climate leadership award

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

China Telecom, ZTE jointly build spatiotemporal cognitive network for digital transformation

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

Highlights of Dell’Oro’s 5-year RAN forecast

Market conditions remain challenging for the broader RAN market. Following the 40% to 50% ramp between 2017 and 2021, the RAN market has been declining since then. These trends are expected to prevail throughout the forecast period. However, the pace of the decline should moderate somewhat after 2024.

“It is not a surprise that there is rain after sunshine,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “In addition to MBB-based coverage-related challenges, this disconnect between mobile data traffic growth and the capacity boost provided by the mid-band, taken together with continued monetization uncertainty, is clearly weighing on the market,” Pongratz added.

- Worldwide RAN revenues are projected to decline at a 2 percent CAGR over the next five years, as continued 5G investments will be offset by rapidly declining LTE revenues.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North American region. Even with some recovery, North American RAN revenues are expected to remain significantly lower relative to the peak in 2022.

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

Commentary:

Worldwide RAN revenues are projected to decline at a 2% CAGR between 2023 and 2028, as rapidly declining LTE revenues will offset continued 5G investments. This is predicated on the assumption that the MBB portion of the RAN market will continue to trend downward, and the upside from new growth opportunities is not enough to change the trajectory.

The mix between existing and new use cases has not changed. We still forecast private/enterprise RAN to grow at a 20%+ CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some for private RAN to move the broader RAN needle.

As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels, there are serious concerns about the timing of capacity upgrades. The network utilization metric will play a much more significant role as we move further into the capacity phase.

Generally, the less advanced 5G regions are expected to perform better than the mature 5G markets. As a result, markets with lower 5G POP coverage, including Middle East & Africa, Caribbean and Latin America, and APAC Excluding China/India should perform better.

Easier comparisons following steep contractions in 2023 will improve the North American region’s growth prospects. Even with some recovery, North American RAN revenues are expected to remain significantly below peak levels in 2022.

5G-Advanced will play an essential role in the broader 5G journey. However, 3GPP Releases 18-20 are not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets. Also, ITU-R WP5D has not started any work related to a 5G-Advanced recommendation(s).

More importantly, some RAN segments will stand out even as the broader RAN market shrinks. RAN segments expected to grow over the next five years include 5G NR, Non-MM 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

References:

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Mobile data demand is in a steep decline in China, the world’s largest 5G market by subscribers. China’s MIIT numbers released this week show per user data consumption (DOU) grew just 8.1% in the first half of the year. That compares to a 68% increase in 2019, the year that 5G licenses were issued. That fell to 13% in 2022 and 11% at end- 2023. Since then, there’s been a decrease in growth of nearly three percentage points in six months.

| Indicator name | unit | Cumulative from January to June | Year-on-year

Growth ( %) |

| Total volume of telecommunication business (at constant prices of the previous year) | 100 million yuan | 8992 | 11.1 |

| Operating income | 100 million yuan | 10712 | 2.8 |

| Including: Telecommunication business income | 100 million yuan | 8941 | 3.0 |

| Total call duration of fixed-line outgoing calls | 100 million minutes | 380 | -3.4 |

| Total mobile phone call duration | 100 million minutes | 10688 | -4.6 |

| Mobile SMS traffic | 100 million | 9407 | 0.5 |

| Mobile Internet access traffic | 100 million GB | 1604 | 12.6 |

| Average mobile Internet access traffic per household in the month (DOU) | GB/household · month | 18.15 | 8.1 |

| Note: 1. The duration of fixed-line outgoing calls and mobile phone calls includes the corresponding IP phone call duration.

2. Starting from February 2024, the 5G mobile Internet access traffic and the number of 5G mobile Internet users of China Radio and Television Network Group Co., Ltd. (hereinafter referred to as China Radio and Television) will be included in the industry summary data, and the data for the same period last year will be adjusted synchronously. |

|||

“While China has rapidly rolled out 5G and continues to perform well vs other markets, there is a limit to the number of people in the market that will engage in advanced data services; the slowdown in traffic growth is an indication that we could be reaching that limit,” according to GSMA.

Commercial 5G standalone (SA) networks, now present in seven APAC countries (Australia, India, Japan, the Philippines, Singapore, South Korea, and Thailand), will help fuel this growth, alongside 5G Advanced, RedCap and AI, creating opportunities to launch new 5G applications and kick start a fresh round in 5G investments for enterprises and consumers.

The authors of the report, GSMA Intelligence, expect 5G to add almost $130 billion to the Asia Pacific economy in 2030, with the manufacturing industry forecast to benefit the most, driven by new 5G-enabed applications including smart factories, smart-grids, and IoT-enabled products. Financial services and public administration are also expected to be big beneficiaries, as they turn to 5G to digitally transform services and operations. To help support this growth the GSMA today launched the GSMA APAC Fintech Forum, a new community programme to unite the connected fintech and commerce sectors with Asia Pacific’s mobile network operators through new technologies.

…………………………………………………………………………………………………………………………………………

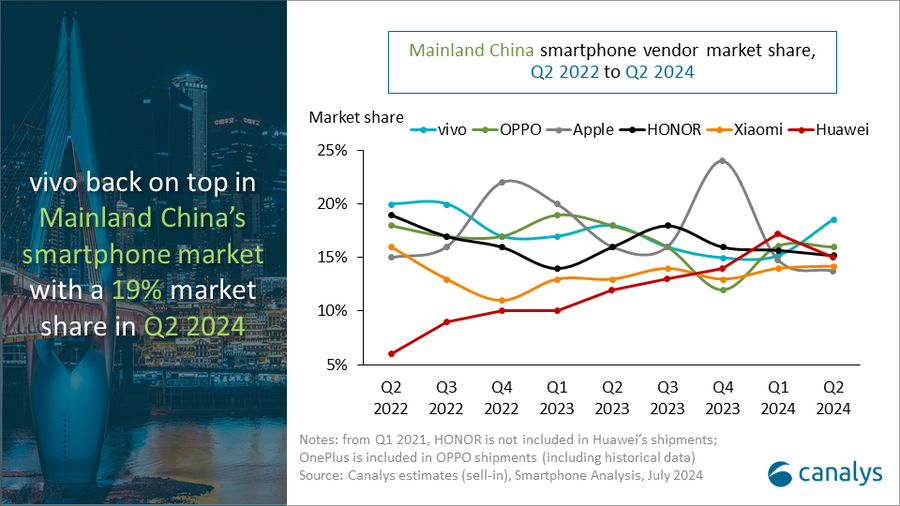

Meanwhile, Apple’s smartphone market share in China shrank by two percentage points in the second quarter of 2024 and the company is no longer one of the top vendors, according to data from market research firm Canalys. The decline underscores the difficulties the U.S. tech giant faces in its third-largest market.

Huawei’s smartphone shipments surged 41 per cent year on year in the the quarter, bolstered by the launch of its new Pura 70 series in April. Chinese smartphone vendors held the top five spots in the second quarter.

“It is the first quarter in history that domestic vendors dominate all the top five positions,” said Canalys Research Analyst Lucas Zhong. “Chinese vendors’ strategies for high-end products and their deep collaboration with local supply chains are starting to pay off in hardware and software features. HONOR’s latest Magic V3, which leverages GenAI, has significantly enhanced the user experience of foldable devices. Conversely, Apple is facing a bottleneck in mainland China. The vendor’s current channel strategy maintains a healthy inventory level and aims to stabilize retail prices and protect margins of channel partners. In the long term, the Chinese high-end market is ripe with opportunity. Local brands such as Huawei, HONOR, OPPO, and vivo are leading the way by incorporating technologies such as GenAI into products and services. Additionally, the localization of Apple’s Intelligence services in mainland China will be crucial in the next 12 months.”

People’s Republic of China (Mainland) smartphone shipments and annual growth

Canalys Smartphone Market Pulse: Q2 2024

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

vivo |

13.1 |

19% |

11.4 |

18% |

15% |

|

OPPO |

11.3 |

16% |

11.4 |

18% |

-1% |

|

HONOR |

10.7 |

15% |

10.3 |

16% |

4% |

|

Huawei |

10.6 |

15% |

7.5 |

12% |

41% |

|

Xiaomi |

10.0 |

14% |

8.6 |

13% |

17% |

|

Others |

14.8 |

21% |

15.1 |

24% |

-2% |

|

Total |

70.5 |

100% |

64.3 |

100% |

10% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|||||

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2024/art_e2f06366bb134479a40cf4cf86445b1e.html

https://canalys.com/newsroom/china-smartphone-market-Q2-2024

https://www.lightreading.com/5g/slowing-mobile-numbers-cast-doubt-on-gsma-s-buoyant-forecasts

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

Microsoft choses Lumen’s fiber based Private Connectivity Fabric℠ to expand Microsoft Cloud network capacity in the AI era

Lumen Technologies and Microsoft Corp. announced a new strategic partnership today. Microsoft has chosen Lumen to expand its network capacity and capability to meet the growing demand on its datacenters due to AI (i.e. huge processing required for Large Language Models, including data collection, preprocessing, training, and evaluation). Datacenters have become critical infrastructure that power the compute capabilities for the millions of people and organizations who rely on and trust the Microsoft Cloud.

Microsoft claims they are playing a leading role in ushering in the era of AI, offering tools and platforms like Azure OpenAI Service, Microsoft Copilot and others to help people be more creative, more productive and to help solve some of humanity’s biggest challenges. As Microsoft continues to evolve and scale its ecosystem, it is turning to Lumen as a strategic supplier for its network infrastructure needs and is investing with Lumen to support its next generation of applications for Microsoft platform customers worldwide.

Lumen’s Private Connectivity Fabric℠ is a custom network that includes dedicated access to existing fiber in the Lumen network, the installation of new fiber on existing and new routes, and the use of Lumen’s new digital services. This AI-ready infrastructure will strengthen the connectivity capabilities between Microsoft’s datacenters by providing the network capacity, performance, stability and speed that customers need as data demands increase.

Art by Midjourney for Fierce Network

…………………………………………………………………………………………………………………………………………………………………………………..

“AI is reshaping our daily lives and fundamentally changing how businesses operate,” said Erin Chapple, corporate vice president of Azure Core Product and Design, Microsoft. “We are focused both on the impact and opportunity for customers relative to AI today, and a generation ahead when it comes to our network infrastructure. Lumen has the network infrastructure and the digital capabilities needed to help support Azure’s mission in creating a reliable and scalable platform that supports the breadth of customer workloads—from general purpose and mission-critical, to cloud-native, high-performance computing, and AI, plus what’s on the horizon. Our work with Lumen is emblematic of our investments in our own cloud infrastructure, which delivers for today and for the long term to empower every person and every organization on the planet to achieve more.”

“We are preparing for a future where AI is the driving force of innovation and growth, and where a powerful network infrastructure is essential for companies to thrive,” said Kate Johnson, president and CEO, Lumen Technologies (a former Microsoft executive). “Microsoft has an ambitious vision for AI and this level of innovation requires a network that can make it reality. Lumen’s expansive network meets this challenge, with unique routes, unmatched coverage, and a digital platform built to give companies the flexibility, access and security they need to create an AI-enabled world.”

Lumen has launched an enterprise-wide transformation to simplify and optimize its operations. By embracing Microsoft’s cloud and AI technology, Lumen can reduce its overall technology costs, remove legacy systems and silos, improve its offerings, and create new solutions for its global customer base. Lumen will migrate and modernize its workloads to Microsoft Azure, use Microsoft Entra solutions to safeguard access and prevent identity attacks and partner with Microsoft to create and deliver new telecom industry-specific solutions. This element alone is expected to improve Lumen’s cash flow by more than $20 million over the next 12 months while also improving the company’s customer experience.

“Azure’s advanced global infrastructure helps customers and partners quickly adapt to changing economic conditions, accelerate technology innovation, and transform their business with AI,” said Chapple. “We are committed to partnering with Lumen to help deliver on their transformation goals, reimagine cloud connectivity and AI synergies, drive business growth, and help customers achieve more.”

This collaboration expands upon the longstanding relationship between Lumen Technologies and Microsoft. The companies have worked together for several years, with Lumen leveraging Copilot to automate routine tasks and reduce employee workloads and enhance Microsoft Teams.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Lumen’s CMO Ryan Asdourian hinted the deal could be the first in a series of such partnerships, as network infrastructure becomes the next scarce resource in the era of AI. “When the world has talked about what’s needed for AI, you usually hear about power, space and cooling…[these] have been the scarce resources,” Asdourian told Fierce Telecom. Asdourian said Lumen will offer Microsoft access to a combination of new and existing routes in the U.S., and will overpull fiber where necessary. However, he declined to specify the speeds which will be made available or exactly how many of Microsoft’s data centers it will be connecting.

Microsoft will retain full control over network speeds, routes and redundancy options through Lumen’s freshly launched Private Connectivity Fabric digital interface. “That is not something traditional telecom has allowed,” Asdourian said.

Asdourian added that Lumen isn’t just looking to enable AI, but also incorporate it into its own operations. Indeed, part of its partnership deal with Microsoft involves Lumen’s adoption of Azure cloud and other Microsoft services to streamline its internal and network systems. Asdourian said AI could be used to make routing and switching on its network more intelligent and efficient.

…………………………………………………………………………………………………………………………………………………………………………………..

About Lumen Technologies:

Lumen connects the world. We are igniting business growth by connecting people, data, and applications – quickly, securely, and effortlessly. Everything we do at Lumen takes advantage of our network strength. From metro connectivity to long-haul data transport to our edge cloud, security, and managed service capabilities, we meet our customers’ needs today and as they build for tomorrow. For news and insights visit news.lumen.com, LinkedIn: /lumentechnologies, Twitter: @lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies and YouTube: /lumentechnologies.

About Microsoft:

Microsoft (Nasdaq “MSFT” @microsoft) creates platforms and tools powered by AI to deliver innovative solutions that meet the evolving needs of our customers. The technology company is committed to making AI available broadly and doing so responsibly, with a mission to empower every person and every organization on the planet to achieve more.

…………………………………………………………………………………………………………………………………………………………………………………..

References:

https://news.lumen.com/2024-07-24-Microsoft-and-Lumen-Technologies-partner-to-power-the-future-of-AI-and-enable-digital-transformation-to-benefit-hundreds-of-millions-of-customers

https://fierce-network.com/cloud/microsoft-taps-lumens-fiber-network-help-it-meet-ai-demand

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Lumen, Google and Microsoft create ExaSwitch™ – a new on-demand, optical networking ecosystem

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

Lumen to provide mission-critical communications services to the U.S. Department of Defense

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

Comcast faces competitive intensity; loses 120K broadband subs in 2Q-2024

Comcast today reported adjusted earnings of $1.21 a share for the quarter, beating Wall Street’s call for $1.12, according to FactSet. Revenue of $29.7 billion was slightly below consensus estimates of $30 billion. However, the company reported a loss of 120,000 total domestic broadband customers and 419,000 domestic video subscribers in the 2nd quarter.

“The competitive intensity that we’ve seen for the past several quarters, and which is particularly felt in the market for price-conscious consumers, remains essentially unchanged,” Comcast President Mike Cavanagh said on today’s earnings call.

“One of the most important metrics we monitor is the magnitude of data traffic flowing across our network. And again, we saw a double-digit year-over-year growth this quarter, with broadband-only households consuming over 700 gigabytes of data each month. And our customers continue to take faster speeds, with around 70% of our residential subscribers receiving speeds of 500 megabits per second or higher and one-third getting a gigabit or more. These positive consumer trends play to our strengths and will only accelerate with the shift of live sports to streaming, which together with entertainment on streaming accounts for nearly 70% of our network traffic today.My final thought on broadband is the importance of bundling with mobile, with 90% of Xfinity Mobile smartphone traffic traveling over our WiFi network. These two products work seamlessly together to benefit our customers from both the products’ experience and financial value standpoint.”

Seaport Research analyst David Joyce:

“Due to continued Broadband subscriber losses (where growth is driven by pricing), an elevated competitive environment for the time being, and the mixed Media topline and profitability trajectories, we remain Neutral,” Joyce wrote. Sentiment will improve when there are signs of stabilization in broadband market share, he added.

Comcast is moving ahead with HFC network upgrades, including “mid-splits” that dedicate more capacity to the upstream. Watson said mid-splits have been completed in about 42% of Comcast’s HFC footprint, a figure he expects to reach 50% by the end of the year. Comcast’s mid-splits are occurring alongside a plan to deploy DOCSIS 4.0 upgrades that are initially delivering symmetrical speeds of up to 2 Gbit/s. Comcast has D4.0-based services available in three markets – Philadelphia, Atlanta and Colorado Springs – with Seattle up next.

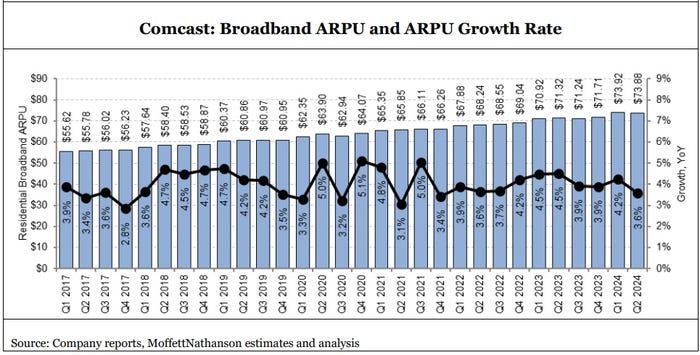

Broadband average revenue per unit (ARPU), which was up 3.6% in the quarter, remains a bright spot as customers continue to gravitate to higher speed tiers. Comcast CEO Brian Roberts: “Broadband ARPU increased by 3.6% and we delivered 6% revenue growth in our connectivity businesses, while expanding our Adjusted EBITDA margin across Connectivity & Platforms to a record-high 41.9%.”

“Faster homes passed growth shouldn’t be expected to turn broadband subscribership back into a growth engine, but it is a critical factor in keeping broadband subscriber results stable,” MoffettNathanson analyst Craig Moffett explained in a research note (payment required) issued today.

Comcast also expects to participate in the $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

Comcast’s pay-TV business continued its downward spiral. The company lost 419,000 video subs in Q2, an improvement from a year-ago loss of 543,000. Analysts were expecting Comcast to shed about 502,000 video subs in Q2.

The Peacock streaming service, which broadcasts live sporting events like the upcoming summer Olympics, reported paid subscribers soared 38% from a year ago to 33 million, while revenue rose 28% in the 2nd quarter to $1 billion.

2nd Quarter 2024 Highlights:

• Adjusted EPS Increased 7.0% to $1.21; Generated Free Cash Flow of $1.3 Billion, Including a Tax

Payment Related to the Previously Announced Hulu Transaction and Other Tax Related Matters

• Return of Capital to Shareholders Totaled $3.4 Billion Through a Combination of $1.2 Billion in

Dividend Payments and $2.2 Billion in Share Repurchases

• Connectivity & Platforms Adjusted EBITDA Increased 1.6% to $8.5 Billion and Adjusted EBITDA

Margin Increased 90 Basis Points to 41.9%, Its Highest on Record

• Continued the Successful Execution of Our Domestic Network Expansion and Upgrade Strategy;

Expanded Deployment of Mid-Split Technology to 42% of Our Footprint; And Added 302,000 New

Homes and Businesses Passed in the Second Quarter

• Domestic Broadband Average Rate Per Customer Increased 3.6%, Driving Domestic Broadband

Revenue Growth of 3.0% to $6.6 Billion.

• Domestic Wireless Customer Lines Increased 20% Compared to the Prior Year Period to 7.2 Million,

Including Net Additions of 322,000 in the Second Quarter.

• Business Services Connectivity Adjusted EBITDA Increased 4.4% to $1.4 Billion and Adjusted

EBITDA Margin Was 57.0%.

• Media Adjusted EBITDA Increased 9.0% to $1.4 Billion, Driven by Improved Performance at Peacock

• Peacock Paid Subscribers Increased 38.0% Compared to the Prior Year Period to 33 Million;

Peacock Revenue Increased 28% to $1.0 Billion; Best Year-Over-Year Improvement in Adjusted

EBITDA for Any Quarter Since Launch in 2020.

…………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/static-files/68abe434-80f7-437e-8e7a-fa457e43e63b

https://seekingalpha.com/article/4705822-comcast-corporation-cmcsa-q2-2024-earnings-call-transcript

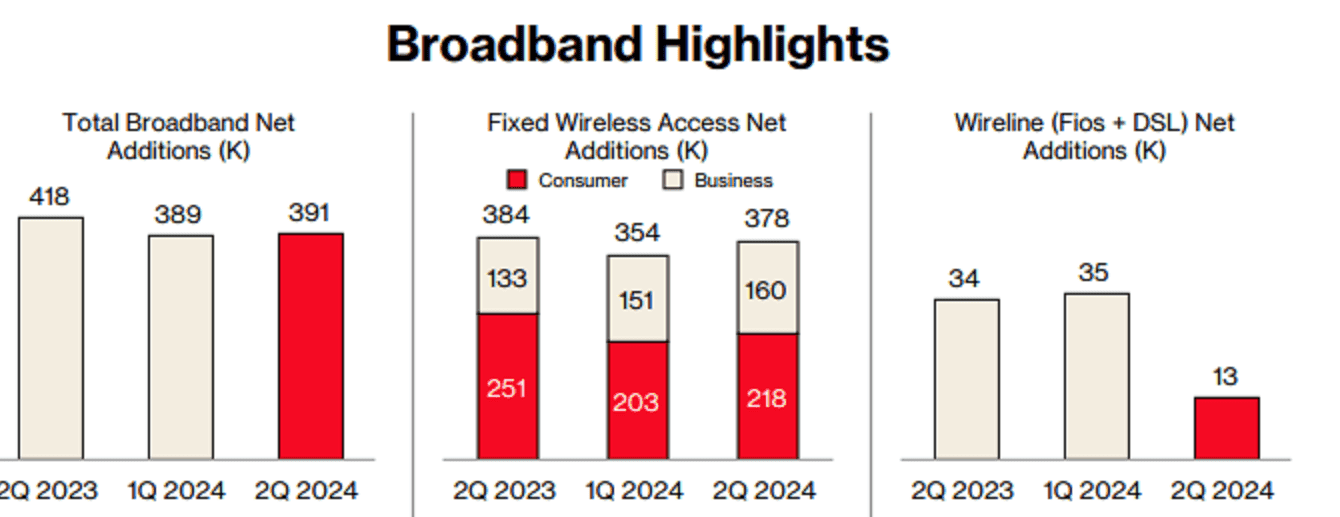

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

Verizon Communications wireless and wireline subscriber growth expectations in the second quarter beat estimates with 148K postpaid phone net additions vs. 118K expected. There were 391,000 total broadband wireline net additions. The company ended the quarter with 11.5 million broadband subscribers, up 17.2% year over year. However, the telecom company posted lower operating revenue that was below expectations. Earnings mostly matched expectations, but were below the year ago level.

“Demand for the service is strengthening as small businesses and enterprises continue to trust the reliability of the product and the speed and east of deployment,” Verizon CFO Tony Skiadas said on Monday’s earnings call.

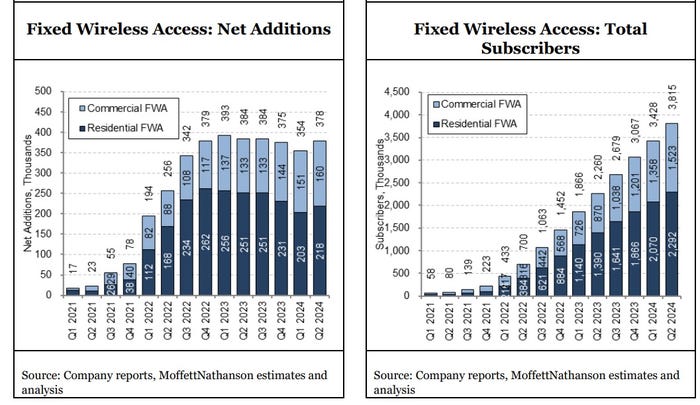

- Verizon added 160,000 business Fixed Wireless Access (FWA) subs in 2Q-2024 – a record quarterly gain in the category that was better than the 138,000 expected by analysts. That quarterly intake was up from a gain of 133,000 in the year-ago quarter and improved from a gain of 151,000 in the prior quarter. Verizon ended Q2 with 1.52 million business FWA subs.

- The company added 218,000 residential FWA subs in Q2 2024, down from a gain of 251,000 in the year-ago quarter, but ahead of the 208,000 residential FWA subs added in the prior quarter. Verizon ended the period with 2.29 million residential FWA subs.

A recent OpenSignal study revealed that Verizon’s 5G customers are rarely connected to the 5G network – in range just 7.7% of the time compared to AT&T (11.8%) and T-Mobile (67.9%). Verizon has not come close to adding as many FWA subs as T-Mobile has each quarter, particularly in the residential market.

New Street Research expects Verizon to cross the 4 million FWA subscriber mark in mid-August. In New Street’s follow-up note, analyst Jonathan Chaplin points to a recent estimate from the firm that data consumption among consumer FWA subs could be four to five time greater than business subscribers. On that basis, an estimate of FWA capacity for 4.1 million Verizon subs would really equate to 6.1 million total customers, he wrote.

2Q 2024 Highlights:

Wireless: Accelerated growth in wireless service revenue

- Total wireless service revenue1 of $19.8 billion, a 3.5 percent increase year over year.

- Retail postpaid phone net additions of 148,000, and retail postpaid net additions of 340,000.

- Retail postpaid phone churn of 0.85 percent, and retail postpaid churn of 1.11 percent.

Broadband: Double-digit broadband subscriber growth

- Total broadband net additions of 391,000. This was the eighth consecutive quarter with more than 375,000 broadband net additions.

- Total fixed wireless net additions of 378,000. At the end of second-quarter 2024, the company had a base of more than 3.8 million fixed wireless subscribers, representing an increase of nearly 69 percent year over year.

- 11.5 million total broadband subscribers as of the end of second-quarter 2024, representing a 17.2 percent increase year over year.

- Fixed wireless revenue for second-quarter 2024 was $514 million, up more than $200 million year over year.

Other results and FY 2024 forecast:

- Verizon reported adjusted earnings of $1.15 a share for the quarter, in line with analyst expectations, but a slowdown from last year’s adjusted earnings of $1.21 a share. This was also the lowest earnings per share for a second quarter since 2017.

- Total operating revenue came in at $32.8 billion, 0.6% higher than a year ago, but below estimates of $33.8 billion.

- Total wireless service revenue was $19.8 billion, up 3.5% year over year, driven primarily by growth in Consumer wireless service revenue.

- FY-2024 Outlook: Verizon reiterated a 2.0% – 3.5% wireless service revenue growth. It maintained an adjusted EPS of $4.50 – $4.70 versus consensus of $4.58.

References:

Nokia cuts sales forecast as mobile sales drop 25%

Yesterday, Nokia cut its full-year sales forecast as the telecom market remains uncertain with network operators continuing to cut spending (CAPEX) in new network equipment, especially for the disappointing 5G (which is actually 4G with a 5GNR for 5G NSA which are by far the majority of 5G network deployments).

Nokia, like its Swedish rival Ericsson, has struggled to replace the strong revenue, high-margin contracts they enjoyed in North America early in the 5G cycle. When work in the region dried up, India became the main revenue generator, but work there attracted much lower margins and sales have now also slowed sharply.

Overall, sales at Nokia’s key mobile networks business fell 25% on year, mainly due to the sharp drop in India, but the company got a EUR150 million boost from a contract resolution with AT&T. 2Q-2024 net sales declined 18% y-o-y in constant currency (-18% reported) primarily due to strong year-ago quarter in India.

Nokia doesn’t provide specific group sales guidance but instead offers sales growth assumptions across its business units, which are all now seen at a weaker level than earlier as the expected net sales recovery is happening later than previously hoped.

The company said Thursday that comparable operating profit guidance of 2.3 billion euros to 2.9 billion euros ($2.52 billion-$3.17 billion) this year remains intact, tracking toward the mid-point or slightly below the mid-point.

“We believe the industry is stabilizing and given the order intake seen in recent quarters we expect a significant acceleration in net sales growth in the second half,” said Chief Executive Pekka Lundmark.

High inflation and rising interest rates have seen network operators spend cautiously over the last couple of years, but orders have slowly ticked higher over the last couple of quarters and the trend is continuing, particularly in network infrastructure, he said.

Late last year the U.S. operator awarded a major network contract to Ericsson for OpenRAN, replacing Nokia equipment. Nokia had contracts with AT&T and the Finnish company said it will still receive the value of those contracts while remaining a significant customer through other deals.

Network infrastructure sales declined 11% on the year, but Nokia said the unit has returned to growth in North America, which is important as it was one of the first markets to experience the 2023 market slowdown.

Nokia is desperately trying to reduce annual costs. Lundmark’s goal is to make cuts of between €800 million ($875 million) and €1.2 billion ($1.3 billion) by 2026, reducing the size of the workforce from about 86,000 employees when the program was first announced to between 72,000 and 77,000. Expect at least 14,000 Nokia employees to be axed in the next 18 months

To date, Nokia has been able to achieve “run-rate” savings of about €400 million ($437 million), it revealed in its earnings report.

“With the challenges of 2023 behind us, and more normalized customer inventory levels, we believe we can now look forward to a stronger second half and a return to growth [in network infrastructure], which we expect to continue into 2025,” Lundmark said.

The company reported an operating margin of 8.7% in its mobile networks unit and it now expects to report a margin of between 4% and 7% in 2024, from 1% to 4% previously. It reported a margin of 6.4% in network infrastructure and still expects a margin of between 11.5% and 14.5% this year.

Group comparable net profit fell 21% to EUR325 million in the second quarter, beating a FactSet estimate of EUR280 million. Sales fell 18% to EUR4.47 billion, missing consensus at EUR4.78 billion.

Improving cash generation means Nokia now intends to accelerate its continuing EUR600 million buyback program with the view to completing it by the end of this year, compared to its previous end-of-2025 target, it said.

References:

https://www.lightreading.com/5g/nokia-takes-big-axe-to-mobile-jobs-but-grows-footprint-outside-at-t