India’s TRAI releases Recommendations on use of Tera Hertz Spectrum for 6G

Telecom Regulatory Authority of India (TRAI) is urging the government and wireless network operators to explore the use of terahertz spectrum for new 6G technologies and services. “The government should introduce a new experimental authorization for the spectrum in the 95 GHz to 3 THz range termed as ‘Tera Hertz Experimental Authorization’ [THEA],” said a press release issued by TRAI.

THEA’s primary objective would be to promote “research and development (R&D), indoor and outdoor testing, technology trial, experimentation and demonstration in the 95 GHz to 3 TZ range,” said TRAI. Any Indian entity, including academic institutes, R&D labs, telecom service providers, central or state government bodies and original equipment makers, will be eligible for an authorization covering a maximum of five years. The scope of THEA should be to conduct R&D, indoor and outdoor testing, technology trial, experimentation, and demonstration in the 95 GHz to 3 THz range; and to market experimental devices designed to operate in the 95 GHz to 3 THz range via direct sale.

TRAI believes the terahertz frequency band is likely to play a crucial role in upcoming 6G technology. “The high-speed point-to-point wireless data link is an emerging usage of Terahertz radiation,” said TRAI in its recommendations. “For this reason, communications in the Terahertz band are expected to play a pivotal role in the upcoming 6th generation (6G) of wireless mobile communications, enabling ultra-high bandwidth communication paradigms.”

“The large Terahertz bandwidths and massive antenna arrays, combined with the inherent densification caused by machine-type communications, will result in an enhanced communication system performance,” added TRAI.

“TRAI is laying the groundwork for India to become a global powerhouse in testing as well as in research and development so that we are fully geared to produce cutting-edge technologies and services in the near future,” said TV Ramachandran, the president of the Broadband India Forum (BIF), in his response to the announcement.

The recommendations are a further sign of India’s interest in shaping the 6G standard, likely to appear around 2030. Vocal about its ambitions, India has already set up the Bharat 6G Alliance to actively contribute to 6G activities. It has also collaborated with several organizations, including the US-based Next G Alliance, Europe’s 6G Smart Networks and Services Industry Association (6G IA) and the 6G Flagship of Oulu University as it tries to position itself as a “global leader” in digital infrastructure and innovation.

The terahertz band has been attracting attention as an option for 6G deployment, with the European Telecommunications Standards Institute (ETSI) recently releasing two reports on the band and the use cases it could support.

“Due to their shorter wavelengths, Terahertz communication systems can support higher link directionality, are less susceptible to free-space diffraction and inter-antenna interference, can be realized in much smaller footprints, and possess a higher resilience to eavesdropping,” said the TRAI report. Even so, there are several challenges that would need to be addressed before terahertz could be feasible for widespread usage. Above all, signal propagation is generally weak in higher frequency bands and power limitations can also result in poor coverage, said TRAI.

The Recommendations have been placed on the TRAI’s website (www.trai.gov.in). For any clarification! information Shri Akhilesh Kumar Trivedi, Advisor (Networks, Spectrum and Licensing), TRAI may be contacted at Telephone Number +91-11-20907758.

References:

https://www.lightreading.com/6g/india-gets-behind-terahertz-push-for-6g

https://www.trai.gov.in/sites/default/files/PR_No.56of2024.pdf

www.trai.gov.in

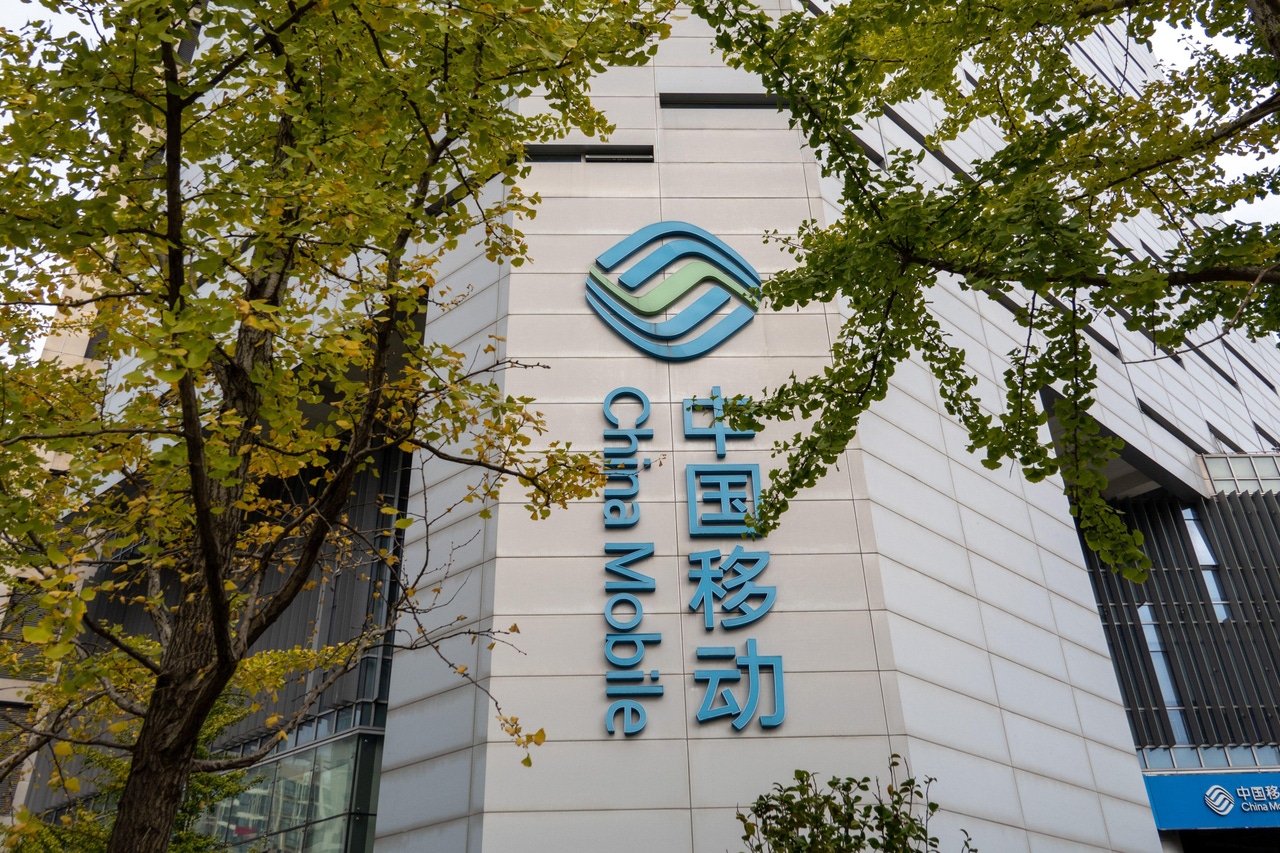

China adds 20M “5G package” subscribers in July; 1H-2024 earnings gains outpace revenues for all 3 major China telcos

The number of 5G subscribers in China increased by a sizeable 20 million last month, according to new data from the country’s big three state owned network providers (China Mobile, China Telecom, China Unicom). Of the three, China Mobile is still the only one to report actual customers using its 5G network; China Telecom and China Unicom are sticking to their 5G package subscribers metric, which essentially means customers signed up to a 5G plan, regardless of whether they use 5G network services (most continue to use 4G).

- China Mobile’s July net adds came in at 13.7 million, pushing its 5G customer base up to a colossal 528 million. China Mobile disclosed that it has 129 million customers using its 5G New Calling over high-definition video service reached 129 million, of which, smart application subscribers numbered 11.82 million.

- China Telecom added 3.1 million 5G package customers for a total of 340 million. They did not talk about 5G in their earnings report (more below).

- China Unicom added 2.9 million 5G package customers for a total of 279 million. China Unicom shared details of its 5G network build-out, pointing out that its 5G mid-band base stations numbered in excess of 1.31 million as of mid-year, while low-band sites reached 780,000.

For each of them, cloud and digital transformation (rather than 5G subs) drove topline growth, profit rose more than revenue and shareholder returns increased.

- China Mobile said net profit had improved 5.3% to RMB80.2 billion ($11.2 billion), outpacing revenue, which rose 3% to RMB546.7 billion ($76.6 billion).

- China Telecom, reported net earnings of 21.8 billion Chinese yuan (US3.1 billion), an 8.2% gain over last year, with revenue up 2.8% and service revenue 4.3% higher.

- China Unicom reported 11.3% higher net income of 13.8 billion ($1.93) on the back of a 2.9% lift in sales to RMB197.3 billion ($27.6 billion).

China Mobile says its digital transformation business grew 11% to RMB147.1 billion ($20.6 billion), accounting for 26% of all revenue. China Telecom reported digital industry sales of RMB73.7 billion ($10.3 billion), a 7% increase, and China Unicom said revenue grew 7% to RMB43.5 billion ($6.1 billion).

Source: Cynthia Lee/Alamy Stock Photo)

All three state owned telcos experienced double-digit growth in cloud services. China Telecom’s Tianyi Cloud grew revenue by 20% to RMB55 billion ($7.7 billion), while China Mobile Cloud hiked sales by 19% to RMB50 billion ($7 billion) and China Unicom grew 24% to RMB32 billion ($4.5 billion).

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

Silence is Golden?

There was a distinct lack of 5G commentary in China Telecom’s half year report; it is the last of the three to post numbers and did so alongside the publication of the market’s operational statistics for July. The telco shared its 5G package figures – it added almost 18 million in the first six months of 2024, incidentally – but made no other reference to the technology in a fairly wordy statement about its year-to-date performance. Instead, the operator focused on the progress of its digital transformation strategy, leaning heavily on the promise of artificial intelligence. Specifically, China Telecom is talking up what it terms AI+ – there’s always one – and the Xingchen large language model it launched at the back end of last year.

“The Company strengthened the integration and mutual promotion of capabilities in various fields, continuously enriched the Xingchen large model series product portfolio, empowered the intelligent transformation for thousands of industries, and supported enterprises to achieve costs reduction and efficiency enhancement,” it said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecoms.com/5g-6g/china-added-20-million-5g-subs-last-month

https://www.lightreading.com/finance/cloud-digital-transformation-drive-chinese-telcos-h1-growth

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China Telecom and China Mobile invest in LEO satellite companies

WSJ: China’s Telecom Carriers to Phase Out Foreign Chips; Intel & AMD will lose out

China’s telecom industry business revenue at $218B or +6.9% YoY

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

RAN market conditions continued to remained challenging in the second quarter despite some faint signs of improvements. Dell’Oro estimates that the overall 2G–5G Radio Access Network (RAN) market—including baseband plus radio hardware and software, excluding services—declined at a double-digit rate for a fourth consecutive quarter in 2Q24. The results in the second quarter were mostly an extension of what we have seen over the past year, characterized by cautious capex spending and challenging comparisons.

“Even if the RAN market is still down at a double-digit rate in the first half, the second quarter offered some glimmer of hope that the nadir of this cycle with double-digit declines might now be in the past for the time being,” said Stefan Pongratz, Vice President and analyst at the Dell’Oro Group. “This does not change the fact that the RAN market is expected to decline at a 2 percent CAGR over the next five years. But the pace of the decline should moderate somewhat going forward,” continued Pongratz.

Additional highlights from the 2Q 2024 RAN report:

- Total RAN revenues were mostly in line with expectations.

- Strong growth in North America and stable trends in China were not enough to offset steep declines in the Asia Pacific region, partly driven by sharp drops in India.

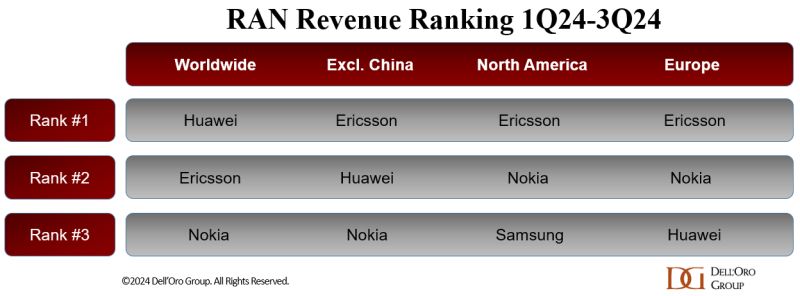

- Vendor rankings are mostly unchanged. The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Relative to 2023, Huawei’s 1H 2024 revenue share is up, ZTE is stable, and Nokia/Ericsson are together down 3 to 4 percentage points.

- Short-term RAN projections are mostly unchanged since the 5-year forecast update. Global RAN is expected to decline 8 percent to 12 percent outside of China.

On the bright side, the overall results were fairly aligned with expectations, and more regions are now growing. Our initial analysis shows that three out of the six tracked regions advanced on a year-over-year basis in the quarter, up from just one region in the first quarter (North America, MEA, and CALA increased while Europe, China, and Asia Pacific Excl. China declined).

Strong growth in North America and stable trends in China were not enough to offset steep declines in the Asia Pacific region, partly driven by sharp drops in India.

The supplier landscape is mostly unchanged with Huawei, Ericsson, Nokia, ZTE Corporation, and Samsung Networks still leading the way, while many of the non-top 5 suppliers are declining.

Relative to 2023, Huawei’s 1H 2024 revenue share is up, ZTE is stable, and Nokia/Ericsson are together down 3 to 4 percentage points.

Short-term RAN projections have remained mostly unchanged since the 5-year forecast update. Global RAN is expected to decline 8% to 12% outside of China. This implies a stronger-than-typical 2024 second half, comprising more than 53% of full-year revenues.

References:

RAN Market Still Down with Some Glimmer of Hope, According to Dell’Oro Group

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

ZTE reports H1-2024 revenue of RMB 62.49 billion (+2.9% YoY) and net profit of RMB 5.73 billion (+4.8% YoY)

China’s ZTE reported a 2.9% rise in total revenue to RMB62.5 billion ($8.76 billion), with net profit attributable to holders of ordinary shares of the Hong Kong listed company at RMB 5.73 billion, up 4.8% year-over-year (YoY). The biggest growth surge was in the corporate and government unit, which boosted revenue by 56% to RMB9.2 billion yuan ($1.29 billion), mainly through stronger server and storage sales. However, that was offset by a 68% hike in costs, depressing the gross margin by 5.7 points – a result of “changes in revenue mix,” the company said.

The company’s core carrier network equipment business declined 8.6% in the first half of 2024, holding back underlying earnings to 4.96 billion Chinese yuan (US$700 million) – a gain of just 1.1% over last year. The carrier unit, which accounted for 60% of the company’s total revenue, brought in RMB37 billion ($5.18 billion) in sales in H1, the company revealed in its stock exchange filing.

ZTE said demand from Chinese telecom operators had been constrained by “overall investment sentiments,” but it pointed to improved sales of indoor distribution, high-speed rail and metro networking equipment. ZTE’s consumer business, which includes mostly handsets and home routers, grew 14% to RMB16 billion ($2.24 billion). R&D spending remained flat at RMB12.7 billion ($1.78 billion).

_International_Software_Products.jpeg?width=1280&auto=webp&quality=95&format=jpg&disable=upscale)

Source: Cynthia Lee/Alamy Stock Photo

China’s domestic market accounted for 69% of total sales, roughly the same as last year. The biggest offshore growth region was Asia (excluding China), which grew 23%. ZTE said it is positioning itself as a “path-builder for the digital economy” and aimed to further expand its legacy connectivity business while growing its computing business. Its AI portfolio includes full-stack intelligent solutions, backed by key technologies such as high-speed networking, network computing and data processing.

ZTE is developing their own custom silicon. In the first half of 2024, the company continued to increase investment in advanced semiconductor process technologies, advanced architecture and seal packaging design, core intellectual properties and digitalized efficient development platform on the back of close to 30 years’ R&D build-up. We are an industry leader in terms of the ability to design the whole process of chip. On top of a solid foundation in the R&D of base-level technology for DICT chip, the Group has also constructed an ultra-efficient, green and intelligent full-stack computing network base pivoting on “data, computing and network” in line with developments in computing-network integration. The creation of a product regime meeting the core requirements of the diversified scenarios of “cloud, edge, terminal” has supported our ongoing leading position in terms of competitiveness.

ZTE has used its expertise in communication software and hardware development, engineering capabilities and industrialization to intensify its investment in computing power products and solutions. The company has launched a comprehensive suite of full-stack, full-scenario intelligent computing solutions, covering computing, networks, capabilities, intelligence and applications. These solutions include a full range of general computing servers, high-performance AI training servers, inference servers, liquid-cooled servers, distributed storage systems, high-end multi-control magnetic arrays, integrated training-inference machines and high-speed lossless switches.

In the terminal sector, ZTE has introduced the concept of “AI for All”, focusing on five core consumer scenarios: sports and health, audio and video entertainment, business and travel, home and education, and smart driving. The company has launched a full range of AI-driven terminal products, including smartphones, tablets, laptops and mobile internet devices, as part of its Full-Scenario Intelligent Ecosystem 3.0. This ecosystem promotes the integration of AI technology across mobile terminal devices, smart home devices, cloud computing and automotive electronics.

Moving forward, ZTE is dedicated to advancing its core technological innovations and accelerating its expansion into the “connectivity + computing + capability + intelligence” domain. The company will focus on strengthening its digital and intelligent infrastructure. By fostering open collaboration and pursuing diverse, mutually beneficial partnerships, ZTE aims to build a highly efficient and intelligent digital future with industry partners. The company said it expects: gradual adoption of 5G-Advanced, further rollout of 400G optical and construction of intelligent computing centers to drive the China’s telecom carrier market in the second half. Offshore, it will continue to focus on large national markets and big telcos for its wirelines and wireless product lines.

References:

https://www.lightreading.com/finance/zte-s-carrier-sales-slump-9-in-h1

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0816/2024081601602.pdf

ZTE reports H1 2024 revenue of RMB 62.49 billion and net profit of RMB 5.73 billion

ZTE reports higher earnings & revenue in 1Q-2024; wins 2023 climate leadership award

China Telecom with ZTE demo single-wavelength 1.2T bps hollow-core fiber transmission system over 100T bps

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

Türk Telekom and ZTE trial 50G PON, but commercial deployment is not imminent

ZTE sees demand for fixed broadband and smart home solutions while 5G lags

AI RAN Alliance selects Alex Choi as Chairman

Backgrounder:

The AI RAN Alliance, formed earlier this year, is a groundbreaking collaboration aimed at revolutionizing the RAN industry. Partnering with tech giants, the goal is to transform traditional Radio Access Networks (RANs) into intelligent, self-optimizing systems using advanced AI technologies. Their website states:

Bringing together the technology industry leaders and academic institutions, the AI-RAN Alliance is dedicated to driving the enhancement of RAN performance and capability with AI. Moreover, we aim to optimize RAN asset utilization, and unlock new revenue streams. By pioneering AI-based innovations in RAN, we aspire to profitably propel the telecom industry towards 6G.

The alliance’s founding members include Amazon Web Services, Inc. (AWS), Arm, DeepSig Inc. (DeepSig), Telefonaktiebolaget LM Ericsson (Ericsson), Microsoft Corporation (Microsoft), Nokia, Northeastern University, NVIDIA, Samsung Electronics, SoftBank Corp. (SoftBank) and T-Mobile USA, Inc. (T-Mobile).

The group’s mission is to enhance mobile network efficiency, reduce power consumption, and retrofit existing infrastructure, setting the stage for unlocking new economic opportunities for telecom companies with AI, facilitated by 5G and 6G.

Image Courtesy of the AI RAN Alliance.

Purpose:

The AI RAN Alliance is dedicated to eliminating the inefficiencies of traditional RAN systems by embedding AI directly into network infrastructures. This shift will enable, for example, dynamic resource allocation, predictive maintenance, and proactive network management.

Industry Benefits:

Enhanced Network Efficiency: Real-time optimized bandwidth allocation and improved user experiences.

Economic Advantages: Cost savings from AI-driven automation and reduced energy consumption.

Innovative Revenue Opportunities: New services such as real-time AI Assistants on your mobile devices.

Key Focus Areas:

- AI for RAN

- AI on RAN (RAN for AI)

- AI and RAN

………………………………………………………………………………………………………………………….

New AI RAN Alliance Chairman:

On August 15, 2024, the AI RAN Alliance appointed Dr. Alex Jinsung Choi, Principal Fellow of SoftBank Corp.’s Research Institute of Advanced Technology as Chairman.

“The AI-RAN Alliance is set to transform telecommunications through AI-RAN advancements, increased efficiency, and new economic opportunities,” said Choi. “As Chair, I’m excited to lead this AI-RAN initiative, working with industry leaders to enhance mobile networks, reduce power consumption, and modernize infrastructure with 5G and 6G with AI/ML. Our goal is to drive societal progress through AI-RAN, transitioning from traditional to next-generation communications infrastructure.”

Satadal Bhattacharjee, Sr. Director of Marketing, Infrastructure BU, ARM, said, “We’re excited to collaborate with Choi, the Chair of the AI-RAN Alliance. Like Choi, we believe that AI will fundamentally change the way wireless services are deployed, fostering broad innovation and enhancing operational efficiency. We look forward to working with key industry leaders from silicon to software to fulfill the promise of ubiquitous AI and 6G.”

Jim Shea, Co-founder and CEO of DeepSig, said, “As a pioneer in AI-native communications together with his prior experience growing the O-RAN ALLIANCE, Choi will lead this important initiative that is shaping the future of intelligent radio access networks. DeepSig’s extensive AI/ML wireless expertise will play a key role in this exciting collaboration to leverage advanced technologies to help the industry unlock unprecedented network efficiency and accelerate innovation.”

Mathias Riback, VP & Head of Advanced Technology U.S., Ericsson, said, “I’m thrilled to welcome Dr. Choi as Chair of the AI-RAN Alliance. As a non-standardization organization, the Alliance can uniquely complement the work of existing SDOs by focusing on shaping innovative use cases that integrate AI with RAN. In addition to realizing benefits from AI in RAN implementations, it will be important to advance ‘AI on RAN’ use cases, where mobile networks play a critical role in enabling AI applications. Ericsson is fully committed to fostering a collaborative environment that unites all players in the evolving AI ecosystem to shape the future of telecom together.”

Shawn Hakl, VP of 5G Strategy, Microsoft, said, “At Microsoft, we recognize artificial intelligence (AI) as a pivotal technology of our era. We are excited to be a part of the AI-RAN Alliance and are particularly pleased to see Choi step into the role of Chair. Choi’s leadership will be key as we collaborate to leverage AI in optimizing RAN infrastructure investments and expanding the capabilities of RAN to introduce new AI-driven services for modern mobile applications.”

Ari Kynäslahti, Head of Strategy and Technology, Mobile Networks at Nokia commented, “Nokia is proud to be part of the AI-RAN Alliance and contribute towards integrating AI into radio access networks. The potential of AI to optimize networks, predict and resolve issues, and enhance performance and service quality is significant. As we embark on this transformative journey, collaboration is essential to harness our collective expertise. We are pleased to see Dr. Alex Choi appointed to this role, and look forward to him guiding our efforts to achieve these goals.”

Tommaso Melodia, William L. Smith Professor, Northeastern University, said, “We are pleased to have Choi as the Chair of the AI-RAN Alliance, leading our efforts to transform the industry. Choi has been a strong advocate for the evolution towards a more open, software-driven, and AI-integrated future. Under Choi’s leadership, the AI-RAN Alliance is set to fast-track the development of new services and use cases by leveraging openness, softwarization, and AI integration to enhance network performance, energy efficiency, spectrum sharing, and security, ultimately redefining the landscape of global communications.”

Soma Velayutham, GM, AI and Telecoms, NVIDIA, said, “The AI-RAN Alliance is a critical initiative for advancing the convergence of AI and 5G/6G technologies to drive innovation in mobile networks. The consortium’s new leadership will bring a fresh perspective and focus on delivering the next generation of connectivity.”

Dr. Ardavan Tehrani, Samsung Research, AI-RAN Alliance Board of Directors Vice Chair, said, “We are excited to have Dr. Alex Choi leading the AI-RAN Alliance as the Chair of the Board. The Alliance will play a pivotal role in fostering collaboration, driving innovation, and transforming future 6G networks utilizing AI. Under Dr. Choi’s leadership, the Alliance will strive to deliver substantial value to end users and operators through pioneering AI-based use cases and innovations.”

Ryuji Wakikawa, VP and Head of Research Institute of Advanced Technology, SoftBank Corp., said, “SoftBank is committed to realizing an AI-powered network infrastructure, and we strongly believe that Choi’s extensive background and expertise will be a great force in advancing AI-RAN technology and driving significant progress for the mobile industry in this AI era with lightning speed.”

John Saw, EVP and CTO, T-Mobile, said, “We are thrilled to have Alex Choi as Chair of the AI-RAN Alliance. AI is advancing at an unprecedented rate and with our 5G network advantage we have a unique opportunity to harness this momentum. By developing solutions that make the most of both RAN and AI on GPUs — and working alongside Choi and the top industry leaders within the Alliance — we believe there is potential for change that will revolutionize the industry.”

Dr. Akihiro Nakao, Professor, The University of Tokyo, said, “Dr. Alex Jinsung Choi’s appointment as Chair of the AI-RAN Alliance represents a pivotal step in advancing AI within the telecommunications sector. His leadership is expected to unite academic and industry efforts, nurturing the next wave of innovators who will drive the future of AI and telecommunications. This initiative will not only fast-track the adoption of AI across diverse applications but also foster international collaboration and set new standards for efficiency, energy management, resilience, and the development of AI-driven services that will reshape the telecommunications industry and benefit society worldwide.”

……………………………………………………………………………………………………………………………………………….

References:

https://ai-ran.org/news/industry-leaders-in-ai-and-wireless-form-ai-ran-alliance/

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Tech layoffs continue unabated: pink slip season in hard-hit SF Bay Area

A combination of strategic pivots toward the red-hot AI sector and corrections after pandemic-era over hiring have pushed companies across the tech sector to lay off massive number of employees, according to outplacement firm Challenger, Grey & Christmas. Tech companies including Cisco Systems, Intel and Dell have cut tens of thousands of jobs in August, the latest in a year that began with layoffs at companies such as Amazon and Google.

On Wednesday, Cisco announced in a notice posted with the Securities and Exchange Commission that it was laying off 5,500 workers (7% of its employees) as part of an effort to invest more in AI. In a short statement, CEO Chuck Robbins used the term “AI” five times, highlighting the company’s efforts to keep up in the ongoing AI race. Earlier this year, Cisco also laid off 4,000 or 5% of its workforce, saying that the company wanted to “realign the organization and enable further investment in key priority areas.” Cisco joins a litany of other companies like Microsoft and Intuit that have used AI as the justification for mass layoffs.

- As of August 17, 2024, 404 tech companies have laid off 132,498 workers this year, according to layoffs.fyi, a website that tracks tech industry job cuts. This includes major tech companies like Amazon, Google, Microsoft, Tesla, TikTok, and Snap, as well as smaller startups and apps.

- Crunchbase says that in 2023, more than 191,000 workers in U.S.-based tech companies (or tech companies with a large U.S. workforce) were laid off in mass job cuts. In 2022, more than 93,000 jobs were slashed from public and private tech companies in the U.S.

The SF Bay Area has been particularly hard-hit, with companies such as Twitter, Meta, and Salesforce announcing significant job cuts. The layoffs are sending shockwaves through the region’s economy. The tech industry has long been a major driver of growth and employment in the Bay Area, accounting for a significant portion of tax revenue and supporting numerous ancillary businesses. The sudden loss of jobs has raised concerns about a potential economic downturn. Many of the affected workers are highly skilled in areas such as software engineering, product development, and data science.

Here are the largest Bay Area tech company layoffs in 2024 and 2023:

| March 14, 2023 | Meta/FB |

21,000

|

13% | Menlo Park |

| August 1, 2024 | Intel |

18,720

|

15% | Santa Clara |

| January 20, 2023 | Alphabet |

12,000

|

6% | Mountain View |

| Feb 14 & Aug14, 2024 | Cisco Systems | 9,500 | 13% | San Jose |

The tech layoffs have created a fiercely competitive job market, with many qualified individuals seeking new employment. This has put pressure on salaries and benefits, further exacerbating the economic impact. The tech layoffs have also had a psychological toll on the Bay Area community. Many workers have lost their sense of stability and are worried about their financial future. The uncertainty has created a climate of anxiety and stress, particularly among those who are still employed.

Government officials and economic development agencies are working to mitigate the effects of the layoffs. They are providing support services to displaced workers, such as job retraining and placement assistance. However, the full extent of the economic impact remains to be seen. The surge in tech layoffs underscores the cyclical nature of the industry. While the Bay Area has weathered economic downturns in the past, the unprecedented scale of the current tech job cuts raises questions about the long-term health of the tech sector. As companies adapt to a changing economic landscape, the region’s economy is struggling to evolve to meet the challenges and perceived opportunities (e.g. AI).

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.wsj.com/finance/investing/tech-media-telecom-roundup-market-talk-12947dd6

https://futurism.com/the-byte/cisco-layoff-ai-profit

https://news.crunchbase.com/startups/tech-layoffs/

https://www.challengergray.com/tags/job-cut-report/

Massive layoffs and cost cutting will decimate Intel’s already tiny 5G network business

Cisco to lay off more than 4,000 as it shifts focus to AI and Cybersecurity

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

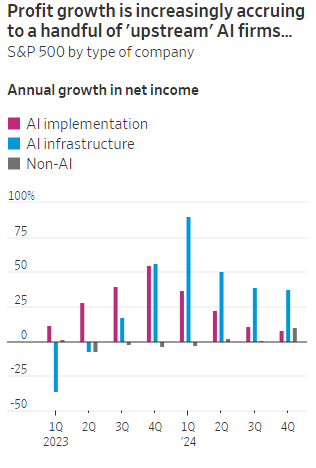

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

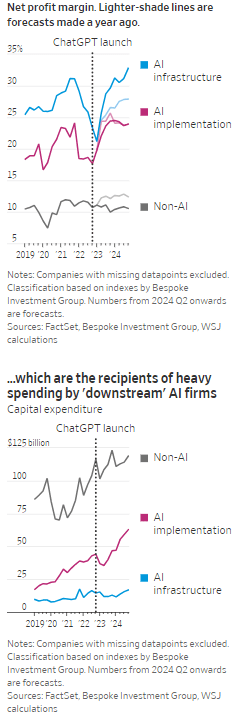

According to the Wall Street Journal, the AI industry has become an “Echo Chamber,” where huge capital spending by the AI infrastructure and application providers have fueled revenue and profit growth for everyone else. Market research firm Bespoke Investment Group has recently created baskets for “downstream” and “upstream” AI companies.

- The Downstream group involves “AI implementation,” which consist of firms that sell AI development tools, such as the large language models (LLMs) popularized by OpenAI’s ChatGPT since the end of 2022, or run products that can incorporate them. This includes Google/Alphabet, Microsoft, Amazon, Meta Platforms (FB), along with IBM, Adobe and Salesforce.

- Higher up the supply chain (Upstream group), are the “AI infrastructure” providers, which sell AI chips, applications, data centers and training software. The undisputed leader is Nvidia, which has seen its sales triple in a year, but it also includes other semiconductor companies, database developer Oracle and owners of data centers Equinix and Digital Realty.

The Upstream group of companies have posted profit margins that are far above what analysts expected a year ago. In the second quarter, and pending Nvidia’s results on Aug. 28th , Upstream AI members of the S&P 500 are set to have delivered a 50% annual increase in earnings. For the remainder of 2024, they will be increasingly responsible for the profit growth that Wall Street expects from the stock market—even accounting for Intel’s huge problems and restructuring.

It should be noted that the lines between the two groups can be blurry, particularly when it comes to giants such as Amazon, Microsoft and Alphabet, which provide both AI implementation (e.g. LLMs) and infrastructure: Their cloud-computing businesses are responsible for turning these companies into the early winners of the AI craze last year and reported breakneck growth during this latest earnings season. A crucial point is that it is their role as ultimate developers of AI applications that have led them to make super huge capital expenditures, which are responsible for the profit surge in the rest of the ecosystem. So there is a definite trickle down effect where the big tech players AI directed CAPEX is boosting revenue and profits for the companies down the supply chain.

As the path for monetizing this technology gets longer and harder, the benefits seem to be increasingly accruing to companies higher up in the supply chain. Meta Platforms Chief Executive Mark Zuckerberg recently said the company’s coming Llama 4 language model will require 10 times as much computing power to train as its predecessor. Were it not for AI, revenues for semiconductor firms would probably have fallen during the second quarter, rather than rise 18%, according to S&P Global.

………………………………………………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………………………………………………..

A paper written by researchers from the likes of Cambridge and Oxford uncovered that the large language models (LLMs) behind some of today’s most exciting AI apps may have been trained on “synthetic data” or data generated by other AI. This revelation raises ethical and quality concerns. If an AI model is trained primarily or even partially on synthetic data, it might produce outputs lacking human-generated content’s richness and reliability. It could be a case of the blind leading the blind, with AI models reinforcing the limitations or biases inherent in the synthetic data they were trained on.

In this paper, the team coined the phrase “model collapse,” claiming that training models this way will answer user prompts with low-quality outputs. The idea of “model collapse” suggests a sort of unraveling of the machine’s learning capabilities, where it fails to produce outputs with the informative or nuanced characteristics we expect. This poses a serious question for the future of AI development. If AI is increasingly trained on synthetic data, we risk creating echo chambers of misinformation or low-quality responses, leading to less helpful and potentially even misleading systems.

……………………………………………………………………………………………………………………………………………

In a recent working paper, Massachusetts Institute of Technology (MIT) economist Daron Acemoglu argued that AI’s knack for easy tasks has led to exaggerated predictions of its power to enhance productivity in hard jobs. Also, some of the new tasks created by AI may have negative social value (such as design of algorithms for online manipulation). Indeed, data from the Census Bureau show that only a small percentage of U.S. companies outside of the information and knowledge sectors are looking to make use of AI.

References:

https://deepgram.com/learn/the-ai-echo-chamber-model-collapse-synthetic-data-risks

https://economics.mit.edu/sites/default/files/2024-04/The%20Simple%20Macroeconomics%20of%20AI.pdf

AI wave stimulates big tech spending and strong profits, but for how long?

AI winner Nvidia faces competition with new super chip delayed

SK Telecom and Singtel partner to develop next-generation telco technologies using AI

Telecom and AI Status in the EU

Vodafone: GenAI overhyped, will spend $151M to enhance its chatbot with AI

Data infrastructure software: picks and shovels for AI; Hyperscaler CAPEX

KT and LG Electronics to cooperate on 6G technologies and standards, especially full-duplex communications

In a joint statement, KT (South Korea’s #2 mobile network operator) and LG Electronics will work together to promote 6G technology research and technology standardization. The two companies plan to develop full-duplex communication technology, global standardization cooperation (presumably in 3GPP and ITU-R WP5D for IMT-2030), and 6G application services and next-generation transmission technologies. The companies had previously announced partnerships to develop AI service platforms and AI service robots.

Full-duplex communications will be introduced as part of the 5G-Advanced Release 18 and is expected to increase spectrum efficiency by enabling uplink and downlink data to be simultaneously transmitted and received over a single frequency band. The companies said it can increase frequency efficiency by up to two times. They will design technologies that operate in the 6G candidate frequency bands and transmit and receive simultaneously to verify actual performance. The duo also plan to promote global standardization of 6G (that can only be done by ITU-R IMT-2030 recommendations).

“Through this 6G research and development collaboration with LG Electronics, KT expects to lead the development of 6G mobile communication technology and strengthen its global standardization leadership,” said Lee Jong-sik, executive director of KT Network Research Institute. “We will do our best to secure innovative network technology and capabilities for providing differentiated services.”

Je Young-ho, executive director of LG Electronics C&M Standard Research Institute added: “LG Electronics has been proactively leading research and development to discover core 6G technologies since 2019,” and added, “Through our collaboration with KT, we expect to contribute greatly to not only leading 6G standardization, but also discovering core services.”

…………………………………………………………………………………………………………………………………………………………………………………………………

Singtel and SK Telecom announced a partnership last month to collaborate on 6G research, including new network slicing capabilities, a fully disaggregated network, and new telco APIs based on Open Gateway. Earlier this year, Samsung and Arm began conducting joint research into parallel packet processing technology, which it described as one of the ‘key software technologies in next-generation communications’ to accelerate 6G software development, while Nvidia launched its 6G Research Cloud Platform, which includes a a digital twin that can simulate 6G systems, a software-defined, full RAN stack that researchers can play around with the Nvidia Sionna Neural Radio Framework which enables developers to use Nvidia GPUs to generate and capture training data.

…………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.koreaittimes.com/news/articleView.html?idxno=133845

https://www.telecoms.com/5g-6g/kt-and-lg-looking-to-take-the-lead-in-6g

https://news.koreaherald.com/view.php?ud=20210406000119

https://www.koreatimes.co.kr/www/tech/2024/06/129_334571.html

South Korea government fines mobile carriers $25M for exaggerating 5G speeds; KT says 5G vision not met

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

SK Telecom (SKT) and Nokia to work on AI assisted “fiber sensing”

SK Telecom (SKT) and Nokia have agreed to work on artificial intelligence (AI) assisted “fiber sensing,” a wired network technology that employs AI to monitor the environment around optical cables. The two companies signed a memorandum of understanding (see photo below) last Wednesday, with a plan to “accumulate empirical data based on machine learning” from SKT’s commercial network. SKT, South Korea’s largest mobile network carrier, said on Monday that it will utilize Nokia’s product to detect earthquakes, climate changes and other unexpected situations that might arise from nearby construction areas in order to stabilize network conditions. The objective is nationwide deployment in South Korea by the end of this year.

In a joint statement, the companies explained when data runs through an optical cable, the phase of the light can change due to various factors like temperature fluctuations or physical strain on the cable. The changes can be detected and analyzed to provide precise measurements of the environmental conditions affecting the fiber. Using AI-based technology, SKT and Nokia aim to stabilize fiber optic networks in advance by tracking the impact of weather conditions and construction on optical cables. The statement added “fiber sensing” has no distance limitations, unlike some existing wired network monitoring technologies, making it possible to quickly apply the new technology to major backbone networks.

SKT-Nokia monitors wired network status with AI:

– Tracking the impact of weather, earthquakes, construction, etc. on optical cables with ‘fiber sensing’ technology

– Immediately applicable to existing networks and no distance restrictions, making it easy to apply to backbone networks

– Both companies’ capabilities will be combined to quickly internalize new AI-based wired network technology

A signing ceremony for the memorandum of understanding took place at SK Telecom’s headquarters Wednesday in central Seoul. SK Telecom’s Ryu Jung-hwan, head of infrastructure strategy and technology, and John Harrington, Nokia’s senior vice president and head of network infrastructure sales for the Asia-Pacific region, attended the event.

SK Telecom’s Ryu Jung-hwan, head of infrastructure strategy and technology, right, and John Harrington, Nokia’s senior vice president and head of network infrastructure sales for the Asia-Pacific region, pose for a photo after a signing ceremony at SK Telecom’s headquarters in central Seoul on Wednesday, August 7th. Photo Credit: SK TELECOM

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

In July, SKT and Singtel announced that they have signed a Memorandum of Understanding (MoU) to collaborate on building next-generation telecommunications networks that will drive innovation, improve network performance and security and deliver enhanced customer experiences over the next two years. The partners will explore the use of artificial intelligence (AI), orchestration tools, and deepen the domain knowledge of network virtualization and other technologies – central to laying the necessary building blocks for progressing to 6G.

References:

https://www.linkedin.com/feed/update/urn:li:activity:7228552138988134402/

Cisco to lay off more than 4,000 as it shifts focus to AI and Cybersecurity

Reuters reports that Cisco Systems will cut thousands of jobs in its second round of layoffs this year. The number of people affected could be similar to or slightly higher than the 4,000 employees Cisco laid off in February, and will likely be announced as early as Wednesday with the company’s fourth-quarter results.

The San Jose, CA headquartered networking company plans to shift its product focus to higher-growth areas, such as AI and cybersecurity. It’s current set of products and services are listed here.

Cisco has been contending with weakening demand and persistent supply chain issues in its core business – routers and switches – that are used by ISPs and enterprise private networks. Two reasons for that are: 1.] the major cloud service providers design their own switch/routers or use bare metal switches (made by ODMs in Taiwan and China), and 2.] enterprise private/virtual private networks are being replaced by cloud network solutions.

- Global enterprise network sales have been declining. Dell’Oro Group reported sales contractions in Branch Routing and Campus Switching in 4Q-2023 and that is expected to continue throughout most of 2024. On premises data centers (which use Cisco Ethernet switches) are not growing. In its place……

- Enterprise spending on cloud infrastructure services is growing by leaps and bounds. It’s now nearing $80 billion per quarter. Cloud customers increased their spending on cloud services by $14.1 billion to $79.1 billion in the 2Q-2024, an increase of 22% year-over-year. It’s the third consecutive quarter in which the year-over-year growth rate was 20% or more, with generative AI being one of the factors behind the market acceleration.

……………………………………………………………………………………………………………………………………………

As a result of stagnant sales of its core networking products, Cisco has been pursuing a strategy aimed at diversifying its revenue streams. One of the most significant moves in this direction was the $28 billion acquisition of Splunk, a cybersecurity firm, which was finalized in March. This purchase is expected to boost Cisco’s subscription-based services, reducing its dependence on one-time hardware sales, which have been increasingly susceptible to market volatility.

Cisco’s major shift towards AI is a key part of its long-term strategy. In May, the company reiterated its ambitious goal of achieving $1 billion in AI-related product orders by 2025. This target is supported by a $1 billion fund launched in June, aimed at investing in AI startups such as Cohere, Mistral AI, and Scale AI. Over the past few years, Cisco has made over 20 AI-focused acquisitions and investments, highlighting its commitment to integrating AI into its product offerings.

……………………………………………………………………………………………………………………………………………..

Over 126,000 employees have been laid off across 393 tech companies since the start of the year, according to data from tracking website Layoffs.fyi. That surely reflects their need to cut costs to balance huge investments in AI, analytics and related technologies.

……………………………………………………………………………………………………………………………………………..

References:

https://www.cisco.com/c/en/us/products/index.html#~products-by-technology

Cisco to Implement Second Round of Layoffs Amidst Strategic Shift to AI and Cybersecurity

Worldwide Enterprise Network Spending Follows Roller Coaster Trajectory

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products