Month: August 2021

Broadcom, Cisco and Facebook Launch TIP Group for open source software on 6 GHz Wi-Fi

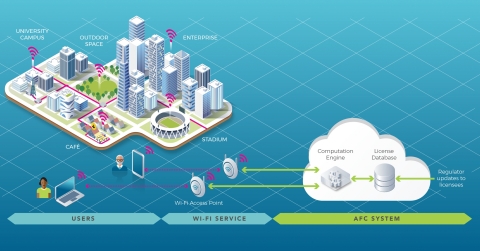

The purpose of this new TIP project group is to develop a common reference open source software for an AFC system. The AFC will be used by unlicensed devices in the newly available 6 GHz band to operate outdoor and increased range indoor while ensuring incumbent services are protected.

The US, EU, Canada, and Brazil, among others, have approved or are finalizing the approval of 6 GHz unlicensed spectrum use, opening up a huge bandwidth for Wi-Fi services.

By 2025, the Wi-Fi Alliance estimates that the 6 GHz Wi-Fi will deliver USD 527.5 billion in incremental economic benefits to the global economy [1]. Standard outdoor power operations will be a key part of the value proposition of 6 GHz Wi-Fi and is critical for enabling more affordable wireless broadband for consumer access.

The FCC is the first regulator to enable its use under an AFC, ISED Canada authorized standard power with AFC in May 2021, with others expected to follow. The AFC will enhance Wi-Fi to provide a consistent wireless broadband user experience in stadiums, homes, enterprises, schools, and hospitals.

“The 6 GHz Wi-Fi momentum is unmistakable. In the year following the historic FCC ruling to open up the band for unlicensed access, we already have an entire ecosystem of Wi-Fi 6E devices delivering gigabit speeds indoors. As we work towards closing the digital divide and further realizing the value of the 6 GHz band, AFC-enabled standard power Wi-Fi operation becomes critical. As Wi-Fi 7 comes along, AFC will turbocharge the user experience by enabling over 60 times more power for reliable, low latency, and multi-gigabit wireless broadband both indoors and outdoors. With this vision in mind, Broadcom is excited to join hands with Cisco and Facebook to create the TIP Open AFC Software Group aimed at enabling a cost effective and scalable AFC system,” said Vijay Nagarajan, Vice President of Marketing, Wireless Communications & Connectivity Division, Broadcom.

“The creation of the TIP Open AFC Software Group represents the immense momentum behind unlicensed spectrum and the potential it holds to deliver innovation,” said Rakesh Thaker, VP of Wireless Engineering, Cisco. “Many of the applications and use cases we’re just beginning to dream up with the introduction of Wi-Fi 6 and the 6 GHz spectrum will rely on standard power, greater range and reliability. This software group will play an important role in ensuring those applications can become reality, while also protecting important incumbent services. We’re thrilled to join Broadcom and Facebook on this effort, and to share a vision with TIP of providing high-quality, reliable connectivity for all.”

Facebook developed a proof of concept Open AFC system, which will protect 6 GHz incumbent operations and enable faster adoption of standard power operations in the 6 GHz band. This prototype system will be contributed to the TIP community through today’s launch of the Open AFC Software Group, with the goal of enabling the proliferation of standard power devices in the United States to start, with other markets to follow.

Broadcom and Cisco have committed to driving the industry forward in developing Open AFC to ensure that the code continues to be developed to meet the needs of the industry and regulators, such that an AFC operator could take the code and build upon it for rapid certification.

The vast majority of Wi-Fi use is indoors, but there are situations where people will want to use Wi-Fi outdoors. The use of AFC provides the flexibility for outdoor deployments in open air stadiums and similar venues.

“Bringing AFC technology to the TIP Open AFC Software Group is a huge milestone for the unlicensed spectrum community,” said Dan Rabinovitsj, vice president for Facebook Connectivity. “We are excited to see the contributions and innovations by Open AFC and we look forward to celebrating the widespread adoption of the 6 GHz band, which will rapidly accelerate the performance and bandwidth of Wi-Fi networks around the world”.

David Hutton, Chief Engineer of TIP, said: “The industry is coming together to support 6 GHz for unlicensed use for Wi-Fi and TIP will be providing the forum to contribute to make this happen, supporting regulatory efforts by ensuring that AFC systems are developed under a common code base that is available to all industry stakeholders.”

Closing Comment:

We wonder why this new WiFi 6GHz group is in TIP rather than the WiFi Alliance. From the WiFi Alliance Certified 6:

“Wi-Fi Alliance is leading the development of specifications and test plans that can help ensure that standard power Wi-Fi devices operate in 6 GHz spectrum under favorable conditions, avoiding interference with incumbent devices.”

In this author’s opinion, there are way too many alliances/ fora/ consortiums that produce specifications that are to be used with existing standards. In this case (IEEE 802.11ax) there is potential overlap amongst amongst groups, which leads to inconsistent implementations that inhibit interoperability.

References:

Verizon CFO talks up fixed wireless, C-band, mmWave, infra bill; Says no to cloud based 5G core

Speaking at an Oppenheimer investor conference, Verizon’s CFO Matt Ellis said the telco is very optimistic about its fixed wireless business (that despite its FTTH leadership position with FiOS):

Yes, I’m very excited about it (fixed wireless). I think it continues to be a very significant opportunity for us as we think about the next few years ahead of us. We’ve talked about how great the LTE network is and it’s been obviously a very, very huge part of our success. But when you bring the bandwidth that comes in 5G, it really opens up the opportunity, not just do mobility wirelessly but also to do home broadband wirelessly as well. So as I think about fixed wireless in kind of 3 different buckets, the first is our millimeter-wave bucket and our 5G home internet. That’s now in almost 50 markets across the country, continuing to expand the number of open for sale as we build out the millimeter-wave network. The second piece that’s in market today is our 4G Home, which we launched late last year. It’s now available in over 200 markets in every — in parts of all 50 states. So we recently doubled the amount of the size of the footprint that our 4G Home is available. And then it comes back to my comment on to the previous questions around monetizing the network that we’ve built and where we have the capacity in addition to our Mobility customers to offer the LTE Home product. We’re doing that. We’re seeing good take rates on that. Customers are seeing great performance on it.

And then last month, we upgraded the hardware, you think the router that customers get. So it doesn’t just support LTE Home, it’s also got C-band in it. So as soon as we turn the C-band network on, that customer can upgrade to 5G Home on C-band without having to change out hardware. So we’re excited that we’re starting to populate the base of LTE Home customers with customers that already have a C-band-ready device and C-band being the third one of the levers here within fixed wireless access. So excited about the opportunity that will kick in when we turn C-band on later this year. But fixed wireless access gives us the opportunity to monetize the network in a way that we haven’t previously been able to, where we can offer not just mobility solutions for our consumers but also home broadband and also for businesses as well. We talk about fixed — LTE Home, but we also have the similar product in 5G Home for business as well. You think 5G office the same way. So it gives us the opportunity to take that network that you built out mobility and yet monetize it with another use case. We’re just scratching the surface here, and I think the next few years are going to be very exciting for us on fixed wireless access.

Ellis also commented about the $1T U.S. infrastructure bill that passed the Senate today (August 10th). He said it takes a technology-neutral approach to broadband funding which would allow Verizon to deploy a mix of fiber and fixed wireless access.

I think one of the important things in the way that the bill has been crafted at this point in time is that it doesn’t favor any particular technology. It’s more based off of outcomes. And so there’s areas where it could make sense to build more broadband. There’s areas where it makes sense to provide a better experience to customers through building out fixed wireless faster than otherwise may happen. So we think it’s a good approach that’s in the bill today. Obviously, it’s got to get all the way through the legislative process. But certainly, the requirement that we continue to build out high-quality broadband throughout the country is something that the bill is focused on, is something that we’re very supportive of. And now we’re looking at geography by geography, where do we think it would make the most sense to either deploy fiber or to deploy fixed wireless as a solution to bring that to the faster broadband to consumers and businesses.

Asked how C-band and mmWave deployments are performing versus your expectations, Matt replied:

For mmWave, we’ve been deploying it for a couple of years now. And we set a target this year to do another 14,000 sites. We’re ahead of pace on that already and that’s by design. We wanted to be ahead of pace in the first half of the year on millimeter-wave, so that when the C-band started picking up in the second half of the year, we had the capacity to do that as well. But the millimeter wave equipment is up and running, has been for a couple of years and is working very well.

On the C-band side, we said we’d have 7,000 to 8,000 sites up by the end of the year or when we launch in December, the expected launch date. But the vast majority of those radios, we already have in our warehouses. The rest of them, purchase orders are out there for the vast majority that we haven’t already received. So I know there’s been a fair amount of concern about the supply chain, just given what we’re seeing not just in our sector but across all sectors with chipsets. I can tell you that in terms of building out the radios for the C-band, those are in good shape.

And we’ve started to test those and we’ve got the first few sites up. Obviously, we can’t turn those on yet because we don’t have the licenses approved from the FCC until we get to the clearing date. But with the early testing we’ve been doing, we’re seeing the equipment perform as we would expect it to, which really isn’t a surprise. This is one of the things that made C-band such an attractive spectrum for us because it’s a global 5G band. And so our partners at Samsung and Nokia and Ericsson aren’t just building C-band equipment for the U.S. market. And so they’ve got the scale there to really have high-performing equipment available. So the supply chain ecosystem is bringing the radio equipment to market as we expected it to.

Noting that some competing telcos (especially AT&T) are looking to take advantage of cloud-based technologies to lower network costs, operating costs, the Oppenheimer moderator asked if Verizon was looking at doing the same? “Or what are you doing on that front?”

Absolutely, we’ve been deploying cloud technologies for the last few years now, both within the network and also within the core operations of the business. It brings significant efficiencies in the right place. We went through an interesting transition from cloud from the standpoint of initially being skeptical about it. Kind of how comfortable am I moving these applications and so on into the cloud?

Then you get comfortable with it and you say, okay, we’re going to move everything. And then if you look at it further, you think about there are some things that some should move and there’s some things that shouldn’t.

And so the team has done a really good job over the past few years of identifying where it makes sense for things to move (to the cloud), and we’ve got that underway. Some things have transitioned already. Other things are still in the process of transitioning.

And then there are some pieces where we don’t think it makes sense, because of the scale we have and so on, and there are certain pieces like the network core [1.], for example, is something that we have our own cloud product that we’re deploying there that we think that’s part of what makes Verizon.

So it’s an application-by-application analysis. That analysis is largely done. Where it makes sense to do to transition to public cloud, we have. Where it doesn’t, we won’t. But it really comes down to finding the most efficient and effective ways of running all parts of the business.

Note 1. Cloud Native 5G Core Network:

The 3GPP System architecture for the 5G System (5GS); Stage 2 [3GPP TS 23.501] specifies a Service Based Architecture (SBA), where the control plane functionality and common data repositories of a 5G network are delivered by way of a set of interconnected Network Functions (NFs), each with authorization to access each other’s services. “Network functions within the 5GC Control Plane shall only use service-based interfaces for their interactions.”

The latest 3GPP TS 23.501 V17.1.1 spec is dated June 24, 2021, so its a work in progress for 3GPP Release 17 (not yet approved).

Although the 5G Core (5GC) implementation is the choice of the network operator, in practice, the expectation is that 5GC will be deployed on software-defined infrastructure which implies a “cloud-native” deployment. In broad terms, this means 5GC implementations that use microservices, containers, centralized orchestration, CI/CD, open APIs, service meshes, and more such new cloud software jargon.

Network Functions are self-contained, independent and reusable. Each Network Function service exposes its functionality through a Service Based Interface (SBI), which employs a well-defined REST interface using HTTP/2.

ETSI (3GPP’s host and secretariat) is transposing their 5G specifications which then become ETSI standards. There is no equivalent work being done in ITU-T.

……………………………………………………………………………

References:

https://www.3gpp.org/ftp/Specs/archive/23_series/23.501/

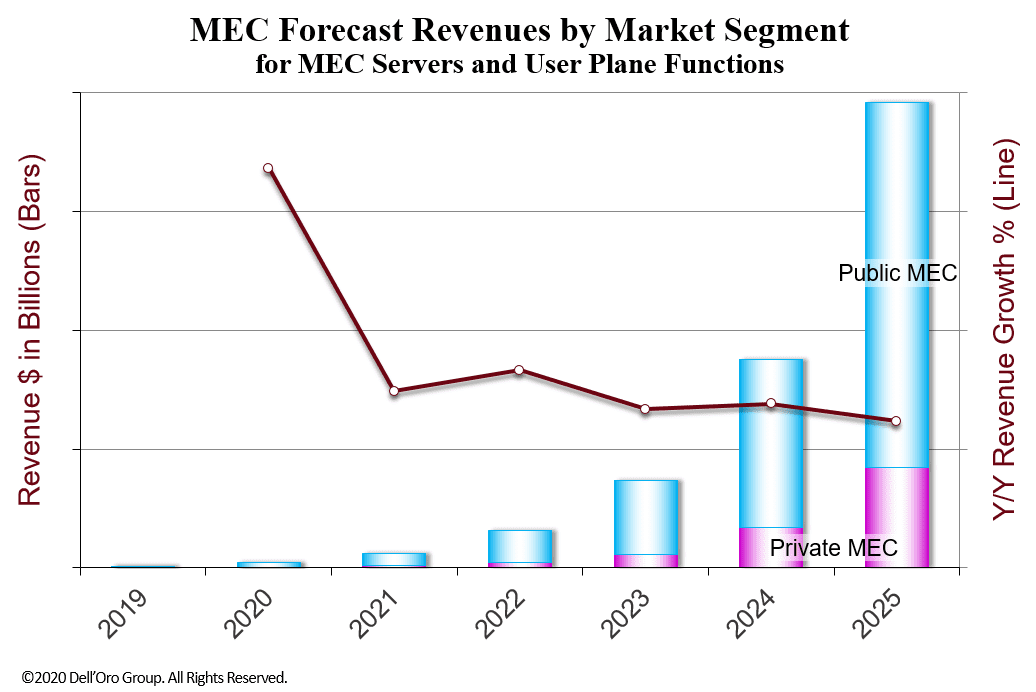

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Dell’Oro Group has published an update to its Multi-Access Edge Computer (MEC) 5-year forecast report. According to Dave Bolan, Research Director, Dell’Oro has lowered their expectations from the previous forecast, because of the slower start than anticipated for 5G SA buildouts, especially for federated MEC capability.

Dish Network’s 5G test network delayed; no firm date for commercial 5G service

We all know that Dish Network’s satellite TV business has been declining for years. Their prepaid Boost Mobile MVNO business is also declining, but that isn’t very important either.

[Dish’s existing prepaid business is largely from the acquisition of the Boost business from T-Mobile, Dish lost 201,000 subscribers in the period, fewer than the -254,000 expected by analysts, but more than the -132,000 expected by New Street Research. Dish ended the quarter with 8.89 million retail wireless subs.]

What really matters is the 5G/O-RAN business they are building with help from Amazon’s AWS. We may not find out anything important about that business for months. See analyst comment at the end of this article.

Dish’s planned 5G test market in Las Vegas, NV will show us whether they can get the network to work. Will they be able to do it for less than the $10B CAPEX to which they have estimated?

That 5G test network is about a quarter behind schedule! The company now says it will run a beta trial for at least 90 days there before pushing ahead with a commercial launch in Las Vegas, possibly in early 2022. However, the timing of commercial 5G is uncertain as per remarks by W. Erik Carlson, Dish President and Chief Executive Officer on their 2Q2021 earnings call:

“We have to see what — how our beta goes, right. So I’m going to beta test now, for service of a different sort then I think about nine months in the beta. So it depends on — we don’t think that’s where we are. But we have to get more data on the beta to know when we roll that. We want to roll — we get a first impression, and we want it to be a good first impression. Obviously we have — we do — and as soon as — everything we learn in Vegas goes directly into the other network, so we can line up it the same time. So the bottom line is that it’s going to be a minimum 90 days, and if we do our jobs correctly and our vendors do our jobs correctly, then we’re going to be ready for prime time at the first of the year.”

……………………………………………………………………………………..

Dish will have 5G construction activities in Las Vegas “substantially complete” within the next 60 days and prior to the end of Q3 2021, Dave Mayo, Dish’s EVP of network development, said Monday on Dish’s Q2 2021 earnings call.

“I think we’ll be in beta for a minimum of 90 days,” said Charlie Ergen, Dish’s chairman, noting that the initial network launch there will feature Dish’s 5G core network being placed in the cloud.

Most of the traffic for the trial will run on Dish’s 5G network. But Ergen noted that the added integration of AT&T’s network in the wake of the recently signed network deal between Dish and AT&T, alongside work already underway to tie into T-Mobile’s network, is one of the reasons for the anticipated 3 month duration of the Las Vegas 5G trial. However, he expects most of the 5G network usage in Las Vegas to run on Dish’s network with AT&T’s network in support.

[Dish’s new MNVO agreement with AT&T means that their focus for the next five years can be on the FCC’s buildout requirements – 70% of each AWS-3 license by June 2025 – and they no longer need to worry after that.]

Dish has yet to announce pricing and packaging for the Las Vegas beta trial and beyond. “We will have a retail presence and we will have offers for consumers that we think will be competitive,” said Ergen. Dish is already seeking testers through its “Project Gene5is” sign-up site.

Dish has commenced 5G network construction on close to 30 “geographies” within the four regions and 36 markets being targeted via the company’s decentralized approach, said Mayo. Much of that early market activity centers on where Dish is collocated with tower companies.

“In that regard we’ve signed substantially all of the leases that are required to meet our 20% mandate for next June and have received notices to proceed on close to one-third of the sites,” said Mayo, noting that, in some cases, there are multiple geographies within a market that are being targeted.

Dish has signed tower lease agreements with each of the big four cell tower companies. Dish Network’s SEC 10-Q report states their “other long-term obligations,” which represent “minimum payments related to tower obligations, certain 5G Network Deployment commitments and satellite-related and other obligations.”

The total tower obligation is up from $8.5B last quarter to $8.8B his quarter, with the largest increase (more than $400M) now called for over the balance of 2021.

Ergen also allowed that it’s “plausible” that Dish could work with enterprise customers to help finance some of the 5G buildout, particularly among those that would use slices of Dish’s 5G network to power private networks.

…………………………………………………………………………………

Stephen Bye, EVP and chief commercial officer for Dish’s wireless business, confirmed that the deal does enable AT&T to deploy Dish’s spectrum for all customers on its network.

“We’re seeing significant traction and interest today in private networks and private 5G networks, and the architecture we’re deploying really enables a level of control and a much deeper layer of security that allows the enterprise to utilize that network for their own business operations,” said Bye.

He added that Dish is responding to multiple requests from enterprises and currently working on proof of concepts. “We’re seeing interest across every vertical and every industrial segment and we’re very well positioned to take the architecture that we’re deploying, being cloud native, but also the open architecture and the ability to do (network) slicing, it is distinctively unique compared to what the operators have in the market today.”

…………………………………………………………………………………….

Dish has not announced a fixed wireless broadband for its upcoming 5G network, but Ergen said he wouldn’t rule it out amid ongoing government-backed subsidy efforts focused on unserved or underserved parts of the country.

“I think fixed wireless is a place where the wireless industry can go,” he said, citing Verizon’s and AT&T’s activity there. The amount of money being plowed into infrastructure is a “positive for all connectivity companies,” Ergen added.

……………………………………………………………………………………….

Analyst and colleague Craig Moffett was not able to value Dish Network as a company, because of so many unknowns about their 5G/O-RAN efforts. He wrote in a note to clients:

There is little one can do here to arrive at an empirically justifiable valuation. Making estimates for subscribers, ARPU, and operating margins would be, at this point, absurd; we have no basis for estimating any of those. So what’s left is merely… sentiment.

Is building a 5G network going to be a good idea? Can it be done at a reasonable cost? If one believes the answer to these questions is “yes,” then one will be positively inclined towards Dish’s equity. If not, then, well, not. It is very unlikely that we will learn anything more anytime soon. (Edited by Alan J Weissberger)

…………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/dish-pushes-5g-network-availability-to-early-2022/2021/08/

https://edge.media-server.com/mmc/p/nf5rkoha

AT&T to be the primary network services provider for DISH MVNO customers

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

ZTE and China Telecom deploy QCell 5G SuperMIMO solution

ZTE Corporation together with the Quanzhou Branch of China Telecom, have deployed the QCell 5G SuperMIMO solution in Quanzhou, China.

The Qcell 5G SuperMIMO solution can combine Super cell and MU-MIMO technologies, to adaptively perform multi-User Endpoint (UE) space division pairing. The solution is applicable to both digital QCell and traditional distributed antenna systems (DAS), which effectively solves the “interference” vs “capacity” tradeoff, while exponentially increasing user perception.

As the field test results show, the QCell super cell throughput is 1.07Gbps before SuperMIMO is enabled. It reaches 2.2Gbps, 3Gbps and 4.05Gbps respectively after it’s been enabled. That greatly improves user experiences with 2 UE, 3 UE and 4 UE performing services at the same time.

In 2020, ZTE and China Telecom jointly launched the innovative 2.1GHz NR eDAS indoor distribution solution, which is the first 5G network performance improvement solution based on the traditional 2.1GHz NR indoor distribution system in the industry. The solution successfully overcomes the bottleneck of the traditional system.

SuperMIMO has developed into another innovative indoor distribution technology following the eDAS solution, thereby demonstrating the strength of the Quanzhou Branch of China Telecom and ZTE in the research and innovative applications of communication networks.

Moving forward, both parties will be further committed to building high-quality 5G networks for their users through technical innovations.

Quanzhou, China. Photo Credit: ZTE Corporation

…………………………………………………………………………………….

Previously, ZTE and the Jiangsu branch of China Telecom deployed 5G 200 MHz Qcell 4T4R digital indoor distribution system in areas with high amounts of data traffic, such as shopping malls and subway stations, in Xuzhou, China.

The system provides high-quality 5G indoor coverage, and accelerates future 5G indoor system deployment. This commercial deployment has employed ZTE’s latest 5G Qcell ultra-wideband product series, which supports 200MHz continuous ultra-large bandwidth at 3.5 GHz frequency band, and 100MHz+100MHZ dual-carrier aggregation technology that doubles download rate.

References:

https://www.zte.com.cn/global/about/news/20210809e1.html

Jio and Airtel against 5Gi standard; 2 GHz of mid-band needed for India 5G demand

Indian telecom operators have informed the India Department of Telecommunications (DoT) that the so-called Indian component of the ITU 5G RAN recommendation M.2150 (Low Mobility Large Cell/LMLC or 5Gi), doesn’t have a device ecosystem and it should only be considered as optional and non-mandatory for the telecom industry. They said that making the 5Gi standard mandatory would increase prices of smartphones.

Backgrounder:

TSDSI’s 5G Radio Interface Technology, referred to as LMLC or “5Gi” cleared the rigorous processes of International Telecommunication Union (ITU) and has been approved by ITU-R WP 5D and then ITU-R SG5 as a part of Draft Recommendation M.[IMT-2020.SPECS] in its meeting held on 23rd November 2020. That recommendation was approved by ITU-R as recommendation M.2150 early this year.

5Gi, the first ever Mobile Radio Interface Technology contribution from India to become part of ITU-R’s IMT recommendation, went through a rigorous evaluation process of the ITU-R working groups over the past 3 years before getting the approval.

This standard is a major breakthrough for bridging the rural-urban digital divide in 5G deployment due to enhanced coverage. It enables connecting majority of India’s villages through towers located at gram panchayats in a cost effective manner. It has found support from several countries as it addresses their regional needs from a 5G standpoint.

Indian telcos, vendors and chipmakers met the DoT Secretary last week for stakeholder consultation on the 5G ecosystem. The meeting was also attended by members from academia, ICEA, TSDSI, CDoT and chipmakers.

During the meeting, an Airtel representative told the secretary that 5Gi is not globally harmonized and will lead to costly devices and delays in rollout.

Reliance Jio representative also urged the department to avoid mandating any requirements for consumer devices for spectrum, features etc., as they are market driven. “No minimum technology specifications approach for 5G devices,” the company said as per the minutes of meetings accessed by ET.

COAI, which represents telcos and telecom equipment vendors, told the department that 5Gi doesn’t have a device ecosystem and efforts to be made as part of 3GPP [1.].

Note 1. That is a false assertion as TSDSI, which is a member of 3GPP, presented its 5Gi/LMLC to ITU WP 5D as a Radio Interface Technology (RIT) for IMT 2020. After numerous contributions and tests, it was accepted as an integral part of ITU-R recommendation M.2150. LMLC was not contributed to 3GPP for inclusion in their 5G Releases 15 and 16.

…………………………………………………………………………………………

“There will be implications if there is a separate handset production line for India which then can increase prices. We have sought clarification. It is claimed that there will be minor tweaks in handsets,” COAI director general S P Kochhar told ET.

Bharti Airtel once again raised the device ecosystem related issue with the department and said that 5G devices are required to support in all licensed bands auctioned in India including 2100 MHz, 1800 MHz in both standalone and non-standalone 5G modes.

“Handsets must support NSA Carrier Aggregation and Dynamic Spectrum Sharing in FDD and TDD spectrum bands,” Airtel said, adding that devices should also be capable of transmitting “26 dBm” both in NSA and SA modes.

Telecom operators reiterated the need for affordable 5G handsets to drive the uptake of high-speed service upon commercial availability. The cheapest 5G device is currently available at Rs 15,000 but only supports N78 band or the mid-band.

During the meeting, the COAI said that 5G standards should support both consumers, industry, and the Indian government must play a facilitating role.

“We are most happy if the local 5G standard is globally harmonized. Globalization will help in lowering the cost of devices and achieving scale. It will also make India an export hub for 5G handsets. Harmonization with 3GPP is crucial even as there is substantial progress for 5Gi with the ITU,” Kochhar said.

Responding to ET’s queries, Prof. Bhaskar Ramamurthi, Director IIT Madras, former Chair-TSDSI and Chief proponent of 5Gi said that 5G handsets require only minor firmware and software changes to become 5G+5Gi handsets, which will not lead to any increase in costs as confirmed by some handset solution providers and operators.

“Even earlier, “operator specific” changes have been implemented by the vendors – example – modems have region specific requirements such as bands, power levels and Dual SIM which involve hardware changes. Also, given the scale of the Indian market in terms of no. of connections and growth rate, the initial development cost of making these modifications, modest as it is, will get amortized very quickly,” Ramamurthi added.

“We should not see a situation where the industry is stuck. If 5Gi gets harmonized then it is a win-win situation. Otherwise the cost to the subscriber will be high,” Kochhar added.

The Jio representative also supported the technology neutral approach for 5G and suggested that India’s government must make efforts for global harmonization of 5Gi standards by making it part of 3GPP [2].

Note 2. This assertion is also completely wrong. 3GPP is NOT a standards body. All of their specs must be transposed by it’s member standards bodies (e.g. ETSI, ATIS, etc) or ITU-R to be considered as standards. TSDSI took their 5Gi/LMLC directly to ITU-R WP-5D which accepted it as part of the first official 5G RAN standard- ITU-R M.2150. Any harmonization of 5G standards must occur in ITU-R WP-5D and NOT 3GPP.

…………………………………………………………………………………..

Samsung, which is the sole 4G equipment provider for Jio and India’s second largest smartphone brand, also supported telcos’ demand for a harmonized 5Gi standard during the meeting.

Both Jio and Airtel reiterated their demand for lowering the reserve price for 5G spectrum.

“Current pricing of mid-band spectrum is unrealistic,” Jio said, supporting the need to seek the reserve price from TRAI for all 5G spectrum bands for auction with a clear request that the reserve price be kept reasonable in order to meet the 5G proliferation goals.

The Department of Telecommunications (DoT) will seek a fresh base price from the telecom regulator for the 3300-3750 MHz as well as floor prices for other bands that can support 5G.

………………………………………………………………………………………….

Jio also urged the department to make available 2 GHz of mid-band spectrum to meet the demands of 2025-2030 timeframe. Airtel, on the other hand, asked the government to auction spectrum in mmWave band along with mid band and 600 MHz band and earmark them for 5G.

Jio has also asked the India DoT to identify and incorporate in NFAP [3] the entire C band 3.3-4.2 GHz, mmWave 24.25-29.5 Ghz, 37 GHz along with E and V bands.

Note 3. The NFAP is a central policy roadmap that defines future spectrum usage by all bodies in India, including DoT, the Department of Space and the defense ministry.

……………………………………………………………………………………..

Closing Comment:

It’s very disappointing that after all of TSDSI’s efforts to get 5Gi/LMLC included in the 1st official IMT 2020 RIT/SRIT standard (ITU-R M.2150) they couldn’t convince India telecom carriers or global equipment/chip vendors to endorse 5Gi/LMLC.

……………………………………………………………………………………..

References:

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

TSDSI’s 5G Radio Interface spec advances to final step of IMT-2020.SPECS standard

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

Executive Summary: IMT-2020.SPECS defined, submission status, and 3GPP’s RIT submissions

https://blog.3g4g.co.uk/2021/06/tsdsis-low-mobility-large-cell-lmlc.html

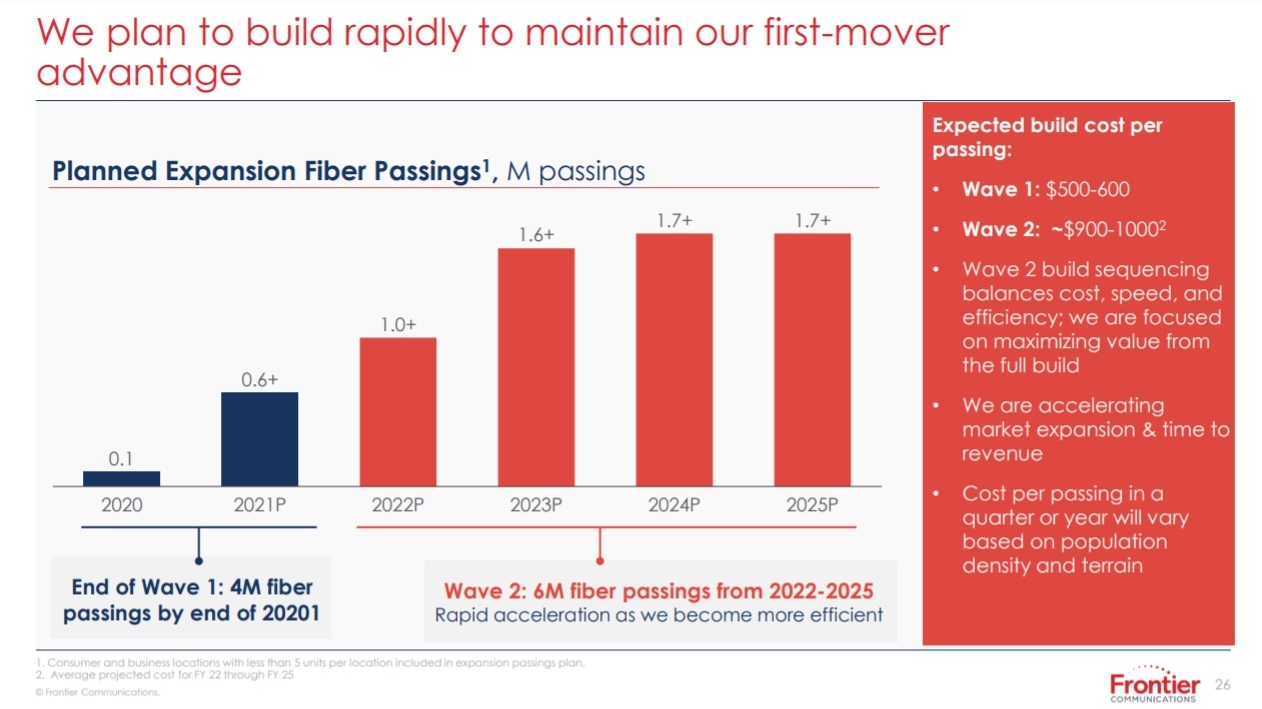

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

On August 5th, Frontier Communications announced an accelerated fiber optics buildout plan that will result in their fiber-to-the-premises (FTTP) network passing 10 million locations (homes/offices) by 2025. Frontier says they will end 2021 with 4 million locations passed by fiber and will then add another 6 million in a revised, multi-year “Wave 2” plan.

Nick Jeffery, President and Chief Executive Officer of Frontier, said, “The acceleration of our fiber network expansion is clear evidence that Frontier’s transformation is taking hold. Over the past several months, we’ve made real progress in executing our strategy – by adding world-class leadership, introducing a purpose-driven culture, improving the customer experience, and making our operations more efficient and sustainable.

“Demand for high-speed broadband is growing rapidly, and fiber is the best product to meet the needs of consumers and businesses. Frontier is already doing what customers want and cable can’t – delivering symmetrical download and upload speeds with far lower latency than our competition. Early next year, we will start delivering 2 gigabit per second services, further stretching our performance lead to where only fiber can compete. We have hard work ahead of us, but momentum is increasing as we rally the Frontier team around our mission to Build Gigabit America.”

Jeffery added, “Our second-quarter results reflect continuing momentum in our fiber expansion strategy, with all key fiber metrics in line or above expectations. In particular, we accelerated our fiber build out, continued our customer momentum with another strong quarter of consumer fiber net adds, and reduced our consumer churn. Taken together, it was another strong quarter that positions Frontier well as we head into the second half of the year.”

At its virtual investor day, Frontier provided an update on the fiber buildout and other priorities resulting from its strategic review. These include:

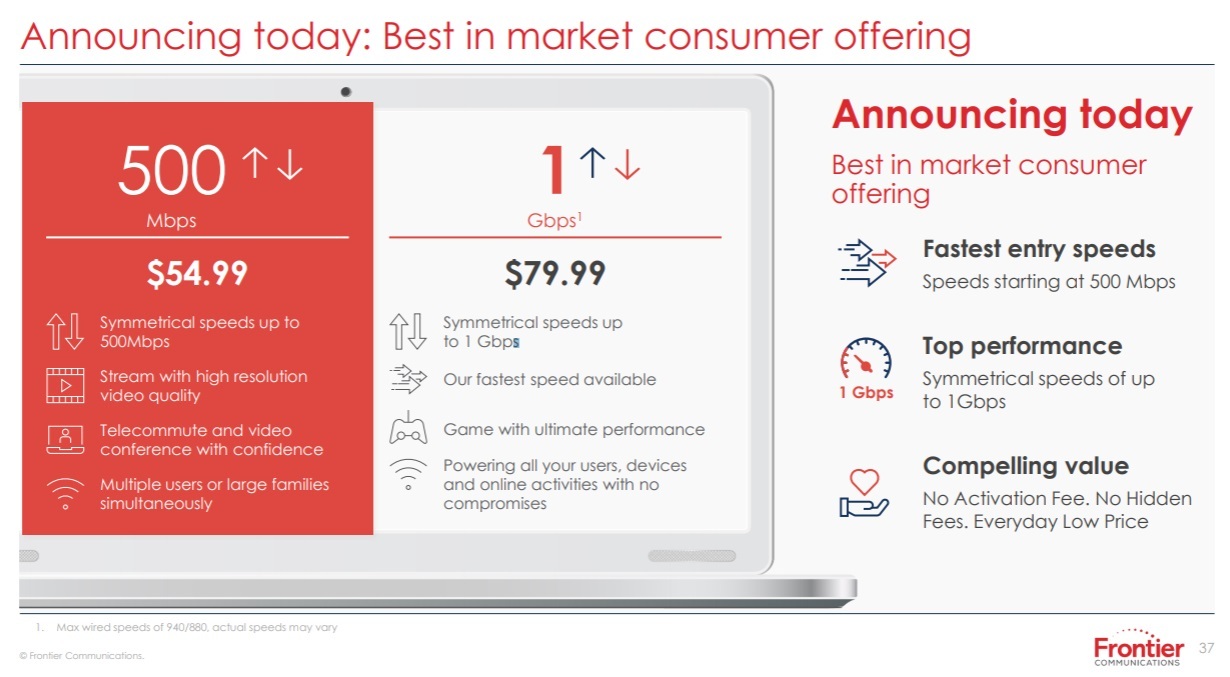

- Frontier’s current ability to provide a best-in-class offering featuring symmetrical 1 gigabit per second download and upload speeds;

- Plans to launch a symmetrical 2 gigabit per second offering in the first quarter of 2022 that will unlock next-generation digital experiences for customers;

- Plans to deploy fiber to reach 10 million locations by 2025; and

- A new target of $250 million run rate savings by 2023 from simplifying the Company’s operations and improving the customer experience.

Image Credit: Frontier Communications

……………………………………………………………………………………….

Frontier also offered some revised predictions on service penetration, expecting them to be in the mid-teens to 20% at the end of year one, rise to 25% to 30% at the end of year two, and then on up to 45%. Frontier introduced new pricing for residential fiber broadband service, with entry-level service at 500 Mbit/s.

MoffettNathanson analyst Nick Del Deo (a colleague) wrote in a note to clients:

The single most important data points from today’s analyst day relate to Frontier’s FTTH deployment plans (Exhibit 1). For 2021, the company increased its expectation for new passings from 495K to >600K, which will complete “wave one” of its fiber upgrade project and leave it with ~4M total FTTH passings. Between 2022 and 2025, the company plans to build to another 6M passings, bringing its total to 10M, or about two thirds of its broadband-enabled locations. The remaining 5M, part of wave three, are currently in a holding pattern, with the company working through the optimal approach: do nothing, upgrade, upgrade with government assistance, divest, swap, or do something more creative that we haven’t come up with.

Image Credit: Frontier Communications

…………………………………………………………………………………….

The company also announced it will start to introduce 2-Gig services over FTTP in early 2022, but didn’t disclose pricing.

Del Deo summarized his assessment of Frontier’s fiber buildout (emphasis added):

Frontier plans to build FTTH to 7M incremental homes through 2025, a rapid acceleration from its current pace. This will leave two thirds of its broadband-enabled footprint served by fiber, with the status of the remaining one third TBD. The deployment costs appear somewhat higher, and returns a bit lower, than what we would have expected, but we had haircut the value of its FTTH expansion in our prior work to account for such risks. The faster pace and certainty now reduce the need for such haircuts. The path to financing the build remains open, but the company will need at least a couple of billion dollars in fresh funding. It’s not clear to us that management’s optimism regarding the commercial unit is warranted, but time will tell whether it can engineer a turnaround.

Management has high hopes for the commercial part of its business, and we don’t doubt that growth can get better from where it is today, but we think this will continue to be a segment that weighs on the company’s overall results.

Light Reading’s Jeff Baumgartner opines that “Frontier’s accelerated FTTP buildout plan, revised pricing and plans for 2-Gig service should pressure cable competitors to match up with speeds and pricing. Frontier’s moves might also cause those cable operators to give more consideration to “mid-split” or “high-split” upgrades that dedicate more upstream capacity to their DOCSIS 3.1 networks, accelerate their pursuit of new DOCSIS 4.0 technologies, or shift to full FTTP upgrades in select areas.”

………………………………………………………………………………………….

References:

Ookla: Starlink’s Satellite Internet service vs competitors around the world

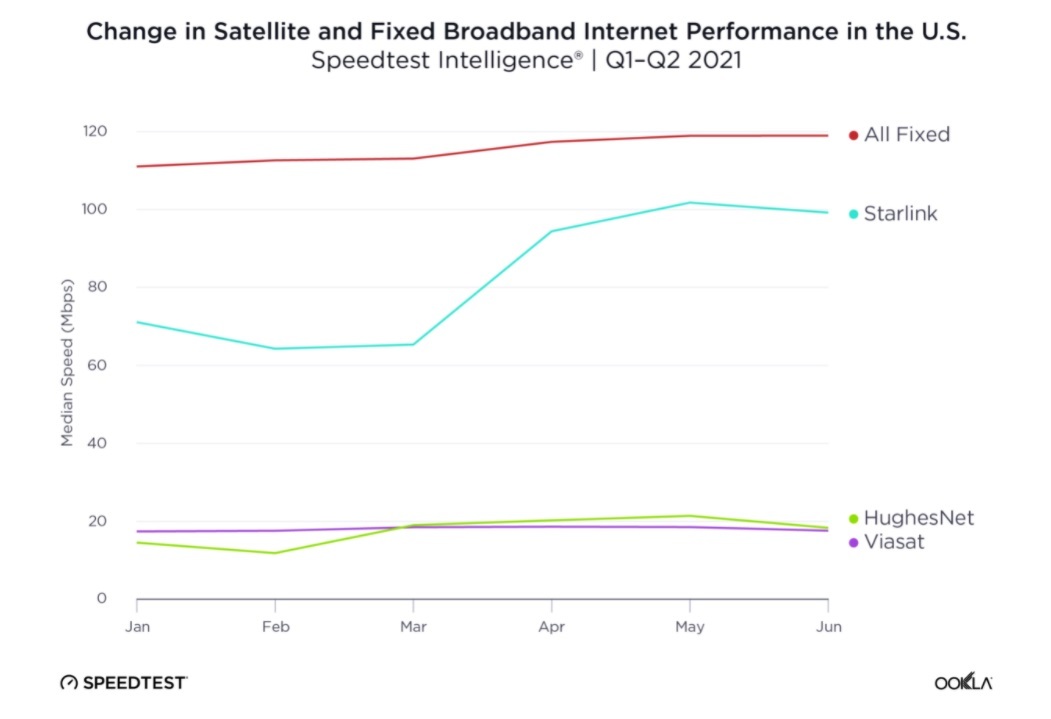

Starlink’s broadband internet speeds continue to outpace those of competitive satellite broadband internet providers Viasat and HughesNet, according to telecom speed tracker Ookla.

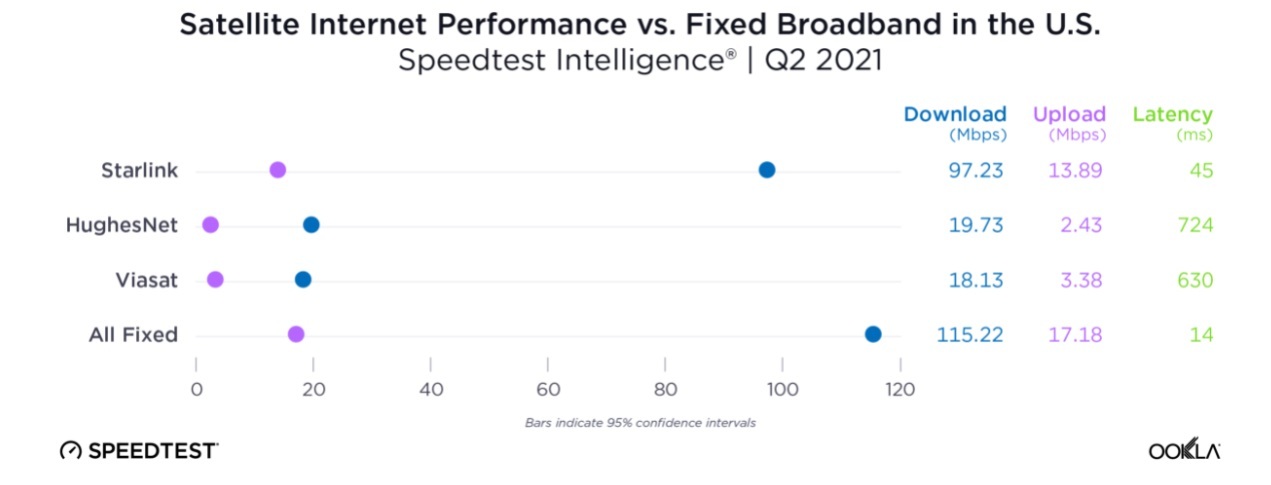

Given that satellite internet is often the only solution for folks in rural or underserved areas with little to no fixed broadband access, the Speedtest® results from HughesNet, Starlink and Viasat during Q2 2021 were encouraging. HughesNet was a distant second at 19.73 Mbps (15.07 Mbps in Q1 2021) and Viasat third at 18.13 Mbps (17.67 Mbps in Q1 2021). None of these are as fast as the 115.22 Mbps median download speed for all fixed broadband providers in the U.S. during Q2 2021, but it beats digging twenty miles (or more) of trench to hook up to local infrastructure.

Moreover, Starlink was the only satellite internet provider in the United States with fixed-broadband-like latency figures, and median download speeds fast enough to handle most of the needs of modern online life at 97.23 Mbps during Q2 2021 (up from 65.72 Mbps in Q1 2021).

Starlink’s median download speeds in the U.S. are starting to rival those of fixed-line broadband networks, according to Ookla’s latest round of Speedtest data.

While Starlink’s U.S. download speeds are “fast enough to handle most of the needs of modern online life,” they do trail the 115.22 Mbit/s median download speed for all U.S. fixed broadband providers, Ookla explained in its report.

In some areas, Starlink’s U.S. download median speed has surpassed those of fixed wireline network providers.

In its analysis of the Ookla data, PCMag (Ookla and PCMag are both owned by Ziff Davis) notes that Starlink’s median download speed in Morgan County, Alabama, reached 168 Mbit/s. Starlink’s slowest median download speed for the U.S. in the quarter, at 64.5 Mbit/s, appeared in Madison County, Indiana.

There’s only a slight difference between Starlink and broadband wireline networks in the upstream direction. Ookla said Starlink’s median upload speed for Q1 2021 was 13.89 Mbit/s, compared to a median upload speed of 17.18 Mbit/s among U.S. fixed wireline broadband networks. Meanwhile, both Viasat and HughesNet trailed with median upload speeds of 3.38 Mbit/s and 2.43 Mbit/s, respectively.

Starlink’s growing network of low-Earth orbit (LEO) satellites continued to deliver relatively low latencies, important for apps such as online gaming and videoconferencing, when compared to geosynchronous (GEO) systems. Ookla said Starlink’s median latency in Q1 2021 was 45 milliseconds. While that was well behind the 14 milliseconds of latency found on fixed-line networks, it was considerably better than the median latency for Viasat (630 milliseconds) and HughesNet (724 milliseconds).

saw sufficient samples during Q2 2021 to analyze Starlink performance in 458 counties in the U.S. While there was about a 100 Mbps range in performance between the county with the fastest median download speed (Morgan County, Alabama at 168.30 Mbps) and the county with the slowest median download speed (Madison County, Indiana at 64.51 Mbps), even the lower-end speeds are well above the FCC’s Baseline performance tier of at least a 25 Mbps download speed. We also saw many more counties qualify for analysis during Q2 2021 than we saw in Q1 2021.

United Kingdom: Starlink beats fixed broadband providers

Starlink showed a much faster median download speed in the U.K. during Q2 2021 (108.30 Mbps) than the country’s average for fixed broadband (50.14 Mbps). Starlink’s upload speed was also slightly faster (15.64 Mbps vs. 14.76 Mbps), and the latency was pretty good, given the distance traveled (37 ms vs. 15 ms). This brings Starlink closer to contender status for consumers across the U.K., not just those stranded in internet-free zones in Northern Scotland, once the service interruptions are under control. It also shows that because satellite internet is not constrained by the infrastructure of a given country, there is the potential to radically outperform fixed broadband.

This data is changing rapidly as satellite internet providers launch new service locations and improve their technology. Ookla will be excited to see if Starlink is still the satellite provider to beat next quarter and in what other countries satellite internet provides a viable alternative to fixed broadband.

……………………………………………………………………………………….

References:

https://www.speedtest.net/insights/blog/starlink-hughesnet-viasat-performance-q2-2021/

https://www.pcmag.com/news/starlink-moves-closer-to-matching-or-even-beating-fixed-broadband-speeds

https://www.lightreading.com/satellite/starlink-speeds-accelerate-in-q2-ookla-says-/a/d-id/771322?

Starlink now covers all of UK; Plans to connect vehicles with satellite Internet service

Counterpoint: Xiaomi #1 in global smart phone sales for 1st time

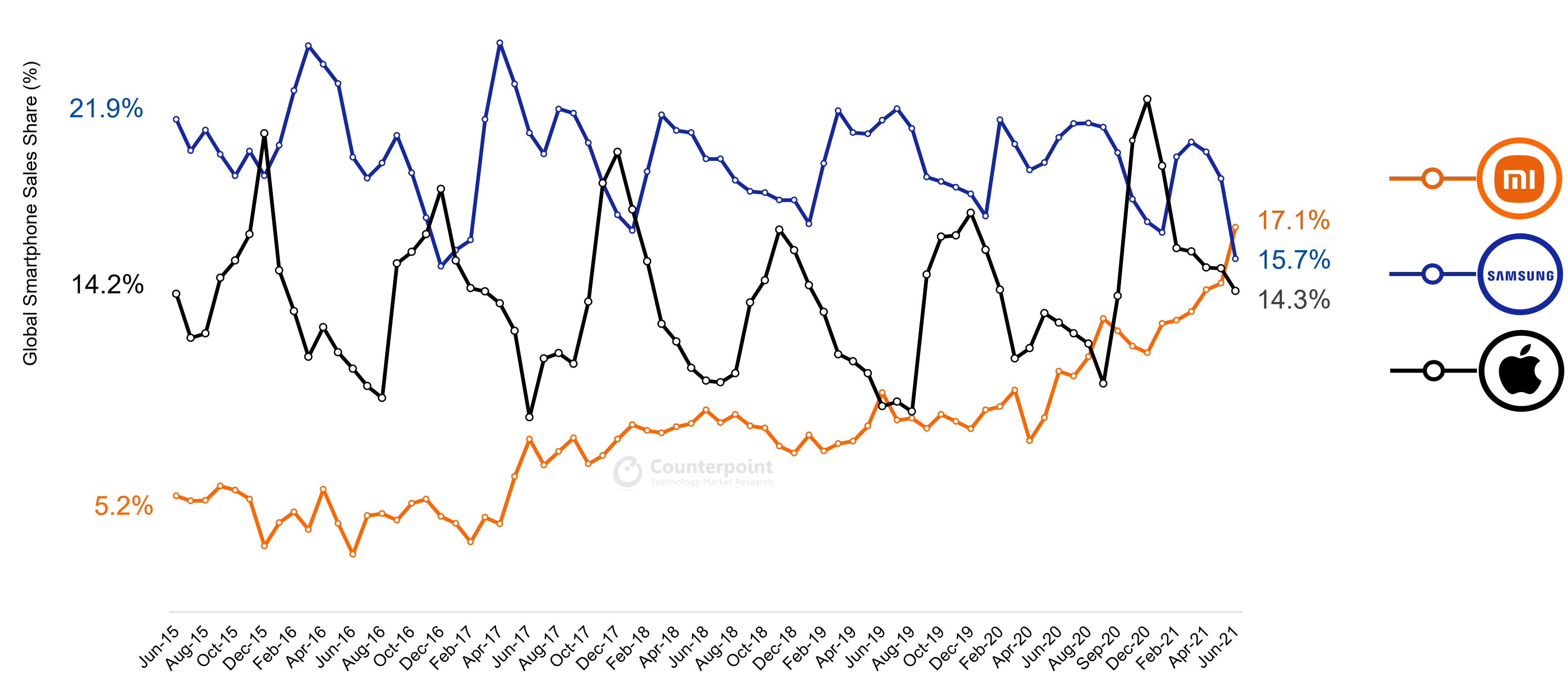

Chinese smartphone maker Xiaomi surpassed Samsung and Apple in June 2021 after a 26% month-on-month increase in sales to become the number one smartphone brand in the world for the first time ever, according to Counterpoint Research’s monthly Market Pulse Service.

Xiaomi was also the number two brand globally for Q2 2021 in terms of sales, and cumulatively, has sold close to 800 million smartphones since its inception in 2011, the report underlined.

Research Director Tarun Pathak noted that Xiaomi has been on a war footing to fill the gap created by the decline of Huawei.

“Ever since the decline of Huawei commenced, Xiaomi has been making consistent and aggressive efforts to fill the gap created by this decline. The OEM has been expanding in Huawei’s and HONOR’s legacy markets like China, Europe, Middle East and Africa. In June, Xiaomi was further helped by China, Europe and India’s recovery and Samsung’s decline due to supply constraints.” Pathak wrote.

Senior Analyst Varun Mishra stated, “China’s market grew 16% MoM in June driven by the 618 festival, with Xiaomi being the fastest growing OEM, riding on its aggressive offline expansion in lower-tier cities and solid performance of its Redmi 9, Redmi Note 9 and the Redmi K series. At the same time, due to a fresh wave of the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A series.” the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A-series,” Mishra commented on Samsung’s performance.

Going forward, the market research firm expects Samsung’s production to be affected if the situation in Vietnam does not improve while Xiaomi will continue to gain share from the Korean brand.

Exhibit: Global Monthly Smartphone Sales Share Trends (%)

Some of our other smartphone market analyses for Q2 2021:

- Apple Achieves Record June Quarter Shipments, Xiaomi Becomes the Second-Largest Smartphone Brand Globally

- India Smartphone Market Stays Resilient During Second COVID-19 Wave, Crosses 33 Million Shipments

- China Smartphone Market Sees Lowest Q2 Sales Since 2012; vivo Leads as Huawei Plummets

- Podcast: How Xiaomi, Qualcomm are Delivering 5G, AI-based Experiences to Consumers

- Q2 2021: Europe Smartphone Market’s Bumpy Road to Recovery

- MEA Smartphone Market Sees Best Q2 on Record; Samsung Leads but TECNO, Xiaomi Close Gap

- Chinese Players Capture Half of Vietnam Smartphone Market in Q2 2021

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (Technology, Media and Telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Monthly Pulse: Xiaomi Becomes #1 Smartphone Brand Globally for First Time Ever

Strand Consult: What NTIA won’t tell the FCC about Open RAN

by John Strand, CEO and Founder of Strand Consult (see company profile and bio below)

Introduction:

In “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks,” (Docket Number: GN-Docket No. 21-63) the National Telecommunications and Information Administration (NTIA) makes many claims about Open RAN [1] and states what appears to be official U.S. Executive Branch policy promoting that technology. In particular:

As stated in the Implementation Plan of the National Strategy to Secure 5G, the U.S. Executive Branch agrees that “close coordination between the United States Government, private sector, academic, and international government partners is required to ensure adoption of policies, standards, guidelines, and procurement strategies that reinforce 5G vendor diversity and foster market competition.” One promising solution in line with these objectives is open, interoperable networks, including Open RAN. While this response focuses on Open RAN, the Executive Branch’s policy is to promote the development of Open RAN alongside other policies, technologies, and architectures that support 5G vendor diversity and foster market competition.

Strand Consult analyzes these claims, their references, and the assumptions underpinning them from security and economics perspectives. Strand Consult’s report also includes an appendix fact checking 35 claims by NTIA and well as 133 additional references to help investigate the technology.

OpenRAN (open radio access network) is an evolving topic. It is an industrial concept, not a technical standard. Stakeholders, including NTIA may define OpenRAN differently, provide different definitions, ascribe different purposes to it, and have different expectations.

Editor’s Note:

There are two Open RAN spec writing bodies- the O-RAN Alliance and the Telecom Infra Project Open RAN Group. Neither of them have a liaison with either 3GPP or ITU-R WP 5D which have produced specifications/standards for 4G-LTE Advanced and 5G RAN/RIT specifications (3GPP Release 10 and Release 15 & 16, respectively) and ITU-R standards (M.2012-4, and M.2150, respectively). The O-RAN Alliance does have a liaison arrangement with GSMA which this author claims was an Ultra-Oxymoron.

……………………………………………………………………………………….

Strand Consult’s research question is to determine if, when, and how OpenRAN and O-RAN will replace conventional RAN on a 1:1 basis without compromising network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality coverage and other factors.

Executive Summary:

We don’t believe NTIA’s comments provide insight to answer our questions. Strand Consult has found that most of the comments in NTIA’s report restate talking points from the OpenRAN industry and present policy arguments as if they were fact or technical analysis. As advisor to the US President and policy lead for the Executive Branch on telecommunications, NTIA is considered an authority and is expected to produce serious, objective policy. Indeed it would be welcome for an objective report from NTIA on OpenRAN with an authoritative list of critical references and information from test installations of the technology. Unfortunately NTIA’s report falls short of this expectation.

In our opinion, the main shortcoming of the report is that NTIA has either overlooked, ignored, or is unaware of the role of Chinese vendors in the OpenRAN industry. The separate but related ORAN Alliance has 44 Chinese vendors, many which are explicitly state-owned and military-aligned. At least 7 of these entities are on the US Dept of Commerce Entity List and others have lost their Federal Communications Commission operating license. NTIA has not conducted a security assessment of OpenRAN and yet it blesses the technology and pronounces that it is Executive Branch policy to pursue it. Strand Consult investigates NTIA’s other comments about the infrastructure market, competition, prices, and innovation and finds that many of them are either unevidenced or proffered by self-interested OpenRAN actors.

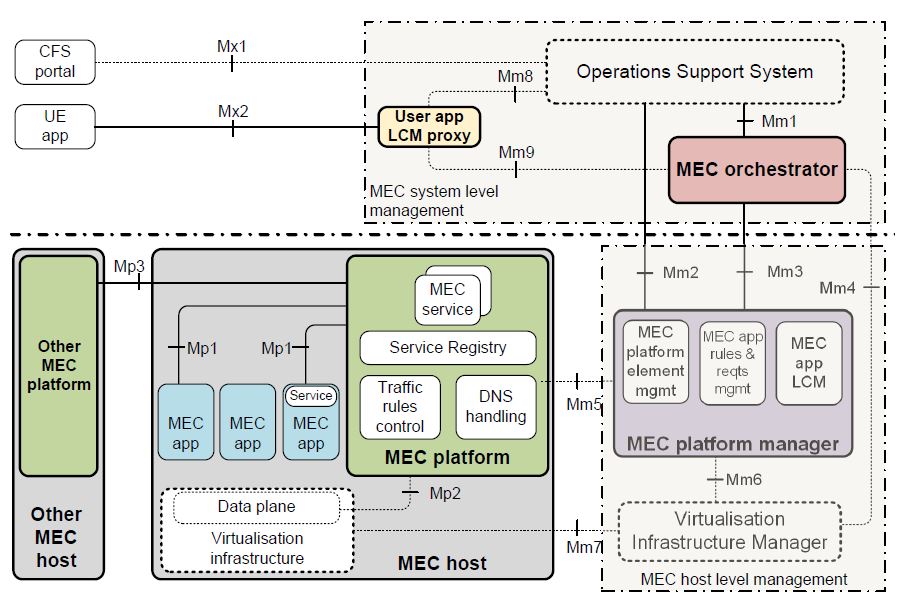

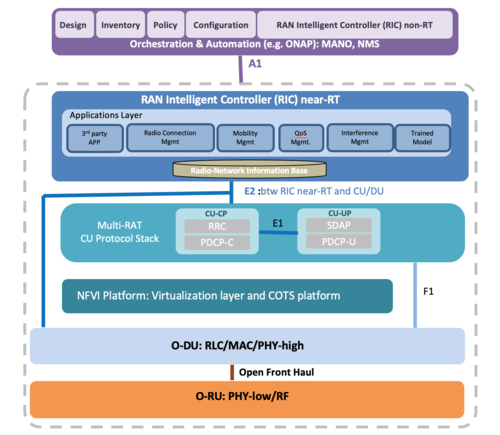

O-RAN Alliance Reference Architecture:

Image Credit: O-RAN Alliance

……………………………………………………………………………………………

Strand Consult’s Analysis:

In an effort to lift the level of policy discussion, Strand Consult reviewed “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks” from July 16th to the U.S. Federal Communications Commission’s (FCC) a part of the Inquiry in the proceeding on open radio access networks (Open RAN). The highly respected NTIA is chartered to advise the President and represent the Executive Branch view on telecommunications, and there is an expectation that NTIA’s reports are objective, authoritative, and empirical, particularly with its roster of employee scientists and technologists. The document submitted to the FCC appears to be written by staff lawyers and makes many debatable claims which are either unsupported or based on advocacy materials from the OpenRAN industry.

NTIA’s OpenRAN document does not live up to expectations for the following reasons:

Its lack of objectivity and empirical support

Its overlooking role of Chinese vendors in OpenRAN ecosystem

Its misunderstanding of the economics of infrastructure and innovation

Its unfounded assertions about competition and the role of OpenRAN.

Lack of objectivity and empirical support. Citing of interested parties as experts. The OpenRAN document published by NTIA offers very little empirical, or even academic policy, evidence for its assertions. Most of references cited, 55%, come from OpenRAN advocacy groups or companies with a financial interest in OpenRAN, for example self-described OpenRAN vendors. The main part of the document’s references are not technical studies but rather policy arguments.

Moreover, NTIA fails to disclose that its preferred sources are advocacy organizations. While there is nothing illegal about citing advocacy organizations, government agencies like NTIA are supposed to be above touting advocacy as fact, science, and official policy.

The O-RAN Alliance [2] develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) [3] like ITU-R and ITU-T. The O-RAN Alliance does not satisfy the openness criteria laid down in Word Trade Organization Principles [4] for the Development of International Standards, Guides and Recommendations.

The O-RAN Alliance is a closed industrial collaboration developing technical RAN specification on top of 3GPP specifications and ITU-R standards for 4G and 5G.

While industrial cooperation is important, there can be no mobile networks without the basic work of organizations like ITU-R WP 5D, 3GPP (which is NOT a SDO) and its seven regional members (which are SDOs) [5].

OpenRAN concepts include: cloudification, automation and open RAN internal interfaces do follow some elements of 3GPP specifications.

It appears that NTIA is attempting to elevate the O-RAN Alliance, essentially a closed association, with established WTO compliant SDOs (e.g. ITU and IEEE) and global consortia like 3GPP. Such an elevation is false and deceptive, and NTIA should clarify why it promotes a closed association that doesn’t meet openness requirements in WTO.

NTIA could have balanced this shortcoming by referencing some the widely published critical reviews of OpenRAN. Unfortunately, it does not. For example, U.S. federal documents can create credibility by objectively stating competing views and discussing the merits, similar to the Congressional Research Service [6].

Because NTIA appears only to provide favorable views of OpenRAN from interested parties, its document is tainted with bias. It reads like a set of talking points from the OpenRAN Policy Coalition, the a front for the OpenRAN industry’s interests.

Overlooking the role of Chinese vendors in the OpenRAN ecosystem:

Another shortcoming is the apparent ignorance of the role of Chinese vendors in the OpenRAN ecosystem. NTIA forgets to name the 44 Chinese companies that make up the second largest national group in the O-RAN Alliance. It failed to disclose that seven of these actors are either on the U.S. Entity List [7] and have lost their FCC license to operate [8] . Those companies include: China Mobile, China Telecom, China Unicom, ZTE, Inspur, Phytium and Kindroid, companies

which are integrated with the Chinese government and military.

Nor does NTIA disclose that the European telco Memorandum of Understanding (MoU) [between Deutsche Telekom, Telefonica, TIM, Vodafone and Orange] that OpenRAN should be built on top of Kubernetes [9], which is a software

technology platform that has been infiltrated by the Chinese.

While it began life in 2014 as a Google project, Kubernetes currently is under the jurisdiction of the Cloud Native Computing Foundation, an offshoot of the Linux Foundation (perhaps the world’s largest open-source organization).

By late 2017, Huawei had gained a seat on the Kubernetes Steering Committee. Huawei claims to be the fifth-biggest contributor of software code to Kubernetes.

According to the “Report on the 2020 FOSS Contributor Survey” [10] from The Linux Foundation & The Laboratory for Innovation Science at Harvard, the open source community spends very little time responding to security issues (an average of 2.27% of their total contribution time) and reports that it does not desire to increase this metric significantly.

It appears to be a problem that Huawei and ZTE are increasingly involved in the leading open source technology 11 used by OpenRAN developers. It is not clear how this acceptance of Chinese involvement in OpenRAN is consistent with President Biden’s tough stance on security vis-à-vis China and other threat actors [12].

Conclusions:

NTIA’s document appears to endorse the O-RAN Alliance for the security of OpenRAN. However, NTIA doesn’t provide technical analysis or a security assessment of O-RAN Alliance specifications. It is not clear from the document whether NTIA had access to these specifications to conduct an assessment. In any event, ORAN Alliance members exchange specifications on OpenRAN every 6 months. This means that the 44 Chinese companies in the O-RAN Alliance get fresh OpenRAN “code” at least twice a year, NTIA provides no threat analysis, risk assessment nor potential mitigation of these processes.

–>This is a breathtaking omission that alone warrants further attention by the NTIA.

NTIA could have strengthened its credibility by providing an authoritative, empirical document to inform policymakers objectively about OpenRAN. Instead NTIA offers a document which merely restates the talking points of OpenRAN advocacy groups and industry. This fails the U.S. Executive branch and the American people who expect quality information and impartial judgement from an expert agency.

More importantly, the NTIA document mis-informs readers about the security risks of OpenRAN which greatly extends the cyber security attack surface with its many “open interfaces.”

Hopefully, NTIA will review the empirical information and update its assessment in a new report.

…………………………………………………………………………………….

Readers who know something about OpenRAN are welcome to weigh in with their comments in the box below this article.

…………………………………………………………………………………….

Notes & Hyperlinks:

https://www.ntia.gov/files/ntia/publications/ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf

2. https://www.o-ran.org/

3. https://en.wikipedia.org/wiki/Standards_organization 4. https://www.wto.org/english/tratop_e/tbt_e/principles_standards_tbt_e.htm

5. https://www.3gpp.org/about-3gpp

6. Disruptive Analysis Report: Telecom & 5G Supply Diversification A long term view: demand diversification, Open

RAN & 6G path dependence

https://www.lightreading.com/open-ran/verizon-t-mobile-outline-their-open-ran-fears/d/d-id/769201 https://www.lightreading.com/open-ran/open-ran-has-missed-5g-boat-says-three-uk-boss/d/d-id/766258?

7. https://www.bis.doc.gov/index.php/policy-guidance/lists-of-parties-of-concern/entity-list

8. https://www.fcc.gov/document/fcc-denies-china-mobile-telecom-services-application-0

https://www.reuters.com/article/us-usa-china-telecom-idUSKBN2B92FE 9.https://www.telefonica.com/documents/737979/146026852/Open-RAN-Technical-Priorities-Executive-Summary.pdf/cdbf0310-4cfe-5c2f-2dfb-c68b8c8a8186

10. Page 5 of: https://www.linuxfoundation.org/wp-content/uploads/2020FOSSContributorSurveyReport_121020.pdf

11. https://merics.org/en/short-analysis/china-bets-open-source-technologies-boost-domestic-innovation

12. https://www.reuters.com/article/us-usa-biden-cyber-war-idUSKBN2EX2S9

………………………………………………………………………………………………..

About Strand Consult:

Strand Consult is an independent consultancy with 25 years of telecom industry experience. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world. It has 170 mobile operators from around the world on its client list.

John Strand (photo below) is CEO of Strand Consult. He founded Strand Consult in 1995.

The mobile industry exploded in the 1990s, and Strand Consult grew along with its new clients from the mobile industry, analyzing market trends, publishing reports and holding executive workshops that have helped telecom operators, mobile services providers, technology manufacturers all over the world focus on their business strategies and maximizing the return on their investments.

References:

ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf (doc.gov)

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consulting: Why the Quality of Mobile Networks Differs