Month: August 2021

Big U.S. Wireless Carriers to bid at FCC mid-band auction; cablecos missing in action

The FCC will conduct another 5G spectrum auction on October 5th. FCC Auction 110 will be for 100MHz in the 3.45GHz to 3.55GHz band for flexible use of wireless services.

Full Title: Auction of Flexible-Use Service Licenses in the 3.45-3.55 GHz Band for Next-Generation Wireless Services; Status of Short-Form Applications to Participate in Auction 110

Auction 110 will offer approximately 4,060 new flexible‐use licenses of 100Mhz within the 3.45–3.55 GHz band (3.45 GHz Service) throughout the contiguous United States. Bidding in Auction 110 is scheduled to begin on October 5, 2021.

…………………………………………………………………………………………….

Analysis:

AT&T, T-Mobile, US Cellular and Dish Network are among the 42 different entities that registered interested in participating in Auction 110, based on the roster contained in FCC filings related to the auction (attachments A & B in References below). Verizon’s application is listed as incomplete.

We’ve never heard of most of the other companies bidding, but note that the big cablecos/MSOs (Comcast, Charter Communications, Altice USA and Cox Communications) are not listed.

3.45 GHz spectrum up for auction is in the mid-band range seen as key for 5G by offering a mix of coverage and capacity, and sits nearby the 3.7 GHz C-band and the shared 3.5 GHz Citizen Broadband Radio Service (CBRS) band.

Financial analysts at New Street Research say that Auction 110 will increase the total overall amount of spectrum in circulation in the US from 1023MHz to 1123MHz. They believe that AT&T and T-Mobile to be the big winners with Dish Network an also ran.

“We think that AT&T, T-Mobile and Dish each want 40MHz in the 3.45GHz auction (the limit any one company can buy), but there is only 100MHz to go around,” the analysts wrote in a note to investors in July. “Based on visible resources, AT&T and T-Mobile are best positioned to end up with 40MHz each, leaving 20MHz for Dish (and other participants).”

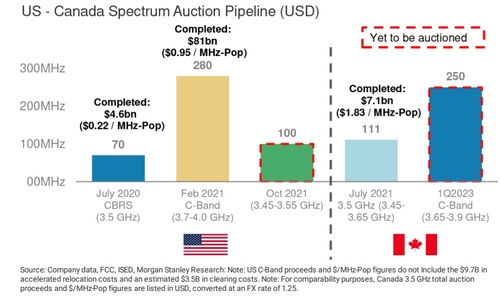

Analysts at Morgan Stanley offered a their perspective at how the upcoming 3.45GHz-3.55GHz FCC auction compares with recently completed spectrum auctions in the U.S. and Canada.

Source: Morgan Stanley

“AT&T will be keen to get the maximum 40MHz allowable on a quasi-nationwide basis, while T-Mobile has said they will be opportunistic, although they and Verizon already have some 200MHz of midband spectrum. Dish is another wild card, although it lacks the financial resources of the larger wireless players,” wrote the financial analysts at Morgan Stanley in a note to investors this week.

…………………………………………………………………………………………….

Recent FCC auctions have included the 37GHz, 39GHz and 47GHz spectrum bands in Auction 103, Auction 101 of 28GHz spectrum and Auction 102 of 28GHz spectrum, Auction 105 for 3.5GHz CBRS spectrum licenses, and Auction 107 -the C-band auction (which ended earlier this year and generated an astounding $81 billion in winning bids).

“We think Auction 110 looks much more similar to the smaller, cheaper CBRS auction that had $4.5 billion in net bids for 70MHz of spectrum ($0.215 per MHz POP), than the larger, more expensive C-band auction that ended with $81 billion in net bids for 280MHz of spectrum ($0.945 per MHz POP),” wrote the financial analysts with Raymond James in a note to investors this week. (The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.) The Raymond James analysts cited Andromeda’s 40MHz ownership cap and military sharing zones as reasons for their conclusions.

“Still, midband spectrum remains crucial in densifying 5G networks, and while we do not expect anywhere close to C-band-like prices, this is a good opportunity for price-conscious bidders (e.g. Dish) to augment spectrum holdings,” the Raymond James analyst team concluded.

………………………………………………………………………………..

Terms & Conditions for Auction 110:

Upfront payments for Auction 110 are due in the proper account at the U.S. Treasury by 6:00 p.m. Eastern Time (ET) on Thursday, September 2, 2021. In order to meet the Commission’s upfront payment deadline, an applicant’s payment must be credited to the Commission’s account by the deadline.

Due Diligence: The FCC reminds each potential bidder that it is solely responsible for investigating and evaluating all legal, technical, and marketplace factors and risks associated with the licenses that it is seeking in Auction 110; evaluating the degree to which those factors and risks may have a bearing on the value of the licenses being offered and/or affect the bidder’s ability to bid on, otherwise acquire, or make use of such licenses; and conducting any technical analyses necessary to assure itself that, if it wins any license(s), it will be able to build and operate facilities in accordance with the Commission’s rules.

Non Disclosure Rules: Bidding applicants must take care not to communicate non-public information to the public, financial analysts, or the press.45 Examples of communications raising concern, given the limited information procedures in effect for Auction 110, would include an applicant’s statement to the press or other public statement (for example, a statement on social media) about its upfront payment or bidding eligibility, an applicant’s statement to the press or other public statement that it is or is not interested in bidding in the auction, or an applicant’s statement to the press or other public statement prior to the down payment deadline that it is the winning bidder in any particular geographic areas.

References:

https://www.fcc.gov/auction/110

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-a

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-b

https://www.fcc.gov/document/facilitating-5g-345-355-ghz-band

https://www.lightreading.com/5g/what-to-expect-from-upcoming-345ghz-auction-for-5g/d/d-id/771612?

https://www.lightreading.com/5g/cable-may-miss-americas-next-big-5g-spectrum-auction/d/d-id/771578?

https://www.benton.org/headlines/big-wireless-carriers-apply-fccs-mid-band-spectrum-auction

Qualcomm unveils 5G and AI-Enabled Drone Platform

Qualcomm Technologies, Inc. is showing off what is says is the world’s first drone platform and reference design to offer both 5G and AI-capabilities, the Qualcomm Flight RB5 5G Platform.

The company says the drone reference design helps accelerate development for commercial, enterprise, and industrial drones, and unleashes innovative possibilities for industries looking to adopt drone solutions and realize the benefits of the intelligent edge. 5G connectivity — including mmWave and sub-6 GHz bands — and WiFi 6. The chip-maker says the networking tech can help support drone-to-drone communications and drone swarms. Both use cases are being explored across industries, from delivering and transporting goods to aerial light displays to military warfare.

The drone model below is includes an embedded Qualcomm® QRB5165 processor and a Qualcomm Spectra 480 Image Signal Processor that can capture 200 megapixel photos and 8K video at 30 FPS. In addition, the drone can record in 4K at 120 FPS with support for HDR.

Image Credit: Qualcomm

………………………………………………………………………………………………..

The company says that the Qualcomm Flight RB5 5G Platform brings cutting-edge capabilities to the drone industry by condensing multiple complex technologies into one tightly integrated drone system to support evolving applications and new use cases in sectors including film and entertainment, security and emergency response, delivery, defense, inspection, and mapping.

At its core, the Flight RB5 5G platform uses the QRB5165 processor and Kryo 585 CPU and Adreno 650 GPU, based on the Snapdragon 865 CPU. The AI enhancements come by way of the Hexagon Tensor Accelerator in the Hexagon 698 DSP. Third-parties that use the platform will also get access to a trio of software development kits for neural processing, computer vision and multimedia applications.

The Qualcomm Flight RB5 5G Platform’s high-performance and heterogeneous computing at ultra-low power consumption provides power efficient inferencing at the edge for AI and Machine Learning (ML) enabling fully autonomous drones. Breakthrough camera capabilities deliver premium image capabilities and performance. With 5G and Wi-Fi 6 connectivity, this platform enhances critical flying abilities beyond visual line-of-sight (BVLOS) to support safer, more reliable flight. In addition, safety controls alone can no longer assure industrial and commercial drone safety, especially when scaling to Beyond Visual Line of Sight operations. The Qualcomm Flight RB5 5G Platform is equipped with a Qualcomm® Secure Processing Unit to support modern drone demands for cybersecurity protections as a key enabler of data-protection and safety requirements.

Qualcomm Technologies is working with Verizon to complete network testing of the Qualcomm Flight RB5 5G Platform for the Verizon 5G network, and expects the platform, which is 5G mmWave capable, will be offered via the Verizon Thingspace Marketplace.

The Qualcomm Flight RB5 5G drone reference design is available for pre-sale now through ModalAI. The Qualcomm Flight RB5 5G development kit is expected to be available in Q4 of 2021. For more information on the platform, including technical features, please visit the product details page here.

Backgrounder:

Qualcomm first got involved in drones in 2015, then ventured into robotics in 2019. Last year it combined the two technologies in its RB5 platform. Chad Sweet’s ModalAI, which in 2018 spun out of Qualcomm, will manufacture and distribute the drone platform, and says the first development kits will ship in the last three months of this year.

Qualcomm, which already commands a huge lead in the 4G/5G smartphone industry, is hoping its Snapdragon chipsets can be the silicon that pushes 5G into a wider range of other devices. The company has made a series of drone platforms since its first, Qualcomm Flight, in 2018.

…………………………………………………………………………………………

Global carriers and IoT ecosystem leaders showcase validation and support for Qualcomm Technologies latest drone solution:

Asia Pacific Telecom

“As the leader in innovative telecom services in Taiwan, Asia Pacific Telecom Co., Ltd (APT) is excited to work with one of our most important strategic collaborators, Qualcomm Technologies on the support of 5G and AI-enabled drones. APT provides 5G and application integration services to advance the performance of robots and drones in different perspectives. We truly believe that 5G capabilities built into the platform will enable new autonomous drone experiences,” said Mr. Shang-Chen Kao, chief technology officer, network and technology center, Asia Pacific Telecom.

AT&T

“Many of the anticipated benefits of drones will be further accelerated and strengthened with 5G, including delivery, inspections, and search and rescue, which will require a highly secure and reliable connection. We are excited to see Qualcomm Technologies continue to innovate with their latest announcement on a platform for 5G drones,” said Kevin Hetrick, vice-president, access construction and engineering, AT&T.

China Unicom

“The 5G-enabled digital era has brought wider boundaries for every industry and China Unicom is committed to pushing the boundaries of the traditional communications ecosystem and working together with the industrial chain to realize mutual complementarity. As one of our important collaborators, Qualcomm Technologies has been working with China Unicom to drive integration of 5G and IoT into vertical use cases and provide products such as 5G modules and 5G industrial gateways for automation and robotics use cases, with focused areas including industrial equipment, iron and steel manufacturing, transportation and port, mining and energy, and healthcare,” said Li Kai, chief product officer, IoT division, China Unicom Digital Technology Company Limited. “We believe the announcement of the Qualcomm Flight RB5 5G Platform will benefit more use cases. China Unicom is looking forward to deepening collaborations with Qualcomm Technologies in IoT and jointly creating a new blueprint for 5G in the future.”

Everguard.ai

“Use of drones to capture imagery for construction site topographic mapping, construction progress tracking, security surveillance and equipment tracking in combination with IoT sensors that are deployed on construction sites are revolutionizing how construction projects are delivered! 5G enabled data from drones can be leveraged to unleash the power of artificial intelligence and machine learning algorithms yielding massive improvements in the safety, efficiency and productivity of construction projects,” said Sandeep Pandya, chief executive officer, Everguard.ai.

FlightOps

“By working with Qualcomm Technologies, we have seamlessly installed the FlightOps onboard software on the Qualcomm Flight RB5 5G Platform, allowing for unparalleled performance, compute power, low energy footprint, high quality video processing and high speed 5G connectivity to achieve high levels of autonomy and mission scalability,” said Shay Levy, chief executive officer, FlightOps.

Juganu

“Qualcomm Technologies has been a leader of breakthrough technologies for years and their announcement of the world’s first 5G, AI-enabled drone platform – the Qualcomm Flight RB5 5G Platform – is the latest example of their continued innovation. We at Juganu are excited to work with Qualcomm Technologies as they continue to push the boundaries of technology and look forward to using these technologies to innovate across our own smart technology quickly, safely and securely,” said chief strategy officer, Eran Efrati, Juganu.

KT Corporation

“KT is excited to see Qualcomm Technologies bringing cutting-edge 5G drone technology based on the Qualcomm Flight RB5 5G Platform. We’re leveraging our deep expertise in translating diverse services and use cases into reality across vertical industries,” said Byungkyun Kim, head of device business unit, KT. “We expect Qualcomm Technologies will expand the 5G–based drone industry and pave a way to the development of the drones based on the Qualcomm Flight RB5 5G Platform.”

LG Uplus

“Qualcomm Technologies’ launch of the Qualcomm Flight RB5 5G Platform has great significance to the drone ecosystem as the integration of drones with 5G communication and AI technology can maximize drone usability and convenience,” said Youngseo Jeon, B2B service development director, LG Uplus. “We are expecting U+ smart drone service which contains telecommunication, control, and video will combine with the Qualcomm Flight RB5 5G Platform and play a key role across diverse drone industry fields.”

MITRE

“The reliability, availability, and low latency of 5G enable previously unavailable command and control of UAS, solving critical UAS safety considerations and enabling operation beyond visual line of sight (BVLOS). With this connectivity and the added benefit of moving intelligence to the edge, we are now beginning to realize real solutions with significant impact on business and our everyday lives,” said Rakesh Kushwaha, managing director, MITRE Engenuity Open Generation. “The Qualcomm Flight RB5 5G Platform brings advanced intelligence to autonomous decisions, enabling detect and avoid (DAA) even beyond network connectivity. It is a game changer. We are looking forward to having Qualcomm Technologies participate in the MITRE Engenuity Open Generation.”

ModalAI

“ModalAI accelerates autonomy by providing innovators with robot and drone perception and communications systems. Since our founding, we have committed to enabling aerial and ground robot manufacturers with capabilities that can excel a broad set of industries. We are thrilled to collaborate with Qualcomm Technologies to bring the first purpose-built 5G drone that opens cutting-edge computing to a broad set of integrators who can build their applications that take advantage of the coming aerial 5G wave,” said Chad Sweet, chief executive officer, co-founder, ModalAI.

Taiwan Mobile

“We are glad to see Qualcomm Technologies innovate on the 5G drone application continuously, including enterprise-related solutions. Taiwan Mobile offers “real 5G” services with safer and faster advantages to support creative development, and get together with Open Possible,” said Mr. C. H. Wu, vice president, chief enterprise business officer, Taiwan Mobile.

TDK

“TDK is extremely excited to join with Qualcomm Technologies on such a state-of-the-art drone platform,” said Peter Hartwell, chief technology officer, InvenSense, a TDK Group Company. “TDK has a multi-technology focus on Robotics across a robust product portfolio – much of which can be found on the Qualcomm Flight RB5 5G Platform and TDK Mezzanine platforms. Our decision to collaborate with Qualcomm Technologies to utilize breakthrough sensor technology alongside the Qualcomm Flight RB5 5G Platform, which I believe to be most innovative drone reference design in the world.”

Veea

“Many of the anticipated benefits of drones will be further accelerated and strengthened with 5G, including monitoring critical infrastructure, crowd management, and emergency response which includes detection, containment and extinguishing of wildfires, reporting on crop health, monitoring of livestock and irrigation systems at large acreage farms, and much more. The large majority of these use cases require a highly secure and reliable connection that can be more readily supported with 5G connections. We are excited to see Qualcomm Technologies continuing to push the boundaries of innovation with their latest announcement on the Qualcomm Flight RB5 5G Platform and we at Veea are looking forward to using these technologies to innovate across our deployments of hybrid edge-cloud solutions such as at large farms, wildlife parks, stadiums, smart cities, large construction sites and similar projects,” said Allen Salmasi, chief executive officer, Veea.

Verizon Skyward

“The Qualcomm Flight RB5 5G Platform provides a robust hardware platform that can be certified for the Verizon 5G network, offering the ecosystem of drone developers a simple path to get connected. That means drones built with the Qualcomm Flight RB5 5G Platform can leverage the massive capacity of Verizon 5G Ultra-Wideband to navigate the National Airspace System in safer and more productive ways than ever before,” said Eric T. Ringer, co-founder, chief of staff, Skyward, a Verizon company.

Zyter

“Many of the anticipated benefits of drones will be further accelerated and strengthened with 5G, which provides a high bandwidth connection that is secure and reliable,” said Sanjay Govil, founder and chief executive officer, Zyter, Inc. “We are excited to begin leveraging and integrating the Qualcomm Flight RB5 5G Platform for 5G drones into our own SmartSpaces™ IoT solutions for smart campuses and cities, smart construction, and other applications.”

About Qualcomm (from the company):

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. When we connected the phone to the internet, the mobile revolution was born. Today, our foundational technologies enable the mobile ecosystem and are found in every 3G, 4G and 5G smartphone. We bring the benefits of mobile to new industries, including automotive, the internet of things, and computing, and are leading the way to a world where everything and everyone can communicate and interact seamlessly.

Qualcomm Incorporated includes the company’s intellectual property licensing business, QTL, and the vast majority of their patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering, research and development functions, and substantially all of our products and services businesses, including the QCT semiconductor business.

…………………………………………………………………………………

References:

ABI Research and Mobile Experts: Fixed Wireless Access CAGR >=70%

ABI Research and Mobile Experts forecast that 5G FWA connections will increase at a compound annual growth rate of 71% and “over 70%,” respectively.

Fixed Wireless Access (FWA) will be among the most valuable use cases for LTE and 5G network operators, according to two new reports that predict compound annual growth rates in excess of 70%.

- ABI Research expects global 5G fixed wireless access to exceed 58 million residential subscribers by 2026.

- Mobile Experts predicts 5G fixed wireless access to serve 66.5 million customers by 2026.

FWA is a decades-old technology (that’s how WiMAX was deployed), but its prominence and rate of growth grew substantially during the last year amid the ongoing COVID-19 pandemic, which has forced billions of people worldwide to stay home (“shelter in place”).

Image Credit: Upward Broadband

…………………………………………………………………………………..

ABI Research:

Remote working, online learning, e-commerce, and virtual healthcare drove high-speed broadband demand throughout 2020. The significant increase in the use of internet-based home entertainment such as video streaming and online gaming also pushed existing broadband users to upgrade their broadband service to a higher-tier package, while households without broadband access signed up for new subscriptions.

“Increasing adoption of internet-connected devices, smart TVs, and smart home devices, as well as consumers’ media consumption through internet applications, will continue to drive high-speed broadband adoption in the years to come. In addition, many businesses are allowing remote working for some of their employees after the pandemic, which will boost the need for home broadband services even further,” explains Khin Sandi Lynn, Industry Analyst at ABI Research.

FWA will be the fastest-growing residential broadband segment, forecast to increase at a CAGR of 71%, exceeding 58 million subscribers in 2026.

As residential broadband penetration saturates mature markets, competition among broadband operators is likely to create challenges to maintain market shares. “In addition to network upgrades, broadband operators need to invest in cutting-edge software and hardware to optimize network performance and support better user experiences. Providing advanced home networking devices, internet security, and home network self-diagnosis tools can help service providers reduce churn and improve average revenue per user,” Lynn concluded.

……………………………………………………………………………….

Mobile Experts:

Mobile Experts forecasts the number of global fixed wireless access connections will more than double to 190 million by 2026. FWA services grew almost 20% yearly to over 80 million in 2020—Mobile Experts sees that number rocketing to almost 200 million by 2026. Around 8-11% of FWA connections over the next five years will be served via proprietary technology primarily deployed by small operators.

FWA equipment sales, including IEEE 802.11 based proprietary, LTE, and 5G CPE revenue, are projected to grow from $4.0 billion this year to over $5.5 billion in 2026. Meanwhile, the proprietary equipment market, including both access point and CPE sales, is expected to stay elevated around $880–$940 million per annum over the next five years.

“Large mobile operators will leverage LTE and 5G for FWA services, and we expect the 5G mm-wave will become a key aspect of their long-term FWA plans—especially in ‘fiber-rich’ markets in the APAC region. That said, large and small operators will benefit from government funding to help build out hybrid fiber plus FWA networks for the next 5-10 years,” said Principal Analyst Kyung Mun.

This report includes 41 charts and diagrams, including a five-year forecast illustrating the growth of the market for infrastructure and customer premise equipment and fixed wireless access connections by technology. Key details such as technical breakdowns, equipment revenue, and market shares are included.

………………………………………………………………………………………..

References:

https://www.mobileexperts.org/reports/p/virtual-mobile-networks-pt3na-zrw9g

https://www.sdxcentral.com/articles/news/5g-fixed-wireless-rides-pandemic-related-shift/2021/08/

Technavio: Disaster Recovery-as-a-Service market CAGR > 44.65% from 2021-2025

The disaster recovery-as-a-service (DRaaS) market is set to grow by $40.97 billion, progressing at a CAGR (compound annual growth rate) of over 44.65% during 2021-2025 (43.19% till 2024), according to this Technavio report.

The report identifies and provides a detailed analysis of the market participants in dominant positions including Amazon.com, Broadcom, Cisco Systems, Dell Technologies, and International Business Machines Corp.

Various factors such as growing improvements in manageability and protection, increasing adoption of cloud-based disaster recovery solutions, and rising need to meet RTO and RPO objectives of enterprises will offer immense growth opportunities for market growth.

In addition, the surging adoption of AI for disaster recovery and deployment of DRaaS by enterprises to reduce the need for secondary data centers will further lead the market to flourish during the forecast period. However, the availability of open-source disaster recovery tools is one of the primary factors anticipated to limit the market’s growth during the next few years.

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Some of the other major vendors of the disaster recovery-as-a-service (DRaaS) market in IT Consulting & Other Services include iland Internet Solutions, Microsoft Corp., NTT Communications Corp., Oracle Corp., and Sungard Availability Services LP.

To help businesses improve their market position and leverage the current opportunities, market vendors must strengthen their foothold in the fast-growing segments, while maintaining their positions in the slow-growing segments. Backed with competitive intelligence and benchmarking, our research report on the disaster recovery-as-a-service (DRaaS) market is designed to provide entry support, customer profile & M&As as well as go-to-market strategy support.

……………………………………………………………………………………….

Disaster Recovery-as-a-Service (DRaaS) Market is segmented as follows:

- Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Geography

- North America

- Europe

- APAC

- South America

- MEA

…………………………………………………………………………..

Separately, Technavio forecasts the fiber optics market will grow at a CAGR of 4.77% till 2024. During the forecast period, the market will show an accelerating growth of $2443.66 million.

References:

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

2Africa subsea cable system adds 4 new branches

2Africa, which will be the largest subsea cable project in the world, will deliver faster, more reliable internet service to each country where it lands. Communities that rely on the internet for services from education to healthcare, and business will experience the economic and social benefits that come from this increased connectivity.

Alcatel Submarine Networks (ASN) has been selected to deploy the new branches, which will increase the number of 2Africa landings to 35 in 26 countries, further improving connectivity into and around Africa. As with other 2Africa cable landings, capacity will be available to service providers at carrier-neutral data centers or open-access cable landing stations on a fair and equitable basis, encouraging and supporting the development of a healthy internet ecosystem.

Marine surveys completed for most of the cable and cable manufacturing is underway. Since launching the 2Africa cable in May 2020, the 2Africa consortium has made considerable progress in planning and preparing for the deployment of the cable, which is expected to ‘go live’ late 2023. Most of the subsea route survey activity is now complete. ASN has started manufacturing the cable and building repeater units in its factories in Calais and Greenwich to deploy the first segments in 2022.

Egypt terrestrial crossing already completed

One of 2Africa’s key segments, the Egypt terrestrial crossing that interconnects landing sites on the Red and the Mediterranean Seas via two completely diverse terrestrial routes, has been completed ahead of schedule. A third diverse marine path will complement this segment via the Red Sea.

About MTN GlobalConnect

GlobalConnect is a Pan-African digital wholesale and infrastructure services company, and an operating company in the MTN Group. GlobalConnect manages MTN’s international and national major wholesale activities, in addition to offering reliable wholesale and infrastructure solutions for fixed connectivity and wholesale mobility solutions that include international mobile services, Voice, SMS, signalling, roaming and interconnect. The MTN Group launched in 1994 is a leading emerging market operator with a clear vision to lead the delivery of a bold new digital world and is inspired by the belief that everyone deserves the benefits of a modern connected life. Embracing the Ambition 2025 strategy, MTN is anchored on building the largest and most valuable platform business, with a clear focus on Africa. The MTN Group is listed on the JSE Securities Exchange in South Africa under the share code “MTN”.

For more information, please visit www.globalconnect.solutions – https://www.mtn.com

About stc

With its headquarter in Riyadh, stc group is the largest in the Middle East and North Africa based on market cap. stc’s revenue for 2020 amounted to 58,953million SAR (15,721 million US dollars) and the net profit amounted to 10,995 million SAR (2,932 million US dollars). stc was established in 1998 and currently has customers around the globe. It is ranking among the world’s top 50 digital companies and the first in the Middle East and North Africa according to Forbes. It focuses on providing services to enterprise and consumer customers through a fiber-optic network that spans 217,000 kilometers. stc group was among the first in MENA region to launch 5G networks and was considered one of the fastest globally in deploying 5G network as stc already deployed around 4,000 5G towers as end of 2020. stc group has 14 subsidiaries in the Kingdom, gulf and around the world, and its own 100% of stc Bahrain, 51.8% stake in stc Kuwait and 25% stake in Binariang GSM Holding in Malaysia which owns 62% of Maxis in Malaysia.

In Saudi Arabia (the group’s main operation site) stc operates the largest modern mobile network in the Middle East as it covers more than 99% of the country’s populated areas in addition to providing 4G mobile broadband to about 90% of the population across the Kingdom of Saudi Arabia. In addition to the above-mentioned, stc is a strong regional player in IoT, managed services, system integration, cloud computing, information security, big data Analytics fintech and artificial intelligence.

For more information, please visit https://www.stc.com.sa; or to follow us on Twitter: @stc , @stc_ksa

About Telecom Egypt

Telecom Egypt is the first total telecom operator in Egypt providing all telecom services to its customers including fixed and mobile voice and data services. Telecom Egypt has a long history serving Egyptian customers for over 160 years maintaining a leadership position in the Egyptian telecom market by offering its enterprise and consumer customers the most advanced technology, reliable infrastructure solutions and the widest network of submarine cables. Aside from its mobile operation “WE”, the company owns a 45% stake in Vodafone Egypt. Telecom Egypt’s shares and GDRs (Ticker: ETEL.CA; TEEG.LN) are traded on The Egyptian Exchange and the London Stock Exchange. Please refer to Telecom Egypt’s full financial disclosure on ir.te.eg

For more information, email: [email protected]

…………………………………………………………………………………………

References:

https://www.orange.com/en/newsroom/press-releases/2021/new-branches-2africa-subsea-cable-system

China (led by Huawei) in bid to take over Africa’s telecom networks

Telecommunications networks funded and built by China are taking over Africa’s cyberspace, a dependence that analysts suggest puts Beijing in a position to exert political influence in some of the continent’s countries.

Bulelani Jili, a doctoral candidate at Harvard University’s Department of African and African American Studies, said that “Huawei is working and partnering with many governments across the continent, and it is those governments that are using quality technology to undermine democratic values.”

Huawei, the world’s leading seller of 5G network equipment is seen by the U.S. and other countries as a pawn of the Chinese government, which could use the company for spying, an accusation Huawei denies, according to the Council on Foreign Relations.

The Center for Strategic and International Studies (CSIS), a think tank in Washington, reported in May that worldwide, “the majority of [Huawei’s] deals (57%) are in countries that are middle-income and partly free or not free.”

The CSIS report added that Huawei’s cloud infrastructure and e-government services are handling sensitive data, services that “could provide Chinese authorities with intelligence and even coercive leverage.”

The “intelligence and even coercive leverage” language stems from China’s 2017 National Intelligence Law, which stipulated that any organization and Chinese citizen should “support, assist and cooperate with the state intelligence work.” The law does not limit these activities to China.

Goals and needs

The African Union has set the goal of connecting every individual, business and government on the continent by 2030, an expansion that is supported by the World Bank Group.

Africa needs 1,000 megawatts (MW) of new facility capacity or about 700 new data center facilities to meet growing demand in the continent, according to the Africa Data Centers Association.

The scale of need for data centers to meet population growth “is astoundingly significant,” Guy Zibi, principal analyst at Xalam Analytics, who is tracking the African data center boom, told the website DataCenterKnowledge.

On June 22nd, the West African nation of Senegal opened a national data center just outside Dakar, the capital. Financed by the Export-Import Bank of China, the center was built with equipment and technical backing from Huawei. Senegal’s status declined from free to partly free in the Freedom in the World 2020 report from Freedom House.

In July 2020, Cameroon completed a government data center on the outskirts of Yaounde, the capital. It was funded by the Export-Import Bank of China, built by the Beijing-controlled China Shenyang International Economic & Technical Cooperation Corporation and equipped with Huawei gear. Freedom House in 2020 rated Cameroon as not free.

In April 2019, Kenya and Huawei signed a deal for a data center, a smart city and surveillance project, according to DataCenterDynamics. The site also reported Huawei was working with the government of Zambia on a $75 million data center. Freedom House rated Kenya as partly free in 2020.

Huawei’s e-government services include elections, document digitization, national ID systems and tax services, according to the CSIS report.

While the digitization of government records may allow greater surveillance, it can also mean more effective tax collection and less corruption, according to a March 2021 post on a tech site of the Brookings Institution a Washington think tank.

“As the continent recovers from the COVID-19 pandemic, its leaders face a choice between harnessing emerging technology to improve government effectiveness, increase transparency and foster inclusion, or as a tool of repression, division and conflict,” said the TechStream post.

China’s expansion

China has a history of financing and supplying telecom and information and computer technology (ICT) throughout Africa, according to an April 2021 report from the Atlantic Council’s African Center.

Over the past two decades, Huawei has built about 50% of Africa’s 3G networks and 70% of its 4G networks, according to the report.

The expansion began in 1999, when China launched its Go Out policy, which pushed Chinese companies to invest abroad and strengthen China’s global business presence.

By 2018, China had expanded to at least 40 African nations, according to Africa Times.

Cobus van Staden, a senior China-Africa researcher at the Johannesburg-based think tank South African Institute of International Affairs (SAIIA), outlined why Chinese firms succeed in Africa.

“First is that the continent has very high demand for digital connectivity, at all levels, from network building to consumer handset sales,” he told VOA in an email.

Second, Chinese companies have easy access to large banks closely tied to Beijing. This, according to van Staden, means Chinese companies have the funding to roll out infrastructure quickly in a variety of environments.

Iginio Gagliardone, an associate professor at the University of the Witwatersrand in Johannesburg, South Africa, has done extensive research on the rise of China’s presence in Africa and is the author of China, Africa and the Future of the Internet.

He said that the relationship Chinese companies have with state-affiliated banks means the companies can lower their prices and maintain a competitive advantage over other bidders.

“The Export-Import Bank [of China] has been able to offer large loans, as part of deals with African governments, with the condition that these loans will be used to deploy technology using a Chinese company,” he said in a phone interview with VOA Mandarin.

Chinese state banks provide such generous financing to Huawei’s customers that most commercial banks cannot match the terms, “making Huawei equipment cheaper to deploy at any price,” according to a 2020 report by the Center for American Progress, a Washington think tank.

A third factor, according to van Staden, is that there has been relatively little attention paid to Africa as an emerging tech market. “There aren’t many credible competitors to Chinese companies on the scene,” he added.

Known player

Because Chinese enterprises are known players in Africa’s telecommunications infrastructure, countries transitioning to 5G often remain with the companies they know, according to analysts.

“Although the Trump administration’s policies successfully curbed Chinese expansion in Western countries, they did not address the growing presence of Chinese technology infrastructure on the African continent,” according to the Atlantic Council’s report. “In African markets, a lack of local champions and infrastructure financing and construction capacity constraints have created a dependence on Chinese-financed projects.”

Van Staden said that the dependence raises the question of possible political influence.

“Research has shown that Chinese companies are responsive to local regulations and governance. In both authoritarian and democratic countries, Chinese contractors have tended to follow local laws and to provide the systems these governments wanted, be these open and inclusive, or centrally controlled,” he said.

“There isn’t proof that China is ‘exporting’ its own domestic system or pressuring countries to emulate it,” he continued. “The issue is less that China is using data networks to influence local politics, and more that its position as a network provider is just one aspect of a much broader trade and investment presence. China’s role as a major trade, financing and development partner to many African countries naturally makes these countries less willing to cross any of Beijing’s ‘red lines.’ ”

References:

VSG Global SD-WAN Leaderboard Rankings and Results

Orange Business Services (France), AT&T (U.S.), and Verizon (U.S.) topped Vertical Systems Group’s (VSG) latest leaderboard for global carrier-managed SD-WAN. They were followed in the rankings by NTT (Japan), BT (UK), Telefonica Global Solutions (Spain), and Vodafone (UK). [The rank order is based on site share outside of the provider’s home country, as of June 30, 2021.]

Rosemary Cochran, principal analyst and co-founder of Vertical Systems Group said that global networks are far more complex to manage and administer compared to domestic SD-WAN offerings. They often require service providers to negotiate contracts with multiple countries, meet diverse regulatory requirements, and support numerous network technologies.

This industry benchmark for multinational SD-WAN market presence ranks companies that hold a 5% or higher share of billable retail sites outside of their respective home countries.

Twelve companies qualify for the Mid-2021 Global Provider Managed SD-WAN Challenge Tier (in alphabetical order):

Aryaka (U.S.), Colt (U.K.), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (U.S.), Hughes (U.S.), Lumen (U.S.), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden) and Telstra (Australia).

The Challenge Tier includes companies with site share between 1% and 5% of this defined SD-WAN segment.

“We’re pleased to release the first benchmark that measures Global Provider market presence based on multinational managed SD-WAN customer sites,” said Rick Malone, principal of Vertical Systems Group. “Enterprises with business-essential applications that span multiple regions of the world are choosing SD-WAN solutions from network operators with the global infrastructures, experience, partnerships and technical expertise necessary to deliver world-class services.”

Research Highlights for Global Provider SD-WAN Services:

- Orange Business Services gained the top share rank on the Mid-2021 Global Provider Managed SD-WAN LEADERBOARD with the largest number of customer sites installed.

- Vertical’s SD-WAN Coverage Analysis for five regional markets – North America, Latin America, Europe, Africa/Middle East, Asia/Pacific – shows that all seven companies ranked on the Mid-2021 Global Provider SD-WAN LEADERBOARD have good to strong coverage in at least three of these regions.

- COVID-19 continues to appreciably impact every region of the world. Just being able to get the SD-WAN equipment and support the services has been a disruptive experience for service providers and their customers.

- Challenges cited by Global SD-WAN operators include: workforce health protection, tracking the shift back from remote to office environments, service disconnects due to business closures, and supply chain disruptions.

- Most multinational Managed SD-WAN customer implementations are hybrid network configurations that incorporate MPLS, IP VPN, Cloud connectivity or other services, plus multiple security capabilities that are integral or supplied by technology partners.

- SD-WAN customers with MPLS connections are migrating to more cloud-suitable broadband services that provide bandwidth flexibility and lower pricing.

- Ethernet DIA (Dedicated Internet Access) is the preferred choice for SD-WAN customers that require dedicated, symmetrical connectivity.

Fictitious image of a global mesh connected SD-WAN

…………………………………………………………………………………………..

Five of the seven companies on the Mid-2021 Global Provider SD-WAN LEADERBOARD are ranked on the 2020 Global Provider Ethernet LEADERBOARD (in rank order): AT&T, Orange Business Services, Verizon, BT Global Services and NTT.

- Two companies ranked on the Mid-2021 Global Provider SD-WAN LEADERBOARD – AT&T and Verizon – have attained MEF 3.0 SD-WAN Services Certification to date. Additionally, three companies cited in the Challenge Tier – Colt, PCCW Global and Telia – have MEF 3.0 SD-WAN Services certification.

- The primary technology suppliers to the nineteen Mid-2021 Carrier Managed SD-WAN LEADERBOARD and Challenge Tier companies are as follows (in alphabetical order): Cisco, Fortinet, HPE Aruba, Nuage Networks (Nokia), Versa and VMware.

The Market Player tier includes providers with site share below 1%. Companies in the Mid-2021 Market Player tier are as follows (in alphabetical order):

Batelco (Bahrain), China Telecom (China), Claro Enterprise Solutions (Mexico), CMC Networks (South Africa), Cogent (U.S.), Epsilon (Singapore), Etisalat (Abu Dhabi), Expereo (Netherlands), HGC Global (Hong Kong), Intelsat (U.S.), KDDI (Japan), Masergy (U.S.), Meriplex (U.S.), PLDT Enterprise (Philippines), SES (Luxembourg), Sparkle (Italy), StarHub (Singapore), Syringa Networks (U.S.), T-Mobile (U.S.), Telenor (Norway), Telin(Singapore), Transtelco (U.S.), Virgin Media (U.K.), Zayo (U.S.) as well as other providers (unnamed) selling SD-WAN services outside their home country.

Closing Comment:

This VSG report highlights the disparate implementations of global SD-WANs. “…implementations are hybrid network configurations that incorporate MPLS, IP VPN, Cloud connectivity or other services, plus multiple security capabilities that are integral or supplied by technology partners.”

That is because there is no clear definition of functionality (yeah we know about MEF’s definition) and no specification of any exposed interfaces, e.g. UNI, network node to network node, or NNI between two SD-WAN networks.

As such, global SD-WANs are really a concept, not a set of required networking technologies with defined reference points and standardized interfaces/APIs. As a result, it’s a serious challenge for the global SD-WAN operator to ensure interoperability between each of the different subnetwork interfaces so that end to end connectivity is achieved.

…………………………………………………………………………………………….

References:

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

NTT launches “global” private 5G network as Network-as-a-Service platform

NTT today announced the launch of its Private 5G platform (P5G), the first globally available private LTE/5G Network-as-a-Service (NaaS) platform. The Japanese company states that NTT P5G will enable Chief Information Officers and Chief Digital Officers leverage the benefits of private 5G (?) to solve business problems and innovate to keep pace with the future of enterprise.

NTT says that their Private 5G platform provides a suite of services built to help Chief Information Officers and Chief Digital Officers drive business outcomes and unlock innovative business models that drive the future of enterprise across industries.

- NTT Private 5G platform offers a single end-to-end management and service creation platform with global visibility, eliminating friction and increasing ROI.

- NTT Private 5G is purpose-built to solve enterprise business challenges with a platform that goes beyond connectivity, providing security, device and edge management, application development, big data analytics and deep back-office integration.

- Wireless industry leader Shahid Ahmed joins NTT as EVP of New Ventures and Innovation to pioneer the Private 5G service portfolio and accelerate ecosystem collaboration.

Running on a cloud-native architecture, the platform can be delivered via cloud, on-premises, or at the edge. The platform is pre-integrated with leading network and software partners (unnamed), allowing enterprises to secure, scale and segment their network flexibly. With patent-pending MicroSlicing™ technology (?), NTT P5G allows mission-critical apps to leverage the advantages of private 5G.

Fueling enterprise digital transformation with cloud-based economics and automation is at the heart of NTT’s vision for private 5G. NTT is focused on driving the global acceleration of private 5G to meet the fast-evolving needs of enterprises across industries, including automotive, manufacturing, healthcare, and retail to create unprecedented alignment of data, connectivity, security, and communications. NTT is the only provider that offers a best-in-class global network, deep vertical expertise, and a full suite of application development and management capabilities.

“As a key partner in our digital transformation journey, NTT has an impressive track record of building and supporting new technologies that help CXOs solve critical business challenges,” said Javier Polit, Chief Information & Global Digital Services Officer of Mondelēz International. “NTT’s unique approach to Private 5G offerings provides the kind of agility and insight that we will need to further accelerate our business.”

NTT appointed wireless industry leader Shahid Ahmed as EVP of New Ventures and Innovation to pioneer the Private 5G service portfolio, drive digital transformation outcomes for clients, and deepen ecosystem collaboration.

Shahid Ahmed, NTT EVP of New Ventures and Innovation

Shahid brings over 25 years of technology experience focused on business transformation, including key leadership roles at Accenture, Pricewaterhouse Coopers, and Sprint. In addition, he is an appointed advisor to the United States Federal Communications Commission (FCC).

“Global enterprises are looking for a single private 5G solution to deploy across multiple countries. They need one truly private network, one point of accountability, one management platform, and one solution partner that eliminates all the major friction points across the entire global footprint of the enterprise,” said Shahid Ahmed, NTT Ltd. EVP New Ventures and Innovation. “Our NTT P5G offering supports many of the CXO requirements today, and we will continue to invest in P5G as enterprise adoption evolves.”

“The private 5G technology has the potential to fundamentally change the way enterprises drive digital transformation,” said Ghassan Abdo, Research Vice President at IDC. “NTT has a strong track record of focusing on breadth of service, and NTT P5G capabilities extend far beyond basic connectivity to offer a comprehensive suite of services geared toward important business outcomes.”

“As data and mobility become more critical to business operations, 5G will enable enterprises to reinvent business operations. With faster speeds and more data, 5G will facilitate advances in artificial intelligence, automation, and IoT,” said Eric Clark, NTT Data Services North America Chief Digital and Strategy Officer. “How a company collects, stores, and uses that data in real-time will be critical to success, and NTT is well positioned to guide our clients on this journey.”

NTT group companies are jointly accelerating the adoption of open and virtualized 5G solutions globally in collaboration with ecosystem stakeholder. The company says this comprehensive approach enables NTT to provide a full suite of digital transformation services (undefined).

………………………………………………………………………………………..

Missing Pieces:

Names of partner companies were not disclosed. The only reference was that NTT P5G was “pre-integrated with leading network and software partners.”

Mondelēz International, with a presence in over 150 countries, is a customer (see above quote), but it was unclear whether they were an active user of NTT P5G and, if so, in which countries.

No other customers were announced or quoted, although the Cologne Bonn Airport said in May that they had “partnered with NTT to develop a wholly private 5G mobile network across its 1,000 hectares premises. Under this joint research and cooperation project, the duo will work on technological innovations, including border control and intelligent luggage checking. The aim of the collaboration is to enhance the operational efficiency of the airport.

Finally, NTT’s “patent-pending MicroSlicing technology,” was not defined other than it “allows mission-critical apps to leverage the advantages of private 5G.”

In conclusion, NTT needs to produce case studies which demonstrate the benefits that P5G brings to enterprise customers, such as Bonn-Cologne airport and Mondelēz International. Also, more details on the functionality are urgently needed.

…………………………………………………………………………………….

References:

https://hello.global.ntt/private5g

https://www.enterprisetimes.co.uk/2021/08/11/ntt-takes-a-leap-into-the-future-with-private-5g/

AT&T’s fiber buildout reduced due to supply constraints

AT&T has experienced recent disruptions in the supply of fiber optic cable, which has caused the company to trim back its planned fiber-to-the-premises (FTTP) buildout for 2021, according to senior EVP and CFO Pascal Desroches.

AT&T had previously said it would build out its fiber network to an additional 3 million homes passed this year. But that’s now been reduced by 1/2 million.

“Since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. We’re probably going to come in a little bit light of 3 million homes passed, probably around 2.5 million,” Desroches said Tuesday at the Oppenheimer Technology, Internet & Communications Conference, according to this transcript.

An AT&T technician working on a fiber project

………………………………………………………………………………………….

Specifically, this is what Pascal said:

But since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. And as a result of those dislocations, we had previously provided guidance of 3 million homes past this year (unedited- very bad grammar). We’re probably going to come in a little bit in light of that, probably around 2.5 million. We don’t think it’s going to impact us long term. But I think it’s really important context because if we’re feeling the pain of this, I can only imagine what others in the industry are experiencing.

John Stankey (AT&T CEO) has always been a believer in fiber. I think when he took over he identified that as a priority area because he understood from a technology standpoint, there is no better technology for connectivity. And therefore, in a world where the demands for symmetrical speed are increasing significantly, this is the technology to bet heavily on. And so we have a great position, and we are leaning into adding to that position. So it’s really a function of when you — and I think others are now recognizing it as a result of what you’ve seen in the last year in the pandemic, the need to do what we’re doing now, 2-way communication can only happen with symmetrical speed. So I think everyone has had an aha moment, like we need to deploy fiber. And so we’ve long believed that. John has long believed that, and this is just really leading into that opportunity.

As we deploy fiber, our goal is to get at least 40% penetration on homes passed. And we think in certain markets, we’ll have an opportunity to do better than that. And the other thing that is great about is when you lay fiber, you lay fiber to a community where there is both homes and businesses. So it also helps boost returns in your enterprise business. And so that’s why it is so critical that we roll this out because the ability to grow both your enterprise and your consumer business is attractive. And we think these investments will provide us with mid-teen returns over time.

I know we’re largest fiber purchaser in the country. And we have prices that are at the best and most competitive among the industry. So we feel really good about the ability to secure inventory, fiber inventory and at attractive price points and the ability to execute and the build-out at scale, something that many others don’t have.

Oppenheimer moderator question: “Can you talk a little bit about where your supply comes from, I guess, both the fiber and the optical components or any other key suppliers? Is that U.S. sourced? Or is it a lot of it outsourced internationally?”

Pascal’s answer: “It is a U.S. company which has locations both domestically and outside the U.S.” [We suspect that it’s Corning].

AT&T typically has had no problem getting fiber at a low cost, Desroches said. “We’re the largest fiber purchaser in the country and we have prices that are the best and most competitive in the industry,” he said. “We feel really good about the ability to secure fiber inventory at attractive price points and the ability to execute the buildout at scale, something that many others don’t have.”

AT&T expects to catch up to its original fiber-construction estimates in the years after 2021, largely because of what Desroches called its “preferred place in the supply chain” and “committed pricing.” As AT&T said in a news release yesterday, AT&T is “working closely with the broader fiber ecosystem to address this near-term dislocation” and “is confident it will achieve the company’s target of 30 million customer locations passed by the end of 2025.”

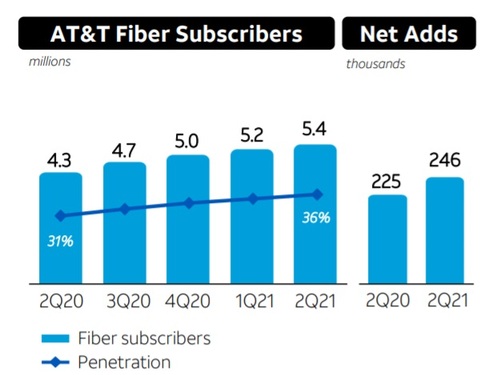

AT&T added another 246,000 fiber broadband subs in Q2 2021, extending its total to 5.43 million, and said last month it was on pace to add about 1 million net fiber subscribers for all of 2021.

AT&T has estimated that nearly 80% of new fiber subscribers are also new AT&T customers, reversing a previous trend that saw a sizable portion of its FTTP customer net adds coming from upgrades of existing AT&T high-speed Internet customers on older VDSL and DSL platforms (which have been largely discontinued).

Speaking on AT&T’s 2Q-2021 earnings call last month, Desroches stated that the company’s consumer wireline business had reached a “major inflection point” as broadband revenues continue to surpass legacy declines. Meanwhile, AT&T’s broadband average revenue per user (ARPU) reached $54.76 in Q2 2021, improving from $51.61 in the year-ago period.

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?