Year: 2023

HPE acquires private cellular network provider Athonet (Italy) to strengthen HPE Aruba’s networking portfolio

Hewlett Packard Enterprise (HPE) today announced the expansion of its connected edge-to-cloud offering with the acquisition of Athonet, a private cellular network technology provider that delivers mobile core networks to enterprises and communication service providers. Combined with the HPE telco and Aruba networking portfolios, Athonet will put HPE at the forefront of a growing market that is predicted by IDC to increase to more than $1.6 billion1 by 2026.

Based in Vicenza, Italy, Athonet has more than 15 years of experience delivering 4G and 5G mobile core solutions to customers and partners globally. Athonet is an award-winning technology pioneer with more than 450 successful customer deployments in various industries, including leading mobile operators, hospitals, airports, transportation ports, utilities, government and public safety organizations.

With enterprises facing complex connectivity challenges across large and remote sites, private 5G offers high levels of coverage, reliability and mobility across campus and industrial environments. It also augments the cost-effective, high-capacity connectivity provided by Wi-Fi. The incorporation of Athonet’s technology will allow HPE to deliver private networking capabilities directly to enterprises as part of HPE’s Aruba networking portfolio, while also enabling communications service providers (CSPs) to quickly deploy private 5G networks for their customers.

“Telco customers are looking for simpler ways to deploy private 5G networks to meet growing customer expectations at the connected edge,” said Tom Craig, global vice president and general manager, Communications Technology Group at HPE. “At the same time, enterprise customers are demanding a customized 5G experience with low-latency, segregated resources, extended range and security across campus and industrial environments that complement their existing wireless networks. With the acquisition of Athonet, HPE now has one of the most complete private 5G and Wi-Fi portfolios for CSP and enterprise customers – and we will offer it as a service through HPE GreenLake.”

HPE expands private 5G solutions for both telcos and the enterprise:

HPE will integrate Athonet’s technology into its existing CSP and Aruba networking enterprise offerings to create a private networking portfolio that accelerates digital transformation from edge-to-cloud. The networking portfolio will provide the following benefits:

- Enhanced private networks that combine the high capacity of Wi-Fi with the coverage and mobility of 5G

- Accelerated private 5G deployments that improve agility and innovation to help telco B2B teams and enterprise customers

- New enterprise revenue streams for telcos with differentiated services leveraging 5G and Wi-Fi

- Alignment of costs to revenues with consumption-based models for enterprises and telcos through HPE GreenLake, reducing the risk of entering new markets

- Management of operational complexity and cost efficiency with 5G orchestration and zero-touch automation to deliver new workloads from edge-to-cloud

With 5G investments running into the billions of dollars, CSPs are looking for simple ways to meet customer needs and drive new B2B revenue by deploying both edge compute and private 5G networks. The addition of Athonet’s software to HPE’s telco portfolio enhances one of the broadest communications portfolios in the market, which serves a base of more than 300 customers across 160 countries and connects more than one billion mobile devices worldwide. Building on its existing private 5G solutions, HPE’s enhanced offering for CSPs will support private 4G and 5G networks and include telco-grade orchestration and automation capabilities. These capabilities will help launch new B2B services that meet growing customer expectations for the connected edge.

“Athonet was founded to provide customers with private 4G and 5G solutions that deliver carrier-grade reliability and performance to suit their increasing and more challenging connectivity needs,” said Gianluca Verin, CEO and co-founder of Athonet. “We are excited to join HPE and combine our highly skilled teams as we expand our joint service provider offerings for the rapidly growing private 5G market and build on HPE’s strategy to be the leading edge-to-cloud solutions provider.”

Private 5G offers enterprises new capabilities that are ultra-secure, easy to deploy and manage, ready for highly specialized applications such as robotics and industrial IoT, data networks and pipelines, and security systems facilitation. The acquisition of Athonet strengthens Aruba’s connected edge portfolio, providing the unique and highly sought-after ability to deliver fully integrated Wi-Fi and private 5G networks. Integration with Aruba Central will enable network managers to administer Wi-Fi and private 5G through a single pane of glass and bring to bear the power of AI-powered insights, workflow automation, and robust security.

HPE GreenLake, HPE’s edge-to-cloud platform, will offer Athonet private 5G offerings, combining all costs for Wi-Fi and private 5G into one single monthly subscription with no capital expenditure. Flexible consumption options, including HPE’s networking as a service, mean private 5G networks can be deployed with reduced risk, little upfront investment and scaled according to demand.

HPE portfolio integration and availability:

HPE will integrate Athonet’s solutions with its existing telco software assets and plans to make them available to customers some time following the close of the transaction. HPE will also integrate the solutions with the Aruba networking portfolio in the near future. The transaction is expected to close at the beginning of the third quarter of HPE’s 2023 fiscal year, subject to regulatory approvals and other customary closing conditions.

About Hewlett Packard Enterprise:

Hewlett Packard Enterprise is the global edge-to-cloud company that helps organizations accelerate outcomes by unlocking value from all of their data, everywhere. Built on decades of reimagining the future and innovating to advance the way people live and work, HPE delivers unique, open and intelligent technology solutions as a service. With offerings spanning Cloud Services, Compute, High Performance Computing & AI, Intelligent Edge, Software, and Storage, HPE provides a consistent experience across all clouds and edges, helping customers develop new business models, engage in new ways, and increase operational performance. For more information, visit: www.hpe.com

Media Contacts for U.S. & Canada:

Ben Stricker [email protected]

…………………………………………………………………………………………………………………………………………

Analysis from Channel Futures:

While HPE already offers a 5G cloud-native software core, Athonet gives deeper in-house capabilities to more quickly and directly deploy private 5G networks.

“Given HPE’s Wi-Fi and security assets – like Aruba – I’d say this makes a clear play to simplify management for key enterprise digital assets. And this is the kind of issue that enterprises are often bringing up to us,” Omdia chief analyst of enterprise services Camille Mendler told Channel Futures. (Omdia and Channel Futures share a parent company, Informa.)

Patrick Filkins, IDC‘s research manager for IoT and telecom network infrastructure, said Athonet can give HPE customers an improved option for deploying a private 5G network together with Wi-Fi. Filkins said that integrated portfolio could well serve an enterprise that has already done the heavy legwork of building a Wi-Fi network.

“This is a very complicated task, and one the enterprise itself controls. They don’t want to start from scratch or be forced to have someone else tinkering in their systems, so this acquisition will hopefully provide some assurance to enterprise customers that the vendors will help ensure their customers can repurpose work they’ve already done to integrate a new network technology, and hopefully new use cases,” Filkins said.

Filkins said the acquisition will immediately improve the HPE 5G core and gradually work its way into Aruba portfolio improvements. For example, HPE will integrate Athonet into the Aruba Central network management platform.

“Specifically, we expect HPE/Aruba to over time release follow-on solutions which help enterprises manage the two technologies seamlessly. Enterprises are not interested in deploying both 5G and Wi-Fi networks in a silo. They want a combined solution that can help tackle the integration and management issues from a single pane. This means you’ll see HPE’s telco and Aruba teams working together more closely over time,” Filkins said.

Mendler said one might see a U.S. equivalent in Celona, despite Athonet’s age (founded 2004) compared to that of Celona (founded in 2019). Filkins added that although many vendors provide private and public LTE/5G cores in the U.S., most run their headquarters abroad. He pointed to Cisco and Microsoft-acquired Mavenir, Affirmed Networks and MetaSwitch as 5G core providers in the U.S.

“However, from a competitive standpoint, Athonet competes globally against Nokia, Ericsson, Mavenir, Microsoft Azure, Cisco, etc., among others,” Filkins told Channel Futures. He described Athonet as “no slouch” in the wireless market. He calls the company’s customer base deep, though consisting of smaller customers. HPE said in an announcement that Athonet has performed 450 customer deployments in various verticals. Athonet’s customers include SpaceX, which uses a private cellular network in Antarctica.

Filkins called the Athonet technology offerings “relatively advanced for 5G.” For example, the cloud-native 5G core meets almost all of 3GPP‘s listed functions. He also said Athonet’s core augments HPE’s 5G core offerings.

“The cloud-native part means it can be deployed fully on-site, fully in the cloud, or in a hybrid format. This should cover any scenario the customer wants. [Athonet] has specialized in selling mobile core software to enterprises, and smaller, regional operations for years. It knows the needs of the enterprise well,” Filkins said.

Athonet CEO and co-founder Gianluca Verin said his team looks forward to joining HPE. Moreover, he said he wants to enhance HPE’s goal of being “the leading edge-to-cloud solutions provider.” Verin worked in support and solution engineer positions at Ericsson for eight years before starting Athonet.

HPE’s GreenLake edge-to-cloud services platform will host the private 5G service. HPE executives have said GreenLake as-a-service consumption model will “simplify” enterprises’ entrance into 5G and lower risk.

“I think this is an important step HPE is taking. For the most part, private 5G and Wi-Fi networks have been offered as point solutions, but HPE/Aruba intend to do the ‘under-the-hood’ work to make them as integrated as possible, which is what enterprise customers want,” Filkins said.

In December, HPE said 80% of its top 100 customers have adopted the GreenLake platform. The vendor is also equipping Aruba partners to deliver its network-as-a-service offering.

When HPE unveiled a private 5G offering one year ago, an executive said HPE preferred to go to market though system integrators, telcos and service providers rather than straight to the enterprise. HPE’s telco business serves 300 customers across the world, the company said.

……………………………………………………………………………………………………………………………………………….

References:

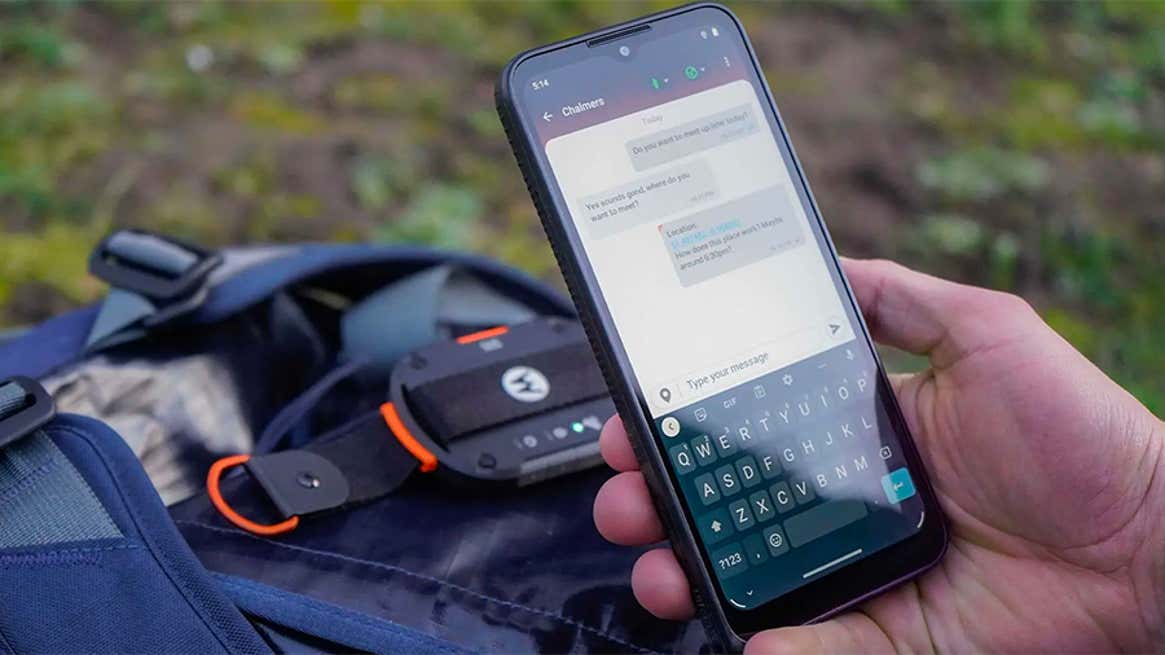

Bullitt Group & Motorola Mobility unveil satellite-to-mobile messaging service device

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications Parent, Inc. (“Frontier”) reported impressive 4th quarter and full-year 2022 results today. The fiber facilities based carrier added a record 76,000 fiber subs in the last quarter, more than two times what it added in the year-ago quarter. The bulk of those fiber subscriber gains are coming from cable competitors, execs said.

Frontier ended 2022 with 1.7 million fiber customers, a figure that represents the majority of its total base of 2.8 million broadband subs. Frontier also built out a record 381,000 new fiber locations in Q4, ending 2022 with 5.2 million fiber locations. That gets Frontier past the halfway point toward a goal of building fiber-to-the-premises to 10 million locations by 2025.

Total revenues were down year-over-year, but consumer fiber revenues rose 7.7% to $436 million versus the prior year period, offsetting declines in video. Consumer fiber broadband revenues surged 15.5%, to $283 million.

“We ended the year strong with another quarter of record operational results. We now have the fiber engine we need to power our growing digital infrastructure business. This is how we advance our purpose of Building Gigabit America,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“This year, we will accelerate our fiber build and give customers more reasons to choose the un-cable provider. The team is fired up and ready to return to growth in 2023.”

Frontier expects to accelerate its fiber build to 1.3 million homes in 2023 – about 20% faster than its 2022 pace – and end the year with 6.5 million fiber locations. Frontier is also exploring fiber builds beyond its initial goal of 10 million. The company has identified 1 million to 2 million copper locations where it can upgrade to fiber cost-effectively. There’s another 3 million to 4 million locations in its footprint that remain financially unattractive but could get over the hump with government subsidies or partnerships.

Even with its faster build pace, Frontier expects 2023 capital expenditures to reach $2.8 billion, essentially flat versus 2022’s $2.74 billion. Frontier anticipates its fiber buildout costs will stay in its envelope of $900 to $1,000 per location passed.

Frontier believes it’s set to grow its average revenue per user (ARPU) by 2% to 3% in 2023. Tied in, it’s updating its pricing and looking to upsell customers to higher speeds (more than half of new subs are choosing speeds of 1-Gig or more) while also reducing its reliance on perks such as gift cards.

Source: Frontier Q4 2022 earnings presentation

……………………………………………………………………………………………………………………………………………………………………

On the wholesale side, Frontier has fiber tower deals with AT&T, Verizon and T-Mobile and recently inked an expanded deal with AT&T to connect it to Frontier’s central offices. Company President and CEO Nick Jeffery suggested that the same model could apply to the likes of Amazon, Microsoft and other cloud companies that are distributing data and could make use of cache locations where data is being consumed.

But that handwork with wireless network operators has yet to drive Frontier toward deals that could enable it to add mobile services to the bundle, and follow the path being taken by major cable operators such as Comcast and Charter Communications.

Jeffery reiterated a position that Frontier is keeping close watch on potential MVNO partnerships but that no such agreement is imminent. Such a deal could be a “distraction of our capital,” he said.

“For the moment, we don’t see the need to launch with an MVNO and bundle with our core broadband offer,” Jeffery explained. “We think it’s something we could spin up relatively quickly and efficiently if we needed to.”

Full-Year 2022 Highlights:

- Built fiber to 1.2 million locations, bringing total fiber passings to 5.2 million by the end of 2022 – more than halfway to our target of 10 million fiber locations.

- Added a record 250,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 17.5% from 2021.

- Revenue of $5.79 billion, net income of $441 million, and Adjusted EBITDA of $2.08 billion.

- Capital expenditures of $2.74 billion, including $1.52 billion of non-subsidy-related build capital expenditures and $0.06 billion of subsidy-related build capital expenditures.

- Surpassed our $250 million gross annualized cost savings target more than one year ahead of plan and raised our target to $400 million by the end of 2024.

4th-Quarter 2022 Highlights:

- Built fiber to a record 381,000 locations

- Added a record 76,000 fiber broadband customers

- Revenue of $1.44 billion, net income of $155 million, and Adjusted EBITDA of $528 million

- Capital expenditures of $878 million, including $517 million of non-subsidy-related build capital expenditures and $33 million of subsidy-related build capital expenditures

- Net cash from operations of $360 million, driven by strong operating performance and increased focus on working capital management

- Achieved annualized run-rate cost savings of $336 million

4th-Quarter 2022 Consolidated Financial Results:

- Frontier reported revenue for the quarter ended December 31, 2022, of $1.44 billion, a 6.9% decline compared with the quarter ended December 31, 2021, as growth in consumer, business and wholesale fiber was more than offset by declines in copper and subsidy.

- Revenue growth was negatively impacted by the expiration of CAF II funding at the end of the fourth quarter of 2021.

- Excluding subsidy-related revenue, revenue for the quarter ended December 31, 2022, declined 2.5% compared with the quarter ended December 31, 2021, an improvement in the year-over-year rate of decline reported for the quarter ended September 30, 2022.

- Fourth-quarter 2022 operating income was $136 million and net income was $155 million.

- Capital expenditures were $878 million, an increase from $559 million in the fourth quarter of 2021, as fiber expansion initiatives accelerated.

4th-Quarter 2022 Consumer Results:

- Consumer revenue of $764 million declined 2.3% from the fourth quarter of 2021, as strong growth in fiber broadband was more than offset by declines in legacy video and voice.

- Consumer fiber revenue of $436 million increased 7.7% over the fourth quarter of 2021, as growth in consumer broadband, voice, and other more than offset declines in video.

- Consumer fiber broadband revenue of $283 million increased 15.5% over the fourth quarter of 2021, driven by growth in fiber broadband customers.

- Consumer fiber broadband customer net additions of 73,000 resulted in consumer fiber broadband customer growth of 17.9% from the fourth quarter of 2021.

- Consumer fiber broadband customer churn of 1.32% was flat with the fourth quarter of 2021.

- Consumer fiber broadband ARPU of $61.20 declined 1.6% from the fourth quarter of 2021, as price increases and speed upgrades were more than offset by the autopay and gift-card incentives introduced in the third quarter of 2021.

- Excluding the impact of gift-card incentives, consumer fiber broadband ARPU increased 0.9% over the fourth quarter of 2021.

4th-Quarter 2022 Business and Wholesale Results:

- Business and wholesale revenue of $659 million declined 2.6% from the fourth quarter of 2021, as growth in our fiber footprint was more than offset by declines in our copper footprint.

- Business and wholesale fiber revenue of $285 million increased 5.5% over the fourth quarter of 2021, driven by growth in both business and wholesale.

- Business fiber broadband customer churn of 1.33% increased from 1.23% in the fourth quarter of 2021.

- Business fiber broadband ARPU of $107.68 increased 0.8% from the fourth quarter of 2021.

…………………………………………………………………………………………………………………………………………………..

Separately, Frontier introduced its Fiber Innovation Labs yesterday – National Innovation Day – designed for inventing and testing new patents, technologies and processes that will advance its fiber-optic network. Improving the customer experience and driving efficiencies are key to accelerating Frontier’s fiber-first strategy. Frontier’s labs serve as a testing ground to find new technologies and procedures to advance the way it delivers blazing-fast fiber internet to consumers and businesses across the country.

“The work we are doing in our Fiber Innovation Labs will change the way we serve our customers and will ultimately change the industry,” said Veronica Bloodworth, Frontier’s Chief Network Officer. “We have the best team in the business – they live and breathe innovation. They have been awarded several patents and are in the process of bringing those new inventions to life to deliver the best ‘un-cable’ internet experience to our customers. Be prepared to be amazed.”

As part of Frontier’s Fiber Innovation Labs, the company has launched its first-ever outside plant facility in Lewisville, Texas. The facility is designed as a miniature suburban neighborhood that mimics the real-life experiences of its techs serving customers every day. It features roads, sidewalks, a state-of-the-art central office, a small house and a reconstructed manhole system. It also simulates weather elements and temperature changes. Here, the Frontier team can test and learn new methods in real-world environments to install and maintain its fiber-optic network.

References:

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

\

Comcast selects Nokia’s 5G SA Core software to support its mobile connectivity efforts

Today, Comcast announced it will roll out Nokia’s 5G Stand Alone Core networking software to support its deployment of CBRS and 600MHz spectrum to Xfinity Mobile and Comcast Business Mobile customers in its service areas across the United States.

Comcast will deploy that spectrum in select, high-traffic areas in support of both residential and business customers that take mobile services from the operator. Deploying fresh spectrum in those areas will give Comcast a greater degree of ownership economics with wireless and help to offset a portion of the MVNO costs associated with its pact with Verizon. Those deployments will also build on Comcast’s current Wi-Fi offload strategy that involves millions of access points deployed in customer homes and in certain metro areas.

Nokia will supply Comcast with its 5G Stand Alone Core networking software, including Packet Core, delivering near zero touch automation and ultra low latency capabilities, as well as operations software and consulting services. These offerings will support Comcast’s efforts to deliver enhanced 5G access to consumer and business customers in the U.S. using Citizens Broadband Radio Service (CBRS) and 600 MHz spectrum.

By combining Nokia’s software with Comcast’s targeted, capital-light network design, Comcast can cost-effectively deliver enhanced 5G and WiFi mobile connectivity to its more than five million Xfinity Mobile and Comcast Business Mobile customers. Comcast and Nokia are currently conducting field trials, which includes Comcast employee testing.

As the demand for reliable Internet access inside and outside of the home and office rapidly increases, Comcast’s mid-band (CBRS) and low-band (600MHz) spectrum enable the company to supplement its existing Xfinity WiFi network and cellular network partnership with additional targeted 5G coverage in certain high-traffic areas within its service territory.

Xfinity Mobile and Comcast Business Mobile services are built for the way people use mobile today, with the Internet at the core of the experience. Calls and texts are free, and customers can experience the freedom of paying by the gig or unlimited, and switch between payment options at any time for any line on their account. For complete pricing and availability details, please visit Xfinity Mobile or Comcast Business Mobile.

Nokia claims to be leading the 5G Standalone Core market, with over 80 communication service provider (CSP) customers around the world. In addition, 25 of the top 40 CSPs by revenue rely on Nokia Core network products.

Comcast and Nokia are currently conducting field trials, including tests with Comcast employees. Comcast didn’t reveal the location of its test markets, but the announcement indicates the operator is finally starting to gear up this important piece of its wireless strategy.

This deal comes more than two years after the company bid for and won licensed CBRS spectrum. Comcast also spent $1.7 billion on 600MHz spectrum licenses in 2017.

Though Comcast has no plans to deploy a national wireless network, it estimates that its current spectrum holdings cover roughly 80% of its homes passed and about 50% of the US population.

Tom Nagel, SVP, Wireless Strategy at Comcast, said: ”We are pleased to be working with Nokia to enable Comcast’s advanced 5G mobile products and services for our customers. Combining Nokia’s industry-leading solutions with Comcast’s targeted network design and new dual SIM technology allows us to create exciting next-generation wireless offerings.”

Fran Heeran, SVP & General Manager of Core Networks, Cloud and Network Services, at Nokia, said: “We are delighted to partner with Comcast and provide Nokia’s advanced 5G Core portfolio to deliver innovative 5G customer offerings securely, at scale, and with advanced operational efficiencies.”

………………………………………………………………………………………………………………………………….

Last fall, Comcast announced it would use Samsung radios, including strand-mounted small cells, for its targeted 5G network. Comcast will deploy separate Samsung radios for the CBRS and 600MHz bands and use its wireline network to help backhaul traffic.

At the time, Comcast confirmed to Light Reading that its wireless network deployment is “using a multi-vendor solution but not within an open RAN framework.”

Comcast’s wireless network evolution is underway as the operator continues to grow a mobile business that launched almost six years ago. Comcast added a record 365,000 mobile lines in Q4 2022, raising its total to 5.31 million.

Meanwhile, Comcast recently introduced a limited-time service convergence bundle for new customers that offers one unlimited mobile line and a 200Mbit/s home broadband service (with the Wi-Fi gateway included) for $50 per month – for a period of 24 months.

……………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g-and-beyond/comcast-shares-wireless-wealth-with-nokia/d/d-id/783415

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

https://www.nokia.com/networks/core/5g-core/

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Samsung Electronics, a leader in advanced semiconductor technology, today announced that it has secured standardized 5G non-terrestrial networks (NTN) [1.] modem technology for direct communication between smartphones and satellites, especially in remote areas. Samsung plans to integrate this technology into the company’s Exynos modem solutions, accelerating the commercialization of 5G satellite communications and paving the way for the 6G-driven Internet of Everything (IoE) era. That’s noteworthy considering Samsung’s latest flagship smartphone, the Galaxy S23, does not use Samsung’s Exynos platform and instead only uses Qualcomm’s Snapdragon chipset.

Note 1. There are no ITU or ETSI standards for 5G NTN– only for 5G terrestrial networks. It is not even under consideration for the next revision o the 5G RAN standard– ITU-R M.2150-1.

NTN is a communications technology that uses satellites and other non-terrestrial vehicles to bring connectivity to regions that were previously unreachable by terrestrial networks, whether over mountains, across deserts or in the middle of the ocean. It will also be critical in assuring operability in disaster areas and powering future urban air mobility (UAM) such as unmanned aircraft and flying cars.

Source: Samsung

“This milestone builds on our rich legacy in wireless communications technologies, following the introduction of the industry’s first commercial 4G LTE modem in 2009 and the industry’s first 5G modem in 2018,” said Min Goo Kim, Executive Vice President of CP (Communication Processor) Development at Samsung Electronics. “Samsung aims to take the lead in advancing hybrid terrestrial-NTN communications ecosystems around the world in preparation for the arrival of 6G.”

By meeting the latest 5G NTN specifications defined by the 3rd Generation Partnership Project (3GPP Release 17), [2.] Samsung’s NTN technology will help ensure interoperability and scalability among services offered by global telecom carriers, mobile device makers and chip companies.

Note 2. 3GPP Release 17 contains specs for 5G-NR over Non terrestrial Networks (NTN) and NB-IoT over NTN,

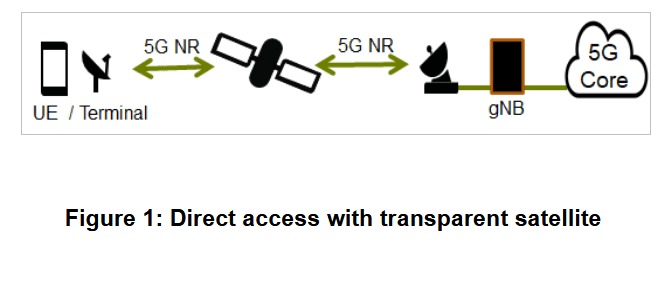

Impacts on 5GC of Satellite NG-RAN used as new RAN 3GPP access

In 3GPP Rel-17, only direct access with transparent satellite is considered, as shown in following figure:

Source: 3GPP

……………………………………………………………………………………………………………………………………………..

For highly reliable NTN communication with low Earth orbit (LEO) satellites, Samsung has developed and simulated 5G NTN standard-based satellite technology using its Exynos Modem 5300 reference platform to accurately predict satellite locations and minimize frequency offsets caused by the Doppler shift. Based on this technology, Samsung’s future Exynos modems will support two-way text messaging as well as high-definition image and video sharing. That would be an important development considering today’s phone-to-satellite services generally support only slow-speed emergency messaging (e.g. Apple iPhone 14). An offering that supports high-bandwidth services like video calling would presumably require far more satellites than today’s services use – and it could also pose a challenge to terrestrial mobile network operators looking to make profits from offering high-bandwidth services in remote or rural areas.

Additionally, Samsung said it plans to secure a standardized NB-IoT NTN technology for use in its next-generation modem platforms. With integrated satellite connectivity, Samsung’s NB-IoT solutions will eliminate the need for a separate high-power wireless antenna chip inside smartphones, providing mobile device makers with much greater design flexibility.

……………………………………………………………………………………………………………………………………………………………….

Samsung has not disclosed when the company might begin offering satellite services in its 5G NTN equipped phones, how much the service might cost, and which satellite operators might support the offering.

…………………………………………………………………………………………………………………………………………………………….

In a related development, Omnispace and Ligado Networks today announced a new Memorandum of Understanding (MoU) to combine their respective spectrum holdings in order to offer “space-based, direct-to-device (D2D) solutions for global voice, text and data connectivity.”

The companies pledged to merge Ligado’s 40MHz of L-band satellite spectrum in the U.S. and Canada with Omnispace’s 60MHz of S-band satellite spectrum. “The combination of L- and S-band spectrum is a unique opportunity to expand the ecosystem of D2D applications and technologies, enhance user experience and extend service globally. For consumer smartphones, the offering will have enough bandwidth to go beyond emergency satellite texting by offering ubiquitous roaming mobile coverage with two-way voice, messaging and data capabilities,” according to the companies’ press release.

However, there are plenty of obstacles to the companies’ ambitions. For example, Ligado has spent years working to free its spectrum of interference concerns, and its financial footing remains a question. “Ligado has no cash and an overwhelming debt load,” tweeted analyst Tim Farrar with TMF Associates following the announcement from Ligado and Omnispace.

References:

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3937

https://www.3gpp.org/specifications-technologies/releases/release-17

GfK: Global telecom market (x-North America) posts 9.7% revenue drop; smartphone revenues -10.2% in 2022

The 9.7% year-over-year drop in the global telecom market is based on GfK’s exclusive POS (point of sale) data for retailers in 67 countries worldwide, excluding North America. The industry had $360 billion (U.S. $) in revenue from January to December 2022.

The smartphone segment, including phablets, experienced a 10.2% drop year over year, but still accounted for $330 billion (US) in revenue. One of the few market drivers in 2022 was consumers with higher and middle incomes. These shoppers now account for 48% of all smartphone buyers, up 4 percentage points compared to 2021. Demand for premium devices also increased; revenue for 5G models, for example, grew by 1.2% in 2022 versus the year before. The same applies to devices with more storage; smartphones with a capacity of over 256GB recorded an increase of 19% and accounted for 41% of total market revenue in 2022.

“While we had already predicted saturation effects in 2022 after the strong telecom sales in pandemic years, the additional weakness of the Chinese market significantly impacted the results,” explains Jan Lorbach, GfK expert for the Telecom industry. “But GfK expects a stabilization of the telecom market in 2023.”

While consumers who are still buying smartphones are opting for premium devices, the total number of purchases decreased in 2022. One reason may be that people are keeping their smartphones for a longer time. Data from gfknewron Consumer shows that, from January to September 2019, only 48% of consumers used their smartphones for two years or longer; for the same period in 2022, that increased to 57% (an increase of plus 9 percentage points).

This new longevity in ownership can especially be observed in Generation Z (15 to 25 years old), where the share of Gen Z consumers keeping their smartphones for two-plus years now stands at 14 percentage points above the average. This younger generation has a clear focus on sustainability and therefore may be consciously extending the lifecycle of their devices.

Wearables Hold Steady:

One of the few telecom segments that managed to survive the difficult year 2022 in a stable manner is wearables. With $13.9 billion (US $) in revenue, the wearables market achieved almost the same level in 2022 as in the previous year (minus 1.1% compared to 2021). Although popular segments have lost ground, this has been offset by growth in other product lines.

GfK also saw significant year-over-year (2022 vs. 2021) increases and declines in revenue in specific wearables categories:

• Health and Fitness tracker: -31%

• Smartwatches: +21%

• Wrist Sport Computers: -43%

These shifts have been driven by increasing consumer demand for greater control of their health, via smart features. Accordingly, wearables with a sleep tracking feature (plus 4%) or blood oxygen sensors (plus 20%) showed strong growth. This trend also led to innovations, such as the new feature of stress level measuring (EDA). Launched in the fourth quarter of 2021, these devices already account for 16% of revenue in the wearables market and continue to grow.

AR/VR headsets: First decline ever, but potential is still high:

Further hot topics for MWC are virtual reality (VR), augmented reality (AR), and the metaverse — made possible by devices such as VR headsets. While awareness and discussions around the metaverse have risen, retail sales of VR headsets in the European market* actually declined by 15% year-over-year in 2022. This is the first decline ever, as the market has previously recorded double-digit growth for years.

“The European market seems to have accomplished initial consumer penetration of VR headsets,” says Sohjin Baek, GfK expert for global IT hardware industry. “The industry should now focus on providing more content, as well as better visual quality and security, to drive the market based on this initial penetration. Convincing consumers about the use cases will be key to drive VR/metaverse forward.”

Outlook 2023:

GfK experts forecast a stronger year 2023 for the global Telecom market overall compared to the relatively weak 2022. At a regional level, China, which is the largest single market, is expected to pick up again and significantly drive global market growth. Additionally, developments within the three main product categories will have a positive impact:

- Although replacement cycles are extending, smartphone purchases made at the height of the pandemic in 2020 and 2021 are entering the expected renewal cycle window this year.

- In wearables the next generation of Health Tracking sensors, which will expand the scope of applications, will drive the market. In addition, positive revenue growth is expected for the smartwatches segment.

- VR/AR is expected to become more tangible and grow into areas beyond gaming. This is one of the segments with the greatest potential in the coming years.

To remain competitive in the market and differentiate from competitors in terms of quality, retailers and manufacturers should continue to innovate for more powerful or faster devices that make consumers’ lives easier. “Innovation will further drive consumer’s demand,” says Jan Lorbach, GfK expert for the Telecom market. “When the holding time of smartphones is extending and budgets are tight, consumers will more than ever ask for value for money.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About the GfK method:

Through its retail panels, GfK regularly collects POS data in more than 70 countries worldwide for the consumer electronics, photography, telecommunications, information technology, office equipment, and small and large household appliances sectors. All figures are according to GfK panel market, with global data excluding North America and presented in US dollars. Revenues are presented in US dollars Non Subsidized Prices (NSP).

gfknewron is an always-on platform that combines market, consumer and brand data supercharged with AI-powered recommendations. It enables companies to gain actionable and connected insights and act at speed to ignite sustainable growth. The platform offers three specific modules: “gfknewron Market” for market and competitor insights, “gfknewron Consumer” for an in-depth consumer understanding and “gfknewron Predict” that delivers recommendations for companies based on market data and AI-powered intelligence.

* European market data include Belgium, Denmark, Finland, France, Germany, United Kingdom, Greece, Italy, Netherlands, Norway, Portugal, Russia, Spain, Sweden

U.S. media contact: David Stanton +1 (908) 875-9844; [email protected]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Separately, ReportLinker forecasts that the Global IoT Telecom Services Market size is expected to reach $97.9 billion by 2028, rising at a market growth of 31.8% CAGR during the forecast period. IoT protocols and 5G interconnection can broadcast information from thousands of devices to a large number of consumers without slowing communication speed or limiting capacity. The market for IoT telecom services is driven by these factors, which are anticipated to increase in the future. The growth of the IoT telecom services market is primarily driven by the increasing acceptance of technological advancement and innovation, as well as IoT-powered smart security cameras.

Based on connectivity, the IoT telecom services market is segmented into cellular technology, LPWAN, NB-IoT, and RF-based. In 2021, the LPWAN segment garnered a substantial revenue share in the IoT telecom service market. This is due to the widespread acceptance of the IoT telecom service market to strengthen LPWA Network (LPWAN) technologies, which offer a low-cost, low-power wireless option with global reach and robust security. In the telecom industry, machine-to-machine connections are crucial; for this, WiFi and GSM technologies are typically employed.

References:

https://www.gfk.com/press/telecom-global-trends-mwc

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

IDC: Global Telecoms Market at $1.53T in 2020; Meager Growth Forecast

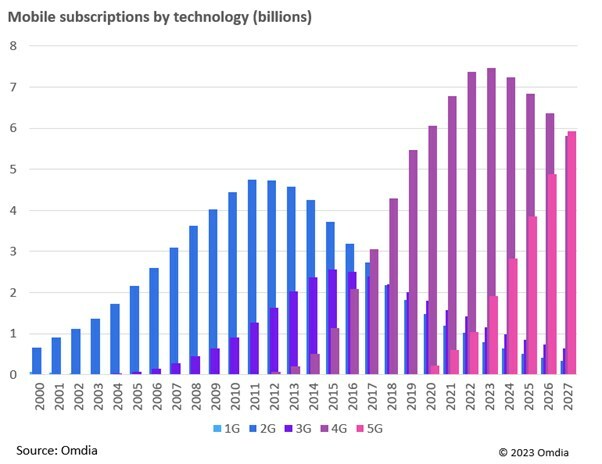

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

Multiple factors have slowed down the transition to 5G such as lower handset sales driven by cost-of-living crisis and inflation, poor network coverage, low performance gain perception, and lack of 5G specific applications. Furthermore, an increasing portion of mobile connections – approximately 30% – are not handsets and will be slower to convert to 5G (e.g., IoT, connected tablets/laptops, wearables).

Omdia Senior Market Forecaster, Garinder Shankrowalia, said: “5G subscription reporting in 2022 has led us to reduce our 2023 forecast by 7.2% -approximately 150 million subscriptions. We anticipate the industry will regain this loss from 2025, once global market conditions are improved.”

Omdia believes it is important for mobile operators to continue investing in next generation mobile networks to enable the application emergence and the overall digital economy to grow. However, having multiple cellular technologies running concurrently on mobile networks is having an adverse effect on operators whereby launching 5G increases complexity and cost for little return in the short term.

Omdia Research Director Ronan de Renesse said: “There needs to be a ‘net-zero’ approach to network development, removing the old as the new gets deployed. Operators are already starting to move capital from next generation network deployment to 3G decommission projects and digital transformation. Key stakeholders should remain realistic about the prospects for 5G and re-evaluate the business case before moving on to the next step.”

Omdia forecasts 5G will account for 5.9 billion subscriptions in 2027 equivalent to a population penetration of 70.9%.

Another Opinion: 5G Fails to Deliver on Promises and Potential

5G is a big letdown and took a “back seat” at CES 2023; U.S. national spectrum policy in the works

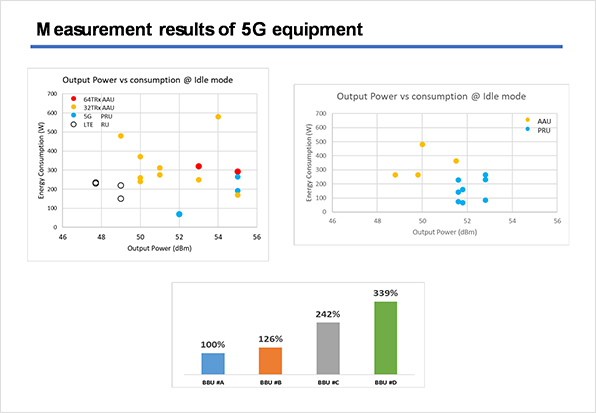

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

- Possibilities to achieve greater energy savings based on energy consumption levels measured in the two companies’ respective base stations

- Technical analysis of candidate energy-saving technologies, including both hardware and software

- The roles that operators and equipment vendors should play, including the need for greater coordination, in the effort to achieve greater energy savings

For 6G, the paper reviews requirements and challenges including specific performance levels and implementation scenarios, focusing on technical issues of particular importance to mobile operators:

- Performance requirements and implementation scenarios for each frequency band, taking into account the characteristics of each frequency

- Issues concerning coverage and devices in high-frequency bands

- Standardization for migration to 6G architecture and application of cloud-native / open architecture

Going forward, NTT DOCOMO and SKT will continue to collaborate in various technical fields, aiming to enhance the competitiveness and operational efficiency of 5G as well as support the global standardization and technical verification of 6G. They will also collaborate with global telecom operators on 6G standardization and R&D with the goal of building a global ecosystem that encompasses advanced industries and technologies.

“The white papers carry a significant meaning as they mark the first tangible result since entering into a strategic partnership with NTT DOCOMO last year,” said Yu Takki, Vice President and Head of Infra Tech Office of SKT. “Based on our experience and knowhow in 5G, we will continue to collaborate with world-leading operators such as NTT DOCOMO to lead 5G evolution towards 6G.”

Takehiro Nakamura, Chief Technology Architect, NTT DOCOMO, said: “We are delighted to jointly announce two white papers on green mobile networks and 6G requirements as our collaborative achievements with SKT started in November 2022. We will continue to enhance cooperation among the two major Asian mobile operators and promote superior concepts and innovative technologies to the world for the 6G deployment.”

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

In addition to Telco Network Builder, AWS today announced its Integrated Private Wireless that acts as an infrastructure bridge for network operators that want to offer a private network service tapping into AWS’ infrastructure to end users. This allows AWS to connect incoming customers interested in a private network platform with the #1 cloud service provider’s telecom partners.

“We are really just connecting the customer with the telco, then that relationship is between the two of them,” said Jan Hofmeyr,VP of Amazon EC2. Initial telecom partners include Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica. Enterprise customers shopping for private wireless services will be able to purchase an installation from one of those participating operators. “The relationship is directly between the customer and the telco,” Hofmeyr said, noting that the resulting private wireless network will then run atop the AWS cloud.

Hofmeyr said that AWS’ goal is to provide customers with an easy set of options that will allow them to deploy or operate a private network in a manner that meets their needs and abilities. “Right now this is their ask, [it’s] helping us make this onboarding easier, and that’s exactly what we’re focusing on. In the future, we’ll continue to listen to what their needs are and continue to support that,” Hofmeyr added.

This new private network offering is different from AWS’ Private 5G platform that it initially unveiled in late 2021, and has since updated. That platform integrates small cell radio units, AWS’ Outposts servers, a 5G core, and radio access network (RAN) software running on AWS-managed hardware. AWS also handles the spectrum management of this service.

AWS will act as the portal, but telcos will be the managed service providers for the network on behalf of those enterprises or smaller service providers, the company said. As with the telco network builder, AWS will provide a dashboard for monitoring performance and modifying it as needed.

“That’s one of the friction points we saw as we started looking at the private network space,” said Ishwar Parulkar, chief technologist for the telco industry at AWS, in an interview. “There are a lot of enterprise customers who really don’t care about all of this. They just want to be able to use the network and run some applications on top. That’s one of the primary values that we bring with this: lifting that undifferentiated work away from them and managing it in the cloud.”

For Amazon, telcos represent a prime business opportunity: as carriers build new networks with increasing reliance on software and cloud services, Amazon is positioning itself as a tech and cloud partner to help run those services better and more cheaply. It’s been interesting to watch how it has worked to build trust among a group of businesses that have at times been very wary of big tech and the threat of being reduced to “dumb pipes” as tech companies lean on their own architecture and technology advances to build faster and cheaper services that compete directly with what carriers have and plan to roll out. As one example, the company is clear to call these new products “offerings” and not services to make clear that it is not the managed service provider, the carriers’ role.

“We’ve been on this journey for a few years now in terms of really getting the cloud to run telco networks,” said Parulkar. “Our goal here is to make AWS the best place to host 5g networks for both public and private. And on that journey, we’ve been making steady progress.”

For carriers, they are now in a world where arguably communications is just another tech service, so many of them believe that running them with less costs and in more flexible ways will be the key to winning more business, introducing more services and getting better margins. Whether carriers want to wholesale work closer with Amazon, or with any of the cloud providers, for such services, will be the big question.

References:

https://www.sdxcentral.com/articles/news/aws-expands-5g-telecom-private-wireless-work/2023/02/

https://au.finance.yahoo.com/news/amazons-aws-cozies-carriers-launches-170645578.html

AWS Telco Network Builder: managed service to deploy, run, and scale telco networks on AWS

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Amazon Web Services, Inc. (AWS) today announced the general availability of AWS Telco Network Builder, a fully managed service that helps customers deploy, run, and scale telco networks on AWS. Now, communications service providers (CSPs) can use their familiar telecom industry standard language to describe the details of their network (e.g., connection points, networking requirements, compute needs, and geographical distribution) in a template uploaded to the service.

AWS Telco Network Builder translates the template into a cloud-based network architecture and provisions the necessary AWS infrastructure, shortening the deployment of an operational, cloud-configured telco network from days to hours. As customers update their networks, AWS Telco Network Builder automatically adjusts compute and storage resources, allowing CSPs to focus on business operations and deliver new services.

AWS Telco Network Builder provides a centralized dashboard to monitor and manage the network running on AWS infrastructure – whether on premises or in AWS Regions. There are no upfront commitments or fees to use AWS Telco Network Builder, and customers pay only for the AWS services used to manage their network.

CSPs want to take advantage of the cloud’s performance, elasticity, and scale to build modern telco networks that support emerging use cases like smart cities, autonomous vehicles, and robotics. However, designing and scaling a telco network in the cloud can be a laborious, time-intensive process due to the iterative nature and breadth of network use cases, such as business support systems, mobile core, and radio networks. CSPs must first deploy and securely interconnect hundreds of specialized network functions (NFs)—containerized network appliances, like routers and firewalls—across dozens of vendors and thousands of locations, often hardcoding the infrastructure’s parameters when replicating across deployment locations.

Once the NFs are deployed, the CSP must update each NF individually to incorporate new software capabilities or make configuration changes, which is time-consuming work that strains resources. Building and running the network also requires skilled network architects with experience in cloud design and management. Additionally, CSPs must often purchase, setup, and maintain separate monitoring tools to observe the health of their on-premises and cloud-based infrastructures, making it challenging to obtain a complete view of their networks and address issues. As a result, CSPs can sometimes allocate too many resources to the undifferentiated heavy lifting of network management instead of focusing on innovating new experiences.

AWS Telco Network Builder is a fully managed network automation service that enables CSPs to deploy, run, and scale their telco networks on AWS faster and more easily. To start, a CSP populates their network architecture (e.g., routing requirements, location of deployment, specific NFs) as a template in the service’s console using telecom industry standard language, making it intuitive and easy to begin. AWS Telco Network Builder translates the customer’s network specifications into a cloud-based network architecture, streamlining programming requirements across multiple software vendors and accounting for the network’s geographic footprint. AWS Telco Network Builder automatically maps the provided topology to network services, provisions the necessary compute and storage resources, and connects the NFs to create an operational telco network. Customers can then reuse the uploaded templates to replicate that network architecture in new regions. As customers change their network configuration or run software updates, AWS Telco Network Builder handles lifecycle management for the NFs, performs updates to the NFs, and adjusts related infrastructure.

AWS Telco Network Builder is being sold to both public and private network operators, including those with existing network operations as well as those launching new networks.

Jan Hofmeyr, VP of Amazon EC2 said telcos those network functions in the format that telecom network operators have can continue to run their networks in the way they have in the past, even as they shift network functions into the AWS cloud. “It’s really an attempt to make it easier for them,” Hofmeyr said of the new product. “It doesn’t require them to be cloud experts on day one.”

Together, AWS Telco Network Builder and Amazon CloudWatch provide a comprehensive view of the NFs and AWS infrastructure, so customers can efficiently monitor and manage their networks to identify and remediate issues more quickly. AWS Telco Network Builder also integrates with popular third-party, end-to-end orchestrators for CSPs to maintain continuity across existing telco network operations and business systems. With AWS Telco Network Builder, customers only pay for the AWS products and services they use, so they can quickly scale their network based on business requirements.

“The telecom industry is undergoing a transformation as CSPs navigate building their telco networks in the cloud,” said Jan Hofmeyr, vice president of Amazon Elastic Compute Cloud (Amazon EC2). “Some of the biggest challenges CSPs face as they look to migrate include manually configuring and then managing these complex networks, which impedes growth and stifles innovation. Groundbreaking in the value it provides to the telecom industry, AWS Telco Network Builder removes the burden of translating a customer’s desired telco network into a cloud architecture, empowering them to easily modernize and quickly scale to meet demand while freeing time and capital to build new offerings, expand coverage, and refocus on invention.”

AWS Telco Network Builder is generally available today in U.S. East (N. Virginia), US West (Oregon), Asia Pacific (Sydney), Europe (Frankfurt), and Europe (Paris), and with availability in additional AWS Regions coming soon.

Amdocs is a leading provider of software and services to communications and media companies. “The current era of 5G cloud-based networks creates an opportunity for communications service providers to deliver accelerated value at unparalleled scale and efficiency,” said Anthony Goonetilleke, group president at Amdocs Technology. “Amdocs Intelligent Networking Suite takes advantage of AWS Telco Network Builder’s support of telecom interfaces to simplify service and network orchestration while bringing agility to network planning, deployment and operations.”

Cloudify is an open source, multi-cloud orchestration platform that packages infrastructure, networking, and existing automation tools into self-service environments. “We’ve observed the challenges the industry faces in bridging the gap between applications and cloud environments,” said Nati Shalom, CTO and founder of Cloudify. “Our work with AWS Telco Network Builder will help communications service providers more easily manage their network services by automating network planning, deployment, and operations activities using standard DevOps and IT service management tools. We are excited to use AWS Telco Network Builder to simplify the orchestration of network workloads using standard European Telecommunications Standards Institute-based interfaces.”

Infosys is a global leader in next-generation digital services and consulting. “The cloud’s scalability and efficiency are key to enabling innovation and reducing the complexity of managing telco network operations, which arms us with the tools to deliver new services for our end users continuously,” said Anand Swaminathan, executive vice president and global industry leader – Communications, Media, and Technology at Infosys. “As we look to build and operate cloud-based networks for our clients with Infosys Cobalt, we are excited to leverage AWS Telco Network Builder to increase the operational efficiency of mobile and private networks, ultimately enabling a streamlined operational model across Multi-G technologies.”

Mavenir is a network software provider building the future of networks with leading 4G, 5G, Core, and IP Multimedia Subsystem cloud-native software. “Managing 4G, 5G, Core, and IP Multimedia Subsystem networks is complex. Often these networks are distributed across the edge continuum,” said Bejoy Pankajakshan, chief strategy officer at Mavenir. “AWS Telco Network Builder allows us to create repeatable network templates that speed up the definition, provisioning, deployment, and upgrading of network services for our customers. The collaboration between Mavenir and AWS offers customers flexibility and agility in the deployment of network functions, furthering us toward our goal of building a single, software-based automated network.”

O2 Telefónica is a leading telecommunications provider in Germany, with around 47 million mobile telephone lines and 2.3 million broadband lines. “As we transition our telco network to the cloud, we strive to achieve greater operational simplicity while accelerating the roll-out of our network and services,” said Bas Hendrikx, head of Cloud Center of Excellence at O2 Telefónica. “We are exploring AWS Telco Network Builder to enable us to leverage automation to deliver new 5G network services faster and manage our networks more efficiently. At O2 Telefónica, we are committed to shaping digital change that benefits everyone, and our investments in building cloud-native networks and using AWS services help to provide greater value and performance to our customers.”

Dish Network in the U.S., Swisscom in Switzerland, and Spark in New Zealand are among the operators that have agreed to put their 5G SA core network functions into the AWS cloud.

To learn more, visit aws.amazon.com/tnb

References:

https://www.businesswire.com/news/home/20230221005644/en/AWS-Announces-AWS-Telco-Network-Builder