BT in new distribution partner agreement with OneWeb for LEO satellite connectivity

BT has announced a new distribution partner agreement with OneWeb for LEO satellite network and connectivity services. The agreement covers BT’s global footprint and supports the UK government’s National Space Strategy.

OneWeb will provide LEO satellite communication services across BT Group’s Global, Enterprise and Consumer divisions. The new agreement expands a MoU signed between the companies in July 2021. BT will test how LEO satellite technology can be integrated with its existing terrestrial capabilities to meet the communications needs of consumer and business customers. Once the network integration tests are completed successfully, BT expects to start live trials with customers in early-2022.

BT will test capabilities at its Bristol lab to show how LEO solutions can integrate with existing services. Due to the current capacity levels of OneWeb satellites, this will focus on the role of LEO as a supplementary, low latency backhaul solution to sites needing extra capacity or a back-up solution, as well as to provide business customers with improved resilience. Once the tests are complete, BT will start early adopter trials with UK and international customers. As the capacity of the OneWeb system expands, the future use cases could extend to include the use of satellite for IoT backhaul and fixed wireless access (FWA) in rural areas.

Business Secretary Kwasi Kwarteng said: “I am thrilled to see the UK at the forefront of this emerging technology thanks to the Government’s investment in OneWeb – a crucial part of our plans to cement our status as a global science and technology superpower.”

Digital Secretary Nadine Dorries said: “The agreement between OneWeb and BT will help bring fast and reliable global connectivity, from the Highlands to the Himalayas. I’m delighted these two British companies have joined forces to research the technological benefits of working together, and I look forward to exploring how this could play a role in our mission to put hard-to-reach areas in the digital fast lane.”

Philip Jansen, Chief Executive of BT Group, said: “Space is an emerging and enormous digital opportunity, and this is an important step towards harnessing its potential for BT’s customers across the globe. We will put OneWeb’s technology through its paces in our UK labs with the goal of delivering live trials in early 2022. Delivered securely and at scale, satellite solutions will be an important part of our plans to expand connectivity throughout the UK and globally, and to further diversify the range of services we can offer our customers.”

OneWeb’s Chief Executive Officer Neil Masterson said: “BT has taken the lead in the recognition of LEO satellite’s advantage. We are delighted as this agreement with BT Group represents an important strategic partnership for OneWeb as we continue to make progress towards our operational launch. We are excited to be playing such a key role in improving the resilience of the overall telecom infrastructure in the UK. OneWeb’s connectivity platform will help bridge the last digital divides across the country and enhance the nation’s digital infrastructure.”

OneWeb is expected to deliver global coverage by June 2022 through a constellation of 648 LEO satellites and is poised to deliver services from the North Pole to the 50th parallel, covering the entire United Kingdom, later this year. The new partnership supports BT’s wider network ambition, set out in July this year, to deliver digital solutions across the entire UK by 2028, through a combination of an expanded network and ‘on demand,’ requestable solutions anywhere beyond. In building a converged, software-defined network, BT will leverage and integrate both terrestrial and non-terrestrial technologies to deliver on the goal of seamless, ubiquitous connectivity.

This agreement marks a clear path towards the first LEO solutions being available for customers within a year. As the next step, BT will test capabilities in its Bristol lab to demonstrate how they integrate with existing services. Current capacity levels within OneWeb satellites mean initial trials will focus on its role as a supplementary, low latency backhaul solution to sites where additional capacity or a back-up solution is required, and to deliver improved resilience for business customers. On successful completion, BT will begin early adopter trials for UK and international customers, expected early next year. As OneWeb grows their capacity, the list of future use cases could also widen, opening up the opportunity to explore the use of satellite for IoT backhaul and Fixed Wireless Access in rural areas.

The work with OneWeb shows the capabilities being developed by UK businesses in the pioneering area of space technology and follows the UK Government’s recently published National Space Strategy, which recognizes the enormous strategic opportunities on offer. BT, which boasts a heritage of nearly 60 years in space and satellite communication innovation, continues to explore a diverse range of partners across all its services, including space, to ensure the latest and best connectivity solutions are available for customers.

*The deal encompasses BT’s Enterprise, Consumer and Global units, serving UK and multinational organizations.

References:

Cable broadband subscriber growth slows while FTTx and FWA gain ground

Cable network operators (cablecos or MSOs) are losing ground to FTTP/FTTx (fiber to the premises/ cabinet/ home) and FWA (fixed wireless access).

- Bloomberg reports that cable broadband growth is sputtering and no one knows why.

- GlobalData agrees, but forecasts a solid increase in U.S. fixed-broadband lines.

Broadband internet subscriber growth at Comcast Corp. and Charter Communications Inc has decreased, raising concerns about an end to what has been a huge growth business, with explanations ranging from a slowdown in consumer spending to competition from phone giants.

Charter on Friday reported 25% fewer new broadband subscribers than analysts estimated and said the overall number of new customers would fall back to 2018 levels. Charter had 1.27 million new broadband customers in 2018 compared with 2.2 million last year. Analysts predict it will add 1.4 million subscribers this year, according to estimates compiled by Bloomberg.

Comcast, which had earlier cut its subscriber forecast, reported 300,000 new internet customers Thursday, less than half the number added a year ago.

Analysts were expecting some slowdown in demand coming off 2020, a year when broadband sign-ups spiked as the pandemic shifted people to working and schooling from home. Still, with Charter echoing Comcast’s gloomy picture from Thursday, suddenly there’s a chill on the cable broadband front, which became the most prized segment of the business as consumers cut traditional TV service.

Charter’s shortfall raises “questions about whether this is the beginning of the end of the cable broadband story,” said Geetha Ranganathan, an industry analyst at Bloomberg Intelligence.

GlobalData forecasts that cable’s share of total U.S. fixed broadband subscriptions will decline to 67.1% by the end of 2026, from 68% in 2021, as other technologies such as fiber and fixed wireless expand their presence. Total U.S. fixed-broadband lines, including fiber, fixed wireless and cable, will increase from 103.1 million in 2021 to 112.3 million by 2026 says the market research firm.

No one has been able to identify the exact reason why the wind has gone out of the sails for big cable. Both Charter and Comcast blamed a slower new home market for some of the slack in demand, leaving the companies to try and squeeze more business out of their saturated markets. Other factors could include a drop off in lower-paying customers as government assisted broadband funds dry up.

Even as Comcast and Charter deploy new faster network technology to attract more lucrative customers, cable’s share of the market is starting to shrink, according to Tammy Parker, a senior analyst with GlobalData.

Total U.S. broadband lines will increase to 112.3 million by the end of 2026 from 103.1 million in 2021, including new wireless internet customers, the market research firm predicts.

The number of U.S. fiber lines will grow at a CAGR of 10.8% to reach 28.2 million lines by the end of 2026. This growth will be due to rising demand for high-speed internet services in the nation, and efforts by the government and operators to expand FTTx networks.

References:

https://www.telecomlead.com/broadband/number-of-us-fiber-lines-to-reach-28-2-mn-by-2026-102290

Open RAN: A game-changer for mobile communications in India?

The author is a former Advisor, Department of Telecommunications (DoT), Government of India

The mobile network comprises two domains: The Radio Access Network (RAN) and the Core Network. The RAN is the final link between the network and the phone. It includes an antenna on the tower plus the base station. Though it was possible for the operators to have one vendor for the core and a separate vendor for the RAN, the same was not done because of interoperability issues.

Open RAN is the hot topic now-a-days and most talked about technology, both in diplomatic and technical circles. This is a three year old technology and fifty operators in more than two fifty countries have deployed open RAN. First it was deployed in the network of Rakuten mobile, a Japanese telecom service provider. This technology makes RAN agnostic to vendors, programmable and converts it to plug & play type. Open RAN is at the epicentre of the digital transformation and plays a critical role in bringing more diversity to the 5G ecosystem. It is required for faster 5G rollout. Domestic (India) vendors may get the opportunity to supply the building blocks of RAN and so it is an initiative towards ‘self-reliant India.’

The RAN accounts for 60 per cent of capex/opex of mobile networks and so a lot of focus is there to reduce RAN costs. 5G signals have a shorter range than previous generation signals. As a result 5G networks require more base stations to provide the required coverage. So in 5G networks this percentage may be still higher.

Open RAN implementation reduces RAN costs. Instead of concentrating on making end-to-end open, opening the RAN ecosystem is given priority by the operators. The open RAN standards aim to undo the siloed nature of the RAN market where a handful of RAN vendors only offer equipment and software that is totally proprietary. Proprietary products are typically more expensive than their generic counterparts. Cellular networks have been evolving with various innovations. It has evolved from 1G to 5G. With these evolutions networks are evolving towards open networks having open interface and interoperability. Open RAN is a term used for industry wide standards for RAN interfaces that support interoperation between different vendor’s equipment and offer network flexibility at a lower cost. The main purpose of open RAN is to have an interoperability standard for RAN elements including non-proprietary hardware and software from different vendors. An open environment means an expanded ecosystem, with more vendors providing the building blocks. Open RAN helps the operators to overcome “Vendor lock in” introducing ‘best of breed’ network solutions.

There will be more innovations and more options for the operators. With a multi -vendor catalog of technologies, network operators have the flexibility to tailor the functionality of their RANs to the operators’ needs. They can add new services easily. Open RAN gives new equipment vendors the chance to enter the market with Commercial off the shelf (COTS) hardware. An influx of new vendors will spur competition. Cell site deployment will be faster. Third Party products can communicate with the main RAN vendor’s infrastructure. New features can be added more quickly for end users.

Current RAN technology is provided as a hardware and software integrated platform. The aim of open RAN is to create a multi supplier RAN solution that allows for the separation or disaggregation between hardware and software with open interface. Open RAN is about disaggregated RAN functionality built using open interface specifications between blocks. It can be implemented in vendor neutral hardware and software based on open interfaces and community developed standards.

In an open RAN environment, the RAN is disaggregated into three main building blocks:

- Radio Unit (RU)

- Distribution unit (DU)

- Centralized unit(CU)

The RU is where the radiofrequency signals are transmitted, received, amplified and digitized. It is located near or integrated into the antenna. The DU and CU are parts of the base station that send the digitized radio signal into the network. The DU is physically located at or near the RU whereas the CU can be located nearer the Core. DU is connected with RU on Optical Fiber cable. The concept of open RAN is opening the protocols and interfaces between these building blocks (radio, hardware and software) in the RAN.

Another feature of Open RAN is the RAN Intelligent Controller (RIC) which adds programmability to the RAN. For example, Artificial Intelligence can be introduced via the RIC to optimise the performance of the network in the vicinity of a cricket stadium on a match day. The RIC works by exposing an API (Application Programming Interface) which lets software talk to each other. There are two types of RIC: near-real time and non real time. Both perform logical functions for controlling and optimizing the elements and resources of open RAN. A near-real time RIC (response time on the order of 10’s of milliseconds) controls and optimizes elements and resources with data collection and communication. A non-real time RIC (response time greater than one second) uses AI and Machine Learning (ML) workflows that include model training, where the workflows learn how to better control and optimize the RAN elements and resources.

The O-RAN alliance has defined eleven different interfaces within the RAN including those for:

Front haul between RU and DU Mid haul between DU and CU Backhaul connecting the RAN to the Core (also called as transport network)

O-RAN alliance is a specification group defining next generation RAN infrastructures, empowered by principles of intelligence and openness. Openness allows smaller players in the RAN market to launch their own services. It was founded in 2018.

O-RAN alliance is a worldwide community of around two hundred mobile operators, vendors and research and academic institutions operating in the Radio Access Network industry. Its goals include to build mechanisms for enabling AI and ML for more efficient network management and orchestration. It supports its members in testing and implementation of their open RAN implementation. O-RAN conducts world wide plug tests to demonstrate the functionality as well as the multi vendor interoperability of open network equipment. O-RAN alliance develops, drives and enforces standards to ensure that equipment from multiple vendors interoperate with each other. It creates standards where none are available, for example Front haul and creates profiles for interoperability testing where standards are available.

Open RAN challenges:

1. Integration of equipment from multiple vendors

2. Since equipment is from different vendors, operators have to have multiple Service Level Agreements (SLAs)

3. Network latency may increase

4. Reliability and availability may be a challenge

5. Staff has to acquire multiple skill sets

6. Security Concerns

Open RAN offers a golden opportunity for software developers to become a global hub for offering RAN solutions. This technology leads to a great disruption to the traditional ecosystem and accelerates the adoption of more innovative technologies. The disaggregation of RAN has also added further advantages by enabling better network slicing and edge compute capabilities.

References:

https://www.telecomtv.com/content/open-ran/how-vran-can-be-a-game-changer-for-5g-40019/

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=1

6 GHz band proposed for WiFi/5G in Asia Pacific region, but it’s not in ITU-R M.1036

It’s well known that mid-band spectrum is very important in the on-going digital evolution as it strikes a good technical trade-off between coverage and capacity. Without adequate spectrum, ubiquitous 5G connectivity fundamental to the digital economy will not materialize.

In his published paper entitled “Optimizing IMT and Wi-Fi mid-band spectrum allocation: The compelling case for 6 GHz band partitioning in Asia-Pacific,” Scott Minehane called on policymakers, regulators, and mobile network operators (MNOs) in Asia Pacific to allocate adequate mid-band spectrum for both IMT and Wi-Fi services. Findings in this paper were also presented in the ITU Regional Radiocommunication Seminar 2021 for Asia-Pacific.

What Scott failed to mention is that neither WRC or ITU-R WG 5D have approved the use of 6 GHz (C-band spectrum) for terrestrial IMT (3G, 4G, 5G) as that band is NOT in the proposed revision to ITU-R M.1036. After 4.800-4.990 GHz, the next band in M.1036 is 24.25-27.5 GHz.

In the United States in April 2020, the FCC made a massive 1200 MHz of bandwidth available in this band for Wi-Fi and other unlicensed technologies such as 5G New Radio/ITU M.2150 in unlicensed bands (not an official ITU-R standard).

Nonetheless, here is Minehane’s case for 6 GHz as published earlier this week in Telecom Review Asia:

In Asia, where more than 4.3 billion people reside in areas subject to monsoons and frequent heavy rainfall, C-Band spectrum is crucial as it is not susceptible to rain attenuation. However, with C-Band being the preferred spectrum widely used by satellite operators in the region, many countries do not have enough 3.5 GHz band to allocate to mobile operators in order to support advanced 5G and future 6G deployments.

As mobile data consumption surge in populous capital cities such as Jakarta, Bangkok, Hanoi, Kuala Lumpur, and Phnom Penh, there is a real threat that spectrum demand would outstrip spectrum supply in the near future. In fact, the GSMA has projected that countries require 2 GHz of mid-band spectrum over the next decade to deliver the full potential of 5G networks.

With spectrum demand on the rise, and competition for frequency bands intensifying, the 6 GHz band has been identified as the ideal substitute for 3.5 GHz because of its good propagation properties and large contiguous bandwidth of 1200 MHz. Comparatively, mmWave is an ill fit in the region as rain attenuation results in significant path loss. Commercially, utilizing 6 GHz for 5G deployment is also more viable (then mmWave) as capex and opex costs are foreseen to be much lower.

Noting that there is no one-size-fits-all approach for the 6 GHz band allocation in a heterogeneous region like the Asia Pacific, Minehane said, “The key is having a customized approach for the 6 GHz band in the Asia Pacific, where emphasis is placed on the early partitioning of the 6 GHz band between IMT and Wi-Fi, as this is the largest remaining single block of spectrum which could be allocated for mobile services in the mid-band.”

Partitioning of the 6 GHz band for IMT and Wi-Fi would balance competing demands for spectrum. To secure the short- and long-term economic benefits of both services, Minehane proposed allocating 500 MHz of the lower 6 GHz band (5925-6425 MHz) for Wi-Fi and 700 MHz of the upper band (6425-7125 MHz) for IMT.

“Making about 700 MHz of 6 GHz spectrum available for IMT services is a good start towards future-proofing 5G advanced and 6G services. Moreover, adequate IMT spectrum fosters healthy competition in the sector, where say 3 to 4 providers prioritize delivering superior customer services and experiences to differentiate themselves,” said Minehane. “From an economic perspective, IMT services also generate greater benefits than Wi-Fi services.”

Source: Qualcomm

Amid uncertainties in how new technologies unravel in the long-term, diversification of the 6 GHz band offers flexibility in future decision-making. Apart from addressing the spectrum demands set out by the GSMA, Minehane recommended making provision for more IMT spectrum as it offers the flexibility to be upgraded to the future 6G or switched to Wi-Fi. However, switching from unlicensed Wi-Fi use to licensed IMT uses will be impossible owing to the proliferation of user-based equipment.

Minehane noted that allocating the entire 6 GHz band to Wi-Fi to bridge the digital divide is futile, as low band spectrum is most suited to deliver connectivity to the underserved in rural areas.

Besides, better, faster, and more secure experiences with 4G or 5G, compounded with more affordable, unlimited data plans result in consumers using less Wi-Fi and data offloading. In South Korea, for instance, about 52% of mobile data traffic was handled by 5G. In Canberra, supported by Australia’s largest free public Wi-Fi network, Wi-Fi usage declined sharply when prices in mobile data dropped even during the pandemic. Similarly, enterprises are likely to rely more on 5G than Wi-Fi 6.

Effective spectrum management is instrumental to economic recovery, growth, and resilient. One of the biggest challenges regulators face is the refarming of spectrum to tap onto the potential of emerging innovations. To this end, regulators need to formulate a long-term spectrum roadmap and strategy to chart progress. Another challenge is keeping spectrum auctions affordable, so that operators can invest in upgrading network infrastructure.

Despite these prevailing challenges, Minehane stressed that collectively, the region is forward-looking. Individual countries are stepping up on initiatives and engaging in ongoing dialogues to discuss spectrum management approaches. The 3GPP has also embarked on standardization work to grow the 6 GHz band ecosystem.

Concluding, Minehane expressed hopes that policymakers would increase IMT spectrum allocations and maximize the value created by key spectrum in the years and decades to come.

Addendum: 14 Oct 2021 Email from Joanne Wilson, Deputy to the Director ITU Radio Communications Bureau (ITU-R) who spoke at SCU:

“ITU-R Recommendations are voluntary (non-binding) unless they, or parts thereof, have been incorporated by reference (IBR) into the Radio Regulations. Rec ITU-R M.1036 has not been incorporated by reference into the Radio Regulations and its implementation is voluntary. As a recommendation that addresses the frequency arrangement for an application (not a service!), there would be no context under which M.1036 would be considered for IBR. Still, M.1036 is one of the most heavily debated recommendations because most countries follow it as the basis for their subsequent domestic rulemakings.”

References:

https://www.fcc.gov/document/fcc-opens-6-ghz-band-wi-fi-and-other-unlicensed-uses-0

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf

OpenSignal: T-Mobile’s 5G speeds are #1 in U.S. thanks to 2.5 GHz mid-band spectrum

The U.S. 5G experience is in the middle of a period of great change. U.S. wireless carriers will be soon be able to start using new mid-band spectrum (3.7 GHz, or C-band) in 46 markets from December. Together they have spent a combined $81.11bn in licences to improve the 5G experience with this additional capacity. Already, Opensignal has observed an impressive rise in T-Mobile users’ 5G Download Speed enabled by T-Mobile’s existing mid-band spectrum. Our T-Mobile 5G users saw their average 5G download speeds soar by 66.5%, from 71.3 Mbps in Opensignal’s April 2021 5G Experience report to 118.7 Mbps in the latest report published in October 2021.

This means that in our most recent analysis T-Mobile led by 62.7 Mbps over second placed Verizon and 67.2 Mbps over AT&T — with 5G download speeds more than twice as fast as those achieved by their competitors. In our new analysis we see that T-Mobile’s use of its 2.5 GHz mid-band spectrum enabled this increase and non-standalone access was important here. Furthermore, this change helps explain the different amounts that each carrier spent in the C-band auction: Verizon, $45.45bn; AT&T, $23.41bn; while T-Mobile spent significantly less at $9.34bn.

To explain the change in 5G experience observed by our T-Mobile users, we analyzed their average 5G download speeds over time looking at the two different spectrum bands that the operator is focusing its 5G deployment efforts on — the 600 MHz (NR band 71) and 2.5 GHz (NR band 41).

Our analysis shows that T-Mobile’s surge in 5G Download Speed was driven by its ongoing deployment of the 2.5 GHz band. We observed that, not only T-Mobile expanded its use of the 2.5 GHz band over time, but the operator has also very likely increased the amount of spectrum capacity allocated for 5G in that band. In fact, we have seen the average 5G download speeds experienced by our T-Mobile users when connected to the 2.5 GHz band increase by more than 40% rising from 170.1 Mbps in March 2021 to 239.3 Mbps in September 2021. By contrast, average 5G speeds on the 600 MHz band had no statistically significant change and remained flat at slightly below 30 Mbps.

Notably, the bulk of the boost on the 2.5GHz band happened between March and July 2021 —an increase of 39.3% — after that average 5G speeds remained stable just above 235 Mbps. For context, in September 2021 T-Mobile said that it had deployed 60-80 MHz of the mid-band, up from the 40-50MHz it had been using in late 2020, and that stated that it is aiming to use 100 MHz on sites by the end of the year. Additional spectrum capacity makes it easier for users to see higher 5G speeds.

We saw much slower speeds that changed little when our T-Mobile users connected to the 600 MHz band. This is not surprising, given the propagation characteristics and amount of spectrum that T-Mobile owns on this band. Low bands like 600 MHz provide mobile coverage to wider areas with fewer cells deployed, but at a cost of more limited capacity. Mid-bands like 2.5 GHz, which T-Mobile acquired after its merger with Sprint, usually offer higher capacity, but need more cells per square mile to achieve similar coverage to the low bands.

T-Mobile refers to its 5G spectrum deployment strategy as a ‘layer cake’ — with low bands used for wide coverage, complemented by mid and higher frequency bands to provide greater capacity for small and dense city areas. The way T-Mobile uses these spectrum bands is consistent with what we observed in our analysis.

We then looked at the proportions of 5G readings that we collected when our users were connected to T-Mobile’s 600 MHz and 2.5 GHz bands. The share of 5G readings observed on the 2.5 GHz band has increased more than three times, from nearly 9% in March 2021 to over 27% in September 2021. This means that T-Mobile 5G users are able to access the 2.5GHz band more easily which further explains the increase in the overall 5G speed seen by T-Mobile users.

We investigated the role of standalone access (SA) and non-standalone access (NSA) 5G in explaining T-Mobile’s experience, building on our previous analysis of standalone 5G on T-Mobile. Now, we can see that the 2.5 GHz band is predominantly used with NSA and so SA is not the key reason for the improvement in 5G speeds (although it likely does continue to have other benefits).

Perhaps counterintuitively, the average 5G download speed our users saw on the 600 MHz band with SA was slower than on NSA. In part, this is because of the role of 4G bands in supporting the 5G experience when a smartphone is in NSA mode as we have seen in other markets (for example South Korea or in Europe).

“Opensignal’s latest report validates what our customers already know – T-Mobile’s differentiated approach to 5G is delivering meaningful 5G experiences now with ever-increasing speeds and expanding coverage,” said Neville Ray, president of Technology at T-Mobile, in a statement. “Our two-year lead on building 5G will continue as we add even more Ultra Capacity coverage and expand it to reach 200 million people nationwide this year. T-Mobile customers benefit from a real 5G network that today can power immersive and transformative experiences.”

T-Mobile justifiably claims they have the largest, fastest and most reliable 5G network. Nearly a dozen independent third-party reports this year also show how T-Mobile’s differentiated 5G deployment delivers meaningful connections to customers – naming T-Mobile 5G #1 in nationwide speed and availability. After recently launching a new Ultra Capacity 5G icon showing customers when they are in an area where they can tap into T-Mobile’s fastest 5G speeds, the number of customers testing T-Mobile’s Ultra Capacity 5G network increased. As customers learned how broadly Ultra Capacity 5G is available, they also experienced how game-changing mid-band 5G can be.

AT&T and Verizon will seek to boost their 5G experience with mid-band soon:

Our analysis shows that T-Mobile’s acquisition of Sprint’s mid-band spectrum assets through the merger allowed it to build a substantial lead over its competitors as measured in our recent USA 5G Experience reports. T-Mobile now has a significant competitive advantage over its competitors, which don’t have access to any mid-band spectrum bands just yet.

However, everything will change soon, as U.S. operators purchased licenses in the C-band spectrum band (3.7 – 3.98 GHz) during Auction 107 earlier this year. In fact, the first tranche of this C-band spectrum will be available for use by December 2021. Plus the second portion will be available by the end of 2023. T-Mobile’s 5G experience highlights the importance for Verizon and AT&T to maximize their use of new mid-band spectrum.

References:

https://www.opensignal.com/2021/10/27/25-ghz-mid-band-spectrum-drives-t-mobiles-5g-speeds-in-the-us

https://www.t-mobile.com/news/network/ultra-capacity-mid-band-5g-opensignal

https://www.fiercewireless.com/5g/t-mobile-5g-speeds-get-40-boost-from-2-5-ghz-opensignal

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Global cloud service provider (CSP) spending on cloud infrastructure services grew by 35 percent to reach a record $49.4 billion in Q3 2021, according to the latest research from Canalys.

Growth was driven by several factors, including continued remote working and learning, and increasing use of industry-specific cloud applications. Spending has increased by $12.9 billion from Q3 2020 and by $2.4 billion from Q2 2021.

Amazon Web Services (AWS) accounted for 32 percent of total cloud infrastructure services spending in Q3, growing 39 percent year-on-year. Microsoft Azure registered growth of more than 50 percent for the 5th consecutive quarter to capture 21 percent of the market; followed by Google Cloud in 3rd place with an 8 percent share (growth of 54%).

…………………………………………………………………………………………………………………………………..

According to Synergy Research Group (SRG), global enterprise spending on cloud infrastructure services reached $45.4 billion in Q3-2021, up 37 percent from the year-earlier quarter. Trailing 12-month revenues reached $164 billion.

Amazon, Microsoft and Google had market shares of 33, 20 and 10 percent respectively in Q3-2021. Their growth rates are higher than the overall market. Other cloud providers are continuing to experience strong cloud revenue growth, with the next 10 largest cloud providers taking 22 percent of the market between them and achieving 28 percent year-on-year growth in Q3-2021.

Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $45.4 billion, with trailing twelve-month revenues reaching $164 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 39% in Q3. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 70% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

“Given their scale, ever-expanding worldwide presence and impressive revenue growth rates, it is understandable that Amazon, Microsoft and Google grab the most attention for their cloud activities. However, that makes it easy to overlook the fact that other cloud providers generated $17 billion in the quarter, a figure which grew by 27% from last year,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “By any standards a $17 billion market growing at such a rate is an attractive proposition for many service providers and their suppliers. Clearly there are challenges with the big three companies lurking in the background, so the name of the game is not competing with them head on. Providing companies are smart about targeting the right applications and customer groups, cloud can provide a broad and exciting range of growth opportunities for them.”

References:

Comcast broadband subscriber growth slows; Business services and Xfinity Mobile gain

The pace of broadband subscriber growth at Comcast slowed to 300,000 in Q3 2021. The +300,000 net adds were in line with analyst expectations of +296,000. But those gains were down from 633,000 adds in the year-ago quarter fueled by the COVID-19 pandemic, and off from the 379,000 adds in the pre-pandemic period of Q3 2019. Comcast ended the quarter with 31.68 million broadband subs, which accounted for 52.2% penetration of homes and businesses passed. Broadband revenues climbed 11.6%, to $5.8 billion.

On today’s earnings call, CEO Brian Roberts made no apologies. He said:

“Our Cable division continues to be a standout delivering over 7% revenue growth and the fifth consecutive quarter of double-digit EBITDA growth of 10%, fueled by our broadband business, which generated 300,000 net additions and contributed to a very healthy 255,000 net new customer relationships. Business services has emerged from the pandemic and was also a key driver of our results and we believe this momentum will continue.”

“Our success comes from our network advantage, innovative products and world-class operational capabilities, which enable us to provide an unparalleled experience. Just like in residential, we are proactively responding to the needs of our commercial customers and offering personalized solutions.”

Dave Watson, CEO of Comcast’s cable unit, attributed the broadband slowdown to a decrease in overall new connects across the company’s footprint, creating fewer opportunities for “jump balls” against broadband competitors. “However, broadband subscriber churn remains at historic lows certainly for quarter three,” he said. Watson added full year 2021 net additions are expected to come in around 2019 levels. Comcast had 1.4 million broadband net additions in 2019 and thus far in 2021 has added 1.115 million, meaning it would need to add 285,000 broadband subscribers in Q4 to hit its target.

“We haven’t changed our view on the long-term trajectory of the connectivity business,” Watson said on today’s earnings call, noting that Comcast has added 1.1 million broadband subs through the first three quarters of 2021. “I’m just as confident and optimistic in the prospects in this business as I’ve ever been … The runway [for broadband subscriber growth] is still absolutely there.”

Capital expenditures for the Cable division fell 5.4% in the quarter to $1.7 billion, as an uptick in spending on line extensions and scalable infrastructure failed to fully offset decreased investment in customer premise equipment.

3rd Quarter 2021 Highlights:

- Consolidated Adjusted EBITDA Increased 18.1% to $9.0 Billion; Adjusted EPS Increased 33.8% to $0.87; Generated Free Cash Flow of $3.2 Billion

- Returned $2.7 Billion to Shareholders Through a Combination of $1.5 Billion in Share Repurchases and $1.2 Billion in Dividend Payments

- Cable Communications Total Customer Relationship Net Additions Were 255,000; Total Broadband Customer Net Additions Were 300,000

- Cable Communications Adjusted EBITDA Increased 10.3% and Adjusted EBITDA per Customer Relationship Increased 5.3%

- Cable Communications Wireless Customer Line Net Additions Were 285,000, the Best Quarterly Result Since Launch in 2017

- NBCUniversal Adjusted EBITDA Increased 48.2% to $1.3 Billion, Including Peacock Losses

- Theme Parks Delivered Its Most Profitable Quarter Since the First Quarter of 2020, Driven by Universal Orlando; Celebrated the Grand Opening of Universal Beijing Resort on September 20th

- Sky Adjusted EBITDA Increased 88.8% to $971 Million; On a Constant Currency Basis, Adjusted EBITDA Increased 76.2%

Business services did very well, as revenues there rose 8.7%, to $2.2 billion. Comcast Business added about 18,000 new customers in Q3, and has added 72,000 business customers over the past year. “Business services have emerged from the pandemic,” Roberts said.

Roberts said the midsized and enterprise segments remain “underpenetrated” categories for Comcast Business. But they also represent areas the company will pursue more aggressively following the recent acquisition of SD-WAN and cloud platform specialist Masergy. Roberts added:

“While small business has led our growth for the last decade. We are still significantly underpenetrated in the mid-market and enterprise segments. We see a lot of potential to take share in our large addressable market, which just got even bigger post our recent acquisition of Masergy, which builds on our strong offering of technology solutions. Masergy has become a leading provider to companies worldwide and unlocks a customer segment that we don’t have today, particularly US-based organizations with multi-site global operations.”

Mobility is now rapidly becoming a major part of the Comcast story, while the company continues to lose pay video subscribers. Xfinity Mobile (MVNO from Verizon Wireless) reached a quarterly record of 285,000 net new subscribers in the third quarter.

- Roberts noted that Xfinity Mobile has achieved a penetration of about 6% of the company’s broadband base of nearly 32 million.

- Watson said Comcast will continue to tie mobile to its core broadband product, but expects Xfinity Mobile to pick up the pace. “We haven’t changed the strategic imperative behind mobile. But most certainly things have accelerated. Our goal … is to go faster, and to leverage mobile completely in everything that we do.”

Analyst Craig Moffett wrote in a note to clients (we highly recommend his service):

Q3 saw Comcast report a positive EBITDA contribution from Mobility for the third straight

quarter, with a swing of more than $100M from the $50M loss a year ago (Exhibit 3).

That Comcast has been able to achieve profitability even before meaningful traffic offload onto CBRS (likely still at least a year away) is significant in a number of ways. Yes, some additional EBITDA is always nice, particularly when compared to the losses of a year and two years ago. But more importantly, Comcast’s profitability demonstrates that they have the headroom to use wireless to defend broadband from incursions from TelCo fiber overbuilds, as we argued in Convergence Apocalypse? – October 14, 2021… and still contribute to overall profitability.

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2021-results

https://www.fiercetelecom.com/financial/comcast-reels-300k-broadband-subs-as-growth-slows

Symware: Carrier-grade Open RAN platform leveraging cloud-native architecture

“We have a great opportunity to disrupt this industry, we have a great opportunity to really connect everything and bring better value to overall society and Rakuten Symphony is the platform idea for all the software technology stack that we have built into Japan. We wanted to take four years of lessons and package them into solutions that deliver immediate benefits to our customers and the telecoms industry,” said Tareq Amin, CEO of Rakuten Symphony.

“Rakuten Symphony constantly looks to introduce leading-edge innovations to accelerate network transformations. With our partners, we have developed a cost-performance optimized appliance that simplifies the cell site deployment for 4G, 5G and future generations of mobile technology. Symware provides operators with the ultimate future-proof cell site solution that enables them to flexibly densify their network and accommodate various network topologies at the lowest cost.”

Tareq Amin, CEO of Rakuten Symphony speaking at 2021 MWC-LA

The Symware multipurpose edge appliance combines the containerized cell site routing functionality and a containerized Distributed Unit on a single general purpose server platform, which significantly reduces the capital and operating expenditures for an operator. Offering consistent carrier-grade routing stack across both physical and virtual Radio Access Networks, the solution readily enables 5G network slicing features both in RAN and transport domains including slice isolation, slice monitoring and dynamic traffic steering through segment routing. The solution supports automation with zero-touch provisioning, rolling updates, telemetry and analytics for all the components, and is based on the Kubernetes® ecosystem for orchestration and networking. Rakuten Symphony believes the solution will help slash total cost of ownership, fast track RAN innovation and provide greater agility, smart security and new levels of automation.

Dan Rodriguez, Intel corporate vice president and general manager, Network Platforms Group added, “We continue to see the industry shift to take advantage of the many benefits provided by the cloudification of the RAN. By utilizing our Next Generation Intel® Xeon® D Processors and FlexRANTM reference software, this collaboration showcases how RAN workloads can be consolidated onto a single server and meet the performance, capacity and cost requirements of 5G RAN deployments.”

Raj Yavatkar, Juniper’s CTO, stated, “Removing the obstacles of deploying ORAN in disaggregated production networks is critical for 5G growth. Integrated routing and ORAN in a single platform delivers cost and operational benefits for network operators. Combined with industry leading Intel technology and Rakuten’s DU software, Juniper’s disaggregated and state-of-art routing stack offers operators a unique solution for delivering differentiated 5G services including network slicing.”

Developed with Rakuten Symphony’s know-how and experience with cloud-native and Open RAN-based networks, leading containerized RAN software from Altiostar, a Rakuten Symphony company, Next Generation Intel® Xeon® D Processors and FlexRANTM reference software, and Juniper’s carrier-hardened cloud-native routing stack, Symware will give operators more opportunity to create innovations within their networks, while broadening and securing their supply chain.

* KUBERNETES ® is a registered trademark of the Linux Foundation in the United States and other countries.

* Intel and Xeon are trademarks of Intel Corporation or its subsidiaries.

About Intel

Intel is an industry leader, creating world-changing technology that enables global progress and enriches lives. Inspired by Moore’s Law, we continuously work to advance the design and manufacturing of semiconductors to help address our customers’ greatest challenges. By embedding intelligence in the cloud, network, edge and every kind of computing device, we unleash the potential of data to transform business and society for the better. To learn more about Intel’s innovations, go to newsroom.intel.com and intel.com.

About Juniper Networks

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

About Rakuten Symphony

Rakuten Symphony, a Rakuten Group organization with operations across Japan, Singapore, India, EMEA, and the United States, develops and brings to the global marketplace cloud-native, Open RAN telco infrastructure platforms, services and solutions, through the Rakuten Communications Platform. For more information visit https://symphony.rakuten.com/.

…………………………………………………………………………………………………………………………………….

In related news, Rakuten Mobile (parent company of Rakuten Symphony) recently announced an agreement to acquire Estmob, a South Korean peer-to-peer file transfer solution start-up. The Japanese carrier said that the acquisition will establish a research and development presence in South Korea for Rakuten Symphony.

Samsung and Ciena partner to deliver pre-validated implementations of 5G networks

At 2021 MWC LA, Samsung Electronics and Ciena announced that they are collaborating to deliver 5G solutions (?) by coupling Samsung’s 5G RAN and core network with Ciena’s xHaul routing and switching portfolio. The collaboration will enable the companies to offer hardware and software solutions to telecom operators to support the increasing volume of 5G data traffic at the edge and within an increasingly distributed 5G architecture.

Rafael Francis, senior director of solutions architecture at Ciena, sited the blurring between the RAN, transport and core network as motivation for the partnership with Samsung.

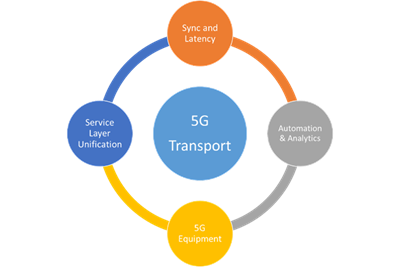

Image Courtesy of ACG Research

“The domains of RAN, transport and core are becoming more tied in the sense as operators roll out 5G with new architectures and approaches, like virtualized RAN (vRAN) or cloud RAN (cRAN),” Francis told RCR Wireless News. “Effectively, the network becomes an integral part of that because you not only have backhaul networks, but you have fronthaul and mid-haul networks, and these things all need to interoperate.”

5G xHaul transport needs a solution-level approach that includes both a feature-rich box and a well-integrated automation and orchestration platform. Ciena provides a complete yet open solution with its innovative Adaptive IPTM portfolio, which is well integrated with its Blue Planet Automation software. The company has simplified the 5G xHaul transport with a lean and open set of IP protocols driven by analytics focused, multidomain and multivendor closed-loop orchestration layer.

Alok Shah, Samsung’s VP of strategy, business development and marketing for the company’s networks business, agreed with Francis, adding, “Networks used to be a lot easier to understand. The RAN and the core were well defined, and the transport was backhaul for the cell sites.”

Now, though, in the world of vRAN and cRAN, the backhaul is only one means of transport. There is also fronthaul and mid-haul and, according to Shah, each one has a different level of performance requirement; when it comes to the fronthaul, in particular, the link between fronthaul and the RAN equipment has to be “really tight.”

“Because, you want to make sure that if you’re running 25 Gbps from your radio back to baseband unit, you want to make sure you’re getting the full performance out of that link,” Shah added.

Further, the combined offering will help operators accelerate critical 5G capabilities such as network slicing (requires 5G SA Core network), which Francis singled out a perfect example of why coordination across network domains has become more critical in a 5G era.

“Concepts and capabilities brought by 5G such as network slicing that can be used to drive new revenues and services for MNOs (mobile network operators) must be well coordinated across RAN, transport and core to really have the correct impact like ensuring SLAs and partitioning resources,” Shah said.

Wonil Roh, SVP and head of product strategy for Samsung Electronics’ network business said, “In order to deliver more powerful 5G services, the current network architecture needs to evolve. Samsung’s ability to couple our best-in-class 5G solutions with a leader in transport technologies like Ciena will give customers a solution to address this need, and do so with the confidence to scale and evolve their networks to support the future of 5G.”

Dell’Oro Group VP Stefan Pongratz noted that the two vendors have no material overlap. “Ciena’s telecom equipment revenues are primarily driven by its optical transport and SP switch portfolio while Samsung focuses on the RAN and mobile core markets,” he said. Stefan added that “as the backhaul becomes fronthaul, the transport requirements will change, which could impact the value of pre-integrated solutions.”

……………………………………………………………………………………………………………………………………………

References:

Samsung, Ciena partner to address ‘blurring between RAN, transport and core’

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

IBM says 5G killer app is connecting industrial robots: edge computing with private 5G

At 2021 MWC-LA, IBM CTO for networking and edge computing Rob High suggested that connecting maintenance robots (one named Spot is pictured below) as the so-called killer application for 5G. citing wide potential benefits for industry. In a keynote presentation made alongside robotics company Boston Dynamics, the IBM CTO (pictured left) highlighted the benefits of systems employing edge computing (more below) technology together with private 5G in industrial scenarios. The two companies highlighted Spot’s role to assess the performance of analog machinery still in use.

“For all my network operator friends in the audience who keep asking what’s the killer app for 5G? This is it,” High said. “It’s around production processes valuable to industries that are needed, and need 5G to accomplish their tasks to maintain operational readiness and efficiencies,” he added.

“That’s where 5G is going to have its biggest benefit,” he added, noting although the maintenance robot did a lot of local processing it needed to be on a communications network as it was programmed to raise urgent issues. However, High did not state what benefits/features 5G has that makes robot connectivity the killer app. In particular, ultra high reliability is required but neither ITU-R M.2150 or 3GPP Release 16 supports that in the 5G RIT/RAN.

Boston Dynamics’ chief sales officer Mike Pollitt highlighted Spot’s ability to assess machinery and other assets across industrial sites in difficult-to-reach areas and those dangerous for humans. Potential applications include taking readings from analog machines, proactive maintenance and general site investigation.

High added with a long asset life on much industrial machinery, these types of technological solutions could fill the “data gap” by assessing sites without the need to retrofit connectivity hardware into every piece of equipment.

The robotics company has been working with IBM on industrial deployments with Spot relying on the latter’s application management system.

IBM says that edge computing with 5G (requires 5G SA core network) creates tremendous opportunities in every industry. It brings computation and data storage closer to where data is generated, enabling better data control, reduced costs, faster insights and actions, and continuous operations. By 2025, 75% of enterprise data will be processed at the edge, compared to only 10% today.

IBM provides an autonomous management offering that addresses the scale, variability and rate of change in edge environments. IBM also offers solutions to help communications companies modernize their networks and deliver new services at the edge.

References:

https://www.mobileworldlive.com/featured-content/top-three/ibm-spots-killer-industrial-5g-app

https://www.ibm.com/cloud/edge-computing