Charter and Cox Communications in $34.5B merger

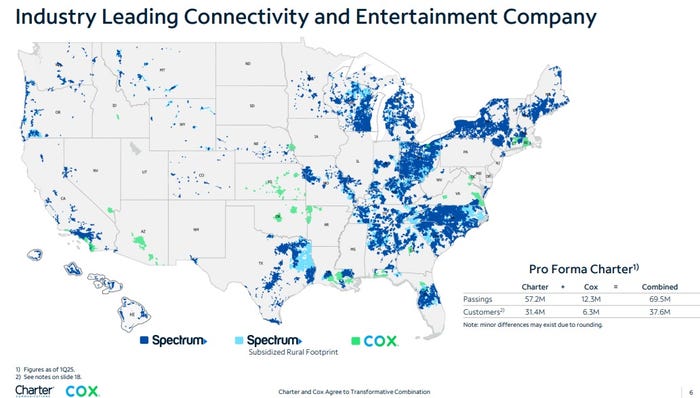

Two of the biggest cable network providers – Charter Communications and Cox Communications – today announced that they have entered into a definitive agreement to combine their businesses in a transformative transaction. The new entity will compete with Comcast for industry leadership in mobile and broadband communications services, seamless video entertainment, and high-quality customer service.

The proposed transaction values Cox Communications at an enterprise value of approximately $34.5 billion1 based on, and at parity with, Charter’s recent enterprise value to 2025 estimated Adjusted EBITDA trading multiple. Within a year after the Charter-Cox deal closes, the combined company, which will be headquartered in Stamford, Conn., plans to change its name to Cox Communications. Spectrum will be the consumer-facing brand name.

Note 1. Comprised of $21.9 billion of equity and $12.6 billion of net debt and other obligations.

Cable internet service, once a reliable engine of high-octane growth that added millions of subscribers a year, is now a grind for the industry’s two heavyweights, Charter and Comcast. Selling a broadband connection remains their main way to reap profits from the internet economy, from streaming to gaming, but that’s not happening now as net broadband losses prevail.

Cable’s pay-TV business is all but dead as video streaming continues to eat away at cable providers’ video packages. So much so that Comcast’s Xfinity brand offers streaming TV packages such as Xfinity StreamSaver, NOW StreamSaver, and Xfinity Stream.

Meanwhile, mobile carriers like Verizon and T-Mobile have heightened the threat with home broadband service beamed over the air. Wireless companies have racked up millions of customers with the offerings, which use 5G technology to provide internet speeds that are competitive with fixed cable lines at lower prices. The pressures of this new landscape have come into focus in recent months: Charter lost 60,000 internet customers in the March quarter, while rival Comcast reported an acceleration in broadband customer losses.

“We have AT&T, Verizon, T-Mobile in 100% of our footprint. We have satellite everywhere we operate,” Charter chief Chris Winfrey said. “It’s significant.”

The deal with Cox gives the combined company more heft in competing for customers, negotiating with programmers and making network investments. It also expands the merged company’s enterprise offerings. Charter has 31.4 million customers while Cox has 6.3 million customers. The companies expect $500 million in annual cost savings within three years of the deal closing.

Source: Charter-Cox merger presentation, May 16, 2025

“Charter’s board and I are excited about this transaction and very supportive of Alex stepping into the board Chairman role,” said Eric Zinterhofer, Chairman of Charter’s Board of Directors. “The combination of Cox Communications with Charter is an excellent outcome for our collective shareholders, customers, employees and the industry.”

Photo: Jeff Roberson/Associated Press

“We’re honored that the Cox family has entrusted us with its impressive legacy and are excited by the opportunity to benefit from the terrific operating history and community leadership of Cox,” said Chris Winfrey, President and CEO of Charter. “Cox and Charter have been innovators in connectivity and entertainment services – with decades of work and hundreds of billions of dollars invested to build, upgrade, and expand our complementary regional networks to provide high-quality internet, video, voice and mobile services. This combination will augment our ability to innovate and provide high-quality, competitively priced products, delivered with outstanding customer service, to millions of homes and businesses. We will continue to deliver high-value products that save American families money, and we’ll onshore jobs from overseas to create new, good-paying careers for U.S. employees that come with great benefits, career training and advancement, and retirement and ownership opportunities.”

Cox is a major player in the internet and pay-TV business, but is still dwarfed by Charter and Comcast. The Atlanta-based family business has opted to stay private for the past two decades as other cable and wireless companies swelled through ever-bigger acquisitions. Cox is the longest continuous cable network operator in the industry, having acquired its first cable television franchise in 1962. “Our family has always believed that investing for the long-term and staying committed to the best interests of our customers, employees and communities is the best recipe for success,” said Alex Taylor, Chairman and CEO of Cox Enterprises. “In Charter, we’ve found the right partner at the right time and in the right position to take this commitment to a higher level than ever before, delivering an incredible outcome for our customers, employees, suppliers and the local communities we serve.”

Cox will eventually launch a range of products under the Spectrum brand, including Spectrum’s Advanced WiFi, Spectrum Mobile, the Spectrum TV app and Xumo, a streaming platform operated by a joint venture of Charter and Comcast.

Cox launched the Xumo Stream Box last fall. Cox also operates Cox Mobile, a mobile service based on an MVNO agreement with Verizon. Charter’s Spectrum Mobile service is also based on a Verizon MVNO. New Street’s Chaplin presumes that Cox’s mobile business will move over the Charter MVNO on Verizon and get better overall terms.

It’s not immediately clear how Cox’s network upgrade plans will change following the combination. Cox recently announced it would deploy a virtual cable modem termination system (vCMTS) from Vecima. Charter has tapped Harmonic as its initial vCMTS partner for a multi-tiered hybrid fiber/coax (HFC) upgrade.

“You really do need scale in this business,” said Andrew Cole, executive chairman of Glow Services, a telecom-focused software company, and board member of European cable company Liberty Global. Liberty Global, like Charter, is part of cable mogul John Malone’s communications empire. “The coming-together of cable in its entirety over time will happen because that’s the only way they can compete against these giants, which are the telcos,” Cole added.

Details of the Merger:

Charter will acquire Cox Communications’ commercial fiber and managed IT and cloud businesses, and Cox Enterprises will contribute Cox Communications’ residential cable business to Charter Holdings, an existing subsidiary partnership of Charter. Cox’s assets have been valued using Cox’s 2025 estimated Adjusted EBITDA, multiplied by Charter’s total enterprise value to 2025 estimated Adjusted EBITDA trading multiple of 6.44x, based on:

- Wall Street consensus for Charter’s 2025 Adjusted EBITDA, and

- Charter’s (NASDAQ: CHTR) 60-day Volume Weighted Average Price of $353.64, as of 4/25/25.

As consideration in the transaction, Cox Enterprises will receive:

- $4 billion in cash,

- $6 billion notional amount of convertible preferred units in Charter’s existing partnership, which pay a 6.875% coupon, and which are convertible into Charter partnership units, which are then exchangeable for Charter common shares, and

- Approximately 33.6 million common units in Charter’s existing partnership, with an implied value of $11.9 billion1, and which are exchangeable for Charter common shares.

Based on Charter’s share count as of March 31, 2025, at the closing, Cox Enterprises will own approximately 23% of the combined entity’s fully diluted shares outstanding, on an as-converted, as-exchanged basis, and pro forma for the closing of the Liberty Broadband merger. The transaction is subject to customary closing conditions, including the receipt of regulatory and Charter shareholder approvals. The combined entity will assume Cox’s approximately $12 billion in outstanding debt.

Within a year after the closing, the combined company will change its name to Cox Communications. Spectrum will become the consumer-facing brand within the communities Cox serves. The combined company will remain headquartered in Stamford, CT, and will maintain a significant presence on Cox’s Atlanta, GA campus following the closing.

Governance:

Following the closing, Mr. Winfrey will continue in his current role as President & CEO, and board member. Mr. Taylor will join the board as Chairman, and Mr. Zinterhofer will become the lead independent director on Charter’s board. Cox will have the right to nominate an additional two board members to Charter’s 13-member board. Advance/Newhouse, another storied cable innovator, which contributed its operations to Charter’s partnership in 2016, will retain its two board nominees.

It is expected that Charter’s combination with Cox will be completed contemporaneously with the previously announced Liberty Broadband merger. As a result, Liberty Broadband will cease to be a direct shareholder in Charter and will no longer designate directors for election to the Charter Board. Accordingly, the three current Liberty Broadband nominees on Charter’s board will resign at closing. Liberty Broadband shareholders will receive direct interests in Charter as a result of the Liberty Broadband merger.

Upon closing, Charter, Cox Enterprises and Advance/Newhouse will enter into an amended and restated stockholders agreement, which will provide for preemptive rights over certain issuances, voting caps and required participation in Charter common share repurchases at specified acquisition caps, and transfer restrictions among other shareholder governance matters.

Community Leadership:

The Cox family of businesses was founded 127 years ago on the promise of “building a better future for the next generation.” Both Cox and Charter want to see that intent reinforced in this new partnership. The Cox family’s commitment to supporting its communities through the philanthropic work of the James M. Cox Foundation will be continued by Charter’s $50 million grant to establish a separate foundation that will encourage community leadership and support where the combined company does business. Additionally, Charter will make an initial $5 million investment to establish an employee relief fund that mirrors the Cox Employee Relief Fund, which Cox and the Cox family created in 2005 to help employees through times of hardships such as natural disasters or other unexpected life challenges.

Strategic and Customer Objectives:

Following the closing, the combined company’s industry-leading products will launch across Cox’s approximately 12 million passings and 6 million existing customers, under the Spectrum brand – including Spectrum’s Advanced WiFi, Spectrum Mobile with Mobile Speed Boost, the Spectrum TV App, Seamless Entertainment and Xumo – and which, when coupled with Spectrum’s transparent and customer-focused pricing and packaging structure, will provide Cox customers with enhanced flexibility and convenience, as well as the choice to pay less for new Spectrum bundled services or to keep their current plans.

The new combination will create a best-in-class customer service model. That model will integrate Cox’s rich service history with Charter’s 100% U.S.-based, employee-focused service and sales model and industry-leading customer commitments. Charter customers will benefit from Cox Business’ well-known industry leadership in business telecommunications, including Segra and RapidScale.

Charter and Cox employees will benefit from investments in employee-focused technology and AI tools and an expansion of Charter’s self-progression career advancement model for promotions and standardized pay increases.

Specific benefits from the combination include:

- The combined company will bring together the best products and practices of each company to benefit all of the combined company’s customers and employees.

- The combined company will be better positioned to aggressively compete in an expanding and dynamic marketplace that includes:

- Larger, national broadband companies with wireline and wireless capabilities,

- Regional wireline and mobile competitors,

- Global video distribution providers and platforms, and satellite broadband companies.

- The combined company also will be better positioned for continued and expanded investment and innovation:

- In mobile, given the increased footprint;

- In video, where Big Tech currently leverages global scale in content and distribution;

- In advertising, where the transaction will expand opportunities for advertisers large and small, national, regional, and local, bringing new competition in an area now dominated by Big Tech;

- In the business sector, where the combined company will have additional coverage, yet still remain a regional player competing against larger, national competitors;

- And through greater product innovation in areas including AI tools and small cell deployment of licensed, shared licensed and unlicensed spectrum, bringing new and advanced services and capabilities to consumers and businesses.

- Cox customers will gain access to Charter’s simple and transparent pricing and packaging structure, including no annual contracts for any residential services, which means customers are free to change service providers at any time, with no risk of early termination fees.

- Cox customers also will benefit from Charter’s industry-first Customer Service Commitments, which include:

- Charter’s 100% U.S.-based customer service team available 24/7.

- Charter has committed to fixing service disruptions quickly, including same-day technician dispatch when requested before 5:00 pm; if not, the next day.

- Charter provides customers credits for outages that last longer than two hours.

- This proposed transaction puts America first by returning jobs from overseas and creating new, good-paying customer service and sales careers.

- The combined company will adopt Charter’s sales and service workforce model, which will fully return Cox’s customer service function to the U.S.

- All employees will earn a starting wage of at least $20 per hour and will gain access to Charter’s industry-leading benefits, which include:

- Comprehensive medical, dental, and vision coverage for all full-time and part-time employees; Charter has absorbed the full premium cost increase for the last 12 years.

- Market-leading retirement benefits, including a 401(k) plan with a company match up to 6% of their eligible pay, with an additional 3% contribution available for most employees.

- Free or discounted Spectrum Mobile, TV and Internet service.

- Multiple opportunities for upward advancement and to build careers, including through tuition-free undergraduate degree and certificate programs via flexible online learning; self-progression programs with standardized pay raises, and formal development programs, such as the Broadband Field Technician Apprenticeship program.

- Employee Stock Purchase Plan, which provides frontline employees the ability to purchase stock and receive a matching grant of Charter Restricted Stock Units (RSUs) up to 1 for 1 based on years of service, offering employees another meaningful incentive to grow their careers with Charter.

- The combined company will expand Charter’s award-winning local Spectrum News stations in the Cox footprint, bringing hyper-local, unbiased news coverage to more communities. The combined company will not own any national programming.

- The combined company will retain its industry leadership in protecting the security of U.S. communications networks from foreign threats.

End Note:

Adding to the near-term uncertainty for internet service providers like Charter, the Trump administration put Biden’s $42.5 billion broadband-construction program on hold. The Broadband Equity, Access, and Deployment (BEAD) Program, is a key component of the “Internet for All” initiative, aiming to expand high-speed internet access across the United States. The program, funded by the Bipartisan Infrastructure Law, allocates grants to states and territories to deploy or upgrade broadband networks, ensuring reliable, affordable, high-speed internet service for all.The Commerce Department has frozen grants to state authorities that were set to start awarding contracts this year while it reviews the program’s criteria.

References:

https://www.lightreading.com/cable-technology/cablepalooza-charter-and-cox-strike-34-5b-merger

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Cox Communications commits to symmetrical 10-Gig; many upgrade paths are possible

T‑Mobile and EQT close JV to acquire FTTH network provider Lumos

FCC to investigate Dish Network’s compliance with federal requirements to build a nationwide 5G network

In a letter to Charlie Ergen, the chairman and co-founder of network operator EchoStar, Federal Communications Commission (FCC) chairman Brendan Carr wrote that the agency’s staff would investigate the company’s compliance with requirements to build a nationwide 5G network as per the terms of its federal spectrum licenses. EchoStar owns both Dish Network and Boost Mobile’s wireless service. Dish has said its 5G network covers more than 268 million people and has met all of its regulatory requirements.

In 2019, the U.S. government set several construction milestones for Dish Network to maintain cellular licenses worth billions of dollars. The company agreed to meet specific buildout obligations in connection with a number of spectrum licenses across several different bands. In particular, the FCC agreed to relax some of EchoStar’s then-existing buildout obligations in exchange for EchoStar’s commitment to put its licensed spectrum to work deploying a nationwide 5G broadband network. EchoStar promised—among other things—that its network would cover, by June 14, 2025, at least 70% of the population within each of its licensed geographic areas for its AWS-4 and 700 MHz licenses, and at least 75% of the population within each of its licensed geographic areas for its H Block and 600 MHz licenses.

“The FCC structured the buildout obligations to prevent spectrum warehousing and to ensure that Americans would gain broader access to high-speed wireless services, including in underserved and rural areas.”

Ergen said that the company has worked collaboratively with FCC leaders since it launched its first pay-TV satellite more than 30 years ago. He added that EchoStar’s network creates American jobs and furthers a critical Trump administration priority of ensuring “the United States is at the forefront of wireless leadership and that our infrastructure is free of Chinese vendors.” Full text of his statement is below.

Ergen is reportedly working to pivot his satellite TV business from a declining pay-TV model to a “direct-to-device” business that connects smartphones from space, among other services. Carr laid out plans for the agency to seek public comment on how mobile-satellite services could use some spectrum that EchoStar currently holds. EchoStar is among a group of satellite companies that already hold licenses to provide mobile-device links, though they lack the dense network of modern satellites that Starlink has at its disposal.

SpaceX said in an April letter that EchoStar’s spectrum in the 2 Gigahertz band “remains ripe for sharing among next-generation satellite systems.” The company urged the commission to launch a new rule-making process to add new competitors to the band. EchoStar has accused SpaceX of a spectrum land grab.

Separately, Dish Network has spent years wiring thousands of cellphone towers to help Boost become a wireless operator that could rival AT&T, Verizon and T-Mobile, but the project has been slow-going. Boost’s subscriber base has shrunk in the five years since Ergen bought the brand from Sprint so it is not at all competitive with its big three U.S. cellular rivals.

Dish Network under FCC microscope, Art by Midjourney for Fierce Network

……………………………………………………………………………………………………………………………………………………………….

Charlie Ergen’s Statement in Response to FCC Letter:

“We have worked collaboratively with FCC leaders since we launched our first DBS satellite more than 30 years ago. Today, we are proud to have invested tens of billions to deploy the world’s largest 5G Open RAN network – primarily using American vendors – across 24,000 5G sites, to offer broadband service to over 268 million people nationwide. Through this deployment, which is possible thanks to scores of tower climbers, engineers, and partners, we have met or exceeded all of the commitments we have entered into with the FCC to date. And our work is not yet finished as we continue to deploy and invest in our network. Not only does our network create American jobs and a competitive alternative to incumbent wireless carriers, it also furthers another critical Trump Administration priority: deploying Open RAN to ensure the United States is at the forefront of wireless leadership and that our infrastructure is free of Chinese vendors. Thanks to our nationwide pricing model and agreements with partner carriers, Boost Mobile is available at affordable prices to Americans across the country – including in rural and hard to reach communities. Indeed, our new buildout deadlines – which are consistent with FCC practice under the past two Administrations where the Wireless Bureau granted hundreds of buildout extensions – came with additional, substantial pro-competitive commitments that EchoStar has fulfilled. As we continue to invest in and expand our terrestrial network deployment, we are also working to provide Open RAN direct-to-device satellite technology, bringing additional connectivity to all Americans in the U.S. and around the world.

EchoStar worked tirelessly to establish 3GPP NTN standard for D2D. With D2D 3GPP standards now complete, EchoStar has the global capability in terms of expertise, spectrum, and ITU priority to bring this to fruition. We are now testing new S-band services in both North America and Europe, and this year we launched a LEO satellite with several more planned in the coming months. We look forward to continuing this important work to help the Administration and FCC continue to deliver for the American people.”

References:

https://prod-i.a.dj.com/public/resources/documents/Carr-Ergen-letter.pdf

https://www.fierce-network.com/wireless/fcc-questions-echostar-about-how-its-using-5g-spectrum

https://www.tipranks.com/news/the-fly/echostar-confirms-fcc-letter-to-company-ergen-makes-statement

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network to FCC on its “game changing” OpenRAN deployment

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

Sources: AI is Getting Smarter, but Hallucinations Are Getting Worse

Recent reports suggest that AI hallucinations—instances where AI generates false or misleading information—are becoming more frequent and present growing challenges for businesses and consumers alike who rely on these technologies. More than two years after the arrival of ChatGPT, tech companies, office workers and everyday consumers are using A.I. bots for an increasingly wide array of tasks. But there is still no way of ensuring that these systems produce accurate information.

A groundbreaking study featured in the PHARE (Pervasive Hallucination Assessment in Robust Evaluation) dataset has revealed that AI hallucinations are not only persistent but potentially increasing in frequency across leading language models. The research, published on Hugging Face, evaluated multiple large language models (LLMs) including GPT-4, Claude, and Llama models across various knowledge domains.

“We’re seeing a concerning trend where even as these models advance in capability, their propensity to hallucinate remains stubbornly present,” notes the PHARE analysis. The comprehensive benchmark tested models across 37 knowledge categories, revealing that hallucination rates varied significantly by domain, with some models demonstrating hallucination rates exceeding 30% in specialized fields.

Hallucinations are when AI bots produce fabricated information and present it as fact. Photo Credit: More SOPA Images/LightRocket via Getty Images

Today’s A.I. bots are based on complex mathematical systems that learn their skills by analyzing enormous amounts of digital data. These systems use mathematical probabilities to guess the best response, not a strict set of rules defined by human engineers. So they make a certain number of mistakes. “Despite our best efforts, they will always hallucinate,” said Amr Awadallah, the chief executive of Vectara, a start-up that builds A.I. tools for businesses, and a former Google executive.

“That will never go away,” he said. These AI bots do not — and cannot — decide what is true and what is false. Sometimes, they just make stuff up, a phenomenon some A.I. researchers call hallucinations. On one test, the hallucination rates of newer A.I. systems were as high as 79%.

Amr Awadallah, the chief executive of Vectara, which builds A.I. tools for businesses, believes A.I. “hallucinations” will persist.Credit…Photo credit: Cayce Clifford for The New York Times

AI companies like OpenAI, Google, and DeepSeek have introduced reasoning models designed to improve logical thinking, but these models have shown higher hallucination rates compared to previous versions. For more than two years, those companies steadily improved their A.I. systems and reduced the frequency of these errors. But with the use of new reasoning systems, errors are rising. The latest OpenAI systems hallucinate at a higher rate than the company’s previous system, according to the company’s own tests.

For example, OpenAI’s latest models (o3 and o4-mini) have hallucination rates ranging from 33% to 79%, depending on the type of question asked. This is significantly higher than earlier models, which had lower error rates. Experts are still investigating why this is happening. Some believe that the complex reasoning processes in newer AI models may introduce more opportunities for errors.

Others suggest that the way these models are trained might be amplifying inaccuracies. For several years, this phenomenon has raised concerns about the reliability of these systems. Though they are useful in some situations — like writing term papers, summarizing office documents and generating computer code — their mistakes can cause problems. Despite efforts to reduce hallucinations, AI researchers acknowledge that hallucinations may never fully disappear. This raises concerns for applications where accuracy is critical, such as legal, medical, and customer service AI systems.

The A.I. bots tied to search engines like Google and Bing sometimes generate search results that are laughably wrong. If you ask them for a good marathon on the West Coast, they might suggest a race in Philadelphia. If they tell you the number of households in Illinois, they might cite a source that does not include that information. Those hallucinations may not be a big problem for many people, but it is a serious issue for anyone using the technology with court documents, medical information or sensitive business data.

“You spend a lot of time trying to figure out which responses are factual and which aren’t,” said Pratik Verma, co-founder and chief executive of Okahu, a company that helps businesses navigate the hallucination problem. “Not dealing with these errors properly basically eliminates the value of A.I. systems, which are supposed to automate tasks for you.”

For more than two years, companies like OpenAI and Google steadily improved their A.I. systems and reduced the frequency of these errors. But with the use of new reasoning systems, errors are rising. The latest OpenAI systems hallucinate at a higher rate than the company’s previous system, according to the company’s own tests.

The company found that o3 — its most powerful system — hallucinated 33% of the time when running its PersonQA benchmark test, which involves answering questions about public figures. That is more than twice the hallucination rate of OpenAI’s previous reasoning system, called o1. The new o4-mini hallucinated at an even higher rate: 48 percent.

When running another test called SimpleQA, which asks more general questions, the hallucination rates for o3 and o4-mini were 51% and 79%. The previous system, o1, hallucinated 44% of the time.

In a paper detailing the tests, OpenAI said more research was needed to understand the cause of these results. Because A.I. systems learn from more data than people can wrap their heads around, technologists struggle to determine why they behave in the ways they do.

“Hallucinations are not inherently more prevalent in reasoning models, though we are actively working to reduce the higher rates of hallucination we saw in o3 and o4-mini,” a company spokeswoman, Gaby Raila, said. “We’ll continue our research on hallucinations across all models to improve accuracy and reliability.”

Tests by independent companies and researchers indicate that hallucination rates are also rising for reasoning models from companies such as Google and DeepSeek.

Since late 2023, Mr. Awadallah’s company, Vectara, has tracked how often chatbots veer from the truth. The company asks these systems to perform a straightforward task that is readily verified: Summarize specific news articles. Even then, chatbots persistently invent information. Vectara’s original research estimated that in this situation chatbots made up information at least 3% of the time and sometimes as much as 27%.

In the year and a half since, companies such as OpenAI and Google pushed those numbers down into the 1 or 2% range. Others, such as the San Francisco start-up Anthropic, hovered around 4%. But hallucination rates on this test have risen with reasoning systems. DeepSeek’s reasoning system, R1, hallucinated 14.3% of the time. OpenAI’s o3 climbed to 6.8%.

Sarah Schwettmann, co-founder of Transluce, said that o3’s hallucination rate may make it less useful than it otherwise would be. Kian Katanforoosh, a Stanford adjunct professor and CEO of the upskilling startup Workera, told TechCrunch that his team is already testing o3 in their coding workflows, and that they’ve found it to be a step above the competition. However, Katanforoosh says that o3 tends to hallucinate broken website links. The model will supply a link that, when clicked, doesn’t work.

AI companies are now leaning more heavily on a technique that scientists call reinforcement learning. With this process, a system can learn behavior through trial and error. It is working well in certain areas, like math and computer programming. But it is falling short in other areas.

“The way these systems are trained, they will start focusing on one task — and start forgetting about others,” said Laura Perez-Beltrachini, a researcher at the University of Edinburgh who is among a team closely examining the hallucination problem.

Another issue is that reasoning models are designed to spend time “thinking” through complex problems before settling on an answer. As they try to tackle a problem step by step, they run the risk of hallucinating at each step. The errors can compound as they spend more time thinking.

“What the system says it is thinking is not necessarily what it is thinking,” said Aryo Pradipta Gema, an A.I. researcher at the University of Edinburgh and a fellow at Anthropic.

New research highlighted by TechCrunch indicates that user behavior may exacerbate the problem. When users request shorter answers from AI chatbots, hallucination rates actually increase rather than decrease. “The pressure to be concise seems to force these models to cut corners on accuracy,” the TechCrunch article explains, challenging the common assumption that brevity leads to greater precision.

References:

https://www.nytimes.com/2025/05/05/technology/ai-hallucinations-chatgpt-google.html

The Confidence Paradox: Why AI Hallucinations Are Getting Worse, Not Better

https://www.forbes.com/sites/conormurray/2025/05/06/why-ai-hallucinations-are-worse-than-ever/

https://techcrunch.com/2025/04/18/openais-new-reasoning-ai-models-hallucinate-more/

Goldman Sachs: Big 3 China telecom operators are the biggest beneficiaries of China’s AI boom via DeepSeek models; China Mobile’s ‘AI+NETWORK’ strategy

Telecom sessions at Nvidia’s 2025 AI developers GTC: March 17–21 in San Jose, CA

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

Does AI change the business case for cloud networking?

Deutsche Telekom and Google Cloud partner on “RAN Guardian” AI agent

Ericsson’s sales rose for the first time in 8 quarters; mobile networks need an AI boost

Google X spin-out Taara and Digicomm International partner to offer high speed wireless communications

Taara, a Google X “Moonshot Factory” spinoff, has chosen Colorado-based Digicomm International, a leading telecommunications distributor and manufacturer, to stock and expand the deployment of Taara’s innovative wireless optical (speeds) communication technology which is generically called Free Space Optics (FSO). Taara has been successful in FSO deployments with fiber and mobile operators in more than a dozen countries (see use cases below). The company has focused on the middle-mile market and intends also to pursue the last-mile connectivity arena, hopes to scale up its reach with operators even further following a new value-added reseller deal with Digicomm which will primarily focus on the North America market.

Taara Lightbridge is a wireless terminal that’s about the size of a traffic light and weights 14 kilograms. It uses beams of light to deliver fiber optic-like speeds through the air, providing an ideal solution for middle-mile connectivity, network resilience, and rapid service restoration. Taara’s core technology traces back to Project Loon, a one-time Google X initiative that explored how to create floating cell towers via the deployment of stratospheric balloons hovering at about 66,000 feet that connected with FSO technology. Taara CEO Mahesh Krishnaswamy, who worked on Project Loon, later decided that Loon’s core connectivity technology could be applied to terrestrial use cases. That idea spawned Taara which was spun off from Google X (Alphabet’s innovation hub) on March 17, 2025.

Taara uses free space optics technology in the unlicensed infrared band (193THz) and eye-safe 1535-1565 nanometer wavelength to deliver low-latency, bidirectional speeds of up to 20 Gbit/s across distances up to 20 kilometers. “It’s almost like a fiber, but it’s in the air,” Krishnaswamy told Light Reading.

By adding Taara Lightbridge to its portfolio, Digicomm says it will strengthen its commitment to provide customers with innovative and scalable products that address today’s growing broadband demands. Digicomm and Taara first connected at last year’s Fiber Connect show, according to Digicomm CEO Rob Donziger.

“Partnering with Taara marks an exciting milestone for Digicomm and our customers,” said Jennifer Nelson, FTTx and Wireless Sales Leader at Digicomm International. “Taara’s Wireless Optical Communication technology is a perfect complement to our extensive wireless, HFC, and FTTx offerings, empowering service providers to expand faster, more efficiently, and at a lower cost.”

“We’re excited to welcome Digicomm as our Master Value-Added Reseller in the Americas region,” said Sanjay Nagpal, Senior Vice President of Global Sales and Partnerships at Taara. “Digicomm’s deep regional expertise and strong ecosystem of relationships will accelerate the deployment of Taara’s high-speed wireless optical technology where it’s needed most. This partnership marks a significant milestone in our mission to expand affordable, reliable internet access with partners seeking innovative, fiber-equivalent solutions.”

FSO has been around for decades, but its success in the market has been limited by weather issues, such as rain, fog and vibration-inducing winds, that can cause service disruptions and reduce overall reliability. Krishnaswamy said Taara isn’t immune to those conditions. However, he said that the company has developed ways to compensate for them, including a pointing-and-tracking system that keeps the beam between terminals centered despite movement and vibrations.

Taara also boosts reliability with the use of automatic repeat request (ARQ) techniques that quickly resend data when, for example, a bird flies in front of the beam or connectivity is impacted by rain droplets. Fog presents a more difficult scenario, but Taara can use a “hybrid” approach – such as creating a redundant path via a different frequency and the use of microwave technology as a failover – to compensate, Krishnaswamy said.

Taara also has developed a planning tool based on years of weather data to help partners predict when weather-related issues might surface. Weather is not the only FSO culprit. In earlier deployment days in India, for example, outages were caused by monkeys jumping on towers and making them sway. The new pointing-and-tracking system resolved that issue by compensating for that movement and keeping the connection stable, Krishnaswamy added. He likened Taara’s technical and operational approach as a “second coming” for free space optics, believing it’s now “primed and ready for the real world.”

Taara was spun out from Google X after there was a “clear signal” that the company’s technology had matured to a certain level and that there was enough traction to support a sustainable business. Taara is now “ready to scale and go to the next stage,” Krishnaswamy said.

Taara currently employs fewer than 100 people and is not yet profitable. However, it has been racking up deployments in more than a dozen countries for a wide range of use cases in both rural and urban areas. Those use cases include bringing fiber-like speeds where fiber can’t (because of factors such as cost and difficult terrain), enterprise connectivity – for portable, redundant connectivity when a service provider experiences a fiber cut – and disaster recovery.

Taara’s technology “has been very versatile and we’ve been very surprised at how customers have been teaching us on how best to use this product,” Krishnaswamy noted. Examples of Taara’s early deployment partners include Liberty Latin America (redundancy and island-to-island connectivity), Airtel (connecting multiple dwelling units and 4G/5G tower backhaul), T-Mobile (portable 5G connectivity), Liquid Telecom in Nairobi (connecting surrounding towns from existing fiber) and Digicel (service failovers).

……………………………………………………………………………………………………………………………………………………………………

With decades of experience delivering advanced broadband technologies, Digicomm’s logistical capabilities and customer reach make it an ideal partner to scale deployment quickly and effectively. Digicomm will stock and support Taara Lightbridge wireless optical solutions, offering link planning services, rapid order fulfillment, and customer service to meet the unique needs of broadband network operators.

……………………………………………………………………………………………………………………………………………………………………

About Digicomm International:

Founded in 1993, Digicomm is an industry-leading, value-added broadband distributor and manufacturer – and a key strategic partner to its customers helping them meet the rigorous demands of broadband network operations. Service providers around the world depend on Digicomm’s extensive inventory of Wireless, HFC, and FTTx products, representing trusted manufacturers such as AOI, PPC, Commscope, Tarana Wireless, and many others. Digicomm also designs and manufactures products including EDFAs, optical passives and more.

For further information, visit www.digicomm.com

About Taara:

Taara is a moonshot for connectivity, with a mission to extend and amplify the global communications network with beams of light. Born at X, Google’s Moonshot Factory, the team combines expertise across disciplines to tackle the world’s toughest connectivity challenges. Taara is now deploying wireless optical communications with industry partners in over a dozen countries, expanding access to fast, reliable connectivity. The company is located in Sunnyvale, CA.

Following about seven years in the incubation phase, Taara spun-out of the Google X Moonshot Factory in March 2025. It has Alphabet and Series X Capital among its financial backers.

Projects such as Wing (lightweight drones to deliver goods), Project Loon, Dandelion (the use of geothermal energy to heat and cool homes) and Waymo (the autonomous vehicle company spun out in 2016) also started at Google X.

Learn more at www.taaraconnect.com

…………………………………………………………………………………………………………………………………………………………………………..

References:

After 9 years Alphabet pulls the plug on Loon; Another Google X “moonshot” bites the dust!

Ultra-secure quantum messages sent a record distance over a fiber optic network

Unlike binary bit based digital communications, quantum information is transmitted in qubits, which can store multiple values at once, making quantum communications more secure. A recently published article in Nature states that scientists have sent quantum information across a record-breaking 158 miles using ordinary computers and fiber-optic cables. It’s the first time coherent quantum communication—an ultra-secure means of transmitting data—has been achieved using existing telecommunications infrastructure, without the expensive cryogenic cooling that is typically required.

“Our equipment was running alongside the fibers that we use for regular communication literally buried underneath the roads and train stations,” said Mirko Pittaluga, a physicist and lead author of the study. Pittaluga and his colleagues at Toshiba Europe sent quantum information from regular computers hooked into the telecommunications network at data centers in the German cities of Kehl and Frankfurt, relaying them through a detector at a third data center roughly midway between them in Kirchfeld. The three-location setup enabled the group to extend the distance the messages were sent more than 150 miles, an uninterrupted distance only ever achieved in a laboratory environment.

Pittaluga said that his team’s work is critical to solving the problem of keeping sensitive data out of the reach of hackers. One means of fixing this problem, Pittaluga said, is through quantum cryptography, which relies on the physics of quantum mechanics rather than mathematical algorithms to generate encryption keys. But to use quantum encryption keys, you have to successfully distribute them across meaningful distances, a task that has stymied researchers outside the lab for decades.

Quantum data was sent over an ordinary telecom network with fiber-optic cables.© julie sebadelha/Agence France-Presse/Getty Images

Integrating the technology into existing infrastructure using largely off-the-shelf equipment is a key step in expanding the accessibility of quantum communication and its use in encrypting information for more secure transmission of data, according to multiple physicists and engineers who weren’t involved in the study.

“This is about as real-world as one could imagine,” said David Awschalom, a professor of physics and molecular engineering at the University of Chicago who wasn’t a part of the new work. “It’s an impressive, quite beautiful demonstration.” Working at these types of distances, Awschalom said, means that quantum information could be sent across entire metropolitan areas or between nearby cities, making it useful for hospitals, banks and other institutions, for which secure communications are paramount.

“The likelihood of them being able to reverse engineer a quantum key, which is the number you would need to decrypt your information, is vanishingly small,” according to Awschalom.

Other groups in the U.K. and U.S., including researchers at the University of Pennsylvania, are also working on extending the distances achievable by quantum communication.

Today, bank statements, health records and other data transmitted online are protected using mathematically formulated encryption keys. These keys are the only means of unlocking the data, keeping it secure from cyber thieves. For conventional computers, breaking these keys takes an impractically long time, but quantum computers are up to the task, and as they become more powerful, encryption keys become vulnerable to attack.

“Anything meaningful that’s over the internet can be tapped, recorded and saved for the next decade, and can be decrypted years later,” according to Prem Kumar, a professor of electrical and computer engineering at Northwestern University, who wasn’t a part of the new work. “It’s what’s called harvest now and decrypt later.”

Internet and telecommunications infrastructure are based on optical fibers all over the world that carry pulses of light containing photons. Classical bits of information are sent as a single impulse of light carrying tens of millions of photons. Quantum information, stored in qubits, is sent in a package of a single photon.

Efficiently detecting single photons usually requires expensive superconducting detectors that cost on the order of hundreds of thousands of dollars. These high-efficiency sensors must be cryogenically cooled, using liquid helium, to super low temperatures below minus 454 degrees Fahrenheit, making the technology expensive and incompatible with existing infrastructure.

Pittaluga and his colleagues at Toshiba got around this by using cheaper detectors known as avalanche photodiodes, which cost just thousands of dollars and can run at or just below room temperature, like today’s traditional internet equipment.

Such detectors hadn’t been used for coherent quantum communication before, as they can be nearly an order of magnitude less efficient at detecting single photons and are affected by what is called the afterpulse effect—when the current detection is frustrated by leftover echoes from an earlier transmission. Superconducting detectors aren’t affected by afterpulsing, Pittaluga said.

To address the effect in the more practical and cost-effective photodiodes, his group employed two separate sets of the detectors, using one to read the signal and the other to remove the environmental noise from that signal. The goal of this setup is to bring us one step closer to a quantum internet, with incredibly secure information, Pittaluga added.

Yet despite this innovation, the technology remains expensive and difficult to implement compared with current encryption systems and networks—for now. “My personal view is that we’ll be seeing quantum encryption of data sets and metropolitan-scale quantum networks within a decade,” Awschalom added.

……………………………………………………………………………………………………………………………………………………………………………..

Why quantum computers are faster at solving problems:

Quantum computers are faster than traditional computers for optimization problems, such as finding the more efficient options for supply chains.

A traditional computer tries each combination individually. A quantum computer tries all combinations at once.

Source: Google Quantum AI

Peter Champelli/THE WALL STREET JOURNAL

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.nature.com/articles/s41586-025-08801-w

Google’s new quantum computer chip Willow infinitely outpaces the world’s fastest supercomputers

Quantum Computers and Qubits: IDTechEx report; Alice & Bob whitepaper & roadmap

Bloomberg on Quantum Computing: appeal, who’s building them, how does it work?

SK Telecom and Thales Trial Post-quantum Cryptography to Enhance Users’ Protection on 5G SA Network

SK Telecom and Thales Trial Post-quantum Cryptography to Enhance Users’ Protection on 5G SA Network

Research on quantum communications using a chain of synchronously moving satellites without repeaters

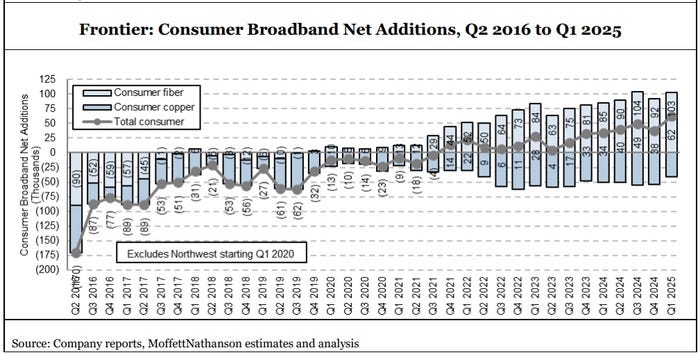

Frontier Communications fiber growth accelerates in Q1 2025

Frontier Communications reported record fiber subscriber net adds in Q1-2025. However, the “fiber first” carrier had a loss of $0.26 per share, compared to break-even earnings per share a year ago. The telco posted revenues of $1.51 billion for the quarter ended March 2025, compared to year-ago revenues of $1.46 billion.

“We had the strongest start to a year yet, led by continued strength in our fiber business,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Consumers, business owners and technology companies are increasingly relying on fiber to power networks and connect to the digital economy – and that trend is shining through in our results. The team delivered 19% growth in fiber broadband customers and 24% growth in fiber broadband revenues this quarter, which taken together drove record first-quarter growth in both revenue and Adjusted EBITDA.”

Jeffery continued, “We also hit a milestone in the first quarter, growing our fiber network to reach more than 8 million passings. We started this turnaround journey with a goal of 10 million fiber passings and four years later, I’m proud to say that we’re nearly there. As we scale our network, we’re expanding access for millions of Americans and building a legacy that will continue to endure long after our planned combination with Verizon.”

First-Quarter 2025 Highlights

- Added 321,000 fiber passings to reach 8.1 million total locations passed with fiber

- Added 107,000 fiber broadband customers, resulting in fiber broadband customer growth of 19.3% year-over-year

- Consumer fiber broadband ARPU of $68.21 increased 4.7% year-over-year

- Revenue of $1.51 billion increased 3.4% year-over-year as growth in fiber-based products was partly offset by declines in copper-based products

- Operating income of $76 million and net loss of $64 million

- Adjusted EBITDA of $583 million increased 6.6% year-over-year driven by revenue growth and lower content expense, partially offset by higher customer acquisition costs1

- Cash capital expenditures of $757 million plus $16 million of vendor financing payments resulted in total cash capital investment of $773 million2

- Generated net cash from operations of $519 million

Frontier added 103,000 residential fiber broadband customers in Q1 2025, beating the 95,000 expected by MoffettNathanson (see graph below). Frontier’s residential fiber additions in the quarter were just shy of the record 104,000 it added in Q3-2024. The fiber facilities based carrier gained a record 59,000 net broadband customers in the period, which included losses of legacy copper subscribers.

Frontier built another 321,000 fiber passings in Q1-2025, pushing its total past the 8 million mark. Alongside subscriber growth, Frontier’s consumer fiber broadband average revenue per unit (ARPU) also climbed – to $68.21, up 4.7% versus the year-ago period.

Frontier said the “vast majority” of new fiber subs are now taking multi-gigabit speeds. A specific number wasn’t shared, but back in Q2 2024 more than 60% of new Frontier fiber customers took speeds of 1 Gbit/s or more.

CEO Jeffery said Frontier is sticking with its plan to build fiber to 1.3 million locations in 2025. The current pace puts Frontier on a path to reach its 10 million fiber passing goal around the third quarter of 2026, New Street Research analyst Jonathan Chaplin said in a research note.

Jeffery said Frontier’s “fiber build machine” is capable of going faster, but he stressed that the current pace gives the company the time it needs to also sell, service and support fiber broadband as it builds. “The whole company needs to be in balance. We want more customers and higher ARPU, and we’ve demonstrated that it’s doable,” Jeffery said.

He attributed ARPU growth to multiple factors, including customers taking higher-level speed tiers and subscribing to additional, premium services. Frontier estimates that more than 50% of new customers take some type of add-on, including whole-home Wi-Fi and YouTube TV.

Jeffery said Frontier is seeing good adoption of “Unbreakable Wi-Fi,” a $25 per month add-on that flips to 4G cellular backup (with 130 gigabytes of data per billing cycle) when the primary fiber connection is down. Those customers can also opt for a battery backup that provides up to four hours of backup power.

Frontier’s Q1 results come as it moves ahead with its proposed acquisition by Verizon which is currently expected to close by the first quarter of 2026. Jeffery would only say that the deal process is going smoothly at the state and federal levels.

“My job is now very much to deliver this asset in the best possible shape it can be to its future owner, Verizon,” he said. “I’m delighted to say that that’s really been evident in our first quarter results.”

References:

https://www.businesswire.com/news/home/20250429128668/en/Frontier-Reports-First-Quarter-2025-Results

Verizon to buy Frontier Communications

Frontier Communications recovering from unknown cyberattack!

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

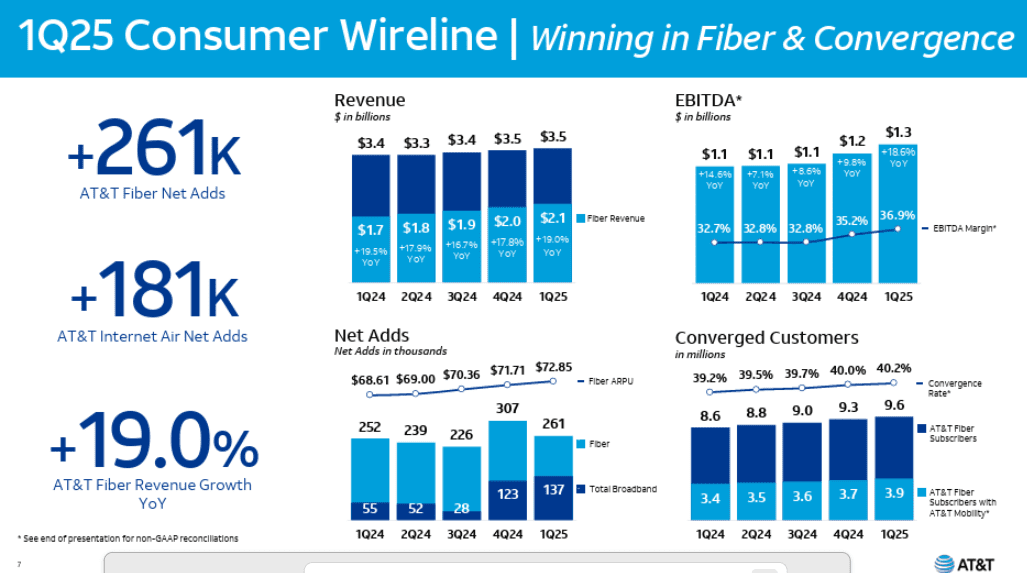

AT&T grows fiber revenue 19%, 261K net fiber adds and 29.5M locations passed by its fiber optic network

In the 1st quarter of 2025, AT&T’s fiber business showed strong performance, with fiber revenue growing by 19% year-over-year and 261,000 net fiber subscribers added. This growth helped drive overall wireline revenue and operating income, with fiber revenue contributing significantly to the 9.6% broadband revenue increase. AT&T’s fiber strategy is a key part of its broader plan for growth, including 5G wireless, and is expected to continue contributing to strong financial results. At the end of the 1Q2025, AT&T said that 29.5 million locations were passed with its fiber network. The company expects to surpass 30 million by midyear, months ahead of its original target. Consumer fiber broadband revenue was $2.1 billion in the quarter, up 19% year-over-year, as more customers upgraded to faster service tiers. Executives noted that more than 40% of AT&T Fiber households now also subscribe to AT&T wireless, part of a deliberate strategy to drive “converged” customer relationships.

AT&T continues to lead the Fiber-to-the-Home market, and has reportedly been in talks to acquire Lumen Technologies’ consumer fiber business in a deal valued at more than $5.5 billion, according to Bloomberg and Reuters

CFO Pascal Duroche on the 1Q2025 earnings call:

“We delivered 261,000 AT&T Fiber net adds, up from 252,000 in the first quarter of last year. This was driven by growth in our consumer locations served with fiber, which reached 23,800,000 at the end of 1Q and growing contribution of net adds in regions served with Giga Power Fiber. We love the return profile of fiber and the lift it provides our mobility business only makes investing in fiber more attractive. AT and T Internet Air net adds were 181,000 in the quarter, which is a significant improvement from a year ago, driven by broader availability across our distribution channels. Our combined success with these two services helped us deliver 137,000 total broadband net adds in the quarter.

This marks our seventh straight quarter of overall broadband subscriber growth and second consecutive quarter with more than 100,000 broadband net adds. We grew Consumer Wireline revenue by 5.1% versus the prior year. This was driven by fiber revenue growth of 19%, reflecting subscriber gains and solid fiber ARPU growth of 6.2%. Consumer wireline EBITDA grew 18.6% for the quarter. Our first quarter results benefited from vendor settlements that positively impacted our total wireline operating expenses by approximately $100,000,000 Roughly $55,000,000 of the impact was in Consumer Wireline with the rest in Business Wireline.”

AT&T is investing heavily in its fiber network which is reflected in the increase in its capital expenditures (CAPEX) which are expected to remain in the $22 billion range annually from 2025 through 2027.

AT&T logo on a building in Pasadena, California, U.S., January 24, 2018. REUTERS/Mario Anzuoni/File Photo Purchase Licensing Rights

………………………………………………………………………………………………………………………………………………………………………………………………………..

“Where we have fiber, we win,” said CEO John Stankey. “This dynamic continues to drive growth, shown by our increasing rate of convergence, customer penetration and significant wireless share gains within our fiber footprint.”

………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.att.com/story/2025/1q-earnings.html

Analysts weigh in: AT&T in talks to buy Lumen’s consumer fiber unit – Bloomberg

AT&T sets 1.6 Tbps long distance speed record on its white box based fiber optic network

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber (he said that in Sept. 2021)

AT&T and Verizon cut jobs another 6% last year; AI investments continue to increase

U.S. export controls on Nvidia H20 AI chips enables Huawei’s 910C GPU to be favored by AI tech giants in China

Damage of U.S. Export Controls and Trade War with China:

The U.S. big tech sector, especially needs to know what the rules of the trade game will be looking ahead instead of the on-again/off-again Trump tariffs and trade war with China which includes 145% tariffs and export controls on AI chips from Nvidia, AMD, and other U.S. semiconductor companies.

The latest export restriction on Nvidia’s H20 AI chips are a case in point. Nvidia said it would record a $5.5 billion charge on its quarterly earnings after it disclosed that the U.S. will now require a license for exporting the company’s H20 processors to China and other countries. The U.S. government told the chip maker on April 14th that the new license requirement would be in place “indefinitely.”

Nvidia designed the H20 chip to comply with existing U.S. export controls that limit sales of advanced AI processors to Chinese customers. That meant the chip’s capabilities were significantly degraded; Morgan Stanley analyst Joe Moore estimates the H20’s performance is about 75% below that of Nvidia’s H100 family. The Commerce Department said it was issuing new export-licensing requirements covering H20 chips and AMD’s MI308 AI processors.

Big Chinese cloud companies like Tencent, ByteDance (TikTok’s parent), Alibaba, Baidu, and iFlytek have been left scrambling for domestic alternatives to the H20, the primary AI chip that Nvidia had until recently been allowed to sell freely into the Chinese market. Some analysts suggest that H20 bulk orders to build a stockpile were a response to concerns about future U.S. export restrictions and a race to secure limited supplies of Nvidia chips. The estimate is that there’s a 90 days supply of H20 chips, but it’s uncertain what China big tech companies will use when that runs out.

The inability to sell even a low-performance chip into the Chinese market shows how the trade war will hurt Nvidia’s business. The AI chip king is now caught between the world’s two superpowers as they jockey to take the lead in AI development.

Nvidia CEO Jensen Huang “flew to China to do damage control and make sure China/Xi knows Nvidia wants/needs China to maintain its global ironclad grip on the AI Revolution,” the analysts note. The markets and tech world are tired of “deal progress” talks from the White House and want deals starting to be inked so they can plan their future strategy. The analysts think this is a critical week ahead to get some trade deals on the board, because Wall Street has stopped caring about words and comments around “deal progress.”

- Baidu is developing its own AI chips called Kunlun. It recently placed an order for 1,600 of Huawei’s Ascend 910B AI chips for 200 servers. This order was made in anticipation of further U.S. export restrictions on AI chips.

- Alibaba (T-Head) has developed AI chips like the Hanguang 800 inference chip, used to accelerate its e-commerce platform and other services.

- Cambricon Technologies: Designs various types of semiconductors, including those for training AI models and running AI applications on devices.

- Biren Technology: Designs general-purpose GPUs and software development platforms for AI training and inference, with products like the BR100 series.

- Moore Threads: Develops GPUs designed for training large AI models, with data center products like the MTT KUAE.

- Horizon Robotics: Focuses on AI chips for smart driving, including the Sunrise and Journey series, collaborating with automotive companies.

- Enflame Technology: Designs chips for data centers, specializing in AI training and inference.

“With Nvidia’s H20 and other advanced GPUs restricted, domestic alternatives like Huawei’s Ascend series are gaining traction,” said Doug O’Laughlin, an industry analyst at independent semiconductor research company SemiAnalysis. “While there are still gaps in software maturity and overall ecosystem readiness, hardware performance is closing in fast,” O’Laughlin added. According to the SemiAnalysis report, Huawei’s Ascend chip shows how China’s export controls have failed to stop firms like Huawei from accessing critical foreign tools and sub-components needed for advanced GPUs. “While Huawei’s Ascend chip can be fabricated at SMIC, this is a global chip that has HBM from Korea, primary wafer production from TSMC, and is fabricated by 10s of billions of wafer fabrication equipment from the US, Netherlands, and Japan,” the report stated.

Huawei’s New AI Chip May Dominate in China:

Huawei Technologies plans to begin mass shipments of its advanced 910C artificial intelligence chip to Chinese customers as early as next month, according to Reuters. Some shipments have already been made, people familiar with the matter said. Huawei’s 910C, a graphics processing unit (GPU), represents an architectural evolution rather than a technological breakthrough, according to one of the two people and a third source familiar with its design. It achieves performance comparable to Nvidia’s H100 chip by combining two 910B processors into a single package through advanced integration techniques, they said. That means it has double the computing power and memory capacity of the 910B and it also has incremental improvements, including enhanced support for diverse AI workload data.

Conclusions:

The U.S. Commerce Department’s latest export curbs on Nvidia’s H20 “will mean that Huawei’s Ascend 910C GPU will now become the hardware of choice for (Chinese) AI model developers and for deploying inference capacity,” said Paul Triolo, a partner at consulting firm Albright Stonebridge Group.

The markets, tech world and the global economy urgently need U.S. – China trade negotiations in some form to start as soon as possible, Wedbush analysts say in a research note today. The analysts expect minimal or no guidance from tech companies during this earnings season as they are “playing darts blindfolded.”

References:

https://qz.com/china-six-tigers-ai-startup-zhipu-moonshot-minimax-01ai-1851768509#

https://www.huaweicloud.com/intl/en-us/

Goldman Sachs: Big 3 China telecom operators are the biggest beneficiaries of China’s AI boom via DeepSeek models; China Mobile’s ‘AI+NETWORK’ strategy

Telecom sessions at Nvidia’s 2025 AI developers GTC: March 17–21 in San Jose, CA

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

FT: Nvidia invested $1bn in AI start-ups in 2024

Omdia: Huawei increases global RAN market share due to China hegemony

Huawei’s “FOUR NEW strategy” for carriers to be successful in AI era

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

NOTE: COMMENTS ARE CLOSED FOR THIS POST:

T-Mobile first entered into the fiber optic Internet access market in 2021. What started as a pilot program four years ago has officially launched as T‑Mobile Fiber Home Internet, offering new plans and expanding availability to over 500,000 U.S. households as of June 2025.

T-Mobile’s fiber business could serve about 5 million U.S. customers and generate up to $5 billion in revenue during the next five years, according to financial analysts at Evercore. That call is the investment advisor firm’s first take at evaluating the maturation of T-Mobile’s fiber plans. It’s based on the assumption that T-Mobile will close its deal to acquire fiber operator Metronet, following the recent closure of another deal with EQT for fiber operator Lumos. Evercore’s projections do not assume that T-Mobile will make a play for another fiber operator like Lumen Technologies.

“Looking to 2030, we expect 14 million [fiber] passings … and 4.8 million subscribers,” the analysts wrote in a note to investors this week. “Assuming a $75 ARPU [average revenue per user] growing 4% year over year implies ~$5 billion of revenue in 2030. “While it hasn’t shared subscriber targets, [T-Mobile] management has expressed confidence that it would see higher long-term market penetration than typical [fiber] overbuilders (e.g., ~35%) benefitting from its national brand and advertising, digital and retail distribution, ability to take advantage of the waiting list it has for FWA [fixed wireless access] in markets where demand outstrips supply,” the Evercore analysts added.

Evercore assumes that T-Mobile Fiber (see plans below) will be able to capture 10% market share within six months of launch and 20% within a year. After two years, the analysts predict T-Mobile Fiber will command 40% penetration (meaning, 40% of the customers reached by its fiber connections will subscribe to those connections).

T-Mobile Fiber Plans:

- Fiber 500 (500 Mbps): Superfast performance for gaming, streaming, and more.

- Fiber 1 Gig (1000 Mbps): Blistering speeds for every device and user in your home.

- Fiber 2 Gig (2000 Mbps): Our fastest speeds and largest capacity for more devices and users.

……………………………………………………………………………………………………………………………………….

……………………………………………………………………………………………………………………………………….“For now, until there’s greater color from management, we’ve assumed T-Mobile will see 25% EBITDA [earnings before interest, taxes, depreciation and amortization] margins on its Fiber revenue. This could be conservative over time,” the Evercore analysts wrote. They predicted overall EBITDA from T-Mobile Fiber of around $340 million in 2026, growing to $1.24 billion in 2030. And that, they said, would equate to free cash flow of $270 million in 2026, growing to $1 billion by 2030.

“Pricing will evolve as T-Mobile acquires and operates Metronet and Lumos’ subscribers along with the competitive dynamics across the broadband market. T-Mobile has a clear history of being a disruptor, so it could be more aggressive on pricing than we expect, resulting in downside to our ARPU and revenue estimates,” the Evercore analysts warned. They noted that T-Mobile Fiber in some Colorado markets today costs $55 per month for 500 Mbit/s connections. That’s similar to local incumbents Lumen Technologies ($50 for 500 Mbit/s) and Comcast ($55 per month for 600 Mbit/s).

Convergence of mobile and fiber access will provide a tailwind for T-Mobile, potentially driving increased postpaid phone share and revenue. “Despite management’s tone around the benefits of convergence, we believe there will clearly be an opportunity to drive higher postpaid phone share across the growing number of households that ultimately end up taking T-Mobile fiber,” according to the Evercore analysts. They predicted that T-Mobile’s fiber operations would eventually help improve the operator’s postpaid smartphone net customer additions by up to 650,000 per year, and that it will drive the operator’s annual wireless service revenues up by $200 million to $350 million.

An important insight into T-Mobile’s convergence strategy emerged in the wake of its acquisition of Lumos. “New and existing customers will enjoy VIP treatment through Magenta Status, which includes exclusive benefits like discounts on food, gas, entertainment and top brands, plus freebies every Tuesday in the T-Life app. All with T-Mobile’s standard ‘no exploding bills’ pricing structure,” T-Mobile said of its new Lumos customers.

“One app. All the things,” T-Mobile proclaims of the T-Life app it launched roughly a year ago. The app is available to all T-Mobile smartphone customers – and now its new fiber customers.

“Get the latest exclusive perks from T-Mobile Tuesdays, and take advantage of all your Magenta Status benefits,” T-Mobile said of its T-Life app. “You can also pay your bill, add a line to your account, and track orders straight from the app. And you can manage your account, configure your T-Mobile Home Internet gateway, and more. If you need help with anything, customer care is available at the tap of a button.”

The analysts expect T-Mobile’s fixed wireless access business to continue gaining traction, potentially reaching 7% of the total broadband subscriber base by 2025.

Separately, Verizon is now Evercore’s top pick among wireless network operators and is its top value idea.

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.lightreading.com/fttx/t-mobile-fiber-could-see-5m-customers-and-5b-in-revenue-by-2030

Malaysia’s U Mobile signs MoU’s with Huawei and ZTE for 5G network rollout

Malaysia’s second 5G network operator, U Mobile Sdn Bhd has signed separate memorandum of understandings (MoU’s) with Chinese technology leaders Huawei Technologies Co Ltd and ZTE Corporation to facilitate the implementation of Malaysia’s second 5G network. U Mobile has invested over RM8 billion in its network and technological infrastructure, with over 10,000 network sites. DNB, the country’s first wholesale 5G network, selected Ericsson as its network equipment provider.

U Mobile chairman Tan Sri Vincent Tan said Huawei will be responsible for deploying the 5G network in Peninsular Malaysia, while ZTE will manage the rollout in Sabah and Sarawak. “We are pleased to formalize our vendor agreements with Huawei and ZTE, two of the world’s leading 5G technology providers. The vendor selection process was conducted in a transparent manner to ensure we chose the most suitable technology partners to support our ambitious goals,” Tan said in his speech at the signing ceremony in Putrajaya. “Huawei and ZTE are no strangers to U Mobile. Having been our long-term infrastructure partners, they have a proven global deployment track record, hence, we are looking forward to pivoting our business together,” Tan added.

U Mobile chief technology officer Woon Ooi Yuen said the selection process began last year with invitations to tender issued to network equipment and software providers from various regions. “Ultimately, only two Chinese companies responded to our 5G tender and we are delighted to work with Huawei and ZTE on this significant endeavor. Apart from their global technology track record, they have also shared vision for an efficient and rapid rollout,” Woon said.

_theedgemalaysia.jpg&w=1080&q=75https://assets.nst.com.my/images/articles/HQ2411038834.jpg_1744701671.jpg)

From left: Huawei M’sia CEO Simon Sun, Huawei president of Apac Terry He, U Mobile CEO Wong Heang Tuck and chairman Tan Sri Vincent Tan, Communications Ministry Deputy SecGen (Telecommunications Infrastructure) Mano Verabathran, Communications Minister Datuk Fahmi Fadzil, China’s Industry & IT Ministry Party Secretary Li Lecheng, Chinese Ambassador to M’sia Ouyang Yujing, U Mobile deputy CEO Kenneth Chang, ZTE vice president of marketing & solutions for Asia & CIS region Bai Yang, and ZTE Malaysia Managing Director Steven Ge.

NSTP/ASWADI ALIAS

……………………………………………………………………………………………………………………………………………………………………………………………….

U Mobile chief executive officer Wong Heang Tuck said the company is targeting to achieve 80% 5G network penetration within 12 months of its rollout, which is scheduled to begin in the second half of this year (2H25). He said the goal is expected to be achievable through the appointment of Huawei and ZTE as strategic technology partners for the implementation of next-generation 5G networks in the country.

“Huawei and ZTE will play a key role in helping U Mobile meet its network expansion targets. We aim to achieve 80% coverage in populated areas within the first 12 months of rollout and subsequently reach 90% coverage in the following 12 months,” he said during the press conference.

Wong said this move aligns with U Mobile’s overall strategy to accelerate the adoption of 5G and 5G-A technologies in Malaysia, with a strong emphasis on supporting the enterprise sector. The signing with Huawei today was witnessed by Communications Minister Datuk Fahmi Fadzil, Tan, party secretary of China’s Ministry of Industry and Information Technology Li Lecheng and Huawei Asia Pacific president Terry He. U Mobile reaffirmed that it remains committed to going for a public listing, though it cautioned that timing would depend on global market conditions which are in an “upheaval state today,” Wong said.

The separate MOU with ZTE was approved by U Mobile’s Fahmi, Li Lecheng, Tan and Bai Yang, ZTE’s vice president of marketing and solutions for the Asia and CIS Region. Separately, the ZTE Privacy Protection White Paper (2025) was released today. The White Paper offers a systematic and comprehensive overview of the company’s achievements in privacy compliance, spanning privacy protection policy, framework, co-building, and practical implementation.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

Backgrounder:

The Malaysian government announced its dual 5G network model in May 2023 to ensure competition, better quality of service and wider coverage, especially in underserved and remote areas. It committed to allowing the construction of a second wholesale network once the DNB network reached 80% coverage. U Mobile was appointed by the government to deploy the second 5G network in November 2024, winning out over larger and more established telco rivals such as CelcomDigi and Maxis. Industry observers considered this a controversial choice. U Mobile is the smallest operator in Malaysia, raising questions about its ability to build a 5G network to rival DNB’s.

The Malaysian Communications and Multimedia Commission (MCMC) issued the official letter of award to U Mobile more than two weeks ago, paving the way for the construction of the country’s second 5G network.

The choice of the Chinese vendors was somewhat controversial in light of Western sanctions against them. In September 2023, Prime Minister Anwar Ibrahim sparked controversy when he said that the decision to allow a second wholesale 5G network would allow for “more effective participation by Huawei.” Ibrahim argued the construction of a second 5G network was made so that Malaysia could benefit from different technologies. “We in Malaysia, and I believe rightly, decided that while we get the best from the West, we also should benefit the best from the East,” he said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

U Mobile’s other MoU:

Last week, U Mobile announced that it has signed a memorandum of understanding with EdgePoint Infrastructure to become one of its preferred partners for 5G in-building communications (IBC) infrastructure. U Mobile will leverage EdgePoint’s expertise for its 5G IBC infrastructure rollout, with plans to collaborate on 5G IBC innovations Both parties will also seek to achieve the most cost-effective rapid rollout through a competitive commercial offer.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

U Mobile picks Chinese giants Huawei, ZTE for 5G network rollout

U Mobile to roll out 5G network with Huawei, ZTE; sees ‘similar’ rates to DNB

U Mobile collaborates with Huawei, ZTE for 5G infrastructure rollout

U Mobile picks Huawei and ZTE to deploy Malaysia’s second 5G network

U Mobile Names EdgePoint as a Preferred 5G IBC Infrastructure Partner for Its Upcoming 5G Rollout

Malaysia’s Maxis agreement with DNB to provide nationwide 5G services

TM and ZTE Malaysia to develop next-gen hybrid cloud 5G core network

Malaysia’s DNB to offer free 5G services to telcos during initial rollout

TM and ZTE Malaysia to develop next-gen hybrid cloud 5G core network

Momentum builds for wireless telco- satellite operator engagements