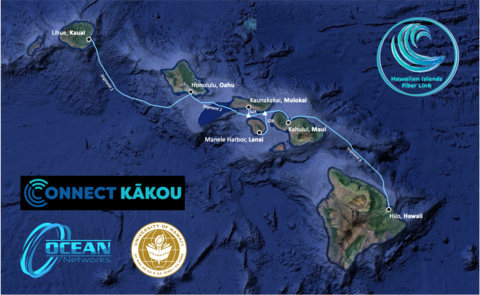

University of Hawai’i and Ocean Networks collaborate for new $120M Undersea Cable Project

Honolulu-based University of Hawaiʻi and Ocean Networks, Inc. (ONI) has launched a $120m, public-private partnership to construct a submarine optical fiber cable system that will connect the Hawaiian Islands and improve and expand high-speed broadband internet throughout the state, the principals said.

The project, the Hawaiian Islands Fiber Link, is a key component of Connect Kākou, the state’s broadband initiative, a top priority of the Governor. Josh Green administration.

HIFL will be a carrier-neutral, open-access system with landing sites on Oʻahu, Hawaiʻi, Maui, Kauaʻi, Lānaʻi and Molokaʻi (graphic above) that will improve Hawaiʻi inter-island and regional connectivity. The system will have 24 fiber pairs with a design life of 25 years and is expected to be ready for service in late 2026. The project is being overseen by the UH System Office for Information Technology with support from the Research Corporation of the University of Hawaiʻi.

Under the direction of Lt. Governor Sylvia Luke, Connect Kākou will ensure that people from all walks of life have reliable and affordable access to high-speed internet.

ONI is responsible for the supply, construction, operations and maintenance of the inter-island cable system.

Partial funding will be provided through a federal grant, and the remaining funds will be secured by ONI through private equity and secured debt.

When it goes online, HIFL will be able to process a high volume of data with minimal delay and will be the inter-island backbone of Connect Kākou.

“We are very pleased to be partnering with Ocean Networks, Inc.,” said Garret Yoshimi, UH Vice President for Information Technology and CIO. “The Ocean Networks team has significant industry experience, specifically working here in Hawaiʻi. It’s an honor for UH to play an important role in connecting Hawaiʻi to the future.”

“We are delighted to collaborate with the UH and proud that ONI has been selected to build and operate the new HIFL submarine cable system,” said Cliff Miyake, VP Business Development of Ocean Networks, Inc. “The HIFL system will provide critical improvement to the broadband infrastructure for the State of Hawaiʻi.”

About Ocean Networks:

Ocean Networks, Inc. is a privately held telecom development and service company that is headquartered in Atlanta, Georgia (USA). Ocean Networks develops submarine cable systems for carriers, content providers, governments, as well as research and education groups. Under its subsidiary Submarine Cable Salvage, Ocean Networks repurposes Out of Service (OOS) submarine cable systems for ocean science. Ocean Networks currently owns 8,000+ km of submarine cable systems globally. Please visit www.OceanNetworks.com for more information.

About University of Hawaii:

Founded in 1907, the University of Hawaiʻi System includes three universities, and seven community colleges and community-based learning centers across Hawaiʻi. As the state’s public system of higher education, UH offers opportunities as unique and diverse as our island home.

References:

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

According to market research firm Omdia, there were 1.8 billion global 5G subscribers at the end of 2023 with 7.9 billion forecast by 2028. This growth trajectory, while substantial, is subject to various influencing factors such as infrastructure development, spectrum availability, device availability, and consumer demand. Kristin Paulin, Principal Analyst at Omdia, has a cautiously optimistic outlook for 5G. She emphasizes that innovation and cooperation are key to unlocking the full potential of 5G and its transformative impact.

Globally, the number of deployed 5G networks is now comparable to 4G LTE deployments. There are currently 296 commercial 5G networks worldwide, a number expected to grow to 438 by 2025.

In North America, 5G deployment was at 176 million connections as of the third quarter of 2023, a 14% increase from the previous quarter. This represents a 26% market share and a 46% penetration rate. However, there were only two U.S. 5G SA network providers – T-Mobile US and Dish Wireless– as of the end of 2023.

in contrast, Latin America and the Caribbean are still in the early stages of 5G adoption. However, the region shows promise with an expected quadrupling of 5G connections in 2023, reaching 46 million. By 2028, it is anticipated that the region will have 492 million 5G connections.

Jose Otero, Vice President of Caribbean and Latin America for 5G Americas, acknowledges the significance of 4G LTE and 5G as vital mobile communication technologies in Latin America. He anticipates more robust opportunities for 5G in the region, driven by upcoming spectrum auctions and wider access to 5G devices in 2024.

“The global 5G landscape shows positive momentum as innovation and collaboration continue to be the mainstays for long term progress.” said Chris Pearson, President of 5G Americas. “With the World Radio Conference wrapping up, it is important that international co-operation and efforts continue to ensure that spectrum and technology standards continue to propel this growth.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

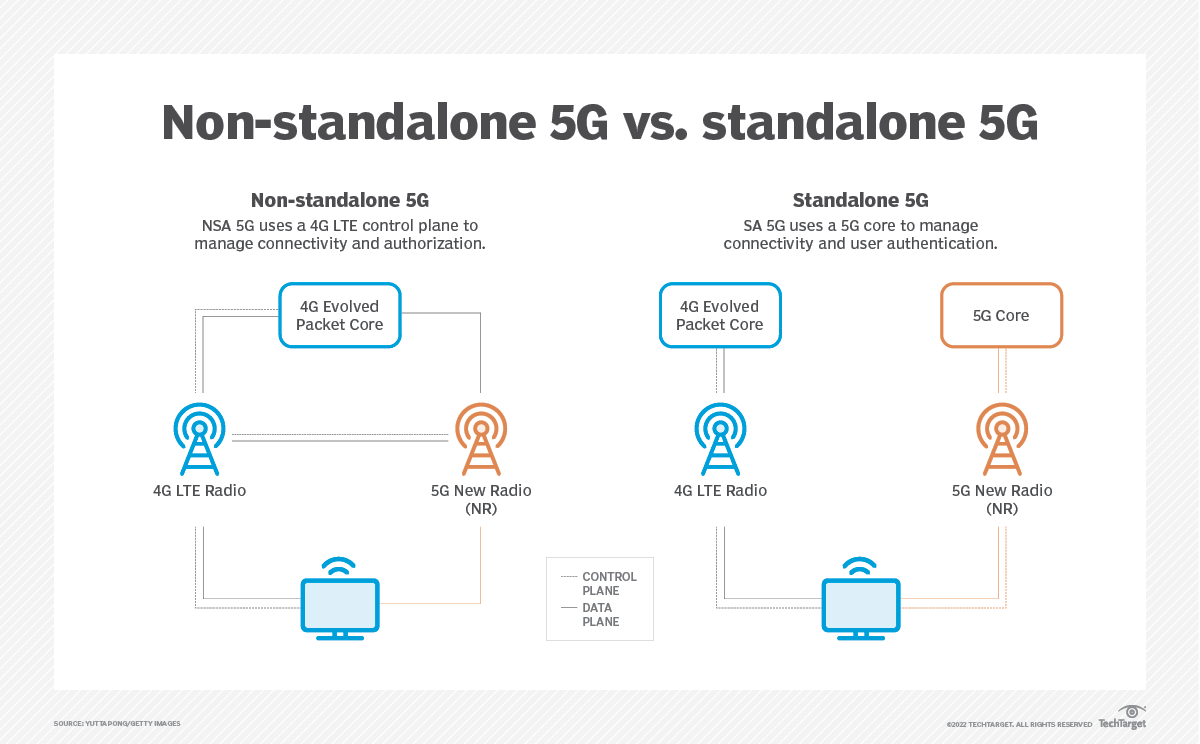

According to a recent report by Dell’Oro Group, the Mobile Core Network (MCN) market growth rate has been reduced to less than a 1% CAGR (2023-2028).

“This is the fourth consecutive time we reduced the growth rate of the MCN market as the build-out of 5G Standalone (5G SA) networks continues to wane compared to 5G Non-standalone (5G NSA) networks,” said Dave Bolan, Research Director at Dell’Oro Group. “The buildout of 5G SA networks is going slower than anticipated which is restraining growth in the marketplace. To date, we count fifty 5G SA eMBB (enhanced Mobile BroadBand) networks that have been commercially deployed worldwide by Mobile Network Operators (MNOs). We counted 18 new 5G SA networks in 2022, but only 12 were launched in 2023. On a positive note, we believe a lot of work has been done in the background, preparing for 5G SA launches by Mobile Network Operators (MNOs) and we expect 2024 to have more launches than 2022.”

Note 1. Importantly, a 5G SA core network is required to realize 3GPP defined 5G features, like 5G Security, Network Slicing (3GPP’s technical specification (TS) 23.501 defines 5G system architecture with slicing included. TS 22.261 specifies the provisioning of network slices, association of devices to slices, and performance isolation during normal and elastic slice operation).

The 5G SA core network relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities.

5G SA core networks require “cloud-native” hardware and software that has a service-based architecture and decentralized functions. A “cloud-native” 5G core allows for flexible and efficient operation, as well as the effective adoption of new services.

………………………………………………………………………………………………………..

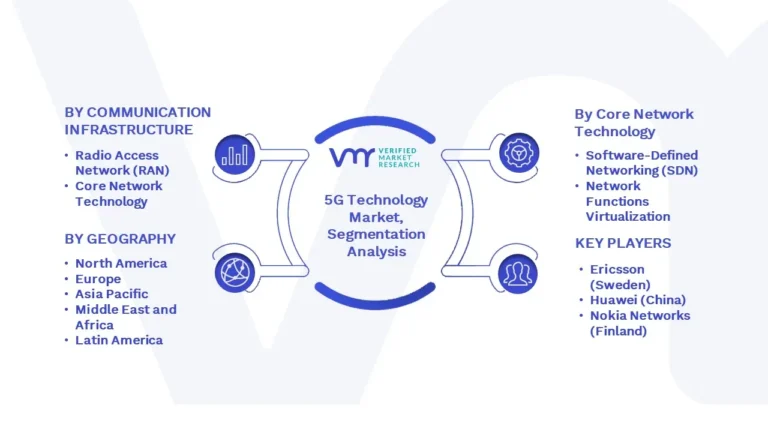

According to Verified Market Research, when the full 5G SA feature set is supported, enterprises can realize the following benefits:

- Further improvements to speed and reach, beyond what 5G NSA brings.

- Support for higher-density deployments of devices.

- Support for low-latency and real-time use cases.

- Support for enhanced enterprise site connectivity via network slicing.

- Better security than 5G NSA (which uses 4G LTE security methods and procedures).

- Simplification of the RAN and core compared to 5G NSA since 5G SA supports only 5G and leaves 4G and older standards behind — and even though the 5G SA core alone is more complex than a pure 4G core alone.

GSA claims that more than 121 network operators in 55 countries and territories have invested in public 5G standalone (SA) networks (but they don’t disclose how many of those have been commercially deployed (for example, AT&T and Verizon have been talking up 5G SA for years, but have yet to deploy it!). We trust Dell’Oro’s number of 5G SA eMBB networks deployed.

Findings from the latest GSA update on the 5G SA ecosystem/devices [2.] include:

- There are 2,130 announced devices with claimed support for 5G SA, up 35.7% from 1,569 at the end of 2022.

- Devices with support for 5G SA account for 90.3% of all 5G devices, as of the end of 2023, up from 35.6% in December 2019.

- 93 modems or mobile processors/platform chipsets state support for 5G SA, 90 of which are understood to be commercially available.

Note 2. It’s crucially important to realize that since all 5G SA core networks are different, a 5G SA device that works on one carrier’s network won’t work on any other without a new 5G SA download.

By the end of December 2023, GSA had identified:

• 28 announced form factors • 261 manufacturers with announced available or forthcoming 5G devices

• 2,358 announced devices, including regional variants, but excluding operator-branded devices that are essentially rebadged versions of other phones. Of these, at least 1,964 are understood to be commercially available:

• 1,255 phones, up 34 from November 2023. At least 1,168 of these are now commercially available, up 56 from November 2023

• 308 fixed wireless access customer-premises equipment (CPE) devices for indoor and outdoor uses, at least 209 of which are now commercially available

• 243 modules • 64 tablets • 33 laptops or notebooks • 77 battery-operated hot spots

• 179 industrial or enterprise routers, gateways or modems

• 13 in-vehicle routers, modems or hot spots

• 29 USB terminals, dongles or modems

• 168 other devices, including drones, head-mounted displays, robots, TVs, cameras, femtocells/small cells, repeaters, vehicle on-board units, keypads, a snap-on dongle/adapter, a switch, a vending machine and an encoder

• 1,098 announced devices with declared support for standalone 5G in sub-6 GHz bands, 904 of which are commercially available.

According to Verified Market Research, the market drivers for the 5G Technology Market can be influenced by various factors. These may include:

- Enhanced Data Speed and Capacity: In comparison to its predecessors (4G/LTE), 5G technology offers far faster data rates and more network capacity. Supporting the increasing need for high-bandwidth applications like virtual reality (VR), augmented reality (AR), and Internet of Things (IoT) devices is imperative.

- Low Latency: The goal of 5G networks is to offer low-latency communication, which shortens the time it takes to send and receive data. This is critical for real-time interactive applications like industrial automation, remote surgery, and driverless cars.

- Growing Need for IoT Devices: One of the main factors driving 5G adoption is the spread of IoT devices across a number of industries, including manufacturing, healthcare, smart cities, and agriculture. 5G is ideally suited for Internet of Things applications due to its low latency and capacity to connect a large number of devices concurrently.

- Rise of Edge Computing: The growth of edge computing is intimately related to 5G networks. Edge computing improves speed and lowers latency by bringing computing resources closer to end users and devices; this makes it a crucial enabler for applications like driverless cars and smart cities.

- Industry 4.0 and Smart Manufacturing: By facilitating effective and dependable communication in smart factories, 5G is anticipated to play a significant role in the fourth industrial revolution, or Industry 4.0. It makes it easier to incorporate technology like automation, robotics, and artificial intelligence into production processes.

- Telecommunications Infrastructure Upgrade: on order to roll out 5G networks, telecommunications service providers are actively spending on infrastructure upgrades. To improve capacity and coverage, new base stations and tiny cells must be installed.

- Government Initiatives and Support: Through legislative frameworks, financial aid, and other means, numerous governments across the globe are actively promoting the rollout of 5G technology. In the global digital landscape, these programmes seek to promote innovation, economic growth, and competitiveness.

- Competitive Environment and Industry Cooperation: Businesses are investing in 5G technology to obtain a competitive advantage due to the highly competitive nature of the telecommunications sector. Furthermore, partnerships between IT firms, telecom service providers, and other relevant parties are quickening the creation and implementation of 5G networks.

Several factors can act as restraints or challenges for the 5G Technology Market. These may include:

- Infrastructure Costs: Given that a large-scale deployment of base stations and small cells is necessary to support 5G, telecom operators may be discouraged by the substantial upfront expenditure necessary for creating and upgrading infrastructure.

- Spectrum Allocation and Availability: The effective operation of 5G networks depends on the allocation and availability of appropriate spectrum bands. Regulatory and geopolitical obstacles can make it difficult to get the necessary spectrum, which can hinder the deployment of 5G services.

- Security Concerns: There are worries about possible cybersecurity attacks due to the vast number of devices connected to 5G networks and the increased connection. Building confidence and promoting wider adoption require overcoming these issues and guaranteeing the security of network infrastructure.

- Interoperability Problems: There are interoperability problems since different generations of cellular technologies coexist. A seamless transition and the prevention of service interruptions depend on the seamless integration of various technologies.

- Regulatory Obstacles: The implementation of 5G networks faces a number of regulatory obstacles, such as spectrum auctions, licence requirements, and local law compliance. Uncertainties surrounding regulations may cause hold-ups and impede the rapid deployment of 5G services.

- Public Health and Safety Concerns: The general public’s reception of 5G networks may be impacted by worries about the possible health impacts of increasing exposure to radiofrequency radiation. Building public trust requires resolving these issues and maintaining clear lines of communication.

- Absence of Killer Applications: The deployment of 5G may be slowed back by the absence of compelling and widely applicable use cases. Creating cutting-edge, impactful apps that take advantage of 5G’s special features is essential to increasing demand.

- Global Economic uncertainty: Businesses’ and operators’ willingness to invest in the rollout of 5G technology can be impacted by economic downturns and uncertainty. Delays in infrastructure upgrades could result from financial considerations and budgetary restrictions.

Charts courtesy of Verified Market Research

References:

5G Continues Robust Momentum Growth and Drives Demand for More Wireless Spectrum

https://www.3gpp.org/technologies/5g-system-overview

https://www.techtarget.com/searchnetworking/definition/5G-standalone-5G-SA

Summit Communications selects Juniper Network’s PTX Series Routers for 400G Converged Optical Network in Bangladesh

Summit Communications, a leading end-to-end infrastructure service provider in Bangladesh has selected Juniper Network’s PTX Series Routers for 400G Converged Optical Routing solution upgrades to serve as the foundation of Summit’s core network. This will enable seamless network capacity expansion and efficient delivery of enhanced connectivity over hundreds of kilometers to various points of presence (PoPs) across the country.

Over the past decade, Bangladesh has undergone significant digitization and is now home to an emerging digital economy with over 66.94 million internet users. To accelerate this transformation further, the country’s Government has announced its vision of “Digital Bangladesh,” aimed at establishing a robust foundation for its digital economy. In support of this vision, Summit Communications has been instrumental in shaping the country’s networking landscape, notably constructing the largest fiber optic network infrastructure in the country.

With demand for mobile, internet and digital services continuing to soar, Summit Communications recognized the need to pioneer the adoption of innovative networking solutions to meet current and future connectivity demands. Building on a long-term relationship spanning over a decade, Summit partnered with Juniper for the next phase of their network transformation journey into 400G.

To enable a seamless transition to a Converged Optical Routing Architecture while improving its core network’s scalability, capacity and power efficiency, Summit Communications selected Juniper’s PTX10000 Series Packet Transport Routers. Equipped with 400G Coherent Optics, these routers will enable Summit’s network to achieve high-speed data transmission over long distances to its PoPs in Bangladesh while maintaining high reliability.

As Summit Communications progresses through its networking transformation journey with Juniper’s solutions, it will be in a strong position to meet its customers’ requirements, offering a superior end-user experience and top-tier performance in Bangladesh’s rapidly expanding digital economy.

Supporting Quotes:

“We have made tremendous progress over the years in delivering the high-quality networking infrastructure services to mobile operators and ISP customers in Bangladesh and are excited to strengthen our relationship with Juniper, particularly in integrating innovative 5G solutions. Their solutions will continue to play an integral role in our network, ensuring that we provide cutting-edge 5G connectivity and services for our customers guaranteeing fast, reliable, ultra-low latency services along with adaptation of network slicing and segment routing. Through our partnership, we look forward to supporting our country’s Digital Bangladesh vision.” – Arif Al Islam, Managing Director & Chief Executive Officer, Summit Communications Ltd.

“At Summit, one of our key goals is to lead the way in network innovation. Juniper’s 400G solutions will empower us to establish a more robust foundation, delivering the performance, scalability and operational efficiencies essential to our network. We are confident that a Juniper-powered network will enable us to continue providing best-in-class services that connect Bangladesh with the world, as well as contributing to the development of a digitally inclusive society in which everyone has access to cutting-edge services.” – Md. Farrukh Imtiaz, Chief Network Architect, Summit Communications Ltd.

“For years, Juniper has been a foundational presence in Bangladesh’s networking landscape through our partnership with Summit Communications, and we are honored to join them on the next phase of their network transformation journey. With our experience-first solutions, we remain committed to providing the technology needed to support their goals and meet the ever-evolving connectivity demands of businesses and consumers for years to come.” – Sajan Paul, Managing Director & Country Manager, India & SAARC, Juniper Networks

Additional Resources:

- Product & Solution Pages:

- Follow Juniper Networks online: Facebook | Twitter | LinkedIn

- Juniper Blogs and Community: J-Net

About Juniper Networks:

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

Juniper Networks, the Juniper Networks logo, Juniper, Junos, and other trademarks listed here are registered trademarks of Juniper Networks, Inc. and/or its affiliates in the United States and other countries. Other names may be trademarks of their respective owners.

References:

Granite Telecommunications expands its service offerings with Juniper Networks

Verizon upgrades fiber optic core network using latest 400 Gbps per port optical technology from Juniper Networks

Synopsys and Juniper Networks form new company to pursue “open” silicon photonics platform

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China’s three state owned telecom operators have announced their subscriber totals for the month of December and for all of 2023. China’ Ministry of Industry and Information Technology (MIIT) said the big three had a combined net increase of approximately 24.82M 5G package subscribers in China, boosting their combined 5G package subscriber base to nearly 1.373B.

As of the end of December, 5G package subscribers accounted for 80.2% and 78.1% of China Mobile’s and China Telecom’s total mobile subscriber bases, respectively.

C114.net reported that 3.377 million 5G base stations have been built, constituting 28.5 percent of the total mobile base stations. There are 23.02 million ports with gigabit network service capabilities. More than 80% of administrative villages nationwide now have 5G connectivity, telecoms portal.

The foundation of the Internet of Things (IoT) is constantly being consolidated, with mobile IoT terminal users accounting for 57.5% of the total number of mobile network terminal connections. Technological industry innovation and development, the commercial deployment of 5G customized base stations and 5G lightweight technology, and the launch of the world’s first satellite communication smartphone, 6G, quantum communication, artificial intelligence and other innovative capabilities have significantly improved.

- China Mobile ended last year with 794.5 million subscribers to its 5G package (contract), while its total mobile subscriber base reached 991 million.

- China Telecom had a total of 407.7 million mobile users, of which 318.66 million had signed up to a 5G package (up by 50.7 million during 2023).

- China Unicom’s 5G package subscriber total hit 259.6 million by the end of last year, though disclosure on total mobile subscribers has not been provided. China Unicom also reported that there were 8,563 “virtual 5G industry private network” subscriber for the month of December which was an increase of 554 month-on-month and up 4,758 since the end of 2022.

Mobile Subscriber Stats for China’s Three Main Carriers (Unit: Millions)

| Operator | December 2023 Month-end Total |

% of Combined Installed 5G Sub Base |

December 2023 Net Change |

Net Change Since Prior Year-End |

|---|---|---|---|---|

| China Mobile | 991.00 | 0.05 | 15.99 | |

| 5G Package Subs | 794.50 | 57.87% | 15.70 | 180.50 |

| China Telecom | 407.77 | 0.54 | 16.59 | |

| 5G Package Subs | 318.66 | 23.21% | 4.03 | 50.70 |

| China Unicom | Not Available | |||

| 5G Package Subs | 259.64 | 18.91% | 5.08 | 46.91 |

China’s fourth 5G telecom network operator, China Broadnet, saw its 5G user base surpass 20 mln on October 19, the company revealed at the 2023 World 5G Convention held in Zhengzhou from December 5-7. Since that time, however, China Broadnet has not publicly released any updated 5G subscriber statistics.

Broadnet officially launched 5G network services just 19 months ago, on June 27, 2022. Because Broadnet is not yet reporting its 5G subscriber totals on a regular, monthly basis, Marbridge is not yet integrating its totals with those of China’s three more established telecom operators above.

Cautionary Note:

The Chinese telecom operators specifically report numbers for 5G packages, rather than citing 5G service users or connections, as while customers may have signed up for a 5G service package offer, that doesn’t necessarily mean they have a 5G-enabled device that enables them to hook up to their network operator’s 5G network, or indeed that their service provider is offering 5G services in their area just yet.

In addition to the growing 5G market in China, the fixed broadband segment is also very large. China Mobile had a total of 298 million wireline broadband customers at the end of December 2023, and throughout the year it added a total of 26 million fixed customers. China Telecom had 190 million fixed broadband subscribers by the year end, having added a total of 9.26 million wireline broadband users in 2023. China Unicom’s operational statistics for the last month of 2023 did not provide a breakdown of broadband customers.

References:

https://en.c114.com.cn/583/a1253372.html

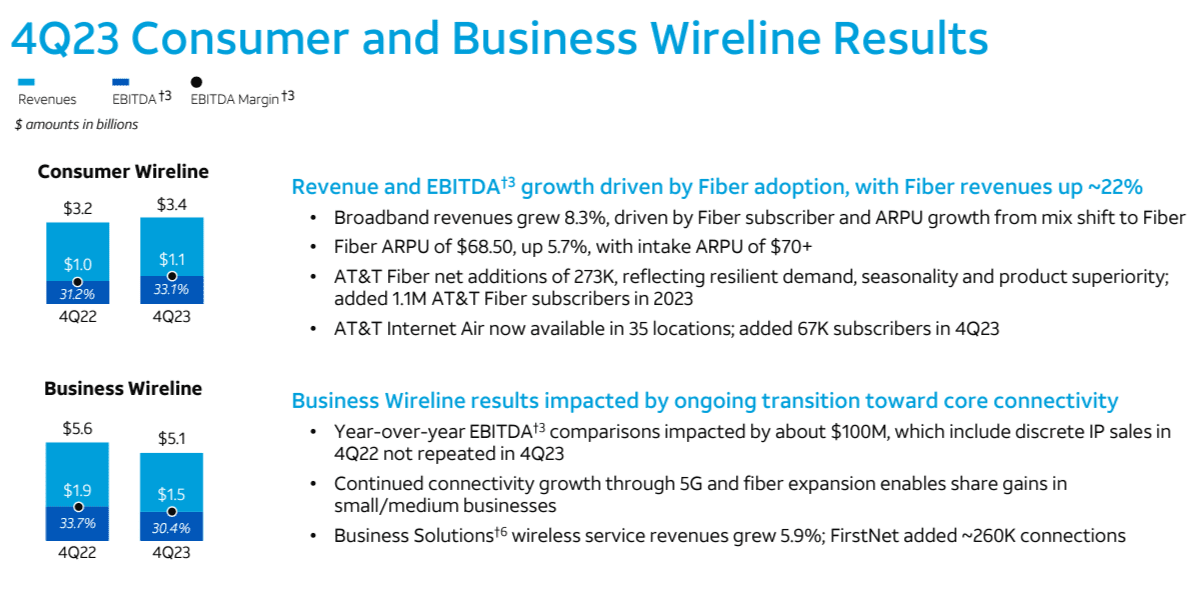

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

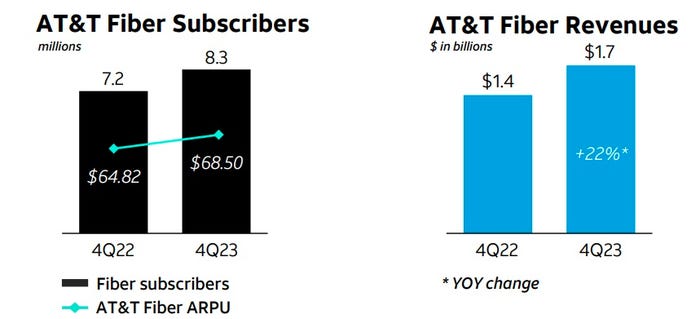

AT&T added 273,000 residential fiber subs in Q4, down slightly from year-ago adds of +280,000 and a gain of +296,000 in the prior quarter. AT&T ended 2023 with 8.3 million fiber subs. The U.S. based carrier added about 400,000 fiber locations in Q4, extending that reach to 21.1 million. AT&T remains committed to expanding its fiber-to-the-premises (FTTP) footprint to 30 million locations by 2025, Stankey said.

Fiber-related revenues hit $1.67 billion, up from $1.37 billion in the year-ago quarter. Fiber average revenue per user (ARPU) reached $68.50, up from $64.82 a year earlier.

AT&T says it has the nation’s largest fiber network, which now passes 26 million+ consumer and business locations; on track to pass 30 million+ locations with fiber by the end of 2025.

…………………………………………………………………………………………………………………

AT&T’s new fixed wireless access (FWA) service dubbed “Internet Air” gained ground in the fourth quarter of 2023. Internet Air added 67,000 subscribers in Q4 of 2023, extending its total to 93,000. Those quarterly FWA subscriber additions were a “surprise,” New Street Research analyst Jonathan Chaplin said in a research note issued after AT&T posted earnings. Yet they are way below Verizon’s FWA numbers which came in at 375,000 FWA subs added in the Q4 of 2023.

However, AT&T’s FWA offering will remain a limited and targeted product in the operator’s home broadband arsenal. “I don’t expect that we are going to be pushing the [Internet Air] product the same way that some others in the market are pushing it today,” AT&T CEO John Stankey said on today’s earnings call. “We made a conscious choice as a company that we want to dedicate capital to invest in fiber, which we believe is a more sustainable long-term means to deal with stationary and fixed broadband needs.”

AT&T will continue to use Internet Air on a selective basis, relying on it as an alternative for customers transitioning off of the telco’s aging copper plant, in pockets of some markets where AT&T offers fiber service, as well as markets where AT&T has no existing wireline business.

……………………………………………………………………………………………………………………….

AT&T claims it has the largest and most reliable wireless network in North America. Its mid-band 5G spectrum now covers 210 million+ people, achieving its end-of-year targets. It expects wireless service revenue growth in the 3% range for 2024.

Stankey said 2024 will be the “proving year” for the Gigapower joint venture with BlackRock that will initially bring open access fiber networks to about 1.5 million locations outside of AT&T’s legacy wireline footprint. Initial Gigapower markets include Las Vegas, three cities in Arizona (Mesa, Chandler and Gilbert), parts of northeastern Pennsylvania (including Wilkes-Barre and Scranton) and segments of Alabama and Florida.

AT&T also said that it now has a FirstNet customer base consisting of more than 5.5 million connections.

“We accomplished exactly what we said we would in 2023, delivering sustainable growth and consistent business performance, resulting in full-year free cash flow of $16.8 billion, ahead of our raised guidance. As we advance our lead in converged connectivity, we will continue to scale our best-in-class 5G and fiber networks to meet customers’ growing demand for seamless, ubiquitous broadband, and drive durable growth for shareholders,” said CEO John Stankey.

References:

https://about.att.com/story/2024/q4-earnings-2023.html

https://edge.media-server.com/mmc/p/keicd3et/ (4Q 2023 earnings call)

https://investors.att.com/news-and-events/events-and-presentations

https://www.lightreading.com/fixed-wireless-access/at-t-nears-100k-internet-air-subs

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Ericsson expects continuing network equipment sales challenges in 2024

Ericsson expects challenges in the mobile-network industry to continue this year as customers remain cautious about spending and as the investment pace normalizes in its key Indian market. The Swedish telecommunications-equipment company said sales in its network equipment unit fell 23% in the fourth quarter, with sales momentum in India slowing, while North America had a 50% drop in sales.

Ericsson, the world’s biggest western vendor of 5G network equipment, had a 10% drop in sales on a constant-currency basis in 2023, despite a renewed focus on cost cutting. Reported revenues fell 3%, to 263.4 billion Swedish kronor (US$25.2 billion), and Ericsson’s closely monitored gross margin shrank from 41.7% to 38.6%. After impairment charges affecting Vonage, the VoIP software company Ericsson bought for $6.2 billion in July 2022, the Swedish vendor went from a SEK19.1 billion ($1.8 billion) net profit the year before to a SEK26.1 billion ($2.5 billion) loss.

Ericsson saw a shift in its business mix through 2023 from higher-margin 5G work in early-mover markets like North America to lower-margin developing markets such as India. This helped keep sales levels propped up but has held margins back.

The rapid phase of 5G deployments in India is now moderating, with sales in the country growing by 14% on year, but declining by almost 40% compared with the third quarter.

“A reduction in capex investments in India was expected in the beginning of 2024 but occurred earlier than anticipated,” Ericsson said in a statement.

“It is important to note that, looking historically, large declines in the mobile network market are followed by a rebound,” said Börje Ekholm, Ericsson’s CEO, on his usual quarterly call with analysts. “Operators can sweat the assets up to a point but eventually will need to invest to manage the data traffic growth, cost, energy usage and, of course, network quality, and give the customer the experience that the customer demands.”

“As we look ahead, 2024 will be a difficult year and market conditions will prevail, and so we currently expect the market outside China to further decline as our customers remain cautious and the investment pace normalizes in India,” said Ekholm. A speedy rollout of 5G in the huge Asian country slowed down massively in the final quarter, explaining why Ericsson’s network sales in India fell sequentially by as much as 40%.

Ericsson reported a net profit attributable to shareholders of 3.39 billion Swedish kronor ($324 million) compared with SEK6.07 billion a year earlier, as sales fell 16% to SEK71.88 billion. Analysts polled by FactSet had expected a net profit of SEK3.29 billion on sales of SEK76.64 billion.

The earnings before interest, tax and amortization margin excluding restructuring charges stood at 11.4%, beating company guidance of around 10%. The Swedish company expects the overall network market to shrink in 2024 and the near-term outlook remains uncertain, mainly due to the decline in India as well as generally cautious customer investments.

However, Ericsson expects to gain market share in North America toward the latter part of 2024 thanks to its recent $14B Open RAN contract win from AT&T. That deal has been heavily promoted by Ericsson and AT&T as an “open RAN” affair. Disaggregated network equipment with “open interfaces”would permit AT&T to pair Ericsson Open RAN gear with that from other Open RAN hardware vendors. Although Fujitsu has been named as another supplier of Open RAN radios, the contract will clearly make AT&T more dependent on Ericsson than it is today.

This author doesn’t believe the reported $14B deal will be totally realized, because AT&T will not deploy much, if any, Open RAN this year.

Ericsson also remains hopeful that Vonage can bring about a recovery. Along with other parts of the industry, it has been working to standardize the application programming interfaces (APIs) between the 5G network and the apps it would support. The idea is that a software developer would be able to write better 5G apps after paying for access to the Vonage platform where these network features are exposed. Money would trickle down to operators and they, in turn, would be more inclined to invest in network upgrades.

“In our view, the current investment levels are unsustainably low for many operators,” Chief Executive Borje Ekholm said. “We are therefore confident that a market recovery should materialize. However, the timing of market recovery is ultimately in the hands of our customers.”

PHOTO: LARS SCHRODER/AGENCE FRANCE-PRESSE/GETTY IMAGES

References:

https://www.wsj.com/business/telecom/ericsson-sees-network-challenges-continuing-in-2024-0c127a4e

https://www.lightreading.com/5g/ericsson-eyes-more-cuts-after-slashing-9-000-jobs-as-outlook-dims

Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

NTT advert in WSJ: Why O-RAN Will Change Everything vs. AT&T selects Ericsson for its O-RAN

Ericsson Mobility Report touts “5G SA opportunities”

.

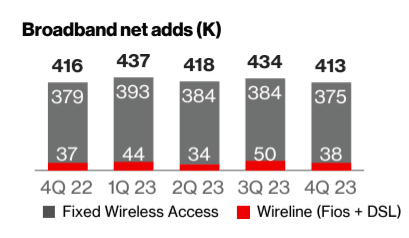

Verizon’s 2023 broadband net additions led by FWA at 375K

At the end of 2023, Verizon’s total broadband base was 10.7 million, with fixed wireless access (FWA) customers making up the bulk of quarterly net additions. For all of 2023, Verizon posted 375,000 net FWA additions, bringing its total fixed wireless subscriber base to over 3 million.

Total broadband net additions were 413,000, compared to 416,000 in Q4 2022. Although Verizon doesn’t post metrics for its DSL customers, overall wireline net adds were 38,000, implying the company lost 17,000 DSL subscribers in the quarter.

In the 4th quarter of 2023, Verizon added 55,000 Fios Internet customers, marking a year-on-year decline of 4,000. Consumer Fios revenue of $2.9 billion increased 1% from Q4 2022, but for the full year was relatively flat at $11.6 billion. Business Fios revenue for the quarter increased 2.6% to $312 million, while jumping 2.8% to $1.2 million for full-year 2023.

CEO Hans Vestberg noted on the earnings call broadband net adds for full-year 2023 totaled more than 1.7 million, “with more than one and a half million from fixed wireless access.” Fios net additions for the year came to 248,000.

Total Broadband:

- Total broadband net additions of 413,000, represented the fifth consecutive quarter that Verizon reported more than 400,000 broadband net additions. Total broadband net additions included 375,000 fixed wireless net additions, bringing the subscriber base to over 3 million. In fourth-quarter 2023, more than 80 percent of Consumer fixed wireless gross additions were in Verizon’s first 76 C-Band markets. Verizon is ahead of schedule to achieve its goal of 4 to 5 million subscribers by the end of 2025.

- 55,000 Fios Internet net additions, down 4,000 from the fourth-quarter 2022.

- 10.7 million total broadband subscribers as of the end of fourth-quarter 2023.

Total Wireless:

- Total wireless postpaid net additions for full-year 2023 increased 26 percent compared to 2022.

- Total wireless service revenue of $19.4 billion, a 3.2 percent increase year over year.

- Retail postpaid phone net additions of 449,000, and retail postpaid net additions of 1,460,000.

- Retail postpaid churn of 1.18 percent, and retail postpaid phone churn of 0.93 percent.

“After delivering continuous improvement throughout 2023, we ended the year strong and continue to pursue the right balance of growth and profitability,” CEO Hans Vestberg said in the 4th quarter earnings statement.

References:

https://www.verizon.com/about/investors/quarterly-reports/4q-2023-earnings-conference-call-webcast

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Verizon once again delays 5G Standalone (SA) commercial service

Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

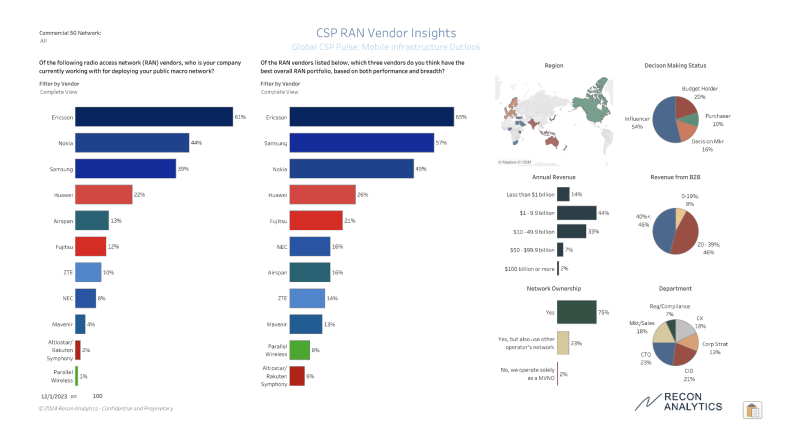

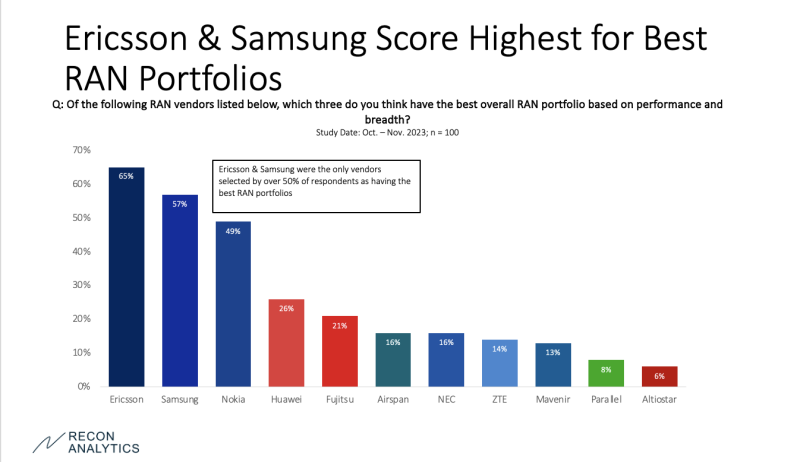

A Recon Analytics on-line survey results show that Ericsson, Nokia and Samsung are the top RAN vendors not including China. When the same global operators were asked which vendor had the best overall radio access network (RAN) portfolios, over 50% of respondents named Ericsson and Samsung as the top two. One would’ve expected Nokia to be #2, but the Finland based vendor ended 2023 on a negative trajectory when AT&T announced that it would work with Ericsson to deploy Open RAN equipment in its 5G network and exclude Nokia.

The survey was conducted in October and November, 2023 with 100 global network operators. Each respondent worked at a service provider that sells mobile services. Only one response per operator per country was allowed. Although a multinational operator like Orange France and Orange Belgium would count as two separate responses.

All respondents were required to have one of the following roles when it came to selecting network partners – influencer, budget holder, decision maker or purchaser.

Recon Analytics estimates there are only about 710 live commercial mobile networks in the world. The 100 network operators captured in its survey, represent the meaningful part of the world, according to Roger Entner, founder of Recon Analytics. However, the relatively low sample size results in a margin of error of 9.8%. Entner had earlier opined that “FWA was the 5G killer application.” That despite it is a wireles network configuration – not an application – and it is not one of the ITU-R use cases for 5G (aka IMT 2020).

Communication Service Provider RAN Vendor Insights:

When survey respondents were asked which vendors have the best overall RAN portfolio, they named Ericsson, Samsung and Nokia, in that order.

“Ericsson, with the overall highest level of positive responses for being a top three vendor, positions the company well for the future,” said Daryl Schoolar, analyst with Recon Analytics.

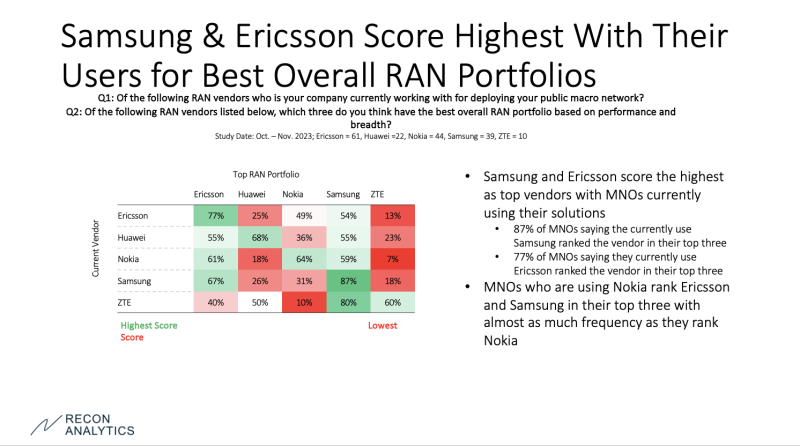

Of respondents who said they were currently using Ericsson equipment, 77% said Ericsson had one of the three best portfolios, followed by Samsung at 54%, and Nokia at 49%. 87% of respondents who say they are using Samsung gear list the Japan based vendor as having a top three portfolio.

“While Ericsson’s users don’t list it in their top three at the same frequency as Samsung, 77% is a strong showing and bodes well for its future,” said Schoolar. “Nokia has reason to be concerned as well. While its current users did select it in top three most often among the five vendors shown here, there was little separation between Nokia versus Ericsson and Samsung,” he added.

Meanwhile, Fujitsu and Mavenir (Open RAN only vendor) also scored well as vendors that operators are interested in for the future. Samsung’s top three status is 18 percentage points over its currently used status; Fujitsu’s top three status is 9 percentage points over currently used; and Mavenir’s top three status is 9 percentage points over currently used.

References:

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

According to a new report by Dell’Oro Group, the Radio Access Network (RAN) market is now in a downward trajectory. That’s no surprise to readers of the IEEE Techblog, as we forecasted the “5G train wreck” many years ago and continued the drumbeat due to the scarcity of 5G SA core networks, without which there are NO 5G features/functions. Also that URLLC performance requirements were not met by either the 3GPP Release 16 Enhancements for URLLC in the RAN spec or the ITU M.2150 recommendation which is the official standard for 5G NR.

Following the >40 percent ascent between 2017 and 2021, RAN revenues stabilized in 2022, and are on target to decline sharply in 2023. Market conditions are expected to remain challenging in 2024 as the Indian RAN market pulls back, though the pace of the global decline this year and for the remainder of the forecast period should be more moderate.

“The big picture has not changed. MBB-based investments are now slowing and the upside with new growth areas including FWA and private wireless is still too small to change the trajectory,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Also weighing on the MBB market is the fact that the upper mid-band capacity boost is rather significant relative to current data traffic growth rates in some markets, which could impact the timing for capacity upgrades,” continued Pongratz.

Additional highlights from the Mobile RAN 5-Year January 2024 Forecast Report:

- Worldwide RAN revenues are projected to decline at a 1 percent CAGR over the next five years.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North America region.

- 5G-Advanced is expected to play an important role in the broader 5G journey, however, it is not expected to fuel another major capex growth cycle.

- RAN segments that are expected to grow over the next five years include: 5G NR, FWA, mmWave, Massive MIMO, Open RAN, private wireless, small cells, and Virtualized RAN.

Dell’Oro said in November said it was optimistic about the long-term growth prospects of the RAN space, but simultaneously noted that after a peak in 2021, RAN revenues will track downwards until the second half of the current decade; overall it predicted a 1% compound annual growth rate between 2020 and 2030. That forecast will now have to be revised DOWN significantly as 6G- the next big RAN mover- won’t be standardized till 2031 at the earliest.

RAN remains a concentrated market, with the top 8 RAN suppliers accounting for more than 98% of the 1Q23-3Q23 RAN market. New technologies, architectures, and segments can in some cases present opportunities for vendors with smaller footprints. Still, the track record for new entrants is far from perfect.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 7 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

References:

RAN Decline to Extend Beyond 2023, According to Dell’Oro Group

https://techblog.comsoc.org/2024/01/18/where-have-you-gone-5g-midband-spectrum-fwa-decline-in-capex-and-ran-revenue-in-2024/

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: OpenRAN revenue forecast revised down through 2027

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

Telstra International, the global arm of leading telecommunications and technology company Telstra, and Trans Pacific Networks (TPN) have partnered to build the Echo cable, the first subsea cable to directly connect the U.S. to Singapore, creating a new route and delivering vital connectivity in the Trans-Pacific.

Echo’s subsea system is a unique express route connecting California, Jakarta, Singapore, and Guam. The system creates a new path and offers low latency, high-speed, resilient network infrastructure connecting South Asia to the US. The first Echo segments (Guam-US) will launch in mid-2024, with the remaining segments in 2025. Telstra will become TPN’s operating partner to provide secure, long-term stability on an efficient route.

In addition, Telstra will be delivering cable landing station services for Echo in Singapore and the Network Operations Centre services. XL Axiata is landing the cable in Indonesia and our partner for delivering services into Indonesia. Telstra International CEO said the geographical area the new cable would be built in was one of the more challenging regions globally in terms of regulation as well as subsea cable cuts. “Our subsea network scale makes Telstra International uniquely placed to successfully navigate the complexity of these environments to ensure the stability of the world’s digital connectivity,” said Roary Stasko, CEO Telstra International.

In the Trans-Pacific, demand for bandwidth is growing at one of the fastest rates in the world, with forecasts showing it will increase by 39% year on year until 2029[1]. As our lives become increasingly digital and new technologies like AI, IoT and cloud computing continue to evolve, bandwidth plays a critical role in supporting these and is set to soar further as the need for reliable, low latency connectivity grows to serve businesses and consumers.

“Trans Pacific Networks is thrilled to partner with industry leader Telstra to expand telecommunication access between the US and Asia. To be partially funded by the US International Development Finance Corporation, the Echo subsea cable system will be a critical element of the Indo-Pacific’s digital infrastructure, ultimately strengthening networks and increasing capacity while reducing internet costs in the region,” said Aaron Knapik, CFO TPN.

“The Trans-Pacific is a critical connection point to reach the US, and the geography of these regions means they will rely on new submarine cable routes like Echo for international connectivity. We’re delighted to partner with TPN to launch capacity via Echo which will significantly enhance the vital data demands of people and businesses and provide much needed diversity, resiliency and reliability which has become critical to keep our everyday lives connected.”

“We’re accelerating growth in our international digital infrastructure with investments in subsea fibre capacity on unique, diverse routes – helping to move more traffic around the world and strengthening connections from Asia to the US. Echo’s cable system has the ability to allow other countries to take advantage of its redundancy. In addition, we’ve recently added 3Tbps of capacity through the SEA-US cable connecting US mainland to Hawaii, Guam and Philippines which complements our existing Trans-Pacific cables like AAG, UNITY, FASTER, NCP and JUPITER,” Roary said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

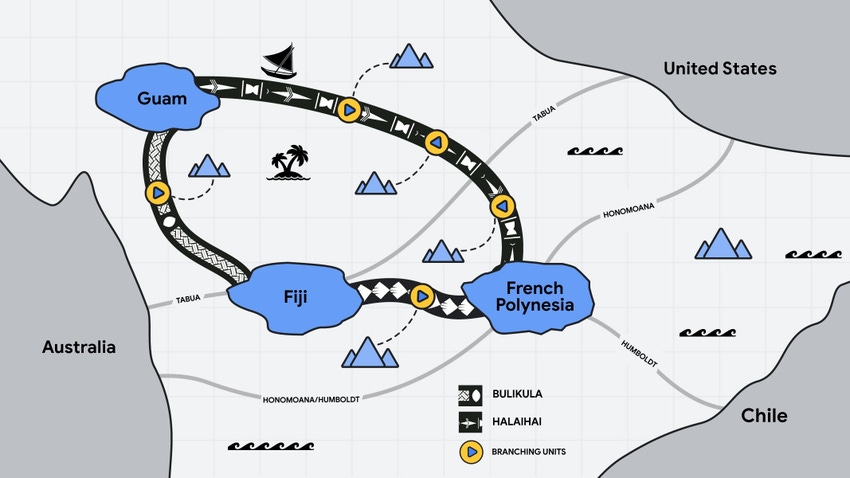

In addition, Telstra International will be partnering with Google and APTelecom to deliver the new central Pacific Connect initiative which will significantly uplift connectivity for people and businesses of the Pacific. The two cables – which make up the central Pacific Connect initiative – Bulikula will connect Guam and Fiji, and Halaihai will connect and Guam and French Polynesia.

Telstra will be one of the key telecommunications providers of central Pacific Connect and will own and operate a fiber pair on the core trunk on the Bulikula cable connecting Guam and Fiji. Bulikula is the Fijian word for “golden cowrie,” a rare shell found in the Pacific Ocean often worn by local chieftains as a badge of rank. The next step will be partnering with other carriers and governments to assist in building and operating branches to the Pacific islands. These branches will power access to vital digital services across the region and will improve network performance, redundancy and reliability.

Bulikula and Halaihai cable systems

“Telstra has decades of experience providing international connectivity in the Pacific, and with our network scale and local expertise, we are looking forward to partnering with Google and APTelecom to build reliable, high-performance connectivity for island countries. We’re committed to improving infrastructure across the region which will support the future growth of local economies,” said Roary Stasko, CEO Telstra International.

In addition, Telstra is partnering with Google on the Tabua cable which combined with the central Pacific Connect initiative, will dramatically improve the diversity of paths between Guam to Australia via Fiji and other Pacific islands, and between the US mainland and Australia.

About Telstra International:

Telstra is a leading telecommunications and technology company with a proudly Australian heritage and a longstanding, growing international business. Telstra International provides services to thousands of business, government, carrier and OTT customers. Over several decades we have established the largest wholly-owned subsea cable network in the Asia-Pacific, with a unique and diverse set of infrastructure that offers access to the most intra-Asia lit capacity. We empower businesses with innovative technology solutions including data and IP networks, and network application services such as managed networks, unified communications, cloud, industry solutions, integrated software applications and services. These services are underpinned by our subsea cable network, with licenses in Asia, Europe and the Americas and access to more than 2,000 Points of Presences (PoPs) in more than 200 countries and territories globally. In July 2022 Telstra completed the acquisition of Digicel Pacific, the largest mobile operator in the South Pacific region.

For more information, please visit www.telstra.com/global.

References:

https://www.telstra.com.au/aboutus/telstra-international

https://www.telecoms.com/fixed-networks/google-preps-for-more-island-hopping-with-telstra