IEEE Techblog recognized by Feedspot!

The IEEE ComSoc Techblog was voted #2 best broadband blog:

https://blog.feedspot.com/broadband_blogs/

2. The IEEE ComSoc Technology Blog

Piscataway, New Jersey, US

Piscataway, New Jersey, US

Featuring the latest in breaking telecom/networking news and analysis, the IEEE ComSoc blog is written by several expert bloggers. IEEE Communications Society is a global community of professionals with a common interest in advancing all communications and networking technologies.

Also in Telecom Blogs

techblog.comsoc.org+ Follow

…………………………………………………………………………………………………

..and #13 best telecom blog in the world:

https://blog.feedspot.com/telecom_blogs/?_src=alsoin

Many thanks to Vinny Rodriquez and Khanh Luh for making our blog so successful!

NTT and SES to Deliver Satellite-based Edge and Private 5G Network Solutions to Enterprise Customers

NTT Ltd., a leading global IT infrastructure and services company, and SES, a leading global content connectivity service provider via satellite, today announced a multi-year partnership to use SES satellites to deliver NTT’s Edge as a Service to enterprise customers. The collaboration will bring together NTT’s expertise in networking and enterprise managed services with SES’s unique satellite capabilities to deliver reliable connectivity to enterprises that must meet surges in connectivity demand or are based beyond the reach of fixed terrestrial networks.

The unique offering combines NTT’s fully managed Private 5G and Edge Compute with SES’s second-generation medium earth orbit communications system – O3b mPOWER – to provide expanded and reliable connectivity. This solution is intended for companies operating in regions where terrestrial networks are lacking and enterprises wanting to leverage high-performance connectivity to increase their efficiency and grow revenue. Through the combined versatility of Private 5G networks and satellite technology, this end-to-end solution is expected to propel industries – such as energy, mining, maritime, manufacturing, industrial, etc. – that have otherwise been limited by connectivity today and will need to ramp up their digital transformation plans and increase revenue streams.

The announcement offers more evidence that the capabilities of modern satellites are able to meet the increasingly complex connectivity demands of enterprises, rather than just being a connectivity solution of last resort for companies brave enough to base themselves in the middle of nowhere. Further proof can be seen from the regularity with which the likes of Low Earth Orbit (LEO) satellite operators Starlink and OneWeb have been signing up new partners lately.

SES offers global coverage via fleets of geostationary (GEO) and mid-Earth orbit (MEO) satellites. It has begun upgrading its MEO constellation, called O3b, to its more powerful, second generation satellites – which it is calling O3b mPower – to provide higher bandwidth and lower latency. The first two of 11 planned satellites blasted off from Cape Canaveral in December. The O3b mPower network is due to enter commercial service in the third quarter of this year.

“We are excited to embark on this journey with SES, combining our collective expertise to help businesses digitally transform and scale,” said Miriam Murphy, CEO Europe at NTT Ltd. “As organizations grapple with the challenges of a rapidly changing world, it is now more important than ever to leverage the power of technology to drive growth and innovation.”

Putting control and ownership back into the hands of the customer, the joint solution will deliver coverage to over 190 countries with public-private roaming. In addition to NTT’s Private 5G and Edge Compute capabilities, NTT will also provide use-case consulting and design, application development, system integration, implementation, and managed services, while SES will provide end-to-end satellite networks via O3b mPOWER that will be seamlessly integrated with NTT’s offering.

“Private 5G is a transformative power that enables enterprises to build upon existing network infrastructure and deliver reliable, high bandwidth, and low latency connections for multiple use cases operating on a single Private 5G network,” said Olivier Posty, Country Managing Director Luxembourg, NTT Ltd. Posty adds, “As our customers continue to innovate, network partners with the right skills and expertise will be critical to success in today’s competitive market. NTT’s robust Private 5G network-as-a-service full stack solution, delivered on-premises, at the edge, or as a cloud service, is complemented by NTT’s 24/7 remote monitoring services and a CIO self-service portal, ensuring that NTT’s full stack of managed Edge Compute services delivers real-time actionable intelligence to drive processing efficiency and accelerate business performance.”

NTT’s Edge-as-a-Service offering includes IoT, Edge Compute, and Private 5G connectivity delivered by NTT across its global footprint. NTT’s Edge-as-a-Service is a unique, fully managed, integrated solution that accelerates business process automation, enabling enterprises to quickly deploy their applications more securely and monitor them closer to the edge, thereby reducing downtime, improving user experience, and optimizing costs.

“This partnership between NTT and SES is an industry-first milestone at the whole industry level, combining massive amounts of expertise that both companies are bringing in each field, and the joint value proposition is ahead of the curve in terms of added value that will be provided to customers. This will open great opportunities also in countries where 5G spectrum is not yet ready, enabling the transformation of companies at a global scale,” said Alejandro Cadenas, Associate Vice President of EMEA Telco Mobility Research, IDC.

According to John-Paul Hemingway, Chief Strategy Officer at SES, the partnership is one of its kind as both companies jointly provide comprehensive and resilient connectivity solutions for customers around the world. “In addition to its predictable low latency capabilities, O3b mPOWER’s best throughput and full flexibility on asymmetric or symmetric services will result in the seamless integration and extension of terrestrial and satellite networks, enabling our customers to unlock the full potential of emerging technologies like 5G, IoT, and cloud computing, and drive digital transformation across industries,” he said.

The partnership between NTT and SES comes as organizations are increasingly turning to technology to drive growth and innovation. Organizations recognize the positive impact of high-speed connectivity and resilient networks on business operations, driving demand and fueling widespread digital transformation. By leveraging their respective strengths, NTT and SES are well positioned to provide customers with the innovative Edge as a Service solutions they need to succeed in a rapidly changing world.

…………………………………………………………………………………………………………………………………………………………………………………………………………………

About NTT Ltd:

As part of NTT DATA, a USD 30 billion IT services provider, NTT Ltd. is a leading IT infrastructure and services company serving 65% of the Fortune Global 500 and more than 75% of the Fortune Global 100. We lay the foundation for organizations’ edge-to-cloud networking ecosystem, simplify the complexity of their workloads across multi-cloud environments, and innovate at the edge of their IT environments where networks, cloud and applications converge. We offer tailored infrastructure and ensure consistent best practices in design and operations across all of our secure, scalable and customizable data centers. On the journey towards a software-defined future, we support organizations with our platform-delivered infrastructure services. We enable a connected future.

Visit us at services.global.ntt

About SES:

SES has a bold vision to deliver amazing experiences everywhere on earth by distributing the highest quality video content and providing seamless connectivity around the world. As the leader in global content connectivity solutions, SES operates the world’s only multi-orbit constellation of satellites with the unique combination of global coverage and high performance, including the commercially-proven, low-latency Medium Earth Orbit O3b system. By leveraging a vast and intelligent, cloud-enabled network, SES is able to deliver high-quality connectivity solutions anywhere on land, at sea or in the air, and is a trusted partner to the world’s leading telecommunications companies, mobile network operators, governments, connectivity and cloud service providers, broadcasters, video platform operators and content owners. SES’s video network carries around 8,000 channels and has an unparalleled reach of 369 million households, delivering managed media services for both linear and non-linear content. The company is listed on Paris and Luxembourg stock exchanges (Ticker: SESG). Further information is available at: www.ses.com

References:

https://telecoms.com/521086/ntt-and-ses-team-up-on-satellite-based-edge-solution/

ITU report on preparatory studies for the WRC 23 (Nov 20-Dec 15 in Dubai)

Among the key issues highlighted during the two-week WRC 23 meeting are:

-

- Identification of additional frequency bands for the continued development of International Mobile Telecommunications (IMT), including the use of high-altitude platform stations as IMT base stations for the universal deployment of wireless networks.

- Improvements to the international regulatory framework for geostationary orbit (GSO) and non-geostationary (NGSO) satellites while promoting equitable access for all countries.

- Use of satellite technologies for broadband services to improve connectivity, particularly in remote areas.

- New spectrum to enhance radiocommunications in the aeronautical mobile service, including by satellite, and to facilitate the use of the Space Research and Earth exploration-satellite services for climate monitoring, weather prediction and other scientific missions.

- The modernization of the Global Maritime Distress and Safety System (GMDSS).

- Regulatory framework for the use of earth stations in motion on board aircraft and ships for communication with geostationary orbit (GSO) and non-geostationary (NGSO) satellites.

- The future of the ultra-high frequency (UHF) broadcasting band which has implications for television broadcast, programme-making and special events, as well as public protection and disaster relief.

Over 1,900 participants from 125 ITU Member States attended CPM23-2. Also in attendance were representatives from ITU Radiocommunication Sector Members as well as delegates from various United Nations agencies and international organizations.

“The discussions and consensus achieved during CPM23-2 will pave the way to a successful world radiocommunication conference,” said Mario Maniewicz, Director of the ITU Radiocommunication Bureau. “The outcomes of WRC-23 will have a tremendous impact on the development of innovative, futuristic radiocommunication services that enable secure, faster, and seamless global communications for all.”

“I am delighted that we have finalized this significant milestone in the preparations for WRC-23 despite the challenges posed by the COVID-19 pandemic from the start of the preparatory process,” said Cindy-Lee Cook, Chairperson of the Conference Preparatory Meeting for WRC-23. “During the four-year study period, we experienced first-hand how essential digital connectivity is. This highlights the importance of the work we do to find new and innovative ways to provide broadband connectivity using terrestrial and space-based communication technologies.”

World radiocommunication conferences, held every three to four years, review and revise the ITU Radio Regulations, the international treaty governing the use of the radio-frequency spectrum, including satellite orbits.

WRC-23 will be preceded by the Radiocommunication Assembly (RA-23) from 13 -17 November 2023. The RA is responsible for the structure, program and approval of radiocommunication studies.

Image Credit: GSMA

Editor’s Note:

There’s a huge unresolved open issue from WRC 19: updating ITU-R recommendation M.1036 Frequency Arrangements for IMT to include the new 5G mmWave frequencies specified by WRC 19. At the conclusion of the last ITU-R WP 5D meeting in February, the WG on Spectrum Aspects and WRC 23 Preparations, could not agree on the revision of Recommendation ITU-R M.1036. It was not possible to resolve two remaining open issues and therefore, it was not possible to complete the revision at this WP 5D meeting. Further work will be required at the next WP 5D in June with the aim of completing the revision for submission to ITU-R Study Group 5 for approval in November.

References:

GSMA vision for more mobile spectrum in advance of WRC 23 this November

WRC 19 Report: IMT in the frequency bands 24.25-27.5GHz & 45.5-47GHz

https://www.itu.int/wrc-23/booklet-wrc-23/

SKT Develops Technology for Integration of Heterogeneous Quantum Cryptography Communication Networks

SK Telecom (SKT) today announced that for the first time in the world, it developed a technology that allows for integrated control and operation of quantum cryptography networks by integrating networks composed of equipment from different manufacturers via software-defined networking (SDN) and distributing quantum keys in an automated manner.

So far it was impossible to connect and operate quantum cryptography communication networks of different companies and countries. However, with SKT‘s new technology, quantum cryptography communication networks of diverse manufacturers, mobile operators and nations can be interconnected and co-operated.

The company said that it completed verification of the technology on the Korea Advanced Research Network (KOREN), a non-profit testbed network infrastructure operated by the National Information Society Agency (NIA) to facilitate research, test and verification of future network leading technologies and related equipment.

Based on the results of development and verification of the technology, SKT has been actively promoting standardization by sharing the case with global telcos.

To set international standards for the integration of quantum cryptography communication networks, SKT proposed two standardization tasks – i.e. ‘Control Interface of Software Defined Networks’ and ‘Orchestration Interface of Software Defined Networks for Interoperable Key Management System’ – to the European Telecommunications Standards Institute (ETSI), and they were chosen as work items by the ETSI industry specification group for QKD (ISG-QKD) in March 2023.

If approved as international standards, they will provide a technical basis for creating a large-scale network by interconnecting quantum cryptography communication networks built by many different operators. SKT plans to continue developing additional technologies for interworking of services between different operators/countries, as well as management of service quality.

Through these efforts, the company expects to strengthen the competitiveness of domestic companies and boost the quantum cryptography ecosystem both home and abroad.

Meanwhile, at this year’s IOWN Global Forum Workshop, SKT presented ‘Quantum Secure Interconnection for Critical Infrastructure,’ covering use cases for next-generation transmission encryption technology and proposal for a proof-of-concept (PoC) of quantum cryptography in All-Photonics Network (APN). The company also showcased its quantum cryptography communication technologies at 2023 MWC Barcelona.

“The two standardization tasks approved as work items by ETSI will boost the expansion of quantum cryptography communication in the global market,” said Ha Min-yong, Chief Development Officer of SKT. “We will work with diverse global players in many different areas to create new business opportunities in the global market.”

Disclaimer:

SK Telecom Co. Ltd. published this content on 05 April 2023 and is solely responsible for the information contained therein. https://www.sktelecom.com/en/press/press_detail.do?idx=1563¤tPage=1&type=&keyword=

………………………………………………………………………………………………………………………………………………………………….

From SDxCentral:

Quantum cryptography communication transmits each bit of information as a single photon of light, which encrypts that information against eavesdropping or decryption. Telecom operators and vendors have been working for several years on integrating that level of encryption into networks.

For instance, Toshiba and the Tohoku Medical Megabank Organization at Tohoku University used quantum technology in 2018 to hit one-month-average key distribution speeds exceeding 10 Mb/s over installed optical fiber lines. They also used the technology to monitor the performance of installed optical fiber lines in different environments.

Toshiba later partnered with U.K.-based operator BT on using QKD across to secure a network transmission.

SK Telecom also has a long quantum history, including work with Swiss-based strategic partner ID Quantique, which focuses on quantum cryptography communication technology.

Industry trade group GSMA last year announced its Post-Quantum Telco Network Taskforce focused on supporting the industry’s creation of a roadmap to secure networks, devices and systems across the entire supply chain.” That work was initiated with IBM and Vodafone, and has since gained more than 45 members.

Lory Thorpe, GSMA Post-Quantum Telco Networks chairperson and head of IBM Consulting’s Telco Transformation Offerings, told SDxCentral last month that the core objective of the taskforce is to ensure the implementation of the right requirements and standards in a timely manner to avoid being “late to the party.” Thorpe explained the initial problem statement was “around how do we support the telco ecosystem to navigate the path to quantum safe.”

“When you look at where cryptography is used in telco systems, it impacts basically all of the different systems. But it also then impacts all of the standards that underpin these systems as well,” she said. “We’re advocating that people start planning, not panicking, but at least planning because … this isn’t something that just happens overnight.”

Shentel joins Frontier and Altice USA with 5-gig broadband service

Shenandoah Telecommunications (Shentel) became the latest wireline network operator to roll out a symmetrical 5 Gbps internet tier, making it available to all 147,000 passings where it currently offers Glo Fiber service. Over 147,000 homes across Virginia, West Virginia, Maryland and Pennsylvania will have access to the fastest fiber speeds available in these markets.

The average U.S. household now has approximately 20 connected devices, and that number is expected to continue to grow. In addition, with more consumers working remotely long-term, video conferencing is here to stay. Multi-gig speeds are designed for these growing demands and will provide more bandwidth to run a multitude of connected devices at once.

“Adding 5 Gig internet service to our multi-gig product portfolio allows Glo Fiber to meet the demands of our customers and communities. 5 Gig is a premium residential service designed to connect multiple devices at their fastest possible speeds over a reliable, 100% fiber optic network,” said Ed McKay, Shentel Chief Operating Officer.

As of the end of Q4 2022, Glo Fiber was live in 17 markets across four states, including Maryland, Pennsylvania, Virginia and West Virginia. Jeff Manning, Shentel’s VP of Product and Network Strategy, said that by the end of 2023, Glo Fiber and the new 5-gig offering will be available to just under 250,000 passings across 23 markets.

“It feels like the right time to launch,” Manning said. “When you look at the number of devices in homes, the average is well over 20 devices in every home now. So, 5-gig service gives you the capability to ensure every device in the home is fully supported with the capacity it needs.”

The regional network operator already offers 600 Mbps, 1.2 Gbps and 2.4 Gbps service tiers at price points ranging from $65 to $135. The new 5-gig tier will cost $285 per month and require customers to bring their own router.

Manning said the reason it is asking 5-gig customers to bring their own router is because that will enable them to select a device with the level of performance they need. That and there aren’t routers on the market yet which are fully capable of delivering 5 gigs over Wi-Fi. When that changes, he said, Shentel will look at options to package routers with the 5-gig plan.

As a leading broadband internet provider in the Mid-Atlantic region, Glo Fiber takes great pride in several key differentiators compared to their competitors:

- Fiber-to-the-home technology with exceptional reliability

- Symmetrical download and upload speeds

- Easy, straight-forward pricing

- Prompt local customer service

Frontier has 125,000 fiber passings in West Virginia and recently announced plans to build another 100,000 there this year. It also provides fiber service in parts of Pennsylvania, including near Harrisburg and Lancaster, areas Shentel is eyeing for its expansion.

Altice also offers its Optimum fiber service in parts of Pennsylvania, including the areas west of Carlisle, which are similarly situated in the general area of a market Shentel is targeting. AT&T and Google Fiber offer 5-gig service tiers as well but don’t appear to operate within Shentel’s footprint. Frontier’s 5-gig service currently runs $164.99 per month while Altice’s costs $180 per month.

Watkins said the majority of Glo Fiber customers today are landing in its 1-gig and 2-gig buckets, though only around 10% fall into the latter. Thus, it’s not expecting huge take rates for the 5-gig product. Instead of mass market appeal, he said it’s designed to cater to select segments of the population with high bandwidth needs.

About Glo Fiber:

Glo Fiber (Glo) provides next-generation fiber-to-the-home (FTTH) multi-gigabit broadband internet access, live streaming TV, and digital home phone service powered by Shentel (Nasdaq: SHEN). Glo provides the fastest available service to residents leveraging XGS-PON, a state-of-the-art technology capable of symmetrical internet speeds up to 10 Gbps. To learn more about Glo Fiber, please visit www.glofiber.com or 1-800-IWANTGLO (1-877-492-6845).

About Shenandoah Telecommunications:

Shenandoah Telecommunications Company (Shentel) provides broadband services through its high speed, state-of-the-art fiber-optic and cable networks to customers in the Mid-Atlantic United States. The Company’s services include: broadband internet, video, and voice; fiber optic Ethernet, wavelength and leasing; and tower colocation leasing. The Company owns an extensive regional network with over 8,300 route miles of fiber and over 220 macro cellular towers. For more information, please visit www.shentel.com.

References:

https://www.fiercetelecom.com/broadband/shentel-targets-power-users-5-gig-broadband-plan

Shentel plots launch of fiber in 6 greenfield markets in 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

4 U.S. Mobile Operators offer C-band FCC proposal to address aircraft interference

Four major U.S. mobile operators have agreed to a series of undertakings designed to address concerns over airline safety and to allow them to use their C-band spectrum to its full extent.

“These voluntary commitments will support full-power deployments across C-Band, and are crafted to minimize the operational impact on our C-Band operations,” says the letter to the FCC, signed by senior executives at AT&T, Verizon, T-Mobile US and UScellular.

“As C-Band licensees, we will abide by the attached voluntary commitments. These voluntary commitments will support full-power deployments across C-Band, and are crafted to minimize the operational impact on our C-Band operations. In agreeing to these commitments, we reserve any and all rights and privileges conferred by our lawfully held spectrum licenses issued by the FCC.”

US mobile operators have been at odds with the airline industry for some time, the latter having strongly objected to the rollout of C-band spectrum for 5G services, fearing interference with the altimeters used by aircraft.

As the operators note in their letter, the FCC adopted licensing and technical rules to ensure the safe coexistence between C-band spectrum – that’s 3.7 GHz-3.98 GHz – and radio altimeters at 4.2 GHz-4.4 GHz; as the telcos put it, “more than 220 megahertz away.” The mobile industry has always insisted that the rules in place were sufficient, but nonetheless made several short-term moves to appease the Federal Aviation Administration.

At the end of 2021 AT&T and Verizon grudgingly offered to reduce power at 5G sites, particularly near airports and heliports, for six months, then later committed to deferring 5G rollout near airports altogether. Last summer the pair agreed to delay 5G rollout using C-band spectrum around US airports for another year to give the airlines time to upgrade their altimeters.

This latest missive to the FCC essentially reinforces that glide path into the full usage of C-band spectrum.

Reuters shared a comment from Verizon that these latest commitments will allow it to fully use its C-band frequencies for 5G “by the previously agreed to deadline of July 1.”

“Despite the sufficiency of the FCC rules, subsequent collaborative engagement across affected industries and with the FCC and Federal Aviation Administration has resulted in the development of the attached voluntary commitments relevant to this coexistence,” the mobile operators said.

Officials from the FCC did not immediately comment, according to Reuters. The Federal Aviation Administration (FAA) told the publication that it continues to “work closely to ensure a safe co-existence in the US 5G C-band environment.”

A representative from Airlines for America, a trade group representing US airlines including American, Delta and United, offered this statement on the new proposal: “We appreciate the collaboration among stakeholders, including the federal government and will continue to work our common goal of ensuring the aviation system remains the safest mode of transportation in the world. While our industry strongly supports 5G deployment, safety is—and always will be—the top priority of US airlines. A4A member carriers are working diligently to ensure fleets are equipped with compliant radio altimeters, but global supply chains continue to lag behind current demand and any government deadline must consider this reality.”

Arguably the most important thing now is that the operators can get the most out of the C-band spectrum they paid so much for just over two years ago. Lest we forget, the final tally came in at $81 billion, with an additional $15 billion on top in clearing costs – to shift the satellite players away from the band, that is. Verizon was famously the biggest spender by some margin, accounting for $53 billion at the auction itself.

Little wonder then that the operators are so keen to declare ‘case closed’ on the interference issue and to crack on with using that spectrum properly.

References:

https://www.fcc.gov/ecfs/document/1033142661477/1

https://telecoms.com/521048/us-telcos-solve-c-band-airline-interference-issue/

FAA NPRM: Aviation Industry Altimeter Upgrades to Thwart C-Band Interference

FAA order to avoid interfering with 5G C-Band services; RootMetrics touts coverage vs performance advantages for 5G

AT&T, Verizon Propose C Band Power Limits to Address FAA 5G Air Safety concerns

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Complete Event Description at:

https://scv.chapters.comsoc.org/event/open-source-vs-proprietary-software-running-on-disaggregated-hardware/

The video recording is now publicly available:

https://www.youtube.com/watch?v=RWS39lyvCPI

……………………………………………………………………………………………………………………………………………….

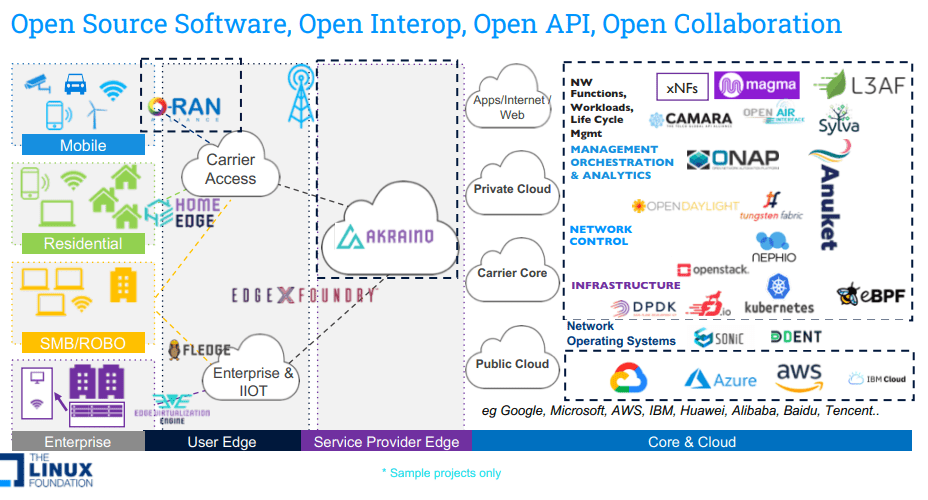

Backgrounder – Open Networking vs. Open Source Network Software

Open Networking was promised to be a new paradigm for the telecom, cloud and enterprise networking industries when it was introduced in 2011 by the Open Networking Foundation (ONF). This “new epoch” in networking was based on Software Defined Networking (SDN), which dictated a strict separation of the Control and Data planes with OpenFlow as the API/protocol between them. A SDN controller running on a compute server was responsible for hierarchical routing within a given physical network domain, with “packet forwarding engines” replacing hop by hop IP routers in the wide area network. Virtual networks via an overlay model were not permitted and were referred to as “SDN Washing” by Guru Parulkar, who ran the Open Networking Summit’s for many years.

Today, the term Open Networking encompasses three important vectors:

A) Beyond the disaggregation of hardware and software, it also includes: Open Source Software, Open API, Open Interoperability, Open Governance and Open collaboration across global organizations that focus on standards, specification and Open Source software.

B) Beyond the original Data/Control plane definition, today Open Networking covers entire software stack (Data plane, control plane, management, orchestration and applications).

C) Beyond just the Data Center use case, it currently covers all networking markets (Service Provider, Enterprise and Cloud) and also includes all aspects of architecture (from Core to Edge to Access – residential and enterprise).

Open Source Networking Software refers to any network related program whose source code is made available for use or modification by users or other developers. Unlike proprietary software, open source software is computer software that is developed as a public, open collaboration and made freely available to the public. There are several organizations that develop open source networking software, such as the Linux Foundation, ONF, OCP, and TIP.

Currently, it seems the most important open networking and open source network software projects are being developed in the Linux Foundation (LF) Networking activity. Now in its fifth year as an umbrella organization, LF Networking software and projects provide the foundations for network infrastructure and services across service providers, cloud providers, enterprises, vendors, and system integrators that enable rapid interoperability, deployment and adoption.

Event Description:

In this virtual panel session, our distinguished panelists will discuss the current state and future directions of open networking and open source network software. Most importantly, we will compare open source vs. proprietary software running on disaggregated hardware (white box compute servers and/or bare metal switches).

With so many consortiums producing so much open source code, the open source networking community is considered by many to be a trailblazer in terms of creating new features, architectures and functions. Others disagree, maintaining that only the large cloud service providers/hyperscalers (Amazon, Microsoft, Google, Facebook) are using open source software, but it’s their own versions (e.g. Microsoft SONIC which they contributed to the OCP).

We will compare and contrast open source vs proprietary networking software running on disaggregated hardware and debate whether open networking has lived up to its potential.

Panelists:

- Roy Chua, AvidThink

- Arpit Joshipura, LF Networking

- Run Almog, DriveNets

Moderator: Alan J Weissberger, IEEE Techblog, SCU SoE

Host: Prof. Ahmed Amer, SCU SoE

Co-Sponsor: Ashutosh Dutta, IEEE Future Networks

Co-Sponsor: IEEE Communications Society-SCV

Agenda:

- Opening remarks by Moderator and IEEE Future Networks – 8 to 10 minutes

- Panelist’s Position Presentations – 55 minutes

- Pre-determined issues/questions for the 3 panelists to discuss and debate -30 minutes

- Issues/questions that arise from the presentations/discussion-from Moderator & Host -8 to 10 minutes

- Audience Q &A via ZOOM Chat box or Question box (TBD) -15 minutes

- Wrap-up and Thanks (Moderator) – 2 minutes

Panelist Position Statements:

1. Roy will examine the open networking landscape, tracing its roots back to the emergence of Software Defined Networking (SDN) in 2011. He will offer some historical context while discussing the main achievements and challenges faced by open networking over the years, as well as the factors that contributed to these outcomes. Also covered will be the development of open networking and open-source networking, touching on essential topics such as white box switching, disaggregation, OpenFlow, P4, and the related Network Function Virtualization (NFV) movement.

Roy will also provide insight into the ongoing importance of open networking and open-source networking in a dynamic market shaped by 5G, distributed clouds and edge computing, private wireless, fiber build-outs, satellite launches, and subsea-cable installations. Finally, Roy will explore how open networking aims to address the rising demand for greater bandwidth, improved control, and strengthened security across various environments, including data centers, transport networks, mobile networks, campuses, branches, and homes.

2. Arpit will cover the state of open source networking software, specifications, and related standards. He will describe how far we have come in the last few years exemplified by a few success stories. While the emphasis will be on the Linux Foundation projects, relevant networking activity from other open source consortiums (e.g. ONS, OCP, TIP, and O-RAN) will also be noted. Key challenges for 2023 will be identified, including all the markets of telecom, cloud computing, and enterprise networking.

3. Run will provide an overview of Israel based DriveNets “network cloud” software and cover the path DriveNets took before deciding on a Distributed Disaggregated Chassis (DDC) architecture for its proprietary software. He will describe the reasoning behind the major turns DriveNets took during this long and winding road. It will be a real life example with an emphasis on what didn’t work as well as what did.

……………………………………………………………………………………………………………….

References:

https://lfnetworking.org/

https://lfnetworking.org/how-

https://lfnetworking.org/

https://lfnetworking.org/open-

Telekom Malaysia Berhad launches fiber optic network hub

Telekom Malaysia Berhad (TM) [1.] announced the completion of its new fiber optic network hub or point of presence (PoP) project phase one installations, across northern region, Sabah and Sarawak.

Note 1. Telekom Malaysia Berhad (TM) is a Malaysian telecommunications company founded in 1984. Beginning as the national telecommunications company for fixed line, radio, and television broadcasting services, it has evolved to become the country’s largest provider of broadband services, data, fixed line, pay television, and network services.

………………………………………………………………………………………………………………………………..

The launch ceremony, which was officiated by YB Fahmi Fadzil, Minister of Communications and Digital, took place at SMK Padang Terap, Kuala Nerang, Kedah. Also present were Dato’ Haji Pkharuddin Bin Haji Ghazali, Director-General of Education and Dato’ Sri Haji Mohammad Bin Mentek, Secretary-General, Ministry of Communications and Digital.

PoP is the location where different devices connect to each other and to the internet. In simple terms, PoP brings fiber optics closer to users. By setting up PoP locations near schools, people in rural and remote areas can get better and faster internet services in their homes, instead of relying on mobile internet. This will improve internet access and connectivity for more people in the community.

During the ceremony, YB Fahmi highlighted the significant benefits and opportunities that the new PoPs would bring. The new PoPs represent a major step forward in the Government’s efforts to narrow the digital gap and promote digital inclusion across Malaysia.

A total of 4,370 PoPs had been planned under the 12th Malaysia Plan (12MP) where 4,323 PoPs will be installed near rural schools and 47 PoPs near industrial area.

Phase one of the project, involves 677 sites. The remaining will be implemented under phase two over the span of three years, 2022-2025. A total of 233 PoP circuits were installed under phase 1, with 100% completion achieved by TM, ahead of other industry players.

“We are thrilled to see the progress and achievements of this project, which will bring significant benefits and opportunities to the community, including improved internet quality, economic development and the development of new infrastructures,” said Shazurawati Abdul Karim, Executive Vice President of TM One.

The PoP will create a more balanced and inclusive regional development, boosting the growth of new technologies like 5G and future generations of communication technologies. Through this initiative, users in TM’s PoP area have now reached over 9,000 and are increasing. A total of 58 of its users are schools that have subscribed to Unifi services. The widespread internet accessibility will not only help to develop the rural economy but more importantly allow learning materials to be downloaded, to improve the quality of education in schools, equipping the future generations with a wealth of knowledge.

“As the nation’s telecommunications leader, and enabler of Digital Malaysia, TM is committed to support the nation’s development agenda through the benefits brought by hyperconnectivity and digital solutions, which will accelerate digital adoption and new economic growth,” added Shazurawati.

“The presence of PoP can attract technology companies, start-ups and other businesses that require a high-speed internet connection to operate. This can create more job opportunities, increase innovation, and stimulate economic growth in local communities,” Shazurawati concluded.

The collaboration between TM and the Government demonstrates the shared commitment to deliver digital inclusivity throughout Malaysia. For phase two of PoP project, TM has been awarded with 174 sites in the central region. This phase is expected to further boost digital connectivity and economic development for Malaysia.

The extensive internet access that PoP provides will not only enhance the rural economy but also enable the download of educational materials, elevating the quality of education in schools and equipping the younger generation with a vast range of knowledge.

References:

https://www.tm.com.my/news/TM%E2%80%99S%20NEW%20FIBRE%20OPTIC%20NETWORK%20HUB

Telekom Malaysia Completes Fibre Optic Network Hub Across Sabah and Sarawak

Comcast Business expands SD-WAN portfolio for SMBs and single location customers

Comcast Business is expanding its SD-WAN portfolio to give more options to SMB customers. The MSO/ cableco on Friday announced two new solutions geared toward standalone business locations. Comcast says the new solutions cater to partners who need to connect to cloud and Software-as-a-Service (SaaS) applications.

The SD-WAN solutions enable small and medium businesses, with either a single location or multiple standalone locations, to help securely connect and manage their network, applications, and users. These businesses rely on SaaS applications and cloud services to operate, making secure networking a critical requirement. Comcast Business’ full range of global secure networking solutions provide connectivity, security, application optimization and control, as well as threat monitoring and response for single and multi-site customers.

![]()

In today’s digital economy, companies of all sizes need to provide their users fast, reliable, and secure connectivity to applications everywhere. This includes delivering high-quality, consistent, and predictable quality of experience for critical applications residing in the Cloud or SaaS and accessed via the public Internet. With the addition of these tailored SD-WAN solutions, Comcast Business can bring the benefits of secure networking to standalone and multi-site businesses around the world.

“Comcast Business’ global SD-WAN solutions are a central component of our secure network solutions strategy,” said Shena Seneca Tharnish, Vice President, Cybersecurity Products, Comcast Business. “With the addition of capabilities that support standalone sites, we are more prepared than ever to partner with businesses of all sizes to tailor solutions that meet their unique needs. At Comcast Business, we’re committed to preparing every business for what’s next.”

The enhancements to Comcast Business’ SD-WAN solutions enable secure networking and application optimization for single or multi-site businesses who need to connect to the Cloud or SaaS applications but may not require site-to-site networking. These solutions provide businesses with resiliency and visibility, as well as intelligent application prioritization and traffic steering, with advanced managed service. Key features include:

- Diverse connectivity, intelligent traffic steering, and direct connections to Cloud services enhance application performance and resiliency

- Advanced security capabilities to help protect against cyberthreats

- 24×7 Security Operations Center (SOC)

- Low-touch deployment capabilities provide easy installation

- Highly competitive pricing

These solutions are ideal for companies that lack IT budgets or a corporate network but need to support single locations with cloud connectivity using public Internet services.

Comcast Business was recognized as a leader by market research firm Frost & Sullivan in its 2022 Managed SD-WAN Services in North America report [1.]. At the time, Comcast was touted as the second-largest provider of SD-WAN connections in North America. Frost & Sullivan noted that the provider is “especially successful among enterprise customers with 250 or more sites.” The market research firm also gave a nod to Comcast’s strategic acquisition of SD-WAN leader Masergy and “the resultant portfolio enhancements and expanded partner ecosystem for SD-WAN and cloud solutions it has enabled.”

Note 1. Frost & Sullivan assessed 12 leading network and managed service providers in the North American market, analyzing their SD-WAN portfolios based on factors including partnerships with SD-WAN equipment vendors, breadth of underlay network technologies, self-service customer portals, and ability to offer value-added virtualized network functions (e.g., firewalls and routers) and other security solutions such as SASE.

…………………………………………………………………………………………………………………………………………………………………..

Previously, Aryaka announced enhanced SD-WAN and SASE products specifically designed to meet the needs of SMEs with a new entry pricing of under $150 per site. Aryaka Chief Product Officer Renuka Nadkarni told SDxCentral that ease of management is another key concern for many small businesses, which is why so many prefer managed services. Dell’Oro Group predicted the untapped networking and security SMB market will grow significantly this year on the backs of providers who can offer managed services.

…………………………………………………………………………………………………………………………………………………………………..

About Comcast Business:

Comcast Business offers a suite of Connectivity, Communications, Networking, Cybersecurity, Wireless, and Managed Solutions to help organizations of different sizes prepare for what’s next. Powered by the nation’s largest Gig-speed broadband network, and backed by 24/7 customer support, Comcast Business is the nation’s largest cable provider to small and mid-size businesses and one of the leading service providers to the Enterprise market. Comcast Business has been consistently recognized by industry analysts and associations as a leader and innovator, and one of the fastest growing providers of Ethernet services.

References:

To learn more about Comcast Business SD-WAN solutions: https://business.comcast.com/enterprise/products-services/sd-wan-solutions/sd-wan

https://www.sdxcentral.com/articles/news/comcast-tailors-sd-wan-portfolio-to-smbs/2023/03/

https://store.frost.com/frost-radartm-managed-sd-wan-services-in-north-america-2022.html

Gartner: changes in WAN requirements, SD-WAN/SASE assumptions and magic quadrant for network services

Arista’s WAN Routing System targets routing use cases such as SD-WANs

Have we come full circle – from SD-WAN to SASE to SSE? MEF’s SD-WAN and SASE standards

Enterprises Deploy SD-WAN but Integrated Security (SASE) Needed

Google Fiber offers 8 Gig symmetric service in Mesa, AZ; Chandler, AZ next in line

Google Fiber is using its service launch in the Westwood neighborhood of Mesa, Arizona, market to also serve as the initial launch point for its new symmetrical 8 Gbit/s broadband service. Residential customers in Mesa can sign up for Google Fiber’s 8 Gig service for $150 per month. 8 Gig offers symmetrical uploads and downloads of up to 8 Gbps with a wired connection, along with a Wi-Fi 6 router (which allows for up to 800 mbps over Wi-Fi) and up to two mesh extenders.

The 8-Gig tier, now Google Fiber’s fastest, sells for $150 per month and comes with a Wi-Fi 6 router and two Wi-Fi mesh extenders. There are three other symmetrical broadband service tiers:

- 1-Gig: $70 per month

- 2-Gig: $100 per month

- 5-Gig: $125 per month

Google Fiber’s debut in the Westwood neighborhood of Mesa arrives about eight months after the city council there approved the buildout. Mesa, the first city in Arizona to get service from Google Fiber, is also being served by primary incumbent providers Cox Communications and Lumen.

Amid the revamp of its network expansion strategy, Google Fiber expects to start construction later this year in Chandler, Arizona, Ashley Church, GM for Google Fiber’s west region, said in a blog post.

As announced last fall, Google Fiber is also in the process of launching new 5-Gig and 8-Gig tiers in additional markets in 2023. Its new 5-Gig service is already available in several Google Fiber markets, including Kansas City, West Des Moines, Iowa, and all the cities it provides service to in Utah.

Google Fiber will start construction later this year in Chandler, AZ. As new segments are completed, we’ll offer service in those neighborhoods. Residents who want to keep up on the construction process or service availability in their area can sign up here. Google Fiber has also conducted lab tests in Kansas City that produced downstream speeds of 20.2 Gbps.

.jpg)

Here’s an updated snapshot of where Google Fiber currently provides or plans to provide via FTTP or fixed-wireless Webpass services:

Table 1:

| Market | FTTP or Webpass |

| Atlanta, Georgia | FTTP |

| Austin, Texas | FTTP |

| Chandler, Arizona | FTTP |

| Charlotte, North Carolina | FTTP |

| Chicago, Illinois | Webpass |

| Council Bluffs, Iowa | FTTP |

| Denver, Colorado | Webpass |

| Des Moines, Iowa | FTTP |

| Huntersville, North Carolina | FTTP |

| Huntsville, Alabama | FTTP |

| Idaho | FTTP* |

| Kansas City, Kansas and Missouri | FTTP |

| Lakewood, Colorado | FTTP |

| Miami, Florida | Webpass |

| Nevada | FTTP* |

| Nashville, Tennessee | FTTP |

| Oakland, California | Webpass |

| Omaha, Nebraska | FTTP |

| Orange County, California | FTTP |

| Provo, Utah | FTTP |

| Salt Lake City, Utah | FTTP |

| San Antonio, Texas | FTTP |

| San Diego, California | Webpass |

| San Francisco, California | Webpass |

| Seattle, Washington | Webpass |

| *Google Fiber FTTP deployments coming to cities yet to be announced. (Source: Google Fiber and Light Reading research) |

|

References:

https://fiber.googleblog.com/2023/03/mesa-here-we-come-and-superfast-too.html