Omdia

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

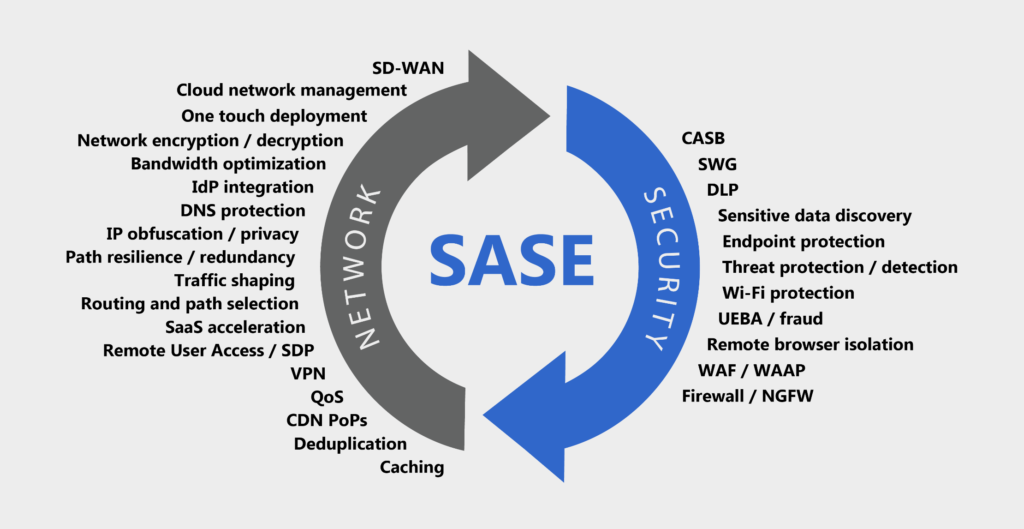

The secure access service edge (SASE) market is expected to triple by 2026, exceeding $13 billion, representing a very healthy CAGR, according to a new forecast by Mauricio Sanchez, Research Director at the Dell’Oro Group. The report further divides the total SASE market into its two technology components, Security Service Edge (SSE) and SD-WAN with SSE expected to double the SD-WAN revenue for SASE. The report further breaks down the SSE market into FWaaS, SWG, CASB, and ZTNA.

Sanchez wrote in a blog post:

“Today, enterprises are thinking differently about networking and security. Instead of considering them as separate toolsets to be deployed once and infrequently changed, the problem and solution space is conceptualized along a continuum in the emerging view. The vendor community has responded with a service-centric, cloud-based technology solution that provides network connectivity and enforces security between users, devices, and applications.

SASE utilizes centrally-controlled, Internet-based networks with built-in advanced networking and security-processing capabilities. By addressing the shortcomings of past network and security architectures and improving recent solutions—in particular, SD-WAN and cloud-based network security—SASE aims to bring networking and security into a unified service offering.

While the networking technologies underpinning SASE are understood to be synonymous with well-known SD-WAN, the security facet of SASE consists of numerous security technologies, such as secure web gateway (SWG), cloud access security broker (CASB), zero-trust network access (ZTNA), and firewall-as-a-service (FWaaS). Recently, a new term, security services edge (SSE), emerged to describe this constellation of cloud-delivered network security services that is foundational in SASE.”

As noted above, Dell’Oro divides the total SASE market into two technology components: Security Service Edge (SSE) and SD-WAN with SSE. Security features such as Firewall-as-a-Service (FWaaS), Secure Web Gateway (SWG), Cloud Access Security Broker (CASB) and Zero Trust Network Access (ZTNA) fall under the umbrella of SSE, according to Dell’Oro. In addition, Dell’Oro predicts that the security component to SASE “will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Dell’Oro’s Sanchez wrote, “We see SASE continuing to thrive independent of the ongoing macro-economic uncertainty as enterprises strategically invest for the new age of distributed applications and hybrid work that need a different approach to connectivity and security. We anticipate that security will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Additional highlights from SASE and SD-WAN 5-Year Forecast Report:

- Within SSE, Secure Web Gateway (SWG) and Cloud Access Security Broker (CASB) are expected to remain the most significant revenue components over the five-year forecast horizon, but Zero Trust Network Access (ZTNA) and Firewall-as-a-Service (FaaS) are estimated to flourish at a faster rate.

- Unified SASE is expected to exceed disaggregated SASE by almost 6X.

- Enterprise access router revenue is expected to decline at over 5 percent CAGR over the forecast horizon.

Dell’Oro expects that under the umbrella of SSE, Secure Web Gateway and Cloud Access Security Broker will continue as the most significant revenue components over the five-year forecast horizon. However, Zero Trust Network Access and Firewall-as-a-Service are expected to grow at a faster rate.

Unified SASE, which Dell’Oro qualifies as the portion of the market that delivers SASE as an integrated platform, is expected to exceed disaggregated SASE by almost a factor of six over the next five years. The disaggregated type is defined as a multi-vendor or multi-product implementation with less integration than unified type. Dell’Oro also predicts that enterprise access router revenue could decline at over 5% CAGR by 2026.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Gartner has a more optimistic forecast of SASE revenue, predicting the market to reach $14.7 billion as early as 2025. “Gartner predicts that global spending on SASE will grow at a 36% CAGR between 2020 and 2025, far outpacing global spending on information security and risk management,” reported VentureBeat last month. According to Gartner, top SASE vendors include Cato Networks, Fortinet, Palo Alto Networks, Versa Networks, VMware and Zscaler.

These disparate predictions could be a result of the nascent nature of the SASE market, a convergence of networking and security services coined by Gartner in 2019. To address the varying definitions for SASE and resulting confusion on the part of enterprise customers, industry forum MEF plans to release SASE (MEF W117) standards this year. MEF started developing its SASE framework in 2020 to clarify service attributes and definitions. (See MEF adds application, security updates to SD-WAN standard and MEF’s Stan Hubbard on accelerating automation with APIs.)

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Omdia’s [1.]research also shows security is a major driver for SASE adoption, according to Fernando Montenegro, senior principal analyst with Omdia. “Our own research indicates that end-user organizations value secure web browsing use cases (SWG, CASB, browsing isolation) particularly as they go further into their deployments of SASE projects,” said Montenegro in an email to Light Reading.

Note 1. Omdia and Light Reading are owned by Informa in the UK

Security is critical for organizations in what Omdia calls the age of “digital dominance” and by how the “demands on security teams – both in terms of time and expertise – make the delivery of security functionality via a services model particularly attractive,” Montenegro said.

SASE services also provide “good performance characteristics” when compared to enterprises utilizing their own VPN headends, and especially when hybrid work continues to be popular, added Montenegro.

References:

Total SASE Market to Nearly Triple by 2026, According to Dell’Oro Group

https://start.paloaltonetworks.com/gartner-2022-report-roadmap-for-sase-convergence.html

Omdia: Enterprise edge services market to hit $214 billion by 2026

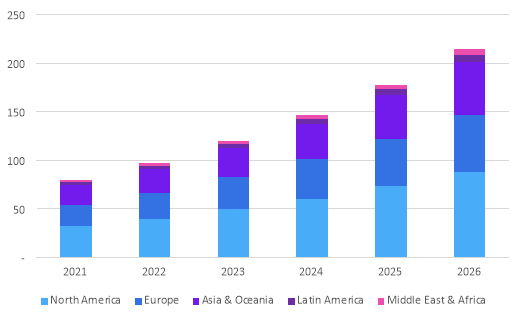

According to a new report by Informa’s Omdia, revenue from edge services (where EXACTLY is the edge?) will reach $214 billion by 2026. That’s more than double the current size of the enterprise edge services market, which will reach $97.0 billion in 2022, says Omdia. With a compound annual growth rate (CAGR) of 20.4%, North America is predicted to dominate with 41% of global revenue share between 2021 and 2026.

This Omdia report discusses the latest global enterprise edge services forecast including edge consulting, integration, network, security, storage/compute and managed edge services considering use cases, verticals and edge deployment models.

Enterprise edge services forecast by region, 2021-26 ($ billions)

Source: Omdia (owned by Informa)

…………………………………………………………………………………………………………

While hyperscalers build out edge access points and systems integrators (SIs) design consulting and professional services for edge use cases, enterprises are looking to service providers to define business cases, run pilot projects and scope out different approaches to edge computing use cases, according to Omdia.

The Informa owned market research group outlines two main consumption models for edge services.

- In one model, enterprises will need consulting, systems integration and other support services to deploy physical edge infrastructure.

- The second method is a cloud-based, as-a-service and fully managed approach, where services provided by hyperscalers and independent software vendors (ISVs) are extended to the edge using local access points or gateways.

Omdia sees several opportunities for network providers to assist enterprises with the challenges that arise from implementing their edge strategies. The firm notes that telcos can help enterprises navigate data location and management considerations; regulatory compliance; network considerations such as the need for and availability of 5G, WAN/LAN and private networks; selecting the right edge setup and location; balancing use of internal skills with managed edge services; defining clear business cases; and more.

Edge consulting services from SIs, telcos, ICT solutions vendors and consulting firms form the largest part of the enterprise edge services market at 39.3% in 2022, says Omdia. While cybersecurity and network management subscriptions from service providers are critical to edge service packages, these subscription-based telco services are declining over time, the research group adds.

However, fully managed, cloud-delivered edge services, including multi-access edge computing (MEC) and workload and database management, are increasing in popularity. Omdia predicts that edge storage and compute services will be the strongest area of growth, with the services emerging as cloud services extensions to the edge provided by major hyperscalers, service providers and data center operators.

“As data volumes continue to grow and enterprises aim to move more workloads to the edge, they require more compute and storage capacity in the form of IaaS and PaaS at edge access points,”Omdia explained.

Edge locations will also shift from customers’ premises (53% in 2022 and 38% in 2026) to PoPs (point of presence) such as cloud access points and to a lesser extent, data centers.

“By 2026, over a third of edge services revenues will be realized as part of PoP deployments, which provides key opportunities and challenges for ICT service providers,” says Omdia.

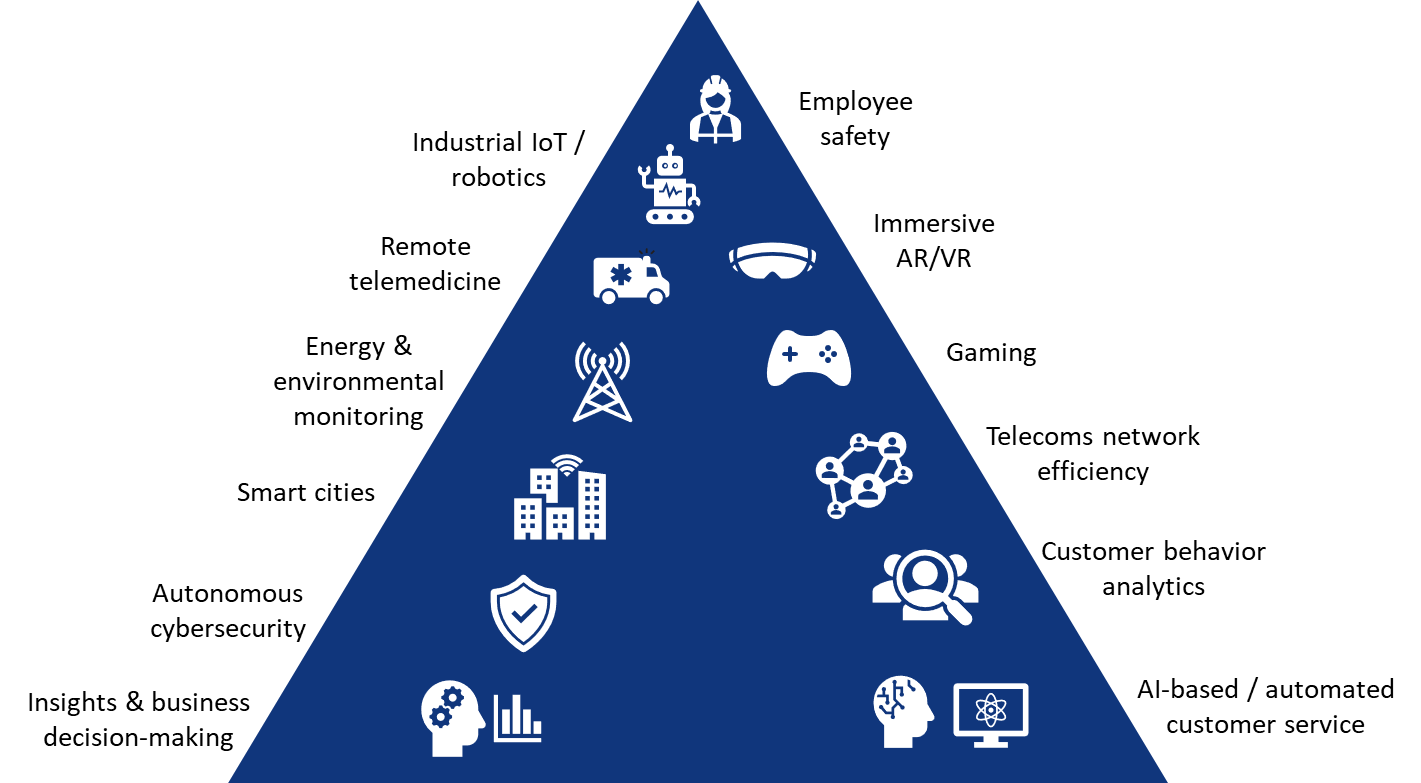

Emerging edge use cases

Edge use cases initially took flight in industrial applications and IoT use cases for worker safety, automated production lines, mining and logistics, explains Omdia. Over the next five years, the largest vertical forecasted to lead growth in edge services is the financial market, which could use AI-based analytics and cognitive systems for business decisions, market insight, risk assessment and customer service platforms.

Source: Omdia

Source: Omdia

…………………………………………………………………………………………………………………

Additional edge service use cases, which network operators could deliver as managed services, include smart meters for energy use and environmental monitoring; transport and container tracking; customer behavior analytics in retail; network efficiency; and data protection compliance and cybersecurity.

What applications do enterprises expect to run at the edge?

Omdia recommends several approaches for service providers, SIs, hyperscalers and ICT solutions vendors to consider when working with enterprises on edge services. Suggestions include developing vertical and workload-specific edge services that can be largely replicated to different customers, creating innovation hubs for edge solutions to test edge setups with customers, developing consulting services and creating a partner ecosystem to reduce vendor lock-in for customers.

References:

https://omdia.tech.informa.com/OM024012/Enterprise-Services-at-the-Edge–Forecast-202226

The Amorphous “Edge” as in Edge Computing or Edge Networking?

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

IBM says 5G killer app is connecting industrial robots: edge computing with private 5G

ONF’s Private 5G Connected Edge Platform Aether™ Released to Open Source

Omdia: Big increase in Gig internet subscribers in 2022; Top 25 countries ranked by Cable

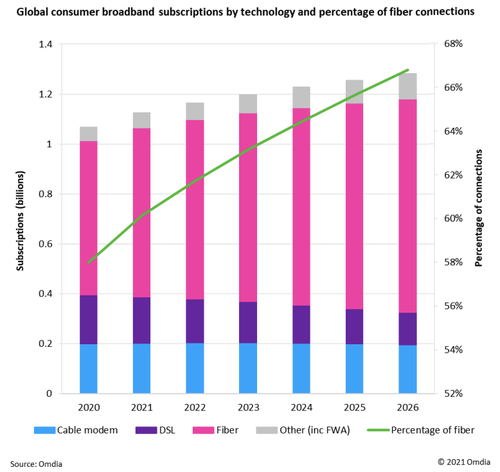

Global gigabit internet subscriptions are expected to increase to 50 million in 2022, more than doubling from 24 million at the end of 2020, according to a new report from market research firm Omdia (owned by Informa).

The Omdia report states that accelerated fiber deployments are helping to drive an increase in gigabit connectivity.

“Demand for reliable broadband is set to drive growth in gigabit services, with fiber playing a key role,” said Peter Boyland, principal analyst, broadband at Omdia.

“There were fewer than 620 million fiber subscriptions globally at the end of 2020, but we expect these to grow to 719 million in 2022, or 62% of total subscriptions.” The majority of fiber internet subscribers are expected to be in China.

However, Omdia warns that service providers must “carefully consider market demand” for their gigabit strategies and make targeted investments in fiber.

“Service providers need to carefully plan and execute gigabit network rollout, analyzing a number of factors, including infrastructure challenges, market competition, and expected demand,” writes Omdia. “But this does not stop with network rollout – operators need to continually monitor potential competitors and constantly innovate, refresh, and build service offerings so they stay ahead of rivals.”

The analysts also point out the opportunity for vendors in the market who can help service providers build “future proof” networks. “Vendors can offer long-term solutions such as monitoring and automation tools to extend the operator/vendor relationship beyond network rollouts,” the report recommends.

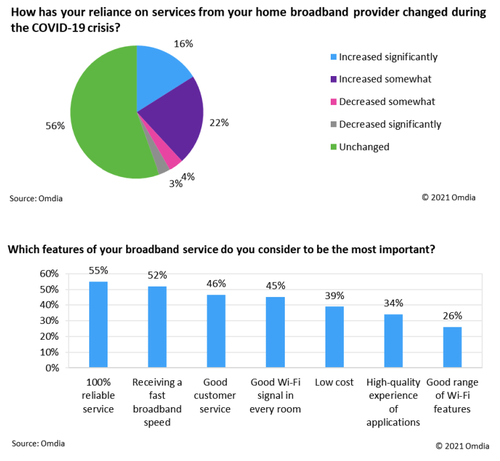

Of course, what matters most to consumers is reliable service. According to Omdia’s Digital Consumer Insights survey, 36% of respondents said they were more reliant on broadband services during COVID-19, and 55% of respondents said reliability ranked top among the most important home broadband features.

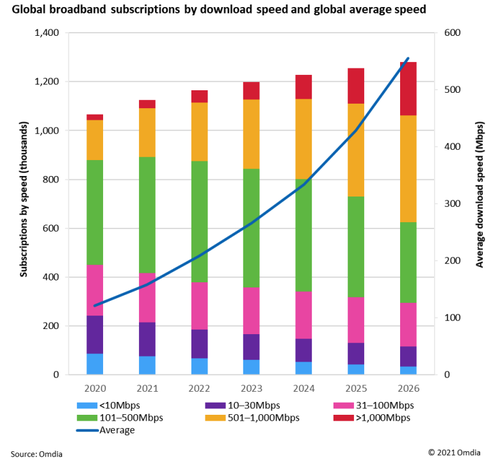

All of this gigabit and fiber growth will impact broadband speeds for years to come. According to Omdia:

“In 2020, just 2% of broadband subscriptions were more than 1Gbps, but this is expected to double to 4% in 2022.”

–>See table below for the 25 countries with the fastest AVERAGE internet speeds, ranked by Cable. Note that none of them is close to 1Gbps.

The report says that subscribers with access to 500 Mbit/s-1 Gbit/s will increase from 15% in 2020 to 21% in 202, with 17% of broadband subscriptions projected to reach speeds over 1 Gbit/s by 2026.

While high-bandwidth entertainment like augmented and virtual reality (AR/VR) and gaming were thought to be the main drivers for ever-faster home broadband speeds in pre-pandemic times, Omdia’s report doesn’t think they are significantly important for gigabit Internet growth, referring to them just once as “other drivers.”

……………………………………………………………………………………………

Internet comparison site Cable has ranked the countries with the fastest broadband internet in the world based on over 1.1 billion speed tests across 224 countries and territories.

“The acceleration of the fastest countries in the world has finally plateaued this year as they reach FTTP pure fibre saturation. Increases in speed among the elite performers, then, can be attributed in greater part to uptake in many cases than to network upgrades. Meanwhile, though the countries occupying the bottom end of the table still suffer from extremely poor speeds, 2021’s figures do indicate that the situation is improving,” said Dan Howdle of Cable.

Here are the 25 countries with the fastest download speeds:

| 1 | Jersey | JE | WESTERN EUROPE | 274.27 |

| 2 | Liechtenstein | LI | WESTERN EUROPE | 211.26 |

| 3 | Iceland | IS | WESTERN EUROPE | 191.83 |

| 4 | Andorra | AD | WESTERN EUROPE | 164.66 |

| 5 | Gibraltar | GI | WESTERN EUROPE | 151.34 |

| 6 | Monaco | MC | WESTERN EUROPE | 144.29 |

| 7 | Macau | MO | ASIA (EX. NEAR EAST) | 128.56 |

| 8 | Luxembourg | LU | WESTERN EUROPE | 107.94 |

| 9 | Netherlands | NL | WESTERN EUROPE | 107.30 |

| 10 | Hungary | HU | EASTERN EUROPE | 104.07 |

| 11 | Singapore | SG | ASIA (EX. NEAR EAST) | 97.61 |

| 12 | Bermuda | BM | NORTHERN AMERICA | 96.54 |

| 13 | Japan | JP | ASIA (EX. NEAR EAST) | 96.36 |

| 14 | United States | US | NORTHERN AMERICA | 92.42 |

| 15 | Hong Kong | HK | ASIA (EX. NEAR EAST) | 91.04 |

| 16 | Spain | ES | WESTERN EUROPE | 89.59 |

| 17 | Sweden | SE | WESTERN EUROPE | 88.98 |

| 18 | Norway | NO | WESTERN EUROPE | 88.67 |

| 19 | France | FR | WESTERN EUROPE | 85.96 |

| 20 | New Zealand | NZ | OCEANIA | 85.95 |

| 21 | Malta | MT | WESTERN EUROPE | 85.20 |

| 22 | Estonia | EE | BALTICS | 84.72 |

| 23 | Aland Islands | AX | WESTERN EUROPE | 81.31 |

| 24 | Canada | CA | NORTHERN AMERICA | 79.96 |

| 25 | Belgium | BE | WESTERN EUROPE | 78.46 |

It is the fourth year of the assessment and the latest ranking uses data collected in the 12 months up to 30th June 2021 to evaluate internet speed by country.

References:

https://www.cable.co.uk/broadband/speed/worldwide-speed-league/

Omdia and IDC: Samsung regains lead in global smartphone market

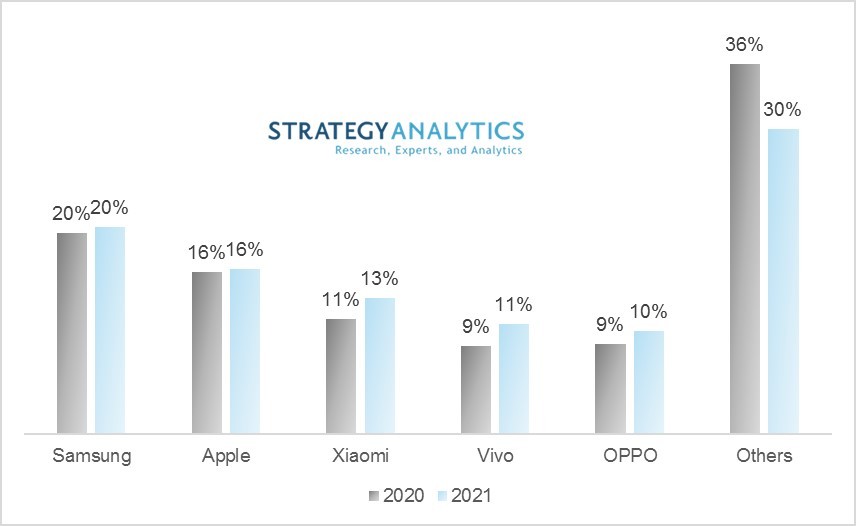

The global smartphone market climbed 28.1% year on year to reach total shipments of 351.1 million units in the first quarter of 2021, according to preliminary data from Informa owned Omdia. That gain consolidates the smartphone market’s recent recovery after it posted its first annual growth since Q3 2019 in the final quarter of 2020. However, Omdia said 2021 is set to be a year of transition with Huawei’s role continuing to change, LG exiting the market and a severe semiconductor shortage affecting sales.

Samsung took over the top spot from Apple in the first 3 months of 2021, shipping 76.1 million units, up 29.2 percent year on year, to reach 22 percent of the market. The company was able to increase shipments by 22.8 percent from Q4 2020 thanks in part to an early update to the Galaxy S line as well as the launch of its latest range of devices in the A series.

Apple followed its blockbuster Q4 2020 with another significant year on year growth of 46.5% to reach 56.4 million units shipped in the quarter, equivalent to 16% of the market, followed in third place by Xiaomi with 14% after shipping 49.5 million units, up 78.3% year on year.

Two more Chinese smartphone brands – Oppo and Vivo – continue to battle for fourth and fifth place in the global rankings and remain tied on 11 percent of the market. Vivo shipped 38.2 million units, just above the 37.8 million units Oppo shipped in Q1.

Year on year, Vivo grew shipments by 95.9 percent and Oppo by 85.3 percent, as they overtook Huawei, which slipped out of the top 5 global smartphone OEM ranking after shipping 14.7 million units, some 70 percent less than in Q1 2020, not including the 3.6 million units shipped by its sub-brand Honor, which is now an independent entity.

Top 10 Shipments per manufacturer

| Rank | OEM | 1Q21 | 4Q20 | 1Q20 | QoQ | YoY | |||

| Shipment (m) | M/S | Shipment (m) | M/S | Shipment (m) | M/S | ||||

| 1 | Samsung | 76.1 | 22% | 62.0 | 16% | 58.9 | 21% | 22.8% | 29.2% |

| 2 | Apple | 56.4 | 16% | 84.5 | 22% | 38.5 | 14% | -33.3% | 46.5% |

| 3 | Xiaomi | 49.5 | 14% | 47.2 | 12% | 27.8 | 10% | 4.9% | 78.3% |

| 4 | vivo | 38.2 | 11% | 34.5 | 9% | 19.5 | 7% | 10.7% | 95.9% |

| 5 | Oppo | 37.8 | 11% | 34.0 | 9% | 20.4 | 7% | 11.1% | 85.3% |

| 6 | Huawei | 14.7 | 4% | 33.0 | 9% | 49.0 | 18% | -55.5% | -70.0% |

| 7 | Motorola | 12.6 | 4% | 9.8 | 3% | 5.5 | 2% | 28.6% | 128.1% |

| 8 | Realme | 11.4 | 3% | 14.3 | 4% | 6.1 | 2% | -20.3% | 86.9% |

| 9 | Tecno | 8.2 | 2% | 7.7 | 2% | 3.5 | 1% | 6.5% | 133.4% |

| 10 | LG | 6.8 | 2% | 8.4 | 2% | 5.4 | 2% | -18.9% | 26.2% |

| Others | 41.3 | 12% | 46.4 | 12% | 41.1 | 15% | -11.0% | 0.6% | |

| Total | 353.0 | 100% | 381.8 | 100% | 275.7 | 100% | -7.5% | 28.1% | |

Gerrit Schneemann, principal analyst at Omdia commented: “The smartphone market continues to show resiliency in the face of multiple challenges. The global component supply shortage is looming large over the market. On the other hand, two well-known smartphone brands will disappear from the global smartphone market this year, in Huawei and LG, opening the door for other brands to reach new markets and buyers.”

……………………………………………………………………………………………………………………………………..

Separately, International Data Corporation (IDC) said that the smartphone market accelerated in the first quarter of 2021 (1Q-2021) with 25.5% year-over-year shipment growth.

According to preliminary data from the (IDC) Worldwide Quarterly Mobile Phone Tracker, smartphone vendors shipped nearly 346 million devices during the quarter. The strong growth came from all regions with the greatest gains coming from China and Asia/Pacific (excluding Japan and China). As the two largest regions globally, accounting for half of all global shipments, these regions experienced 30% and 28% year-over-year growth, respectively.

“The recovery is proceeding faster than we expected, clearly demonstrating a healthy appetite for smartphones globally. But amidst this phenomenal growth, we must remember that we are comparing against one of the worst quarters in smartphone history,1Q20, the start of the pandemic when the bulk of the supply chain was at a halt and China was in full lockdown,” said Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “However, the growth is still very real; when compared to two years ago (1Q19), shipments are 11% higher. The growth is coming from years of repressed refresh cycles with a boost from 5G. But above all, it is a clear illustration of how smartphones are becoming an increasingly important element of our everyday life – a trend that is expected to continue as we head into a post-pandemic world with many consumers carrying forward the new smartphone use cases which emerged from the pandemic.”

As the smartphone market is recovering, a major shift is happening in the competitive landscape. Huawei is finally out of the Top 5 for the first time in many years, after suffering heavy declines under the increased weight of U.S. sanctions. Taking advantage of this are the Chinese vendors Xiaomi, OPPO, and vivo, which all grew share over last quarter landing them in 3rd, 4th, and 5th places globally during the quarter with 14.1%, 10.8%, and 10.1% share, respectively. All three vendors are increasing their focus in international markets where Huawei had grown its share in recent years. In the low- to mid-priced segment, it is these vendors that are gaining the most from Huawei’s decline, while most of the high-end share is going to Apple and Samsung. Samsung regained the top spot in 1Q21 with impressive shipments of 75.3 million and 21.8% share. The new S21 series did well for Samsung, mainly thanks to a successful pricing strategy shaving off $200 from last year’s flagship launch. Apple, with continued success of its iPhone 12 series, lost some share from their very strong holiday quarter but still shipped an impressive 55.2 million iPhones grabbing 16.0% share.

“While Huawei continues its decline in the smartphone market, we’ve also learned that LG is exiting the market altogether,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “Most of LG’s volume was in the Americas with North America accounting for over 50% of its volume and Latin America another 30%. Despite the vendor losing ground in recent years, they still had 9% of the North America market and 6% of Latin America. Their exit creates some immediate opportunity for other brands. With competition being more cutthroat than ever, especially at the low-end, it is safe to assume that 6-10 brands are eyeing this share opportunity.”

| Top 5 Smartphone Companies, Worldwide Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (shipments in millions of units) | |||||

| Company | 1Q21 Shipment Volumes | 1Q21 Market Share | 1Q20 Shipment Volumes | 1Q20 Market Share | Year-Over-Year Change |

| 1. Samsung | 75.3 | 21.8% | 58.4 | 21.2% | 28.8% |

| 2. Apple | 55.2 | 16.0% | 36.7 | 13.3% | 50.4% |

| 3. Xiaomi | 48.6 | 14.1% | 29.5 | 10.7% | 64.8% |

| 4. OPPO | 37.5 | 10.8% | 22.8 | 8.3% | 64.5% |

| 5. vivo | 34.9 | 10.1% | 24.8 | 9.0% | 40.7% |

| Others | 94.1 | 27.2% | 103.0 | 37.4% | -8.7% |

| Total | 345.5 | 100.0% | 275.2 | 100.0% | 25.5% |

| Source: IDC Quarterly Mobile Phone Tracker, April 28, 2021 | |||||

Notes:

- Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

……………………………………………………………………………………………………………………………………………

Closing Comment:

“Globally, the top five vendors combined took a 76% market share in Q1 2021, up from 71% a year ago. Chip shortages and supply side constraints did not have a significant impact in Q1 among the top 5 brands,” said Linda Sui, senior director, Strategy Analytics. Samsung’s newly launched A series 4G and 5G phones, and the earlier launched Galaxy S21 series combined drove solid performance in the quarter. Xiaomi maintained strong momentum in both India and China, and the expansion in Europe, Latin America and Africa region also started to bear fruit.

Note: Strategy Analytics said the global smartphone shipments were 340 million units in Q1 2021, up over 24% (year-on-year) representing the highest growth since 2015. The smartphone market rebound was driven by the healthy demand of consumers with aging devices and a phenomenal 5G push from Chinese smartphone vendors.

References:

https://omdia.tech.informa.com/pr/2021-apr/global-smartphone-market-grows-28

https://www.idc.com/getdoc.jsp?containerId=prUS47646721

https://www.idc.com/tracker/showproductinfo.jsp?containerId=IDC_P8397

Omdia: Telco AI investment starts to pick up and effect automation of network activities

According to Omdia (owned by Informa), service providers face intense pressure to transform their IT systems, operations, and processes. Telco AI investment is expected to ramp up in 2021, but there is not as much clarity as there should be around best practices and business outcomes.

Omdia’s research indicates that early 80% of service providers see the use of AI and analytics, when it comes to the automation of network activities, as an “important” or “very important” IT project for 2021. Nearly 60% of them are planning to increase investment in AI tools.

Top AI use cases are expected to include network fault prediction and prevention, automation of end-to-end life-cycle management, and the management of network slicing. AI will also support a variety of non-network use cases, including using AI to support new

business models such as contextual offer management as well as automating and personalizing customer engagement and delivering customer insights.

Let’s take automation as an example. As networks become more complex and services more difficult to manage (e.g. 5G core networks, edge computing and network slicing), Omdia emphasized that automation was becoming critical. Automation of service fulfillment and assurance and creating highly prized “closed loops” – where the need for human intervention is minimal – are usually seen as some of the main drivers for AI investment, as a way to improve operational efficiencies.

It is often said that it is crucial to consider the potential ROI (Return On Investment) before initiating an automation project. ROI is certainly a good starting point for sorting out “must have” from the “nice to have” automation project, whether looking at it from the perspective of five-year cost savings, annual operating cost, time to value, or some other indicator. However, measuring automation outcomes is more complex than it may at first seem. It is of course useful to directly compare operations costs before and after adoption of an AI-based solution, but it is not the full story. It is also important to consider the business outcomes that require prioritization. These can include improving the accuracy of a process, increasing consistency and predictability, including ensuring compliance with specific SLAs, delivering greater reliability, boosting productivity, or reducing turnaround times. The list is extensive, but to make a success of an automation project it is important not to lose sight of the end goal, and to identify those KPIs (Key Performance Indicators) which specifically support the business outcomes an organization is seeking to achieve.

An AI-driven automation also needs to be sustainable. It’s not just about having the capabilities in place to address incidents as they occur. A process automation also needs to continue to be relevant even when a network/IT element is upgraded, or a vendor swapped out.

Visibility is also essential, because to improve anything you need to be able to measure it. But how does a service provider know if they are automating more successfully than their peers? There are plenty of sources of AI-linked training and support, as well as best practice guidance and models provided by industry bodies like the TM Forum. But there is not as yet a commonly agreed methodology to assess automation in the telco space. Some vendors have internal measures, such as internal process automation indexes, but this is not the same as having an industry-wide measure.

“Cloud-native and distributed cloud architectures and the growing importance of the network edge are adding to the complexity. AI is increasingly needed because existing operations are too reactive and rely heavily on human operators to execute functions,” said Kris Szaniawski, Omdia’s practice leader of service provider transformation.

“In current stressful circumstances, service providers that provide a fragmented customer experience will be quickly punished,” warned Szaniawski, who noted that progress toward enabling omnichannel customer engagement “has not always been as advanced as it should be.”

The Omdia report concluded by by suggesting service providers should make “targeted use of AI to better orchestrate customer journeys, as well as invest in well integrated central data repositories and robust data management capabilities.”

………………………………………………………………………………………………………………………………………………………………………….

Separately, Liam Churchill writes that forward-thinking CSPs have focused their AI investments on four main areas:

- Network optimization

- Preventive maintenance

- Virtual Assistants

- Robotic process automation (RPA)

In these areas, AI has already begun to deliver tangible business results. AI applications in the telecommunications industry are increasingly helping CSPs manage, optimize and maintain not only infrastructure, but also customer support operations. Network optimization, predictive maintenance, virtual assistants and RPA are all examples of use cases where AI has impacted the telecom industry, delivering enhanced CX and added value for enterprises.

As Big Data tools and applications become more available and sophisticated, AI can be expected to continue to accelerate growth in this highly competitive space.

References:

https://omdia.tech.informa.com/products/service-provider-operations-it-intelligence-service

https://techsee.me/blog/artificial-intelligence-in-telecommunications-industry/

Nokia & Omdia: 5G could bring up to $3.3 trillion to Latin America by 2035- vs 13% of mobile subs in 2025?

Executive Summary:

5G services could bring up to $3.3 trillion to Latin America by 2035, according to a new study by Nokia and research firm Omdia. The study, titled ‘Why 5G in Latin America?’ notes the uncertainty around the ongoing Covid-19 pandemic – yet alongside the projected $3.3 trillion in economic and social value promised by 5G, a $9 trillion improvement in productivity is also predicted.

We question what this optimistic forecast is based on since we haven’t been able to identify any real 5G use cases with current and near future 5G deployments.

Latin American operators have been relatively silent, apart from some trials, a deployment in Uruguay, and recent soft launches using DSS in Brazil.

This caution is understandable considering the late adoption of 4G. Omdia estimates that 4G in Latin America is about 52% of lines and 3G about a third (as of year-end 2019). Even 2G remains important at 13%, and it will not disappear until well after 2024.

To ignore the potential of 5G is to miss a considerable opportunity or leave it to one’s competitors, according to Omdia. This report shows the opportunity in the mass market, as a fixed broadband substitute, and in the enterprise market. The mass-market opportunity is based on the immersive technologies powered by 5G that will take our digital experiences to the next level and beyond.

The enterprise opportunity is less familiar because it has not been as important a play in 3G and 4G as Omdia believes it will be in 5G. All Latin American enterprises must explore digital transformation to remain competitive in the rapidly evolving global economy. Latin American governments must transform themselves and, more importantly, encourage digital transformation in their economies to improve productivity and return the region to real growth in income per capita.

5G is not an option but an imperative, and this report discusses what service providers and policy makers must do to get ready. There is a brief overview in the Appendix for those who would like to understand more about 5G technology.

The pandemic can be seen as a major opportunity point for digitisation of essential sectors, such as healthcare and emergency services, manufacturing, and the supply chain. Yet a major roadblock remains; a gap between the haves and have-nots for broadband penetration and connectivity.

This is similar to the reports from the Asia Cloud Computing Association (ACCA) regarding the Asia Pacific region; countries such as China and India score poorly because of the disparity between the rich and poor regions. Brazil, another BRIC region, is therefore set to be a major beneficiary according to the report; $1.22tn of 5G economic impact and an increase in productivity of just over $3 trillion.

The report outlines recommendations for service providers, particularly with regard to upgrading 4G to make it 5G-ready. Policy makers, meanwhile, are encouraged to finish allocating 4G spectrum to enable a ‘clear spectrum policy roadmap and an infrastructure policy which both encourages and facilitates the private sector to invest in 5G.’

“Latin American countries must diversify their sources of income and jobs into higher value-added activities,” said Wally Swain, principal consultant for Omdia Latin America. “Activities including mining and manufacturing must become more productive and 5G will play an important role on this.”

It is too early to be definitive about how COVID-19 will change behaviors and the patterns of 5G adoption in Latin America. But it seems clear that increased demand for broadband can only help the 5G business case, especially in FWA for homes and businesses. Because of the pandemic, there is a clear need for digitalization of essential sectors such as healthcare, emergency services, manufacturing, and supply chain.

The need for better-quality emergency communications will encourage the deployment of network slices, a key feature of the coming versions of 5G. In the future of what is often called Industry 4.0, a large part of the new value creation will be around the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines, and that will be possible with 5G.

Conclusions:

It is too early to be definitive about how COVID-19 will change behaviors and the patterns of 5G adoption in Latin America. But it seems clear that increased demand for broadband can only help the 5G business case, especially in FWA for homes and businesses. Because of the pandemic, there is a clear need for digitalization of essential sectors such as healthcare, emergency services, manufacturing, and supply chain.

The need for better-quality emergency communications will encourage the deployment of network slices, a key feature of the coming versions of 5G. In the future of what is often called Industry 4.0, a large part of the new value creation will be around the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines, and that will be possible with 5G.

You can read the full Omdia report here (name and email address required)

………………………………………………………………………………………………………………………………………………………………………………………

According to Ebanx Labs, 5G will represent 13% of mobile connections in Latin America in 2025, according to the Ericsson Mobility Report. The survey indicates the first 5G network deployments are expected during 2020 in the region, with Argentina, Brazil, Chile, Colombia and Mexico to be the pioneer countries.

Photo Credit: Shutterstock

References:

5G could bring up to $3.3 trillion to Latin America by 2035, says Nokia and Omdia