5G SA/5G Core network

Telefónica launches 5G SA in >700 towns and cities in Spain

Telefónica has followed Orange with the official launch of a 5G standalone (SA) network in more than 700 towns and cities throughout Spain. The service is branded Movistar 5G+ even though it is just 3GPP defined real 5G (with its own core network , rather than 5G NSA which uses LTE core network). The new Telefónica 5G SA network uses Ericsson and Nokia network equipment. Huawei has been excluded from it because the European Commission wants to ban Huawei in the EU for its alleged espionage work for the Chinese government.

Telefonica said its 5G NSA service in the 700 MHz band is currently available to around 85 percent of the Spanish population across 2,200 municipalities. The Spanish operator also uses the 3.5 GHz band for 5G and invested EUR 20 million to secure the maximum possible 1 GHz of spectrum in the 2.6 GHz band.

“Movistar customers will be able to enjoy 5G+ automatically and at no additional cost both in large cities and in small municipalities thanks to a highly capillarity deployment that will allow ultra-fast speeds and very low latency to be obtained in practically all of Spain,” the company explained in a statement.

The launch of 5G+, which offers greater coverage and browsing speeds of up to 1,600 megabits per second (Mbps), will take place within the scope of Movistar’s deployment in the 3,500 MHz band. In practice, 5G+ translates into better mobile experience in content downloads at the speed of fiber optics, streaming High quality and uninterrupted gaming. It also offers greater coverage in crowded spaces such as a sporting event or a music concert, according to Telefónica.

Movistar currently covers a total of 11 cities with 5G SA: Madrid, Barcelona, Malaga, Seville, Palma de Mallorca, Las Palmas de Gran Canaria, Ávila, Segovia, Castellón, El Ferrol and Vigo. The goal for the end of the year is to have “extensive 5G SA coverage in most cities with more than 250,000 inhabitants,” as well as in smaller towns, so that the capillarity of the service continues to be consolidated. However, in order to enjoy this service it is necessary to have a mobile that supports 5G SA. For the moment, Movistar has the new Xiaomi terminals to which new brands will be added.

Gabriel Brown, principal analyst at Heavy Reading, notes that Movistar operates the biggest network in Spain and has the largest number of live 3.5GHz sites, according to the independent AntenasMoviles website.

Said deployment is completed with the coverage in the 700 MHz band that Movistar has been offering since last year and currently reaches more than 2,200 municipalities, with advantages such as improved indoor coverage. The so-called low band is complemented in 5G with that of 3,500 MHz, ideal for services that require a user experience at a very high transmission speed, both for rural areas and large urban centers. In this way, Movistar already offers 5G coverage to more than 85% of the population, reports the company.–

Orange leads 5G SA coverage as it already reaches more than twenty cities that cover 30% of the population in Spain. In the case of Vodafone and MásMóvil, 5G SA is expected to be available before March 2024.

Heavy Reading’s Brown said, “It will be interesting to see if this gives it an edge in SA. Orange Spain, meanwhile, says it will launch network slicing before the end of the year.”

References:

https://euro.eseuro.com/business/572316.html

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Samsung bets on software centric network architectures supporting virtualized services

Kim Woojune, President and General Manager of Samsung Networks [1.] asserted that software capabilities will change the telecommunications landscape, as the South Korean tech giant bets on virtualized services. Kim said that future networks will be transformed more into software-centric architecture, versus the hardware-based networks the world has built and relied upon for about 150 years.

Note 1. Kim was appointed president and general manager of Samsung’s Networks business in December 2022

“Software has become a key driver of innovation, and this transition to software is also a natural shift in the networks industry,” Kim said in a speech at Nikkei’s Future of Asia forum. “Software brings more flexibility, more creativity and more intelligence,” he added.

Kim said the next transition in the network business has already started, as global telecom operators such as Verizon in the U.S., and KDDI and Rakuten in Japan are building their virtualized networks.

In February, Samsung announced that it was selected by KDDI to provide its cloud-native 5G Standalone (SA) Core network for the operator’s commercial network across Japan. The company said that this will usher in a new generation of services and applications available to KDDI’s consumers and enterprise customers — including smart factories, automated vehicles, cloud-based online gaming and multi-camera live streaming of sports events. Samsung and KDDI also successfully tested network slicing over their 5G SA Core network.

The Samsung executive asked global governments to embrace the shift, saying their role “should be to maximize the benefit of this extra use.”

Samsung is also winning contracts with cable providers, like Comcast, where it’s working to deploy 5G RAN solutions to support its efforts to deliver 5G access to consumers and business customers in the U.S. using CBRS and 600 MHz spectrum, Kim noted. Comcast is the first operator to use Samsung’s new 5G CBRS Strand Small Cell, a compact and lightweight solution designed to be installed on outdoor cables. It consists of a radio, baseband, cable modem and antennas, all in one form factor. The solution is also equipped with Samsung’s in-house designed chipset, a second-generation 5G modem SoC, which delivers increased capacity and performance.

References:

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Samsung in OpenRAN deal with NTT DOCOMO; unveils 28GHz Radio Unit (RU)

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

https://www.fiercewireless.com/tech/samsungs-woojune-kim-reflects-vran-leadership-us-inroads

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

The number of 5G subscriptions will surge from 934 million in 2022 to 3.1 billion in 2027 -a Compound Annual Growth Rate (CAGR) of 27% – according to a study from ABI Research. Further, 5G traffic is forecast to increase from 293 Exabytes (EB) in 2022 to 2,515 EB in 2027, at a CAGR of 54%.

ABI’s forecast is largely based on an increase in 5G Core (5GC) networks. To date, more than 35 5GC networks are operating in 5G standalone (SA) mode. 5GC is expected to lead to a growth in devices connected to the network and the traffic routed through it.

“5GC holds potential for operators to monetize further existing cellular connectivity for traditional mobile broadband (MBB) use cases but also offers scope for operators to expand cellular capabilities in new domains. Additionally, 5GC also offers innovation potential for committed telcos to establish new operating models for growth outside of the consumer domain,” explains Don Alusha, Senior Analyst, 5G Core and Edge Networks, at ABI Research.

5GC presents Communications Service Providers (CSPs) with a fluid and dynamic landscape. In this landscape, there is no static offering (requirements constantly change), no uniform offering (one shoe does not fit all), and no singular endpoint (one terminal with multiple applications). 5GC guides the industry into edge deployments and topologies. CSPs step out of the four walls of either their virtual Data Center (DC) or physical DC to place network functionality and compute as close to their customers as possible. This constitutes decentralization, a horizontal spread of network assets and technology estate that calls for a ‘spread’ in the operating model.

The shift from a centralized business (e.g. with 4G EPC) to a decentralized business (5G SA core network) stands to be a significant trend in the coming years for the telecoms industry. Against that backdrop, the market will demand that CSPs learn to drive value bottom-up. “What customers need” is the starting point for companies like AT&T, BT, Deutsche Telekom, Orange, and Vodafone. In other words, in this emerging landscape, there will be enterprise-specific, value-based, and niche engagements where the business strategy sets the technology agenda. So, it is rational to conclude that a “bottom-up” approach may be required to deliver unique value and expand business scope. That said, CSPs may be better equipped to drive sustained value creation if they learn to build their value proposition, starting from enterprise and industrial edge and extending to core networks.

“A 5G cloud packet core can potentially unlock new transactions that supplement existing volume-centered modus operandi with a local, bottom-up value play for discrete engagements. But the power of a bottom-up model is not enough. To monetize a 5G cloud packet core at scale, some of the existing top-down intelligence is needed too. Learning how to operate in this hybrid top-down and the emerging bottom-up, horizontally stratified ecosystem is a journey for NTT Docomo, Rakuten Mobile, Singtel, Softbank, and Telstra, among other CSPs. In the impending cellular market, an effective and efficient operating model must contain both control and lack of control, both centralization and decentralization and a hybrid of bottom-up plus some of the ‘standard’ top-down intelligence. The idea is that CSPs’ operating model should flexibly fit and change in line with new growing market requirements, or new growth forays may hit a roadblock,” Alusha concludes.

Editor’s Note:

It’s critically important to understand that the 3GPP defined 5G core network protocols and network interfaces enable the entire mobile system. Those include call and session control, mobility management, service provisioning, etc. Moreover, the 3GPP defined 5G features can ONLY be realized with a 5G SA core network. Those include: Network Automation, Network Function Virtualization, 5G Security, Network Slicing, Edge Computing (MEC), Policy Control, Network Data Analytics, etc

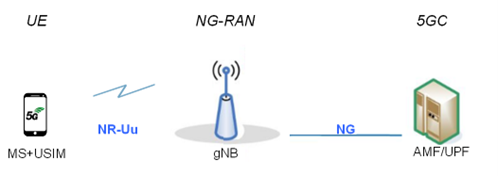

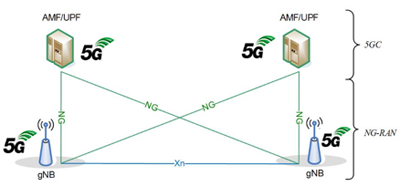

Figure 1: Overview of the 5G system

The 5GC architecture relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities. Via interfaces of a common framework, any given NF offers its services to all the other authorized NFs and/or to any “consumers” that are permitted to make use of these provided services. Such an SBA approach offers modularity and reusability.

Figure 2: 5G SA Core Network Architecture

The 5G SA architecture can be seen as the “full 5G deployment,” not needing any part of a 4G network to operate.

Finally, 3GPP has not liased their 5G system architecture specifications to ITU-T so there are no ITU-T standards for 5G SA Core Network or any other 5G non-radio specification. Instead, 3GPP sends their specs to ETSI which rubber stamps them as “ETSI standards.”

……………………………………………………………………………………………………………………………………………………….

These findings are from ABI Research’s 5G Core Market Status and Migration Analysis report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Based on extensive primary interviews, Application Analysis reports present an in-depth analysis of key market trends and factors for a specific technology.

About ABI Research

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.3gpp.org/technologies/5g-system-overview#

https://www.nokia.com/networks/core/5g-core/

A few key 3GPP Technical Specifications (TSs) are listed here:

- TS 22.261, “Service requirements for the 5G system”.

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)

- TS 32.240 “Charging management; Charging architecture and principles”.

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

- TS 38.300 “NR; NR and NG-RAN Overall description; Stage-2”

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

Backgrounder -5G SA Core Network:

5G SA core is the heart of a 5G network, controlling data and control plane operations. The 5G core aggregates data traffic, communicates with UE, delivers essential network services and provides extra layers of security, and all 3GPP defined 5G features and functions. There are no standards for implementation of 3GPP defined 5G SA core network architecture, which is said to be a service based architecture, recommended to be “cloud native.” Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

A 5G NSA network is a LTE network with a 5G NR, i.e. the 5G NR Access Network is connected to the 4G Core Network.

AT&T Yet to Deploy 5G SA Core Network but is “charging forward to advance 5G SA ecosystem readiness:

It’s been a long wait for AT&T’s 5G SA core network, which is required to realize ALL 5G functions defined by 3GPP, including network slicing, network virtualization, security, and edge computing (MEC).

- The U.S. mega network operator initially said they would launch 5G SA core network in 2020 but that never happened.

- On June 30, 2021, AT&T said their mobile network traffic will be managed using Microsoft Azure technologies. “The companies will start with AT&T’s 5G core, the software at the heart of the 5G network that connects mobile users and IoT devices with internet and other services.” Almost two years later, that hasn’t happened either!

- In an April 18, 2022 blog post on the company’s website, AT&T now says they are “Taking 5G to the Next Level with Standalone 5G.” AT&T has said that they “plan to deploy Standalone 5G when the ecosystem is ready, and AT&T is charging forward to advance 5G SA ecosystem readiness. Businesses and developers will be some of the first to take advantage of the new technologies standalone 5G enables as we continue to move from research & development to their deployment.”

However, AT&T did not provide a date or even a timeframe when its 5G SA core network would be deployed. Instead, the telco lauded several 5G advances they’ve recently made. Those include:

1. Completed the first 5G SA Uplink 2-carrier aggregation data call in the U.S.

Carrier aggregation (CA) means we are combining or “aggregating” different frequency bands to give you more bandwidth and capacity. For you, this means faster uplink transmission speeds. Think of this as adding more lanes in the network traffic highway.

The test was conducted in our labs with Nokia’s 5G AirScale portfolio and MediaTek’s 5G M80 mobile test platform. AT&T aggregated their low-band n5 and our mid-band n77 spectrum. Compared to the low-band n5 alone, AT&T realized a 100% increase in uplink throughput by aggregating the low-band n5 with 40MHz of AT&T’s mid-band n77. Taking it a step further, AT&T achieved a 250% increase aggregating 100MHz of n77. The bottom line: AT&T achieved incredible upload speeds of over 70 Mbps on n5 with 40MHz of n77 and over 120 Mbps on n5 with 100MHz of n77.

2. Using a two-layer uplink MIMO on time division duplex (TDD) in our mid-band n77. MIMO combines signals and data streams from multiple antennas (“vehicles”) to improve signal quality and data rates. This feature will not only improve uplink throughput but also enhance cell capacity and spectrum efficiency.

3. Last fall, AT&T completed a 5G SA four component carrier downlink call by combining two FDD carriers and two TDD carriers. These capabilities allow AT&T devices to aggregate our mid-band n77 in the C-Band and 3.45GHz spectrum ranges. Compared with low band and mmWave spectrum, mid-band n77 provides a good balance between coverage and speed. This follows the 5G SA three component carrier downlink feature that we introduced last year to 2022 AT&T Flagship devices which combines one frequency division duplex (FDD) carrier and two TDD carriers.

4. In the coming months, AT&T will enable 5G New Radio Dual Connectivity (NR-DC), aggregating our low and mid-band spectrum with our high-band mmWave spectrum on 5G SA. Our labs have achieved 5G NR-DC downlink throughput speeds of up to 5.3Gbps and uplink throughput speeds of up to 670Mbps. This technology will help provide high-speed mobile broadband for both downlink and uplink in stadiums, airports, and other high-density venues.

5. Here are some features that are on the horizon for 5G SA (how far away is the horizon?):

- Specialized Network Services – think network slicing, precision location, private routing, etc. – for tailored network solutions to meet specific user requirements;

- Non-terrestrial network solutions to supplement coverage in remote locations ; and

- Reduced capability 5G (RedCap) for a new generation of 5G capable wearables, industrial IoT or wireless sensors and other small form factor consumer devices.

In conclusion, AT&T’s Jason Sikes wrote, “The 5G SA ecosystem is rapidly evolving, with new technologies and capabilities being introduced to set the foundation for next generation applications and services.” Yet no information was provided on the status of AT&T’s 5G SA network running on Microsoft Azure cloud technology!

AT&T to run its mobility network on Microsoft’s Azure for Operators cloud, delivering cost-efficient 5G services at scale.

Image Credit: Microsoft

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

In the U.S., T-Mobile launched 5G SA core network nationwide last year, while Verizon began shifting its own traffic onto its 5G SA core in 2022. More recently, Verizon officials have begun hinting at interest in selling SA-powered network slices to public safety customers and others.

At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks. “Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” said Dave Bolan, Research Director at Dell’Oro Group.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/atandt-to-launch-standalone-5g-later-this-year/d/d-id/764109

https://about.att.com/blogs/2023/standalone-5g-innovations.html

https://about.att.com/story/2021/att_microsoft_azure.html

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

MTN and Microsoft Azure accelerate Africa’s digital transformation via the public cloud

South Africa-based network operator MTN has joined the growing list of telcos that are making the move to public cloud. Following the signing of a five-year strategic partnership in September 2022, MTN and Microsoft are in the process of delivering a program of work that will see the latest technologies deployed for the benefit of MTN’s customers, starting with South Africa and Nigeria.

The company announced it has embarked on a program of work to migrate various back end systems to Microsoft Azure. It is called Project Nephos, and its principle aim is to deliver maximum value as early as possible by identifying the workloads most suited to being redeployed on Azure. It’s initiating the project by transferring the BSS and OSS applications used by MTN’s opcos in South Africa and Nigeria. This approach has already enabled MTN to complete a proof of concept for the world’s first 5G standalone core network solution deployed in Microsoft’s Azure public cloud in just a few weeks!

Under the program, MTN will also migrate EVA, its core big data platform. In addition to putting it existing workloads on Azure, MTN also plans to leverage its capabilities in AI and machine learning to come up with new use cases that, in MTN’s own words, “bridge typical divides across network, IT and commercial domains.”

MTN and Microsoft have hired Accenture to provide technology implementation, integration and support services in hopes of making the whole thing go smoothly. They have also launched a staff training program that covers cloud technologies, devsecops (development, security, and operations), and data management.

MTN and Microsoft first announced they were working together in November last year. Their five-year strategic partnership centres on transforming and modernising MTN’s comms and technology infrastructure, and building what MTN hopes will be the largest and most valuable platform business with a clear focus on Africa.

Given MTN’s scale – it serves more than 270 million subscribers across 19 markets in Africa and the Middle East – it is a pretty big deal. It has echoes of Dish deploying its greenfield 5G network on Amazon Web Services (AWS), or AT&T announcing plans to move its 5G network onto Azure.

In addition to Monday’s OSS/BSS migration, MTN and Microsoft last week showed off what they claim to be the world’s first proof-of-concept (PoC) of a 5G standalone (SA) core network deployed on Microsoft Azure.

Every element, including the control plane, user plane and management nodes was fully deployed on Microsoft’s South Africa Azure Region, giving MTN a taste of what it can expect from a cloud-native 5G network, i.e., rapid deployment and scalability. These two capabilities are particularly important to MTN, which aims to reach 10-30% population coverage with its 5G network in the medium term.

“Our strategic partnership with Microsoft will enable us to transform the way we deliver products and services to our customers. We will bring the power of cloud computing to life, driving development and innovation with speed, flexibility and predictable investments and operations. We remain focused on nurturing the digital skills within MTN and in the societies we operate in, and building digital platforms to drive digital transformation across Africa and the Middle East,” said Nikos Angelopoulos, MTN Group’s CIO, in a statement.

“Harnessing the power of MTN, Microsoft and Accenture, we will be working closely together to build the next wave of compressed digital transformation across the continent. We see this program becoming a global standard in the industry for years to come” Nitesh Singh Communications, Media and Technology Lead for Accenture Africa.

References:

MTN and Microsoft accelerate Africa’s digital transformation in the public cloud

Paradise Mobile’s Open RAN 4G/5G core network to run on AWS cloud

Paradise Mobile, a new Mobile Network Operator (MNO) building a greenfield, cloud-native, Open RAN (oRAN) 4G/5G mobile network from the ground up in Bermuda, today announced the selection of Amazon Web Services, Inc. (AWS) as its preferred cloud provider to help build an Open RAN 4G/5G network and bring innovative services to Bermuda for the first time.

Paradise Mobile will leverage AWS for digital platform workloads, with agreements to roll out AWS edge services on island to host the wireless core and Open RAN DU and CU workloads. Paradise Mobile is also working to bring AWS services to the island, which will provide local businesses and innovators in the IoT industry the necessary tools and infrastructure to rapidly develop, test and deploy cutting edge products and services. The new environment will provide the ability for a secure, scalable, and high-performance network, optimized for businesses to develop and launch their next big thing.

Sam Tabbara, Co-Founder and CEO, Paradise Mobile, said: “We see Amazon as a strategic long-term collaborator who shares our vision and values, and has the ability to significantly accelerate our roadmap of innovative new products and services we want to launch in Bermuda. This relationship will allow us to provide our customers with the best possible experience and create a hub for IoT innovation in Bermuda and beyond.”

Tabbara said Paradise plans to run its 5G network operations – including management software from Mavenir – directly inside a Kubernetes stack running on AWS. To do so, Tabbara explained that Paradise will install an instance of AWS inside a LinkBermuda data center and will run AWS at the base of each of its roughly two dozen planned cell towers. “The opportunity for us with AWS is to accelerate that [5G] future,” Tabbara told Light Reading.

The new IoT environment will also provide businesses with access to a wide range of AWS services. These services will give businesses the ability to process and analyze vast amounts of data in real-time, enabling them to create new and innovative products and services.

Sameer Vuyyuru, head of worldwide business development at AWS, said: “Leveraging AWS helps reduce time-to-market as well as create a new path to deliver innovation to customers. Our work with Paradise Mobile will not only help Paradise Mobile rapidly build, scale, and manage its mobile network but also offer secure solutions to accelerate innovation across Bermuda.”

Paradise intends to build specific network-based applications and services that can be used by other operators. Drone operations is one of the first 5G use cases that Paradise plans to support. Tabbara said that the company is in discussions with an unnamed drone startup that may use the Paradise 5G network for testing.

AWS will play a key role in that strategy, according to Tabbara. He explained that enterprise developers are already familiar with AWS’ cloud computing platform and therefore will be able to add networking into the mix as Paradise lights up its 5G operations. “Anyone who knows how to code applications … if you are able to code within that [AWS] ecosystem, then there’s value add for us to be in that same ecosystem,” Tabbara said. The drone startup plans to do its development work inside the relatively familiar confines of Amazon’s cloud computing platform. “We’re already co-developing some of these solutions,” Tabbara said.

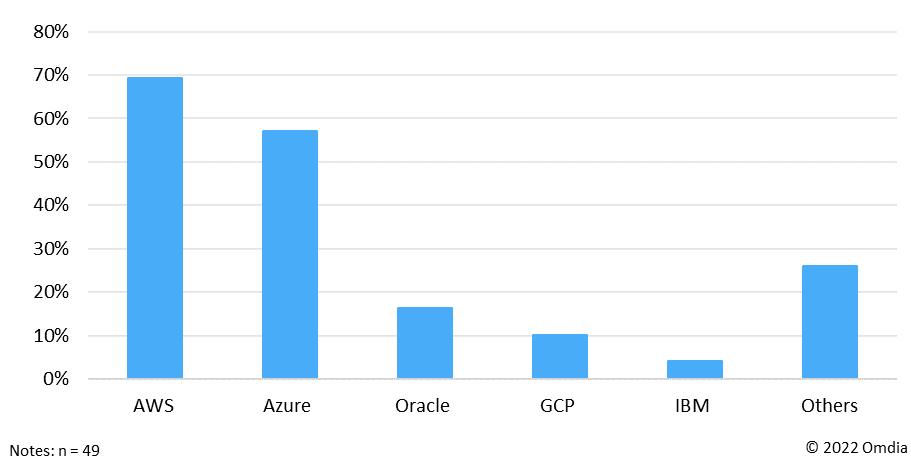

The announcement is yet another win for AWS as the hyperscaler competes against Oracle, Microsoft and Google Cloud for the telecom business. Omdia asked 49 telecom executives to list which public cloud or clouds their company is currently using to run any network functions, and respondents could select all that apply. Here was their response:

Note: Azure is Microsoft’s cloud offering, Google Cloud Platform is Google/Alphabet’s

…………………………………………………………………………………………………………………………………

Paradise Mobile is building a next generation wireless net network in Bermuda, followed by other CARICOM markets to be announced in the near future.

About Paradise Mobile:

Paradise Mobile is building a world of effortless connection with a next generation wireless network launching in multiple markets and countries, starting with Bermuda in 2023. Visit www.paradisemobile.com to learn more.

References:

Huawei says 5.5G is necessary with fully converged cloud native core network

Huawei maintains that a new 5.5G core network is needed to address a plethora of new use cases and new opportunities. That despite of the very limited deployment of 3GPP’s 5G SA Core network architecture specs. The company is calling on partners to promote industry consensus and commercial deployments for the era of 5.5G, an evolution of 5G technology.

Yang Chaobin, senior vice-president of Huawei, said: “The rapid growth of 5G has led to new service requirements that are becoming more diverse and complex. Such changes demand stronger 5G capabilities.”

Yang said that as 6G is still in the early stages of research, 5.5G is a necessary and natural evolution of 5G, which has become an industry consensus.

According to GSA, 35 network operators in 20 countries have launched commercial public 5G SA networks. In addition to those, GSA identified 77 other operators that are currently investing in 5G SA for public networks (including those evaluating/testing, piloting, planning, or deploying).

In 2020, containers and micro-services were introduced as key components of cloud-native network design and migration path to 5G core networks with high degree of much needed automation. At this point, intent-driven algorithms are used to automate large-scale cloud-native 5G telecom networks.

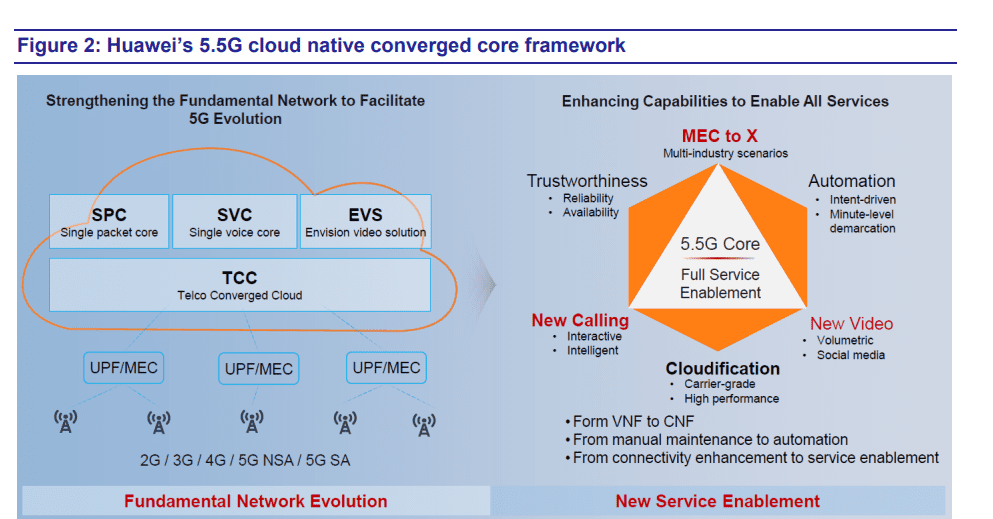

Figure 1. Huawei at MWC 2023

Figure 2. below illustrates Huawei’s complete 5.5G cloud-native converged core strategy that is based on strengthening the current networking building blocks that paved the way to where we are today, and continuously adding new capabilities and enhancing them to enable all services needed to address the plethora of new 5G use cases.

Source: Huawei

……………………………………………………………………………………………………………………………………………………………

Backgrounder on 5G Advanced:

3GPP initiated the 5G-Advanced project in early 2021 and started the formulation of Release 18 specs to enhance the existing mobile network capabilities. Case in point: UPF (User Plane Function) Mesh and MEC (Multi-access Edge Computing) enhancements were introduced to enable 5G to cover more industry scenarios, which in the new 5.5G core platform, is addressed through the “MEC to X” concept to accelerate the digital transformation of industries.

In addition, the Rel. 18 NG-RTC (Next Generation Real-Time Communications) feature enhances the communication capability and enriches the communication services, including calling and video, or “New Calling” and “New Video” in 5.5G core (see Figure 2. above).

……………………………………………………………………………………………………………………………………………………………

Huawei laid out five major characteristics of the 5.5G era – 10 Gbps experiences, full-scenario interconnection, integrated sensing and communication, autonomous networks and green information communications technology.

Yang called on the global telecom industry to jointly promote 5.5G development in four areas including setting clear roadmaps for industry standardization and a clear strategy for spectrum, which is fundamental to wireless networks.

Huawei and Saudi Arabian telecommunications operator Zain KSA signed a memorandum of understanding (MoU) last month for the”5.5G City” joint innovation project.

Under the MoU, both parties will work together to promote technological innovation for 5.5G evolution and expand scalable offerings to individuals, enterprises and government customers. Additionally, they will strengthen the digital infrastructure and build a global 5.5G evolution pioneer network, providing a strong engine to achieve the national digitalization goals outlined in Saudi Vision 2030.

Abdulrahman Al-Mufadda, chief technology officer of Zain KSA, said, “Our commitment to driving digital transformation has been made possible by combining innovative technology investments with pioneering digital solutions across multiple fields, including cloud computing, fintech, business support and drone technologies.”

The cooperation came as 5G is now in the fast lane after three years of commercial use. By the end of 2022, global 5G users exceeded 1 billion, gigabit broadband users reached 100 million, and more than 20,000 industry applications were put into use, according to data compiled by Huawei.

Leading operators in China, South Korea, Switzerland, Finland and Kuwait have already achieved 5G user penetration rates of more than 30 percent with more than 30 percent of their traffic coming from 5G, Huawei said.

Network intelligence and connectivity insights provider Ookla’s latest 5G City Benchmark Report showed Huawei has played an important role in 5G network construction in all of the top 10 cities among the world’s 40 most 5G-enabled cities. Performance results in these 10 cities show 5G networks constructed by Huawei offer the best experience.

Last month, Huawei also revealed a collaboration with Botswana’s Debswana Diamond Co (Pty) Ltd on the world’s first 5G smart diamond mine project.

Debswana’s Head of Information Management Molemisi Nelson Sechaba said that the Huawei-enabled smart mine solution has been deployed at Debswana’s Jwaneng open-pit diamond mine. The project started operation in December 2021.

At present, Huawei’s 4G eLTE, an advanced version of 4G technology, provides stable connectivity for the Jwaneng mine, connecting more than 260 pieces of equipment, including drilling rigs, excavators, heavy trucks and pickup trucks. This enables interconnection between the mine’s production, safety and security systems, Sechaba said.

The Jwaneng mine is the world’s first 5G-oriented smart diamond mine, which means the hardware equipment such as base stations used in the mine’s digital transformation support network has upgraded to 5G, Huawei said.

Huawei claims they’ve seamlessly migrated their existing and dedicated core network platforms (e.g., SPC, SVC, EVS in Figure 2) as well as its telco converged cloud to a fully converged cloud-native 5.5G core that features full-service enablement. In other words, the company says the transition from virtual network functions (VNF) to cloud native network functions (CNF), from manual operation to automation and from connectivity provisioning and enhancement to full-service enablement has been completed.

–>That’s all in advance of 3GPP Release 18 specs on 5G Advanced (which won’t be frozen till March 2024)?

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinadaily.com.cn/a/202303/20/WS6417b0a5a31057c47ebb55b2.html

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

Virtual Network Function Orchestration (VNFO) Market Overview: VMs vs Containers

TM and ZTE Malaysia to develop next-gen hybrid cloud 5G core network

Telekom Malaysia Berhad (TM) and ZTE have entered into a new strategic partnership to build out a hybrid cloud 5G core network in Malaysia which is designed for future technologies and will lead the way for next-generation networks. It’s a three year strategic partnership and the hybrid cloud aspect is part of a plan to ‘foster innovation and advancement of state-of-the-art technologies’ for TM’s 5G Core project, which includes bare metal containers, SDN-based architecture, hardware acceleration, CUPS, and 3-layer decoupling.

As well as generally improving network bandwidth and speed in Malaysia, it’s also pitched as a means to which TM can provide new connectivity services to healthcare, finance, transportation, and education, develop smart city and IoT applications, and it is ‘anticipated to revolutionize Malaysia’s telecommunications industry.

The integration of this converged network will strengthen TM’s capabilities to provide seamless connectivity and exceptional network performance, serving a diverse range of industries, including healthcare, finance, transportation, and education. Additionally, the hybrid cloud 5G core network will aid in the growth of smart cities, Internet of Things (IoT), and other next-generation technologies that necessitate rapid, low-latency connectivity.

This collaboration marks a significant achievement in the advancement of 5G technology in Malaysia, with the novel hybrid cloud 5G core network anticipated to revolutionize Malaysia’s telecommunications industry. With the deployment of these sophisticated technologies, customers will gain unparalleled user experience, while also improving the network’s dependability, safety, and efficiency.

Source: Jordi Boixareu/Alamy Live News

“TM is pleased to partner ZTE in building a hybrid cloud 5G core network that is designed to meet the rising needs for future technologies,” said Jasmine Lee Sze Inn, TM’s Executive Vice President for Mobile. “This strategic partnership will transform 5G-enabled networks to deliver innovative solutions and services through our state-of-the-art network and infrastructure, and enable seamless connectivity and exceptional network performance.”

Steven Ge, ZTE Malaysia’s Chief Executive Officer added: “We’re excited to strengthen our partnership with TM through the development of a hybrid cloud 5G core network. This will accelerate the launch of 5G network across Malaysia, which will bring forth new innovation into the market. As a global leading provider of information and communication technology solutions, we are confident that the advancement of our hybrid cloud 5G core network will be the model for future networks. ZTE is committed in this collaboration that will put Malaysia as one of the leading countries in the region to roll-out its 5G network.”

It’s broadly the same pitch as was delivered in places where the 5G rollout is more advanced, such as the US and Western Europe. While we don’t appear to be much closer to the utopian vision of smart cities over here, there has been some progress in private 5G networks in enterprise and industry settings – though much the emphasis now is on things like 5G SA and mmWave to bring the initial promises over the line.

East Asian contracts may be increasingly important for ZTE following U.S. led bans on Chinese vendor (Huawei and ZTE) equipment and phones. As a result of sanctions, ZTE has become more reliant on its home market. It increased domestic sales 9.2% last year compared to 3.4% offshore, with the China market now accounting for 69% of the total, up from 64% three years ago.

Chairman Li Zixue said 2022 was the start of ZTE’s “strategic expansion phase.” He said the company had achieved good growth from innovative products including server and storage, 5G industry applications, auto electronics, digital energy and smart home. “We firmly grasped the opportunities presented by the global trend of digitalization and low-carbon green principles,” he said.

The company further ramped up R&D spending. Research outlays rose 14.9%, mostly on 5G-related products, chip, server and storage businesses. R&D spending accounts for 17.6% of revenue, up from 13.8% three years ago, with the research division now totaling 49% of total headcount.

Li added that ZTE would seek opportunities for industrial transformation presented by new energy and digitalized industries. While the external environment would likely become more unpredictable, “the digital economy has grown into an irreversible trend.” He also said ZTE would “persist in an approach of precision and pragmatism in 2023,” targeting domestic opportunities in the digital economy and seeking breakthroughs in large telco customers offshore.

“We will strengthen our corporate resilience and control operating risks to achieve prudent growth,” Li concluded.

References:

https://telecoms.com/520567/tm-and-zte-team-up-on-hybrid-cloud-5g-core-network-in-malaysia/

https://www.lightreading.com/asia/zte-hikes-full-year-earnings-by-19-/d/d-id/783787?

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Swiss network operator Swisscom have announced a proof-of-concept (PoC) collaboration with Ericsson 5G SA Core running on AWS. The objective is to explore hybrid cloud use cases with AWS, beginning with 5G core applications. The plan is for more applications to then gradually be added as the trial continues. With each cloud strategy (private, public, hybrid, multi) bringing its own drivers and challenges the idea here seems to be enabling the operator to take advantage of the specific characteristics of both hybrid and public cloud.

The PoC reconfirms Swisscom and Ericsson’s view of the potential hybrid cloud has as a complement to existing private cloud infrastructure. Both Swisscom and Ericsson are on a common journey with AWS to explore how use cases can benefit telecom operators.

The PoC will examine use cases that take advantage of the particular characteristics of hybrid and public cloud. In particular, the flexibility and elasticity it can offer to customers which can mean deployment efficiencies for use cases where capacity is not constantly needed. An example of this could be when maintenance activities are undertaken in Swisscom’s private cloud, or when there are traffic peaks, AWS can be used to offload and complement the private cloud.

Swisscom had already been collaborating with AWS on migrating its 5G infrastructure towards standalone 5G. In addition, it has also used the hyperscaler’s public cloud platform for its IT environments. Telco concerns linger [1.] around the use of public cloud in telecoms infrastructure (especially the core networks) for some operators, hybrid cloud is seemingly gaining momentum as a transitional approach.

Note 1. Telco concerns over public cloud:

- In a recent survey by Telecoms.com more than four in five industry respondents feared security concerns over running telco applications in the public cloud, including 37% who find it hard to make the business case for public cloud as private cloud remains vital in addressing security issues. This also means that any efficiency gains are offset by the IT environment and the network running over two cloud types.

- Many in the industry also fear vendor lock-in and lack of orchestration from public cloud providers. Around a third of industry experts from the same survey find it a compelling reason not to embrace and move workloads to the public cloud unless applications can run on all versions of public cloud and are portable among cloud vendors.

- There’s also a lack of interoperability and interconnectedness with public clouds. The services of different public cloud vendors are indeed not interconnected nor interoperable for the same types of workloads. This concern is one of the drivers to avoid public cloud, according to some network operators.

–>PLEASE SEE THE COMMENT ON THIS TOPIC IN THE BOX BELOW THE ARTICLE.

Quotes:

Mark Düsener, Executive Vice President Mobile Network & Services at Swisscom, says: “By bringing the Ericsson 5G Core onto AWS we will substantially change the way our networks will be built and operated. The elasticity of the cloud in combination with a new magnitude in automatization will support us in delivering even better quality more efficiently over time. In order to shape this new concept, we as Swisscom believe strategic and deep partnerships like the ones we have with Ericsson and AWS are the key for success.”

Monica Zethzon, Head of Solution Area Core Networks, Ericsson says: “5G innovation requires deep collaboration to create the foundations necessary for new and evolving use cases. This Proof-of-Concept project with Swisscom and AWS is about opening up the routes to innovation by using hybrid cloud’s flexible combination of private and public cloud resources. It demonstrates that through partnership, we can deliver a hybrid cloud solution which meets strict telecoms industry requirements and security while making best use of HCP agility and cloud economy of scale.”

Fabio Cerone, General Manager AWS Telco EMEA at AWS, says: “With this move, Swisscom is opening the door to cloud native networks, delivering full automation and elasticity at scale, with the ability to innovate faster and make 5G impactful to their customers. We are committed to working closely with partners, such as Ericsson, to explore new use cases and strategies that best support the needs of customers like Swisscom.”

“How to deploy software in different cloud environments – at a high level, it is hard making that work in practice,” said Per Narvinger, the head of Ericsson’s cloud software and services unit. “You have hyperscalers with their offering and groups trying to standardize and people trying to do it their own way. There needs to be harmonization of what is wanted.”

https://telecoms.com/520337/swisscom-ericson-and-aws-collaborate-on-hybrid-cloud-poc-on-5g-core/

https://telecoms.com/520055/telcos-and-the-public-cloud-drivers-and-challenges/

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

At MWC 2023 Barcelona, Google Cloud announced that they can now run the radio access network (RAN) functions as software on Google Distributed Cloud Edge, providing communications service providers (CSPs- AKA telcos) with a common and agile operating model that extends from the core of the network to the edge, for a high degree of programmability, flexibility, and low operating expenses. CSPs have already embraced open architecture, open-source software, disaggregation, automation, cloud, AI and machine learning, and new operational models, to name a few. The journey started in the last decade with Network Functions Virtualization, primarily with value added services and then deeper with core network applications, and in the past few years, that evolved into a push towards cloud-native. With significant progress in the core, the time for Cloud RAN is now, according to Google. However, whether for industry or region-specific compliance reasons, data sovereignty needs, or latency or local data-processing requirements, most of the network functions deployed in a mobile or wireline network may have to follow a hybrid deployment model where network functions are placed flexibly in a combination of both on-premises and cloud regions. RAN, which is traditionally implemented with proprietary hardware, falls into that camp as well.

In 2021,the company launched Google Distributed Cloud Edge (GDC Edge), an on-premises offering that extends a consistent operating model from our public Google Cloud regions to the customer’s premises. For CSPs, this hybrid approach makes it possible to modernize the network, while enabling easy development, fast innovation, efficient scale and operational efficiency; all while simultaneously helping to reduce technology risk and operational costs. GDC Edge became generally available in 2022.

Google Cloud does not plan to develop its own private wireless networking services to sell to enterprise customers, nor does the company plan to develop its own networking software functions, according to Gabriele Di Piazza, an executive with Google Cloud who spoke at MWC 2023 in Barcelona. Instead, Google Cloud would like to host the networking software functions of other vendors like Ericsson and Mavenir in its cloud. It would also like to resell private networking services from operators and others.

Rather than develop its own cloud native 5G SA core network or other cloud networking software (like Microsoft and AWS are doing), Google Cloud wants to “avoid partner conflict,” Di Piazza said. Google has been building its telecom cloud story around its Anthos platform. That platform is directly competing against the likes of AWS and Microsoft for telecom customers. According to a number of analysts, AWS appears to enjoy an early lead in the telecom industry – but its rivals, like Google, are looking for ways to gain a competitive advantage. One of Google’s competitive arguments is that it doesn’t have aspirations to sell network functions. Therefore, according to Di Piazza, the company can remain a trusted, unbiased partner.

Image Credit: Google Cloud

Last year, the executive said that moving to a cloud-native architecture is mandatory, not optional for telcos, adding that telecom operators are facing lots of challenges right now due to declining revenue growth, exploding data consumption and increasing capital requirements for 5G. Cloud-native networks have significant challenges. For example, there is a lack of standardization among the various open-source groups and there’s fragmentation among parts of the cloud-native ecosystem, particularly among OSS vendors, cloud providers and startups.

In recent years, Google, Microsoft, Amazon, Oracle and other cloud computing service providers have been working to develop products and services that are specifically designed to allow telecom network operator’s to run their network functions inside a third-party cloud environment. For example, AT&T and Dish Network are running their 5G SA core networks on Microsoft Azure and AWS, respectively.

Matt Beal, a senior VP of software development for Oracle Communications, said his company offers both a substantial cloud computing service as well as a lengthy list of network functions. He maintains that Oracle is a better partner for telecom network operators because of it. Beal said Oracle has long offered a wide range of networking functions, from policy control to network slice management, that can be run inside its cloud or inside the cloud of other companies. He said that, because Oracle developed those functions itself, the company has more experience in running them in a cloud environment compared with a company that hasn’t done that kind of work. Beal’s inference is that network operators ought to partner with the best and most experienced companies in the market. That position runs directly counter to Google’s competitive stance on the topic. “When you know how these things work in real life … you can optimize your cloud to run these workloads,” he said.

While a number of other telecom network operators have put things like customer support or IT into the cloud, they have been reluctant to release critical network functions like policy control to a cloud service provider.

References:

https://cloud.google.com/solutions/telecommunications

https://cloud.google.com/blog/topics/telecommunications