Deutsche Telekom CEO receives another towers deal offer

Deutsche Telekom (DT) has reportedly received another €20 billion (US$21 billion) offer for its telecom towers business, this time from a consortium of three private equity firms – KKR, Global Infrastructure Partners (GIP) and Stonepeak Partners – according to Bloomberg.

Cellnex has previously confirmed it is bidding for DT’s towers business, with reports suggesting it has teamed up with Brookfield Asset Management to make an offer. And others are interested too, with Bloomberg reporting that Vodafone-owned Vantage Towers could emerge as a bidder, either on its own or with a partner, as could DigitalBridge. DT has been seeking some kind of deal for quite a while, with the German operator’s CEO Tim Hoettges issuing a very clear invite to all interested parties in November last year: At the time, Cellnex, Vantage Towers and Orange’s towers unit, Totem, looked like the leading candidates in terms of being a good industrial fit.

Talking about DT’s tower assets during the online Morgan Stanley European Technology, Media and Telecoms conference on Thursday, CEO Hoettges said he would “love to have an industrial partner and I’m willing to deconsolidate,” reported Reuters, though DT would need strategic influence in any joint venture, particularly related to any future M&A activity. “I prefer an industrial solution, but I always need two to tango… I’m open for partners,” added the CEO.

Europe’s struggling telecom carriers once saw ownership of these network infrastructure assets as a vital part of their business models. Now, under pressure to raise cash and cut the bill for new network investments, they’ve begun to spin off their wireless masts into separate units or sell them outright.

Private equity firms are drawn to telecoms infrastructure because of its ability to generate steady, long-term returns. KKR raised $17 billion for its latest global infrastructure fund earlier this year, while GIP is targeting $25 billion for what would be the world’s biggest pool of capital dedicated to infrastructure investments.

Cellnex, Europe’s biggest mast operator, already jointly owns towers with Deutsche Telekom in Switzerland and the Netherlands. Germany is the only major European market where Cellnex hasn’t been able to build a presence.

References:

https://www.bnnbloomberg.ca/kkr-gip-make-joint-bid-for-21-billion-deutsche-telekom-unit-1.1780366

In India: What if Jio, Vi, and Airtel Skip 5G and Focus on 4G?

Telcos worldwide have already spent billions of dollars on setting up infrastructure, permissions, spectrum, and more for 4G and it is also bringing them plenty of revenues. While 5G will open up a whole new revenue stream from the enterprise sector, are the telcos really desperate for it? India has yet to hold its first 5G auction which has been repeatedly delayed.

Reliance Jio, Vodafone Idea (Vi), and Bharti Airtel are the only three PAN-India 4G operators in India right now. All the telcos have hundreds of millions of users in their subscriber base to whom they provide 4G network services. There are 2G users as well, but that’s a conversation for another day. Today, what I want to talk about is what if Jio, Vi, and Airtel don’t roll out 5G and just focus on 4G? Note that I very well know this isn’t going to happen. However, I couldn’t help but wonder, what if the telcos just went on with their usual 4G network services and didn’t care about 5G because of the steep spectrum price and the decision of the government to allow the enterprises to get airwaves directly in an administrative manner for captive private networks?

To be very honest, 5G doesn’t seem like the biggest deal-breaker for the telcos right now. From an investor perspective, the kind of expenditure that 5G would entail in 2022, factoring in spectrum price, among other things, doesn’t feel like a very solid option for Jio, Vi, or Airtel. Not to forget, Vi doesn’t even have the capacity to make large investments for 5G in the first place. Expenditure is not the issue; RoI (return on investment) is!

But one thing’s proven for the telecom operators – revenues from 4G networks. They have already spent billions of dollars on setting up infrastructure, permissions, spectrum, and more for 4G, and it is also bringing them plenty of money. While 5G will open up a whole new revenue stream from the enterprise sector, are the telcos really desperate for it? Well, I would argue not, despite fully acknowledging the fact that all the private companies just want to make more money. So, what will happen if the telcos really don’t go for 5G? Let’s take a look at the negatives first.

Negatives

The most obvious thing would be that consumers won’t get to see 5G anytime this year in any part of the nation. Second, enterprises would be very unhappy as not all of them might be looking to get the airwaves directly for setting up private 5G networks. Third, it would potentially affect the sales of 5G smartphones. Fourth, India will be left even further behind other nations in 5G network technology.

Positives

A delayed 5G rollout would mean that more users would start owning 5G smartphones over the long horizon and when telcos do launch 5G, it will be a more than ready market for them to monetise through retail consumers. Second, the industry and the government would get more time to sort through policies and the telcos would get sufficient room to set up a denser infrastructure.

Moreover, the telecom industry can upskill more people with knowledge about technologies such as 5G, AI, ML, and more which are going to be very relevant.

Again, it is unlikely that the telcos will miss out on 5G this year. But even if they do, I don’t think it is that big of an issue both from a consumer and an investor’s point of view. A seamless 4G experience is still something Indian consumers crave for! Hopefully, that is sorted along with the 5G rollout.

References:

NTT Docomo will use its wireless technology to enter the metaverse

Japan’s NTT Docomo will move into the industrial metaverse in the next few years by offering design and other tools powered by its own wireless technology, CEO Motoyuki Ii told Nikkei Asia.

“Games have driven the metaverse so far, but industrial applications will grow in the future,” Ii said in a recent interview.

He acknowledged that Japanese companies have lagged international peers in staking claim to the metaverse — a virtual space where people interact through avatars. But Ii sees helping companies go digital as a way to make a comeback.

For Docomo, which leads rivals KDDI and SoftBank in wireless market share but not in profitability, the metaverse offers a chance to diversify. Docomo aims to have operations beyond its core telecom business, including the metaverse, account for at least half of sales by fiscal 2025.

Jun Sawada, president of Docomo’s parent NTT, sees the metaverse as the group’s next mainstay business. “We need to plan for the post-smartphone era,” Sawada said.

Docomo will work with partners including startups to develop the industrial metaverse tools. They will be made available to a wide range of businesses large and small. By October, the carrier plans to establish a company with about 150 engineers and other staff to start the project.

For its metaverse tools, Docomo envisions a virtual space where engineers in remote locations can come together and use the tools to jointly develop products or test prototypes. These services also will employ augmented reality, in which real-world objects are enhanced with pop-up data.

The tools are meant to help manufacturers overcome staff shortages and pass on skills from experienced workers to a new generation.

Computer-assisted 3D design and development is already widespread in the automotive industry. But this process remains mostly confined to computer screens. The metaverse is expected to provide greater immersion so that engineers can better evaluate virtual prototypes.

Competition is fierce in virtual reality goggles and other wearables, with companies like Facebook parent Meta and Apple joining the fray. But bulky VR equipment has yet to reach the mainstream. Ii said Docomo aims to provide “user-friendly devices that are comfortable,” including lightweight VR glasses.

Docomo’s industrial metaverse ambitions will build on the Innovative Optical and Wireless Network, a next-generation communications infrastructure known as IOWN being developed by the entire NTT Group.

IOWN envisions optical signals replacing electrical ones as carriers of data through networks. This would multiply data transfer capacity by a factor of 125, while slashing latency and power usage by factors of 200 and 100, respectively, according to Docomo.

NTT is developing proprietary semiconductor devices using this technology, which will make possible compact and lightweight VR equipment.

Such devices could use sixth-generation, or 6G, telecommunications. Data transmission speeds on 6G are expected to be more than 10 times faster than 5G. IOWN is expected to become commercially available as early as 2025, with 6G hitting the market around 2030. NTT and Docomo intend to start an indoor 6G test with Japanese electronics group NEC and other partners this fiscal year.

Docomo already has a metaverse business for the consumer market. The company in March established XR World, where participants can experience concerts and other events. Users can enter the platform via smartphones and PCs without relying on VR goggles.

In the NTT Group vision, the metaverse will take advantage of its photonic-based IOWN (Innovative optical and wireless network), still under development, that is aimed at improving bandwidth by 125 times and delivering latency of 1/200 of a second.

Docomo sees the metaverse as an important part of its diversification strategy. It’s aiming at non-telecom services accounting for half of revenue in three years.

Docomo’s pursuit of industrial customers reflects Japan’s shrinking smartphone market and falling mobile rates. The carrier intends to shut 30% of its brick-and-mortar Docomo shops by the end of fiscal 2025. Meanwhile, it aims to draw more virtual customer visits.

Docomo became wholly owned by NTT in 2020 and delisted from the Tokyo Stock Exchange. The carrier earned an operating profit of 927.9 billion yen ($6.94 billion) for the fiscal year ended March 31, accounting for roughly 50% of NTT’s profit groupwide.

The metaverse market is expected to expand to $828 billion in 2028, or nearly 20 times the scale in 2020, Canadian analytics firm Emergen Research predicts. Industry lines are blurring: Japanese advertising group Hakuhodo DY Holdings has started selling virtual ads for metaverse platforms.

……………………………………………………………………………………………………………………………………

The leading telecom operator in the metaverse space is SK Telecom. Its Ifland platform is one of South Korea’s two big metaverse services, with a reported 1.5 million MAUs. It has signed up Deutsche Telekom as a European partner and says it wants further partners around the world (see SKT soars into metaverse as AI businesses gather steam). Ifland is one of two services run out of SKT’s AI unit, which took in $222 million in revenue last year and is aiming to reach $1.6 billion by 2025. SKT’s thinking about the metaverse is interesting. It sees that Ifland doesn’t suck up much capex and can leverage the operator’s 5G infrastructure and customer base to grow the business. Over time, Ifland will help expand the user base and enable new subscriptions and other services.

Telcos everywhere else in the world will struggle to build a business case for a metaverse platform – but there are plenty of other metaverse roles for them to chew on, and it increasingly looks like it is going to be too big to ignore.

Consultancy McKinsey has forecast that the metaverse could generate a “$5 trillion impact” by 2030. In a recent survey of executives, it found that 95% believe the metaverse will have a positive impact on their industry.

“About a third of them think the metaverse can bring significant change in how their industry operates, and a quarter of them believe it will generate more than 15% of corporate revenue in the next five years,” McKinsey said. It urges companies to venture into the metaverse to get a better sense of what it entails.

“There is no avoiding the fact that if you want to both understand consumers and opportunities that may be available to your organization, you need to be familiar with the metaverse,” McKinsey said.

Synopsys 5G SoC enhances 5G development with new RF design flow for TSMC N6RF process

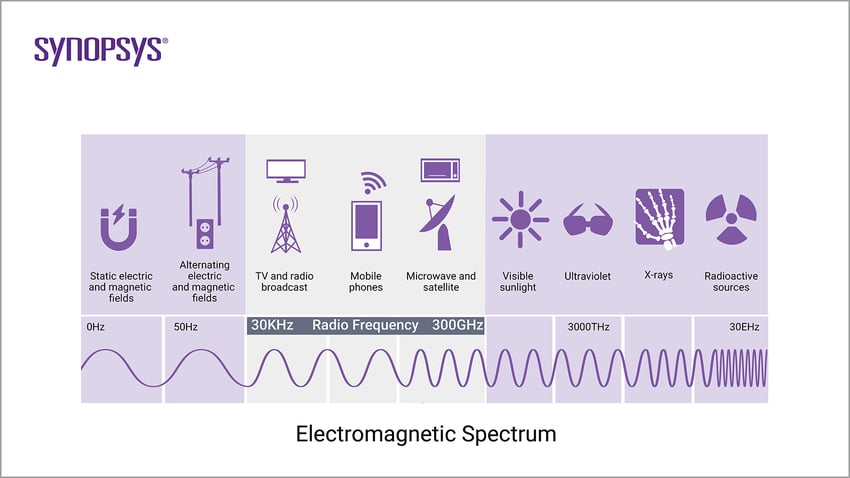

RFICs (Radio Frequency Integrated Circuits) for wireless data transmission systems, such as transceivers and RF front-end components, are becoming more complex based on the demands of our connected world. These next-generation wireless systems are expected to deliver higher bandwidth, lower latency and better coverage across more connected devices. To ensure their RFICs can meet these requirements, designers must be able to accurately measure parameters such as RF performance, spectrum, wavelength and bandwidth.

To address increasingly complex RFIC design requirements, Synopsys, Inc. today announced a new RF design flow developed with Ansys and Keysight for the TSMC N6RF process, the most advanced RF CMOS technology that offers significant performance and power efficiency boosts. The flow helps mutual customers achieve power and performance optimizations for 5G chips while also accelerating design productivity for faster time-to-market.

“Our latest collaboration with Synopsys addresses the challenges of next-generation wireless systems, enabling designers to deliver greater connectivity, higher bandwidth, lower latency and better coverage for our increasingly connected world,” said Suk Lee, vice president of the Design Infrastructure Management Division at TSMC. “With high-quality, tightly integrated solutions from Synopsys as well as Ansys and Keysight, the new TSMC RF Design Reference Flow for the TSMC N6RF process provides a modern, open approach that enhances productivity for developing these complex ICs.”

The new RF design reference flow improves design turnaround time with industry-leading circuit simulation and layout productivity performance, as well as accurate electromagnetic (EM) modeling and electromigration/IR-drop (EMIR) analysis. The flow includes the Synopsys Custom Compiler™ design and layout product, Synopsys PrimeSim™ circuit simulation product, Synopsys StarRC™ parasitic extraction signoff product and Synopsys IC Validator™ physical verification product; Ansys VeloceRF™ inductive component and transmission line synthesis product, Ansys RaptorX™ and Ansys RaptorH™, the advanced nanometer electromagnetic (EM) analysis products, and Ansys Totem-SC®; and Keysight’s PathWave RFPro for EM simulation.

RF applications include:

- Wireless communications, e.g., 5G, cell phones, WiFi, Bluetooth

- Radio broadcasting, e.g., AM/FM radio

- RF remote control, e.g., garage door opener, drones

- Remote sensing, e.g., weather or surveillance radar

- Satellite navigation, e.g., GPS, Galileo, Glonass, Beidou

- Imaging, e.g., body scanners for airport security

“To enable key differentiating advantages for 5G designs, Synopsys continues to deliver robust RF design solutions that integrate electromagnetic synthesis, extraction, design, layout, signoff technologies and simulation workflows,” said Aveek Sarkar, vice president of engineering at Synopsys. “Because of our deep collaboration with TSMC and strong relationships with Ansys and Keysight, our customers can now take advantage of the advanced features within the Synopsys Custom Design Family, using TSMC’s advanced N6RF technology for 5G applications, to improve productivity and achieve silicon success.”

“RF design customers benefit significantly from the interoperability between Synopsys Custom Compiler and PathWave RFPro in the TSMC reference flow,” said Niels Fache, vice president and general manager of PathWave Software Solutions at Keysight Technologies. “Shifting electromagnetic co-simulation left in the design process enables RF circuit designers to optimize for the parasitic effects in advanced chips and multi-technology modules for 5G and WiFi 6/6E applications. This saves days and sometimes weeks in the simulation workflow, while reducing the risk of costly re-spins in the product development cycle. Our partnership with Synopsys and TSMC gives RF customers the design tools and advanced process technology they need to ensure high performance with first-pass success.”

“Ansys is excited to collaborate with Synopsys and TSMC on an advanced reference flow for RFIC designs,” said Yorgos Koutsoyannopoulos, vice president of research and development at Ansys. “Significant complexity driven by the growing need for 5G and 6G designs, along with advanced process effects at nanometer nodes, pose a big challenge to RFIC designers. Accurately modeling advanced process effects in EM and EMIR analyses is critical to creating first-pass silicon operating from DC to tens of GHz. Working seamlessly with the Synopsys Custom Complier platform, Ansys tools such as VeloceRF, RaptorX, Exalto and Totem-SC have the highest capacity to handle the most challenging designs as well as the ability to model all advanced process effects. They provide an intuitive and easy-to-use flow for the design, optimization and verification of RF design blocks.”

Synopsys, Inc. is the Silicon to Software™ partner for innovative companies developing the electronic products and software applications we rely on every day. As an S&P 500 company, Synopsys has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP and offers the industry’s broadest portfolio of application security testing tools and services. Whether you’re a system-on-chip (SoC) designer creating advanced semiconductors, or a software developer writing more secure, high-quality code, Synopsys has the solutions needed to deliver innovative products. Learn more at https://www.synopsys.com.

References:

https://www.synopsys.com/glossary/what-is-rf-circuit-design.html

Telefónica Tech to integrate Red Hat’s OpenShift platform into new enterprise cloud service in Europe and Latin America

Telecom technology integrator Telefónica Tech has signed an agreement with IBM/Red Hat to integrate Red Hat’s OpenShift platform into a new cloud service marketed at enterprises across Telefónica’s footprint in Europe and Latin America.

The integration will be marketed as the Telefónica Red Hat OpenShift Service (TROS), which will tap into the use of containers to help organizations modernize their cloud applications and drive their digital transformation. It will allow those organizations to migrate applications to hybrid cloud or multi-cloud environments using either private or public clouds from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP).

OpenShift is based on the Kubernetes container orchestration project that allows for the migration of applications across different cloud and on-premises environments. A recent report from TBR Senior Analyst Catie Merrill noted that Red Hat’s OpenShift platform has four-times as many customers as it did before IBM acquired the company for $34 billion in mid-2019.

Red Hat OpenShift differentiates itself by combining multiple hardened open source technologies to provide a more complete modern application platform, enabling organizations to use it as the foundation for current and future IT strategies. Additionally, the use of Red Hat OpenShift allows for use in any type of cloud, facilitating the creation of this Multi-Cloud service for Telefónica Tech.

This new, open hybrid, multi-cloud approach will allow Telefonica Tech to strengthen and differentiate its value proposition, and provide more flexibility to its customers in their digital transformation and application modernization in the markets where Telefónica Tech is present.

The complementary nature of cloud technologies integrated in TROS will enable Telefónica Tech, Red Hat and IBM to jointly define innovative use cases and provide high value-added professional services to customers to help them make the process more efficient, cost-effective and cost-optimal.

The strategic agreement also enables Telefónica Tech to develop additional services on TROS based on Red Hat technologies and IBM Cloud Paks so that customers can accelerate their transformation to cloud-native applications, enabling a more consistent user experience both in their own cloud and on the hyperscalers.

María Jesús Almazor, CEO of Cybersecurity and Cloud at Telefónica Tech, said: “This strategic agreement allows us to strengthen our differential multicloud offer by integrating world class technologies from Red Hat and IBM and consolidate our position as a leading partner for the digital transformation of businesses. We continue to evolve our ecosystem of alliances to enhance the digital capabilities of our professionals and to include in our portfolio the most innovative proposals in the market, fundamental aspects to continue offering the best service to our customers.”

Horacio Morell, IBM General Manager for Spain, Portugal, Greece and Israel: “This alliance enables us to take a quantum leap in our business collaboration with Telefonica Tech to continue co-creating enterprise multi-cloud and cybersecurity solutions that will enable companies around the world, across all industries, to implement their technology transformation strategies with greater speed, consistency and agility, while ensuring data control, privacy and reliability and increasing decision-making efficiency through the unique capabilities of IBM’s technologies.”

Julia Bernal, Country Manager for Spain and Portugal at Red Hat, said: “Red Hat is fully committed to helping our customers and partners optimize their business with open hybrid cloud and focus on innovation rather than simply managing their IT infrastructure. Our mission is to mitigate the complexities of modern cloud-scale IT environments and with managed cloud services they can do just that. Telefónica Red Hat OpenShift Service enables customers to free resources to create and manage applications more quickly across multiple clouds, streamlining time to market and accelerating growth opportunities.”

“It is going to be the way forward and what many customers who want to evolve their business models,” said Santiago Madruga, VP for ecosystem success in EMEA at Red Hat, in an interview with SDxCentral. “When going digital, it’s not just putting workloads on the cloud but really transforming businesses.” Madruga added that the use of OpenShift also allows for the micro-segmentation of application components that will open the door for edge distributed cloud work.

References:

https://www.sdxcentral.com/articles/news/ibm-red-hat-expand-telefonicas-cloud-push/2022/06/

https://newsroom.ibm.com/2021-09-23-Telefonica-Chooses-IBM-To-Implement-Its-First-Ever-Cloud-Native-5G-Core-Network-Platform

Globe Telecom using next-generation antennas to facilitate 4G acceleration and 5G evolution

Philippine’s carrier Globe Telecom Inc. announced it is using next-generation antennas to facilitate 4G acceleration and 5G evolution. The telco said it has completed the deployment of a new series of antennas that efficiently enables the acceleration of 4G and the evolution of 5G technology. Globe said that the antennas adopts enhanced multi-array modules, ultra-high integration architecture, and full-band technology. The deployment is seen to boost the company’s 4G and 5G network and ensure energy efficiency, Globe added.

Since the antenna is smaller than the traditional design, Globe said it makes installation easier and faster even on cell sites with limited space.

The technology combines different frequency bands and accommodate different generations of cellular technologies, including 5G.

It also minimizes feed loss and improves energy efficiency, which means Globe can maximize energy efficiencies and lower electricity utilization through antenna development and power consumption innovation.

Globe said the use of the latest technology is part of its commitment to the United Nations Sustainable Development Goals, particularly UN SDG No. 9, which highlights the roles of infrastructure and innovation as crucial drivers of economic growth and development.

Globe has earmarked P89 billion for 2022 capital expenditures to roll out more 5G sites and in-building solutions, upgrade cell towers to 4G LTE, add more 4G cell sites, and lay down fiber to the homes.

The company deployed 380 new 5G sites in Metro Manila, Rizal, Cavite, Batangas, Bulacan, Davao, Cebu, Misamis Oriental, and Iloilo in the first quarter.

Globe is innovating with its vendor partners on the latest technologies available to improve customer experience through efficient 4G/5G network deployment.

References:

https://www.gizguide.com/2022/06/globe-uses-new-antennas-4g-5g.html

Arrcus MCN solution now part of CoreSite’s Open Cloud Exchange®

Arrcus, a hyperscale networking software company, today announced that CoreSite deployed its MCN solution to help enable CoreSite’s Open Cloud Exchange® (OCX) [1.]

Note 1. Open Cloud Exchange® is an enterprise network services solution that enables customers to deploy high-performance hybrid architectures in a quick, secure, and economical way. CoreSite is leveraging the Arrcus Multi-Cloud Networking (MCN) solution to extend its software-defined networking platform through automating additional provisioning functionality within AWS and Microsoft® Azure Cloud and direct cloud-to-cloud communication capabilities on CoreSite’s fully managed virtual routers.

CoreSite together with Arrcus’ ACE MCN enables enterprises to do the following:

- Rapidly scale and deploy new applications across multiple U.S. markets using inter-market connectivity

- Improve network performance and security with guaranteed private network isolation, throughput and lower latency compared to public internet connections

- Increase speed to market and gain greater control and optionality

- Recoup expensive cloud egress fees and redirect funds and internal resources to other business priorities

“Arrcus is delighted to have been selected by CoreSite for their OCX platform. Enterprises are looking for a seamless and secure hybrid cloud connectivity solution with the flexibility to rapidly scale up or down,” said Shekar Ayyar, CEO and chairman at Arrcus. “The ACE MCN solution differentiated by our unique strength in routing is providing the OCX with secure hyper-scale performance, quicker time to market, and improved economics, giving their customers a competitive edge.”

The Arrcus ACE MCN solution enables highly available connectivity for workloads and data with hyperscale performance and security across any cloud, any region, and any site. Solution consists of ArcEdge – secure data plane software that leverages unique virtual routing capabilities with ArcOS and ArcOrchestrator for cloud-native orchestration that dramatically automates and shortens multi-cloud networking setup time from days to hours.

The programmability and flexibility of the Arrcus solution enable CoreSite to provision virtual routing services for customers in a matter of minutes, dramatically increasing agility and efficiency. Rapid and secure cloud connectivity is critical for businesses to succeed in today’s digital economy. The Arrcus solution enables CoreSite to provide integrated security and orchestration to gain greater control and increased speed to market. This results in their customers’ ability to recoup expensive cloud egress fees and redirect funds and internal resources to other business priorities.

“We leverage Arrcus’ virtual routers in the CoreSite OCX to help enable our customers to quickly expand market reach and gain a competitive edge while lowering TCO,” said Brian Warren, Senior Vice President, Development and Product Engineering at CoreSite. “With just a few clicks in MyCoreSite, our service delivery platform, customers can quickly establish direct and secure virtual connections to multiple service providers and to the public cloud for rapid, automated provisioning.”

The recent Gartner® report that recognizes Arrcus MCN recommends, “Infrastructure and operations leaders responsible for cloud and edge infrastructure should improve networking inside the public cloud by deploying MCNS when advanced networking features and/or a consistent network operations model across multiple public cloud environments is required. Optimize investments in MCNS by choosing lightweight, “cloud-fluent” products that are offered with robust and well-documented APIs, and allow trials before purchase.

Arrcus ACE software is also available on the CoreSite Marketplace.

Additional Resources

T-Mobile US achieves speeds over 3 Gbps using 5G Carrier Aggregation on its 5G SA network

T-Mobile US said it was able to aggregate three channels of mid-band 5G spectrum, reaching speeds over 3 Gbps on its standalone 5G network. It’s the first time the test has ever been done with a commercial device, here the Samsung Galaxy S22 powered by Snapdragon 8 Gen 1 Mobile Platform with Snapdragon X65 Modem-RF System), on a live production network, the company said.

5G Carrier Aggregation (New Radio or NR CA) allows T-Mobile to combine multiple 5G channels (or carriers) to deliver greater speed and performance. In this test, the carrier merged three 5G channels – two channels of 2.5 GHz Ultra Capacity 5G and one channel of 1900 MHz spectrum – creating an effective 210 MHz 5G channel.

The achievement is only possible with standalone 5G architecture (SA) and is just the latest in a series of important SA 5G milestones for T-Mobile. The carrier said it was the first in the world to launch a nationwide SA 5G network nearly two years ago. The carrier began lighting up Voice over 5G (VoNR) this month so that all services can run on 5G. By removing the need for an underlying LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity, the company mentioned.

NR CA is live in parts of T-Mobile’s network today, combining two 2.5 GHz 5G channels for greater speeds, performance and capacity. Customers with the Samsung Galaxy S22 will be among the first to experience a third 1900 MHz 5G channel later this year. This functionality will expand across the carrier’s network and to additional devices in the near future.

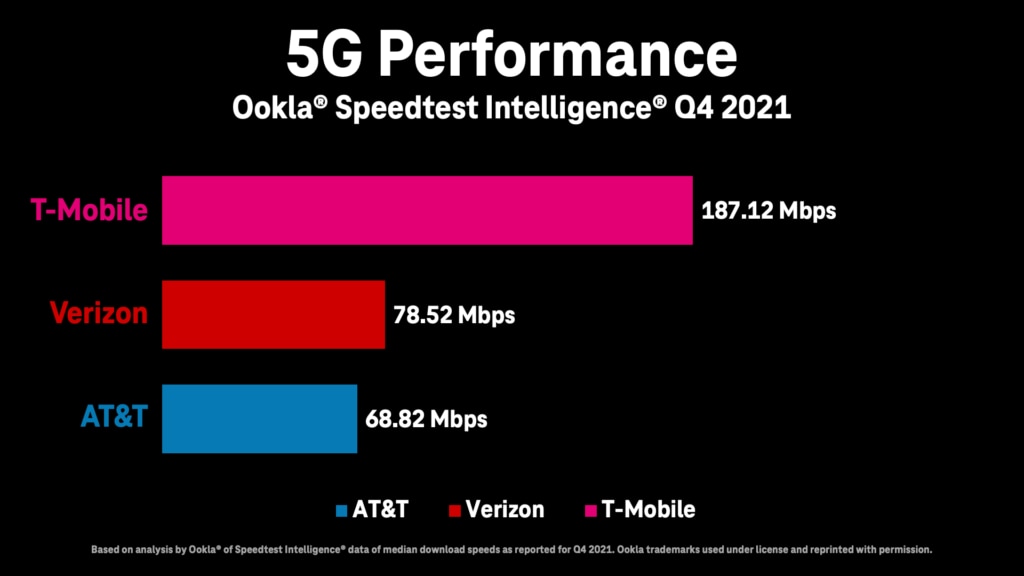

T-Mobile US was the first in the world to launch a nationwide SA 5G network nearly two years ago and has been driving toward a true 5G-only experience for customers ever since. Just this month the Un-carrier began deploying Voice over 5G (VoNR) so ALLvoice services can run on 5G. By removing the need for an underlying 4G LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity. The carrier’s 5G network covers 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year. It also has the fastest 5G network, according to Ookla speed tests in Q4 2021:

Note that neither Verizon or AT&T have deployed 5G SA core networks with no future dates specified.

References:

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

At the Credit Suisse Communications Conference on Tuesday, AT&T CFO Pascal Desroches said Tuesday that inflation is the issue he is most concerned about, and one that he expects to continue “for the foreseeable future. It’s hard for me to envision that that’s not going to impact the consumer negatively,” Desroches said. “And that we and some others will see some pressure,” he added.

AT&T has already raised prices on some mobile service plans in order to combat the impacts of inflation. The CFO’s comments were made mere weeks after the telecom giant increased the pricing for certain older single-line individual plans by $6 per month or $12 a month for family plans.

Yet Desroches said the company may review its pricing again. AT&T is seeing the impacts of inflation across labor, supplies, energy and transport. Nonetheless, AT&T is expecting to see profit margins expand during the course of the second half of the year, as well as improved profit trends, Desroches added.

Desroches reiterated that AT&T has taken a disciplined approach to growth and investment and made the following points:

- The company continues to grow customer relationships in its strategic focus areas of 5G and fiber. Desroches said the company continues to see healthy consumer demand even with continued expectations that 2022 postpaid wireless industry demand is unlikely to replicate 2021 levels. AT&T continues to successfully attract high-value customers with its consistent, simple go-to-market strategy.

- Desroches remains comfortable that the company can deliver improving postpaid phone ARPU trends in 2022. He noted that postpaid phone ARPU could in fact edge up sequentially in the second quarter.

- Desroches also reiterated expectations for gradual improvement in year-over-year mobility EBITDA trends through the course of 2022. Following a more pronounced impact in the second quarter, the revenue and EBITDA impacts of the previously announced 3G network shutdown and the absence of approximately $100 million in CAF II and FirstNet related reimbursements are expected to be more than mitigated in the back half of year by organic service revenue growth and the lapping of 3G shutdown costs comparisons in the second half of 2021.

- AT&T’s fiber build progress continues with expectations to achieve 30+ million customer locations by 2025. Desroches noted that AT&T is acquiring new customers and seeing strong penetration rates thanks to a straightforward go-to-market approach.

- Desroches shared that the company continues to work with state and local government municipalities across the country to provide affordable broadband connectivity to low-income customers through the Affordable Connectivity Program. Over time, the company believes these efforts can help provide internet for all Americans and expand the total addressable market for broadband access. Additionally, Desroches indicated that any federal funding in support of the company’s fiber buildout would be deployed to expand its network to additional customer locations, representing potential upside above AT&T’s existing guidance.

- AT&T continues to work through its business wireline portfolio rationalization process and focus its efforts on core transport and connectivity solutions. Desroches noted that the company has yet to see a recovery in government sector demand trends which impacted the business during the first quarter.

- With regard to the macroeconomic environment, Desroches said that the company considered a higher-than-typical level of inflation when setting 2022 budget. The company’s recent pricing increases were a response to higher-than-expected inflation trends. Additionally, the company has opportunities to address the impacts of inflation with its ongoing cost savings initiative, which is expected to reach a run rate of $4+ billion by the end of this year.

- Desroches stated the company feels good about its financial flexibility, does not plan to issue any debt in the near-term and remains focused on its goal of achieving a net debt-to-adjusted EBITDA ratio in the 2.5x range by the end of 2023.

References:

https://about.att.com/story/2022/pascal-desroches-webcast-summary-june-14.html

https://www.barrons.com/articles/att-prices-inflation-51655220258

Data Center Networking Market to grow at a CAGR of 6.22% during 2022-2027 to reach $35.6 billion by 2027

According to Arizton’s latest market research report, the data center networking market is expected to grow at a CAGR of 6.22% during 2022-2027. Growth in the adoption of high-capacity switches, Big Data & IoT solutions, and rising data center investments are driving the market.

Data Center Networking Market Report Scope

| Report Attributes | Details |

| MARKET SIZE (INVESTMENT) | $35.6 billion (2027) |

| CAGR | 6.22% (2022-2027) |

| GEOGRAPHICAL COVERAGE | North America (US, Canada), Latin America (Brazil, Rest of Latin America), Western Europe (UK, Germany, France, Netherlands, Ireland, Other Western European Countries), Nordics (Sweden, Other Nordic Countries), Central & Eastern Europe (Russia and Other Central and Eastern European countries), Middle East (UAE, Saudi Arabia, Other Middle Eastern Countries), Africa (South Africa, Other African Countries), APAC (China & Hong Kong, Australia & New Zealand, Japan, India, Rest Of APAC, Singapore, and Other Southeast Asian Countries) |

| MARKET PARTICIPANT COVERAGE | 20+ Network Infrastructure vendors |

| SEGMENTS COVERED | Sectors (BFSI, Government, Cloud, IT & Telecom, & Other Sectors), Product Types (Ethernet Switches, Routers, Storage Networking & Other Network Infrastructure) |

Click Here to Download the Free Sample Report

The data center networking market is dominated by cloud service providers. The increase in data traffic is raising the complexity both on the internet and external data center networks. Internally, the growth in data traffic necessitated the use of a 10 GbE switch configuration on the top of the rack, and switches of higher capacity (greater than 10 GbE) are deployed in aggregation and core layers.

Highlights:

- The increasing bandwidth requirements due to the growing adoption of technologies such as big data, IoT, AI, ML, cloud services, data center consolidation, and virtualization are some major factors driving the demand for high capacity ethernet port switches, controllers, and adaptors.

- The market is witnessing growth in the adoption of software-defined networking solutions as well as application-centric infrastructure by data center operators across all industry sectors.

- The market is dominated by industry sectors such as cloud service providers contributing over 60% of the market share followed by the telecom sector.

- The market is witnessing a trend of businesses switching from FC SAN switches to Ethernet-based data exchanges using iSCSI SAN or FCoE in data centres.

- The growing adoption of converged and hyper-converged infrastructure will increase the opportunities for vendors offering innovative network infrastructure solutions in the market.

Key Offerings:

- Market Size & Forecast by Volume | 2022−2028

- Market Dynamics – Leading trends, growth drivers, restraints, and investment opportunities

- Market Segmentation – A detailed analysis by industry, product, and geography

- Competitive Landscape – 25 vendors are profiled in the report

Competitive Landscape:

Cisco Systems, Dell Technologies, Hewlett Packard Enterprise, Huawei, Juniper Networks, Lenovo, and Oracle have significant revenue shares in the market. Several vendors have begun to sell their goods in different parts of the world. Due to the intense competition among large suppliers, new vendors have been able to enter the market. In terms of opportunities, the United States is already a mature market, with regions such as APAC, Western Europe, and the Nordics seeing considerable demand growth. Central and Eastern Europe, as well as the Middle East and Africa, are in the early stages of development and are projected to see an increase in demand for network infrastructure.

The adoption of orchestration and management solutions in data centers and the automation of network operations will have an impact on the market during the forecast period, requiring vendors to offer solutions matching every business network’s operational needs. The implementation of 5G has taken off in many countries, which is likely to boost data traffic, leading to the procurement of high-capacity networking solutions i.e., 200 GbE/400 GbE switches, as a part of the data center interconnect solutions.

Infrastructure Vendors

- Alcatel-Lucent Enterprise

- Arista Networks

- Black Box offers

- Broadcom

- Cisco Systems

- Dell Technologies

- Digisol Systems

- D-Link

- Enterprise Engineering Solutions (EES)

- Extreme Networks

- Fujitsu

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- Intel

- Inventec

- Juniper Networks

- Lenovo

- Marvell Technology

- MiTAC Computing technology

- Oracle

- Quanta Cloud Technology (Quanta Computer)

- Ruijie Networks

- Tripp Lite (EATON)

- Super Micro Computer

- ZTE

Industry

- BFSI Sector

- Government Sector

- Cloud Sector

- It & Telecom Sector

- Other Industry Sectors

Products

- Ethernet Switches

- Storage Networking

- Routers

- Other Network Infrastructure

Geography

- North America

- US

- Canada

- APAC

- China & Hong Kong

- Australia & New Zealand

- Japan

- India

- Rest of APAC

- Western Europe

- UK

- Germany

- France

- Netherlands

- Ireland

- Other Western Europe

- Central & Eastern Europe

- Russia

- Other Central & Eastern Europe Countries

- Latin America

- Brazil

- Other Latin American Countries

- Nordics

- Sweden

- Other Nordics Countries

- Africa

- South Africa

- Other African Countries

- Middle East

- UAE

- Saudi Arabia

- Other Middle Eastern Countries

- Southeast Asia

- Singapore

- Other Southeast Asia countries

Explore our data center knowledge base profile to know more about the industry.

Click Here to Download the Free Sample Report

Read some of the top-selling reports:

- Data Center Market – Global Outlook & Forecast 2022-2027

- Green Data Center Market – Global Outlook & Forecast 2022-2027

- Data Center Server Market – Global Outlook & Forecast 2022-2027

- Data Center Fire Detection and Suppression Market – Global Outlook & Forecast 2022-2027

About Arizton:

Arizton Advisory and Intelligence is an innovation and quality-driven firm, which offers cutting-edge research solutions to clients across the world. We excel in providing comprehensive market intelligence reports and advisory and consulting services.